#Green hydrogen

Text

#good news#science#environmentalism#climate change#co2#carbon emissions#hydrogen#green hydrogen#fossil fuel alternatives#green energy#airplanes#aviation#sustainable aviation#environment

179 notes

·

View notes

Text

TES Canada is investing $4 billion, without public funding, to build a Shawinigan, Que. plant producing "green" hydrogen, a fuel used to reduce dependence on hydrocarbons in industry and heavy transport.

"This is the first green hydrogen project in the country," said federal Innovation Minister François-Philippe Champagne at a press conference in Shawinigan on Friday morning, accompanied by Quebec's Economy and Energy Minister Pierre Fitzgibbon.

The plant's main customer will be Énergir, which will use the hydrogen to produce around one-fifth of its 115 million cubic meters of renewable natural gas (RNG) by 2030.

Continue Reading.

Tagging @politicsofcanada

39 notes

·

View notes

Text

8 notes

·

View notes

Text

Green hydrogen successfully produced from plastic waste

Scanning electron microscope (SEM) image of layered stacks of nano-scale flash graphene sheets formed from waste plasticKevin Wyss/Tour lab

Low-emissions strategy that could pay for itself helps scientists achieve high-yield hydrogen gas and high-value graphene.

Climate change has made scientists seek renewable energy where it can be found. While manufacturing products out of waste is on the…

View On WordPress

8 notes

·

View notes

Text

News from Africa, 19 June

Hage Geingob will host Danish PM Mette Frederiksen and Dutch PM Mark Rutte today in Namibia. Green hydrogen will reportedly be among the subjects discussed.

2. Namibia's proposed visa exemption for Chinese nationals is a bilateral agreement that would benefit both countries, according to China's ambassador to Namibia, Zhao Weiping.

Some Namibian politicians have objected to the proposal, with opposition leader McHenry Venaani claiming it is a "hoodwinking process" for Chinese prisoners to come to the country, and aspiring presidential candidate Job Amupanda alleging that it involves a deal between the ruling party and China to garner support for next year's elections.

The proposed agreement's main goal is to attract Chinese tourists and help Namibia become competitive again after the Covid-19 pandemic, according to Namibia's minister of home affairs, immigration, safety and security, Albert Kawana.

3. Angola and Zambia signed a memorandum of understanding to enhance cooperation in information technology, including digital transformation, AI, and space technology.

The agreement includes the establishment of direct cross-border optical fibre backbone connectivity between the two countries, scheduled to happen this month.

The collaboration is expected to help improve the regulation of the Angolan and Zambian telecom markets and lead to improved coverage and quality of ICT services provided in both countries.

4. Namibia is embarking on a journey of digital transformation to modernize various aspects of the country's life.

The Department of Home Affairs, Immigration and Security recently announced the successful implementation of an online passport application system, a major step towards delivering home affairs government services through digital channels. Namibia is partnering with Estonia to bring government services online and gradually prepare citizens for the transformation ahead. The Vice Minister of ICT recognizes the importance of foreign direct investment (FDI) for African technology spaces, but stresses the need for a clear roadmap or strategy to ensure that solutions developed in Africa fit the lifestyle on the continent.

5. Nigeria has 71 million people living in extreme poverty and 133 million people are classified as multidimensionally poor, according to 2023 data from the World Poverty Clock and the National Bureau of Statistics.

6. The Bank of Namibia increased the repo rate to safeguard the dollar-rand peg and contain inflationary pressures, but this will severely impact consumers who rely on debt to survive.

The governor expressed empathy for people losing their homes due to rising debt costs, and urged the nation to find better solutions to keep more Namibians in their homes while maintaining financial stability.

7. The fighting in Sudan has caused a surge in refugees fleeing to South Sudan, exacerbating an already dire humanitarian crisis.

The UN has called for $253 million in funding to respond to the crisis, but donations have been slow to come in.

The lack of resources and funding has led to inadequate food, water, and sanitation facilities in transit camps, resulting in malnutrition, disease, and preventable deaths.

