#GST software India

Explore tagged Tumblr posts

Text

CompuTax GST Software – File Accurate GST Returns Instantly

File GST returns with ease using CompuTax GST software. Designed for seamless invoice tracking, returns, and audit trails.

0 notes

Text

GST Software Free Trial | Bharat Bills GST Software

GST Billing Software - Easily Create Bills with Bharat Bills Billing Software which is India's ideal and Trustworthy GST Billing Software for small and medium-sized organizations.

Contact us at +91 9992 321 321 E-mail [email protected] for more info.: https://bharatbills.com/contact-us/ Or Visit our website https://bharatbills.com/

0 notes

Text

GST Software: Streamlining Taxes for Businesses

Introduction

In the digital age, managing taxes can be a challenging task for businesses of all sizes. With various tax laws and regulations in place, keeping track of finances and complying with tax requirements can become a cumbersome process. However, with the advent of Goods and Services Tax (GST) software, businesses can now streamline their tax operations, ensuring compliance, accuracy, and efficiency. In this article, we will delve into the world of GST software, exploring its benefits, features, and how it simplifies tax management for businesses.

What is GST Software?

GST software is a digital solution designed to automate and simplify the process of calculating, collecting, and remitting Goods and Services Tax. It is specifically tailored to meet the unique needs of businesses, whether they are small startups or large enterprises. This software eliminates the need for manual calculations and paperwork, significantly reducing the likelihood of errors and enhancing overall efficiency.

How GST Software Works

1. Data Integration

GST software seamlessly integrates with a business's financial systems, such as accounting software and Enterprise Resource Planning (ERP) systems. It automatically extracts the necessary financial data, ensuring that the tax calculations are accurate and up-to-date.

2. Tax Calculation

Once the data is integrated, the GST software employs advanced algorithms to calculate the applicable taxes based on the GST rates and the specific nature of the goods or services provided by the business.

3. Return Filing

GST software generates comprehensive tax reports and assists businesses in filing their GST returns online. This feature eliminates the need for manual form-filling and simplifies the entire return filing process.

4. Compliance Management

One of the key advantages of GST software is its ability to help businesses stay compliant with GST regulations. The software keeps track of the filing deadlines and ensures that businesses adhere to the latest tax rules, minimizing the risk of penalties and legal complications.

Benefits of Using GST Software

1. Time-Saving

Automating tax-related processes with GST software saves a significant amount of time for businesses. The software handles repetitive tasks, allowing business owners and finance professionals to focus on strategic decision-making and core operations.

2. Reduced Errors

Manual tax calculations are prone to errors, which can lead to serious repercussions. GST software eliminates human errors, providing accurate tax computations and reducing the likelihood of audit triggers.

3. Enhanced Efficiency

GST software streamlines the entire tax management process, enabling businesses to work more efficiently. The software's user-friendly interface makes it easy for even non-technical personnel to use it effectively.

4. Real-Time Insights

With real-time data updates, businesses can gain valuable insights into their tax liabilities and financial standing. This helps them make informed decisions and adjust their financial strategies accordingly.

Choosing the Right GST Software

1. Scalability

When selecting GST software, it is essential to choose one that can scale with the growth of the business. A software solution that can accommodate increasing transaction volumes and complexities will ensure long-term usability.

2. Security

Security is a critical factor when dealing with sensitive financial data. Businesses must opt for GST software that offers robust data encryption and secure storage to protect their information from unauthorized access.

3. Integration Capabilities

The ideal GST software should seamlessly integrate with existing financial and ERP systems. This integration ensures a smooth flow of data between different software solutions, minimizing manual data entry.

4. Customer Support

Reliable customer support is essential, especially during the initial implementation phase. Businesses should opt for GST software providers that offer responsive customer support to address any issues or concerns promptly.

Conclusion

In conclusion, GST software has emerged as a game-changer for businesses when it comes to tax management. By automating tax calculations, simplifying return filing, and ensuring compliance, GST software offers a myriad of benefits for businesses of all sizes. It streamlines processes, saves time, reduces errors, and provides valuable insights, empowering businesses to focus on growth and success. Embracing GST software is a crucial step for modern businesses looking to thrive in a highly competitive and digitally-driven environment.

1 note

·

View note

Text

Availment of ITC under GST

GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India. It is a destination-based tax, which means that the tax is collected by the state where the goods or services are consumed. Under GST, the input tax credit (ITC) is an important concept that allows businesses to reduce their tax liability by claiming credit for the taxes paid on their purchases.

In this article, we will discuss everything you need to know about the availment of ITC under GST. We will cover the basics of input tax credit, the conditions to claim ITC, the documentation required, and the time limit for claiming ITC.

What is Input Tax Credit (ITC)?

Input tax credit (ITC) is the credit that a business can claim for the tax paid on its purchases used for business purposes. The tax paid on input goods or services can be set off against the output tax liability (i.e. tax payable on sales) of the business. This helps businesses reduce their tax burden and improve their cash flow.

