#Battery-Powered Electric Vehicles (EVs)

Text

Portable EV Chargers: Charge Your Electric Vehicle Anywhere, Anytime

Electric vehicles (EVs) are becoming increasingly popular due to their environmental benefits, lower running costs, and technological advancements. However, one of the main concerns of owning an EV is finding a charging station when you’re on the road. This is where portable EV chargers come in. Click the image below to explore the prices and detailed features of the DELTA Pro Portable EV…

View On WordPress

#Battery Chargers#Battery Charging Convenience#Charging Convenience#Charging Flexibility#Charging Solutions#Electric Charging#Electric Mobility Solutions#Electric vehicles#EV Charging#EV Charging Mobility#EV Connectivity#EV Mobility#EV Power#Mobile Chargers#Mobile Electric Vehicle Chargers#Mobile Power#On-the-Go Charging#On-the-Go Charging Solutions#Portable Chargers#Portable Charging Stations#Portable Energy#Portable EV Chargers#Portable Power#Portable Power Stations#Portable Stations#Travel Chargers#Travel-Friendly Chargers#Vehicle Chargers#Vehicle Charging Flexibility#Vehicle Mobility

0 notes

Text

Volvo Software to Reduce EV Battery Charging Time by 30% - Technology Org

New Post has been published on https://thedigitalinsider.com/volvo-software-to-reduce-ev-battery-charging-time-by-30-technology-org/

Volvo Software to Reduce EV Battery Charging Time by 30% - Technology Org

Volvo Cars has made an investment in the UK startup Breathe Battery Technologies, aiming to leverage its battery software to achieve a 30% reduction in charging time for the upcoming generation of electric vehicles (EVs).

A Volvo car – illustrative photo. Image credit: media.volvocars.com.

The exact size of the investment from Volvo Cars Tech Fund, the company’s corporate venture capital arm, has not been disclosed.

Breathe’s technology is expected to be integrated into new Volvo EVs within the next two to three years. The partnership aims to address challenges related to power intake limitations in EVs during rapid charging, providing customers with a more efficient charging experience.

Breathe Battery Technologies’ CEO, Ian Campbell, highlighted that the company’s charging software, based on algorithms, offers enhanced visibility into the health of individual cells within a battery pack. This enables electric vehicles (EVs) to charge at full power while ensuring safety and without altering battery chemistry.

Campbell emphasized that this marks just the beginning of a substantial shift in batteries as they increasingly rely on software-defined solutions.

Faster charging times are crucial in encouraging more customers to adopt EVs. Breathe is also developing software to enhance battery durability and performance, with plans to make it available for EV batteries, aligning with automakers’ priorities in extending battery life.

Written by Vytautas Valinskas

You can offer your link to a page which is relevant to the topic of this post.

#Algorithms#arm#Authored post#batteries#battery#battery charging stations#battery life#Cars#Cells#CEO#chemistry#electric cars#electric vehicles#Energy & fuel news#EV#EVs#Featured technology news#Full#Health#investment#it#life#Link#media#partnership#performance#photo#power#Reduction#safety

0 notes

Text

#EV Car Charger cornwall#electric car charging cornwall#cornwall car chargers#solar panel installation cornwall#solar installation in cornwall#power point installer#solar installers cornwall#ev charging installer#commercial ev charger installation#solar cornwall#battery installations#solar panels cornwall#electrician jobs cornwall#ev charging cornwall#Electric Vehicle Charger#Home Car Charging#Electric Vehicle Charger Installer#zappi charger installation#cornwall services ev charging#zappi car charger installation#install electric car charger#electric car charging stations home installation#install home charger for car#electric car chargers for home use#installing electric vehicle charger#solar installation#home solar installation#pv installation#installation of ev charger#charging point installation

1 note

·

View note

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

1 note

·

View note

Link

In April 2023, BYD sold 1,377 EVs in Israel, accounting for about 40% of total EV sales. BYD has become one of the top automakers in Israel, with its primary export model, the ATTO 3, accounting for most of its sales in the country(..)

P.S. The entry of affordable EVs into the Israeli market will significantly improve the country's energy security and independence, as electric car owners do not need to buy either gasoline or diesel fuel, and Israel has a huge amount of solar energy resources as well. Whether we like it or not, along with Tesla, BYD is also becoming a very important company to reduce the West's dependence on fossil fuel imports and clean the air in our cities...

