#Monte Carlo Simulation Assignment Help

Explore tagged Tumblr posts

Text

When I was a young excited physics student I went down to my advisor and asked for a job in a lab. Those of you who are in the sciences may recognize this as exceedingly common, most schools with science departments will hire undergrads for their labs both to give the undergrads experience and to have someone comparatively cheap to do the least skilled labor in those labs.

For me, the lab I was sent to was one doing cool photonics projects and I was assigned to a guy who was doing the theoretical modeling for them and I got put on a side project for them to develop a method to double check their results using Monte Carlo simulations.

Put bluntly, I toiled away in the little cubicle they had me in for about half a year before I transferred to a different school without ever having produced anything of any particular value other than a Monte Carlo simulation whose temperature readings were not taking into account the existence of a heat sink and therefore got overwhelmed by thermal photons in a completely inaccurate and unhelpful way.

Ultimately, many tasks, farmed out like this in a speculative way to undergrads, fail, certainly it's not exceptional that mine did and I learned a lot about the process in the process, so it wasn't wasted time for me, but it produced absolutely nothing the lab could use to further its results.

This is where it turns from a little anecdote about my work history into a morality tale, because what I have thus far deliberately failed to tell you is that the lab I was assigned to is a provider of radar services to the US Military. Had I produced anything of any value whatsoever the work I did would have been used by the US military to help with its capacity to deliver bombs. This is, unfortunately, as those of you who are in the sciences may recognize, also exceedingly common. Luckily, and through no foresight or moral thinking of my own, simply the inexperience of youth, I produced nothing of value but view the path they tried to set me down as a grim warning of what might have been.

I'm not asking for forgiveness, the harm I might have done was not done by me, although I'm also sure was done without my help. They didn't need it to be me they just needed someone with basic calculus knowledge who wouldn't think too hard about the connection between the work and the world, and they were happy enough that particular warm body was me.

So this is my plea, if you're young and getting involved in the sciences because you're passionate about knowledge and understanding our place in the universe. When you go to get that job in that lab that's such a good stepping stone to the next thing you want to do, take a second and look into where that lab's funding is coming from. If it turns out it's the military, maybe then take another second and really deeply consider what kind of thing your work can be used to do and if you would like some of the most bloodthirsty people on the planet to be able to do that thing because of your help.

I got lucky that I didn't help, but I'm hoping that with this warning you might be able to not help on purpose which is a greater moral good than what I managed.

#IDK been thinking about this a lot recently for obvious reasons#I should've known better at the time too to be clear I was just blinded by excitement#If I'd stayed at that school and that lab and got to the level where I could contribute#They would have happily sent me to the Raytheon office down the street#Where I would've been well paid as my soul chipped away at itself#And I will never not resent the structure of the system that had that future in mind for me#I feel extra foolish for having nearly fallen for it considering my grandfather's history as a member of the Union of Concerned Scientists#Which is in part because he didn't talk much about that with us grandkids in large part because we weren't old enough early enough#There's a lot I wish he could've talked to me about now that I'm old enough to really understand it#But back to the point tell your advisor 'I'm not comfortable working in a military lab do you have any other options'#That's what I wish I'd said#Meanwhile my dad (the legend) claims to have cost the military millions of hours of productivity and credibly so

63 notes

·

View notes

Text

How 3D CAD Helps Engineers Perform Thermal Analysis for Spacecraft

The extreme conditions of space pose significant challenges for spacecraft design, particularly in thermal management. Spacecraft experience fluctuating temperatures, intense solar radiation, and the vacuum of space, all of which can impact performance. Thermal analysis is a critical step in spacecraft engineering, ensuring that systems remain operational under these harsh conditions. One of the most transformative tools in this process is 3D CAD (Computer-Aided Design). By integrating CAD with thermal analysis software, engineers can efficiently simulate, analyze, and optimize spacecraft designs.

The Role of Thermal Analysis in Spacecraft Design

Thermal analysis involves predicting how a spacecraft will behave thermally under various conditions. Engineers use simulations to evaluate heat transfer mechanisms such as conduction, convection (if applicable), and radiation. This process ensures that components stay within their operational temperature limits and identifies the need for heaters, radiators, or insulation layers to maintain thermal balance.

Spacecraft thermal analysis typically includes:

Modeling energy exchange factors: Calculating absorbed energy from orbital sources like the Sun and reflected planetary radiation.

Simulating heat dissipation: Predicting how internal components generate and transfer heat during operation.

Designing control systems: Determining heater power requirements and radiator sizing to regulate temperatures.

How 3D CAD Enhances Thermal Analysis

3D CAD tools revolutionize thermal analysis by enabling engineers to create detailed models of spacecraft geometry. These models serve as the foundation for simulations and allow engineers to visualize complex systems under varying environmental conditions. Here’s how 3D CAD contributes to thermal analysis:

1. Accurate Geometry Representation

Spacecraft designs often involve intricate geometries with multiple subsystems. 3D CAD software allows engineers to create highly detailed models that account for every component's size, shape, and orientation. Tools like NX Space Systems Thermal simplify the modeling of large assemblies without requiring manual geometry conversions. This level of detail ensures accurate predictions during simulations.

2. Integration with Thermal Analysis Software

Modern CAD tools are seamlessly integrated with thermal analysis software such as Thermal Desktop or Simcenter 3D Space Systems Thermal. These integrations enable engineers to import CAD models directly into simulation environments without losing fidelity. For example:

Thermal Desktop uses AutoCAD-based models to compute radiative exchange factors and orbital heating via Monte Carlo methods.

Simcenter 3D synchronizes CAD data automatically, reducing errors and improving efficiency during iterative design processes.

3. Material Property Assignment

Thermal performance depends heavily on material properties like conductivity, emissivity, and specific heat capacity. CAD-based tools often include databases of thermophysical properties, allowing engineers to assign realistic materials to spacecraft components. This capability ensures that simulations reflect real-world behavior.

4. Visualization and Post-Processing

Engineers can use CAD-integrated tools to visualize temperature distributions across spacecraft surfaces in 3D. Features like contour plots or scatter plots make it easier to identify hotspots or areas requiring additional thermal control measures. Visualization enhances collaboration among teams by presenting complex data in an intuitive format.

Applications of 3D CAD in Spacecraft Thermal Analysis

Orbital Simulations

Orbital mechanics significantly influence a spacecraft's thermal environment due to changing positions relative to the Sun and Earth. Engineers use 3D CAD models to simulate these dynamics and predict temperature fluctuations over time. For instance, NX Space Systems Thermal enables orbital simulations with synchronized geometry updates for evolving designs

Component-Level Analysis

Thermal analysis extends beyond the spacecraft as a whole—it includes evaluating individual subsystems like electronics or propulsion units. Tools like Solaria Thermal specialize in finite element analysis (FEA) for detailed component-level simulations. Engineers can model copper layers in PCBs or heat dissipation from rocket engines using these tools.

Iterative Design Optimization

Thermal analysis is an iterative process involving multiple design revisions. With CAD-integrated software, engineers can quickly update models based on simulation results without starting from scratch. This agility accelerates development timelines while improving accuracy.

