#GST Practitioner Course

Explore tagged Tumblr posts

Text

Top Institutes Offering GST Practitioner Courses in India

The Labor and products Duty (GST) has changed the Indian tax collection framework, spurring an interest for talented experts who can oversee GST-related errands. A GST Expert Course is a particular program intended to outfit people with the information and abilities expected to fill in as guaranteed GST specialists.

If you’re thinking about a profession in tax collection or need to grow your skill in monetary consistence, signing up for a GST Expert Course can be a distinct advantage. This article investigates all that you want to be familiar with the course, including its advantages, structure, vocation possibilities, and how to get everything rolling.

What is a GST Specialist Course?

A GST Expert Course is an expert preparation program pointed toward instructing people about GST regulations, guidelines, consistence techniques, and documenting necessities. It plans contender to become confirmed GST experts, empowering them to help organizations and people in gathering their GST commitments.

Why Pick a GST Professional Course?

Here are a few justifications for why this course merits considering:

1. Appeal for GST Specialists

The execution of GST has provoked a consistent interest for gifted experts who can explore its intricacies.

2. Rewarding Profession Open doors

GST experts can acquire well by offering types of assistance, for example, charge documenting, consistence the board, and warning to organizations.

3. Enterprising Possibilities

Subsequent to following through with the tasks, you can begin your training and fabricate a client base, offering GST-related benefits freely.

4. Esteem Expansion for Experts

For bookkeepers, charge experts, and money experts, this course increases the value of their range of abilities.

Qualification to Turn into a GST Expert

Prior to signing up for a GST Professional Course, guarantee you meet the accompanying qualification models to enroll as a GST Expert with the GST Organization (GSTN):

Indian citizenship.

An advanced education in business, regulation, banking, or related fields, or comparable capabilities.

Working information on bookkeeping or tax collection.

What Does the GST Professional Course Cover?

The course educational plan is intended to give inside and out information on GST regulations, consistence methods, and down to earth applications. Here is a breakdown of the center points covered:

1. Prologue to GST

History and advancement of roundabout charges in India.

Goals and advantages of GST.

2. GST Enlistment

Sorts of GST enrollments.

Qualification standards and enrollment process.

Figuring out GSTIN (GST Recognizable proof Number).

3. GST Brings Documenting back

Kinds of GST returns (GSTR-1, GSTR-3B, and so forth.).

Cutoff times and recording methodology.

Normal mistakes and their goal.

4. Input Tax break (ITC)

Idea and advantages of ITC.

Conditions for guaranteeing ITC.

Compromise of ITC with GSTR-2A.

5. GST Consistence and Punishments

Consistence prerequisites for organizations.

Outcomes of resistance.

Question goal components.

6. GST Review and Evaluation

GST review methodology.

Evaluation types and rules.

Dealing with reviews by charge specialists.

7. Pragmatic Preparation

Active preparation in GST recording programming.

Contextual analyses and recreations.

Client association and true situations.

Advantages of a GST Specialist Course

1. Thorough Information

The course gives a careful comprehension of GST, making you capable in all parts of the tax collection framework.

2. Pragmatic Abilities

Through involved preparing and contextual investigations, you gain pragmatic experience that sets you up for certifiable difficulties.

3. Confirmation and Acknowledgment

After finishing the tasks, you get a certificate that adds believability to your profile and improves your expert standing.

4. Organizing Amazing open doors

The course permits you to interface with industry experts, tutors, and companions, extending your expert organization.

The most effective method to Sign up for a GST Expert Course

Stage 1: Pick the Right Establishment

Select a rumored establishment that offers a very much organized GST Specialist Course. Search for the accompanying:

Authorization and acknowledgment.

Experienced staff.

Situation help and industry associations.

Stage 2: Comprehend the Course Charge and Length

The course charge commonly goes somewhere in the range of ₹10,000 and ₹25,000, contingent upon the organization. The span is by and large somewhere in the range of 1 and 90 days.

Stage 3: Register for the Course

Complete the enrollment cycle by giving the necessary records and paying the expense.

Vocation Valuable open doors In the wake of Finishing a GST Expert Course

In the wake of finishing the tasks and enlisting with GSTN, you can seek after the accompanying jobs:

1. Autonomous GST Specialist

Offer GST-related administrations to people and organizations, like documenting returns, enlistments, and consistence the board.

2. Charge Advisor

Function as a specialist for firms, prompting on GST consistence, charge arranging, and question goal.

3. Bookkeeper or Money Leader

Join an organization’s money or bookkeeping office to oversee GST filings, ITC compromise, and consistence.

4. Coach or Teacher

Share your insight by turning into a GST coach, helping other people find out about GST guidelines and techniques.

Compensation Possibilities for GST Experts

The acquiring potential for GST experts relies upon variables like insight, area, and customer base. Overall:

Fledglings can acquire ₹20,000 to ₹30,000 each month.

Experienced professionals can procure ₹50,000 to ₹1,00,000 each month or more, particularly with a different client base.

Ways to succeed as a GST Expert

1. Remain Refreshed

GST regulations are dynamic, so it’s fundamental for stay up to date with the most recent revisions and notices.

2. Construct Solid Relational abilities

Clear correspondence is crucial for making sense of assessment ideas and consistence necessities for clients.

3. Influence Innovation

Dive more deeply into GST recording programming and apparatuses to further develop effectiveness and precision.

4. Grow Your Insight Base

Consider signing up for extra courses, for example, a Fundamental PC Course, to improve your specialized abilities.

End:

A GST Specialist Course is a superb decision for people looking for a remunerating profession in tax collection and consistence. With the rising reception of GST in India, organizations are effectively searching for gifted experts who can assist them with exploring this perplexing tax assessment framework.

By signing up for this course, you gain complete information, down to earth abilities, and a confirmation that can open ways to various vocation open doors. Whether you seek to work freely or inside an association, a GST Specialist Course can prepare for an effective and satisfying vocation.

Venture out today and position yourself as a confided in master in the field of GST.

