#Tweezer candlestick pattern

Explore tagged Tumblr posts

Text

How Many Candlestick Patterns Are There

How Many Candlestick Patterns Are There? A Friendly Guide to Understanding the Basics

Understanding the world of trading can feel like learning a new language. And if you’ve ever seen a candlestick chart, you might’ve wondered, “What am I even looking at?” Don’t worry—you're not alone! Whether you're someone just getting into trading or simply curious about how it all works, this article will walk you through the mysterious world of candlestick patterns. We’ll break it down in a way that makes sense, no financial dictionary required.

Imagine candlestick patterns like traffic signals on the road of trading—they give hints about what might happen next. Some say, “Hey, the market might go up!” Others hint, “Watch out, things could go south.” So, how many candlestick patterns are there? Great question—let’s find out.

Learn how many candlestick patterns are there, different types of candlestick patterns, and what is candlestick patterns in simple language for beginners.

Introduction to Candlestick Patterns

Let’s start at the beginning. If you’ve ever seen a stock or cryptocurrency chart, you’ve probably noticed those little red and green rectangles—they're called candlesticks. They're not just colorful bars; they tell a story about price movement.

What is Candlestick Patterns?

Candlestick patterns are specific formations of these candles on a chart. Think of them as facial expressions of the market. Just like a smile can tell you someone’s happy, a certain pattern in candles can suggest whether the market is feeling bullish (going up) or bearish (going down).

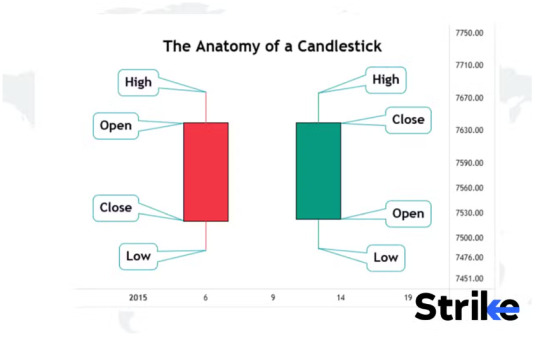

Each candlestick gives four main pieces of information:

Open Price

Close Price

High Price

Low Price

Why Are Candlestick Patterns Important?

Imagine driving with your eyes closed. Sounds scary, right? That’s what trading without understanding patterns is like. Candlestick patterns act like headlights—they help traders see where the road might lead. While they don't guarantee success, they give valuable clues that many traders use to make decisions.

How Many Candlestick Patterns Are There?

Here’s the big question: how many candlestick patterns are there? Well, in total, there are more than 50 recognized patterns, but most traders focus on about 30 key ones. These patterns are grouped into:

Single Candlestick Patterns

Double Candlestick Patterns

Triple Candlestick Patterns

Each category offers insight into different possible future movements of the market.

Types of Candlestick Patterns

To make things easier, let’s break them down:

Single Candlestick Patterns

These involve just one candlestick. They're quick and simple.

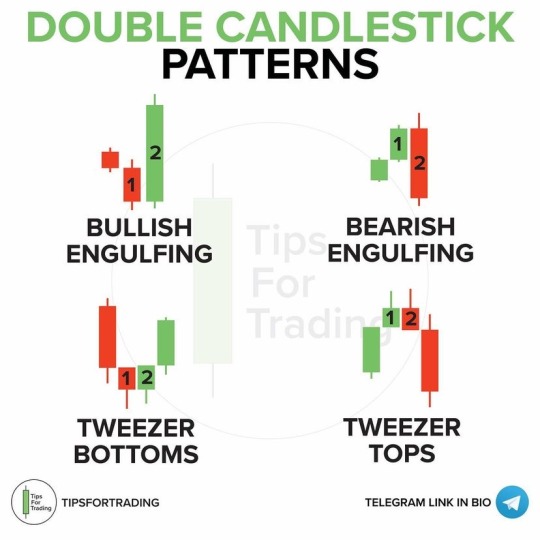

Double Candlestick Patterns

These involve two candles and often signal a trend reversal.

Triple Candlestick Patterns

These use three candles to tell a more complete story about what the market might do next.

Let’s dig deeper into each one.

Single Candlestick Patterns

These are the building blocks of chart reading. They’re easy to spot and understand.

Doji

A Doji looks like a cross. It happens when the open and close prices are almost the same. It shows market indecision—like the market saying, “I’m not sure which way to go.”

Hammer

A Hammer looks like—you guessed it—a hammer! It has a small body with a long lower wick. It usually shows up at the bottom of a downtrend, signaling a potential reversal upward.

