#OilStocks

Text

Oil Stocks: A Sustainable Investment for a Greener Future

#attractiveinvestmentopportunity #carbonFootprint #Chevron #dyingindustry #environmentalresponsibility #ExxonMobil #longtermgrowth #longtermprospects #OccidentalPetroleum #oilindustry #oilstocks #predictableinvestmentenvironment #renewableenergysources #renewableenergytechnologies #stabilizeoilprices #sustainability #valueandgrowthopportunities #volatilityofoilprices

#Business#attractiveinvestmentopportunity#carbonFootprint#Chevron#dyingindustry#environmentalresponsibility#ExxonMobil#longtermgrowth#longtermprospects#OccidentalPetroleum#oilindustry#oilstocks#predictableinvestmentenvironment#renewableenergysources#renewableenergytechnologies#stabilizeoilprices#sustainability#valueandgrowthopportunities#volatilityofoilprices

0 notes

Video

youtube

Oil Volatility Presents "Buy" On Exxon #stockinvesting #oilstocks #oilma...

0 notes

Text

Stocks to turn Ex-Dividend Next week.

Have you invested in any of these stocks?

Join our free telegram channel now.

The link is in the bio.

Follow @profinserv For More Market Details

#stockmarket #stockmarketindia #trading #stocks #dividendstocks #coalindia #shipbuilders #oilstocks #finance #financestocks #investing

instagram

0 notes

Text

In Focus: Oil to $100

Almost a year ago I advised investors to avoid this trade. My warning came during Wall Street's celebration of Warren Buffett's deal to purchase Dominion Energy's (D) natural gas and transmission assets. Wall Street was happy to see a deal taking place during the pandemic and also ecstatic that Buffett was spending some of the $36 billion sitting on Berkshire Hathaway's (BRK-A) balance sheet at the time.

Several months before my advice and Buffett's purchase, oil prices had turned negative making me question the future of oil. Others however only saw really cheap oil prices. At the time of my advice to avoid the oil trade the U.S. Oil Fund (USO) was trading for just under $30 per share, a year prior, in July 2019 it was trading for ~$93 per share. Investors who ignored me and invested in USO are up more than 60% after taking advantage of cheap oil prices in 2020. That's a very nice win for a 12 month hold.

My instinct to avoid oil trades wasn't because I disliked oil or oil companies, it's because I saw alternative energy stock prices rising. I also saw electric car manufacturer Tesla (TSLA) growing in popularity, and several new electric vehicle companies ready to break into the market. I also expected the work-from-home phase to continue for the foreseeable future, prompting less demand for gas.

Increasing Oil Prices

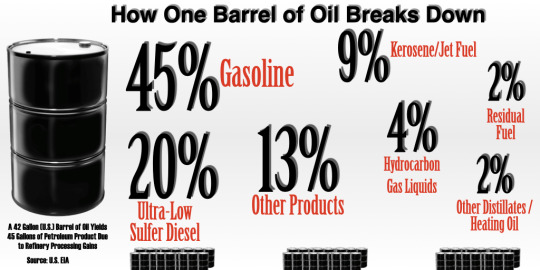

In 2021 gasoline producers in the United States have wisened up, they no longer drill all day and stockpile oil all night. Instead, they've taken a wait and see approach by watching the national demand for gas and oil and waiting to drill. This has translated into higher prices at the pump for consumers and a higher price per barrel of oil for investors, because there's no longer an oversupply of oil and gas.

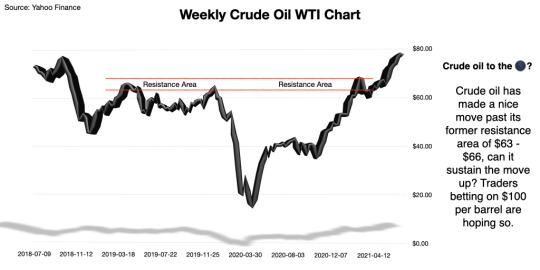

This time last year Crude Oil WTI (CL=F) was trading between $40 and $41 per barrel. Oil supplies were high and demand was low with many parts of the U.S. and the world still in lockdown. Now, crude oil is trading at $74.63 per barrel as of this writing and supplies are dwindling as demand ramps up.

The question for investors now is can oil hit $100 per barrel again? Analysts at Bank of America seem to think so. Analysts for BofA believe oil prices could hit $100 per barrel by mid 2022. Crude oil WTI hasn't seen $100 a barrel since July of 2014.

Bank of America believes that the work-from-home trend is also a work-from-car trend, and that people who are working from home also have errands to run, and then there's the pent up demand for travel. Both cases create an increase in demand for oil.

The post pandemic reopening has seen Americans as well as others around the world take road trips and flock to the airports for much needed getaways and reconnection with family and friends. This need to get away has caused gas prices to jump from $2.19 per gallon a year ago to $3.22 per gallon for the week ending July 5, 2021 according to the U.S. Energy Information Administration (EIA).

For investors playing the markets for the $100 barrel of oil there are a lot of balls in the air that they need to keep an eye on like OPEC+ and Saudia Arabia.

OPEC's proposal to add 400,000 barrels per day to the oil supply through the end of this year was rebuffed by the United Arab Emirates. The UAE is seeking an updated production quota for itself, and isn't willing to agree to an OPEC increase without securing a favorable production increase of its own. Assuming all OPEC+ players stay in line with the current agreement, global oil supplies could remain below demand, keeping oil prices high.

Last year, OPEC and Russia failed to come to an agreement on a production cut, which was intended to level out inventories created by the shrinking demand caused by the coronavirus pandemic. When Russia refused to cut production Saudi Arabia flooded the markets with cheap oil. Saudi Arabia's move last year displayed that OPEC members are willing to take matters into their own hands if necessary.

