#Reserve Bank of New Zealand

Text

The Bateman Illustrated History of New Zealand - third edition. Something awesome this way comes

Next week my long-standing general history of New Zealand is being published in third edition. Updated, expanded and with all-new chapters that run from about 1980 to 2023 and explain why New Zealand’s in such a mess.

In those chapters, you’ll learn:

How the Reserve Bank mucked up in the early 1990s, helping throw the country into the worst downturn since the Great Depression.

Who was the ‘Mr…

View On WordPress

#Bateman Illustrated History of New Zealand#History#Illustrated history#New Zealand history#Reserve Bank of New Zealand

0 notes

Text

NSA Outs Chinese Hackers Exploiting Citrix Zero-Day

NSA Outs Chinese Hackers Exploiting Citrix Zero-Day

Home › Cyberwarfare

NSA Outs Chinese Hackers Exploiting Citrix Zero-Day

By Ryan Naraine on December 13, 2022

Tweet

Virtualization technology giant Citrix on Tuesday scrambled out an emergency patch to cover a zero-day flaw in its networking product line and warned that a Chinese hacking group has already been caught exploiting the vulnerability.

Citrix sounded the alarm via a critical-severity…

View On WordPress

#0day#apt5#bug bounty#China#Citrix#citrix adc#csrb#CVE-2022-27518#disclosure#email notification#exploitation#exploits#file transfer#katie moussouris#keyhole panda#Log4j#luta security#manganese#NSA#Reserve Bank of New Zealand#vulnerability#zero-day

0 notes

Text

New Zealand accepts house price falls and recession to protect the Kiwi Dollar

New Zealand accepts house price falls and recession to protect the Kiwi Dollar

Today I am returning to s subject which was rather exercising me on Saturday evening. To be precise it was 71 minutes of pain followed by 9 minutes of delight as I watched England play the All Blacks at rugby. It was a curious way to end up at a draw but now in a rugby obsessed country we see this.

The Monetary Policy Committee today increased

the Official Cash Rate (OCR) from 3.5 percent to

4.25…

View On WordPress

#business#economy#Finance#house prices#interest-rate rise#mortgage rates#New Zealand#New Zealand Dollar#RBNZ#Recession#Reserve Bank of New Zealand

0 notes

Photo

I went to the city and found myself, rather strangely, either in a Bruce Davidson photo book and on the mean streets of early 1980′s New York or that I had come full circle and I was back in the 1970′s, in my hometown. The city stumbling, the closed shop fronts, no new ideas, rising crime, people directionless after two decades of excessive consumption and yet, never filling that void. Pulled to the left then the right in petty culture wars. Politics blah blah blah ... Environmental tokenism blah blah blah ... The “Few %” still taking more.

Back in the 70′s the “right” used the fear of Communism to hold onto power here. Today it’s called “Nanny State”. “The market should be left to decide the best supply and demand formula”. The only problem is, the market is a psychopath. The market is Ted Bundy with a bandage on his arm. But Ted doesn’t touch the wealthy, he only harms the poor, the marginalized, the young and minorities. Eventually he will come for the middle class. When are you going to wake up?

Back then, in the 1970′s, I took early retirement. I was 18 years old. I explained to the person at the welfare office that I was, in fact, an admirable boy who was willing to step aside so that a person who received their identity through work or who had a young family to support, could take my place in the workforce. They didn’t care. They had given up too.

For some period of time the State paid me to dream. You might call me a quitter but I was only just beginning. We should pay more people to dream.

A headline in the news this week - the Reserve Bank, which sets monetary policy here, tells us 75,000 New Zealanders (around 3% of the workforce) will have to lose their jobs to cool inflation and for those with mortgages, there is no end in sight to rising interest rates. The Governor of the Reserve Bank, talking as if he is an economic genius, tells us that by “manufacturing” a recession we will be able to get inflation down to between 2 - 3%. And when I look at him, smug as “Toad of Toad Hall” and when I think of Donald Trump and all the other representatives of the selfish, I think - “Ted Bundy, at least you had a charming smile”.

- One Kindred Spirit

Polaroids

#polaroid#urban decay#photographers on tumblr#original words#original photography#instant film#analog photography

193 notes

·

View notes

Text

Economic Overview: Key Market Developments

Critical Update

Sudden market shifts may occur due to significant events. Monitor trading positions and implement risk management strategies during these uncertain times.

Economic Overview

As we enter a new quarter, the market faces numerous challenges. Rising war tensions, de-dollarization efforts, and upcoming elections in the U.S., France, and Iran contribute to the uncertainty. Here’s a detailed analysis of these developments and their potential impacts.

Currency Shifts

Russia’s move to use the Chinese Yuan for international trade and the increase in gold reserves by central banks are noteworthy. While the Yuan may not replace the U.S. Dollar soon, these actions indicate strategic shifts. Gold purchases serve as a hedge against potential currency volatility.

