#Michael Benveniste

Text

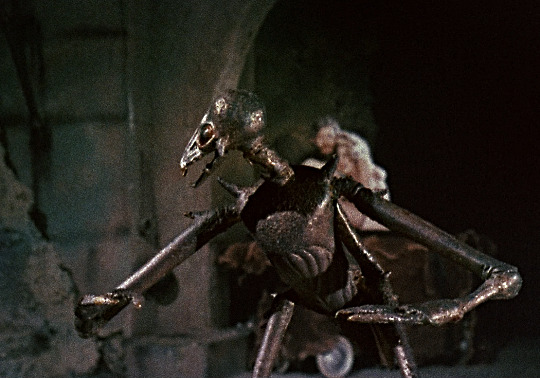

Flesh Gordon (1974)

#flesh gordon gif#sci fi comedy#stop motion animation#jim danforth#dave allen#penisaurus#70s comedy#70s movies#michael benveniste#seventies#1974#gif#chronoscaph gif

270 notes

·

View notes

Photo

Flesh Gordon (1974) // dir. Michael Benveniste, Howard Ziehm

115 notes

·

View notes

Text

Blackcrowing's Master Reading List

I have created a dropbox with pdfs I have gathered over the years, I have done my best to only allow access to documents which I found openly available through sites like JSTOR, Archive.org, or other educational resources with papers available for download.

That being said I ALSO recommend (I obviously have not read all of these but they are either in my library or I intend to add them)

📚 Celtic/Irish Pagan Books

The Morrighan: Meeting the Great Queens, Morgan Daimler

Raven Goddess: Going Deeper with the Morríghan, Morgan Daimler

Irish Paganism: Reconstructing Irish Polytheism, Morgan Daimler

Ogam: Weaving Word Wisdom, Erynn Rowan Laurie

Celtic Cosmology and the Otherworld: Myths, Orgins, Sovereignty and Liminality, Sharon Paice MacLeod

Celtic Myth and Religion, Sharon Paice MacLeod

A Guide to Ogam Divination, Marissa Hegarty (I'm leaving this on my list because I want to support independent authors. However, if you have already read Weaving Word Wisdom this book is unlikely to further enhance your understanding of ogam in a divination capacity)

The Book of the Great Queen, Morpheus Ravenna

Litany of The Morrígna, Morpheus Ravenna

Celtic Visions, Caitlín Matthews

Harp, Club & Calderon, Edited by Lora O'Brien and Morpheus Ravenna

Celtic Cosmology: Perspectives from Ireland and Scotland, Edited by Jacqueline Borsje and others

Polytheistic Monasticism: Voices from Pagan Cloisters, Edited by Janet Munin

📚 Celtic/Irish Academic Books

Early Medieval Ireland 400-1200, Dáibhí Ó Cróinín

The Sacred Isle, Dáithi Ó hÓgáin

The Ancient Celts, Berry Cunliffe

The Celtic World, Berry Cunliffe

Irish Kingship and Seccession, Bart Jaski

Early Irish Farming, Fergus Kelly

Studies in Irish Mythology, Grigory Bondarnko

Prehistoric Archaeology of Ireland, John Waddell

Archeology and Celtic Myth, John Waddell

Understanding the Celtic Religion: Revisiting the Past, Edited by Katja Ritari and Alexandria Bergholm

A Guide to Ogam, Damian McManus

Cesar's Druids: an Ancient Priesthood, Miranda Aldhouse Green

Animals in Celtic Life and Myth, Miranda Aldhouse Green

The Gods of the Celts, Miranda Green

The Celtic World, Edited by Miranda J Green

Myth and History in Celtic and Scandinavian Tradition, Edited by Emily Lyle

Ancient Irish Tales, Edited by Tom P Cross and Clark Haris Slover

Cattle Lords and Clansmen, Nerys Patterson

Celtic Heritage, Alwyn and Brinley Rees

Ireland's Immortals, Mark Williams

The Origins of the Irish, J. P. Mallory

In Search of the Irish Dreamtime, J. P. Mallory

The Táin, Thomas Kinsella translation

The Sutton Hoo Sceptre and the Roots of Celtic Kingship Theory, Michael J. Enright

Celtic Warfare, Giola Canestrelli

Pagan Celtic Ireland, Barry Raftery

The Year in Ireland, Kevin Danaher

Irish Customs and Beliefs, Kevin Danaher

Cult of the Sacred Center, Proinsais Mac Cana

Mythical Ireland: New Light on the Ancient Past, Anthony Murphy

Early Medieval Ireland AD 400-1100, Aidan O'Sullivan and others

The Festival of Lughnasa, Máire MacNeill

Curse of Ireland, Cecily Gillgan

📚 Indo-European Books (Mostly Academic and linguistic)

Dictionary of Indo-European Concepts and Society, Emily Benveniste

A Dictionary of Selected Synonyms in the Principle Indo-European Languages, Carl Darling Buck

The Horse, the Wheel and Language, David W. Anthony

Comparative Indo-European Linguistics, Robert S.P. Beekes

In Search of the Indo-Europeans, J.P. Mallory

Indo-European Mythology and Religion, Alexander Jacob

Some of these books had low print runs and therefore can be difficult to find and very expensive... SOME of those books can be found online with the help of friends... 🏴☠️

library genesis might be a great place to start... hint hint...

