#TAX Simulation Software for institutes

Explore tagged Tumblr posts

Text

What is GST Simulation Software? A Complete Guide

The introduction of Goods and Services Tax (GST) has transformed tax systems worldwide, simplifying taxation while posing new challenges for businesses, particularly in compliance and accurate tax calculation. GST Simulation Software has become an invaluable tool for businesses of all sizes, providing a digital solution to manage GST calculations, reporting, and compliance. But what exactly is GST Simulation Software, and how can it help organizations? In this comprehensive guide, we’ll dive into everything you need to know about GST Simulation Software, its benefits, features, and how to choose the right software for your business.

Table of Contents

What is GST Simulation Software?

How Does GST Simulation Software Work?

Key Features of GST Simulation Software

Benefits of Using GST Simulation Software

Types of GST Simulation Software

Common Applications of GST Simulation Software

How to Implement GST Simulation Software in Your Business

Tips for Choosing the Right GST Simulation Software

Top GST Simulation Software in the Market

Potential Challenges with GST Simulation Software

Conclusion

1. What is GST Simulation Software?

GST Simulation Software is a digital tool designed to automate and simplify GST-related tasks. It helps businesses calculate and simulate their GST obligations based on the current GST rates, laws, and regulations. By using this software, companies can predict their GST liabilities, prepare for tax filings, and avoid costly errors in tax reporting.

This software is particularly useful for businesses operating in multiple tax jurisdictions, as it incorporates region-specific rules and automates compliance, reducing the risk of human error. Essentially, GST Simulation Software ensures that businesses adhere to tax laws while simplifying the process of managing their tax obligations.

2. How Does GST Simulation Software Work?

GST Simulation Software uses real-time data and rule-based algorithms to calculate and simulate GST. The software typically integrates with a company’s accounting or ERP system, enabling it to access financial data directly. Based on this information, it applies GST rates to different transactions, depending on the nature of goods and services, jurisdiction, and applicable exemptions.

Many GST Simulation Software platforms are powered by machine learning and artificial intelligence, which allow them to stay up-to-date with changing tax regulations and predict GST amounts accurately. By running various simulations, businesses can get insights into their potential tax liabilities and prepare accordingly.

3. Key Features of GST Simulation Software

While the features of GST Simulation Software can vary, here are some common ones that help businesses manage their GST obligations efficiently:

Automated Calculations: Calculates GST based on applicable tax rates, making it easier to handle complex transactions.

Multi-Jurisdiction Compliance: Supports multiple regions and jurisdictions, ensuring the right rates and rules are applied for each location.

Real-Time Reporting: Provides up-to-date reports on tax liabilities, helping companies stay compliant and informed.

Data Integration: Integrates with accounting and ERP systems for seamless data transfer and accurate calculations.

Customizable Dashboards: Allows users to customize reports and dashboards to view important metrics at a glance.

Error Detection: Identifies discrepancies and errors in tax calculations to reduce risk and ensure accuracy.

User-Friendly Interface: Many tools offer easy-to-navigate interfaces that make it simple for users of all experience levels.

4. Benefits of Using GST Simulation Software

Using GST Simulation Software offers several benefits, including:

a) Enhanced Compliance

With automated updates to tax laws and regulations, businesses can stay compliant without constantly monitoring changes manually. This reduces the risk of non-compliance, which can lead to penalties.

b) Time Efficiency

Manual GST calculations are time-consuming, especially for large businesses with extensive transactions. GST Simulation Software automates these tasks, saving valuable time for finance teams.

c) Accuracy and Reduced Errors

By using rule-based calculations, the software ensures accuracy in GST simulation, minimizing the chance of human error in tax calculations.

d) Cost Savings

Automating GST management with software reduces the need for dedicated tax specialists and minimizes potential fines, leading to significant cost savings.

e) Data-Driven Insights

Many GST Simulation Software tools come with analytics capabilities, providing insights into GST trends and helping companies make data-driven decisions.

5. Types of GST Simulation Software

There are several types of GST Simulation Software tailored to different business needs:

a) Cloud-Based GST Software

This type of software is hosted on the cloud, offering easy access from any device and reducing the need for on-premise infrastructure. It’s suitable for businesses that require flexibility and scalability.

b) On-Premise GST Software

On-premise GST Simulation Software is installed on a company’s local servers, giving them complete control over their data. It’s a better fit for businesses with specific security or customization requirements.

c) Hybrid GST Software

Hybrid software combines elements of both cloud and on-premise solutions, giving companies the flexibility to manage certain operations in-house while using cloud capabilities for other tasks.

d) Industry-Specific GST Software

Some software solutions are designed for specific industries with unique GST requirements, such as manufacturing, retail, or healthcare. These solutions are tailored to meet the distinct needs of these industries.

6. Common Applications of GST Simulation Software

GST Simulation Software is versatile and can be used in various applications:

Tax Calculation: Calculate GST on individual transactions based on product type, jurisdiction, and other factors.

GST Return Preparation: Generate reports required for GST returns, simplifying the filing process.

Audit Support: Generate detailed reports and maintain records for audits.

Financial Forecasting: Predict future tax liabilities based on simulated scenarios and projected financial performance.

Scenario Analysis: Run simulations to understand how changes in tax laws or rates might impact your business.

7. How to Implement GST Simulation Software in Your Business

Implementing GST Simulation Software involves several steps:

Identify Your Business Needs: Determine the specific needs of your business and the type of software that best fits those needs.

Evaluate Software Options: Research different software providers, looking at features, compatibility, and cost.

Plan for Integration: Ensure the software integrates seamlessly with your existing systems, such as your ERP or accounting software.

Training and Onboarding: Train your staff on how to use the software effectively.

Monitor and Optimize: Regularly assess the software’s performance and make adjustments as needed to maximize efficiency.

8. Tips for Choosing the Right GST Simulation Software

Choosing the right GST Simulation Software can be overwhelming with so many options on the market. Here are a few tips:

Understand Your Budget: Choose software that fits within your budget but still provides the features you need.

Look for Scalability: Select software that can grow with your business, especially if you plan on expanding operations.

Check for Customer Support: Look for providers that offer comprehensive customer support to help with setup, troubleshooting, and maintenance.

Consider Security Features: Ensure the software has robust security features, particularly if handling sensitive financial data.

Evaluate Usability: Opt for software that is user-friendly and provides an intuitive interface for your team.

9. Top GST Simulation Software in the Market

Here’s a look at some of the top GST Simulation Software currently available:

Zoho Books: Known for its user-friendly interface and strong integration capabilities, Zoho Books is ideal for small to medium-sized businesses.

Tally ERP 9: Popular in various regions, especially India, Tally ERP 9 offers robust GST capabilities and a comprehensive set of features for accounting and compliance.

QuickBooks: This software provides excellent GST simulation features, along with a range of accounting tools for small businesses.

SAP GST Solutions: SAP provides a high-level GST simulation solution suitable for large corporations needing extensive customization.

10. Potential Challenges with GST Simulation Software

While GST Simulation Software offers many benefits, there are potential challenges to be aware of:

Initial Setup Costs: Some software may require a significant upfront investment, particularly for on-premise solutions.

Training Requirements: Employees may need time and training to learn the new software, which could temporarily impact productivity.

Data Security: Cloud-based solutions need to ensure data protection to prevent unauthorized access or breaches.

Continuous Updates: GST regulations change frequently, and if the software is not updated promptly, it could lead to inaccuracies in calculations.