IPA offers:-

Accounting Course , Diploma in Taxation, Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course , Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

GST for Online Business and E-commerce: A Step-by-Step Guide

E-commerce and online businesses have totally transformed the global economy. Entrepreneurship is made easy now since it is much simpler for entrepreneurs to sell goods and services across geographical boundaries. But ease brings along with it the problem of compliance, particularly in the case of the Goods and Services Tax (GST). In this blog post, we will look at how GST has impacted e-commerce and online businesses, main compliance requirements, and how businesses can remain compliant while also obtaining maximum returns.

GST for E-commerce Businesses

GST is an indirect tax that is imposed on the supply of goods and services. It consolidates various indirect taxes such as VAT, service tax, and excise duty into one uniform tax system. E-commerce companies are governed by certain provisions of the GST Act, hence it is critical for online sellers, marketplaces, and service providers to know their tax liability.

Who Have to Get Registered Under GST in E-commerce?

E-commerce Operators (Marketplaces): Marketplaces in e-commerce such as Amazon, Flipkart, and Shopify who process sales on sellers' behalf must follow GST law.

Online Sellers & Vendors: Companies which sell products or services online either through third-party marketplaces or their own web pages are necessary to get registered for GST without regard to turnover.

Dropshipping Businesses: Those businesses running dropshipping models need to be GST compliant too, if they sell taxable goods or services.

Freelancers & Digital Service Providers: Freelancers offering digital services like graphic designing, content writing, programming, or consulting services through digital platforms need to get GST registered, if their turnover exceeds the threshold limit.

GST Registration Threshold for E-commerce Businesses

Unlike regular business units, GST registration is required only when turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services (₹10 lakhs for special category states), while e-commerce vendors have to mandatorily register under GST irrespective of turnover under Section 24 of the CGST Act.

Tax Collected at Source (TCS)

E-commerce operators (marketplaces) need to collect 1% TCS (0.5% CGST + 0.5% SGST or 1% IGST) from the sellers on the platform. The amount is withheld while paying sellers and has to be remitted to the government.

GST Return Filing

E-commerce companies need to file GST returns from time to time, depending upon their registration type:

GSTR-1: Quarterly or monthly return of outward supplies (sales).

GSTR-3B: Combined monthly tax liability return.

GSTR-8: Filed by e-commerce operators reporting TCS collected.

Place of Supply & GST Applicability

Place of supply plays an important role in identifying whether CGST, SGST, or IGST applies. For e-commerce transactions:

Intra-state sales (seller and buyer within the same state) attract CGST + SGST.

Inter-state sales (seller and buyer in different states) attract IGST.

Exports are considered zero-rated supplies, and firms are entitled to recover refund of GST paid on inputs.

Reverse Charge Mechanism (RCM)

E-commerce firms need to understand RCM, where the purchaser is required to pay GST in lieu of the supplier in certain situations (i.e., obtaining services from unregistered persons).

GST Benefits & Problems for E-commerce Firms

Benefits:

✅ Uncomplicated Tax Structure: GST is a change from several indirect taxes, making compliance less complex.

✅ Input Tax Credit (ITC): Enterprises can take credit of GST paid on procurement.

✅ Ease of Doing Business: Easy inter-state business due to GST.

✅ Promotes Compliance: Compulsory registration helps ensure transparency.

Concerns:

❌ Mandatory Registration: Small online vendors too must register, thereby enhancing cost of compliance.

❌ Different Return Filing: Multiple GST returns complicate the job of small sellers.

❌ Cash Flow Problems: TCS deduction impacts suppliers' working capital.

How Online Businesses Can Remain Compliant

Register GST Timely: Avail GST registration before initiating an online business.

Keep Proper Invoices & Documents: Provide invoices with GST compliance and keep procurement records.

Submit Returns Timely: Avoid charges by following the due dates of GST returns.

Be Aware of TCS & RCM: Be aware of deductions and liability that apply.

Claim Input Tax Credit: Record GST paid while procuring to minimize tax outgo.

Conclusion

GST compliance is required for online and e-commerce businesses in India. While it brings about challenges such as compulsory registration and TCS deductions, it also offers advantages such as uniformity of tax and input tax credit. If e-commerce companies learn about GST rules and adopt best practices, they can stay compliant while growing their business economically.

For expert assistance with GST registration and filing, consider consulting a tax professional or using online tax compliance tools. Staying informed and proactive can help businesses navigate GST complexities effectively!

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

Top 9 GST Certification Courses In India With Placement Opportunities

Explore the top 9 GST certification courses in India, offering certified GST courses, GST accounting courses, and placement opportunities. Get your certificate course in GST now!

#gst certification course india#gst certification course#online certificate course in gst#best gst certification course#gst certification course online#gst practitioner certification course#gst courses in india#gst practitioner certificate course#gst course with placement#diploma in gst course#gst certification#course for gst practitioners#gst certificate course online#gst certification courses#gst courses#online gst course certificate#certified gst course#certification course on gst#gst course#course on gst#gst accounting course#certificate course in gst#gst courses in kolkata#gst course online#gst training online

0 notes

Text

GST Certification Courses With Placements

In today's busy and also vibrant organization setting the demand for skilled specialists in tax has actually risen considerably. The Goods as well as Services Tax (GST) in India has actually improved the indirect tax obligation system producing a need for professionals that can browse its intricacies successfully. Enlisting in a GST online course with certificate not just gives detailed understanding however likewise opens up doors to encouraging work chances. Whether you are a current grad or a functioning specialist acquiring a GST certification online can dramatically boost your job leads plus guarantee you remain in advance in the affordable work market.

Understanding GST and Its Importance GST executed on July 1 2017, is an extensive, multi-stage, destination-based tax obligation imposed on every worth enhancement. It changed a number of indirect tax obligations formerly enforced by the main plus state federal governments. Comprehending GST is essential for services as it affects different elements of their procedures, from procurement to sales. Specialists with a deep understanding of GST can assist organizations follow tax obligation laws, maximize tax obligation responsibilities and also stay clear of charges.