Inverted Hammer

Similar to the Hammer, but flipped upside down. It also signals a possible trend reversal, but needs confirmation from the next candles.

Double Candlestick Patterns

These patterns give a stronger message since they involve two candles working together.

Bullish Engulfing

This happens when a small red candle is followed by a big green candle that completely “engulfs” it. It signals a potential move upward.

Bearish Engulfing

The opposite of bullish. A small green candle is followed by a larger red one. This can signal a downward move ahead.

Tweezer Tops and Bottoms

These are two candles with matching highs (tops) or lows (bottoms). They can suggest that a trend is losing strength.

Triple Candlestick Patterns

When three candles join forces, the pattern becomes even stronger and more reliable.

Morning Star

This is a bullish reversal pattern made of three candles: a bearish candle, a small-bodied candle (which can be a Doji), and a bullish candle. It's like a sunrise—things are looking up!

Evening Star

The opposite of Morning Star. It begins with a bullish candle, followed by a small one, and ends with a bearish candle. It's a sign the sun is setting on an uptrend.

Three White Soldiers

This pattern consists of three strong green candles in a row. It’s a very bullish sign, showing continued buying pressure.

Three Black Crows

You guessed it—this one's bearish. It’s made of three long red candles in a row, suggesting strong selling pressure.

Common Mistakes When Reading Patterns

Let’s face it, we all mess up sometimes. Here are some pitfalls to avoid:

Relying on patterns alone: Always use other tools too.

Ignoring the bigger trend: A bullish pattern in a strong downtrend may not hold up.

Overtrading: Just because you see a pattern doesn’t mean you must act on it.

Tips for Learning Candlestick Patterns

Learning candlestick patterns is like learning to read emotions. Start small:

Practice with paper trading.

Use flashcards to memorize patterns.

Review historical charts to see how patterns played out.

Keep a trading journal to track your learning.

Conclusion

So, how many candlestick patterns are there? There are over 50—but don’t panic! You really only need to master about 30 core patterns to start making smarter decisions. Whether you’re an aspiring trader or just a curious learner, understanding these patterns is like having a window into the market’s soul.

Remember, candlestick patterns are tools—not magic tricks. Use them wisely, and always double-check with other indicators and research.

FAQs

How many candlestick patterns are there?

There are over 50 recognized candlestick patterns, but traders mostly use 30 key ones regularly.

What is candlestick patterns in simple terms?

They are visual representations of price movements in a chart. Each pattern gives clues about where the market might go next.

Are candlestick patterns accurate?

They can be helpful, but no pattern is 100% accurate. They're best used with other tools and indicators.

Can beginners learn candlestick patterns easily?

Absolutely! With practice, even beginners can understand and use them to make better trading choices.

What's the difference between bullish and bearish patterns?

Bullish patterns suggest prices may rise, while bearish patterns indicate a possible decline in prices.

#how many candlestick patterns are there#what is candlestick patterns#how to read candlestick pattern#types of candlestick patterns

1 note

·

View note

Link

#BearishEngulfing#BearishMomentum#BearishReversalPatterns#candlestickpatterns#chartpatterns#DarkCloudCover#DowntrendSignals#EveningStar#ForexTrading#MarketSentiment#priceaction#riskmanagement#ShootingStar#StockMarket#supportandresistance#technicalanalysis#ThreeBlackCrows#TradingSignals#TradingStrategy#TrendReversal#TweezerTop

0 notes

Text

🚨 Tweezer Top Candlestick Pattern = Bearish Reversal Signal! 🚨

📉 Spotted two candles with equal highs after an uptrend? Watch out! The bulls tried, but sellers took control. This signals a potential trend reversal!

🔥 How to Trade It? ✅ Short below the low of the second candle 📍 Stop-loss above the highs 🎯 Target nearby support levels

⚠️ Works best with confirmation from RSI (overbought) or key resistance zones!

💬 Drop a “📉” in the comments if you’ve used this pattern before! 📲 Follow for more trading hacks! 🚀

For more join us :

#forex#forex education#forex expert advisor#forexmentor#forex broker#forex indicators#forex market#forexsignals#forexmastery#crypto#money maker#make money online#earn money online#money#forex jaipur#jaipur#learn forex trading in jaipur#cryptomarket#digitalcurrency#cryptocurrency#blockchain#bitcoin

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

35 Powerful Candlestick Patterns

As you step in the world of forex, there is an essential indicator that traders should know. With our 35 powerful candlestick pattern guide, it can enhance you to make effective decision while trading.

