#TECH STOCKS

Explore tagged Tumblr posts

Text

Alphabet: A Tech Titan Undeterred by Regulator's Wrath

#Google Antitrust#Regulating Tech#Tech Monopoly#Google In Focus#Invest In Google#Wall Street Views#Tech Stocks#Google Investors#Microsoft Vs Google#Tech Antitrust#Regulatory History#Tech Giants#Future Of Google#Google Growth#Tech Innovation#Long Term Investing#Market Cap#Google Vs Microsoft#Tech Titans#Stock Market#Supergirl#Batman#DC Official#Home of DCU#Kara Zor-El#Superman#Lois Lane#Clark Kent#Jimmy Olsen#My Adventures With Superman

3 notes

·

View notes

Text

Tech Stocks Plunge as DeepSeek Disrupts AI Landscape

Market Reaction: Nvidia, Broadcom, Microsoft, and Google Take a Hit On January 27, the Nasdaq Composite, heavily weighted with tech stocks, tumbled 3.1%, largely due to the steep decline of Nvidia, which plummeted 17%—its worst single-day drop on record. Broadcom followed suit, falling 17.4%, while ChatGPT backer Microsoft dipped 2.1%, and Google parent Alphabet lost 4.2%, according to Reuters.

The Philadelphia Semiconductor Index suffered a significant blow, plunging 9.2%—its largest percentage decline since March 2020. Marvell Technology experienced the steepest drop on Nasdaq, sinking 19.1%.

The selloff extended beyond the US, rippling through Asian and European markets. Japan's SoftBank Group closed down 8.3%, while Europe’s largest semiconductor firm, ASML, fell 7%.

Among other stocks hit hard, data center infrastructure provider Vertiv Holdings plunged 29.9%, while energy companies Vistra, Constellation Energy, and NRG Energy saw losses of 28.3%, 20.8%, and 13.2%, respectively. These declines were driven by investor concerns that AI-driven power demand might not be as substantial as previously expected.

Does DeepSeek Challenge the 'Magnificent Seven' Dominance? DeepSeek’s disruptive entrance has sparked debate over the future of the AI industry, particularly regarding cost efficiency and computing power. Despite the dramatic market reaction, analysts believe the ‘Magnificent Seven’—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—will maintain their dominant position.

Jefferies analysts noted that DeepSeek’s open-source language model (LLM) rivals GPT-4o’s performance while using significantly fewer resources. Their report, titled ‘The Fear Created by China's DeepSeek’, highlighted that the model was trained at a cost of just $5.6 million—10% less than Meta’s Llama. DeepSeek claims its V3 model surpasses Llama 3.1 and matches GPT-4o in capability.

“DeepSeek’s open-source model, available on Hugging Face, could enable other AI developers to create applications at a fraction of the cost,” the report stated. However, the company remains focused on research rather than commercialization.

Brian Jacobsen, chief economist at Annex Wealth Management, told Reuters that if DeepSeek’s claims hold true, it could fundamentally alter the AI market. “This could mean lower demand for advanced chips, less need for extensive power infrastructure, and reduced large-scale data center investments,” he said.

Despite concerns, a Bloomberg Markets Live Pulse survey of 260 investors found that 88% believe DeepSeek’s emergence will have minimal impact on the Magnificent Seven’s stock performance in the coming weeks.

“Dethroning the Magnificent Seven won’t be easy,” said Steve Sosnick, chief strategist at Interactive Brokers LLC. “These companies have built strong competitive advantages, though the selloff served as a reminder that even market leaders can be disrupted.”

Investor Shift: Flight to Safe-Haven Assets As tech stocks tumbled, investors moved funds into safer assets. US Treasury yields fell, with the benchmark 10-year yield declining to 4.53%. Meanwhile, safe-haven currencies like the Japanese Yen and Swiss Franc gained against the US dollar.

According to Bloomberg, investors rotated into value stocks, including financial, healthcare, and industrial sectors. The Vanguard S&P 500 Value Index Fund ETF—home to companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola—saw a significant boost.