For example, if a manufacturer,

To continue reading click here

For more detailed inofrmation, visit Swipe Blogs

2 notes

·

View notes

Text

Understanding HSN/SAC Codes for Indian Businesses

For any business working in the Goods and Services Tax regime in India, understanding HSN codes and SAC codes or applying them correctly is not merely a matter of fulfilling a legal requirement-it is an important aspect of ensuring bills are correctly prepared, that the right amount of tax is calculated, and GST has been properly complied with.

At first glance, these codes can appear complicated, but that is far from the truth-just like everything is based on common sense—these codes were developed with the intention that they provide uniformity and clarity in respect of classification of goods and services. Any other form of misclassification may have various consequences like levy of wrong tax, imposition of penalties, and reconciliation problems.

Tririd Biz, your trusted accounting and billing software in India, believes that GST compliance can be a little less challenging if it is clear upfront. This comprehensive guide will clarify HSN and SAC codes, show why these matters are of significance to your business, and even walk you through how our software makes managing HSN and SAC codes quite simple.

What are HSN Codes and SAC Codes?

Briefly:

HSN Code (Harmonized System of Nomenclature): These are internationally accepted classification codes for goods. The codes were evolved by the World Customs Organisation (WCO) to classify traded goods the world over systematically. In India, these codes are used in GST to assess the rate of tax applicable to different products.

Structure: While HSN codes remain international only till 6-digits, India in reality uses an HSN code of 2, 4, 6, or 8 digits depending on the turnover of the business. The more digits the code has, the finer the classification.

SAC Code (Service Accounting Code): In the same manner HSN is structured for goods, SAC codes are used to classify services. These codes are restricted to India and were developed by the Central Board of Indirect Taxes & Customs (CBIC) for service tax purposes, which were subsequently taken over by GST.

Structure: The SAC code is of 6 digits only; the initial two digits are '99' for services, and the next four digits specify the exact nature of service.

Why are HSN/SAC Codes Necessary for GST Compliance in India?

The primary reasons HSN/SAC codes are mandatory under GST are:

Uniform Classification: They ensure that goods and services are classified uniformly across India, preventing ambiguity and disputes regarding tax rates.

Tax Rate Determination: Every HSN/SAC code is linked to a specific GST rate. Using the correct code ensures you charge and pay the right amount of tax.

Invoice Generation: It is mandatory to mention the HSN/SAC code on GST-compliant invoices, especially for B2B transactions, if your turnover exceeds certain limits.

GST Return Filing: HSN/SAC-wise summary of outward supplies (sales) is required in GSTR-1, providing granular detail to the tax authorities.

Data Analysis & Policy Making: The government uses these codes to analyze trade data, understand consumption patterns, and formulate economic policies.

How Many Digits of HSN/SAC Code Do You Need to Use?

The number of digits you need to declare depends on your business's aggregate annual turnover in the preceding financial year:

For Goods (HSN):

Turnover up to ₹5 Crore: 4-digit HSN code (mandatory for B2B invoices)

Turnover exceeding ₹5 Crore: 6-digit HSN code (mandatory for all invoices)

Exports & Imports: 8-digit HSN code is generally required.

For Services (SAC):

All Turnovers: 6-digit SAC code is generally required.

(Always refer to the latest notifications from the GST portal for the most accurate and up-to-date requirements, as these thresholds can be revised.)

How to Find Your HSN/SAC Codes

Finding the right HSN/SAC code relevant to your goods or services is extremely important. Some good ways include:

GST Portal: The GST portal at times has search methods or links to official HSN/SAC code lists.

CBIC Website: Lists of HSN codes for goods and SAC codes for services are available on the Central Board of Indirect Taxes & Customs (CBIC) website.

Industry Associations: Your industry association might have compiled lists or issued guidelines for your particular industry.

Tax Consultants: A professional tax consultant will assist in determining the correct codes for your particular offerings.

Through Your Accounting Software: A good smart GST accounting software like Tririd Biz will take away a lot of these worries.

Common Mistakes to Avoid with HSN/SAC Codes

Using Wrong Codes: It is the commonest mistake, and these wrong codes can lead to wrong tax calculations, penalties, and problems for the customers in claiming ITC.

Not Updating Codes: As products or services change, or as GST rules change, always ensure your codes are up to date.

Ignoring Compulsory Requirements: Not mentioning the HSN/SAC code in the invoice, when it is required to do so, or putting in lesser digits than required, with respect to the turnover.

Confusing Goods with Services: Remember to use the HSN for goods and SAC for services.

Lack of Documentation: Failure to maintain documentation explaining the basis for assigning a certain HSN/SAC code, especially in the case of complex items.

How Tririd Biz Accounting & Billing Software Simplifies HSN/SAC Management

Managing HSN/SAC codes manually for every product and service can be tedious and error-prone, especially for businesses with diverse offerings. Tririd Biz is designed to take this burden off your shoulders:

Product/Service Master Data: Easily store and manage your products and services, each tagged with its correct HSN/SAC code and corresponding GST rate, within our software.

Automated Tax Calculation: When you create an invoice in Tririd Biz, the software automatically picks up the HSN/SAC code and applies the correct GST rate based on your master data. This minimizes manual errors.

