#Stockstobuy

Text

This is weird.

Im writing in a…blog? Is that a journal or a diary? What’s the difference, actually?

Will I even use this in a year?

Will this be successful? Or maybe a complete failure. Wait, no- it’s a learning experience!

Ok here it is…

…I’m going to (attempt) to learn the workings of the US stock market and day trade for profit.

Sounds easy enough 🤯

So let’s start this blog with a poll (mainly because I accidentally added it and don’t know how to delete it):

Until next time,

AH

3 notes

·

View notes

Text

US stock trading sharing

As long as you have any investment questions, you can ask me and I can help you solve any investment problems. My confidence comes from the recognition of my abilities

#donald trump#finance#investing#nyc#stock market#ask#answered#ask game#stock trading#shares#stock tips#stockstowatch#stockstobuy#stockholm#investment#investors#real estate investing#investing stocks#savings#options#opportunities

4 notes

·

View notes

Text

Value vs. Growth Stocks: What’s the Difference and Which One Should You Invest ??

When it comes to investing in stocks, there are various strategies and approaches that investors can employ. Two popular investment styles are value investing and growth investing. Understanding the difference between these two approaches is essential for making informed investment decisions. In this blog, we will delve into the characteristics of value and growth stocks, explore their differences, and help you determine which one aligns with your investment goals.

Value Stocks: Uncovering Hidden Gems

Value stocks are companies that are considered undervalued by the market, trading at prices lower than their intrinsic value. These stocks often have stable earnings, pay dividends, and possess solid fundamentals. Value investors typically focus on identifying stocks with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, or other valuation metrics that suggest the stock is priced lower than its actual worth. Value stocks may include mature companies in established industries that may have experienced temporary setbacks or are overlooked by the market.

Top of Form

Bottom of Form

Key Characteristics of Value Stocks:

Low valuation metrics: Value stocks often have low P/E ratios, P/B ratios, or other valuation metrics compared to their industry peers.

Dividend payments: Many value stocks are known for their consistent dividend payments, making them attractive to income-focused investors.

Established companies: Value stocks are typically found in well-established industries, where companies have a long history and solid track records.

Potential for turnaround: Value investing involves identifying companies with potential for a turnaround or market correction, where their true value may be unlocked over time.

Growth Stocks: Investing in the Future

Growth stocks, on the other hand, are companies that exhibit strong growth potential, often characterized by above-average revenue and earnings growth rates. These companies typically reinvest their earnings back into the business to fuel expansion, rather than paying dividends. Growth investors seek companies that are at the forefront of innovation, disruptive technologies, or emerging industries, with the expectation that their earnings and stock prices will rise substantially in the future.

Key Characteristics of Growth Stocks:

High revenue and earnings growth: Growth stocks typically demonstrate above-average revenue and earnings growth rates compared to their peers and the overall market.

Limited or no dividends: Instead of distributing profits as dividends, growth companies reinvest earnings into research, development, and expansion.

Technological or industry disruptors: Growth stocks are often associated with companies leading the charge in innovative sectors or disrupting traditional industries.

High valuations: Due to their growth potential, growth stocks may trade at higher P/E ratios and valuation multiples compared to their current earnings.

Which Should You Invest In: Value or Growth?

Deciding whether to invest in value or growth stocks depends on your investment objectives, risk tolerance, and investment horizon. Both approaches have their merits:

Value stocks can offer stability, income potential, and the opportunity to buy companies at a discount. They are favored by conservative investors seeking established companies with solid fundamentals and attractive dividend yields.

Growth stocks, on the other hand, offer the potential for significant capital appreciation. They are suitable for investors with a higher risk appetite, a long-term investment horizon, and an interest in innovative industries and emerging trends.

Some investors choose to maintain a balanced portfolio that includes both value and growth stocks, diversifying their risk and capitalizing on opportunities across different market segments.

Ultimately, the decision between value and growth investing comes down to your personal financial goals, investment strategy, and risk tolerance. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Conclusion:

Value and growth investing represent distinct approaches to stock selection, each with its own set of characteristics and potential rewards. Value investing focuses on finding undervalued companies with solid fundamentals and stable earnings, while growth investing targets companies with high growth potential and innovation. The choice between value and growth stocks ultimately depends on your investment objectives, risk tolerance, and time horizon.

