#SavingsJourney

Text

Event details:

5.14-5.16 Savings on Home Revamp

Up to 50% off (Except MX, RU, UZ, AM, KZ, TJ, BY, MD, AZ, TM, KG, GE)

Ship to:

TOTAL&Countries EXCLUDING: RU, UZ, AM, KZ, TJ, BY, MD, AZ, TM, KG, GE

Promotion Period:

14-05-2024 - 16-05-2024 👇

#Aliexpress#BeGouriStore#HomeRevamp#Savings#savingsplan#savingstips#SavingsAlert#savingsgoals#SavingsEvent#SavingsGalore#SavingsAccount#SavingsJourney#savingschallenge#upto50off#aliexpress_products#aliexpressbr#aliexpresswig#aliexpresshaul#aliexpressfinds#AliExpressDeals#aliexpressshopping#aliexpressunboxing#AliExpressYourself#home#homecare#homemade#homedecor#homeoffice#homedesign#homeforsale

0 notes

Text

youtube

#TaxTips#FinanceGoals#Entrepreneurship#TaxDeductions#FinancialFreedom#BusinessGrowth#MoneyManagement#FinancialSuccess#SavingsJourney#TaxPlanning#TaxWriteOffs#TaxStrategies#TaxSavings#BusinessFinance#SmallBusinessAdvice#WealthBuilding#FinancialEmpowerment#EntrepreneurLife#MoneyMatters#InvestingTips#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

0 notes

Text

Time Management Meets Affordability: SAMSUNG Galaxy Watch 4 44mm Student Discount Code

In the fast-paced world we live in, having a reliable smartwatch isn't just a luxury; it's a necessity. Enter the SAMSUNG Galaxy Watch 4 44mm, a cutting-edge timepiece that seamlessly blends technology with style. Whether you're a fitness enthusiast, a tech geek, or a busy student trying to stay on top of your schedule, this smartwatch is designed to meet your needs. And the best part? You can now enjoy this advanced gadget at a 20% discount, thanks to the exclusive SAMSUNG Galaxy Watch 4 44mm student discount code. In this article, we'll delve into the features that make this smartwatch a must-have, explore how it can enhance your daily life, and guide you on how to snag this deal of a lifetime.

Stay Ahead with Style: SAMSUNG Galaxy Watch 4 44mm at 20% Off with Student Discount Code

In the realm of smartwatches, the SAMSUNG Galaxy Watch 4 44mm stands out not just for its exceptional functionality but also for its sleek design. Crafted with precision and attention to detail, this watch is a fashion statement on your wrist. Its large, vibrant display offers crystal-clear visuals, making it a joy to interact with your notifications, apps, and health data. With a wide range of watch faces and bands to choose from, you can customize your Galaxy Watch 4 to match your style effortlessly.

But the Galaxy Watch 4 isn't just about aesthetics. Underneath its stylish exterior lies a powerhouse of features. From advanced fitness tracking to in-depth health monitoring, this smartwatch empowers you to take control of your well-being. It tracks your workouts, monitors your heart rate, analyzes your sleep patterns, and even measures your body composition. With insights provided by this watch, you can make informed decisions about your fitness and health, ensuring you stay on top of your game.

At Cashbackint, our commitment is to assist you in both saving money on your Samsung purchases and earning Cash Back. At present, we feature over 20 active discount deals for Samsung products on our platform, providing you with ample opportunities to maximize your savings.

Smart Savings for Smart Students: SAMSUNG Galaxy Watch 4 44mm Student Discount Revealed

As a student, balancing academics, extracurricular activities, and personal life can be challenging. That's why having a reliable smartwatch like the SAMSUNG Galaxy Watch 4 44mm can be a game-changer. Imagine having your notifications, messages, and reminders right on your wrist, allowing you to stay connected without constantly reaching for your phone. Picture tracking your study sessions, workouts, and sleep patterns effortlessly, gaining valuable insights into your routines and making adjustments for a healthier, more balanced life.

Now, add a generous 20% discount to the mix, and you've got a deal that's too good to pass up. The SAMSUNG Galaxy Watch 4 44mm student discount code opens the door to a world of smart possibilities at a price that won't break the bank. Whether you're a tech-savvy student looking for the latest gadget or someone who values functionality and style in equal measure, this discount is your ticket to experiencing the future of wearable technology.

Tech meets Fashion: SAMSUNG Galaxy Watch 4 44mm Now 20% Cheaper with Student Discount Code

Wearable technology has come a long way, and the SAMSUNG Galaxy Watch 4 44mm is at the forefront of this revolution. More than just a timekeeping device, it's your personal assistant, your fitness coach, and your style companion, all rolled into one. Its advanced features, such as the ability to track multiple types of workouts, monitor your stress levels, and even provide real-time feedback during exercises, make it an indispensable tool for anyone leading an active lifestyle.

Yet, despite its myriad of features, the Galaxy Watch 4 remains remarkably user-friendly. Its intuitive interface ensures that you can access the information you need with just a few taps and swipes. Whether you're checking your schedule, controlling your music, or setting a reminder, everything is effortlessly accessible, allowing you to focus on what matters most.

