#Inheritance Tax

Explore tagged Tumblr posts

Text

#unsuccessful#successful people#ausgov#politas#australia#the inheritance games#class war#the inheritance cycle#the inheritance trilogy#inheritantroyalty#inheritance tax#inheritsnothing#inheritanceplanning#auspol#tasgov#taspol#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#extortion#exploitation#exploitative#society#humanity#humans#money#late stage capitalism

21 notes

·

View notes

Text

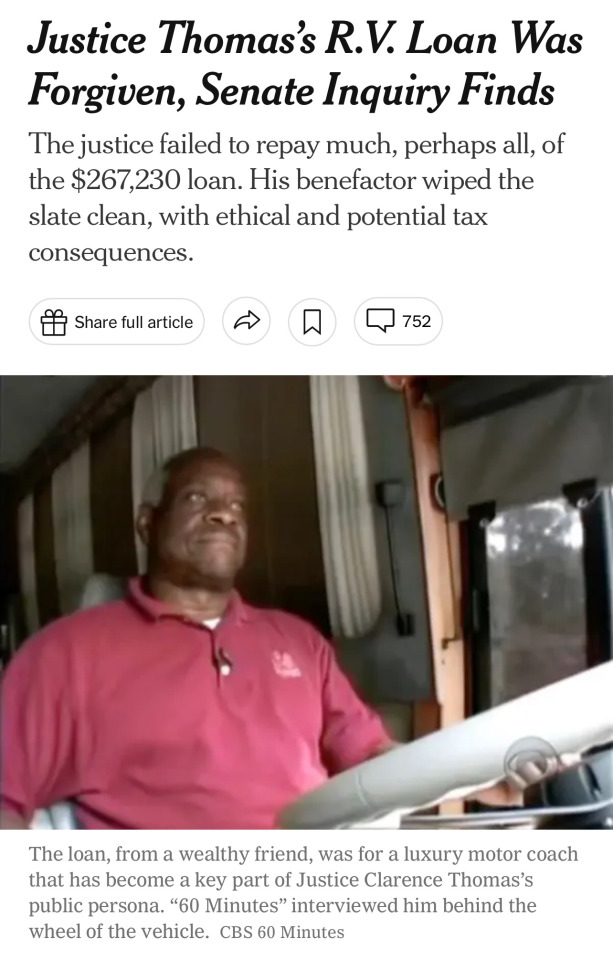

🗣The United States Supreme Court is a corrupt, depraved, illegitimate institution

This coming term, the Supreme Court will hear United States v. Moore, a case that could determine the constitutionality of a hypothetical wealth tax. Given his years of palling around with billionaire benefactors, one thing seems quite clear: Justice Clarence Thomas needs to recuse himself from the case. Commentators who downplay Thomas’ acceptance of massive gifts ask: Maybe it looks bad, but why does it matter? Moore tells us loud and clear.

Moore involves a provision of the 2018 Trump tax bill enacting a “mandatory repatriation tax” for any U.S. taxpayer who owns shares in a foreign corporation, even if the taxpayer never cashed out the money, but automatically reinvested it. Behind this seemingly abstruse issue is a crucial constitutional question: Does the 16th Amendment, which enables the federal government to tax “income,” allow the government to put levies on taxpayers’ assets if they didn’t actually get the money in cash?

In other words, can the federal government place a tax on wealth? This has real implications for both the budget and inequality. Indeed, most ultra-high-wealth individuals possess their assets: They make investments, and hold them. When they die, their heirs’ tax is figured not on the amount of profit earned off of the original cost, but the amount of profit earned off of its value at the time of the original purchaser’s death.

Thus, hundreds of billions of dollars go untaxed—which is just the way multibillionaires like it.

