#Prop Firm Accounts

Text

Conquer the US forex market! Bespoke Funding Program helps you choose the right forex trading platform. Explore benefits, key considerations & popular platforms in the USA.

#forex funding program#forex trading platforms usa#forex trading usa#prop trading firms in usa#prop firm accounts#forex trader in uk#prop firms uk

0 notes

Text

Discover the One Step Prop Firm – a streamlined solution for traders seeking capital without complex evaluation processes. With a single-step funding model, this firm provides traders with quick access to trading capital, allowing them to focus on what they do best. More: https://www.thetalentedtrader.com/one-step-prop-firm/

#onesteppropfirm #trading #forextrading #fundedtraderprograms #proptrading #usa #newyork #instantfundingpropfirm #passpropfirm #propfirms #propfirmchallenge #instantfunding #thetalentedtrader

#One step prop firm#One step funding prop firm#Two step evaluation prop firm#Three step evaluation prop firm#prop firms#cheapest prop firms#funded trading accounts#trading risk management#instant funding prop firm#the talented trader#proprietary trading firm#prop firm trading#prop firm challenge#prop firms instant funding#forextrading#forex trading

0 notes

Text

What are some trading strategies that proprietary trading firms use?

Introduction

Proprietary trading firms, or prop trading firms, have an important role in financial markets. The trading of various financial instruments such as stocks, currencies, commodities, and derivatives involves the capital of a proprietary trading firm. Proprietary trading firms are basically adopted for the generation of profits by employing the best trading strategies.

A few of the most commonly used trading strategies that a proprietary trading firm relies on to generate consistent returns follow.

1. Market Making

Market making is one of the key proprietary trading strategies. In this kind of strategy, the firm quotes to buy and sell a financial instrument simultaneously. The profit comes from the spread between the bid and the ask prices of the financial instrument. In this, the firm assures market-wide liquidity by entering into transactions with both the buyer and the seller. This strategy excels exceptionally within highly liquid markets like equities, futures, and forex, where participation is high.

The worth of market making, nevertheless, can be said to be considered as such to allow a proprietary trading firm to capture profits on each trade while minimizing its exposure to substantial market movements. Moreover, as they would be actively taking part in both sides of the transaction, they could benefit from high trading volume and, at the same time, provide market liquidity with earning good returns through spreads.

2. Arbitrage Trading

Arbitrage trading is also among the favorite strategies of proprietary trading firms. Arbitrage means simultaneous buying and selling of various markets or financial instruments to take advantage of the difference in pricing that may occur.

There are several types of arbitrage strategies:

Statistical Arbitrage: This involves the usage of statistical models to determine the mispricing between related financial instruments. Every time two 'correlated' assets diverge in price, the trader can buy the undervalued asset and simultaneously sell the overvalued one, making a profit when the prices get closer.

The triangular arbitrage in the forex market profits from the price divergence of three currency pairs. A trader executes the buy-sell operation by buying the currency, exchanging it for another one, and then finally selling it at a profit, without taking any directional risk.

Merger Arbitrage/Risk Arbitrage: This is applied in the case of any merger or acquisition of a company. Traders buy the stock of the target company and simultaneously short the stock of the acquiring company on the assumption that upon completion of the deal the price difference between the two would get adjusted.

It is attractive for proprietary trading firms because, in most cases, it entails very minimal risks, where traders will exploit inefficiencies rather than take directional bets on the market.

3. High-Frequency Trading, HFT

High-Frequency Trading, HFT, is another sophisticated strategy employed by a number of proprietary trading firms. It makes use of complex algorithms coupled with ultra-fast computers to execute a huge amount of trades within fractions of a second. This includes the exploitation of tiny price movements that occur within milliseconds, through which HFT traders may make small but consistent profits across thousands of trades per day.

HFT basically relies on speed, precision, and technology. Proprietary trading firms invest millions in the latest hardware and software to outcompete competitors. Co-locating their servers next to major stock exchanges helps them reduce latency and guarantee faster execution of trades.

HFT strategy varies from market making and statistical arbitrage to the provision of liquidity. This sort of strategy is actually used mostly by big proprietary trading firms because the complexity of the trade, its speed, and resource intensiveness are quite high.

4. Momentum Trading

Momentum trading is one of the most popular strategies, through which a trader tries to reap profits from the continuation of an already developed market trend. The philosophy behind it is that a trend, once established, is most likely to keep on going for some time. In momentum trading, traders will buy assets showing upward momentum and sell those with a downward trend.

Proprietary trading firms that use momentum strategies usually depend on technical analysis tools to identify the trend and timing of entry and exit. Markets on which momentum trading can be applied include commodities, stocks, and forex. This strategy will be of great help during great market movements, for instance, at earnings reports, central bank announcements, or geopolitical events.

For a proprietary trading firm, momentum trading can bring in a lot of money within the shortest period. It is also extremely risky because trends can shift back without any warning, making losses inevitable, especially when traders are not able to get out of those trades efficiently.

5. Quantitative Trading

Quantitative trading, sometimes referred to as "quant" trading, relies upon mathematical models in conjunction with statistical analysis. Proprietary trading firms utilize complex algorithms to pinpoint trading opportunities and automate an execution process. Quantitative trading strategies more often than not involve analysis of voluminous data to come up with patterns, correlations, and anomalies that could be profitably exploited.

Examples of quantitative strategies include:

Mean Reversion: This is a strategy based on the belief that over time, prices would revert to their mean. This strategy involves looking for assets that have diverted from the average taken through history and takes positions that price goes back to normal.

Trend Following: Trend following entails the use of algorithms in noticing and reacting to market trends. However, in general, the trend-following strategies tend to be even more systematic and depend a lot on predefined rules and parameters.

Quantitative trading: therefore, finds its largest following among big proprietary trading houses that possess technological capability and market data. Obviously, such firms can process much more information than human traders can, thanks to algorithms.

6. Event-Driven Trading

Event-driven trading is a strategy that tries to gain from important events that have an impact on the financial markets-for instance, earning reports, mergers and acquisitions, product launches, or releases of macroeconomic data. In this strategy, the traders focus on the anticipation of the immediate change in price an asset will undergo as a result of a specific event and will take positions accordingly.

Event-driven trading desks are run by proprietary trading firms through the constant screening of news and events to find an edge. In this strategy, traders need to have a good understanding of the various events that move markets and fast decision-making capabilities to take advantage of short-term price movements.

For instance, if a company announces earnings higher than expected, an event-driven trader will buy a stock in anticipation of the stock price going up; he or she can sell it short in case he or she expects news to declare something negative and lower the price.

7. Options Trading

Options trading is a form of speculation, by utilizing a derivative contract, on the movement of the prices of underlying positions or hedging an existing position. In options trading, a proprietary trading firm deploys several strategies that seek to benefit from price volatility, market movements, or time decay.