Geopolitical Conflicts

Middle East: The conflict between Israel and Hezbollah in Lebanon has intensified, with Iran warning of severe retaliation if Lebanon is attacked. Daily strikes continue, and countries like the U.S. and Germany have advised their citizens to leave Lebanon.

South China Sea: On June 19, 2024, Chinese coast guard officers attacked Philippine military personnel near the Second Thomas Shoal, escalating tensions. The U.S. has reaffirmed its defense treaty with the Philippines, which could lead to military involvement if violence escalates.

Korean Peninsula: North and South Korea are on edge, with Russia signing a defense treaty with North Korea. Border incidents and threats over South Korea’s potential troop deployment to Ukraine have heightened tensions.

Nuclear Brinkmanship: France and Russia’s nuclear brinkmanship is a significant risk, with both countries attempting to establish deterrent boundaries.

Economic and Market Effects

These conflicts could alter monetary power dynamics and supply chains. Expect increased oil demand and gold purchases as safe-haven assets. Silver demand will also rise due to its military applications.

Diplomatic Relations

Zimbabwe and Zambia: Tensions are high as Zimbabwe aligns more closely with Russia, accusing the U.S. of militarizing Zambia.

Election Updates

Iran: Presidential elections are nearing completion as candidates drop out.

France: The first stage of snap parliamentary elections is complete.

U.S.: The first debate between Biden and Trump was contentious, adding to the uncertainty of the upcoming election.

Natural Disaster Considerations

While not detailed here, it’s crucial to consider the impact of natural disasters on economic activities and implement strong risk management.

Key Market Data and Analysis

Final GDP: Increased from 1.3% to 1.4%.

Unemployment: Fell by 3k more than forecasted, indicating a stronger U.S. economy.

Core PCE: Decreased from 0.3% to 0.1%.

Consumer Confidence: Fell but remained above forecasted numbers.

Housing Market: New home sales dropped significantly, while pending home sales improved slightly but missed expectations.

GOLD

Gold prices remain within a range, with resistance at 2431.705 and support at 2295.536. A bullish trend is expected despite fluctuations.

SILVER

Silver prices showed growth, reaching 29.900 before settling at 29.018. Resistance is expected at 29.900, but an overall upward trend is anticipated.

DXY (Dollar Index)

The dollar index showed growth but may face weakness with the anticipated September rate cut. A bearish outlook is expected.

GBPUSD

The pound remains within a range. With potential rate cuts in both the U.K. and the U.S., significant price changes are unlikely in the near term.

AUDUSD

The Aussie dollar shows upward momentum but needs to break above 0.67142 to confirm this trend. Analysts predict rate cuts only in late 2025, potentially benefiting the currency.

NZDUSD

Similar to the Aussie dollar, the New Zealand dollar shows growth and may benefit from delayed rate cuts until late 2025.

EURUSD

The ECB’s cautious rate cut approach has weakened the Euro. Further cuts are expected but at a slower pace, indicating potential continued weakness.

USDJPY

Despite interventions, the USDJPY continues to grow. Watch for further interventions and economic data to gauge future movements.

USDCHF

The Swiss Franc fell after recent rate cuts. Further rate cuts are uncertain, making the USDCHF volatile.

USDCAD

The CAD showed weakness against the dollar, with analysts predicting further rate cuts. Price consolidation is expected as we await more data.

Stay informed and practice diligent risk management as we navigate these challenging market conditions. More updates to come.

2 notes

·

View notes

Text

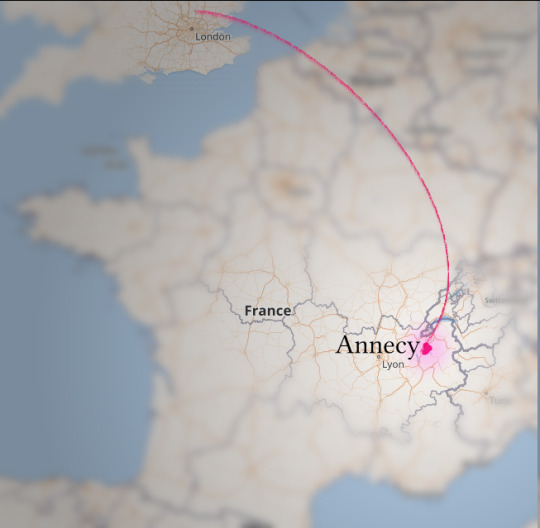

L’Aventure de Canmom à Annecy - Dimanche/Lundi

Bonsoir mes amis!

I am in Annecy, the unreasonably picturesque home of the Annecy International Animated Film Festival! I have discovered that the Annecy International Animated Film Festival involves a lot more standing in long queues in the hot sun than I expected! Nevertheless, I’m here and making the best of it.

So.

dimanche - le voyage à annecy

First of all, Sunday! I set off at 3am on Sunday morning, taking a bus, followed by two tubes, followed by another bus to the airport. The last bus was late. I met a couple of nice PhD students on their way to the same airport, and they were gonna get all of us an uber, but then the bus showed up after all.