#Israel#BYD#ev sales#BYD Atto 3#electric crossover#affordable ev#LFP battery#fossil fuel phase-out#demise of big oil#russian defeat#electric car#electric vehicle#lithium iron phosphate battery#solar power#rooftop solar#Europe

0 notes

Photo

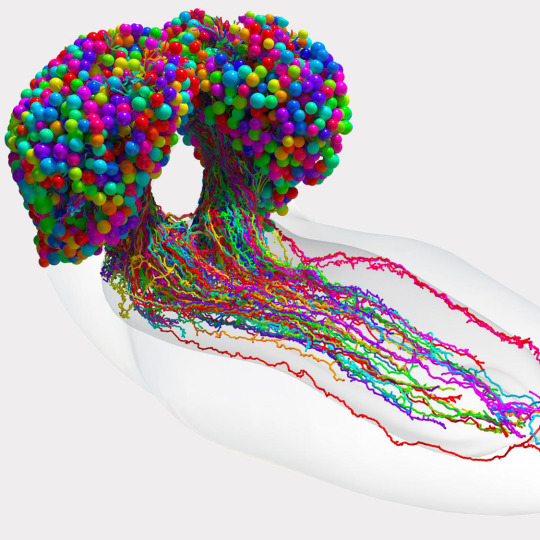

Link About It: This Week’s Picks

Volcanoes on Venus, the history of reggaeton, gravity-free drinking in space and more from around the web The First Complete Map of an Insect Brain A team led by John Hopkins University and the University of Cambridge have completed the most expansive map of a brain to date. The diagram, which traces every neuron and connection of a larval fruit fly (whose biology is comparable with …

https://coolhunting.com/link-about-it/link-about-it-this-weeks-picks-472/

#Link About It#Animals#Batteries#Electric Vehicles#EVs#Gravity#Insects#LinkAboutIt#Medicine#Music#Music History#Musical History#NASA#Power#Puerto Rico#Reggaeton#Science#Scientific Studies#Space#Venus#Volcanoes#CH Editors#COOL HUNTING®

0 notes

Text

2022 Kia EV6 GT-Line AWD

Best electric car yet? Very possibly the Kia EV6 is the winner!

View On WordPress

#Kia#2022 Kia EV6 GT-Line AWD#battery-powered#electric vehicle#Electrify America#EV#featured#Genesis GV60#Hyundai Ioniq 5#Meridian surround system#WordPrompt

0 notes

Text

Clean energy contributed a record 11.4tn yuan ($1.6tn [USD]) to China’s economy in 2023, accounting for all of the growth in investment and a larger share of economic growth than any other sector.

The new sector-by-sector analysis for Carbon Brief, based on official figures, industry data and analyst reports, illustrates the huge surge in investment in Chinese clean energy last year – in particular, the so-called “new three” industries of solar power, electric vehicles (EVs) and batteries.

Solar power, along with manufacturing capacity for solar panels, EVs and batteries, were the main focus of China’s clean-energy investments in 2023, the analysis shows.[...]

Clean-energy investment rose 40% year-on-year to 6.3tn yuan ($890bn), with the growth accounting for all of the investment growth across the Chinese economy in 2023.

China’s $890bn investment in clean-energy sectors is almost as large as total global investments in fossil fuel supply in 2023 – and similar to the GDP of Switzerland or Turkey.

Including the value of production, clean-energy sectors contributed 11.4tn yuan ($1.6tn) to the Chinese economy in 2023, up 30% year-on-year.

Clean-energy sectors, as a result, were the largest driver of China’ economic growth overall, accounting for 40% of the expansion of GDP in 2023.[...]

The surge in clean-energy investment comes as China’s real-estate sector shrank for the second year in a row. This shift positions the clean-energy industry as a key part not only of China’s energy and climate efforts, but also of its broader economic and industrial policy.[...]

The growing importance of these new industries gives China a significant economic stake in the global transition to clean-energy technologies.[...]

In total, clean energy made up 13% of the huge volume of investment in fixed assets in China in 2023, up from 9% a year earlier.[...]

