#Home loan services in Pune

Text

Catch Rupee offers hassle-free loans for home construction, plot purchase, and commercial property with easy documentation, quick disbursal, and full transparency. Apply Now www.catchrupeeindia.com!

#Apply for home loan online#Home loan services in Pune#Home loan EMI of Interest#New housing loan#Home loan interest rates#Home loan balance transfer#Home loan companies near me#Best home loan rates in Pune

0 notes

Text

Instant Personal Loans: The Ultimate Guide to Quick and Easy Financing

In today’s fast-paced world, financial needs can arise unexpectedly, and having quick access to funds can be a lifesaver. Whether it’s for an emergency, a sudden medical expense, or an unplanned travel opportunity, instant personal loans offer a convenient solution. This guide will explore what instant personal loans are, their benefits, how to apply, and tips for choosing the best loan for your needs.

What Are Instant Personal Loans?

Instant personal loans are short-term loans designed to provide fast financial assistance. Unlike traditional loans that may take days or weeks for approval and disbursement, instant personal loans are typically processed within a few hours or even minutes. These loans are often unsecured, meaning you don’t need to provide collateral, and they are available for a variety of purposes, from medical emergencies to debt consolidation.

Benefits of Instant Personal Loans

Quick Approval and Disbursement: The primary advantage of instant personal loans is the speed with which they are approved and disbursed. Many lenders use automated processes to review applications, allowing for rapid decisions and quick access to funds.

Convenience: The application process for instant personal loans is usually straightforward and can often be completed online. This means you can apply from the comfort of your home without the need for lengthy paperwork or in-person visits.

Flexibility: Instant personal loans can be used for a variety of purposes, giving you the flexibility to address whatever financial need arises. Whether it’s covering medical expenses, home repairs, or consolidating debt, you can use the funds as needed.

No Collateral Required: Most instant personal loans are unsecured, meaning you don’t need to put up any assets as collateral. This makes them accessible to a broader range of people, including those who may not have significant assets.

Credit Score Improvement: Timely repayment of instant personal loans can help improve your credit score. This can be particularly beneficial if you’re looking to build or repair your credit history.

How to Apply for an Instant Personal Loan

Applying for an instant personal loan is generally a simple and quick process. Here’s a step-by-step guide to help you navigate the application:

Research Lenders: Start by researching different lenders to find one that offers the best terms and interest rates. Look for reputable lenders with positive customer reviews.

Check Eligibility: Each lender will have specific eligibility criteria, such as minimum income requirements and credit score thresholds. Make sure you meet these criteria before applying.

Gather Documentation: While the process is often quick, you’ll still need to provide some basic documentation. This usually includes proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or bank statements), and proof of residence (such as a utility bill).

Fill Out the Application: Complete the online application form with accurate information. Double-check your entries to avoid any errors that could delay the process.

Submit the Application: Once your application is complete, submit it for review. Many lenders offer instant approval decisions, while others may take a few hours.

Receive Funds: If your application is approved, the funds will typically be disbursed to your bank account quickly, often within the same day.

Tips for Choosing the Best Instant Personal Loan

Compare Interest Rates: Interest rates can vary significantly between lenders. Shop around to find the lowest rate, as this will reduce the overall cost of the loan.

Review Fees and Charges: Be aware of any additional fees, such as origination fees, late payment fees, or prepayment penalties. These can add to the cost of the loan.

Check Repayment Terms: Look for a loan with flexible repayment terms that fit your budget. Some lenders offer the option to choose your repayment period, which can help manage your monthly payments.

Read the Fine Print: Always read the loan agreement carefully before signing. Ensure you understand all the terms and conditions, including the interest rate, repayment schedule, and any fees.

Assess Your Financial Situation: Before taking out an instant personal loan, assess your financial situation to ensure you can comfortably manage the repayments. Borrow only what you need and can afford to repay.

Conclusion

Instant personal loans can be a valuable financial tool for managing unexpected expenses or urgent financial needs. Their quick approval and disbursement process make them an attractive option for those in need of fast cash. By understanding the benefits, application process, and how to choose the best loan, you can make informed decisions and effectively use instant personal loans to your advantage. Always remember to borrow responsibly and within your means to ensure a positive borrowing experience.

Take Control of Your Finances Today!

Apply Now

0 notes

Video

youtube

Job Consultancy Website Design For My Chennai Client 🔥🔥🔥 | 13500 Rupees...

Website Design For Job Consultancy -Website Design Company Coimbatore #webdesigncompanyincoimbatore #chennai #chennaisuperkings #chennaifoodie #canadajobs #usajobs

Arien Technology :: (Google Rating 5/5)

My Google Review

https://g.co/kgs/t99YkrD

https://maps.app.goo.gl/rvnWHXzLGWE6J...

