#TPAP

Explore tagged Tumblr posts

Text

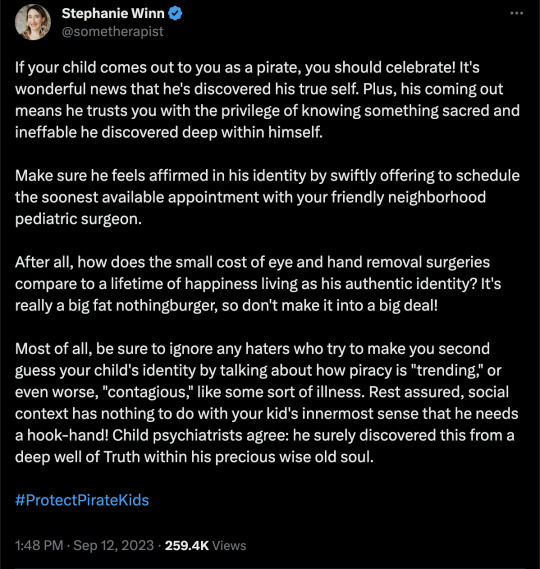

Pirate Rights are Human Rights. #TPAP

Pirate Affirming Care is healthcare.

#Stephanie Winn#TPAP#parody#pirate affirming care#pirate affirming#pirate ideology#pirate theory#pirate identity#pirate transition#gender affirming care#gender affirming#gender ideology#queer theory#gender identity#gender transition#religion is a mental illness

21 notes

·

View notes

Text

TPAP Support – Seamless UPI Integration for Fintechs

The UPI ecosystem in India is booming, and Third-Party Application Providers (TPAPs) play a crucial role in this revolution. Bharat Inttech offers full-service TPAP Support, enabling fintechs and apps to launch UPI services with ease, speed, and full compliance.

Who Are TPAPs?

TPAPs are non-bank fintech companies that provide UPI-enabled payment apps or services. They rely on Payment Service Providers (PSPs) and must be authorized by NPCI. Being a TPAP requires technical integration and strict regulatory compliance.

Our TPAP Support Services:

End-to-End Onboarding: From application to NPCI approval.

Compliance Management: Help with KYC, AML, data storage, and user verification.

System Integration: Connect your app to PSP banks and UPI switches.

Monitoring & Analytics: Transaction logs, performance reports, and alerts.

Why It Matters:

Without proper TPAP onboarding, launching a UPI service is difficult and risky. Our solution simplifies the journey:

Reduces setup time from months to weeks

Ensures compliance with NPCI/RBI mandates

Handles technical complexities and certification

Offers scalable UPI architecture with redundancy

Who Should Use Our TPAP Support?

Fintech startups building new apps

Wallet companies expanding into UPI

Marketplaces enabling in-app payments

Social or messaging apps integrating peer-to-peer transfers

Why Bharat Inttech?

With a proven track record in UPI infrastructure, we help TPAPs go live faster. Our experts provide:

Custom API documentation

Test environments and support

NPCI coordination and audits

Post-launch monitoring

Conclusion:

Becoming a TPAP doesn't have to be complicated. With Bharat Inttech's dedicated support and powerful tools, your app can quickly join India’s growing UPI ecosystem.

For More Information Visit Us:

0 notes

Text

YyyyyYYYYYYYYYYYYYYYYYYYYYYYAAAAAOAAIAIAIIAIAOOAIAIIAIAI. TLALL TOAPEPEPROBRIHSEIYFZEFIYVDZW IG WSGUB S KS RUPAPPYPALLWLTMT. TALLPPENT

TnebrhuajajaAAAAAh

(now there’s less) tangotronic doodles part 6

this time with tall tappers, a stepswitcher, a chorus kid, and tj snappers gf!

and a rh x jd doodle! wowie zowie!! 😃

#HHRHHRHAGGAGAAAAGAAHAHHHSCSCCCWS#SORTM T#TALL TAPP!!!!!!!!!#Hancebuvs1ihvwsugc uGvuequtqcucfysqqscfyz1ygcene#VIYAVUTSW FQ YBo wevgi2rsS guY#MMKKAKKEKEKKDKKDKNANNSFNX#KKWDJGBGD2IBGIZWBSE1IBGE#IMINSANE#IM. IEIWIABAAAA#tlal tpappe t TPAP ETLLE#TAPPLETLL#KSWKKmanananjanaJjajajauhshshshhehejueifjhfhdjjjjjjjjjjjjjj#WOAOWIEKS#SNNSNSHSNK[