At the airport, security threw away my 200ml bottle of sunblock. Can never be too careful I guess >< Inevitably, Richard Dawkins and his little pot of honey leapt unbidden into my brain. I promise I did not call anyone a “dundridge”.

The flight itself was uneventful! I was behind three other Annecy-goers, a very sweet gay couple and their friend... we hit it off pretty well but they were on a later bus and I haven’t seen them since I got here ^^’ Once I landed in Geneva I was racing across the city to try to get to the Annecy bus in time (I left myself an hour, which turned out to be way too little time to get through customs, out the airport, onto the train etc.) Trains in Switzerland are nuts, some of them are split across multiple levels and even the ones that aren’t have like, steep steps to get aboard.

Like “fuck you if you’re in a wheelchair” I guess.

Luckily the bus to Annecy was late! So by midday on Sunday I was in Annecy!

I ran into a group of Swiss animation students who were happy to let me tag along for a while. They just finished their graduation films and they were terribly excited about Spider-Verse. They ended up arranging to meet a couple of animators at Cartoon Saloon so I ended up witnessing some honest to god Networking. The imposter syndrome kicked in about when they were showing the cartoon saloon animators clips from their demo reels. I didn’t even have business cards. Apparently that’s a thing people bring???

pictured: swiss animation students approaching Lake Annecy.

Anyway my legs got really tired from standing up and no sleep. I bought myself an expensive crêpe and sat down on the floor to eat it. No films were due to start for hours.

I went down to a comic book shop in Bonlieu. French comic book shops are fucking insane. All the books are enormous glossy hardbacks that cost like 50+ euros. I could totally walk away with the complete works of Moebius or Enki Bilal if things like ‘money’ and ‘getting through the airport’ and ‘not reading French’ weren’t factors. But equally there’s so much stuff that I’ve just plain never heard of. I could spend a month in this one shop easy.

At 3am my hotel checkin opened! Though in French you don’t say ‘check in’, you say j’ai un reservation. By this point I had been awake for more than 24 hours so I decided to go have a nap and eat the falafels I brought with me (very good idea, would recommend having a snack) and wake up for the opening ceremony.

Hotel comments: It’s pretty comfy! Nothing super fancy but I don’t need super fancy. The breakfast is kind of crazy expensive. I had a bit of a scare when it turned out that they hadn’t charged me when I booked the room, and wanted payment now, but thankfully I have a job now so I could take that in stride ^^’

At this point I discovered my plug adapter supports the US, Australia, New Zealand and Japan... but not Europe. Fortunately I had a power bank with me so I could keep my phone alive (its battery is pretty shot) so I resolved to buy a new adapter on Monday.

I woke up shortly before the opening ceremony and quickly concluded that there was no way I was going to be making it down to the opening ceremony and went back to sleep. I slept a really long time. But I think I needed it. Shame to miss the ceremony but odds are I probably wouldn’t have even been able to get in, someone else said she’d queued for two hours.

lundi - les files d'attente

(lmao is that really the french for ‘queues’? ‘files d’attente’?)

A beautiful morning in Annecy! I walked over to the supermarché and got myself some pasta ingredients and a ‘veggie dog’ (falafels in a baguette) from a French bakery. I learned just how limited my French vocab is. But it’s a little reassuring to find French people who speak about as much English as I speak French. (Have not yet tried to speak Japanese to any French person but it will probably happen.)

Anyway. Films time, at last!

So the way Annecy works is, you get a certain number of reservations per day depending on your ticket type. If you don’t have a reservation you can optimistically show up at the theatre anyway, and whatever seats they have left go to the line. From the website it sounded like you’d have a pretty good chance to get in.

My friends. That is a lie.

To get in to a popular non-reserved screening you have to turn up basically hours in advance. Otherwise you arrive at the back of a queue like this, stand in line for a while, and then someone in a red shirt comes out and tells you you’re too late and you go find something else to do.

I have already become very familiar with this particular stretch of ground outside Cinema Pathé. That said, the queues are a good chance to meet people! So I ended up making a couple of connections, mostly with animation students from various places. It turns out a ‘Grand Public’ ticket is a bit of an odd duck.

As you can see in that picture, a lot of people had umbrellas. This is something I neglected, and had to use my bag instead, like so:

Guess where I got sunburned.

One of those something elses I did was walk into the VR films room. This runs on its own reservation system, with each film having somewhere between 2 and 6 headsets, which get sanitised between viewings. The whole room looks kinda scifi with its cables dangling from the ceiling...

The only VR film available when I arrived was called Black Hole Museum + Body Browser by Su Wen-Chi from Taiwan. This was very demoscene, with a lot of particles flying around under force fields in a black and white space; the second part involved a dancer who’d been photoscanned somehow and was displayed using waves of particles. It was neat, but I can’t say I was hugely moved? The display device was a Quest 2, but I’m not sure if it was running the particle sim on Quest 2 hardware. If it was, I’m impressed.

The other VR films were all but fully booked so I resolved to come back another day.