We Are Doing All Types Of Categories Demo Also Available

Contact Us :: 9003835095,9944066784

Available Language ( Tamil,English,Hindi)

Tamilnadu,

Arien Technology :: (Google Rating 5/5)

Web design services for ur business

Cool and customize theme

1 year free ssl certificate

1 year free domain

1 year free business Email

👋 Social media integrate

👋 Whatsapp and live chat intergrate

👋 Google map intergrate

👋 3 days delivery

More Categories We Do Like :

Building Construction Website Design For 7500 Rupees Only

Grocery Shop Website Design For 9000 Rupees Only

Home Appliances Website Design For 9000 Rupees Only

Boutique Website Design For 9000 Rupees Only

Photography Studio Website Design For 8500 Rupees Only

Luxury Hotel Website Design For 9000 Rupees Only

Beauty-Salon & Spa Website Design For 9000 Rupees Only

Bakery & Cake Shop Website Design For 9000 Rupees Only

Real Estate Website Design For 7500 Rupees Only

Loan - Finance Website Design For 9000 Rupees Only

Day-care Services Website Design For 7500 Rupees Only

Catering Website Design For 9000 Rupees Only

Ice Cream Shop Website Design For 9000 Rupees Only

Restaurant Website Design For 9000 Rupees Only

Domain And Hosting Service (GoDaddy, Hostinger, namecheap, etc..)

Website Redesign

Best Website Designer In Coimbatore Tamilnadu

Contact For Best Discounts

Feel Free to contact us or WhatsApp in Tamil ,English

We do WebDesign all over Tamilnadu -

Thankyou நன்றி

Website Design Company in Chennai

Website Design Company in Coimbatore

Website Design Company in Salem

Website Design Company in Tiruppur

Website Design Company in Vellore

Website Design Company in Erode

Website Design Company in Pollachi

Website Design Company in Mettupalayam

Website Design Company in Ooty

Web design company in Coimbatore Saravanampatti,

ECommerce website development company in Coimbatore,

Mechanical design company in Coimbatore,

Best web development company in Coimbatore,

Free website design company in coimbatore,

Website design company in coimbatore contact number,

website design for online shopping

website design for beginners

website design for online shopping

website design for business

website design for educational institutions

website design for dropshipping

website design for event management

website design for portfolio

website design for clothing

website design for clothing brand

website design for real estate

website design for digital marketing

website design for affiliate marketing

website design for selling products

Google my business

ecommerce business

ecommerce business for beginners

ecommerce business in tamil

ecommerce dropshipping

startup business ideas

startup business ideas in tamil

online shopping websites

music website design

how to create website for business

furniture website design

construction website design

business ideas in chennai

flipkart website design

furniture manufacturers in tamilnadu

designer shirts in coimbatore

Motiviton

Startup business

Ecommerce

Amazon

Flipkart

Google my business

Job Consultancy Website Design For My Chennai Client 🔥🔥🔥 | 13500 -Just 3 Days Delivery

Tags ::

job consultancy in hyderabad

job consultancy in bangalore

job consultancy business plan

job consultancy in chennai

job consultancy in delhi

job consultancy in kolkata

job consultancy in kolkata

job consultancy malayalam

job consultancy in pune

job consultancy kaise khole

job consultancy in coimbatore

job consultancy in dubai

job consultancy in noida

job consultancy in bhubaneswar

What is JOB Consultancy | How Placement Consultancy Works

Get A Job || Chennai Best Job Consultancy

What is consultancy in tamil | Consultancy review in tamil | can we join job through consultancy

Singapore job opportunities E-Pass Agents Paavangal real life experience shared

How to Start a Job Consultancy Business | Free Job Consultancy Business Plan Template Included

In this video you will learn how a job consultancy business works in India, USA, UK and Canada in 2024. Learn Recruitment Service Agency Business. Like, share and subscribe our young entrepreneurs forum channel to get future videos.

#websitedesign #websiteredesign #webdevelopment #webdesignagency #webdevelopmentservices #coimbatore #chennai #vellore #selam #trending #fashion #webstore #ecommercewebsite #saravanampatti

#tiruppur #pollachi #mettupalayam #ooty #webdesigncompanyincoimbatore #trending #trendingshorts

#pets #furniture & #products

Location ::

Address: No.27, Mayilkal, Nila Complex, Bus Stop, Podanur Main Rd, Rail Nagar, Coimbatore, Tamil Nadu 641023

https://maps.app.goo.gl/rvnWHXzLGWE6J...

https://g.co/kgs/t99YkrD

1 note

·

View note

Text

Locality Inside – Edition – Punawale

Punawale Nestled within the vibrant Pimpri-Chinchwad area, Punawale emerges as a promising residential haven in the flourishing Pune Metropolitan Region. Situated advantageously along the Mumbai Highway (NH-48), this locality enjoys close proximity to the thriving Hinjewadi IT hub, making it a prime magnet for real estate development.

Punawale’s strategic location has positioned it as a hub of convenience and connectivity. Despite being 20 km from the city center, seamless transportation is assured. The Mumbai Highway (NH-48) and Aundh-Ravet BRTS Road intersect here, ensuring smooth commuting options. The nearby Akurdi Railway Station, just 5 km away, provides a vital link to the main Pune Junction. Even the Pune International Airport, at a distance of 27 km, is a mere hour's drive away.

Beyond its strategic location, Punawale strives to cater to its residents' needs by tapping into surrounding areas. Education finds a haven with institutions like Lotus Business School and Indira College of Commerce & Science, while healthcare needs are met by establishments like Ojas Multispecialty Hospital. Retail therapy is just around the corner with Dmart Ravet (3 km), City One Mall (9 km) and Xion Mall (7 km), within a convenient distance.

