#P E Ratio meaning

Text

PE or PEG ratio: Which one should you use

Experts and investors use several ratios to determine the worth of a company before investing. Price-to-earning ratio is a popular metric of stocks that expresses the current price of the company’s share against its earnings per share. It indicates whether the stock at the current price is expensive or cheap. Let’s understand the PE ratio meaning and how to use it to make investment decisions.

The PE ratio is also sometimes called the price multiple or the earnings multiple.

PE ratio formula

The PE ratio is one of the most common ratios used by experts in evaluating a company’s share price. They use a simple formula to calculate the PE ratio.

P/E ratio = current market price of the shareearning per share

Analysts and investors can use earnings from any period in calculating the PE ratio. But the most common is the company’s earnings for the last twelve months.

Depending on the period, the calculated PE is of two types - forward and trailing PE.

Let’s understand the PE ratio with an example.

PE ratio is an important metric. It determines how much money investors are willing to pay to receive ₹1 of the company’s earnings. For instance, if a company has a PE ratio of 20, the investors are ready to pay ₹20 for ₹1 of its current income.

Analysts use the PE ratio to determine whether a company’s shares are expensive or cheap.

Interpretation of PE ratio

Companies with high PE ratios are the growth stocks that promise higher capital appreciation.

Low PE ratio stocks are undervalued - trading at a lower price than their fundamentals. These are targeted by value investors.

What is the PB ratio?

The Price to Book ratio compares the company’s existing market price with its book value.

PB ratio = Current market capitalisationNet book value

The current market value refers to the price of all the outstanding shares. On the other hand, the book value is the amount left after the liquidation of all the company’s assets or repaying all its liabilities. The book value is available on the company’s balance sheet.

The PB ratio depicts the market’s understanding of the stock or how much investors are paying for ₹1 of the company’s net asset.

PB ratio is more helpful in comparing businesses which have a large number of assets and liabilities like real estate, banks, insurance companies and investment trusts. But for companies which are asset-light, comparing the PB ratio isn’t very effective.

Interpretation of PB ratio

Like the PE ratio, analysts use the PB ratio for comparing peers.

A high PB ratio indicates the company share is expensive.

A low PB ratio means the stocks are undervalued.

When it comes to evaluating banks, the PB ratio is a more acceptable method. It is because it gives a more accurate picture of the company’s financial status than the PE ratio. PE ratio doesn’t provide an accurate value for companies with negative income or making losses.

Final words

These ratios form the foundation of fundamental analysis. However, they shouldn’t be used in isolation. Once you understand PE and PB ratios you can evaluate any stock before investing. If you are interested in investing in Indian banks you can use metrics ratios along with Nifty Fin service, which is a benchmark reflecting the performance of Indian financial companies.

0 notes

Text

How to choose which stocks to invest in

Warren Buffett, the most famous investor in the stock market, always said that it is not advisable to buy stocks based on temporary changes in price and volume. He was of the opinion that it is more important to evaluate a stock’s fair value and then check if the stock is trading at a price higher or lower than the true value. He would buy a stock if it was undervalued and then hold it until it reached its highest potential.

How do you check if a stock is undervalued

The best way to do this is to find the sustainable growth rate of the company’s net worth and thereby find out the potential book value of each share, say 10 years from now, depending upon the timeline that you are looking at. Thereafter you can find what the price of each share would be at the end of that period.

For this you would have to first find the Earnings per share (by multiplying Return on Equity and future Book Value per Share). Once you have the EPS, multiply it by the P/E Ratio and you will get the potential share price 10 years from now. If the difference between the potential share price and current market price of the share (along with the possible dividends that can be earned in the same period) is large enough, based on the rate of interest per year needed for the share price to reach that level, then buy the share.

You can also work it backwards by choosing a minimum benchmark rate of interest that you want to earn and then check how much the current market price should be in order to achieve the potential share price at that rate of interest (that also seems risk averse to you). If that benchmark price is higher than the current market price then buy the share - because this means the share is currently being traded at a less value than what it is actually worth.

Limits of the strategy

This strategy, however, is not to be used in isolation. The first step in investing always is evaluating the sector, the product and the business model that the company is in. If these criteria are met, only then should the aforementioned fair value approach be adopted. In fact, the formula mentioned above only tells you when to invest in a company that is considered good/attractive by you already. It does not tell you on its own whether the company in question is good to invest in or not.

Furthermore, you will have to do adequate research and learn the significance of all the ratios and terms mentioned, such as P E Ratio meaning. You will also have to understand your own risk profile, preference for companies (for example large cap stocks or small cap stocks, sectors that you understand etc.).

Final words

All that we discussed right now comes under fundamental analysis of companies used by long term investors. People who perform short term trades use their interpretation of price and volume more in order to judge whether the stock price is going to go up or down.

0 notes

Text

After Work Activities | Sinclair/Reader

Summary: You're tired of waiting for Sinclair to finish work, so you take matters into your own hands.

AN: This is a birthday present for the wonderful @snowblossomreads who said all she wanted for her bday was thighriding with pupper ❤

Warning/content: thighriding, sexy times in the office, boss/employee relationship

Read now on Ao3 or below the cut:

It was a quarter past five on a Friday, and Sinclair still hadn’t come out of his office. You sat on a chair outside his closed door, huffing and puffing as colleagues streamed past you on their way home, and you were still waiting for your boyfriend to finish work, even though home time was fifteen minutes ago.

While he was always busy, being so high up in the company, you had a smaller role and sometimes had very quiet days. This had been such a day, and you’d spent most of the past few hours passing the time by fantasising about Sinclair and all the things you wanted to do to him at the weekend.

With a sigh of impatience, you stood up and let yourself into Sinclair’s office. He was bent over some files, a frown on his face as he stared intently at the reports on his desk. You knew exactly what was going on - he was so hyperfocused on his work, he probably hadn’t even looked at the clock, let alone thought about packing up to go home and spend the weekend with his girlfriend.