Masterlist | Rules | Taglist | Other Socials

if no art makes you feel anything, make your own art and feel something

Mari, late 20s

Found on Bluesky, Pillowfort, Dreamwidth, and AO3 with the same username. I’m also on discord in f1 themed server hosted by @/sinofwriting. I’m not sure how active I’ll be on those sites but I’ll be there!

LS2, CL16, MV1, OP81 - They could never make me hate you

AA23, GR63, PG10, LN4, CS55 - It goes day by day

Series

Vegas Series (Logan)

MVxW!V!Reader (4/9)

Rookies!Max

Full Febuwhump Piece x LS2

Future Plans

Soulmate!MVxReader

Ideas

LSxWDC!Reader

OPxProfessor

CLxChildhood Penpal!Reader

Requests (Closed)

Birthday!PG10 x reader

Relationship Rumors x The Grid

PG10 x New GF!reader

Singer!Leclerc!Sister x Surprise

Summer Dream 2

WIPs

TPAP 4 (Max)

+1s (Logan)

Traveling x The Grid

Scheduled (6pm EST)

To Paint a Picture 1 — 6/20

To Paint a Picture 2 — 6/27

To Paint a Picture 3 — 7/4

# of hateful messages — 1!

99 notes

·

View notes

Text

TPAP UPDATE TONIGHT CHAT COME GET YALL FOOD

#shut up quill#velvet trolls#trolls 3#my art#velvet and veneer#trolls#veneer trolls#bcs hes actually important in this chapter#kid ritz trolls#kid ritz x velvet#kid ritz#velvet x kid ritz#velritz#tpatp

6 notes

·

View notes

Text

i've been listening on repeat, analyzing lyrics, and watching reactions for good kid, M.A.A.D city for a week now, and i LOVE KENDRICK!! omg. i can't wait for TPAP i know it's going to be amazing

2 notes

·

View notes

Note

🌷 🦋 🐥

🌷 writing achievement you want to brag about:

Finishing TPAP and Fairian as quickly as I did and also JUICE BOX. everything about juice box feels like a writing achievement we have unlocked something good here

🦋tell us about your current wip:

i have two- one is an excuse for me to throw up dark kingdom lore, codependent team awesome and some good old fashioned varigo tragedy and one is juice box part 4 and it is already approaching 10,000 words because i have mental problems also it's murder mystery style :)

🐥 here's some writing motivation!

i can't tell if im meant to give u motivation or if ur giving me motivation so i will assume its both GRAHGH THANK U ALSO FWOOSH ILY GIVES U KISS HAVE SOME MOTIVATION

3 notes

·

View notes

Text

[ad_1] New Delhi: National Payments Corporation of India (NPCI) has lifted the limit from onboarding UPI users for the third-party app provider WhatsApp Pay with immediate effect.With this development, WhatsApp Pay can now extend UPI services to its entire user base in India, NPCI said in a statement.Previously, NPCI had permitted WhatsApp Pay to expand its UPI user base in a phased manner, it added.There was a cap of 100 million users which has been lifted by NPCI.With this notification, it said, NPCI is removing the limit restrictions on user onboarding on WhatsApp Pay.WhatsApp Pay will continue to comply with all existing UPI guidelines and circulars applicable to existing Third-Party Application Providers (TPAPs), it said.NPCI, an initiative of the Reserve Bank of India (RBI) and the Indian Banks' Association, is an umbrella organisation for operating retail payments and settlement systems in India (IBA).NPCI governs the Unified Payments Interface (UPI) framework in India. [ad_2] Source link

