#Silver Bullion

Photo

~ Silver ~

26 notes

·

View notes

Text

Should You Invest in Silver Bullion?

If you're considering investing in silver bullion, there are a few important things to keep in mind. These include price, reliability, and convenience. Buy silver bullion from a reputable dealer can help you protect your money. Also, there are several different storage options for your bullion. This article will help you determine which method is best for you.

The price of silver bullion

The price of silver bullion is a fluctuating commodity on the global market. It has risen from below $1 to over $1 in the 1960s when the United States government stopped issuing silver coins for circulation. This led to many people hoarding silver coins for their precious metal content. Today, you can buy and sell silver bullion at a range of prices, depending on your budget and personal preference.

One way to invest in silver is through an exchange-traded fund (ETF). These funds invest in silver bullion. They trade just like stocks. They have a fund manager and are backed by physical silver bullion that is stored in a custodian. These funds do not use futures contracts, thereby eliminating backwardation and contango risks. However, they may not be ideal for long-term buy-and-hold investments.

If you plan to sell silver bullion, it is best to shop around and compare prices. Make sure that the dealer you are dealing with is honest about their prices and the justifications for them. Then, you can make an informed decision.

Convenience of investing in silver bullion

Investing in silver bullion offers investors a number of benefits. For one thing, it allows for direct access to the asset. Investors can contact an account representative from 5:30 a.m. to 4:30 p.m. Pacific time to make inquiries and to get help with their orders. Additionally, investors do not have to worry about storing and transporting the silver. The company provides a range of secure storage options.

In addition to physical bullion, investing in silver is also possible in derivative forms. Investors can purchase silver in the form of ETFs or mutual funds, silver stocks, and silver futures contracts. By buying silver in these forms, investors can hedge their portfolios against market volatility and do not need large amounts of initial capital to get started. Although these investments offer high returns, they are also accompanied by a high risk. Although savvy investors can earn a large percentage of the initial investment, losing a lot of money is quite easy.

The price of silver is based on its supply and demand. This means that investors can buy silver at low prices, and then sell it for a profit at a higher price later. Buying physical silver also provides investors with peace of mind as it is weatherproof and can survive fires and floods. However, it is possible to lose your investment if you do not store it properly.

Reliability of investing in silver bullion

As with any investment, investing in silver bullion has its risks. The price of silver can go up and down, and you may pay too much or too little. As a result, you may not make as much money as you think you can. In addition, silver prices are closely tied to the health of the manufacturing and industrial sectors. Therefore, if the economy slows down, a shortage of silver may lead to a drop in the value of the metal. Also, sudden changes in the manufacturing industry may result in the depreciation of the metal.

Investing in silver can be a safe alternative to traditional stock trading. It can also be used as a hedge against inflation. Although the price of silver is not as diversified as that of gold and other investments, it can still provide a good hedge in times of uncertainty.

Storage options for silver bullion

There are a number of storage options for silver bullion. Generally, investors store their silver bullion at home, in their safe or at a third party storage facility. Each method has its own advantages and disadvantages. The advantage of home storage is that it is readily accessible in case of an emergency. Alternatively, investors can also keep their silver bullion in banks.

While a safe deposit box provides security and convenience, it can also be subject to tax debts, court orders, and other risks. In addition, bank holidays can affect access to stored bullion. In addition, third party storage facilities must adhere to the same standards and regulations as bank safe deposit boxes.

Storage options for silver bullion vary depending on the size of the bullion, the price, and the risk level of the investor. Ideally, the silver bullion should be stored in airtight containers that are protected from humidity. In addition, it should be stored in a location that is free of temperature and humidity fluctuations. If an investor plans to store their bullion at home, airtight containers will be the best solution. However, plastic or PVC materials should not be used in coin albums because they tend to release acidic gases.

youtube

4 notes

·

View notes

Video

youtube

Silver and Gold - Unlocking The Secrets And Benefits Part 2 of 3

Unlocking the Secrets and Benefits of Silver And Gold - Part 2 of a 3 part informational and educational series on Gold and Silver.

Part 2: Silver vs Gold (The direct correlation)

How to benefit from Gold without buying Gold

Tips to keep in mind for your next purchase - short and long-term

SHOCKING results - Comparing checkout on 5 different companies for purchasing Gold and Silver (you will be shocked with who has the Best price)

Please feel free to reach out with any questions. Thank you - Rick

#youtube#silver#gold#silver vs gold#financial literacy#gold and silver education#silver bullion#gold bullion#American silver eagle#saving for your future#Unlocking the secrets and benefits of silver and gold#rick fronek

0 notes

Text

The Environmental Impact of Silver Bullion Production

The production of silver bullion has significant environmental implications, from mining to refining. This blog examines the environmental challenges and explores sustainable practices in the silver industry.

Environmental Challenges

Silver mining, especially on a large scale, poses several environmental challenges:

Deforestation: Mining activities often require clearing large areas of forest, leading to habitat destruction and loss of biodiversity.