Here are examples of powerful candlestick patterns:

Hammer The hammer is an important candlestick shape often seen when prices are falling. It looks like a hammer with a small top and a long lower stick. This happens when sellers bring the price down, but strong buying forces push it back up to close almost where it started. This leaves a candle that has a small body and a long bottom stick, which makes it look like a “hammer.”

Bullish Engulfing Bar The bullish engulfing bar is a key pattern with two candles, usually appearing when a downtrend is about to end. It starts with a smaller candle showing a drop in price, followed by a bigger candle that fully covers the first one from its opening to closing prices.

Piercing Pattern The piercing pattern is a sign that prices might start going up, usually showing up when they’ve been falling. It has two candles: the first one shows a drop in prices and is followed by one that starts even lower but goes up past the middle of the first candle.

Three White Soldiers The three white soldiers is a pattern of three long candles going up in price, often seen as a strong clue that a downward trend could be flipping. Each of these candles starts within the last one and ends almost at its highest point, with little or no upper stick.

Three Inside Up The three inside up is a pattern of three candles that often hints at prices moving up. It’s seen as a strong clue that the market could be shifting in a positive direction. Here’s how to spot it:

First Candle: This is a long downward candle that usually comes at the end of a period where prices have been falling. It’s like the opening act for a possible change in direction.

Second Candle: This is an upward candle that starts lower than where the first one ended and closes within the first candle. It suggests a turn might be coming but doesn’t confirm it.

Third Candle: This last upward candle starts and ends above the second one, sealing the deal on the upward trend.

6. White Marubozu The White Marubozu is a single candle pattern that’s seen as a strong hint that prices will keep going up. Here’s what you should look for in this pattern:

Color: The candle is green, which means the price ended up higher than where it started.

No Upper or Lower Shadow: Unlike most candles that have either a higher or lower tail, this one doesn’t have any. Both the high and low prices are the same as the start and end prices.

7. Bullish Harami The Bullish Harami is a two-candle pattern that might signal a change from a falling market to a rising one. The first candle is a big one that shows a drop in price, and the second, smaller one shows an increase.

8. Inverted Hammer The inverted hammer is a single-candle pattern that often shows up when a market is going down but could be about to go up. This candle has a small body at the bottom and a long upper wick, with almost no wick at the bottom.

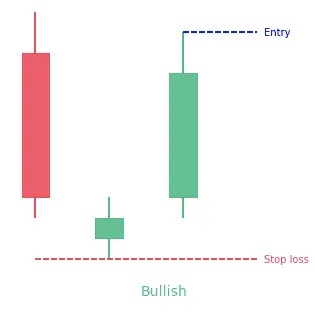

9. Tweezer Bottom The tweezer bottom is a pattern you might see when the market is going down but could be getting ready to go up. It shows up as two candles that line up perfectly at their lowest points. The first candle is generally going down, following the current market trend. The second candle is going up, hinting that things might be about to change.

10. Three Outside Up The three outside up is a pattern that suggests the market might be about to go up. It shows up as three candles on a chart. It consists of three candles:

First Candle: A bearish candle in a prevailing downtrend.

Second Candle: A bullish candle that completely engulfs the first one, signifying that buyers are starting to take control.

Third Candle: Another bullish candle that closes higher than the second, confirming the bullish momentum.

Find more details: Finxpdx

Download PDF file: Candlestick Patterns

#investing#finance#investment#financial#forex#forextrading#forex market#candlestick#candlesticks pattern

0 notes

Text

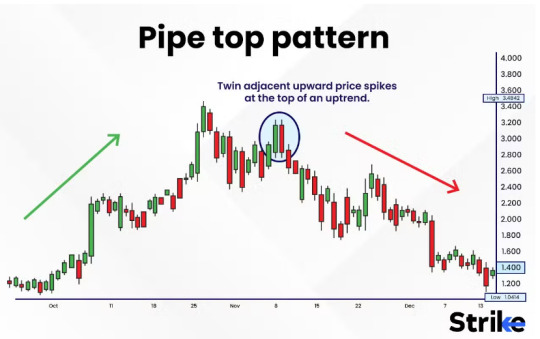

🔍 Complete Guide to Pipe Top & Bottom Patterns: The Reversal Signals Smart Traders Don’t Miss

Market reversals are where big money is made. But spotting them early? That’s an art—and a science. Among the sea of candlestick patterns, Pipe Top and Pipe Bottom patterns stand tall as powerful indicators of a potential trend reversal.