Benefits of Pursuing a GST Certification Course Enlisting in a GST online program with certification provides various advantages consisting of:

Thorough Knowledge: These training courses offer thorough understandings right into GST regulations, policies as well as conformity demands. Practical Skills: Learners gain hands-on experience with study, functional workouts, as well as real-world circumstances. Occupation Advancement: A GST certification boosts your return to making you a preferable prospect to companies. Networking Opportunities: Many training courses use accessibility to specialist networks assisting you get in touch with sector professionals as well as peers. Positioning Assistance: Reputable programs frequently give positioning assistance, attaching you with prospective companies looking for GST specialists. Top Features to Look for in a GST Online Course with Certificate When picking a GST certification online program take into consideration the complying with functions to guarantee you obtain the most effective education and learning as well as occupation assistance:

Recognized Curriculum: Ensure the training course is recognized coupled with identified by appropriate specialist bodies. Experienced Instructors: Look for programs shown by sector specialists with functional experience in GST. Interactive Understanding Modules: Opt for programs that supply interactive lessons, live sessions, plus Q&An; online forums. Upgraded Content: GST regulations are vibrant, so the training course web content need to be frequently upgraded to show the current adjustments. Versatile Learning Options: Choose a program that provides adaptability in regards to discovering speed as well as timetable enabling you to stabilize it with various other dedications. Positioning Assistance: Verify if the program uses specialized positioning assistance to aid you safeguard work chances upon conclusion.

Career Opportunities After Obtaining a GST Certificate Online Finishing a GST online program with certification can open different occupation chances throughout various industries. Several of the possible task functions consist of:

GST Consultant: Advising organizations on GST conformity, declaring returns, as well as enhancing tax obligation responsibilities. Tax obligation Analyst: Analyzing tax obligation information, preparing records, together with making certain exact tax obligation filings. Financial advisor: Managing monetary documents planning income tax return plus making certain conformity with GST guidelines. Money Manager: Overseeing the monetary procedures of a firm, consisting of GST conformity and also coverage. Compliance Officer: Ensuring that the company sticks to all GST legislations as well as policies. Tips for Succeeding in a GST Certification Course To make one of the most of your GST certification online program take into consideration the adhering to ideas:

Stay Updated: GST regulations are often upgraded. Maintain on your own notified concerning the most recent modifications as well as changes. Method Regularly: Engage in useful workouts as well as study to use academic understanding. Network: Connect with peers as well as trainers to develop a solid specialist network. Look for Help: Don't wait to ask inquiries plus look for information from instructors. Make Use Of Placement Support: Make complete use of the positioning aid supplied by the training course to safeguard work possibilities. Conclusion A GST online course with certificate is an important financial investment for anybody seeking to construct a job in tax and also financing. These programs provide detailed expertise, useful abilities plus positioning assistance, guaranteeing you are well-prepared to satisfy the needs of the work market. By selecting a trustworthy program as well as devoting on your own to continual knowing you can open various job chances as well as accomplish specialist success in the area of GST.

#GST online course with certificate#gst registration certificate"#“online tally course with gst with certificate”#“certificate course in gst”#“best gst practitioner course”

0 notes

Text

If you want best practice course of GST then our Online GST Practitioner course is best for you. Enroll now and learn GST through tyariexamki.com

⭐️⭐️⭐️⭐️⭐️ star ratings Course

For more information Visit at:- https://www.tyariexamki.com/CourseDetail/14/GST-Practitioner-Course-Online

1 note

·

View note

Text

RTS PROFESSIONAL STUDY offers a top range of professional training on GST Return filing, Income Tax Return filing, TDS Return Filing, and GST audit preparation accounts audit, Company Secretaries, Tax professionals, Tax Consultants, cost accountants, accountants, and other accounts professionals. We also provide various types of pen drive & certification courses online. See more: https://rtsprofessionalstudy.com/

#income tax practitioner course online#gst return filing online course#gst filing online course#Basic gst course online#basic gst course

0 notes

Text

The Impact of GST on Exporters: New Opportunities

The introduction of the Goods and Services Tax (GST) represented a watershed moment in India's taxation environment, impacting many industries, including the export industry. GST presented both obstacles and possibilities for exporters, transforming the way international commerce is done. This detailed handbook examines the effect of GST on exporters, examining the changes, advantages, and tactics that have resulted. Exporters may manage the difficulties of global commerce with more efficiency and success by exploring the various pathways and opportunities that GST has opened up.

1. Introduction

GST was implemented in India to simplify the tax system, reduce cascading effects, and streamline tax administration. GST brought substantial changes that impacted different areas of exporters' business.

2. The Evolution of Export and GST Taxes

Exporters have experienced difficulties due to complicated tax regimes, export taxes, and administrative impediments. The GST Mumbai attempted to solve these concerns by establishing a consistent tax framework.

3. Important GST Changes for Exporters

GST brought various reforms that benefited exporters, such as zero-rated supply, streamlined refund methods, and access to Input Tax Credit (ITC) on inputs and input services.

4. Improving Export Compliance and Documentation

GST simplified export paperwork by standardizing processes such as export invoices and freight bills. The Letter of Undertaking (LUT) has become an essential document for exporters.

5. Increasing Competitiveness and Saving Money

The abolition of the Central Sales Tax (CST) and decreased levies under GST increased exporters' competitiveness in the global market while lowering overall tax burdens.

6. Exporters' Difficulties

Despite the favorable developments, exporters faced obstacles such as operating capital obstruction owing to delayed reimbursements and refund processing complications.

7. Export Benefits Maximization Strategies

Exporters may use tactics to successfully handle difficulties. Efficient refund claim handling, technology integration for compliance, and capitalizing on export promotion programs are all required.

8. Global Perspective: Implications for International Trade

GST influences India's boundaries, altering international trade dynamics, supply chain optimization, and the worldwide competitiveness of Indian exports.

9. Prospects for the Future and Potential Reforms

Potential GST revisions may solve issues experienced by exporters, improve refund procedures, and provide an even more hospitable climate for foreign commerce as the system evolves.

Conclusion

The effect of GST on exporters demonstrates the fluidity of taxation policies. Exporters may position themselves as nimble participants in the global trade arena by embracing the changes and possibilities afforded by GST. Understanding the subtleties of GST and its effects is critical for exporters to negotiate obstacles, grasp new opportunities, and drive development in the international market as the export environment transforms.