The major role that clean energy played in boosting growth in 2023 means the industry is now a key part of China’s wider economic and industrial development.[...]

Solar was the largest contributor to growth in China’s clean-technology economy in 2023. It recorded growth worth a combined 1tn yuan of new investment, goods and services, as its value grew from 1.5tn yuan in 2022 to 2.5tn yuan in 2023, an increase of 63% year-on-year.

While China has dominated the manufacturing and installations of solar panels for years, the growth of the industry in 2023 was unprecedented.[...]

An estimated 200GW was added across the country during 2023 as a whole, more than doubling from the record of 87GW set in 2022[...]

China experienced a significant increase in solar product exports in 2023. It exported 56GW of solar wafers, 32GW of cells and 178GW of modules in the first 10 months of the year, up 90%, 72% and 34% year-on-year respectively [...] However, due to falling costs, the export value of these solar products only increased by 3%.

Within the overall export growth there were notable increases in China’s solar exports to countries along the “belt and road”, to southeast Asian nations and to several African countries.[...]

China installed 41GW of wind power capacity in the first 11 months of 2023, an increase of 84% year-on-year in new additions. Some 60GW of onshore wind alone was due to be added across 2023[...]

In addition, offshore wind capacity increased by 6GW across the whole of 2023.[...]

By the end of 2023, the first batch of “clean-energy bases” were expected to have been connected to the grid, contributing to the growth of onshore wind power, particularly in regions such as Inner Mongolia and other northwestern provinces. The second and third batches of clean-energy bases are set to continue driving the growth in onshore wind installations.

The market is also being driven by the “repowering” of older windfarms, supported by central government policies promoting the model of replacing smaller, older turbines with larger ones.[...]

Despite technological advancements reducing costs, increases in raw material prices have resulted in lower profit margins compared to the solar industry[...]

China’s production of electric vehicles grew 36% year-on-year in 2023 to reach 9.6m units, a notable 32% of all vehicles produced in the country.

The vast majority of [B]EVs produced in China are sold domestically, with sales growing strongly despite the phase-out of purchase subsidies announced in 2020 and completed at the end of 2022.[...]

Sales of [B]EVs made in China reached 9.5m units in 2023, a 38% year-on-year increase. Of this total, 8.3m were sold domestically, accounting for one-third of Chinese vehicle sales overall, while 1.2m [B]EVs were exported, a 78% year-on-year increase.[...]

China’s EV market is highly competitive, with at least 94 brands offering more than 300 models. Domestic brands account for 81% of the EV market, with BYD, Wuling, Chery, Changan and GAC among the top players.[...]

The analysis assumes that EVs accounted for all of the growth in investment in vehicle manufacturing capacity [...] while investment in conventional vehicles was stable[...]

Meanwhile, EV charging infrastructure is expanding rapidly, enabling the growth of the EV market. In 2022, more than 80% of the downtown areas of “first-tier” cities – megacities such as Beijing, Shanghai and Guangzhou – had installed charging stations, while 65% of the highway service zones nationwide provided charging points.

More than 3m new charging points were put into service during 2023, including 0.93m public and 2.45m private chargers. The accumulated total by November 2023 reached 8.6m charging points.[...]

China is rapidly scaling up electricity storage capacity. This has the potential to significantly reduce China’s reliance on coal- and gas-fired power plants to meet peaks in electricity demand and to facilitate the integration of larger amounts of variable wind and solar power into the grid.

The construction of pumped hydro storage capacity increased dramatically in the last year, with capacity under construction reaching 167GW, up from 120GW a year earlier.[...]

Data from Global Energy Monitor identifies another 250GW in pre-construction stages, indicating that there is potential for the current surge in capacity to continue.

Construction of new battery manufacturing capacity was another major driver of investments, estimated at 0.3tn [yuan].[...]

Investment in electrolysers for “green” hydrogen production almost doubled year-on-year in 2023, reaching approximately 90bn yuan, based on estimates for the first half of the year from SWS Research. [...]

China’s ministry of transportation reported that investment in railway construction increased 7% in January–November 2023, implying investment of 0.8tn for the full year. This includes major investments in both passenger and freight transport. Investment in roads fell slightly, while investment in railways overall grew by 22%.

