#Receiver Software

Explore tagged Tumblr posts

Text

1506TV NEW SOFTWARE SEPTEMBER 2024 DOWNLOAD

#1506tv all software#1506TV DVB Finder Software#1506TV to 1506FV Software#Download#Receiver Software#Satellite Receiver Software#Sunplus Receiver

0 notes

Text

Laptop is finally starting to give up the ghost 😔 it's a 2015 laptop so it stopped receiving OS upgrades a couple years ago 😔 and MS Office hasn't been able to update in over a year 😔 which has finally culminated in OneDrive no longer being able to sync to finder (or run at all as a desktop app) 😔

#i've been saying i need to replace it since it stopped receiving OS upgrades but oofa are new macbooks expensive and not really what i want#i got it at a five finger discount so my tolerance for wonkiness is pretty high but this requires a real pita workaround#where i need to save locally and then manually upload via the onedrive web app#i went through multiple major data loss events in college so yes i pay for onedrive#i dont really like gsuite bc i find sheets lacks some functionalities i use vs excel and i prefer desktop apps for office software#the size of my air (11in) is also perfect for travel so i'll probably hang onto it just for that since i do 1-2 overnights/mo for work#it is just like. come the fuck on. really? i know that nothing new will last this long :\

2 notes

·

View notes

Text

My game might be toast (again). I made it through all 3 base game hoods, and I have posts queued past Christmas. Hopefully I'll be in a position to switch to Linux before my queue runs out

#I have a lot of non-gaming software that I'm not sure is compatible with L/nux#I'm looking to get a laptop anyway so once I can move that software over I'll be free to do w/e with my desktop#I was already thinking of switching to L/nux anyway bc my pc can't upgrade to w/n11#And I'm def not PAYING to keep receiving updates

2 notes

·

View notes

Text

oh. my phone is too old so i can never have the new emojis unless i get a new stupid ugly new one. awesome.

#can no longer receive software updates 😂😂😂😂#i hate the newer iphones my dad has one and i had to navigate it the other day and i hated it so much#where is the button. give me my button back

7 notes

·

View notes

Text

for some reason ive been extremely paranoid about my phone getting an eas alert while im sleeping or trying to sleep, but ive been especially since the national test back in october. like generally im pretty good about them, they scare me but the fear is completely gone after a couple days max and i don't worry about it going off again. not sure why ive been so afraid since the test. the night before last i almost shut off my phone but i went into settings to turn off all alerts except for national, but i suddenly got really scared i was going to accidentally wake my whole house by somehow blaring the noise (it doesn't unless you go to past alerts and tap one). last night i had the same fear but didn't touch my phone and went to sleep fairly quickly after i cried. and instead of my phone in real life making a sound, my phone and computer in my dream made the sound instead. so now im scared of falling asleep and my own dreams

#not a vent#i feel like my phone vibrates more when getting those alerts than like phone calls#when the national test went off i was holding my phone and then again it was on the floor next to me#and both times it was loud vibrating louder than the vibration i get from phone calls#that sound is terrifying like compared to alert sounds from around the world why is ours so fuckingscary#i know it's to get your attention but is it required of me to be extremely paranoid and feel like im being watched as soon as i hear it#also laptops don't receive eas alerts at least mine doesn't. you have to install some software or something

3 notes

·

View notes

Text

Accounts Receivable vs Accounts Payable: Key Differences

When it comes to understanding how a business manages its money, two essential terms often pop up: accounts receivable and accounts payable. These are basic, yet powerful parts of financial management that every business, no matter the size, deals with regularly. While they might sound similar at first, they actually represent opposite sides of a company’s financial activities. In simple terms,…

#accounting software#accounts payable#accounts payable definition#accounts payable process#Accounts Receivable#accounts receivable definition#accounts receivable process#AP turnover#AR turnover#AR vs AP#balance sheet items#bookkeeping#business accounting basics#Business Finance#business operations#Cash Flow Management#cash inflows#cash outflows#Credit Management#current assets#current liabilities#difference between accounts receivable and accounts payable#financial accounting#Financial Management#Invoicing#managing payables#managing receivables#Payment Terms#receivables vs payables#small business finance

0 notes

Text

I haven’t really seen any of the more recent U.S. election news hitting tumblr yet so here’s some updates (now edited with sources added):

There’s evidence of Trump cheating and interfering with the election.

Possible Russian interference.

Mail-in ballots are not being counted or “recognized” in multiple (notably swing) states.

30+ bomb threats were called in and shut down polling stations on Election Day.

20+ million votes are still unaccounted for, and that’s just to have the same voter turnout as 2020.

There was record voter turnout and new/first-time voter registration this year. We definitely should be well over the turnout in 2020.

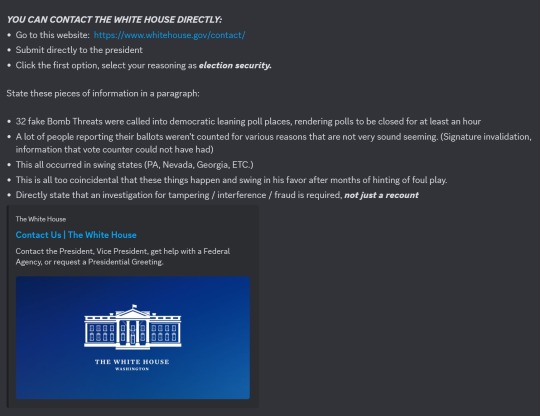

U.S. citizens are using this site to demand, not only a recount, but a complete investigation into election fraud and interference for the reasons stated above:

Here is what I submitted as an example:

An investigation for election interference and fraud is required. We desperately need a recount or even a revote. The American people deserve the right to a free and fair election. There has been evidence unveiled of Trump cheating and committing election fraud which is illegal. There is some evidence of possible Russian interference. At least 30+ bomb threats were called in to polling places. Multiple, notably swing states, have ballots unaccounted for and voting machines not registering votes. Ballots and ballot boxes were tampered with and burned. Over 20 million votes that we know of are unaccounted for. With record turnout and new voter registration this year, there should be no possibility that there are less votes than even in the 2020 election.