A defining attribute of Punawale is its close proximity to the bustling Hinjewadi Rajiv Gandhi Infotech Park, a short 20-minute drive away. This technology hub houses corporate giants like IBM, Cognizant, and Tech Mahindra, creating a fertile ground for career advancement. The industrial core of Pimpri-Chinchwad, home to manufacturing giants like Bajaj Auto and Tata Motors, adds to Punawale's appeal, offering a blend of work and lifestyle benefits.

While Punawale's merits shine bright, it's important to acknowledge certain challenges. Road conditions, though improving, can pose commuting hurdles. The locality also grapples with low-pressure water supply, necessitating private water storage solutions. Additionally, limited exit points along the Mumbai Highway between Bhumkar Chowk and Punawale sometimes lead to service lane congestion.

The future holds promise for Punawale. The upcoming extension of Pune Metro's Purple Line, only 5 km from Nigdi Station, promises enhanced connectivity. Moreover, the planned Pune Ring Road, set to pass through nearby Shelarwadi, is bound to further elevate Punawale's status. Punawale, with its strategic positioning, burgeoning infrastructure, and emerging community, beckons as a place where modern aspirations find a perfect abode.

For more details, click the link: https://www.propertycolossal.com/LocalityInformation/punawale-l-id32

1 note

·

View note

Text

Why You Should Invest in Residential Projects in India

Investing in the best residential projects in India offers a wealth of opportunities and advantages, making it an attractive option for both domestic and international investors. With its rapidly growing economy, expanding urbanization, and favorable government policies, India presents a dynamic real estate market ripe for investment. Here’s a comprehensive look at why you should consider investing in residential projects in this vibrant country..

1. Robust Economic Growth

India's economy has been one of the fastest-growing in the world, creating a strong foundation for real estate investments. The country's economic stability and growth projections offer a conducive environment for property investment. A growing economy generally leads to increased disposable incomes, higher demand for housing, and better returns on real estate investments.

2. Urbanization and Demand for Housing

India is undergoing significant urbanization, with millions of people moving to cities in search of better opportunities. This urban migration is driving the demand for a residential project in Panipat, Haryana. Other cities like Uttarakhand, Uttar Pradesh, Mumbai, Delhi, Bangalore, and Pune are expanding rapidly, creating a constant need for new housing projects to accommodate the growing population.

3. Government Initiatives and Policies

The Indian government has introduced several initiatives to boost the real estate sector. Schemes like Pradhan Mantri Awas Yojana (PMAY) aim to provide affordable housing to all, which in turn stimulates the residential property market. Additionally, the Real Estate (Regulation and Development) Act (RERA) has brought transparency and accountability to the sector, protecting investors' interests.

4. High Rental Yields and Appreciation Potential

Investing in residential properties in India can yield significant returns. High rental yields in urban areas provide a steady income stream for investors. Moreover, property values in growing cities tend to appreciate over time, offering substantial capital gains. Strategic investments in emerging neighborhoods or upcoming cities can maximize these returns.

5. Diverse Investment Options

The Indian real estate market offers many investment options, from luxury apartments and villas to affordable housing and serviced apartments. This diversity allows investors to choose properties that align with their budget, risk appetite, and investment goals. Whether you’re looking for a high-end or affordable property, there’s something for everyone in India’s real estate market.

6. Growing Middle Class

India’s burgeoning middle class is a significant driver of the real estate market. As more people move into the middle-income bracket, the demand for quality housing increases. This demographic shift not only boosts the demand for residential projects in India but also enhances the overall quality of living, as developers cater to the evolving needs and aspirations of middle-class buyers.

7. Favorable Financing Options

Financing options for real estate investments in India have become more accessible and attractive. Banks and financial institutions offer a variety of home loan products with competitive interest rates and flexible repayment terms. Additionally, the government provides tax benefits on home loan interest payments, making real estate investments more affordable and financially viable.

8. Infrastructural Development

India is witnessing significant infrastructural development, including the expansion of metro networks, improved road connectivity, and the development of smart cities. These infrastructural projects enhance the livability of cities and towns, making them more attractive for residential investments. Proximity to infrastructure projects often results in higher property values and better investment returns.

9. NRI Investment Opportunities

India’s real estate market is also appealing to Non-Resident Indians (NRIs). Favorable exchange rates, the potential for high returns, and the emotional value of owning property in their homeland make new housing projects in India an attractive investment for NRIs. The regulatory environment has also been streamlined to facilitate NRI investments, ensuring smooth and secure transactions.

10. Quality of Life and Modern Amenities

Modern residential projects in India are designed to offer a high quality of life, with state-of-the-art amenities and facilities. Gated communities, green spaces, recreational facilities, and 24/7 security are standard features in many new developments. Investing in such projects not only provides a comfortable living experience but also enhances the long-term value of the property.

Conclusion

Investing in residential projects in India is a strategic and rewarding decision. The country’s robust economic growth, urbanization, favorable government policies, and diverse investment options create a dynamic and promising real estate market. Whether you’re looking for rental income, capital appreciation, or a combination of both, India offers a wealth of opportunities for savvy investors. By carefully selecting the right projects and locations, you can reap significant benefits and contribute to the growth of one of the world's most exciting real estate markets.