The share of freight volumes transported by rail in China has increased from 7.8% in 2017 to 9.2% in 2021, thanks to the rapid development of the railway network.

In 2022, some 155,000km of rail lines were in operation, of which 42,000km were high-speed. This is up from 146,000km of which 38,000km were high-speed in 2020.[...]

In 2023, 10 nuclear power units were approved in China, exceeding the anticipated rate of 6-8 units per year set by the China Nuclear Energy Association in 2020 for the second year in a row.

There are 77 nuclear power units that are currently operating or under construction in China, the second-largest total in the world. The total yearly investment in 2023 was estimated for this analysis at 87bn yuan, an increase of 45% year-on-year[...]

State Grid, the government-owned operator that runs the majority of the country’s electricity transmission network, has a target to raise inter-provincial power transmission capacity to 300GW by 2025 and 370GW by 2030, from 230GW in 2021. These plans play a major role in enabling the development of clean energy bases in western China.

China Electricity Council reported investments in electricity transmission at 0.5tn yuan in 2023, up 8% on year – just ahead of the level targeted by State Grid.[...]

China’s reliance on the clean-technology sectors to drive growth and achieve key economic targets boosts their economic and political importance. It could also support an accelerated energy transition.

The massive investment in clean technology manufacturing capacity and exports last year means that China has a major stake in the success of clean energy in the rest of the world and in building up export markets.

For example, China’s lead climate negotiator Su Wei recently highlighted that the goal of tripling renewable energy capacity globally, agreed in the COP28 UN climate summit in December, is a major benefit to China’s new energy industry. This will likely also mean that China’s efforts to finance and develop clean energy projects overseas will intensify.

Globally, China’s unprecedented clean-energy manufacturing boom has pushed down prices, with the cost of solar panels falling 42% year-on-year – a dramatic drop even compared to the historical average of around 17% per year, while battery prices fell by an even steeper 50%.

This, in turn, has encouraged much faster take-up of clean-energy technologies.[...]

The clean-technology investment boom has provided a new lease of life to China’s investment-led economic model. There are new clean-energy technologies where there is scope for expansion, such as [Hydrogen] electrolysers.

Mind-blowing is the only word for it rly [25 Jan 24]

122 notes

·

View notes

Text

Venturi Antarctica EV, 2021. The most recent version of Venturi's electric ATV has been in service at Belgium's Princess Elisabeth Antarctica Station since December 2021. The Antarctica's tracks are powered by a pair of 80 hp (60 kW) electric motors, which are fed by a 52.6 kWh battery pack that gives the vehicle a range of 31 miles (50 km) in temperatures as low as -58˚F (-50˚C). For longer trips, it can fit a second pack to extend the range.

184 notes

·

View notes

Text

Came across another example...

"Electric vehicles are not the solution!"

"Yes, I really wish we could focus more on trains and public transportation."

"Mining for battery materials hurts the environment more than fossil fuels!"

"Oh."

EVs are *part* of the solution. There are going to be people who insist on driving their own vehicle. Not to mention public transport is not always viable for disabled folks. And even if we were building trains and public transportation infrastructure, that is a multi-decade project.

But the laser focus on EVs is very disappointing. We need trains and buses and more trains and let's throw in a few more trains for good measure.

Thomas knows what I'm talking about...

EVs are definitely better than ICE vehicles. And if we can build a renewable charging infrastructure by installing more solar on homes and near charging stations, while also reducing our reliance on coal power plants, EVs can be a decent part of the solution.

But the mining argument is silly. How do people think we get coal and oil? Have people not seen the effects of fracking? Mining for rare earth elements is fraught with issues currently. But pretty much every problem is mirrored in the extraction of fossil fuels. I guess we are just used to coal miners sacrificing their lungs and residents dealing with fracking faucets of fiery doom.

Some reciepts...

The effects of mining coal in Columbia.

The consquences of mountaintop mining.

The health impacts of fracking.

The health impacts of oil spills in Niger.

The thing is... once we burn fossil fuels... that's it.

We gotta go extract more.

Whereas almost everything in a lithium battery can be recycled.

Zack (JerryRigEverything) did a tour of a recycling plant. And unlike some other things we recycle with poor results, batteries are well suited to the process.

youtube

Should EVs be our sole focus for transportation?