With the SAMSUNG Galaxy Watch 4 44mm student discount code, this remarkable piece of technology becomes even more appealing. Suddenly, the prospect of owning a high-end smartwatch becomes not just a dream but a tangible reality. Imagine the convenience of receiving notifications discreetly during lectures, the motivation of tracking your steps and workouts, and the assurance of having your health data at your fingertips, all while saving a substantial amount.

Gear Up for Success: SAMSUNG Galaxy Watch 4 44mm Student Discount Unveiled

Success in today's world often requires a combination of knowledge, efficiency, and adaptability. The SAMSUNG Galaxy Watch 4 44mm is designed with these principles in mind. It equips you with the tools you need to stay organized, stay fit, and stay ahead. With its built-in GPS, you can confidently explore new places, whether it's finding your way around campus or discovering scenic routes for your runs. Its water-resistant design means you can keep it on even during intense workout sessions or when you're caught in the rain.

But the Galaxy Watch 4 isn't just about physical activities. It's also your companion in mindfulness. Its guided breathing exercises, sleep tracking capabilities, and stress management features help you achieve a sense of balance and well-being, ensuring that you're mentally and emotionally prepared to tackle whatever challenges come your way.

Now, with the SAMSUNG Galaxy Watch 4 44mm student discount, you can gear up for success without stretching your budget. Whether you're a student athlete striving for peak performance, a tech enthusiast exploring the latest gadgets, or simply someone who values the convenience of smart wearable devices, this discount allows you to enjoy the benefits of this exceptional smartwatch at a significantly reduced cost.

Seize the Savings: SAMSUNG Galaxy Watch 4 44mm Student Discount Code Exposed

Are you ready to seize the savings and elevate your lifestyle? Here's how you can unlock the 20% discount on the SAMSUNG Galaxy Watch 4 44mm using the exclusive student discount code:

Visit the Official SAMSUNG Website: Begin by visiting the official SAMSUNG website, where you can explore the Galaxy Watch 4 product page.

Select Your Desired Variant: Choose the Galaxy Watch 4 variant that suits your preferences, whether it's the classic black, the stylish silver, or any other available color option.

Add to Cart: Once you've made your selection, add the Galaxy Watch 4 to your shopping cart.

Apply the Student Discount Code: During the checkout process, you'll have the opportunity to apply the student discount code. Look for the designated field or box where you can enter the code provided.

Finalize Your Purchase: Review your order to ensure that all details are accurate. Select your preferred payment and shipping options, and proceed to finalize your purchase.

It's important to note that student discounts are typically offered for a limited time and may have specific eligibility criteria. Be sure to check the terms and conditions provided by SAMSUNG to ensure that you meet the requirements for the discount.

Conclusion: The Future on Your Wrist

The SAMSUNG Galaxy Watch 4 44mm isn't just a smartwatch; it's a gateway to the future on your wrist. With its advanced features, stylish design, and user-friendly interface, it's a timepiece that complements your active, tech-savvy lifestyle. And with the 20% student discount code, it's an opportunity to make this sophisticated gadget your own without a steep price tag.

From tracking your workouts to providing insights into your health, from keeping you connected to helping you find your way, the Galaxy Watch 4 is a versatile companion that simplifies your life. Whether you're a student who values staying on top of your schedule or someone who seeks the convenience of having essential information right at hand, this smartwatch is designed to meet your needs.

Seize the savings and unlock a future of possibilities with the SAMSUNG Galaxy Watch 4 44mm student discount code. It's not just a discount; it's a ticket to the world of advanced technology, convenience, and style.

0 notes

Text

From Broke to Financially Independent (How I saved my first $100,000)

youtube

"Join me on my journey from broke to financially independent as I share my tips and strategies on how I saved my first $100,000. Discover the secrets to achieving financial success!"

#FinancialIndependence#SavingsJourney#MoneyManagement#BrokeToRich#FinancialGoals#SavingMoney#InvestingTips#BudgetingSuccess#WealthBuilding#FinancialFreedom#Youtube

0 notes

Text

How To Save Money: Effectively And Efficiently

Saving money is a cornerstone of financial stability and a pathway to achieving future goals. In a world where financial uncertainties can arise unexpectedly, having a robust savings plan can provide a safety net and peace of mind.

This blog explores the art of frugal living and presents a comprehensive guide to the best ways to save money. By adopting these strategies, you can not only bolster your financial well-being but also lay the groundwork for realizing your dreams and aspirations.

As we delve into the intricacies of saving money, we will uncover a plethora of valuable insights and actionable tips. From budgeting techniques that allow you to stretch your dollar further, to lifestyle adjustments that help you cut unnecessary expenses, this guide is designed to empower you with the knowledge and tools to navigate your financial journey more effectively.

Before we dive into the specifics, let's take a moment to understand the significance of saving money and why it's worth dedicating time and effort to master the art of prudent financial management. By implementing the frugal saving strategies discussed in this blog, you can create a solid foundation for achieving both short-term financial stability and long-term dreams.

So, without further ado, let's embark on this enlightening exploration of the best ways to save money.