GST Simulation Software is an essential tool for businesses navigating the complexities of Goods and Services Tax. By automating tax calculations, providing real-time reporting, and ensuring compliance, it empowers organizations to manage their GST obligations with greater accuracy and efficiency. While the initial investment and training requirements can be challenging, the long-term benefits in terms of time, cost savings, and data accuracy make it a worthwhile consideration for any business subject to GST regulations. When selecting GST Simulation Software, businesses should carefully assess their specific needs, budget, and desired features to choose a solution that supports their tax management goals effectively.

For More Details Visit us

StudyAccounts.com

#GST simulation software#GST filing simulation software#GST simulation software for institutes#ITR simulation software#Income tax simulation software#Gulf VAT simulation software#TDS Simulation Software#TAX Simulation Software for institutes

0 notes

Text

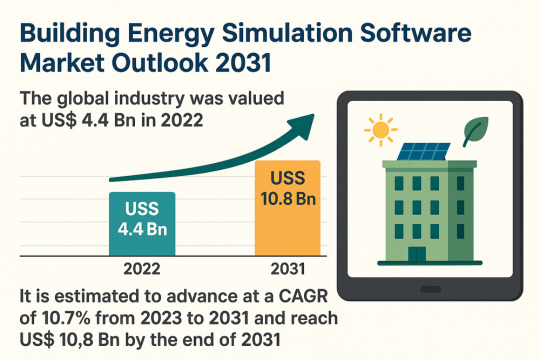

Sustainable Design Powers Building Energy Simulation Software Market Boom

The global building energy simulation software market is poised for significant growth, expanding from US$ 4.4 billion in 2022 to an estimated US$ 10.8 billion by 2031, at an impressive CAGR of 10.7%. This growth trajectory reflects the increasing demand for energy-efficient and sustainable building solutions driven by stricter environmental regulations, integration of smart technologies, and the adoption of AI and ML in building simulation tools.

Market Overview

Building energy simulation software enables stakeholders including architects, engineers, and energy consultants to model, simulate, and optimize the energy performance of buildings. These tools help reduce carbon emissions, lower operating costs, and ensure compliance with stringent energy codes and standards. They also support performance analysis for HVAC systems, lighting, plug loads, and water usage in residential, commercial, and institutional buildings.

The industry is experiencing strong momentum with the growing emphasis on green building certifications, retrofitting of existing infrastructure, and the integration of Internet of Things (IoT) technologies into construction and facilities management processes.

Market Drivers & Trends

The growth of the building energy simulation software market is primarily driven by:

Government regulations aimed at reducing building emissions

Increased adoption of smart building technologies and IoT

Rising demand for energy-efficient retrofitting of older structures

Technological advancements enabling real-time modeling and faster simulations

Financial incentives and tax benefits for energy-efficient construction

The increasing urgency to comply with frameworks such as the EU’s Energy Performance of Buildings Directive (EPBD), New York City’s Local Law 97 (LL97), and other national standards like Germany’s Buildings Energy Act and the Dubai Green Building Regulations, continues to create substantial demand for these tools.

Latest Market Trends

One of the most notable trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into simulation software. These technologies improve modeling accuracy, reduce simulation time, and provide advanced predictive analytics. AI algorithms can automatically generate energy models based on design inputs, simulate future energy demand, and suggest optimal solutions for minimizing consumption and enhancing occupant comfort.

Another key trend is the availability of cloud-based platforms that enable collaboration and access to real-time simulation data, making energy modeling more accessible and scalable for small- to mid-sized firms.

Key Players and Industry Leaders

Major players in the global market include:

Autodesk, Inc.

4M S.A.

Integrated Environmental Solutions Ltd (IES)

DesignBuilder Software Ltd

Trimble Inc.

EQUA Simulation AB

Trane Technologies plc

StruSoft AB

BuildSimHub, Inc.

Environmental Design Solutions Ltd

Maalka Inc.

BRE Group

These companies are heavily investing in R&D to improve simulation speed, user interfaces, and integration with Building Information Modeling (BIM) tools, thus enhancing market competitiveness.

Access important conclusions and data points from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77350

Recent Developments

Autodesk Inc., in November 2022, launched rapid operational energy analysis tools in Autodesk Spacemaker, allowing real-time visual feedback during early design phases—enabling energy-efficient decisions from the outset.

In February 2023, Glodon Company Limited, via its subsidiary MagiCAD Group, acquired a majority stake in EQUA Simulation AB. This strategic acquisition is expected to accelerate simulation technology development and expand global market reach.

These developments reflect the industry’s move toward comprehensive, real-time, and AI-integrated platforms.

Market Opportunities

Several untapped opportunities lie ahead for market players:

Emerging markets in Asia Pacific, the Middle East, and South America are expected to experience robust demand for simulation tools amid urbanization and green building initiatives.

AI-enabled automation can open new possibilities in design optimization and energy forecasting.

Partnerships with government bodies and educational institutions may drive innovation and training in simulation technologies.

Smart city projects and rising interest in Net-Zero Energy Buildings (NZEBs) present a fertile ground for software deployment.

Future Outlook

The future of the building energy simulation software market looks promising, with robust growth expected across all regions. The emphasis on data-driven architecture, zero-emission goals, and sustainable urban development will continue to influence market dynamics.

With continued advances in ML algorithms, simulation engines, and 3D visualization capabilities, energy simulation tools will become indispensable for building design, renovation, and facility management. Furthermore, integration with digital twins and BIM platforms will enhance their strategic role in urban planning and smart infrastructure development.

Market Segmentation

By Component:

Software / Platform

Services

Professional

Consulting & Integration

Support & Maintenance

Managed

By Deployment:

Cloud

On-premise

By End-user:

Residential

Commercial

Others

By Region:

North America

Europe

Asia Pacific

Middle East & Africa

South America

Regional Insights

North America leads the market due to a well-established ecosystem of universities, research labs (like NREL), and government-funded sustainability programs. The U.S., in particular, is witnessing widespread adoption of simulation software driven by regulations such as LL97 in New York.

Europe remains at the forefront of green construction regulations and energy performance mandates, making it a lucrative market for simulation software providers.

Asia Pacific is expected to record the fastest CAGR during the forecast period. Rapid urbanization, combined with rising environmental consciousness and increasing investments in green buildings across China, India, and Southeast Asia, is fueling demand in the region.

Why Buy This Report?

This comprehensive report offers:

In-depth analysis of market trends, drivers, and opportunities

Detailed segmentation and regional analysis

Competitive landscape with profiles of major players

Insights into government regulations and their impact on market dynamics

Forecasts up to 2031 with historic data and growth projections

Updates on key market developments and strategic movements

AI and ML integration trends reshaping the simulation software ecosystem

Whether you are a software developer, a building consultant, a policymaker, or an investor, this report offers invaluable insights into the future of energy-efficient construction technologies.

Explore Latest Research Reports by Transparency Market Research: Data Center Rack Market: https://www.transparencymarketresearch.com/data-center-rack-market.html

Virtual Reality in Gaming Market: https://www.transparencymarketresearch.com/virtual-reality-gaming-market.html

Retail Analytics Market: https://www.transparencymarketresearch.com/retail-analytics-market.html

3D Reconstruction Technology Market: https://www.transparencymarketresearch.com/3d-reconstruction-technology-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Why Choose a Tally Training Institute in Pitampura

In the world of finance, efficiency is key. Tally, a powerful accounting software, has become a staple for businesses worldwide. If you're looking to enhance your accounting skills, a Tally training institute in Pitampura is the perfect place to start your journey.