These formations appear loud and clear when the market is exhausted, giving seasoned traders a chance to enter before the herd. In this guide, we break down how these patterns work, how to trade them with precision, and how you can spot them using tools like Strike Money, TradingView.

Let’s decode the mindset of the market and master the Pipe Patterns.

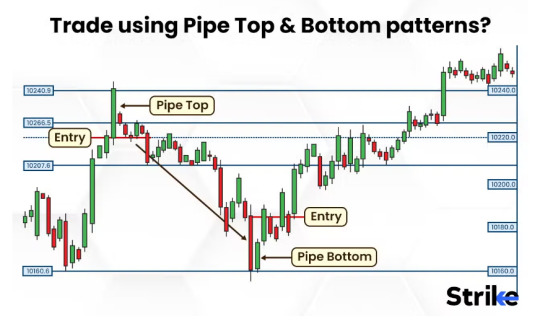

🚀 What Exactly Are Pipe Top & Pipe Bottom Patterns?

Pipe Top Pattern appears at the end of an uptrend. It shows two tall bullish candles followed by sharp reversal—indicating buying pressure is exhausted. Pipe Bottom Pattern is its mirror image—found after a downtrend. It shows two deep bearish candles, then a surge of demand signaling buyers stepping in with force.

These are not random candles. They’re reversal footprints formed by a combination of price rejection and trader psychology.

🧠 Think of them like this: 👉 Pipe Top: “This rally is over. Sellers have entered with authority.” 👉 Pipe Bottom: “Enough bleeding. Buyers are ready to reverse the trend.”

🎯 Why Traders Love These Patterns for Reversals

✅ High reliability when confirmed with volume ✅ Quick entries after exhaustion wicks ✅ Clear stop-loss and entry levels ✅ Works well across stocks, forex, commodities, and crypto ✅ Easy to recognize once you know what to look for

🧩 According to Thomas Bulkowski, author of Encyclopedia of Chart Patterns, reversal patterns like Pipe formations show consistent returns when combined with volume and trendline breakouts.

🔬 Anatomy of the Pipe Pattern: What to Look For

🎥 Imagine a stock like TATA Motors moving sharply upward. Suddenly, two large green candles appear—only to be followed by a sharp bearish engulfing. You just spotted a Pipe Top.

What defines the pattern?

📍 Tall identical candlesticks (same height) 📍 Long upper or lower wicks 📍 Extreme volumes during formation 📍 Occurs near resistance or support zones 📍 Signals exhaustion of buyers or sellers

In Pipe Bottoms, you’ll often see volume climax followed by a bullish engulfing candle or hammer-like reversal.

🧠 The Psychology Behind Pipe Patterns

Every candlestick tells a story. Pipe patterns scream one thing: “The crowd has lost control.”

💥 In Pipe Tops, greedy buying pushes prices unrealistically high—only to get trapped by institutional selling. 💥 In Pipe Bottoms, panic selling exhausts sellers, triggering sharp rebounds led by informed buyers.

These formations reflect emotional extremes: Fear, Greed, Panic, and Exhaustion.

Understanding this psychological layer gives you an edge. You’re not just reading charts—you’re reading market intent.

🔄 Pipe Pattern vs Double Top, Tweezer, and V-Bottom – Know the Difference

🧠 Many confuse Pipe Tops with Double Tops or Tweezer Tops. But there’s nuance here.

🔺 Pipe Tops: Sharper, aggressive, usually have long upper wicks 🔺 Double Tops: Require a pause between two peaks 🔺 Tweezer Tops: Both candles are nearly identical; Pipe Tops can have variation 🔻 V-Bottoms: More “instant” than structured; Pipe Bottoms often include confirmation

Remember: Pipe patterns are velocity-driven. They appear fast, decisive, and loud.

📈 How to Trade Pipe Top and Bottom Patterns with Precision

Here’s how savvy traders act when they spot a Pipe formation:

💡 Step 1: Wait for the pattern to form fully. 💡 Step 2: Confirm with volume (look for spike or divergence). 💡 Step 3: Use indicators like RSI <30 for Pipe Bottom, RSI >70 for Pipe Top. 💡 Step 4: Look for support/resistance break with follow-through candle. 💡 Step 5: Place SL above the wick (Pipe Top) or below the wick (Pipe Bottom).

📍 Pro Tip: Use Strike Money’s charting tools to mark reversal zones and set alerts for candle structures. The platform’s clean visuals make Pipe patterns easy to identify—even for beginners.