Sources (working on finding more links but if anyone wants to add info, it’s appreciated):

FBI addressing Russian interference and bomb threats:

Emails released by Rachael Bellis (private account, can’t share original tweet) confirming Trump committing election fraud:

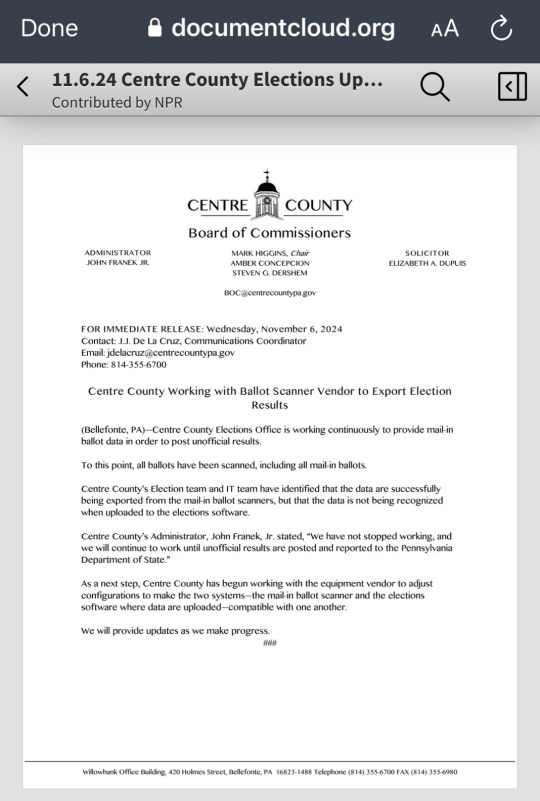

Pennsylvania's Centre County officials say they are working with their ballot scanner vendor to figure out why the county's mail-in ballot data is "not being recognized when uploaded to the elections software:”

Wisconsin recount:

[ID:

Multiple screenshots and images.

The first is a screenshot with a link and information for contacting the White House directly regarding election fraud. The instructions include choosing to leave a comment to President Joe Biden directly and to select election security as the reason.

The screenshot then instructs people to include any or all of the following information in a paragraph as a comment to the president:

32 fake bomb threats were called into Democratic leaning poll places, rendering polling places closed for at least an hour.

A lot of people reporting their ballots were not counted for various reasons.

This all occurred in swing states.

This is too coincidental that these things happen and swing in his favor after months of hinting at foul play.

Directly state that an investigation for tampering, interference, fraud is required, not just a recount.

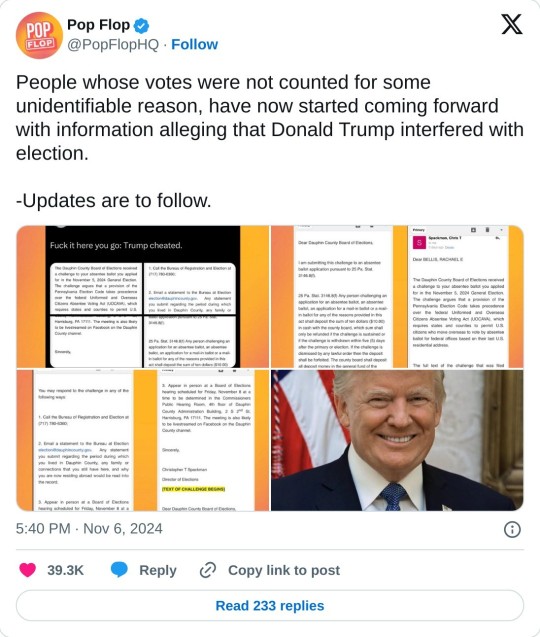

The second image is from the FBI Twitter account that reads:

The FBI is aware of bomb threats to polling locations in several states, many of which appear to originate from Russian email domains. None of the threats have been determined to be credible thus far. https://t.co/j3YfajVK1m — FBI (@FBI) November 5, 2024