No. Trains, trains, and more trains.

Are they better than ICE?

In most areas, yes.

And hopefully in all areas in the near future.

Are there issues with the mining process?

Yes. Tragic and terrible issues.

Does fossil fuel extraction have basically all of those same issues?

Also, yes.

However, smart people are already trying to solve the impacts of rare earth mining. I don't know if we can ever make it a perfectly humane, low impact process. But we can certainly improve circumstances substantially. And the stuff that is mined will not just be set on fire and pumped into the air. It will be reused again and again.

NUANCE!

222 notes

·

View notes

Text

Portable EV Chargers: Charge Your Electric Vehicle Anywhere, Anytime

Electric vehicles (EVs) are becoming increasingly popular due to their environmental benefits, lower running costs, and technological advancements. However, one of the main concerns of owning an EV is finding a charging station when you’re on the road. This is where portable EV chargers come in. In this blog post, we will explore the benefits of portable EV chargers and how they work.

EXPLORE…

View On WordPress

#A#AC power#Adapter cables#Charging#Convenience#Convenient and cost-effective portable EV chargers for electric vehicles#Cost-effective#DC power#Efficient AC to DC power conversion for EV charging using portable chargers#Electric vehicles#Emergency Backup#Emergency backup power for electric vehicles: Portable EV chargers with built-in batteries#Exploring the benefits of portable EV chargers for environmentally conscious drivers#Maximizing the range of your electric vehicle with portable EV chargers and regenerative braking#Never run out of charge with portable EV chargers and adapter cables#Portability#Portable EV Chargers#Portable EV chargers: The future of charging for electric vehicles#Portable EV chargers: The solution for charging electric vehicles on-the-go#Stay charged on your road trip with portable EV chargers and solar panels#The portability advantage: Why you should invest in a portable EV charger for your electric vehicle

0 notes

Text

New Test Rules - Less Range for Teslas - Technology Org

New Post has been published on https://thedigitalinsider.com/new-test-rules-less-range-for-teslas-technology-org/

New Test Rules - Less Range for Teslas - Technology Org

Tesla has revised down its driving-range estimates for its electric vehicle lineup due to new U.S. government regulations.

Tesla Model S Bluefire at Tesla service center – illustrative photo. Image credit: Tesla Fans Schweiz via Unsplash, free license

The new regulations are aimed at ensuring more accurate real-world performance reporting. In the past, Tesla has faced criticism for providing range estimates that were higher than what its cars could deliver.

In October, Tesla disclosed that federal investigators had subpoenaed the company for information related to the driving range of its vehicles. The driving range has been a crucial factor in marketing Tesla’s electric vehicles and other EV models, especially in the U.S., where consumers often express concerns about the availability of public charging infrastructure for battery-powered cars.

Recent adjustments made by Tesla have resulted in lower driving range estimates for various models, such as the Model Y Long Range and the performance variant of the Model Y.

The updated regulations mandate automakers to conduct tests for electric vehicles (EVs) in their “default” driving mode, the setting the car employs upon initial activation. Many modern vehicles, including Teslas, feature various driving modes designed to optimize either efficiency or power.

In cases where a car lacks a default or standard driving mode, the EPA requires automakers to test the vehicle in both its best-case and worst-case modes for efficiency, with the results averaged.

Tesla, in its marketing pages, does not specify a model year for the estimated ranges of its models. Tesla’s driving modes, such as “Chill” mode for efficiency and “Drag Strip Mode” for enhanced acceleration in performance models, are outlined in the 2023 Tesla owners’ manuals available online. The Model Y owner’s manual suggests using “Chill Mode” to maximize range.

According to EPA spokesperson Nick Conger, automakers commonly adjust efficiency estimates for a new model year when changes or updates to test procedures yield new data. It remains unclear if Tesla applied range estimate reductions to every variant of each model.

Automakers independently conduct tests for range and fuel efficiency estimates for promotional purposes, but they must strictly adhere to EPA guidelines. The EPA also conducts retests on a specific number of vehicles to verify the accuracy of manufacturers’ figures.