Benefits of Using 3D CAD for Thermal Analysis

The integration of 3D CAD with thermal analysis software offers several advantages:

Efficiency: Automated synchronization between CAD models and simulation tools reduces manual effort.

Accuracy: Detailed geometry and material property assignments result in more reliable predictions.

Cost Savings: Virtual testing minimizes the need for expensive physical prototypes.

Collaboration: Intuitive visualizations enhance communication among engineering teams.

Conclusion

In the realm of spacecraft engineering, thermal analysis is indispensable for ensuring mission success under extreme conditions. The integration of 3D CAD tools with advanced simulation software has streamlined this process, enabling engineers to design more robust systems efficiently. From orbital simulations to component-level evaluations, these tools provide unparalleled accuracy and visualization capabilities.

As space exploration continues to push boundaries, the role of 3D CAD design services in thermal analysis will only grow more critical, empowering engineers to tackle increasingly complex challenges with confidence. Whether designing satellites for Earth's orbit or interplanetary missions, leveraging these technologies ensures that every spacecraft is prepared for its journey into the unknown.

#Thermal Analysis in Spacecraft Design#Spacecraft Design#Thermal Analysis#3D CAD Design#3D CAD Design Services#3d app development services#3d application development#3d mobile app development#3d desktop application development#3d desktop application#3d desktop application development companies#best 3d application development company#3d engineering application development services#3D application development for engineering#3D development tools for engineering applications#3d web application development services#3d mobile application development

0 notes

Text

Risk Modeling in Finance Assignments: Key Concepts for Help

In finance, risk is an ever-present factor that influences decision-making. From buying equity shares in a company, lending money, or issuing insurance policies, a financial professional undergoes the process of assessing and mitigating risks on a daily basis. Risk modeling is the way to quantify and predict potential financial losses and uncertainties. By using mathematical models, statistical tools and financial theories, students and professionals can forecast the probability of bad outcomes and make better decisions. For finance students, learning risk modeling is not only important to understand the backbone of financial markets but also to ace coursework and assignments.

Risk modeling is an advanced topic which requires explaining the concepts in layman terms for making students (especially beginners) to have a deep understanding. Students often get stuck in complex assignment questions, that can be dealt by opting for finance assignment help only. We will explore the benefits of hiring this service later in detail. Let us start with the basics.

What is Risk Modeling and Why is it Important?

Risk modeling requires the application of quantitative models in the assessment and management of risks inherent in financial investments and portfolio. It helps organizations to forecast the impact that various risks, namely interest rate, inflation, and fluctuations in the market, could have on overall financial performance. This plays an important role in finding the capital requirements for banks, insurance and investment firms as they all operate in volatile market conditions.

It is important for finance students to comprehend risk modeling so that concepts taught in classroom can be applied real business problems. Risk modeling provides the tools needed to:

Quantify uncertainty: Using models such as Value at Risk, students are able to understand how to estimate the loss on an asset or a portfolio.

Make data-driven decisions: Risk modeling uses past statistical data together with market assessments and simulations, empowering students to model different financial scenarios.

Comply with regulatory standards: Many industries rely on risk models to comply with regulations like Basel III, making risk modeling an integral part of finance education.

Key Concepts in Risk Modeling

Now that we've established the importance of risk modeling, let's go deeper into some key concepts that can provide

1. Value at Risk (VaR)

The Value at Risk model is one of the most implemented models in finance, showing the potential loss in value of a portfolio over a specific time period considering the market conditions being normal. VaR is typically expressed in three variables:

Time period (e.g., 1 day, 10 days, etc.)

Confidence level (e.g., 95%, 99%)

Loss amount (the worst expected loss)

For example, a VaR of $1 million at a 95% confidence level over 10 days implies that there’s a 95% chance the portfolio will not lose more than $1 million over 10 days. Although VaR is certainly informative, it is critical to bear in mind that it does not take extreme market conditions into consideration.

2. Monte Carlo Simulations

Monte Carlo simulation involves simulating thousands of scenarios to analyze the effect of risks and uncertainty. This method facilitates students to model uncertain variables and determine potential outcomes across a range of possibilities.

For instance, if a finance student wants to find the future value of a investment portfolio, he/she can utilize monte Carlo simulation to make multiple scenarios on the basis of various combinations of stock price trends, interest rates and economic conditions.

3. Credit Risk Modeling

Credit risk models can be used by financial institutions in assessing the probability of a loan default. One of the methods is Credit Metrics model, in which probability distributions are used and default probability is estimated from past data.

Example: Consider a bank assessing the credit risk of a borrower applying for a $100,000 loan. The bank would then employ default history data, interest rates on the specific loan and the credit score of the specific borrower to predict a probability of default. This enables the bank in fixing the correct interest rate charges as well as risk premiums.

Our team of skilled analysts is available to provide expert guidance to students seeking finance homework support for credit risk modelling assignments.

4. Stress Testing

Stress testing is a technique used to assess how financial firms and investment portfolios can cope with unfavorable economic conditions. This type of risk modeling started gaining popularity after the year 2008 financial crises.

Example: An investment firm may apply stress testing to its portfolio by assuming that stock prices have dropped by 30% or the rates of interest have risen substantially. It assists them in assessing the capacity with which their investments can resist extreme conditions and whether they have adequate capital to handle losses.

Case Studies in Risk Modeling: JPMorgan Chase and VaR

JPMorgan Chase and co is credited for developing of the VaR model during the 1990s. This is because the bank was using VaR to calculate its risk position under various conditions, hence being in a better position to manage financial risks. Many other financial institutions have also followed similar systems of risk management over the years but JPMorgan has continued to enhance its risk models, especially post global financial crisis in 2008.

Why Do Students Struggle with Risk Modeling?

While risk modeling is a vital aspect of finance, many students find it difficult to grasp the typical concepts and apply them effectively in assignments. Here are some common challenges that students face:

Complex Mathematical and Statistical Formulas: Risk modeling involves technical skills and through understanding of some mathematical and statistical concepts. Topics such as stochastic processes, probability distributions, and regression models create confusion for students who have little or no knowledge of quantitative methods.

Interpreting Large Datasets: Most of the risk models especially in credit risk and market risk involve the use of massive data analysis. The process involved are usually lengthy, time intensive and requires expertise in software like R, Excel, Python etc.

Lack of Real-World Application Knowledge: Often, students face difficulties in establishing a connection between the theoretical concepts studied in class to the practical problem solving. Academic courses usually teach the basics, but handing complex techniques like stress testing and monte carlo simulation in real professional environment can be challenging.

Time Constraints: Finance courses often come with complex assignments, and balancing risk modeling assignments with other subjects become strenuous.

How Finance Assignment Help Services Assist Students

To overcome such challenges, utilizing our Finance Assignment Help service can be very helpful. We provide expert guidance on risk modeling and other complex topics in finance and provide step-by-step solutions for easy understanding.

Here is how such services can be of help:

Expert Guidance: Our platform engages experts having years of experience in finance, mathematics, and data analysis.

