#which stocks to invest in

Text

How to choose which stocks to invest in

Warren Buffett, the most famous investor in the stock market, always said that it is not advisable to buy stocks based on temporary changes in price and volume. He was of the opinion that it is more important to evaluate a stock’s fair value and then check if the stock is trading at a price higher or lower than the true value. He would buy a stock if it was undervalued and then hold it until it reached its highest potential.

How do you check if a stock is undervalued

The best way to do this is to find the sustainable growth rate of the company’s net worth and thereby find out the potential book value of each share, say 10 years from now, depending upon the timeline that you are looking at. Thereafter you can find what the price of each share would be at the end of that period.

For this you would have to first find the Earnings per share (by multiplying Return on Equity and future Book Value per Share). Once you have the EPS, multiply it by the P/E Ratio and you will get the potential share price 10 years from now. If the difference between the potential share price and current market price of the share (along with the possible dividends that can be earned in the same period) is large enough, based on the rate of interest per year needed for the share price to reach that level, then buy the share.

You can also work it backwards by choosing a minimum benchmark rate of interest that you want to earn and then check how much the current market price should be in order to achieve the potential share price at that rate of interest (that also seems risk averse to you). If that benchmark price is higher than the current market price then buy the share - because this means the share is currently being traded at a less value than what it is actually worth.

Limits of the strategy

This strategy, however, is not to be used in isolation. The first step in investing always is evaluating the sector, the product and the business model that the company is in. If these criteria are met, only then should the aforementioned fair value approach be adopted. In fact, the formula mentioned above only tells you when to invest in a company that is considered good/attractive by you already. It does not tell you on its own whether the company in question is good to invest in or not.

Furthermore, you will have to do adequate research and learn the significance of all the ratios and terms mentioned, such as P E Ratio meaning. You will also have to understand your own risk profile, preference for companies (for example large cap stocks or small cap stocks, sectors that you understand etc.).

Final words

All that we discussed right now comes under fundamental analysis of companies used by long term investors. People who perform short term trades use their interpretation of price and volume more in order to judge whether the stock price is going to go up or down.

0 notes

Text

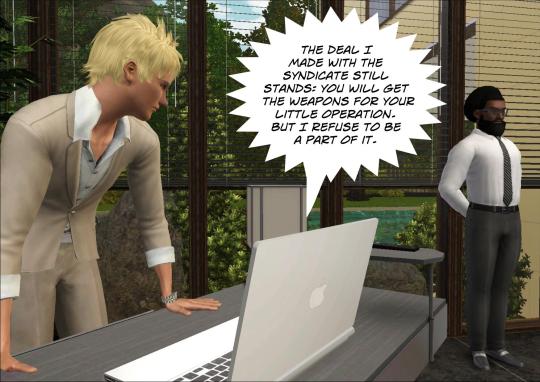

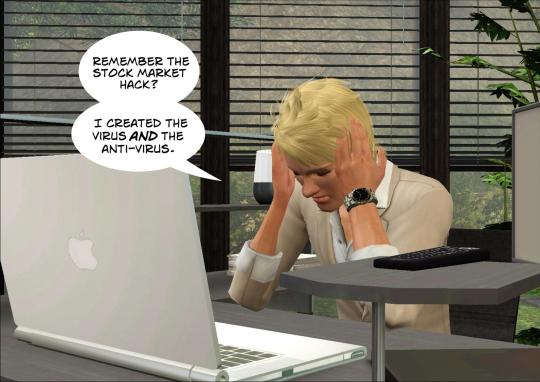

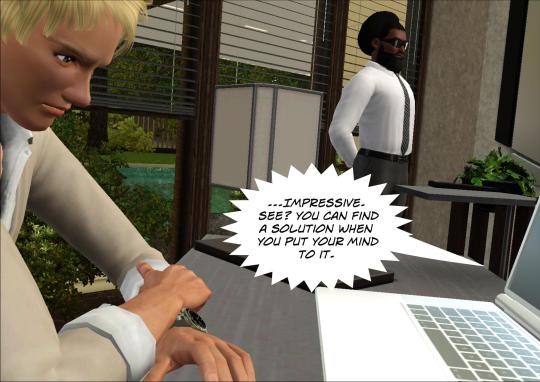

Author's note: Reference is made to the following scenes: (1), (2), (3)

