#types of candlestick patterns

Explore tagged Tumblr posts

Text

Types Of Candlestick Patterns And Their Meaning

Learn about types of candlestick patterns, all types of candlesticks, and their meaning to improve your stock market trading strategies

https://quanttrix.io/types-of-candlestick-patterns-and-their-meaning/

0 notes

Text

Types of Candlestick Patterns Explained Simply

Types of Candlestick Patterns: A Beginner-Friendly Guide

Have you ever looked at a stock chart and felt like it was speaking a foreign language? Those little red and green bars—known as candlesticks—aren’t just random shapes. They tell stories. Stories of fear, greed, hesitation, and opportunity. If you've ever wished to understand those stories, you're in the right place.

In this article, we’re going to explore the types of candlestick patterns in a way that’s easy to grasp, even if you're brand new to trading. Think of candlestick patterns like emojis—small symbols packed with emotional context. Just as means happiness, a Hammer candlestick might signal a bullish reversal.

Explore types of candlestick patterns in simple terms. A complete guide to all types of candlestick patterns for beginners and curious traders.

Introduction to Candlestick Patterns

Candlestick patterns are visual tools used in stock trading to predict potential price movements. Each candlestick shows four key details: the opening price, closing price, highest price, and lowest price for a specific time frame.

These patterns originated in 18th-century Japan—yes, that far back!—when rice traders used them to predict future prices.

Why Candlestick Patterns Matter

Understanding candlestick patterns is like learning to read body language. While price tells you what happened, candlesticks hint at why. Are traders getting scared? Is there confidence building up? Candlestick patterns provide these answers through easy-to-spot formations.

Single Candlestick Patterns

Let’s begin with the simplest types. These involve only one candlestick and are often the first step for beginners.

The Hammer & Hanging Man

These two look nearly identical but mean very different things.

Hammer: Appears at the bottom of a downtrend. Think of it as the market “hammering out” a bottom. It has a small body and a long lower shadow.

Hanging Man: Shows up after an uptrend. Same shape as the hammer but signals a potential drop in price.

Tip: The color of the body isn’t as important as the position and size of the shadow.

Doji – The Market's Pause Button

The Doji is like a moment of hesitation. The opening and closing prices are nearly the same, forming a tiny body.

Types of Doji:

Neutral Doji: Price goes up and down, but ends unchanged.

Long-legged Doji: Large wicks on both sides, signaling major indecision.

Gravestone Doji: Looks like an upside-down “T” and suggests bearish pressure.

Dragonfly Doji: Resembles a “T” and may signal bullish strength.

Spinning Top – Indecision Alert

A Spinning Top has a small body and long upper and lower shadows. It signals that buyers and sellers fought hard but neither won.

It usually shows up during a trend and indicates a possible reversal or slowdown.

Marubozu – Full of Confidence

This candlestick has no shadows—just a solid body.

Bullish Marubozu: Opens at the low and closes at the high. Total buyer control.

Bearish Marubozu: Opens at the high and closes at the low. Total seller control.

Think of it like someone shouting, “I’m all in!” without hesitation.

Engulfing Patterns – Power Shifts

These are two-candlestick patterns that reflect changing momentum.

Bullish Engulfing: A small red candle followed by a large green one that "engulfs" it. Suggests a reversal to the upside.

Bearish Engulfing: Opposite of the above, often indicating a drop ahead.

Morning Star & Evening Star

These are three-candle patterns that often signal major turning points.

Morning Star: Appears after a downtrend. A long red candle, then a small one (any color), followed by a strong green candle. Signals a bullish reversal.

Evening Star: The bearish cousin. Appears after an uptrend.

Three White Soldiers & Three Black Crows

These are sequences of three strong candles.

Three White Soldiers: Three long green candles in a row. Very bullish.

Three Black Crows: Three long red candles. Very bearish.

These patterns indicate strong sentiment, either positive or negative.

Harami – Inside Moves

The Harami pattern looks like a small candle hiding inside a larger one.

Bullish Harami: Small green candle inside a large red one. Signals a possible reversal upward.

Bearish Harami: Small red inside a green. Signals a potential downturn.

Piercing Line & Dark Cloud Cover

These two-candle patterns are also all about reversal signals.

Piercing Line: A red candle followed by a green one that opens lower but closes past the midpoint of the previous red. Bullish sign.

Dark Cloud Cover: The opposite. Bearish sentiment taking over.

Tweezer Tops and Bottoms

Tweezer Top: Two or more candles with identical highs. Suggests price resistance and a possible drop.

Tweezer Bottom: Identical lows over two or more candles. Suggests price support and possible rise.

Think of tweezers picking the top or bottom out of a price trend.

How to Read Candlestick Patterns Together

One candle alone doesn't tell the full story. It's like reading just one sentence of a novel. To truly understand the plot, you need context. Combine patterns with:

Volume

Trend direction

Support and resistance levels

Tips for Using Candlestick Patterns Effectively

Don’t trade patterns in isolation. Always confirm with other indicators.

Practice makes perfect. Use demo accounts to test your pattern-reading skills.

Stay patient. Candlestick patterns are signals, not guarantees.

Conclusion

Candlestick patterns are like the facial expressions of the stock market. They give you hints, nudges, and sometimes loud warnings about what might happen next. Whether you’re just curious or planning to dive deeper into trading, understanding these patterns will help you navigate the charts with confidence.

Remember, while this article covers all types of candlestick patterns, experience and context make all the difference in using them effectively.

FAQs

What are candlestick patterns in simple terms? Candlestick patterns are visual tools on price charts that show how a stock's price moves during a certain period, helping predict future movements.

How many types of candlestick patterns are there? There are over 30 commonly used candlestick patterns, including single, double, and triple candlestick formations.

Are candlestick patterns reliable for trading? They can be helpful indicators but should always be used with other tools like volume and trend analysis for accuracy.

What is the most bullish candlestick pattern? The “Morning Star” and “Three White Soldiers” are among the most bullish, often indicating a strong reversal to the upside.

Can I use candlestick patterns in all markets? Yes! These patterns work in stocks, forex, commodities, and crypto markets, thanks to their universal price action behavior.