You cleared your throat, and Sinclair glanced up. He smiled.

“Hi, [Y/n],” he said, clearly glad to see you, but his eyes drifted back down to his reports.

You rolled your eyes.

“Clair, you know it’s quarter past five, right? Everyone else has gone home.”

“Is it?” Sinclair replied absentmindedly. He looked up at the clock and his eyebrows shot up in surprise. “So it is! I had no idea. I’m nearly finished here, then we can go home.”

Well, that wouldn’t do. You were bored, you were horny, and you wanted him. You had to snap him out of his bubble.

You crossed the room and came up behind his desk to wrap your arms around him from behind.

“Pay attention to meeeeee,” you whined, and Sinclair chuckled. He straightened up and pushed his chair back a little, and you took the opportunity to jump onto his lap, straddling him in his office chair.

“Can I sit here while you finish work?” you asked with the cutest pout you could muster. “I’ll be really still and silent and I won’t disturb you, promise. I just wanna hold my puppy.”

Sinclair smiled coyly, and you knew you had him. He couldn’t resist you, especially when you called him puppy .

“Of course, my darling,” he agreed, and shifted you in his lap slightly so he could still see his papers.

You were trying your very best to be quiet and still as you’d promised, but you had a big problem. Sinclair had moved you to the side so you were in just the right position for his thigh to be pressing between your legs. You were wearing a skirt and no tights thanks to the warm weather, so you could feel the texture of his corduroy trousers pressing up against the very pussy that had been aching for him all day.

In a bid to distract yourself from your lewd thoughts, you asked Sinclair what he was working on, hoping that listening to him ramble on about something as boring as work would stop you from being so horny. But as you listened to him talk about P/E ratios as if they were the most interesting thing in the world, all you could focus on was the way his chest rumbled when he spoke, and the cute way his amber eyes lit up when he was talking about something he thought was very interesting.

“So really we need a P/E lower than twenty - hey, what are you doing?” Sinclair interrupted himself when he noticed the way you were squirming on his lap.

“Need you,” you mumbled.

Sinclair frowned, confused, then his eyebrows shot up when he clocked your meaning.

“[Y/n], are you… horny?”

“Desperately!” you whined. “I know your work’s important, Clair, but I’ve been thinking about you all day. See?”

You lifted your skirt to show him your wet panties, which were beginning to soak through to his trousers.

Sinclair gaped like a fish, his cheeks flushing red.

“Darling, you should have said, I - I can come in and finish these tomorrow —”

“No!” you protested. “I don’t want you coming into work tomorrow, I like our Saturday morning lie-ins. You finish your work, Clair. I’ll just suffer.”

You sighed dramatically as you collapsed against him, head on his shoulder, and Sinclair found himself torn. You were right, if he didn’t finish these reports now he’d have to come in tomorrow and neither of you liked it when he worked on a Saturday - but his girlfriend was on his lap begging for him, he couldn’t just leave her like this!

His leg began bouncing, as it often did when he was anxious or uncertain about something, and it just so happened to be the leg you were pressed up against.

You let out a surprised oh!, which prompted Sinclair to stop.

“Keep doing that, I liked it,” you giggled.

“Oh - erm - like this?”

He bounced his leg again, and you made another happy noise.

“Mmm, yes, Clair, keep doing that - you keep working, I’m quite happy here, thank you.”

Ever obedient, Sinclair kept bouncing his leg, which was causing the texture of his trousers to rub against your clit through your wet panties. You began wriggling back and forth on his leg to increase the friction, and you let out a whine as the pleasurable feeling shot right up into your core.

“Keep telling me about the P/E ratios,” you begged, your voice hoarse and dripping with lust.

“Do you find P/E ratios sexy, [Y/n]?” Sinclair asked, half joking but also wondering if you really did find it arousing.

“No, but your voice turns me on so much,” you told him between moans. “Keep - keep talking, Sinclair, please…”

“Okay, well, um… the problem with P/E is it doesn’t account for growth, so then you need to look at the PEG ratio…”

God, your mind was deranged. You didn’t know what PEG ratio was, but you did know that peg —> pegging, and suddenly you were thinking about bending Sinclair over his desk and taking him with a strap-on. He’d probably turn the colour of beetroot if you suggested it to him, but he might come around to it eventually. You’d learnt very early on when dating him that he’d only ever really had vanilla sex, but you were slowly introducing him to new ideas, some of which he liked and some he didn’t, but he was always willing to try.

Like what you were doing now - he’d probably never considered that you found his voice sexy no matter what he was talking about, or that you could get yourself off just by riding his thigh, but he certainly knew it now, because you were humping his thigh faster and faster, chasing that high you’d been fantasising about all day.

At some point, although in your ecstasy you couldn’t say when, your gyrating and moaning became too much for Sinclair to resist, and he tossed aside the report to worry about on Monday. Instead, he focused on you, and the way you were pleasuring yourself using just his thigh was unbelievably hot. He could feel his trousers getting tighter as his cock grew in response to your movements and your sounds, and although he’d sworn never to do this at work, that thought was tucked away quietly in the corner of his mind as he unbuckled his belt to pull his cock out, even if only to get some release from the tightness of his clothing.

You giggled happily when you saw his cock was out, and you adjusted yourself on your lap to slide down onto him, both of you groaning with relief as he slid past your soaked walls.

“It’s been a long week,” Sinclair sighed as you settled onto his lap, knees either side of his hips and his cock hilted inside you.

“You want me to make it better, baby?” you cooed.

He looked at you, his pupils blown with lust, breathing heavily as he let his walls fall down with you.

“Yes, please, darling.”

You smiled triumphantly and happily obliged, riding him as hard and fast as you could.

“Is this what you’ve been doing all day, thinking about this?” Sinclair asked between gasps. “I don’t think that’s - ah! - what I pay you for.”