I tried to get into the anime film The Tunnel to Summer, the Exit of Goodbyes. Predictably, I was too late. However, the next queue over was for a Spanish film called Inspector Sun and the Curse of the Black Widow, and, wanting to see at least one film I hopped onto that queue and found myself inside the cinema in short order.

The auditorium was packed and I got to witness firsthand such Annecy traditions as throwing paper aeroplanes at the screen, shouting ‘Lapin!’ whenever a rabbit appears onscreen, and making a weird popping sound with your mouth while waiting for the film to start (??? it sounded like frogs ig???). The movie itself was greeted with excitement but honestly? It was pretty eh, which is a shame since the idea of a world of bugs is a fun one! The story concerns a bumbling spider detective, his aspiring sidekick spider, and his feud with the leader of a locust underworld, playing out on a seaplane en route to San Francisco. The characters are all very one-note archetypes, and the dialogue felt like it was trying way too hard to be funny quippy movie dialogue... only to land on the painfully obvious. A big shame.

But what’s worse is that I had spent my one daily reservation on Mars Express by Jérémie Périn at 4:30 and I’d completely lost track of time. By the time I walked out of Inspector Sun my phone was almost dead (see above about the adapter) so I popped into a French electronics store and bought a couple of EU adapters and set off to charge my phone. But then on the bus I thought, hold on a minute, when is Mars Express, I have like an hour right---oh fuck. Well fine it’s at Bonlieu right? I can just walk there? ...it’s at Le Mikado Novel? Where the fuck is that? Half an hour away?

...so to make a long story short I got off the bus, walked down the street, my phone died, there was no way I could find my way to Le Mikado in time to get in even with my reservation, so I had to go back to my hotel and waste my precious reservation. And I hear the film was great. Sob.

There are a bunch of other screenings this week but they’re all packed so who knows if I’ll get to see this movie.

Despite this big oof I charged up my phone and headed back to meet up with my friend (hi to my friend!) who was in the queue for Production I.G.’s new film The Concierge. My friend was more than an hour early, so we thought we had a pretty good chance... lol nope. After standing in line for 45 minutes we were informed the cinema is full and had to leave.

It wasn’t a complete waste though. We met up with another friend and had a little picnic of bagels. Unfortunately the bagel I got was not the bagel I thought I was getting (idk what happened) but even so, it was nice to meet two online friends who by bizarre coincidence both turned out to be from Singapore.

To close the night I decided to take one more shot at getting in to see a movie, and went for a late showing of The Sacred Cave, a movie from Cameroon. Which is pretty neat, it’s not every day you see a movie from Cameroon. This one was... well, technically it’s definitely rough, but I don’t wanna be hard on it. The story is a fairy tale: a traditional healer is called in to attempt to save a dying king, and he dispatches his son on a mission to retrieve special medicine alongside the Prince.

On the way the son encounters a weird forest wizard, then a princess of a neighbouring clan who’s been turned into an anthro frog by an evil wizard; as he tries to head back with the medicine, he’s captured by said clan and almost executed, but because of his pure nature he alone can draw the special magic sword, and using this power he helps his captors overcome the evil wizard’s raiding party. But on the way home he gets betrayed by the Prince! A whole lot of betraying unfolds, killing off the old seer, and it turns out that our boy is actually the true son of the King. Despite the whole ‘executing his adoptive father on spurious charges’ thing, it all shakes out; the baddies are driven off, the princess unfrogged, and our very special good boy is rewarded.

It’s animated largely in Flash, and it has the feel of an online Flash video. All the same, I believe this is the first feature-length animated film from Cameroon. Bootstrapping an animation industry capable of putting together a coherent film is a hell of a feat, and must take an enormous degree of passion and dedication to make that happen. (Also not to put too fine a point on it but there are certain historical reasons why France has a much more developed animation industry than the country it had colonised until 1971.) Anyway, although principally made in Cameroon, the credits name a whole bunch of different countries, mostly in West Africa. Probably it would make sense to compare it to Princess Iron Fan or something like that, and I’m excited to see what comes down the line. And it was a very sincere movie, the setting presented with a great deal of love, especially when it came to costumes. I’m glad to have seen it.

Tomorrow morning Im gonna get up very early and take another shot at The Concierge, and try and plan better around the queuing system to try to make the best of it and catch more of the short films. It’s definitely not been the day of back to back films I was expecting, but honestly despite all that I’m having a good time just being in Annecy and the week is yet young...

good god is it expensive here though

14 notes

·

View notes

Text

Daniel Ricciardo: Alpha Tauri driver will miss Italian Grand Prix because of broken hand

Daniel Ricciardo had to be replaced by Red Bull reserve driver Liam Lawson for the rest of the Dutch Grand Prix weekend

Daniel Ricciardo will miss the Italian Grand Prix as a result of the broken hand he sustained in an accident at Zandvoort on Friday.

Australian Ricciardo crashed his Alpha Tauri at the banked Hugenholz corner during the second practice session for the Dutch Grand Prix.