#types of candlestick patterns#all types of candlestick patterns#types of candlesticks#types of candlesticks and their meaning

0 notes

Link

Crypto Trading with Candlestick Charts

Crypto Trading

0 notes

Text

Ghidul complet pentru înțelegerea formațiunilor de lumânări japoneze în trading

Așa cum am promis episodul trecut videoclipul de azi va fi despre formațiunile de lumânări japoneze.Rămâneți până la finalul videoclipului pentru că arăt exemple de formațiuni de lumânări și explic interpretarea graficelor în funcție de ele.

youtube

View On WordPress

#Acțiuni#administrare capital#brokeri#candlesticks patterns#clasele de active#Cătălin D. Iamandi#Cătălin Daniel Iamandi#dezvoltare personala#dividende#domeniu financiar#educatie financiara#ETF#Financial Education#Financial Success#finante personale#Fonduri mutuale#formațiuni de lumânări#independență financiară#investiții#investiții în acțiuni#investiții în ETF#Investing#investitor#motivatie#R-type Evolution#risc-randament#România#română#subtirare#surse suplimentare venit

1 note

·

View note

Text

How to Trade with Engulfing Candlestick Patterns

Engulfing Candlestick Patterns are a type of chart pattern used in technical analysis to predict market trends. They occur when a larger candlestick completely covers or “engulfs” the previous smaller one, signalling a potential reversal in price direction. There are two types of engulfing candlestick patterns, i.e., bullish engulfing pattern and bearish engulfing pattern. These patterns are a useful tool in determining entry and exit points for trade or understanding the market behaviour to make informed portfolio decisions.

Types of Engulfing Candlestick Patterns

How to Trade Using Engulfing Candlestick Patterns

Pros and Cons of Bullish Engulfing Candlestick Pattern

Pros and Cons of Bearish Engulfing Candlestick Pattern

#engulfing candlestick#types of engulfing candlestick pattern#bullish engulfing candlestick#bearish engulfing candlestick pattern

0 notes

Text

Dirty Work 2

Warnings: this fic will include dark content such as bullying, familial discord/abuse, and possible untagged elements. My warnings are not exhaustive, enter at your own risk.

This is a dark!fic and explicit. 18+ only. Your media consumption is your own responsibility. Warnings have been given. DO NOT PROCEED if these matters upset you.

Summary: You start a new gig and find one of your clients to be hard to please.

Characters: Loki

Note: Let me know if you want more. Didn't get too much on Part 1 but I have ideas so...

As per usual, I humbly request your thoughts! Reblogs are always appreciated and welcomed, not only do I see them easier but it lets other people see my work. I will do my best to answer all I can. I’m trying to get better at keeping up so thanks everyone for staying with me.

Your feedback will help in this and future works (and WiPs, I haven’t forgotten those!)

I love you all immensely. Take care. 💖

Your third week begins in the same place. Before the iron gate, the code unlocking the green maze within. You’re still just as impressed as your first day there. To you, it’s like a fantasy. Entirely unattainable but it’s right there. You can look, but you can’t touch… not beyond cleaning.

You linger outside, not thinking. You admire the tall tulips and the hedge trimmed to resemble some landmark you can’t quite place. You could see a place like this in an Austenian film or perhaps something Victorian. You don’t have an eye for the difference.

You key in the code for the backdoor and continue on. You put covers on your shoes and grab a fresh set of gloves. You’re getting into a pattern, though each client differs slightly. You put your things away and bring your water bottle with you. You bought a cool strap that keeps it against your hip, a small splurge with your first paycheck. The rest went to bills.

As you start on your usual journey through the many rooms of the airy house, you wonder how its sole resident isn’t lonely. Or perhaps he is. He doesn’t seem the type to admit to it. You turn your thoughts back to your work. You try not to think of him, truly, you don’t know much of him.

You take a candlestick and polish it. You move on the small globe; an ivory orb on a silver axes, the outlines of the continent carved into the surface. As you put it back, you notice something. An item you can’t recall being there before. You reach for it but stop as you realise it’s a camera.

You retract your hand and move on to dust the shelf itself. Does he not trust you or was it there before? Of course, somewhere like this would need security. There was a story just the other day about a break-in, but that was closer to your father’s where those culprits dwell.

The second floor is always easier. It seems even less lived-in than below. All but the study and the main bedroom. You flit in and out, checking points off the list until you’re content. You can only hope he will be too.

As you descend, the epiphany tickles your brain. It’s the first shift he hasn’t appeared. It’s easy to assume he’s busy. You don’t expect him to hang around. As if he would supervise you. Besides, that’s probably what the cameras are for.

You pack up and get your single refill of water. You leave the way you came, as you have twice before. The keypad flashes red to signal the lock is in place. You haul your kit higher on your shoulder and tread slowly along the little path along the side of the house.

You look at the gazebo trimmed in hanging ivy. It’s beautiful. You’d like to venture up and sit on that bench. Just sit and watch and smell and feel. You force the thought away and turn back along the stonework.

You’re going home. Not to pollen but tobacco smoke. Not to lush gardens but wilting strands in soggy mud. Not to immaculate floors and pristine decor but to stained walls and broken springs in your mattress.

Home, to another man that makes you nervous.

🧹

Your father is as he always is, smoking on the couch. You say hi as you come in with a bag of groceries, the prize for what was left of your check. He grumbles and flicks through the channels. You go to the kitchen to put away the food.

You’re almost at the end of your first month, a third of the way through your probationary period. Hopefully after that, you can pick up more clients. You shut the cupboard and go back to the living room. Your father coughs into a crumpled tissue. He sounds horrible. You can’t say so, he doesn’t seem to care.

“I got some fresh produce,” you announce proudly, “I’ll steam some veggies with the chops.”

“You get fries?” He growls.

“Uh, no,” you admit, “I thought we could eat something healthier–”

“I don’t like steamed veggies,” he drops the remote and grabs his pack of smokes.

“Oh, sorry, I was only thinking–”

“Don’t lie and say you were,” he snorts as he pulls out a cigarette and taps the end of the pack. “Go on, I’m tryna watch this.”