#ts3#sims 3#sims 3 story#sims stories#tteot story#laurie golzine#omar ayad#muhammad al-saud#i'm sorry for going into details#i hate doing that#look i work in investment but imposter syndrome is kicking me hard#plus it's kind of difficult to make a plot look seamless when there is so much time between updates#in summary: laurie is managing a conglomerate including an investment fund of which noah is a partner#so laurie is a shareholder of a small tech company through that fund#he sold the antivirus via noah to that company as a solution to the virus he developed himself#when the stock market got hacked (by laurie) all companies rushed to get an anti-virus#but it also contained a spyware (also by laurie)#and this is how laurie's main business is now stealing data#laurie arc

70 notes

·

View notes

Text

In case anyone else has the brain worm that makes them want exact details anytime people talk numbers, in Too Much Birthday the offer to buy Kendall out says that he has 12,904,663 shares of Waystar (worth ~2bil at $156/share), so assuming he didn't sell any stock after that and also that Shiv and Roman all had an equal stake, which the show implies, that means that when they sell the company at $192/share in the finale, each of the siblings gets just under $2.5 billion, half of it in Gojo stock, not counting whatever they inherit from Logan.

#this is way higher than the combined 3 bil they say they said they'd have when they're trying to buy Pierce but the deal is#a 50/50 stock cash split so that doesn't factor in the $$$ they'd get in gojo stock plus its before ATN is valued in#i did some googling earlier out of curiosity but all of the articles/posts about their actual net worths either use old info#or guesstimate the number of shares the kids have based on other things the show tells us or are just straight up#inaccurate even to the info they had and none of them actually used the pretty significant info we get in that doc#their actual net worths are obviously a bit higher than this since we know they own property and it doesn't account for any#other investments or what they may have inherited from Logan (which also likely includes more stock) but waystar stock is#definitely the majority of what they have value wise so the only unknown that would make their net worths significantly#higher than this (when the scale is billions) is any stock they may have inherited from logan#succession#roman roy#shiv roy#kendall roy#connor roy#siobhan roy

22 notes

·

View notes

Text

I can understand why people have fifty thousand WIPs because I've been waiting so long for my yarn to come back in stock that I'm going insane and will continue adding WIPs until I can get my yarn(tm)

#art#crochet#fiber art#i'm going to go to the store and if they don't have My Yarn then i'm getting some yarn for a hook holder i saw (which will be my third WIP)#if you look at my carrd you'd think i'm chugging along one wip at a time but. no.#i also don't want to order this yarn unless they aren't stocked up by tomorrow or tuesday (would rather not pay more for shipping)#also all my hooks are just thrown haphazardly in my nightstand so a hook holder would be a good investment i think

23 notes

·

View notes

Note

there's this blog called sbrown82 always talking some gross sexist crap about marianne, anita and bianca as marsha hunt is superior to them or smt its giving closet fan tbh 💀

Sounded familiar so I looked it up, and yeah I have that user blocked. I followed them for a hot second because they made some really good posts about the life of Marsha Hunt, but as I saw how they started talking about other 1960s "Stones muses" (as people call them) and saying really sexist and unfair things (especially stigmatizing drug addiction in the case of Anita and Marianne) I was like... mmm ok I'm out. And I blocked just to ensure I'd never see them in the tags again, since the only tag I follow on here is Marianne.

I'm not like an insecure stan who can't bear to see my favs criticized. But when it comes to Marianne, I just see no justice or catharsis you can have by tearing her down. She's already largely forgotten and erased in favor of her ex, reduced in memory to an angel with big tits who turned junkie plaything. That's already how most Stones fans who even know her name see her. 30 years after her book, people will just bring up her name to make a disgusting Mars Bar joke (that story was made up by a cop, but it's funnier to treat it as real). Meanwhile, just about everything she has done which is worth celebrating over her long career is neglected and underrated except by the cult fans. That stands true for any other creative working woman the Stones associated with when they were young. It's extremely true for Marsha Hunt, too, who you don't see as much appreciation for on Tumblr, as relatively small as even Marianne's 'fandom' is. Ah, oh well. Someday I hope history will view these women with more dignity. Much of what they've suffered in the public eye is overlapping.

Edit: oh yeah, and fuck Mick Jagger.