🇮🇳 Real Examples from Indian Stock Market

📊 Let’s bring this home with Indian stocks.

🔸 HDFC Bank: In March 2023, the stock formed a clear Pipe Top near ₹1700 with two tall green candles, followed by a massive bearish engulfing candle. What followed? A 9% drop in 5 sessions.

🔸 Infosys: In July 2022, Pipe Bottom was formed around ₹1380. After heavy panic selling, buyers stepped in. Within a week, the stock rallied 11%.

🔸 Reliance Industries: Pipe Top at ₹2580 (Jan 2023) gave a clean reversal. Sellers dominated right after pattern confirmation—leading to a 7% downside.

🔎 Use these examples to train your eye. Backtest them using Strike Money, TradingView for consistent practice.

📚 Research Backing & Pattern Performance

📖 According to CMT Association resources and Bulkowski's historical tests:

✅ Pipe Bottom has a success rate of around 72% when combined with volume confirmation ✅ Pipe Top patterns succeed 68% of the time when they break below support with momentum ✅ The average reward-to-risk ratio improves by 35% when combined with RSI/MACD

⚠️ But remember: no pattern is a holy grail. Use confirmation indicators and risk management discipline.

⚠️ Common Mistakes to Avoid While Trading Pipe Patterns

🚫 Entering too early—without volume support 🚫 Ignoring context—trying to trade it in sideways markets 🚫 Forgetting stop-loss—especially during news-driven volatility 🚫 Misidentifying similar candles—especially Doji and Evening Star 🚫 Chasing trades instead of waiting for retests

💡 One smart move: Use Strike Money’s pattern replay feature to simulate past price action and test entries/exits.

🔧 Best Indicators to Combine with Pipe Patterns

🔹 RSI: Use to detect overbought/oversold confirmation 🔹 MACD: Divergence near Pipe formations = strong signal 🔹 Volume Oscillator: Tracks unusual buying/selling volumes 🔹 Fibonacci Levels: Check for 38.2% or 61.8% retracement around Pipe patterns

🛠️ Strike Money lets you layer these indicators with zero clutter, helping you build a clean confluence zone.

🧠 Trader Mindset: Why Confidence Beats Complexity

Technical setups are only half the story. A trader's psychological resilience completes the picture.

✅ Trust your system. ✅ Respect stop-loss. ✅ Accept false signals—they happen. ✅ Use tools like Strike Money and TradingView to remove noise.

Remember: Pipe patterns aren’t magical. But with consistent practice, they help you enter reversals early with confidence—before the majority even sees the setup.

🏁 Final Takeaway: Pattern Mastery = Market Mastery

Pipe Top and Bottom patterns are more than candlesticks. They are moments of truth in the market—where crowd behavior shifts, liquidity changes hands, and momentum pivots.

🎯 If you want to stay ahead, stop chasing breakouts. Start mastering exhaustion signals like Pipe formations.

🔥 Use the right tools. Strike Money gives you the edge with precise visual cues, alerts, and smart chart setups. 📊 Backtest, reflect, and refine. Because repetition builds intuition. 📈 Master this pattern—and you’ll start seeing the market with clarity others miss.

Ready to spot the next Pipe Reversal? Start analyzing your charts with Strike Money today.

0 notes

Text

Trend reversal patterns | tradesense institute

The trend reversal candlestick patterns are commonly used in technical analysis to indicate indecision in the market. They indicate that the market's trend, which may have been going either up or down, is probably going to change.

Traders can use these patterns to help them decide whether to purchase or sell a specific security when making investing decisions.

There are various types of trend reversal patterns five of which are listed below:

Morning star

Evening star

Bullish engulfing

Bearish engulfing

Tweezer bottom

View on wordpress

#Chart patterns#Price action trading#Trading basics#Technical analysis#Candlestick patterns#Reversal patterns#trendreversal#morningstar candlestick#eveningstar candlestick

1 note

·

View note

Text

The Tweezer Candlestick Pattern

The Tweezer Candlestick Pattern

The Tweezer candlestick pattern has its advantages and disadvantages. The first is its reliability. This candlestick pattern is often used by traders to determine the resistance zone in the market. The second is its reversal potential. The wicks of each candlestick are different, so it can be hard to tell which one is stronger or weaker. The Tweezer candlestick pattern appears when two…

View On WordPress

0 notes

Link

#BreakoutTrading#BullishEngulfing#BullishHarami#BullishReversalPatterns#chartpatterns#CupandHandle#DoubleBottom#ForexTrading#Hammer#InvertedHammer#MarketSentiment#MomentumReversal#MorningStar#PiercingLine#priceaction#riskmanagement#StockMarket#supportandresistance#technicalanalysis#ThreeWhiteSoldiers#TradingSignals#TradingStrategy#TrendConfirmation#TrendReversal#TweezerBottom#volumeanalysis#WedgePattern

0 notes

Text

A Tweezer Bottom is a bullish reversal candlestick pattern that typically appears at the end of a downtrend, signaling a potential price reversal to the upside. It consists of two consecutive candles with matching or nearly identical lows.