Step-by-Step Solutions: Risk modeling involves a systematic process. We assist students in every step of risk modeling starting from data collection to application of financial models and report writing.

Practical Application Support: We provide various case studies and practice assignments that can expose students to various risk modeling tasks and the correct way to solve them.

Software Proficiency: Our experts help learners with developing basics programming skills required in risk modeling courses such as Excel, Python, R among others.

Also Read: A 5-Step Framework for Analyzing Interest Rate Trends in Finance Assignment Guide

How our Service Helps with Risk Modeling Assignments?

We explain practical strategies for difficult risk modeling tasks, including Value at Risk (VaR), Monte Carlo simulations, credit risk models, and stress testing. By opting our finance assignment help services, students can learn how to apply Excel, Python or R to solve large scale problem or data analysis to achieve correct answers.

Typical Assignment Questions:

"Calculate the VaR for a portfolio at a 95% confidence level over 10 days."

"Perform a Monte Carlo simulation to evaluate the risk of a bond portfolio."

"Assess the credit risk of a borrower using historical default data."

our service provides answers to these typical questions with a step by step structure to have a clear understanding of the process.

Key Features of our Service:

Plagiarism-Free Solutions: All solutions are unique and prepared from scratch.

Step-by-Step Working in Excel or Other Tools: Detailed reports along with steps to be performed in software to replicate the results.

Assured Grades: Our experts strive to provide the best work that ensures desired grade in class.

Helpful Resources for Students

"Risk Management and Financial Institutions" by John C. Hull: This book offers a comprehensive overview of risk management in financial institutions, including detailed explanations of risk models and how they are applied.

"Options, Futures, and Other Derivatives" by John Hull: A classic textbook that covers various risk modeling techniques used in the context of options and futures markets.

0 notes

Text

Mastering Capital Budgeting: Key Strategies for Managerial Accounting Assignments

Capital budgeting is a critical component of managerial accounting that involves evaluating investment opportunities to determine their financial viability. As students delve into this complex area, understanding key strategies and concepts becomes essential for mastering their managerial accounting assignments. This blog will guide you through effective strategies for capital budgeting, helping you tackle accounting assignment with confidence and precision.

Understanding Capital Budgeting

Capital budgeting is the process through which businesses assess the potential value of long-term investments or projects. These can include new equipment, expansion of facilities, or launching new products. The primary goal is to allocate resources effectively to maximize returns and ensure sustainable growth. For students, grasping the intricacies of capital budgeting is crucial as it forms a significant part of managerial accounting assignments.

Key Strategies for Capital Budgeting

Identify and Evaluate Investment OpportunitiesThe first step in capital budgeting is identifying potential investment opportunities. This involves understanding the strategic goals of the organization and aligning investment decisions with these objectives. For students, this means carefully analyzing case studies or hypothetical scenarios presented in assignments to identify the best investment options.Key Considerations:

Alignment with Strategic Goals: Ensure the investment aligns with the company's long-term goals.

Risk Assessment: Evaluate potential risks associated with the investment.

Financial Projections: Analyze projected cash flows and returns.

Determine Relevant Cash FlowsCash flow estimation is a fundamental aspect of capital budgeting. It involves forecasting the inflows and outflows of cash associated with an investment. Students should focus on distinguishing between relevant and irrelevant cash flows. Relevant cash flows are those directly attributable to the investment decision and include initial investment costs, operating cash flows, and terminal cash flows.Types of Cash Flows:

Initial Investment: The upfront cost of acquiring the asset or starting the project.

Operating Cash Flows: Net cash flows generated from the investment’s operations.

Terminal Cash Flows: Salvage value or final cash inflows from the project’s disposal.

Apply Evaluation TechniquesSeveral techniques are used to evaluate capital budgeting projects. Students should familiarize themselves with these methods to apply them effectively in their assignments.

Net Present Value (NPV): NPV measures the difference between the present value of cash inflows and outflows. A positive NPV indicates that the investment is expected to generate more value than its cost.

Internal Rate of Return (IRR): IRR represents the discount rate at which the NPV of cash flows equals zero. It helps determine the profitability of an investment.

Payback Period: This technique calculates the time required to recover the initial investment. While it provides a simple measure of investment recovery, it does not account for the time value of money.

Profitability Index (PI): PI measures the ratio of the present value of cash inflows to the initial investment. A PI greater than 1 suggests a profitable investment.

Incorporate Risk AnalysisEvery investment carries a certain level of risk. Risk analysis involves identifying potential uncertainties and evaluating their impact on the project’s outcomes. Students should integrate risk assessment techniques into their capital budgeting analysis.Risk Analysis Techniques:

Sensitivity Analysis: Examines how changes in key assumptions (e.g., sales volume, cost) impact the project’s viability.

Scenario Analysis: Evaluates different scenarios to understand how various factors affect the investment’s performance.

Monte Carlo Simulation: Uses statistical models to assess the probability of different outcomes and their impact on the investment.

Consider Non-Financial FactorsWhile financial metrics are crucial, non-financial factors also play a significant role in capital budgeting decisions. These can include strategic alignment, regulatory compliance, and environmental impact. Students should be mindful of these factors when analyzing investment opportunities in their assignments.Non-Financial Considerations:

Strategic Fit: Does the investment align with the company’s strategic goals?

Regulatory Requirements: Are there any legal or environmental regulations to consider?

Stakeholder Impact: How will the investment affect various stakeholders, including employees, customers, and the community?

Practical Tips for Students

Organize Your ApproachWhen tackling managerial accounting assignments related to capital budgeting, organization is key. Start by clearly defining the scope of the assignment and outlining the steps involved in the analysis. This will help you stay focused and ensure you cover all necessary aspects of the assignment.

Use Real-World ExamplesIncorporating real-world examples can enhance the quality of your analysis. Look for case studies or recent investment decisions made by companies to provide practical insights into your assignment. This will not only demonstrate your understanding of the concepts but also add depth to your analysis.

Seek Expert Help if NeededIf you find yourself struggling with complex capital budgeting concepts, seeking assistance from experts can be beneficial. Online resources and professional help, such as Managerial Accounting Assignment Help Online, can provide valuable insights and guidance. These resources can help clarify doubts, provide additional examples, and ensure you’re on the right track with your assignment.

Review and ReviseAlways review your work thoroughly before submission. Ensure that your analysis is accurate, well-organized, and free of errors. Revising your assignment helps catch any mistakes and improves the overall quality of your work.

Conclusion

Mastering capital budgeting is essential for excelling in managerial accounting assignments. By understanding key strategies, applying evaluation techniques, and considering both financial and non-financial factors, students can effectively tackle their assignments and make informed investment decisions. Remember, if you encounter challenges, leveraging resources like Managerial Accounting Assignment Help Online can provide the support you need to succeed. Embrace these strategies, apply them to your assignments, and enhance your understanding of capital budgeting to achieve academic excellence.

Reference: https://www.domyaccountingassignment.com/blog/capital-budgeting-managerial-accounting-tips/

#education#college#domyaccountingassignment#accounting#accountingexpert#accounts#managerial accounting assignment help#university student

0 notes

Text

How to Use Our Monte Carlo Simulation Assignment Help Platform?