“Maybe not, but you’ve got to admit it’s hot, right? Knowing while you’re sitting in here in your meetings, taking calls, reading reports, whatever - that I’m a few doors away, thinking about how I’m gonna make you cum tonight?”

Sinclair just whined in response, and you knew you had him. Fucking him good was one of the few ways to shut him up, and certainly the only one exclusive to you.

“We should do this more often… maybe I’ll schedule meetings with you in the day, just to fuck you senseless.”

Sinclair nodded eagerly. You took his hand and guided him towards your clit; ever quick on the uptake, Sinclair pressed his thumb against your sweet spot, causing you to let out a low groan of pleasure as he flicked his thumb back and forth just the way you liked it.

“Oh god, Sinclair, just like that!” you cried out. “Fuck, Sinclair, I’m gonna cum - gonna cum all over your cock… fuck, yes, yes - Clair!”

You cried out his name as you came, legs turning to jelly on his lap, and Sinclair quickly took over thrusting as he held you close, mumbling your name as he chased his own peak, and when he came, it was loud enough that you had to be grateful the office was empty or you’d have multiple HR complaints on your hands.

You stayed in his lap, cuddling up to him as you felt his cock softening inside you and the two of you came down from your highs, sticky and sweaty and still mostly in your office clothes, and as the oxytocin wore off, the reality of what you’d just done set in.

“Sinclair, do you remember when we got together and we agreed to keep it professional at work?” you asked as you sat up sleepily.

“Mmm,” he responded absentmindedly, his brain apparently still empty of words in his post-orgasm bliss.

“This doesn’t count if it’s past the end of the work day, right?”

Sinclair blinked his eyes open and looked up at you, a blissed-out smile on his face.

“I’ll have to report this to your boss,” he teased.

“Oh nooo, not Mr Bryant!”

Sinclair grinned, then pulled you back towards him for a kiss.

“You’ll get away with it,” he murmured when your lips parted. “I’m pretty sure your boss is in love with you.”

“Only pretty sure?”

“Well, actually, no. I’m certain your boss is head over heels in love with you.”

You both laughed, and when you both emerged from his office ten minutes later looking completely innocent as you giggled together like schoolchildren about what you’d just done, you thought it would be absolutely worth getting fired over fucking a coworker in the office so long as it meant you had Sinclair.

Besides, who’s going to fire you for fucking a coworker when the coworker you’re fucking is your boss, who is, in his own words, head over heels in love with you?

Sinclair sure wouldn’t.

105 notes

·

View notes

Text

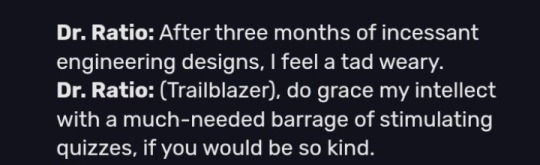

I went to read Ratio's messages again and:

He encourages Stelle to enroll on Veritas Prime, a.k.a his very own alma mater, for REALSIES. Not only that, but:

He's willing to personally recommend her. P e r s o n a l l y.

And that's kinda surprising, in a good way. Like, I know Ratio isn't a condescending prick that thinks himself above others (or, well... There's a lot more to him than the condescension, is what I mean to say), but he looked at Stelle and saw potential in her. Veritas Ratio, the man who'd rather wear a fucking plaster head in front of his students because he's allergic to dumbassery, looked at Stelle, our resident unhinged raccoon, and saw enough potential to personally encourage and oversee her pursuit of knowledge.

Look at this! He's genuinely interested in her worldview and her opinions! He doesn't consider a waste of time to discuss topics with her! He spent the entirety of this message batch simulating a debate with her and sharing knowledge on the subject!

Again, it's not like I thought Ratio was incapable of any of this, but I never imagined that he'd be like that with the Trailblazer either. It's surprising, but in a very pleasant way? Like, "wow, I wasn't expecting this dynamic to be so genuine but it is and I like it". Honestly, I'll never not be impressed by Ratio and his particular ways of showcasing kindness to others/seeking companionship. He's such a compelling character.

Oh, and this is my favorite message batch of his. He feels tired by the monotony of his projects and he decides to relax by... Humoring Stelle? He goes and says "Hey, think of something you want and I'll make up a project" and Stelle, huge dork that she is, goes "Make me a cool weapon!" and "Make the Express move forever!" and he just... Does it? Sends a project of transforming the Express into a mecha?? Says he wants to disassemble the Express to figure it out???

It feels like I'm rambling for nothing but this is truly disarming to me. It's easy to dismiss Stelle as a goofball (and she very much IS a goofball) but Ratio actually takes her seriously and seeks to nurture her progress. Beyond that, he honestly likes to entertain her ideas and thinks that hearing her out is a positive thing.

If I had to describe their relationship, I'd say it's all very cute, in a pure and wholesome way, and I cannot believe I'm using these words to describe Veritas freaking Ratio out of all characters. This gotta be a new kind of brainworm.

#ratio looking into stelle's no-thought-head-empty eyes: hold on she might be able to cook something#after this whole crusade i remembered how ratio sees aventurine as someone of equal standing that deserves life#and how he wants people to stop worshipping geniuses and start pursuing knowledge on their own#it's all such a compelling character trait of his#constantly advocating for people's inner potential even if they themselves don't realize it/believe in it#he's a good teacher at his very core#honkai star rail#hsr stelle#dr ratio#wait is this ratiostelle#oh god it is#ratiostelle#the protagonist ship compels me yet again sorry

118 notes

·

View notes

Text

Putting on my “Religions” and “History” proficiencies in real life to use

I have a huge feeling that the Bobby Dawn is a direct descendant of the people who were responsible for translating Ankarna’s story from Giant to Common, much like there were translations of the Bible from Latin to English by individuals.

However, translation from one language to another is very rarely a 1:1 ratio.