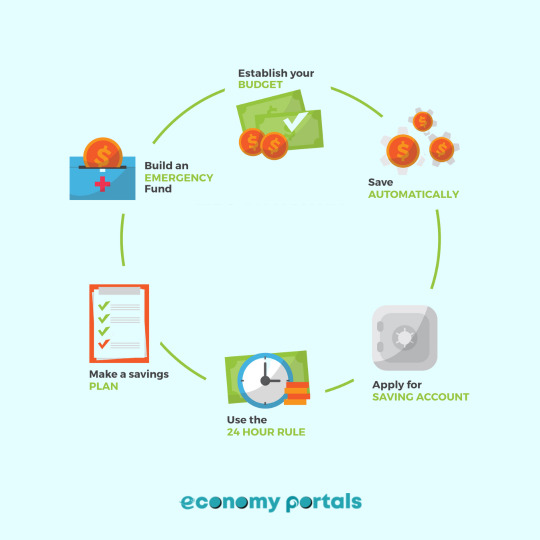

The Best Ways To Save Money

Saving money is a financial goal that many of us strive to achieve. Whether you're looking to build an emergency fund, make a big purchase, or simply improve your financial security, finding the best ways to save money can make a significant difference in your financial well-being.

In this first part of our guide, we'll explore some of the most effective strategies to help you save money smartly and efficiently.

1. Create a Detailed Budget:

One of the foundational steps in effective money-saving is creating a comprehensive budget. Track your income and expenses meticulously to understand where your money is going. This clarity will allow you to identify areas where you can cut back and allocate more funds towards savings.

2. Set Clear Savings Goals:

Establish specific savings goals for different purposes, such as an emergency fund, vacation, or down payment for a house. Having clear goals in mind motivates you to stay committed to your saving journey.

3. Embrace Frugality:

Practicing frugality doesn't mean sacrificing your quality of life; it's about making conscious spending choices. Look for ways to reduce discretionary expenses, such as dining out or entertainment, without compromising on things that truly matter to you.

4. Automate Savings:

Take advantage of technology by setting up automatic transfers from your checking to your savings account. This "set it and forget it" approach ensures that a portion of your income goes directly into savings before you even have the chance to spend it.

5. Comparison Shopping:

Amidst the current economic downturn, Whether you're shopping for groceries, clothing, or electronics, compare prices from different retailers to ensure you're getting the best deal. Utilize apps and websites that help you find discounts and coupons to save even more.

6. Cut Down Unnecessary Subscriptions:

Review your monthly subscriptions and eliminate those that you no longer use or need. This could include streaming services, magazines, or software subscriptions that can quietly drain your finances.

7. Reduce Energy Consumption:

Lower your utility bills by adopting energy-efficient practices. Switch to LED light bulbs, unplug electronics when they're not in use, and adjust your thermostat to save on heating and cooling costs.

By incorporating these best ways to save money into your lifestyle, you'll be well on your way to achieving your financial goals. In the next part of our guide, we'll provide you with a step-by-step guide to saving money effectively using these strategies and optimizing your saving efforts.

Money-Saving Mindset

When it comes to achieving smart financial savings, cultivating a frugal mindset is a foundational step that paves the way for successful money-saving endeavors. A frugal mindset is not about deprivation; it's about making intentional choices that align with your financial goals and values.

By consciously evaluating your spending habits and redefining your relationship with money, you can embark on a journey of intelligent financial management.

One of the cornerstones of this mindset is recognizing the immense value of small savings in the grand scheme of things. It's easy to dismiss the impact of cutting back on minor expenses, such as daily coffee runs or impulse purchases.

However, when you compound these seemingly insignificant savings over time, you'll be amazed at the substantial sum they can add up to. Imagine redirecting the money you'd otherwise spend on impulse buys towards a dedicated savings account or an investment portfolio.

This shift in perspective not only empowers you to take control of your finances but also opens doors to more significant opportunities down the road. In essence, cultivating a frugal mindset and acknowledging the significance of small savings lays a solid foundation for your journey towards effective and efficient money-saving.

It's about recognizing that every financial decision, no matter how trivial it may seem, contributes to the larger goal of achieving smart financial savings.

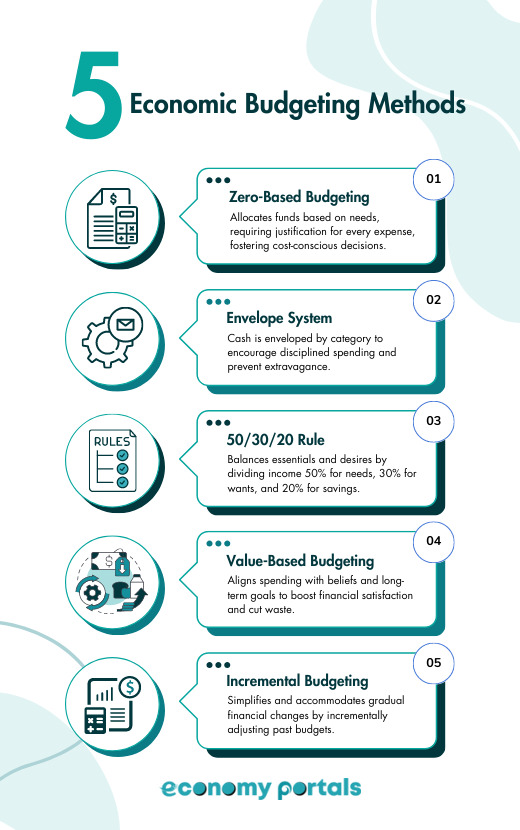

Economic Budgeting Methods

When it comes to mastering the art of saving money, one of the most foundational strategies is creating a well-structured, balanced Budget. An economic budget serves as your financial roadmap, helping you navigate through your income and expenses with precision. This section delves into the best ways to save money by effectively and efficiently managing your finances through budgeting.