0 notes

Text

How an Accounting Course Can Help You Start Your Own Business in 2025, 100% Job, Accounting Course in Delhi, 110059 - Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification,

Enrolling in an Accounting Course in Delhi in 2025 is a powerful step for anyone aiming to start their own business, especially in Delhi’s 110059 area where comprehensive programs like those offered by SLA Consultants India—featuring free SAP FICO certification, GST certification, ITR and DTC classes with the 2025 update, and Tally Prime certification—provide a robust foundation for entrepreneurial success. These courses do more than prepare you for employment; they equip with practical skills and knowledge essential for running and growing a business in today’s digital and regulatory landscape.

A key benefit of an Accounting Training Course in Delhi is learning how to establish and maintain a reliable financial system for your business. This includes tracking income and expenses, organizing transactions using a chart of accounts, and generating critical financial reports such as profit and loss statements, balance sheets, and cash flow statements. These skills are vital for making informed business decisions, securing funding, and ensuring compliance with tax and regulatory requirements. With hands-on training in Tally Prime and SAP FICO, you gain the ability to automate routine tasks, manage inventory, process payroll, and handle complex tax scenarios—saving time and reducing the risk of errors.

Accounting Certification Course in Delhi

Understanding the latest GST, ITR, and DTC regulations is another major advantage. Tax compliance is a significant challenge for new businesses, and errors can lead to penalties or legal issues. An accounting course ensures you are up to date with the latest tax rules and filing procedures, helping you avoid costly mistakes and build credibility with clients and partners. Additionally, proficiency in advanced accounting software allows you to streamline operations, gain real-time insights into your business performance, and respond quickly to market trends—skills that are increasingly important in the era of digital transformation and remote work.

E-Accounting, E-Taxation and E-GST Course Modules Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax) Module 2 - Part A – Advanced Income Tax Practitioner Certification Module 2 - Part B - Advanced TDS Practical Course Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA Module 3 - Part B - Banking & Finance Module 4 - Customs / Import & Export Procedures - By Chartered Accountant Module 5 - Part A - Advanced Tally Prime & ERP 9 Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance Module 6 – Financial Reporting - Advanced Excel & MIS For Accounts & Finance - By Data Analyst Trainer Module 7 – Advanced SAP FICO Certification

Beyond technical skills, accounting courses foster entrepreneurial thinking and adaptability. Many accountants use their training as a springboard to launch their own firms or consultancy services, leveraging their expertise to help other businesses navigate financial challenges. The Accounting Training Institute in Delhi provides 100% job guarantee provided by SLA Consultants India offers added security, giving you the option to gain industry experience before venturing out on your own. In summary, an accounting course in Delhi (110059) is a strategic investment for aspiring entrepreneurs, providing the knowledge, tools, and confidence needed to start, manage, and grow a successful business in 2025. For more details Call: +91-8700575874 or Email: [email protected]

0 notes

Text

Want to Become a GST Expert in 2025?

GST isn’t just a tax update—it’s a powerful boost for your career path! If you're dreaming of becoming a certified GST practitioner, tax consultant, or accounts executive, then this is your moment. Step into the world of taxation with GVT Academy’s Best GST Course in Noida — expertly crafted to make you industry-ready from day one.

🔥 What Makes Our GST Course the Best in Noida?

✅ Includes every essential concept and detail related to GST From GST basics, registration, returns, ITC, e-way bill, to refunds—our course covers ALL 174 GST sections with 100% practical implementation.

✅ Income Tax + TDS Training Included Learn to file ITRs under all heads—Salary, Business, Capital Gains & more using real offline utilities.

✅ Tally + BUSY Mastery Become a pro in GST-enabled accounting software. Gain hands-on skills in GSTR filing, reconciliation, and ledger auditing using Tally and BUSY software.

✅ Live Client Data Practice No boring theory. We train you on real data with actual return filings, so you learn exactly what the job demands.

✅ Finalization of Balance Sheet & Tax Planning Learn how to finalize books like a CA, avoid tax scrutiny, and prepare CMA/project reports to impress your future employers.

🎓 Who Should Join? Students, working accountants, tax consultants, freelancers, or anyone who wants a high-paying, future-proof career in finance.

🎯 If you're looking for the Best GST Course in Noida with a real chance at career growth, practical skills, and job opportunities, GVT Academy is where your future begins.

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#data analytics#advanced excel training#data science#python#sql course#best powerbi course#power bi#gst services

0 notes

Text

Learn Taxation with Real-Life Examples | Join Online Today

Taxation Course Online – ऑनलाइन टैक्सेशन कोर्स से करियर बनाएं

💼 Why Choose a Taxation Course Online? – टैक्सेशन कोर्स ऑनलाइन क्यों करें?

आज के time में online taxation course बहुत demand में है। Students और working professionals दोनों ही इसे करना चाहते हैं।

क्योंकि यह course comfort के साथ flexibility भी देता है। इसके ज़रिए आप घर बैठे ही tax laws, GST, TDS जैसी चीजें सीख सकते हैं।

🎯 Scope of Taxation Course Online – टैक्सेशन ऑनलाइन कोर्स का स्कोप

India में tax professionals की ज़रूरत हर industry को है। चाहे वो private firm हो या government office, हर जगह tax experts की ज़रूरत होती है।

Online taxation course से आप finance, accounts, और auditing field में jobs पा सकते हैं। इससे freelancing opportunities भी खुल जाती हैं।

🏫 Top Institutions Offering Online Taxation Courses – प्रमुख संस्थान जो टैक्सेशन कोर्स ऑफर करते हैं

कुछ famous institutes जो ये course online mode में offer करते हैं:

The Institute of Professional Accountants (IPA) – Certified taxation programs in Hindi-English mix

NIIT – GST and Income Tax specialization

Coursera/EdX – International level content with certificates

इन platforms पर आपको recorded और live classes दोनों का access मिलता है। साथ ही downloadable study material और doubt-clearing sessions भी मिलते हैं।

📘 What You Learn in Taxation Course Online – टैक्सेशन कोर्स में क्या सिखाया जाता है?

Online course content काफी detailed होता है। यह syllabus को छोटे-छोटे modules में divide किया जाता है।

Main topics include:

Income Tax Act और उसका implementation

GST (Goods and Services Tax) की पूरी प्रक्रिया

TDS & TCS rules

Return filing through online portals

Assessment procedures और penalties

हर topic को real-life case studies के साथ समझाया जाता है। इससे समझने में आसानी होती है और practical knowledge भी बढ़ती है।

🧑🏫 Who Should Do This Course? – कौन-कौन कर सकता है टैक्सेशन कोर्स ऑनलाइन?