He nods at the television and you follow his gaze to the rerun of All in the Family. He’s seen them all before. You take the dismissal and retreat up to your room. Like you always do.

It’s always been like this. You don’t hate your father but sometimes it feels like he hates you. You put your kit and your water bottle on your dress and change into clean clothes. You lay in bed and close your eyes, trying to let go of the tension in your muscles.

You don’t remember your mom but he does. You assume that’s why he’s like this. It’s not you, it’s what happened. Tragic. A loss he won’t talk about.

You rub your forehead and let your arms fall to bend on either side of your head. You only ever saw one picture of your mother. You don’t think you look like her. She was pretty. And young. You were always too afraid to ask about her but you could tell she was younger than him. No one could’ve expected her to go so soon.

You close your eyes. It’s a strange sort of grief to miss someone who is only a shadow in your mind. Not even a voice, just this ghost you know by name. Mommy…

You blow out a deep breath in an effort to bid away the sadness. That was so long ago. This is now and you have a lot to worry about.

🧹

The Laufeyson house greets you once more with its elaborate brickwork. It’s starting to feel familiar, like a habit to put in the new code and walk along the winding path around to the back door. Six more numbers and you’re inside; shoe covers, gloves, bottle, and the list.

You always check the new email sent by the agency. There’s always something small and new squeezed into the bullet points. This week, you notice the first task is laundry.

‘Retrieve hamper from hallway. When hamper is left outside door, it means clothes must be washed.’

Easy enough. You go upstairs first and take the tall hamper from beside the door frame. It’s heavy and there’s no wheels to aid in your struggle. The laundry room is downstairs. Your descent is treacherous, one step at a time as you haul the basket down step by step. If Mr. Laufeyson is there, he can’t happy with the noise.

You finally get to the machine and follow the instructions about cycle type and separating colours from whites. However, there is only the bedding to be cleaned. You load the linens in and take a moment to figure out the touchscreen. Your father’s machine has a dial that only works on one setting and gives off a dingy stench.

You leave the basket in front of the washer and retreat to start your usual progression through the urban manse. Mop, sweep, dust, vacuum, polish; hallway, kitchen, dining room, sitting room… Nothing unusual or unexpected.

As you cross the narrow foyer to the den, the sunshine glows a warm orange through the slender windows on either side of the front door. The patterning of the glass reflects prettily on the floor. Despite your best efforts, you can’t help but imagine residing somewhere so brilliant.

You sigh and carry on. You’re sure to open the long drapes to let in the late spring sunshine. It’s not so bad working in the light and you can see where the rare spec of dust is hiding. You go to the tall shelf beside the record player and pull out the albums to wipe beneath them. Music would be jarring in a place always so silent.

You slip the albums back into place, pulling out one to admire the cover; Ane Brun. You’ve never heard of them. You read the track list curiously. You know you shouldn’t be wasting time.

“I don’t believe I’d have anything to your taste on my shelf,” the mocking slither has you pushing the album in line with the rest.

You almost apologise but you remember. You don’t speak. You just clean. So clean.

You glance over at Mr. Laufeyson as he struts in, a book held in one hand as his other is tucked in his pocket. He wears his usual pressed attire; a dark button-up and even darker slacks. You note that he has no tie that day. A single curl dangles by his temple as the rest of his black hair is precisely combed back.

You return to your tasks, gently wiping the cover of the record player and along the stand. You hear the book drop onto the low table before the sofa before his footsteps continue on; closer. He approaches as you get to the next shelf, a collection of EPs in unmarked sleeves.

You wince as he stops near you, flipping up the cover of the sleek record player before stepping back to peruse his selection. You do your best to keep on as he looms. The air is thick and suffocating. Should you go to the next room and come back?

He slips a record free of its sleeve and places it carefully on the players. He moves the needle over and flips the switch, a crackle before the sound drones from the tall standing speakers. Acoustic guitar with a gritty feel to it. The sudden addition of a woman’s voice jolts you; her tone is peculiar but not unpleasant.

When I woke I took the backdoor to my mind And then I spoke I counted all of the good things you are

He backs away without a word. Not an explanation. You finish cleaning the second shelf and dare to glance over. He reads his book on the couch, unbothered by your existence. That isn’t too unfamiliar.

You finish the space but leave the vacuuming for later. You wouldn’t want to ruin the music. You go into what you can only call a sunroom. The french doors peek out onto the garden and a patio set with a large dining set in white iron and glass.

The music drifts in and keeps you company. It almost makes the work easier. You make quick work and go to check the washer to switch over the load. Once you have the dryer figured out, you begin on the second floor.

It’s only as you come out of one of the guestrooms that you notice the silence is returned. You turn down the hallway and near the next door. You enter the study with your usual reverence. Something about the space is intimidating.

The large leather chair with its dimpled back and the even bigger desk; slabs of marble set into polished ebony. Shelves of a similar material, decked out with numerous volumes and the occasional ornament. Some appear even to be genuine artifacts. The rug at the centre is patterned in Persian style.

Behind the desk are a set of doors that open onto a balcony. The drapes are drawn shut. You find that is often the case. It’s a sombre and dark space hidden from the bright gardens without. Your tasks here are minimal. You use the hand vacuum and dust the shelves. You aren’t to touch the desk at all.

A shadow startles you as you drag the cloth along the edge of the bookshelf. Your eyes round and you look over as Mr. Laufeyson enters. You blanch but he doesn’t acknowledge you. He sighs and goes to the desk, sitting in the chair and wheeling it closer. You narrow your sights on the shelves; focus.

You feel a tremble but quickly shake it away. This is his home, he must be able to exist within it, but this feels strange, almost deliberate. Is he trying to make some point? To scare you? You remember the mention of those who came before you. Did they quit or did he dismiss them? Regardless, you can’t afford either.

It isn’t that difficult to follow the rules. Don’t speak? You haven’t much to say. You get closer as you advance along the shelves to the back of the office. He lets out another long exhale. His chair creaks, once, twice, and again.

“Hm,” he rolls back and swivels, an action you observe from the corner of your eye. He tuts and wheels back to the desk, resuming tapping on the keys of his slender laptop. The glow limns his silhouette sinisterly.