Why Tally?

Tally simplifies complex accounting tasks, making it accessible for everyone—from small business owners to finance professionals. Its features include:

User-Friendly Interface: Easy navigation helps you focus on learning rather than struggling with software.

Comprehensive Reporting: Generate detailed financial reports to gain insights into your business.

GST Compliance: Stay updated with tax regulations effortlessly.

Benefits of Tally Training

Enrolling in a Tally training institute in Pitampura offers numerous advantages:

Expert Instructors: Learn from experienced professionals who provide real-world insights.

Hands-On Practice: Gain practical experience through live projects and simulations, ensuring a deep understanding of Tally.

Networking Opportunities: Connect with like-minded individuals and industry experts, opening doors for future collaborations.

Course Highlights

A typical Tally course at a training institute includes:

Introduction to Tally: Understanding the basics and software installation.

Setting Up Companies: Learn to create and manage multiple business profiles.

Transaction Management: Record sales, purchases, and expenses seamlessly.

Financial Reporting: Master the art of generating and analyzing reports.

Why Choose a Local Institute?

Opting for a Tally training institute in Pitampura means you have the advantage of localized support and tailored courses that cater to the needs of the local business environment. Plus, it’s convenient!

Conclusion

Investing in Tally training is a smart move for anyone looking to excel in finance and accounting. With the right skills, DICS Innovatives you can enhance your career prospects and become a valuable asset to any organization.

Ready to dive into the world of Tally? Enroll at a Tally training institute in Pitampura today and take the first step toward financial mastery!`

0 notes

Text

Everything You Need to Know About Becoming a Certified Industrial Accountant

In an ever-evolving business world, accounting professionals are expected to do more than just maintain books. Companies today are on the lookout for financial experts who can not only manage numbers but also contribute to strategic decision-making, cost control, and operational efficiency. This is where a Certified Industrial Accountant (CIA) stands out.

The CIA certification equips individuals with specialized knowledge in industrial finance, making them highly valuable across sectors like manufacturing, logistics, retail, and supply chain. Whether you're a student, a graduate, or a working professional, this course can provide a competitive edge in today’s dynamic job market.

Why Pursue Industrial Accounting?

Industrial accounting focuses on the financial processes specific to industrial environments, such as product costing, inventory valuation, and process efficiency. Unlike general accounting roles, which center around financial statements and audits, industrial accountants delve deep into operational finance.

Some key benefits of pursuing this career path include:

Higher Demand: Companies with production lines or logistics operations need skilled accountants who understand industry-specific financial nuances.

Diverse Career Options: From costing and MIS reporting to tax planning and compliance, the field offers varied opportunities.

Career Advancement: Many industrial accountants progress to managerial or strategic roles over time.

Ideal Candidates for the Course

This course is best suited for:

Commerce or finance graduates seeking industry-focused careers

Working professionals aiming to specialize in cost and industrial accounting

Entrepreneurs and business owners looking to strengthen financial control

Accountants who want to shift from general accounting to a more analytical, decision-support role

Even final-year students can enroll in many programs, allowing them to hit the ground running post-graduation.

What Does the Course Cover?

The course curriculum is comprehensive and hands-on. Key modules typically include:

Industrial Costing & Budgeting: Learn to manage and forecast costs in a production or manufacturing setup.

Accounting Software Training: Get trained in tools like Tally ERP, SAP, or other industry-standard software.

Taxation & Compliance: Gain knowledge of direct and indirect taxes relevant to industrial sectors.

MIS and Financial Reporting: Learn how to develop reports that support business decisions.

Internal Controls and Auditing: Understand how to safeguard assets and ensure compliance with procedures.

These topics are taught through a mix of lectures, case studies, projects, and software simulations.

Certified Industrial Accountant Course Duration

The certified industrial accountant course duration generally ranges from 6 months to 1 year, depending on the institute and the mode of delivery (full-time, part-time, or online). Fast-track options are also available for experienced professionals or students looking to complete the course quickly.

Some institutions offer modular formats that allow learners to progress at their own pace, which is ideal for those balancing work and study.

Post-Certification Career Opportunities

Once certified, you’ll be eligible for roles in both domestic and international companies. Some potential job titles include:

Cost Accountant

Industrial Auditor

Budget & Planning Analyst

Inventory Controller

ERP Consultant (Finance Module)

Finance Executive in Manufacturing

Sectors that frequently hire certified industrial accountants include:

Manufacturing & Engineering

FMCG

Construction & Infrastructure

Logistics & Supply Chain

Textile & Apparel

Automobile & Ancillaries

Salary Expectations

Entry-level industrial accountants can expect to earn between ₹2.5 to ₹4.5 LPA in India. With 3–5 years of experience and added expertise in ERP or automation tools, professionals can command salaries of ₹6–10 LPA or more.

In international markets, certified professionals with industrial experience are often in high demand, particularly in countries with large manufacturing bases.

Final Thoughts

A career in industrial accounting is not only financially rewarding but also intellectually fulfilling. By bridging the gap between operations and finance, Certified Industrial Accountants help businesses streamline their processes and improve profitability. If you’re someone who enjoys working with numbers, systems, and strategy, this course is well worth your time.

Whether you're just starting out or looking to upskill, consider enrolling in a certified industrial accountant program to take your accounting career to the next level.

0 notes

Text

Career in e-Accounting? Here’s Why Busy Software Should Be Your Next Step

Introduction

In today’s fast-evolving business landscape, the need for skilled professionals in e-Accounting is higher than ever. From managing complex financial records to filing GST returns, companies are increasingly looking for candidates who are well-versed in accounting software. While Tally remains a popular name in the accounting world, Busy Accounting Software is rapidly gaining recognition for its user-friendly interface and advanced features—especially when it comes to GST, inventory, and multi-location business management.

If you're planning to build a career in e-Accounting, mastering Busy Software can give you a competitive edge.

What is Busy Accounting Software?

Busy Software is a powerful business accounting tool tailored for small to medium-sized enterprises (SMEs). Unlike basic accounting tools, Busy integrates accounting, inventory, billing, taxation, and payroll into one comprehensive platform. It's especially effective for businesses that require detailed financial analysis and real-time reporting.

Busy is an excellent next step after learning tools like Tally ERP 9 or Tally Prime, which are taught in top-rated institutions offering Tally classes in Yamuna Vihar and Tally classes in Uttam Nagar.

Why Busy Software is Ideal for e-Accounting Professionals

1. Integrated GST Functionality

Busy offers a fully integrated GST accounting solution, making it easier to manage GST billing, filing, and returns. It automatically prepares GSTR-1, GSTR-2, and GSTR-3B forms and stays up-to-date with the latest compliance rules. If you’re already enrolled in a GST certification course in Delhi, complementing your learning with Busy will enhance your practical skill set.

Students interested in the GST Coaching Centre in Yamuna Vihar or the GST Training Institute in Uttam Nagar should consider pairing their training with Busy Software knowledge.

2. Multi-Company and Multi-Branch Handling

One of Busy’s strengths lies in its ability to handle multiple companies and branches—perfect for accountants working in corporate setups. It also includes features like role-based access, real-time data sync, and advanced reporting, making it a go-to tool for professionals managing large data sets.

Boost Your Career with Busy: The e-Accounting Advantage

Most e-Accounting courses in Yamuna Vihar and e-Accounting training in Uttam Nagar focus on industry-standard software. Adding Busy to your learning path after completing a Tally course in Yamuna Vihar or Tally course in Uttam Nagar makes you industry-ready and more employable.