अगर आप commerce background से हैं, तो ये course आपके लिए perfect है। लेकिन इसका मतलब ये नहीं कि दूसरे stream वाले नहीं कर सकते।

Students, accountants, business owners, CA aspirants – सभी लोग ये course कर सकते हैं। Even housewives भी इसे part-time सीखकर freelancing start कर सकती हैं।

💻 Benefits of Online Taxation Course – ऑनलाइन टैक्सेशन कोर्स के फायदे

Flexibility – आप कभी भी, कहीं से भी सीख सकते हैं।

Affordability – Offline course के मुकाबले ये सस्ता होता है।

Updated Syllabus – नए amendments और rules पर आधारित content होता है।

Career Growth – Promotions और better salary opportunities भी बढ़ जाती हैं।

साथ ही कई platforms आपको placement assistance भी offer करते हैं। ये आपको job ढूंढ़ने में मदद करता है।

📅 Duration and Fees – कोर्स की अवधि और फीस

Course की duration average 3 से 6 months तक होती है। कुछ fast-track programs 1 month में भी complete हो जाते हैं।

Fees normally ₹5,000 से ₹25,000 के बीच होती है। Depends करता है course के level और institute पर।

💼 Job Roles After Taxation Course – टैक्सेशन कोर्स के बाद कौन-कौन सी Jobs मिल सकती हैं?

Taxation course online करने के बाद आप नीचे दिए गए roles में काम कर सकते हैं:

Tax Consultant – Individuals और companies को tax advice देना

GST Practitioner – GST registration, return filing व compliance में expert

Income Tax Return (ITR) Expert – Salaried और business ITRs prepare करना

Tax Analyst – Companies के लिए tax reports और projections बनाना

Accounts Executive – Accounting और tax management का combo role

इन roles की demand हर financial year में बढ़ती जाती है। इसलिए taxation skill हमेशा relevant रहेगी।

📚 Certifications You Get – कोर्स पूरा करने पर क्या सर्टिफिकेट मिलता है?

हर reputed institute completion पर आपको digital या hardcopy certificate देता है। कुछ institutes government-recognized certification भी offer करते हैं।

ये certificate आपके resume में value add करता है। और job interviews में आपके knowledge को validate करता है।

🌍 Language of Instruction – कोर्स की भाषा

Most online taxation courses bilingual होते हैं – English और Hindi में। इससे students को अपनी comfortable language में सीखने में मदद मिलती है।

IPA जैसे institutes pure Hindi-English mixed format offer करते हैं। इससे beginners को content grasp करने में दिक्कत नहीं होती।

📲 Tools and Software You Learn – कौन-कौन से software सीखते हैं?

Taxation course online में practical tools की knowledge भी दी जाती है:

Tally ERP 9 / Tally Prime for GST

Income Tax Portal for ITR filing

GSTN Portal for monthly filings

Excel में tax sheets बनाना भी सिखाया जाता है

इन skills की मदद से आप actual work में जल्दी expert बन सकते हैं।

🔗 Sources of Authentic Information – विश्वसनीय जानकारी के स्रोत

Taxation course में reference लिए जाते हैं इन authentic sources से:

Income Tax Department

GSTN Portal

CBIC circulars & notifications

ICAI और ICMAI जैसे bodies के publications

इनसे आपको सही और updated जानकारी मिलती है।

👨👩👧👦 Who Offers the Best Course in Delhi/NCR? – दिल्ली में सबसे अच्छा टैक्सेशन कोर्स कौन कराता है?

Delhi में "The Institute of Professional Accountants (TIPA)" top ranking institute माना जाता है। TIPA के courses practical और industry-oriented होते हैं।

Address: E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar, Delhi 110092 Phone: 9213855555 Website: www.tipa.in

यहां पर आपको placement support, bilingual classes, और GST training भी मिलेगी।

🎯 Conclusion – निष्कर्ष

अगर आप accounting या finance field में career बनाना चाहते हैं, तो Taxation Course Online आपके लिए एक smart choice है।

यह ना सिर्फ career options बढ़ाता है, बल्कि आपको self-employed बनने का मौका भी देता है।

अब जब दुनिया online हो रही है, तो learning भी online ही best तरीका बन चुका है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

How e-Accounting Helps You Stay Ahead in Finance Jobs

Introduction

In today’s fast-evolving financial industry, employers are no longer just looking for candidates who know traditional accounting. They need professionals who understand e-Accounting, GST compliance, e-filing, and modern tools like Tally Prime. This is where e-Accounting steps in as a game-changer—especially for students who want to stand out in the finance job market.

Whether you’re from Yamuna Vihar, Uttam Nagar, or any part of Delhi, gaining practical knowledge in e-Accounting can open doors to career paths in finance, taxation, and business management.

What is e-Accounting and Why Does It Matter?

e-Accounting stands for “electronic accounting”—a modern accounting system where financial data is recorded and managed digitally using software such as Tally ERP 9 and Tally Prime.

In today’s digital economy, companies prefer hiring candidates who are skilled in:

Online GST return filing

e-Taxation and compliance

Payroll processing

Advanced Excel

Cloud-based financial record keeping

These skills are in high demand across industries and are often taught through specialized e-Accounting training in Delhi, e-filing courses, and GST training.

Benefits of Learning e-Accounting for Finance Jobs

1. Stay Job-Ready with Practical Knowledge

Finance recruiters today expect job seekers to be industry-ready. Completing an financial e-accounting course in Uttam Nagar gives students hands-on experience in preparing ledgers, filing GST, processing payroll, and generating reports—all essential for finance jobs.

2. Master Tally Prime and GST Filing

Tally is still the backbone of accounting for thousands of businesses. Institutes offering Tally classes in Yamuna Vihar or Tally Prime courses in Uttam Nagar focus on the latest updates like GST integration and advanced inventory management. You’ll also learn about Tally with GST certification, which is a must for accounting roles in MSMEs and startups.