“The volatility in tech stocks will prompt banks to reevaluate their risk exposure, likely leading to more cautious positioning,” a trading executive told Reuters.

OpenAI’s Sam Altman Responds to DeepSeek’s Rise OpenAI CEO Sam Altman acknowledged DeepSeek’s rapid ascent, describing it as “invigorating” competition. In a post on X, he praised DeepSeek’s cost-effective AI model but reaffirmed OpenAI’s commitment to cutting-edge research.

“DeepSeek’s R1 is impressive, particularly given its cost-efficiency. We will obviously deliver much better models, and competition is exciting!” Altman wrote. He hinted at upcoming OpenAI releases, stating, “We are focused on our research roadmap and believe

4 notes

·

View notes

Text

Explore Zscaler’s stock forecast for 2025–2029, analyzing its operations, financial performance, and competitive edge in cloud security. #Zscaler #ZS #Zerotrust #SASE #Cybersecurityinvestment #ZSstockforecast #Stockpriceanalysis #Techstocks #AIsecuritysolutions #Investmentopportunities

#AI security solutions#AI-driven cybersecurity investments#Best cybersecurity stocks to buy#Cloud security#Cybersecurity investment#Investment#Investment Insights#Investment Opportunities#Is Zscaler a good investment#SASE#SASE market growth 2025#Stock Forecast#Stock Insights#Stock price analysis#Tech stocks#When to buy Zscaler stock#Zero trust#ZS#ZS stock forecast#Zscaler competitive landscape#Zscaler financial performance 2025#Zscaler Inc#Zscaler stock analysis and prediction#Zscaler stock price forecast 2025#Zscaler zero trust security solutions

0 notes

Text

Dixon Technologies Dips after 379% Q4 Profit Jump: Top Nifty 50 Stock to Buy After Sensex Crash? Complete Stock Market Strategy.

Tailor your #stockmarket strategies with our SEBI-registered RA expertise. Register now - www.intensifyresearch.com or call 9111777433 now!

#stock market#finance#share market#investing#banknifty#sensex#nifty prediction#nifty50#nse#bse#bse sensex#intradaytrading#tech stocks

1 note

·

View note

Text

0 notes

Text

🚀 AI Disruptors on the ASX: Transforming Key Industries!

The Australian Securities Exchange (ASX) is buzzing with innovation as companies harness artificial intelligence to reshape security, environmental management, and road safety. Discover how RocketDNA, Envirosuite, and Acusensus are leading the charge!

🌟 Key Players to Watch:

RocketDNA (ASX: RKT)

🔒 Revolutionizing Security: Introducing AI-powered xBot PatrolBots for real-time security monitoring in mining and industrial sectors.

📊 Key Benefits:

Autonomous patrols for detecting threats.

Instant alerts for rapid response.

Envirosuite (ASX: EVS)

🌱 Leading Environmental Management: Utilizing AI for real-time monitoring of air quality, water contamination, and noise pollution.

🔍 Game Changer:

Predictive analytics for risk management.

Strong market growth after partnerships with industry giants.

Acusensus (ASX: ACE)

🚦 Enhancing Road Safety: AI-driven systems for automated traffic enforcement, reducing accidents and improving compliance.

🔥 Rapid Growth:

Real-time violation detection and swift authority alerts.

Securing government contracts across major cities.

🔮 The Future is Bright:

As AI technology continues to advance, these disruptors are not just improving operational efficiencies but are also creating new growth opportunities. Watch these companies closely as they lead the charge in transforming traditional industries and driving innovation on the ASX!

Stay tuned for more updates on how AI is shaping our world! 🌍✨

0 notes

Text

youtube

0 notes

Link

🚨 Sinking Fast: The Crypto Downfall 🚨

The crypto market just experienced its largest crash in nearly a year, losing a staggering $500 billion! 🌊💸 Dive into our latest article to uncover the reasons behind this dramatic plunge and what it means for the future of Bitcoin, Ethereum, and other major cryptocurrencies. 📉📊

#crypto crash#bitcoin#ethereum#crypto market#altcoins#crypto news#market crash#recession#tech stocks#crypto analysis#crypto investment

0 notes

Text

Global X Semiconductor ETF (ASX: SEMI) Buying Insight: Watch for buying opportunities in SEMI as it recovers from a recent price dip, with strong long-term growth prospects.

