#Funded Trader Challenges

Text

How to pass prop firm account | The Talented Trader

Unlock the secrets, how to pass prop firm account with ease at The Talented Trader. Discover expert tips, proven strategies, and invaluable insights to navigate the challenges and maximize success in prop trading.

Whether you're a novice trader or seasoned professional, our comprehensive guide offers step-by-step guidance to conquer the prop firm account challenge and achieve your trading goals. Explore now and embark on your journey to prop trading success with confidence. Learn more: https://www.thetalentedtrader.com/how-to-pass-prop-firm-account

Company Name: The Talented Trader

Address: Champlain, New York, USA - 12919

Email: [email protected]

Discord Link: https://discord.gg/edrPkWSh3w

#proprietarytradingfirm #cheapestpropfirms #leverageintrading #trading #usa #newyork #unitedstates #champlain #forextrading #fundedtraderprograms #proptrading #instantfundingpropfirm #fundedtradingaccounts #propfirms #propfirmchallenge #instantfunding #thetalentedtrader #talentedtrader

#the talented trader#talented trader#instant funding prop firm#prop firms instant funding#prop firm challenge#prop firms#funded trading accounts#trading risk management#funded trader challenges#prop trading#How to pass prop firm account

0 notes

Text

What is leverage in trading? | The Talented Trader

Leverage in trading is a powerful tool that allows traders to control a larger position in the market with a relatively small amount of capital. Essentially, it involves borrowing funds from your broker to increase your trading position beyond what would be possible with your own capital alone.

Here's a detailed explanation of what is leverage in trading:

Amplifying Potential Gains and Losses: Leverage enables traders to amplify their potential gains. For instance, if you have $1,000 and use a leverage ratio of 1:100, you can control a position worth $100,000. If the market moves in your favor, your profits are significantly magnified. However, it’s important to note that leverage also amplifies potential losses. If the market moves against your position, losses can exceed your initial investment.

Leverage Ratios: Leverage is often expressed as a ratio, such as 1:10, 1:50, or 1:100. A leverage ratio of 1:10 means you can control $10 for every $1 of your own capital. Higher leverage ratios allow for greater market exposure but also increase the risk.

Margin Requirements: When you use leverage, you are required to maintain a margin, which is a portion of your own capital that acts as collateral for the leveraged position. The margin requirement varies depending on the broker and the leverage ratio used.

Risk Management: Understanding what is leverage in trading also involves recognizing the risks associated with it. Traders need to implement strict risk management strategies to protect their capital. This includes setting stop-loss orders, not over-leveraging, and being mindful of market volatility.

Regulatory Limits: Different markets and regulatory bodies have varying limits on the amount of leverage that can be offered. For example, in Forex trading, some jurisdictions may limit leverage to 1:30 for retail traders to protect them from excessive risk.

Example of Leverage in Action: Suppose you have $1,000 in your trading account and use a leverage ratio of 1:50. This allows you to control a $50,000 position in the Forex market. If the currency pair you’re trading moves in your favor by 1%, you would make a $500 profit (1% of $50,000), which is a 50% return on your initial $1,000. Conversely, if the market moves against you by 1%, you would lose $500, which is also a significant loss relative to your initial investment.

In summary, what is leverage in trading is the ability to control a larger market position with a smaller amount of capital through borrowing. While it can amplify potential gains, it also increases the risk of significant losses. Proper understanding and cautious use of leverage are essential for successful trading.

#the talented trader#prop firms#instant funding prop firm#funded trading accounts#cheapest prop firms#trading risk management#proprietary trading firm#prop firm challenge#prop firm trading#prop firms instant funding#What is leverage in trading

0 notes

Text

Gain access to professional trading resources and capital with Prop Firm Accounts. Elevate your trading career by partnering with reputable firms offering tailored solutions for traders. Unlock the potential of your trading strategy with dedicated support and advanced tools

#prop firm account#bespoke prop firm#instant funding prop firm#Trading Prop Firms#Free Prop Firm Challenge#Funded Trader Prop Firm#Prop Trading Firms Forex#Forex Prop Trading

0 notes

Text

Funded Traders: Reshaping the Future of Online Trading

Funded traders have emerged as influential players in the world of online trading, reshaping the dynamics of financial markets. These traders participate in funded trading programs that provide them with access to substantial trading capital and resources. Funded trading programs, such as Funded Traders Global, have gained global popularity by offering traders the opportunity to access significant capital and compete on an equal footing in the forex market. The advantages of funded trading include reduced financial risk, the possibility of earning a share of profits without personal investment, and the ability to focus solely on trading strategies and performance. However, funded traders also face challenges such as performance evaluation and risk management. Despite the challenges, funded trading programs have profoundly impacted the online trading industry, leading to the evolution of trading platforms, increased competition and innovation, and the potential disruption of traditional trading models. Funded traders are poised to redefine the way traders participate in financial markets, and platforms like Funded Traders Global offer a supportive ecosystem for traders to thrive.