If you’ve already completed your e-taxation training in Delhi or taken up an e-filing course in Yamuna Vihar, learning Busy will help you execute those skills with better efficiency.

Learning Path for Students: From Tally to Busy

Here’s a suggested learning roadmap for students looking to make a career in financial e-Accounting:

Start with Basics: Enroll in a Tally Prime Course in Yamuna Vihar or Tally Prime Course in Uttam Nagar.

Understand Taxation: Take up an e-taxation course in Uttam Nagar or GST return course in Delhi to grasp practical tax knowledge.

Advance to Busy Software: Specialize in Busy for integrated e-accounting, GST filing, inventory, and payroll.

You can also download free Tally study material, Tally ERP 9 eBooks, and explore Tally ERP 9 video tutorials to reinforce your foundation before transitioning to Busy.

Why Busy Software Makes You Job-Ready

Today, companies are hiring candidates who are trained in practical accounting environments. Busy allows students to simulate real business scenarios, which are also taught during payroll courses in Yamuna Vihar or tax filing courses in Uttam Nagar.

Whether you’re enrolled in a Tally Training Institute in Yamuna Vihar or a GST Training Institute in Uttam Nagar, learning Busy makes you a multi-software expert, which is a valuable asset in today’s job market.

Final Thoughts

The future of e-Accounting is digital, and mastering Busy Accounting Software is a smart move for any student or working professional. From GST compliance to inventory management, Busy offers the tools that modern accountants need.

If you’re serious about building a strong career in finance, don’t stop at just a Tally institute in Yamuna Vihar or a GST course in Uttam Nagar. Go a step further and invest in learning Busy—because that’s where the future of financial e-accounting lies.

Suggested Links:

Tally Prime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#tally master#tally prime#e-accounting#financial education#skills development#accounts#busy software#GST#e-filing

0 notes

Text

How Are Personalized Investment Strategies Created?

Financial goals are as unique as fingerprints. Some dream of early retirement on a seaside; others focus on funding their kid's education, even as many simply are looking for financial safety via market volatility. The path to these dreams is not one-size-fits-all; that's why portfolio management firms have revolutionized how buyers method wealth building.

Understanding Your Financial DNA

Before any funding selections show up, investment portfolio management companies start with a comprehensive evaluation of every consumer's unique scenario. This discovery section is going far beyond fundamental questionnaires.

Portfolio management services dive deep into elements like risk tolerance, time horizons, tax conditions, and current monetary commitments. This holistic photo bureaucracy is the inspiration upon which personalized funding techniques are built.

The Science Behind Strategy Development

With purchaser profiles mounted, investment portfolio management enters its strategic section. Here, portfolio management services apply sophisticated modeling techniques to craft allocation techniques aligned with customer targets.

Modern portfolio management companies utilize superior technology to simulate thousands of capacity market eventualities, stress-testing portfolios against various economic situations. These quantitative processes might also include:

Modern Portfolio Theory programs

Monte Carlo simulations

Factor-primarily based investment modeling

Dynamic asset allocation frameworks

The resulting techniques balance potential returns in opposition to desirable risk tiers, developing a roadmap particular to every investor's wishes and desires.

Beyond the Numbers: The Human Element

While algorithms and information force many choices in investment portfolio management, the human detail remains irreplaceable. Seasoned portfolio managers apprehend market psychology and behavioral finance traps that simple quantitative techniques may miss.

This human insight lets portfolio control companies assume how clients might react all through market downturns and build strategies with mental sustainability in mind.

Customization Across Asset Classes

Personalization extends some distance past basic inventory-and-bond allocations. Today's sophisticated investment portfolio management tactics comprise numerous asset lessons tailor-made to precise purchaser wishes:

Alternative Investments

For clients in search of uncorrelated returns, portfolio management firms might comprise non-public fairness, hedge funds, or even project capital allocations.

ESG and Values-Based Investing

When personal values pressure funding decisions, portfolio managers can construct techniques reflecting unique environmental, social, and governance priorities while retaining overall performance targets.

Income-Focused Approaches

Retirees and profit seekers benefit from specialized dividend strategies, bond ladders, and alternative earnings assets calibrated to their particular coin drift desires.

Continuous Refinement and Adaptation

Perhaps the most precious component of running with portfolio control corporations is the continued refinement process. What begins as a carefully crafted method evolves through:

Regular overall performance evaluations in opposition to mounted benchmarks

Tactical adjustments responding to converting market conditions

Tax-loss harvesting and performance optimizations

The Technology-Human Partnership

The most effective portfolio management corporations leverage AI not to update human judgment, however, to beautify it. Advanced portfolio management software lets in for:

Real-time performance tracking

Tax-impact evaluation before trading decisions

Comprehensive chance tests throughout complete portfolios

Detailed reporting that transforms complicated records into actionable insights

This era democratizes state-of-the-art investment portfolio management, making institutional high-quality techniques accessible to a broader range of traders.

Finding the Right Financial Partner

The dating between traders and portfolio control corporations often spans decades. This partnership calls for mutual consideration, transparent verbal exchange, and aligned expectations.

When in search of portfolio management services, traders need to prioritize corporations with:

Clear fee systems without hidden prices

Investment philosophies aligned with private values

Communication patterns that resonate on both analytical and emotional degrees

The Future of Personalized Investing

As financial markets grow increasingly complicated, the price of personalized funding techniques continues to rise. Portfolio management firms stand at the intersection of state-of-the-art financial ideas and deeply personal client wishes.

For investors navigating complicated economic landscapes, expert investment portfolio control offers not only monetary optimization but also peace of mind—perhaps the most precious asset of all.

#personalized investments#investment strategies#financial goals#risk tolerance#market insights#custom investments#portfolio management#wealth planning#investment advice#risk management#financial advisor#asset allocation#investment plan#financial planning#personalized finance#long-term investments#diversified portfolio#investment options#retirement planning#tailored strategies.

0 notes

Text

The Importance of Financial Planning & Analysis: Finding the Right Local CPA for Small Business

Small businesses in Cleveland, financial stability and strategic growth depend on solid financial planning and analysis. Whether you’re launching a startup or running an established company, a skilled Certified Public Accountant (CPA) can make all the difference. Local CPAs offer tailored financial strategies to ensure your business remains profitable and compliant with regulations. This article explores the importance of financial planning and analysis and how to find the best local CPA for small business owners.

Understanding Financial Planning & Analysis (FP&A)

What is Financial Planning & Analysis?

Financial Planning & Analysis (FP&A) is a crucial component of business success. It involves budgeting, forecasting, and evaluating financial performance to ensure long-term sustainability. FP&A professionals analyze financial data, identify trends, and provide insights that help businesses make informed decisions.

Why is FP&A Important for Small Businesses?

Many small business owners focus on daily operations but often overlook financial forecasting. Effective FP&A ensures:

Better Cash Flow Management — Helps monitor revenue and expenses to maintain liquidity.

Informed Decision-Making — Provides insights on where to allocate resources for maximum growth.

Risk Mitigation — Identifies potential financial pitfalls before they become major issues.

Improved Profitability — Helps businesses optimize pricing, reduce costs, and enhance overall performance.

Key Components of FP&A

Budgeting & Forecasting — Creating financial plans based on historical data and market trends.

Variance Analysis — Comparing projected results with actual performance to identify gaps.

