#Risk Management Process

Explore tagged Tumblr posts

Text

Comprehensive Solutions for Data, Credit Risk Management, and Corporate Intelligence: A Guide to Eff

In today’s fast-paced, data-driven world, businesses are continuously facing various risks that could impact their growth and stability. From financial risks to regulatory challenges, understanding and managing these risks is crucial. This is where robust data solutions, credit risk management, and corporate intelligence come into play. Implementing an effective risk management process helps businesses mitigate these risks and ensure long-term success. In this blog, we explore how these elements work together and how Cedar Rose’s advanced due diligence and risk management services can support your company’s strategic goals.

Data Solutions: The Foundation of Risk Management

Effective risk management starts with accurate and comprehensive data. Data solutions refer to the systems and technologies used to collect, process, analyze, and store data that are critical for making informed business decisions. In the context of risk management, this data helps companies assess potential risks, identify vulnerabilities, and predict future challenges.

Cedar Rose, a leader in data solutions for businesses, offers an array of tools to help companies gather valuable insights. By leveraging data from trusted sources, businesses can ensure their risk management strategies are built on a solid foundation. These insights can include information about financial health, operational risks, and even reputational concerns of potential partners and clients.

When businesses have access to accurate, up-to-date data, they are in a better position to evaluate risk and take proactive measures to mitigate it. Whether it’s assessing a supplier’s reliability or analyzing market conditions, data solutions are essential for managing risks effectively.

Credit Risk Management: Safeguarding Financial Health

One of the most critical aspects of any business’s risk management strategy is credit risk management. Credit risk refers to the possibility of a borrower or counterparty failing to meet their financial obligations. This can lead to financial losses, reputation damage, or legal complications for businesses.

Cedar Rose’s credit risk management services are designed to help organizations evaluate and monitor the creditworthiness of their clients, partners, or investors. By assessing a client’s credit history, outstanding debts, and payment behaviors, businesses can better predict the likelihood of defaults and take steps to minimize exposure to credit risk.

Furthermore, with Cedar Rose’s due diligence services, businesses can perform in-depth checks on potential clients or partners to ensure that their credit history aligns with their risk tolerance. Whether you’re considering a new supplier, expanding into new markets, or providing financing options, credit risk management provides a safeguard against unexpected financial troubles.

Corporate Intelligence: A Key to Informed Decision-Making

In an increasingly complex business environment, companies need to be aware of external and internal factors that may impact their operations. Corporate intelligence involves the collection, analysis, and use of information to make strategic decisions that support business objectives.

By leveraging corporate intelligence, organizations gain a deeper understanding of market conditions, competitor strategies, and regulatory changes. This intelligence is invaluable when assessing risks related to potential mergers, acquisitions, investments, and partnerships.

Cedar Rose’s corporate intelligence services provide comprehensive reports on companies’ financials, ownership structures, litigation history, and more. This type of intelligence helps businesses identify potential risks such as fraud, corruption, or reputational damage before making critical decisions. With a solid understanding of the competitive landscape and company profiles, businesses can navigate risks with confidence.

Risk Management Process: A Holistic Approach to Mitigating Risks

A sound risk management process encompasses the identification, assessment, mitigation, and monitoring of risks. Cedar Rose offers a holistic approach to risk management, where businesses can integrate various solutions like data, credit risk management, and corporate intelligence to build a cohesive strategy.

Risk Identification: The first step in any risk management process is identifying potential risks that could impact the business. These could include financial risks, legal challenges, market volatility, or even environmental factors. Accurate data and corporate intelligence are crucial in this step.

Risk Assessment: Once the risks are identified, they must be assessed for their likelihood and potential impact. This is where credit risk management tools become essential for evaluating the probability of defaults or financial distress.

Risk Mitigation: After assessing the risks, businesses can develop strategies to mitigate them. This could involve diversifying investments, strengthening credit controls, or implementing compliance measures. Cedar Rose’s due diligence services ensure that businesses have the right information to make informed decisions and reduce risk exposure.

Risk Monitoring: The final step is continuous monitoring of risks. With changing market conditions and evolving business environments, it’s important to stay updated. Regularly reviewing corporate intelligence and financial data helps businesses stay ahead of emerging risks.