#Funded traders#online trading#financial markets#funded trading programs#access to capital#trading resources#advantages#challenges#impact#evolution#traditional trading models#Funded Traders Global#forex market#profit-sharing#risk management#trading strategies#performance evaluation#trading platforms#competition#innovation#accessibility#online trading landscape#transformation.#ftg#fundamental analysis

0 notes

Text

youtube

Hey everyone! In today's video I discuss how you bounce back from failing a prop firm challenge. If you are struggling to hit your goals with prop funding and payouts you may be interested to hear about.

#prop firm challenge#prop firm#proprietary trading firms#best prop trading firms#forex prop firms#proprietary trader#instant funding prop firm#best prop firms#Youtube

0 notes

Text

youtube

If You Fail A Prop Firm Challenge How Do You Bounce Back

#prop firm challenge#prop firm#proprietary trading firms#best prop trading firms#forex prop firms#proprietary trader#instant funding prop firm#best prop firms#Youtube

0 notes

Note

Do you think Alfred is insecure about being young? Like I know that there’s countries younger or closer to age to Alfred, but the people Alfred hangs out with the most, has more economic ties, and has military alliances with are way older than Alfred (ex literally all of Europe and Asia). So I was wondering if you think Alfred, being always around people with way more experience than him, feels insecure about being so young and ‘inexperienced’ maybe that’s why he wears glasseS

Interesting question! As I see it, yes and no.

Yes—in the 18th century, when he was much younger, and rebelling against Arthur. Going hat in hand to the other Old World empires and nations like Francis and Antonio for money was a pretty intimidating experience. So it was with Gilbert, coming to whip his ass into shape in Valley Forge. Even with other nations where he wasn't asking for major favours to fund his rebellion but more like 'hey recognise me? please? can my ships come to your ports?' like Morocco or Yao, during the Old China Trade (uhhhhh ive been banned from all the usual trading posts all across my father's empire...and I heard you guys like otter pelt and ginseng?).

No, because from the 19th century onwards, he's very much growing into a world power. I see Alfred as being quite a zealous idealist who sees potential for improving the world (not always in the best way, but from his POV it is), and this is the period where his mindset is increasingly one of brazen, youthful self-confidence. To him, his age is an asset. He's casting a pretty jaundiced eye on the Old World as a whole—perceiving them as being full of religious feuds, outdated monarchies and straitjacketed by nonsensical traditions: they’re ossified fucks who ought to realise the glory of republican civilisation and everything else he's got grand ideas about. Like, one contrast is really how much more intimidated I see him being going to China during the Old China Trade in the late 1700s—versus the brazen gunboat diplomacy of the Perry expedition to Japan in 1853. Like, the contrast with how the Americans behaved themselves when they had no navy and their ships were so small the Chinese traders thought they were tenders from larger vessels and not ocean going ships (lmao) and the Perry expedition is huge. 18th century Alfred would’ve been more intimidated around a nation who beheaded Kublai Khan’s emissaries and fought in more battles long before he was born—19th century Alfred isn’t.

And even less so in the 20th century—especially during WWII. There’s no victory unless he puts his thumb on the scale, and even Sir Lord Arthur Kirkland is openly begging for it. If people had any remaining thought of him as the young, ambitious crown prince somewhat walking in the shadow of his father, all that is gone in WWII. He steals the fire of the gods and literally makes it shine brighter than a thousand suns in all its terror and awe. Other nations can get under his skin, especially in the dynamics of a rivalry (Arthur, in their power struggle over influence, Kiku, as a duelling Pacific empire in the late 1800s—1945 and then also Ivan). But older Alfred is far less likely to be insecure solely on account of them being older than him. It’s more if he perceives they’re challenging his dominance and hegemony—or if they’re questioning his idealism and principles. Like Antonio at the end of the Spanish-American War—oh, you really are your father’s son. I can see moments of vulnerability where his youth and inexperience shines through (such as the American Civil War), but older Alfred’s insecurities tend to dig on faultlines regarding: challenges to his hegemony and principles because unlike Lord Father (tm), I think he’s far more of an idealist. He wants to be great and good, but greatness often is in direct conflict with the latter.

