#Refund Consulting Program Business

Explore tagged Tumblr posts

Text

Honest Confession of a Female Separatist #6

Sex, Men, and Friendships w/Men

I've had pretty good sex with two men.

The first (3+ year relationship)in the sense that I loved him, I felt safe, and it felt good to be able to be safely exposed and vulnerable with someone I loved. Of course that ended when he made several admissions of his own verbally and behaviorally that clearly demonstrated he didn't give two shits about me.

The second(3+ month relationship) in the sense that he was just good at the act itself and very sweet. That is of course until he became an asshole, or dropped the sweet honey trap game to draw me in and as a result of which I promptly dumped him.

If only I could have good sex with a man that loved, respected, and was kind to me all the time 🙄. Because that's not a thing and because I don't want to risk it I have sex with myself and that has been excellent but I still daydream about a man that could see me as a human not an object but the world isn't that way at all. I can't wait till I overcome this nasty ass desire.

Friendships w/ Men

I have several friends that are male. I've been slowly eliminating them. I have one that has invited himself to visit me-- I actually thought for a bit this was something I did (the patrichchal brainwash still has me programmed -- this will take a lifetime of work) -- but actually it's quite clear he's coming to be entertained and hosted. I'm busy as fuck! I work two jobs + consult. Additionally I'm selling/packing everything in my house, and doing so many other grown women things of which he is fully aware. And yet he wants to come to my fucking house and hang out--no hotel, no car rental, just being catered to and entertained!!! I want to cancel! Girl programming has me wanting to be nice and feeling ashamed. I literally don't want male juice in my house, car, shower, kitchen, any fucking where. I feel absolutely disgusted -- this feels extreme like full on hate for men. Additionally I hate his text messages every fucking day -- he's like "Hey" 🙄 why don't you have your own thoughts asshat? Why do you want me to do mental labor for you? Lastly this guy has a girlfriend and they are in an open relationship of which he is unable to make connections with women to be open with while his gf is country hopping with a side beau-- which again is telling because he's coming here for his ego gross 🤢

Anyways, I'm cancelling the visit and also the nice girl in me (programmed, not natural) will probably pay the cost of his ticket because of course he booked non-refundable flights. Fml.

I'm a fuckin work in progress and jesus is the decolonizing rough.

#fuck the patriarchy#all men#male violence#4b movement#proud misandrist#female separatist#god is a woman#misandry#fuck all men#fuck these guys

4 notes

·

View notes

Text

Thailand Privilege Visa

The Thailand Privilege Visa, also known as the Thailand Elite Visa, is a long-term visa program designed for high-net-worth individuals, retirees, businesspeople, and frequent travelers seeking extended residency in Thailand. Managed by Thailand Privilege Card Co., Ltd., the program offers multiple visa options, with durations ranging from 5 to 20 years. Unlike traditional visas, the Privilege Visa provides VIP services, multi-entry privileges, and a range of exclusive benefits that enhance convenience and lifestyle in Thailand.

1. Key Features and Benefits of the Thailand Privilege Visa

Long-Term Residency – Valid for 5, 10, or 20 years without annual visa renewals.

Multiple Entry Visa – Unlimited travel in and out of Thailand during the visa validity period.

VIP Immigration Services – Access to fast-track immigration lanes at major Thai airports.

Airport Concierge and Lounge Services – Personal assistance at airports and complimentary access to luxury lounges.

Health and Wellness Benefits – Discounts at hospitals, spas, fitness centers, and golf courses.

Exclusive Business and Lifestyle Opportunities – Invitations to networking events, luxury accommodations, and cultural experiences.

2. Membership Packages and Fees

The Thailand Privilege Visa program offers various membership options tailored to individual lifestyles:

2.1 Elite Easy Access

Duration: 5 years

Fee: 600,000 THB (non-refundable)

Designed for frequent business travelers and digital nomads.

2.2 Elite Superiority Extension

Duration: 20 years

Fee: 1,000,000 THB

Ideal for long-term residents and retirees seeking hassle-free living.

2.3 Elite Ultimate Privilege

Duration: 20 years

Fee: 2,000,000 THB + 20,000 THB annual fee

Offers the most comprehensive benefits, including complimentary golf, spa treatments, and private concierge services.

2.4 Elite Family Excursion

Duration: 5 years

Fee: 800,000 THB for two family members (300,000 THB per additional member)

Designed for families relocating to Thailand.

3. Application Process

Submit the Application: Applicants must provide a copy of their passport, personal information, and proof of financial means.

Background Check: The Thai Immigration Bureau conducts a thorough background check.

Membership Approval and Payment: Once approved, the applicant pays the membership fee.

Visa Issuance: The visa is issued at a Thai consulate or immigration office.

The approval process typically takes 30 to 45 days.

4. Tax Implications and Legal Considerations

Tax Residency: Thailand Privilege Visa holders may be considered tax residents if they stay in Thailand for more than 180 days per year. Tax residents are required to declare income earned in Thailand and may be subject to tax on foreign-sourced income if it is remitted to Thailand within the same tax year.

Work Restrictions: The visa does not include a work permit. Visa holders must apply for a separate permit to work legally in Thailand.

Conclusion

The Thailand Privilege Visa is a unique and flexible residency option for individuals seeking a premium lifestyle and long-term stay in Thailand. With multiple packages to suit different needs, the program offers unparalleled convenience and exclusive benefits. While the membership fees are substantial, the visa’s privileges—such as fast-track immigration services, healthcare benefits, and business opportunities—make it an attractive option for many. Prospective applicants should carefully assess their needs and consult with professionals to determine the most suitable package.

#thailand#thai#visa#thaivisa#thailandvisa#visainthailand#thaiprivilegevisa#thailandprivilegevisa#thaipr#pr#immigration#immigrationinthailand#thailandimmigration#immigrationlawyers#immigrationlawyersinthailand

2 notes

·

View notes

Text

How To Manage Negative Online Reviews For Your Business?

No one likes to receive terrible online reviews, but it’s an inevitable thing in the world of business. While it’s normal to feel insulted and take it as an offense at first, it matters how you handle these negative reviews.

Having such reviews is healthy for your business because, with these, you can set standards on how you can improve your services. You don’t need to worry about any of this on your own if you can’t handle it. Leave it to the hands of a reliable SEO agency providing services of an SEO company in Chandigarh.

Monitor Online Platforms

Stay vigilant and regularly monitor online platforms where customers can leave reviews about your business, such as review websites, social media platforms, and search engine listings. Being aware of negative reviews as soon as they are posted allows you to respond promptly and address the concerns.

Stay Calm and Objective

It’s natural to feel defensive when faced with negative feedback, but it’s crucial to stay calm and objective in your response. Take a step back, carefully read the review, and try to understand the customer’s perspective. Remember, a thoughtful and professional response can go a long way in resolving the issue.

Respond Promptly

Time is of the essence when dealing with negative reviews. Respond to them promptly to demonstrate that you value customer feedback and are committed to resolving any issues. Ignoring or delaying responses can worsen the situation and give the impression that you don’t care about your customers’ concerns.

Personalize Your Responses

Address the reviewer by name if possible and use personalized language in your response. This shows that you are genuinely engaging with the customer and not providing a generic reply. Acknowledge their concerns, apologize for any inconvenience caused, and offer a solution or steps to rectify the issue.

