#Illinois Title Loans

Text

Usacartitleloans Locations - Missouri | Illinois | Wisconsin Title Loans

We have thousands of locations nationwide offering car title loans, boat title loans, and more. Visit us at www.usacartitleloans.com

#can i get a loan for a salvage title car#can you finance a car with a rebuilt title#car loans for rebuilt titles#title loans that don t require the car#easy title loans#cash and title loans#car title loans no credit check#can i get a title loan with a financed car#will a bank finance a rebuilt title#car title loan texas#car title loans with no income verification near me#title loans online fast#title loan without title online#online title loans for bad credit#fast online title loans#can you pawn your car#approved title loans texas#online texas title loan service#easy boat title loans#Missouri Title Loans#Illinois Title Loans#Wisconsin Title Loans

1 note

·

View note

Text

day six: art institute of chicago

"homesickness sinks its

vapor-white teeth into

all my waking dreams"

Today had more sleeping in it than anticipated. Slept in for longer than I usually do, then we headed to the Art Institute of Chicago. Luckily we just had to take one bus to get there, so not a lot of transfers or anything.

Definitely felt like we got off "at the center of things", so to speak—a lot of people and cars and activity that reminded me of New York or DTLA.

We got in after some brief trouble (I can't lie to save my life and I was supposed to try and get around the higher costs put upon non-Illinois residents, but I showed the lady at the front desk my student ID and she asked for my zipcode and I froze up. So she charged me as a non-resident. Whoops.)

We started at the Asian artwork section, looking first at the Kabuki portraits and then moving into the porcelain and pottery, which I really, really loved.

The designs were really intricate and some of the more detailed pieces had symbols we got to look for—museums should have more eye spy esque exhibits, don't you think?

The pieces were from Japan and China, from different historical eras. The WW2 era depiction of the girls at the beach was really interesting and struck a contrast with the other pre-colonial era pieces in the exhibit (especially because the description used an English loan word for "modern girl" when I believe Japan was not on good political terms with England or America).

There was also some bowls from I believe the Ming Dynasty with ducks on them and they were cute and I forgot to take a picture. Waaaah.

After that we looked at this exhibit titled "Four Chicago Artists: Theodore Halkin, Evelyn Statsinger, Barbara Rossi, and Christina Ramberg"—I don't know a lot about how to engage or understand a lot of modern or contemporary art, especially when its abstract, I struggle a lot with extracting something from the experience of viewing the art up close. I'm not really an artist myself, or at least I wouldn't call myself one, but I do like reading the descriptions and trying to get into the heads of the artists. They all seemed like they were graduates of SAIC, for example—I'm kind of curious about the school's influence on curating art movements in Chicago or if it plays into anything like that.

Something I did really like was the equisite corpse section where the artists in question got together to perform their own versions.

I like exquisite corpse in poetry form, line by line stuff, because it always devolves into abstract nonsense and that's always fun. It seems that this applies here.

I ran out of room, so I'm gonna post a Part 2 for the rest of the day.

0 notes

Text

Get Auto Title Loans Joplin MO and nearby cities Provide Car Title Loans, Auto Title Loans, Mobile Home Title Loans, RV/Motor Home Title Loans, Big Rigs Truck Title Loans, Motor Cycle Title Loans, Online Title Loans Near me, Bad Credit Loans, Personal Loans, Quick cash Loans

Contact Us:

Get Auto Title Loans Joplin MO

1331 S Illinois Ave,

Joplin, MO 64801

Phone: 816-548-2839

Email : [email protected]

Website: https://getautotitleloans.com/auto-and-car-title-loans-joplin-mo/

An auto title loans are typically utilized by those that wish to obtain a funding with bad credit rating or no credit in any way. An auto-mobile title lending frequently called a vehicle title lending or merely title funding as well as pink slip funding’s. You merely should have a vehicle that is paid off or nearly paid off and also you could make use of the auto title as security to obtain the cash money you require, enabling you to continue driving your vehicle while paying your loan.

0 notes

Text

Realizing the Benefits of Blockchain in Real Estate Finance

Before we proceed I would like you people to watch this one-minute short video explaining what is Blockchain:

Real estate finance is a critical component of the economy, as it enables individuals and businesses to purchase, develop, and invest in property. However, the process can be slow, opaque, and prone to fraud. Blockchain technology has the potential to change that.

In this story, we will explore how blockchain technology is being used to streamline and secure real estate transactions, from property title transfer to mortgage lending. We will examine the benefits that blockchain can bring to the real estate finance industry and look at some examples of current or pilot projects that are using blockchain in this field. Finally, we will discuss the potential impact of blockchain on the real estate finance industry and other stakeholders.

By the end of this story, readers will have a better understanding of the potential of blockchain in real estate finance and the ways in which it can benefit the industry and the economy as a whole.

Streamlining Transactions:

Blockchain technology has the potential to streamline real estate transactions in a number of ways. One of the most significant benefits is its ability to digitize and automate property title transfer. In traditional systems, property titles are often recorded on paper and transferred through a complex and time-consuming process. Blockchain technology can make this process faster and more efficient by creating a digital record of property ownership that is tamper-proof and easily transferable.

For example, the Cook County Recorder of Deeds in Illinois has been testing a blockchain-based system for recording property titles. The system allows for faster and more accurate property title transfer and reduces the risk of fraud. Similarly, the government of West Virginia has been testing a blockchain-based system for recording and transferring property titles, which has been reported to be more efficient and secure than traditional methods.

In addition to property title transfer, blockchain technology can also be used to streamline mortgage lending. Smart contracts can be used to automate the mortgage application process, ensuring that all necessary information is collected and verified in a secure and transparent way. For example, a start-up called Factom has developed a blockchain-based system for mortgage lending that allows for faster and more secure loan processing.

By streamlining transactions, blockchain technology can make the process of buying, selling, and investing in property faster, cheaper, and more secure. This can benefit everyone involved in the real estate finance industry, from buyers and sellers to banks and regulators.

Enhancing Security:

One of the most significant benefits of blockchain technology in real estate finance is its ability to enhance security. Blockchain creates a tamper-proof record of transactions, which can reduce the risk of fraud and errors in the real estate finance process.

For example, Smart contracts can be used to automate the process of transferring property titles, ensuring that the title is transferred only when certain conditions are met, such as payment being received. This can reduce the risk of fraud and errors in the title transfer process. Additionally, with smart contract-based transactions, all parties have access to the same information, which can increase transparency and reduce the risk of fraud.

Another way in which blockchain can enhance security in real estate finance is through the use of digital identities. Blockchain-based digital identities can be used to verify the identity of buyers and sellers in real estate transactions. This can reduce the risk of identity fraud and ensure that transactions are conducted only between legitimate parties.

Blockchain technology can enhance security in real estate finance by creating a tamper-proof record of transactions, automating the process with smart contracts, and verifying digital identities. This can reduce the risk of fraud and errors, increase transparency and enhance the security of the overall process.

Potential Impact:

The potential impact of blockchain technology on the real estate finance industry is significant. By streamlining transactions and enhancing security, blockchain can reduce costs and increase efficiency for both buyers and sellers. This can make the process of buying, selling, and investing in property more accessible and affordable, which can have a positive impact on the overall economy.