Red Bull team boss Christian Horner said Ricciardo had an operation on Sunday to insert screws into the bone.

"It was a fairly straightforward procedure," Horner said.

"Now it's all about recovery. For a normal human being that would be a couple of months. For a grand prix driver, it's usually much shorter.

"We need to see how the recovery goes but certainly not Italy."

On Sunday, Ricciardo posted an updateexternal-link on his Instagram account from his hospital bed in Barcelona, having been ruled out of race action.

"Had surgery this morning, got my first bit of metal work so that's pretty cool," he wrote.

"Big thanks to everyone who reached out and kept my spirits up. This ain't a setback, just all part of the comeback."

Ricciardo will be replaced again next weekend at Monza by New Zealander Liam Lawson, who was drafted in at Zandvoort on Saturday and finished 13th on Sunday.

The 34-year-old Ricciardo returned to the grid in July as a replacement for Dutchman Nyck de Vries, who was dropped by Alpha Tauri following a disappointing run of results.

Although broken bones typically take about six weeks to heal, F1 drivers are renowned for their determination to race as soon as possible after injury.

At the start of this season, Aston Martin driver Lance Stroll raced in the Bahrain Grand Prix just 12 days after receiving medical treatment for a total of four fractures in his hands, wrists and feet.

Last year, Alex Albon raced for Williams in Singapore three weeks after an operation to remove his appendix.

And in 2021, Fernando Alonso took part in pre-season testing a month after breaking his jaw in a cycling accident. The two-time champion raced for Alpine with two metal plates in his jaw for the entire season.

On that basis, Ricciardo may well try to return in time for this year's Singapore race on 15-17 September. It is followed a week later by the Japanese Grand Prix.

via BBC Sport - Formula 1 http://www.bbc.co.uk/sport/

#F1#Daniel Ricciardo: Alpha Tauri driver will miss Italian Grand Prix because of broken hand#Formula 1

3 notes

·

View notes

Text

#1941 - Crocosmia × crocosmiiflora - Garden Montbretia

Photo by @purrdence at Lake Mangamahoe, NZ.

From the Greek krokos, meaning "saffron", and osme, meaning "odor" – the dried leaves emitting a strong smell like that of saffron (another genus in the Iridaceae) – when immersed in hot water. Montebretia is a heterotypic synonym of the genus Tritonia in which some species of Crocosmia used to be included. In the British Isles the common name Montebretia for orange-flowered cultivars that have aggressively naturalised, while "crocosmia" is reserved for less aggressive red-flowered cultivars.

A garden hybrid of Crocosmia aurea and Crocosmia pottsii, both of which originated from South Africa, first bred in 1880 in France by Victor Lemoine, and now an invasive weed in the UK, California, Australia and New Zealand. The weed grows in all states of Australia bar the Northern Territory, most often close to highly populated city and coastal areas where garden waste was illegally dumped. It is of particular concern in the Manly and Blue Mountains areas near Sydney. but is present at various locations along the eastern coast, the Tablelands regions and on Lord Howe Island.

Montbretia grows in dense clumps and is capable of adapting to a variety of conditions (hybrid vigour is a sod), out-competing native plants, particularly in native bushland and riparian areas, causing creek bank erosion and sedimentation where it changes water flow.

Montbretia can sometimes still be found for sale at local fetes, nurseries and markets but mostly spreads from underground runners and bulbs. Each plant can produce over a dozen new bulbs each year, which break off from the parent plant and begin to produce their own root network.

3 notes

·

View notes

Text

The single biggest flaw with democrat supporters is...

They think they are the 'left, progressive, for the people' party when they are not.

Sure, there IS a right party: the conservative, for the rich, republicans.

But if you did any BASIC research into canada, europe, australia, new zealand, etc, you would realize, by comparison, our 'left' party is 'centralist at BEST.'

Because USA democrats are not fighting for ALL the following (which those other countries, for the most part, ALREADY HAVE or are fighting for currently):

-free healthcare

-paternity leave

-decent wages (and stopping the BILLIONS stolen in unpaid wages)

-paid time off

-clean drinking water (they have better water than us too)

-less infant deaths (for a 1st world country, for the past 40 years, we have had some of the MOST infant deaths)

-earlier retirement

-low income housing for ALL (not some)

-mental health assurances

-disability assurances

-stopping our perpetual wars and war funding (both bernie AND AOC signed war bills)

-closing the federal reserve and big banking

-strict term limits

-ending lobbying and gerrymandering (democrats LOVE this as much as republicans)

-ending corruption (not just making a show of it.)

-slowing our ever growing police abuses and prison populations (especially victimless crimes)

-ending for profit prisons

-ending deadly drugs approved by the government (and toxic food the ABOVE countries BANNED)

-making schools actually EDUCATE and give them proper food

-holding news organizations accountable for spreading lies

and SO SO SO fucking much more.

So when USA democrats get even 1/2 of the above list started, you can maybe (MAYBE) call them the left. Till then, they are in the middle, closer to leaning right, and NOT HELPING ANYONE!!!