Creating A Realistic Budget Tailored To Your Income And Expenses

Crafting a budget that genuinely reflects your financial situation is the cornerstone of effective money management. The process begins by thoroughly assessing your income sources and understanding your regular expenses.

This includes fixed costs like rent or mortgage payments, utilities, insurance, and loan repayments. Factor in variable expenses as well, such as groceries, entertainment, and discretionary spending. To ensure the utmost accuracy, utilize budgeting tools and apps that are designed to streamline the process.

These tools can categorize your expenses, track your spending patterns, and provide valuable insights into where your money is going. The best ways to save money often stem from the ability to visualize your financial landscape clearly.

Allocating Funds For Necessities And Identifying Areas For Cutbacks

Once you've established a clear picture of your income and expenses, it's time to allocate funds strategically. Necessities such as housing, utilities, and groceries should be prioritized. This ensures that you're covering your fundamental needs before indulging in discretionary spending.

The key to effective budgeting is identifying areas where cutbacks can be made without sacrificing your quality of life. Analyze your spending patterns and pinpoint expenses that might be draining your finances unnecessarily.

This might involve evaluating subscription services you rarely use, dining out less frequently, or finding more cost-effective alternatives for certain products or services.

By strategically reallocating funds from non-essential areas, you can channel these savings into more impactful endeavors, such as establishing an emergency fund, reducing debts to enhance your debt-to-income ratio, or making investments for your future.

The beauty of this approach lies in its adaptability; you can adjust your budget over time as your financial goals evolve.

Money-Saving Hacks For Daily Life

In today's fast-paced world, managing your finances has become more important than ever. If you're looking to bolster your savings and secure your financial future, incorporating effective money-saving habits into your daily routine is a smart choice.

In the context of financial planning, we will delve into a pair of potent approaches that can assist you in attaining your financial goals. These approaches involve the reduction of superfluous subscriptions and services, as well as the adoption of home cooking and meal planning practices, aiming to curtail expenses related to dining out.

Cutting Unnecessary Subscriptions And Services

In the digital age, we're surrounded by a plethora of subscription services, ranging from streaming platforms and software subscriptions to beauty boxes and gym memberships.

While each individual service might seem affordable, their cumulative costs can sneak up on you, making a significant dent in your budget over time.

Here are some tips for effectively cutting down on unnecessary subscriptions and services:

Subscription Audit: Take some time to review all your subscriptions and categorize them as essential or non-essential. Cancel any services that you rarely use or that no longer provide value to you.

Bundling Services: Consider bundling services that you frequently use from the same provider. This can often lead to discounted rates and help you save money.

Free Alternatives: Explore free alternatives for certain services. For instance, if you have multiple streaming subscriptions, you might find that there are free platforms that offer similar content.

Rotating Subscriptions: If you're a fan of different subscription boxes or services, consider rotating them on a monthly basis. This way, you can enjoy variety without paying for everything simultaneously.

Cooking At Home And Embracing Meal Planning

Dining out frequently can quickly become a major drain on your finances. Preparing meals at home not only helps you save money, but it also allows you to have better control over your diet and nutrition.

Here's how you can effectively incorporate home cooking and meal planning into your lifestyle:

Weekly Meal Planning: Set aside some time each week to plan your meals. Create a menu, make a shopping list, and stick to it. This reduces impulse buying and minimizes food waste.

Batch Cooking: Cook in larger quantities and freeze extra portions for later. This is not only cost-effective but also saves you time on busy days.

Use Coupons and Discounts: Keep an eye out for grocery store coupons, loyalty programs, and special discounts. These can significantly reduce your grocery bill over time.

Try New Recipes: Experimenting with new recipes can be fun and cost-effective. You might discover delicious meals that you can recreate at a fraction of the cost of dining out.

By applying these best ways to save money and tips for effective money saving in your daily life, you'll gradually notice a positive impact on your finances.

Cutting down on unnecessary subscriptions and services and embracing home cooking through meal planning are practical strategies that can help you achieve your financial goals while still enjoying a fulfilling lifestyle.