Financial Modeling — Simulating different business scenarios to anticipate future performance.

Key Performance Indicators (KPIs) — Measuring financial health using metrics like revenue growth, profit margins, and return on investment.

The Role of a Local CPA for Small Business Owners

A local CPA is more than just a tax preparer; they serve as a financial advisor, ensuring small businesses achieve long-term success. Here’s why working with a local CPA is beneficial:

Expertise in Local Regulations and Compliance

Cleveland CPAs are well-versed in Ohio tax laws and business regulations. They ensure your business remains compliant with state and federal requirements, avoiding costly penalties.

Personalized Financial Strategies

A local CPA understands the specific challenges of running a small business in your area. They provide customized financial advice that aligns with your industry and business goals.

Tax Planning and Optimization

Small businesses need to maximize deductions and credits to minimize tax liabilities. A CPA helps develop tax-saving strategies and ensures accurate filings, reducing the risk of audits.

Business Growth and Financial Advisory

Beyond taxes, CPAs offer strategic guidance on:

Business expansion plans

Investment decisions

Cost-cutting measures

Cash flow optimization

Accounting and Bookkeeping Support

Managing finances can be overwhelming for small business owners. A CPA provides bookkeeping support, ensuring accurate record-keeping and financial reporting.

How to Choose the Right CPA for Your Small Business

Finding the right CPA is essential for long-term financial success. Here are key factors to consider:

1. Experience and Specialization

Look for a CPA with experience in working with small businesses. Some CPAs specialize in specific industries, offering tailored expertise.

2. Credentials and Licensing

Ensure the CPA is certified and licensed in Ohio. Check their professional affiliations with organizations like the American Institute of CPAs (AICPA) and the Ohio Society of CPAs.

3. Technology and Software Proficiency

Modern CPAs use accounting software like QuickBooks, Xero, or Sage. Ensure they are proficient in digital tools that streamline financial management.

4. Reputation and Reviews

Read online reviews and ask for client references. A reputable CPA should have positive testimonials from satisfied small business owners.

5. Accessibility and Communication

Choose a CPA who is responsive and available for consultations. Clear communication is crucial for financial planning and decision-making.

6. Pricing and Fee Structure

CPAs charge differently based on services provided. Some work on an hourly basis, while others offer fixed-rate packages. Understand the pricing model before committing.

The Impact of a CPA on Small Business Success

Hiring a local CPA can transform your business by providing expert financial guidance. Here’s how they contribute to business success:

Enhanced Profitability — Helps identify cost-saving opportunities and revenue growth strategies.

Time-Saving — Allows business owners to focus on operations while CPAs handle financial management.

Reduced Financial Stress — Ensures compliance, accurate tax filings, and financial stability.

Better Decision-Making — Provides data-driven insights for informed business strategies.

Conclusion

For small business owners in Cleveland, financial planning and analysis are critical to long-term success. Partnering with a knowledgeable local CPA ensures your business remains financially stable and compliant. From tax planning to strategic financial advice, a CPA plays a crucial role in helping small businesses thrive. Take the time to find the right CPA who aligns with your business needs and watch your company grow with confidence.

0 notes

Text

How AI and Machine Learning are Transforming Credit Risk Management Software

Introduction

The rapid advancements in artificial intelligence (AI) and machine learning (ML) are revolutionizing industries worldwide, and credit risk management is no exception. Financial institutions and businesses are leveraging AI-driven Credit Risk Management Software (CRMS) to enhance risk assessment, automate decision-making, and improve predictive analytics. This article explores how AI and ML are transforming CRMS and reshaping the way credit risk is managed.

The Role of AI and Machine Learning in Credit Risk Management

AI and ML enhance credit risk management software by improving accuracy, efficiency, and adaptability. Traditional credit risk models often rely on historical data and predefined rules, limiting their ability to adapt to changing market conditions. AI-driven CRMS, however, uses real-time data, sophisticated algorithms, and automation to provide more precise and dynamic risk assessments.

1. Enhanced Credit Scoring and Risk Assessment

Traditional credit scoring models depend on fixed parameters such as credit history, income levels, and debt-to-income ratios. AI and ML introduce more advanced credit scoring techniques by analyzing vast amounts of structured and unstructured data.

Alternative Data Sources: AI integrates alternative data such as online transactions, social media behavior, and digital payment histories to assess creditworthiness more comprehensively.

Pattern Recognition: ML algorithms identify trends and anomalies that traditional models might overlook, improving credit risk predictions.

Real-Time Risk Assessment: AI continuously updates risk profiles based on changing financial behaviors, ensuring more accurate evaluations.

2. Predictive Analytics and Risk Forecasting

AI-powered predictive analytics enable businesses to foresee potential credit risks before they escalate.

Early Warning Systems: AI detects warning signs of financial distress by analyzing patterns in payment behavior, economic trends, and market fluctuations.

Scenario Analysis and Stress Testing: Machine learning models simulate different economic conditions and predict their impact on credit portfolios.

Customized Risk Models: AI tailors risk assessment models to specific industries, borrower types, and market conditions, allowing for personalized risk strategies.

3. Fraud Detection and Anomaly Identification

AI enhances fraud detection capabilities in CRMS by identifying suspicious patterns and anomalies in credit applications and transactions.

Real-Time Fraud Prevention: AI-driven CRMS flags unusual activities, such as rapid credit applications or inconsistencies in financial records.

Behavioral Analysis: ML algorithms compare borrower behavior against historical data to detect fraudulent patterns.

Automated Decision-Making: AI automates approval or rejection processes, reducing human error and potential biases in credit evaluations.

4. Automation and Efficiency Gains

AI and ML streamline credit risk management processes, reducing manual workloads and increasing operational efficiency.

Automated Loan Approvals: AI processes credit applications faster by analyzing multiple risk factors simultaneously.

Intelligent Document Processing: ML-powered CRMS extracts key information from financial statements, tax returns, and contracts to automate underwriting.

Reduction in Human Bias: AI-based decision-making ensures fairness by eliminating subjective biases in credit assessments.

5. Regulatory Compliance and Risk Mitigation

AI assists financial institutions in adhering to regulatory requirements by automating compliance checks and generating reports.

Regulatory Reporting Automation: AI simplifies the preparation of compliance documents and audits.

Real-Time Risk Monitoring: ML continuously evaluates compliance risks and alerts institutions to potential regulatory violations.

Data Privacy and Security: AI-driven CRMS ensures secure handling of sensitive financial information.

6. Adaptive Learning and Continuous Improvement

Unlike traditional models, AI-driven CRMS continuously learns and evolves to improve accuracy and efficiency.

Self-Learning Algorithms: ML models refine risk assessment methodologies over time.

Market Adaptability: AI adapts to economic shifts and emerging risks, making credit risk management more resilient.

Customizable AI Models: Financial institutions can fine-tune AI models to align with their risk appetite and business strategies.

Conclusion

AI and machine learning are transforming Credit Risk Management Software by improving credit scoring, enhancing predictive analytics, detecting fraud, automating processes, ensuring regulatory compliance, and enabling continuous learning. As AI-driven CRMS continues to evolve, financial institutions and businesses will benefit from more precise, efficient, and adaptive credit risk management strategies. Embracing AI and ML in credit risk assessment is no longer optional but essential for staying competitive in today’s rapidly changing financial landscape.