Cedar Rose’s comprehensive due diligence services ensure that every step of the risk management process is backed by reliable, up-to-date information. This enables businesses to not only identify and manage risks effectively but also uncover opportunities for growth and expansion.

Conclusion

In conclusion, effective data solutions, credit risk management, and corporate intelligence are integral components of a successful risk management process. By working with Cedar Rose, businesses can leverage advanced tools and expert insights to safeguard their financial health and make informed decisions that drive success. Whether you are managing existing risks or looking to enter new markets, Cedar Rose’s due diligence and risk management solutions offer a competitive edge in today’s complex business landscape.

For more information about Cedar Rose’s due diligence and risk management services, visit Cedar Rose Due Diligence and Cedar Rose Home.

0 notes

Text

Understanding the Risk Management Process – Key Steps in Identifying Risks

Explore the essential steps of the risk management process with IRM India. This comprehensive guide helps you identify, assess, and mitigate potential risks that can impact your organization. From initial identification to implementing risk control measures, learn how to safeguard your business effectively. Visit our blog to dive into the detailed risk management process and strengthen your risk management strategy today.

0 notes

Text

Data Intelligence

Unlock business insights with Cedar Rose's advanced data intelligence. Leverage comprehensive analytics for strategic advantage.

#Data Intelligence#Data solutions#Proprietary corporate data#Corporate intelligence#Risk Management Process#Credit Risk Management#Risk Management Software

0 notes

Text

Comprehensive Risk Assurance and Advisory Services by Nexdigm

Nexdigm offers specialized risk assurance and risk management services designed to help businesses identify, assess, and mitigate potential risks effectively. Our experts work closely with clients to develop a robust risk management process that aligns with their unique operational needs and regulatory requirements. By implementing proactive risk strategies, we empower organizations to enhance resilience and secure their assets.

Our risk advisory services include comprehensive risk assessments, internal audits, and compliance solutions that support informed decision-making. Nexdigm's approach to risk management helps clients address financial, operational, and strategic risks while ensuring optimal performance and compliance. This holistic risk management framework is built to adapt to the evolving business environment, offering clients a competitive edge.

Partnering with Nexdigm for risk assurance and advisory solutions enables businesses to manage uncertainties confidently. Our tailored services are designed to safeguard assets, enhance operational stability, and build trust with stakeholders, ensuring long-term success in an increasingly complex landscape.

0 notes

Text

Understanding the Risk Management Process – Key Steps in Identifying Risks

Explore the essential steps of the risk management process with IRM India. This comprehensive guide helps you identify, assess, and mitigate potential risks that can impact your organization. From initial identification to implementing risk control measures, learn how to safeguard your business effectively. Visit our blog to dive into the detailed risk management process and strengthen your risk management strategy today.

0 notes

Text

Small and Medium-sized Enterprises (SME): Definition and Examples explained! Dive into the world of SMEs and their impact on business and innovation.

#Small and Medium-sized Enterprises#sme ipo#micro-cap stocks#investment plans#stock market news#risk management process#investing stocks#stock market analysis

0 notes

Video

youtube

Mastering Risk Management: Why, What, and How

0 notes

Text

things i really enjoy doing

designing workspaces

asking questions about problems

optimizing processes

these are highly paid jobs in theory, but i think they probably come with a lot of bullshit, so i guess i'll keep being a glorified PC repair technician

#bathroom wall#jobs#process optimization#risk management#ux design#<- hey i've used all of these before! i love them <3

4 notes

·

View notes

Text

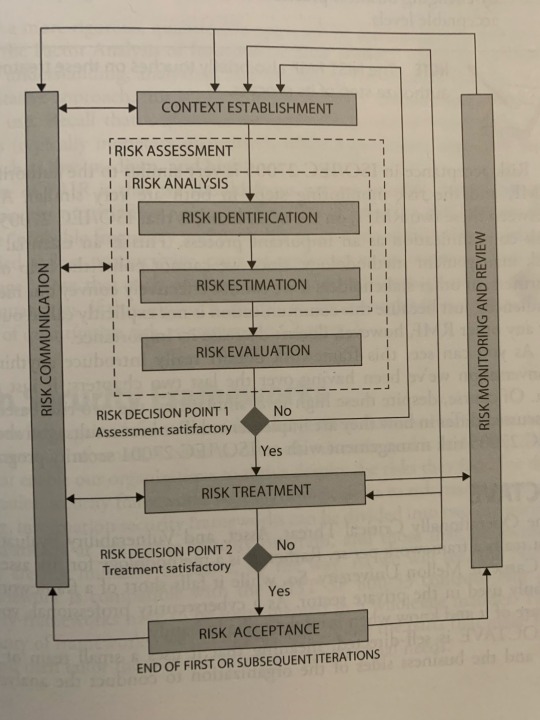

If you work in information security you too can study the world’s most boring, obvious diagrams