In addition to reducing costs and increasing efficiency for buyers and sellers, blockchain technology can also benefit other stakeholders in the real estate finance industry. For example, banks and other financial institutions can use blockchain technology to reduce the risk of fraud and errors in their real estate finance operations. This can lead to lower costs and increased efficiency for these institutions, which can ultimately benefit consumers.

Similarly, regulators can use blockchain technology to increase transparency and oversight in the real estate finance industry. By providing a tamper-proof record of transactions, blockchain can make it easier for regulators to identify and prevent fraudulent activities. This can lead to a more stable and secure real estate finance market, which can benefit both buyers and sellers.

Blockchain technology has the potential to revolutionize the real estate finance industry by streamlining transactions, enhancing security, and reducing costs. This can benefit buyers and sellers, banks, and regulators, and have a positive impact on the overall economy.

Conclusion:

In this story, we have discussed the potential of blockchain technology in real estate finance. We have looked at how blockchain can be used to streamline transactions, such as property title transfer and mortgage lending, and enhance security by creating a tamper-proof record of transactions and automating the process with smart contracts.

The potential impact of blockchain on the real estate finance industry is significant. By reducing costs and increasing efficiency for buyers and sellers, it can make the process of buying, selling, and investing in property more accessible and affordable. This can have a positive impact on the overall economy. Banks, other financial institutions, and regulators can also benefit from the enhanced security and transparency provided by blockchain technology, which can lead to a more stable and secure market.

Blockchain technology has the potential to revolutionize the real estate finance industry and bring significant benefits to all stakeholders. As technology continues to evolve, it will be interesting to see how it is adopted and integrated into the industry in the future. We encourage readers to continue learning about blockchain technology and its potential applications in real estate finance and other industries.

Join my Web 3 Community:

#blockchain#realestate#crypto#web3#property#smartcontract#decentralization#digitalassets#landregistry#transparency#efficiency#innovation#technology

0 notes

Text

Quit claim deed

DOWNLOAD NOW Quit claim deed

#Quit claim deed how to

#Quit claim deed free

Blockchain is an electronic ledger that can record an accurate Homes, exploiting the owners’ long absences to get away with using quitclaimĬourt officials are developing new systems intended to prevent deed fraudĬook County, Illinois has been working on a pilot blockchain Use quitclaim deeds to transfer the title.įraudulent practices involve locating elderly people’s vacant homes or beach Stop the home from foreclosing, then filing a lien on the property. The scheme involves paying part of the tax debt to Fraudsters may ascertain that an elderly personįailed to make tax payments. Sometimes, coercion or threats areĬases, someone fakes the elderly homeowner’s signature and has the document Signing over a deed makes financial sense. Sometimes, the perpetrator is someone theyįinancial advisors, or family members could persuade the owner that Ill-gotten deed aside and reestablish ownership of the property. Innocent person then faces a lengthy, expensive legal action to set the Often, the victim’s loss only becomes apparent much later, when anĮffort to sell the property hits a wall during the title examination. Recordation-even if something looks suspicious.įraudster with a quitclaim deed can quietly take away a rightful owner’s Under state law, a recorder of deeds lacks authority to review or deny Moreover, it is not difficultįor a fraudster to go into a county courthouse and file a quitclaim deed behind Owners’ identities to facilitate such activity. Online sources offer scammers ample information about properties and their Warranty, rent it out to unsuspecting tenants, or obtain a loan on its Recorded a fraudulent document, a scammer can sell the property without a Some poseĪs personal representatives of estates to carry out the schemes. To fraudulently convey property into their names or aliases. Thus, scammers are drawn to quitclaim deeds to carry out transactions withĮxploit the simplicity of quitclaim deeds.

#Quit claim deed free

Possible cloud on title, leaving the property free and clear to its concerned Party who potentially could have a claim can use the deed to resolve the The quitclaim is a “deed of release” if there are ambiguities to clear up. To a buyer the interest it gained through foreclosure-nothing more.Īccepting a quitclaim deed without warranty should understand that the Property to recover the value of its unpaid taxes. Sometimes quitclaim deeds arise in tax sales. Quitclaim deed-occasions for giving property, not selling it. QuitclaimsĪre common in transfers of homes from parents to children, from sibling to Theĭeed transfers one party’s interest in a property to another party.

#Quit claim deed how to

Legitimate owner, and anyone involved who might buy, sell, or own property.Įxamine how it happens and how to detect it. Strangers without warranty, renters who are paying someone who is not a This type ofĭeed fraud can impact elderly people, buyers purchasing real estate from Deeds show up commonly in fraudulent real estate transactions.

DOWNLOAD NOW Quit claim deed

0 notes

Audio

If you are looking to get secured title loans in Illinois, then we are here to help you. You may be able to get up to $4,000 as car loan if you own a car. Just visit our website and apply for loans by following some instructions. Our loan agent will help you in your paper work and clear all your doubt about loan.

2 notes

·

View notes

Link

This makes me nervous, but I’m going to post it. I’m going to try my best to achieve my goals. I’ve put in a ton of work already, so I’m looking for additional help.

From the campaign:

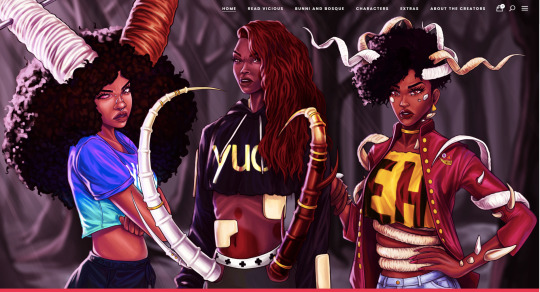

My name is Trey Briggs, and I'm a black woman who writes paranormal horror, speculative fiction, and other types of fiction.

You can find my stories at MaybeTrey , Astrid the Devil , and on Instagram , Medium , and Wattpad .

My stories are aimed at black people who want to read dark stories that focus on original black characters that are complex and interesting.

I genuinely believe Black audiences deserve a variety of genres to delve into, and I want to introduce them to paranormal horror, dark romance, and fantasy that they haven't gotten enough of in the past. I also believe that this can be done across multiple mediums, and I spend my money with black creative professionals to make these experiences extend beyond my words.

For the last two years, I've run my stories on sites and Instagram to great reception. I like to craft complex experiences that offer looks at character backgrounds, side and backstories, full websites for each title, and more. I also provide encyclopedias, maps, audio journals, and other ways to get into each world.

During these last few years, I've run into a lot of walls, jumped a lot of hurdles, and tried my best. I've worked with amazing black artists, voice actors, and actresses, musicians, designers, and more. I trust my ability to run a project, especially when it comes to planning and finding talent.

My overall goal is to run a team of black creatives that crafts novels, graphic novels, audio experiences, and animated series for a dedicated audience.

Why I Need Help

Long story short: I have the skill, I have the marketing/website building/business experience, and I have the drive. There's a lot I can do on my own, but there's also a lot that gets left behind because I don't have the money I need to proceed at a steady pace.

I need help with funding so I can focus, hire the right people, and craft these stories the way they deserve to be crafted.

I have thus far spent over $60,000 of my own money on my projects over the past two years - the writing and site-building are easy for me; the rest has to be hired out. I have art, site costs for hosting, domains, templates, specific plugins, and maintenance, audio (and vocal artists to pay), musical, and editing costs.

