#TradingIndicator

Explore tagged Tumblr posts

Text

Best Technical Indicator for Trend Reversal: A Comprehensive Guide

Discover the best technical indicator for trend reversal to enhance your trading strategy. Master trend reversals with powerful indicators like MACD, RSI, Bollinger Bands, and Fibonacci Retracement, designed to help identify momentum shifts and perfect entry/exit points for maximum success. Utilize MACD crossovers, RSI overbought/oversold levels, and Bollinger Band price rejections for precise trend reversals. For in-depth insights and advanced tools, visit Miyagi Trading and take your trading to the next level!

Visit:- https://miyagitrading.com/best-technical-indicator-for-trend-reversal-a-comprehensive-guide/

0 notes

Video

youtube

💹 TOP STRATEGY | IQ OPTION | VELOCITY X INDICATOR ⭐

0 notes

Text

FX Cash Generator Review-Greatest Trading Robot

Overview With FX Money Generator, you may immediately turn into a productive and confident merchant. This imaginative marker precisely and definitively recognizes productive exchanges. Take a look at these genuine screen captures that show tremendous profit from FX Money Generators' unrivaled tips. Proof that this instrument is dependable. At the point when you regard the alerts, your record equilibrium will take off. You can exchange reliably with an uncalled for advantage thanks to FX Money Generator. Turn into a beneficial merchant more rapidly than you at any point envisioned. How FX Money Generator functions? "FX Money Generator" has gotten a huge influence increment. The designer has incorporated a Following Stop and Breakeven blend, what capabilities as your solid boundary for straightforward exchanges. To lay it out plainly, a following stop limits misfortunes and expands gains, going about as your exchange watchman. It shrewdly changes the StopLoss to make your exchange a success as the cost moves in support of yourself. It's your undercover apparatus for changing over potential mishaps into fulfilling triumphs! Breakeven, a security net, is going to show up. Breakeven happens on the off chance that the sign doesn't precisely raise a ruckus around town, no matter what the Take Benefit level you've chosen. You actually win regardless of whether your objective was to take benefit two yet you simply figured out how to take benefit one. There's compelling reason need to stress over losing crisis stops. As you can see on the graph, exploit the Purchase Passage signal — shown by a sky-blue line — and submit your request. As another option, for the Sell signal alarm, position yourself decisively by watching out for the yellow line to show up. The noticeable Crisis StopLoss, showed by a green line on the outline, is essential. This pivotal part fills in as a two-crease defender, safeguarding your benefits and diminishing any misfortunes. It fills in as an intense ally of chance decrease and a careful watchman of gains. (Note: The framework settings have this component enacted as a matter of course.)