Some of the common options strategies include:

Straddles and Strangles: A position utilizing these two spreads goes with call and put options on an asset. This creates profit capability from considerable price movements on either side of the asset.

Iron Condor: The Iron Condor is an option selling strategy to take advantage of volatility selling. Selling one out-of-the-money call and one out-of-the-money put, this is constructed to hedge against an extremely low volatility environment.

This provides flexibility and leverage for proprietary trading firms to generate high returns with relatively small investments. Options trading provides many opportunities to a firm, enabling the firm to hedge positions and manage the risk of their portfolio.

Conclusion

The proprietary trading firms are involved with the following varied strategies to generate profit in the financial markets. Starting from market making to arbitrage, from high-frequency trading to event-driven strategy-the firms need cutting-edge technologies, data analysis, and sophisticated algorithms to stay competitive in each trading technology. Also, each of these strategies involves its own associated risks and rewards, so combining these strategies is probably the best approach among proprietary trading firms towards return maximization with minimum risk.

While being constantly adaptive and evolving, proprietary trading firms lead the edges of the market by introducing innovative concepts along with liquidity and benefiting from dynamic market conditions.

#proptech#fxproptech#best prop firms#prop firms#prop trading firms#forex prop firms funded account#funded trading accounts#my funded fx#best trading platform#funded

0 notes

Text

Is it possible to earn ₹1000 daily from the stock market? | Or Prop firms with instant funding?

Is it possible to earn ₹1000 daily from the stock market? | Or Prop firms with instant funding?

#propfirms #trading #forextrading #proptrading #usa #newyork #instantfunding #passpropfirm #propfirmchallenge #thetalentedtrader #protradingtips

#funded trading accounts#prop firm challenge#prop firms#instant funding prop firm#trading risk management#prop trading#prop firms instant funding#funded trader challenges#talented trader#the talented trader

0 notes

Text

Forex Trading Tips: Advice & Mistakes To Avoid

The forex market has made significant strides, which has led many forex traders to dive into the pool of trading with their meager savings. However, many people who are following laxity about the market’s fickle nature need to remember what mistakes they must avoid to keep up their trading pace. This situation gets more apprehensive for beginners because they don’t lack practical experience and knowledge. While your perseverance might be a good tool to play in the market, without adequate knowledge and experience, you may experience consistent mistakes and lose a big chunk of money. But do not worry, because this blog has all the forex trading tips that you might have been looking for. So stay tuned and read until the end to discover the knowledge, practice, management, discipline, and risk rules to follow. You can make big with these forex strategies if you just have a hunger for knowledge and practice risk.

Visit our website for more information: https://myfundedcapital.com/blog/avoid-mistakes-in-forex-trading/

0 notes

Text

Unlock Trading Success: The Ultimate Guide to Instant Funding Prop Firms

In the ever-evolving landscape of trading, instant funding prop firms have emerged as a game-changer. But what exactly are they, and why are they so significant in the trading world? Let's dive in and explore this fascinating topic.

Understanding Prop Firms

What is a Prop Firm?

A prop firm, short for proprietary trading firm, is a financial company that invests its own capital in trading. Unlike traditional firms that manage client funds, best prop firms leverage their own resources, taking on the risk and reward themselves.

History and Evolution of Prop Firms

Prop trading has its roots in the early days of Wall Street, where firms employed skilled traders to maximize their profits. Over time, this model has evolved, incorporating advanced technologies and diverse financial instruments, making prop firms more dynamic and accessible.

What is Instant Funding?

Explanation of Instant Funding

Instant funding refers to the immediate provision of capital to traders by prop firms. This model allows traders to start trading without the usual lengthy vetting process associated with traditional funding methods.

How it Differs from Traditional Funding

Traditional funding often involves rigorous evaluations, capital commitments, and long waiting periods. Instant funding, on the other hand, bypasses these hurdles, offering traders quick access to funds based on their trading potential and performance.

Advantages of Instant Funding Prop Firms

Quick Access to Capital

One of the biggest draws of instant funding prop firms is the speed at which traders can access capital. This allows traders to seize market opportunities without delay.

Flexibility in Trading

These firms provide significant flexibility, allowing traders to employ various strategies without being tied down by stringent rules or substantial personal capital.

Low-Risk Opportunities

For many traders, the risk is a significant barrier. Instant funding prop firms mitigate this by sharing the risk, providing a safety net that encourages more bold and innovative trading approaches.

How Instant Funding Prop Firms Operate

Funding Process

The funding process in these firms is streamlined. Traders typically go through one step evaluation prop firm period, after which they receive immediate capital to start trading.

Requirements for Traders

While requirements can vary, most firms look for traders with a proven track record, a sound trading strategy, and a clear understanding of trading risk management.

Performance Evaluations

Regular performance evaluations are conducted to ensure traders meet specific benchmarks. These evaluations help both the trader and the firm align their strategies for mutual success.

Popular Instant Funding Prop Firms

Overview of Top Firms

Several firms stand out in the instant funding space, each offering unique benefits. Some of the most popular include FTMO, TopstepTrader, and MyForexFunds.

Comparison of Their Offerings

The Talented Trader: Known for its comprehensive evaluation process and generous profit splits.

TopstepTrader: Focuses on futures trading and offers extensive educational resources.

MyForexFunds: Provides a range of account types and flexible funding options.

How to Choose the Right Prop Firm

Factors to Consider

When selecting a prop trading firms, consider factors like the funding amount, profit split, evaluation process, and support services. It's essential to choose a firm that aligns with your trading style and goals.

Questions to Ask

What is the evaluation process like?

How much capital can I access initially?

What are the performance benchmarks?

Are there any hidden fees?

Requirements to Join an Instant Funding Prop Firm

Skills Needed

Successful traders typically possess strong analytical skills, discipline, and a deep understanding of market dynamics.

Trading Experience

While some firms welcome beginners, having prior trading experience can significantly boost your chances of securing funding and succeeding.

Financial Prerequisites

Most firms require a small initial fee to cover the evaluation process. This fee is usually nominal compared to the potential funding amount.

Trading Strategies for Success

Recommended Trading Strategies

Strategies like day trading, swing trading, and scalping are popular among prop traders. Each strategy requires a different approach and level of expertise.

Risk Management Tips

Effective risk management is crucial. Techniques like setting stop-loss orders, diversifying trades, and keeping a trading journal can help mitigate losses and maximize profits.

Common Challenges and Solutions

Dealing with Performance Pressure

Performance pressure is a common challenge. To manage this, set realistic goals, maintain a positive mindset, and avoid overtrading.

Overcoming Trading Losses

Trading losses are inevitable. The key is to learn from them, adapt your strategy, and stay disciplined to bounce back stronger.

The Role of Technology in Instant Funding

Technological Advancements

Technology plays a pivotal role in modern prop trading. Advanced algorithms, AI, and real-time data analytics empower traders to make informed decisions swiftly.