In Hawaiian (I’m a second language learner), one word can encompass multiple meanings. A first-language speaker and listener would be able to discern which context to use which meaning. The cooler thing though, is that there is meaning in using a word and allowing ALL meanings to matter as well.

When when Portuguese and English settlers began translating Hawaiian language into English for their own records (which, fun fact, Hawaiian was entirely oral so P/E settlers had even less clue of mechanics), they did similar things.

The way Bobby Dawn acts is right on par with the dozens of religious figures of monotheistic religions (remember his pause before “deities”).

Most monotheistic religions despise polytheistic religions, and when translating, they tend to also try to translate the actual written words to be replicate their goal to eliminate polytheistic religions because while polytheistic religions can survive the entering of a new god to the pantheon, a monotheistic religion is rocked to its core and can not logically survive.

In Hawaiian, with the influence of Christianity and Catholicism, LDS— the word “nā akua” (nā = plural the, akua = divine beings) was almost always translated to Ke Akua— THE god.

Followership influences the domain of the gods. If the people of the church of Sol caught wind that their deity had participated in the wedding of Cassandra and Ankarna, it would mean Sol is NOT the only god.

It only takes one follower to change the narrative, to choose power, to rewrite the narrative. And maybe, like Hawaiians, Giants were seen stereotypically as either brutes or hedonist crazy people for having different domains and complex god systems BEYOND one-god-one-son type religions.

It seems power is huge here and no one else can coexist, like how extremists of monotheistic religions can be.

Lucy represents a giant who honored a domain so kind, but maybe her own reaching into her goddess’ powers were helping to awake the REAL Ankarna story.

Kristin being in a polytheistic world where it focuses on the interconnection of parts in order to balance and keep each other in check. Cassandra is seeking her connection to Ankarna again, to need the conviction to doubt, wouldn’t destroy Sol at all— but reveal the INSTITUTION of Sol/Helio’s followers that committed a harm a long time ago for a human grab at power over others.

Kristin I believe WILL bring her family with her, but wishes, like many, that they could all coexist and see the goal is balance and not one story that triumphs all.

#hawaiian#hawaiian history#moolelo#dimension 20#dnd#d20#fantasy high junior year#brennan lee mulligan#ally beardsley#kristin applebees#cassandra d20#d20 theories

44 notes

·

View notes

Text

If Your First Name Has These Letters…

Prominent letters: check the first letter, second letter, first vowel, last letter, most frequently occurring type of letters

Note: you relate to these characteristics if TWO letters out of the prominent letters are of the same following group or if a certain type (3 groups) of letter has the highest ratio, does that make sense?

A, D, G, J, M, P, S, V, Y: honest, can be easily confused, seen as aggressive, difficulties comforting people, noticeable body proportions especially their biceps and ass 🔥 flaunt it!, can be seen as happy, selfish, can have difficulties finding people that truly understand or relate to them, expect too much of people, accidentally coming across as rude and standoffish, people thinking you’re not the friendliest, can give off happy vibes, having basic common sense, generally reliable

Prominent examples: Sarah, Mark, Maddie, Maddison, Gabby, Yana, Vanessa, Jamie

B, E, H, K, N, Q, T, W, Z: can get along with everyone, has no problems being friends with any gender, has a keen understanding of science, commerce, and mathematics, efficient because they always figure out a way to execute a task with the lowest energy required 💪, sooooo intelligent, their way with words and style are on point, creative thinkings, unconventional/abstract thinkers, quick to learn, a lack of these letters may mean bad at/slow to learn math or quite bad at simple mental maths especially addition/subtraction, can be unreliable, prone to being an initiator/victim of gossip

Prominent examples: Ben, Teagan, Henry, Bella, Bethany, Neo, Weasley

C, F, I, L, O, R, U, X: skilled at expressing emotions, very emotional, people finding you so likable, people magnet, everyone getting along with you but you feel like you only get along with a handle of people, may have difficulties with academics, excellent at comforting people, high levels of empathy, interactive with their surroundings, knowing how to have a good time at a party

Prominent examples: Olivia, Lola, Coco, Ruby, Chris, Xiao-, Fiona, Lily

24 notes

·

View notes

Text

I'm plotting to make a game out of the stock market, by which I mean pretending I have $X to invest (probably 10k?), choosing actual companies to "buy" pretend shares in, and seeing how the fake portfolio does over time.

This is in part to apply what I'm learning about stocks, and in part to grade my comprehension.

Also, it sounds fun, because I'm a dork who likes spreadsheets and statistics.

I don't plan to share my picks, because that could inadvertently influence others and/or be interpreted as financial advice (in spite of what I've named this blog).

THAT, and I'll be going by numbers, so who knows what companies I'll pretend to invest in? Maybe "We Kick Puppies Inc" has a good P/E ratio with a consistent history with dividends.

Also, it's pretend, so certain IRL complications won't apply, skewing the results in my favor.

For example, I'm going to assume I can immediately get X shares of whatever at the current listed price, and do similar with selling. That's a VERY convenient oversimplification that gives me a level of control that doesn't reflect reality.

6 notes

·

View notes

Note

Do you know about formal logic? if so, do you know how defining a statement as a fixed point of a formula can make sense?

I do, but I haven't studied modal logic at all. I think that maybe @loving-n0t-heyting would be able to help you? Not sure though.

Anyway, just from the excerpt you sent, what it basically seems to be saying is that a proposition P is common knowledge if P is true, and everybody knows P is true, and everybody knows that everybody knows P is true, and so on ad infinitum. But this definition contains an infinite conjunction (infinitely many ands), which logical systems typically do not allow, instead requiring that all statements must be finite in length. So this presents a problem for trying to definite "common knowledge" as above in formal logic.