#hetalia#hetalia headcanons#hws america#alfred f jones#aph america#long post#i dont really do him with glasses mainly bc I see him as a pilot#during WWII and no lasik then#you'd have to have good vision

163 notes

·

View notes

Note

How did you go about finding all the original artwork etc., for your preservation project?

Did you start searching for it and then others started sending you stuff?

When I was just getting into Star Trek I was gifted 3 boxes of fanzines by an ex-convention organizer. I had started to write a book (/extended thesis; the PhD I never did) on Kirk and Spock's characterization and relationship, and as part of my research I realised that a lot of physical fandom history was in danger of disappearing, or already had, as original generation fans were dying and their collections - art, written/publishing materials, and fannish ephemera - was becoming lost (e.g. disposed of by disinterested parties). I saw a lot of art in zines and newsletters and wondered where the original work had all gone. I was gifted the two giant Shelley Butler pieces, that so moved me, that (also as an artist myself) I decided to create the first archive dedicated to Kirk and Spock (and the Enterprise) that prioritized collecting, preserving and sharing original art pieces related to them. Shelley, for example, does not know where most of her originals are now. It would be great to find more of hers, and provide her with scans.

The biggest challenge is when collections including art and fanworks pop up that have come from estate sales and third parties try to cash in; finding funds and negotiating is tricky, and I am glad of the team stateside who help with that in the immediate term. It leaves the challenge of fundraising to cover these costs. Unfortunately my industry is fickle and terrifically difficult to tame, and my income is not a lot to write home about. It would be much easier if I were doing the work I'm capable of, and earning accordingly!

I make it a point to support fellow artists whenever I can, and so the collection is a mixture of contemporary and vintage. Every artists' take has a story to tell. There is also some official and production related art but it is not easy to find, nor often affordable. I missed a TMP concept sketch of Spock on Vulcan due to hesitating over cost, and regret that greatly. There is a set of TAS animation cels to share that was offered at modest cost by a friendly trader at my local comic con, and this is a terrific piece, but requires a custom display that has not yet been addressed (time and cost).

I do wish more vintage pieces would come out of the woodwork and simply land on the doorstep, so to speak, but it's not an expectation; it's a lucky and generous thing if it happens, and always so encouraging. I have also acquired art from other fandoms and gifted that to appropriate fans/archivists - it all works best by supporting each others' efforts.

#star trek#captain kirk#jim kirk#james t kirk#star trek the original series#star trek tos#tos#spock#james kirk#fan art#fan fic#fan archives

23 notes

·

View notes

Text

"The Funded Trader" Enabling traders to reach their full potential.

With the arrival of the booming prop firm industry, aiming to fund the traders to take their trading career to next levels, there is one name that stands out , a leading prop firm in the prop firm space "The Funded Trader".

With their carefully designed programs to help traders of all kids and styles. They provide upto $600000 in funded capital that can be scaled upto $1.5million allowing you to never depend on small capital and in the process helping you to take the big step towards a better future in financial markets.

Offering different account options to accomodate your trading style and your trading strategy. you can choose betwqeen regular or swing tading accounts.

Standard Challenge:

Choose account sizes ranging from $5000 to $400000. Pass two step varification process with leading industry standard rules and regulation.

phase 1 target: 8%

phase2 target 5%

Rapid Challenge:

With zero minimum trading days, to fast track your journey to be a funded trader.

Accounts ranging from $5000 to $200000.

Royal Challenge:

With the accounts ranging from $50,000 to $400,000. Royal challenge has no limits on EA's and the news trading is allowed.

Knight challenge:

One step challenge with unlimited days and 0 minimum days. you can select challenge accounts ranging from $25000 to $200000.

Why The Funded Trader is industry leader?

Social media presence: With their different accounts type and a bigger community of traders, The funded trader helps you to connect with like minded traders and take your trading journey to the next level.

Discord: A very active discord to help with any queries and the constant give aways keep you engage in the community.

Treasure Hunt app: very first of its kind, treasure hunt app to keep you engaged within the community and you can earn rewards every month. https://hunt.thefundedtraderprogram.com/r/adnanali?fbclid=IwAR3ZVgXIIRLB7yker6-I93290JdC8r57rUDdh5w3J9_vdToWgwwFfqtZQFU

Monthly trading competition: The biggest monthly trading competition in the industry where you can showcase your trading potential and earn rewards and different challenge accounts.