Tesla’s adjustments to range estimates varied, with some being minor, such as the shift from a 333-mile estimated range to 326 miles for the Model X Plaid variant. In contrast, other changes were more substantial, like the reduction of the estimate for the Model S Plaid, a luxury sport sedan, from 396 miles to 359 miles.

Written by Alius Noreika

#2023#Authored post#battery#battery-powered#Cars#consumers#data#driving range#efficiency#electric cars#electric vehicles#EPA#EV#EVs#express#factor#Featured technology news#fuel#Government#guidelines#Infrastructure#it#LESS#Marketing#model#Other#performance#photo#power#ranges

0 notes

Text

Discover the convenience of EV Charge Points tailored for holiday parks and campsites and manage them with our easy-to-use software and earn extra revenue on every charge. Manta Power makes eco-friendly travel a breeze. Contact us for more information! https://www.mantapower.co.uk

#EV Car Charger cornwall#electric car charging cornwall#cornwall car chargers#solar panel installation cornwall#solar installation in cornwall#power point installer#solar installers cornwall#ev charging installer#commercial ev charger installation#solar cornwall#battery installations#solar panels cornwall#electrician jobs cornwall#ev charging cornwall#Electric Vehicle Charger#Home Car Charging#Electric Vehicle Charger Installer#zappi charger installation#cornwall services ev charging#zappi car charger installation#install electric car charger#electric car charging stations home installation#install home charger for car#electric car chargers for home use#installing electric vehicle charger#solar installation#home solar installation#pv installation#installation of ev charger#charging point installation

1 note

·

View note

Text

I think the thing that's important for us to remember is that cost volatility is actually all about fossil fuel dependency.

The more that we are dependent on fossil fuels, it means the more we are dependent on global events. As we saw with Russia's invasion of Ukraine, as we see with the choices that come out of the UAE, as well as many other regions of the world, oil and gas development and drilling in Latin America, as well as in the United States. The more dependent we are on oil and gas, the more crazy our prices are going to be, and the more up and down our prices are going to be. And the fact that, for example, we have not developed electric or alternative energy vehicles earlier is one of the reasons why we pay such close attention to gas prices to begin with.

And we would not be as sensitive to the changes in energy costs if we weren't so fossil fuel dependent.

And Donald Trump knows that.

The oil and gas industry knows that.

And that is why they finance huge parts of lobbying our government in order to keep the country entirely dependent on fossil fuels.

Now, if you prefer gas cars and gas stoves, you're free to make that choice.

But what we haven't had is accessible and broad choices for something else. EVs have been in development, but for a very long time, they've been financially inaccessible to a lot of people in this country. The Inflation Reduction Act helped change that. We got huge tax breaks for both new and used EVs. If you're trying to buy one off your neighbor or whatever that may be, as well as many other things that are accessible, whether it's induction stoves, heat pumps for one's home, et cetera. But the oil and gas industry is deploying all of their political and special interest money towards one central goal, which is to keep virtually every American completely dependent on their product.

And Donald Trump is very closely aligned with them.

And not only that, but the larger point is that it's not a coincidence that his authoritarian tactics are tied to fossil fuels.

This is a global phenomenon.

And what we are seeing is authoritarianism is very, very closely linked with oil and gas interests around the world.

That's Putin, that's Trump. That's folks like Bolsonaro. That's a lot of the political instability we see out of Saudi Arabia, the UAE.

And I believe that it is not a coincidence, because you have one central industry that has a clear vested, both political and financial interest, and an authoritarian…that is also increasingly becoming politically unpopular, by the way, because the vast majority of Americans believe that the U.S. should start winding down our subsidization of the fossil fuel industry. They want to see clean energy alternatives available to them and financially accessible to them. And they understand that it's just more volatile to be so chained to fossil fuels.

And so the only way that you can really empower both financially a political sect, is through the fossil fuel industry, the oil and gas industry.

The Koch brothers are an oil and gas dynasty who had such large influence on our political system. They come from an oil and gas dynasty, or rather, came. One of them has passed, there's that, but then you see that link crossing across the world, and the ascent of authoritarianism, paired with the fact that every single one of them is very closely aligned to the fossil fuel industry.

And the ascent of the fossil fuel industry is not a coincidence. It's not a mistake.