My kofi

#books#book#resource#blackcrowing#pagan#paganism#irish mythology#celtic#irish paganism#irish polytheism#celtic paganism#celtic polytheism#celtic mythology#indo european#indo european mythology#historical linguistics#paganblr#masterlist#irish reconstructionism#irish reconstructionist#celtic reconstructionist#celtic reconstructionism#masterpost

120 notes

·

View notes

Photo

Michael Benveniste and Howard Ziehm’s Flesh Gordon (1974)

394 notes

·

View notes

Text

#movies#flesh gordon#Howard Ziehm#Michael Benveniste#Jason Williams#Suzanne Fields#Candy Samples#1974

14 notes

·

View notes

Video

youtube

Hot Saucer by Bootsy Collins (featuring Musiq Soulchild and Big Daddy Kane) from the album World Wide Funk

#music#bootsy collins#big daddy kane#antonio m hardy#william earl collins#musiq soulchild#talib johnson#alissia benveniste#antonio hardy#eric moore ii#jason gilmore#michael granger#rashon murph#musiq#funk#eric moore (drummer)

1 note

·

View note

Text

Books On Books Collection - Ron King

Books On Books Collection – Ron King

The Burning of the Books (2009)

The Burning of the Books (2009)George Szirtes (poems) and Ron King (prints)Slipcase with sewn hardback, duotone letterpress reproduction of the 2008 artist book version. H220 x W160 mm, 66 unnumbered pages. Edition of 1000, the first 100 signed and numbered by the author and artist and presented in a specially designed slipcase. Acquired from the artist, 28…

View On WordPress

#Andrew Lambirth#Asa Benveniste#Barbara Tetenbaum#Cathy Courtney#Elias Canetti#Geoffrey Chaucer#George Szirtes#Henri Matisse#Ken Campbell#Larry Eigner#Michael Donaghy#Ron King#Roy Fisher

0 notes

Photo

0 notes

Text

First Trailer for Serj Tankian Documentary Released

New Post has been published on https://armenia.in-the.news/culture/first-trailer-for-serj-tankian-documentary-released-46656-25-06-2020/

First Trailer for Serj Tankian Documentary Released

Serj Tankian performing in Armenia

The first trailer from “Truth To Power,” director Garin Hovannisian’s feature documentary chronicling Serj Tankian, the lead singer of System Of A Down, has been released, Deadline reported.

The film follows the rock band and specifically Tankian’s social justice activism work, including his role in inspiring the peaceful protests as part of the 2018 Velvet Revolution in Tankian’s native Armenia. The project comes from Live Nation Productions, according to Deadline.

[embedded content]

The documentary also features appearances from System Of A Down band members John Dolmayan and Shavo Odadjian, the band’s manager David “Beno” Benveniste, filmmaker/journalist Carla Garapedian, Rage Against the Machine’s Tom Morello, and record producer Rick Rubin.

The film was slated to premiere at Tribeca Film Festival before it was cancelled due to the COVID-19 pandemic.

The project is executive produced by Oscar-mominee Joe Berlinger (Paradise Lost trilogy) and Live Nation Production’s Ryan Kroft (Emmy winner for The T Word), Michael Rapino (A Star is Born), Damian Vaca, and Vaughn Schoonmaker.

The documentary will also be feature the Cannes Virtual Film Market, known as the Cannes Marche this week.

Read original article here.

0 notes

Photo

Flesh Gordon (1974) dir. Michael Benveniste, Howard Ziehm

2 notes

·

View notes

Photo

HOLLYWOOD BLUE (1970) - MARILYN MONROE JAPANESE MOVIE POSTERS (Part 8/10)

A rarity among MARILYN MONROE Japanese movie posters is this colorful image - taken from her unfinished/unreleased last movie, Something’s Gotta Give - with the now famous half naked swimming pool scene

The iconic photo was used in Japan to advertise the 1970 sex documentary about Hollywood’s sexual debauchery

Director: Michael Benveniste

Actors: Marilyn Monroe (footage only)

All Our MARILYN MONROE movie posters are here

If you like this entry, check the other 9 parts of this week’s Blog as well as our Blog Archives and all our NEW POSTERS

All our ON SALE posters are here

The poster above courtesy of ILLUSTRACTION GALLERY

#illustraction gallery#illustraction#marilyn monroe#hollywood blue#something's gotta give#1970#movies#Movie Poster#documentary#Japanese movie poster#film#vintage

1 note

·

View note

Photo

Flesh Gordon Japanese poster (Howard Ziehm & Michael Benveniste, 1974)

241 notes

·

View notes

Text

“Vieni dalla Via Lattea, bella pupona?”

Quando a cavallo del 1968 scoppia la contestazione nelle piazze del mondo occidentale, l’impulso al cambiamento riguarda anche la liberazione dei costumi sessuali e l’emancipazione della donna dai ruoli tradizionalmente attribuiti dalla società di fidanzate, mogli e madri. Si inizia a parlare di sesso, nelle sue diverse forme, con maggiore frequenza e in modo esplicito. Le donne rivendicano la proprietà del loro corpo, capaci di pensare al sesso come scoperta e non come destino riproduttivo o esperienza di sottomissione. Come è naturale, tutto questo fermento influenzerà le varie forme espressive umane e si riverserà anche nella fantascienza cinematografica.

Proprio nel 1968 compare sugli schermi Barbarella. La protagonista è una specie di Flash Gordon al femminile nata nel 1962 sulle pagine di un fumetto francese per mano di Jean-Claude Forest. Il film non mancò di destare polemiche seppur oggi il suo erotismo appare all’acqua di rose.