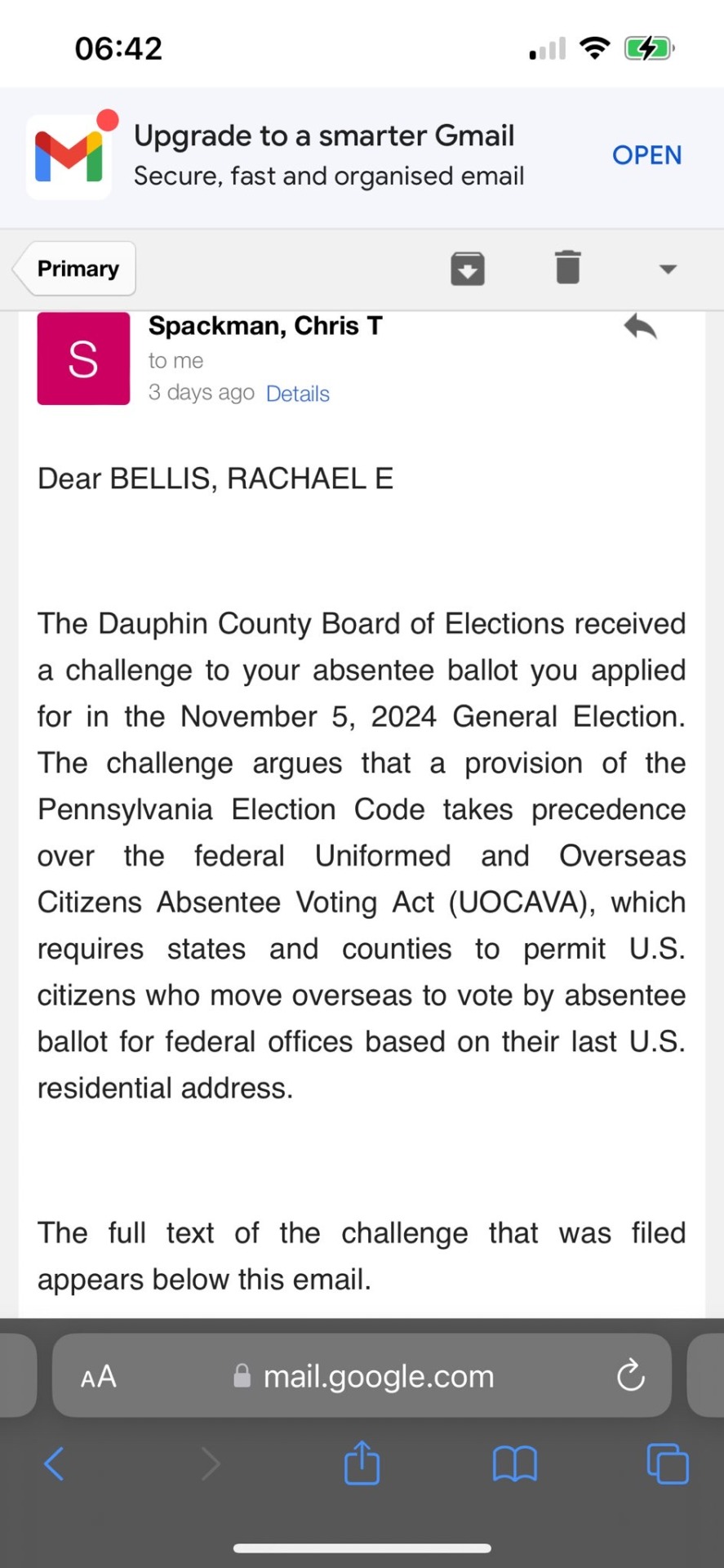

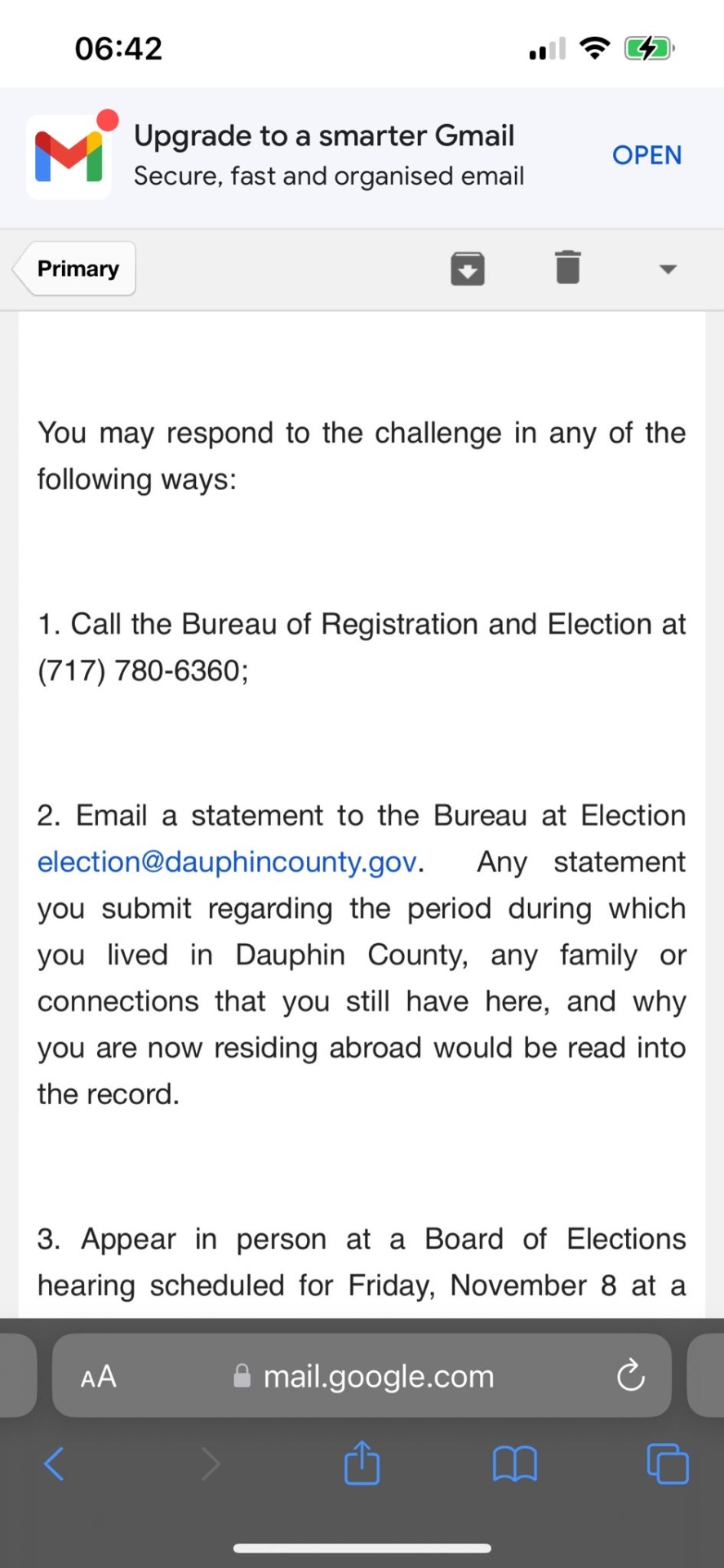

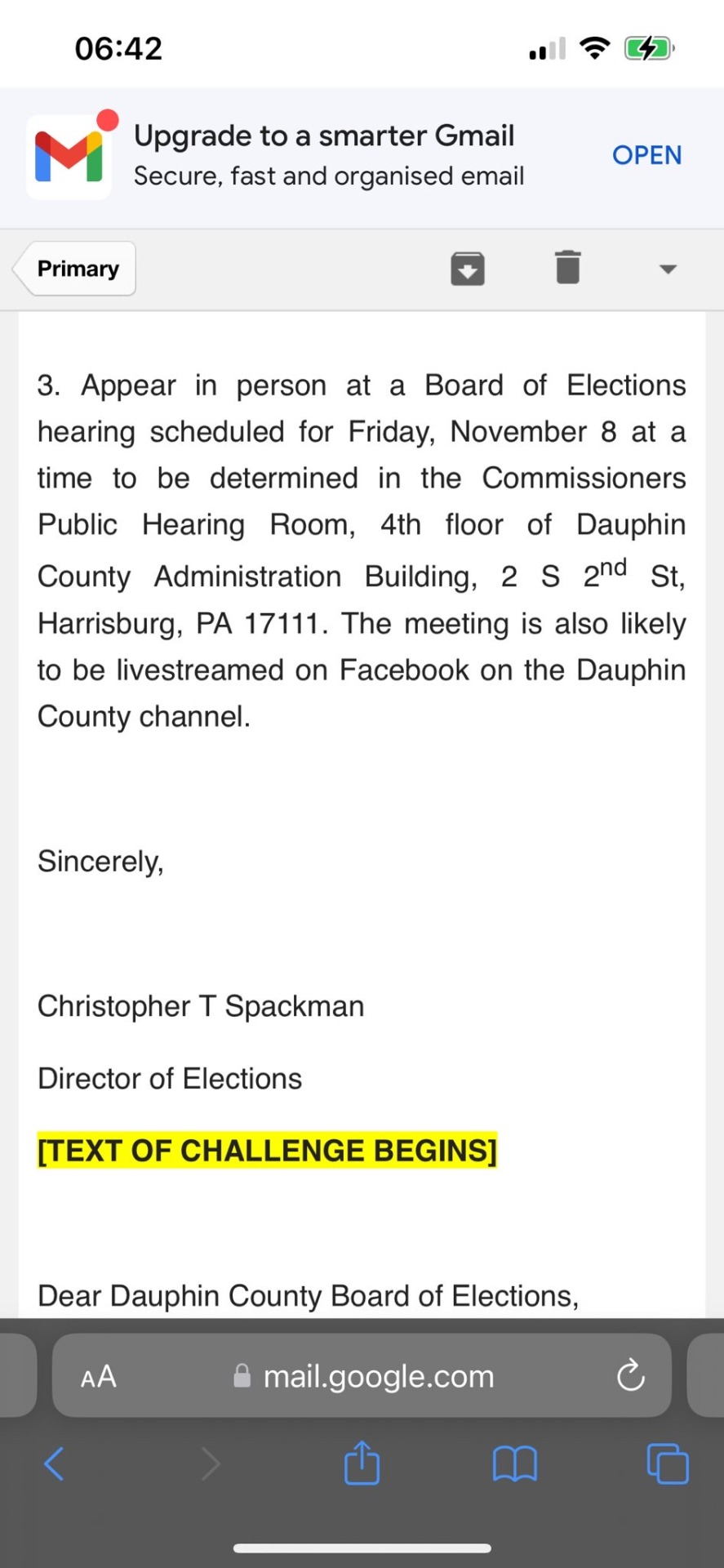

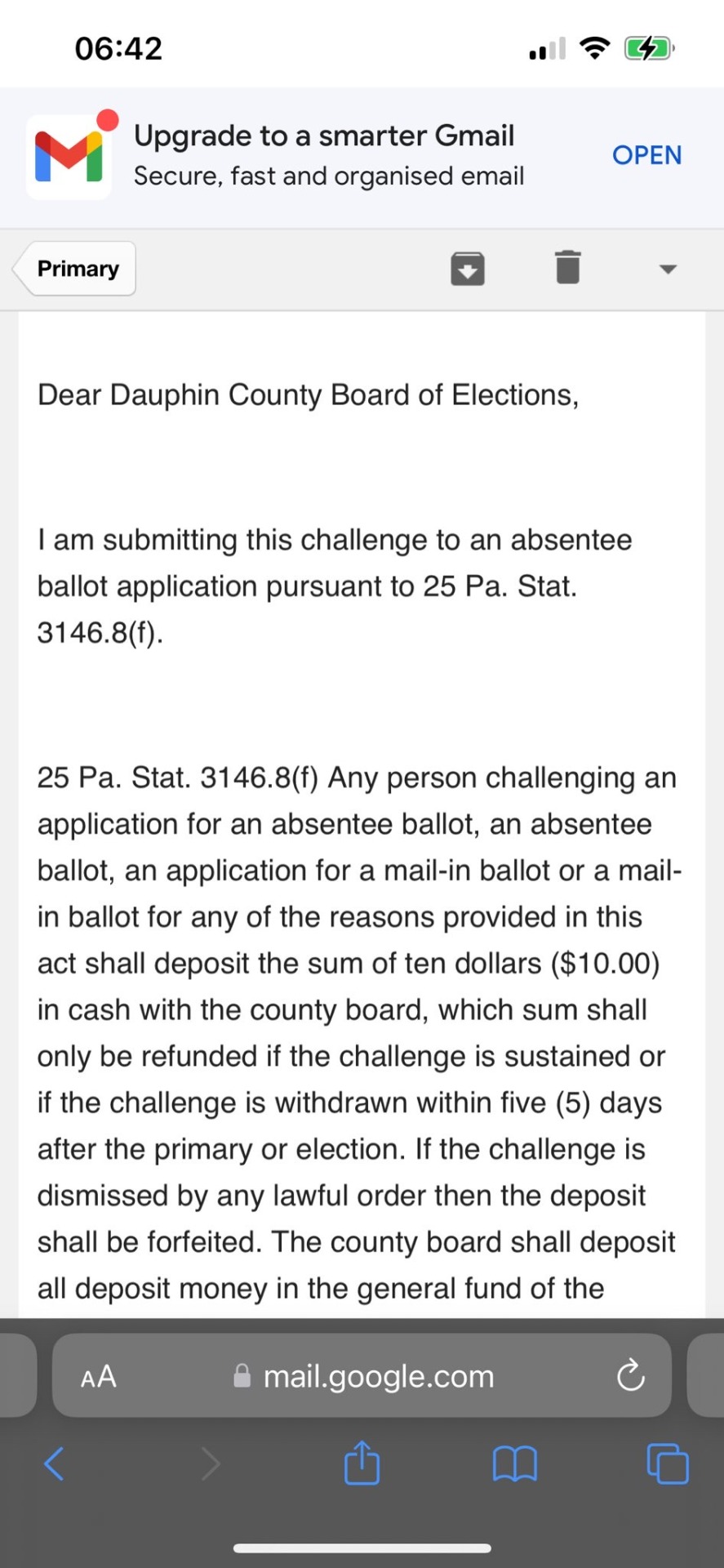

The next four Gmail screenshots of an email sent to Rachael Bellis from Chris T. Spackman that read together as follows:

Dear BELLIS, RACHAEL E., The Dauphin County Board of Elections received a challenge to your absentee ballot you applied for in the November 5, 2024 General Election. The challenge argues that a provision of the Pennsylvania Election Code takes precedence over the federal Uniformed and Overseas Citizens Absentee Voting Act (UOCAVA), which requires states and counties to permit U.S. citizens who move overseas to vote by absentee ballot for federal offices based on their last U.S. residential address.

The full text of the challenge that was filed appears below this email.

You may respond to the challenge in any of the following ways:

1. Call the Bureau of Registration and Election at (717) 780-6360;

2. Email a statement to the Bureau at Election [email protected]. Any statement you submit regarding the period during which you lived in Dauphin County, any family or connections that you still have here, and why you are now residing abroad would be read into the record.