You rustle the drapes as you pass them and cross to the opposite shelves. As you brush over the spines of the books, you nearly drop the cloth. His low hum frightens you as he mimics the same melody that played from the speakers below. His tone is deep and sonorous, even delightful.

You squeeze the cloth and pause before regaining your composure. This cannot be a coincidence. The camera and now he’s following you. Or so it seems. Does he distrust you? What reason have you given him?

You are mindful to wipe down the bronze statue of what you assume is a viking warrior. You place it back staunchly, making sure your work is entirely visible to him. You are honest and you like to think you do your work well. Or at least, you try to. Perhaps if he sees that effort, he won’t be so suspicious.

As you head for the door, he quits his humming. His chair squeaks again.

“You are rather more thorough than the last,” he muses.

You stop and turn your head. You nod. He’s baiting you to break his number one rule.

“And you take orders well,” he adds blithely, “that is rare these days.” He taps a key again, “as you were.”

You take the dismissal in stride and flit off to your next task. It isn’t much, maybe only a statement of fact, but it’s something. He isn’t unhappy with your work. So far, neither are you.

#loki#dark loki#dark!loki#loki x reader#fic#dark fic#dark!fic#series#au#maid au#marvel#mcu#thor#avengers

321 notes

·

View notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

Hammer Candlestick: Make Reversal Opportunities

In the world of technical analysis, identifying potential market reversals is important for traders seeking to maximize their profits and minimize their losses. One of the most reliable patterns for spotting these reversals is candlestick patterns, especially hammer candlestick

What Is a Hammer Candlestick?

A hammer candlestick pattern is a specific type of candlestick pattern used in technical analysis to indicate a potential reversal in a downtrend. It appears at the bottom of a downward trend and is characterized by a small body at the upper end of the trading range with a long lower shadow. The length of the lower shadow is at least twice the length of the body. This pattern suggests that despite the sellers pushing prices down significantly during the trading period, strong buying pressure drove the prices back up near the opening price by the end of the period, indicating a possible reversal to the upside.

Types of Hammer Candlestick

Hammer Candlestick The hammer candlestick pattern appears at the bottom of a downtrend and is characterized by a small body with a long lower shadow and little to no upper shadow. The lower shadow should be at least twice the length of the body.

Inverted Hammer Candlestick The inverted hammer candlestick pattern also appears at the bottom of a downtrend but is characterized by a small body with a long upper shadow and little to no lower shadow. The upper shadow should be at least twice the length of the body.

Limitations of Hammer Candlestick

Confirmation Required: A hammer candlestick alone does not guarantee a trend reversal. Subsequent bullish price action is needed to validate it.

No Price Target: The pattern does not provide a specific price target for the potential reversal, requiring other tools for determining exit points.

Context-Dependent: The hammer pattern is most reliable at the bottom of a downtrend and may not be valid in other market conditions.

False Signals: In highly volatile markets, hammer patterns can occur frequently without indicating a true reversal.

Additional Indicators Needs: It will be more effective with other technical analysis tools, rather than relying solely on the hammer candlestick.

Learn more: https://finxpdx.com/hammer-candlestick-how-to-spot-reversal-opportunities/

5 notes

·

View notes

Text

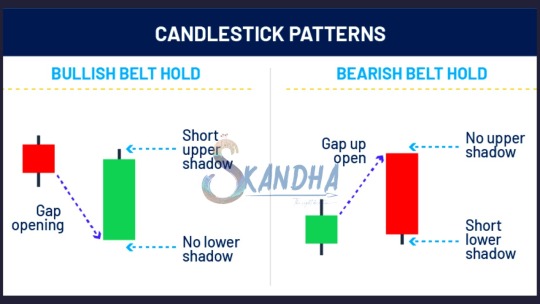

A belt hold pattern suggests that a trend may be reversing and indicates investor sentiment may have changed. When looking at them historically, there will often be a clear trend in one direction, followed by a clear trend in the other direction as the color of the candlestick changes.

There are two types of belt hold candlestick: one bullish and one bearish.

#skandhatrade #belthold #support #resistance #stock #chart #Trade #signal #patterns

#trend #Technicals #analysis #strategies #candlestick #priceaction #entry #supply #demand

To Learn More DM us

We Offer Paid Courses And Training Contact us Via

Email : [email protected]

https://forms.gle/8rWzz1gUuerxwVM49

Website: https://skandhatrade.com/

To Register for Learning:

2 notes

·

View notes

Text

Expert Tips from Trainers at the Best Stock Market Institute in Chandigarh

The stock market can seem like a complex puzzle when you're just getting started. From deciphering candlestick charts to understanding trading psychology, there's a lot to take in. That’s why having expert guidance from the very beginning is essential. If you’re searching for the Best Stock Market Institute in Chandigarh, you're already on the right path—and this article is here to help you go even further.

Let’s explore some expert tips straight from experienced trainers at the best stock market training institute in Chandigarh, giving you a solid foundation to build your trading journey.

1. Start with the Basics—But Don’t Skip Them

Every pro trader once began as a beginner. The first tip shared by trainers at top institutes like those offering the Best Share Market Training in Chandigarh is to master the basics. You need to understand how the stock market works, the role of exchanges, and the types of financial instruments you’ll encounter—like equities, futures, and options.

At the best stock market training institute in Tricity, trainers focus on building a strong base. Skipping the fundamentals might lead to costly mistakes down the line. So, no matter how eager you are to start trading, take time to understand core concepts.

2. Learn Technical Analysis—But Don’t Ignore Fundamentals

Many new traders get fascinated with charts, patterns, and indicators. While technical analysis is powerful, experts from the best share market training institute Chandigarh emphasize that fundamental analysis should not be overlooked.

Understanding a company’s earnings, market position, and future potential helps you make long-term investment decisions. Combining both techniques is the secret sauce many successful traders use.

Trainers at top institutions offering the Best Stock Market Courses in Chandigarh stress the importance of using both technical and fundamental approaches to make more informed decisions.