Take the Conversation Offline

While it’s important to respond publicly to negative reviews, it’s equally essential to take the conversation offline. Provide a contact email or phone number where the customer can reach out to discuss the issue in more detail. This demonstrates your willingness to resolve the problem privately and shows other potential customers that you are proactive in addressing concerns.

Offer a Resolution

In your response, provide a solution or offer to make amends. Whether it’s a refund, a replacement, or additional assistance, showing that you are willing to go the extra mile to resolve the issue can help mitigate the impact of the negative review. Be transparent about your intentions and actions to rebuild trust with the customer and other readers.

Encourage Positive Reviews

Actively encourage your satisfied customers to leave positive reviews about their experiences. This helps counterbalance negative reviews and showcases the positive aspects of your business. Implement strategies such as sending follow-up emails, offering incentives, or creating a loyalty program to encourage customers to share their positive experiences online.

Learn from Feedback

Negative reviews can provide valuable insights into areas where your business may be falling short. Use them as an opportunity to learn, adapt, and improve your products, services, or customer experience. By addressing recurring issues, you can prevent similar negative reviews in the future and enhance your overall business operations.

Seek Professional Help if Needed

In some cases, negative reviews may be particularly damaging or involve false information. If you encounter such situations, it may be beneficial to consult with a reputation management professional who can guide how to handle the issue effectively and minimize any long-term damage.

5 notes

·

View notes

Text

How to Get Business Visa for USA – A Complete 2025 Guide

The United States continues to be a leading destination for global business professionals, investors, and entrepreneurs. If you are planning to travel to the U.S. for meetings, conferences, negotiations, or other business-related purposes, you will need to apply for a B-1 Business Visa. This blog provides a comprehensive guide on how to get a U.S. business visa, including the application process, required documents, fees, processing times, and frequently asked questions.

What is a U.S. Business Visa (B-1 Visa)?

The B-1 visa is a non-immigrant visa that allows foreign nationals to enter the United States temporarily for business activities that do not involve employment or receiving a salary from a U.S. source. Common permitted activities include:

Attending business meetings and negotiations

Participating in professional or industry conferences

Consulting with business associates

Contract signing or market exploration

Settling an estate

Short-term training (non-technical)

It is important to note that B-1 visa holders are not allowed to engage in gainful employment or long-term work in the U.S.

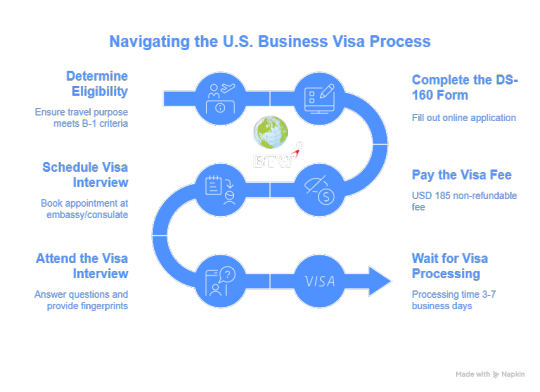

Step-by-Step Process to Apply for a U.S. Business Visa

1. Determine Eligibility Before applying, ensure that your purpose of travel meets the criteria for the B-1 visa. You must also demonstrate ties to your home country and the intention to return after your short visit.

2. Complete the DS-160 Form The DS-160 is the standard online visa application form for non-immigrant visas. Fill out the form at: https://ceac.state.gov/ceac/ Once submitted, save the confirmation page with the barcode.

3. Pay the Visa Fee As of 2025, the application fee for a B-1 visa is USD 185. This fee is non-refundable, even if the visa is denied.

4. Schedule Visa Interview After paying the fee, schedule your visa appointment at the nearest U.S. embassy or consulate. Depending on the location, waiting times may vary from a few days to several weeks.

5. Attend the Visa Interview During the interview, you will be asked questions about your travel plans, business purpose, financial status, and ties to your home country. You will also need to provide fingerprints as part of the biometric process.

6. Wait for Visa Processing If approved, your passport with the visa stamp will be returned by courier or can be collected at the visa center. Processing times usually range from 3 to 7 business days, but it may take longer during peak seasons.

Documents Required

Valid passport (minimum 6 months validity beyond intended stay)

DS-160 confirmation page

Visa fee payment receipt

Appointment confirmation letter

Letter of invitation from U.S. business associate or company

Proof of employment or business ownership in home country

Travel itinerary (flight and hotel bookings)

Financial documents (bank statements, salary slips, tax returns)

Evidence of ties to home country (property ownership, family documents)

Reference website: https://travel.state.gov

FAQs – Business Visa for USA

Q1. How long is a U.S. business visa valid? The validity depends on the applicant’s nationality. Many applicants receive a 10-year multiple-entry visa, but the length of each stay is generally limited to 6 months.

Q2. Can I extend my B-1 visa stay? Yes, extensions may be granted for up to an additional 6 months if justified. You must file Form I-539 before your current stay expires.

Q3. Do I need a business invitation letter? Yes. A letter from your U.S. host company or associate outlining the purpose and duration of your visit significantly strengthens your application.

Q4. Can I work in the U.S. on a B-1 visa? No. The B-1 visa does not permit paid employment in the U.S. It is only for business-related visits.

Q5. Is a personal interview mandatory for all applicants? Most applicants between the ages of 14 and 79 are required to attend a personal interview unless they qualify for interview waiver programs.

Final Thoughts

Getting a U.S. business visa is a straightforward process if you follow the steps, provide the necessary documentation, and meet the eligibility criteria. Ensure that your purpose of travel is genuine and that you can demonstrate your intention to return to your home country after the trip. Always check the latest information on the official U.S. Department of State website.

For more information, visit: https://travel.state.gov

0 notes

Text

Settle Your IRS Debt Smartly: Understanding the Offer in Compromise with IRS

If you’re feeling overwhelmed by tax debt and unsure how to move forward, you’re not alone. Many individuals and businesses find themselves facing large IRS tax balances they simply cannot afford to pay in full. That’s where an Offer in Compromise with IRS can be a game-changer. This program allows qualified taxpayers to settle their tax liabilities for less than the full amount owed — and in many cases, much less.

At Hall & Associates, we help individuals, families, and businesses navigate the complexities of the IRS Offer in Compromise program with confidence. Let’s dive into what this program is, who qualifies, and how we can help you achieve a fresh financial start.

What Is an Offer in Compromise with IRS?

An Offer in Compromise (OIC) is a legal agreement between a taxpayer and the IRS that allows the taxpayer to settle their tax debt for less than the full amount owed. The IRS may accept an OIC if it believes:

You truly cannot afford to pay the full debt.

There is doubt as to the amount of the tax liability.

Paying in full would cause financial hardship.

This settlement option is part of the IRS’s Fresh Start Initiative and is designed to help taxpayers in genuine need get back on their feet without the burden of overwhelming debt.

Why Consider an Offer in Compromise?

Choosing an Offer in Compromise with IRS could be the right move if:

You owe a significant amount in back taxes and can’t afford to pay it all.

You’re facing wage garnishment or tax liens.

You want to avoid more aggressive IRS collection tactics.

You need peace of mind and financial breathing room.

The IRS doesn’t grant these offers easily. But with the right preparation and representation, you can present a strong case that reflects your true financial situation.

Who Qualifies for an Offer in Compromise?

The IRS uses a strict set of criteria to determine who is eligible for an Offer in Compromise. Key factors include:

Income and Expenses: You must demonstrate that your income is insufficient to pay the full debt.