#Dutch PM#Danish PM#visit#Namibia#Green Hydrogen#China#visas#tourists#Angola#Zambia#ICT#network#digital#Nigeria#poverty#clock#currency peg#South Africa#refugees#crisis#food#sanitation#Sudan#Africa

3 notes

·

View notes

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

2 notes

·

View notes

Text

GERMANY’S FAR RIGHT IS SURGING

Peter Fitzek is the self-proclaimed “King of Germany.” (https://www.haaretz.com/world-news/europe/2018-08-09/ty-article-magazine/.premium/guns-anti-semitisms-and-fake-kings-germanys-dangerous-new-cult/0000017f-f7e9-ddde-abff-ffedb1fd0000)

A Skynews report earlier this week profiled a town in Germany where thousands of “extremists” were gathering to give their allegiance to the new king of…

View On WordPress

#Bill Gates#BRICS#Burisma#CEFC#CELAC#Chris van Tulleken#Communit of Latin Americanand aribbean States#First Steps Nutrition Trust#green hydrogen#Hamtramck#Hunter Bden#Jenny Hill#Johannesburg#Kaiser#King of Germany#Konigreich Deutchland#LGBTQ#Marshall Plan#Narendra Modi#OceanGate#Peter Fitzak#Peter the First#Reichsburger#Reichstag#Rushi Sunak#Suzanne Lynch#Titanic#Ukraine#Ukraine Recovery Conference#UNESCO

3 notes

·

View notes

Text

Different colours for hydrogen gas

Using the right type of hydrogen gas can help achieve net zero.

Energy gotten from hydrogen gas is the only available energy that produces water, electricity, and heat when consumed in a fuel cell.

View On WordPress

4 notes

·

View notes

Text

Abu Dhabi Sustainability Week 2023, Agenda for Global Climate Action

Abu Dhabi Sustainability Week (ADSW) 2023, features discussions on climate action leading up to COP28, including the opening ceremony held on Saturday and followed by Zayed Sustainability Awards ceremony, and the first Green Hydrogen Summit.

Read More

#united arab emirates#uae#abudhabi gp#sustainability#sustainable#ecology#climate and environment#climate change#climate action#cop28#sheikh mohammed bin zayed al nahyan#zayed#awards#award ceremony#ceremony#green hydrogen#summit#dubai#abudhabi#emirates#gulf#gulf countries#middleeast#arabian#arab news#economy#economics#global#economic situation#economic conditions

4 notes

·

View notes

Text

Looking for the best ASME Services in UAE - Globe Inspection

Searching for the best ASME services in the UAE? Globe Inspection offers expert solutions for compliance, inspection, and certification to meet ASME standards. Trust us for reliable, top-tier services. To learn more visit our website globeinspections.com today.

#Industry inspection#third party inspection#engineering#Green hydrogen#product design#Nuclear#scholarship

0 notes

Text

28 notes

·

View notes

Text

Hydrogen Storage Market - Forecast(2024 - 2030)

Hydrogen storage is a critical area of research and development, particularly as hydrogen is being positioned as a key player in clean energy transition strategies. Hydrogen is an attractive energy carrier due to its high energy content per unit mass and its potential for producing zero emissions when used in fuel cells or combustion engines. However, efficient, safe, and cost-effective storage of hydrogen presents significant challenges due to its physical properties.

Methods of Hydrogen Storage

Compressed Hydrogen Gas (CHG):

How it works: Hydrogen gas is compressed at high pressures (typically 350–700 bar) and stored in high-strength tanks.

Challenges: High energy consumption for compression, safety concerns related to high-pressure storage, and the need for heavy, reinforced storage vessels.

Applications: Widely used in hydrogen-fueled vehicles, hydrogen refueling stations, and industrial applications.

Liquid Hydrogen (LH2)

How it works: Hydrogen is cooled to cryogenic temperatures (-253°C) and stored as a liquid in insulated containers.

Challenges: Significant energy is required for cooling, and hydrogen boil-off can occur due to heat transfer, leading to losses. Insulation must be very effective, and maintaining these low temperatures is expensive.

Applications: Used in space exploration (rocket fuel) and some large-scale transportation solutions, but not as common in everyday applications due to cost and technical difficulties.

Sample Report:

Solid-State Hydrogen Storage:

Metal Hydrides:

How it works: Hydrogen is chemically bonded to metals or alloys, forming metal hydrides. These materials can store hydrogen at lower pressures and release it when heated.

Challenges: The materials used (such as magnesium, titanium, or palladium) are often expensive, and hydrogen uptake/release cycles can be slow or require substantial heating.

Applications: Still in research, with potential applications in portable electronics, stationary energy storage, and automotive systems.

Chemical Hydrogen Storage:

How it works: Hydrogen is stored in chemical compounds (such as ammonia or liquid organic hydrogen carriers — LOHCs). Hydrogen can be released through chemical reactions, typically requiring catalysts or specific conditions.