1 note

·

View note

Text

Choosing the Best Software for Practical Tax Learning vs. Tally for Teaching

In today’s rapidly evolving educational landscape, finding the right tools to teach complex topics like taxation is critical. Whether you’re an instructor, a student, or an institution aiming to provide top-notch training, choosing between software specifically designed for practical tax learning or traditional tools like Tally can be challenging. Let’s break it down and explore what works best for different needs.

Why Practical Tax Learning Matters

Taxes are a crucial part of any business, and understanding how they work in real-life scenarios is invaluable. Practical tax learning bridges the gap between theoretical knowledge and real-world applications. Instead of just memorizing tax rules, students gain hands-on experience in handling GST, TDS, and other tax-related processes.

The Limitations of Tally for Teaching

Tally is widely recognized as a robust accounting software used by businesses across industries. While it includes tax features, its primary focus is accounting and inventory management. Here’s why Tally might fall short of teaching practical tax concepts:

Complex Interface: For beginners, Tally’s interface can be overwhelming, making it less suitable for step-by-step learning.

Limited Tax Simulations: Tally lacks dedicated features for simulating various tax scenarios, such as filing GST returns or calculating TDS practically.

Focus on Professionals: Tally is designed for business operations rather than educational purposes, which may leave students struggling to connect theory with application.

Why Choose Specialized Tax Practically learning software

Modern tax learning software is tailored to bridge the gap between education and practical application. Here’s what makes it an excellent choice:

User-Friendly Design: These platforms are built with students in mind, offering intuitive interfaces that simplify complex tax concepts.

Comprehensive Simulations: They provide tools to simulate filing GST, TDS, and other tax forms, enabling students to gain practical experience.

Real-Time Scenarios: Specialized software often includes real-world examples, helping learners understand the practical implications of tax rules.

Assessment Tools: Features like quizzes and progress tracking allow educators to evaluate student performance effectively.

Earning Opportunities: Institutes using such software can not only teach effectively but also generate revenue by offering high-quality courses.

Which One Should You Choose?

If your goal is to equip students with practical skills and prepare them for the real-world tax environment, specialized tax learning software is undoubtedly the better option. It offers a comprehensive learning experience that goes beyond theoretical knowledge.

On the other hand, if you are training students to work in businesses where Tally is widely used, integrating Tally into your teaching curriculum can be beneficial. It’s all about understanding the learning objectives and the specific needs of your students or organization.

Final Thoughts

Both Tally and specialized tax learning software have their strengths, but when it comes to practical tax education, purpose-built solutions offer a more targeted and impactful learning experience. By choosing the right tool, you can ensure that students not only understand tax concepts but are also ready to apply them confidently in the real world.

Make an informed choice and empower your learners to excel in their tax education journey!

#billing software#best tax learning app#tax solutions#tax services#software#erp#erp software#best gst billing software#tax software

0 notes

Text

Best Online Income Tax Course with Certification

Introduction

Income tax is a cornerstone of any nation's economic system. Professionals who understand tax laws, compliance requirements, and filing procedures are in high demand. An income tax course equips individuals with the skills and knowledge required to handle taxation tasks effectively.

What is an Income Tax Course?

An income tax course provides comprehensive training on tax laws, filing procedures, and compliance regulations. These courses are tailored for accountants, finance professionals, and business owners seeking to master tax-related concepts.

This course ensures learners gain practical experience along with theoretical knowledge. It covers everything from basic definitions to advanced tax planning strategies.

Importance of Income Tax Courses

Understanding income tax is not just crucial for accountants but also for individuals managing personal finances. The key reasons to pursue an income tax course include:

Professional Growth: Enhance your career prospects with advanced knowledge.

Compliance Mastery: Stay updated on tax laws and regulations.

Better Financial Planning: Help clients or businesses save taxes legally.

Key Features of Income Tax Courses

Income tax courses come with unique features designed to deliver a complete learning experience:

Updated Curriculum: Focused on current laws and regulations.

Expert Faculty: Industry professionals lead the courses.

Practical Training: Hands-on experience with tax filing software.

Certifications: Earn credentials recognized across industries.

Types of Income Tax Courses

Basic Income Tax Courses

These are entry-level courses suitable for beginners. They cover fundamental concepts like tax slabs, exemptions, and deductions.

Advanced Income Tax Courses

Designed for professionals, these courses delve into complex topics like international taxation, audits, and litigation.

Specialized Income Tax Courses

These focus on niche areas, such as GST integration, corporate tax planning, or digital tax filing.

Curriculum of an Income Tax Course

Core Subjects

Income Tax Laws: Definitions, exemptions, and penalties.

Tax Compliance: Filing returns and documentation.

Tax Planning: Strategies for legal tax savings.

Practical Training Modules

Software Use: Hands-on training with tax filing tools.

Case Studies: Real-world examples for better understanding.

Project Work: Filing mock returns and preparing audit reports.

Case Studies and Projects

Practical application is vital in taxation. Case studies simulate real-life scenarios, helping students develop problem-solving skills.

Benefits of Enrolling in an Income Tax Course

Enhanced Knowledge: Gain in-depth understanding of tax regulations.

Career Opportunities: Access to roles like tax consultant or analyst.

Higher Earnings: Skilled professionals command better salaries.

Personal Benefits: Manage personal or family tax filings efficiently.

Eligibility and Prerequisites

Most income tax courses require a background in commerce or accounting. However, some basic courses welcome beginners. Prerequisites typically include:

A bachelor's degree (preferred for advanced courses).

Basic computer literacy for digital filing tools.

Duration and Fee Structure

Duration: Courses range from 3 months to 1 year, depending on complexity.

Fee: Costs vary widely, starting from ₹10,000 for basic courses to ₹50,000 or more for advanced ones.

Top Institutes Offering Income Tax Courses

Institute of Chartered Accountants of India (ICAI).

National Institute of Financial Markets (NIFM).

Coursera and Udemy (online platforms).

Local coaching centers with tailored training programs.

Job Opportunities After Completion

Completing an income tax course opens doors to several career paths, including:

Tax Consultant: Advising clients on tax planning.

Tax Analyst: Working with firms to ensure compliance.

Auditor: Verifying financial statements for accuracy.

Finance Manager: Overseeing tax-related aspects of businesses.

Tips for Choosing the Right Course

Evaluate Your Goals: Choose a course aligned with your career aspirations.

Check Accreditation: Ensure the institute is reputable.

Look for Practical Training: Hands-on experience is essential.

Consider Flexibility: Online courses offer convenience for working professionals.

Conclusion

An income tax course is an investment in your professional future. It provides the expertise required to excel in taxation, enhances career prospects, and builds trust with clients or employers. Whether you are an aspiring accountant or an experienced professional, mastering income tax concepts will set you apart in the competitive finance sector.

IPA offers:-

Accounting Course , Courses after 12th Commerce , courses after bcom

Diploma in Financial Accounting , SAP fico Course , Accounting and Taxation Course , GST Course , Basic Computer Course , Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

What is GST Simulation Software? A Complete Guide

GST Simulation Software The introduction of Goods and Services Tax (GST) has transformed tax systems worldwide, simplifying taxation while posing new challenges for businesses, particularly in compliance and accurate tax calculation. GST Simulation Software has become an invaluable tool for businesses of all sizes, providing a digital solution to manage GST calculations, reporting, and…

View On WordPress

#GCC vat simulation software#GST filing simulation software#GST simulation software#Gulf VAT simulation software#Income tax simulation software#ITR simulation software for institutes#TDS Simulation Software

1 note

·

View note

Text

Top 5 Key Developments in Taxation Accounting Education for 2024

As we progress into 2024, the field of taxation accounting education continues to evolve, adapting to new technologies, methodologies, and regulatory changes. Staying updated with these developments is crucial for students and professionals alike to remain competitive and effective in their roles. This blog explores the top five key developments in taxation accounting education for 2024, highlighting how these changes are shaping the future of the discipline.