Asset Equity: The IRS reviews the value of your property, savings, and other assets.

Ability to Pay Over Time: If you can afford to pay off your tax debt over time through an installment plan, you may not qualify.

The application process includes submitting IRS Form 656 and Form 433-A (OIC) or 433-B (OIC), depending on whether you’re an individual or a business. You’ll also need to pay a non-refundable application fee and provide supporting documentation.

How Hall & Associates Can Help

Applying for an Offer in Compromise with IRS can be complex and time-consuming. At Hall & Associates, our tax resolution experts handle the entire process for you — from reviewing your financials to submitting a strong, well-supported offer to the IRS.

Here’s what we offer:

Free Consultation: We evaluate your eligibility and explain your options clearly.

Full Financial Review: Our team digs deep into your finances to craft the strongest possible case.

Experienced Representation: We communicate directly with the IRS on your behalf, reducing your stress and ensuring compliance.

Negotiation Expertise: We understand how to position your case for acceptance, based on IRS standards and your unique circumstances.

You don’t have to face the IRS alone. Our experienced professionals have helped hundreds of clients reduce or eliminate tax debt through the Offer in Compromise program.

Common Myths About the Offer in Compromise Program

Myth 1: The IRS Always Says No Truth: While the IRS does carefully review each offer, thousands of OICs are accepted each year. The key is submitting a realistic offer with the proper documentation.

Myth 2: You Have to Be Completely Broke Truth: You don’t have to be destitute. The IRS looks at your ability to pay, not just your current income or bank balance.

Myth 3: It’s Easy to Do It Yourself Truth: Technically, you can apply on your own, but errors in documentation or misrepresenting your financial picture can lead to delays or rejections. Working with a professional increases your chances of approval.

What Happens After the Offer Is Accepted?

Once your Offer in Compromise with IRS is accepted, you’ll need to:

Stick to the agreed-upon payment plan.

Stay compliant with all future tax filings.

Avoid defaulting, or the IRS could reinstate the original debt.

Successfully completing your OIC gives you a fresh start, free from the weight of back taxes and the stress of constant collection notices.

Final Thoughts

An Offer in Compromise with IRS offers real hope for people drowning in tax debt. It’s not a loophole or a quick fix — it’s a legitimate option for those who meet the criteria and are willing to follow through.

At Hall & Associates, we specialize in helping taxpayers navigate this process and secure the relief they need. Don’t wait for the IRS to take more drastic action. Contact us today and let’s explore whether an Offer in Compromise is the right path for you.

Ready to Take Control of Your Tax Debt?

Visit https://www.hallsirs.com/services/offer-in-compromise/ to learn more or schedule your free consultation. We’re here to help you find peace of mind and get back on solid financial ground — one step at a time.

1 note

·

View note

Text

How Business Bookkeeping and R&D Tax Consultants Help Maximise the R&D Tax Incentive Australia

In today’s competitive business landscape, having accurate financial records isn’t just about staying compliant—it’s also about unlocking financial opportunities. By combining reliable bookkeeping services with the expertise of R&D tax consultants, businesses in Australia can significantly benefit from the R&D tax incentive Australia program.

Why Bookkeeping Services Matter for R&D Claims

Every successful R&D tax claim starts with strong financial documentation. That’s where professional business bookkeeping comes in. Many innovative companies conduct eligible R&D activities but fail to maintain the level of documentation required to support a claim. Poorly managed records can lead to missed opportunities or rejected claims.

Bookkeeping services help track:

Eligible R&D expenses

Staff salaries and contractor costs

R&D-related overheads

Project-based time allocation

When done correctly, business bookkeeping creates a clear financial trail that simplifies the R&D claim process.

The Role of R&D Tax Consultants

While your bookkeeping records the data, R&D tax consultants analyse and present it in a way that aligns with government requirements. These consultants understand the legislative framework behind the R&D tax incentive Australia, ensuring your application is accurate, thorough, and audit-ready.

They help by:

Identifying qualifying R&D activities

Estimating eligible expenditure

Preparing detailed supporting documentation

Submitting the claim to the ATO and AusIndustry

Without this guidance, many businesses either underclaim or make costly mistakes in their R&D applications.

Combining Bookkeeping and R&D Tax Expertise

The real magic happens when you combine accurate business bookkeeping with expert R&D consultancy. This partnership ensures you’re not only compliant but also taking full advantage of Australia’s generous incentive—up to 43.5% refundable tax offset for eligible companies.

Whether you're a startup building new tech or a manufacturing company improving processes, the R&D tax incentive Australia can give your innovation strategy a financial boost—if you're properly prepared.

Final Thoughts

Smart businesses don’t leave money on the table. With high-quality bookkeeping services and strategic guidance from R&D tax consultants, you can maximise your benefits under the R&D tax incentive Australia scheme.

If you want to grow your business and reduce your tax liability while investing in innovation, now is the time to get your finances and R&D strategy aligned.

Partner with Fullstack to get started—your trusted team for business bookkeeping and R&D tax success.

0 notes

Text

Nutrofit — A Modern Webflow Website Template for Nutritionists and Wellness Coaches

Whether it’s a personalized diet plan, fitness coaching, or lifestyle advice, people often start their wellness journey online. That’s why having a professional, approachable, and informative website is key to growing your practice. Enter Nutrofit — a Webflow Website Template designed specifically for nutritionists, health coaches, and wellness experts.

With its fresh design and client-focused features, Nutrofit helps you build a standout website that reflects your passion for healthy living — without needing any coding skills.

What is Nutrofit?

Nutrofit is a clean, easy-to-navigate Webflow Website Template tailored for dietitians, nutrition coaches, holistic health professionals, and anyone offering wellness services. It gives you everything you need to showcase your expertise, promote your programs, and connect with potential clients — all through a beautifully designed site that builds trust and encourages action.

Why Choose Nutrofit for Your Nutrition Business?

Here’s why Nutrofit is a perfect choice for modern wellness professionals:

Focused on Health & Nutrition Services: This webflow template contains all the elements, pages and sections that a health, nutrition or wellness website should have.

Modern Design: Nutrofit has a simple, clean, and minimal, yet modern design style. It follows the latest design trends, so your website will have a modern and premium website design.

CMS Included: This template allows you to publish informative blog posts, client testimonials and doctor profiles that showcase your expertise with powerful CMS integration.

Excellent Services Page Showcase: You can highlight each of your nutrition plans, health and diet plans, baby nutrition, pregnancy tips and guidelines so that your audience can know every information and attract your services. From comprehensive meal plans to advanced nutritional guidance systems, you can perfectly showcase all of your offerings.

Animation, Video & Responsive Sliders: Show off your skills and some treatment procedures with beautiful animation and video segments. Navigate your services effortlessly with responsive sliders, animations and videos.

Appointment Booking: Simplify your appointment booking process and improve your professional service. Our expertly designed templates provide a perfect booking experience for your clients, while giving you a powerful backend to efficiently manage your schedule.

Contact details: Clearly display your information, including address, phone number, and an interactive map, so patients can easily find and reach you.

Terms and Conditions Showcase: This page displays all information with professionalism to the users. They cover important aspects like use of services, payment and refund policy, limitation of liability, privacy and confidentiality and more.

Pricing Page Showcase: Our pricing page highlights every detail perfectly and provides pricing information about your services. This ensures transparency and helps potential customers choose the most suitable package as per their needs.