Anno 40.000 (la datazione appare solo nel materiale pubblicitario, nel film non è indicata nessun anno), l’agente terrestre Barbarella è incaricata dal Primo Ministro della Terra di ritrovare lo scienziato Durand Durand, inventore del micidiale raggio positronico, scomparso su Sogo, un pianeta che appare come una proiezione futuristica di Sodoma e Gomorra (So-Go, dalle iniziali delle empie città bibliche) dominato dalla saffica Regina Nera. Durante la missione passerà attraverso a grottesche e surreali situazioni e incontrerà una variopinta galleria di personaggi che vorranno o ucciderla o fare sesso con lei o entrambe le cose…

Barbarella fu la prima delle tre colorate produzioni di Dino De Laurentis adattate da un fumetto popolare, gli altri furono Diabolik (1968) di Mario Bava e il delirante Flash Gordon (1980) di Mike Hodges. Come accennato, Barbarella nacque sulle pagine della rivista V-Magazine, creata e disegnata da Jean-Claude Forest (che lavorò al film come consulente al design). La sceneggiatura del film adattò porzioni della sua prima avventura fumettistica.

La sceneggiatura del film adattò porzioni della sua prima avventura fumettistica, dove era più una fuorilegge piuttosto che un agente intergalattico. L’aspetto che la protagonista aveva sulle strisce disegnate richiamava esplicitamente quello dell’attrice Brigitte Bardot ma nel film fu interpretata dall’americana Jane Fonda, all’epoca moglie del regista Roger Vadim (che tra le file delle varie mogli e amanti annoverava anche la Bardot, cui aveva divorziato un decennio prima). Il ruolo era stato in precedenza proposto, ottenendo un rifiuto, alla stessa Bardot, a Virna Lisi e a Sophia Loren. Per la prima volta si vede in scena un’eroina ingenuamente sexy e trasgressiva, con una disinibita vita sessuale e che sceglieva da se i propri partner, il tutto pervaso da compiaciuta autoironia. Memorabile la sua scena dello spogliarello integrale a gravità zero dove i titoli di testa intervengono a coprire, malamente, le zone più “scabrose”. La scena, che simula piuttosto bene l’assenza di gravità, fu girata riprendendo l’attrice, sdraiata su un tavolo di plexiglas, dall’alto. Dopo questo ruolo il New York Times definì la Fonda come “la dea del sesso più iconica degli anni Sessanta“. In seguito l’attrice si affrancò dall’immagine di “gattina sexy” e svoltò la propria carriera in ruoli più politicizzati. Barbarella divenne un’icona femminista ma il film non mancò di destare polemiche. Realizzato con dispendio di mezzi, fu commercialmente un insuccesso ma, come accade spesso, divenne un vero cult negli anni successivi diventando fonte d’ispirazione se non del cinema di fantascienza a venire, sicuramente della moda degli anni Settanta e oltre. La creazione dei I costumi dello stilista Paco Rabanne, che letteralmente cucì addosso al perfetto corpo dell’attrice un look futuristico fatto di corpetti in plexiglass e in plastica trasparente, abiti in argento e stivali cuissardes, le psichedeliche scenografie di Mario Garbuglia e gli effetti speciali di August Lohmann contribuirono a creare questa dimostrazione di pop art applicata al cinema.

Il film fu una co-produzione Italia/Francia girato a Roma e annovera anche il nostro Ugo Tognazzi tra gli interpreti. Nella parte del rivoluzionario Dildano era stato originariamente scritturato l’italiano Antonio Sabato ma la particolare scena di sesso con Jane Fonda fu giudicata troppo seriosa da Vadim che lo sostituì con l’inglese David Hemmings. Da ricordare anche la presenza nel cast del famoso mimo francese Marcel Marceau in un ruolo per una volta parlante e con molte battute. Anita Pallenberg, che interpreta la Regina Nera, era all’epoca conosciuta come la musa dei Rolling Stone, avendo avuto relazioni sentimentali con Brian Jones, Keith Richards e Mick Jagger in successione.

CURIOSITÀ

Nel film appare per la prima volta al cinema (era già apparso nel fumetto) un orgasmatron, dispositivo capace di indurre una sensazione simile all’orgasmo e che la nostra eroina, grazie alla propria esuberanza erotica, manda in sovraccarico e distrugge quando vi è sottoposta. Apparecchi con funzioni simili apparvero in seguito in altri film di fantascienza come Il dormiglione (Sleeper, 1973) di Woody Allen, in Flesh Gordon – Andata e ritorno… dal pianeta Porno! (Flesh Gordon, 1974) di Michael Benveniste e Howard Ziehm e in Demolition Man (1993) di Marco Brambilla. Nella realtà un apparecchio simile è stato realizzato dal Dr. Stuart Meloy nel 1998 e funziona grazie ad alcuni elettrodi impiantati nella colonna vertebrale.

Il gruppo pop britannico dei Duran Duran prese il nome proprio da uno dei personaggi del film. In un video live del gruppo del 1985 (Arena: An Absurd Notion) comparve pure Milo O’Shea, l’attore che lo interpretava nel film.

Llanfairpwllgwyngyllgogerychwyrndrobwllllantysiliogogogoch è nel film la password del quartier generale di Dildano. Nella realtà è il nome di villaggio gallese che con i suoi 58 caratteri è il toponimo più lungo d’Europa.

David Gilmour, futuro chitarrista dei Pink Floyd, è stato uno dei musicisti che hanno eseguito la colonna sonora originale del film (composta da James Campbell, Bob Crewe, Charles Fox e Michel Magne).

Barbarella (Id., Francia/Italia 1968, 98’, C). Regia di Roger Vadim. Sceneggiatura di Roger Vadim e Terry Southern basata sul fumetto di Jean-Claude Forest Barbarella (1962). Con Jane Fonda (Barbarella), John Phillip Law (Pygar), Anita Pallenberg (Regina Nera), Milo O’Shea (Durand Durand), Marcel Marceau (Professor Ping), Claude Dauphin (Presidente della Terra), Ugo Tognazzi (Mark Hand), David Hemmings (Dildano), Giancarlo Cobelli (Rivoluzionario), Serge Marquand (Captain Sun).