For more join us and learn more:

#forex#forex education#forex expert advisor#forexmentor#forex broker#forex indicators#forex market#forexsignals#forexmastery#crypto#stock market#investing stocks#bitcoin#cryptocurrency#binance#usd#cryptonews#coinbase#forex traders#forexlifestyle#forexstrategy#forexsuccess#forextips#forex trading#forextrading

1 note

·

View note

Text

These reversal patterns are a sign that a strong move may be approaching.

The Engulfing pattern is a two candlestick pattern where a small first candlestick is then followed by a large candlestick in the opposite direction.

The Tweezer pattern can be found after an extended up or down trend. In this double candlestick pattern the first candlestick follows the general trend, and the second candlestick will be in the opposite direction, the wick lengths should also be of equal size.

🔗 Click the link in our bio to join the FREE Telegram group

⤵️ Follow our Analysts

@ja_tipsfortrading

@sa_tipsfortrading

👉 Follow us for more

@tipsfortrading

#forextrade #forexprofit #tradingforex #forexmoney #forexeducation #traderlifestyle #tradeforex #forexnews #forexgroup #technicalanalysis #traders #swingtrading #forexanalysis #daytrade #forexlife #forexsignal #forex #forexmentor #pips #forexmentor #pips

0 notes

Text

Learn advanced tools for forex trading with 'Candlestick Pattern'

Candlestick charts are widely used in forex trading as a tool for technical analysis. They provide a visual representation of price movements over a specified period, showing the opening, closing, high, and low prices. Each candlestick typically consists of:

Body: The rectangular part, which shows the difference between the opening and closing prices.

Wicks (or Shadows): The thin lines above and below the body, indicating the highest and lowest prices during the period.

Top Powerful Candlestick Patterns

1. Hammer: This happens when sellers bring the price down, but strong buying forces push it back up to close almost where it started.

2. Bullish Engulfing Bar: It starts with a smaller candle showing a drop in price, followed by a bigger candle that fully covers the first one from its opening to closing prices.

3. Piercing Pattern: It has two candles: the first one shows a drop in prices and is followed by one that starts even lower but goes up past the middle of the first candle.

4. Three White Soldiers: The three white soldiers is a pattern of three long candles going up in price, often seen as a strong clue that a downward trend could be flipping.

5. Three Inside Up: The three inside up is a pattern of three candles that often hints at prices moving up.

6. White Marubozu: The White Marubozu is a single candle pattern that’s seen as a strong hint that prices will keep going up.

7. Bullish Harami: The Bullish Harami is a two-candle pattern that might signal a change from a falling market to a rising one.

8. Inverted Hammer: The inverted hammer is a single-candle pattern that often shows up when a market is going down but could be about to go up.

9. Tweezer Bottom: The tweezer bottom is a pattern you might see when the market is going down but could be getting ready to go up.

10. Three Outside Up: The three outside up is a pattern that suggests the market might be about to go up.

Learn more about other top 35 candlestick pattern: https://finxpdx.com/35-powerful-candlestick-patterns-pdf-download/

0 notes

Text

Complete Guide to Candlestick Patterns: Master Market Signals with Confidence

Reading charts is like reading a market’s diary. Among all the technical tools out there, candlestick patterns are one of the most reliable ways to decode price behavior. They don’t just show what happened—they hint at what’s about to happen.

Whether you’re trading Nifty 50, Bank Nifty, or mid-cap stocks, understanding candlestick signals can help you make sharper, faster decisions.

Let’s dive deep.

Why Candlestick Patterns Still Rule the Charts in 2025

Originally developed by Japanese rice traders in the 1700s, candlestick charting was brought to the West by Steve Nison through his groundbreaking book Japanese Candlestick Charting Techniques. Since then, these patterns have become a global standard in technical analysis, especially in Indian stock trading.

Today, platforms like Strike Money, TradingView offer real-time candlestick visualization for intraday and positional traders.