#oh I need to assess risks before I decide what to do about them???#amazing#don’t get me wrong#i got into this field because flowcharts and other node-graphs are my favorite way to express information#But I have been reading 30+ pages about how risk management is all about managing risk#also there’s no entry point into this graph#help im trapped in a risk management process and there’s no way out#the Minotaur’s labyrinth except it’s just a 9-5 desk job#wait that’s just called being alive#hmm#actually they should show this diagram during sex ed

8 notes

·

View notes

Text

.

#i have had the same reaction to the discourse around how gendered words like guys are in the english language for as long as i can remember#yeah sure cool if it's offensive to you to use it as a gender neutral phrase i won't do that around you#but i will also likely gradually start to avoid you because i am already hypervigilent about my speech to a degree i can barely tolerate#so if you're going to add to that process for me i have to actually enjoy our friendship enough to keep being that retraumatizing to myself#and for whatever reason that usually doesn't end up being true with people i know who find the word guys to be misgendering#i don't have a point or an opinion here just an observation that when we ask others to remove triggers on our behalf#it may take the work of managing those triggers off our shoulders#but it doesn't go away#it just gets moved#and you need to keep track of how many triggers you're asking another person to manage on your behalf or you risk#overextending your friends' love and care for you in relation to their ability to love and care for themselves#so maybe try to share the weight when you can rather than handing it off.

5 notes

·

View notes

Text

Understanding the Risk Management Process and the Importance of Risk Management Software and Solutio

Risk management is a crucial aspect of any business or organization. It ensures that potential risks, whether they are financial, operational, or reputational, are properly identified, assessed, and mitigated. Businesses are increasingly relying on advanced risk management software and solutions to help them manage these risks in a more effective and efficient manner. In this blog post, we’ll delve into the risk management process, the importance of credit risk management, and how modern risk management software and solutions can streamline the entire process.

What is Risk Management?

Risk management is the practice of identifying, assessing, and controlling risks that could potentially harm a business or an organization. It involves recognizing potential threats, understanding the impact they may have, and then taking proactive steps to prevent or mitigate these risks.

The goal of risk management is to protect the organization from the adverse effects of risks while ensuring smooth operations and compliance with legal, regulatory, and financial standards.

The Risk Management Process

The risk management process involves several key steps to ensure that risks are properly identified and mitigated. Here's a breakdown of the typical process:

Risk Identification This is the first step in the risk management process. Businesses need to identify potential risks that could affect their operations. Risks can come from many sources, including financial markets, legal obligations, accidents, or cyber threats. In this step, it’s essential to conduct a thorough analysis of internal and external factors that could potentially lead to risk.

Risk Assessment After identifying risks, the next step is to assess their likelihood and potential impact on the organization. Businesses must evaluate how severe each risk is, how likely it is to occur, and what the consequences could be. This step often involves the use of risk matrices, simulations, or expert judgment.

Risk Control and Mitigation Once risks have been assessed, businesses need to implement measures to mitigate or control them. This can include adopting new policies, changing operations, securing insurance, or investing in technology solutions to help reduce the likelihood or impact of identified risks.

Risk Monitoring and Review The risk management process doesn’t stop once mitigation plans are implemented. Risks and their impacts change over time, so it’s essential to continuously monitor and review the effectiveness of risk management strategies. Regular updates and assessments should be performed to adapt to new risks or changes in the business environment.

Credit Risk Management

One of the most critical aspects of risk management is credit risk management. Credit risk refers to the possibility that a borrower will default on their obligations, leading to financial losses for lenders or investors. It is particularly important for financial institutions, such as banks, lenders, and investors, to carefully manage this risk.

Credit risk management involves assessing the creditworthiness of potential borrowers, monitoring existing loans, and ensuring that sufficient safeguards are in place to mitigate the risk of default. Financial institutions use various tools and strategies, including credit scoring models, background checks, and credit limit settings to manage and reduce credit risk effectively.