Planned explicitly for dealers searching for detectable outcomes, "FX Money Generator" chugs along as expected throughout Each Time period, ensuring that no worthwhile potential outcomes cruise you by. Recollecting that "FX Money Generator" signals don't repaint is significant." When they appear, they don't disappear; all things being equal, they remain and offer you reliable guidance for your exchanging decisions. The brilliant witness innovation that has been incorporated to FX Money Generator is expected to make exchanging more advantageous and simple. The source shows: - Name of marker - Exchanging style - Current time - Next candle's term - Past sign - Spread - Equilibrium Free Edge; Consistently Value Change - Pattern Bearing - Pattern Strength across all time spans for the particular pair - The unpredictability diagram, which shows the everyday level of bullish and negative candles A significant illustration for all merchants: pursue the direction consistently to try not to settle on unfortunate choices. It is basic to never exchange against the pattern. We've likewise presented a particular region that represents which course the pattern is moving to additionally further develop things for you. For the best outcomes, stick to exchanging reasonably and in accordance with patterns. What is FX Cash Generator Premium Version? Set yourself up for an unmatched exchanging experience with the FX Money Generator Premium! On the off chance that you are significant about making the most of the market, this force to be reckoned with, stacked with cutting edge advancements, is your pass to incredible and productive exchanging. With specialized investigation, Programming Designer takes care of you as the go-to asset for both beginner and experienced brokers. Specialized investigation works much the same way to having what might be compared to a precious stone ball. Also, guess what? Two amazing assets in this space are Turn Point and Moving Normal. The Turn Point uncovers potential degrees of help and opposition, while the Moving Typical guides in deciding a value's pattern. You have the best exchanging group, empowering you to pursue more educated choices on the lookout. Maybe you have your own special gathering of proficient counsels! Envision that all dynamic matches' pattern course and signals are shown in the market data. It features the open matches in distinctive varieties, causing it to feel like you have an individual right hand assisting you with your exchanges. You don't have to stress over part sizes or cerebral pains making plans any longer since we take care of you. The Cash The board Number cruncher is only another awesome component of FX Money Generator Premium. Assist you with accomplishing the ideal parcel size, brighten up your arrangements, and smooth out your exchanging! To help you in using sound judgment, you are given point by point data on Pair, Spread, Day to day Rate, Bearing of Moving Normal, and Relative Strength File. With FX Money Generator Premium, exchange the future without depending on mystery — where state of the art innovation and ease of use converge to guarantee your prosperity! Enter a future loaded with satisfaction and confidence! It's your pass to a forthcoming outing liberated from tension. What is FX Money Generator Pack? No matter what your degree of involvement, our one of a kind device, the "FX Money Generator Right hand," can expand your profit and exchanging independence. Open boundless open doors and unequaled adaptability, from dealing with a regular occupation to taking part in leisure activities. Work together with "FX Money Generator Aide" and see how your exchanging experience changes. When you can accomplish phenomenal outcomes, why settle for common? Incredible exchange results are ensured by our precise and proficient programming, which is upheld by verifiable market investigation. Try not to miss the potential chance to increment serotonin levels and benefits. Move FX Money Generator immediately! The instrument gives three exchanging modes: Full Auto, Semi-EA, and Manual At the point when you pick Manual mode, the collaborator naturally arranges each setting for you. You go with the choice to enter an exchange or not while exchanging. You have three choices to choose from while utilizing Semi-EA mode: "Just Sell," "All Exchanges," and "Full Auto." The associate will not enter Purchase exchanges assuming that you select "Just Sell," as well as the other way around. Set the Maximum Spread, Parcel, Open Hour, and Close Hour before you exchange. As such, you can decide how long the partner will function. Contingent upon the boundaries you indicate, Full-Auto mode will naturally enter or leave exchanges for your sake. What a wealth of decisions! Pick what suits you the best. You will all find how to make decisions!piness and confidence! It's your pass to a forthcoming outing liberated from tension. Conclusion solid marker "FX Money Generator" gives you an uncalled for advantage that you can save perpetually and doesn't need repeating installments for. Your outcomes can be radically different by this one powerful instrument. Bit by bit Client Guide: This guide contains straightforward directions that even a fledgling can use to immediately set up the framework and start bringing in cash. Free updates to guarantee that it keeps on working regardless of whether the market shifts. Free Future Updates: Since the "FX Money Generator" group is continuously attempting to work on its marker, you will consequently get any updates we make at no expense for you. My objective is for you to prevail with regards to exchanging the long run. Click Here To Get FX Money Generator With Unique Markdown Cost Affiliate Disclosure: The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team and please know we only recommend high quality products. Read the full article

0 notes

Text

An Overview of the MACD Indicator: Identifying Market Trends

Understanding MACD in Technical Analysis

The average convergence divergence indicator, known as the Moving Average Convergence Divergence (MACD) indicator, is one of the most widely used tools in technical analysis, helping traders and investors assess momentum, trend direction, and potential buy or sell signals across various markets. Developed in the late 1970s by Gerald Appel, MACD has stood the test of time, consistently serving as a go-to indicator for analyzing price action in stocks, forex, commodities, and indices.

Unlike indicators that rely solely on historical price levels or volume, MACD analyzes the relationship between moving averages to generate insights. The indicator simplifies trend-following by visualizing the momentum behind a price move and how it is shifting over time. As with any technical tool, MACD is not predictive in isolation, but when used in conjunction with a sound strategy, it can provide valuable support for buy and sell signals in trading decisions.