3. Follow a Trading Plan Religiously

One of the biggest differences between amateurs and professionals is the presence of a trading plan. Experts at the Best Stock Market Training Institute in Chandigarh advise students to create a trading plan and stick to it. This plan should include:

Your entry and exit strategies

Risk management rules

Capital allocation

Daily/weekly goals

Institutes like those offering candila share trading in Chandigarh often provide personalized mentorship to help students create and follow a proper trading plan. This guidance is crucial, especially when emotions take over during real-time trading.

4. Practice Before You Trade with Real Money

Many beginners are tempted to dive into the market with real money after just a few lessons. Trainers at the Best Stock Market Institute in Mohali caution against this. Instead, use demo accounts or paper trading platforms to practice your strategies.

This approach allows you to learn from your mistakes without facing financial losses. Practicing under the supervision of experienced mentors—like those at Candila Stock Trading in Chandigarh—can help you gain the confidence and discipline required for real-time trading.

5. Keep Emotions in Check—Especially Greed and Fear

No matter how great your analysis is, emotional trading can quickly derail your progress. The best trainers often say, “The market doesn’t reward emotion; it rewards strategy.” Greed may push you to overtrade, and fear might stop you from taking valid opportunities.

Courses at the Best Stock Market Training Institute in Chandigarh often include lessons on trading psychology. You’ll learn how to recognize emotional triggers and develop the mental discipline to handle wins and losses with a level head.

6. Don’t Chase the Market—Wait for the Right Setup

One expert tip that often gets repeated at the Best Stock Market Institute in Chandigarh is to wait for your setup. Patience is one of the most undervalued skills in trading. Just because the market is moving doesn’t mean you have to jump in.

Following your strategy and waiting for the right signals will often save you from making impulsive trades. This is a key principle taught at top institutes providing Share and Stock Market Training in Chandigarh.

7. Risk Management Is Non-Negotiable

Managing your risk is as important as selecting the right stocks. Trainers at the Best Share Market Training in Chandigarh strongly advise never risking more than a small percentage of your trading capital on a single trade.

You’ll learn to:

Use stop-loss orders

Set risk-reward ratios

Diversify your portfolio

Avoid over-leveraging

These strategies are foundational parts of any quality Share Marketing Course in Chandigarh, and they help ensure long-term survival in the market.

8. Stay Updated with Market News and Events

Staying informed is part of being a responsible trader. Economic reports, government policies, global news, and company earnings reports all impact the stock market.

Top trainers at the best stock market training institute Chandigarh emphasize incorporating market news into your analysis. This doesn’t mean acting on every piece of news, but understanding how to interpret it and respond smartly.

Courses from leading institutes like those offering candila stock trading in Chandigarh often include regular market updates and real-time case studies to train you in this area.

9. Join a Learning Community

One of the best ways to accelerate your learning is by surrounding yourself with like-minded people. Many students benefit significantly from the peer learning environment found in the best stock market training institute in Tricity.

These institutes not only offer classes but also provide access to forums, Telegram groups, or WhatsApp communities where you can ask questions, share ideas, and get feedback. Being part of such a community helps you stay motivated and continuously improve.

10. Review and Reflect on Your Trades

Learning from past trades is an underrated tip. The best trainers in Share and Stock Market Training in Chandigarh often recommend maintaining a trading journal. This journal should include:

The reason behind each trade

Entry and exit points

Profit or loss

Lessons learned

This practice helps you identify patterns in your own behavior, track progress, and improve over time. Many courses under Best Stock Market Courses in Chandigarh have dedicated modules on journaling and trade reviews.

11. Upgrade Your Skills with Advanced Modules

After getting a solid grip on the basics, don’t stop learning. Advanced modules are available at the Best Stock Market Institute in Mohali and Chandigarh to help you move to the next level. These modules may cover:

Intraday and swing trading strategies

Options and derivatives trading

Algo and automated trading

Portfolio management

Institutes like Candila Share Trading in Chandigarh keep their curriculum updated with the latest trends and tools in the stock market. This helps you stay competitive and ready for market evolution.

12. Avoid the Herd Mentality

Just because everyone is investing in a particular stock doesn’t mean it’s the right choice for you. Expert trainers warn against following the crowd without doing your own research.

At the best stock market training institute Chandigarh, you’ll be trained to analyze opportunities independently and develop confidence in your strategy, rather than being influenced by market noise.

13. Have Realistic Expectations

Finally, it’s important to know that trading is not a get-rich-quick scheme. Trainers at the Best Share Market Training in Chandigarh emphasize the importance of setting realistic goals and managing expectations.

Success in the stock market requires time, effort, consistency, and emotional control. The sooner you internalize this mindset, the more stable your journey will be.

Conclusion: Learn from the Best at Candila Education

There’s no shortcut to becoming a successful trader, but learning from experienced mentors can make the journey smoother and more structured. If you’re looking for the Best Stock Market Institute in Chandigarh, Candila Education offers everything from beginner-friendly courses to advanced trading modules—all designed with real market applications in mind.

Whether you’re in Chandigarh, Mohali, or anywhere in the Tricity region, Candila Education provides practical, hands-on training that bridges the gap between theory and real-world trading. With a focus on clarity, discipline, and long-term success, it’s no surprise that it’s recognized as one of the best stock market training institute Chandigarh has to offer.

If you're serious about trading or investing and want expert guidance from a trusted name, Candila Share Trading in Chandigarh could be your perfect starting point.

0 notes

Text

Expert Tips from Trainers at the Best Stock Market Institute in Chandigarh

The stock market can seem like a complex puzzle when you're just getting started. From deciphering candlestick charts to understanding trading psychology, there's a lot to take in. That’s why having expert guidance from the very beginning is essential. If you’re searching for the Best Stock Market Institute in Chandigarh, you're already on the right path—and this article is here to help you go even further.

Let’s explore some expert tips straight from experienced trainers at the best stock market training institute in Chandigarh, giving you a solid foundation to build your trading journey.

1. Start with the Basics—But Don’t Skip Them

Every pro trader once began as a beginner. The first tip shared by trainers at top institutes like those offering the Best Share Market Training in Chandigarh is to master the basics. You need to understand how the stock market works, the role of exchanges, and the types of financial instruments you’ll encounter—like equities, futures, and options.