Monte Carlo Simulation is a statistical method used to generate random variables for modeling uncertainty and risk of a particular system. The random inputs or variables are modeled through various probability distributions like lognormal, normal, uniform, triangular, PERT, discrete, etc. Monte Carlo simulation has a number of benefits over the standard single-point or deterministic analysis in that:

The results provided show both what could happen and the likelihood of it to happen

Since the data generated by Monte Carlo is detailed enough, it is easy for statisticians to draw graphs to represent different outcomes as well as their likelihood of occurrence. Having this information is important because it helps in communicating findings to other stakeholders.

It is difficult to see the variables that affect the outcome the most when using deterministic analysis. When using Monte Carlo simulation, it is easy to find out what variables have the biggest impact on the results.

When using Monte Carlo method it is also possible to model relations between input variables

Monte Carlo simulation has enabled researches to perform multiple trials and determine potential outcomes of an investment or event. It creates a probability, risk assessment, and distribution for a given event or investment.

Steps for Using Our Assignment Help Portal

College students often feel troubled when dealing with Monte Carlo simulation assignments and mostof them result in seeking help with the same. There are those who have contacted Statistics Assignment Experts for Monte Carlo simulation assignment help and managed to solve their projects’ problems through the assistance of our professionals. If you too want to hire our Monte Carlo simulation homework help experts for the job, here are the quick steps you should follow:

1. Tell us more about your assignment: To do this, just upload your requirements through our online portal or send us an email with details of what you want done. Make sure to mention the date or time you need the solution sent to you, the kind of paper you want us to prepare, any special material you want us to use for research, and any other information you may find necessary for successful completion of your project. We will read everything keenly and send you a quote with the amount you should pay for the task.

2. Make payment: The next thing you need to do to acquire Monte Carlo simulation assignment help from us is paying for the task. Don’t worry; it is usually a very small amount so just proceed to our payment page, choose the method you feel the most convenient from the options provided, and make your fund transfer. Once the transaction is verified, you will receive a confirmation method and your project will be assigned to one of our experts immediately.

3. Wait for delivery: Once you have made your payment, you don’t need to do anything else other than wait for our Monte Carlo simulation homework helpers to deliver the assignment. All solutions are delivered before the stipulated date or time.

0 notes

Text

#Monte Carlo Simulation assignment#Simulation assignment help#best assignment expert#online assignment writer#assignment help#college#university#writing#united kingdom#management#assignment

0 notes

Link

Are you looking for Monte Carlo Simulation Homework Help? Contact us today! We are available 24x7 online and students may contact us by mail, by phone call or by joining on live –chat platform.

0 notes

Text

Ftmo Robotic Ea - The Great Ftmo Passing Ea

Ftmo is one of the leading proprietary buying and selling firms within the global. It is also one of the first firms to provide trading robots to its clients. The robot is designed to help make your money give you the results you want rather than you running to your money. The ftmo robot is likewise designed to be a passive profits device. The robot augments your trading capital via 25% each four months. The ftmo robot ea additionally incorporates an set of rules for statistics series and slippage manipulate. Those features permit the robotic to perform better on its personal account. It has additionally been tested in a monte carlo simulation of numerous data feeds. It has additionally reportedly passed a hard and fast of strict standards for historic data. The ftmo mission is a free threat to test your mettle at a prop firm. In reality, a hit candidates will acquire a $200k buying and selling account. Buyers are required to trade a minimum of 10j every level to finish the venture.

After this, ftmo will electronic mail you a certificate of completion within 24 hours. This is a small price to pay for the chance to make numerous cash. The robot's exceptional performance is completed on the gbp usd pair. The best ftmo passing robot is a specialized bot designed for the ftmo proprietary buying and selling company. It has several features that improve the possibilities of triumphing the ftmo challenge. Its maximum magnificent feature is that it predicts marketplace moves with high probability. Some other characteristic is the fact that it could reveal extraordinary overall performance even if it is going in opposition to the trend. The exceptional ftmo passing ea is likewise able to do some thing even higher. The robot can enhance your chances of prevailing the ftmo assignment by way of a thing of five. It makes use of the today's in generation and algorithms to increase your probabilities of prevailing. It also has a patented approach to decrease your losses. If you want to know more about forex flex, you can find its details on forexflexea.com.

The robotic uses a technique of hedging called the equity protector. The robot is likewise capable of make its personal trades if the marketplace traits towards it. The ftmo ea also has a characteristic called the equity putting that is designed to maximize the profitability of every trade. The ftmo ea is likewise capable to utilize a information filtering function to maximize income. The excellent ftmo passing robot additionally has some different functions to its credit. One characteristic, the ftmo smart, permits the robot to find out about your buying and selling fashion and make suggestions based totally to your beyond overall performance. Another feature is the ftmo ea's algorithm for measuring slippage and improving broking execution. The ea also can be configured through our personnel.

Every other characteristic, the ftmo assignment, requires no modifications to your account. The first-class ftmo passing clever has additionally been examined through real buyers. The robotic has been able to reveal astonishing overall performance even if it is going in opposition to the fashion. The ea additionally comes with a loose demo account for a tribulation run.

1 note

·

View note

Link

0 notes

Link

0 notes

Text

Top Markov Chain Monte Carlo

Top Markov Chain Monte Carlo

Markov Chain Monte Carlo (MCMC) is a statistical technique used to estimate the parameters of a population. It is an attempt to model the probability distribution of data as a function of some states. MCMC is commonly used in the field of statistics and mathematical modeling, but it can be applied to other areas as well. Are you looking for top Markov chain monte Carlo assignment help? Worry no more! We got you covered!

Top Markov Chain Monte Carlo

What is Markov Chain Monte Carlo (MCMC)?

For example, if we want to estimate the mean and variance for an entire population, we can apply MCMC on it and obtain estimates for each variable for each state. The first step would be to calculate confidence intervals for each variable and then we could compute means and variances by applying the algorithm repeatedly until we obtain statistically acceptable results. Markov chain Monte Carlo is one of the most important techniques for analyzing data sets. It is used to simulate the behavior of a population, and to test hypotheses about the distribution of data. A Markov chain is a sequence of states or states-possible values that are determined by an initial state parameter, which are then used to generate subsequent states. While generating an event-history record in a simulation might be simple, there are situations where generating an event-history record for all possible outcomes is impossible or very difficult. For instance, if you have an algorithm that will randomly select for you for each day at which you want to run your simulation based on historical data, this would require having access to every single day in the past history. Markov chains are a well-known abstraction of the generalization of the deterministic finite state machine. They have been applied to many different problems including generating images, generating medical images, and solving optimization problems. While I have already written a paper on Markov chains as a generative model for image generation, this article is more about using Markov chains as a tool for content generation. MCMC is an algorithm that has been used extensively in the field of statistical modeling. It is also used to optimize the quality of results produced by algorithms. It is important to understand that MCMC isn’t only used for modeling. We can use it for example in shipping industry to make sure that each parcel will arrive at their destination on time. Or more simply, there are many problems associated with shipping which are solved with MCMC. We can also use it to generate content ideas for a particular topic or niche or even just generate random numbers by selecting one of them and check if that one produces better results than others with the help of MCMC algorithm. Markov chain Monte Carlo (MCMC) or Markov chain Monte Carlo (MCMC) is an algorithm developed by John Hopcroft, the father of statistics, in 1972. MCMC is based on the estimation of likelihoods (or probabilities) of various random distributions by means of Markov chains, which are a special type of probability distributions. The word 'Markov' is derived from the Russian word 'марков' meaning "mathematician", and 'k' meaning "number". The algorithm utilizes a stochastic process - the limit-cycle method - to generate random numbers that represent sequences that are approximately Gaussian distributed. The algorithm uses various hyperparameters to model the distribution parameters that describe this distribution. It can be used to find statistical properties, such as

How does Markov Chain Monte Carlo work?