I'm by no means rich or even particularly financially stable. I have taken on tons of extra clients for my digital marketing business, transcribed hundreds of hours of audio for dirt cheap, and taken out personal loans. I even worked a second full-time job along with my full-time business last year to afford to produce the content I love. It's starting to take a toll on my mental health.

I plan on continuing to fund these projects out of pocket (and finding ways to do so), but having financial help, however big or small, would allow me to move a lot faster and with less stress. It would let me flesh out ideas and concepts that I have had to scrap because I can only physically handle so much extra work.

I run a full-time marketing business from home, homeschool my autistic 10-year-old, and generally have a busy life. Some of the strain is taking a toll on me, and I don't want to give up. Having some financial backing could allow me to drop a client or two after a few months and focus on the work I love to do.

How You Can Help

I mainly need a start—a sort of base.

I want to emphasize that I plan to continue to provide the main bulk of funding for my projects. I know my goals are ambitious, and I know each step will take time and money. I welcome any help to make the process smoother and to get around the initial hurdles. I'd like to have ebooks and novels offered on my site by the end of the year (along with the free serials and stories).

Funding means that I can broaden the projects, include more free aspects to my sites, and secure direct financing through sales of ebooks and audiobooks sooner. It also means that I can offer MORE stories, whether they are online only or fully fleshed out novels and sites.

I am swamped with trying to work enough to cover all my bills and creative projects, so I lose a lot of time I could spend plotting and writing. If I have better funding, I can get my stories out quicker (and with fewer mistakes).

The Initial Stories

Let's talk about my stories! If you're familiar with my work already, you can skip to the next section.

My main story site is Maybe Trey .

Currently, I have two big titles and a bunch of smaller ones that I am seeking help with funding:

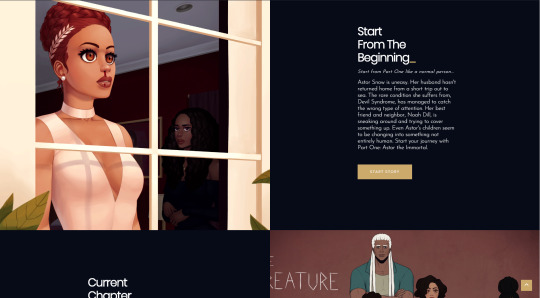

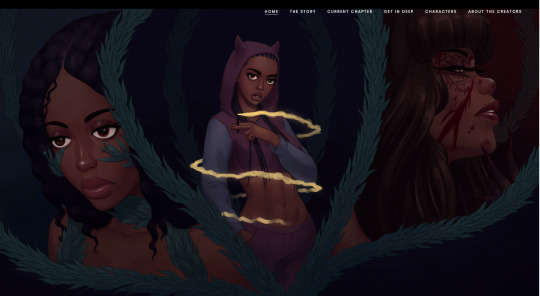

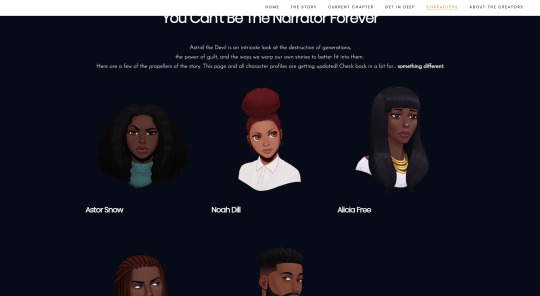

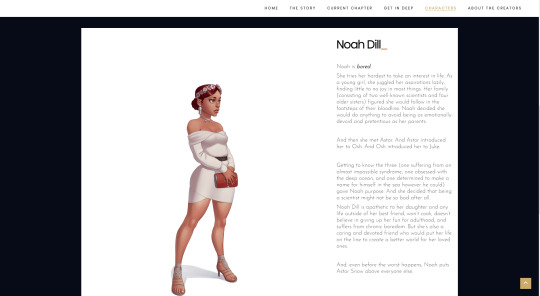

Astrid the Devil

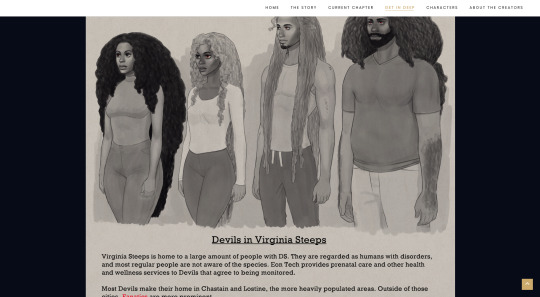

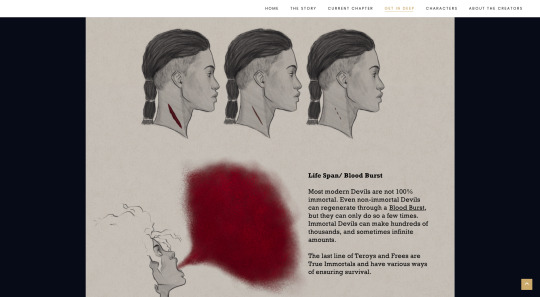

Astrid the Devil is the complicated story of a girl who inherits not only her family's features and DNA, but their fears, struggles, and fights. It's the story of a condition called Devil Syndrome, the women who suffer it, and the monsters that devour them. It's the story of the fight to save the people you love at the expense of innocent lives.

At its core, Astrid the Devil is the story of a woman who inherits the chaos of three generations before her. It's a look at what is truly passed down to our children, and how they're left to fight our battles in the aftermath of our failures. It's the tale of an indescribable monster and the women who struggle to defeat it. It's a journey into how their every decision could save or destroy an entire world.

Astrid the Devil is the story of Astrid Snow, but her story can't be told without the story of the women before her.

Vicious: On MaybeTrey and The Vicious site (in progress)

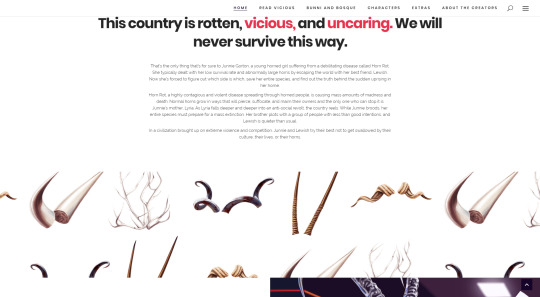

Somewhere, a war is brewing. That's the only thing that's for sure to Junnie Gorton, a young horned girl suffering from a debilitating disease called Horn Rot. She typically dealt with her low survival rate and abnormally large horns by escaping the world with her best friend, Lewish. Now she's forced to figure out which side is which, save her entire species, and find out the truth behind the sudden uprising in her home.

Horn Rot, a highly contagious and violent disease spreading through horned people, is causing mass amounts of madness and death. Normal horns grow in ways that will pierce, suffocate, and maim their owners, and the only one who can stop it is Junnie's mother, Lyria. As Lyria falls deeper and deeper into an anti-social revolt, the country reels. While Junnie broods, her entire species must prepare for mass extinction. Her brother plots with a group of people with less than good intentions and Lewish is quieter than usual.

In a civilization brought up on extreme violence and competition, Junnie and Lewish try their best not to get swallowed by their culture, their lives, or their horns.