Dedicated Customer Support: When you choose Nutrofit, you get exceptional support from the TNCFlow support team. Our dedicated professionals can answer your questions and help you immediately.

Ideal For:

Nutritionists & dietitians

Health & fitness coaches

Holistic lifestyle consultants

Meal planning experts

Wellness bloggers & content creators

If your work helps others lead healthier lives, Nutrofit is built to support and amplify your mission.

Final Thoughts

First impressions matter — especially when it comes to health and wellness. With Nutrofit, you can present your services, values, and expertise through a beautifully designed Webflow Website Template that’s fast, responsive, and easy to manage.

Whether you’re just starting your practice or ready to level up your brand, Nutrofit gives you the perfect digital foundation to grow and thrive.

Launch your nutrition or wellness website today with Nutrofit and inspire healthy living from the very first click.

#nutrition#healthyliving#healthy food#health and wellness#wellnessgoals#wellnessjourney#healthcare#health & fitness#web design#webflow#business#small business#website#digital marketing agency#startup#architecture#hospital

0 notes

Text

Business Intelligence with Power BI Coaching: Transforming Data into Strategic Insights with Gritty Tech

Introduction

In the digital age, data is more than just numbers—it's the fuel driving modern decision-making across every industry. Business intelligence with Power BI coaching is an essential toolset for professionals looking to gain a competitive edge in data analysis, reporting, and business strategy For More...

Gritty Tech, a global leader in accessible and affordable tech education, offers specialized training to help individuals and teams master Power BI and become proficient in business intelligence. With a focus on quality, trust, and flexibility, Gritty Tech ensures that learners are equipped with both the technical knowledge and practical skills to thrive.

What is Business Intelligence with Power BI Coaching?

Business intelligence (BI) refers to the techniques and tools used to transform raw data into actionable insights that inform strategic business decisions. Power BI, developed by Microsoft, is a leading BI platform known for its robust data visualization capabilities, user-friendly interface, and real-time analytics.

Power BI coaching at Gritty Tech takes this a step further by providing learners with guided, hands-on training. This ensures a deep understanding of the platform, along with practical applications tailored to various industries and job roles.

Why Power BI Coaching is Essential

Demand for Data Skills: With data becoming the foundation of strategic planning, organizations seek professionals who can extract insights efficiently.

Ease of Use and Versatility: Power BI's intuitive design makes it accessible for beginners while offering advanced features for experts.

Integration Capabilities: Power BI connects seamlessly with Excel, SQL databases, cloud platforms, and hundreds of other services.

Gritty Tech’s Distinct Advantage in BI Coaching

1. Affordable, High-Quality Education

Gritty Tech believes that quality education should not come at a high price. All our programs, including business intelligence with Power BI coaching, are priced competitively without compromising content depth or tutor expertise.

2. Experienced Global Tutors

Our tutors are not only subject-matter experts but also experienced educators. Connected across 110+ countries, they bring global insights to every session.

3. Flexible Payment Plans

We offer monthly and session-wise payment options to suit various budget needs. This flexibility ensures that cost is never a barrier to learning.

4. Customer-Centric Policies

Gritty Tech prioritizes learner satisfaction. If a student is unsatisfied, we offer tutor replacement and easy refunds. This commitment builds trust and fosters long-term learning relationships.

Course Highlights

Comprehensive modules on Power BI Desktop and Power BI Service

Real-world projects simulating business problems

Data cleaning, transformation, modeling, and visualization

DAX (Data Analysis Expressions) mastery

Dashboard design for executive-level reporting

Hands-on assignments with personalized feedback

Career Opportunities After Power BI Coaching

With specialized training from Gritty Tech, learners are well-positioned for roles such as:

Business Intelligence Analyst

Data Analyst

Reporting Analyst

Data Consultant

Power BI Developer

Business Data Strategist

These roles are not just in IT but span across healthcare, finance, marketing, logistics, and government sectors.

SEO Keywords Integration

Beyond the main keyword business intelligence with Power BI coaching, this article integrates semantically related terms such as:

Power BI training

Data visualization coaching

Business data analytics

Learn Power BI online

Affordable BI courses

Real-time data dashboards

This approach enhances discoverability and improves SERP ranking without keyword stuffing.

Trust-Building Factors at Gritty Tech

1. Transparent Course Outlines

Every program offers detailed curriculum plans so learners know exactly what they’re getting.

2. Personalized Learning Paths

Tutors adapt content delivery based on the learner’s pace and background.

3. Positive Alumni Outcomes

Many of our learners have successfully transitioned into data roles at major corporations.

Frequently Asked Questions (FAQs)

1. What is business intelligence with Power BI coaching?

Business intelligence with Power BI coaching is a training program that teaches you how to analyze data and generate reports using Microsoft Power BI, enhancing your decision-making skills.

2. Why should I choose Gritty Tech for Power BI coaching?

Gritty Tech offers top-quality education, affordable pricing, and global tutor support, making it ideal for learners seeking value and results.

3. Is Power BI difficult to learn without a background in IT?

No, our coaching is designed for all skill levels, and tutors provide step-by-step guidance to make learning smooth and accessible.

4. How long does the business intelligence with Power BI coaching course last?

Course duration varies by program type, but most learners complete it within 6 to 8 weeks on a part-time basis.

5. Can I get a job after completing the Power BI coaching program?

Yes, many learners secure roles as data analysts, BI consultants, and Power BI developers post-training.

6. What tools will I need for business intelligence with Power BI coaching?

You’ll need a computer with internet access and Power BI Desktop (free to download). No other tools are mandatory.

7. How is this course different from other online Power BI tutorials?

Gritty Tech offers live, interactive coaching with real-time feedback, unlike self-paced video tutorials that lack engagement.

8. What if I am not satisfied with my tutor?

We offer tutor replacement options and easy refunds if you're not satisfied with the instruction.

9. Are there any prerequisites for joining the Power BI coaching program?

No specific prerequisites, although basic Excel skills can be helpful.

10. How do I enroll in business intelligence with Power BI coaching at Gritty Tech?

Simply visit our official website, fill out the enrollment form, and a representative will guide you through the next steps.

Conclusion

If you're looking to enhance your data skills and open new career opportunities, business intelligence with Power BI coaching from Gritty Tech is your pathway to success. With expert tutors, flexible plans, and a learner-focused approach, we help transform your potential into performance.

Start your journey today—make data your greatest asset with Gritty Tech.

0 notes

Text

Metcon-6™ Review: Can 6 Minutes a Day Really Transform Your Body? (Spoiler: YES.)

That hour on the treadmill, grueling weight sessions, and endless gym memberships are not the keys to a lean, strong, energized body.

But thousands of people are ditching marathon workouts for Metcon-6™ by Chandler Marchman—a 6-minute daily program that claims to burn fat, build muscle, and skyrocket energy faster than traditional training.

Is it legit?

I tested it. I researched it. Here is the unfiltered truth.

See More about "Metcon-6" Here!

What is Metcon-6? – The Science of 6-Minute Workouts

Metcon-6™ stands for Metabolic Conditioning in 6 Minutes—a revolutionary approach to fitness that maximizes fat burn in minimal time.

By using high-intensity, scientifically optimized exercises that:

Trigger EPOC (burn calories for 48+ hours post-workout)

Boost human growth hormone (for lean muscle gains)

Crush stubborn fat (especially belly & thigh fat)

Require NO equipment (do it anywhere, anytime)

However, who created this? Moreover, can you trust him?