#thought about not going on a rant but then went on a rant anyway bc it's my blog#dianswered#anon#they also seemed to have a very very protective towards marsha in a way that struck me as kinda... personal#not to say u can't feel personally invested in her reputation bc you identify w her in some way#but it always seemed a bit like 'she can do no wrong; everyone around her always did her wrong'#particularly in like. defending her from ever doing anything that could be seen as promiscuous or mentally unstable#ill say it here first folks. my girl marianne was very promiscuous and mentally unstable in those years#does that means she deserved to he torn down in the public eye?#i don't know as much about marsha bc i haven't read her book and interviews w her are hard to find#(so is her book lol. it's never in stock on thriftbooks)#but i think defending her honor in these old ways is kind of missing the point. in my opinion#which is a shame because there are a lot of good points to be made about how marsha deserves better#yeah. that's that on that

8 notes

·

View notes

Text

the way that i am now downloading stock market news apps......... and squinting at these crazy ass news articles and learning finance terms n shit.... trying to read these number and graphs........

i am morphing into a middle aged dad of 3 kids. 🧍♂️

#mine#its so joever for me guys.#it started with the boomer ellipses and now here we are#save yourselves gang.... SAVE YOURSELVES#to be clear yes i am still Anarchist and anticapitalist#but man. sometimes you get sick and tired of being sick and tired and if pretending to day trade along with finance bros#and laughing at their misfortunes when stock values plummet helps out my mental health? then babey. lemme get my trading apps open#to be clear also: i'm not trading stocks either. well not actively anyways#ive just become irrationally obsessed with this shit out of nowhere. but rn my broke ass cannot afford to gamble money#on the current volatile ass market#so i'm safely sticking to my bonds and my etfs for now#and watching the circus that the NYSE turns into every 3rd quarter or so#oh ye btw finance news: warren buffet sold half of his tech shares recently including apple stocks#so its looking like it is So Joever for ai and tech which is absolutely hilarious considering all these phone companies#are pushing ai SO HARD rn. but even investors arent buying it anymore#news articles are saying lots of investors are pulling out of risky investments rn. selling stocks. piling their money into bonds for now#but last 2 quarters of every finance year are like that so i'm not too concerned#the October Scare is real with these guys lol#more reasons why october is my absolute fave month LMAO

3 notes

·

View notes

Text

i actually don't mind that the norwegian sheltie club has a recommended puppy price of $2500 (even if it's gone over inflation a bit). what i do mind is that a dog can technically have 1 specialized health test at 8 weeks old and be set for life w/o complaints while (certain) breeders claim we are "testing our breed to death" 🥰

#the current price is overshot by 3-500 USD now they shouldn't have increased in 2021 or whenever it was#i'd say most random mixes hover around 1k-1.5k /pomchidoodles excluded#unless you want an unregged farm bred border collie which you can get for a mediocre cup of coffee and a snickers#^ same w alaskan huskies#i dont care about show results#i dont give a shit about titles#i like that we don't differ between fckn pet or show quality or whatever#but the fact that you can get a puppy from parents whose only health merit is being born w/o cataracts or CEA#and pay the same#as one with full rundown over several generations#is FRUSTRATING to me because we are effectively AWARDING mediocre (and shitty) breeders for not investing in their stock#the less you spend the less you have to exclude or counter the less critical you have to be etc etc the more profit you can turn

24 notes

·

View notes

Text

Like okay. You're picking fights with the #1 bringer of people (and their money) into the state and provider of jobs, you're threatening all the gays and trans ppl and drag queens and Chinese ppl and immigrants as a whole and Black people and anyone who isn't You like Bitch WHO do you have left what money do you have left you stupid cunt !!!

#LITERALLY running the state into the ground#he's doing all this crazy fucking bullshit RIGHT before he's supposed to announce his bid for presidency#then Disney drops 'hey actually we aren't gonna invest in your state like we were going to so say goodbye to those 2000 jobs'#and he keeps digging his own grave like talking abt how Disney stocks r tanking like sorry but. it's Disney. they can afford a 1 billion#dollar investment LMAO#and every single thing he does resitricts freedoms and he's getting sued out the asshole#wasting taxpayer dollars to beef with the mouse which Will Win no matter what#like goddamn choose your battles#UGH I'm so sick of republicans claiming they want to protect children when they rly mean from the gays and the ~Woke Agenda~#fight tooth and nail for a fuckin fetus that'll threaten a woman's life and or livelihood then turn around and make it legal to conceal#carry WITHOUT A FUCKING PERMIT#IM AAAAAAAAAAAAAA#everyone is leaving and I s2g I'm.gonna fucking join them as soon as humanly possible if shit doesn't pan out vis a vis lawsuits#like fucking Dwayne Wade. DWAYNE. WADE.#LEFT. FLORIDA. IN PART BECAUSE HIS DAUGHTER IS TRANS#THATS HOW BAD IT IS#DWAYNE WADE!!!#edit: got so mad I fuckin forgot to tag this as#text