BARBARELLA “Vieni dalla Via Lattea, bella pupona?” Quando a cavallo del 1968 scoppia la contestazione nelle piazze del mondo occidentale, l’impulso al cambiamento riguarda anche la liberazione dei costumi sessuali e l’emancipazione della donna dai ruoli tradizionalmente attribuiti dalla società di fidanzate, mogli e madri.

0 notes

Text

137 Economists Support GOP Tax Reform

In an open letter to Congress today, 137 economists backed the GOP tax reform effort, saying: “Economic growth will accelerate if the Tax Cuts and Jobs Act passes, leading to more jobs, higher wages, and a better standard of living for the American people.” Senator Portman echoed this point on Fox Business earlier today, saying the Senate’s Tax Cuts & Jobs Act “will generate more jobs and higher wages because of the increased investment and productivity.”

The full letter is below and at this link.

An open letter to Congress signed by 137 economists supporting GOP tax reform bill

CNBC

November 29, 2017

Dear Senators and Representatives:

“Ask five economists,” as the Edgar Fiedler adage goes, “and you'll get five different answers.”

Yet, when it comes to the tax reform package aimed at fixing our broken system, the undersigned have but one shared perspective: Economic growth will accelerate if the Tax Cuts and Jobs Act passes, leading to more jobs, higher wages, and a better standard of living for the American people. If, however, the bill fails, the United States risks continued economic underperformance.

In today’s globalized economy, capital is mobile in its pursuit of lower tax jurisdictions. Yet, in that worldwide race for job-creating investment, America is not economically competitive.

Here’s why: Left virtually untouched for the last 31 years, our chart-topping corporate tax rate is the highest in the industrialized world and a full fifteen percentage points above the OECD average. As a result of forfeiting our competitive edge, we forfeited 4,700 companies from 2004 to 2016 to cheaper shores abroad. As a result of sitting idly by while the rest of the world took steps to lower their corporate rates, we lowered our own workers' wages by thousands of dollars a year.

Our colleagues from across the ideological spectrum – regardless of whether they ultimately support or oppose the current plan – recognize the record-setting rate at which the United States taxes job-creating businesses is, either significantly or entirely, a burden borne by the workers they employ. The question isn't whether American workers are hurt by our country's corporate tax rate – it's how badly. As such, the question isn't whether workers will be helped by a corporate tax rate reduction – it's how much.

The enactment of a comprehensive overhaul – complete with a lower corporate tax rate – will ignite our economy with levels of growth not seen in generations. A twenty percent statutory rate on a permanent basis would, per the Council of Economic Advisers, help produce a GDP boost “by between 3 and 5 percent.” As the debate delves into deficit implications, it is critical to consider that $1 trillion in new revenue for the federal government can be generated by four- tenths of a percentage in GDP growth.

Sophisticated economic models show the macroeconomic feedback generated by the TCJA will exceed that amount – more than enough to compensate for the static revenue loss.

We firmly believe that a competitive corporate rate is the key to an economic engine driven by greater investment, capital stock, business formation, and productivity – all of which will yield more jobs and higher wages. Your vote throughout the weeks ahead will therefore put more money in the pockets of more workers.

Supporting the Tax Cuts and Jobs Act will ensure that those workers – those beneficiaries – are American.

Sincerely,

James C. Miller III, Former OMB Director, 1985-88

Douglas Holtz-Eakin, American Action Forum

Alexander Katkov, Johnson & Wales University

Ali M. Reza, San Jose State U (Emeritus)

Ann E. Sherman, DePaul University

Anthony B. Sanders, George Mason University

Anthony Negbenebor, Gardner-Webb University

Arthur Havenner, University of California, Davis

Austin J. Jaffe, Penn State University

Barry W. Poulson, University of Colorado

Boyd D, Collier, Tarleton State University, Texas A&M University System (Emeritus)

Brian Stuart Wesbury, Joint Economic Committee

Carlisle E. Moody, College of William and Mary

Charles W. Calomiris, Columbia University

Christine P. Ries, Georgia Institute of Technology

Christopher C. Barnekov, FCC (Retired)

Christopher Lingle Universidad Francisco Marroquin

Clifford F. Thies, Shenandoah University

Daniel Fernandez Universidad Francisco Marroquin

Daniel Houser, George Mason University

David H. Resler, Chief US Economist, Nomura (Retired)

David Ranson, HCWE & Co.

Dennis E. Logue Steven Roth Professor, (Emeritus) Tuck School, Dartmouth Colleges

Derek Tittle, Georgia Institute of Technology

DeVon L. Yoho, Economist Ball State University (Retired)

Donald J. Oswald California State University, Bakersfield (Retired)

Donald Koch, Koch Investments

Donald L. Alexander, Western Michigan University

Donald Luskin, TrendMacro

Douglas C Frechtling, George Washington University

Douglas Kahl, The University of Akron

Douglas O. Cook, The University of Alabama

Kingdon Hurlock Jr., Calvert Investment Counsel

Edward M. Scahill, University of Scranton

Eleanor Craig, University of Delaware

Owen Irvine Michigan State University (Emeritus)

Farhad Rassekh, University of Hartford

Francis Ahking, University of Connecticut

Frank Falero, California State University (Emeritus)

Gary R. Skoog, Legal Econometrics, Inc.