Markov chain is a type of stochastic simulation for which the probability that each state in the chain will be observed in some future time is given by a function of time. A typical example would be the weather forecast where the probability that it will rain today is given by a function of time. Since it's an inverse problem, MCMC can be solved efficiently via gradient descent methods. We can think of MCMC as solving a "continuous" optimization problem, which means that we are trying to find something called an "optimal" value for some continuous variable. The continuous variable in this case is temperature measured at an airport terminal. The plane takes off and reaches its cruising altitude after which it returns to earth and lands again at the same airport again later on in another day. It is widely accepted that the implementation of MCMC algorithms in AI is difficult to achieve. Many researchers have tried to solve the problem but they have failed because it requires too much computing power and time. Recently, Intel has developed a technology called Real-time Markov Chain Monte Carlo (R-MCMC) which can do MCMC estimation using only one processor instead of having to service more than one processor simultaneously. However, Real-time Markov Chain Monte Carlo (R-MCMC) still needs more resources than other techniques used by AI writers. R-mcmc is also not suitable for producing content at scale because it does not run-on large data sets or complex datasets designed for statistical analysis because it requires high precision.

How Is Markov chain used for Machine Learning?

Markov chain models are used for Agent-based modeling algorithms. They are used to create intelligent agent-based applications which can take decisions based on situations under consideration. This includes actions that can be taken by an agent without input from other agents. This is where AI writing assistants play their greatest role because they help in generating content ideas, which can be evaluated and acted upon by other agents without human intervention. “Markov chain are used in various fields. They are used for predicting future data, for learning data, and so on. We usually know how to write code based on these mathematical rules but now we can use this knowledge to implement algorithms at a higher level. Machine Learning is the term given to these algorithms that tries to predict the next state of an object using an algorithm.

Markov Chains & Alpha Monte Carlo in Artificial Intelligence

Markov chains and Alpha Monte Carlo methods are used in investigative forensic assignments. An AI system with these tools is able to handle the task of analyzing raw data, which can be difficult to interpret or impossible for human analysts. These technologies will allow sensitive and confidential information to be analyzed more easily and in a secure way in an investigative setting:

Markov Chain Monte Carlo Estimation Algorithm

Markov Chain Monte Carlo Estimation Algorithm (MCMC) is a well-known and popular algorithm for robust estimation of distributions. Compared to other approaches, MCMC is known as non-parametric because it has no inherent assumptions about the distribution of the data. It has been widely used for many different types of forecasting tasks; such as linear regression, polynomial regression, moving average, power law, etc. The MCMC algorithm is composed of three major steps: 1) Randomly sampling data from a sample space 2) Estimating conditional distributions by sampling from random subsets Markov Chain Monte Carlo (MCMC) algorithm is used for estimating the parameters of a Markov chain. CME is a statistical software that enables the computation of the probability density function (pdf) of Markov chains. Simply put, MCME is used to estimate the PDF of a stochastic process with parameters set by the user.

Conclusion

Machine learning is a very powerful technology. It can take in huge amounts of information to have an accurate simulation of the world around us. This allows us to learn about our world, create models based on it, and even predict the future. The field of machine learning is growing rapidly, and there are many different types of machine learning algorithms that are being developed to take advantage of these advances. The algorithms can be used for both supervised learning (e.g., classification) and unsupervised learning (e.g., search).

Why Hire our experts?

Hiring academic writers is a decision that should be made with care. It will be helpful to consider the following points: - If you hire an expert, you can expect great results. They will produce quality and unique content and help users to learn and grow much faster. - You can save money on time and effort as they work on several projects simultaneously and deliver high-quality content much faster than average human writers could. Our experts have the above qualities. Get our services today. Click to Order

Top Markov Chain Monte Carlo Read the full article

0 notes

Text

AI, Machine & Deep Learning Training Institute In Hyderabad

360DigiTMG envisions to fill the hole of expert expertise in analytics, Data Science and machine studying and provide greatest profession opportunities for tech enthusiasts. It supplies learners with classroom training, workshops, consulting, mentoring sessions and hiring options to supply the most effective studying expertise. 360DigiTMG is one of India’s leading Data Science coaching institutes, providing training in analytics, Data Science, machine studying, AI & huge information globally. It has trained over 10,000 professionals in 25 international locations in these areas. It is an IIM-IIT-ISI alumni enterprise for constructing capabilities in Data Science & AI and works with over 75 main corporations including Fortune 100 firms.

Our self-paced training costs about ₹15,048, while our on-line instructor-led training for a similar costs ₹22,743. It was a wonderful experience becoming a member of this Data Science course at 360DigiTMG. According to me, for studying cutting-edge applied sciences, 360DigiTMG is the proper place. I signed up for 360DigiTMG's Data science course on-line certification once I realized that it is an excellent spot for learning new applied sciences. 360DigiTMG’s course completion certificates will be awarded to you when you complete the project work and rating a minimum of 60 % marks within the quiz.

360DigiTMG is a pioneer and a leading name in the Edutech Industry. It has a reputation of providing high-quality coaching solutions since 2011 and has been honing abilities true to its established mission statement. They are led by a group of McKinsey, IIM, ISB, FMS and IIT alumni having wealthy business experience. This ranking is a result of the in-depth in-house analysis, inputs from colleges and trade experts and conducting a survey of the place we took inputs from Data Science lovers who have already taken these courses. Master in-demand expertise and obtain your career targets with our world class school and in-depth courses. We are dedicated to supply cost-effective and superior programs to candidates.

We may help connect you with a bank so you might pursue the graduate stage certification without hassle. The graduate stage certification in Data Science is a 7 months program taught over the weekends, to accommodate working professionals’ schedules. Students who have a bachelors in engineering and fundamentals of computer programming expertise are eligible to apply to this graduate degree PGP certification. Students will study linear programming, monte carlo simulations, and genetic algorithms together with receiving hands-on periods using Excel and KNIME.

360DigiTMG presents over 15 job oriented courses from experienced professionals. Once you've completed the coaching, abundant alternatives are waiting for you all over the world. Attaining expertise in Data Science enables you to be one of the most demanding professionals at present incomes with a very sturdy wage base. I thank Apponix for serving me to overcome the fear of finding out the complicated concepts in Data Science. In this project, we'll build a predictive framework that is ready to infer the final destination of taxi rides based on their partial trajectories.