0 notes

Text

[ad_1] New Delhi: National Payments Corporation of India (NPCI) has lifted the limit from onboarding UPI users for the third-party app provider WhatsApp Pay with immediate effect.With this development, WhatsApp Pay can now extend UPI services to its entire user base in India, NPCI said in a statement.Previously, NPCI had permitted WhatsApp Pay to expand its UPI user base in a phased manner, it added.There was a cap of 100 million users which has been lifted by NPCI.With this notification, it said, NPCI is removing the limit restrictions on user onboarding on WhatsApp Pay.WhatsApp Pay will continue to comply with all existing UPI guidelines and circulars applicable to existing Third-Party Application Providers (TPAPs), it said.NPCI, an initiative of the Reserve Bank of India (RBI) and the Indian Banks' Association, is an umbrella organisation for operating retail payments and settlement systems in India (IBA).NPCI governs the Unified Payments Interface (UPI) framework in India. [ad_2] Source link

0 notes

Text

plutos ONE Wins 'Fintech Startup of the Year 2024' by Outlook Business: Redefining Innovation in India's Fintech Landscape

India’s fintech industry continues to be a hotbed of innovation, and at its forefront is plutosONE, the youngest TSP (Technology Service Provider) for the Bharat Connect (BBPS). We are thrilled to share that our company has been honored with the prestigious 'Fintech Startup of the Year 2024' award by Outlook, recognizing our relentless pursuit of excellence in bill payment solutions, consumer engagement, and incentivization platforms. This milestone highlights our pivotal role in transforming the way businesses and customers interact within the financial ecosystem.

A Decade of Leadership: The Evolution of plutos ONE

Our journey, spanning over 14 years, is a testament to our vision of making financial transactions seamless and rewarding. Starting in 2010 as a merchant aggregator for leading Brands in India, we quickly expanded our expertise. Over the years, we added industry giants like ICICI, SBI, HDFC, and Mastercard to our portfolio and became synonymous with innovation.

Fast forward to 2022, plutos ONE emerged as a licensed and empaneled BBPS TSP, offering a comprehensive suite of cutting-edge fintech solutions for banks and financial networks. These include:

Conversational AI Solutions for bill payments via WhatsApp and other platforms.

Incentives and Engagement Platforms to reward customers for every transaction.

Biller Onboarding Services, including onboarding, settlements, and refunds.

Simplify your billing process with our Unified Presentment Management System. Consolidate bills, automate payments, and improve customer satisfaction.

Agent Institution BBPS, enabling banks to activate new agent institutions seamlessly.

India’s Largest Incentive Platform

Apart from bill payment innovations, we operate India’s largest Merchant-funded Offers Platform. With partnerships spanning over 300+ online brands, 60+ cities for dining and hotel offers, and 3,000+ wellness points, we have cemented our reputation as the ultimate rewards ecosystem for customers and businesses. Collaborating with industry leaders like Myntra, Burger King, McDonald’s, Cult.Fit, and Visa, our platform offers unmatched value for its users.

A Comprehensive Bill Payment Stack

Our BBPS solutions are tailored to empower banks and customers alike. Our bill payment stack includes:

COU TSP (Customer Operating Unit TSP): Streamlining bill acceptance from customers.

BOU TSP (Biller Operating Unit TSP): Enabling billers to issue invoices and receive payments efficiently.

Payments on WhatsApp: Delivering chatbot-led payment solutions for ultimate convenience.

AI-driven solutions for rapid activation of agent institutions.

Partnering with India’s Financial Giants

Our success stems from strong partnerships with major players in the Indian financial ecosystem. These include NPCI (RuPay, UPI, Bharat Connect), HDFC Bank, Kotak Mahindra Bank, Punjab National Bank, and Bandhan Bank. Our role in managing card activation and loyalty platforms for banks and large brands further underscores our capabilities.

Recognition as the Fintech Startup of the Year

Winning the “Fintech Startup of the Year 2024 award” is not just an acknowledgment of our innovative solutions but also a celebration of our commitment to empowering India’s digital economy. By leveraging cutting-edge technology, we have made bill payments more accessible, engaging, and rewarding for millions of users.

A Vision for the Future

As we look ahead, our team remains committed to pioneering solutions that redefine financial services in India. From upcoming innovations like UPI TPAP solutions to scaling our BBPS capabilities, we are well-poised to shape the future of fintech in India.

Conclusion

Our journey from a merchant aggregator to a leader in India’s fintech space is nothing short of remarkable. With a robust suite of BBPS solutions, the largest merchant-funded offers platform, and partnerships with leading banks, we exemplify the spirit of innovation and excellence.

