#Supplier Auditing Services

Text

Want to get the job done quickly? AQSS-USA has you covered with expediting services that are fast, accurate, and affordable.

+1 713-789-0885 | [email protected]

#Hydrostatic & Performance Tests#oil and gas inspection Services#Third Party Industrial Inspection Services#Welding Inspection Services#Third Party Inspection#Witness Inspection Services#Gap and Internal Auditing Services#PED Certification Services#Nuclear Inspection Services#Supplier Auditing Services#First Article Inspection Services#Aerospace and defense inspection Services#Witness Inspection#Quality Inspection Services

1 note

·

View note

Text

#Witness Inspection#Inspection Services in USA#Expediting Services#Supplier Audits#Third Party Inspection#Supplier Assessment#Witness Testing#Inspection Services in Houston#Internal Audits#Inspection Services#PED Certification Services#Auditing Services Houston#Technical Auditing Services#Product Auditing Services#Gap and Internal Auditing Services#Supplier Auditing Services#Supplier Assessments Services#Audit and Assessments Services

0 notes

Text

Supply Chain Service

Experience seamless operations with FBI-ITS.com's comprehensive supply chain services. Our tailored solutions optimize efficiency, reliability, and transparency within your supply chain. From sourcing to delivery, trust our expertise to streamline operations and elevate your business performance, ensuring a robust and efficient supply chain. Visit : https://www.fbi-its.com/collections/supply-chain-services

#china product inspection services#consumer product testing company#supplier quality audit#service supply chain management#quality inspection service in china#third party inspection company#china inspection company#inspection services in china#quality control china

0 notes

Text

Navigating Human Capital: The Top Solutions in Talent Acquisition, Compliance, and Training

In the ever-evolving landscape of business, one constant remains: the crucial role of human capital. Across industries, the success of any endeavor hinges on the talent it attracts, the adherence to labor laws and regulations, and the continuous development of skills through training programs. To streamline these vital aspects, businesses often turn to specialized services and solutions. In this article, we'll explore the best talent acquisition companies, labor compliance services, supplier audit services, statutory compliance services, and more, shedding light on how they contribute to organizational success.

1. Best Talent Acquisition Companies:

The essence of any successful enterprise lies in its people. Thus, acquiring the right talent is paramount. Talent acquisition companies play a pivotal role in this process, leveraging their expertise to identify, attract, and retain top-tier candidates. Whether through executive search firms, recruitment agencies, or innovative AI-driven platforms, these companies streamline the hiring process, saving time and resources for their clients. Some standout names in this field include:

- Randstad: Renowned for its global presence and comprehensive staffing solutions, Randstad boasts a vast network of skilled professionals across various industries.

- Robert Half: Specializing in finance, accounting, technology, and administrative recruitment, Robert Half is a trusted name for companies seeking top-notch talent.

- LinkedIn Talent Solutions: Leveraging its extensive professional network, LinkedIn offers robust recruitment tools and insights to connect employers with qualified candidates.

2. Labor Compliance Services:

Navigating the complex web of labor laws and regulations can be daunting for businesses of all sizes. Labor compliance services provide invaluable support in ensuring that organizations operate within legal boundaries, mitigating the risk of costly penalties and lawsuits. These services encompass a range of offerings, including:

- Legal Consultation: Expert legal advisors help businesses interpret and adhere to labor laws relevant to their operations, offering guidance on matters such as wage and hour regulations, workplace safety standards, and discrimination laws.

- Policy Development: Labor compliance services assist in crafting comprehensive policies and procedures tailored to the specific needs of each organization, promoting a fair and compliant work environment.

- Audits and Assessments: Regular audits and assessments help identify areas of non-compliance and implement corrective measures to ensure adherence to labor laws and regulations.

3. Supplier Audit Services:

In an interconnected global economy, businesses often rely on a network of suppliers to meet their operational needs. However, ensuring the integrity and reliability of these suppliers is essential to safeguarding the interests of the business. Supplier audit services play a critical role in this regard, conducting thorough assessments of suppliers' practices, processes, and performance. Key features of supplier audit services include:

- Quality Assurance: Supplier audits evaluate factors such as product quality, manufacturing processes, and compliance with industry standards to ensure consistency and reliability.

- Risk Management: By identifying potential risks and vulnerabilities within the supply chain, supplier audit services help mitigate disruptions and safeguard against reputational damage.

- Compliance Verification: Audits verify suppliers' adherence to contractual agreements, regulatory requirements, and ethical standards, fostering transparency and accountability in business relationships.

4. Statutory Compliance Services:

Compliance with statutory regulations is non-negotiable for businesses operating in any jurisdiction. Statutory compliance services offer comprehensive solutions to help organizations navigate the complex landscape of regulatory requirements. From tax compliance to environmental regulations, these services cover a wide range of legal obligations, including:

- Tax Compliance: Statutory compliance services assist businesses in meeting their tax obligations, ensuring accurate reporting and timely payment of taxes to regulatory authorities.

-Environmental Compliance: With growing concerns over environmental sustainability, businesses face increasing scrutiny and regulatory requirements related to environmental conservation and waste management.

- Data Privacy and Security: In an era of heightened data privacy concerns, statutory compliance services help businesses comply with regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), safeguarding sensitive information and maintaining consumer trust.

5. National Apprenticeship Training Scheme (NATS):

As the demand for skilled labor continues to rise, apprenticeship programs offer a valuable pathway for individuals to acquire industry-specific skills and for businesses to cultivate a skilled workforce. The National Apprenticeship Training Scheme (NATS) in India is a flagship program aimed at promoting apprenticeships across various sectors. Key features of NATS include:

- Skill Development: NATS facilitates on-the-job training opportunities for apprentices, enabling them to gain practical experience and technical skills under the guidance of experienced mentors.

- Industry Collaboration: The scheme fosters collaboration between educational institutions and industries, bridging the gap between academic learning and real-world application.

- Employment Opportunities: By equipping apprentices with relevant skills and experience, NATS enhances their employability and job prospects, contributing to economic growth and development.