Use of Trading Platforms

Prop firms often provide state-of-the-art trading platforms, offering tools and resources that enhance trading efficiency and effectiveness.

Instant Funding vs. Traditional Prop Trading

Key Differences

Instant funding offers faster access to capital and fewer barriers to entry compared to traditional prop firm trading, which often involves extensive evaluations and higher initial capital requirements.

Pros and Cons of Each

Instant Funding: Pros include quick access and lower risk. Cons might include less comprehensive support and training.

Traditional Prop Trading: Pros include thorough training and higher potential funding. Cons involve longer waiting times and higher initial costs.

Case Studies

Success Stories

Many traders have found success with instant funding prop firms. For example, a trader might secure $100,000 in capital after a brief evaluation and quickly double it through strategic trading.

Lessons Learned from Failed Attempts

On the flip side, some traders fail due to poor risk management or lack of discipline. These cases highlight the importance of a solid strategy and emotional control.

Future of Instant Funding Prop Firms

Emerging Trends

The industry is evolving with trends like AI-driven trading, decentralized finance (DeFi) integrations, and more personalized trader support services.

Predictions for the Industry

Experts predict continued growth for instant funding prop firms, with increasing accessibility and more innovative funding solutions becoming the norm.

Conclusion

Instant funding prop firms are revolutionizing the trading world, offering traders quick access to capital and low-risk opportunities. By understanding how these firms operate and what they offer, traders can make informed decisions and capitalize on the benefits they provide.

Frequently Asked Questions (FAQs):

Q. What is the typical funding amount provided by instant funding prop firms?

The typical funding amount varies but usually ranges from $10,000 to $200,000, depending on the trader's experience and the firm's evaluation process.

Q. Can beginners join an instant funding prop firm?

Yes, some firms welcome beginners, although having some trading experience can increase your chances of success.

Q. How do instant funding prop firms make money?

These firms make money through profit splits with traders, evaluation fees, and sometimes through spreads and commissions on trades.

Q. What happens if I don't meet the trading performance requirements?

If performance requirements aren't met, traders might lose access to their funding or face reevaluation. Some firms offer second chances or retraining programs.

Q. Are there any hidden fees in instant funding prop firms?

While most firms are transparent about their fees, it's essential to read the fine print to ensure there are no unexpected charges.

Blog Source: Unlock Trading Success: The Ultimate Guide to Instant Funding Prop Firms

#Instant funding prop firm#Funded forex accounts#Funded trading accounts#How to pass prop firm account#Prop Firm Trading#Funded trading programs#Prop Trading Firms#Get funded to trade#Prop firms with no time limit#Forex Funding Challenge#Prop firms with instant funding#One step evaluation prop firm#How To Pass Prop Firm Challenge#No minimum trading days prop firm#One Step Prop Firm#Instant Forex Funded Account#Buy forex trading account

0 notes

Text

Smart Prop Trader: Earn a Day Trading Funded Account in Just a Few Hours!

A day trading funded account is when a trader receives funding from a prop trading firm to trade risk-free. This funded trading account allows traders to profit from day-trading futures markets without risking their own capital. Smart Prop Trader offers an incentive for traders where they receive 75% of subsequent profits. Traders who meet the conditions of the firm’s scaling plan can enjoy a 25% increase in their virtual account balance, with the payout ratio automatically changing to 95:5. Being funded removes the worries of trading personal capital, allowing traders to test systems and strategies. It also gives them the chance to be successful in the trading markets.

Build Your Career with SPT’s Funded Trading Account

Get funded by Smart Prop Trader, a prop firm whose interests will surely align with your trading objectives.

Complete the firm’s 2-step evaluation in both its Standard and Pro Challenges and get fully funded with capital allocation of up to $400,000.

Access day trading funded accounts ranging from $5K to $100K in the firm’s Standard Challenge and accounts ranging between $5K and $50K in the firm’s Pro Challenge.

One-time reimbursable trading account fee for accounts in the Standard Challenge ranges between $57 and $497. Trading accounts in the Pro Challenge may cost between $67 and $357.

Join the firm’s Discord channel to chat, comment, share, post, and analyze trading tips and insights. Maximize your profit potential with the firm’s multiple funding sources and huge funding network.

Why Smart Prop Trader Beats the Rest in Competition?

Some exclusive points that make SPT an unmatched choice when it comes to choosing the best day-trading funded account provider are as follows:

Meet 7% and 5% profit targets in the first and second phases of the Standard Challenge and progress as a Smart Prop Trader.

Opt for the Pro Challenge; meet profit targets of 8% and 5% for Phase 1 and Phase 2 to become a successful Smart Prop Trader.

Trade with up to $400,000 allocated as capital and withdraw profits up to 75%.

Perform well consistently and extend your profit split ratio to 95:5 and a 25% increase in your virtual trading account balance.

Get a $ 400,000-day trading-funded account with a maximum 8% drawdown and a daily drawdown of 4% in the firm’s Standard Challenge. Maximum drawdown is set at 12% and daily drawdown at 5% in SPT’s Pro Challenge.

Unlimited profit withdrawals right from Day 1.

24/7 customer support through email, live chat, and phone

Simple and generous referral program where existing traders can earn a commission of 7.5% up to 12.5% of their first paid Smart Prop Trader Challenge price. For 1-9 referrals, you earn a commission of 7.5%, 10% commission for 10-99 referrals, and 12.5% commission for more than 100 referrals.

The firm starts processing your day trading funded account as soon as payment is received. The moment your trading virtual account is created, you will get an email notification with your login credentials to the platform.

So, without delay, make the smart choice and become a funded trader today; contact the support team at Smart Prop Trader via the platform’s 24/7 discord support: https://discord.gg/spt

Register on their website to buy your challenge account, track your account growth, participate in free monthly trading competitions, and join their online community by engaging in tasks for giveaways at https://www.smartproptrader.com/ now!

Follow, Like, Subscribe, and Join it on its social handles for updates on free prop firm account giveaways:

1. YouTube: https://youtube.com/@smartproptrader

2. Twitter: https://twitter.com/SmartPropTrader

3. Instagram: https://instagram.com/smartproptrader?igshid=OGQ5ZDc2ODk2ZA==

0 notes

Text

✮⋆˙ I LUV WHEN WE GET FREAKY ON CAMERA !?

featuring. g. satoru, f. toji, g. suguru, n. kento x afab!reader

warnings. cybersex, camgirl!reader, facetiming, onlyfans account, dirty talking, usage of toys, reader wears lingerie, fingering, anal play, consented video taping, feminine pet names, let’s pretend toji has money okay? okay.

rena’s note. big shoutout to my dawgs @screampied ! would’ve suffered a bad writer’s block if not for them <3 ly pooks

𝐆𝐎𝐉𝐎 𝐒𝐀𝐓𝐎𝐑𝐔

“yeah baby~ fuck, arch your back just like that—shit!”

you complied to his request, moaning as you arch your back and push your hips backwards, deepening the angle of which your dildo penetrated inside of you.

from your facetime call, you faced the camera and propped your dildo to the wall behind you. you watched as your ass recoiled like waves, flesh bouncing off the wall in hypnotic motions, giving your boyfriend the pov he demanded at the start of this call.

you watched through your laptop screen as your boyfriend held his cock tightly with one hand, his other hand propped at the back of his head. his stomach clenched tightly as he matched your pace with his jerks. your wet squelches filled the atmosphere followed by your moans, arms stretched out to claw at the silk sheets on your bed.