Water Pollution: The use of toxic chemicals like cyanide and mercury in silver extraction can contaminate water sources, affecting aquatic ecosystems and local communities.

Soil Erosion: Mining operations disturb the soil, leading to erosion and sedimentation in nearby rivers and streams, degrading water quality and harming wildlife.

Waste Management: Silver mining produces significant amounts of waste rock and tailings. Improper disposal can lead to long-term environmental hazards.

Sustainable Practices

To mitigate these impacts, the silver industry is increasingly adopting sustainable practices:

Responsible Mining: Implementing responsible mining techniques involves minimizing land disturbance, protecting water quality, and ensuring the safety of local communities.

Recycling Silver: Recycling scrap silver reduces the need for new mining, conserving natural resources and lowering the environmental footprint. This practice also decreases the demand for energy and chemicals used in extraction.

Eco-Friendly Technologies: Advances in technology are making silver production more environmentally friendly. For example, new methods reduce the use of harmful chemicals and promote water recycling.

Restoration and Rehabilitation: Post-mining land restoration involves rehabilitating mined areas to their natural state, including reforestation and soil stabilization to promote biodiversity recovery.

Conclusion

The environmental impact of silver bullion production is a pressing concern, but sustainable practices are making a difference. By supporting responsible mining and recycling efforts, the silver industry can reduce its ecological footprint and ensure that silver remains a valuable and environmentally conscious asset. As consumers and investors increasingly prioritize sustainability, the shift towards greener silver production aligns with broader environmental and social goals.

0 notes

Text

What impact do market trends have on silver's price?

The price of silver is significantly influenced by market trends. Since silver is both a precious metal and an industrial commodity, positive economic indicators like strong industrial demand or inflationary pressures usually result in higher prices for the metal. On the other hand, market turbulence or economic downturns may cause demand to decline and silver prices to drop. In addition, silver prices are subject to market volatility due to geopolitical events, currency fluctuations, and investor sentiment.

#australia#melbourne#sliver#commercial#entrepreneur#economy#bullion#silver bars#silver coins#silver bullion#silver buyer near me

0 notes

Text

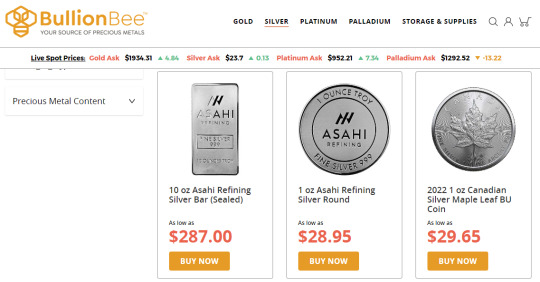

Looking to buy silver bullions, silver coins & silver bars online in New York? BullionBee has the variety of the best silver bullions, coins and bars.

#Silver Bullion#Silver Bullion Bars#NYC#Precious Metals#America#USA#BullionBee#investing#Silver Coins

1 note

·

View note

Video

youtube

FDIC Lied About Banks on Purpose | Exposing Policy Lies and Hidden Agend...

You better pay attention here. Your future depends on it.

0 notes

Text

The Midas Touch: Gold And Silver Bullion From Coventry Gold Bullion Ltd.

Gold and silver bullion have been long-standing investments well-known for their durability, rarity, and value. They are also widely accepted as currency, which makes them a valuable hedge against economic uncertainty. Coventry Gold Bullion Ltd. is one of the top gold bullion dealers UK and offers investors a reliable source for gold and silver bullion.

Here are some reasons why you should consider investing in gold and silver bullion from Coventry Gold Bullion Ltd.:

Diversification of Investment Portfolio:

One of the most important reasons for investing in gold and silver bullion from Coventry Gold Bullion Ltd. is to diversify your investment portfolio. By including gold and silver bullion in your investment portfolio, you can spread your risk across different asset classes and reduce the impact of any potential economic downturns.

Stability of Value:

Gold and silver bullion have been valued for centuries and have proven to be stable investments. Unlike stocks and bonds, which are subject to market fluctuations, gold and silver bullion from Coventry Gold Bullion Ltd. retain their value over time. This makes them a safe investment choice, particularly during times of economic uncertainty.

Inflation Hedge:

Inflation is a significant risk to the value of the paper currency, and Coventry Gold Bullion Ltd.’s gold and silver bullion provides an effective hedge against inflation. As the value of paper currency decreases due to inflation, the value of gold and silver bullion increases. This makes them an ideal investment option for investors looking to protect their wealth over the long term.

Liquidity:

Gold and silver bullion are highly liquid investments, meaning they can be easily bought and sold. Coventry Gold Bullion Ltd. provides a platform for investors to buy and sell gold and silver bullion easily. This means you can easily convert your investment into cash when needed.