#residential projects#residential projects in india#residential project in india#housing projects in india#housing projects#residential property#residential property in india#residential properties in india#residential project in panipat#india

1 note

·

View note

Text

One Point One Solutions Limited Secures Major Client Win with Leading Indian NBFC

One Point One Solutions Limited, a prominent provider of technology-enabled business process management (BPM) services, has announced an exciting new partnership with one of India's leading non-banking financial companies (NBFC). This collaboration underscores One Point One Solutions' growing influence and commitment to delivering top-notch, customer-centric solutions.

New Partnership Details

The new client, a diversified financial services firm, focuses on product innovation and cutting-edge technology to meet the evolving needs of its customers. This NBFC leverages technology and data science to make lending processes quick, simple, and hassle-free. Its broad portfolio includes affordable home loans, personal loans, education loans, and SME business loans.

One Point One Solutions will support the NBFC by providing comprehensive customer care solutions. The services will include lead generation, expert guidance, efficient process handling, and product promotions. This partnership aims to streamline the NBFC’s client support operations and enhance its ability to deliver innovative financial products.

Scope of the Partnership

The collaboration is set to expand significantly, with plans to scale operations to accommodate up to 300 seats in the coming months. Additionally, the NBFC intends to incorporate collection processes into the scope of services offered by One Point One Solutions. This expansion highlights the mutual commitment to improving operational efficiency and customer satisfaction in the financial services sector.

One Point One Solutions is eager to embark on this partnership, anticipating new milestones in business process management and customer care excellence.

About One Point One Solutions Limited

Established in 2006, One Point One Solutions Limited is a full-stack provider in BPO, KPO, IT Services, Technology & Transformation, and Analytics. The company offers comprehensive solutions in technology, accounting, skill development, and analysis. In 2024, One Point One Solutions acquired a major stake in ITCube Solutions Pvt Ltd., an IT + BPM/KPO services company headquartered in Pune and Cincinnati, Ohio. ITCube Solutions, with over two decades of experience, serves clients across various sectors and has a robust presence in the USA, UK, Netherlands, Germany, Kuwait, Oman, UAE, Qatar, India, Singapore, and Australia.

One Point One Solutions serves a diverse range of industries including Telecom & Broadcasting, Retail and E-commerce, Consumer Durables & FMCG, Banking and Finance, Travel & Hospitality, Insurance & Healthcare. The company operates six service centers located in Navi Mumbai, Gurgaon, Chennai, Bangalore, Indore, and Pune, with a capacity of over 5,600 seats per shift. This extensive infrastructure enables the company to handle a significant volume of clients efficiently.

The company’s services encompass Originations, Customer Services, Sales, Collections, Tech Helpdesk, Back Office, Accounting, Litigation, Recruitment, Design, Development, and Intelligence. Under the leadership of founder Akshay Chhabra, One Point One Solutions focuses on technology-driven innovation to build efficiencies and position itself as a leader in the BPM space.

Global Presence and Growth

One Point One Solutions has also expanded into global markets with its wholly-owned subsidiary, ONE POINT ONE USA INC, based in Delaware, USA. Since its listing in 2017, the company has built a robust portfolio of over 50 clients, including prominent players across various sectors.

0 notes

Text

Discover Your Dream Property with Divyasparsh Infra LLP, Pune

Your Gateway to Premium Real Estate in Pune

Are you searching for the perfect property in Pune? Look no further than Divyasparsh Infra LLP. As a leading name among real estate builders and developers in Pune, Divyasparsh Infra is dedicated to delivering exceptional quality and innovative architectural designs. Our projects, such as the prestigious Ambrosia Galaxy, reflect our commitment to high standards and customer satisfaction.

Why Choose Divyasparsh Infra?

Innovative Designs: Our properties are crafted with a focus on modern aesthetics and functionality.

Top-Notch Quality: We adhere to the highest standards of construction and business ethics.

Customer-Centric Approach: Transparency and customer satisfaction are at the core of our operations.

Featured Project: Ambrosia Galaxy

Experience luxury living with our flagship project, Ambrosia Galaxy. This elite residential complex offers world-class amenities, superior construction quality, and a strategic location. Designed to cater to the needs of discerning homebuyers, Ambrosia Galaxy is set to become a landmark in Pune’s real estate landscape.

Client Testimonials

Our clients speak for us. Here’s what they have to say:

Mrs. Namita Bhat: "Professional and approachable staff, excellent service."

Mr. Rahul Karandikar: "Continuous updates and support for home loan processing."

Mr. P. Tripathi: "Transparent, customer-friendly, and dedicated team."

Join the Divyasparsh Family

Whether you are looking to buy, rent, or invest in a commercial property, Divyasparsh Infra offers a range of options tailored to your needs. Explore our current and completed projects on our website and find your dream property today.

Visit Divyasparsh Infra LLP for more details and to explore our projects.

0 notes

Text

Premium 2 BHK Flats in Khopoli | Modern Amenities & Prime Location

Experience upscale living with our premium 2 BHK flats in Khopoli, designed to offer modern amenities and located in a prime area. These apartments are perfect for families and professionals seeking comfort and convenience. Here's why our 2 BHK flats are the ideal choice for your next home:

Prime Location

Central Access: Conveniently situated near major highways and public transport, providing easy connectivity to Mumbai and Pune.

Essential Services: Close to top-rated schools, healthcare centers, shopping malls, and entertainment zones.