Invoice Printing: Your GST-compliant invoices generated by Tririd Biz will automatically include the required HSN/SAC codes, ensuring you meet legal requirements.

GSTR-1 Summary: Tririd Biz helps in generating HSN/SAC-wise summaries for your GSTR-1, streamlining your return filing process.

Seamless Data Management: Update codes centrally, and the changes reflect across all relevant transactions, ensuring consistency.

By leveraging Tririd Biz, you can focus on growing your business, knowing that your GST billing and accounting are accurate and compliant with the latest HSN/SAC regulations.

Ensure Compliance, Embrace Simplicity

Understanding HSN/SAC codes is a fundamental aspect of GST compliance for Indian businesses. By dedicating time to correctly classify your goods and services and utilizing smart tools like Tririd Biz, you can ensure accuracy, avoid penalties, and simplify your entire GST filing process.

Ready to streamline your GST compliance with intelligent HSN/SAC management?

Get a Free Demo of Tririd Biz Today! Learn More About Tririd Biz GST Software Explore Tririd Biz Features

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Tririd Biz Accounting Software#HSN SAC codes India#GST codes for goods and services#Understanding HSN code#What is SAC code in GST#GST invoice HSN SAC

0 notes

Text

All-in-One Restaurant POS Software – ChefDesk

ChefDesk is a complete restaurant management solution that simplifies day-to-day operations for food businesses. Whether you're running a single outlet or a multi-location chain, ChefDesk helps you take full control with smart POS billing, order processing, inventory management, KOT integration, customer feedback, and insightful sales reports.

With an intuitive interface and cloud-based access, ChefDesk ensures smooth restaurant workflows, faster billing, and better decision-making. From kitchen display systems to GST-compliant invoicing, it offers everything you need to improve service quality and boost profit margins. It’s the perfect POS system for restaurants, food trucks, bakeries, cloud kitchens, and quick-service restaurants.

🚀 Boost your restaurant’s efficiency and customer satisfaction with ChefDesk. 🔗 Visit www.chefdesk.in and book your free demo today! Cal: +91 9666984984 Email: [email protected]

#restaurant POS software#POS for restaurants India#cloud kitchen billing software#QSR management system#restaurant inventory software#ChefDesk POS#restaurant billing app#café POS solution#KOT integration#GST billing software#Business#Software#Restaurant Management#Food Industry

1 note

·

View note

Text

What to consider when selecting reconciliation software? Why Businesses Need Reconciliation Software

Reconciliation is a critical financial process that ensures accuracy by matching internal records with external statements, such as bank transactions, supplier invoices, and customer payments. Without proper reconciliation, businesses risk financial misstatements, fraud, and compliance issues.

To streamline this process, companies rely on reconciliation software, which automates transaction matching, detects errors, and ensures data accuracy. By reducing manual effort, businesses save time, enhance compliance, and maintain financial transparency.

Types of Reconciliation

Bank Reconciliation: Matches internal cash records with bank statements to prevent errors.

Vendor Reconciliation: Ensures payments align with supplier invoices.

Customer Reconciliation: Verifies that all payments are correctly recorded.

Intercompany Reconciliation: Ensures consistency across subsidiaries.

Payroll Reconciliation: Confirms payroll transactions match records.

General Ledger Reconciliation: Validates financial transactions for accurate reporting.

Choosing the Right Reconciliation Software

Selecting reconciliation software involves considering compatibility with existing tools, scalability for business growth, automation capabilities, and compliance with financial regulations. Features like real-time processing, fraud detection, and multi-currency support can further enhance financial control.

How Automation Simplifies Reconciliation

Manual reconciliation is time-consuming and error-prone. Automation speeds up transaction matching, reduces human errors, improves compliance, and enhances fraud detection. It ensures businesses are always audit-ready while cutting costs and increasing efficiency.

To read the full article, click on the link here.

#business intelligence software#bi tool#bisolution#businessintelligence#bicxo#data#business solutions#business intelligence#businessefficiency#reconciliation#gst reconciliation software#reconciliation software#software#India

0 notes

Text

The Role of GST Billing Software in Enhancing Tax Filing Efficiency for Indian Startups

In recent years, the Goods and Services Tax (GST) has revolutionized the tax landscape in India, unifying multiple indirect taxes into a single framework. For Indian startups, the adoption of GST billing software has become a crucial factor in ensuring tax compliance and maximizing efficiency. Startups, often facing resource and time constraints, can benefit significantly from GST billing software. This article explores how GST billing software plays a key role in enhancing tax filing efficiency for Indian startups.

What is GST Billing Software?

GST billing software is an automated tool designed to help businesses generate GST-compliant invoices, calculate GST on transactions, maintain records, and file returns. The software ensures that businesses comply with GST regulations while also streamlining the entire process of tax-related documentation and filing. The benefits of GST billing software are particularly impactful for startups, where managing resources and time efficiently is essential for growth.