(continue reading) → (more)

#politics#scotus#clarence thomas#harlan crow#wealth tax#taxes#inequality#tax avoidance#united states v. moore#tax dodgers#inheritance tax#legalized bribery#bribery

62 notes

·

View notes

Text

“The Nation that destroys its soil destroys itself” – Franklin D Rooevelt

Last week I heard an inheritance tax bemoaning farmer claiming he was a “custodian" of the countryside as if that claim alone should exempt him from tax. But he is not the only one making this claim:

Sue Pritchard, Chief Executive of the Food, Farming and Countryside Commission said she sees:

“... farmers both as custodians of the countryside as well as food producers, putting nature-based farming at the heart of our future agricultural policy..." (ffcc.co.uk: ‘Farmers are custodians of the countryside' 30/11/20)

The Farmers Union also claims British farmers are “custodians of the iconic British landscape." (NFU General Election Manifesto 2024) and accused the Labour government of “betrayal" with regard to the changes in inheritance tax.

The dictionary definition of “custodian" is:

"A person who has responsibility for protecting or taking care of something or keeping something in good condition".

Lets examine how well British farmers have protected and taken care of Britain’s iconic landscape and the wildlife that lives within it.

Since the 1970’s 41% of all UK wildlife species have declined – mammals, amphibians, birds, reptiles, and insects. One of the main reasons for this is the intensification of agricultural methods.

“More than 50 conservation groups say the "policy-driven" intensification of farming is a significant driver of nature loss in the UK. The State of Nature report assessed 8,000 UK species and found that one in 10 are threatened with extinction." (BBC News: 14/09/2016)

Needless to say farm leaders disputed the findings. Yet a team of ornithologists, zoologists, biologists and ecologists reported that the chief cause of declining bird populations in the UK was due to the use of pesticides and herbicides by farmers. Runoff from farms, including fertilizers and animal waste pollute waterways and soil, affecting the health of ecosystems and the wildlife that depend upon them. Grubbing up hedgerows and cutting down woodland has led y to a loss of habitat for many of our native mammals and other species.

Not content with killing off Britain’s wildlife, many farmers are also threatening the health of British consumers, in particular the long-term wellbeing of our children.

The use of pesticides which contain “forever chemicals” are a direst threat to public health. PFA chemicals, which take centuries to break down in the environment, were found in 3300 samples tested by the UK government in 2022.

Farmers do not have to use these chemicals. They choose to do so because it increases output and therefore their profits.

“Common UK fruits, vegetables and spices have been found to be contaminated with long-lasting toxins known as "forever chemicals", prompting alarm over potential impacts on public health ...” (itvX: 09/04/24)

“Profit before people” would seem to be the farmers' motto!

Rather than being “custodians” of the iconic British landscape farmers have traditionally been one of its worst enemies, bent on its destruction if it affords them a few more pennies in the bank.

In 1950, a Forestry Commission assessment concluded that we had 1 million km of hedgerow. By 2007, this reduced to 477,000km, a loss of approximately 52%. This loss of habitat for wildlife was the direct result of farmers deliberately removing hedgerows because by so doing they made more money.

Kemi Badenoch, objecting to rich farmers now having to pay inheritance tax (albeit only 50% of what everyone else has to pay) said:

“This policy is cruel, it is unfair and it is going to destroy farming as we know it”

I would suggest that “farming as we know it” isn’t fit for purpose.

“A study found that that UK is one of the world's most nature-depleted countries, with on average about half its biodiversity left - far below the global average of 75%. It means the UK is in the bottom 10% globally for biodiversity.” (CBBC: 11/10/21)

This isn’t custodianship, this is environmental vandalism on an industrial scale. The destruction of habitat, the use of pesticides and herbicides, the culling of foxes, rabbits and badgers, the eradication of meadows. wetlands and grassland, have all contributed to the catastrophic loss of biodiversity In Britain, and all in the pursuit of farmers making greater profits.

5 notes

·

View notes

Text

Something I admire about calypsonians is their willingness to write songs about current political issues, and I wish we heard more of that in other genres.

Well, here's a folk song about inheritance tax by Murray Shelmerdine. I heard him sing this live in Guildford. I'd like to cover it sometime: the rhyming is impressive.

youtube

3 notes

·

View notes

Text

Hiso/Illu committing tax fraud and being very serious about their marriage.