Even when you can’t pay the entire amount at one time, we encourage you to pay in two instalments but don’t stop you from enrolling. 360DigiTMG is totally centered on your learning, gaining data, and getting a great job. 360DigiTMG also encourages you for this coaching by offering you 24/7 support, permits you to pay in two instalments, and most importantly, it can be designed based upon your specific wants. This module deals with the fundamental ideas of data structures and knowledge visualization. In this module, you will learn the basics of Data Science and R programming, Importance of Data Science. Learn the concept of business analysis and descriptive statistics of knowledge analysis.

three.2 You will deploy multiple regression and notice down the MPG for automotive make, model, velocity, load conditions, and so on. three.1 You will understand the way to evaluate the miles per gallon of a car based mostly on varied parameters. 360DigiTMG has assisted me throughout my journey from being a brisker to a Data Engineer. They made concepts simpler to understand which has helped me make a clean change. This metropolis is considered one of India’s high IT hubs and has a number of the largest tech corporations. As a result, the demand for Data Scientists is comparatively greater than the other cities.

The prediction of compressive power of concrete based on uncooked supplies composition and age using statistical models in order to reduce manpower, reduce time consumed and improve the quality of concrete. The project aims to Identify pathological components that affect the risk of CHD and predict danger for the next 10 years primarily based on present knowledge. Students might be taught the method for building efficient and advanced data visualizations using Python and Tableau.

360DigiTMG provides quality and real-time coaching courses on big data, DevOps, cloud computing, machine learning, AI, blockchain, salesforce, Data Science, software testing, and extra. The institute has helped many freshers, software program engineers and dealing professionals get placed in noteworthy firms. At 360DigiTMG, you probably can enroll in both the instructor-led on-line training or self-paced training. Apart from this, 360DigiTMG additionally presents company coaching for organizations to upskill their workforce. All trainers at 360DigiTMG have 12+ years of relevant industry expertise, and they have been actively working as consultants in the identical area, which has made them subject matter experts.

Mock Interviews Mock interviews help you in understanding your strengths and areas you want to give attention to bettering to clear interviews. Built-in Support Instructional design that helps you master programming abilities on this difficult and accelerated course. Job Assistance 80% of the job market is hidden and we will help deserving candidates to find the best alternatives. Be prepared with the skills before the business adopts the know-how. Excellent coaching delivery expertise with a capability to current info well. Thank you 360DigiTMG for giving me such better training in Data Science.

data science training in hyderabad

This PGP certification is designed for school students from completely different engineering backgrounds who want to perceive applications of Data Science in their area of interest in engineering domains. The curriculum covers 10 significant programs and 53 real-world assignments and projects, together with 1 CAPSTONE project. Also, you'll have a complete entry to the IBM Watson Cloud Lab for Chatbots. Huge information is available out there, however the problem lies in analyzing this database that reveals the road map for enterprises to develop. These days, firms are in tough competition to leverage big data analytics and Data Science to get the nerves of users first, to benefit from the primary mover’s advantage. This graduate level certification in Data Science will equip college students to utilize current frameworks and algorithms to resolve problems and build products/services particular to their specialised engineering domain.

Although the demand is rising, there is an acute shortage of expert professionals.

There are varied options out there based mostly upon your availability to take up this coaching -- Self-paced training, Online instructor-led training, and company training. Data science coaching from Apponix helped lots in pursuing a greater profession. Unlike different online training, it offers a feeling of classroom expertise.

These SMEs have designed the course in such a fashion that even in case you are from a non-technical background and have virtually zero data of this area, you can nonetheless learn and adapt all ideas easily. Also, we offer practical experience through real-time tasks that enable even freshers to simply grasp the ideas. The first milestone for a Data Scientist aspirant is to study programming languages similar to Python, R and get hands-on analytical tools such as SAS. The next stage could possibly be getting data from massive data analytics and statistical tools, for instance, Hadoop, Spark. Yet one other milestone could be understanding of visualization, charts, maps, and reports to analyze the massive chunk of knowledge.

Enroll into a machine learning training institute in Hyderabad and get hands-on experience on the latest applied sciences by world-class faculty. We inform our students about entrepreneurial abilities for success & being a data science course in hyderabad , we additionally supply soft skill coaching to students. 360DigiTMG provides the most credible certification coaching in Data Science to realize one of the highest paying job-roles present right now. The deficit of skilled professionals in this area has made this most promising career with quite a few alternatives and rising salaries. According to payscale.com, in India, common wage a data scientist earns is around 9-10 lakhs.

360DigiTMG is providing you essentially the most up to date, related, and high-value real-world projects as a half of the coaching program. This way, you probably can implement the education that you've acquired in a real-world industry setup. All training comes with multiple projects that thoroughly take a look at your expertise, studying, and sensible knowledge, making you fully industry-ready. Since it involves numerous features of superior applied sciences, similar to Machine Learning, Deep Learning, and Artificial Intelligence, among others, it is comparatively tough to be taught. However, 360DigiTMG’s Data Scientist coaching is offered by specialists in this domain who've plenty of expertise in the subject.

The PGP in Data Science is designed for newly graduated students and working professionals. The courses are designed such that people may proceed working whereas finishing the program requirements. 360DigiTMG doesn't immediately forward resumes to any companies or recruiters. However, we do have a placement group that can conduct a quantity of mock interviews and will assist you in updating your resume to arrange you for job interviews. The team thus helps you land a lucrative job in the Data Science area.

We additionally don't put a restriction on the variety of tickets you possibly can raise for question decision and doubt clearance. It doesn't matter in which area of Hyderabad you're in, be it Ameerpet, Gachibowli, HITEC City, Secunderabad, Kukatpally, Dilsukhnagar, Madhapur, Kondapur, Uppal, Banjara Hills, Begumpet, Somajiguda, or wherever. 360DigiTMG selects material specialists from high MNCs, who've at least eight to 12 years of expertise within the area, as instructors.

The trainer was an experienced professional and coated concepts with real-time examples. This made me simple to know and I totally loved training classes. Best technical coaching in the city offering an unbeatable platform for forming sturdy theoretical and sensible data with immense practical experience. We have chosen a versatile mode to impart information to the candidates offering each online and offline classes for all types of courses. "It’s a cost-effective institute where real-time consultants impart information to students through excellent principle and sensible training."

For more information

360DigiTMG - Data Analytics, Data Science Course Training Hyderabad

Address - 2-56/2/19, 3rd floor,, Vijaya towers, near Meridian school,, Ayyappa Society Rd, Madhapur,, Hyderabad, Telangana 500081

099899 94319

https://g.page/Best-Data-Science

0 notes

Text

Backtesting in AmiBroker

Backtesting in AmiBroker

Before getting into any technicalities or know-how, it is important for us to know what do we mean by backtesting in Amibroker.

Backtesting is an easy process used by Traders to evaluate the Trading Ideas and provides information regarding how good is a trading system based on historical datasets. Precisely, it talks about the behavior of the trading system, risks involved in a particular trading system, and more regarding the performance of the trading system.

