#IRS tax exemptions

Text

Wes Weston: IRS.

Wes Weston is used to billionaires having sketchy finances. An offshore account here, and offshore account there-- A second home in a tax haven. He's never seen books like Wayne Enterprise's before.

"What even is BASE jumping? Why do they have a whole Applied Sciences department with only one guy working in it?"

Wesley Weston had questions for Bruce Wayne. Questions he would get answered, if the billionaire was ever actually in his office. This was why he found himself rumbling up to the Wayne's well manicured, monoculture lawn in an only slightly questionable Uber.

"Wes Weston, IRS," he whispers, practicing under his breath before knocking on the door. "Wes Weston. IRS," he says more confidently, fumbling to get his badge out of his pocket. The door swung open, and he jumped. Goddamn rich people with their motion detecting doorbells.

"Dick Grayson, Blüdhaven P.D."

---

Wes Weston stood back from his cork board as rain pelted his hotel room window.

"Holy ghost. Bruce Wayne is the fucking Batman."

#dp x dc#dc#IRS agent Wes Weston#Wes Weston#dp#Dick Grayson#Bruce Wayne#Wayne Enterprises tax situation is dodgy#Bruce is not exempt from shady billionaire activity (or from paying taxes)#Cop Dick Grayson#I'm sorry :(#He doesn't have to be a cop by the end though!#And maybe they can fall in love?#That's up to you#Batman identity reveal#fanfic#prompt#Death and Taxes

455 notes

·

View notes

Text

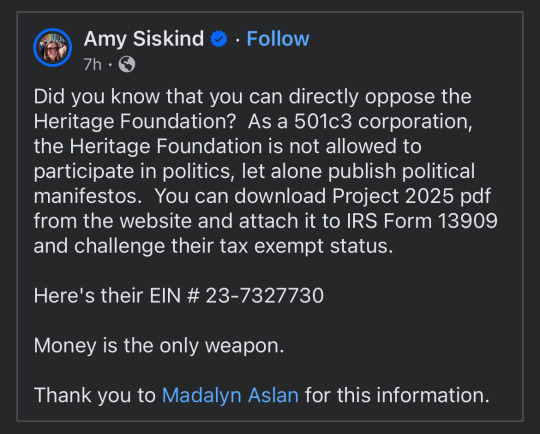

#heritage foundation#project 2025#501c3#politics#politricks#United States#united states of america#USA#republicans#republican agenda#agenda#manifesto#manifestos#report them#report#irs#internal revenue service#tax exemption#tax exempt#tax exempt status#money#weapons#reality#vote#voting#please vote#go vote#say no#tyranny#unpatriotic

2 notes

·

View notes

Text

2 notes

·

View notes

Text

HA!

#work bullshit#extremely rude lady (who originally came in last week with zero documentation) scheduled the rudest appointment I’ve ever seen#like ‘I need a banking officer not entry level staff’ like ma’am you talked to my manager last time what the hell are you on#anyway I managed to get her to explain she was actually looking for a bank account for a (imo stupidest) political campaign#which she did not say anything about last week#anyway she had a single document with no signatures saying she was the treasurer and no ein#and she kept trying to tell me she didn’t need one for this#but anyway we don’t do banking for political campaigns it’s not in our footprint#but! I looked it the fuck up! you are required to have an ein *even as a tax exempt political campaign*#which….. y’know….. I don’t think they were#another thing I learned today is per the irs not all political campaigns qualify for tax exemption#and even those who do might have employment taxes to pay because those are a separate issue#but yeah rude as hell so I am getting a little thrill that she’s not going to have any more luck at any other bank fuck her too

3 notes

·

View notes

Text

Texas gubernatorial candidate Beto O’Rourke and Lt. Gov. Dan Patrick, who is seeking reelection, have been crisscrossing the state in the lead-up to Tuesday’s election, visiting megachurches and smaller houses of worship packed tight with parishioners.

The stops are part of a longstanding tradition for political candidates that often accelerates as Election Day nears.

Two Sundays ago, O’Rourke, a Democrat, and Patrick, a Republican, visited different churches where pastors praised them and allowed them to give speeches about the upcoming election. This was in violation of federal law, according to tax law experts. Known as the Johnson Amendment, the law bars tax-exempt organizations from intervening in political campaigns.

At St. Luke “Community” United Methodist Church in Dallas on the morning of Oct. 23, Pastor Richie Butler introduced O’Rourke to his congregation as “the next governor of Texas.”