And in fact, the democratization of our energy system, which is a means of production that has been privatized and concentrated into the hands of the very few, the democratization of our energy system means that people have the potential. We're doing this in Puerto Rico. When you have a battery pack on your house, when the power goes out, you're not as dependent on a central system. You have a backup reserve in case of an emergency, you can give energy to your neighbor.

This is what the democratization of our energy system looks like.

This is also what a fairer economic system that is less volatile for everyday people looks like as well.

And that is a direct threat to authoritarianism.

It's a direct threat to the extreme concentration of wealth in the hands of the very few.

But it also represents a shift for the betterment of mankind and our democracy.

—Alexandria Ocasio-Cortez, noting the link between the fossil fuel industry and authoritarian regimes

#politics#aoc#alexandria ocasio cortez#authoritarianism#fossil fuels#green energy#gnd#green new deal#capitalism#renewable energy#solar power#green power#gas and oil#fossil fuel dependency

61 notes

·

View notes

Text

[In February, 2023], a small warehouse in the English city of Nottingham received the crucial final components for a project that leverages the power of used EV batteries to create a new kind of circular economy.

Inside, city authorities have installed 40 two-way electric vehicle chargers that are connected to solar panels and a pioneering battery energy storage system, which will together power a number of on-site facilities and a fleet of 200 municipal vehicles while simultaneously helping to decarbonize the UK’s electrical grid.

Each day Nottingham will send a combination of solar-generated energy — and whatever is left in the vehicles after the day’s use — from its storage devices into the national grid. The so-called “vehicle to grid” chargers deliver this energy just when it’s needed most, during peak evening demand, when people are home cooking, using hot water or watching TV. Later, the same chargers pull energy from the grid to recharge the vehicles in the wee hours of the night, when folks are sleeping and electricity is cheaper and plentiful.

“We are trying to create a virtual power station,” says Steve Cornes, Nottingham City Council’s Technical Lead. “The solar power and battery storage will help us operate independently and outside of peak times, making our system more resilient and reducing stress on the national grid. We could even make a profit.” ...

After around a decade, an EV battery no longer provides sufficient performance for car journeys. However, they still can retain up to 80 percent of their original capacity, and with this great remaining power comes great reusability.

“As the batteries degrade, they lose their usefulness for vehicles,” says Matthew Lumsden, chairman of Connected Energy. “But batteries can be used for so many other things, and to not do so results in waste and more mining of natural resources.”

The E-STOR hubs come in the form of 20-foot modular containers, each one packed with 24 repurposed EV batteries from Renault cars. Each hub can provide up to 300kW of power, enough to provide energy to dozens of homes. One study by Lancaster University, commissioned by Connected Energy, calculated that a second life battery system saved 450 tons of CO2 per MWh over its lifetime...

Battery repurposing and recycling is set to play a massive role over the coming years as the automobile industry attempts to decarbonize and the world more broadly attempts to fight waste. The production of EVs, which use lithium-ion batteries, is accelerating. Tesla, for example, is aiming to sell 20 million EVs per year by 2030 — more than 13 times the current level. In turn, 12 million tons of EV batteries could become available for reuse by 2030, according to one estimate.

“Over the next decade we are going to see this gigantic wave,” says Jessica Dunn, a senior analyst at the Union of Concerned Scientists. “Companies are recognizing this is a necessary industry. They need to ramp up infrastructure for recycling and reuse.”

-via Reasons to Be Cheerful, March 13, 2023

#ev#ev charger#electric vehicle#electric cars#batteries#battery recycling#lithium ion battery#auto industry#sustainability#circular economy#recycling#reuse#uk#nottingham#england#good news#hope

216 notes

·

View notes

Text

12 Truths About Electric Vehicles

High Maintenance and Repair Costs

Public Charging Infrastructure Has a Ways To Go

EVs Cost More Than Gas-Powered Cars

There’s Just Not That Many EV Options Yet

Home Charging Installation Is Expensive

EV Resale Value Sucks

EVs Don’t Like Finicky Weather

You’ll Be Hard-Pressed To Find a Used EV

Range Anxiety Is Real

Charging Time Is So Long

EV Batteries Are Very Costly and Complicated To Replace

EVs Aren’t All That Environmentally Friendly

21 notes

·

View notes