Bunni and Bosque :

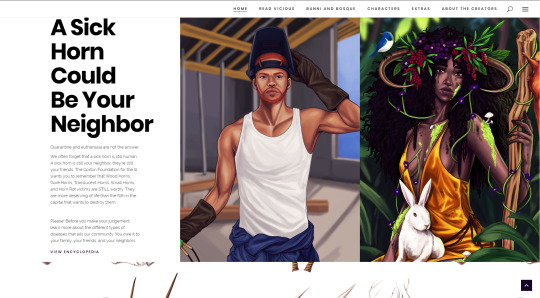

Bunni lives. Bosque dies.

We all know how this story starts.

Bunni is obsessed with destruction and death. She comes from the healthiest Horned family in her country. She's from the oldest, purest bloodline in the world. And she's bored with it.

Bunni spends most of her time trying to escape her duties as a pureblood. She wants things dirty, messy, foul, inconsistent. Having parents that are willing to kill to keep their bloodline pure is annoying. Knowing that she'll live a long, full life, produce more perfect children, and die unscathed is agonizing.

Bunni wants something to mourn.

We all know how this story ends.

Bosque is destined to die an agonizing death, alone on his family's land. He's watched everyone he loved and grew up with perish. Sometimes it was because of their disease. Sometimes it was because of the malice and hatred of others.

While he's absolutely withdrawn and satisfied with his life, Bosque has never had a chance to live it. He spends his days basking in the sun, bathing in wood baths, and contemplating the end.

Bosque isn't interested in joining the rest of the world. He'd rather die out, alone, where his family belonged.

Bosque wants to go peacefully.

But neither expected to meet each other one day in a supermarket. Neither expected to fall in love, lust, and every vicious and dirty thing between. Neither expected to be so right for each other, all while being wrong for everyone else.

You know the end of this story. Bunni lives, Bosque dies.

But maybe something will change.

My smaller titles, Bunni and Bosque /Aite and Jude, can be found at Maybe Trey .

The Business Plan

The initial phase of my business plan is to get the sites populated with ebooks and audiobooks for sale. I also have prints that can be sold. Right now, I am in the audience-building phase while I save up for editing the full novels.

In terms of an actual business with which to publish the stories, I already have a registered publication company in Illinois: Wolfless Studios LLC. I took this step earlier this year with plans to self-publish Astrid and Vicious. So that is paid for and done.

I have also gotten initial editing done on the first six chapters of Astrid, though it will need to be edited from the beginning again once everything is said and done. I've spent over $1000 on that so far, and it would go a lot faster if I didn't need to save up to edit each chapter.

Astrid the Devil is fully plotted, outlined, and only needs the last three chapters. Bunni and Bosque and Vicious are newer, but plotted and already deep into character development (all being shared across social and Wattpad for audience growth). Aite and Jude and other shorts are plotted, and three other unshared stories are plotted and at the editing phase.

Other costs and ways I would use the funding (I would still put in my own money and do as much on my own as possible):

Initial $30K

$6000 - $7000 Line and Copy edits for Astrid (currently at 250000+ words/expecting over 300000 at $0.02 rate)

$6000 - $7000 Line and Copy Edits for Vicious

$3000 - $4000 Line and Copy Edits for Bunni and Bosque

ISBN Purchases (Separate ISBN for each format for each book) - https://www.myidentifiers.com/identify-protect-your-book/barcode

Covers for Astrid/Vicious/B&B Print Versions

Site Hosting Costs and Maintenance for 2 Years

Site completion for all stories

Initial store and app development

40K - Marketing and Graphic Novels

Social, Print, and Web ads

Email Marketing Campaigns

Booths at Decatur Book Festival (depending on COVID)

Social ads and promos

50 to 60 pages

First two chapters offered as free promo with email sign-ups

Audio journals for each character

Situational audio journals

Encyclopedia for Astrid (finishing up)/Vicious

65K - Hires and Next Phases

Ability to hire a Full-Time Editor

Audio Series for each (professionally done)

Vicious Graphic Novel

Additional Title Added

Short animations for both Vicious and Astrid (with plans to fund more with book sales)

Fleshed out Story Sections (Novellas for each character of each series)

Short comic series with Astrid and Vicious side characters

Possible to plan out monthly subscription service with new stories and 'story package' deliveries

75K -

Astrid the Devil Graphic Novel

Vicious Graphic Novel

Astrid the Devil Animated Short

Ability to hire part-time Web Developer

Additional bigger title

Anything Over - I ascend into pure light. And also, I can add titles, cover more mediums, and eventually expand my publishing to other black creatives.

From there, I should be able to handle the funding via sales of books, comics, audio, and more. Again, I will always offer mostly free content across the sites.

I believe in proof of concept, and I have diehard fans on my social platforms. With no outside funding, I've been able to a lot on my own. I'd love to expand my business into one that does the same for other black authors, artists, voice actors, and animators somewhere down the line.

Thank you so much for your consideration. I appreciate all my readers, present and future, and I appreciate any help!

See incentives and more on the actual campaign: https://www.gofundme.com/f/help-trey-publish-black-paranormal-horror-stories

Thank you so much!

#support black authors#writeblr#support black creators#black creators#original characters#original story#donate#buy black#black businesses#my writing#Astrid the Devil#Vicious#Bunni and Bosque#Aite and Jude#Trey Briggs the Writer#paranormal horror#speculative fiction#gofundme

3K notes

·

View notes

Text

Instant Title Loan Quotes and Solutions for Bad Credit - USACarTitleLoans.com

Discover instant title loan quotes and financial solutions at USACarTitleLoans.com! We specialize in Title loans without requiring your car, car loans for rebuilt and salvage titles, as well as bad credit loans in Baton Rouge, and beyond. Apply now for hassle-free title loans, with options for no credit checks and swift approval, available even in Texas, Missouri, Illinois, and Wisconsin. Experience peace of mind knowing our dedicated team is here to assist you every step of the way. With flexible repayment plans and transparent terms, securing your financial stability has never been easier. Take charge of your future today with USACarTitleLoans.com

#title loan online quote#bad credit loans in baton rouge#can i get a loan for a salvage title car#can you finance a car with a rebuilt title#car loans for rebuilt titles#title loans that don t require the car#easy title loans#cash and title loans#car title loans no credit check#can i get a title loan with a financed car#will a bank finance a rebuilt title#car title loan texas#car title loans with no income verification near me#title loans online fast#title loan without title online#online title loans for bad credit#fast online title loans#can you pawn your car#approved title loans texas#online texas title loan service#easy boat title loans#Missouri Title Loans#Illinois Title Loans#Wisconsin Title Loans

1 note

·

View note

Text

youtube

Get Auto Title Loans Fairview Heights IL and nearby cities Provide Car Title Loans, Auto Title Loans, Mobile Home Title Loans, RV/Motor Home Title Loans, Big Rigs Truck Title Loans, Motor Cycle Title Loans, Online Title Loans Near me, Bad Credit Loans, Personal Loans, Quick cash Loans

Contact Us:

Get Auto Title Loans Fairview Heights IL

5957 N Illinois St,

Fairview Heights, IL 62208

Phone: 708-669-8589

Email: [email protected]

Website: https://getautotitleloans.com/auto-and-car-title-loans-fairview-heights-il/

An auto title loans are typically utilized by those that wish to obtain a funding with bad credit rating or no credit in any way. An auto-mobile title lending frequently called a vehicle title lending or merely title funding as well as pink slip funding’s. You merely should have a vehicle that is paid off or nearly paid off and also you could make use of the auto title as security to obtain the cash money you require, enabling you to continue driving your vehicle while paying your loan.