7 notes

·

View notes

Text

I would be so heartbroken if I still don't get calls like. During sept/oct I was like yeah ok no one's hiring bc of Diwali but if I still don't get any screenings and interviews post diwali it's just so terrible surely I can't be all that much unemployable

#my sister's classmate was involved w g20. HOW do people find these opportunities?? im genuinely confused. how do u learn about mutual funds#and which stocks to invest in and what to pursue for money. passion and love is for classics but my god#personal

2 notes

·

View notes

Text

any time I see people tying minor world events to economics I’m like. that’s not how economics works. I know you want it to be how it works so you can blame someone. but that’s not how it works in any country or global economy.

#it’s like saying gravity only exists on Tuesdays#this is directly looking at two things:#one: saying the FFR (federal funds rate) is why ‘start up’s’ in the gig economy are failing#and two: someone saying we should cause a bank run (multiple bank runs) when we’re still in pre-recession waters#per point one: the FFR is for banks and credit unions and determines what rate at which lending happens#it effects things like housing; car loans; savings accounts; etc because it sets a floor at which interest rates have to be#it does not affect how much money VCs pour into companies they think are going to be worth billions#which VCs pour money into them so they get a % of the company as stock#so they’re incentivized for the company to do well and make them a profit when they go public#not to say these companies might not have traditional bank loans but it’s very unlikely for the amount they’re spending#additionally as we all should have learned from the Glass-Stegel act and the 08 crash#banks need to keep their commercial investments and consumer investments separate#so yes these companies are failing…. but for other reasons like increased regulation; changing preferences in the consumer and economy;#but MOSTLY they were unsustainable businesses at the onset; they didn’t need to be profitable; just go public and make billions on stock#now for point two this one is simple: IF YOU CAUSE MULTIPLE BANK RUNS#THEY BECOME A SELF FULFILLING PROPHECY#AND THEN MORE BANKS FAIL AND WE GET A RECESSION#all caps were necessary here#if you look at the Great Depression (a great example of a banking panic)#not all of the banks were initially failing#but by people panicking about their money (and a lack of the FDIC at the time)#but because people panicked and pulled their money out the banks failed anyway and caused the worst recession in US history#so yes feel free to cause a banking run and tank the economy#it’s likely Europe will enter a recession in the next 6 months so please exacerbate the situation#(which because global economy will push us further into possible recession)#I’m sure people will have plenty of time to feel smug and superior while sitting on a mattress of cash and looking for jobs#ugh anyway bad economics bothers me#just cause you watched a dude rant about it on YouTube (when he doesn’t know what a Phillips curve is) doesn’t mean you know economics#thoughts? thoughts#or: wHy DoNt YoU jUsT bAlAnCe ThE eCoNoMy LiKe My ChEcKbOoK

1 note

·

View note

Text

Forex - Has no End?

Riddle: What has no end, yet always comes back around?

Forex trading and stock trading are both popular investment options, but many people are unsure which one is better. Both forex and stocks offer the potential for profitability, but they also bring their own unique risks. To help you decide which one is right for you, let’s take a look at the pros and cons of forex trading versus stock trading.

When it comes to forex trading, the primary benefit is that it is a 24-hour market. This means that you can trade any time of day or night, regardless of the stock market hours. This can be particularly advantageous for investors who have busy schedules or who trade from different parts of the world. Additionally, forex trading allows you to trade on multiple currency pairs, giving you the potential to diversify your portfolio.

The downside of forex trading is that it is a highly leveraged market. This means that you can leverage your investments to a greater degree than you can with stocks, which can result in greater potential losses. Additionally, the forex market can be extremely volatile, making it difficult to predict future movements.

When it comes to stock trading, the primary benefit is that it is a regulated market. This means that stocks are traded under set rules and regulations, making it easier to protect your investments. Additionally, stock trading allows you to invest in individual companies and funds, giving you the potential to diversify your portfolio more than you can with forex.

The downside of stock trading is that you have to pay fees to trade stocks. These fees can add up quickly, making it difficult to make a profit on small trades. Additionally, stock markets tend to be less liquid than forex markets, making it more difficult to buy and sell stocks quickly.

Overall, forex trading and stock trading both offer the potential for profitability, but they also bring their own unique risks. Forex trading allows you to trade on multiple currency pairs and offers the potential for 24-hour trading, but it is highly leveraged and can be extremely volatile. Stock trading offers the potential to invest in individual companies and funds and is regulated, but it also comes with fees and is less liquid. Ultimately, the best choice for you will depend on your own personal goals and risk tolerance.