“mmh—fuck baby, wish you were h-here right now,” you whine, bringing your fingertips to your lolled out tongue, coating the digits with your saliva, before slipping them between your thighs to focus on your neglected clit.

drawing figure eights to the bundle of nerves, your cheek smushed against the mattress, face heating and tears streaking down your cheeks.

bottom lip tucked in his teeth, gojo narrows his cerulean eyes to zero in on your figure, the sounds of your creamy pussy rocking back and forth on your dildo, your teary eyes watching him with such want— and fuck if he doesn’t wish this conference meeting overseas would end so he could blow your back out.

“i know, ‘m sorry— hah, princess,” he whines, thumbing his leaking slit as the hand behind his hair starts to grip at his own locks. the stinging feeling reminded him of you and it only turned him on further.

“just a f—few more days, yeah? and i’m all yours, promise baby, wait out for me,” he prods further, upset at the fact he has to reach out to you virtually. even behind the low quality of your camera, you shone like an angel sent from heaven, lashes wet with tears and your lips glistening from your smeared gloss.

you nod your head, before fluttering your eyes close as your gut begins to coil. your limbs grow hot and limp, toes curling and you up the pace of your rocking, the drag of the customized silicone dildo against your velvety walls stretching you in ways that reminded you an awful lot of your boyfriend.

“toru—fuck, i’m cumming!” you arch your back deeper, chest pressed flat against the mattress, fingernails scratching the softness of your sheets.

gojo had been on the brink of an orgasm eons ago, but he held back for you. to him, nothing beat busting a nut at the same time you did. his snowy white hair matted to his forehead, cheeks flushed a pretty red as he now focuses on his stiff cock with two firm hands.

he mimics circular motions you usually do, fighting to keep his eyes open as his orgasm washes over him just from the sight of your cries alone. your body shudders, your own orgasm washing over you from head to toe as you mewl out his name, spraying your juices all over the wall behind you and down your plush thighs.

your back arches outwards and you’re drooling all over yourself but gojo doesn’t think he’s seen anything prettier in his entire life.

“shit—oh fuck, cum for me princess, make a mess all over—ngh, yourself for me—my perfect fuckin’ girl.”

𝐅𝐔𝐒𝐇𝐈𝐆𝐔𝐑𝐎 𝐓𝐎𝐉𝐈

“welcome back everyone~”

there was something terribly sinful in the way the girl currently clothed in skimpy lingerie, fingers rubbing at her pussy in lazy circles with a dildo to her lips, tip of the toy teasingly grazing at her pink tongue—was also the same girl toji paid money to babysit his kid whenever he was away at work.

toji was no good man. this was definitely wrong on many personal levels, but alas he was still a man, if the way his dick hardened painfully quick at the sound of your honeyed voice alone.

he shifts in his chair, leaning back into it as he palms his hard on through his sweats. he watches with narrowed green orbs as you finally swallow the silicone toy down your throat, the dildo lubed in your saliva whenever it came out of contact from your mouth.

“wishin’ it was your fat cock instead, mmh,” you swirl your tongue around the dildo, before arriving to the tip and latching your plump lips around it.

you simultaneously increase the speed at your folds, fingers soon growing sticky with your essence as the obscene wetness fills the room. you moan around the toy, spreading your lips for the camera while clenching around nothing.

dick long freed from his pants and tucked tightly in his fist, toji groans as he watches your pretty pussy flutter and basically beg for him to fill you up. he hacks up some spit and drips it down on his girthy length, before roughly going back to jerking at his dick.

“i wonder which one of my lucky viewers is gonna get to fuck me next live?” you breathlessly giggle, before lowering the dildo in your free hand to your gaping cunt.

your comments flood with praises and pleasantries, with money flowing in easily—anything to capture your attention and have you notice them. they’re desperate, toji thinks, but realizes he’s definitely no better—hands already moving to donate a much bigger sum than whatever pussydestroyer69 could ever offer you.

“ooh, four bills is a hefty amount,” you tilt your head to the side, your pretty lips stretched in a perfect smile. you giggle when the comments start to insult toji but he’s too far enamoured in the way your free hand now travelled to your breast, groping at the mounds and flicking at your stiff buds.

you return to the regular programming, pressing the tip of your dildo to your cunt, dragging it up and down your wet folds, teasing yourself with your legs spread open for the viewers to see.

“fuck— this feels amazing, mmh, ‘m sooo sensitive,” you whine, applying a small amount of pressure to slightly push the tip in but pull it back out.

this was torturous— your thong pushed to the side to reveal your puffy lips as it leaked your essence. toji let his mind run to how badly he wanted to taste you. he was sure you’d be as sweet as honey, a potent taste on his tongue, and the thought of you face down with your ass up, begging for him to eat you out had his balls tightening with eagerness.

“fuckin’ shit— what a tease.” toji grunts, throwing his head back as he rubs the callouses at his palms against his veiny skin. his hips jerked up in anticipation, feeling his limbs run hot while his thumb circled at his reddened tip.

“y’wanna fuck my gaping pussy? yeah, ‘m all wet and tight just for you— hnng, bet i’d have you cumming quicker than you ever had~” you taunt, and finally push the toy all the way in, moaning at the stretch of the toy at your pussy.

your toes curl and you tighten your hold at your tits, slowly thrusting the dildo in and out of your cunt, the slick sound of the friction enticing toji as he matches your pace, fanged teeth biting down at his bottom lip.

you pout your bottom lip, small whines escaping your throat as you fuck yourself desperately. “feels’good— shit, need you to fuck me daddy!”

call him delusional but he felt you spoke to him and not the rest of these bums, legs opened and pussy clenching down at the dripping toy, as your hips rocked upwards to try and meet the dildo for further pleasure.

the telltale of his dick twitching uncontrollably told he was on the brink of an orgasm, one that has him cursing incessantly and brings sweat to his hairline. he pries his eyes open, refusing to miss out on how your folds get abused by yourself, multitasking between thrusting inside and attacking your clit.

“‘m gonna cum daddy—please lemme cum—ngh!” you plead, and as if some force between the two of you is pulled, you spray your essence all over yourself, slick dripping down your sheets and wetting your lingerie, staining your panties soaked as toji calls out your name, hips bucking into his tight fist as ropes of hot cum are pulled out of him.