Click Here to Download PDF "Metcon-6" eBook by Chandler Marchman!

About Chandler Marchman – The Man behind the Method

Chandler Marchman is not a random influencer—he is a D1 athlete-turned-coach with a degree in Exercise Science.

After training elite athletes and busy professionals, he discovered a game-changing truth:

Metcon-6™ is his proven formula to get twice the results in a fraction of the time.

PERFECT FOR:

Overweight & frustrated dieters

Busy professionals with no time for the gym

Stay-at-home parents who need quick workouts

Athletes wanting explosive endurance

Anyone who HATES long workouts

NOT FOR:

Bodybuilders (this is not a bulk-up program)

People who enjoy 2-hour gym sessions

Those with severe heart/joint issues (consult a doctor first)

The Jaw-Dropping Benefits – Real Users, Real Results

People using Metcon-6 report:

15-30 lbs of fat loss in weeks

Visible muscle tone without heavy weights

Crazy energy spikes (no more afternoon crashes)

More free time (6 minutes vs. 60+ at the gym)

However, what is the catch?

The Brutal Pros & Cons

PROS:

Only 6 minutes a day (No more "I don’t have time")

No equipment needed (Hotel room? Done)

Works for all fitness levels (Modifications included)

60-day money-back guarantee (Zero risk)

CONS:

HARD at first (You will sweat… a LOT)

Digital-only (Need a phone/laptop)

Requires discipline (No program works if you skip days)

Pricing & Guarantee – Is It Worth It?

Metcon-6 costs just $20 (one-time payment).

Let us put that in perspective:

1 personal training session = $50-$100

1 month of a gym membership = $30-$100

Metcon-6 = Less than $1 per day for life-changing results.

IN ADDITION, it has backed by a 60-day "No-Questions-Asked" refund policy.

Translation: Try it for 2 months. If you do not love it, get every penny back.

Final Verdict – Should You Buy It?

If you want:

A lean, toned body

More energy than a double espresso

To ditch long, boring workouts forever

Then YES—Metcon-6 is worth every penny.

Click Here to Download eBook "Metcon-6" PDF by Chandler Marchman!

0 notes

Text

SR&ED Consulting Services for Ottawa Businesses

Businesses in Ottawa are actively pursuing technological advancement and innovation to stay ahead in competitive markets. The cost of research and development, however, can be substantial. SR&ED Consulting in Ottawa helps companies navigate the Scientific Research and Experimental Development (SR&ED) tax credit program offered by the Canadian government.

This program, administered by the Canada Revenue Agency (CRA), is designed to encourage R&D efforts through tax incentives. Whether it’s software development, engineering, or prototyping, many activities that involve solving technical challenges may qualify under SR&ED.

What is the SR&ED Program?

The SR&ED program supports Canadian companies by providing refundable and non-refundable tax credits for eligible R&D work. It applies across industries and encourages innovation by reducing financial risks.

SR&ED may cover:

Wages for technical and engineering staff

Material costs used in experimental processes

Subcontractor or consultant fees

Overhead expenses directly tied to R&D

Development of new processes, products, or systems

Both successful and unsuccessful projects may qualify, as long as a systematic investigation was carried out to resolve uncertainty.

Role of a Consultant in SR&ED Claims

Navigating SR&ED requirements is not always straightforward. A qualified consultant helps identify eligible activities, organizes documentation, and ensures compliance with CRA standards. Their role is essential in translating technical work into terms the CRA can evaluate and approve.

Key tasks of an SR&ED consultant include:

Evaluating R&D activities against eligibility criteria

Writing technical project descriptions for the T661 form

Calculating and allocating expenses properly

Coordinating with technical teams and finance departments

Guiding businesses through CRA audits, if needed

In cities like Ottawa, where tech-driven industries are prominent, having a consultant who understands both the local ecosystem and the federal rules is an asset.

How Ottawa Businesses Benefit

Ottawa is home to a mix of established firms, startups, and government-funded organizations, many of which are involved in scientific or technical development. Local businesses often don’t realize the extent of work that may qualify under SR&ED.

Examples of eligible local activities may include:

Developing new IT infrastructure or applications

Enhancing telecommunications technology

Engineering improvements in manufacturing workflows

Environmental innovations such as sustainable packaging

Research in biotech, medical devices, or aerospace

Whether you're improving a product or solving a technical bottleneck, SR&ED may help recover a portion of your investment. Find us here

Common Filing Challenges

Even when the work qualifies, companies often run into roadblocks when preparing their SR&ED claims. This can lead to missed opportunities or delayed returns. Consultants are skilled in preventing these common issues.

Frequent errors in SR&ED filings:

Misunderstanding what constitutes a technological uncertainty

Submitting overly generic or sales-focused project descriptions

Missing out on internal documentation that proves eligibility

Incorrectly tracking or attributing R&D costs

Filing late or missing relevant tax schedules

Getting these details right improves your chances of approval and reduces the likelihood of a CRA review.

Improving Documentation and Process

A major part of SR&ED success lies in documentation. Keeping proper records makes it easier to justify a claim and withstand CRA scrutiny. Consultants help implement systems that streamline this process throughout the year.

Helpful records to maintain include:

Timesheets for team members involved in R&D

Meeting notes that track research progress and technical decisions

Experimental data, failed tests, and iterations

Design documentation and version histories

Financial breakdowns of costs tied to research work

Having these records in place means you won’t have to scramble at tax time or risk submitting an incomplete claim.

When to Bring in a Consultant

Some businesses wait until tax season to seek SR&ED help. However, involving a consultant earlier in the R&D process provides better results. They can advise on what documentation to collect and identify qualifying activities from the start.

Consider hiring a consultant if:

Your company is starting a new R&D project

You’re unsure if certain technical work qualifies

You’ve had an SR&ED claim denied or reduced in the past

You don’t have internal resources for technical reporting

You’re interested in optimizing claims across multiple projects

Early support leads to smoother, more thorough submissions and maximized returns.

Selecting the Right SR&ED Consultant in Ottawa

Ottawa offers a range of consulting firms that specialize in SR&ED claims. Choosing the right partner depends on your industry, company size, and the complexity of your R&D work.

Look for a consultant who:

Understands your technical domain

Has experience with CRA compliance and documentation

Offers support throughout the entire claim process

Has a history of successful claims in your industry

Uses a performance-based or transparent pricing model

Having a consultant nearby also offers practical benefits, such as easier access to in-person meetings or site visits.

0 notes

Text

Key slim Drops: The Natural Solution for Safe and Effective Weight Loss?

(A Science-Backed Guide + Tips to Maximize Results)

Introduction: Why Are Weight Loss Supplements So Popular?

In a world obsessed with quick fixes and wellness trends, millions struggle to shed stubborn pounds. Crash diets fail, gym memberships go unused, and frustration grows. But what if there was a smarter way to achieve your weight loss goals? Enter [Key slim Drops], a cutting-edge dietary supplement designed to support healthy metabolism, curb cravings, and help you unlock a slimmer, more confident version of yourself naturally.

What Makes Key slim Drops Stand Out?

1. Scientifically Formulated Ingredients

[Key slim Drops] combines nature and innovation with a potent blend of clinically studied ingredients, including:

Green Tea Extract: Rich in antioxidants like EGCG to boost fat oxidation and metabolic rate.

Glucomannan: A natural fiber from konjac root that expands in the stomach, reducing hunger pangs.