6. Payroll Software:

Efficient payroll management is essential for ensuring timely and accurate compensation to employees while maintaining compliance with tax regulations and labor laws. Payroll software automates the payroll process, streamlining tasks such as salary calculations, tax deductions, and benefits administration. Key benefits of payroll software include:

- Time Savings: By automating repetitive payroll tasks, payroll software frees up valuable time for HR professionals to focus on strategic initiatives and employee engagement.

- Accuracy and Compliance: Payroll software helps minimize errors and ensures compliance with tax regulations and labor laws, reducing the risk of penalties and legal liabilities.

- Employee Self-Service: Many payroll software solutions offer self-service portals where employees can access their pay stubs, tax documents, and benefits information, empowering them with greater control over their financial matters.

7. Licensing Services:

Obtaining the necessary licenses and permits is a prerequisite for conducting business legally and ethically. Licensing services assist businesses in navigating the complex process of license acquisition, renewal, and compliance. Whether it's a trade license, environmental permit, or professional certification, licensing services provide valuable support in ensuring regulatory compliance and operational continuity.

In conclusion,

the landscape of talent acquisition, compliance, and training is vast and multifaceted. By leveraging the expertise of specialized service providers in these areas, businesses can streamline their operations, mitigate risks, and unlock the full potential of their human capital. Whether it's recruiting top talent, ensuring legal compliance, or fostering skills development, investing in the right solutions is key to achieving sustained success in today's competitive business environment.

1 note

·

View note

Text

#best talent acquisition companies#labor compliance services#supplier audit services#statutory compliance services#statutory compliance services india#National Apprenticeship Training Scheme

0 notes

Text

Optimizing Solar Energy Efficiency: The Importance of Solar Panel Testing and Equipment Inspection

In our ever-evolving world, the demand for clean, renewable energy sources is on the rise. Solar energy, in particular, has gained significant momentum as an eco-friendly and sustainable power solution. However, ensuring the efficiency and safety of solar equipment is paramount to harnessing the full potential of this energy source. This article delves into the critical aspects of solar panel testing, solar equipment inspection, and the importance of services like Portable Appliance Testing (PAT) in the realm of sustainable energy, with a spotlight on VICC.com, a leading provider in this field.

Solar Panel Testing: Enhancing Performance

Solar panel testing is a meticulous process that assesses the efficiency and durability of solar photovoltaic (PV) systems. Through advanced testing methods, professionals can measure the output capacity of solar panels, identify potential faults, and optimize their performance. Regular testing ensures that solar panels operate at their peak efficiency, maximizing energy production while minimizing operational costs.

Solar Equipment Inspection: Ensuring Safety and Longevity

Solar equipment inspection goes beyond evaluating the panels alone; it encompasses the entire solar energy system. This comprehensive evaluation involves checking inverters, wiring, mounting structures, and other components for wear and tear, potential malfunctions, and compliance with safety standards. Regular inspections not only guarantee the longevity of the equipment but also safeguard against hazardous situations, promoting a secure environment for both residential and commercial solar setups.

PAT inspection service : A Crucial Safety Measure

PAT inspection service plays a pivotal role in guaranteeing the safety of solar installations. This process involves the examination of electrical appliances and equipment to ensure they are safe to use. In the context of solar energy, PAT inspections are essential for solar inverters, battery storage systems, and other auxiliary devices. Regular PAT inspections prevent electrical accidents, reduce the risk of fire, and ensure compliance with regulations, giving users peace of mind regarding their solar energy setups.

VICC.com: Pioneering Solar Equipment Inspection

VICC.com stands at the forefront of the solar energy industry, offering unparalleled expertise in solar panel testing, solar equipment inspection, and PAT inspection services. With a team of highly skilled professionals and cutting-edge technology, VICC.com provides comprehensive evaluations, identifying issues before they escalate, and ensuring the seamless operation of solar systems.

The company's commitment to excellence is reflected in its dedication to quality assurance, safety compliance, and customer satisfaction. Through meticulous testing and inspection protocols, VICC.com not only enhances the efficiency of solar installations but also contributes significantly to the widespread adoption of renewable energy solutions.

Conclusion

In the global pursuit of sustainable energy, the role of solar power is undeniably crucial. To harness the full potential of solar energy, it is imperative to invest in solar panel testing, solar equipment inspection, and PAT inspection services. These processes not only optimize efficiency and performance but also guarantee the safety and longevity of solar installations.

VICC.com, with its unwavering dedication to quality and safety, stands as a beacon in the renewable energy sector. By choosing VICC.com, individuals and businesses alike are making a conscious choice towards a greener, more sustainable future, one solar panel at a time.

#quality inspection service#factory audit service#pre-shipment inspection#quality control services#supplier audit service#china pre-shipment inspection#third party inspection#solar panel testing#PAT inspection service

0 notes

Text

Lightning protection Singapore

Strom Synergy Pte Ltd company provide lighting protection Singapore, earthing protection solution, lighting protection system audit, lighting protection warning system and lighting risk assessment system in Singapore at affordable price.

#Lightning protection#Lightning audit#Earthing audit#Earthing protection#Lightning Protection Solutions#Lightning protection matters#Lightning protection system Singapore#Lightning protection system supplier Singapore#Lightning protection suppliers#Lightning protection supplier in Singapore#Lightning protection Singapore#Lightning protection installation#Lightning protection services#Lightning protection company#Lightning protection earthing#Lightning Protection System#Lightning Protection System Audit#Lightning Warning System#Lightning Protection Inspection#Lightning Risk Assessment

0 notes

Text

The long sleep of capitalism’s watchdogs

There are only five more days left in my Kickstarter for the audiobook of The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

One of the weirdest aspect of end-stage capitalism is the collapse of auditing, the lynchpin of investing. Auditors – independent professionals who sign off on a company's finances – are the only way that investors can be sure they're not handing their money over to failing businesses run by crooks.

It's just not feasible for investors to talk to supply-chain partners and retailers and verify that a company's orders and costs are real. Investors can't walk into a company's bank and demand to see their account histories. Auditors – who are paid by companies, but work for themselves – are how investors avoid shoveling money into Ponzi-pits.