“there we go baby—damn, keep creamin’ just like that.”

𝐆𝐄𝐓𝐎 𝐒𝐔𝐆𝐔𝐑𝐔

“c’mon mama—don’t you let up, fuck, keep bouncin’ f’me.”

you whined some more, thighs aching and trembling from your consistent riding mixed with the added stimulation to your rim from your gifted anal plug. behind you was geto’s set up, computer camera propped as your back faced it, with geto seated at the edge of the bed.

hands planted firmly onto his chest, you stabilized yourself as you continued to rock your hips, dragging yourself up and down on his inches of dick, feeling his hardness stretch out your walls.

“sugu, ‘s too much— shit, want you to fuck me already!” you moaned, leaning your head downward to his broad shoulders, forehead slippery with sweat.

geto chuckled at your neediness, clicking his tongue as he lands a firm slap to your reddened ass. you all but moaned, hips moving back and forth as you clenched your mounds around his cock.

“but baby,” geto complains mockingly, slipping his hand in between your bodies and thumbing at your swollen clit. “y’wouldn’t wanna disappoint your fans, would ya?”

as he spoke, he glanced over your shoulder to check the comment section, as it was filled with numerous donations, praises as well as degradations. the more his viewers donated money to him, the quicker the toy plugged in your ass vibrated.

the triple stimulation had your brain gone to mush, your golden spot brutally toyed with as the foreign but pleasurable feeling in your puckered hole stretched it out, added with the circles at your bundle of nerves, sending shivers all throughout your body.

“uhn uhn,” you shake your head, all but against the idea of ruining his live stream simply because you were tired. more than anything, you wanted to cum, even if it had been in the most torturous way you could think of.

“that’s my good girl,” geto presses his lips at the crane of your head. his praise sends tingles in your belly, core licking with heat. his hands find their way to your ass cheeks, groping the soft mounds as encouragement, the actions causing a shift in the toy to be pushed slightly deeper inside of you.

“f-fuck—don’t do that, i’ll cum!” you complain, arching your chest into his, sensitive nipples brushing into his own.

the creamy mess at the base of his cock clearly accessible to the viewers sent a massive amount of money right into geto’s account and straight to your ass, as you jolted into his hold, clinging your arms around his neck.

“holy shit—one thousand?” geto asks breathlessly, followed by immediate more pinging indicating more donations. “you’re a hit baby—they fuckin’ love this pussy. too bad it’s all fuckin’ mine though, hah,”

you’re flattered by it all, and hit with a final wave of confidence before you’re sure the dam in your gut will snap, you push him back to lay on his bed. geto watches you with a cocked brow and smug smile, baby hairs messily framing his flushed skin.

“oh?” he asks, amused by the sudden turn of events. he never lets go of your hips, instead tightening his hold on you as you plant your feet to the mattress.

you hop up and down, his dick nearly slipping by how far up you rode him, with your palms pressed against the plane of his abs. feeling tears build up at your lash line, you moan and wail, dick penetrating deep into your cunt deliciously.

“fuckin’ ride this dick, ‘s all yours mama—shit, gonna make me cum all inside that pretty pussy, mmh. give it all t’me,”

it doesn’t take much between his constant praising, the slickness of your wetness around his cock and the additional vibrations to your ass to have you cumming hard around him. you clamp your walls down, momentarily pausing your riding as you let it take over your entire body.

geto comes through, hips bucking upwards to further your orgasm and you’re sure you momentarily blacked out, eyes rolling to the back of your head as your tongue lolls out of your mouth.

“what a pretty fuckin’ face baby, all mine. goddamn, ‘s too bad your biggest fan won’t get to see it— ain’t that right, satoru?”

𝐍𝐀𝐍𝐀𝐌𝐈 𝐊𝐄𝐍𝐓𝐎

“k-kento—oh fuck daddy, ‘s so fucking deep!”

his wrist ached as he worked his way up and down his cock, tip throbbing an angry red. he watched himself hold your waist with one grip of his hand, the other propped up to film the lewd scenery, capturing you in all your glory.

nanami maintained a steady focus, pistonning into your cunt at a ruthless pace, a ruthless angle, and judging by the sound of your broken moans, he was thrusting into that spot that had you seeing stars and slurring your words.

on the screen showed you face down with your ass up, hands bind by his tie behind your back, face planted into his bed as he fucked into you passionately. your pussy gripped onto his cock greedily, sucking him in as the ripples of your ass bounced on his pelvis.

“my perfect girl, fuck, keep taking it just like that.” his large hand held at your waist firmly, bottoming out just to pull out all the way to where your lips latched at his tip, coating his dick in your creamy essence.

his hand made it to the top of his shaft, and when the screen presented him an erotic view of both your body fluids— semen, juices, sweat— sticking between both your damp skin, where you lowered yourself on his cock and where he pushed forward to fasten the process, his thumb grazed over his slit tauntingly, the same way he’s seen you done it dozens of times.

it’d never occur to him that watching himself plow into you would turn him on so, but you were so far away and he was immensely turned on.

his button down now unbuttoned, his chest heaved up and down as he panted heavily, sliding his other hand down to cup at his balls, the way you’ve done to him so many times. he winces at the feeling, dick painfully hard as it twitches in his hold.

“holy fuck— my perfect fuckin’ girl, shit.” he groans, narrowing his eyes to focus on the hypnotic sight that had his erection crying impossibly further.

the sight of you unable to do anything but take his dick like the slut you were made to be for him had him curling his feet and thighs tremble rather quickly. your fingers twitched as you begged him to free you, to let you touch him, but all that resorted to was your ass getting slapped for your disobedience.

“behave princess.” nanami warned you while rubbing his hand at the reddened skin, and you whined a ‘m so sorry daddy but obeyed nonetheless, and whatever kink triggered in nanami activated, as he jerked off faster, desperate to chase that release.

in the video, nanami pulled his dick out momentarily, causing you to cry out at your pussy’s emptiness. lowering the camera to your abused cunt, your pink walls gaped and clenched around nothing, practically calling out for him to fill the void. he chuckles behind his phone, before grabbing at his cock and lining himself at your entrance, teasing your folds by dragging his tip up and down before bottoming out again.

“fuckin’ hell, i need you right now,” nanami cussed, wanting nothing more than to feel your warmth around his cock instead of his own hand, to feel you clamp and suck him into your pussy, to have you squirt on his cock and still beg him for more despite your sensitivity.

between the pornographic sight of your cunt clenching down on his cock, your asshole winking at him, the recoil of your ass onto him and the sinful arch of your back, nanami soon painted his fist white in his cum, head thrown back as he was overtaken by an orgasm.