We are immensely grateful to our customers and clients for their trust and continued support, which drives us to innovate and excel every day. A heartfelt thank you to Outlook for recognizing our efforts with the 'Fintech Startup of the Year' award. This acknowledgment inspires us to strive harder and achieve greater milestones and reaffirms our position as a transformative force in the industry. As India’s fintech ecosystem continues to grow, plutos ONE stands as a beacon of progress, innovation, and success.

#fintech startup#fintech company in India#fintech award#fintech startup of the year#plutos.ONE#Bharat Bill Payment System#BBPS TSP#digital payments#fintech solutions#bill payment innovation#incentives platform#Outlook awards

0 notes

Text

TLDR: Did you know that the Unified Payments Interface (UPI) in India recorded transactions worth over ₹126 lakh crore (approximately $1.7 trillion) in the financial year 2022-2023? That staggering number reflects the immense growth and adoption of digital payments in India. As consumers and merchants increasingly embrace digital transactions, the demand for reliable intermediaries, known as Third Party Application Providers (TPAPs), has surged. If you’re considering entering this lucrative market, you’re in the right place! This article will guide you through the journey of becoming a certified TPAP in India, breaking down everything you need to know in a conversational and engaging manner.

0 notes

Text

IMPS Switch – The Future of 24x7 Instant Banking

In a world where consumers expect immediate financial transactions, real-time banking has become a necessity. The Immediate Payment Service (IMPS) is one of India’s most powerful digital banking infrastructures. At Bharat Inttech, our IMPS Switch solution empowers banks and fintechs to deliver 24x7 instant banking—anytime, anywhere.

What is an IMPS Switch?

An IMPS Switch is a secure and scalable software system that facilitates round-the-clock money transfers between accounts through mobile banking, net banking, ATMs, or USSD. It acts as the middle layer between banks and the National Payments Corporation of India (NPCI), handling transaction requests securely and efficiently.

Key Features of Our IMPS Switch:

24x7 Availability: Funds are transferred instantly—even on holidays and weekends.

Secure Transfers: Built with end-to-end encryption and fraud monitoring.

Multi-channel Support: Supports transactions via mobile, ATM, internet banking, and POS.

NPCI Certified: Ensures full regulatory compliance and reporting.

High Scalability: Handles thousands of concurrent transactions with low latency.

Benefits for Banks & Fintechs:

By deploying Bharat Inttech’s IMPS Switch, institutions can:

Offer instant customer service with real-time settlements

Enhance digital engagement across banking platforms

Minimize transaction downtime and improve operational efficiency

Enable quick onboarding of merchants and partners for real-time payments

Who Can Use This Solution?

Traditional Banks upgrading their digital infrastructure

Neo-banks & Payment Banks launching instant services

NBFCs and MFIs seeking customer convenience

PSPs looking for direct switch integration

Why Choose Bharat Inttech?

We bring a robust, developer-friendly solution with dedicated onboarding support. Our IMPS Switch includes:

Customizable modules

Compliance-ready features

24x7 monitoring & support

Simple integration with core banking

Conclusion:

Today’s customers expect fast and secure banking services—IMPS is no longer a luxury, it’s a standard. With Bharat Inttech’s IMPS Switch, your organization can lead the way in digital transaction innovation.

For More Information Visit Us:

0 notes

Text

Kendrick Lamar might be the greatest musical artist of all time.