1. Integration of Advanced Technologies

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) have become integral in various fields, and taxation accounting is no exception. These technologies are being incorporated into educational programs to enhance the learning experience and provide practical skills relevant to the industry. AI and ML are used to automate complex data analysis, predict trends, and optimize tax planning strategies.

Students are now learning to leverage these technologies through hands-on projects and simulations, which prepare them for real-world applications. For instance, universities and online courses are offering modules that teach how to use AI-driven tax software, allowing students to experience firsthand how these tools can streamline processes and improve accuracy.

Blockchain Technology

Blockchain technology is revolutionizing the way transactions are recorded and verified, offering increased transparency and security. Taxation accounting education is embracing this innovation by integrating blockchain principles into the curriculum. Students are learning about blockchain's impact on tax compliance, audit trails, and fraud prevention.

Courses now include practical exercises on implementing blockchain solutions in taxation, helping students understand how to maintain accurate and immutable records. This knowledge is crucial as blockchain becomes more prevalent in the financial sector, ensuring that future taxation professionals are well-equipped to handle these advancements.

2. Emphasis on Global Taxation Standards

International Taxation Courses

With the globalization of economies, understanding international taxation laws and regulations has become essential. Taxation accounting education is increasingly focusing on global taxation standards, ensuring that students are well-versed in the complexities of cross-border transactions and compliance.

Institutions are offering specialized courses on international taxation, covering topics such as transfer pricing, double taxation treaties, and tax havens. These courses often include case studies and collaborative projects that provide students with practical insights into managing international tax issues.

Cross-Border Taxation Workshops

To complement theoretical knowledge, many educational programs now include workshops and seminars on cross-border taxation. These sessions often feature guest speakers from multinational corporations and international tax advisory firms, offering students a real-world perspective on global taxation challenges and strategies.

Such initiatives not only enhance students' understanding of international tax laws but also help them build a network of professionals in the field, which can be invaluable for their future careers.

3. Focus on Sustainable Tax Practices

Environmental, Social, and Governance (ESG) Reporting

Sustainability is becoming a significant focus in taxation accounting education, with an increasing emphasis on Environmental, Social, and Governance (ESG) reporting. Educational institutions are incorporating ESG principles into their curricula, teaching students how to assess and report on the tax implications of sustainable business practices.

Courses on ESG reporting cover various aspects, including the tax benefits of sustainable investments, the impact of carbon taxes, and the role of taxation in promoting corporate social responsibility. By understanding these concepts, students can advise businesses on how to align their tax strategies with their sustainability goals.

Green Taxation Policies

The rise of green taxation policies, such as carbon taxes and incentives for renewable energy investments, is also being addressed in taxation accounting education. Students are learning about the design and implementation of these policies, as well as their economic and environmental impacts.

Practical case studies and policy analysis exercises help students develop the skills needed to navigate the evolving landscape of green taxation. This knowledge is particularly relevant as governments worldwide continue to introduce measures aimed at combating climate change through tax policy.

4. Enhanced Regulatory Compliance Training

Tax Compliance Software

The complexity of tax regulations requires robust compliance mechanisms, and educational programs are responding by providing training on advanced tax compliance software. Students are learning to use these tools to ensure accurate and timely tax filings, reducing the risk of non-compliance and penalties.

Modules on tax compliance software often include simulations and practical exercises, allowing students to gain hands-on experience with the latest technologies used in the industry. This training is essential for preparing future taxation professionals to navigate the intricate regulatory environment effectively.

Continuous Professional Development (CPD)

Recognizing the need for ongoing education in the ever-changing field of taxation, many institutions are emphasizing Continuous Professional Development (CPD). CPD programs offer a range of courses and certifications that enable professionals to stay updated with the latest regulatory changes and best practices.

Students are encouraged to participate in CPD activities as part of their education, fostering a culture of lifelong learning. This approach ensures that they remain knowledgeable and competent throughout their careers, adapting to new regulations and industry trends as they arise.

5. Increased Use of Data Analytics

Big Data in Taxation

The advent of big data is transforming the way tax information is collected, analyzed, and utilized. Taxation accounting education is incorporating big data analytics into the curriculum, teaching students how to harness large datasets to identify patterns, predict outcomes, and make informed tax decisions.

Courses on big data in taxation often include practical projects where students analyze real-world datasets using advanced analytical tools. This hands-on experience equips them with the skills needed to leverage data analytics in their future roles, enhancing their ability to provide strategic tax advice.

Data-Driven Decision Making

In addition to technical skills, educational programs are focusing on the strategic aspect of data-driven decision making. Students are learning how to interpret data insights and apply them to develop effective tax strategies. This includes understanding the implications of data privacy laws and ensuring that data usage complies with regulatory standards.

By integrating data analytics into taxation accounting education, institutions are preparing students to excel in a data-centric world, where the ability to analyze and interpret information is crucial for success.

Conclusion

The field of taxation accounting education is undergoing significant transformations, driven by advancements in technology, globalization, sustainability, regulatory compliance, and data analytics. These developments are reshaping the way taxation is taught and practiced, equipping students with the knowledge and skills needed to thrive in a dynamic and complex environment.

For those looking to excel in taxation accounting, staying abreast of these trends is essential. Embracing the integration of advanced technologies, understanding global and sustainable tax practices, mastering regulatory compliance, and utilizing data analytics are key to becoming a proficient taxation professional. Whether you're a student or a seasoned practitioner, adapting to these changes will enhance your expertise and ensure you remain relevant in the ever-evolving field of taxation accounting.

As you navigate these developments, consider how a reliable Taxation Assignment Doer can support your academic journey, providing the expertise and guidance needed to tackle complex taxation assignments effectively. With the right resources and knowledge, you can confidently address the challenges and opportunities that lie ahead in 2024 and beyond.

#education#college#domyaccountingassignment#accounting#accountingtutor#taxationaccounting#online help#university student

0 notes

Text

SAP HR Online Course

Unlock Your HR Potential with SAP HR Online Courses

SAP HR, also known as SAP HCM (Human Capital Management), is a powerful software suite designed to streamline and automate essential HR processes. As businesses increasingly rely on SAP HR solutions, there’s a growing demand for skilled professionals. Online SAP HR courses offer a convenient and flexible way to gain the expertise you need to excel in this lucrative field.

Why Choose SAP HR Online Courses?

Flexibility: Online courses let you learn at your own pace and from anywhere with an internet connection. This is perfect for busy professionals or anyone seeking a more adaptable learning environment.

Cost-effectiveness: Online courses are often more affordable than traditional classroom training, saving you money on tuition and travel expenses.

Wide Variety: Find courses catering to various skill levels, from beginner introductions to advanced SAP HR modules.

Interactive Learning: Many online platforms offer interactive elements like quizzes, simulations, and discussion forums to keep you engaged.

What You’ll Learn

SAP HR online courses typically cover the following core modules:

Organizational Management: Build organizational structures, model hierarchies, and manage job descriptions effectively.

Personnel Administration: Controller employee data management, hiring and termination processes, and personnel actions.

Time Management: Configure work schedules, track attendance, calculate leave balances, and manage overtime scenarios.