“damn it—shit, just like that princess—keep gripping onto me, gonna fill that pretty pussy full of my cum.”

yes, gojo was the generous donator on geto’s live stream. pervert

#rena☆star.#www.tumblr.com/satorena#jujutsu kaisen#jjk#jujutsu kaisen x reader#jujutsu kaisen smut#jjk x reader#jjk smut#jjk x you#gojo satoru#gojo satoru x reader#gojo satoru smut#gojo x reader#gojo smut#toji fushiguro#toji fushiguro smut#toji fushigro x reader#toji x reader#toji smut

11K notes

·

View notes

Text

Serving Up Romance

Author’s Note: Guys holy FUCK y’all have blown up my account!! Thank you all so much! I just can’t believe it like i'm going bonkers. Thank you so much for all your kind words and everything!! Also, I can’t believe I’ve never written for 80s Stan that’s crazy. (Also i know he’s never worn a denim jacket but i had a vision)

“Serving up Romance”

You had been working as a waitress at Greasy’s Diner since you first moved to the strange town of Gravity Falls. While others might turn their nose up at waitressing, you loved it. You got the opportunity to know everyone in town, hear their gossip, and meet passer-bys driving through on road trips. You never knew who was going to walk through those doors or what incredible story they were going to tell you. One slow day at the diner, you were making a pot of coffee when you heard the bell above the door jingle.

“Welcome to Greasy’s! Sit wherever you want, and I’ll be with you in just a sec,” you called out, pouring water into the coffee maker. You heard someone sit at the swivel stool behind you.

“Take your time, doll. I’m in no rush,” a gruff voice responded. Hm. You didn’t recognize that tone. You turned around to see a man with dark brown hair in a white t-shirt and denim jacket, chewing on a toothpick. You noticed that there were patches of different fabrics and patterns all over the jacket. He hadn’t noticed you were looking at him because he was reading the small menu that was attached to the metal condiment holder.

You smiled at him. “I like your jacket,” you complimented the handsome stranger.

His attention quickly diverted to you. He chuckled. “Oh, this old thing?” He lifted up his arms to show off more of his patches. “Thanks. It’s been through the ringer let me tell ya. My ma taught me how to hand stitch so that any time I ripped it, I could fix it right up.”

“That’s so sweet.” You reached out to point at one that was yellow with small, red flowers on his shoulder. “I like this one.” He looked over to see which one you were talking about and laughed.

“That one I got from a motel pillow case! I accidentally caught my shoulder on fire.” You raised your eyebrows at him. His gaze became stern. “I learned to keep my distance from candles that day on.”

You burst out laughing. “Now is this a true story?” you asked, propping your chin up on the palm of your hand.

He grinned, moving his toothpick to the other side of his mouth. “True as you are pretty, sweetheart.”

You giggled as a blush started to spread across your cheeks.“Alright, slick, what can I get you?” you responded, removing a notepad from the front pocket of your apron. He picked up the menu and gave it a quick once over.

“Uh… Give me the bacon and eggs. Scrambled, please, and one cup of coffee.” You finished scribbling his order and turned to put it in the window.

“Can I get a name for this order?” you asked, winking at him from the coffee pot. You began to walk back over to him with a mug of black coffee.

He gave you a wide smile. “Stan Pines, proprietor of The Mystery Shack,” he answered, hand outreached to you in greeting.

“Y/N Y/L/N, waitress at Greasy’s Diner.” You shook his hand; it was firm, calloused, and felt very nice against your smooth skin. You turned over his hand to take a look at his scarred knuckles you noticed when he was holding the menu earlier. You dragged your thumb over the puckered, white lines.

“You got fighting hands, Stan.” You gazed at him through your lashes and grinned.“Sexy.” Now it was his turn to be flustered. His face grew red at your bold statement and laughed nervously.

“Thank you.” He cleared his throat. “I, uh, used to box, and I’ve gotten myself into a fair share of…scuffles.” You gave him a small smile. You were about to comment on that until the bell dinged from the window signaling that his food was done.

“Bacon and eggs are up!” the chef barked. His loud voice startled you which made Stan laugh.

“Sorry, let me get your food real quick.” You let go of his hand reluctantly and went to get his plate. What you didn’t see was him smirking to himself and touching the scars you grazed. He couldn’t remember the last time someone genuinely complimented him.

Things started to pick up after you served Stan his food, so you didn’t get to continue your conversation. However, you made sure that when he paid for his meal, you got to talk to him one last time.

“Will I be seeing you again, Stan?” you asked, getting his change from the cash register. “You should come next Tuesday! We serve waffle tacos then.” He laughed as you dropped the coins into his hand.

“Well, I obviously can’t miss waffle tacos,” he responded with a smile.

“I’ll see you then. It was nice to meet you, Stan! Don’t go catching yourself on fire on your way out!” you joked as he began walking towards the exit.

“No promises, doll.”

Over the next couple weeks, Stan continued to come into the diner and sit in the same swivel stool as he did when you first met him. He ordered a different thing on the menu each time making it his goal to try everything you had to offer. Your conversations were playful, flirty, but, most of all, interesting. He had quite the colorful past, but that didn’t scare you off. In fact, it made you more intrigued.

One day, during a particularly busy shift, Stan walked in as always. “Hey, hon!” you greeted him while placing a plate of pancakes in front of a fussy toddler. “I’ll be right with ya!” You then noticed he had one of his hands behind his back, and he seemed a bit nervous.

He didn’t sit down this time, but instead stood at the cash register. You walked over with a confused expression on your face. “Stan? Are you not eating today?”

“Um, well, no. Not today, doll. I, uh, wanted to give you these.” His face was bright pink as he presented you with a large bouquet of wildflowers. You gasped. “I hope you like them. I found a whole bunch of them in a field near one of the backroads.”

“Oh, Stan,” you said softly. You took the bouquet from him and held it gently, admiring it. “It’s just beautiful, but why?”

He started to rub the back of his neck and looked down at his feet. “There’s a drive-in movie happening tonight outside of town, and I wanted to take you with me,” he murmured shyly. “I think you’re real nice and fun to talk to and you got a knock-out smile.” He paused. “I would…like to get to know you outside the diner.” He finally made eye contact with you to see your reaction to everything he had said.

You hadn’t stopped beaming at him since he handed you the flowers. “Stan, I would love to join you.” You reached out to cup his face with your free hand and gave him a peck on his cheek, his stubble tickling your lips. “What time should I be expecting you?”

His eyes widened at you, his hand touching where you had kissed him. “Um, I. The, uh, movie starts at 7:45, so I’ll pick you up at 7:00,” he stammered, face as red as his Diablo.

“Sounds good, sugar,” you replied, giving him a slip of paper that you had written your address on while he was talking. “I can’t wait to see what tricks a romantic like you has up his sleeves.”

Stan let out a giggle before quickly covering it up by clearing his throat. “I guess you’ll have to find out tonight. I’ll see you then, sweetheart.” He gave your hand a squeeze before walking out the way he came in.