Gary Wolfram, Hillsdale College

Gene Simpson, NPTC, Auburn University

George Langelett, South Dakota State University

Gerald P. Dwyer, Clemson University

Gil Sylvia, University of Georgia

H Daniel Foster, HDFCO

Hugo J. Faria, University of Miami

Inayat Mangla, Western Michigan University

Edward Graham, UNC Wilmington

Jagdish Bhagwati, Columbia University

James B Kau, University of Georgia

James C.W. Ahiakpor California State University, East Bay

James D. Adams, Rensselaer Polytechnic Institute

James D. Miller, Smith College

James F. Smith, EconForecaster, LLC

James Keeler, Kenyon College

James M. Mulcahy SUNY - Buffalo economics department

James Moncur, University of Hawaii at Manoa

Jeffrey Dorfman, University of Georgia

Jerold Zimmerman, University of Rochester

Jody Lipford, Presbyterian College

John A. Baden, Chm., Foundation for Research on Economics and the Environment (FREE)

John C. Moorhouse Wake Forest University (Emeritus)

John D. Johnson, Utah State University

John H McDermott, University of South Carolina

John McArthur, Wofford College

John P. Eleazarian, American Economic Association

John Ruggiero, University of Dayton

John Semmens, Laissez Faire Institute

Joseph A. Giacalone, St. John's University, NY

Joseph Haslag University of Missouri- Columbia

Joseph S. DeSalvo University of South Florida - Tampa

Joseph Zoric Franciscan University of Steubenville

Kathleen B. Cooper, SMU's John Tower Center for Politico Science

Kenneth V. Greene Binghamton University (Emeritus)

Lawrence Benveniste Goizueta Business School, Emory University

Lawrence R. Cima, John Carroll University

Leon Wegge, University of California, Davis

Lloyd Cohen, Scalia Law School

Lucjan Orlowski, Sacred Heart University

Lydia Ortega, San Jose State University

Northrup Buechner, St. John's University, New York

Maurice MacDonald, Kansas State University

Michael A. Morrisey, Texas A&M University

Michael Connolly, University of Miami

Michael D Brendler Louisiana State University Shreveport.

Michael L. Marlow, Cal Poly, San Luis Obispo

Moheb A. Ghali, Western Washington University

Nancy Roberts, Arizona State University

Nasser Duella, California State University, Fullerton

Nicolas Sanchez, College of the Holy Cross, Worcester, MA (Emeritus,)

Norman Lefton, Southern Illinois University, Edwardsville

Paul H Rubin, Emory University

Pavel Yakovlev, Duquesne University

Pedro Piffaut, Columbia University

Peter E. Kretzmer, Bank of America

Peter S. Yun, UVAWISE (Emeritus)

Phillip J. Bryson Brigham Young University (Emeritus)

Ashley Lyman, University of Idaho

L. Promboin, University of Maryland University College (former)

Richard J. Cebula, Jacksonville University

Richard Kilmer, University of Florida

Richard Timberlake, Prof. of Econ., Univ. of Ga. (Retired)

Richard Vedder, Ohio University

Robert B Helms, American Enterprise Institute (Retired)

Robert F Stauffer, Roanoke College , (Emeritus)

Robert H. Topel, University of Chicago Booth School of Business

Robert Heller, Former Governor, Federal Reserve Board

Robert Sauer, Royal Holloway University

Robert Tamura, Clemson University

Roger Meiners, University of Texas-Arlington

Sanjai Bhagat, University of Colorado Boulder

Scott Hein, Texas Tech University

Seth Bied, New York State Tax Department

Stan Liebowitz, University of Texas

Stephen Happel, Arizona State University

Craig Tapley, University of Florida

Thomas H. Mayor, University of Houston

Thomas J Kniesner, Claremont Graduate University

Thomas M. Stoker, MIT (retired)

Thomas Saving, Texas A&M University

Timothy Mathews, Kennesaw State University

Tomi Ovaska, Youngstown State University

Tony Lima, California State University, East Bay

Victor a Canto, La Jolla economics

Vijay Singal, Navrang Inc

Wallace Hendricks, University of Illinois

Ward S. Curran Trinity College Hartford Connecticut (Emeritus)

Wayne T. Brough, FreedomWorks Foundation

William B. Fairley, Analysis & Inference, Inc.

William Buchanan, Valdosta State University

William McKillop, Resource Economics (Emeritus)

William R. Allen UCLA Department of Economics

William S. Peirce Case Western Reserve University

Wim Vijverberg, CUNY Graduate Center

Xuepeng Liu, Kennesaw State University

Yuri N. Maltsev, A.W. Clausen Center for World Business, Carthage College

###

from Rob Portman http://www.portman.senate.gov/public/index.cfm/press-releases?ContentRecord_id=0407B2E2-F566-4B88-BC06-FE84678C8E52

0 notes

Text

137 economists sign open letter to Congress supporting GOP tax reform bill

New Post has been published on https://nexcraft.co/137-economists-sign-open-letter-to-congress-supporting-gop-tax-reform-bill/

137 economists sign open letter to Congress supporting GOP tax reform bill

Our colleagues from across the ideological spectrum – regardless of whether they ultimately support or oppose the current plan – recognize the record-setting rate at which the United States taxes job-creating businesses is, either significantly or entirely, a burden borne by the workers they employ. The question isn’t whether American workers are hurt by our country’s corporate tax rate – it’s how badly. As such, the question isn’t whether workers will be helped by a corporate tax rate reduction – it’s how much.