3. Gain Expertise in Taxation and E-Filing

From managing tax deductions to filing returns, taxation plays a huge role in every organization. Specialized e-taxation courses and e-filing training empower you with complete understanding of Indian tax systems and help you support businesses in staying compliant.

4. Explore Diverse Career Options

By pursuing professional courses in financial e-accounting, you become eligible for roles like:

Accounts Executive

GST Practitioner

Tax Assistant

Payroll Executive

Audit Assistant

Institutes offering GST coaching and e-accounting training offer real-time projects and mock return filing which build confidence and experience.

Centers provide short-term and diploma-level courses in Tally ERP 9, Tally Prime, e-Taxation, and e-filing, including free tally eBooks, video tutorials, and downloadable Tally PDFs for self-practice.

If you're from Bhajanpura, Shahdara, or nearby areas, you can also explore or tally classes near Yamuna vihar for convenient access.

Online and Offline Support for Learners

In addition to classroom training, students can:

Download free tally study material for self-paced learning.

Watch Tally ERP 9 video tutorials to revise concepts anytime.

Access GST coaching classes near me using location-based search.

Opt for accounting internships or project-based learning for practical exposure.

Institutes also offer dedicated Tally coaching centres in Yamuna Vihar and Uttam Nagar, so students can choose according to their locality.

Final Thoughts

The finance industry is transforming rapidly, and digital skills are no longer optional. Investing in an e-Accounting course or a financial e-accounting training gives you a head start in your career.

Whether you're a fresher, commerce student, or working professional looking to upskill, e-Accounting combined with GST, Tally, and taxation training is the perfect formula to stay ahead in finance jobs.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#tally prime course#tally prime with GST course#e Accounting course in uttam nagar#e Accounting course in yamuna vihar#ms excel#advance ms excel#GST course with e Filling

0 notes

Text

10 Reasons to Consider a GST Practitioner Course Today

The Labor and products Duty (GST) has reformed the Indian tax collection framework, making it more smoothed out and proficient. With the rising interest for GST experts, signing up for a GST Professional Course has turned into a rewarding choice for those trying to construct a fruitful vocation in tax collection. This guide investigates the advantages, construction, and profession valuable open doors related with the GST specialist course while featuring how it supplements a more extensive GST Course for a total comprehension of the subject.

What is a GST Expert Course?

A GST Professional Course is a particular preparation program intended to outfit people with thorough information on GST regulations, consistence, and procedural perspectives. It plans members to become affirmed GST specialists, empowering them to offer proficient administrations like duty recording, warning, and portrayal for the benefit of clients.

Key Targets of a GST Professional Course

Inside and out Information on GST Regulations

Grasp the design, parts, and execution of GST.

Dominating GST Consistence

Become familiar with the cycles of GST enlistment, returns recording, and keeping up with consistence with lawful guidelines.

Charge Documenting Aptitude

Acquire commonsense abilities for getting ready and submitting GST returns for people and organizations.

Warning Abilities

Foster the capacity to give vital exhortation on GST-related matters, including charge arranging and streamlining.

Why Seek after a GST Specialist Course?

Developing Interest for GST Experts

With GST being an obligatory expense structure, each business expects experts to oversee consistence and documenting.

Professional success

Turning into a guaranteed GST professional opens as high as possible paying open doors in charge consultancy, corporate money, and bookkeeping.

Pioneering Open doors

Begin your consultancy to help organizations with GST consistence and warning administrations.

Adaptable Application

Information on GST is important across different businesses, from retail to assembling and then some.

Grasping the More extensive GST Course

A GST Course offers basic information on the Labor and products Duty, covering its hypothetical and commonsense perspectives. While a GST specialist course is more engaged, an overall GST course fills in as a superb beginning stage for novices.

Themes Shrouded in a GST Course

Prologue to GST

Get familiar with the nuts and bolts of GST, its advantages, and its effect on the Indian economy.

Sorts of GST

Figure out the three parts: CGST (Focal), SGST (State), and IGST (Incorporated).

GST Enrollment

Bit by bit direction on the enrollment interaction for organizations.

Input Tax reduction (ITC)

Investigate the idea of ITC and how it benefits organizations.

GST Consistence and Recording

Figure out how to get ready and submit exact GST returns.

Invert Charge Instrument (RCM)

Comprehend the situations where RCM is pertinent and its suggestions.

Advantages of Joining a GST Course and GST Professional Course

While a GST Course gives an essential comprehension, the GST Expert Course centers around cutting edge applications, making the blend a strong couple for trying experts.

Benefits of Joining The two Courses

Far reaching Information

Cover both fundamental and high level parts of GST, guaranteeing balanced training.

Functional Application

Acquire the abilities to deal with genuine GST issues certainly.

Upgraded Vocation Valuable open doors

The consolidated skill opens ways to different jobs, from GST specialist to corporate expense guide.

Groundwork for Affirmation

A GST specialist course is fundamental for those looking for certificate from GST specialists.

Who Ought to Sign up for These Courses?

A GST professional course and GST course are great for:

Trade Graduates

Understudies with a foundation in trade or bookkeeping can upgrade their capabilities with these courses.

Charge Experts

Bookkeepers, reviewers, and money experts hoping to represent considerable authority in GST.

Business people

Entrepreneurs looking to effectively deal with their organization’s GST consistence.

Specialists and Experts

People meaning to give GST warning and consistence administrations to numerous clients.

Vocation Open doors Subsequent to Finishing a GST Professional Course

Finishing a GST Professional Course opens up a scope of vocation potential open doors in tax collection and money.

1. GST Expert

As a confirmed specialist, you can deal with GST consistence, enrollment, and petitioning for clients.

2. Charge Expert

Give master exhortation on charge arranging and GST-related systems to organizations.

3. Corporate GST Supervisor

Deal with the GST consistence and detailing necessities of huge organizations.

4. Bookkeeper with GST Ability

Incorporate GST information into general bookkeeping jobs for improved esteem.

5. Autonomous GST Expert

Begin your consultancy to take special care of SMEs and individual citizens.

Instructions to Pick the Right GST Course

Choosing the right GST professional course or GST course is basic for your vocation achievement.

Variables to Consider

Certification

Guarantee the course is perceived by GST specialists or rumored instructive establishments.

Experienced Staff

Pick programs drove by experts with useful involvement with GST.