<I think that's what pisses me off the most: everyone agree the republicans work for the rich. But the democrat supporters deny that the democrats do it too. If they didn't, you would've had so much more by now, morons!!!>

#progressive#liberal#democrat#democrats#bernie#aoc#republicans#government#usa#america#biden#trump#canada#europe#new zealand#austalia#left#right#centralist

5 notes

·

View notes

Text

Daily Forex Market Overview: USD Gains Against Yen, Euro, and Sterling Slightly Retreat

In the latest forex market movement, the U.S. dollar (greenback) strengthened against the yen, while the euro and British pound saw slight retreats after hitting multi-session highs.

USD Gains Against Yen

The greenback made significant gains against the yen, rising by 0.58% to reach 143.12. This uptick reflects the continued strength of the U.S. economy and ongoing speculation around the Federal Reserve's stance on interest rates.

Euro Slightly Falls From Recent High

The euro witnessed a minor decline of 0.04%, settling at $1.1113. This comes after the euro touched a three-week high in the previous session. The recent dip indicates slight adjustments as traders await key data releases from the European Central Bank (ECB) regarding inflation trends and economic recovery.

Sterling Retreats After Peak

The British pound (sterling) saw a 0.11% drop to $1.3199, pulling back from a peak of $1.3298, its highest since March 2022. This slight dip follows a rally driven by confidence in the UK economy's resilience and expectations of further interest rate hikes by the Bank of England.

AUD and NZD Show Minor Gains

Meanwhile, the Australian dollar edged higher by 0.05% against the U.S. dollar to trade at $0.6768. The New Zealand dollar also rose modestly, gaining 0.04% to reach $0.6210. Both currencies saw slight boosts due to positive economic signals and stable commodity prices in their respective regions.

0 notes

Text

Fortinet Ships Emergency Patch for Already-Exploited VPN Flaw

Fortinet Ships Emergency Patch for Already-Exploited VPN Flaw

Home › Cyberwarfare

Fortinet Ships Emergency Patch for Already-Exploited VPN Flaw

By Ryan Naraine on December 12, 2022

Tweet

Fortinet on Monday issued an emergency patch to cover a severe vulnerability in its FortiOS SSL-VPN product, warning that hackers have already exploited the flaw in the wild.

A critical-level advisory from Fortinet described the bug as a memory corruption that allows a…

View On WordPress

#0day#bug bounty#China#csrb#CVE-2022-4247#CWE-122#disclosure#email notification#exploitation#exploits#file transfer#Fortinet#FortiOS#FortiOS SSL-VPN#katie moussouris#Log4j#luta security#Reserve Bank of New Zealand#vulnerability#zero-day

0 notes

Text

Dolar Merosot Pasca Data Infalasi AS yang Jinak; Kiwi Merosot

PT BESTPROFIT FUTURES BANJARMASIN – Dolar tetap melemah pada hari Rabu (14/8) setelah jatuh terhadap mata uang utama lainnya semalam karena pembacaan yang jinak untuk harga produsen AS memperkuat taruhan pada penurunan suku bunga Federal Reserve tahun ini. PT. BESTPROFIT

Dolar Selandia Baru turun tajam dari level tertinggi empat pekan setelah Reserve Bank of New Zealand menurunkan suku bunga…

#BEST PROFIT#BEST PROFIT FUTURES#BestPro#BESTPROFIT#BESTPROFIT FUTURES#BPF#BPF BANJAR#BPF BANJARMASIN#PT BEST#PT BEST PROFIT#PT BEST PROFIT FUTURES#PT BESTPROFIT#PT BESTPROFIT FUTURES#PT BPF#PT.BPF

0 notes

Text

Hong Kong stocks ended five consecutive gains. The Hang Seng Index opened 59 points or 0.35% higher at 17,233 points. It once rose 80 points to the day's high of 17,254 points, and then turned back and fell 60 points or 0.35% for the day to 17,113 points. The Technology Index fell 33 points or 0.99%. It was quoted at 3,395 points. The market transaction volume was only HK$68 billion, a new low in the past six months.

Mainland economic data are still lower than expected. Unless there is a policy shift and domestic demand and consumption improve significantly, the real economy will continue to be under pressure. The Hang Seng Index will remain at 16,600 to 17,300 points in the short term. In the short term, you can pay attention to the upcoming results of technology and Internet stocks to see whether they will surprise the market.

European stock markets remained stable, with British, French and German stocks closing up 0.56%, 0.79% and 0.41% respectively.

U.S. core inflation decelerated for four consecutive months in July, clearing the way for the Federal Reserve to start cutting interest rates in September. U.S. stocks rose repeatedly on Wednesday. After opening 34 points higher, the Dow Jones Industrial Average fell 28 points. It reached a maximum of 303 points and reached a high of 40,068 points. Financial stocks were favored; the S&P Index once rebounded by 0.53%; the Nasdaq Index once fell by 0.9% and then stabilized repeatedly, eventually recovering all lost ground.