Trustworthy Dealers:

When investing in gold and silver bullion, it is essential to work with trustworthy dealers. Coventry Gold Bullion Ltd. is one of the top gold and silver dealers UK and has a reputation for providing high-quality, authentic bullion. This means you can trust that you are getting a fair deal and investing in genuine bullion.

Final Thoughts:

Coventry Gold Bullion Ltd. is one of the UK’s most reliable gold bullion dealers. With their reputation for providing high-quality, authentic bullion, you can be sure that your investment is in good hands.

So visit https://www.coventrygold.co.uk/ to invest in gold and silver bullion today and secure your financial future.

Original Source: https://bit.ly/3KW1mbM

1 note

·

View note

Text

Metals: Gold

Gold is forever. It is beautiful, useful, and never wears out. Small wonder that gold has been prized over all else, in all ages, as a store of value that will survive the travails of life and the ravages of time.

#metals#gold#gold moodboard#gold aesthetic#gold metal#elements#gold accessories#gold jewelry#gold bars#gold bullion#metal aesthetic#metal moodboard#elemental metals#moodboard#aesthetic#gold and silver#gold gold gold#gold medal#gold nugget#gold chain#gold coins#colors#color aesthetic#color moodboard#James Blakeley

19 notes

·

View notes

Photo

~ Silver and Gold ~

132 notes

·

View notes

Text

The Role of Silver Bullion in Portfolio Diversification

Silver bullion plays a pivotal role in diversifying investment portfolios, offering investors a reliable hedge against market volatility and economic uncertainty. Its unique properties and historical performance make it an essential component of diversified investment strategies, providing stability and potential for long-term growth.

One of the key benefits of including silver bullion in a diversified portfolio is its low correlation with traditional asset classes, such as stocks and bonds. This means that silver often behaves differently from other assets, particularly during times of market stress. When stock markets decline or economic uncertainties arise, silver bullion tends to hold its value or even appreciate, providing a buffer against losses in other parts of the portfolio.

Portfolio diversification with silver bullion helps investors reduce overall risk while enhancing long-term returns. By spreading investments across different asset classes, investors can minimize the impact of market downturns and improve the resilience of their portfolios. Silver's ability to perform well in both inflationary and deflationary environments further enhances its appeal as a diversification tool.

Moreover, silver bullion's industrial applications provide additional support for its value, making it a compelling option for investors seeking exposure to sectors such as technology, renewable energy, and healthcare. As societies continue to evolve and innovate, the demand for silver in these industries is expected to grow, driving long-term price appreciation for silver bullion.

Investing in silver bullion offers investors a tangible asset with intrinsic value, immune to the whims of market sentiment and economic fluctuations. Whether used as a hedge against market volatility, inflation, or simply as a diversification tool, silver bullion provides a reliable refuge in uncertain times.

In conclusion, the role of silver bullion in portfolio diversification cannot be overstated. Its low correlation with traditional assets, coupled with its industrial applications, makes it a valuable addition to investment portfolios seeking stability, resilience, and long-term growth potential. As investors navigate an increasingly complex and uncertain economic landscape, the enduring allure of silver bullion shines bright as a reliable diversification tool.

0 notes

Text

What impact do market trends have on the cost of a kilogram of silver?

The one kilo silver price is affected by market trends, which include supply and demand, the state of the economy, and investor sentiment. Demand for silver as a safe-haven asset is usually driven by inflation and economic uncertainty, which raises prices. Prices are also influenced by industrial demand, particularly from the IT and renewable energy sectors. Conversely, as investors move to riskier assets, rapid economic growth may cause silver prices to decline.

0 notes

Text

Is It Better to Buy Gold or Silver Bullion Online?

Now that we've explored the allure of both gold and silver, it's essential to consider the convenience of making these investments online. RPS Bullion offers a seamless and secure platform for enthusiasts to buy gold and silver bullion online.

0 notes

Text

5oz of Engelhard silver bars

Bin:$125 each

#black metal#heavy metal#precious metals#coin slot#coinstats#meme coins#roman coins#ancient coins#my coins#crypto coins#investment#investors#real estate investing#numismatics#silverbars#silver coins#old money#bullion#history

5 notes

·

View notes

Text

The Details

Year of Issue: 2022 Country of Issue: Palau Mint: Mayer Mint Face Value: 10 Dollars Coin Weight: 2 Troy Ounces Metal Purity: 0.999 Metal Composition: Fine Silver Mintage: 500 Features: Antique Finish For the 120th anniversary of the first ever science fiction film, Trip to the Moon, this 2 oz coin features the Man in the Moon himself! The original quirky film, directed by Georges Méliès, was released in 1902 at about 14 minutes long, completely silent, and all in black and white. Science fiction has made bounds and leaps since, but we love to remember the pioneers of the craft.

0 notes

Text

Get insights for buying silver and gold bullion with one click at Bullion Mentor. Compare the price and get gold and silver spot prices at best dealers.

3 notes

·

View notes