Implementing a robust credit risk management strategy is essential for ensuring the long-term financial stability of any organization that deals with loans, credit, or investments.

The Role of Risk Management Software and Solutions

The complexities of modern business environments have made risk management more challenging. Organizations now have to handle a wider range of risks, and many businesses are turning to technology to help manage these challenges. This is where risk management software and risk management solutions come into play.

Risk Management Software Risk management software is designed to help businesses identify, assess, and manage risks more effectively. These platforms provide a centralized location to track risks, store risk-related data, and generate reports. Modern software often includes tools for risk assessment, real-time risk monitoring, and reporting. It also aids in collaboration by enabling teams across departments to work together and ensure that risk mitigation strategies are aligned and executed properly.

Risk Management Solutions Risk management solutions go beyond just software and include services, consulting, and custom-designed strategies. Companies like Cedar Rose offer end-to-end risk management solutions that help businesses streamline their risk management process. These solutions combine advanced technology with industry expertise, offering tailored approaches to tackle specific risks within different industries. By utilizing these comprehensive solutions, businesses can improve their decision-making, reduce uncertainties, and safeguard their assets from potential threats.

Cedar Rose is one of the leading providers of risk management solutions. With their extensive experience in the field, they offer a range of services that include business intelligence, credit risk assessments, and due diligence checks. Their innovative tools and solutions empower businesses to make data-driven decisions, minimizing potential risks and maximizing profitability.

Conclusion

In today’s fast-paced business environment, effective risk management is essential for the survival and growth of any organization. By understanding the risk management process, implementing solid credit risk management practices, and leveraging advanced risk management software and solutions, businesses can significantly reduce the likelihood of negative outcomes. With companies like Cedar Rose offering state-of-the-art solutions, organizations now have the tools they need to manage risks more effectively and stay ahead of potential threats.

For more information on how Cedar Rose can help you implement a robust risk management strategy, visit their website at www.cedar-rose.com.

0 notes

Text

Mastering Risk: A Deep Dive into the Risk Management Process and Identification Strategies

Delve into the intricacies of risk management with our latest blog post, where we dissect the process of identifying risks and explore further steps in mitigating potential threats. Gain insights into effective risk management strategies and how they can be applied across various industries. Read more about the risk management process at The IRM India.

0 notes

Text

You know what I think is so....there's such a pseudo respect for science on this website specifically but - just like in many societies generally - only when it speaks with authority. And yeah, the scientific method is how we're trying to find out truth about things, so we can base our decisions on this truth. At one point - you're gonna have to speak with some authority based on the research that has been done. But. So many people - in society and on this website - have not studied to become scientists. They have not learned about the scientific method. So all they see is apparently - science as authority. But science as authority is a consensus. 'Consensus' reached by multiple individual scientists who are no longer in major disagreement because so much research has been done that it SEEMS LIKE we're on to something. And yet, even then, everything may turn out to be wrong. Because people have been fabricating results for example (happened really seriously within the field of psychology) or because it turned out that most studies' methods or assumptions were less rigorous or accurate than desirable (lookin askance at economics) or the classic paradigm shift in physics where some whole new set of ideas topples earlier ones. It seems like we've reached a pretty solid idea of things. But when is that point? Very few people have been taught to recognise it. Which requires actually reading/scanning studies. Or at least good summaries. Getting a sense of what the landscape of ideas is. What are major theories and assumptions and results? (In uni, you get handed this in a course). More importantly, what is missing?? Once you go digging into any subject it generally turns out there's more gaps in understanding and especially empirical results WITH good methods than what's actually known. In uni, you're taught to recognise how researchers might have fucked up (at least, they attempt to teach this). What's solid stuff? What's rigorous research? What is valid and reliable? When is something TRUE? Here comes my personal opinion: if there's not 3- 10 citations behind a statement then you're knitting a web of maybes together. Actually it's NOT just my personal opinion, it's a major problem in scholarship and science that scientists are NOT reproducing studies because they are not rewarded for it - when the scientific method REQUIRES reproduction of results for any kind of robust 'truth' to emerge.