There is one such program AmiBroker which performs all these functions and does much more for the traders.

Introduction

To keep it simple, AmiBroker is a full-fledged professional Technical Analysis and charting tool which can be used by the traders to Analyse Market, prepare charts, and for backtesting trading strategies.

It is quite important for you to know about AmiBroker is before using it to backtest. Better make an informed decision rather than just going with a feature that you might regret later (which you won’t!)

Features of AmiBroker

Here is a list of features which are offered by the trading platform apart from backtesting–

Analysis Window –

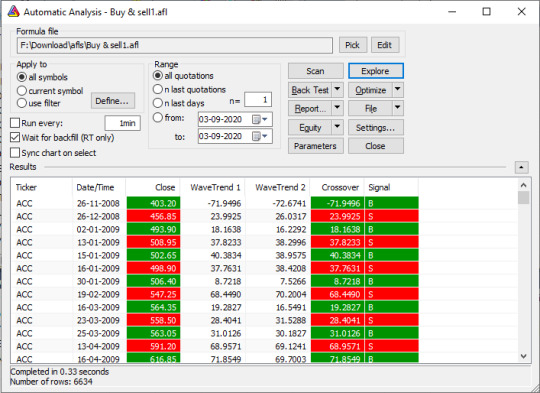

On the analysis window, you will be able to see almost everything, i.e. portfolio, walk-forward tests, optimization, backtests, explorations, Monte Carlo Simulation, and so on.

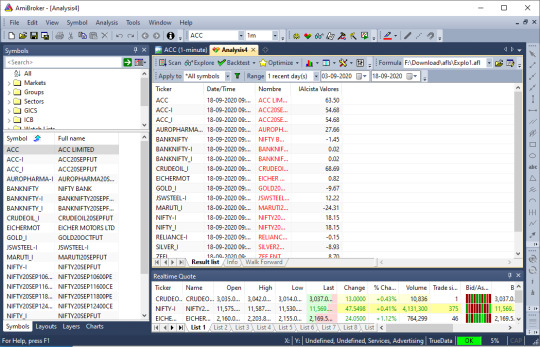

Exploration/Market Screening –

AmiBroker is a multi-purpose tool for data screening/mining which supplies programmable output with infinite rows and columns.

Charting –

This feature of Charting in AmiBroker comes with several built-in indicators, multiple time frames (which can be used as per your own convenience), drag and drop indicators, customizable parameters, object creating capabilities, etc. Sliders are the good options to modify parameters in real-time and can also customize it in various styles and gradients.

Walk-forward Testing –

It is ideal for confirming the robustness of the trading sample before and after optimization.

Multi-Threading –

AmiBroker assigns different threads for each graphics renderer and each formula chart.

Code Editor –

The code editor pairs up with parameter call-tips, auto indenting, code folding, etc. Whenever you encounter an error, a meaningful message alerts you promptly.

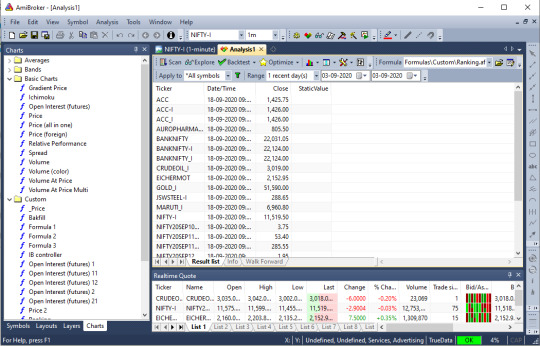

Ranking and Scoring –

It is used to perform bar-by-bar ranking depending upon the user score to find a suitable trade.

Advantages of AmiBroker

It provides the user with top-notch technical support for trading accounts.

The main features of this tool are fast array and matrix processing.

AmiBroker ensures that the traders are provided with safe and full-proof trading support in order to have 100% security and that you don’t lose money.

The features of AmiBroker are customizable and flexible.

It is the fastest backtesting tool and provides the user with a custom backtesting facility, custom metrics, rotational trading, etc. Also, it provides the user with advanced ranking, scoring, and positioning.

The most productive thing that can be done in the analysis window is to backtest the trading strategy on historical data. It helps you to gain insight into the strengths and weaknesses of the system before you begin to invest real money.

And thus, AmiBroker is a feature which can help you to save lots of money.

Writing Your Trading Rules

The first thing that needs to be done is that you must have objective or mechanical rules to enter and exit the market. This step is necessary in order to create a base of your strategy and whether or not the system matches with risk tolerance, portfolio size, money management techniques, and several other factors.

Once you have established rules for trading, you must write to them as buy and sell rules in AmiBroker Formula Language.

Backtesting

In order to Backtesting in AmiBroker, you need to click on the Backtest button in the Automatic analysis window. Ensure that you have typed the formulas which contain buy and sell trading rules. Once the correct formula is entered, AmiBroker starts to analyze symbols according to trading rules and generates a list of simulated trades. This process is rapid in terms that you can easily backtest thousands of symbols in a few minutes. There is a progress window that will show the estimated completion time. If you wish to stop the process at any given point of time, click on the Cancel option in the progress window.

Analyzing Results

When the process is completed, you will be presented with a list of simulated trades in the bottom part of the Automatic analysis window aka the Results pane. Here, you can examine when the buy and sell signals occur only by double-clicking on the trade in the Results pane. Post this, you are presented with raw or unfiltered signals for each bar where buy and sell conditions are met. If you wish to see only a single trade arrow (opening and closing currently selected trade) you are required to double click a line while holding the SHIFT key pressed down. The other option that you can choose is the kind of display by choosing the appropriate item from the context menu which appears once you click on the results pane with a right-click.

In addition to the results, you will also be provided with detailed statistics on the performance of your system by choosing the Report option.

Changing Your Backtesting Settings

Backtesting in AmiBroker makes use of predefined values for performing its task including portfolio size, periodicity, i.e. daily/weekly/monthly, amount of commission, type of trades, price fields, interest rates, and so on. These settings can be altered by the user settings window. Post changing the settings, you must remember to run your backtesting if you wish the results to be in-sync with the settings.

Advanced Concepts

Until now, we have discussed fair simple use of the backtesting. However, AmiBroker comes with a lot more sophisticated concepts and methods.

We will be listing the new introduced-features of the back tester. There you go –

AFL scripting host for Advanced Formula Writers

Enhanced Support for Short Trades

Way to Control Order Execution Price from the Script

Types of Stops in Back-tester

Position Sizing

Round Lot Size and Tick Size

Margin Account

Backtesting Futures

Frequently Asked Questions (FAQs)

Ques. 1. What skills do I require to build an effective Algo Trading Solution using AmiBroker?

Ans. 1. Here is the list of following skills you may require to build an effective Algo Trading Solution using AmiBroker –

It is necessary for you to have knowledge in AmiBroker AFL Programming, Backtesting, Optimization, System Validation of Training

You must have an understanding of the Broker API’s/Bridge Function and knowledge in the know-how of integrating with AmiBroker.

It is essential to have knowledge about VPS (Virtual Private Servers) and how to remotely connect and deploy AmiBrokers, Trading Terminal, and Bridge Components in the servers.