The solution that they present is to define it as the fixed point of a particular logical expression. So, I don't recall exactly what background you have in math, but I assume you know about fixed points in general. A fixed point of a given function f is an element x such that f(x)=x. So, speaking a bit informally, a fixed point of the expression x^2 would be an element x such that x=x^2. In this case, the equation has a solution because the function x^2 does indeed have a fixed point, in fact it has of two them: 1 and 0.

Anyway, very often, we can convert an "infinite" statement into a finite one by talking about fixed points. The classic example is the infinite fraction 1+1/(1+1/(1+1/(1+1...))). Uh, hold on, it's better if I can get a picture:

How can we interpret this infinite fraction? Well, we can notice that, because it repeats infinitely, just the part in the denominator is equal to the entire fraction x itself! So we can re-write this equation as x=1+1/x, and now the statement is finite! In order to solve it we just need to find a fixed point of the function f(x)=1+1/x, which turns out to be the golden ratio.

Sorry if this is all too basic and it's all stuff you already know—again, I don't recall exactly what your math background is, and even if you know it already hopefully it will be interesting to somebody else.

Anyway, this is the strategy that is being attempted in the screenshot in order to define common knowledge in a finite way. They have this operator E, where EP means "everyone knows that P". And they want to define a common knowledge operator C, where CP means "P and EP and EEP and EEEP and EEEEP and...", but they can't because that's infinitely long. But notice that, much like in the golden ratio example, "EP and EEP and EEEP and EEEEP and..." is equivalent to "E(P and EP and EEP and EEEP and...)". And guess what: that part in the parentheses, "P and EP and EEP and EEEP and...", is just the whole of CP again! So we can re-write

CP = P and EP and EEP and EEEP and...

as

CP = P and E(CP)

and now that's a finite expression. And it defines C as a fixed point x of the expression "P and E(xP)".

As to how this definition is made, like, formally, I don't know. Maybe they're working in a logical system in which you can just axiomatically declare solutions to fixed-point equations to exist, so they're saying "it's an axiom that this expression has a fixed point C". I am really not sure. And if this is the question you were asking, sorry for all the fluff and then no actual answer. But hopefully someone else can help you out with this.

25 notes

·

View notes

Text

Words I’ve had to seriously struggle to define when explaining to my sister-in-law and/or mother (a list in progress):

POG. - She was aware what “Play Of Game” meant but didn’t understand usage outside of sports.

Blorbo - After much stuttering we came to the conclusion that it’s “a character you really like.”

FML - After explaining what it literally means, I then had to quickly explain that it’s just a way to say “ugh, this sucks”.

Uncle Rick - This was actually done by my little brother who became incensed when he learned my mother didn’t know Rick Riordan was nicknamed that.

Isekai - I accidentally used this term while explaining the story I beta for and then had to Google it so I didn’t explain it wrong.

Rip - obviously she knew what “R. I. P.” means but i had to specify the nuance of just saying the word “rip”.

E - in reference to when people just type the letter “E” in people’s comments in streams. Specifically back when I watched Technoblade and Ranboo streams. I gave up explaining this one.

AO3 - the website. I just had to explain the whole concept of the website. It took like ten minutes.

RSlash or R/ - the YouTuber, and by extension, saying the thread out loud. This one was amusing because my dad was confused too and he spends hours on Reddit.

Beta reading - when I needed to explain why I couldn’t help with the dishes I was in the middle of something. After explaining, she was surprisingly lenient.

Oof - I struggled explaining this one a lot.

IRL - I really didn’t expect this to be a problem. It somehow took longer than you’d expect.

TL;DR - once again, really didn’t expect this to be a problem. Didn’t take that long to explain tho.

Anon - specifically in reference to asking questions on Tumblr. Had to explain it is not the same as QAnon.

Tags - I was talking about fics on AO3. This was what led to me explaining AO3.

Ratio - I’m still not sure she gets it but she doesn’t use Twitter or Insta much anyways.

Stan/Stanning - I’m also not sure she gets it but she claimed to and I don’t use it enough for this to be a problem.

Vibe - how do you describe the concept of vibe? Cause idk and my sister-in-law still doesn’t either. We’re both just winging it.

Slay - this was my sister-in-law trying to explain it to my mother. That was very entertaining.

I’ll reblog if another interesting one comes around.

2 notes

·

View notes

Text

What is the significance of a company's P/E ratio?

The price-to-earnings (P/E) ratio of a corporation is a financial indicator that assesses the stock price in relation to earnings per share (EPS). By dividing the market price per share by the EPS, the P/E ratio is determined.

The P/E ratio of a company is important because it allows for a comparison of the relative values of several companies operating in the same sector or industry. A high P/E ratio could mean that investors expect future earnings to expand rapidly, whilst a low P/E ratio could mean that investors expect future earnings to grow slowly.

A corporation with a high P/E ratio is typically thought to be more expensive than a company with a low P/E ratio, and the opposite is true. But it's significant

9 notes

·

View notes

Note

6, 37, 19 for the writing ask!

6. What's your ratio for rating your works?

I realized I have no idea what this means! I'm guessing it's either like... how do you decide what rating to give things? or else, how do you decide what stats make your work 'good enough'? If it's the first, my very simple rule of thumb is if I say 'cock' or 'pussy', it's rated E. if I get through without mentioning genitals, it can be M. If it's a non-porny fic then I decide whether it's G, T, or (occasionally) M based on vibes like "would you see this in a kids' TV show? it can be G. Can you show this on prime time? it can be T. Would this have to air on one of those specialty cable channels after 10pm? maybe that's M."

If it's the second, I simply do not really care about stats on my works. Of course it's nice to get comments and kudos! but I don't fool myself into thinking that more comments and kudos mean my work is better.

37. Do you research before writing or while you write? Is it fun or boring for you?

I love doing research! Possibly more than writing, sometimes :p I will do research before, during, and after I write. Sometimes I have to make myself stop researching just so I can finish the writing in time. I am a historian by training and historical research is my favourite, but I'll research anything. I at least like to know when I'm making a change to known facts for the sake of a better story.