I believe that in hxh world putting a bounty on your own head and assigning a hunter to get the reward in case of your death is a tax dodging scheme. So when hisoka married illumi and did exactly that it's a way to avoid inheritance tax in case of his death. I bet illumi did the same but I guess some of his head bounty will go to his family.

It seems like on top on travel and education benefits hunters' bounties and jobs are practically untaxed and I don't think it is this way for inheritance.

#hisoillu#hxh#hisoilu headcannon#hisoka#illumi#hisoka headcanons#illumi zoldyck#illumi headcanons#hisoka morow#hisoillu husbands#taxes#inheritance tax#hisoillu committing tax fraud

24 notes

·

View notes

Text

The UK is about to become more spicy

Anyone who has been UK resident for at least 10 years will be within the scope of inheritance tax on their worldwide assets

Basically our inheritance tax is going up in percentage and scope big time so the rich are legging it abroad to avoid it

I'm not saying it's right or anything or that it shouldn't go up, but the economy is in large part propped up by shady shenanigans (read up on city of London (yes city not London they're different lol) financial laws)

Something insane like 80 to 90 percent of the gdp is from service sector esp. financial sector services

All I'm saying is I'm physically seeing people pack their bags and go. Big old homes in big expensive areas. I think the shady people are looking for new shades to hide under and fleeing the sunlight of inheritance tax.

And when your whole economy is based on shady worms you will be revealed to be a half eaten apple core when they all leave.

Fun times.

3 notes

·

View notes

Text

I’m kinda rich and ready to help the poor i gained this charity act from my fa👨

#inheritance cycle#inheritance tax#the inheritance games#the inheritance trilogy#inheritance#tran#pro transid#trans cult#trans community#trans artist#trans man#queer#transsexual#transparent#transformation#trans rights

5 notes

·

View notes

Text

Britain’s great tax con

“Labour will soon face an inescapable choice. In order to spend money in government, the party will need to raise it. There is a very good way to do that. It is to shift the tax burden away from labour and on to capital, away from work and on to wealth ...

“Starmer and Reeves are following an electoral script written for a different era. Britain has been transformed since Labour won in 1997. One part of the country has lived through an asset boom. The other is living on wages that have not risen in real terms for 15 years, since before the 2008 financial crash. For those with assets, the crash is a distant memory. London house prices have risen inexorably since 2010, by 31 per cent after inflation. The FTSE 100 is 58 per cent higher after dividends. Real average weekly pay is, meanwhile, no higher today than in July 2006. Those who live in Asset Britain have no idea what Austerity Britain is like.

“Labour is ignoring wealth at its peril. Reeves is rejecting the most consequential tax reforms open to her, despite polling that suggests each reform she has ruled out would be highly popular. They are also vital. Britain’s growth rate is in a multi-decade decline, while wealth inequality has become entrenched. It hasn’t fallen in the 17 years the Office for National Statistics has recorded it. Every year you can expect £4 in every £10 of new wealth to go to the wealthiest 10 per cent, while £1 in £10 is shared by the bottom half. In stagnant societies, capital reigns ...

“There is one more major reform Labour is refusing to adopt: a tax on the very richest ... The only way to raise money from the very richest is to charge a wealth tax, as Labour once won an election promising to do. A tax of 1 per cent on wealth over £10m would fall on around 20,000 people – the 0.1 per cent. In the 1970s Healey thought the revenues on offer didn’t justify the cost. Advani’s research has, however, shown that a one-off version of the tax could today raise £11bn. He estimates capital flight would be rare, as it was for non-doms. And evasion is less possible than people think. The wealth of the very richest is boundless yet bound in by Britain. Land may be leased out but it cannot be moved. Estates can always be taxed. It is a political choice.

“Labour has never fought against capitalism. It once sought to alleviate its inequities through control of the commanding heights of industry. Now it risks governing without a creed. Yet one is on offer. In Britain the rules of the tax game have been stacked against working people. The question for Labour is simple and deafening: are you going to fix that or not?”