Modern Amenities

Contemporary Design: Thoughtfully designed interiors with spacious rooms, abundant natural light, and ventilation.

High-End Construction: Quality materials and superior craftsmanship ensure durability and aesthetic appeal.

Safety & Security: Comprehensive security measures including gated entry, 24/7 surveillance, and on-site security personnel.

Enhanced Lifestyle

Green Living: Lush green surroundings and landscaped gardens for a tranquil living experience.

Recreational Options: State-of-the-art gym, swimming pool, multipurpose hall, and dedicated kids' play area.

Community Engagement: Active residential community with events and activities to foster social connections.

Affordable Pricing

Value for Money: Competitive pricing that offers great value without compromising on quality and amenities.

Flexible Financing: Attractive payment plans and home loan assistance to make your purchase hassle-free.

Why Choose Us?

Reputed Builder: A trusted name in real estate with a history of delivering projects on time and to high standards.

Customer-Centric Approach: Dedicated support team to guide you through the buying process and address all your queries.

Make the smart choice with our 2 BHK flats in Khopoli. Contact us today to book a site visit and start your journey towards owning a premium home.

For more details:

Visit Us - https://www.unimont.in/projects/unimont-imperia/

0 notes

Text

Benefits of Choosing Home Loan Providers in Pune

Pune, a bustling metropolis known for its educational institutions, IT hubs, and vibrant cultural scene, is a city where many aspire to own a home. When it comes to financing such a significant investment, choosing the right home loan provider is crucial. Opting for local home loan providers in Pune offers several distinct advantages over national or international lenders. Here are some key benefits of choosing home loan providers in Pune.

1. Personalized Customer Service

Local home loan providers in Pune often excel in offering personalized customer service. Unlike large, impersonal banks, local lenders can provide a more tailored experience, addressing specific concerns and requirements of individual borrowers. They take the time to understand your financial situation, goals, and preferences, ensuring that the loan product you choose aligns perfectly with your needs. This personalized approach can significantly ease the stress and complexity often associated with obtaining a home loan.

2. Local Market Expertise

Home loan providers based in Pune possess an in-depth understanding of the local real estate market. They are well-versed with the city’s neighborhoods, property values, and market trends. This expertise allows them to offer insightful advice and guidance on the best areas to invest in and the realistic valuation of properties. Their knowledge of local regulations and processes can also streamline the loan approval process, reducing delays and complications.

3. Faster Loan Processing

Local lenders can often process home loan applications more quickly than larger national banks. Since they operate within the city and have direct access to local resources, they can expedite various steps in the loan approval process. This includes property verification, legal checks, and documentation. Faster processing times mean you can secure your dream home without unnecessary delays, making local providers a more convenient choice for many borrowers.

4. Competitive Interest Rates and Flexible Terms

Many home loan providers in Pune offer competitive interest rates and flexible loan terms to attract local borrowers. They understand the economic landscape of the city and can tailor their products to better suit the financial capacities and repayment abilities of Pune’s residents. Additionally, local providers may have special offers or lower processing fees, making home loans more affordable overall.

5. Ease of Accessibility

Having your home loan provider based in Pune means easier access to their branches and services. You can visit their offices for face-to-face consultations, which can be invaluable for discussing loan options, resolving issues, or submitting documentation. This direct access can enhance the overall customer experience, as you can receive immediate assistance and support.

6. Stronger Community Ties

Local lenders often have stronger ties to the community and a vested interest in the city’s development. This connection can translate into a more compassionate and understanding approach to lending. They are more likely to consider individual circumstances and offer flexible solutions in times of financial difficulty, such as temporary reductions in EMIs or restructuring of loans.

7. Specialized Loan Products

Home loan providers in Pune often offer specialized loan products designed to meet the unique needs of local borrowers. These can include loans for specific types of properties common in Pune, such as apartments in IT corridors or houses in newly developed suburban areas. They may also offer products tailored to first-time homebuyers, making it easier for young professionals and new families to enter the property market.

8. Enhanced Trust and Reliability

Choosing a local lender often means dealing with an institution with a well-established reputation in the community. Local home loan providers in Pune rely on their reputation and customer satisfaction to attract business. This can lead to a higher level of trust and reliability, as these providers are motivated to maintain positive relationships with their clients.

Conclusion

In conclusion, opting for a home loan provider in Pune comes with numerous benefits that can make the home-buying process smoother, more efficient, and ultimately more rewarding. Personalized service, local market expertise, faster processing times, competitive rates, accessibility, community ties, specialized products, and enhanced trust are all compelling reasons to choose a local lender. By leveraging these advantages, you can secure a home loan that not only meets your financial needs but also supports your goal of owning a home in one of India’s most dynamic cities.

0 notes

Text

Catch Rupee | Apply home loan online | Best home loan interest rates

Catch Rupee provides you best personal loans services in Pune. Apply for a personal loan online, get instant approval, and avail of various other benefits. Call Us Today 8956235976 / 9175674659

#Apply for home loan online#Home loan services in Pune#Home loan EMI of Interest#New housing loan#Home loan interest rates#Home loan balance transfer#Home loan companies near me#Best home loan rates in Pune

0 notes

Text

The Role of a Financial Advisor in Your Financial Journey

In today’s complex financial landscape, managing your personal finances can be a daunting task. Whether you’re just starting out in your career, planning for retirement, or navigating significant life changes, a certified financial advisor can be an invaluable ally. But what exactly does a financial advisor do, and how can they help you achieve your financial goals? In this blog, we’ll explore the essential role of a financial advisor in your financial journey.