The funded trader is true industry leader in the prop firm industry. so take a leap of faith and embark on a trading journey to keep you financially independent.

Click on the Affiliate link below to buy a challenge today.

#the funded trader#stockmarket#crypto#finance#forex#marketing#crptocurrency#gold#sucess story#binance#lifestyle#life skills#forex online trading#forex education#forex trading#forexsignals#forextrading#forexmarket#forexmentor#trader

18 notes

·

View notes

Text

Trading risk management

Explore the importance of trading risk management with The Talented Trader. We offers valuable insights and strategies to help traders mitigate risks, protect capital, and optimize trading outcomes. Learn essential risk management techniques to navigate volatile markets and safeguard your investments effectively. More: https://www.thetalentedtrader.com/trading-risk-management

#propfirmtradingaccount #fundedtradingaccounts #propfirms #usa #newyork #unitedstates #propfirmchallenge #tradingriskmanagement #instantfunding #thetalentedtrader #talentedtrade

#trading risk management#prop firms#funded trading accounts#instant funding prop firm#proprietary trading firm#prop firm challenge#prop firm trading#prop firms instant funding#cheapest prop firms#the talented trader

0 notes

Text

Trading Prop Firms

refers to trading accounts provided by proprietary trading firms, enabling traders to access capital and engage in trading activities. These accounts often come with unique features, such as leverage, risk management tools, and access to proprietary trading strategies. Traders can benefit from these accounts to amplify their trading capacity and potentially increase profitability.

#Prop Firm Accounts#Free Prop Firm Challenge#Prop Firm Account#Instant Funding Prop Firm#Bespoke Prop Firm#Trading Prop Firms#Funded Trader Prop Firm#Forex Prop Trading#Prop Funding

0 notes

Text

The SEC Approves Ethereum ETFs: A New Era for Institutional Adoption

The U.S. Securities and Exchange Commission (SEC) has recently approved the first batch of spot Ethereum (ETH) ETFs, marking a pivotal moment for Ethereum and the broader cryptocurrency market. This approval is anticipated to usher in increased institutional adoption and liquidity, setting the stage for potentially significant price movements and technological advancements within the Ethereum ecosystem.

Key Implications of the ETF Approval

1. Institutional Adoption and Market Liquidity: The approval of Ethereum ETFs is a critical development that could lead to a surge in institutional investment. This influx of institutional funds is expected to enhance market liquidity, making Ethereum a more attractive asset for both retail and institutional investors. By allowing investors to gain exposure to Ethereum through regulated financial products, the ETFs reduce the barriers to entry and provide a more secure investment avenue.

2. Potential Price Surge: Market analysts predict a substantial increase in Ethereum's price due to the ETF approval. Standard Chartered analysts foresee Ethereum's price potentially doubling, reaching $4,000 or higher by the end of the year if the ETFs perform well and attract significant investment. This optimistic outlook is driven by the expectation that the ETFs will boost demand for Ethereum, thus driving up its price.

3. Technological Advancements: Alongside the regulatory advancements, Ethereum is also making strides in technological innovation. The implementation of roll-up technology and EIP-4844 are poised to significantly increase the network's transaction capacity and efficiency. These upgrades are crucial for maintaining Ethereum's competitiveness, especially as it faces stiff competition from other blockchains like Solana.

Trading Strategies for the Evolving Landscape

The approval of Ethereum ETFs presents new opportunities and strategies for traders and investors. Here are a few approaches to consider:

1. Volatility Management: Given the potential for increased volatility around the ETF approval dates, strategies such as dynamic hedging and dollar-cost averaging could be beneficial. These methods help manage risk and capitalize on price fluctuations.

2. Market Sentiment Analysis: Understanding and exploiting market sentiment is crucial, especially in a market influenced by speculation about institutional adoption and ETF approvals. Using tools like artificial intelligence and machine learning to analyze social media, news outlets, and other sources for sentiment indicators can provide valuable insights for trading decisions.

3. Contrarian Investing: Taking positions against the market consensus when sentiment analysis suggests extremes of optimism or pessimism can be a profitable strategy. This approach, often summarized as "buy the rumor, sell the fact," involves making trades based on anticipated market reactions to news events.

4. Timing Regulatory Decisions: Staying informed on regulatory developments is essential. Strategically timing trades around the expected decision dates for ETF approvals can help investors capitalize on market movements triggered by anticipation and reaction to such news.