#tax reform#wealth tax#inheritance tax#capital gains tax#taxes#assets#income#keir starmer#rachel reeves#labour party#labour#conservative party#conservatives#inequality#asset taxes#capitalism#economy#politics#uk

2 notes

·

View notes

Text

I think if I knew that my own death was going to happen in the near future, being old or some terminal diagnosis or something, I would probably transfer all my money and assets to my next of kin and then continue to spend it as needed as if they were now supporting me in end of life care.

That way when I die they have nothing to inherit, all of it already belonged to them.

4 notes

·

View notes

Text

Abolish inheritance

#the inheritance cycle#the inheritance games#inheritance tax#the inheritance trilogy#inheritance series#inheritance#financial#capitalism#venture capital#washington capitals#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#working class#class war#classwar#poverty#fuck money#money

111 notes

·

View notes

Text

Farmers Protest Inheritance Tax Changes in York with 300 Participants, Including Children on Toy Tractors

Farmers Rally in York Against Government’s Proposed Inheritance Tax Changes On 15 February 2025, up to 300 farmers, along with children on toy tractors, marched through York to protest against the government’s controversial inheritance tax (IHT) proposals. These changes, introduced by Chancellor Rachel Reeves, could devastate family-run farms across the UK, potentially imposing a 20% IHT on…

1 note

·

View note

Text

“Taxes are not good thing, but if you want service, somebody’s got to pay for them so they are a necessarily evil” – Michael Bloomberg

You just have to laugh at Jeremy Clarkson. Apparently he is comparing himself to the striking miners of 1984.

"... the farmers are the new miners, pawns in a political game they don’t understand, and they are being absolutely battered.” (GB News: 02/06/25)

As I remember rightly, the miners were fighting against pit closer and job losses, not about a desire to escape paying inheritance tax. I don’t know of any miners who had enough wealth to pay inheritance tax.

It was Margaret Thatcher who decided to use the miner’s strike as a means to curb union power in the UK. In that sense, Clarkson is right; the miners were political pawns in a wider political game.

What Clarkson is neglecting to tell us in comparing himself to a miner is that the architect of the miner's downfall, Margaret Thatcher, is someone Clarkson has expressed his admiration for several times over the decades. In fact Clarkson was one of the 2000 special guests invited to her funeral in 2013.

Clarkson is on record as supporting Thatcher's economic policies, particularly her stance on privatisation and curbing union power. Despite being a proud Yorkshireman, Clarkson had no sympathy for striking Yorkshire miner’s and certainly no sympathy for unions in general; quite the opposite in fact. In 2011 he openly expressed his view that "striking public sector workers should be shot in front of their families.”

The sad fact is, Clarkson is one of those individuals who earn their living by being deliberately controversial. From advocating public sector workers being shot through to suggesting Meghan Markle) should be "paraded naked through the streets" while crowds "throw lumps of excrement at her", Clarkson will say almost anything to gain a headline.

He has made so many controversial remarks, like the one's above, (for which he has later been forced to apologised) that this is obviously his preferred modus operandi. He has been widely criticised for sexist, racist, and insensitive comments. He was fired from Top Gear after punching a producer over an altercation about food.

His latest exaggerated rants defending farmers are nothing more than him being his own self-publicist, and keeping himself in the public eye while he tries to maintain an income stream from his pub, farm, and TV show.

It is hard to believe anything Clarkson says when it comes to his defence of farmers not paying inheritance tax on farms worth more than £1 million. His public defence of farmers is blatant self interest for not only is he a farmer himself, but he told the Times newspaper in 2024:

“Land is a better investment than any bank can offer. The Government doesn’t get any of my money when I die. And the price of the food that I grow can only go up.” (Reported in the London Economic;19/11/24)

This is surely Clarkson at his hypocritical best.