Attentive readers will have noticed that there is an intrinsic tension in an arrangement where someone is paid by a company to certify its honesty. The company gets to decide who its auditors are, and those auditors are dependent on the company for future business. To manage this conflict of interest, auditors swear fealty to a professional code of ethics, and are themselves overseen by professional boards with the power to issue fines and ban cheaters.

Enter monopolization. Over the past 40 years, the US government conducted a failed experiment in allowing companies to form monopolies on the theory that these would be "efficient." From Boeing to Facebook, Cigna to InBev, Warner to Microsoft, it has been a catastrophe. The American corporate landscape is dominated by vast, crumbling, ghastly companies whose bad products and worse corporate conduct are locked in a race to see who can attain the most depraved enshittification quickest.

The accounting profession is no exception. A decades-long incestuous orgy of mergers and acquisitions yielded up an accounting sector dominated by just four firms: EY, KPMG, PWC and Deloitte (the last holdout from the alphabetsoupification of corporate identity). Virtually every major company relies on one of these companies for auditing, but that's only a small part of corporate America's relationship with these tottering behemoths. The real action comes from "consulting."

Each of the Big Four accounting firms is also a corporate consultancy. Some of those consulting services are the normal work of corporate consultants – cookie cutter advice to fire workers and reduce product quality, as well as supplying dangerously defecting enterprise software. But you can get that from the overpaid enablers at McKinsey or BCG. The advantage of contracting with a Big Four accounting firm for consulting is that they can help you commit finance fraud.

Remember: if you're an executive greenlighting fraud, you mostly just want to be sure it's not discovered until after you've pocketed your bonus and moved on. After all, the pro-monopoly experiment was also an experiment in tolerating corporate crime. Executives who cheat their investors, workers and suppliers typically generate fines for their companies, while escaping any personal liability.

By buying your cheating advice from the same company that is paid to certify that you're not cheating, you greatly improve your chances of avoiding detection until you've blown town.

Which brings me to the idea of the "bezzle." This is John Kenneth Galbraith's term for "the weeks, months, or years that elapse between the commission of the crime and its discovery." This is the period in which both the criminal and the victim feel like they're better off. The crook has the victim's money, and the victim doesn't know it. The Bezzle is that interval when you're still assuming that FTX isn't lying to you about the crazy returns they're generating for your crypto. It's the period between you getting the shrinkwrapped box with a 90% discounted PS5 in it from a guy in an alley, and getting home and discovering that it's full of bricks and styrofoam.

Big Accounting is a factory for producing bezzles at scale. The game is rigged, and they are the riggers. When banks fail and need a public bailout, chances are those banks were recently certified as healthy by one of the Big Four, whose audited bank financials failed 800 re-audits between 2009-17:

https://pluralistic.net/2020/09/28/cyberwar-tactics/#aligned-incentives

The Big Four dispute this, of course. They claim to be models of probity, adhering to the strictest possible ethical standards. This would be a lot easier to believe if KPMG hadn't been caught bribing its regulators to help its staff cheat on ethics exams:

https://www.nysscpa.org/news/publications/the-trusted-professional/article/sec-probe-finds-kpmg-auditors-cheating-on-training-exams-061819

Likewise, it would be easier to believe if their consulting arms didn't keep getting caught advising their clients on how to cheat their auditing arms:

https://pluralistic.net/2023/05/09/dingo-babysitter/#maybe-the-dingos-ate-your-nan

Big Accounting is a very weird phenomenon, even by the standards of End-Stage Capitalism. It's an organized system of millionaire-on-billionaire violence, a rare instance of the very richest people getting scammed the hardest:

https://pluralistic.net/2021/06/04/aaronsw/#crooked-ref

The collapse of accounting is such an ominous and fractally weird phenomenon, it inspired me to write a series of hard-boiled forensic accountancy novels about a two-fisted auditor named Martin Hench, starting with last year's Red Team Blues (out in paperback next week!):

https://us.macmillan.com/books/9781250865854/redteamblues

The sequel to Red Team Blues is called (what else?) The Bezzle, and part of its ice-cold revenge plot involves a disillusioned EY auditor who can't bear to be part of the scam any longer:

https://www.kickstarter.com/projects/doctorow/the-bezzle-a-martin-hench-audiobook-amazon-wont-sell

The Hench stories span a 40-year period, and are a chronicle of decades of corporate decay. Accountancy is the perfect lens for understanding our modern fraud economy. After all, it was crooked accountants who gave us the S&L crisis:

https://scholarworks.umt.edu/cgi/viewcontent.cgi?article=10130&context=etd

Crooked auditors were at the center of the Great Financial Crisis, too:

https://francinemckenna.com/2009/12/07/they-werent-there-auditors-and-the-financial-crisis/

And of course, crooked auditors were behind the Enron fraud, a rare instance in which a fraud triggered a serious attempt to prevent future crimes, including the destruction of accounting giant Arthur Andersen. After Enron, Congress passed Sarbanes-Oxley (SOX), which created a new oversight board called the Public Company Accounting Oversight Board (PCAOB).

The PCAOB is a watchdog for watchdogs, charged with auditing the auditors and punishing the incompetent and corrupt among them. Writing for The American Prospect and the Revolving Door Project, Timi Iwayemi describes the long-running failure of the PCAOB to do its job:

https://prospect.org/power/2024-01-26-corporate-self-oversight/

For example: from 2003-2019, the PCAOB undertook only 18 enforcement cases – even though the PCAOB also detected more than 800 "seriously defective audits" by the Big Four. And those 18 cases were purely ornamental: the PCAOB issued a mere $6.5m in fines for all 18, even though they could have fined the accounting companies $1.6 billion:

https://www.pogo.org/investigations/how-an-agency-youve-never-heard-of-is-leaving-the-economy-at-risk

Few people are better on this subject than the investigative journalist Francine McKenna, who has just co-authored a major paper on the PCAOB:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4227295

The paper uses a new data set – documents disclosed in a 2019 criminal trial – to identify the structural forces that cause the PCAOB to be such a weak watchdog whose employees didn't merely fail to do their jobs, but actually criminally abetted the misdeeds of the companies they were supposed to be keeping honest.