0 notes

Text

NVIDIA Stock Split - Yay!

I just happened to notice today that the price of Nvidia stock was $120. That didn’t look right since I just bought three shares for $1155. I scrolled down to the news to find that there was a 10 for 1 stock split. Cool! Now I have 30 shares and the price is back in the affordable range for everyone. That was good news because I didn’t have enough in my etrade account to buy another share, and…

View On WordPress

0 notes

Text

Google: Still the King of Search, Despite the Crown Tipping

#Google#Wall Street#Tech Stocks#Investing#Finance#Google Stock#Google Valuation#AIand Search#Market Sentiment#Tech Industry#Valuation#Supergirl#Batman#DC Official#Home of DCU#Kara Zor-El#Superman#Lois Lane#Clark Kent#Jimmy Olsen#My Adventures With Superman#Daily Planet

3 notes

·

View notes

Text

Explore International Business Machines (IBM) stock price forecasts for 2025–2029, diving into financials, dividends, and competitive trends. #InternationalBusinessMachines #IBM #IBMstock #Stockpriceforecast #Dividendyield #Hybridcloud #AItechnology #Investmenttips #Techstocks #Stockmarketanalysis

#AI technology#Best time to buy IBM shares#Competitive Landscape#Dividend Yield#How to invest in IBM stock today#Hybrid cloud#IBM#IBM competitive analysis 2025#IBM dividend yield and buyback policy#IBM financial performance#IBM hybrid cloud and AI growth potential#IBM stock#IBM stock forecast and financial ratios#IBM stock price history and trends#IBM stock price prediction 2025–2029#International Business Machines#Investment#Investment Insights#Investment tips#Is IBM stock a good long-term investment#Should I buy IBM stock in 2025#Stock Forecast#Stock Insights#Stock market analysis#Stock Price Forecast#Tech stocks

0 notes

Text

Chill afternoon while horror preps some stuff for dinnerrr :')

#doodles#killer sans#dust sans#horror sans#my sona art#theyve kidnapped me but im willingly staying#killer shit talking me while i play my own game#dust minding his own bisnes as usual#i htink hes a headphones guy#i c him as the tech guy in the group#id love to see him try to explain computer stuff to nm#and nm being like HOH WHUH#i hope horror is making seafood chowder cuz mannnn#what id do for some thiccc seafood chowder rn#i bet he prefers to make his own homemade stock#and ye i HC dust to wear joggers instead of the usual shorts#i have my own HC of what the differences in their outfits r#i prolly will draw that out someday for my own personal reference too

842 notes

·

View notes

Text

AI and the fatfinger economy

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me at NEW ZEALAND'S UNITY BOOKS in WELLINGTON TODAY (May 3). More tour dates (Pittsburgh, PDX, London, Manchester) here.

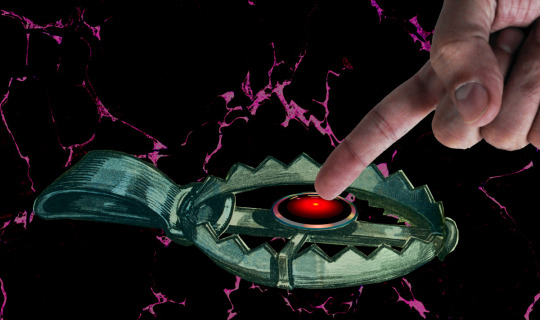

Have you noticed that all the buttons you click most frequently to invoke routine, useful functions in your device have been moved, and their former place is now taken up by a curiously butthole-esque icon that summons an unwanted AI?

https://velvetshark.com/ai-company-logos-that-look-like-buttholes

These traps for the unwary aren't accidental, but neither are they placed there solely because tech companies think that if they can trick you into using their AI, you'll be so impressed that you'll become a regular user. To understand why you find yourself repeatedly fatfingering your way into an unwanted AI interaction – and why those interactions are so hard to exit – you have to understand something about both the macro- and microeconomics of high-growth tech companies.