3. Appear in person at a Board of Elections hearing scheduled for Friday, November 8 at a time to be determined in the Commissioners Public Hearing Room, 4th floor of Dauphin County Administration Building, 2 S 20d St, Harrisburg, PA 17111. The meeting is also likely to be livestreamed on Facebook on the Dauphin County channel.

Sincerely,

Christopher T Spackman

TEXT OF CHALLENGE BEGINS

Dear Dauphin County Board of Elections,

I am submitting this challenge to an absentee ballot application pursuant to 25 Pa. Stat.

3146.8(f).

25 Pa. Stat. 3146.8(f) Any person challenging an application for an absentee ballot, an absentee ballot, an application for a mail-in ballot or a mail-in ballot for any of the reasons provided in this act shall deposit the sum of ten dollars ($10.00) in cash with the county board, which sum shall only be refunded if the challenge is sustained or if the challenge is withdrawn within five (5) days after the primary or election. If the challenge is dismissed by any lawful order then the deposit shall be forfeited. The county board shall deposit all deposit money in the general fund of the…

The rest of the forwarded email is cut off.

The last image is a screenshot of the official statement from the Centre County, Pennsylvania Board of Commissioners released on November 6, 2024 that states:

Centre County Working with Ballot Scanner Vendor to Export Election Results.

(Bellefonte, PA) -Centre County Elections Office is working continuously to provide mail-in ballot data in order to post unofficial results.

To this point, all ballots have been scanned, including all mail-in ballots.

Centre County's Election team and IT team have identified that the data are successfully being exported from the mail-in ballot scanners, but that the data is not being recognized when uploaded to the elections software.

Centre County's Administrator, John Franek, Jr. stated, "We have not stopped working, and we will continue to work until unofficial results are posted and reported to the Pennsylvania Department of State."

As a next step, Centre County has begun working with the equipment vendor to adjust configurations to make the two systems-the mail-in ballot scanner and the elections software where data are uploaded -compatible with one another.