At the best stock market training institute in Tricity, trainers focus on building a strong base. Skipping the fundamentals might lead to costly mistakes down the line. So, no matter how eager you are to start trading, take time to understand core concepts.

2. Learn Technical Analysis—But Don’t Ignore Fundamentals

Many new traders get fascinated with charts, patterns, and indicators. While technical analysis is powerful, experts from the best share market training institute Chandigarh emphasize that fundamental analysis should not be overlooked.

Understanding a company’s earnings, market position, and future potential helps you make long-term investment decisions. Combining both techniques is the secret sauce many successful traders use.

Trainers at top institutions offering the Best Stock Market Courses in Chandigarh stress the importance of using both technical and fundamental approaches to make more informed decisions.

3. Follow a Trading Plan Religiously

One of the biggest differences between amateurs and professionals is the presence of a trading plan. Experts at the Best Stock Market Training Institute in Chandigarh advise students to create a trading plan and stick to it. This plan should include:

Your entry and exit strategies

Risk management rules

Capital allocation

Daily/weekly goals

Institutes like those offering candila share trading in Chandigarh often provide personalized mentorship to help students create and follow a proper trading plan. This guidance is crucial, especially when emotions take over during real-time trading.

4. Practice Before You Trade with Real Money

Many beginners are tempted to dive into the market with real money after just a few lessons. Trainers at the Best Stock Market Institute in Mohali caution against this. Instead, use demo accounts or paper trading platforms to practice your strategies.

This approach allows you to learn from your mistakes without facing financial losses. Practicing under the supervision of experienced mentors—like those at Candila Stock Trading in Chandigarh—can help you gain the confidence and discipline required for real-time trading.

5. Keep Emotions in Check—Especially Greed and Fear

No matter how great your analysis is, emotional trading can quickly derail your progress. The best trainers often say, “The market doesn’t reward emotion; it rewards strategy.” Greed may push you to overtrade, and fear might stop you from taking valid opportunities.

Courses at the Best Stock Market Training Institute in Chandigarh often include lessons on trading psychology. You’ll learn how to recognize emotional triggers and develop the mental discipline to handle wins and losses with a level head.

6. Don’t Chase the Market—Wait for the Right Setup

One expert tip that often gets repeated at the Best Stock Market Institute in Chandigarh is to wait for your setup. Patience is one of the most undervalued skills in trading. Just because the market is moving doesn’t mean you have to jump in.

Following your strategy and waiting for the right signals will often save you from making impulsive trades. This is a key principle taught at top institutes providing Share and Stock Market Training in Chandigarh.

7. Risk Management Is Non-Negotiable

Managing your risk is as important as selecting the right stocks. Trainers at the Best Share Market Training in Chandigarh strongly advise never risking more than a small percentage of your trading capital on a single trade.

You’ll learn to:

Use stop-loss orders

Set risk-reward ratios

Diversify your portfolio

Avoid over-leveraging

These strategies are foundational parts of any quality Share Marketing Course in Chandigarh, and they help ensure long-term survival in the market.

8. Stay Updated with Market News and Events

Staying informed is part of being a responsible trader. Economic reports, government policies, global news, and company earnings reports all impact the stock market.

Top trainers at the best stock market training institute Chandigarh emphasize incorporating market news into your analysis. This doesn’t mean acting on every piece of news, but understanding how to interpret it and respond smartly.

Courses from leading institutes like those offering candila stock trading in Chandigarh often include regular market updates and real-time case studies to train you in this area.

9. Join a Learning Community

One of the best ways to accelerate your learning is by surrounding yourself with like-minded people. Many students benefit significantly from the peer learning environment found in the best stock market training institute in Tricity.

These institutes not only offer classes but also provide access to forums, Telegram groups, or WhatsApp communities where you can ask questions, share ideas, and get feedback. Being part of such a community helps you stay motivated and continuously improve.

10. Review and Reflect on Your Trades

Learning from past trades is an underrated tip. The best trainers in Share and Stock Market Training in Chandigarh often recommend maintaining a trading journal. This journal should include:

The reason behind each trade

Entry and exit points

Profit or loss

Lessons learned

This practice helps you identify patterns in your own behavior, track progress, and improve over time. Many courses under Best Stock Market Courses in Chandigarh have dedicated modules on journaling and trade reviews.

11. Upgrade Your Skills with Advanced Modules

After getting a solid grip on the basics, don’t stop learning. Advanced modules are available at the Best Stock Market Institute in Mohali and Chandigarh to help you move to the next level. These modules may cover:

Intraday and swing trading strategies

Options and derivatives trading

Algo and automated trading

Portfolio management

Institutes like Candila Share Trading in Chandigarh keep their curriculum updated with the latest trends and tools in the stock market. This helps you stay competitive and ready for market evolution.

12. Avoid the Herd Mentality

Just because everyone is investing in a particular stock doesn’t mean it’s the right choice for you. Expert trainers warn against following the crowd without doing your own research.

At the best stock market training institute Chandigarh, you’ll be trained to analyze opportunities independently and develop confidence in your strategy, rather than being influenced by market noise.

13. Have Realistic Expectations

Finally, it’s important to know that trading is not a get-rich-quick scheme. Trainers at the Best Share Market Training in Chandigarh emphasize the importance of setting realistic goals and managing expectations.

Success in the stock market requires time, effort, consistency, and emotional control. The sooner you internalize this mindset, the more stable your journey will be.

Conclusion: Learn from the Best at Candila Education

There’s no shortcut to becoming a successful trader, but learning from experienced mentors can make the journey smoother and more structured. If you’re looking for the Best Stock Market Institute in Chandigarh, Candila Education offers everything from beginner-friendly courses to advanced trading modules—all designed with real market applications in mind.

Whether you’re in Chandigarh, Mohali, or anywhere in the Tricity region, Candila Education provides practical, hands-on training that bridges the gap between theory and real-world trading. With a focus on clarity, discipline, and long-term success, it’s no surprise that it’s recognized as one of the best stock market training institute Chandigarh has to offer.