Extensive Educational program

Search for courses that cover both hypothetical and useful parts of GST.

Position Help

Pick foundations that proposition work position or temporary job amazing open doors.

Adaptability

Online courses or end of the week bunches can be great for working experts.

The most effective method to Get everything rolling

This is the way you can set out on your excursion to turning into a GST master:

Research Courses

Investigate different GST courses and GST expert courses that line up with your profession objectives.

Really take a look at Qualification Prerequisites

Guarantee you meet the essentials, like a foundation in business or money.

Sign up for a Perceived Program

Pick a trustworthy foundation offering quality schooling and certificate.

Acquire Viable Experience

Take part in temporary jobs or parttime jobs to fabricate active experience.

Remain Refreshed

Charge regulations every now and again advance; nonstop learning is fundamental for stay applicable.

End:

A GST Specialist Course is a superb pathway for anybody hoping to construct a compensating vocation in tax collection. By joining it with a fundamental GST Course, you can foster a hearty comprehension of GST regulations and their pragmatic applications. These courses set you up for assorted jobs, from consistence the executives to burden consultancy, guaranteeing long haul profession development.

Venture out today by signing up for a GST course and making way for an effective future in the unique universe of tax collection.

Visit more course-

0 notes

Text

Introduction to GST: A Complete Handbook

Goods and Services Tax (GST) is a major tax reform across the globe that has revolutionized the tax incidence of goods and services. Adopted in various nations, including India, Canada, and Australia, GST is a single indirect tax that subsumes several other taxes, thus eliminating the complexity and transparency of taxes. Through this blog, we will understand the basics of GST, its advantages, and its influence on business and customers.

What is GST?

GST is a value-added tax charged on the supply of goods and services. GST is a tax on consumption, i.e., charged at every stage in the chain of supply, from the manufacturers to the retailers, and input tax credits are provided to companies for tax paid on acquisitions.

The tax ultimately ends up with the final consumer because companies can get back the previously paid tax at the earlier steps so that cascading effect of the tax gets eliminated.

Main Features of GST

Single Indirect Tax:

GST substitutes diverse taxes like VAT, service tax, excise duty, and other indirect taxes and makes compliance with tax simpler.

Destination-Based Tax:

GST is levied in the state where goods or services are consumed, not where they are manufactured.

Multi-Stage Taxation:

GST is levied at every stage of production and distribution, and tax credits at every stage lower the burden.

Input Tax Credit:

Tax credits on inputs can be claimed by businesses, lowering the overall tax burden.

Standardized Tax Structure:

In India, GST is categorized into CGST (Central GST), SGST (State GST), and IGST (Integrated GST) to allow revenue sharing between central and state governments.

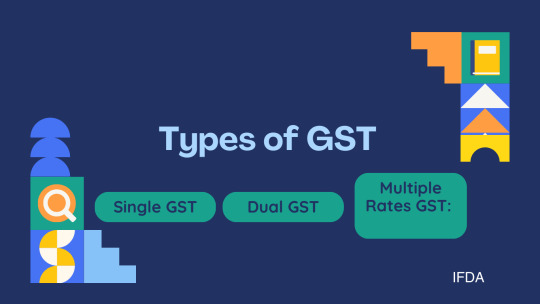

Types of GST

Various nations have implemented different models of GST according to their political and economic configurations. The most prevalent types are:

Single GST:

Implemented in Canada, Australia, etc., where the same tax is levied uniformly.

Dual GST:

Used in India, where central GST and state GST are divided.

Multiple Rates GST:

Multiple GST rates are used by some nations depending upon the product or service.

Advantages of GST

1. Removal of Tax Cascading

Prior to GST, there were several taxes that resulted in a cascading effect, which made goods and services more expensive for customers. GST removes the cascading effect, making goods and services cheaper in the end.

2. Streamlined Tax Compliance

Firms no longer need to file numerous taxes individually since GST consolidates the reporting of taxation into a single regime.

3. Increased Transparency

GST makes firms keep records electronically, reducing the incidence of tax evasion as well as increased accountability.

4. Economic and Trade Stimulus

Because there's a unified system of taxation now, firms can easily expand across states or nations and stimulate economic activities.

5. Promotion of Small Enterprises

GST provides small business firms with the option to take advantage of a composition scheme, under which they pay tax at a rate lower than their real tax liability.

Problems of GST Implementation

There are some problems in implementing GST, which are:

Compliance Burden:

Small and medium enterprises can be dismayed by the periodic filing and electronic documentation.

Initial Inflation:

The shift to GST may be responsible for temporary inflation.

Technical and Administrative Issues:

It may be complicated to implement the infrastructure for GST collection and refund.

Multiple Rates of Taxation:

In a few nations, various slabs of GST on various commodities confuse citizens.

Impact of GST on Businesses and Consumers

For Businesses:

Simplified tax return process

Increased efficiency through input tax credit

Relief in expansion with single system of tax

For Consumers

Less overall burden of tax on most goods and services

Greater transparency in prices

Transitory price adjustments as companies adopt to the new regime

Conclusion

GST is a path-breaking tax reform that simplifies, increases economic growth, and enhances transparency. Though its initiation is foreboding with issues, its long-term advantages for industry and consumers make it a natural segment of contemporary taxation systems. With the increasing adoption and evolution of their GST policies by more nations, it is the unparalleled instrument in forming a successful and equitable tax system globally.

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

E-Accounting Course: Your Gateway to a Future-Ready Accounting Career

In today’s fast-evolving digital economy, traditional accounting methods are giving way to smarter, faster, and more accurate digital tools. This transformation has given rise to E-Accounting—a modern approach to financial management. Whether you're a student, a professional, or a business owner, enrolling in an E-Accounting course can open up a world of opportunities and give you a competitive edge in the job market.

📘 What is E-Accounting?

E-Accounting, or electronic accounting, refers to using software and digital platforms to manage financial tasks like bookkeeping, tax filing, payroll, and audits. Instead of paper ledgers and manual entries, accountants now use applications like:

Tally ERP 9 / Tally Prime

QuickBooks

Zoho Books

Busy Accounting

MS Excel

GST & Income Tax Portals

This digital transformation allows businesses to maintain accurate records, improve financial reporting, and stay tax compliant with minimal effort.