Chromium Picolinate: Helps regulate blood sugar levels, minimizing sugar cravings.

Vitamin B12: Enhances energy production to keep you active and motivated.

2. Effortless Integration into Daily Life

No pills, no powders—just 10 drops daily mixed with water or tea. Perfect for busy lifestyles!

3. Real User Success Stories

"I lost 12 pounds in 8 weeks without starving myself. This product changed my relationship with food!" – Sarah, 29 "Finally, a supplement that doesn’t cause jitters or crashes. I’m down 2 dress sizes!" – Mark, 42

4. Safety First

Free from artificial stimulants, GMOs, and gluten. Non-habit-forming and suitable for most adults.

Get the offer before it runs out

How Does Key slim Drops Work?

This triple-action formula targets weight loss from multiple angles:

Accelerates Fat Burning: Activates thermogenesis to convert stored fat into energy.

Suppresses Appetite: Glucomannan promotes satiety, helping you eat smaller portions naturally.

Balances Metabolism: Chromium and B12 optimize nutrient absorption and energy levels.

Maximize Your Results: Pair Key slim Drops with These Habits

For optimal outcomes, combine the supplement with:

Hydration: Drink 8-10 glasses of water daily to flush toxins and enhance fat metabolism.

Whole Foods: Prioritize lean proteins, leafy greens, and healthy fats. Avoid processed sugars.

Daily Movement: Even 30 minutes of walking or yoga can amplify results.

FAQs About Key slim Drops

Q: Is Key slim Drops safe for long-term use? A: Yes! Our formula uses natural ingredients with no reported side effects. However, consult your doctor if pregnant, nursing, or on medication.

Q: When will I see results? A: Most users notice reduced cravings within 1-2 weeks. Average weight loss is 1-2 labs per week with consistent use.

Q: How do I order? A: Visit [Click here] today!

Why Choose Key slim Drops Over Other Solutions?

Cost-Effective: Far cheaper than weight loss surgery or fad diet programs.

Risk-Free: Backed by a 60-day money-back guarantee. Not satisfied? Get a full refund.

24/7 Support: Our team is here to guide you via chat, email, or phone.

Conclusion: Your Weight Loss Journey Starts Now

Don’t let another year pass wishing for change. [Key slim Drops] isn’t just a product—it’s a partner in your wellness journey. Click here to claim your discount and transform your body, one drop at a time!

#Best weight loss supplements#Fastest way to burn fat#Natural appetite suppressant#Fat burner pills#How to lose weight fast#Keyslim Drops reviews#Buy weight loss drops online#Keto-friendly weight loss supplements#Vegan appetite suppressant#Sugar blocker supplements

1 note

·

View note

Text

Top 10 Tips for Hassle-Free Income Tax Filing

Filing your income tax doesn't have to be stressful or confusing. Whether you're a working professional, freelancer, or small business owner, knowing how to navigate the process smoothly can help you save time, money, and avoid penalties. For Hassle-Free Income Tax Filing—a must-read if you’re studying Certified Corporate Accounting, SAP FICO (Finance & Controlling), or Taxation (Income Tax & GST). These tips will make your tax filing journey simple and stress-free.

1. Get Your Documents Ready Early

Start early, stay ahead. Gather the essential documents such as:

Form 16 (for salaried employees)

Bank interest certificates

Investment proofs (LIC, PPF, ELSS, etc.)

Rent receipts & loan statements

2. Choose the Right Tax Regime

India has two tax regimes now:

Old Regime: Higher tax rates with deductions and exemptions

New Regime: Lower tax rates, but no deductions

Use a reliable tax calculator or consult a professional to choose the most beneficial one. This is a vital concept in Taxation (Income Tax & GST) training programs.

3. Don’t Miss Out on Deductions

Claiming deductions can significantly reduce your taxable income. Check for:

Section 80C: Up to ₹1.5 lakh for investments like PPF, ELSS, tuition fees

Section 80D: Health insurance premiums

Section 24(b): Home loan interest

Section 80G: Donations

These are thoroughly covered in top programs like Certified Corporate Accounting.

4. Select the Correct ITR Form

Using the wrong ITR form can get your return rejected. Choose based on your income:

ITR-1: Salary income up to ₹50 lakh

ITR-3: Business or professional income

ITR-4: Presumptive income scheme

The best GST course in Kolkata will help you master this step through hands-on training.

5. Link PAN with Aadhaar

Linking your PAN with Aadhaar is mandatory. If not linked, your PAN becomes inactive, blocking your ability to file returns. This is a common topic taught in e-filing modules of Certified Corporate Accounting and SAP FICO (Finance & Controlling) courses.

6. Report All Income Sources

Don’t hide income. Apart from salary, declare:

Interest income from banks

Rental income

Freelance or side gig earnings

Capital gains (stocks, mutual funds, property)

Students from the best accounting institute in Kolkata learn to handle multi-source income using real-world examples.

7. Match with Form 26AS & AIS

Before filing, double-check your records with:

Form 26AS: TDS and advance tax

AIS (Annual Information Statement): Summary of your income and high-value transactions

8. Verify Your Bank Details

Ensure the correct and active bank account is linked to your return. Tax refunds will only be credited if:

The account is valid

It’s linked to your PAN

This process is emphasized in SAP FICO (Finance & Controlling) and advanced taxation modules.

9. File Before the Deadline

The deadline for individual returns is usually July 31st.

Avoid penalties, system crashes, and last-minute rush by filing early. Whether you’re trained at the best GST course in Kolkata or learning online, this is a deadline you cannot ignore.

10. E-Verify Your Return

Filing isn’t complete until you e-verify. Choose from:

Aadhaar OTP

Net banking login

Sending signed ITR-V to CPC Bengaluru

Without e-verification, your return is invalid.

Conclusion

Mastering income tax filing doesn’t just make you tax-smart—it opens doors to high-paying finance careers. These Top 10 Tips for Hassle-Free Income Tax Filing will help you stay compliant, save money, and build your professional edge.

Planning a career in finance or accounting? Opt for career-building certifications like:

Certified Corporate Accounting

SAP FICO (Finance & Controlling)

Taxation (Income Tax & GST)

#accounting#education#finance#gst course#taxation#best tax service company in kolkata#best accounting institute in kolkata#best institute in kolkata

0 notes

Text

Dominica Citizenship by Investment | Flyingcolour Relocation Services

1. Introduction: A Caribbean Jewel Offering a Global Gateway

Nestled in the Eastern Caribbean, Dominica is a verdant gem known for its lush rainforests, thermal springs, and untouched beauty. But beyond the postcard-perfect vistas lies an exceptional opportunity—Dominica’s Citizenship by Investment (CBI) program. It’s not just a passport; it’s a gateway to global freedom, financial agility, and personal security.

2. Understanding the Concept of Citizenship by Investment

Citizenship by Investment is a legal process wherein individuals can obtain a second citizenship and passport by contributing economically to a country. It's an elegant solution for those seeking global mobility, diversified assets, or a strategic exit plan. This concept has flourished as nations open their borders to investors in exchange for contributions that bolster national development.

3. Why Dominica? A Unique Blend of Nature and Opportunity

Dominica isn’t just another tropical destination—it’s a sanctuary of serenity and stability. The island’s commitment to sustainable development, coupled with its robust democratic governance, makes it an ideal candidate for global citizens. Its CBI program stands out for its integrity, accessibility, and streamlined process.