We will provide updates as we make progress.

/end ID]

#sources added#us politics#us election#presidential election#2024 presidential election#election interference#election integrity#election security#image described#image description in alt#image description included#image description added#described#kamala harris#kamala 2024#us news#us presidents#updated id

36K notes

·

View notes

Text

Drive Financial Efficiency with Outsourced Accounts Receivable Services

For businesses focused on maximizing revenue, managing the accounts receivable (AR) process efficiently is essential. Accounts receivable outsourcing offers a strategic solution to streamline your revenue cycle, reduce administrative burdens, and enhance cash flow.

One of the key benefits of outsourcing AR is revenue management. Outsourcing partners specialize in tracking outstanding invoices, managing payment terms, and ensuring that payments are received on time. This leads to a more predictable cash flow, which is crucial for making informed business decisions.

Billing services provided by outsourcing firms are designed to eliminate errors and inconsistencies in invoices. Automated billing and accurate invoicing reduce the likelihood of disputes and ensure clients are billed correctly, leading to faster payments and fewer follow-up issues.

By entrusting receivables tracking to professionals, businesses can improve the accuracy of their AR data. Specialized teams use sophisticated software to monitor overdue accounts, prioritize collections, and send timely payment reminders—ensuring that no invoice is overlooked or delayed.

Another critical aspect is the use of AR software, which enhances the overall efficiency of the receivables process. These tools offer real-time insights, track payment trends, and provide reports that help businesses assess their financial health. With AR software, businesses can optimize collections and avoid cash flow disruptions caused by late payments.

In conclusion, accounts receivable outsourcing helps businesses streamline their revenue cycle by improving revenue management, reducing errors in billing, enhancing receivables tracking, and providing access to advanced AR software. This leads to faster payments, improved cash flow, and a more efficient overall financial operation.

#accounts receivable outsourcing#revenue management#billing services#receivables tracking#AR software

0 notes

Text

PostGhost helps you combat physical junk mail effectively. Discover innovative solutions to reduce unwanted mail, protect your privacy..."

#eco-friendly junk mail removal#how to stop junk mail from usps#how to stop receiving junk mail#software company#reduce physical junk mail#information technology#junk mail management service#how to stop spam mail usps#how to stop junk postal mail

0 notes

Text

Master Account Receivable Management: Boost Efficiency

Improve your account receivable management and streamline collections. Boost efficiency, minimize delays, and enhance cash flow with expert strategies to maintain financial stability and long-term growth.

#account receivable#account receivable financing#account receivable financing company#account receivable management#account receivable management software#cash flow optimization#Effective account receivable management#financial stability#invoicing automation#optimize account receivable management

0 notes

Text

MEDIASTAR MS-MINI790 SUPER

MEDIASTAR MS-MINI790 SUPER Digital Satellite Receiver New Software, Dump Flash Software PC, Loader, and apps Download. Mediastar tools, channel editor, and Upgrade Tools.

#Mediastar Receiver#mediastar receiver 4k#Mediastar Receiver Software#MediaStar sw#Receiver Software#دانلود نرم افزار مدیا استار#سایت رسمی مدیا استار آپگرید

0 notes

Text

Aip Manufacturers in india

#time and frequency synchronization solutions asia#meinberg products india#IEEE 1588 Solutions#PCI Express Radio Clocks Solutions#USB Radio Clocks Solutions#GNSS Systems#GPS satellite receiver#GLONASS satellite receiver#Galileo satellite receiver#BeiDou satellite receiver#Meinberg Software#Meinberg Germany#Distributor of Meinberg Germany#Solutions of Meinberg Germany#network time servers india#meinberg software maharashtra

0 notes

Text

The Future of Accounts Payable and Receivable Automation in India

In today’s fast-paced business environment, financial transactions must be handled efficiently to maintain cash flow and profitability. Companies are rapidly shifting towards digital solutions to optimize their financial operations. Accounts payable automation in India is revolutionizing how businesses manage their outgoing payments, ensuring accuracy, compliance, and seamless processing. Likewise, accounts receivable automation in India is helping organizations streamline invoicing, payment collection, and reconciliation, reducing manual errors and delays.

The Rise of Financial Services Automation in India

As industries expand and transactions increase, traditional manual financial processes become inefficient and error-prone. This has led to a surge in demand for financial services automation in India. Businesses across sectors are embracing automation to improve efficiency, enhance compliance, and minimize risks. Automated financial workflows not only speed up payment cycles but also provide real-time visibility into transactions, ensuring better decision-making.

Key Benefits of Accounts Payable and Receivable Automation

1. Enhanced Efficiency and Speed

Automation eliminates repetitive tasks, reducing the time spent on invoice processing and payment approvals. Companies using accounts payable automation in India can process invoices swiftly and avoid late payment penalties.

2. Error Reduction and Compliance

Manual data entry often results in miscalculations and compliance issues. With accounts receivable automation in India, businesses can ensure accurate billing, automated reminders, and error-free financial records.

3. Improved Cash Flow Management

By automating accounts payable and receivable functions, businesses can maintain a healthy cash flow, avoid bottlenecks, and ensure timely payments and collections.

4. Fraud Prevention and Security

Automation software comes with built-in security features that protect businesses from fraud, unauthorized access, and financial discrepancies.