If you're serious about trading or investing and want expert guidance from a trusted name, Candila Share Trading in Chandigarh could be your perfect starting point.

0 notes

Text

How Many Candlestick Patterns Are There

How Many Candlestick Patterns Are There? A Friendly Guide to Understanding the Basics

Understanding the world of trading can feel like learning a new language. And if you’ve ever seen a candlestick chart, you might’ve wondered, “What am I even looking at?” Don’t worry—you're not alone! Whether you're someone just getting into trading or simply curious about how it all works, this article will walk you through the mysterious world of candlestick patterns. We’ll break it down in a way that makes sense, no financial dictionary required.

Imagine candlestick patterns like traffic signals on the road of trading—they give hints about what might happen next. Some say, “Hey, the market might go up!” Others hint, “Watch out, things could go south.” So, how many candlestick patterns are there? Great question—let’s find out.

Learn how many candlestick patterns are there, different types of candlestick patterns, and what is candlestick patterns in simple language for beginners.

Introduction to Candlestick Patterns

Let’s start at the beginning. If you’ve ever seen a stock or cryptocurrency chart, you’ve probably noticed those little red and green rectangles—they're called candlesticks. They're not just colorful bars; they tell a story about price movement.

What is Candlestick Patterns?

Candlestick patterns are specific formations of these candles on a chart. Think of them as facial expressions of the market. Just like a smile can tell you someone’s happy, a certain pattern in candles can suggest whether the market is feeling bullish (going up) or bearish (going down).

Each candlestick gives four main pieces of information:

Open Price

Close Price

High Price

Low Price

Why Are Candlestick Patterns Important?

Imagine driving with your eyes closed. Sounds scary, right? That’s what trading without understanding patterns is like. Candlestick patterns act like headlights—they help traders see where the road might lead. While they don't guarantee success, they give valuable clues that many traders use to make decisions.

How Many Candlestick Patterns Are There?

Here’s the big question: how many candlestick patterns are there? Well, in total, there are more than 50 recognized patterns, but most traders focus on about 30 key ones. These patterns are grouped into:

Single Candlestick Patterns

Double Candlestick Patterns

Triple Candlestick Patterns

Each category offers insight into different possible future movements of the market.

Types of Candlestick Patterns

To make things easier, let’s break them down:

Single Candlestick Patterns

These involve just one candlestick. They're quick and simple.

Double Candlestick Patterns

These involve two candles and often signal a trend reversal.

Triple Candlestick Patterns

These use three candles to tell a more complete story about what the market might do next.

Let’s dig deeper into each one.

Single Candlestick Patterns

These are the building blocks of chart reading. They’re easy to spot and understand.

Doji

A Doji looks like a cross. It happens when the open and close prices are almost the same. It shows market indecision—like the market saying, “I’m not sure which way to go.”

Hammer

A Hammer looks like—you guessed it—a hammer! It has a small body with a long lower wick. It usually shows up at the bottom of a downtrend, signaling a potential reversal upward.

Inverted Hammer

Similar to the Hammer, but flipped upside down. It also signals a possible trend reversal, but needs confirmation from the next candles.

Double Candlestick Patterns

These patterns give a stronger message since they involve two candles working together.

Bullish Engulfing

This happens when a small red candle is followed by a big green candle that completely “engulfs” it. It signals a potential move upward.

Bearish Engulfing

The opposite of bullish. A small green candle is followed by a larger red one. This can signal a downward move ahead.

Tweezer Tops and Bottoms

These are two candles with matching highs (tops) or lows (bottoms). They can suggest that a trend is losing strength.

Triple Candlestick Patterns

When three candles join forces, the pattern becomes even stronger and more reliable.

Morning Star

This is a bullish reversal pattern made of three candles: a bearish candle, a small-bodied candle (which can be a Doji), and a bullish candle. It's like a sunrise—things are looking up!

Evening Star

The opposite of Morning Star. It begins with a bullish candle, followed by a small one, and ends with a bearish candle. It's a sign the sun is setting on an uptrend.

Three White Soldiers

This pattern consists of three strong green candles in a row. It’s a very bullish sign, showing continued buying pressure.

Three Black Crows

You guessed it—this one's bearish. It’s made of three long red candles in a row, suggesting strong selling pressure.

Common Mistakes When Reading Patterns

Let’s face it, we all mess up sometimes. Here are some pitfalls to avoid:

Relying on patterns alone: Always use other tools too.

Ignoring the bigger trend: A bullish pattern in a strong downtrend may not hold up.

Overtrading: Just because you see a pattern doesn’t mean you must act on it.

Tips for Learning Candlestick Patterns

Learning candlestick patterns is like learning to read emotions. Start small:

Practice with paper trading.

Use flashcards to memorize patterns.

Review historical charts to see how patterns played out.

Keep a trading journal to track your learning.

Conclusion

So, how many candlestick patterns are there? There are over 50—but don’t panic! You really only need to master about 30 core patterns to start making smarter decisions. Whether you’re an aspiring trader or just a curious learner, understanding these patterns is like having a window into the market’s soul.

Remember, candlestick patterns are tools—not magic tricks. Use them wisely, and always double-check with other indicators and research.

FAQs

How many candlestick patterns are there?

There are over 50 recognized candlestick patterns, but traders mostly use 30 key ones regularly.

What is candlestick patterns in simple terms?

They are visual representations of price movements in a chart. Each pattern gives clues about where the market might go next.

Are candlestick patterns accurate?

They can be helpful, but no pattern is 100% accurate. They're best used with other tools and indicators.

Can beginners learn candlestick patterns easily?

Absolutely! With practice, even beginners can understand and use them to make better trading choices.

What's the difference between bullish and bearish patterns?

Bullish patterns suggest prices may rise, while bearish patterns indicate a possible decline in prices.

#how many candlestick patterns are there#what is candlestick patterns#how to read candlestick pattern#types of candlestick patterns

1 note

·

View note

Text

Technical Analysis for Beginners: Start Your Trading Journey with Confidence

Technical Analysis for Beginners is the perfect starting point for anyone new to the stock market. This beginner-friendly course teaches you how to read charts, identify trends, and use basic indicators to make smart trading decisions. No prior experience needed—just curiosity and a willingness to learn.