Answer to Riddle: The Stock Market

#“forex vs stocks which is more profitable”#“which is best forex or stock market”#“forex vs stocks for beginners”#“is technical analysis the same for forex and stocks”#“pros and cons of forex vs stocks”#“forex market vs stock market size”#“forex vs stocks which is more profitable reddit”#“forex stock price”#stock market#investors#investment#invest

4 notes

·

View notes

Text

my heart goes out to any artist whos main platform is twitter, but ngl i think musk bein forced to buy twitter is the best thing ever just cuz of how utterly FUCKED he is financially now

#june speaks#he had to take out a massive loan cuz he lacked the liquid assets to buy the site as promised#so now his financial liquidity is fucked n he owes a MASSIVE loan with billions in interest#n the loan was made based on tesla stock which is constantly goin down#on top of all of this twitter is WILDLY unprofitable. shit loses like 1-2 billion annually#and his ideas and fanboys are so awful that basically all advertisers (advertising makes up like 80% of twitters funds) are backin out#cuz his ''process'' (if u can call it that) is so volitile n his fanboys are so rancid that advertisers don't wanna invest#from where they're standin twitter looks like a burnin ship whos captaincy was jus handed over to a guy who thinks the boat is too wet#now he's strugglin to make ends meet cuz nobody wants to pay for verification#only way he can make money is to sell more of people's data to more buyers#but i bet $50 bucks that him doin that will end in him gettin caught supressin tweets about it n bein seen as a liar by even his fanboys#ultimately resultin in him havin to resell twitter for a fraction of what he bought it for and/or havin to shut it down#which i think will be good for society#edit: apparently by layin off all these poor twitter employees so quickly he's in MASSIVE violation of a california labour law#basically he's gotta pay all of em lots of benefits lmao

3 notes

·

View notes

Text

For those wondering wtf is going on in the stock market, it's just market-wide contagion affecting almost all stocks. Banks and hedge funds borrowed Yen cheaply to invest in US Stocks, Japanese government raised rates, anyone who borrowed Yen now has to cover their asses, i.e. a market-wide stock sell-off.

Retail traders are suspiciously being told "no, you can't sell your stocks" or "no, you can't log into your account at all", just to ensure that the poor people end up holding the bag as usual.

So, in other words, the rich people rigged the game again, and while they are struggling to cover their own asses they are screwing over the average investor yet again.

#honestly ive got a bucket of popcorn and im watching the chaos unfold#Bloomburg has reported that there are going to be a ton of margin calls happening over the next couple of days#and tbh the only stock i have invested in is still in the green#over the course of today gamestop went down by... 14 cents#and they are still a holding company with 4 billion in cash on hand and the ability to do exactly what im gonna do#which is buy up as many cheap stocks as i can and wait for them to go back up

0 notes

Text

The economic indicators speak of nothing less than an economic catastrophe. Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel’s credit rating was lowered, Israeli bonds are sold at the prices of almost “junk bonds” levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel’s far-right government before October 7) show no prospects of recovery. The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel. This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel. But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever.

These are all financial indicators. But the crisis strikes deeper at the means of production of the Israeli economy. Israel’s power grid, which has largely switched to natural gas, still depends on coal to supply demand. The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing. After Colombia, the next two biggest suppliers are South Africa and Russia. Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy. Server farms do not work without 24-hour power, and no one knows how many blackouts the Israeli high-tech sector could potentially survive. International tech companies have already started closing their branches in Israel.

Israel’s reputation as a “startup nation” depends on its tech sector, which in turn depends on highly educated employees. Israeli academics report that joint research with universities abroad has declined sharply thanks to the efforts of student encampments. Israeli newspapers are full of articles about the exodus of educated Israelis. Prof. Dan Ben David, a famous economist, argued that the Israeli economy is held together by 300,000 people (the senior staff in universities, tech companies, and hospitals). Once a significant portion of these people leaves, he says, “We won’t become a third world country, we just won’t be anymore.”

19 July 2024

6K notes

·

View notes

Text

Okay, y'all.

I'm gonna be really up front with everybody in a way that I'm usually not:

This year so far has been really rough, in a way that kinda has me worried. Bear with me, and there will be dog pictures along the way and pictures of new swag at the end, ok?

Running a small business is always rough, and with everything going on - with me being down-and-out struggling to get my hysterectomy approved, with everything going on financially & politically, with Jake moving out here - we knew that this year probably wouldn't be a banner year, but...