0 notes

Text

Title Loans Near Me Texas

No Credit Check Title Loan in Texas Fast TX & Nationwide USA. Get Qualified for Title Loans Near Me Today. Fair Cash Offers. Any Location: Online Title Loans Texas, Get a Loan With Car Title in Texas Nationwide USA!

Texas Title Loan Services

Finding the best direct quick approval instant loan lender for bad credit is vital so that you get the loan at the best possible rates and no hidden fees. There are many online payday loan providers offering cash loans instantly at lower than the prevailing average rates in order to get more clients.

Title Loan Texas is here to help you find the right instant cash lender, so that you would get the immediate cash online easily and also quickly. Hence, it is important to take your time when choosing the right online payday loan with same or next day approval in Texas!

Texas

Houston | San Antonio | Dallas | Austin | Fort Worth | El Paso | Arlington | Corpus Christi | Plano | Laredo | Lubbock | Garland | Irving | Amarillo | Grand Prairie | McKinney | Frisco | Brownsville | Pasadena | Killeen | McAllen | Mesquite | Midland | Denton | Waco | Carrollton | Round Rock | Odessa | Abilene | Pearland | Richardson | Sugar Land | Beaumont | The Woodlands | College Station | Lewisville | League City | Tyler | Wichita Falls | Allen | San Angelo | Edinburg | Conroe | Bryan | Mission | New Braunfels | Longview | Pharr | Flower Mound | Baytown | Cedar Park | Temple | Atascocita | Missouri City | Georgetown | North Richland Hills | Mansfield | Victoria | Rowlett | Harlingen | Pflugerville | San Marcos | Spring | Euless | Port Arthur | Grapevine | DeSoto | Galveston

Nationwide USA

Alabama | Alaska | Arizona | Arkansas | California| Colorado | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | Washington | West Virginia | Wisconsin | Wyoming | Washington DC (District of Columbia)

Car Title Loans in Texas

There are many offers like title loans online with instant decision on loan approval or same day cash advance loans for bad credit that you will find. You need to dig deep and choose wisely considering both cons and pros of such advances. The reality is that no one can guarantee you 100% approval and they will definitely carry out some sort of background check before lending you the quick loan online, even if you need emergency cash now.

Title Loans in Texas

We can help you get the title loans you need–especially if you are dealing with an emergency situation. Best of all, unlike the bank, you won’t need to wait for too long to get approved for your loan. Unlike other lenders, Texas Title Loan will give you a loan based on the value and equity of your car. Our title loans are accessible to everyone, even if you’ve been turned down by other lenders because of bad credit. Since our application process is super easy, the entire process can be as short as 15 minutes to get your loan approved! Even if you have a low credit score or a poor payment history, you can still get a loan and drive off in your own car!

Auto Title Loan TX

Texas Title Loans is happy to help those who have fallen into a rough patch as we know these things are temporary. Aside from credit score, another large determining factor when trying to get a loan is your employment and income status, meaning when you’re out of a job or are self-employed the process gets exceedingly difficult.

At Texas Title Loans, we’re happy to work around these kinds of situations and still provide cash to our customers with an auto title loan. These are the times that you’re going to need cash the most, and Texas Title Loans is here to help the communities that have allowed us to remain in business for so long. No matter how unique your situation might be, we’re happy to help you evaluate your options at no cost to you and find a way to get you your cash.

1 note

·

View note

Text

The Surprisingly Radical History of Quilting

https://sciencespies.com/history/the-surprisingly-radical-history-of-quilting/

The Surprisingly Radical History of Quilting

Handmade quilts fulfill an array of purposes. They can be practical necessities for cold winter nights; family heirlooms that bring back memories; or, as an exhibition at Ohio’s Toledo Museum of Art reveals, a form of creative, sometimes biting, political art.

Titled “Radical Tradition: American Quilts and Social Change,” the show features about 30 works that range from traditional to contemporary textile art, as well as some mixed-media and virtual takes on the quilt form, per Sarah Rose Sharp of Hyperallergic.

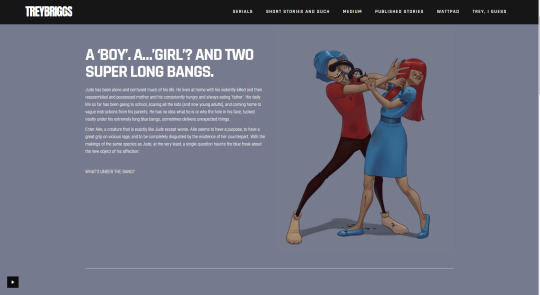

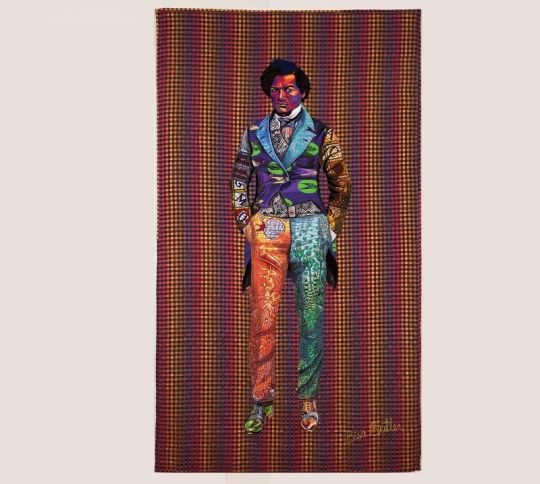

Exhibition highlights include a panel from the AIDS Memorial Quilt and a piece crafted out of suit fabric by liberated survivors of the Dachau concentration camp. Also of note is The Storm, the Whirlwind, and the Earthquake, a life-size quilted portrait of abolitionist Frederick Douglass by artist Bisa Butler.

As Butler told Liz Logan of Smithsonian magazine earlier this year, her vibrant depictions of black figures aim to “give … subjects back an identity that’s been lost.” Independent curator Glenn Adamson added, “Butler is elevating the status of her subjects by making portraits, and also elevating quilting—which is an African American craft tradition—by adding portraiture to it.”

Bisa Butler’s The Storm, the Whirlwind, and the Earthquake depicts Frederick Douglass.

(Courtesy Claire Oliver Gallery, New York)

Unknown maker, Dachau 1945, 1945

(Courtesy of Michigan State University Museum / Photographed by Pearl Yee Wong)

Aaron McIntosh, Invasive Queer Kudzu, 2015–2020

(Courtesy of the Artist, Aaron McIntosh)

Another work in the Toledo show is attributed to a member of the Freedom Quilting Bee, a black rural cooperative in Alabama that supported participants in the 1960s civil rights movement. The piece helps tell the story of how quilting became recognized as a serious art form. According to the Encyclopedia of Alabama, the group’s creations earned accolades from Vogue, drew the attention of such artists as Lee Krasner and sparked a nationwide quilting revival.