But most people are simply 100% not taught about HOW our societies make truth (emerge) - or rather how scientists should be doing this. They are delivered truth by the authority: science. But the nature of the scientific process delivers differing narratives, theories, hypotheses, especially until a kind of consensus is reached. So people take one study and run with it. Or 7 wildly differing studies which seem to be about the same thing but really aren't. And that's not even non-uni-educated people only, I've seen plenty of paper-publishing people knit their stuff together that way. Sometimes that's all the information there is! But though scientists are taught to point to the sources of information for statements they make - that doesn't mean that everything published is Fact. Most discussions of results would acknowledge this strenuously. Still, they're often cited that way if it suits the narrative of the paper pointing at them.

My point? Wish people would be MORE skeptical of 'science'. What? I hear you ask? More crazies who don't listen to reason? No - I just wish more people would have access to and the means to and the desire to and have respect for doing one's own research with the scientific method as FALLIBLE BUT ENDLESSLY SELF- ADJUSTING TRUTH-SEEKING MECHANISM in the backs of their minds. Which means reading. Literally just means reading, and staying critical, and recognising when things are not nearly ready to be called TRUTH yet at all and when things ARE ready to be called TRUTH (looking at climate change and its human causes and the major consensus on this).

What I mean is - again - wish people would actually read studies. Wish this was a thing taught to every child in secondary school. Otherwise you get people pointing at 30 studies about completely different arguments / completely different scope that lead back to about three studies of actual results eventually which didn't have amazing methods. And that's TRUTH and anyone who denied this Substantiated Common Sense is a moral idiot. Maybe let's do some rigorous testing first and then some pilots.

#genuinely dont think that the major truth -seeking process should be comprehensibly taught to only those people who might#do research in the future. should be taught to every citizen.#my stuff#personal#do i think that after having researched nuclear power plants four times 'superficially' i know whether its good or bad to invest in?#no#maybe the risks are overstated or maybe the risk is minimal and worth it maybe waste CAN be managed well despite historical#problems. maybe the risk of a huge national security risk and international health risK REALLY IS worth it BECAUSE#tech HAS developed enough and responsibility risks can be prevented eniugh that emissionless energy output for 30 years will be essential#do i know? no. and obviously im skeptical#but i never deny that there is a possibility i just need to get a clearer picture by actually looking at some actual literature#maybe its gonna save the damn world! who knows#not me#people r so bad at not knowing

3 notes

·

View notes

Text

Discover the definition of risk management and explore real-world examples on our webpage. Stay informed and prepared!

0 notes

Text

Tfw u were discussing a quit-risk employee JUST yesterday. And then she no-call-no-shows 😐

#speculation nation#by 'quit-risk' i mean someone who just doesnt do her job right so we cant promote her#but thinks it's her God Given Right to be a supervisor & was threatening to quit if she got written up even one more time#(she only got written up like. twice. ive actually been incredibly lenient with her.)#like theres a process to the training. you have to learn to prep things in the back. u take a test & when u pass u get trained on drinks#and you CERTAINLY cant become a supervisor until after you know drinks#girl was given her test. given all the opportunities. didnt take them. and yet is still dissatisfied.#like girl idk what to tell u. no we r not unfairly singling u out u just have not been doing ur fuckin Job#anyways she's been on rocky ground for basically since she got here. maybe she just got sick of the place idk.#she called ME. BOSSY. FOR DOING MY JOB!!!!!!#im the most lenient goddamned assistant manager ever while still Technically doing my job#i let employees get away with so fucking much.#but im Bossy for telling her to do her job 🙄🙄🙄🙄🙄🙄🙄#technically theres a no phones allowed rule on shift. but i dont rly enforce it.#i just kinda nudge ppl along to do things if things need done. but for phone use here n there i just look the other way.#but apparently expecting some1 to do the work theyre being paid to do us tooooooo much#honestly it'll probably be a good thing if she leaves. just means im gonna have 2 pick up more hours probs#but she was only scheduled like 10 hours a week or so. im sure we'll manage.

3 notes

·

View notes

Text

youtube

#BookSummaries#BookBite#the hard thing about hard things summary#the hard thing about hard things#the hard thing about hard things book summary#hard choices#business coaching#self improvement#adaptive leadership#decision-making strategies#business advice#decision making process#entrepreneurship#entrepreneurial leadership#personal growth#leadership#risk management#how to lead#making decisions#importance of decision making#management#how to make tough decisions#Youtube

0 notes