19. Share a snippet from a wip without giving any context for it.

"Is this what you think you deserve?" He traced the flexible tongue of the riding crop along Gojo's throat, down the center line of his chest, and let it linger there. "You deserve to suffer, and maybe if you suffer enough, it will make up for your flaws? Your weaknesses? Your failures?"

Gojo's throat worked as if he was trying to swallow a lump, but no words came out. Maybe there was nothing he could say.

"If you think this is what you deserve, then I can give you more," Nanami told him softly. He lowered the crop still further, grazing threateningly across Gojo's stomach. "But this will never erase your past, Satoru."

2 notes

·

View notes

Text

School.

Fuck school.

I'm going on a rant about the flaws of school, just try and stop me.

I know that school is meant to teach you important stuff, stuff that you may need and stuff that you take interest in, and it does a decent job at this. However, school is built on the expectation that you are "normal". That you have zero health problems. That if you have something like ADHD you have working pills for it. But what about the people who aren't "normal"? What about people like me? I have an extremely hard time focusing on things that aren't interesting to me, and I do try hand to work around this but I can't. A good way to help with this would be to MAKE THE LESSONS INTERESTING. When you're talking about how ratios are different from fractions, half the class isn't listening. A good way to get us to listen would be to spice it up a bit, give us good ways to use this, make us think we need this and get us hooked, most teachers can't do that these days. Another very important thing is choosing the classes you want to take. In Canada, you can "pick" your classes in grade 8, which is pretty late on, but it only really takes effect in grade 9. There's also a very limited amount of stuff you can choose, with no guarantee you'll get what you picked. And yet ANOTHER important note to discuss is the teachers themselves. More often than not you get teachers that aren't the nicest. Like last year I had a teacher named Ms. Santos. She was my math teacher. I d e s p i s e d her. She was always grouchy and mean, and she failed one of her least favorite students even though she was doing everything correct. Teachers need check-ins from the students, not just themselves and other teachers, which I don't even know if they're done. Going back to the thing on the education system being built on the "normal" people of society, schools are still incredibly bad at handling depression, homosexuality and transexuality. On the depression note, all schools do is give up the silent option of getting help from the guidance councillor, they don't even mention it on sheets of paper pinned to the cork board at the office. On the homosexuality and transexuality note, there's probably a few sheets of paper on stuff relating to it on the cork board at the office, but NO ONE READS IT DAMNIT. Having trouble coming out to your parents? Come see this gay club at 7:30 - 8:30 here at the school to meet other gay kids, make sure to get your parents permission to go. That's what most of them are like. All in all, the education system is severely flawed. Actually, here's a list of thing I would do to fix it:

Spread much more awareness about depression and suicide, don't frame it as an enemy, but more of a big challenge to overcome. Also make a good program to help with overcoming this challenge.

Do background checks on teachers about half way into each school year, not just checking their records and stuff, but also asking what the students and other teachers think of them, focusing on mainly how nice they treat their students and if they discriminate against any majority.

Changing how fast you can control your classes. Make it so that more classes start to open up at around grade 6 and let you choose your own classes at grade 8, only a year back from norms but still a big leap.

Understanding. Teachers should know all the challenges of their students, they should know the true reason why their student didn't finish their poster, not just the excuse in black and white. Most importantly they need to understand why this is, some people just don't understand that a select few don't like making their parents worry so they don't mention their homework, then it piles up and that would stress them tf out, making them worse and worse and worse. I'm not venting shut up. Ok maybe.

As much as I do have some more things I would change, it's probably best not to express them because as of now I've said enough. The education system sits on a throne all proud people can't reach, but they cry when people throw stones at their feet. Fuck school, evolve to crab.

#fuck the education system#school#shitpost#rant post#education system needs help desperately#what i would do#i hate the education system#i cannot stress this enough

2 notes

·

View notes

Text

How NSE Unlisted Shares Have Performed Over the Years

NSE unlisted shares have had remarkable growth over the years, as it has been marked by high demand from retail and institutional investors alike. The performance has been influenced by multiple factors such as strong financial results, strategic developments and market dynamics occurring within the company.

Overview of Performance

Finance

In the year 2023, NSE had reported a revenue of Rs 12650 Crore, growing to Rs 14793 Crore in 2024. The year-on-year growth was 16.95% approximately. PAT or Profit After tax also increased from Rs 7501 Crore to Rs 8406 Crores during this period, thereby showing a growth rate of 12.02% approximately.

Share Price

In May 2023, the share price was around Rs 3,600 for each share, rising to Rs 4,200 by January 2024, and further reaching approximately Rs 4,800 per share by May 2024, marking a significant increase of 33.33% over the year. NSE unlisted shares’ current price in 2024 is about Rs 6,000 per share, with the market cap standing at Rs 14.85 lakh crore.

Comparison of Market

As compared to BSE, NSE shares show commendable growth. However they have been slightly outperformed by BSE in terms of growth of percentage in the last year. Irrespective of this, NSE’s valuation metrics and market capitalization remains stronger for its dominant position in the financial ecosystem of India.

Valuation and Returns

NSE unlisted shares trade at a P/E ratio of around 36.51. The return on equity for NSE is at 35.06%, highlighting strong profitability relative to its shareholders' equity. The valuation metrics indicate the attractive returns that NSE shares have offered investors.

Bonus and Dividend

NSE has announced a 4:1 bonus issue and a substantial dividend of Rs 90 each share in recent developments, showing how it’s committed to rewarding shareholders. These moves enhance shareholder value and also demonstrate confidence in the future growth trajectory of the company.

Buy NSE Unlisted Shares from Altius Investech.

Factors Driving the Growth

Strategic Initiatives

NSE has continued to develop innovative solutions for trading, such as options trading platforms, that have boosted its market position. This, in conjunction with an increasing number of investors is a major factor in the growth of share price.