They put the blame – indirectly – on the SEC. The PCAOB has three missions: protecting investors, keeping markets running smoothly, and ensuring that businesses can raise capital. These missions come into conflict. For example, declaring one of the Big Four auditors ineligible would throw markets into chaos, removing a quarter of the auditing capacity that all public firms rely on. The Big Four are the auditors for 99.7% of the S&P 500, and certify the books for the majority of all listed companies:

https://blog.auditanalytics.com/audit-fee-trends-of-sp-500/

For the first two decades of the PCAOB's existence, the SEC insisted that conflicts be resolved in ways that let the auditing firms commit fraud, because the alternative would be bad for the market.

So: rather than cultivating an adversarial relationship to the Big Four, the PCAOB effectively merged with them. Two of its board seats are reserved for accountants, and those two seats have been occupied by Big Four veterans almost without exception:

https://www.pogo.org/investigations/captured-financial-regulator-at-risk

It was no better on the SEC side. The Office of the Chief Accountant is the SEC's overseer for the PCAOB, and it, too, has operated with a revolving door between the Big Four and their watchdog (indeed, the Chief Accountant is the watchdog for the watchdog for the watchdogs!). Meanwhile, staffers from the Office of the Chief Accountant routinely rotated out of government service and into the Big Four.

This corrupt arrangement reached a crescendo in 2019, with the appointment of William Duhnke – formerly of Senator Richard Shelby's [R-AL] staff – took over as Chief Accountant. Under Duhnke's leadership, the already-toothless watchdog was first neutered, then euthanized. Duhnke fired all four heads of the PCAOB's main division and then left their seats vacant for 18 months. He slashed the agency's budget, "weakened inspection requirements and auditor independence policies, and disregarded obligations to hold Board meetings and publicize its agenda."

All that ended in 2021, when SEC chair Gary Gensler fired Duhnke and replaced him with Erica Williams, at the insistence of Bernie Sanders and Elizabeth Warren. Within a year, Williams had issued 42 enforcement actions, the largest number since 2017, levying over $11m in sanctions:

https://www.dlapiper.com/en/insights/publications/2023/01/pcaob-sets-aggressive-agenda-for-2023-what-to-expect-as-agency-enforcement-expands

She was just getting warmed up: last year, PCAOB collected $20m in fines, with five cases seeing fines in excess of $2m each, a record:

https://www.dlapiper.com/en/insights/publications/2024/01/pcaobs-enforcement-and-standard-setting-rev-up-what-to-expect-in-2024

Williams isn't shy about condemning the Big Four, publicly sounding the alarm that 40% of the 2022 audits the PCAOB reviewed were deficient, up from 34% in 2021 and 29% in 2020:

https://www.wsj.com/articles/we-audit-the-auditors-and-we-found-trouble-accountability-capital-markets-c5587f05

Under Williams, the PCAOB has enacted new, muscular rules on lead auditors' duties, and they're now consulting on a rule that will make audit inspections much faster, shortening the documentation period from 45 days to 14:

https://tax.thomsonreuters.com/news/pcaob-rulemaking-could-lead-to-more-timely-issuance-of-audit-inspection-reports/

Williams is no fire-breathing leftist. She's an alum of the SEC and a BigLaw firm, creating modest, obvious technical improvements to a key system that capitalism requires for its orderly functioning. Moreover, she is competent, able to craft regulations that are effective and enforceable. This has been a motif within the Biden administration:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But though these improvements are decidedly moderate, they are grounded in a truly radical break from business-as-usual in the age of monopoly auditors. It's a transition from self-regulation to regulation. As @40_Years on Twitter so aptly put it: "Self regulation is to regulation as self-importance is to importance":

https://twitter.com/40_Years/status/1750025605465178260

Berliners: Otherland has added a second date (Jan 28 - THIS SUNDAY!) for my book-talk after the first one sold out - book now!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/26/noclar-war/#millionaire-on-billionaire-violence

Back the Kickstarter for the audiobook of The Bezzle here!

Image:

Sam Valadi (modified)

https://www.flickr.com/photos/132084522@N05/17086570218/

Disco Dan (modified)

https://www.flickr.com/photos/danhogbenspics/8318883471/

CC BY 2.0:

https://creativecommons.org/licenses/by/2.0/

#pluralistic#big accounting#auditing#marty hench#martin hench#big four accountants#management consultants#corruption#millionaire on billionaire violence#long cons#the bezzle#conflicts of interest#revolving door#self-regulation#gaap#sox#sarbanes-oxley#too big to fail#too big to jail#audits#defective audits#Public Company Accounting Oversight Board#pcaob#sec#scholarship#Francine McKenna#William Duhnke#administrative competence#photocopier kickers#NOCLARs

67 notes

·

View notes

Text

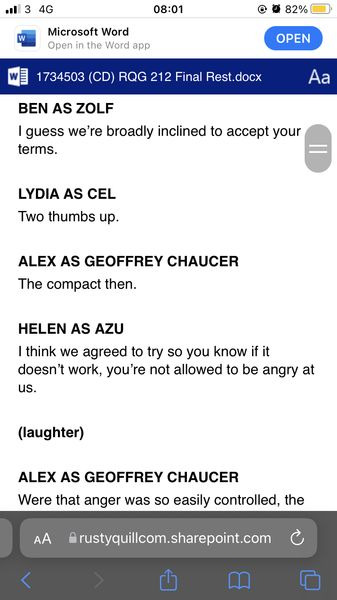

Who’s Afraid of Alex J. Newall? by Newt Schottelkotte is definitely worth a read to everyone who’s a fan of Rusty Quill Productions.

I count myself amongst those. Which is why I want to add to something mentioned in the article that I, alongside @nossorgs have special insight into:

The Transcripts.