Kendrick Lamar might be the greatest musical artist of all time. When talking about musical greatness you have to take modernity into consideration. People like Elvis and the Beatles have secured themselves in the top 10 oat but they fall short because of advancements and the shortcomings of rock. Just so I don’t get misrepresented I believe the Beatles are the most talented artists to ever exist but there is a difference between talent and objective quality. As we advance as a society our capabilities to artistically express ourselves advance as well. This is the edge new artists have over older ones but regardless of this rap has a greater capacity for quality than rock. Rap is more flexible which is seen by the many more sub genres they have which allows for more samples and types of synths/beats. Now don’t get me wrong the majority of rap is garbage which is the same reason why the vast majority of the top 10 oat is rock. Rock is way more consistent but this is mostly due to its simplicity compared to rap. Rap has the highest skill ceiling which unfortunately makes it the most difficult to master. There is only one other genre that has the same flexibility as rap which makes the majority garbage but the peak the greatest, pop. Michael Jackson who is the king of pop I believe is the only contender for greatest oat against Kendrick seeing he also dominated a very high skill ceiling genre. I do believe Kendrick has a slight edge seeing he benefits from the advancements of modernity but Michael Jackson is an unbelievable close second. Overall rock is way more consistent than rap but rap is more difficult to master than rock so that along with modern synths, beats, and samples makes Kendrick the greatest artist to ever exist in music.Don’t comment unless u listened to Tpap, DAMN, and good kid maad city. Submitted September 29, 2024 at 05:38AM by AcceptableFruit7067 https://ift.tt/aZm2EiI via /r/Music

0 notes

Text

Understanding NPCI's Role in Shaping India's Digital Payments Future

By the end of this year, the National Payments Corporation of India (NPCI) might change its decision about limiting the market share of companies offering Unified Payments Interface (UPI) services to 30%. The deadline for this limit to take effect is December 2024.

A source in the industry told Business Standard that the 30% cap on transaction volume for UPI services will be reviewed by the end of the year.

In November 2022, a 30% cap on transaction volume for third-party app providers was proposed. UPI players were asked to limit their market share to 30% within two years.

In March, the NPCI discussed UPI growth with new players and strategies to empower them in the UPI ecosystem. This included encouraging third-party payment apps to attract users through investments and incentives.

Brands like Cred, Slice, Fampay, Zomato, Groww, and Flipkart are trying to attract users and promote their UPI services.

Last year, NPCI introduced an interchange fee on prepaid payment instrument (PPI)-based merchant transactions through UPI. The interchange fee for PPI issuers on transactions over Rs 2,000 is up to 1.1%, but it applies only to PPI-based merchant UPI transactions. UPI transactions in India increased by 56% in volume and 44% in value in FY24 compared to the previous year.

Google Pay, PhonePe, and Paytm were not invited to a recent meeting. This was because these three companies control more than 90% of both the number and value of UPI transactions.

NPCI wants to hear from different people about how they can make things fairer for smaller companies in the payment system.

Earlier this week, NPCI said One 97 Communications (OCL), Paytm's parent company, can move its users to new banks for UPI payments. This means Paytm can now offer UPI services through other banks.

In March, NPCI also let OCL work as a Third-Party Application Provider (TPAP) using many banks.

"After NPCI said yes on March 14, 2024, to let OCL work as a Third-Party Application Provider (TPAP) using many banks, Paytm has made it easier to move user accounts to Axis Bank, HDFC Bank, State Bank of India (SBI), and YES Bank. All four banks are now ready to help Paytm with this," the company said in a stock exchange filing.

0 notes

Text

Paytm shares trade 5% higher, stock rises 14% in last three days

One 97 Communications, the parent company of Paytm, saw its share price continue its upward trajectory on March 19, climbing nearly 5 percent from the previous session. Over the span of three days, the stock has surged by 14 percent. This surge propelled by an upgrade by Yes Securities, which raised its rating on the payment company's stock from "neutral" to "buy." Additionally, the target price was increased from ₹350 to ₹505. The recent approval by NPCI for Paytm to operate as a third-party application provider (TPAP) within UPI has alleviated pessimism surrounding the company. This approval allows Paytm to facilitate payments, contributing to renewed investor confidence. Yes Securities attributed the upgrade to several factors, including Paytm's reduced reliance on its wallet business for revenue, effectively managed client loss despite reputational challenges, continuous addition of partners, and the competitive edge demonstrated by the company.

“Having received feedback from the regulator and undergone a de-risking process, we now believe that a less volatile future lies ahead for Paytm," the brokerage firm said in its note.

The brokerage appraises Paytm at 2.7 times the projected FY25E price-to-sales ratio, anticipating a compound annual growth rate (CAGR) in earnings per share (EPS) of 78% for FY28-31E.

"We have not assumed any rehabilitation of OCL’s Wallet business in our assumptions. We have assumed a relatively constrained outlook for the loan distribution business. The market is currently pricing in an even more acute scenario," it further added.

0 notes