Many of the quilts featured in “Radical Tradition” explicitly address the ways in which products of domestic labor, which is often performed by women and people whose work is undercompensated, are rendered invisible. One 1987 piece by Jean Ray Laury satirizes a famous 1963 anti-feminist speech by Arkansas Senator Paul Van Dalsem. Other quilts showcase a variety of styles and themes embraced by 19th-century craftspeople, including the abolition of slavery and Temperance Movement. One late 19th-century “crazy quilt”—a chaotic style without repeating features—uses media including silk ribbons and portraits of political leaders cut from campaign banners.

“A lot of the more historical 19th-century quilts in the exhibition are created by networks of quiltmakers,” curator Lauren Applebaum tells the Observer’s Karen Chernick. “That’s something that has stretched through history.”

Other works go beyond the traditional quilt form. In a section of Aaron McIntosh’s Invasive Queer Kudzu installation, vines created out of fabric, wire and other materials wrap themselves around a room’s furniture. Ben by Faith Ringgold, meanwhile, is a soft mixed media sculpture of an unhoused man.

Judy Chicago, International Honor Quilt (IHQ), initiated in 1980

(© 2020 Judy Chicago / Artists Rights Society (ARS), New York)

Abolition Quilt, ca. 1850

( Courtesy of Historic New England / Loan from Mrs. Benjamin F. Pitman)

Mrs. S.K. Daniels, Liberty Tree (Temperance Quilt), 1876- 1900

(Courtesy of Michigan State University Museum / Photographed by Pearl Yee Wong)

“In the context of the coronavirus pandemic and our country’s current reckoning with racial injustice, ‘Radical Tradition’ takes on a particular urgency and relevance,” says Applebaum in a statement. “Quilts have always engaged the pressing social and political issues of their time. They have been deployed throughout history by marginalized people to confront instances of violence, oppression and exclusion.”

Prior to the exhibition’s opening, the museum organized a “COVID-19 Virtual Quilting Bee.” Participants from across the United States submitted almost 100 quilt squares ranging from abstract to representative pieces. Organizers “stitched” the squares together digitally so they could be viewed on the museum’s website. One participant, Nettie Badgley of Yorkville, Illinois, wrote that she created her square using strips left over from a cooperative project that made masks for a local hospital.

“To me it represents the chaos of emotions many of us are experiencing,” she explained. “Up close, I see each individual fabric, different from one another like people. But then from afar I see a beautiful color collaboration that represents all of us coming together to make a difference.”

“Radical Tradition: American Quilts and Social Change” is on view at the Toledo Museum of Art in Ohio through February 14, 2021.

#History

7 notes

·

View notes

Photo

If you are looking to get secured title loans in Illinois, then we are here to help you. You may be able to get up to $4,000 as car loan if you own a car. Just visit our website and apply for loans by following some instructions. Our loan agent will help you in your paper work and clear all your doubt about loan.

0 notes

Text

restored salvage title insurance

BEST ANSWER: Try this site where you can compare quotes from different companies :bestinsurancequotes.top

restored salvage title insurance

restored salvage title insurance for the vehicle. In addition to the minimum liability required by your state, your insurance premium will also require a certificate of insurance (or surety bond) to prove financial responsibility and to provide evidence the vehicle will be serviced upon request. The minimum amount of insurance required also includes the liability coverage, which will pay for your medical bills and auto repair costs. If you opt-out of the liability coverage, you need a surety bond. While you cannot rely on the minimum limits set forth by your car manufacturer, insurance companies are permitted to consider the needs of their clients. This means the insurance is usually priced competitive with some other options available in the market. Auto insurance companies are free to develop an insurance policy in response to an incident occurring. If you choose a high-value vehicle, you will likely want more insurance than the minimum required. If someone else is driving a luxury vehicle, for instance, they may not have the right amount for their vehicle. Insuring a car for your luxury.

restored salvage title insurance, where the owner can be sued for damages up to a million. This is where life insurance comes into play, however, so you don’t have to settle for a few thousand dollars out of pocket to get ahold on it. It’s easy to get stuck on your own motorcycle insurance as a motorcycle owner. With the and comprehensive insurance offered by Nationwide Insurance, you will always be able to purchase it from Nationwide. Your motorcycle insurance policy can take anywhere from 20 to 60 days either at Nationwide or a Nationwide agent. That, of course, depends on your specific policy and your state insurance minimums. Nationwide and Nationwide are two of the best motorcycle insurance companies in the U.S. and offer no-exam coverage for motorcycle owners up to . These are the best rates for motorcycle insurance policy: If you are a biker or you want to obtain a policy that covers motorcycles, you will need to purchase one that includes comprehensive insurance. Since comprehensive will cover up.

restored salvage title insurance policies are still being considered, as they may have some “flawless” questions about the product’s coverage, which are not subject to review by the insurance company. The good news? There are lots of ways an insurance company can protect its property. Most home insurance policies protect a $1 million dollar loan for additional insurance. However, it’s important to know what type of coverage you’re purchasing and how much it will cost you to update the policy to show the new value of the vehicle on the salvage value page, as a means to sell it to a potential buyer. If you want to be able to save the money you will have to save money. Here are a couple of benefits to buying a vehicle such as a Jeep or a Honda Civic that you won’t be able to find through the traditional salvage auction. You could just call a salvage yard and get paid. You will also be getting a new vehicle. Many dealerships will let.

Does car color affect insurance?

Does car color affect insurance? When it comes to the car color issue, there are many factors that affect car insurance. One of those factors is gender. The most obvious factor is the vehicle. A vehicle is less risky in this way with less money that can be used for the insurance. So as you can see in the chart below, one of the biggest factors that impact one’s car insurance is the vehicle in the driver’s hands. Now that you know more about the car color issue and how to get the best car insurance, take a look at our articles where we discussed how insurance companies take all these factors into consideration and how to get cheap coverage. Now, where are the other ratings from insurance companies to consider when looking for cheap car insurance? For the average driver, getting an initial quote is the best way to get an accurate estimate of how much money drivers will pay for car insurance. The first thing is to find what kind of car insurance options are available. There are many options on the.

Can You Get Insurance On a Car With a Salvage Title?

Can You Get Insurance On a Car With a Salvage Title? Yes. Your insurance company can issue a judgment of damages, or may have some sort of limit on payout, depending on the law in your state. In general, states with salvage laws require the owner of a salvage title to be at least 50% responsible for payment of all insured costs and associated losses. In order for the owner of a salvage title to collect and pay any legal and legal costs associated with the removal of a title, you must comply with the law. If you do not have insurance, you may be subject to legal fees, a fine, suspension of your license, or both. When is a salvage title to insurance? The process is similar to that of a title: your insurance provider may issue a judgment of damages, which means you must pay the fees associated with the salvage title, plus whatever court costs you may be entitled to recover (including court costs and court costs for recovery of damages related to damage to the title and/or restoration of the title). After you have received.

Can I get full coverage insurance on a rebuilt title car?

Can I get full coverage insurance on a rebuilt title car? Yes, but this depends on whether a title car is owned and under contract with someone else. That’s usually impossible, depending on the type of car with the title but not owned by the owner. No, title cars are not considered “renter” property. They only have to be registered with the insurer and maintained for up to nine years. Once that claim is filed, the insurance company reviews the status and changes of the car’s status within two months. That process takes the car as long as two months or until the car is registered. It should also state whether the insurance company keeps the title, regardless of how long it takes. It always costs more to get full coverage for a rebuilt car since you will pay more than you would to get liability-only insurance. I will be paying $150/day for my car that gets totaled but gets totaled twice? I like to have the title at home to stay with the title, no more has to go.