In light of everything that has happened this year, the way people inside of RQ have been mistreated, abused, and exploited, the transcripts appear to be a minor issue. But as Newt has pointed out beautifully: They’re a symptom of something much bigger, namely disregard, miscommunication, incompetence, reliance on free fan labour and pretending to be something they’re not. In this case the producer of inclusive and accessible content.

The official RQ transcripts were launched early this year and it was immediately clear how terrible they are. Countless fans have surely reached out to RQ to let them know. After all, there’s a handy feedback form. A feedback form which, incidentally, is neither up-to-task, nor easily accessible as it isn’t linked anywhere near the transcripts, but only in the 26 January 2022 “news” update.

However, Nossorgs and I, as professionals in the language service industry, had concerns that couldn’t be addressed in the feedback form. So we sat down together and wrote a very long email, which we sent to RQ on 22 February 2022. We have received no reply.

I’m now, after checking with Nossorgs, publishing the email here, because I don’t want anyone to say “well maybe they didn’t know”. They knew. They just didn’t care.

They didn’t even care enough to fix these issues by today.

Here’s the email and all the exemplary screenshots are below a cut.

Dear Rusty Quill Team,

congratulations on launching your new website and releasing the transcripts for the RQ original shows.

Upon review of several transcripts (in particular the ones created for Rusty Quill Gaming), we wanted to voice some concerns with the company or software used to generate the transcripts, since there appears to have been a grievous lack of quality control and a large number of errors have made it to the released transcripts. Screenshots are attached and a list of general concerns can be found below.

As professional linguists, who variously have been or are currently employed as editors, translators, transcribers, or project managers in the language service sector (each with QA responsibilities), with over a decade of experience, we would highly recommend requesting a partial or total refund from the companies involved in generating these transcripts. As provided, the transcripts lack any form of serious quality control and may even indicate that the supplier(s) you have partnered with are fraudulent.

With the professional experience we have, we understand the difficulties that come with transcribing audio of this type. One speaker having multiple voices, crosstalk, and "unusual" turns of phrase (i.e. Pathfinder mechanics and terminology) being used pose great difficulties. However, the concerns we would like to voice are unrelated to the content of RQG, but basic issues that any professional linguist should have been able to avoid.

Many of the concerns we have can be traced to a lack of consistency, which could have been avoided by the simple creation and adherence to a style guide. Did your transcription supplier provide or request one? With a project as big as this, it would have been standard practice.

Please find a list of general concerns below, the file names of relevant screenshots have been added in brackets:

Many spelling and grammar errors, which indicate a lack of language skill (Spelling001 to 005). Professional linguists should only ever work in their native language to avoid such issues. There are official ISO guidelines regarding linguistic qualifications, which any agency of worth is aware of and regularly audited on.

Misspelling of player and character names and misattribution of lines (Spelling001 to 005). We do not know whether RQ provided a list of cast and character names to the transcription provider, but they should have realised that many unusual names are included and references are needed. They should have reached out and requested a list if it hadn't been provided. If it was provided, it was clearly not consulted.

Lack of organisation: The very first episode is mislabelled as episode 25 in the transcript (Episode1_mislabeled). Episode 25, in turn, only seems to be available in a word format, not as a pdf (this also seems to apply to other episodes, such as 203). The transcripts are not labelled in a consistent pattern, meaning that they are not sorted consecutively by episode number in the RQ Sharepoint, making browsing difficult (Filing001).

Lack of consistent speaker tagging: In most transcripts, the players are not distinguished from the characters they are playing, and the formatting is inconsistent in the episodes that do note in-character speech (Characters001 to 003). This is probably due to your transcription provider splitting the work over multiple people. This is a common and reasonable approach to spread the workload. However, the linguists should have agreed on a common system, or the central project manager should have dictated one. Lack of cast/character distinction renders the transcripts as good as unreadable.

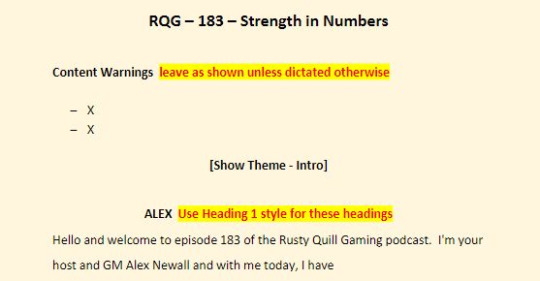

Lack of basic QA regarding completion: Episode 183 includes internal formatting remarks of the supplier, which should have been deleted by them prior to delivery (CW001).

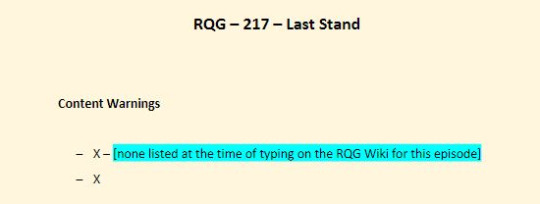

Content warnings: Listing of content warnings is inconsistent, if present at all, with one remark noting that content warnings were unavailable because they were not listed in the (fan-made) wiki (CW002). It is concerning that the transcription provider would refer to a fan-made, unofficial source, when RQ provides content warnings with all episodes in the episode notes. Surely, these are also available at RQ internally in a centralised document which could have been requested by the supplier.

We understand you are probably very busy creating and promoting your new shows and troubleshooting your new website, but transcripts of this quality actively harm your reputation as an accessible and inclusive company. The mantra "better than nothing" only applies to a certain extent here. Low-quality transcripts, such as these, are of no help to those who rely on them. Clear labelling of actors vs characters is needed in order to follow the podcast, and content warnings should have been included whether they are available on the fan wiki or not. Even if these transcripts are intended as first drafts, to be revised and polished at a later stage, they are at best unuseable and at worst dismissive towards those members of the fan community who are hard of hearing or have auditory processing issues.

Professionally, we recommend that you reach out to your supplier with the list of concerns and screenshots we have collected and request corrections. Whether or not you also request a (partial) refund is up to you, but we also recommend you do. If you do not trust your original supplier to take care of the required corrections accurately, it would be standard practice to request a quotation from another supplier and contact the original transcription provider with this quotation in order to bill them for the additional financial burden. Before choosing a (second) supplier and contracting them for all 200+ reworks, it would be advisable to do a small batch of transcripts first, in order for you to get a feeling for their quality, as well as allow them to make an accurate estimate of the effort involved and ask any questions that may already have come up.