Challenges: The reversibility of reactions and the energy required to release hydrogen are major challenges. Some chemicals involved can also be toxic or require special handling.

Applications: Research is ongoing, with potential for large-scale energy storage solutions and industrial hydrogen supply chains.

Carbon-based Storage:

How it works: Materials like carbon nanotubes and graphene are being explored for their potential to adsorb hydrogen on their surfaces or within their structures.

Inquiry Before:

Challenges: Carbon-based storage materials are still in early development stages, and while they show promise, achieving commercial viability and scaling these solutions is a major hurdle.

Applications: Long-term potential for energy storage and transportation applications if scalability and cost issues are resolved.

Key Considerations in Hydrogen Storage

Energy Density:

Hydrogen has a very high energy content by mass, but a low energy density by volume in its gaseous state. This means it takes up a lot of space unless compressed or liquefied.

Safety:

Hydrogen is highly flammable, so storage solutions need to prioritize preventing leaks and ensuring robust safety protocols. High-pressure storage, in particular, poses risks.

Cost:

Hydrogen storage is expensive, especially at the compression, liquefaction, and solid-state storage stages. Developing cost-effective storage solutions is essential for the widespread adoption of hydrogen energy.

Material Durability

Storage materials must be able to withstand hydrogen embrittlement, a process that weakens metals over time when exposed to hydrogen.

Schedule a Call:

Scalability:

For hydrogen to play a significant role in future energy systems, storage methods must be scalable from small applications (such as portable electronics) to large industrial and grid-scale energy storage.

Hydrogen storage technologies are evolving rapidly. There is significant research focused on developing materials that are lighter, more energy-efficient, and cost-effective. Solid-state storage methods, particularly using metal hydrides and carbon-based materials, are showing promise, though they require further research to overcome challenges related to reaction rates and material stability.

Hydrogen Infrastructure: In tandem with storage development, there is a growing need for hydrogen production and transportation infrastructure, which will determine the feasibility of large-scale hydrogen energy systems.

In the future, breakthroughs in material science and advancements in hydrogen technologies could make hydrogen storage more practical, playing a key role in sectors such as transportation, renewable energy integration, and industrial applications.

Buy Now:

The Hydrogen Storage Market is gaining attention as hydrogen emerges as a key player in the transition to cleaner energy systems. Here are the top 10 key trends shaping this market:

Increased Demand for Green Hydrogen

Green hydrogen, produced using renewable energy, is becoming a focus due to global decarbonization goals. The growth in renewable energy generation, such as wind and solar, is driving the demand for effective hydrogen storage solutions.

Technological Advances in Storage Methods

New innovations in hydrogen storage, such as solid-state storage, liquid organic hydrogen carriers (LOHC), and improved compressed gas and liquid hydrogen technologies, are advancing the efficiency and safety of storage.

Focus on Cost Reduction

As production and storage of hydrogen are still relatively expensive, efforts are being made to reduce costs through economies of scale, innovations in materials, and government support. Cheaper storage solutions are vital to making hydrogen competitive with fossil fuels.

Growing Role of Hydrogen in Transportation

Hydrogen-powered fuel cell vehicles (FCVs), including trucks, buses, and ships, are driving the need for mobile hydrogen storage solutions. The transportation sector is increasingly adopting hydrogen as a clean alternative to fossil fuels, necessitating efficient storage.

Development of Large-Scale Storage Solutions

The industry is moving towards large-scale hydrogen storage systems, such as salt caverns, underground pipelines, and depleted oil & gas fields. This allows for long-term energy storage and utilization during times of peak demand or low renewable energy production.

Government Policies and Incentives

Government initiatives, including subsidies, tax breaks, and hydrogen-specific strategies (e.g., the EU’s Hydrogen Strategy), are fueling investment in hydrogen storage technologies and infrastructure, pushing forward the commercialization of hydrogen.

Decentralized Hydrogen Production and Storage

With the rise of small-scale, localized renewable energy projects, decentralized hydrogen storage systems are becoming popular. These enable local hydrogen production and storage, reducing transportation costs and energy losses.

Integration with Renewable Energy

Hydrogen is increasingly being seen as a renewable energy storage medium, enabling the storage of excess energy produced by wind and solar farms. This “power-to-gas” system allows renewable energy to be stored in the form of hydrogen and used when needed.