Investors also have to keep an eye on the weather. In the summer of 2007, Hurricane Humberto caused refineries in the Port Arthur, Texas region to shut down which created supply issues that sent oil to over $80 a barrel, a 31% increase from where it started the year in 2007.

The National Oceanic and Atmospheric Administration (NOAA) predicted 13 to 20 named storms and three to five hurricanes in 2021. So far we've seen five tropical storms according to the Palm Beach Post.

A major tropical storm or hurricane could add to the oil supply issues and push oil prices to the triple digits once again. Not that I'm advocating for a hurricane or even triple digit oil prices, but the reality is, with a bit of bad luck, we could get back to the $100 per barrel price soon.

What's in the way of the $100 Target

There's the coronavirus, the Delta variant has been another headache for some countries in addition to the headache already created by the original strain of the coronavirus. Delayed re-openings and more lockdowns could impact global oil demand. While the United States is on its way to a full reopening, places like the U.K. and Australia are still having to lockdown to contain the spread of the Delta variant.

Another round of major lockdowns could bring us back to where we were in 2020 with a large supply and little demand for gas and oil.

Going back to the OPEC / UAE issue, former U.S. Energy Secretary Dan Brouillette says we could see a collapse in oil prices from current levels if countries were to go off and "do their own thing, or do their own production."

Brouillette, did also state that oil could easily hit the $100 per barrel mark or even higher in the aftermath of the failed OPEC+ talks.

While oil investors would love to see another 30% plus gains in oil prices this year, the $100 barrel of oil comes with some downside for oil producers. At $100 a barrel, governments could be motivated to increase their investments into electric cars and alternative energy. Higher gas prices could force traditional combustion engine car drivers to start shopping electric.

Being a long term investor my instinct is still to avoid the oil trade. I don't see American refiners maintaining a wait and see approach for a sustained period of time. I believe their instincts will kick in and they'll start pumping out oil and in turn create more supply than demand. I also think after the initial wave of what I call reopening travel - travel to make up for not traveling in 2020 - has subsided, oil will find its way back to around $50 - $60 per barrel.

I'm still on the train of thought that alternative energy is the future, maybe not this year, or the end of next year, but it is the future. I have a fear of being stuck in an oil trade when the first functional electric plane rolls out or being in an oil trade on the day EVs outsell gas powered cars. For those reasons and reasons similar to those I will miss out on oil's possible run to $100.

#oil#OilStocks#Stocks#Investing#Investments#WallStreet#StockMarket#Oil Market#Commodities#Money#Investment Education#Financial Education#Tesla#WarrenBuffett#OPEC#saudi aramco

5 notes

·

View notes

Photo

More power to Oil #russai #oilindustry #oil #oilstocks #oilcompany #putin #vladimirputin #ukraine #MarketBlade (at India) https://www.instagram.com/p/CaeZ5f9BN_6/?utm_medium=tumblr

0 notes

Photo

West Texas Intermediate oil: - It describes a light-weight oil with relatively low sulfur. While it’d be produced in West Texas, the WTI designation are often designated to any crude which will meet the standards of being a light-weight sweet crude with the “light” aspect being defined as API 41 gravity and sulfur content of approximately 0.4%, which would make it “sweet.”

WTI is that the crude that’s the idea for the crude contract on the NYMEX division of the CME. The delivery point for that crude isn’t actually in Texas; it’s at the pipeline and tank gathering point of Cushing, Oklahoma. Crudes that meet the essential specifications of WTI are often delivered into the contract albeit they’re not produced in West Texas.

WTI was the primary actively-traded crude contract, launched on NYMEX in 1983. It was considered the key benchmark for several years until it had been disp

0 notes

Link

Oil prices rise on Tuesday on expectations of a recovery within the global economy after the U.S. Senate approved a $1.9 trillion stimulus bill and on a possible drawdown in crude oil inventories within the United States , the world's biggest fuel consumer.

0 notes

Text

Energy stocks are hitting new highs, but some investors are concerned about a pullback

#energystocks #fossilfuelstocks #gasstocks #oilstocks #renewableenergystocks

0 notes

Text

War Room 2020: Which Commodity Stocks to Own During Conflict

With tensions in the Middle East rising we examine what commodities and stocks to own during conflict, it's your financial insurance policy. #stocks #oilstocks #goldstocks

Read the full article

#BTO.TO#CNQ.TO#CVE.TO#CXO#DGC.TO#EDV.TO#EOG#EPD#Gold#GoldStocks#NGD.TO#OGC.TO#Oil#OilStocks#PXD#SSRM#SSRM.TO#War

0 notes

Text

Denbury Resources Is in a Spot of Bother

Until and unless there is an improvement in oil prices, it makes sense to stay away from Denbury Resources (NYSE: DNR) because it lacks upside potential. #oilstocks #energystocks

Read the full article

0 notes

Photo

Oil prices fall amid rising U.S. production @wsj #oilstocks #intelligentinvestor #marketanalysis #crude

0 notes

Text

[#ChartOfTheDay] #StarAllianceInternational (USA: #STAL) Could Rally Hard As #Gold Approaches All Time Highs #Bullish

#PennyStocks #TradeIdea #LearnToTrade #STONKS #Options #Stocks #TradeIdeas #GoldStocks #Oil #OilStocks #VIX #TheVIX

[ All Content Is For Informational & Educational Purposes Only / Refer To Both The Disclaimer & Privacy-Policy ]

#FullReport | Click Here >> http://www.icontact-archive.com/archive?c=925383&f=3061&s=47512&m=2691355&t=60cdc38d7f837e301d71d48058b93fb1cb947f1b0f2df356195a63ba34938e6f

0 notes