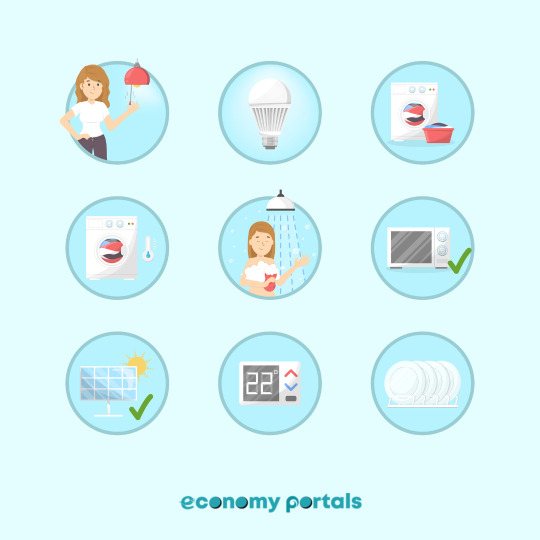

Utility Savings: Effective Ways To Save For The Future

When it comes to finding efficient ways to save money for your future goals, optimizing your utility usage can have a significant impact on your financial journey.

Two key strategies that align with your goal involve conserving energy and water. Not only do these strategies contribute to a greener environment, but they also lead to substantial savings on your utility bills, bringing you closer to achieving your desired future milestones.

Conserving Energy And Water: Building Blocks Of Effective Savings

Efficiency starts with mindfulness. Being mindful of your energy and water consumption can go a long way in reducing your monthly expenses.

Start by making subtle changes in your daily routines, such as turning off lights when they're not needed, ensuring doors and windows are closed to maintain indoor temperatures, and utilizing natural light during daylight hours.

Leveraging technology can also play a pivotal role. For instance, consider utilizing smart thermostats that empower you to manage your home's temperature remotely, adapting it to your schedule.

This not only enhances your living comfort but also curbs unnecessary energy consumption.

Unplugging Electronics: A Simple Yet Potent Strategy

Were you aware that electronics continue to draw power even when switched off, as long as they're plugged in? This phenomenon, often termed "phantom energy" or "vampire power," can impact your utility costs.

Combat this by adopting the habit of unplugging chargers, appliances, and devices when they're not in use. This seemingly minor action can accumulate into substantial savings over time, bolstering your financial preparation for the future.

Embracing Energy-Efficient Appliances: A Long-Term Investment

Another strategy that aligns seamlessly with efficient savings is upgrading your appliances to energy-efficient models. When acquiring new electronics or appliances, prioritize those adorned with the ENERGY STAR label.

This label signifies that the product meets stringent energy efficiency criteria outlined by the Environmental Protection Agency. While the initial cost might be marginally higher, the enduring savings on your utility bills transform it into a prudent investment.

Within the realm of water conservation, even modest adjustments such as repairing leaky faucets and incorporating low-flow showerheads can yield a remarkable impact on your water expenses.

Moreover, embracing practices like collecting rainwater for gardening and non-potable purposes introduces an eco-friendly and budget-conscious dimension to your approach.

By embracing these efficient ways to economize on utilities, you're not only nurturing a sustainable future but also taking meaningful strides towards realizing your financial ambitions.

Keep in mind, the cumulative effect of these minor changes is what paves the way for substantial, lasting savings. Your commitment to these strategies sets you on a promising path towards securing your future goals.

Tips For Effective Money-Saving In Daily Life

Saving money doesn't have to be an arduous task; in fact, it can seamlessly become a part of your daily routine. By incorporating practical and mindful habits into your lifestyle, you can achieve substantial savings without sacrificing your comfort or enjoyment.

Here are some succinct yet impactful effective money-saving ways in your everyday life:

Budgeting Brilliance: Create a detailed budget outlining your income and expenses. This proactive approach allows you to allocate funds for necessities while curbing overspending.

Smart Shopping Strategies: Before making a purchase, compare prices, utilize coupons, and take advantage of loyalty programs to score the best deals.

Meal Planning Mastery: Plan your meals and snacks for the week, make a shopping list, and stick to it. This prevents impulse buys and reduces food waste.

Energy Efficiency Excellence: Conserve energy by turning off lights, unplugging devices, and using energy-efficient appliances. This not only benefits the environment but also trims your utility bills.

Transportation Tactics: Opt for public transport, carpooling, biking, or walking whenever possible. Minimizing fuel and parking costs contributes to significant savings.

Delectable Dining In: Cut back on eating out and embrace home-cooked meals. Cooking at home is not only healthier but also substantially cheaper.

Subscription Scrutiny: Review your subscription services and cancel those you rarely use. Streaming platforms, magazines, and apps can accumulate expenses over time.

Secondhand Success: Explore thrift stores, online marketplaces, and garage sales for clothing, furniture, and other items. Quality secondhand finds can save you a bundle.

Cash in on Free Time: Engage in free or low-cost leisure activities such as hiking, picnics, and visiting museums on discount days.

Automate Savings: Set up automated transfers to your savings account. This "out of sight, out of mind" tactic ensures consistent savings.

DIY Delights: Take up basic repairs and simple DIY projects. Learning to fix minor issues around the house can spare you hefty service fees.

Credit Caution: Pay off credit card balances in full to avoid high interest charges. Responsible credit card usage can prevent unnecessary debt.

Bulk Buying Benefits: Purchase non-perishable items in bulk. This is particularly advantageous for products you use regularly and have a long shelf life.

Financial Goals Focus: Keep your financial goals at the forefront of your mind. Whether it's a vacation or a down payment, visualizing your objectives can reinforce your commitment to saving.