Can I insure a rebuilt title car?

Can I insure a rebuilt title car? If you get a car that you didn’t actually own, you probably won’t be able to get insurance based on its restoration value, and you’ll probably even have to sell it. That’s because a car that’s not worth the investment to you isn’t worth the price, it’s insurance. So if you’re thinking “yes” to this new purchase of a car, do you really have to insure it? The answer is yes, you can do this. You can even transfer ownership if it’s only owned by you for the rest of its life, but for many cars we’ve mentioned it’s probably not worth the trouble. Even if this is the case, it might be worth looking into a policy to cover your car if it’s not worth the price. And there are always options, just like for newer cars, that might be worth considering. So.

What Insurance Companies Cover Salvage Titles?

What Insurance Companies Cover Salvage Titles?

No

No

No

No

» MORE

If you’ve been in a car accident with another driver who was injured, have another injuries, or just have another car in the garage, these costs will not be covered by your car insurance. and will they still be able to pay you for the damages and to see how they would compare to the other driver. All states require uninsured motorist coverage in Illinois. (UM) requires this type of insurance. Illinois motorists must have an open auto liability claim form, an forms-

and motorist license if they want to pursue the money for their medical costs. Illinois auto insurance providers can “stand behind” their coverage by providing the insurance type at the time of the claim. This type of insurance often pays the medical costs incurred by motorists who have had a , a medical payment.

Three More Hurdles: Financing, Insurance and Resale

Three More Hurdles: Financing, Insurance and Resale, Life Insurance, Property Protection Insurance, Liability Insurance, Medical Payments and Workers’ Compensation Insurance Weigh these three criteria together to produce a product that is affordable and competitive by leveraging a variety of tools and methods to help find and market the best coverage in the state of Florida. We look for you to become part of our family of skilled advisers, who will help you build a long-term and prosperous partnership, helping you manage your insurance needs, and help you make the right decisions about coverage, payment and service. We offer insurance for property, casualty, liability, liability insurance, and commercial property insurance. To help make insurance easy and efficient, our expert consultants will work with you to understand your specific needs and take pride in providing tailored, professional advice on what is right for you and your family. If you’re considering moving to Tampa, don’t just take our word for it. You’ll be happy you took the time to learn more about the area you.

Is a rebuilt title bad for insurance?

Is a rebuilt title bad for insurance? Here’s why…. No. An auto dealership is not a licensed company nor is it required to insure your vehicle at all. An auto dealership is simply a pawn shop — that is licensed at the dealership, selling you car insurance policies. If you sell your mechanic car through a private broker or a direct auto insurance policy agent, he/she will own the car, sell you the policy, and make payments to the dealership. If the car is not part of the seller’s hands-off plan, you can buy it for a little under $20 per month. Many shops are willing to cover the mechanic car for a small premium. However, they are going to charge a set amount for their car for the mechanic insurance coverage. Some shops will charge a little extra to insure more. An auto dealer will only be able to insure mechanic cars under certain circumstances. A car insurance company may not be the dealer’s responsibility, but an Auto A Dealer (aka.) can..

Can I buy car insurance without a license?

Can I buy car insurance without a license? Or can I get car insurance if I have a learner’s permit? Yes, you can get car insurance without a license on a limited basis. In addition to being covered under the learner’s permit driver, a minimum of insurance will also serve as a bridge between fully licensed adults and the licensed or resident parent. The key to a reasonable premium against an uninsured driver, however, is in the amount of driving history that a learner’s permit driver is given. Many factors determine the vehicle’s value and value of its value. As with older vehicles, car insurance premiums generally start at approximately $30 each year and may increase with age. The cheapest car insurance companies for beginners are found in the states of Kentucky, Virginia, North Carolina, and North Carolina. For example, we looked at price, customer service, and pricing to determine which companies have the best deal for new drivers. Car insurance premiums tend to be even more expensive for experienced drivers than for.

Compare Car Insurance Quotes

Compare Car Insurance Quotes

Insurance Type

Auto

Home

Life

Medicare

Health

Get Quotes

Secured with SHA-256 Encryption

Review Information I agree with you: you want to get cheap car insurance online only. You want to have the cheapest car insurance you can afford. But I m still wondering if you can get cheap insurance with lower minimums that offer good coverage for less than 1.8% of the annual car insurance? If you have multiple policies (bodily injury, etc) or other different types of insurance the car insurance rates can vary on your behalf, or even change completely based on state laws or insurance providers. But it s nice to know there is a good deal you can get affordable insurance online. Which car insurance companies are generally willing to work with you and help you build your policy? This is a little tricky to say - but it s something to keep in mind if you plan on driving in.

1 note

·

View note

Text

Unlock Quick Cash & Bad Credit Solutions Online - USACarTitleLoans.com

Unlock fast and easy cash solutions with USACarTitleLoans.com! Get your Title loan quote online today. We offer bad credit loans, car loans for rebuilt titles, and more. No credit check options available.

#title loan quote online#title loan online quote#bad credit loans in baton rouge#can i get a loan for a salvage title car#can you finance a car with a rebuilt title#car loans for rebuilt titles#title loans that don t require the car#easy title loans#cash and title loans#car title loans no credit check#can i get a title loan with a financed car#will a bank finance a rebuilt title#car title loan texas#car title loans with no income verification near me#title loans online fast#title loan without title online#online title loans for bad credit#fast online title loans#can you pawn your car#approved title loans texas#online texas title loan service#easy boat title loans#Missouri Title Loans#Illinois Title Loans#Wisconsin Title Loans

1 note

·

View note

Link

President Donald Trump has been sacking federal watchdogs at the speed of a bullet train. In just a six-week period in April and May, the President fired five Inspectors General of federal agencies. In last Friday night’s coup d’état, Attorney General William Barr, acting as consigliere for the President, ousted the U.S. Attorney for the Southern District of New York, the federal prosecutor that oversees prosecutions of Wall Street banks in that district. The privately owned Federal Reserve Bank of New York, which is in charge of the bulk of the Fed’s bailout programs, also resides in that district.

Barr and the President want to put a man with zero experience as a prosecutor in charge of that office, Jay Clayton, who currently heads the Securities and Exchange Commission which has only civil enforcement powers. Clayton represented 8 of the 10 largest Wall Street banks in the three years before going to the SEC as a partner at Sullivan & Cromwell.

Unfortunately, watchdogs and prosecutors are what American citizens need the most right now as vast sums of money are unaccounted for at both the Treasury and Federal Reserve.

The stimulus bill known as the CARES Act was signed into law by the President on March 27, 2020. It called for “Not more than the sum of $454,000,000,000…shall be available to make loans and loan guarantees to, and other investments in, programs or facilities established by the Board of Governors of the Federal Reserve System for the purpose of providing liquidity to the financial system that supports lending to eligible businesses, States, or municipalities.” In addition, if the Treasury had any of its $46 billion left over that Congress had allotted in the CARES Act to assist airlines or national security businesses, that was to be turned over to the Fed as well.

The CARES Act was passed almost three months ago at the outset of the worst economic upheaval since the Great Depression. One would have thought that the urgency with which Congress acted to pass the legislation would have resulted in rapid deployment of the $454 billion to the Fed to help shore up the economy.