I hope you have received all of the necessary information, for additional information, please see our blog area

#investment shares StockPicks#stockmarket#Strategy#Stockstobuy#BestStockstobuy#investment#stock market#stockpicks#best stocks for swing trading#crypto#stock market news#stockxpo#stocks#stock

2 notes

·

View notes

Text

#StocksToBuy#stocks#StockMarket#finance#stock#krishafinance#broker#bestdemataccount#freedemataccount#India#stockbroker#StockMarketindia#Nifty#update#news#sensex#evening

3 notes

·

View notes

Text

10 Stock Picks from Axis Securities with upside potential of up to 42%

Aarti Industries :- Target price: Rs 815

Steel Strips Wheels :- Target price: Rs 300

Bank of Baroda :- Target price: Rs 300

State Bank of India - Target price: Rs 1,030

Welspun Living :- Target price: Rs 224

KPIT Technologies :- Target price: Rs 2,150

Juniper Hotels :- Target price: Rs 475

NLC India :- Target price: Rs 340

Federal Bank :- Target price: Rs 230

10.J Kumar Infraprojects Ltd :- Target price: Rs 950

0 notes

Text

Stocks to buy -

Tamil Nadu Newsprint & Paper Ltd (Buy): LCP : ₹291.25; Stop Loss : ₹280.50; Target Price: ₹310.00

Sagar Cements Ltd (Buy): LCP : ₹257.75; Stop Loss : ₹246.00; Target Price: ₹275.00

IFGL Refractories Ltd (Buy) : ₹661; Stop Loss : ₹638; Target Price: ₹702

Get insights from SEBI Registered experts -

FILL https://intensifyresearch.com/web/landingpage NOW & avail 3 Days DEMO

#banknifty#economy#stock market#investing#nifty50#nifty prediction#nse#sensex#share market#finance#niftytrading#sebi#trading tips#option trading#options#bseindia#bse sensex#bse#nseindia#stocks#invest#ipo#stockstobuy#stockstowatch#stocks today

1 note

·

View note

Text

I'm A Horrible Trader :(

I have come to the realization that I am a horrible trader. Today I lost $5, I was happy with my $158 profit yesterday then I realized my percent returns are not great. After live trading I realized I don't really know what I'm doing. I can't log my trades are even tell people what my plan is if they asked. My goal is to improve my trading in every way. Today I have been taking notes and using RSI in back testing. I'm not 1000% understanding in it yet but I'm not giving up. My biggest issue is watching trades play out even though they play out how I want. I don't know why I do it. :) Hopefully future me is not a complete idiot. Account Size: $782.47

AMZN move that i just watched play out :0

0 notes

Text

#Robinhood#stock market#stock trading#investment#investing stocks#investors#stockstowatch#stockstobuy#stock tips

0 notes

Text

stockyfly.com : Stockyfly Algo is now more powerful with more powerful features: Trailing SL feature in all algo trades Hero or Zero trades auto execution Dynamic SL feature to handle various market situation For Onboarding for Jun series: @mausumip whatsapp: 8658013933 https://t.me/best_algo_trading

0 notes

Text

INOX India Share Price Soars: What's Behind the Surge?

The price of INOX India shares has gone up by 60% this year. Why is this happening suddenly?

INOX India shares have been going up since late January 2024 when they were at around ₹810 each.

Experts think it's a good time to buy INOX India shares when their price drops a bit.

So far this year, INOX India shares have jumped from about ₹880 to ₹1395 each on the NSE, which is almost a 60% increase.

INOX India has a good track record in making cryogenic storage and transport equipment.

Demand for cryogenic equipment in India is expected to keep growing at a rate of 7.2% until 2028.

Investors who already have INOX India shares should keep a close eye and sell if the price drops below ₹1350.

The stock might reach levels between ₹1460 to ₹1500 in the near future.

New investors can buy INOX India shares now and continue buying more if the price drops, with a target of ₹1500.

Investors should be cautious and sell the stock if the price falls below ₹1350.

For Trade Insights: thebusinesscorridor

0 notes

Text

I need to watch this a second time and take notes.

ROSS CAMERON IS REALLY, REALLY GOOD.

He’s so clear and concise. His teaching flows so smoothly and his data-driven information is easy to digest.

Wow wow wow- I’ll be logging many hours on Ross’ account m.