Choosing the Right Accounts Payable and Receivable Automation Software

Selecting a reliable Accounts Payable Receivable Automation Software Company is crucial for businesses looking to modernize their financial operations. A good software provider offers features such as AI-powered invoice processing, automated reconciliation, seamless integration with ERP systems, and real-time reporting. Investing in the right automation solution ensures long-term financial efficiency and business growth.

Conclusion

The demand for accounts payable automation in India and accounts receivable automation in India is growing as businesses recognize the advantages of financial digital transformation. Partnering with a top Accounts Payable Receivable Automation Software Company can help organizations achieve operational excellence, reduce costs, and improve financial accuracy. Embracing financial services automation in India is no longer a choice but a necessity for companies looking to stay ahead in the competitive market.

If your business is looking for a seamless transition to automated financial processes, now is the time to explore cutting-edge solutions and take a step towards financial excellence!

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india#Accounts Payable Receivable Automation Software Company#financial services automation in india

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

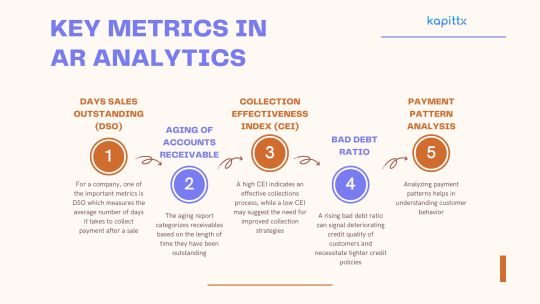

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

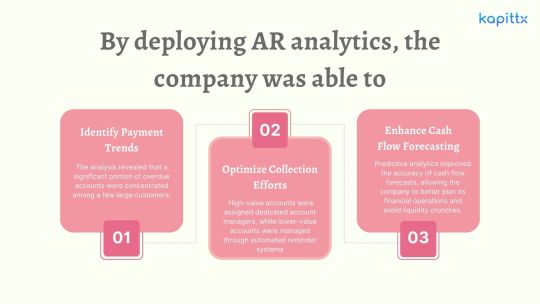

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Plot armor but it’s Bruce Wayne’s wealth.

Bruce is one of the richest men in the world. Bruce does not want to be one of the richest men in world.

He starts by implementing high starting salaries and full health care coverages for all levels at Wayne Enterprises. This in vastly improves retention and worker productivity, and WE profits soar. He increases PTO, grants generous parental and family leave, funds diversity initiatives, boosts salaries again. WE is ranked “#1 worker-friendly corporation”, and productively and profits soar again.

Ok, so clearly investing his workers isn’t the profit-destroying doomed strategy his peers claim it is. Bruce is going to keep doing it obviously (his next initiative is to ensure all part-time and contractors get the same benefits and pay as full time employees), but he is going to have to find a different way to dump his money.

But you know what else is supposed to be prohibitively expensive? Green and ethical initiatives. Yes, Bruce can do that. He creates and fund a 10 year plan to covert all Wayne facilities to renewable energy. He overhauls all factories to employ the best environmentally friendly practices and technologies. He cuts contracts with all suppliers that engage in unethical employment practices and pays for other to upgrade their equipment and facilities to meet WE’s new environmental and safety requirements. He spares no expense.

Yeah, Wayne Enterprises is so successful that they spin off an entire new business arm focused on helping other companies convert to environmentally friendly and safe practices like they did in an efficient, cost effective, successful way.

Admittedly, investing in his own company was probably never going to be the best way to get rid of his wealth. He slashes his own salary to a pittance (god knows he has more money than he could possibly know what to do with already) and keeps investing the profits back into the workers, and WE keeps responding with nearly terrifying success.

So WE is a no-go, and Bruce now has numerous angry billionaires on his back because they’ve been claiming all these measures he’s implementing are too expensive to justify for decades and they’re finding it a little hard to keep the wool over everyone’s eyes when Idiot Softheart Bruice Wayne has money spilling out his ears. BUT Bruce can invest in Gotham. That’ll go well, right?

Gotham’s infrastructure is the OSHA anti-Christ and even what little is up to code is constantly getting destroyed by Rogue attacks. Surely THAT will be a money sink.

Except the only non-corrupt employer in Gotham city is….Wayne Enterprises. Or contractors or companies or businesses that somehow, in some way or other, feed back to WE. Paying wholesale for improvement to Gotham’s infrastructure somehow increases WE’s profits.

Bruce funds a full system overhaul of Gotham hospital (it’s not his fault the best administrative system software is WE—he looked), he sets up foundations and trusts for shelters, free clinics, schools, meal plans, day care, literally anything he can think of.

Gotham continues to be a shithole. Bruce Wayne continues to be richer than god against his Batman-ingrained will.

Oh, and Bruice Wayne is no longer viewed as solely a spoiled idiot nepo baby. The public responds by investing in WE and anything else he owns, and stop doing this, please.

Bruce sets up a foundation to pay the college tuition of every Gotham citizen who applies. It’s so successful that within 10 years, donations from previous recipients more than cover incoming need, and Bruce can’t even donate to his own charity.

But by this time, Bruce has children. If he can’t get rid of his wealth, he can at least distribute it, right?

Except Dick Grayson absolutely refuses to receive any of his money, won’t touch his trust fund, and in fact has never been so successful and creative with his hacking skills as he is in dumping the money BACK on Bruce. Jason died and won’t legally resurrect to take his trust fund. Tim has his own inherited wealth, refuses to inherit more, and in fact happily joins forces with Dick to hack accounts and return whatever money he tries to give them. Cass has no concept of monetary wealth and gives him panicked, overwhelmed eyes whenever he so much as implies offering more than $100 at once. Damian is showing worrying signs of following in his precious Richard’s footsteps, and Babs barely allows him to fund tech for the Clocktower. At least Steph lets him pay for her tuition and uses his credit card to buy unholy amounts of Batburger. But that is hardly a drop in the ocean of Bruce’s wealth. And she won’t even accept a trust fund of only one million.