The Path Forward for Ethereum

The approval of Ethereum ETFs is a monumental step forward, but it also underscores the ongoing challenges and opportunities within the Ethereum ecosystem. As Ethereum continues to evolve, addressing scalability, security, and privacy concerns will be crucial for sustaining its growth and adoption. The network's ability to navigate the competitive landscape, marked by rivals like Solana and Cardano, will play a significant role in shaping its future.

As we move through 2024, Ethereum stands on the brink of transformative growth. The convergence of regulatory advancements, technological upgrades, and increasing institutional interest sets the stage for Ethereum to solidify its position as a leader in the blockchain and decentralized finance space.

For those interested in the future of Ethereum and the broader cryptocurrency market, staying informed and adaptive to the rapidly changing landscape will be key to navigating this exciting new era.

By understanding the implications and opportunities presented by the approval of Ethereum ETFs, investors and enthusiasts can better position themselves to take advantage of this significant development in the cryptocurrency world.

#Ethereum#SECApproval#EthereumETFs#Cryptocurrency#InstitutionalAdoption#MarketLiquidity#PriceSurge#RollUpTechnology#EIP4844#Blockchain#DecentralizedFinance#EthereumPrice#CryptoTrading#FinancialMarkets#CryptoRegulation#Investment#CryptoInnovation#ETFApproval#EthereumUpgrades#SolanaCompetition#CryptoMarket#FinancialNews#EthereumInvestment#CryptoAdvancements#CryptoUpdates#bitcoin#financial education#financial empowerment#financial experts#digitalcurrency

2 notes

·

View notes

Text

Dawn Of The Simfected Set-Up

(2)

Meet Charles, a nightshift dock worker, a loner that likes to curl up with a good book and avoid social interactions. When the neighbours start to get a bit bitey, Charles manages to avoid becoming a Sim-burger and finds himself in charge of a small group trying to make it to tomorrow and not only survive but thrive. Or do they? Try the challenge and see.

To begin:

When selecting a new game, select the story option where you answer questions to create a Sim. Select young adult and then just click randomly on the answers. Don't change too much about the Sim created. You can also use https://perchance.org/random-sim-generator. Best is to start with a male Sim.

Your Sims will have to be tested for the virus on a regular basis. The test is simple, just roll the dice and if you get even numbers, your Sim is safe. Uneven number means your Sim is infected so roll again and if you roll even numbers, they stay alive. Uneven numbers means your Sim didn't make it. If your Sims rolls clean or survive, they are immune for two rolls. When your Sim “dies” because of a roll, you can either have them die for real and have Grim come get them or change them into a zombie and move them out.

Start in Spring in San Myshuno in 17 Culpepper House in the spice market. Set life span to long and seasons to max, turn off the celebrity system, turn on the basic living system in lot challenges and you're only allowed to have the cheapest of the cheap furniture. Open the calendar and go to the first day of autumn. Create a holiday called "supply run" and choose fighting as a tradition(this holiday can be deleted once done). After a few days in game, go to the first day spring and create a holiday called "The Beginning" so your Sims can always celebrate this day. Set funds to $500.

Go to Strangerville to the Sigworth household. Give Jess the pack items(by pressing shift on Jess and going to pack cheats), put her in a hazmat suite and open all the doors to the motherplant at the secret lab to activate the Strangeville storie. When she returns to her lot, zombie proof it the way you'd think someone with a military background and in a hurry would do. Give her ammo, a weapon and a radio from the zombie mod and listen to the broadcast to activate the zombie event. Do one event every day for 3 days.

Mods for this challenge:

⦁ Deaderpool's MC Command Center

⦁ Sacrificial's Zombie, Life Manager, Release Bladder Anywhere

⦁ Zero's historical mods

⦁ Turbodriver's Wicked or Wonderful whims

⦁ Frankk's Language Barrier

⦁ LittleMsSam's Miscarriage

⦁ Pandasama's Child Birth

⦁ NeedCoffee4That's Begging and Pick-pocket

⦁ Lumpinou's RPO Collection and Rambunctious Religions

⦁ Midnitetech's Hunter, Gatherer and Crafter careers

When moving over to stage:

⦁ Kuttoe's Enlist in war

⦁ adeepindigo Health redux

⦁ Basemental's drugs and gangs

Supernaturals are "infected" so they can't be added to your household.

World Setup:

Rooftop lot in the City: should be on one of the roofs with a campfire, generator, water tower, tents, washing line and tub. This lot will have water and power but the simple living trait.

In the spice district create a clinic lot with a army feel to it on one of the ground lots in the spice district.

Create a groceries store in the city.