#day trading#penny stocks#stock tips#stockstobuy#stock trading#stocks#investing stocks#money#make money online#earn money online

1 note

·

View note

Text

#investing stocks#stock trading#stock#stockstobuy#stock market#stock tips#nseindia#ai stocks#artificial intelligence

1 note

·

View note

Text

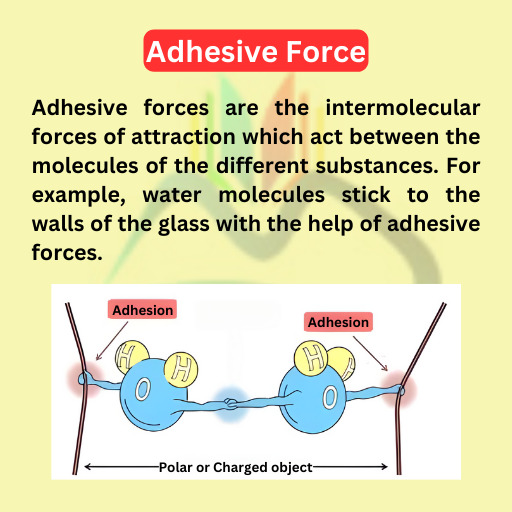

Adhesive Force

.

INDIA's FIRST E- MAGAZINE WITH LIVE TESTING

.

LINK IN BIO... .

#sciencenews#jeemain2024#Pushpa2FirstSingle#Ghaziabad#SupremeCourtOfIndia#StocksToBuy#Besharm_Rohini#Iran#Israel#efastforward#jee#neetpreparation

0 notes

Text

Bajaj Finance Share Price Target 2030

Bajaj Finance Share Price Target 2030 तक बढ़ोतरी ने पूरे देश भर में कस्टमर बेस पर नजर डाले तो काफी मजबूत देखने को मिलता है और हर साल देखा जाए तो काफी अच्छी तेजी से कंपनी के साथ नए कस्टमर जुड़ने हुए देखने को मिल रहा है अभी तक कंपनी ने लगभग 6.29 करोड़ से भी ज्यादा कस्टमर कस्टमर को फाइनेंसिंग का सुविधा प्रदान किया है और जो भी नए कस्टमर आते हैं उनमें से लगभग 57% कस्टमर दूसरी बार भी बजाज फाइनेंस से ही लोन लेते हुए देखने को मिलते हैं।

कंपनी के साथ जैसे-जैसे नए कस्टमर जुड़ते जाएंगे बजाज फाइनेंस शेयर प्राइस टारगेट द्वारा 26 में देखा जाए तो आपको बहुत ही बेहतरीन रिटर्न कमाई करके देने के साथ ही पहला टारगेट आपको ₹12000 दिखाते हुए जरूर नजर आ सकता है उसके बाद आप जरूर दूसरा टारगेट ₹12500 रुपए के लिए होल्ड करने की सोच सकते हैं।

Bajaj Finance Share Price Target 2030 हर साल देखा जाए तो Bajaj Finance Share Price में जिस तरह की ग्रोथ लगातार Increase होते हुए नजर आ रही है रेवेन्यू और प्रॉफिट (Revenue and Profit ) के साथ आगे बढ़ रही है इसकी वजह से कंपनी के शेयर प्राइस में भी उसी अनुसार बढ़त होते हुए नजर आया है मैनेजमेंट की माने तो मार्केट में जिस तरह से कंपनी का ब्रांड वैल्यू मजबूत होते देखना को मिल रहा है इसकी वजह से आने वाली दिनों में कंपनी के फाइनेंशियल प्रदर्शन और भी बेहतर होने की पुरी उम्मीद नजर आ रही है।

इसके साथ ही बजाज फाइनेंस ने धीरे-धीरे टू व्हीलर की फाइनेंस के साथ-साथ और भी नए नए कैटेगरी के अंदर भी अपने रिटेल्स कस्टमर को फाइनेंसिंग सुविधा ऑफर करने की योजना पर काम कर रही है आने वाले समय में जैसे-जैसे बजाज फाइनेंस नए-नए कैटेगरी के अंदर अपने कस्टमर को फाइनेंसिंग सुविधा ऑफर करते हुए नजर आएंगी इसके चलते जरूर कंपनी के बिजनेस में अच्छी बढ़त होते हुए नजर आने वाली है।

Bajaj Finance Share Price Target । 2030 आने वाले सालों मे Bajaj Finance रिटर्न्स की भरमार देखने को मिलेगी