Key Benefits of GST Billing Software for Indian Startups

1. Automated GST Calculations

GST billing software automates the calculation of GST on sales and purchases, reducing the possibility of human error. Startups can rest assured that their GST calculations are accurate, which is critical when filing returns. Whether dealing with multiple tax rates (CGST, SGST, IGST) or exemptions, the software ensures that businesses comply with the latest tax laws.

2. GST-Compliant Invoice Generation

One of the primary features of GST billing software is its ability to generate GST-compliant invoices. These invoices follow the GST format, including details such as the GSTIN number, tax amount, and applicable tax rates. By automating the invoicing process, startups can ensure that they always issue accurate invoices, which is a key requirement for claiming input tax credit (ITC).

3. Streamlined GST Return Filing

GST filing can be complex, especially for startups that are still learning the ins and outs of tax compliance. GST billing software simplifies the process by automating the preparation of returns like GSTR-1, GSTR-3B, and other relevant forms. The software also integrates directly with the GST portal, enabling seamless filing with minimal manual effort. This ensures that startups don’t miss deadlines and avoid penalties for late or incorrect filings.

4. Time and Resource Efficiency

For startups, time and resources are limited. GST billing software can save valuable time by automating tasks such as invoicing, tax calculation, reconciliation, and filing. This reduces the administrative burden on startup teams, enabling them to focus on core business operations and growth strategies. The software also eliminates the need for manual entries and error-prone spreadsheets, reducing the chances of mistakes.

5. Real-Time Data Access and Reporting

GST billing software allows businesses to access real-time data, helping them stay on top of their financials. This includes tracking sales, purchases, and GST-related transactions. The software generates detailed reports on tax liabilities, input tax credits, and other key financial metrics. These insights help startups make informed decisions and maintain financial transparency, both of which are vital for securing funding or attracting investors.

6. GST Reconciliation Made Easy

GST billing software makes it easier to reconcile sales and purchase data. This feature ensures that the input tax credit (ITC) claimed by the business matches the tax paid on purchases. GST reconciliation can be a tedious task, but with automated software, discrepancies are flagged early, and businesses can correct them before filing returns. This ensures that no credits are missed, reducing tax liabilities and increasing the efficiency of the entire GST process.

7. Cost-Effective Solution

Many GST billing software options come with affordable pricing plans, making them accessible for startups operating on a tight budget. By using GST billing software, startups can avoid penalties associated with non-compliance or incorrect tax filings. Additionally, the software's ability to streamline tax filing and invoicing reduces the need for hiring dedicated accountants or tax professionals, further lowering operational costs.

How GST Billing Software Enhances Tax Filing Efficiency for Startups

1. Minimizes Errors and Ensures Accuracy

GST filing involves dealing with various tax rates and compliance requirements. Mistakes in tax calculations or filings can lead to penalties and legal issues. GST billing software reduces human error by automating the entire process, ensuring that all transactions are correctly accounted for and reported.

2. Reduces Compliance Risks

GST compliance is mandatory, and failing to comply with regulations can result in heavy penalties and fines. GST billing software ensures that startups remain compliant with the latest GST rules, automatically updating the software to reflect any changes in tax laws or requirements. This reduces the risk of non-compliance, which is especially critical for new businesses trying to establish themselves in the market.

3. Faster Filing and Submission

Filing GST returns manually can be time-consuming and prone to delays. GST billing software streamlines the filing process by automatically generating returns and submitting them directly to the GST portal. This ensures that startups can meet filing deadlines, avoiding penalties for late submissions.

4. Real-Time Updates on GST Liabilities

GST billing software tracks GST liabilities in real-time, providing startups with a clear view of how much tax they owe. This enables businesses to make timely payments and avoid late fees. Moreover, the software ensures that startups do not miss out on claiming input tax credit, which can significantly reduce tax liabilities.

5. Easy Integration with Other Tools

Most GST billing software can integrate with other accounting, inventory, and ERP software, creating a seamless flow of data across platforms. This integration helps startups streamline their entire financial workflow, from procurement to invoicing to tax filing, resulting in better operational efficiency.

Popular GST Billing Software for Startups in India

Several GST billing software options are tailored for startups in India. Here are a few of the most popular choices:

1. TallyPrime

TallyPrime is a trusted and comprehensive GST software, offering features like automatic tax calculation, multi-GST return filing, and seamless integration with GST portals.

2. Zoho Books

Zoho Books is an affordable GST-compliant accounting software that enables startups to create GST invoices, file returns, and track taxes. Its intuitive interface makes it an excellent choice for small businesses.

3. ClearTax

ClearTax is a user-friendly GST software designed for simplicity and accuracy. It helps businesses file returns, generate invoices, and track GST liabilities without any hassle.

4. QuickBooks

QuickBooks is another popular choice for startups, offering features like automated GST calculations, GST return filing, and real-time financial reporting.

5. Smaket Billing Software

Smaket offers GST-compliant invoicing and easy GST return filing. It provides customizable templates and is suitable for small startups looking for an efficient, cost-effective solution.

Conclusion

For Indian startups, the adoption of GST billing software is not just about compliance; it’s about increasing efficiency and freeing up valuable resources. By automating tax calculations, simplifying GST return filing, and improving data accuracy, startups can focus on scaling their operations and driving growth. With the right GST billing software, Indian startups can navigate the complexities of GST compliance with ease, ensuring a smoother and more successful business journey.