“He needs us to get him across the finish line,” Butler told parishioners.

O’Rourke then walked to the stage, where he gave a speech that would be familiar to those who have seen him on the campaign trail. He called for fixing the state’s electric grid and expressed alarm over the high rate of school shootings and gun violence.

“If our votes were not important, they would not be trying so hard to keep us from voting in this election, and our vote is how we overcome,” O’Rourke told the crowd.

The same morning, hundreds of miles away, Pastor Steve Riggle introduced Patrick to his congregation at Grace Woodlands Church north of Houston by saying the Lieutenant Governor is someone that “God has given us at the very top.”

“If the nation is to be saved, it’s going to take some leaders who, beyond their concern about being reelected, will stand for values that are critical to the future of this nation,” Riggle said. “Dan Patrick is one of those.”

Patrick then took the stage and cast the election in stark terms. “This is not a race between Republicans and Democrats,” he told the congregation. “This is a race about darkness and light. This is a race about power and principalities. And the devil is at full work in this country.”

He later added: “I don’t even recognize the other party. It’s been taken over by communists and socialists.”

Tax law experts told ProPublica and The Texas Tribune that the pastors’ support of the candidates in their sermons violated the Johnson Amendment. The experts also raised concerns about what appeared to be the churches’ failure to give equal time to their opponents. O’Rourke is facing Republican Gov. Greg Abbott in the general election, and Patrick is being challenged by Democrat Mike Collier.

“Beto O’Rourke is introduced as the ‘next Governor of Texas,’ which highlights both that he is a candidate and one whom the church supports,” said Lloyd Hitoshi Mayer, a tax and election law expert at the University of Notre Dame. “And O’Rourke’s comments are a sales pitch for his candidacy. There is no indication that any opposing candidate has been given a similar opportunity, and, even if he had been, the favorable introduction of O’Rourke would still be across the line.”

St. Luke Pastor Butler did not answer questions about Mayer’s assessment or whether the church had also invited Abbott to speak.

“Black churches have been important hubs for civic engagement and organization in the fight for social justice since Reconstruction,” Butler said in a statement. “The mixing of faith-based congregations and electoral engagement is not a new concept.”

O’Rourke did not respond to questions about the visit.

Sam Brunson, a law professor at Loyola University Chicago, said the language Riggle used while introducing the Lieutenant Governor was an “endorsement of Patrick by the pastor of a church acting in his capacity as pastor in the course of ordinary church meetings.”

Riggle said in an interview that his church did not endorse any candidate and that his introduction was focused on biblical values, not politics. He added that he believes the Johnson Amendment should be overturned.

“The government has no right, at any time, to, in any way, tell the church who it can have or who it cannot have to speak,” he said. “It can’t tell the church what it can preach on or not preach on. This is America, and we believe in a free church. Not one controlled by the government.”

Patrick did not respond to requests for comment or to emailed questions.

Last week, ProPublica and the Tribune reported about numerous apparent violations by church pastors who supported political candidates from the pulpit. A candidate endorsement is a “clear violation” under IRS rules. But the law itself is complex and can be vague, leaving gray areas that make identifying other violations more difficult. Below are answers about what it does and doesn’t do.

WHAT IS THE JOHNSON AMENDMENT?

In 1954, then-U.S. Sen. Lyndon Baines Johnson of Texas proposed an amendment to the U.S. tax code that prohibited nonprofits, including religious institutions, from involvement in political campaigns.

The amendment was uncontroversial at the time. It passed with bipartisan support and was signed into law by Republican President Dwight Eisenhower.

Though Johnson did not single out churches, religious organizations are subject to the law because they are nonprofit organizations. Violations can result in revocation of their tax-exempt status.

WHAT DOES THE JOHNSON AMENDMENT PROHIBIT?

Nonprofit organizations are barred from directly or indirectly participating in, or intervening in, “any political campaign on behalf of (or in opposition to) any candidate for elective public office.”

Contributions to political campaigns made on behalf of the tax-exempt organizations supporting or opposing a candidate also “clearly violate the prohibition against political campaign activity,” according to the IRS.

The IRS periodically produces lengthy guides that spell out the “facts and circumstances” the agency considers when determining whether political activity is allowable.

In some cases, such as pulpit endorsements, violations can be clearly identified. But violations can be harder to distinguish in other cases.