The enactment of a comprehensive overhaul – complete with a lower corporate tax rate – will ignite our economy with levels of growth not seen in generations. A twenty percent statutory rate on a permanent basis would, per the Council of Economic Advisers, help produce a GDP boost “by between 3 and 5 percent.” As the debate delves into deficit implications, it is critical to consider that $1 trillion in new revenue for the federal government can be generated by four- tenths of a percentage in GDP growth.

Sophisticated economic models show the macroeconomic feedback generated by the TCJA will exceed that amount – more than enough to compensate for the static revenue loss.

We firmly believe that a competitive corporate rate is the key to an economic engine driven by greater investment, capital stock, business formation, and productivity – all of which will yield more jobs and higher wages. Your vote throughout the weeks ahead will therefore put more money in the pockets of more workers.

Supporting the Tax Cuts and Jobs Act will ensure that those workers – those beneficiaries – are American.

Sincerely,

James C. Miller III, Former OMB Director, 1985-88

Douglas Holtz-Eakin, American Action Forum

Alexander Katkov, Johnson & Wales University

Ali M. Reza, San Jose State U (Emeritus)

Ann E. Sherman, DePaul University

Anthony B. Sanders, George Mason University

Anthony Negbenebor, Gardner-Webb University

Arthur Havenner, University of California, Davis

Austin J. Jaffe, Penn State University

Barry W. Poulson, University of Colorado

Boyd D, Collier, Tarleton State University, Texas A&M University System (Emeritus)

Brian Stuart Wesbury, Joint Economic Committee

Carlisle E. Moody, College of William and Mary

Charles W. Calomiris, Columbia University

Christine P. Ries, Georgia Institute of Technology

Christopher C. Barnekov, FCC (Retired)

Christopher Lingle Universidad Francisco Marroquin

Clifford F. Thies, Shenandoah University

Daniel Fernandez Universidad Francisco Marroquin

Daniel Houser, George Mason University

David H. Resler, Chief US Economist, Nomura (Retired)

David Ranson, HCWE & Co.

Dennis E. Logue Steven Roth Professor, (Emeritus) Tuck School, Dartmouth Colleges

Derek Tittle, Georgia Institute of Technology

DeVon L. Yoho, Economist Ball State University (Retired)

Donald J. Oswald California State University, Bakersfield (Retired)

Donald Koch, Koch Investments

Donald L. Alexander, Western Michigan University

Donald Luskin, TrendMacro

Douglas C Frechtling, George Washington University

Douglas Kahl, The University of Akron

Douglas O. Cook, The University of Alabama

Kingdon Hurlock Jr., Calvert Investment Counsel

Edward M. Scahill, University of Scranton

Eleanor Craig, University of Delaware

Owen Irvine Michigan State University (Emeritus)

Farhad Rassekh, University of Hartford

Francis Ahking, University of Connecticut

Frank Falero, California State University (Emeritus)

Gary R. Skoog, Legal Econometrics, Inc.

Gary Wolfram, Hillsdale College

Gene Simpson, NPTC, Auburn University

George Langelett, South Dakota State University

Gerald P. Dwyer, Clemson University

Gil Sylvia, University of Georgia

H Daniel Foster, HDFCO

Hugo J. Faria, University of Miami

Inayat Mangla, Western Michigan University

Edward Graham, UNC Wilmington

Jagdish Bhagwati, Columbia University

James B Kau, University of Georgia

James C.W. Ahiakpor California State University, East Bay

James D. Adams, Rensselaer Polytechnic Institute

James D. Miller, Smith College

James F. Smith, EconForecaster, LLC

James Keeler, Kenyon College

James M. Mulcahy SUNY – Buffalo economics department

James Moncur, University of Hawaii at Manoa

Jeffrey Dorfman, University of Georgia

Jerold Zimmerman, University of Rochester

Jody Lipford, Presbyterian College

John A. Baden, Chm., Foundation for Research on Economics and the Environment (FREE)

John C. Moorhouse Wake Forest University (Emeritus)

John D. Johnson, Utah State University

John H McDermott, University of South Carolina

John McArthur, Wofford College

John P. Eleazarian, American Economic Association

John Ruggiero, University of Dayton

John Semmens, Laissez Faire Institute

Joseph A. Giacalone, St. John’s University, NY

Joseph Haslag University of Missouri- Columbia

Joseph S. DeSalvo University of South Florida – Tampa

Joseph Zoric Franciscan University of Steubenville

Kathleen B. Cooper, SMU’s John Tower Center for Politico Science

Kenneth V. Greene Binghamton University (Emeritus)

Lawrence Benveniste Goizueta Business School, Emory University

Lawrence R. Cima, John Carroll University

Leon Wegge, University of California, Davis

Lloyd Cohen, Scalia Law School

Lucjan Orlowski, Sacred Heart University

Lydia Ortega, San Jose State University

Northrup Buechner, St. John’s University, New York

Maurice MacDonald, Kansas State University

Michael A. Morrisey, Texas A&M University

Michael Connolly, University of Miami

Michael D Brendler Louisiana State University Shreveport.