At the close of the U.S. stock market, the Dow rose 242 points, or 0.61%, to 40,008 points; the S&P 500 rose 20 points, or 0.38%, to 5,455 points, rising for five consecutive trading days; the Nasdaq rose 5 points, or 0.03%, to 17,192 points.

The U.S. dollar index fell as much as 0.28% to 102.27, the Euro rose 0.49% to $1.1049, and the Japanese yen fell 0.51% to 147.58 per dollar. The Bank of New Zealand unexpectedly cut interest rates by 0.25%, and the New Zealand dollar surged by 1.4%, reaching a low of 59.94 US cents. Inflation in the British service sector slowed sharply, and the pound fell 0.33% to $1.282.

SK is cooperating with TSMC to develop HBM4 and mass-produce it in 2026.

0 notes

Text

New Zealand eases level of monetary policy restraint

New Zealand’s central bank eased the level of monetary policy restraint by reducing the official cash rate (OCR) by 25 basis points to 5.25 per cent on Wednesday due to eased inflation.

New Zealand’s annual consumer price inflation is returning to within the Monetary Policy Committee’s (MPC) 1 to 3 per cent target band, Xinhua news agency reported, citing a statement of the Reserve Bank of New…

0 notes

Text

ForexLive Asia-Pacific FX News Wrap: RBNZ Cuts Rates, Japan PM to Step Down

In the fast-paced world of forex trading, recent events in the Asia-Pacific region have created notable ripples. The Reserve Bank of New Zealand’s (RBNZ) unexpected decision to cut interest rates and the surprising resignation of Japan’s Prime Minister are significant developments that could reshape the forex market. This in-depth analysis explores these pivotal events and their potential impact on forex trading strategies.

RBNZ Cuts Rates: Implications for Forex Traders

On August 13, 2024, the Reserve Bank of New Zealand (RBNZ) reduced its official cash rate from 5.0% to 4.5%. This decision is a strategic move aimed at countering a slowing economy and addressing lower-than-expected inflation rates. By lowering interest rates, the RBNZ intends to stimulate economic activity by making borrowing cheaper for businesses and consumers.

Impact on the New Zealand Dollar (NZD)

The immediate effect of the RBNZ’s rate cut was a depreciation of the New Zealand Dollar (NZD) against major currencies. Lower interest rates typically diminish the appeal of a currency for investors seeking higher returns, leading to a weaker NZD. Forex traders should be alert to the potential for further declines in the NZD if the RBNZ continues its dovish monetary policy.

Market Reactions and Forecasts

Market analysts anticipate that the NZD may face additional pressure in the short term. The RBNZ’s decision suggests a more accommodative stance, which could influence global forex markets. Traders should remain vigilant and monitor any subsequent policy updates or economic data releases from New Zealand that may affect the NZD’s trajectory.

Japan’s Political Transition: Prime Minister’s Resignation

In a surprising turn of events, Japanese Prime Minister Fumio Kishida has announced his resignation, effective by the end of August 2024. This development introduces uncertainty into Japan’s political and economic environment.

Effects on the Japanese Yen (JPY)

The resignation of Prime Minister Kishida is likely to lead to increased volatility in the Japanese Yen (JPY). Political instability often results in market uncertainty, which can impact investor confidence. As a result, the JPY may experience fluctuations based on the political transition and potential policy shifts.

Economic and Political Implications

The new leadership’s approach to economic policies will be crucial for forex traders to watch. Any proposed changes in fiscal policies or economic reforms could significantly impact Japan’s economic outlook and, consequently, the JPY.

Broader Implications for Forex Markets

Regional Currency Impacts

The recent developments in New Zealand and Japan have broader implications for regional currencies and the global forex market. Forex traders should consider how these events intersect with other economic factors, such as trade relations, geopolitical tensions, and global economic trends.

Strategies for Forex Traders

In response to these developments, forex traders should consider the following strategies:

Monitor Central Bank Announcements: Stay updated on central bank decisions and economic data releases that could influence currency movements.

Assess Political Stability: Evaluate the impact of political changes on currency markets and adjust trading strategies accordingly.

Diversify Currency Exposure: To mitigate risk, diversify exposure across different currencies and markets.

Combine Technical and Fundamental Analysis: Use a combination of technical indicators and fundamental analysis to make informed trading decisions.

Conclusion

The RBNZ’s recent rate cut and the resignation of Japan’s Prime Minister are significant events that forex traders should closely monitor. These developments have the potential to impact currency movements and market dynamics in the Asia-Pacific region. By staying informed and employing effective trading strategies, traders can navigate these changes successfully.

0 notes

Text

Forex Trading: Navigating the Currency Markets

The foreign exchange (forex) market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Unlike other financial markets, forex operates 24 hours a day, five days a week, allowing traders from all over the globe to participate at any time. For those looking to diversify their investment portfolio or capitalize on the constant movement of global currencies, forex trading offers unique opportunities and challenges. In this blog, we’ll explore the basics of forex trading, the key factors that influence currency movements, and strategies for successful trading.