“I’m going on a date with Mr. Mystery,” you whispered to yourself excitedly, burying your nose in the bouquet.

PART 2 COMING SOON

#ford pines#gravity falls#grunkle ford#grunkle stan#stanley pines#ford pines x reader#stanford pines#imagine#pines family#fluff#stan pines#stan pines x reader#gravity falls fandom#gravity falls fanfiction

366 notes

·

View notes

Text

Trading Prop Firms

refers to trading accounts provided by proprietary trading firms, enabling traders to access capital and engage in trading activities. These accounts often come with unique features, such as leverage, risk management tools, and access to proprietary trading strategies. Traders can benefit from these accounts to amplify their trading capacity and potentially increase profitability.

#Prop Firm Accounts#Free Prop Firm Challenge#Prop Firm Account#Instant Funding Prop Firm#Bespoke Prop Firm#Trading Prop Firms#Funded Trader Prop Firm#Forex Prop Trading#Prop Funding

0 notes

Text

One step funding prop firm

Get funded quickly with our one-step funding prop firm. At The Talented Trader, we offer a streamlined funding process for skilled traders looking to trade with firm capital. No complex evaluations or multi-step challenges—just prove your trading skills in one step and start trading live capital. More: https://www.thetalentedtrader.com/one-step-funding-prop-firm/

#onestepevaluation #trading #forextrading #fundedtraderprograms #proptrading #usa #newyork #instantfundingpropfirm #passpropfirm #propfirms #propfirmchallenge #instantfunding #thetalentedtrader

#One step funding prop firm#prop firms#funded trading accounts#cheapest prop firms#trading risk management#proprietary trading firm#instant funding prop firm#prop firm trading#prop firm challenge#prop firms instant funding#the talented trader

0 notes

Text

How do Forex trading contests work and What is the process for entering Forex contests?

The Preface – The Thrill of Forex Trading Contests:

Forex trading contests offer a thrilling and rewarding opportunity for traders of all levels. Competitions like these are the venues where you can show off your talent, try out your ideas and possibly make a lot of money. In this detailed manual, we will discuss the ins and outs of forex trading competitions including what they are all about, why people take part in them, and how to succeed in them.

Knowing the operation of forex brokers’ contest operations and having the right strategies can help in improving one’s trade journey while giving rise to more development and success.

What are Forex Trading Contests?

In a forex trading contest, participants compete for the highest profit or return on investment (ROI) over a given timeframe using either demo or live accounts. Forex brokers, trading platforms, and independent organizations can all host such contests.

How Forex Trading Contests Work?

Registration: For each contest, participants register and open a trading account.

Deposit: In some cases, it may be necessary to make a deposit in order to take part.

Trading Period: Forex brokers’ contest organizers set the trading period which may last from days to weeks and even months.

Trading: Participants perform trade activities with their respective accounts for the purpose of getting maximum profit or ROI in the specified period.

Evaluation: The accounts of participants are evaluated at the end of trading period using performance measurements.

Prize Distribution: Awards are given to winners as cash, trading bonuses or other rewards.

Types of Forex Trading Contests:

Demo Account Contests: In these contests, the contestants can use demo accounts to trade and yet risk nothing in their own funds.

Live Account Contests: To participate in such trading competitions, a trader has to use real money.

Risk-Free Contests: There are some tournaments that provide risk-free participation whereby participants can win prizes even when they lose.

Time-Based Contests: This type of forex contest is one that has a certain period, like a day, week or month.

Profit-Based Contests: Normally in this type of competition there is an evaluation of total profit for all participants in the given span.

Highest Return on Investment (ROI) Contests: Under these competitions, percentages of how much money has been made out of the original amount serve as judging criteria.

Correctness Competitions: The goal of these trading competitions is to make true guesses about the market trends.

Minimum Loss Contests: The aim of these competitions is to minimize the losses that occur during the competition.

Team Competitions: These are events where groups of traders compete against each other.

Contests for education: There are certain competitions that comprise instructional parts like webinars or workshops so that participants can enhance their trading capabilities.

These instances provide only a glimpse into the various kinds of forex trading contests. The specific contest might differ from one organizer to another or depend on the targeted group.

Benefits of Participating in Forex Trading Contests:

Competitions give you a chance to check your exchange talents and find out where you need more work.

Meet different merchants and learn from their methods.

Get familiar with FX markets and create your name.

You can obtain financial awards, trading bonuses or some other valuable prizes.

The reasons why competitions can be so motivating and inspirational are many.

Achieving success in a competition helps to enhance one’s belief in self and the psychology of trading.

Educational resources as well as webinars are available in many competitions to help the participants improve their skills.

Performances that are impressive in the forex trading contest can also lead to better job opportunities.

Tips for Success in Forex Trading Contests:

Practice Regularly: In forex trading competitions, persistent exercising is obligatory for triumph. Furthermore, if you trade frequently, you will learn more about market dynamics and how to come up with informed choices.

Develop a Solid Trading Strategy: A concise trading plan detailing your risk management method, entry and exit points as well as position sizes must be in place. Consequently, adhere to the strategy and resist spontaneous actions.

Manage Risk Effectively: Implement effective risk management strategies to protect your capital and limit losses. Use stop-loss and take-profit orders to control your risk exposure.

Stay Informed: Keep up-to-date with market news, economic indicators, and geopolitical events that can impact the forex market.

Network with Other Traders: Connect with other participants in the contest and learn from their experiences and strategies.

Final Analysis:

Forex trading contests offer a thrilling opportunity to test your skills, compete against other traders, and potentially win substantial prizes. By understanding the rules, developing a solid trading strategy, and practicing regularly, you can increase your chances of success in these competitions.

Remember, the key to success in forex trading contests lies in a combination of skill, knowledge, and discipline. By honing your trading abilities and staying informed about market trends, you can position yourself for success in this exciting and competitive field.

#best prop firms#prop firms#fxproptech#proptech#funded trading accounts#forex prop firms funded account#prop trading firms#my funded fx#best trading platform

0 notes

Text

How to pass prop firm account | The Talented Trader

Unlock the secrets, how to pass prop firm account with ease at The Talented Trader. Discover expert tips, proven strategies, and invaluable insights to navigate the challenges and maximize success in prop trading.