Understanding the Financial Advisor’s Role

A financial advisor is a professional who provides expert advice on managing your finances, including investments, savings, retirement planning, tax strategies, and estate planning. Their primary goal is to help you make informed decisions to secure your financial future. Here are some key aspects of their role:

Personalized Financial PlanningOne of the most significant benefits of working with a financial advisor is receiving a personalized financial plan tailored to your unique circumstances and goals. Whether you’re saving for a home, planning for your children’s education, or building a retirement nest egg, a financial advisor can create a comprehensive plan that aligns with your objectives.

Investment ManagementInvesting can be a powerful tool for building wealth, but it also comes with risks. A financial advisor can help you develop an investment strategy that matches your risk tolerance, time horizon, and financial goals. They can also provide ongoing management and adjustments to your portfolio to ensure it remains aligned with your objectives.

Retirement PlanningPlanning for retirement is a critical component of your financial journey. A financial advisor can help you determine how much you need to save, choose the right retirement accounts, and select appropriate investment options. They can also assist with strategies to maximize your Social Security benefits and create a sustainable withdrawal plan for your retirement years.

Tax PlanningEffective tax planning can significantly impact your financial health. Financial advisors can provide guidance on tax-efficient investment strategies, help you understand tax implications of various financial decisions, and identify opportunities to reduce your tax burden. This can include advice on utilizing tax-advantaged accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs).

Debt ManagementManaging debt is a crucial aspect of financial wellness. A financial advisor can help you develop strategies to pay off debt faster, consolidate high-interest debts, and improve your credit score. They can also provide guidance on using debt responsibly and avoiding common pitfalls.

Estate PlanningWhile it may not be pleasant to think about, planning for the distribution of your assets after your passing is essential. A financial advisor can help you create an estate plan that ensures your wishes are carried out and minimizes potential legal and tax issues for your heirs. This can include setting up wills, trusts, and beneficiary designations.

Navigating Life Changes

Life is full of unexpected events, such as marriage, divorce, job changes, or the birth of a child. A financial advisor can provide guidance during these transitions, helping you adjust your financial plan to accommodate new circumstances and ensure your long-term goals remain on track.

Choosing the Right Financial Advisor

When selecting a financial advisor, it’s essential to find someone who understands your needs and has the expertise to guide you effectively. Here are some tips for choosing the right advisor:

Credentials and Experience: Look for advisors with reputable certifications, such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These credentials indicate a high level of expertise and commitment to ethical standards.

Fee Structure: Understand how the advisor is compensated. Some advisors charge a flat fee, hourly rate, or a percentage of assets under management. Make sure their fee structure aligns with your preferences and budget.

Client Focus: Choose an advisor who listens to your needs and prioritizes your interests. They should be willing to educate you about your options and involve you in the decision-making process.

Reputation and Reviews: Research the advisor’s reputation and read reviews or testimonials from other clients. This can provide insight into their reliability and the quality of their services.

Conclusion

A financial advisor plays a pivotal role in helping you navigate the complexities of personal finance and achieve your long-term financial goals. By providing personalized advice, investment management, retirement planning, tax strategies, and more, they can empower you to make informed decisions and secure your financial future. Whether you’re just starting your financial journey or looking to optimize your existing plan, partnering with a certified financial advisor can make a significant difference in your financial well-being.

0 notes

Text

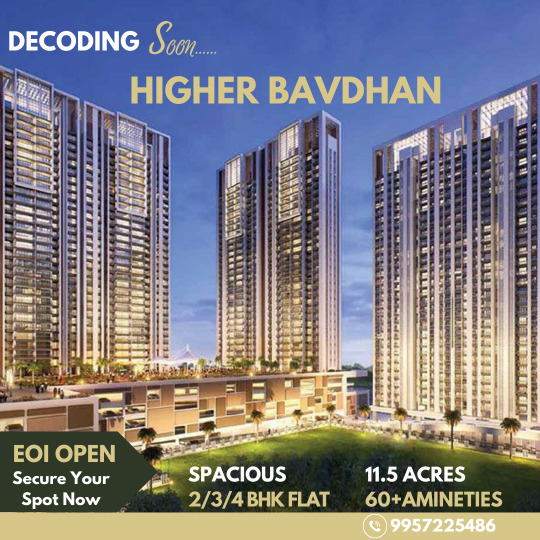

Embark on a Luxurious Journey at Kekarav

Are you in search of a residential oasis that seamlessly blends luxury, sustainability, and convenience? Look no further than Kekarav, an exceptional residential project meticulously crafted by the esteemed team at . Nestled in the prestigious locale of Bavdhan, Pune, Kekarav offers a unique perspective on urban living with its innovative design and eco-conscious features.

Unveiling a World of Sophistication

Step into the realm of Kekarav and experience the pinnacle of luxurious living. Featuring meticulously planned plots, each offering a canvas for your dream home, Kekarav sets a new standard of sophistication. With prices starting from INR 1.69 crore*, Kekarav presents an unparalleled opportunity to invest in upscale living in one of Pune's most sought-after neighborhoods.