1 note

·

View note

Text

The English Palaces Lost to History Due to Death Duties

A few hundred years ago, England was famous for its grand palaces owned by the nobility and the newly rich. However, over time, these estates became tedious to maintain due to high costs. In the early 20th century, labor laws and the aftermath of World War II led to the introduction of an inheritance tax, which ultimately contributed to the decline of these grand homes. English palaces lost to…

0 notes

Text

A Comprehensive Guide to Inheritance Tax Planning Services

Inheritance tax (IHT) can be a significant financial burden for families, often reducing the wealth passed on to future generations. However, with proper planning, it’s possible to minimize or even eliminate this tax liability, ensuring your assets are preserved for your loved ones. Inheritance tax planning services offer expert guidance to help you navigate this complex area. Here’s everything you need to know about these services and their benefits.

What is Inheritance Tax?

Inheritance tax is a levy on the estate (property, money, and possessions) of a deceased person.

Threshold: In the UK, the IHT threshold (or nil-rate band) is £325,000.

Tax Rate: Any amount above this threshold is typically taxed at 40%.

Exceptions: If you leave your home to direct descendants, the threshold can increase under the residence nil-rate band (RNRB).

Why is Inheritance Tax Planning Important?

Preserves Wealth Effective planning helps ensure that more of your hard-earned wealth stays within your family.

Reduces Tax Liability By using allowances, exemptions, and reliefs, you can significantly reduce the tax owed.

Provides Peace of Mind You can rest assured knowing your loved ones will not face unnecessary financial strain.

Supports Charitable Giving Inheritance tax planning allows you to make tax-efficient donations to charities.

How Inheritance Tax Planning Services Can Help

Expert Assessment of Your Estate Professionals will evaluate your assets and liabilities to determine potential IHT exposure.

Customized Strategies Tailored solutions are created to align with your goals, whether it’s protecting family wealth, supporting charities, or maintaining business continuity.

Utilization of Tax Reliefs Advisors ensure you make the most of reliefs like Business Relief, Agricultural Relief, and the RNRB.

Gifting and Trusts Guidance on making tax-free gifts and setting up trusts to reduce your estate’s taxable value.

Integration with Estate Planning Comprehensive IHT planning works in tandem with wills and other legal arrangements for a holistic approach.

Regular Reviews Your circumstances and tax laws may change over time. Professional services offer periodic reviews to keep your plan up-to-date.

Key Inheritance Tax Planning Strategies

Make Use of Gifting Exemptions

Annual Gift Allowance: You can give up to £3,000 each tax year without it being taxed.

Small Gifts: Gifts of up to £250 per person are exempt.

Wedding Gifts: Contributions to weddings are also tax-free within limits.

Establish Trusts Placing assets into trusts can remove them from your estate, reducing IHT liability.

Charitable Donations Leaving 10% of your estate to charity can reduce the overall IHT rate from 40% to 36%.

Life Insurance Policies can be used to cover IHT liabilities, ensuring your beneficiaries are not burdened.

Business and Agricultural Reliefs Qualifying businesses and farms may be exempt from inheritance tax or taxed at reduced rates.

Choosing the Right Inheritance Tax Planning Service

When selecting a service provider, consider the following:

Experience and Expertise: Look for advisors with proven experience in estate and tax planning.

Reputation: Check client reviews and testimonials for reliability and effectiveness.

Transparent Fees: Opt for services that clearly outline their costs without hidden charges.

Comprehensive Advice: Ensure the service integrates IHT planning with broader financial and estate planning.

Benefits of Acting Early

Inheritance tax planning isn’t just for the elderly or those with significant wealth. Starting early provides:

Greater flexibility in transferring assets.

More time to explore advanced strategies like trusts and investments.

Peace of mind knowing your estate is protected.

Conclusion

Inheritance tax planning services offer invaluable support in navigating the complexities of UK tax laws. By taking proactive steps with expert guidance, you can minimize tax liabilities, preserve your wealth, and ensure your legacy is passed on as intended.

1 note

·

View note

Text

Closure of London Iconic Smithfield Market after 800 years

London’s iconic Smithfield Market is set to close after almost 800 years. Yet another hammer blow on our independent food supply and trading networks. Just 1 week beyond British Farmers marching in London to protest about the Labour Government’s move to destabilise British Family Farms through Inheritance Tax. This break in the independent food supply chain into the heart of London will be wide…

0 notes