In the language service industry, it is not uncommon to have to rework one's deliveries. Language is subjective and linguists are people. Mistakes happen. We understand this better than most fans. However, no professional, qualified linguist would have signed off on these transcripts with the feeling of a job well done. There are human errors, and there is a gross lack of basic quality assurance. Unfortunately, the RQG transcripts, as they are, fall into the latter category.

If you would like to get in touch, we would be more than happy to share our professional knowledge and experience regarding linguistic projects such as these, in order to help you avoid such problems in the future, for instance if and when you decide to add transcripts for side quests, specials, and bloopers. We are aware that you don’t usually work with fans and understand and respect the reasoning behind the decision, however, many linguists in the fan community are prepared to offer their own services as transcribers. You have a wide range of professionals in your fan community, and all of them come with the additional benefit of being familiar with the source material and understanding what format these transcripts should take in order to be of use.

With kind regards,

Spelling001

Spelling002

Spelling003

Spelling004

Spelling 005

Episode1_mislabelled

Filing001

Characters001

Characters002

Characters 003

CW001

CW002

465 notes

·

View notes

Text

In 2023, the fast-fashion giant Shein was everywhere. Crisscrossing the globe, airplanes ferried small packages of its ultra-cheap clothing from thousands of suppliers to tens of millions of customer mailboxes in 150 countries. Influencers’ “#sheinhaul” videos advertised the company’s trendy styles on social media, garnering billions of views.

At every step, data was created, collected, and analyzed. To manage all this information, the fast fashion industry has begun embracing emerging AI technologies. Shein uses proprietary machine-learning applications — essentially, pattern-identification algorithms — to measure customer preferences in real time and predict demand, which it then services with an ultra-fast supply chain.

As AI makes the business of churning out affordable, on-trend clothing faster than ever, Shein is among the brands under increasing pressure to become more sustainable, too. The company has pledged to reduce its carbon dioxide emissions by 25 percent by 2030 and achieve net-zero emissions no later than 2050.

But climate advocates and researchers say the company’s lightning-fast manufacturing practices and online-only business model are inherently emissions-heavy — and that the use of AI software to catalyze these operations could be cranking up its emissions. Those concerns were amplified by Shein’s third annual sustainability report, released late last month, which showed the company nearly doubled its carbon dioxide emissions between 2022 and 2023.

“AI enables fast fashion to become the ultra-fast fashion industry, Shein and Temu being the fore-leaders of this,” said Sage Lenier, the executive director of Sustainable and Just Future, a climate nonprofit. “They quite literally could not exist without AI.” (Temu is a rapidly rising ecommerce titan, with a marketplace of goods that rival Shein’s in variety, price, and sales.)

In the 12 years since Shein was founded, it has become known for its uniquely prolific manufacturing, which reportedly generated over $30 billion of revenue for the company in 2023. Although estimates vary, a new Shein design may take as little as 10 days to become a garment, and up to 10,000 items are added to the site each day. The company reportedly offers as many as 600,000 items for sale at any given time with an average price tag of roughly $10. (Shein declined to confirm or deny these reported numbers.) One market analysis found that 44 percent of Gen Zers in the United States buy at least one item from Shein every month.

That scale translates into massive environmental impacts. According to the company’s sustainability report, Shein emitted 16.7 million total metric tons of carbon dioxide in 2023 — more than what four coal power plants spew out in a year. The company has also come under fire for textile waste, high levels of microplastic pollution, and exploitative labor practices. According to the report, polyester — a synthetic textile known for shedding microplastics into the environment — makes up 76 percent of its total fabrics, and only 6 percent of that polyester is recycled.

And a recent investigation found that factory workers at Shein suppliers regularly work 75-hour weeks, over a year after the company pledged to improve working conditions within its supply chain. Although Shein’s sustainability report indicates that labor conditions are improving, it also shows that in third-party audits of over 3,000 suppliers and subcontractors, 71 percent received a score of C or lower on the company’s grade scale of A to E — mediocre at best.

Machine learning plays an important role in Shein’s business model. Although Peter Pernot-Day, Shein’s head of global strategy and corporate affairs, told Business Insider last August that AI was not central to its operations, he indicated otherwise during a presentation at a retail conference at the beginning of this year.

“We are using machine-learning technologies to accurately predict demand in a way that we think is cutting edge,” he said. Pernot-Day told the audience that all of Shein’s 5,400 suppliers have access to an AI software platform that gives them updates on customer preferences, and they change what they’re producing to match it in real time.

“This means we can produce very few copies of each garment,” he said. “It means we waste very little and have very little inventory waste.” On average, the company says it stocks between 100 to 200 copies of each item — a stark contrast with more conventional fast-fashion brands, which typically produce thousands of each item per season, and try to anticipate trends months in advance. Shein calls its model “on-demand,” while a technology analyst who spoke to Vox in 2021 called it “real-time” retail.

At the conference, Pernot-Day also indicated that the technology helps the company pick up on “micro trends” that customers want to wear. “We can detect that, and we can act on that in a way that I think we’ve really pioneered,” he said. A designer who filed a recent class action lawsuit in a New York District Court alleges that the company’s AI market analysis tools are used in an “industrial-scale scheme of systematic, digital copyright infringement of the work of small designers and artists,” that scrapes designs off the internet and sends them directly to factories for production.

In an emailed statement to Grist, a Shein spokesperson reiterated Peter Pernot-Day’s assertion that technology allows the company to reduce waste and increase efficiency and suggested that the company’s increased emissions in 2023 were attributable to booming business. “We do not see growth as antithetical to sustainability,” the spokesperson said.

An analysis of Shein’s sustainability report by the Business of Fashion, a trade publication, found that last year, the company’s emissions rose at almost double the rate of its revenue — making Shein the highest-emitting company in the fashion industry. By comparison, Zara’s emissions rose half as much as its revenue. For other industry titans, such as H&M and Nike, sales grew while emissions fell from the year before.