... when I pulled reports at the end of May, I was kinda shocked and gutted because at the start of June, we were actually down a considerable amount year over year. I knew the year wouldn't be great, but like, oof.

Pride is usually where we make our money for the year - we call it "gay Christmas," because where other retailers count on their holiday season, we count on Pride to make sure that our employees get paid during January of the following year.

Pause for Ser Davos Seawoof:

This Pride has started ... slowly. Not terribly, but a little more slowly than I'm comfortable with, and slowly enough that I'm nervous. We invested a lot of money in new stock and equipment, and that's got to pay off. Right?

So here's the pitch:

We need to make at least $60K in sales this month to make sure that we're in good shape for the upcoming year. We are currently at $8100, and we have a two-day event coming up in Seattle at the end of the month, but that still gives us an awful lot of ground to make up.

If we hit our sales goal for this month, NerdyKeppie will donate 1% of our net profit for June to @queerliblib.

Just hitting that goal would both make it possible for us to know we can make it through the year & even if we have the worst profit margins this month, it'd be a minimum $250 donation.

We just added Express delivery as a shipping upgrade on most of our t-shirts (limited color and size options on that, which isn't under our control) so if you need something quick, we've got you, and everything from our Portland HQ collection ships usually within 2 business days.

Everything in our Bottoms & Tops collection is Buy 2, Get a 3rd 69% off with code TOP2BOTTOM until midnight tonight:

And as always, NerdyKeppie is 100% trans-owned and queer-run. We start all of our employees at a minimum of $25/hr, and all eligible employees are IWW members. We have no investors, and we have no shareholders to please. Big box corporations screw over small artists and drop Pride the minute it gets hard or controversial, but this is our life.

We're here for the long run. Help us stay and help us build resources for today & tomorrow, and get some cool-ass swag while you do.

💗🏳️🌈

4K notes

·

View notes

Text

It's funny how clearly uninformed a lot of criticism of Mozilla and its browser Firefox is. Like people say "it's just another corporation, out to make profit, just like Google." And that ordinary users promoting Firefox are just giving them free advertising.

It's in basically any post criticizing Mozilla, including on this site. Like using tumblr search I quickly found a post that was largely positive, but argued that Mozilla operates "under capitalist incentives" And outside tumblr I found a blog post out on the interwebs that criticized Mozilla and outright wondered "I don't know if Mozilla's business model ever made sense, it makes a lot more sense if it's something closer to a nonprofit rather than a commercial entity."

Well, let's research the Mozilla Corporation, see what that business model actually is. Let's begin that research by going to the wikipedia article, and read the two introductory paragraphs. And it turns out that it's "a wholly owned subsidiary of the Mozilla Foundation", which is a non-profit.

"The Mozilla Foundation will ultimately control the activities of the Mozilla Corporation and will retain its 100 percent ownership of the new subsidiary. Any profits made by the Mozilla Corporation will be invested back into the Mozilla project. There will be no shareholders, no stock options will be issued and no dividends will be paid. The Mozilla Corporation will not be floating on the stock market and it will be impossible for any company to take over or buy a stake in the subsidiary."

Turns out that it is not just "closer to a non-profit", it is literally a non-profit. Turns out you only needed two paragraphs on wikipedia to learn that, the most basic online research possible, which basically every post I found criticizing Mozilla failed to do.

This is entirely different from any other entity calling itself corporation, which is all about creating profit or money for its shareholders, the "capitalist incentives" spoken about earlier.

If you read further into that article, you will learn that the Mozilla corporation literally only exists separate from the foundation for tax and legal purposes, but it's still a non-profit operation.

This makes it reasonably immune from the enshittification process I've written about before. there is no incentive to fuck over the experience for end users for the sake of shareholder profits, like what tumblr is doing right now.

It means that Firefox is an exemption to the rule that "if something is free, you are the product", because there is no product to produce profits for shareholders, it's a charitable endeavour for a free and open internet, as laid out in the Mozilla manifesto.

This doesn't mean non-profits make corruption impossible, there is plenty of corruption in non-profit foundations. But unlike actual capitalist corporations, it doesn't have the greed and corruption built in. And if you are going to criticize Mozilla and Firefox, which it does sometimes deserve, you should have your basic facts straight before doing so, if you expect me to take you seriously.

#mozilla firefox#mozilla foundation#my writings#i ranted about this before including in the post i linked#but so much of the mozilla criticism i see about is just plain objectively wrong

14K notes

·

View notes