4. History and Credibility of Dominica’s CBI Program

Launched in 1993, Dominica’s CBI program is one of the longest-standing and most reputable in the world. It has consistently ranked highly in global citizenship indices due to its rigorous vetting procedures and transparency. Over the decades, it has evolved into a gold standard for those seeking a second nationality through legitimate means.

5. The Key Benefits of Dominica Citizenship

5.1 Visa-Free Travel Across the Globe

Dominican citizens enjoy visa-free or visa-on-arrival access to over 140 countries, including the UK, Schengen Area, Singapore, and Hong Kong. This mobility transforms business travel and leisure into seamless experiences.

5.2 No Residency Requirement

Applicants are not required to live in or even visit Dominica. This remote accessibility is a huge advantage for busy entrepreneurs and high-net-worth individuals.

5.3 Dual Citizenship is Allowed

Dominica permits dual nationality, allowing you to retain your original citizenship while acquiring a Dominican one. This legal flexibility is particularly beneficial for maintaining business and familial ties.

5.4 Favourable Tax Regime

Dominica imposes no wealth, gift, inheritance, foreign income, or capital gains taxes, making it a haven for global investors looking for tax efficiency.

6. Eligibility Criteria: Who Can Apply?

Applicants must be over 18 years of age, in good health, and possess a clean criminal record. Dependents, including spouses, children, and even parents or grandparents, can be included in the application. Integrity, financial solvency, and a lawful source of funds are critical.

7. Investment Options Under Dominica’s CBI Program

7.1 Economic Diversification Fund (EDF) Contribution

This non-refundable contribution supports national development projects. The minimum contribution starts at $100,000 for a single applicant and varies based on the number of dependents.

7.2 Real Estate Investment

Applicants may invest at least $200,000 in government-approved real estate projects. These properties can be sold after three years, potentially yielding returns while securing citizenship.

8. Step-by-Step Application Process

The process starts with choosing an authorized agent, such as Flyingcolour Relocation Services. Following initial consultation, the application dossier is prepared, including background documentation and financial disclosures. Once submitted to Dominica’s CBI Unit, it undergoes rigorous scrutiny. Upon approval, the investment is made, and citizenship is granted.

9. Processing Time and Timelines

Dominica’s CBI program is known for its efficiency. From submission to approval, the process typically takes 3 to 6 months. With proper guidance and documentation, delays are minimal.

10. Due Diligence and Background Checks

Dominica enforces one of the most stringent due diligence processes globally. Independent international agencies conduct multi-layered checks to ensure applicants pose no risk to the nation’s integrity. This ensures the prestige of Dominican citizenship remains intact.

11. Costs Involved: Breaking Down the Fees

In addition to the investment amount, applicants should consider government processing fees, due diligence charges, and agent fees. For a single applicant, the total cost usually ranges from $110,000 to $120,000 through the EDF route.

12. The Role of Flyingcolour Relocation Services

Flyingcolour Relocation Services acts as a trusted bridge between applicants and the Dominican government. With deep expertise in global migration, Flyingcolour ensures a seamless, transparent, and confidential application process. From documentation to final handover of the passport, every detail is meticulously managed.

13. Comparing Dominica to Other CBI Programs

Compared to other Caribbean CBI programs—such as those of St. Kitts & Nevis or Antigua—Dominica offers one of the most cost-effective routes without compromising quality. Its political neutrality, judicial independence, and climate resilience add to its long-term appeal.

14. Life After Citizenship: What to Expect

New citizens of Dominica can access global education opportunities, enhanced healthcare options, and secure financial planning. The passport opens doors not only for travel but also for new perspectives—geopolitically and economically.

15. Conclusion: Secure a Borderless Future with Flyingcolour

Dominica’s Citizenship by Investment program represents more than just a travel document—it’s a declaration of freedom, opportunity, and legacy. With Flyingcolour Relocation Services as your guide, acquiring a second citizenship becomes a stress-free journey into global citizenship. Let your future take flight—starting with Dominica.

0 notes

Text

Why R&D Tax Consultants Are Essential for Innovative Businesses

Innovation is at the heart of every successful business. Whether you're developing new technology, improving existing processes, or testing prototypes, your activities could qualify for valuable tax incentives. But navigating the complexities of the R&D tax incentive can be overwhelming. That’s where R&D tax consultants come in.

R&D tax consultants specialise in helping businesses identify, document, and claim research and development (R&D) activities that are eligible under government tax incentive programs. In Australia, the R&D Tax Incentive program is designed to encourage innovation by providing tax offsets for eligible R&D expenditures. However, the guidelines are specific, and claims must be supported by detailed evidence.

Hiring R&D tax consultants gives you access to professionals who understand the technical and financial aspects of the incentive. They work closely with your team to review your projects, assess eligibility, and prepare all necessary documentation. This reduces the risk of audit issues and ensures you don’t miss out on potential refunds.

For startups and small businesses, cash flow is often tight. The R&D tax offset can make a big difference by returning a percentage of your R&D costs, allowing you to reinvest in growth. The right R&D tax consultants can help you access this funding quickly and without stress.

What sets experienced consultants apart is their ability to align your innovation strategy with compliance. They not only maximise your claim but also help you build a strong, consistent approach to tracking and reporting R&D work year after year.

At Fullstack Advisory, our R&D tax consultants have helped hundreds of innovative businesses across Australia unlock their full tax benefit potential. We take a proactive approach, guiding you through eligibility criteria, project descriptions, cost breakdowns, and submission to ensure your application meets all ATO requirements.

In an increasingly competitive landscape, every advantage matters. By working with expert R&D tax consultants, your business can stay focused on innovation while we handle the complex tax work behind the scenes.

0 notes

Text

GST for Online Business and E-commerce: A Step-by-Step Guide

E-commerce and online businesses have totally transformed the global economy. Entrepreneurship is made easy now since it is much simpler for entrepreneurs to sell goods and services across geographical boundaries. But ease brings along with it the problem of compliance, particularly in the case of the Goods and Services Tax (GST). In this blog post, we will look at how GST has impacted e-commerce and online businesses, main compliance requirements, and how businesses can remain compliant while also obtaining maximum returns.

GST for E-commerce Businesses

GST is an indirect tax that is imposed on the supply of goods and services. It consolidates various indirect taxes such as VAT, service tax, and excise duty into one uniform tax system. E-commerce companies are governed by certain provisions of the GST Act, hence it is critical for online sellers, marketplaces, and service providers to know their tax liability.

Who Have to Get Registered Under GST in E-commerce?

E-commerce Operators (Marketplaces): Marketplaces in e-commerce such as Amazon, Flipkart, and Shopify who process sales on sellers' behalf must follow GST law.

Online Sellers & Vendors: Companies which sell products or services online either through third-party marketplaces or their own web pages are necessary to get registered for GST without regard to turnover.

Dropshipping Businesses: Those businesses running dropshipping models need to be GST compliant too, if they sell taxable goods or services.

Freelancers & Digital Service Providers: Freelancers offering digital services like graphic designing, content writing, programming, or consulting services through digital platforms need to get GST registered, if their turnover exceeds the threshold limit.

GST Registration Threshold for E-commerce Businesses

Unlike regular business units, GST registration is required only when turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services (₹10 lakhs for special category states), while e-commerce vendors have to mandatorily register under GST irrespective of turnover under Section 24 of the CGST Act.