Growth is a heady advantage for tech companies, and not because of an ideological commitment to "growth at all costs," but because companies with growth stocks enjoy substantial, material benefits. A growth stock trades at a higher "price to earnings ratio" ("P:E") than a "mature" stock. Because of this, there are a lot of actors in the economy who will accept shares in a growing company as though they were cash (indeed, some might prefer shares to cash). This means that a growing company can outbid their rivals when acquiring other companies and/or hiring key personnel, because they can bid with shares (which they get by typing zeroes into a spreadsheet), while their rivals need cash (which they can only get by selling things or borrowing money).

The problem is that all growth ends. Google has a 90% share of the search market. Google isn't going to appreciably increase the number of searchers, short of desperate gambits like raising a billion new humans to maturity and convincing them to become Google users (this is the strategy behind Google Classroom, of course). To continue posting growth, Google needs gimmicks. For example, in 2019, Google intentionally made Search less accurate so that users would have to run multiple queries (and see multiple rounds of ads) to find the answers to their questions:

https://www.wheresyoured.at/the-men-who-killed-google/

Thanks to Google's monopoly, worsening search perversely resulted in increased earnings, and Wall Street rewarded Google by continuing to trade its stock with that prized high P:E. But for Google – and other tech giants – the most enduring and convincing growth stories comes from moving into adjacent lines of business, which is why we've lived through so many hype bubbles: metaverse, web3, cryptocurrency, and now, of course, AI.

For a company like Google, the promise of these bubbles is that it will be able to double or triple in size, by dominating an entirely new sector. With that promise comes peril: growth must eventually stop ("anything that can't go on forever eventually stops"). When that happens, the company's stock instantaneously goes from being a "growth stock" to being a "mature stock" which means that its P:E is way too high. Anyone holding growth stock knows that there will come a day when those stocks will transition, in an eyeblink, from being undervalued to being grossly overvalued, and that when that day comes, there will be a mass sell-off. If you're still holding the stock when that happens, you stand to lose bigtime:

https://pluralistic.net/2025/03/06/privacy-last/#exceptionally-american

So everyone holding a growth stock sleeps with one eye open and their fists poised over the "sell" button. Managers of growth companies know how jittery their investors are, and they do everything they can to keep the growth story alive, as a matter of life and death.

But mass sell-offs aren't just bad for the company – it's also very bad for the company's key employees, that is, anyone who's been given stock in addition to their salary. Those people's portfolios are extremely heavy on their employer's shares, and they stand to disproportionately lose in the event of a selloff. So they are personally motivated to keep the growth story alive.

That's where these growth-at-all-stakes maneuvers bent on capturing an adjacent sector come from. If you remember the Google Plus days, you'll remember that every Google service you interacted with had some important functionality ripped out of it and replaced with a G+-based service. To make sure that happened, Google's bosses decreed that the company's bonuses would be tied to the amount of G+ activity each division generated. In companies where bonuses can amount to 90% of your annual salary or more, this was a powerful motivator. It meant that every product team at Google was fully aligned on a project to cram G+ buttons into their product design. Whether or not these made sense for users, they always made sense for the product team, whose ability to take a fancy Christmas holiday, buy a new car, or pay their kids' private school tuition depended on getting you to use G+.

Once you understand how corporate growth stories are converted to "key performance indicators" that drive product design, many of the annoyances of digital services suddenly make a great deal of sense. You know how it's almost impossible to watch a show on a streaming video service without accidentally tapping a part of the screen that whisks you to a completely different video?