Track and Adjust: Regularly review your spending patterns and adjust your budget as needed. This ongoing evaluation ensures you stay on track with your savings goals.

Efficiency in money-saving arises from these practical tips seamlessly blending into your daily routine. Incorporating them into your life can gradually pave the way for a healthier financial future, empowering you to achieve your goals and aspirations with confidence.

Conclusion

In conclusion, a variety of money-saving tactics makes personal finance management easier. This comprehensive book covers the best ways to save money, stressing their efficacy and efficiency. Let's conclude by reviewing the several strategies and emphasizing the need for a diversified approach to financial goals.

From cutting wasteful spending to developing mindful spending habits, financial stability is a multifaceted journey. The best ways to save money is to build a tapestry, with each thread contributing to financial success.

One major lesson is that frugality and foresight go together. Cutting discretionary spending, adopting the sharing economy, and using energy-efficient techniques can save money over time. These acts are the "best ways to save money," we've found, helping people protect their finances.

It's crucial to note that financial growth requires multiple approaches. Tracking spending can help discover areas for improvement, but investing intelligently and developing new revenue streams can speed up financial goals.

A diversified investment portfolio reduces risk, and a variety of money-saving methods reduces financial instability. Implementing these tactics into daily life may seem difficult, but with commitment and consistency, they may become habits.

These methods maintain a steady pace toward financial freedom and stability, which is a marathon, not a sprint. Individuals can optimize their savings and improve their financial future by making smart decisions. By following advice from financial experts, individuals can effectively enhance their savings and cultivate a more promising financial future through astute decision-making.

#MoneySavingTips#BudgetingHacks#FinancialPlanning#SavingsStrategies#FrugalLiving#SmartSpending#FinancialGoals#PersonalFinance#MoneyManagement#SavingsJourney

0 notes

Text

🏦 Personal savings strategies are like 🚀s that propel individuals towards their financial goals. These strategies enable people to 📊 effectively manage their income, ✂️ reduce expenses, and 📌 allocate funds towards their savings goals.

Effective financial planning is vital for remote workers to secure retirement, protect against unforeseen risks, and build personal savings. Visit Relo.ai today and empower yourself to make informed decisions for a secure and prosperous future.

#PersonalFinance#SavingsStrategies#FinancialGoals#BudgetingTips#ExpenseReduction#FinancialSecurity#SavingsJourney#FinancialWellness#MoneyManagement#FinancialPlanning

1 note

·

View note

Text

Saving money doesn't have to be a puzzle! Start with small pieces, and before you know it, you'll complete the picture of financial success! Call us at: +91 8411002452 OR Visit: www.goldenbulls.co.in

0 notes

Text

"Mastering the Art of Saving: Practical Tips for Financial Wellness 💰"

Hey there, Tumblr fam! 🌟 Mr. FinancialMoneyMatters here, bringing you some savvy tips on how to save money and pave the way to financial freedom. Let's dive in! 💸

Budget Like a Pro 📊: Start by tracking your income and expenses. Create a budget that allocates funds for essentials, savings, and a little fun. This way, you'll have a clear roadmap for your finances.

Cut Unnecessary Expenses 🚫: Evaluate your spending habits and identify areas where you can cut back. Whether it's daily coffee runs or impulse purchases, small changes can add up to significant savings.

Automate Your Savings 🔄: Set up automatic transfers to your savings account each month. Treating savings like any other bill ensures consistency and discipline in growing your financial nest egg.Embrace the 50/30/20 Rule 📉: Allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings. It's a balanced approach that promotes financial stability while allowing room for enjoyment.

Explore Side Hustles 💼: Leverage your skills! As an IT whiz, consider freelancing or offering your expertise online. The extra income can fast-track your savings goals.

Invest Wisely 📈: Research investment options that align with your financial goals. Whether it's stocks, real estate, or retirement accounts, smart investments can make your money work for you.

Stay Mindful of Impulse Buys 🛍️: Before making a purchase, give it some thought. Ask yourself if it's a want or a need. Delaying gratification can prevent unnecessary spending.

Remember, saving is a journey, not a destination. By incorporating these tips into your financial routine, you'll be well on your way to building a solid financial foundation. Here's to a future filled with financial prosperity and exciting travels! ✈️💼 #FinancialWellness #SavingsJourney #MoneyMatters

3 notes

·

View notes

Text

Why you need to create a budget and track your spending | Family FIRE 2025

Why you need to create a budget and track your spending | Family FIRE 2025

https://www.youtube.com/watch?v=7AczG_1MdQc

In this eye-opening video, discover the transformative power of budgeting and tracking your spending. 📊💸 Learn the key reasons why establishing a budget is crucial for financial success and how keeping tabs on your expenses can empower you to take control of your money. From achieving your financial goals to avoiding unnecessary stress, this video provides valuable insights and practical tips that will set you on the path to financial freedom. Don't let your money manage you – take charge today! 💪✨

🔔Ready to achieve Financial Independence by 2025? Click 'Subscribe' and embark on a transformative journey with us: https://www.youtube.com/@family.fire.by.2025