Whether you're a novice trader or seasoned professional, our comprehensive guide offers step-by-step guidance to conquer the prop firm account challenge and achieve your trading goals. Explore now and embark on your journey to prop trading success with confidence. Learn more: https://www.thetalentedtrader.com/how-to-pass-prop-firm-account

Company Name: The Talented Trader

Address: Champlain, New York, USA - 12919

Email: [email protected]

Discord Link: https://discord.gg/edrPkWSh3w

#proprietarytradingfirm #cheapestpropfirms #leverageintrading #trading #usa #newyork #unitedstates #champlain #forextrading #fundedtraderprograms #proptrading #instantfundingpropfirm #fundedtradingaccounts #propfirms #propfirmchallenge #instantfunding #thetalentedtrader #talentedtrader

#the talented trader#talented trader#instant funding prop firm#prop firms instant funding#prop firm challenge#prop firms#funded trading accounts#trading risk management#funded trader challenges#prop trading#How to pass prop firm account

0 notes

Text

Get Funded to Trade: Unlocking Capital for Aspiring Traders

With My Funded Capital, you can unleash your trading potential! Get funded to trade and the capital you require to advance your trading career. Our funding initiatives are intended to assist aspiring traders by giving them access to the capital and instruments required to be successful in the markets. Invest with confidence by signing up with My Funded Capital right now!

Visit our website for more information:

0 notes

Text

BROKEN BABE

SAN / FEM READER

⤏ Synopsis: A minute and 30-second clip of you getting railed by your boyfriend has skyrocketed to the top of a subreddit.

⤏ Genre(s): drabble*, smut smut smut

⤏ Content: cam couple!au, established relationship!au, non-idol!au

⤏ NSFW Warning(s): unprotected piv sex (use your rubbers and stay safe), choking, dacryphilia (I guess??), creampie, lewd comments

⤏ Note*: this content is completely fictional.

The slew of new subscribers rolling in from the past few days was a surprise to say the least. Having started a little over two years ago after discussing carefully with your boyfriend, you both agreed that your part-time jobs were just barely enough to get you two by as college students. And as unoriginal as it was, you agreed to open an account to post adult content, grasping onto whatever hope you had left of earning extra income. Though you hadn’t really gained much traction with a mere 2,051 subscribers, and ultimately put your little stint on the backburner.

But you were tired of consuming instant ramen every night on your incredibly stiff couch, tired of getting emails from job applications telling you that they’ve decided to move on with other candidates, and tired of sinking your body into the thin mattress you shared with your boyfriend. You loathed seeing the thumbnails of girls feigning happy-shock with titles enticing viewers with how they made 200 grand, wishing it were you. And for two years, you stayed that way: dejected, sleep-deprived and with only your beloved by your side to woe in misery with you.

But that was until your phone began to jitter and buzz constantly, begging to tell you what the fuss was all about. And that’s when you picked it up and darted to the bathroom, calling out his name and receiving a jolt of mild surprise from San. He’s in all his naked glory with his fingers tangled in his sud-blanketed hair, water pelting at his skin. If you weren’t so preoccupied with the news, you would’ve spent a good, long time taking a mental picture of him.

“You startled me,” he chided, softly.

“Look!” you said with haste, panning the screen toward him.

He smoothed his palms over his face, fanning away the drops of water before squinting his eyes. With his brows furrowed, he looked at you and asked, “Where’d all this come from?”

You didn’t have an answer for him, shrugging your shoulders with an optimistic glimmer in your eyes. And what neither of you were aware of was that this surge of growth was all thanks to a short clip of you getting fucked stupid finding its place on the top of a subreddit.

u/10_TreasureChest_24 • 5d • redgifs

A good boyfriend knows how to break his girlfriend

With your phone propped clumsily against your bottle of lotion, you stayed in frame as it recorded you in 1080p, getting fucked by your boyfriend on your good-for-nothing mattress. The bed frame croaked and squeaked under the pressure of each harsh thrust of his hips and the pathetic squirms of your pliant body. You laid flat on your tummy, fingers twisting the sheets while you helplessly accepted each force his cock imposed in your cunt. Your moans were guttural and broken, and from your neck to your face, you were flushed and burning up.

One hand of his released its firm grip on your breast and made way to your neck, fingers pressing just enough to render you putty under him. If you weren’t so fucked out, you’d swipe away the drool stringing from your lips and the tears running free down your cheeks. But how could you focus on anything other than the cock relentlessly stroking your walls? For once in a while, there were no worries in your mind because the man pinning you down gave you no chance to think straight.

You felt his lips graze your cheek before he muttered, “You okay, Baby?”

A few beats were what it took for you to register his question, before answering with a keen hum.

Warning you with a sharp smack to the side of your thigh, he ordered, “I want a yes or a no.”

“A-Ah…yes—yes, yes, yes! Please"—you swallowed, kicking your feet up behind you—"please, keep g-going!”

“That’s my good girl,” he grunted. “Gonna cum? Can you do that for me, Baby?”

You couldn’t pinpoint how many yeses you spewed from your spit-pooled mouth, while your trembling thighs sandwiched together in a piss-poor attempt to regain any bit of control you had left. Your pussy fluttered around his cock as you saw black, eyes rolling to the back of your skull when you finally reached climax. Every muscle in your body froze in time, and a shiver skimmed down your spine while you waited patiently for him to cum. It felt like hours for you, the overstimulation pushing and pulling you between pleasure and pain until he had completely hunched himself on top of you.

With a lazy smile, you happily milked his load in your cunt and cherished the way his cock throbbed with each pump of his seed. No words were spoken and none needn’t to be. This was pure bliss, and you wanted to soak it in with every selfish fiber of your being. The giggles you shared together almost made it seem like you hadn’t just been choked, plowed into and used as a cum dump. When you were left empty between your legs, you flipped onto your back with your jelly-like limbs sprawled out on the mattress.

If you weren’t so fucked out, you would’ve jumped him again when he crawled and hovered over you with his lips curled into a wolfish smirk.

“I’ll be back,” he murmured, sinking his teeth playfully into the flesh of your breast before pushing himself off.

BEST COMMENTS

fanunesven 5d

Holy fuck he really broke her

hornypoptart17_ 5d

sauce???

thisisathrowaway__21 3d

i need a man to fuck me dumb like this– and those arms 😍 she’s a lucky girl

amazingorgeouspiderman 3d

How the hell did they manage to make rough sex look so wholesome

dinoartistic 4d

Who are they? Names??

Replenish_Clever 3d

that cute little smile she makes when he cums in her tho. mmm…she likes it

interested_lucky23 5d

And that’s how she falls in love

notonmahmahway 1d

Damn, she took it like a champ

#ateez smut#ateez imagines#ateez scenarios#ateez drabbles#kpop smut#choi san smut#ateez san smut#san smut#ateez x reader

2K notes

·

View notes

Text

The long, bloody lineage of private equity's looting

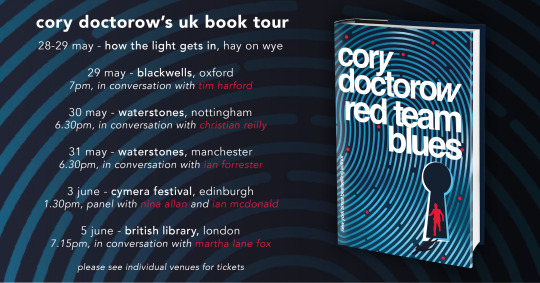

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”