Learn More About NSE:-

NSE Gets Closer to an IPO with Potential Settlement with MSEI

Key Highlights from NSE India’s 4QFY24 Conference Call

NSE’s Fiscal Triumph: Crossing the $1 Billion Profit Milestone

National Stock Exchange (NSE) Announces Bonus Issue

Greater Accessibility

The unlisted shares market, which was previously accessible only by institutional investors, is now opened for retail investors, offering an unique opportunity to be part of the growth of large corporations such as NSE prior to when they go public. The increase in demand by retail investors is a major factor in driving share prices up.

Regulation Changes

Reforms to the regulatory system including cutting down the lock-in time for shares that are not listed and the tax benefits that come to holding times, make unlisted shares more appealing to investors, further increasing the market's interest.

Final Thoughts

Unlisted NSE shares have been performing exceptionally well and consistently over time due to solid financial performance, innovative strategies, as well as growing investor accessibility through platforms like Altius Investech. While investing in unlisted shares is risky, it actually has the potential for huge yields, as evident by NSE's rapid growth, which continues to draw investors who want to diversify their portfolios by investing in high-growth assets.

The option of investing in unlisted shares like NSE through platforms such as Altius Investech provides a means to get early exposure to companies with promising growth trajectories, making it a popular choice for retail and institutional investors. However, proper diligence and an in-depth analysis of market conditions are essential to make the most of an evolving investment market.

0 notes

Text

More specifically, treasury shares are the portion of shares that a company keeps in its treasury. While outstanding shares of stock are those that can be purchased or sold on the secondary market, treasury shares are those that are held by the company and are not available in the open market. The total number of issued shares is the sum of the outstanding shares and the treasury shares. In the financial landscape, outstanding shares represent the total number of shares a company has issued and is currently held by shareholders.

Can Outstanding Shares Change Over Time?

Public companies are required to report both Basic and Diluted Shares, which they use in their calculation of Earnings Per Share (EPS). Conversely, the larger a company is, does not necessarily mean it is a better investment. Large companies may be saddled with debt, have limited growth prospects, and a multitude of other problems that come with operating on a larger scale.

Helpful Fool Company’s board has elected to issue just 2,000 shares at this time.

John, as an investor, would like to calculate the company’s market capitalization and its earnings per share.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

For most companies, the number of authorized shares well exceeds the shares outstanding.

Corporations raise money through an initial public offering (IPO) by exchanging equity stakes in the company for financing.

The company hasn’t taken action yet; it’s just gotten approval to take action and sell some shares if it chooses to.

What Do Business Analysts Do? Key Responsibilities

Outstanding shares decrease if the company buys back its shares under a share repurchase program. Outstanding shares provide insights into a company’s size, ownership structure, and market capitalization. The number of outstanding shares affects several key financial metrics and ratios, including earnings per share (EPS) and price-to-earnings (P/E) ratio. A stock split occurs when a company increases its shares outstanding without changing its market cap or value.

Can Float Be Higher Than Shares Outstanding?

Knowing the difference between authorized shares and outstanding shares is important for calculating important ratios that accurately reflect the financial status and stability of a company.

For starters, a company’s market capitalization is determined by multiplying the current market price of one share of the corporation by the total number of outstanding shares.

When a company buys back its own shares, that stock is accounted for as “treasury stock” on its balance sheet.

Shares Outstanding represent all of the units of ownership issued by a company, excluding any shares repurchased by the issuer (i.e. treasury stock).

You can find this figure on stock listings and through stock data providers.

However, it is important to double-check that the number only includes shares that have actually been issued by the company. The first step in calculating outstanding shares is to determine the total number of shares issued by the company. This information can usually be found on the company’s financial statements or annual reports.

Companies with a market cap of less than $2 billion are considered small-cap. Companies with a market cap of $2 billion to $10 billion are mid-cap, and anything larger than $10 billion is considered large-cap. Large-cap companies are the big ones, such as General Electric (GE), Apple (AAPL), or Starbucks (SBUX). When identifying potential companies for trading opportunities, there are many areas of study, including technical analysis and fundamental analysis.

Types of Stocks You Should Know

These shares come from a share repurchase program, where the firm buys back shares from the public, or these are shares that were never issued to the public in the first place. The weighted average method doesn’t consider shares that can be potentially created through various mechanisms. As a result, the weighted average shares outstanding calculation of outstanding ...

View On WordPress

0 notes

Text

How to Identify Shares to Buy Today

Buying shares, also known as stocks, is like becoming a part-owner of a company. When you purchase shares, you're investing in that company's future. If the business thrives, your investment could grow in value. However, choosing the right shares requires some thought and research. Here's a simple guide to help you identify shares to buy today:

1. Research the Company

Start by learning about the company whose shares you’re considering. Look for information on its history, products or services, and market position. A company with a strong reputation and solid business fundamentals is often preferred. Check out their official website and recent news to get a clear picture of what they do and how they are performing.

2. Analyse Financial Performance

Examine the company’s financial health by looking at:

Earnings Reports: Check if the company is making a profit. Consistent profits are a good sign of a stable business.

Revenue Growth: Look at how the company’s sales are trending. Increasing revenue often indicates a company is growing.

Stock Price Trends: Review the stock’s recent performance. An upward trend might suggest good future prospects.

3. Read Financial News

Stay informed about the latest financial news related to the company and the market in general. Company announcements, industry trends, and economic news can all influence stock prices. Keeping up with this information will help you make more informed decisions about which shares to buy.

4. Evaluate Financial Ratios

Financial ratios can help you assess a company’s financial health. Key ratios include:

Price-to-Earnings (P/E) Ratio: This ratio shows how much investors are willing to pay for each rupee of earnings. A lower P/E ratio might indicate that a stock is undervalued.

Debt-to-Equity Ratio: This measures how much debt a company has compared to its own funds. A lower ratio generally means less financial risk.