Michael L. Marlow, Cal Poly, San Luis Obispo

Moheb A. Ghali, Western Washington University

Nancy Roberts, Arizona State University

Nasser Duella, California State University, Fullerton

Nicolas Sanchez, College of the Holy Cross, Worcester, MA (Emeritus,)

Norman Lefton, Southern Illinois University, Edwardsville

Paul H Rubin, Emory University

Pavel Yakovlev, Duquesne University

Pedro Piffaut, Columbia University

Peter E. Kretzmer, Bank of America

Peter S. Yun, UVAWISE (Emeritus)

Phillip J. Bryson Brigham Young University (Emeritus)

Ashley Lyman, University of Idaho

L. Promboin, University of Maryland University College (former)

Richard J. Cebula, Jacksonville University

Richard Kilmer, University of Florida

Richard Timberlake, Prof. of Econ., Univ. of Ga. (Retired)

Richard Vedder, Ohio University

Robert B Helms, American Enterprise Institute (Retired)

Robert F Stauffer, Roanoke College , (Emeritus)

Robert H. Topel, University of Chicago Booth School of Business

Robert Heller, Former Governor, Federal Reserve Board

Robert Sauer, Royal Holloway University

Robert Tamura, Clemson University

Roger Meiners, University of Texas-Arlington

Sanjai Bhagat, University of Colorado Boulder

Scott Hein, Texas Tech University

Seth Bied, New York State Tax Department

Stan Liebowitz, University of Texas

Stephen Happel, Arizona State University

Craig Tapley, University of Florida

Thomas H. Mayor, University of Houston

Thomas J Kniesner, Claremont Graduate University

Thomas M. Stoker, MIT (retired)

Thomas Saving, Texas A&M University

Timothy Mathews, Kennesaw State University

Tomi Ovaska, Youngstown State University

Tony Lima, California State University, East Bay

Victor a Canto, La Jolla economics

Vijay Singal, Navrang Inc

Wallace Hendricks, University of Illinois

Ward S. Curran Trinity College Hartford Connecticut (Emeritus)

Wayne T. Brough, FreedomWorks Foundation

William B. Fairley, Analysis & Inference, Inc.

William Buchanan, Valdosta State University

William McKillop, Resource Economics (Emeritus)

William R. Allen UCLA Department of Economics

William S. Peirce Case Western Reserve University

Wim Vijverberg, CUNY Graduate Center

Xuepeng Liu, Kennesaw State University

Yuri N. Maltsev, A.W. Clausen Center for World Business, Carthage College

For more insight from CNBC contributors, follow

@CNBCopinion

on Twitter.

Share & Written By CNBC

0 notes

Text

An open letter to Congress from over 100 economists: Pass tax reform and watch the economy roar

Carlos Barria/Reuters

Dear Senators and Representatives:

"Ask five economists," as the Edgar Fiedler adage goes, "and you'll get five different answers."

Yet, when it comes to the tax reform package aimed at fixing our broken system, the undersigned have but one shared perspective: Economic growth will accelerate if the Tax Cuts and Jobs Act passes, leading to more jobs, higher wages, and a better standard of living for the American people. If, however, the bill fails, the United States risks continued economic underperformance.

In today’s globalized economy, capital is mobile in its pursuit of lower tax jurisdictions. Yet, in that worldwide race for job-creating investment, America is not economically competitive. Here’s why: Left virtually untouched for the last 31 years, our chart-topping corporate tax rate is the highest in the industrialized world and a full fifteen percentage points above the OECD average. As a result of forfeiting our competitive edge, we forfeited 4,700 companies from 2004 to 2016 to cheaper shores abroad. As a result of sitting idly by while the rest of the world took steps to lower their corporate rates, we lowered our own workers' wages by thousands of dollars a year.

Our colleagues from across the ideological spectrum — regardless of whether they ultimately support or oppose the current plan — recognize the record-setting rate at which the United States taxes job-creating businesses is, either significantly or entirely, a burden borne by the workers they employ. The question isn’t whether American workers are hurt by our country’s corporate tax rate — it’s how badly. As such, the question isn’t whether workers will be helped by a corporate tax rate reduction — it’s how much.

The enactment of a comprehensive overhaul — complete with a lower corporate tax rate — will ignite our economy with levels of growth not seen in generations. A twenty percent statutory rate on a permanent basis would, per the Council of Economic Advisers, help produce a GDP boost "by between 3 and 5 percent." As the debate delves into deficit implications, it is critical to consider that $1 trillion in new revenue for the federal government can be generated by four-tenths of a percentage in GDP growth.

Sophisticated economic models show the macroeconomic feedback generated by the TCJA will exceed that amount — more than enough to compensate for the static revenue loss. We firmly believe that a competitive corporate rate is the key to an economic engine driven by greater investment, capital stock, business formation, and productivity — all of which will yield more jobs and higher wages. Your vote throughout the weeks ahead will therefore put more money in the pockets of more workers.

Supporting the Tax Cuts and Jobs Act will ensure that those workers — those beneficiaries — are American.

Sincerely,

James C. Miller III

Former OMB Director, 1985-88

Douglas Holtz-Eakin

American Action Forum

Alexander Katkov

Johnson & Wales University

Ali M. Reza

San Jose State U (Emeritus)

Ann E. Sherman

DePaul University

Anthony B. Sanders

George Mason University

Anthony Negbenebor

Gardner-Webb University

Arthur Havenner

University of California, Davis

Austin J. Jaffe

Penn State University

Barry W. Poulson

University of Colorado

Boyd D, Collier

Tarleton State University, Texas A&M University System (Emeritus)

Brian Stuart Wesbury

Joint Economic Committee

Carlisle E. Moody

College of William and Mary

Charles W. Calomiris

Columbia University

Christine P. Ries

Georgia Institute of Technology

Christopher C. Barnekov

FCC (Retired)

Christopher Lingle Universidad Francisco Marroquin

Clifford F. Thies

Shenandoah University

Daniel Fernandez Universidad Francisco Marroquin

Daniel Houser

George Mason University

David H. Resler

Chief US Economist, Nomura (Retired)

David Ranson

HCWE & Co.