Build a vet clinic that doubles as a hospital. Willow Creek, Newcrest, Windenburg, Evergreen, Mt. Komberi, Tartosa and San Sequoia are all available.

Build a "trader" post on the bar lots in Henford, Brindelton, Chestnut and Sulani.

Build a military base in Oasis Springs with family housing

Build a science facility in Strangerville with family housing

In Henford, Brindleton and Chestnut on the largest lot build a town (think Hilltop from The Walking Dead). Make it a rental property so many Sims can live in your town.

All towns are destroyed. It's the apocalypse, seed your worlds accordingly.

This challenge is ever evolving. I'm trying to use every world, every pack and use every bit of what Sims 4 has to offer.

Next post you'll get to meet the Sims your going to find in game. I've uploaded most of them to the gallery already or you can create your own. Gallery ID: suesimming

#the sims 4#gaming#simblr#thesims4#the sims challenge#the sims gameplay#the sims legacy#thesims#simfected#simfection#thesims4 simblr#DawnOfTheSimfected#the sims community#sims 4#sims#apocalypse#post apocalyptic#zombie

6 notes

·

View notes

Text

youtube

Hey everyone! In today's video I discuss how you bounce back from failing a prop firm challenge. If you are struggling to hit your goals with prop funding and payouts you may be interested to hear about.

#prop firm challenge#prop firm#proprietary trading firms#best prop trading firms#forex prop firms#proprietary trader#instant funding prop firm#best prop firms#Youtube

0 notes

Text

youtube

How you bounce back from failing a prop firm challenge.

#prop firm challenge#prop firm#proprietary trading firms#best prop trading firms#forex prop firms#proprietary trader#instant funding prop firm#best prop firms#Youtube

0 notes

Text

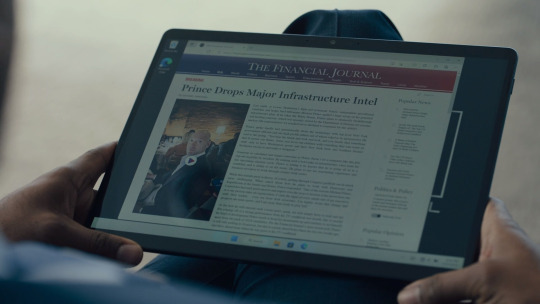

THE FINANCIAL JOURNAL

BREAKING

Prince Drops Major Infrastructure Intel

Last night, at Lower Manhattan’s high-end restaurant Torrisi, independent presidential candidate and hedge fund billionaire Michael Prince spilled a huge scoop on his potential infrastructure plan. If he takes the White House, Prince plans to declassify breakthrough self-healing concrete, which was recently seized by the Department of Defense for reasons unclear (the representative we reached out to declined to comment for this article).

Prince spoke fondly and optimistically about the technology with top-level New York government officials and one high-profile athlete (all of whom asked to be anonymous). He said to the group, “You beat the brush and look and look, and you finally find something that’ll ensure our future. Some real leave-our-children-with-something-they-can-count-on stuff, only to have Washington goons and their New York State and Southern District hooligans swoop in and make it disappear.”

Someone as calculated and image-conscious as Prince doesn’t let a comment like this just slip out in public by accident. By making such a bold stake in infrastructure, a key issue for this upcoming election cycle, Prince is letting it be known that he is going all in as a candidate and is doing so on his own terms. He plans to use his engineering experience and business savviness to work through country-wide issues.

While this sounds great in theory, of course, getting through Congress gridlock can be much more challenging. When asked about how he plans to work with Democrats and Republicans in the Senate and House, Prince responded, “One of the reasons Michael Prince Capital has had such great success and impact over the years is because […] as a one person rules all organization. I value the input of every single one of my […] staff, floor traders… even our front desk assistants. I’m highly aware that change and progress are team sports, and I am more than ready to play ball.”

As for how he will execute such a […], again, we will simply […] that coming off of a strong performance from his TV […] last month, this is exactly the kind of development Prince needs to keep his momentum up and […] to set himself apart from the pack of 2024 candidates. Per the Financial Journal’s […] poll, Prince is still only polling at 24 percent, but that is a […], and there should […] his TV […].

#billions#7x08#mike prince#mike dimonda#interestingly the “quote” from prince in the second paragraph isn't a word-for-word match with how he actually said it#“he plans to use his engineering experience” WHAT engineering experience lmao. software development doesn't count here#and of course lol and lmao at “i value the input of all my employees”

2 notes

·

View notes