5. Compare with Peers

Compare the company with others in the same industry. This comparison can reveal if the company is performing better or worse than its competitors. Look at other companies’ earnings, growth rates, and market position to gauge relative performance.

6. Consider Market Conditions

Understand the current market environment. A rising market may present good buying opportunities, while a declining market might offer lower prices. Pay attention to economic indicators like interest rates and inflation, as these can impact stock prices.

7. Assess Growth Potential

Evaluate whether the company has potential for future growth. Look for companies that are expanding into new markets, launching new products, or adopting innovative technologies. Growth potential can lead to higher returns on your investment.

8. Diversify Your Investments

Avoid putting all your money into one stock. Spread your investments across different companies and sectors to reduce risk. Diversification helps protect your portfolio from significant losses if one stock underperforms.

Conclusion

Identifying the right shares to buy involves researching the company, analysing its financial performance, staying updated with news, and using financial ratios. Comparing companies and understanding market conditions are also crucial. If you are looking to elevate your investment strategy turn to IndiaInfoline for expert guidance. Their comprehensive platform offers in-depth market analysis, real-time data, and personalised advice to suit your financial goals. With educational resources, user-friendly tools, and professional insights, IndiaInfoline equips you to make informed decisions in the dynamic world of stocks. Start your journey towards smarter investing today.

0 notes

Text

How to Identify Promising Small-Cap Stocks to Buy: Tips from Market Experts

Investing in small-cap stocks can be an attractive option for those looking to maximize returns. Small-caps, defined as companies with a market cap of $300 million to $2 billion, tend to have higher growth prospects compared to their larger counterparts but the potential for higher returns comes with risk and volatility it goes upwards. To successfully navigate this scenario, it’s important to follow expert advice on how to identify promising small coins to buy.

1. Understand the small-cap stock landscape

Before diving into the specifics, it’s important to understand the unique characteristics of small-cap stocks. These companies are often in the early stages of growth and deliver great growth but also face significant market and financial risks. Understanding the broader market environment and industry dynamics in which these subgroups operate is key. For example, emerging industries such as renewable energy or technology can provide fertile ground for high-growth microfinance opportunities.

2. Evaluate Financial Health

When searching for microcap stocks to buy, a thorough evaluation of financial health is paramount. Key financial metrics provide insights into a company’s stability and growth potential:

· Revenue Growth: Look for smaller amounts with steadily increasing income. This means that the company is expanding and gaining market share successfully. Good earnings growth is a good sign that business is improving.

· Profitability: Look at the profitability of the company. A high or improving profit margin indicates that the company is managing its costs effectively and could be on track for higher profitability.

· Balance Sheet Strength: Analyze a company’s balance sheet, focusing on its debt-to-equity ratio. Companies with manageable levels of debt and strong balance sheets are better positioned to weather a recession and invest in growth.

3. Assess Management Quality

The quality of a company’s management team is a critical factor when evaluating small-cap stocks to buy. Strong leadership can significantly influence a company’s success:

· Experience and References: Examine the background and accomplishments of the company’s executive and board members. Experienced leaders with a history of success in similar projects or previous startups can be good indicators of future performance.

· Strategic vision: Determine the management team’s strategic vision and executive power. Effective leaders must have a clear plan for growth, be able to adapt to market changes, and drive innovation within the company.

4. Analyze Industry and Market Position

Understanding where the company stands within its industry is essential for identifying promising small-cap stocks. Consider these factors:

· Competitive Advantage: Look for companies that have a competitive foundation, such as unique technology, a strong brand, or a proprietary business model. A competitive advantage can help a company maintain its market share and grow.

· Market Trends: Identify industry trends and the company’s position on them. Small-cap stocks in fast-growing or emerging industries such as biotechnology or green technology can generate significant growth compared to more established industries.

5. Conduct Valuation Analysis

Valuing small-cap stocks correctly is crucial for determining their investment potential. Use the following metrics to assess whether a stock is reasonably priced:

· Price-to-Earnings (P/E) Ratio: The P/E ratio compares the price of a stock to its earnings per share. A low P/E ratio may indicate that a stock is undervalued relative to earnings, although comparisons with industry peers are important for context

· Price-to-Sales (P/S) Ratio: The P/S ratio measures stock price compared to earnings per share. This is particularly useful for smaller banks that may not yet be profitable but are showing strong earnings growth.

· Price-to-Book (P/B) Ratio: The P/B ratio compares the price of a stock to its book value per share. A low P/B ratio may indicate that the stock is undervalued relative to assets.

6. Monitor Insider Activity

Insider activity can provide valuable clues about a company’s prospects. Consider the following:

· Insider purchases: Large amounts of stock purchases by executives or board members can signal confidence in the future performance of the company. Internal purchases generally reflect positive internal expectations.

· Insider sales: Beware if there are a lot of insider sales, especially without a clear description. While a sale is common, larger or more frequent sales raise concerns about the future of the company.

7. Consider Market Sentiment and Story

Market sentiment and recent news can have a significant impact on small caps. Stay informed about:

· News and Events: Follow the latest news about the company, including financial reports, announcements, and associations. Positive developments can boost stock prices, while negative news can create opportunities if the issues are temporary.

· Analyst ratings: Keep a close eye on analyst ratings and recommendations. While not foolproof, analyst opinions can provide fresh perspective and insight into a stock’s potential.

Conclusion

Identifying promising small cap stocks to buy requires a combination of investment analysis, industry analysis and market knowledge. By evaluating key financial metrics, measuring management quality, analyzing industry conditions, and staying abreast of market trends, investors can identify high-growth albeit risky small-cap funds smaller in the more the Ability to analyze and spend money can increase Always remember to do thorough research and assess your risk tolerance before making an investment decision.

#best stock to buy now#stock market investing#stock market advisory services#financial advisor#top sebi registered research analyst#investment advisory services

0 notes