Fun fact: According to a 2023 survey by Zerodha Varsity, over 74% of Indian retail traders rely on candlestick patterns for entry or exit signals.

Understand This First: Anatomy of a Single Candlestick

Each candlestick tells a story:

Open: Where the price started

Close: Where it ended

High and Low: The price extremes

Wicks (or Shadows): Indicate price rejection

Body: Shows strength or weakness of the move

💡 Example: If Reliance opens at ₹2,200, touches ₹2,250, dips to ₹2,180, and closes at ₹2,240—you’ll see a long green candle with wicks on both sides.

Bullish Candlestick Patterns That Shout ‘Buy!’

These patterns signal potential upward movement and are especially useful during downtrends or consolidations.

🔹 Hammer

A short body with a long lower wick. Often appears at market bottoms.

🧠 Seen in: Tata Motors (May 2023), post a 3-week downtrend. It rallied 12% within the next 7 sessions.

🔹 Morning Star

A three-candle pattern. It starts with a bearish candle, followed by a small-bodied candle (indecision), and ends with a strong bullish candle.

⚡ Seen in: Infosys during Q2 FY24 earnings rebound.

🔹 Bullish Engulfing

When a green candle fully “engulfs” the previous red candle. A sign of reversal and strong buying interest.

📊 Research insight: A QuantInsti backtest on Nifty stocks (2022) showed a 67% success rate when bullish engulfing appeared with rising volume.

Bearish Candlestick Patterns That Scream ‘Exit Now!’

These patterns signal exhaustion or reversal from an uptrend. Great for catching tops or placing short trades.

🔻 Shooting Star

Long upper wick with a small body near the bottom. Often seen before price drops.

🧠 Seen in: Adani Enterprises (Feb 2023) before a 20% correction post-Hindenburg report.

🔻 Evening Star

The bearish sibling of Morning Star. Appears after a bullish trend.

🧠 Seen in: HDFC Bank (Oct 2022) before quarterly result disappointment.

🔻 Bearish Engulfing

A strong red candle that swallows the previous green candle.

💡 Tip: Confirm it with RSI divergence for stronger probability.

Trend Continuation Patterns: When the Market Just Takes a Breather

These patterns don’t reverse trends—they reaffirm them.

🔁 Rising Three Methods

Three small red candles sandwiched between two strong green ones. Indicates bullish continuation.

⚡ Seen in: TCS after its Q1 FY24 earnings rally.

🔁 Falling Three Methods

Exactly the opposite. A sign that sellers are still in control.

📈 Seen in: Nifty IT Index, April 2023, during tech sell-off.

Reversal Patterns That Can Turn the Market on Its Head

When you spot these, be ready for change.

🔄 Doji

Open and close are nearly the same. Signals indecision.

⚠️ When seen at the top of a rally (e.g., Nifty Midcap, July 2023), it's often a red flag.

🔄 Tweezer Tops & Bottoms

Two candles with similar highs or lows. Shows rejection of a price level.

🧠 Common in sideways market phases—look for confirmation!

Live Examples from Indian Market That Prove Candlestick Power

ICICI Bank (Feb 2024): A bullish engulfing candle at ₹890 led to a 6% rally in just 4 days.

Wipro (July 2023): A shooting star on daily chart signaled a drop from ₹450 to ₹410 in one week.

Nifty 50: Morning Star in March 2023 sparked a rally that added 400 points in 6 sessions.

💡 Use Strike Money to backtest these patterns visually, with historic charts and customizable timeframes.

How to Actually Use Candlestick Patterns in Your Strategy

Candlestick patterns should never be used in isolation.

Here’s how to combine them effectively:

🔍 Support & Resistance: Patterns near key levels have higher accuracy.

📉 Indicators: Combine with RSI, MACD, or Bollinger Bands.

🕐 Timeframes: Higher timeframes (daily, weekly) offer stronger signals than intraday 5-min charts.

📊 Volume Confirmation: A pattern with rising volume has better success odds.

📘 Suggested read: Encyclopedia of Chart Patterns by Thomas Bulkowski

Do Candlestick Patterns Actually Work? What Data Says

Not every pattern leads to profit. But statistically, they offer edge—not certainty.

🔎 Research Highlights:

A study by National Stock Exchange (NSE) of India in 2021 on retail traders found that patterns like Engulfing and Morning Star had a 60-65% win rate when paired with moving averages.

CFA Institute papers show candlestick setups work best when aligned with broader market structure—not in isolation.