The Core Components of the MACD Indicator

The MACD indicator consists of three main components, each of which plays a distinct role in interpreting market behavior:

MACD Line: This is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. It represents the short-term momentum of a stock relative to its longer-term trend.

Signal Line: The signal line is a 9-period EMA of the MACD line. It helps smooth out the fluctuations in the MACD line and is used to generate potential trading signals.

Histogram: This is the graphical difference between the MACD line and the signal line. It provides a visual indication of momentum shifts and the strength of the current trend.

These components work in tandem as a momentum indicator to help traders identify key inflection points in price movements, where momentum may be strengthening or weakening.

How the MACD Indicator Is Calculated?

While most charting platforms automatically plot MACD, understanding the underlying calculations adds context to the signals it produces. Here's a breakdown of the standard MACD formula:

MACD Line = 12-period EMA − 26-period EMA

Signal Line = 9-period EMA of the MACD Line

Histogram = MACD Line − Signal Line

The MACD line provides a view of short-term momentum versus long-term trend, while the signal line offers smoothing to reduce noise. The histogram acts as a visual cue to identify shifts in momentum more clearly.

Using MACD to Identify Market Trends

MACD can help traders across all timeframes identify whether a market is trending and where momentum is heading. Here are the primary ways MACD is applied in trading:

1. Trend Confirmation

When the MACD line is above the signal line and both are above the zero line, it typically confirms a bullish trend. Conversely, when the MACD line is below the signal line and both are below zero, it generally confirms a bearish trend. Traders use these signals to validate market direction and align their trades with the prevailing trend, whether it indicates bullish or bearish momentum.

2. MACD Line Crossovers

Bullish Crossover: This occurs when the MACD line crosses above the signal line, indicating a potential upward move. It often serves as an early buy signal, especially when confirmed by price action or volume.

Bearish Crossover: This occurs when the MACD line crosses below the signal line, suggesting a potential downtrend. It may be used as a sell or short-entry signal, depending on market context.

While crossovers are among the most popular uses of MACD, they are more effective in trending markets than in sideways or choppy environments.

3. Zero Line Crossovers

Crossing the zero line can indicate a more significant shift in momentum:

A move from below to above zero supports a bullish case.

A move from above to below zero suggests growing bearish momentum.

These zero-line crossovers are often used to confirm trend continuation or new trend development, especially when accompanied by strong price movement.

4. MACD Histogram Analysis

The histogram is a visual way of analyzing the difference between the MACD line and the signal line. Its height shows the strength of the current momentum:

A growing histogram above zero suggests strengthening bullish momentum.

A shrinking histogram above zero may indicate weakening bullish momentum.

A growing histogram below zero signals increasing bearish pressure.

A shrinking histogram below zero may point to a potential reversal.

Many traders look for changes in histogram direction as early signals of momentum shifts.

5. Divergence Between MACD and Price

MACD divergence can be a powerful tool in spotting trend reversals. Divergence occurs when the price is moving in one direction while the MACD indicator moves in the opposite direction.

Bullish Divergence: Price makes lower lows, but MACD forms higher lows. This may indicate a loss of downward momentum and a potential reversal to the upside.

Bearish Divergence: Price makes higher highs, but MACD forms lower highs. This can suggest weakening upward momentum and a potential downside reversal.

However, divergence alone is not always sufficient for decision-making. Traders often combine it with support/resistance zones or candlestick patterns for confirmation.

Strengths of the MACD Indicator

MACD is favored by many traders due to its adaptability and the clear, visual nature of its signals. Some of its key strengths include:

Combines Trend and Momentum: Unlike indicators that focus solely on one aspect, MACD blends both trend-following and momentum analysis.

Works Across Markets: MACD can be applied to stocks, forex, commodities, and cryptocurrencies.

Customizable Settings: Traders can adjust the EMAs for shorter or longer timeframes to suit their strategy.

Easy to Interpret: The visual nature of the MACD line, signal line, and histogram makes it relatively simple to read.

Limitations and Risks of Using MACD

Despite its strengths, MACD is not without limitations. Understanding its weaknesses can help traders use it more effectively:

Lagging Nature: MACD is based on moving averages, which are lagging indicators. Signals may appear after a trend has already begun.