Introduction to Forex Trading

What is Forex Trading?

Forex trading involves the exchange of one currency for another in the global marketplace. The primary goal of forex trading is to profit from the changes in currency exchange rates. For example, if you believe the value of the euro (EUR) will increase relative to the U.S. dollar (USD), you might buy euros with dollars and later sell them back when the exchange rate has risen.

How Does Forex Trading Work?

Currencies are traded in pairs, meaning when you buy one currency, you simultaneously sell another. Each currency pair is represented by a three-letter code, such as EUR/USD (euro against U.S. dollar) or GBP/JPY (British pound against Japanese yen). The first currency in the pair is the base currency, and the second is the quote currency.

Forex trading involves predicting whether the base currency will strengthen (appreciate) or weaken (depreciate) against the quote currency. If you believe the base currency will appreciate, you go long (buy). If you think it will depreciate, you go short (sell).

Key Features of the Forex Market

- Leverage: Forex trading often involves the use of leverage, allowing traders to control large positions with relatively small amounts of capital. While leverage can amplify profits, it also increases the potential for significant losses.

- Liquidity: The forex market’s immense liquidity means that trades can be executed quickly and with minimal price slippage.

- 24-Hour Trading: The forex market operates around the clock, enabling traders to react to global events in real-time.

Key Factors Influencing Currency Movements

1. Economic Indicators

Economic indicators, such as gross domestic product (GDP), unemployment rates, and inflation, have a profound impact on currency values. Strong economic performance in a country often leads to an appreciation of its currency, while weak performance can cause depreciation. For instance, if the U.S. reports better-than-expected GDP growth, the USD may strengthen against other currencies.

2. Interest Rates

Interest rates set by central banks are one of the most critical factors influencing currency movements. Higher interest rates typically attract foreign investment, leading to a stronger currency. Conversely, lower interest rates can result in a weaker currency. Traders closely monitor decisions by central banks like the Federal Reserve, European Central Bank, and Bank of Japan for any changes in interest rate policies.

3. Political Stability and Geopolitical Events

Political stability and geopolitical events can cause significant fluctuations in currency prices. For example, uncertainty surrounding elections, government policies, or international conflicts can lead to increased volatility in the forex market. A country with stable political conditions is more likely to attract foreign investment, which can strengthen its currency.

4. Market Sentiment

Market sentiment, or the overall mood of investors, can drive currency movements. If traders are optimistic about the global economy, they may favor riskier currencies with higher yields, such as the Australian dollar (AUD) or New Zealand dollar (NZD). In times of uncertainty or fear, they may seek safety in traditionally stable currencies like the U.S. dollar (USD) or Swiss franc (CHF).

5. Trade Balances

A country’s trade balance, which measures the difference between exports and imports, can also influence its currency. A trade surplus (more exports than imports) typically strengthens a currency, as foreign buyers must purchase the domestic currency to pay for the country's goods. A trade deficit (more imports than exports) can weaken the currency.

Strategies for Successful Forex Trading

1. Technical Analysis

Technical analysis involves studying past price movements and using various tools, such as charts and indicators, to predict future price action. Common technical indicators in forex trading include moving averages, relative strength index (RSI), and Fibonacci retracement levels. By identifying trends and patterns, traders can make more informed decisions about when to enter or exit trades.

2. Fundamental Analysis

Fundamental analysis focuses on the economic, political, and social factors that influence currency prices. Traders who use this strategy analyze economic data, central bank policies, and geopolitical events to anticipate how they might affect currency values. For example, a trader might buy a currency if they expect a central bank to raise interest rates, leading to an appreciation of that currency.

3. Risk Management

Effective risk management is crucial in forex trading, given the potential for significant losses due to leverage and market volatility. Traders should set stop-loss orders to limit losses on any given trade and avoid risking more than a small percentage of their capital on a single trade. Diversifying trades across different currency pairs can also help reduce risk.

4. Trend Following

Trend following is a strategy where traders identify and capitalize on existing market trends. The idea is to enter trades in the direction of the trend and hold the position until signs of a reversal appear. For example, if the EUR/USD is in a strong uptrend, a trend-following trader would look for opportunities to buy the pair and ride the trend for as long as it lasts.

5. Carry Trade

The carry trade strategy involves borrowing money in a currency with a low-interest rate and using it to buy a currency with a higher interest rate. The goal is to profit from the difference in interest rates between the two currencies, known as the "carry." This strategy is popular when interest rate differentials are significant, and market volatility is low.

Conclusion

Forex trading offers a dynamic and potentially lucrative way to engage with the global financial markets. By understanding the basics of forex trading, recognizing the key factors that drive currency movements, and applying effective trading strategies, you can navigate the forex market with greater confidence and success. However, it's important to remember that forex trading carries risks, and success requires continuous learning, discipline, and careful risk management. Whether you're a beginner or an experienced trader, staying informed and adaptable is the key to thriving in the ever-changing world of forex trading.

1 note

·

View note