💡 Tip: Use paper trading on Strike Money to validate any new strategy before going live.

Avoid These Rookie Mistakes with Candlestick Charts

🚫 Chasing Every Pattern: Not every Doji means reversal. Context is key. 🚫 Ignoring Volume: A pattern without volume is like a car with no engine. 🚫 Trading Against the Trend: Counter-trend setups are risky. 🚫 Skipping Confirmation: Wait for the next candle to confirm the signal.

🔁 What to do instead? Track 3–5 patterns that suit your style and backtest deeply.

Top Tools You Can Use to Practice and Master Candlestick Trading

You don’t need to fly blind. These tools can sharpen your skills:

✅ Strike Money: Indian-focused, real-time charting with advanced candlestick pattern detection.

✅ TradingView: Community scripts and global market access.

✅ MetaTrader 5: Deep indicator integrations for forex and commodities.

✅ Thinkorswim: Great for simulation if you're trading U.S. stocks too.

So, Is Learning Candlestick Patterns Worth Your Time?

Short answer? Absolutely.

Understanding candlestick patterns gives you a visual edge. They simplify what’s happening beneath the hood—buyer vs. seller psychology.

✅ They don’t guarantee success ✅ They’re not magic formulas ✅ But when combined with smart risk management, they can boost your win rate significantly

👣 Start with the basics. Practice on Strike Money with your favorite Indian stocks. Watch how patterns unfold on different timeframes. Track your results.

Final Word: The Market Talks in Candles—Learn Its Language

Every Nifty rally, every Bank Nifty dip, every midcap breakout—starts with a few humble candles on a chart.

If you want to trade with confidence and reduce noise, mastering candlestick patterns is your first step.

Ready to make sense of market moves like a pro? 🔥 Open your charts on Strike Money and start decoding candlestick signals today.

0 notes

Text

Engulfing Patterns and Tweezers

Candlestick chart patterns are widely used in technical analysis to identify potential trend reversals or continuations in financial markets. Engulfing patterns are a type of candlestick pattern that can provide traders with valuable insights into market trends. In this article, we'll explore everything you need to know about engulfing patterns, including their definition, types, identification,…

View On WordPress

1 note

·

View note

Text

candle stick patterns cheat sheet work 6CR!

💾 ►►► DOWNLOAD FILE ��🔥🔥🔥🔥 In this book you will see bullish, bearish, and neutral candlestick chart patterns and it is important to take the signals that they give in the. To that end, we'll be covering the fundamentals of candlestick charting in this tutorial. More importantly, we will discuss their significance and reveal 5 real. Five bullish candlestick patterns. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. They are an indicator for. # Candlestick Patterns Cheat Sheet. In today's training, you will learn how to read candlestick patterns like a professional trader. 9 This cheat sheet will help you to easily identify what kind of candlestick pattern you are looking at whenever you are trading. It is that latter perspective that holds a lot of people back. Amrit Sall. Partner Center Find a Broker. Next Lesson Candlesticks with Support and Resistance. Spinning Top. White Marubozu. Black Marubozu. Hanging Man. Inverted Hammer. Shooting Star. Bullish Engulfing. Bearish Engulfing. Tweezer Tops. Tweezer Bottoms. Morning Star. Evening Star. Three White Soldiers. Three Black Crows. Three Inside Up. Three Inside Down.

1 note

·

View note

Text

candle stick patterns cheat sheet new F6I+

💾 ►►► DOWNLOAD FILE 🔥🔥🔥🔥🔥 In this book you will see bullish, bearish, and neutral candlestick chart patterns and it is important to take the signals that they give in the. To that end, we'll be covering the fundamentals of candlestick charting in this tutorial. More importantly, we will discuss their significance and reveal 5 real. Five bullish candlestick patterns. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. They are an indicator for. # Candlestick Patterns Cheat Sheet. In today's training, you will learn how to read candlestick patterns like a professional trader. 9 This cheat sheet will help you to easily identify what kind of candlestick pattern you are looking at whenever you are trading. It is that latter perspective that holds a lot of people back. Amrit Sall. Partner Center Find a Broker. Next Lesson Candlesticks with Support and Resistance. Spinning Top. White Marubozu. Black Marubozu. Hanging Man. Inverted Hammer. Shooting Star. Bullish Engulfing. Bearish Engulfing. Tweezer Tops. Tweezer Bottoms. Morning Star. Evening Star. Three White Soldiers. Three Black Crows. Three Inside Up. Three Inside Down.

1 note

·

View note