Embracing Sustainable Elegance

At Kekarav, sustainability takes center stage, with eco-friendly elements woven into every aspect of the project. From on-site holding ponds ensuring efficient water management to smart metering systems monitoring usage for optimal conservation, Kekarav is committed to environmental responsibility. Recycled plastic is utilized for internal and access roads, complementing the estate's eco-conscious ethos. Multiple Miyawaki Urban Forests further enhance the green landscape, offering residents a serene retreat amidst the bustling cityscape.

Elevate Your Lifestyle with Unmatched Amenities

Indulge in a wealth of world-class amenities meticulously curated to elevate your everyday experience. From a sprawling clubhouse and expansive open spaces to round-the-clock security, Kekarav caters to the diverse needs of its residents. Whether you seek relaxation or recreation, Kekarav offers a lifestyle of utmost comfort and convenience.

Prime Location, Seamless Connectivity

Strategically situated amidst premier educational institutions, healthcare facilities, and recreational hubs, Kekarav offers unparalleled convenience to its residents. With prominent landmarks such as Jumbo Just For Kids and Chellaram Hospital in close proximity, residents enjoy easy access to essential services and entertainment options.

Seamless Property Acquisition

For those looking to invest in Kekarav, provides comprehensive support throughout the purchasing journey. As a trusted channel partner, ensures a seamless experience, from facilitating home loan documentation to overseeing property registration. With their expertise in Pune's real estate landscape, assists buyers in securing the best deals and investment opportunities.

Your Gateway to Luxury Living Awaits

Experience a new dimension of urban living at Kekarav by . With its blend of luxury, sustainability, and strategic location, Kekarav offers an unparalleled residential experience. Don't miss the opportunity to claim your slice of Pune's thriving real estate market. Contact today to explore the endless possibilities awaiting you at Kekarav.

0 notes

Video

youtube

Website Design For Perfume Shop -Website Design Company Chennai #webdesigncompanyinChennai

Website Design For Perfume Shop -Website Design Company Chennai #webdesigncompanyinChennai

Arien Technology :: (Google Rating 5/5)

My Google Review

https://g.co/kgs/t99YkrD

We Are Doing All Types Of Categories Demo Also Available

Contact Us :: 9003835095,9944066784

Available Language ( Tamil,English,Hindi)

Tamilnadu,

Arien Technology :: (Google Rating 5/5)

Web design services for ur business

Cool and customize theme

1 year free ssl certificate

1 year free domain

1 year free business Email

👋 Social media integrate

👋 Whatsapp and live chat intergrate

👋 Google map intergrate

👋 3 days delivery

More Categories We Do Like :

Building Construction Website Design For 7500 Rupees Only

Grocery Shop Website Design For 9000 Rupees Only

Home Appliances Website Design For 9000 Rupees Only

Boutique Website Design For 9000 Rupees Only

Photography Studio Website Design For 8500 Rupees Only

Luxury Hotel Website Design For 9000 Rupees Only

Beauty-Salon & Spa Website Design For 9000 Rupees Only

Bakery & Cake Shop Website Design For 9000 Rupees Only

Real Estate Website Design For 7500 Rupees Only

Loan - Finance Website Design For 9000 Rupees Only

Day-care Services Website Design For 7500 Rupees Only

Catering Website Design For 9000 Rupees Only

Ice Cream Shop Website Design For 9000 Rupees Only

Restaurant Website Design For 9000 Rupees Only

Domain And Hosting Service (GoDaddy, Hostinger, namecheap, etc..)

Website Redesign

Best Website Designer In Coimbatore Tamilnadu

Contact For Best Discounts

Feel Free to contact us or WhatsApp in Tamil ,English

We do WebDesign all over Tamilnadu -

Thankyou நன்றி

Website Design Company in Chennai

Website Design Company in Coimbatore

Website Design Company in Salem

Website Design Company in Tiruppur

Website Design Company in Vellore

Website Design Company in Erode

Website Design Company in Pollachi

Website Design Company in Mettupalayam

Website Design Company in Ooty

Web design company in Coimbatore Saravanampatti,

ECommerce website development company in Coimbatore,

Mechanical design company in Coimbatore,

Best web development company in Coimbatore,

Free website design company in coimbatore,

Website design company in coimbatore contact number,

website design for online shopping

website design for beginners

website design for online shopping

website design for business

website design for educational institutions

website design for dropshipping

website design for event management

website design for portfolio

website design for clothing

website design for clothing brand

website design for real estate

website design for digital marketing

website design for affiliate marketing

website design for selling products

Google my business

ecommerce business

ecommerce business for beginners

ecommerce business in tamil

ecommerce dropshipping

startup business ideas

startup business ideas in tamil

online shopping websites

music website design

how to create website for business

furniture website design

construction website design

business ideas in chennai

flipkart website design

furniture manufacturers in tamilnadu

designer shirts in coimbatore

Motiviton

Startup business

Ecommerce

Amazon

Flipkart

Google my business

Tags ::

perfume shop in delhi

perfume shop in chennai

perfume shop in mumbai

perfume shop in kolkata

perfume shop in coimbatore

perfume shop in pune

perfume shopping in dubai

perfume shop in bangalore

perfume shop in hyderabad

perfume shop in madurai

perfume shop business plan

perfume shop in bhubaneswar

perfume shop in ahmedabad

#websitedesign #websiteredesign #webdevelopment #webdesignagency #webdevelopmentservices #coimbatore #chennai #vellore #selam #trending #fashion #webstore #ecommercewebsite #saravanampatti