O’Rourke made another stop on Oct. 23 at The Chosen Vessel Cathedral in Fort Worth, where Pastor Marvin L. Sapp introduced him to the crowd. “If y’all notice, nobody else came,” Sapp said. “But we recognize people that come to see about us.”

He then said O’Rourke would be in the lobby after the service to “meet and greet.”

“This situation is a close call,” Mayer said. He said the visit could be a violation because Sapp gave candidates a chance to meet with congregants on church property after the service.

Brunson said that if O’Rourke solicited votes or funds in the lobby it would likely be a violation.

In a statement, Sapp said he did not believe the visit was barred by the Johnson Amendment and pointed out that O’Rourke did not address parishioners during the service.

“I have been a pastor for 19 years and have never endorsed a candidate,” Sapp said. “I understand the parameters of the Johnson Amendment and do not violate them. While I believe in the inherent separation of church and state, I also believe in empowering marginalized communities, the African American community in particular, to participate in the democratic process.”

WHAT DOES THE JOHNSON AMENDMENT ALLOW?

Religious institutions are allowed to invite candidates to speak to their congregations.

But if one person is invited in their capacity as a candidate, everyone in the race must be given equal opportunity to address parishioners, according to IRS rules. Fundraising is also not allowed during the appearance and the church must maintain a “nonpartisan atmosphere,” the rules state.

“As long as all candidates are invited and there’s no endorsement, candidates can appear at a church and can even explain why the congregation should vote for them,” Brunson said.

While only inviting one candidate violates the law, enforcement is difficult.

“All sorts of houses of worship do this,” Ellen Aprill, an emerita tax law professor at Loyola Marymount University’s law school, said. “Think about the enormous amount of resources it would take for the IRS to enforce the ban and to do so in a way that avoids accusations of political favoritism.”

In some cases, a single politician can be invited to speak as long as they are not identified as a candidate.

On the evening of Oct. 23, Patrick attended a “Night to Honor Israel” event at Cornerstone Church in San Antonio.

Pastor John Hagee introduced Patrick. He avoided violating the prohibition on supporting a political candidate because he praised the Lieutenant Governor in his capacity as a current public official and did not mention his candidacy, Mayer said. The tax law expert added that Patrick also did not mention the upcoming election, voting or his candidacy.

Churches also can provide voter guides and have voter registration drives as long as they avoid showing preference for specific candidates. They can also weigh in on such issues and policies as abortion if they steer clear of targeting individual candidates. The Congressional Research Service acknowledged in 2013 that “the line between issue advocacy and campaign activity can be difficult to discern.”

Religious institutions have more flexibility in supporting or opposing ballot measures like bonds and referendums that don’t involve specific candidates.

In Michigan, Catholic churches have put up signs against a ballot measure that would enshrine the right to abortion access in the state constitution. They’ve also spoken out against the measure during sermons and sent campaign letters to parishioners urging them to oppose it.

The Detroit archdiocese told The Detroit News last month that IRS rules allow the church to participate in political activity related to the ballot proposal and that it would continue to follow the law “while remaining firm” in its advocacy efforts. Critics have accused the church of violating IRS rules.

Churches can be involved in noncandidate elections as long as such lobbying work is not “substantial,” which the tax code does not explicitly define, Mayer said.

Outside of official church functions or publications, pastors and other church leaders can endorse candidates and engage in political activity in their private capacity. A religious leader’s church affiliation can be identified in such an endorsement, as long as it’s clear that the church leader is not speaking on behalf of the institution.

HOW LIKELY IS THE IRS TO CRACK DOWN ON JOHNSON AMENDMENT VIOLATORS?

Not very.

In the 68 years since the Johnson Amendment became law, the IRS has only publicly acknowledged revoking the tax-exempt status of one church. (The Congressional Research Service said a second church lost its status, but its identity is unknown.)

In 1992, just four days before the presidential election, Branch Ministries in New York paid for ads in USA Today and the Washington Times attacking then-Arkansas Gov. Bill Clinton, a Democrat, who was challenging Republican President George H.W. Bush.

The ads started with the headline: “Christian Beware. Do not put the economy ahead of the Ten Commandments.” They claimed Clinton violated scripture by supporting “abortion on demand,” homosexuality and the distribution of condoms to teenagers in public schools. Clinton, the ads stated, was “openly promoting policies that are in rebellion to God’s laws.”