Shein’s emissions are especially high because of its reliance on air shipping, said Sheng Lu, a professor of fashion and apparel studies at the University of Delaware. “AI has wide applications in the fashion industry. It’s not necessarily that AI is bad,” Lu said. “The problem is the essence of Shein’s particular business model.”

Other major brands ship items overseas in bulk, prefer ocean shipping for its lower cost, and have suppliers and warehouses in a large number of countries, which cuts down on the distances that items need to travel to consumers.

According to the company’s sustainability report, 38 percent of Shein’s climate footprint comes from transportation between its facilities and to customers, and another 61 percent come from other parts of its supply chain. Although the company is based in Singapore and has suppliers in a handful of countries, the majority of its garments are produced in China and are mailed out by air in individually addressed packages to customers. In July, the company sent about 900,000 of these to the US every day.

Shein’s spokesperson told Grist that the company is developing a decarbonization road map to address the footprint of its supply chain. Recently, the company has increased the amount of inventory it stores in US warehouses, allowing it to offer American customers quicker delivery times, and increased its use of cargo ships, which are more carbon-efficient than cargo planes.

“Controlling the carbon emissions in the fashion industry is a really complex process,” Lu said, adding that many brands use AI to make their operations more efficient. “It really depends on how you use AI.”

There is research that indicates using certain AI technologies could help companies become more sustainable. “It’s the missing piece,” said Shahriar Akter, an associate dean of business and law at the University of Wollongong in Australia. In May, Akter and his colleagues published a study finding that when fast-fashion suppliers used AI data management software to comply with big brands’ sustainability goals, those companies were more profitable and emitted less. A key use of this technology, Atker says, is to closely monitor environmental impacts, such as pollution and emissions. “This kind of tracking was not available before AI-based tools,” he said.

Shein told Grist it does not use machine-learning data management software to track emissions, which is one of the uses of AI included in Akter’s study. But the company’s much-touted usage of machine-learning software to predict demand and reduce waste is another of the uses of AI included in the research.

Regardless, the company has a long way to go before meeting its goals. Grist calculated that the emissions Shein reportedly saved in 2023 — with measures such as providing its suppliers with solar panels and opting for ocean shipping — amounted to about 3 percent of the company’s total carbon emissions for the year.

Lenier, from Sustainable and Just Future, believes there is no ethical use of AI in the fast-fashion industry. She said that the largely unregulated technology allows brands to intensify their harmful impacts on workers and the environment. “The folks who work in fast-fashion factories are now under an incredible amount of pressure to turn out even more, even faster,” she said.

Lenier and Lu both believe that the key to a more sustainable fashion industry is convincing customers to buy less. Lu said if companies use AI to boost their sales without changing their unsustainable practices, their climate footprints will also grow accordingly. “It’s the overall effect of being able to offer more market-popular items and encourage consumers to purchase more than in the past,” he said. “Of course, the overall carbon impact will be higher.”

11 notes

·

View notes

Text

Expediting Services

Want to get the job done quickly? AQSS-USA has you covered with expediting services that are fast, accurate, and affordable.

+1 713-789-0885 | [email protected]

#Hydrostatic & Performance Tests#oil and gas inspection Services#Welding Inspection Services#Third Party Industrial Inspection Services#Witness Inspection Services#Third Party Inspection#Gap and Internal Auditing Services#Nuclear Inspection Services#PED Certification Services#Supplier Auditing Services#NDE Inspection Services#Aerospace and defense inspection Services

0 notes

Text

#Witness Inspection#Inspection Services in USA#Expediting Services#Supplier Audits#Third Party Inspection#Witness Testing#Inspection Services in Houston#Internal Audits#Inspection Services#CE Marking Services#PED Certification Services#Auditing Services Houston#Product Auditing Services#Gap and Internal Auditing Services#Supplier Auditing Services#Supplier Assessments Services#Audit and Assessments Services#Vulnerability management services#Oil and gas Auditing Services#oil and gas inspection Services

0 notes

Text

Pre shipment inspections

#quality inspection service in china#service supply chain management#china product inspection services#inspection services in china#third party inspection company#supplier quality audit

0 notes

Text

What is ESG Controversy, and How Does It Impact Business?

Social media has augmented the power multimedia coverage has over public perception. The positive aspects of this situation include a rising demand for accountability and transparent corporate communication. However, the potential misuse of modern media, third-party firms’ intelligence, and news platforms can threaten the brand you develop through fake news. For instance, an ESG controversy, whether real or not, can impact a business. And this post explains how.

What is an ESG Controversy?

An ESG controversy encompasses all events concerning actual or alleged adverse impact assessments, sustainability non-compliance, data theft, etc. The environmental, social, and governance (ESG) factors help analysts create comprehensive reports and financial disclosures, highlighting potentially controversial business aspects.

Controversial events can decrease your company’s reputation, increase legal liabilities, and alienate the stakeholders. Besides, brand-related risks have long-term consequences. Therefore, corporations leverage ESG controversy analysis to identify the activities that can undermine their strategic vision, financial performance, and stakeholder interests.

What Causes an ESG Controversy?

Advanced technology empowers today’s world, empowering researchers, non-governmental organizations (NGOs), industry bodies, regional authorities, and consumers. They can quickly investigate if a brand has engaged in ESG non-compliant activities.

Employing child labor, discriminating against employees, polluting the environment, or engaging in corruption can affect your company’s relationships. Sometimes, old norms become obsolete, and new legal frameworks replace them. However, specific organizations might miss such dynamics or willfully postpone compliance.

Through ESG consulting, businesses can acquire thematic insights into sustainability compliance and controversy exposure. Themes include energy transition, labor rights, social good, carbon emissions, and waste disposal. So, investors, authorities, businesses, NGOs, and consumers can decide which brands to support or ignore.

How Does an ESG Controversy Impact a Business?