#accounting software#software#gst billing software#accounting#smaket#gst#billing#Startups#INDIA#ODISHA#BHUBANESWAR

0 notes

Text

The Role of AI in Cybersecurity: A Double-Edged Sword?

Introduction

The integration of Artificial Intelligence (AI) into cybersecurity has been a game-changer, offering unparalleled advantages in threat detection, response automation, and risk mitigation. AI-driven security solutions enhance the efficiency and speed of cyber defenses, making it increasingly difficult for cybercriminals to breach networks. However, just as AI strengthens cybersecurity frameworks, it also serves as a tool for cybercriminals, making cyber threats more sophisticated and elusive. This dual nature of AI in cybersecurity presents both opportunities and challenges, raising concerns about the balance between technological advancement and security risks.

The Role of AI in Strengthening Cybersecurity

AI has revolutionized cybersecurity by bringing automation, predictive analysis, and enhanced decision-making to the forefront. Here are some of the most significant ways AI contributes to cybersecurity:

1. Threat Detection and Prevention

Traditional cybersecurity measures rely on rule-based detection systems, which are often ineffective against advanced persistent threats (APTs) and zero-day attacks. AI-powered solutions use machine learning algorithms to analyze patterns, identify anomalies, and detect potential threats in real time. This proactive approach significantly reduces the risk of cyberattacks.

2. Incident Response and Mitigation

AI-driven security tools can autonomously respond to threats, minimizing human intervention. Automated responses, such as isolating infected systems or blocking malicious IP addresses, help contain threats before they escalate. This is particularly beneficial for industries relying on manufacturing planning software, where uninterrupted operations are crucial.

3. Predictive Analysis and Risk Assessment

By analyzing historical data and recognizing patterns, AI can predict potential vulnerabilities and recommend preventive measures. Companies using the best HR software for retail can leverage AI to detect insider threats, ensuring employee data remains protected from unauthorized access.

4. Enhancing Endpoint Security

AI-driven endpoint security solutions continuously monitor devices for unusual activities. These systems can identify compromised endpoints and take necessary actions, such as alerting security teams or executing remediation protocols. For businesses managing large inventories, integrating AI with the best inventory management software in India helps safeguard data from cyber threats while ensuring smooth supply chain operations.

The Dark Side: AI-Powered Cyber Threats

While AI enhances cybersecurity, it also presents new risks. Cybercriminals are increasingly using AI to launch sophisticated attacks that are difficult to detect and mitigate. Some of the key threats posed by AI-driven cyberattacks include:

1. AI-Driven Phishing Attacks

Traditional phishing attacks rely on human error, but AI-powered phishing attacks take deception to a new level. Cybercriminals use AI to craft highly personalized phishing emails, making them more convincing and harder to identify as fraudulent.

2. Automated Malware and Ransomware Attacks

AI enables cybercriminals to develop malware that can adapt and evolve, bypassing traditional antivirus solutions. AI-driven ransomware attacks have become more targeted, encrypting critical business data and demanding high ransoms for decryption keys.

3. Deepfake and Social Engineering Attacks

Deepfake technology, powered by AI, allows attackers to manipulate video and audio to impersonate individuals. This poses a significant risk in financial and corporate settings, where fraudulent transactions and misinformation campaigns can cause substantial damage.

4. Adversarial AI

Cybercriminals use adversarial AI techniques to trick machine learning models into misclassifying data. For instance, attackers can manipulate AI-driven security tools to overlook malware, allowing them to bypass defenses undetected.

Balancing AI's Benefits and Risks in Cybersecurity

Given AI’s dual nature, businesses must adopt a balanced approach to leveraging AI in cybersecurity. Here are some key strategies:

1. Invest in AI-Driven Security Solutions

Organizations should deploy AI-powered security tools to enhance their threat detection and response capabilities. This is particularly important for companies using manufacturing planning software, where cyber threats can disrupt production schedules and lead to financial losses.

2. Continuous AI Model Training and Updating

AI models should be regularly updated to stay ahead of evolving cyber threats. Implementing real-time threat intelligence feeds ensures that AI-driven security solutions remain effective.

3. Human-AI Collaboration

While AI can automate many security processes, human oversight remains essential. Cybersecurity teams should work alongside AI-driven tools to validate alerts, assess risks, and make informed decisions.

4. Ethical AI Development

Organizations developing AI solutions must adhere to ethical AI practices to prevent misuse. Implementing robust governance frameworks and ensuring transparency in AI-driven decision-making can help mitigate risks.

5. AI for Threat Hunting

Proactive threat hunting using AI-driven analytics can help businesses detect hidden threats before they cause damage. For example, integrating AI with the best HR software for retail can help identify suspicious login activities and prevent data breaches.

6. Robust Cybersecurity Policies and Employee Training

AI-driven security solutions alone are not enough; businesses must also enforce strong cybersecurity policies and conduct regular employee training. Employees should be educated about AI-driven threats such as deepfake scams and phishing attacks.