Less Effective in Sideways Markets: MACD can generate false signals during consolidations, leading to whipsaws.

Doesn’t Reflect Volume: MACD analyzes price, not volume, which can leave out critical information about conviction.

Requires Confirmation: Relying solely on MACD may lead to premature or delayed entries. Best results often come when combined with other tools like RSI, support/resistance levels, or candlestick patterns.

MACD Across Multiple Timeframes

Using MACD on multiple timeframes helps build context and filter out noise. For example:

A bullish signal on a daily chart may carry more weight if the weekly MACD is also bullish.

A short-term MACD reversal on a 1-hour chart might have limited reliability if the daily chart still shows strong bearish momentum.

Traders who align signals across timeframes can improve their confidence in trade setups and reduce the likelihood of acting on misleading signals.

Popular MACD Trading Strategies

MACD can be integrated into a variety of trading strategies, including forex trading, depending on a trader’s risk profile and market preferences.

MACD and RSI Combo: Use MACD for trend confirmation and RSI for identifying overbought/oversold conditions. This combo helps filter out false signals.

MACD Trend-Following Strategy: Enter trades when MACD confirms trend direction and exit when a crossover occurs against the trend.

MACD Histogram Fade: Enter trades when the histogram peaks and begins to contract, indicating a potential reversal in momentum.

MACD Divergence Reversal: Look for divergence on the MACD indicator while price tests key support/resistance levels.

Each strategy must be complemented by strict risk management practices, including stop-loss orders and proper position sizing.

MACD in Different Market Conditions

MACD performs differently depending on the nature of the market:

Trending Markets: MACD excels in capturing sustained moves and confirming trend strength. Crossover signals are generally more reliable.

Range-Bound Markets: MACD tends to be less reliable, with frequent crossovers and potential whipsaws. In such cases, traders may rely more on oscillators like RSI or Bollinger Bands.

Identifying the current market environment is key to applying MACD appropriately.

Combining MACD with Fundamental Analysis

While MACD is a technical indicator, it can be used alongside fundamental analysis to enhance trading decisions. For example:

After a positive earnings report, a bullish MACD crossover could reinforce a long position.

If economic data points to slowing growth, and MACD turns bearish, it could confirm a cautious or defensive outlook.

Using both technical and fundamental tools creates a more well-rounded view of the market.

Final Thoughts on Using MACD in Trading

The MACD indicator, a trend following momentum indicator, remains one of the most valuable tools in a trader’s arsenal. By providing clear signals on momentum and trend strength, it helps traders make more informed decisions and navigate market volatility. However, MACD should never be used in isolation. Its signals are most effective when combined with other technical indicators, sound market context, and disciplined risk management.

Understanding the intricacies of how MACD works, including crossovers, divergences, and histogram behavior, allows traders to tailor strategies that match their style and goals. With practice and a thoughtful approach, MACD can become an indispensable component of any trading system aimed at identifying high-probability market trends.

0 notes

Text

youtube

How to Count Pips in Forex Trading Explained in 52 Seconds! 📊

#crypto#crypto trading#tradingtactics#tradingindicators#trading performance#forex#stock market#trading tutorial#day trading#forex trading#protect your capital#high-quality trades#how to count pips#forex for beginners#pip calculation#forex tutorial#forex explained#forex basics#forex trading tips#forex pip definition#forex beginner guide#learn forex#forex profits#forex risk management#Youtube

1 note

·

View note

Text

Top 5 Indicators Every Trader Should Know

Exchanging the monetary business sectors can be complicated, yet understanding key markers can altogether improve your direction and productivity. Pointers are instruments that assist merchants with investigating value developments, patterns, and likely inversions, giving significant bits of knowledge to trading resources. While there are many markers accessible, a stand apart because of their dependability and flexibility. This blog investigates the main 5 markers each dealer ought to be aware, their applications, and how to actually utilize them. read more

0 notes

Text

TradingView Alert Indicator: Real-Time Alerts for Better Decisions

The TradingView Alert Indicator offers traders an efficient way to set up customized alerts for key market conditions. By integrating seamlessly with TradingView, it helps you monitor price movements, trends, and indicators in real time. Stay informed, never miss trading opportunities, and optimize your strategy with precise, automated alerts.