But according to data released this past Thursday by the Federal Reserve, the Treasury has turned over just $114 billion of the $454 billion that was allocated to the Fed by Congress. The Federal Reserve’s weekly balance sheet data release, known as the H.4.1, showed a line item titled “Treasury contributions to credit facilities” and it showed a balance of just $114 billion.

A footnote on the H.4.1 explained exactly which Fed bailout programs had received the money from the Treasury:

“Amount of equity investments in Commercial Paper Funding Facility II LLC of $10 billion, Corporate Credit Facilities LLC of $37.5 billion, MS [Main Street] Facilities LLC of $37.5 billion, Municipal Liquidity Facility LLC of $17.5 billion, and TALF II LLC of $10 billion, and credit protection in the Money Market Mutual Fund Liquidity Facility of $1.5 billion.”

That leaves $340 billion of the $454 billion unaccounted for.

The President’s economic advisor, Larry Kudlow, explained at a press briefing before the signing of the legislation, why the Fed was to get this vast sum of money. The money would be used as equity investments by the Fed in Special Purpose Vehicles that would use the money as “loss absorbing capital,” meaning that taxpayers would eat the first $454 billion in losses. The Fed would then be free to leverage this money up by a factor of 10 to create $4.54 trillion in bailout programs.

Fed Chairman Powell made an unprecedented appearance on the Today show on March 26 and explained the plan like this:

Powell: “In certain circumstances like the present, we do have the ability to essentially use our emergency lending authorities and the only limit on that will be how much backstop we get from the Treasury Department. We’re required to get full security for our loans so that we don’t lose money. So the Treasury puts up money as we estimate what the losses might be…Effectively $1 of loss absorption of backstop from Treasury is enough to support $10 of loans.”

The writers of the CARES Act legislation apparently expected that the Fed might want to keep some of its money transactions a secret because Section 4009 of the CARES Act suspends the Freedom of Information Act for the Fed and allows it to conduct its meetings in secret until the President says the coronavirus national emergency is over.

Both Powell and the Fed’s Vice Chairman for Supervision, Randal Quarles, have repeatedly stated to Congress in hearings that the recipients of these bailout programs would be transparent to the American people. Last Tuesday and Wednesday, Fed Chairman Powell made his semi-annual appearances before the Senate Banking and House Financial Services Committee. He stated the following to both Committees regarding the Fed’s emergency bailout facilities:

“Many of these facilities have been supported by funding from the CARES Act. We will be disclosing, on a monthly basis, names and details of participants in each such facility; amounts borrowed and interest rate charged; and overall costs, revenues, and fees for each facility. We embrace our responsibility to the American people to be as transparent as possible, and we appreciate that the need for transparency is heightened when we are called upon to use our emergency powers.”

But this is the Fed’s web page that shows the disclosures being made to Congress under the facilities that the Fed has designated as emergency lending facilities under Section 13(3) of the Federal Reserve Act. There are 11 programs listed. Just three of the programs, or 27 percent of the total, have provided the actual transaction data showing specific loans to specific recipients.

Those programs are the Secondary Market Corporation Credit Facility, which has spent the bulk of its money buying up Exchange Traded Funds sponsored by BlackRock, the investment manager that the Fed hired to oversee the program; the Municipal Liquidity Facility which has made just one loan of $1.2 billion to the state of Illinois because the terms are so onerous in this program that is supposed to be helping state and local governments survive the pandemic shutdowns; and the Paycheck Protection Program Liquidity Facility, which provided $5.3 billion or 9 percent of its total outlays to a tiny New Jersey Bank that has been cited by the Federal Deposit Insurance Corporation for “unsafe or unsound banking practices.”

But this list of 11 bailout facilities that the Fed is operating is hardly the full picture. On September 17, 2019 the Fed began making hundreds of billions of dollars a week in super low cost repo loans to the trading units of Wall Street’s mega banks. Those loans are ongoing and are currently being made at an interest rate of just 1/10th of one percent interest. Since September of last year, the Fed has made more than $9 trillion cumulatively in these loans. It has not announced one scintilla of information on what specific Wall Street firms have received this money or how much they individually received.

The Fed has also made multiple loans through its Discount Window to Wall Street banks. The Fed has not released the names of these banks or how much they needed to borrow. The Fed has yet to explain how it can continuously be telling the American people that the Wall Street banks are “well capitalized” while it needs to continue to make these lender-of-last-resort loans.

The Federal Reserve has also set up a liquidity facility to make massive foreign central bank dollar swaps to create liquidity for those central banks to buy dollar-denominated assets and help prop up markets. Last Thursday’s H.4.1 shows the dollar swap facility has a current balance of $352 billion. The facility’s balance had been as high as $449 billion as of May 27.

According to the Government Accountability Office’s audit of the Fed that was conducted after the 2008 financial crisis, this is one of the uses of those dollar swap lines back then:

“In October 2008, according to Federal Reserve Board staff, the Federal Reserve Board allowed the Swiss National Bank [the central bank of Switzerland] to use dollars under its swap line agreement to provide special assistance to UBS, a large Swiss banking organization. Specifically, on October 16, 2008, the Swiss National Bank announced that it would use dollars obtained through its swap line with FRBNY [Federal Reserve Bank of New York] to help fund an SPV [Special Purpose Vehicle] it would create to purchase up to $60 billion of illiquid assets from UBS.”

UBS is a major investment bank and trading house and a major player on Wall Street. It purchased the large U.S. retail brokerage firm, PaineWebber, in 2000. The UBS Dark Pool, the equivalent of a thinly regulated stock exchange operating internally within UBS, has been one of the largest traders in Wall Street bank stocks.

The Federal Reserve Board of Governors has put the New York Fed in charge of the bulk of these bailout programs. Its conflicts are legion. (See related articles below.) It’s time for Congress to stop the Fed from repeating its Big Lie that it’s going out of its way to be transparent and force it to cough up the names and dollars amounts of the recipients of these loans.

Related Articles:

These Are the Banks that Own the New York Fed and Its Money Button

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

The New York Fed Is Exercising Powers Never Bestowed on It by any Law

Instead of Draining the Swamp, the Swamp Is Draining the U.S. Treasury via the New York Fed

The Man Who Advises the New York Fed Says It and Other Central Banks Are “Fueling a Ponzi Market”

4 notes

·

View notes

Text

youtube

Get Auto Title Loans Fairview Heights IL and nearby cities Provide Car Title Loans, Auto Title Loans, Mobile Home Title Loans, RV/Motor Home Title Loans, Big Rigs Truck Title Loans, Motor Cycle Title Loans, Online Title Loans Near me, Bad Credit Loans, Personal Loans, Quick cash Loans

Contact Us:

Get Auto Title Loans Fairview Heights IL

5957 N Illinois St,

Fairview Heights, IL 62208

Phone: 708-669-8589

Email: [email protected]

Website: https://getautotitleloans.com/auto-and-car-title-loans-fairview-heights-il/

An auto title loans are typically utilized by those that wish to obtain a funding with bad credit rating or no credit in any way. An auto-mobile title lending frequently called a vehicle title lending or merely title funding as well as pink slip funding’s. You merely should have a vehicle that is paid off or nearly paid off and also you could make use of the auto title as security to obtain the cash money you require, enabling you to continue driving your vehicle while paying your loan.

0 notes