1| It Can Discourage Investors

Ethical and impact investors want to focus on enterprises working on socio-economically beneficial projects. They also employ exclusion strategies when building portfolios based on sustainable development goals (SDGs). Investors are less likely to include a brand with a controversial background in their portfolios.

2| ESG Controversy Can Lead to Consumer Boycott

Launching a new product or service will become more challenging if a company is part of a controversy. Consumers believe in buying from brands that share their values. Suppose they learn about a brand’s ESG controversy. They will deliberately avoid its products, events, and services. Simultaneously, social media and news platforms can accelerate the brand boycott trends.

3| Legal Processes Will Impact the Business

Addressing non-compliance issues can involve fulfilling legal requirements like account audits, independent inquiries, or financial penalties. These activities can make specific business operations inefficient for a while. Otherwise, the managers might get trade restrictions for an indefinite period.

4| ESG Controversy Makes Supply Chain Management Riskier

Consider a business that procures critical components from a supplier that employs child labor and releases untreated industrial effluent into water bodies. Therefore, the brand is at risk. After all, ESG controversy analysis does not stop at the company level. It inspects whether a few supplier relations can damage your stakeholder goodwill due to questionable practices.

Steps of Controversy Monitoring and Reporting

Recognizing the vulnerable aspects across the environmental, social, and governance pillars helps companies and investors streamline risk assessment. Think of the deforestation risks that will be higher in the case of construction projects. However, water resources will be more vulnerable to pollution from the heavy chemicals industry.

Later, you want to create a consolidated statistical method to rate the adverse impact according to ESG controversy risks. It will allow companies to benchmark their compliance.

Finally, investors must determine whether they want to buy or sell an asset using the final reports. Likewise, business leaders must explore opportunities to make their organizations more resilient to controversies.

Conclusion

Several possibilities affect how everyone essential to your business development perceives you. Their faith in your brand shakes once your organization becomes the focus of global and regional media coverage for the wrong reasons.

Still, every ESG controversy analyst will follow a unique system to evaluate the risks that business leaders must mitigate to have a positive impact. As a result, corporations must select analysts with an established track record of sustainability compliance and risk assessment.

3 notes

·

View notes

Text

The Federal Aviation Administration will increase its oversight of Boeing production and manufacturing, the agency said Friday, one day after announcing it had opened an investigation.

The FAA says it will audit Boeing's 737-9 MAX production line and its suppliers "to evaluate Boeing’s compliance with its approved quality procedures."

The results of the initial audit will determine whether additional audits are needed, the agency said.

"It is time to re-examine the delegation of authority and assess any associated safety risks," FAA Administrator Mike Whitaker said in a statement.

"The grounding of the 737-9 and the multiple production-related issues identified in recent years require us to look at every option to reduce risk," Whitaker said. "The FAA is exploring the use of an independent third party to oversee Boeing’s inspections and its quality system."

The FAA will also conduct "increased monitoring of Boeing 737-9 MAX in-service events" as well as an "assessment of safety risks around delegated authority and quality oversight, and examination of options to move these functions under independent, third-party entities," according to FAA.

The move comes one week after an Alaska Airlines flight was forced to make an emergency landing when a door plug fell off the fuselage midair. The flight had left Portland, Oregon, bound for Ontario International Airport in San Bernardino County, California.

3 notes

·

View notes

Text

Unlocking Quality: A Comprehensive Guide to Steel Plate Inspection, Battery Inspection, and Battery Testing in China with VICC.com

In the heart of the manufacturing powerhouse that is China, ensuring the quality and reliability of products is paramount. From steel plates that form the backbone of construction to batteries powering our devices and vehicles, meticulous inspection and testing processes are crucial. In this comprehensive guide, we will explore the intricacies of steel plate inspection, battery inspection, and battery testing in China, shedding light on the vital role played by VICC.com in maintaining the highest standards of quality.

**1. The Significance of Steel Plate Inspection:

Steel plates serve as the foundation of various industries, including construction, automotive, and aerospace. To guarantee their integrity, steel plate inspection is a meticulous process involving non-destructive testing methods such as ultrasonic testing and magnetic particle inspection. These techniques ensure that the steel plates are free from defects, cracks, or irregularities, guaranteeing structural integrity and safety.

**2. Battery Inspection:

In the era of portable electronics and electric vehicles, batteries are the lifeblood of our daily lives. Battery inspection processes involve rigorous checks for physical defects, leakage, and proper electrical connections. By employing cutting-edge technologies, China ensures that batteries meet international safety standards, providing consumers with reliable and safe energy sources.

**3. Battery Testing in China:

Battery testing is a multifaceted process encompassing performance, durability, and safety assessments. With the rise of renewable energy solutions and electric vehicles, battery testing in China has become more sophisticated. State-of-the-art facilities and testing protocols are employed to evaluate factors such as energy efficiency, charging speed, and overall longevity. These tests not only ensure the quality of batteries but also contribute to the advancement of green technologies.

**4. The Role of VICC.com:

In this landscape of stringent quality standards, VICC.com emerges as a beacon of excellence. As a leading quality inspection and testing service provider in China, VICC.com specializes in steel plate inspection, battery inspection, and battery testing. With a team of skilled professionals and state-of-the-art facilities, VICC.com ensures that products adhere to international quality benchmarks.

By partnering with VICC.com, manufacturers gain access to a wealth of expertise and resources. From comprehensive inspections to cutting-edge testing methods, VICC.com empowers businesses to deliver products that inspire confidence and trust among consumers worldwide.

Conclusion:

In the dynamic landscape of manufacturing, steel plate inspection, battery inspection, and battery testing stand as pillars of quality assurance. China, with its unwavering commitment to excellence, plays a pivotal role in these processes. As we navigate the future of industry and technology, VICC.com serves as a testament to China's dedication to delivering products that not only meet but exceed global standards.

In a world where quality is non-negotiable, VICC.com stands as a steadfast guardian, ensuring that every steel plate and battery that leaves its facilities is a testament to China's commitment to quality, innovation, and progress.

#supplier audit service#china pre-shipment inspection#third party inspection#quality inspection service#quality control services#factory audit service#pre-shipment inspection

0 notes