0 notes

Text

Enhance Your Trading Strategy with the Relative Vigor Index (RVI)

Ever feel like your trading strategy could use a little boost? Enter the Relative Vigor Index (RVI), a technical analysis tool that’s like a double shot of espresso for your trading game. Just as we tend to feel energized when things are on the up (or after a good coffee), asset prices typically close higher during uptrends. Let’s dive into how the RVI indicator can help you identify these momentum-packed market moves.

Read more: https://www.investchannels.com/boost-your-trading-strategy-with-the-relative-vigor-index-rvi/

What is the Relative Vigor Index (RVI)?

The Relative Vigor Index, or RVI, is a momentum oscillator that helps traders gauge the strength and direction of a market trend. It operates by comparing an asset’s closing price with its overall trading range and then smoothing this data with a simple moving average (SMA). The core idea behind the RVI is to capitalize on a common market behavior: during uptrends, prices tend to close higher than they open, and the opposite happens in downtrends. This characteristic makes the RVI a useful tool for traders seeking a clear view of the market’s momentum.

How Does the Relative Vigor Index (RVI) Work?

As traders analyze the RVI, they’ll notice its values increase as an uptrend builds. In this bullish setting, an asset’s closing price generally gravitates toward the top of its trading range, while the opening price sits closer to the bottom. Essentially, when markets are trending upwards, prices tend to close stronger than they opened; conversely, downtrends see prices weakening toward the end of the trading session.

Much like other oscillators, such as the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI), the RVI oscillates around a central line. Rather than tracking price movements directly, it rotates around this central point, which is often displayed separately beneath the main price chart. Understanding this nuance is essential for using the RVI effectively within a trading toolkit.

Building a Strategy with the Relative Vigor Index (RVI)

There are several methods traders can use with the RVI to understand market trends and identify potential entry points. Two of the most widely used techniques are spotting divergences and observing crossovers. Let’s explore each approach in more detail.

Divergence in the RVI

One of the primary functions of the RVI is to identify divergences, which happen when the RVI moves in one direction while the asset price moves in another. Such divergence can indicate a likely trend reversal in the direction of the RVI. For example, if an asset’s price is rising, but the RVI is falling, this could be a signal that a reversal is imminent.

As a leading indicator, the RVI often highlights possible trend changes before they appear on the price chart. When the RVI’s movement diverges from the asset’s price, it frequently serves as an early warning of a potential shift in trend. This divergence can offer traders an advantage by allowing them to adjust their strategies ahead of the curve.

RVI Crossovers

Another popular way to read the RVI is through crossovers, which occur when the RVI line crosses above or below its centerline. If the RVI line crosses above the centerline, it signals a potential uptrend, while crossing below suggests a possible downtrend. These crossovers serve as early indicators of where the price might move next, helping traders to position themselves accordingly.

Including the RVI in your trading arsenal can provide an added layer of insight into market momentum, helping you stay one step ahead of potential price moves. Whether you’re looking for divergences or following crossovers, the RVI provides key insights that can help refine your strategy and boost your confidence in navigating the markets.

Optimizing the Relative Vigor Index (RVI) Settings

To improve the RVI’s accuracy, traders might consider adjusting its timeframe settings. Extending the timeframe can help smooth out short-term fluctuations, enabling the RVI to capture the broader market trend more reliably. This adjustment allows the RVI to focus on the bigger picture, providing clearer signals by filtering out some of the short-term market noise.

If you’re trading on platforms like IQ Option, you can easily find and apply the RVI by going to the “Indicators” section, searching for “Relative Vigor Index,” and adjusting settings directly on the price chart. Testing different configurations can help you find the setup that best aligns with your trading style and goals.

Relative Vigor Index (RVI) vs. Relative Strength Index (RSI)

Since both the RVI and RSI belong to the oscillator category, they share certain similarities. However, they serve distinct purposes and can provide traders with different insights, making it essential to know when to use each.