The Future of AI in Cybersecurity

As AI continues to evolve, its role in cybersecurity will become more complex. The key to leveraging AI effectively lies in balancing its benefits with potential risks. Future developments in AI-driven security will likely focus on:

Explainable AI (XAI): Enhancing transparency in AI-driven security decisions to improve trust and accountability.

AI-Augmented Security Operations Centers (SOCs): Integrating AI to automate threat detection and response within SOCs.

Federated Learning: Allowing AI models to learn from decentralized data sources while maintaining privacy and security.

Conclusion

AI’s impact on cybersecurity is undeniable—it is both a formidable defender and a potent weapon in the hands of cybercriminals. Businesses must adopt AI-driven security measures while remaining vigilant against AI-powered threats. Whether it’s protecting manufacturing planning software, securing data within the best HR software for retail, or safeguarding assets using the best inventory management software in India, AI plays a crucial role in modern cybersecurity strategies. By striking the right balance between AI's capabilities and ethical considerations, organizations can harness AI's potential without falling prey to its risks.

0 notes

Text

EazyBills is the Best Billing Software in India, designed to simplify and streamline billing for businesses of all sizes. With its user-friendly interface and powerful features, EazyBills makes invoicing faster, more accurate, and hassle-free. Whether you’re a small startup or an established enterprise, EazyBills helps you manage invoices, track payments, and automate billing tasks with ease. Its comprehensive reporting and analytics tools offer valuable insights to optimize your cash flow and business operations. Trusted by businesses across India, EazyBills is the ultimate choice for anyone looking to enhance their billing process and drive growth.

0 notes

Text

#disqus#erp software#erp manufacturing#trending#india#finance#accounting software#gst registration#b2bmarketing

0 notes

Text

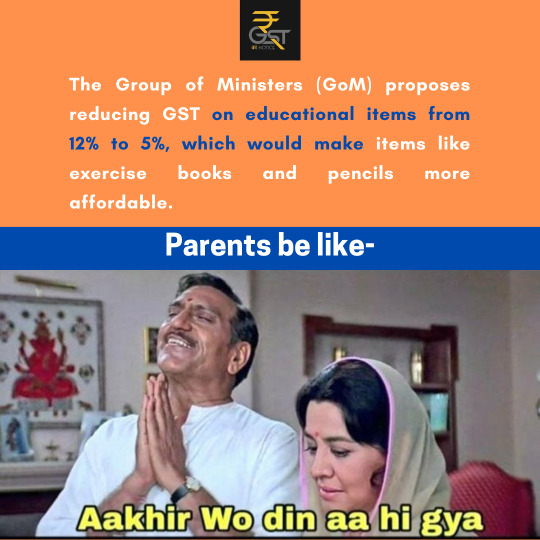

GoM purposes reducing GST on educational items... Find your information...

For more information visit- gstkanotice.com or DM GST ka Notice

#gom #gst #gommeeting #gst #gstkanotice #gstnotice #gstnoticereply #gstregistration #school #books #education #gsthelp #apperal #gstassistance #gstfact #gstupdates #gstcircular #gstcouncilmeeting #gstcouncil #gstn #gstindia #cbic #icai #business #profit #nirmalasitharaman #narendramodi #budget

#best gst consultation in india#best gst services in india#best gst lawyers in india#corporate lawyer in india#gst#best taxation law firm#gst consultation firm#gst experts in india#gst help#gst india#gstreturns#gst billing software#gstfiling#gst registration#gst assistance#gst services#gst services in india#taxation#education#school#books#school supplies

0 notes

Text

GST Software India: Simplify Your Taxation Process with Advanced Solutions

Introduction: Embracing Technology for Smooth GST Management

The implementation of the Goods and Services Tax (GST) in India marked a significant milestone in the country’s taxation history. With the aim to streamline the tax structure and eliminate cascading taxes, GST has brought about a paradigm shift in the way businesses manage their taxes. To keep pace with this transformative taxation system, businesses have turned to technology-driven solutions – GST software – that empower them to navigate the complexities seamlessly.

In this article, we delve into the realm of GST software in India, exploring its features, benefits, and the top options available for businesses of all sizes. Whether you are a startup, SME, or a large enterprise, embracing GST software can elevate your tax management process, ensuring accuracy, compliance, and enhanced efficiency.

GST Software India: Understanding the Essentials

What is GST Software India?

GST software India refers to specialized software solutions designed to assist businesses in managing their GST-related tasks efficiently. These solutions are tailored to simplify the compliance process, help with GST return filing, and provide real-time updates on changes in GST regulations. GST software plays a pivotal role in easing the burden of tax calculations and ensuring accurate tax submissions.

Key Features of GST Software India

Modern GST software comes equipped with a plethora of features that cater to the diverse needs of businesses. Some of the key features include:

GST Return Filing: Simplifies the process of filing GST returns by automating calculations and ensuring compliance with the latest rules and regulations.

Real-time GST Updates: Keeps users informed about any changes or amendments in GST laws, ensuring accurate and up-to-date tax calculations.