✅ For Business Inquiries: [email protected]

=============================

✅ Recommended Playlists

👉 Financial Independence Facts

https://www.youtube.com/watch?v=OSsqUU0UnJ8&list=PLFbNQzXkUGyw0P-rfVrdiC4-ph8ky3uL_&pp=iAQB

👉 Financial Independence

https://www.youtube.com/watch?v=VG-32QwZ1T0&list=PLFbNQzXkUGyytYLW5TZHFg_Kxdd-bEOfU&pp=iAQB

✅ Other Videos You Might Be Interested In Watching:

👉 Overcoming Money Setbacks Road to Financial Freedom!💰

https://www.youtube.com/watch?v=5avpEXdIbE8

👉 Supercharge Your F.I.R.E Journey: Unleashing the Power of Dividend Reinvestment!

https://www.youtube.com/watch?v=1Jq-nmMxplU

👉 Stop Losing Money! How Lifestyle Inflation Erodes Your Financial Freedom

https://www.youtube.com/watch?v=_uRVmjuZyWU

👉 A Surprising Way to Retire Early & Keep Your Luxury Life! Financial Independence Retire Early

https://www.youtube.com/watch?v=w0GfswvQmrI

👉 Location is the Key to Financial Freedom--But How? Financial Independence Retire Early

https://www.youtube.com/watch?v=SbGOvfoTptE

=============================

✅ About Family FIRE 2025.

Welcome to "Family Fire 2025"! Join our Singaporean family's quest for Financial Independence Retire Early (F.I.R.E) by 2025.

Our channel is your ultimate guide to understanding the F.I.R.E movement, achieving financial freedom, and exploring effective investment strategies, personal finance, budgeting, stock market investing, real estate, saving techniques, and essential financial tools.

We're on a mission to educate and inspire you by sharing our family's journey toward financial independence and demonstrating how smart money habits can lead to a life free from financial stress. We believe everyone can achieve F.I.R.E. with dedication and the right knowledge.

Subscribe to our channel, and let's ignite the F.I.R.E within you together!

Let us embark on this transformative journey, empowering you to take control of your financial destiny and attain the freedom you've always desired.

For Collaboration and Business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔From real estate to stock markets, discover the roadmap to financial freedom with us. Hit that subscribe button: https://www.youtube.com/@family.fire.by.2025

=================================

#Budgeting101 #FinancialWellness #MoneyMatters #SmartSpending #FinancialGoals #BudgetTips #ExpenseTracking #FinancialEmpowerment #SavingsJourney #MoneyMindset #PersonalFinance #BudgetSuccess #WealthBuilding #FinancialPlanning #MoneyWisdom

Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of our publications. You acknowledge that you use the information we provide at your own risk. Do your research.

Copyright Notice: This video and our YouTube channel contain dialog, music, and images that are the property of Family FIRE 2025. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to our YouTube channel is provided.

© Family FIRE 2025

via Family FIRE 2025 https://www.youtube.com/channel/UCUbT9IupjUO551P-H-NAH1g

December 10, 2023 at 01:00AM

#FinancialIndependence#Budgeting#SavingMoney#Investing#PassiveIncome#DebtReduction#WealthCreation#Entrepreneurship#FinancialFreedom#MoneyManagement#PersonalFinance

0 notes

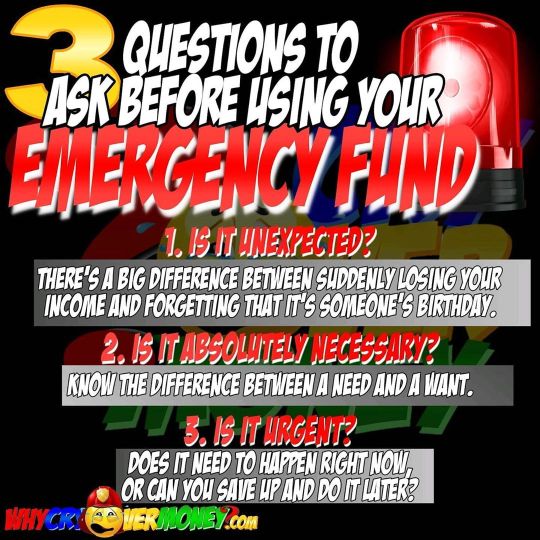

Photo

Stay calm. Don't freak out. Remember to take your time and make smart decisions during a time of crisis.⠀ ⠀ #emergencyfund #emergencyfunds #savingpot #savings #savingsgoals #savingschallenge #savingsaccount #savingtips #savingstracker #savingsplan #savingsgoal #savingsjourney #savingstip #savingsjar #savingsbox #whycryovermoney https://www.instagram.com/p/CBoZHsqhfby/?igshid=7bbznjb71ub6

#emergencyfund#emergencyfunds#savingpot#savings#savingsgoals#savingschallenge#savingsaccount#savingtips#savingstracker#savingsplan#savingsgoal#savingsjourney#savingstip#savingsjar#savingsbox#whycryovermoney