#tiruppur #pollachi #mettupalayam #ooty #webdesigncompanyincoimbatore #trending #trendingshorts

#pets #furniture & #products

Location ::

Address: No.27, Mayilkal, Nila Complex, Bus Stop, Podanur Main Rd, Rail Nagar, Coimbatore, Tamil Nadu 641023

https://maps.app.goo.gl/zGbqao9aC8jqr...

https://g.co/kgs/t99YkrD

0 notes

Text

New Rules in the Banking Sector

Banking services must include accepting deposits, lending money, facilitating transactions, and offering various transaction products such as saving accounts, loans, and credit cards. Mainly bank is a type of financial institution that is permitted to accept customers' deposits and provide a loan. There are such types of banking sectors as Retail banks, Commercial banks, corporate banks, cooperative banks, Regional rural banks, central banks, and investment banks.

Why Banking sector is good?

Checking and saving accounts, loans, mortgage services, wealth management, providing credit and debit cards, and overdraft services, are the most important banking services in the banking sector.

How does the banking sector work?

The customers deposit their money in banks, and then banks lend the money in different loans like car loans, credit loans, business loans, home loans, etc. the loan recipients spend the money they borrow, then the banks earn the interest loans, and the process keeps money moving through the systems.

The rules of banking sectors:

Demat account holders' nomination declarations:

Demat account holders will have to provide nomination declarations or opt out of nominations by January 1, 2024. Account holders failing to do so will not be able to transact in stocks. Earlier, the deadline to furnish nomination details was September 30.

Aadhaar Card:

Aadhaar card holders wanting to change their details will be able to do so till December 31, 2024. However post this date, an amount of Rs 50 will be imposed on those wanting to change their personal details in the Aadhaar card.

KYC for SIM card:

All KYC-related work will be done in digital mode only. People applying for new SIM cards will not have to fill out paper forms for the Know-Your-Customer process.

Bank locker agreement:

People holding lockers in banks will have to sign the revised agreement by December 31, 2023. If customers will fail to do so, their lockers will be frozen.

New rule to save users from online fraud:

As smartphone usage has unscaled in India, online fraud and scams have unscaled and have seen a parallel increase. The government has been taking a decisive stance to curb these issues.

Legal consequences for fake SIMs:

As per the new Telecommunication Bill, individuals who will be found purchasing fake SIM cards will be facing severe consequences and the offenders will further be subjected to a jail term of up to 3 years and a fine worth Rs. 50 lakh.

Mandatory biometric details for verification:

Telecom companies will now collect biometric data which will be mandated for every customer who is purchasing a SIM card. The inclusion of biometric details is a measure to safeguard fraudulent SIM card transactions and ensures strict action against the offenders.

Income Tax Return:

People will not be able to file Income Tax Returns (ITR) for financial year 2022-23 from January 1, 2024. Those who have not filed ITR for 2022-23 can file them with penalty fee till December 31.

Inactive UPI IDs:

The National Payments Corporation of India (NPCI) in a circular dated 7 November, has asked payment apps and banks to deactivate the UPI IDs and numbers that have not been active for more than one year. Every bank and third-party app has to follow these till 31st December.

UPI transaction limit hiked for hospitals, schools.

Deactivation of inactive UPI IDs.

UPI Lite wallets transaction limit increased.

No authentication for UPI auto payments.

Interchange fee on UPI merchant payments.

Google Pay:

The Gpay limit per day for money transfers for users in India is ₹1, 00,000. Moreover, the maximum times you can send money in a day cannot exceed 10 in Gpay or any other UPI app.ShreeCom Infotech Pvt. Ltd. Pune offering different types of banking sectors software’s like Co-Operative credit society software, core banking software, Retail banking software, SMS banking software, Pat pedhi software, Employees co-op credit society software, salary earners society software or you can google search for banking software near me

#co-op credit society software#pat pedhi software#pat sanstha software#salary earners society software#retail banking software

0 notes

Text

1BHK FLAT PUNE

1BHK flat for sale in pune

Location: Mention popular areas in Pune where 1 BHK flats are available for sale, such as Wakad, Hinjewadi, Kothrud, Hadapsar, etc. Emphasize the convenience of these locations in terms of proximity to IT parks, schools, hospitals, and shopping centers.

Affordability: Highlight the affordability factor of 1 BHK flats compared to larger configurations, making them ideal for young professionals, couples, and small families.

Amenities: the amenities offered in these flats, such as parking facilities, security services, power backup, gymnasium, swimming pool, etc., which enhance the quality of living.

Property Features:the features of the flats, such as the size of the apartment, number of rooms, kitchen amenities, balcony, view from the apartment, etc.

Builder Reputation:If applicable, mention reputed builders or developers offering 1 BHK flats for sale in Pune and highlight their track record in delivering quality projects.

Investment Potential; Talk about the investment potential of buying a 1 BHK flat in Pune, considering factors like rental income, resale value, and appreciation potential in the real estate market

Loan Options Provide information about financing options available for buyers, including home loan facilities, EMI calculations, and eligibility criteria

for more info click here

1 note

·

View note