The revocation of the church’s tax-exempt status spurred a yearslong legal battle. In 2000, a U.S. Appeals Court ruled in favor of the IRS.

During a four-year period that started in 2004, the IRS sent dozens of churches warning letters about political activity and initiated some audits. The result of the audits is unclear.

Then, in 2013, a scandal related to nonprofits that were not churches helped further dampen the agency’s enthusiasm for politically sensitive investigations, said Philip Hackney, a University of Pittsburgh law professor and former IRS official.

Congressional Republicans accused the agency of bias against conservative groups after the Treasury Department’s inspector general found that the agency had given extra scrutiny to Tea Party nonprofits seeking tax-exempt status. Two high-ranking IRS officials stepped down.

“They got burned badly as a result of being in that space,” Hackney said, adding that the incident led IRS leaders to be particularly “careful about how they tread in those waters.”

The IRS has not released data on enforcement of church political activity over the last decade and does not publicly confirm individual investigations.

But in response to a Freedom of Information Act request from ProPublica and the Tribune last year, the agency produced a severely redacted spreadsheet indicating the agency had launched inquiries into 16 churches since 2011. IRS officials shielded the results of the probes, and they have declined to answer specific questions.

The more of us sending in Form 13909 to the IRS, the quicker they’ll act...

#us politics#news#the texas tribune#propublica#2022 midterms#2022 elections#2022#texas#form 13909#irs#internal revenue service#separation of church and state#tax exempt status#religion#organized religion#beto o'rourke#lt. gov. dan patrick#Johnson Amendment#us tax code#president dwight d. eisenhower

18 notes

·

View notes

Text

FFRF applauds Reps. Huffman and DelBene’s reissued call for IRS review

Publisher: In-Sight Publishing

Publisher Founding: September 1, 2014

Publisher Location: Fort Langley, Township of Langley, British Columbia, Canada

Publication: Freethought Newswire

Original Link: https://ffrf.org/news/releases/ffrf-applauds-reps-huffman-and-delbenes-reissued-call-for-irs-review/

Publication Date: July 10, 2024

Organization: Freedom From Religion Foundation

Organization…

#Annie Laurie Gaylor#church status#congressional oversight#constitutional principles#Family Research Council#Freedom From Religion Foundation#IRS regulations#IRS review#Jared Huffman#nontheism#political advocacy#secular government#separation of church and state#Suzan DelBene#tax-exempt status#transparency concerns

0 notes

Text

IRS calls terrorist front a charity

Brothers and Sisters;

The Council on American Islamic relations (CAIR), an organization US Air Force Investigator and Investigative reporter David Gaubatz called a "Muslim Mafia," is a proven front for the terrorist organization Hamas, and according to the Justice department an "unindicted co-conspirator" in the Holy Land terrorist financing trial, CAIR Is listed by the IRS as a 501 (c) (3) tax exempt charity. As such they are eligible to receive donations from foundations that are also. Some of the foundations that have made donations to CAIR include American Online Giving Foundation, the California Endowment, the Weingart Foundation, Schwab Charitable Fund, Asian Americans Advancing Justice, East Bay Community Foundation and many others.

Fortunately there are remedies available to informed and concern citizens. Any citizen can complain that an undeserving organization is enjoying tax exempt status by.

One of these two processes the public can use to notify the IRS of perceived violations by tax-exempt organizations. The first, which has no specific statutory basis, is Form 13909, which the IRS released in 2007.

If you suspect a tax-exempt organization is not complying with the tax laws, you may send information to the Tax Exempt and Government Entities Division. You may use Form 13909, Tax-Exempt Organization Complaint (Referral) Form PDF, or send the information in letter format, and attach any supporting documentation for this purpose. Form 13909 PDF, or complaint letter, can be submitted one of the following ways:

Email to [email protected], or

Mail to TEGE Referrals Group, 1100 Commerce Street, MC 4910 DAL, Dallas, TX 75242

0 notes

Text

Doooooo eeeeeeet!