Tax Collected at Source (TCS)

E-commerce operators (marketplaces) need to collect 1% TCS (0.5% CGST + 0.5% SGST or 1% IGST) from the sellers on the platform. The amount is withheld while paying sellers and has to be remitted to the government.

GST Return Filing

E-commerce companies need to file GST returns from time to time, depending upon their registration type:

GSTR-1: Quarterly or monthly return of outward supplies (sales).

GSTR-3B: Combined monthly tax liability return.

GSTR-8: Filed by e-commerce operators reporting TCS collected.

Place of Supply & GST Applicability

Place of supply plays an important role in identifying whether CGST, SGST, or IGST applies. For e-commerce transactions:

Intra-state sales (seller and buyer within the same state) attract CGST + SGST.

Inter-state sales (seller and buyer in different states) attract IGST.

Exports are considered zero-rated supplies, and firms are entitled to recover refund of GST paid on inputs.

Reverse Charge Mechanism (RCM)

E-commerce firms need to understand RCM, where the purchaser is required to pay GST in lieu of the supplier in certain situations (i.e., obtaining services from unregistered persons).

GST Benefits & Problems for E-commerce Firms

Benefits:

✅ Uncomplicated Tax Structure: GST is a change from several indirect taxes, making compliance less complex.

✅ Input Tax Credit (ITC): Enterprises can take credit of GST paid on procurement.

✅ Ease of Doing Business: Easy inter-state business due to GST.

✅ Promotes Compliance: Compulsory registration helps ensure transparency.

Concerns:

❌ Mandatory Registration: Small online vendors too must register, thereby enhancing cost of compliance.

❌ Different Return Filing: Multiple GST returns complicate the job of small sellers.

❌ Cash Flow Problems: TCS deduction impacts suppliers' working capital.

How Online Businesses Can Remain Compliant

Register GST Timely: Avail GST registration before initiating an online business.

Keep Proper Invoices & Documents: Provide invoices with GST compliance and keep procurement records.

Submit Returns Timely: Avoid charges by following the due dates of GST returns.

Be Aware of TCS & RCM: Be aware of deductions and liability that apply.

Claim Input Tax Credit: Record GST paid while procuring to minimize tax outgo.

Conclusion

GST compliance is required for online and e-commerce businesses in India. While it brings about challenges such as compulsory registration and TCS deductions, it also offers advantages such as uniformity of tax and input tax credit. If e-commerce companies learn about GST rules and adopt best practices, they can stay compliant while growing their business economically.

For expert assistance with GST registration and filing, consider consulting a tax professional or using online tax compliance tools. Staying informed and proactive can help businesses navigate GST complexities effectively!

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

ESTA for USA from UK: Cost and How to Apply

If you're a UK citizen planning to travel to the United States for tourism, business, or transit, one of the most important steps in your travel preparation is applying for an ESTA (Electronic System for Travel Authorization). This digital authorization is required for travelers from countries that participate in the Visa Waiver Program (VWP), including the UK. In this guide, we’ll cover the cost of ESTA for USA from UK, how to apply, and provide helpful tips for a smooth experience.

What is ESTA?

ESTA is an electronic travel authorization that allows citizens from Visa Waiver Program countries, such as the UK, to travel to the United States for short stays (up to 90 days) without needing a traditional visa. It is an essential requirement for travelers arriving in the U.S. for tourism, business, or transit.

While ESTA is not a visa, it serves as a pre-screening mechanism, allowing U.S. authorities to determine whether a traveler is eligible to enter the country. After approval, the ESTA is electronically linked to your passport, and you do not need to carry any additional documents unless specifically requested.

How Much Does ESTA Cost for UK Citizens?

The cost of ESTA for USA from the UK is $21 USD per application. This fee is required at the time of submitting your ESTA application and covers the processing and administrative costs associated with the authorization.

It’s important to note that the ESTA fee is non-refundable. Even if your application is denied, the fee will not be returned. However, if approved, the ESTA is valid for two years or until your passport expires, whichever comes first. During this period, you can use the ESTA for multiple trips to the United States, as long as each visit does not exceed 90 days.

How to Apply for ESTA from the UK: A Step-by-Step Guide

Applying for an ESTA is a simple online process. Here’s how you can apply from the UK:

Step 1: Visit the Official ESTA Website

Go to the official U.S. government ESTA website. Be sure to use the official site, as there are third-party sites that may charge additional fees or offer unnecessary services.

Step 2: Fill Out the Application Form

On the website, you will find an online application form that asks for basic information, including:

Personal details (name, date of birth, etc.)

Passport details (number, issue date, expiration date)

Travel details (your flight information, U.S. address, etc.)

Background questions (criminal history, health-related issues, previous immigration violations, etc.)

Step 3: Pay the ESTA Fee

After filling out the form, you will be prompted to pay the $21 USD fee. Payment can be made using a credit card, debit card, or PayPal.

Step 4: Submit the Application

Once you’ve completed the form and made your payment, submit the application. Most applicants will receive ESTA approval within minutes, but it’s recommended to submit the application at least 72 hours before your flight to allow time for any delays or issues.

Step 5: Receive Your ESTA Approval

After approval, your ESTA will be electronically linked to your passport. Although you do not need to carry a physical copy of your ESTA approval, it’s a good idea to keep a record of it for reference.

What to Do if Your ESTA Application is Denied?

In the event that your ESTA application is denied, you may still be eligible to travel to the U.S. by applying for a U.S. visa. A denied ESTA may occur for a variety of reasons, including:

Criminal history

Previous violations of U.S. immigration laws

Incomplete or incorrect information on the application

If your ESTA is denied, it’s essential to consult the U.S. embassy in the UK to explore alternative visa options and determine the next steps.

How Long is ESTA Valid?

Once approved, your ESTA is valid for two years or until your passport expires. This means that you can make multiple trips to the USA within this period without needing to reapply for ESTA, as long as each visit is for tourism, business, or transit, and the duration does not exceed 90 days.

However, if your passport expires before the two-year validity period, you will need to apply for a new ESTA using your new passport details.

Why Apply for ESTA Online?

The ESTA application process is straightforward and can be completed from anywhere in the world. Applying online is not only more convenient than applying for a traditional U.S. visa, but it also saves you time and money. The entire process can be done from the comfort of your home, and approval is typically received within minutes.

Additionally, because ESTA approval is valid for two years, it provides greater flexibility for future trips to the U.S. without needing to reapply every time you plan a visit.

Tips for a Successful ESTA Application

Apply early: Always apply for your ESTA at least 72 hours before your flight to account for any delays or potential issues.

Ensure your passport is valid: Your passport should be valid for at least six months beyond your planned departure date from the U.S..

Double-check your details: Accuracy is key. Make sure all information on your ESTA application matches your passport exactly to avoid mistakes and delays.

Keep a record: It’s a good idea to save a copy of your ESTA approval for future reference, even though you do not need to carry it with you.

Conclusion

If you're a UK citizen planning a trip to the United States, obtaining an ESTA is a must. The cost of ESTA for USA from UK is $21 USD, and the process is quick and easy to complete online. The ESTA is valid for two years and allows multiple visits to the U.S. without the need for a traditional visa, provided your stay is for tourism, business, or transit and does not exceed 90 days.

For a smooth and hassle-free trip, make sure to apply for your ESTA well in advance of your travel date, double-check your information, and keep your passport up to date. If your ESTA is denied, you can still explore other visa options through the U.S. embassy.

Are you ready to apply for your ESTA? CLICK HERE to get started with your ESTA application today!

0 notes