The reason you have to handle your phone like a photonegative while watching a movie – the reason every millimeter of screen real-estate has been boobytrapped with an icon that takes you somewhere else – is that streaming services believe that their customers are apt to leave when they feel like there's nothing new to watch. These bosses have made their product teams' bonuses dependent on successfully "recommending" a show you've never seen or expressed any interest in to you:

https://pluralistic.net/2022/05/15/the-fatfinger-economy/

Of course, bosses understand that their workers will be tempted to game this metric. They want to distinguish between "real" clicks that lead to interest in a new video, and fake fatfinger clicks that you instantaneously regret. The easiest way to distinguish between these two types of click is to measure how long you watch the new show before clicking away.

Of course, this is also entirely gameable: all the product manager has to do is take away the "back" button, so that an accidental click to a new video is extremely hard to cancel. The five seconds you spend figuring out how to get back to your show are enough to count as a successful recommendation, and the product team is that much closer to a luxury ski vacation next Christmas.

So this is why you keep invoking AI by accident, and why the AI that is so easy to invoke is so hard to dispel. Like a demon, a chatbot is much easier to summon than it is to rid yourself of.

Google is an especially grievous offender here. Familiar buttons in Gmail, Gdocs, and the Android message apps have been replaced with AI-summoning fatfinger traps. Android is filled with these pitfalls – for example, the bottom-of-screen swipe gesture used to switch between open apps now summons an AI, while ridding yourself of that AI takes multiple clicks.

This is an entirely material phenomenon. Google doesn't necessarily believe that you will ever want to use AI, but they must convince investors that their AI offerings are "getting traction." Google – like other tech companies – gets to invent metrics to prove this proposition, like "how many times did a user click on the AI button" and "how long did the user spend with the AI after clicking?" The fact that your entire "AI use" consisted of hunting for a way to get rid of the AI doesn't matter – at least, not for the purposes of maintaining Google's growth story.

Goodhart's Law holds that "When a measure becomes a target, it ceases to be a good measure." For Google and other AI narrative-pushers, every measure is designed to be a target, a line that can be made to go up, as managers and product teams align to sell the company's growth story, lest we all sell off the company's shares.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/05/02/kpis-off/#principal-agentic-ai-problem

Image: Pogrebnoj-Alexandroff (modified) https://commons.wikimedia.org/wiki/File:Index_finger_%3D_to_attention.JPG

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#kpis#incentives matter#ui#ux#video streaming#google plus#g plus#ai#artificial intelligence#growth stocks#business#big tech

613 notes

·

View notes

Text

💼 Why Investors Are Eyeing Megaport's Cloud Power 💼

🚀 As Cloud Networking surges, Megaport Limited (ASX: MP1) stands out as a leading choice in tech stocks for the AI age. Discover why analysts are giving it a "Strong Buy" with a price target of AU$12.00! 📈

📊 Megaport: The Ultimate Cloud Connector

🔹 Network-as-a-Service (NaaS) platform connects businesses with over 380 providers like AWS, Google Cloud, and Azure 🌐

🔹 Supports high-demand AI and #MachineLearning tasks with low-latency and high-bandwidth connections ⚡

🔹 Offers flexible, scalable, on-demand cloud networking 🔗

💡 GPUaaS: Fueling AI Growth

🔸 Growing demand for GPUaaS is revolutionizing industries with pay-as-you-go GPU power

🔸 Perfect for High Performance Computing needs in #BigData, #DeepLearning, and #AI applications 🚀

📉 Analyst Confidence

🔹 Stock at AU$7.27 as of Oct 29, 2024 (up +1.68%) ⬆️

🔹 Market Cap: AU$1.16 billion 💰

🔹 Ranked 17 in Technology Sector 🏆

🕒 Why Invest Now?

🔸 The world’s largest NaaS provider, Megaport is perfectly positioned to capitalize on growing demand 🌍

🔸 Perfect for diverse industries like healthcare, finance, and autonomous tech 🤖

🔸 Goldman Sachs Price Target: AU$12.00 💸

💬 With a surge in GPUaaS demand and Megaport’s vital role in #AI and cloud tech, this is one to watch for long-term growth! 🌐💡

#Investment Opportunity#Tech Stocks#Megaport#Technology#ASX Investor update#ASX NEWS#AUSTRALIA#AI#Cloud Computing

1 note

·

View note