Payroll: Understand payroll calculations, deductions, tax regulations, and how to integrate payroll with other modules.

Recruitment: Optimize the hiring process, manage applicant data, and integrate recruitment with other HR functions.

Choosing the Right SAP HR Online Course

Here are things to consider when selecting the best course:

Your Experience Level: Choose a beginner course if you’re new to SAP HR or select specialized courses if you have some experience and want to focus on specific areas.

Course Provider: Look for reputable platforms with experienced instructors and positive reviews. Popular options include Udemy, Coursera, and SAP’s training portal.

Certification: If your goal is to become SAP certified, make sure the course helps prepare you for the relevant exam.

Cost: Compare prices across platforms to find one that fits your budget.

Beyond the Basics

After completing your core SAP HR training, consider these options:

SAP SuccessFactors: Courses on this cloud-based HR solution will further enhance your skills.

HR Analytics: Master the art of data-driven decision-making in HR.

Specializations: Delve deeper into areas like talent management, benefits administration, and HR reporting.

Transform Your HR Career

SAP HR online courses offer a fantastic pathway to start or advance your HR career. These courses give you the in-demand skills to help organizations optimize their HR processes, improve workforce management, and gain valuable business insights. Start your SAP HR learning journey today!

youtube

You can find more information about SAP HR in this SAP HR Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP HR Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP HR here – SAP HR Blogs

You can check out our Best In Class SAP HR Details here – SAP HR Training

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

0 notes

Text

How many exams are there in CCNA?

A Complete Guide for Beginners in Networking

The Cisco Certified Network Associate (CCNA) certification is widely regarded as the entry point into the world of networking. It is highly sought after by IT professionals aiming to build careers in system administration, network support, or cybersecurity. One of the most common questions among aspiring candidates is: How many exams are there in CCNA?

This article answers that question and explores all related aspects—exam structure, topics covered, costs, and why this certification is essential for networking professionals.

Overview of CCNA Certification

The CCNA is a credential offered by Cisco Systems, one of the global leaders in networking hardware, software, and telecommunications equipment. The certification is designed to validate a professional’s ability to install, configure, manage, and troubleshoot networks. It covers a wide range of foundational networking topics, making it suitable for entry-level IT roles and a stepping stone to advanced certifications.

So, How Many Exams Are There in CCNA?

As of now, the CCNA certification requires passing just one exam.

This is a major shift from previous versions, where candidates had to take two or more separate exams depending on the specialization. However, Cisco consolidated its associate-level certifications in 2020 into a single, comprehensive CCNA exam.

Exam Code: 200-301 CCNA

This single exam tests your knowledge across multiple domains of networking, rather than focusing on one specific area. It is considered a generalist exam that prepares candidates for a wide range of networking responsibilities.

Topics Covered in the 200-301 CCNA Exam

Though it’s just one exam, it covers a broad spectrum of networking areas. Here’s a breakdown:

1. Network Fundamentals

IPv4 and IPv6 configuration and addressing

OSI and TCP/IP models

Networking components (routers, switches, access points)

2. Network Access

VLANs and trunking

EtherChannel

Wireless networking fundamentals

3. IP Connectivity

Routing concepts including OSPF

Static vs dynamic routing

Troubleshooting routing issues

4. IP Services

DHCP, NAT, NTP, and QoS

DNS and SNMP

Network configuration and verification tools

5. Security Fundamentals

Device access control

VPNs and firewalls

Common security threats and prevention

6. Automation and Programmability

Controller-based architectures

REST APIs

Cisco DNA Center basics

Even though it's a single exam, the breadth and depth of the material require thorough preparation and hands-on practice.

Exam Format and Details

Here are the logistics of the 200-301 CCNA exam:

Format: Multiple choice, simulations, drag-and-drop

Duration: 120 minutes

Number of Questions: Around 100

Cost: USD $300 (plus taxes, depending on region)

Delivery: Online proctoring or Pearson VUE testing centers

Best Way to Prepare for the Single CCNA Exam

Since there is only one consolidated exam, it is critical to approach preparation systematically. Here’s how:

1. Use Cisco’s Official Study Guide

Cisco offers comprehensive resources, including the CCNA Official Cert Guide and e-learning on the Cisco Learning Network.

2. Enroll in Instructor-Led Training

Structured training can significantly increase your chances of passing. If you're located in northern India, many professionals recommend the best CCNA training institute in Chandigarh, known for offering in-depth labs, certified trainers, and real-time scenarios.

3. Hands-On Labs

Use tools like Cisco Packet Tracer, GNS3, or even real hardware to simulate networks and get practical experience.

4. Practice Exams

Attempting mock tests and practice questions will help you assess your readiness and identify weak areas before the real test.

Why the Shift to One Exam?

Cisco’s shift to a single exam format was driven by:

Simplicity: One clear path instead of multiple tracks

Relevance: Incorporating automation and security, which are now critical in networking

Accessibility: Lower cost and fewer exams make it more achievable

This change ensures that all CCNA holders have a well-rounded foundation in networking, regardless of their future specialization.

What Comes After CCNA?

After achieving your CCNA certification, you can pursue:

CCNP (Cisco Certified Network Professional) – for advanced networking

Cisco CyberOps Associate – for security and operations

DevNet Associate – for network automation and development

Each of these paths offers specialization and deeper knowledge in specific domains, allowing you to tailor your career to your interests.

Final Thoughts

To summarize, only one exam is required to achieve the CCNA certification today. While it may seem simpler, the 200-301 CCNA exam covers a wide range of complex topics, demanding focused study and practical experience.

Whether you're a student, an IT technician, or a professional seeking career growth, CCNA is a solid foundation. Enrolling in a reliable and reputed training program—such as the Best CCNA training institute in Chandigarh—can make your preparation more efficient and effective.

The road to CCNA may be challenging, but with the right resources and dedication, it is a rewarding investment in your future.

0 notes

Text

Pro accountant course in budh vihar

The Pro Accountant course offered by IPA Studies is a comprehensive and advanced program designed to equip individuals with the skills and knowledge required to excel in the field of accounting and finance. This course goes beyond the basics of accounting and delves into the intricacies of financial management, taxation, auditing, and more. With a strong emphasis on practical application and real-world scenarios, the Pro Accountant course is ideal for both beginners looking to enter the accounting field and professionals seeking to enhance their expertise.

The curriculum of the Pro Accountant course covers a wide range of topics, starting from the fundamentals of accounting principles and practices to advanced financial analysis techniques. Students are introduced to various accounting software and tools used in the industry, gaining hands-on experience that is invaluable in today's digital-driven business landscape. The course also covers taxation laws and regulations, ensuring that students have a thorough understanding of how taxes impact financial decisions and business strategies. This is the best basic computer institute in budh vihar.

One of the highlights of the Pro Accountant course is its focus on practical training. Students engage in real-world case studies, simulations, and projects that mirror the challenges faced by accounting professionals in their day-to-day work. This approach not only enhances theoretical understanding but also hones problem-solving skills, critical thinking, and decision-making abilities. Additionally, guest lectures by industry experts provide insights into the latest trends and practices, bridging the gap between academic learning and practical application.

All courses are- Pro accountant, Digital Marketing, Graphic designing, Tally prime, Basic computer with advance excel.

0 notes

Link

As film and TV sets reopen at Pinewood Atlanta Studios, home to big-screen juggernauts like "Avengers: Endgame," the biggest job is keeping the coronavirus off the Georgia studio's lot.