For more details about Hydrogen Storage Market click here

0 notes

Text

Hydrogen Storage Market — Forecast(2024–2030)

Overview of Hydrogen Storage

Request Sample

Types of Hydrogen Storage

Gaseous Hydrogen Storage:

Liquid Hydrogen Storage:

Solid-State Storage:

Chemical Hydrogen Storage:

Advantages of Hydrogen Storage

Energy Density: Hydrogen has a high specific energy (approximately 33.6 kWh/kg), making it a potent energy carrier.

Renewable Integration: Hydrogen storage can help balance supply and demand in renewable energy systems, storing excess energy generated during peak production times for later use.

Decarbonization: As a clean fuel, hydrogen can significantly reduce carbon emissions, particularly in sectors that are hard to electrify, such as heavy industry and long-haul transport.

Inquiry Before Buying

Challenges

Despite its advantages, hydrogen storage faces several challenges:

Cost: High costs associated with storage technologies, especially high-pressure and cryogenic systems, limit widespread adoption.

Safety: Hydrogen is flammable and requires careful handling and infrastructure to ensure safety.

Efficiency: Energy losses during hydrogen production, storage, and reconversion to electricity can be substantial.

Schedule a Call

Future Prospects

Research and development in hydrogen storage technologies are ongoing, with a focus on improving efficiency, reducing costs, and enhancing safety. Innovations such as advanced materials for solid-state storage and better liquefaction techniques are promising. As global efforts to transition to clean energy intensify, effective hydrogen storage solutions will be pivotal in establishing hydrogen as a cornerstone of sustainable energy systems.

In conclusion, hydrogen storage is a dynamic field with significant implications for energy security, environmental sustainability, and technological advancement. Its development will play a crucial role in the future energy landscape, facilitating the transition to a low-carbon economy.

Buy Now

Gaseous Storage: Hydrogen is compressed in high-pressure tanks, typically at 350 to 700 bar. This method is common in hydrogen vehicles but requires robust materials to prevent leaks.

Liquid Storage: Hydrogen can be cooled to cryogenic temperatures to become liquid, offering higher energy density. However, it demands significant energy for liquefaction and poses challenges with boil-off.

Solid-State Storage: This involves storing hydrogen in solid materials like metal hydrides, allowing for moderate temperature and pressure storage. It offers safety benefits but faces issues related to weight and release kinetics.

Chemical Storage: Hydrogen is stored in chemical compounds, such as ammonia. This method can leverage existing infrastructure but requires additional steps for hydrogen extraction.

About IndustryARC™:

IndustryARC primarily focuses on Cutting Edge Technologies and Newer Applications of the Market. Our Custom Research Services are designed to provide insights on the constant flux in the global demand-supply gap of markets. Our strong analyst team enables us to meet the client research needs at a very quick speed with a variety of options for your business. We look forward to support the client to be able to better address customer needs; stay ahead in the market; become the top competitor and get real-time recommendations on business strategies and deals.

Contact Us: https://www.industryarc.com/contact-us.php

Website URL: https://www.industryarc.com/

0 notes

Text

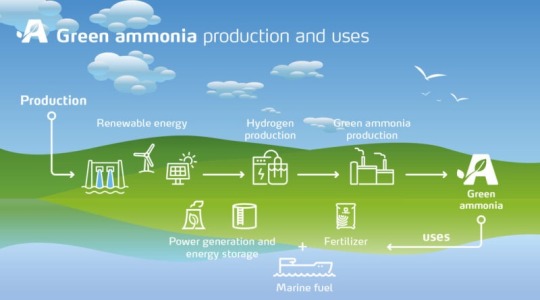

Green Hydrogen with Green Ammonia Twist + $4 BILLION USD in Investment Support Solidifies Path to Large and Small GH Commercialization

Image: Green ammonia production from green hydrogen courtesy of World Economic Forum.

The debate over green hydrogen continues, but the flow, the deluge of BILLIONS of DOLLARS into new and larger GH projects, solidifies the path to Commercialization for both large and small applications.

In the latest news, the Saudi-listed desalination powerhouse ACWA Power has just added another notch in its…

View On WordPress

#Amonia#Colorado School of Mines#Genesis Nanotechnology#Green Hydrogen#Nanomaterials#Nanotechnology#NREL#Toyota

3 notes

·

View notes

Text

Explore the Future of Sustainable Energy with Green Hydrogen Production, Clean Storage, and Graphene-Powered Hydrogen Energy Solutions.

1 note

·

View note