Dennis E. Logue Steven Roth Professor, (Emeritus) Tuck School, Dartmouth Colleges

Derek Tittle

Georgia Institute of Technology

DeVon L. Yoho

Economist Ball State University (Retired)

Donald J. Oswald California State University, Bakersfield (Retired)

Donald Koch

Koch Investments

Donald L. Alexander

Western Michigan University

Donald Luskin

TrendMacro

Douglas C Frechtling

George Washington University

Douglas Kahl

The University of Akron

Douglas O. Cook

The University of Alabama

Kingdon Hurlock Jr.

Calvert Investment Counsel

Edward M. Scahill

University of Scranton

Eleanor Craig

University of Delaware

Owen Irvine Michigan State University (Emeritus)

Farhad Rassekh

University of Hartford

Francis Ahking

University of Connecticut

Frank Falero

California State University (Emeritus)

Gary R. Skoog

Legal Econometrics, Inc.

Gary Wolfram

Hillsdale College

Gene Simpson

NPTC, Auburn University

George Langelett

South Dakota State University

Gerald P. Dwyer

Clemson University

Gil Sylvia

University of Georgia

H Daniel Foster

HDFCO

Hugo J. Faria

University of Miami

Inayat Mangla

Western Michigan University

J. Edward Graham

UNC Wilmington

Jagdish Bhagwati

Columbia University

James B Kau

University of Georgia

James C.W. Ahiakpor California State University, East Bay

James D. Adams

Rensselaer Polytechnic Institute

James D. Miller

Smith College

James F. Smith

EconForecaster, LLC

James Keeler

Kenyon College

James M. Mulcahy SUNY - Buffalo economics department

James Moncur

University of Hawaii at Manoa

Jeffrey Dorfman

University of Georgia

Jerold Zimmerman

University of Rochester

Jody Lipford

Presbyterian College

John A. Baden

Chm., Foundation for Research on Economics and the Environment (FREE)

John C. Moorhouse Wake Forest University (Emeritus)

John D. Johnson

Utah State University

John H McDermott

University of South Carolina

John McArthur

Wofford College

John P. Eleazarian

American Economic Association

John Ruggiero

University of Dayton

John Semmens

Laissez Faire Institute

Joseph A. Giacalone

St. John's University, NY

Joseph Haslag University of Missouri- Columbia

Joseph S. DeSalvo University of South Florida - Tampa

Joseph Zoric Franciscan University of Steubenville

Kathleen B. Cooper

SMU’s John Tower Center for Politico Science

Kenneth V. Greene Binghamton University (Emeritus)

Lawrence Benveniste Goizueta Business School, Emory University

Lawrence R. Cima

John Carroll University

Leon Wegge

University of California, Davis

Lloyd Cohen

Scalia Law School

Lucjan Orlowski

Sacred Heart University

Lydia Ortega

San Jose State University

M. Northrup Buechner

St. John's University, New York

Maurice MacDonald

Kansas State University

Michael A. Morrisey

Texas A&M University

Michael Connolly

University of Miami

Michael D Brendler Louisiana State University Shreveport.

Michael L. Marlow

Cal Poly, San Luis Obispo

Moheb A. Ghali

Western Washington University

Nancy Roberts

Arizona State University

Nasser Duella

California State University, Fullerton

Nicolas Sanchez

College of the Holy Cross, Worcester, MA (Emeritus,)

Norman Lefton

Southern Illinois University, Edwardsville

Paul H Rubin

Emory University

Pavel Yakovlev

Duquesne University

Pedro Piffaut

Columbia University

Peter E. Kretzmer

Bank of America

Peter S. Yun

UVAWISE (Emeritus)

Phillip J. Bryson Brigham Young University (Emeritus)

R. Ashley Lyman

University of Idaho

R. L. Promboin

University of Maryland University College (former)

Richard J. Cebula

Jacksonville University

Richard Kilmer

University of Florida

Richard Timberlake

Prof. of Econ., Univ. of Ga. (Retired)

Richard Vedder

Ohio University

Robert B Helms

American Enterprise Institute (Retired)

Robert F Stauffer

Roanoke College , (Emeritus)

Robert H. Topel

University of Chicago Booth School of Business

Robert Heller

Former Governor, Federal Reserve Board

Robert Sauer

Royal Holloway University

Robert Tamura

Clemson University

Roger Meiners

University of Texas-Arlington

Sanjai Bhagat

University of Colorado Boulder

Scott Hein

Texas Tech University

Seth Bied

New York State Tax Department

Stan Liebowitz

University of Texas

Stephen Happel

Arizona State University

T. Craig Tapley

University of Florida

Thomas H. Mayor

University of Houston

Thomas J Kniesner

Claremont Graduate University

Thomas M. Stoker

MIT (retired)

Thomas Saving

Texas A&M University

Timothy Mathews

Kennesaw State University

Tomi Ovaska

Youngstown State University

Tony Lima

California State University, East Bay

Victor a Canto

La Jolla economics

Vijay Singal

Navrang Inc

Wallace Hendricks

University of Illinois

Ward S. Curran Trinity College Hartford Connecticut (Emeritus)

Wayne T. Brough

FreedomWorks Foundation

William B. Fairley

Analysis & Inference, Inc.

William Buchanan

Valdosta State University

William McKillop

Resource Economics (Emeritus)

William R. Allen UCLA Department of Economics

William S. Peirce Case Western Reserve University

Wim Vijverberg

CUNY Graduate Center

Xuepeng Liu

Kennesaw State University

Yuri N. Maltsev

A.W. Clausen Center for World Business, Carthage College

NOW WATCH: How much money you need to save each day to become a millionaire by age 65

from Feedburner http://ift.tt/2Akell3

0 notes