0 notes

Text

youtube

#TaxTips#FinanceGoals#Entrepreneurship#TaxDeductions#FinancialFreedom#BusinessGrowth#MoneyManagement#FinancialSuccess#SavingsJourney#TaxPlanning#TaxWriteOffs#TaxStrategies#TaxSavings#BusinessFinance#SmallBusinessAdvice#WealthBuilding#FinancialEmpowerment#EntrepreneurLife#MoneyMatters#InvestingTips#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

0 notes

Photo

Item of the Day. Full Reign Gold Choker - Paparazzi Accessories. #Savings #savingsgains #savingsqueen #savingsjourney #Savingsadvice #savingspace #savingsapps #savingsday #savingspree #savingsframe #savingsonsavings #savingsgoals #savingstips #savingsolutions #SavingsHacker #SavingSoulsIsWhatMatters #savings #savingsisters #shopping #fashion #biggerpockets #financialfreedom (at All Eyes On U) https://www.instagram.com/p/B4zfLVDhcH0/?igshid=1ejdl688a8g85

#savings#savingsgains#savingsqueen#savingsjourney#savingsadvice#savingspace#savingsapps#savingsday#savingspree#savingsframe#savingsonsavings#savingsgoals#savingstips#savingsolutions#savingshacker#savingsoulsiswhatmatters#savingsisters#shopping#fashion#biggerpockets#financialfreedom

0 notes

Photo

Introducing HDFC Life Sanchay Plan (Entry Ages 5 to 60 years) Give Rs. 1,00,000 p.a. for 10 years (Total = Rs. 10 Lakh) Get Rs. 1,00,000 p.a. for 25 years + ROP of Rs. 10,00,000 on 36th yr (Total = Rs. 35 Lakh) 📞Call 86550-18000

#Kifs#tradecapital#HDFC#savings#savingsplan#savingstips#savingsgoals#savingsjourney#SavingHacks#savingstip#savingsplans#savingfund#spend#spendless#savemore#taxefficient

0 notes

Photo

My First #SavingsJourney - Complete!

in partnership with Scotriabank

Can’t believe it’s been a week since I came back from my trip to Toronto. It was so great to be back on the East Coast to finally get reap the benefits the perks of my #SavingsJourney!

I’m here to tell you all about it!

It started 6 months ago when Scotiabank introduced the new MomentumPLUS Savings Account. An account geared toward short-term savers (aka, me!). I frankly was a little skeptical because I had never been a savvy saver. However, when I learned about the account’s benefits and how easy it was to get started, I decided to give it a try.

To kick off the #SavingsJourney, I set a goal. I explored my options: new suit? new bags? or I could pack my bag and go somewhere. As tempting as my options were, I decided to travel. Trying to be as realistic as possible I picked Toronto as my destination since it’s not too far and I felt like it was time to see my Toronto friends.

Was it easy? Not at first, honestly. It was very tempting to take out the funds that I set aside for this trip to splurge on immediate things like... a new pair of shoes. However, seeing how fast my savings grew by leaving the funds in the account, it got easier and easier to stay on track.

How it works: The account allows you to earn more by offering a higher interest rate the longeryou save. You get to select a savings period – 90, 180, 270 or 360 days – rewarding you with a premium interest rate the longer you leave the money untouched in your account. You can track all the progress online and the account has no minimum balance or monthly fees.

That being said, my #SavingsJourney wasn’t always smooth sailing. If you know me at all, I spend most of my days at coffee shops and restaurants. It was in my DNA to order a cup of coffee with an avocado toast in the morning and to end my evening with a delicious meal out. What I realized was these habits added up real quick. When I did the math, having that $15 toast and coffee twice a week came to $720 in six months! So I made the call to start makingthis at home, because... it’s avocado toast - it’s literally avocado on toast.

The money I saved by making this small change was added to the money I set aside for my trip to Toronto! As I mentioned, I was a latecomer to this saving game, so this didn’t come as natural to me as to the rest of the financially-responsible crowd. I learned though, that it’s never too late or too early to start and there’s never too big or too little amount of money to put aside for your savings.

With the fabulous interest rate that the account offers, trust me, it’s a lot easier andmore exciting to get your savings going! Right now, Scotiabank is offering a bonus interest rateof 2.65% for those who sign up for the MomentumPLUS Savings Account before June 29, 2018.

Details can be found here!

So here I am, one hundred and eighty days later. I am typing this just as I’ve returned back home from my trip to Toronto and reflecting on all the amazing times I had! I even treated myself to a fancy avocado toast and some delicious meals out. Thanks for keeping up with my #SavingsJourney and big thanks to Scotiabank for introducing me to the MomentumPLUS Savings Account - I think it’s time to start saving for a bigger goal!

instagram @viranlly

Vancouver | Toronto | Travel

4 notes

·

View notes

Photo

Saving for your future is something to look forward to. What's your best #savings strategy? 💰 Comment below 👇 ⠀ ⠀ 12 Tips for Securing Your Financial Future | Link in Bio 😎 | follow @geoffreyjthompson⠀ .⠀ .⠀ .⠀ .⠀ ⠀ #financialfuture #savingsplan #savingstips #savingsgoals #savingsblog #budgeting #financialgoals #IRAs #savingsjourney — view on Instagram https://ift.tt/2CFGuV9

0 notes