Bajaj Finance Share Price Target 2030 कंपनी आने वाले कुछ सालों में मैनेजमेंट पूरी प्लान कर रही है कि अपने ब्रांच नेटवर्क देश के हर कोने-कोने तक फैलाएं जिसके लिए कंपनी हर ग्रामीण और शहरी क्षेत्र में जहां पर कंपनी के ब्रांच नेटवर्क मौजूद नहीं है उन सभी जगह पर अपने ब्रांच नेटवर्क को फैलाने की पूरी प्लेन के तहत काम करता हुआ देखने को मिल रहा है जैसे-जैसे वायर फाइनेंस का ब्रांच नेटवर्क मजबूत होता जाएगा उसी अनुसार कंपनी के बिजनेस में भी बढ़त देखने को मिलेगी

कंपनी का नेटवर्क जैसे-जैसे मजबूत होते जाएंगे Bajaj Finance Share Price Target2030 तक आपको बहुत ही बेहतरीन रिटर्न कमाई करके देने के साथ ही पहला टारगेट 17500 के आसपास दिखाते हुए नजर आ सकता है और फिर जरूर दूसरा टारगेट ₹18000 हिट होने के लिए रख सकते हो

Bajaj Finance Share Price Target 2030 बजाज फाइनेंस अपने कस्टमर को बेहतर से बेहतर फाइनेंसिंग सुविधा प्रदान करने के लिए लगातार दूसरी कंपनियों के साथ पार्टनरशिप के तहत भी काम करता हुआ देखने को मिल रहा है दूसरे कंपनियों के साथ पार्टनरशिप बढ़ाने के चलते धीरे-धीरे अपने कस्टमर को बहुत सारे अलग-अलग फाइनेंस से जुड़े प्रोडक्ट सेगमेंट में कंपनी अच्छी ऑफर देने में कामयाबी हासिल करते हुए देखने को मिल रही है जिससे कंपनी के। बिजनेस को बहुत ही ज्यादा फायदा मिलते हुए नजर आ रहा है।

Read More

#Bajaj Finance#trends#shares#stockstowatch#stock trading#stock market#investing stocks#stock tips#stockstobuy

0 notes

Text

Stock Market Today: On Tuesday, April 9, the Indian stock market saw a mixed session. The Sensex and Nifty 50 opened the day higher, setting new records, but they ended the day lower due to weak global cues. This volatility was indicative of the general mood of the market, which was impacted by both local and foreign variables.

India’s benchmark index, the Sensex, started the day at 75,124.28, breaking through its previous close of 74,742.50 and setting a new session high of 75,124.28. It did, however, later retreat from these peaks and close at 74,683.70, down 59 points, or 0.08 percent. In a similar vein, the Nifty 50 began trading at 22,765.10, starting at 22,666.30, and reached a new high of 22,768.40 before closing the day 24 points, or 0.10 percent, lower at 22,642.75.

0 notes

Text

11 Stocks to Watch for Next 5 year With 25% returns from Jefferies

Jefferies has identified 11 stocks that are expected to deliver 12-25% compound annual growth rate (CAGR) returns over the next five years, driven by themes like the capex cycle, government manufacturing push, state-owned enterprise (SOE) reforms, and financialization of savings. Here are the stocks and their growth outlooks:

Amber Enterprises: A leader in AC outsourcing, benefiting from low AC penetration in India compared to global averages.

Ambuja Cement: India’s second-largest cement producer, focusing on expansion and efficiency improvements.

Axis Bank: Expected to grow earnings at a CAGR of 18% due to its strong deposit franchise and digital platforms.

Bharti Airtel: Positioned well due to market share gains and potential ARPU growth in the telecom sector.

JSW Energy: Focused on renewable energy, with plans to increase its capacity significantly by FY30.

Larsen & Toubro (L&T): A major player in India’s infrastructure and capex upcycle.

Macrotech (Lodha): A key beneficiary of the ongoing housing upcycle, with strong growth in pre-sales.

Max Healthcare: Expected to deliver robust revenue and EBITDA growth due to expansion in healthcare services.

State Bank of India (SBI): Leveraging its large customer base and digital expansion to drive loan and earnings growth.

TVS Motor Company: Set to benefit from a revival in two-wheeler demand and growth in the electric vehicle segment.

Zomato: India’s leading food delivery platform, benefiting from growth in food delivery and quick commerce segments��(mint)(FortuneIndia).

These stocks are favored due to their strong growth potential, leadership positions, and alignment with key economic themes expected to drive market performance over the next five years.

0 notes