Invoice Generation and Management: Allows businesses to generate GST-compliant invoices and manage them efficiently, reducing the chances of errors.

Integration with Accounting Software: Seamless integration with accounting software enables automatic transfer of GST-related data, minimizing manual efforts.

Data Security: Robust data security measures safeguard sensitive financial information, providing peace of mind to businesses.

GST Analytics and Reports: Provides in-depth analytics and reports to analyze business’s GST liabilities, ITC claims, and overall tax compliance.

The Benefits of Using GST Software India

Streamlined Tax Compliance

GST software India streamlines the entire tax compliance process, from generating invoices to filing returns. With automation at its core, businesses can reduce the risk of human errors and penalties associated with incorrect submissions. The software ensures timely and accurate filing, keeping businesses compliant with GST regulations.

Time and Cost Savings

Manual tax calculations and return filing can be time-consuming and laborious. GST software eliminates the need for manual intervention, enabling businesses to save time and redirect resources to core activities. Moreover, avoiding errors in tax filing prevents costly penalties and fines.

Increased Accuracy

GST software leaves little room for errors, as it automates complex calculations and cross-verification of data. This accuracy not only ensures proper compliance but also builds trust with tax authorities and vendors.

Improved Business Efficiency

By automating GST-related tasks, businesses can focus on their core competencies and enhance overall efficiency. With GST software India handling tax management, teams can allocate more time to strategic decision-making and business growth.

Better Decision Making

Insightful analytics and reports generated by GST software provide valuable data on tax liabilities, cash flow, and ITC claims. This information empowers businesses to make informed decisions and optimize their financial strategies.

The Top GST Software Solutions in India

1. Microvista PowerGST Software: Empowering Businesses with Seamless Tax Management. Microvista PowerGST is a cutting-edge GST software designed to empower businesses with efficient tax management solutions. With its user-friendly interface and advanced features, it streamlines the entire GST compliance process, ensuring accuracy and timely filings.

Key Feature:

Automated GST Return Filing: Microvista PowerGST automates the process of GST return filing, reducing manual effort and minimizing the chances of errors. It ensures that businesses stay compliant with the latest GST regulations.

Real-time GST Updates: The software keeps users informed about any changes or updates in GST laws, ensuring that businesses are always up-to-date with the latest tax rules and regulations.

Smart Invoice Generation and Management: With Microvista PowerGST, businesses can generate GST-compliant invoices with ease. The software also offers efficient invoice management, reducing the risk of errors and ensuring smooth transactions.

Seamless Integration with Accounting Systems: The software seamlessly integrates with various accounting systems, facilitating the automatic transfer of GST-related data. This integration streamlines the overall tax management process.

Data Security: Microvista PowerGST employs robust data security measures to protect sensitive financial information. Businesses can trust the software to safeguard their data and ensure confidentiality.

Comprehensive GST Analytics and Reports: The software provides detailed analytics and reports that offer valuable insights into a business’s GST liabilities, input tax credit claims, and overall tax compliance. These insights enable informed decision-making and efficient financial planning.

Microvista PowerGST stands out as a reliable and feature-rich GST software solution, catering to businesses of all sizes and industries. By leveraging the power of technology, businesses can simplify their taxation processes, save time, reduce errors, and focus on their core operations for growth and success.

2. GST Mastermind

GST Mastermind is an all-in-one GST software that caters to businesses of all sizes. It offers a range of customizable features and modules, making it adaptable to diverse industry verticals.

Key Features:

GST-compliant invoice and billing system.

Inventory management with real-time updates.

Automated calculation of GST liabilities.

Audit trail for transparent tax reporting.

3. EasyGST Suite

As the name suggests, EasyGST Suite is known for its simplicity and ease of use. It is a cloud-based GST software suitable for startups and small businesses looking for hassle-free tax management.

Key Features:

Cloud-based access for anytime, anywhere usage.

Simplified GST return filing process.

Interactive dashboard for quick insights.

Integrated tax calendar for timely reminders.

FAQs About GST Software India

Q: Is GST software mandatory for businesses in India?

A: GST software is not mandatory but highly recommended, especially for businesses dealing with high volumes of transactions. It simplifies tax compliance and ensures accurate filing.

Q: Can GST software adapt to changes in GST regulations?

A: Yes, modern GST software is designed to stay updated with the latest GST regulations, providing real-time updates to users.

Q: Is cloud-based GST software secure?

A: Cloud-based GST software providers prioritize data security, implementing encryption and secure servers to protect sensitive financial information.

Q: Can GST software help with GST audit preparation?

A: Absolutely! GST software maintains a comprehensive audit trail and provides accurate reports, making GST audit preparation smoother.

Q: How can I choose the right GST software for my business?

A: Consider factors such as business size, industry, scalability, ease of use, and customer support while selecting the best-suited GST software for your business.

Q: Is there any free GST software available?

A: Yes, some GST software providers offer free basic versions, but for advanced features and scalability, businesses may opt for paid plans.