The RSI is primarily designed to identify overbought and oversold conditions, which helps traders recognize extreme market levels. The RVI, in contrast, focuses on the direction and momentum of the trend, offering clues about the current market sentiment—whether it’s bullish or bearish. While the RSI evaluates the trend’s strength, the RVI guides traders toward the prevailing sentiment, making it useful for capturing opportune moments to enter a trade.

Combining Indicators for a More Comprehensive Strategy

Many experienced traders enhance their strategies by combining several indicators to get a more comprehensive view of market behavior. By blending multiple tools, traders can achieve a clearer and more accurate reading, which helps them make informed trading decisions. For example, pairing the RVI with indicators like the RSI or MACD can reveal insights that may not be as apparent with just one tool.

Experimenting with different indicators can help you develop a toolkit that aligns with your trading approach. Whether you prefer to rely on the RVI, RSI, or a combination, taking the time to test different strategies can help you craft a unique approach that suits your specific goals and risk tolerance.

By exploring the Relative Vigor Index and integrating it into your trading strategy, you can unlock deeper insights into market momentum and potential reversals. With practice and patience, the RVI can become a valuable tool in your trading toolkit—empowering you to identify trend shifts, anticipate moves, and navigate the markets with greater precision and confidence.

#TradingStrategy#TechnicalAnalysis#ForexTrading#CryptoTrading#StockMarket#Forex#DayTrading#RelativeVigorIndex#RVI#TradingIndicators#MomentumIndicators#RVIIndicator#Oscillator#MarketAnalysis#PriceAction#TrendReversal#TradingSignals#ForexStrategy#CryptoAnalysis#SwingTrading#Investing#FinancialMarkets#StockAnalysis#CryptoInvesting#ForexCommunity#TradingTools#FinancialEducation

0 notes

Video

youtube

LIVE Trading: How to Use MACD & EMA 8 to Make 3% Daily Profits in Any Ma...

Welcome to Smart Wolf Club! In this exciting LIVE trading session, we dive deep into two powerful indicators—MACD (Moving Average Convergence Divergence) and EMA 8 (Exponential Moving Average)—to show you how to make real-time trading decisions in the stock, forex, and crypto markets. Whether you’re a beginner or an experienced trader, this step-by-step guide will teach you how to use these indicators to spot trends, confirm entries and exits, and maximize your profits.

>> https://www.youtube.com/watch?v=qU--DFH0GJo

0 notes

Text

Comprehensive Market Analysis of Major Indices and Assets

Explore a detailed market analysis featuring Dow Jones, S&P 500, Nasdaq 100, Bitcoin, Ethereum, Apple, Tesla, Gold, Crude Oil, Natural Gas, EUR/USD, and the US Dollar. Understand the moving averages and indicators, with summaries revealing strong buy or sell trends for informed trading decisions. Stay ahead in the market with this in-depth overview of key assets and their performance indicators.

#MarketAnalysis#DowJones#SP500#Nasdaq100#Bitcoin#Ethereum#AppleStock#TeslaStock#GoldPrices#CrudeOil#NaturalGas#EURUSD#USDollar#MovingAverages#TradingIndicators#BuyTrends#SellTrends#InformedTrading#AssetPerformance#FinancialMarkets

0 notes

Text

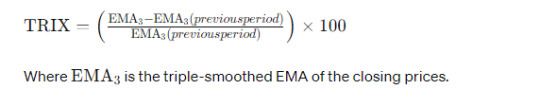

Mastering the TRIX Indicator: A Comprehensive Guide to Trading Success

In the dynamic world of trading, indicators play a crucial role in guiding traders to make informed decisions. Among these, the TRIX (Triple Exponential Average) indicator stands out for its unique ability to smooth price movements and identify market trends effectively. In this comprehensive guide, we will delve deep into the TRIX indicator, exploring its origins, functionality, and how to…

View On WordPress

#CryptocurrencyTrading#FinancialMarkets#ForexTrading#InvestmentStrategies#learn technical analysis#MarketAnalysis#StockMarket#technical analysis#TechnicalAnalysis#Trading with TRIX#TradingIndicators#TradingStrategy#Trend indicators#Triple exponential average#TRIX divergence#TRIX indicator#TRIX signals#TRIX technical analysis#TRIX trading strategy#TRIX vs EMA#TRIX zero line crossover#TRIXIndicator