1 note

·

View note

Text

today is tax day in the us

time to give the government money to do shady stuff with for some reason

#Tax day#Do your taxes#This is stupid#Rich people don't even have to do this why do y'all#Good thing kids are tax exempt for now#But I fear the day I will have to go to the tax peoples website and do my taxes so I don't get fucking kneecapped by the IRS

1 note

·

View note

Text

#IRS#Form 8940#electronic filing#tax-exempt organizations#miscellaneous determination requests#Pay.gov#user fees

0 notes

Note

you’ve inspired me so here’s a thing you can do whatever with cause I got a migraine and lost my train of thought

so Danny’s working the bar at the iceberg lounge and notices more people are stress drinking, even the Big Names and asks what’s up only to find it’s ✨Tax Season✨

Danny: oh I always forget about that

someone: (aghast) you don’t pay your taxes

Danny: *shrugs* I’m not allowed to pay taxes

wtf does that mean, is he exempt, someone asks but no Danny explains that the first and only time he tried to pay his taxes he received a full refund and a cease and desist order

word gets around and not even the joker want to mess with Danny because what kind of a monster can scare the irs

(This is actually an inherited problem from his parents)

"What did you just say?" Danny looks up from where he is mixing drinks. Across from him is a purple suit-wearing clown- he hates clowns, so he was attempting not to make eye contact- whose whole white face is twitching slightly.

Danny blinks slowly, using every ounce of self-control to not give in to the urge to reach across the bar and slap him. After a moment, he answered, "I always forget tax season."

"You're crazy enough to take on the IRS?" The clown's jaw drops. "I mean Batman, sure, I understand that, but the IRS?"

Danny frowns. "I don't take them on. I don't have to do my taxes."

"How?" A man in a suit covered in question marks demands from further down the bar.

He shrugs his shoulders a little. "I tried it once, but they sent me a full refund and a cease and desist order. They only remind me that I cannot file taxes now."

"Prove it," A man covered in scales hisses.

Danny grabs a rag, using it to clean off the lemon juice. He reaches into his apron pocket, pulling out a folded-up letter. He could have left it in his locker, but stuff always went missing there. Best to keep his stuff on his person while working. "Sure. Here I have it now. I went to the post office before my shift-hey!"

The lade covered in leaves yanks the letter out of his hand, unfolding it and reading the words as though it wasn't a federal crime. Her voice wavers when she gets to the reminder that the United States of America Internal Revenue Service would not stand another attempt at Daniel Fenton's taxes.

"This can't be real," She scoffs, but there is an underline of worry in her voice that she can't entirely hide.

She turns to a man in a strange white and black suit- like it's evenly split down the middle strange. It matches his face, though; one side is gorgeous, and the other is deformed. "This isn't real, is it Two-Face?"

Two-face takes the paper from her hand, carefully reading the words before pulling out his phone and typing away. After a few seconds, he pauses, then gasps. "It's real. My boys just confirmed the Tax ID number. He is not legally allowed to do taxes."

"Holly Molly, you're insane," the clown gasped, backing out of the seat while pointing at Danny as though he was the devil. "Stay away from me you lunitic! I'm not messing with the IRS's boogie man!"

He turned tail and ran, leaving behind a stunned Danny, wondering what he could have said to earn that reaction. His parents back home were also ordered to not do their taxes. It's common.

He turns to his other customers, ready to take their order, but they all pale and quickly duck away from him as well.

Strange.

Then, Danny notices the silence that has fallen upon the Iceberg Lounge. Even the music has been cut off as everyone stares at him in disbelief.

He shifts, a little uncomfortable with the stares. Danny has never grown used to attention, no matter how much he craved it as a teenager. He always wanted to be in the It Crowd and be given an official membership to the A-listers, but he grew to understand that the only way they liked seeing him was in pain.

So Danny learned to avoid attention as he could, which wasn't complex as the part of the town's freaks, but the very few mintues someone did pay attention to him something terrible ended up happening.

Dash stuffed him into a locker while classmates laughed and cheered the bully on.

A teacher calling on him just to make him feel stupid.

His parents realized he was slipping in his grades and reminded him that he was a failure to the family's intelligence.

Or some random GIW agent that "banished" him from his Earth, flinging Danny straight across the universe to whatever hellhole Gotham crawled out of.

He barely got this bartending job only a few weeks ago- lying about his age which he thinks his boss doesn't care about- and using a shade of an old bartender to coach him in mixology.

Shades were different from ghosts. For one thing, they were weaker and unable to be seen by regular people. They could not interact with the world and often didn't even know they were dead. If Danny had been able to see them before the portal, he would have known they were the cause of what is commonly known as a "ghost."

They were the myths.