You have knowledge about Setting Risk Control Parameters and Order Execution Logic.

You must take data backup and trade logic backup at regular intervals.

It is necessary to use a statistical test like Monte Carlo Analysis to determine if the trading system has broken.

Ques. 2. Are there any additional requirements to build an effective automated trading system infrastructure?

Ans. 2. Yes, you do need additional requirements to build an effective automated trading system infrastructure.

Here are these additional requirements –

You must have a Good Historical Data for Backtesting.

It is necessary to have a Good Realtime for Live Trading.

You should have Trade Execution Capabilities, i.e. market order, limit order, bracket order, cover order, etc.

It is essential for you to have a good understanding of money management and types of systems, i.e. trend following, mean reversion, pattern recognition, seasonal, cynical, and so on.

It is important for you to have a sense of risk management in terms of what to trade, symbol level stop-loss, portfolio level stop-loss, fnoban check, panic button square-off, etc.

You require capabilities in position sizing, i.e. partial profit/loss booking, adding positions to the existing trade (scale).

Ques. 3. What availabilities does one need after taking your system live?

Ans. 3. You should have the following availabilities after taking your system live –

Ensure that the trading model that you use is free of glitches and that the system is tradeable.

You should have enough time to compute and place orders.

The assumptions that you make regarding trading costs, i.e. brokerage, commissions, slippage, taxes are realistic.

Ques. 4. Are there any disadvantages to use AmiBroker?

Ans. 4. Well, not technically disadvantages but yes, there are a few issues with AmiBroker which one must know –

This tool is not really suitable for those who aren’t tech-savvy and are unaware of the programming languages such as HTML, C/C++, etc.

This tool works best for those who are keen to write their own codes.

Since the tool is fully customizable, AmiBroker does not have a standard template, to begin with. It might not be an issue for an advanced coder, however, it can be quite cumbersome to come up with a new code or research about it.

The managing of quotes takes a lot of time.

It isn’t practically possible for you to run two or more databases per instance/session.

AmiBroker isn’t suitable for big traders who transact in lump-sum money and not for one-time traders or small traders.

AmiBroker is one of the best when it comes to coding, programming, developing, however, it does not satisfy those who are from a non-technical background. One requires extensive training before using the analysis and charting tool.

Even though AmiBroker has quite a number of features and tools, that makes it the trading process safe and satisfying.

We are hoping that in neat future AmiBroker will become popular among the non-technical users as well.

Till then, keep trading!

#Amibroker#Analysis#Backtesting#Backtesting in AmiBroker#charting#indicators#Live Tradin#market#Real Time Data#Technical Analysis#Traders#True Data

0 notes

Text

Blackjack Background and Card Counting

Blackjack

Background lo khung 2 ngay Blackjack turned into derived from the French game vingt-et-un or twenty-one which originated inside the 1700s. The Blackjack call passed off as casinos inside the USA, in order to attract players offered odds of up to ten to at least one to any player who is hand consisted of an Ace of spades and a blackjack (jack of spades or clubs).

Blackjack is one of the most popular on line casino video games because of the simple reality that BlackJack like Poker is a sport of success in addition to skill and therefore the on line casino may be continuously overwhelmed with the aid of a professional player the usage of a right strategy. More complicated techniques which include 'card counting' described below have brought to the sport's popularity.

In 1956, a paper turned into published via Baldwin, Cantey, Maisel, and McDermott inside the "Journal of the American Statistical Association" laying out a set of tips for the play of the sport, those hints had been very near modern fundamental strategy. The following year, they published a manual for the general public with this machine of play, but it attracted little interest till, Edward O. Thorp (PhD), saw the paper and understood that there were components of the sport that have been neglected in the beyond. The first being that the composition of the deck changed with every card dealt, additionally, a few combinations of the final playing cards favoured the house and others favoured the players.

In 1962, Dr. Thorp posted his now famous e book, "Beat the Dealer", which contained a easy yet profound message that decks of cards have reminiscence. Each hand is dependent on the make-up of the deck at that point and by listening to the cards already played, the participant can almost are expecting what will be appearing inside the deck subsequent.

Simulation and Card Counting

With the help of a laptop, Thorp did a statistical evaluation called the Monte Carlo simulation and observed that 10's and Aces remaining inside the deck put the participant at a bonus, while five's and 6's being left in the deck placed the provider at an advantage. Thus, card counting become born.

If the participant should hold song of the playing cards left in the deck, they may determine the way to guess on every hand. For instance, if there are many 10's and aces left they might be smart to guess excessive, and if there are lots of fives and sixes left they might want to wager low.

Card counters make approach adjustments primarily based on the ratio of high playing cards to low playing cards. These modifications to their betting and playing method can provide them a small mathematical benefit over the house. Card counters, do not rely on notable reminiscence, so that you can be counted cards, because they're now not tracking and memorising specific playing cards. Instead, card counters assign a point rating to every card they see and then song only the full rating. (This rating is referred to as the "rely".)

Different card counting structures assign distinctive point values to the various cards. One of the maximum commonplace systems, the Hi-Lo Count, is a good example of a counting device. In this machine, the cards numbered 2 through 6 are counted as +1 and all tens (which encompass 10s, jacks, queens and kings) and aces are counted as -1. The cards 7, eight, and nine are given a depend of 0. The Hi-Lo device illustrates a "level one" counting gadget; extra complicated "level two" counting systems assign +2 and -2 counts to sure cards. However any possible gain won inside the accelerated accuracy of a "level 2" gadget is usually offset with the aid of a greater frequency of errors because of the gadget's more complexity.

Another usually used card counting system is the "K-O", an unbalanced card counting system derived from Arnold Snyder's unbalanced Red 7 be counted, posted in 1981. The first blackjack researcher to post an unbalanced card counting gadget became Jacques Noir, in his 1968 ebook Casino Holiday. Unbalanced card counting systems do away with the need to estimate remaining decks to be dealt, a not unusual supply of player mistakes in card counting.

A point to word is that both land based totally and on line casinos, are minimising the card counters benefit by means of both presenting decreased odds on blackjack hands from 3:2 to six:5 on unmarried deck video games, or by way of shuffling the packs randomly earlier than the give up. Online casinos in standard shuffle the packs after every recreation. Nevertheless if a participant makes use of a legitimate simple approach they stand a much extra chance of optimising their chances in minimising the casinos gain. This is meditated inside the online on line casino payout reports, the payout percentage for BlackJack, wherein in my opinion listed, is commonly inside the pinnacle two video games.

0 notes

Photo

www.allhomeworkassignments.com offers the best Monte Carlo homework help to students who are struggling with their assignments. We are a one stop solution for all your Monte Carlo assignment related tasks. Place your order with us now.

https://www.allhomeworkassignments.com/key-statistics-concepts/monte-carlo-simulation-assignment-help.html

#Assignmenthelp#MonteCarloassignmenthelp#MonteCarloonlinehelp#MonteCarlohomeworkhelp#MonteCarloprojecthelp#onlinehelp#homeworkhelp

0 notes