0 notes

Text

Unveiling Tushar Chande’s Oscillator

#ChandeOscillator#TradingStrategy#MarketMomentum#TechnicalAnalysis#TradingIndicators#upcomingtradera#day trading#futures trading#investing#finance#investors#financial literacy#investments#personal finance

0 notes

Text

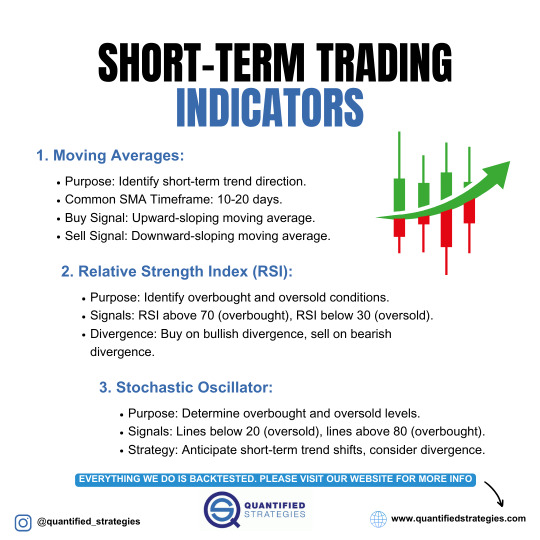

Short-Term Trading Indicators

Moving Averages identify short-term trends with a common SMA timeframe of 10-20 days; an upward slope signals a buy, while a downward slope signals a sell. The Relative Strength Index (RSI) spots overbought (above 70) and oversold (below 30) conditions, with divergence indicating potential buy or sell opportunities. The Stochastic Oscillator determines overbought (above 80) and oversold (below 20) levels, helping anticipate short-term trend shifts.

#tradingstrategies#TradingIndicators#TechnicalAnalysis#MovingAverages#RSI#StochasticOscillator#StockTrading#MarketTrends

0 notes

Video

youtube

IQ Option Trend Finder - Tradingview Script

#youtube#iqoption#iqoptiontrend#iq#IQOptionTrendFinder IQOptionTrading Tradingview2024 AdvancedTradingStrategies MarketTrends TradingForBeginners LiveTrading TradingIndicators#iqoptiontrendfinder#iqoptiontrading#tradingview2024#advancetradingstrategies

0 notes

Video

youtube

Bollinger Bands Explained: Unlocking Trading Success with Proven Strateg...

#BollingerBandsTutorial#TradingStrategies#TechnicalAnalysis#DayTradingTips#ForexTrading#CryptoAnalysis#StockMarketSignals#MarketAnalysis#ProfitableTradin#InvestingStrategies#FinancialEducation#TradingIndicators#MarketTrends#TradingSignals#StockMarketEducation#tradingcharts#BollingerBandsStrategy#TradingCommunity#MarketInsights

0 notes

Text

First Trade | Unraveling Gold's Resistance | AUD/USD's Overbought Surge

As the first trade unfolds, traders are closely watching the price movements in the gold market and the AUD/USD currency pair. Gold's resistance levels are under scrutiny as market participants analyze whether the precious metal will break through and continue its upward trend or face a pullback. Traders are paying particular attention to key technical levels and any significant news or events that could influence the direction of gold prices. On the other hand, the AUD/USD currency pair has experienced an overbought surge, raising concerns among some traders about a potential correction. The rapid rise in the pair's value has led to increased scrutiny of its short-term sustainability. Traders are monitoring various indicators, including RSI and MACD, to gauge whether the currency pair is overextended and poised for a potential reversal.

#FirstTrade#GoldMarket#ResistanceLevels#TechnicalAnalysis#PreciousMetal#MarketSentiment#CurrencyPair#AUDUSD#OverboughtSurge#MarketVolatility#ShortTermOutlook#TradingIndicators#MarketAnalysis#TraderInsights#FinancialMarkets

0 notes