Conclusion: Transforming Tax Management with GST Software India

As businesses navigate the complexities of GST compliance, embracing technology becomes crucial to ensure seamless tax management. GST software India has emerged as a powerful ally in this journey, enabling businesses to achieve accuracy, compliance, and efficiency in their taxation processes. From streamlining return filing to providing real-time updates, the top GST software solutions cater to the diverse needs of businesses across India.

Embrace the future of tax management with GST software and experience the transformation it brings to your organization’s financial landscape.

1 note

·

View note

Text

Welcome to NamasteNet: Your Trusted Partner in Web Design and POS Software Solutions

At NamasteNet, we believe in the power of digital transformation for businesses of all sizes. Located in the heart of Hyderabad, we specialize in providing affordable web design and POS software solutions tailored specifically for Indian startups and small businesses.

Affordable Web Design That Elevates Your Business

NamasteNet offers custom website design services starting at just ₹4,999, making high-quality web design accessible to all. We don’t just build websites—we create digital experiences that reflect your brand's unique identity. Whether you're an emerging startup or an established business, our team ensures that your online presence stands out and delivers a seamless experience across all devices.

With a focus on responsive web design, we ensure that your website looks stunning whether viewed on a desktop, tablet, or smartphone. In today's mobile-first world, responsive design isn't just a feature—it's a necessity. And with our SEO-optimized websites, your business will not only look great but also rank higher in search engine results, driving organic traffic to your site.

Revolutionary POS Software to Streamline Your Operations

NamasteNet offers POS software starting at just ₹3,999, designed to streamline sales processes, enhance inventory management, and provide real-time business insights. Our cloud-based POS solutions are built to help retail stores, restaurants, and pharmacies run efficiently, without the hassle of paperwork or manual tracking.

Whether you’re a retailer in need of a reliable retail POS system or a restaurant seeking to improve customer service with a restaurant POS solution, NamasteNet’s software provides easy-to-use interfaces and robust functionality. With features like real-time sales tracking and inventory management, our POS systems will save you time and boost your bottom line.

Why NamasteNet?

NamasteNet prides itself on delivering Made-in-India solutions under the Digital India initiative. Our local expertise and understanding of the Indian market allow us to craft products that are not only affordable but highly effective for Indian businesses. We’re committed to supporting the growth of businesses with our affordable digital solutions that cater specifically to their needs.

Your Success is Our Success

We don’t just stop at providing the technology. The NamasteNet team is dedicated to offering unparalleled customer support and assistance every step of the way. Whether you need a complete digital overhaul or just a single service, we are here to help your business thrive in the digital age.

For businesses looking for an all-in-one solution to both their web design and POS software needs, NamasteNet is the partner you can trust. With affordable pricing and tailored solutions, we help businesses unlock their full digital potential.

Contact us today to learn more:

📞 +91 905 905 4355 📧 [email protected] 🏢 16-11-220, East Prasanth Nagar, Moosarambagh, Hyderabad - 500036

#Web Development Company Hyderabad#Best Web Designers Hyderabad#Top Web Development Companies Hyderabad#Affordable Web Design Services Hyderabad#Custom Website Design Hyderabad#E-commerce Website Development Hyderabad#Mobile App Development Hyderabad#SEO Services Hyderabad#Digital Marketing Company Hyderabad#Responsive Web Design Hyderabad#Retail POS Software Hyderabad#POS Billing Software Hyderabad#Best POS Software for Retail Stores Hyderabad#Cloud-based POS Solutions Hyderabad#Affordable POS Software Hyderabad#POS Software with Inventory Management Hyderabad#GST Billing Software Hyderabad#Mobile POS Systems Hyderabad#Made-in-India Software#Digital India Initiative.

0 notes

Text

🚨 Special All India Drive Against Fake GST Registrations 🚨

The Indian government has launched a nationwide crackdown on fake GST registrations. It's crucial to ensure your compliance to avoid hefty penalties. 💼💰 🔍 Why This Matters: - Protect your business from legal consequences. - Ensure your GST registration is valid and up-to-date. - Stay ahead of the curve with proper documentation and filings. 📍 For more information and support, visit the AJMS Global office in Jaipur. Our experts are here to guide you through the process and ensure full compliance. Don't take any risks—get the right advice today!

📞 Contact Us: https://wa.link/8zz9db

Landline: 0141-4812238 - Mobile: +91-7303587271

#tax managed services#gst services#gst compliances#gst registration#india gst#gst filing 2024#accounting services#company registration#investing#gst accounting software

0 notes

Text

EAZYBILLS stands out as the best free billing software in India, offering a comprehensive solution for businesses of all sizes. This intuitive platform simplifies invoicing and billing processes with features such as GST compliance, multi-currency support, and detailed financial reports. EAZYBILLS enhances efficiency with its user-friendly interface, automated reminders, and seamless integration with various payment gateways. Ideal for startups, SMEs, and freelancers, it ensures accurate and timely invoicing, making financial management hassle-free. Choose EAZYBILLS for a reliable, feature-rich billing experience that supports your business growth without incurring additional costs.

#best billing software#best billing software in india#gst billing#best billing software india#easy billing

0 notes