Jeff Ricci is Shade, one who is aware he died. He was killed in a gang shoot-out a few years after he and his sister ran away from an abusive home. They traveled through three states, dodging police and CPS, before they disappeared among Gotham's homeless population.

The pair of siblings survived for a while doing odd jobs for local gangs- things like drug runs or helping them move guns- which is why Jeff was out there the night the fight broke out.

It was an imperfect stroke of luck, the wrong place and time. The two had been doing so well, too. They had both gotten jobs at the Iceberg Lounge, lying about their ages, where Jeff was a dishwasher, and Lucia was a housekeeper.

After hours, Jeff was taught by his coworkers how to properly mix drinks, waiting for Lucia to finish her job. When the two turned eighteen, Lucia became a waitress, and Jeff joined the bar- though if anyone asked or checked their employee records, both were twenty-one.

With better pay and hours, they could rent an apartment, finally gaining a home after three years of homelessness. Jeff had lived in that home for only a month when he accepted a job to buy Lucia some migraine medication and had perished.

Lucia lived on without her twin, broken far more than before, but she still had the apartment and job at the Iceberg Lounge. She was unaware her brother still followed her around, watching her actaully turn twenty-one while he remained eighteen.

That's how Danny met him, a somewhat see-through man casually following one of the prettiest waitresses. He had assumed he was being a creep, but Jeff had been delighted that someone could not only see him but was willing to protect his sister by threatening him away from her.

In exchange for lessons on proper mixing, Jeff asked Danny to keep an eye on his sister. Help her when he could not. It was a fair trade from one younger brother to another.

The shade is currently leaning against the counter beside Danny, staring at him as though Danny was a god. "You scare the Joker. Shit, Danny, I knew you were some kind of Rouge in the making, but to take out heavy hitters like this before your debut!? That's just terrifying! Would you be willing to pay my sister to be your secretary or something? She's a great typer!"

What a strange place Gotham is.

#dcxdpdabbles#dc x dp crossover#IRS's boogie man#Danny freaking out the Gotham Rouges#The Fentons are outlawed from their Taxes#Danny is in a new dimension and knowns nothing#He isn't even aware he was serving some of the worst criminals of Gotham#Jeff and Lucia Ricci have accidentally made a Deal with Ghost King Danny

2K notes

·

View notes

Text

There seems to be a trend of US church leaders telling their young folks to get on social media and spread the church's message - which is invariably anti-LGBTQ, anti-choice, etc. That's not just astroturf; it could cost them their tax-exempt status. If you see them doing this, here's the link you need.

1K notes

·

View notes

Text

this isn't the first time we've seen evidence that the current climate of anti-trans panic in the US has largely been manufactured by (or at the very least, stoked by) a small number of conservative interest groups, but the leaked materials from this group do make it pretty clear that trans people are being used a wedge issue to increase republican turnout:

In a member briefing video, one of Ziklag’s spiritual advisers outlined a plan to “deliver swing states” by using an anti-transgender message to motivate conservative voters who are exhausted with Trump.

although it does seem like they believe their own rhetoric and aren't "just" willing to turn trans people into collateral damange:

Other internal Ziklag documents voice strong opposition to same-sex marriage and transgender rights. One reads: “transgender acceptance = Final sign before imminent collapse.”

and somehow this is only the tip of the iceberg here:

a charity funded by mega-wealthy christian donors who think that secular mega-wealthy donors are more generous than christians (much to unpack there lol) and want to close that gap

the fact that it's set up a tax-exempt 5013c org but 100% operating as a PAC, which according to a little group called the IRS is super duper illegal

general christian nationalist shit, including a belief that “the biblical role of government is to promote good and punish evil” and that “the word of god and prayer play a significant role in policy decisions"

using a tool called eagleAI that "claim[s] to use artificial intelligence to automate and speed up the process of challenging ineligible voters" in a bid to kick 100k+ voters off the rolls in swing states

a seven-pronged plan that extends into non-political avenues like the entertainment industry, like a goal to make 80% of movies produced either have a G or PG rating and offer a tidy moral

the hobby lobby family is here because of course they are

486 notes

·

View notes

Text

In case you don't know, churches in the US are required to remain non-political in order to keep their tax exempt status. You can fill out a Form 13909 with the IRS to file a complaint about a church or other tax exempt organization that violates these kinds of rules.

Ya know, if you ever wanted to send the IRS after Christofascist churches. It's safer than arson.

2K notes

·

View notes