Jason wins for best-worst child though because he currently runs a very lucrative crime empire. And although he pours the vast, vast majority of his profits back into Crime Alley, whenever he gets a little too rich for his tastes, he dumps the money on Bruce. At this point, Bruce almost wishes he was being used for money laundering because then he’s at least not have the money.

So children—generous, kindhearted, stubborn till the day they die the little shits, children—are also out.

Bruce was funding the Justice League. But then finances were leaked, and the public had an outcry over one man holding so much sway over the world’s superheroes (nevermind Bruce is one of those superheroes—but the public can’t know that). So Bruce had to do some fancy PR trickery, concede to a policy of not receiving a majority of funds from one individual, and significantly decrease his contributions because no one could match his donations.

At his wits end, Bruce hires a team of accounts to search through every crinkle and crevice of tax law to find what loopholes or shortcuts can be avoided in order to pay his damn taxes to the MAX.

The results are horrifying. According to the strictest definition of the law, the government owes him money.

Bruce burns the report, buries any evidence as deeply as he can, and organizes a foundation to lobby for FAR higher taxation of the upper class.

All this, and Wayne Enterprises is happily chugging along, churning profit, expanding into new markets, growing in the stock market, and trying to force the credit and proportionate compensation on their increasingly horrified CEO.

Bruce Wayne is one of the richest men in the world. Bruce Wayne will never not be one of the richest men in the world.

But by GOD is he trying.

#batman#bruce wayne#laws of this dc universe say Gotham is always a hellcity#and bruce wayne is always filthy rich#bruce wayne is fighting with everything he has against both those facts#he’s not going to win#but he’s not going to stop either#bruce crying with fistfuls of money in his hands: take it. PLEASE#the public: donate more???

66K notes

·

View notes

Text

How To Opt Out Of Junk Mail From Xfinity (Comcast)

How to Put a Stop to Xfinity’s Persistent Junk Mail

As America’s leading cable provider, Xfinity (owned by Comcast) has been feeling the crunch of cord-cutting more than most. To keep their customer base intact, they’ve doubled down on aggressive marketing, sending out promotional mailers and offers like clockwork.

If your mailbox is drowning in Xfinity advertisements and you’ve had enough, don’t worry—you’re not powerless. Whether or not you’re a customer, there are simple ways to break free from the junk mail cycle.

Not a Customer? Here’s How to Stop Xfinity Junk Mail

Unsubscribe URL: https://pc2.mypreferences.com/Comcast/OptOut/Default.aspx

Phone #: +1-800-934-6489

Company Website: https://www.xfinity.com/

Even if you’re not an Xfinity subscriber, you can still block their marketing materials. Here’s how:

Use Their Online Opt-Out Tool: Comcast offers a straightforward opt-out form to remove your address from their mailing list.

Call Their Helpline: Ring them at 1-800-XFINITY. While this works, it can feel like a patience test with lengthy hold times.

Skip the Chatbot: The Xfinity Assistant bot isn’t ideal—it typically requires a login and provides limited options without an account.

Are You a Customer? Manage Xfinity’s Marketing Overload

Xfinity customers face a barrage of upgrade offers, mobile promotions, and more. Here’s how to regain control over your inbox and mailbox:

Submit the Online Form: Opt out of marketing mail, calls, and emails through Comcast’s preference center.

Switch to Paperless Billing: While account-related communications won’t disappear, you can minimize paper clutter by enabling paperless billing through your My Account profile.

Give Them a Call: For a personal touch, contact a customer service representative at 1-800-XFINITY to adjust your marketing preferences.

Try the Chatbot: If you prefer not to call, the Xfinity Assistant bot can help, though you’ll need to verify your account details (like the last four digits of your card on file).

When Will the Junk Mail Stop?

Postal Mail: Xfinity claims it takes up to 60 days to process opt-out requests. Based on user experiences, it’s safer to expect a 90-day window before the mail stops completely.

Email and Calls: Marketing emails and phone calls are typically halted within 30 days of your request.

Let PostGhost Take Care of It—Effortlessly!

Tired of junk mail piling up? PostGhost is the easiest, quickest way to reclaim your mailbox and your peace of mind. Forget the hassle of forms or waiting in queues—PostGhost has you covered in just a few simple steps.

A 3-Minute Setup: Verify your identity through PostGhost’s secure platform. It’s quick, easy, and takes less than three minutes of your time.

Snap, Tap, Done: Want an even simpler option? Use the PostGhost app! Just snap a photo of unwanted mail, and we’ll handle the rest. It’s like having your personal mailbox assistant!

Stops More Than Just Xfinity: From catalogs to credit card offers and charity mailers, PostGhost works with thousands of senders to clear out your mailbox for good.

Take Back Control: With PostGhost, you’ll enjoy a clutter-free mailbox—and a stress-free life.

Why wait? PostGhost makes it easier than ever to say goodbye to junk mail. Get started today and let us do the hard work for you!

#how to stop junk postal mail#reduce physical junk mail#eco-friendly junk mail removal#Environment#Software Company#junk mail management service#postghost mail service#information technology#how to stop junk mail from usps#how to stop receiving junk mail

1 note

·

View note