🎯 Why Choose an E-Accounting Course?

Here are some compelling reasons to consider an E-Accounting course:

✅ High Job Demand: Skilled E-Accounting professionals are needed in every industry.

✅ Practical Learning: Courses focus on real-world applications, not just theory.

✅ Better Career Options: Open doors to jobs in finance, taxation, auditing, and business consulting.

✅ Remote Work & Freelancing: Digital tools allow flexible work-from-home opportunities.

✅ Self-Employment: Ideal for entrepreneurs or freelancers offering accounting services.

📚 What You'll Learn in an E-Accounting Course

An E-Accounting course is designed to make you job-ready by teaching:

Fundamentals of Accounting

Tally Prime (with GST)

GST Filing & Returns

TDS Calculation & Filing

Payroll Management

Bank Reconciliation

Advanced Excel for Finance

MIS Report Generation

Income Tax Basics

Practical Business Scenarios

👨💼 Career Opportunities After E-Accounting

Once you complete the course, you can explore roles such as:

Accountant / Junior Accountant

Accounts Executive

Tally Operator

GST Practitioner

Payroll Executive

Tax Consultant

Freelance Accountant

Bookkeeper for startups or SMEs

You can also assist CA firms, work in corporate finance departments, or start your own digital accounting service.

🕒 Course Duration & Eligibility

Duration: 2 to 6 months (varies based on modules and mode)

Eligibility: No strict requirement; basic knowledge of computers and interest in accounting is sufficient. Ideal for commerce students, graduates, MBAs, or professionals looking to upskill.

🌐 Online vs Offline Learning

Many training institutes now offer online E-Accounting courses with live sessions, recorded classes, practical projects, and even internship opportunities. You can choose the mode that suits your schedule and location.

💬 Testimonials

“The E-Accounting course helped me understand GST filing and Tally in a hands-on way. I got placed within a month of completing the course!” – Neha Sharma, Delhi

“As a freelancer, I now manage accounts for multiple small businesses using the tools I learned in this course.” – Ravi Kumar, Freelance Accountant

For More Details:-

visit website :- www.artheducation.com

contact us :- 8860222625

1 note

·

View note

Text

Understanding the Key Relation Between Accounting vs Finance

Many students ask: What is the difference between accounting and finance? While both deal with money, their roles are different. Still, they work together closely.

This blog will explain the relation between accounting vs finance, how they support each other, and why learning both through Certified Corporate Accounting, SAP FICO, and Taxation (Income Tax & GST) courses is important.

What is Accounting?

Accounting means keeping track of a company’s money. It records past transactions and prepares reports.

Key tasks in accounting:

Recording income and expenses

Creating balance sheets and profit & loss statements

Calculating Income Tax and GST

Ensuring legal compliance

To learn these skills, you can join the best accounting institute in Kolkata or take a Certified Corporate Accounting course.

What is Finance?

Finance is about managing money for the future. It helps in making plans and decisions.

Key tasks in finance:

Budgeting and forecasting

Making investment decisions

Managing risk

Planning business growth

A great course to learn this is SAP FICO (Finance & Controlling). It teaches how accounting and finance work together in companies.

Key Differences Between Accounting and Finance

FeatureAccountingFinanceFocusPast transactionsFuture planningMain GoalAccurate reports & complianceGrowth & value creationDaily WorkRecording, tax filingBudgeting, investingPopular ToolsTally, Excel, GST softwareSAP FICO, financial models

How Accounting and Finance Work Together

The relation between accounting vs finance is strong.

Accounting records the data.

Finance uses that data to plan and decide.

For example: If accounting shows that the business made ₹10 lakhs in profit, finance will decide how to use it—whether to invest, save, or pay debts.

Finance also needs accurate GST and Income Tax records. That’s why learning both areas is useful. You can start by joining the best GST course in Kolkata.

Why Learning Both Is Important

Companies want people who understand both subjects. Here’s why:

✅ Accounting keeps the company legal and organized. ✅ Finance helps the company grow and succeed.

If one fails, the other suffers. So, if you want a strong career, learn both accounting and finance.

Best Courses That Teach Both

Here are three great options to build your skills:

✅ Certified Corporate Accounting

This beginner course covers:

Bookkeeping and ledgers

Final accounts

Taxation (Income Tax & GST)

Corporate laws

You can take this at the best accounting institute in Kolkata.

✅ SAP FICO (Finance & Controlling)

This course is perfect for:

Financial reporting

Budget planning

Integrating finance with accounting

It’s ideal for jobs in MNCs or finance departments.

✅ Best GST Course in Kolkata

This course helps you master:

GST registration and return filing

Input tax credit

GST compliance and audit

It’s great for finance officers and tax professionals.

Top Careers After Learning Accounting and Finance

Knowing the relation between accounting vs finance gives you more job choices.

🧾 Accounting Careers:

Junior Accountant

GST Practitioner

Tax Consultant

Auditor

💼 Finance Careers:

Financial Analyst

Investment Planner

Budget Manager

Risk Officer

These jobs offer good salaries and long-term growth.

Example: How Both Work in Real Life

Imagine a company earns ₹15 lakhs this year.

The accountant records the income, files GST, and prepares tax reports.

The finance manager uses this information to plan next year’s budget, investments, and spending.

This is how both roles work hand-in-hand.

Tips for Students and Job Seekers

Don’t choose only accounting or only finance—learn both.

Start with a basic accounting course.

Then upgrade your skills with SAP FICO.

Learn GST and tax filing from the best GST course in Kolkata.

Always choose trusted training providers.

Final Thoughts

The relation between accounting vs finance is about teamwork.

Accounting tells the story of the past.

Finance writes the plan for the future.

If you want a successful career, you need both skills. The good news? You can learn them through:

✅ Certified Corporate Accounting ✅ SAP FICO (Finance & Controlling) ✅ Taxation (Income Tax & GST) training

0 notes

Text

Income tax practitioner course online

Are you seeking income tax practitioner course online? Look no further. This course is specifically designed to meet the expectation of aspirants and those who wish to become Tax Practitioners. The complete course module has explained on our website with a price. For more information, you can call us at 7530813450.

0 notes