Key Highlights:

Learn candlestick patterns and chart types

Understand support, resistance, and trendlines

Introduction to RSI, MACD, and Moving Averages

Simple, practical strategies for entry and exit 🔴 Kickstart your trading career—Join the Technical Analysis course for beginners today! 🔴

0 notes

Text

Unlock the Secrets of Market Success with Expert Share Market Trading Courses by ICFM in Delhi NCR

Introduction In the evolving world of financial independence and investment opportunities, understanding the share market is becoming an essential life skill. Among the most effective ways to gain this knowledge is by enrolling in well-structured share market trading courses. These courses serve as the foundation for anyone looking to confidently enter the world of stock trading. In India, ICFM – Stock Market Institute is one of the most trusted names that delivers quality education through professionally curated share market trading courses. With a focus on real-time exposure, strategic insight, and comprehensive learning, ICFM’s training ensures students get the right skills to navigate financial markets with confidence.

Why Share Market Trading Courses Are a Necessity Today The Indian stock market is no longer reserved for brokers or high-net-worth individuals. From college students to retired professionals, individuals are now participating in market trading like never before. However, entering the market without proper education is risky. Most traders fail due to lack of understanding, incorrect strategies, or emotional trading. This is why enrolling in proper share market trading courses is not just recommended—it’s crucial. These courses cover everything from stock selection, technical analysis, and market indicators to intraday and positional trading strategies.

ICFM – A Trusted Name for Share Market Trading Courses ICFM – Stock Market Institute, headquartered in Delhi, stands as a beacon for aspiring traders and investors. It offers industry-oriented share market trading courses designed with the current Indian financial ecosystem in mind. These are not generic tutorials or passive classes. ICFM ensures each course is practical, interactive, and based on real market behavior. The institute believes in empowering students with knowledge that translates directly into the ability to trade effectively and profitably.

Course Structure Tailored for Indian Traders The curriculum at ICFM is divided into beginner, intermediate, and advanced levels, ensuring that learners from any background can benefit. The beginner level in the share market trading courses introduces students to the basics of trading, types of markets, and how to interpret charts. As the course progresses, topics such as technical indicators, candlestick patterns, and trend analysis are covered. In the advanced modules, learners dive deep into intraday setups, swing trading, futures and options strategies, and risk management techniques. What makes ICFM different is their market-aligned approach that includes daily trade planning and post-market analysis.

Live Market Practice and Trading Simulations ICFM emphasizes real-time application over theoretical knowledge. All its share market trading courses come with live market training sessions. Students sit in front of real market data, watch trades unfold, and learn how to make decisions in real-time with the guidance of industry professionals. This level of exposure is unmatched and equips learners with the confidence needed to trade independently. Simulations also allow for strategy testing without financial risk, making learning safe and effective.

Expert Faculty and Individual Guidance Another strong pillar of ICFM is its team of experienced faculty members. These are not just trainers but seasoned traders and analysts who bring years of practical knowledge to the table. Their role goes beyond teaching—they mentor. Throughout the share market trading courses, students get access to one-on-one guidance, portfolio reviews, and continuous feedback. This mentorship helps bridge the gap between understanding a concept and executing it correctly in the market.

Accessibility: Online and Classroom Options ICFM offers its share market trading courses both online and offline. Students from anywhere in India can enroll in live online classes, interact with trainers, and access recorded sessions anytime. Those in or near Delhi can attend classroom sessions for a more hands-on experience. Both options include assignments, real-market case studies, trading software tutorials, and interactive doubt-clearing sessions.

Certification and Career Pathways Once the course is completed, students are awarded a certification from ICFM – Stock Market Institute, a valuable credential in the world of finance and stock trading. The institute’s alumni have successfully gone on to become full-time traders, financial influencers, research analysts, and employees at reputed brokerages. For those seeking job placement, ICFM also offers career support, referrals, and internship assistance based on course performance and assessment.

Affordable Pricing with High ROI ICFM ensures that its share market trading courses are affordable without compromising on quality. The courses are competitively priced and offer tremendous value considering the live trading experience, mentorship, and long-term skills students acquire. Multiple batches, weekend classes, and EMI options make the programs flexible and accessible to everyone.

Real Testimonials from Past Students Alumni of ICFM frequently share their success stories, crediting the institute for their transformation from trading novices to confident market participants. Their feedback often highlights the clarity of teaching, quality of mentorship, and real-time training as the reasons for their progress in the stock market. These testimonials reinforce the fact that ICFM’s share market trading courses do more than educate—they build careers.

Conclusion For anyone serious about understanding and succeeding in the Indian stock market, quality education is the first step. ICFM – Stock Market Institute’s comprehensive and practical share market trading courses offer the perfect launchpad. From beginners to advanced traders, everyone can benefit from the institute’s market-driven training, expert guidance, and real-world application. It’s not just about learning to trade; it’s about becoming a confident, strategic, and consistent trader. Enroll today in one of ICFM’s renowned share market trading courses and begin your journey toward financial mastery and independence.

Read more: https://www.icfmindia.com/blog/stock-market-courses-in-delhi-online-free-get-ahead-without-spending-a-rupee

Read more: https://www.openpr.com/news/4065877/shocking-air-india-crash-triggers-stock-market-panic-across

0 notes

Text

Build Your Basic Knowledge of Trading with ICFM

ICFM (Institute of Career in Financial Market) helps beginners develop basic knowledge of trading through structured learning programs. Our foundation course explains market mechanics, chart patterns, and risk principles in simple terms. You'll understand candlesticks, trends, and order types while learning to analyze stocks systematically. ICFM's expert trainers break down complex concepts into digestible lessons with practical examples. This fundamental training prepares you for advanced strategies while emphasizing disciplined trading habits. Whether you want to trade or invest smarter, our course builds confidence in market navigation. Start with strong basics – enroll in ICFM's essential trading program today.

To Contact Us:

Phone:- +91 9871230635 Email:- [email protected] Web:- https://www.icfmindia.com/blog/basic-knowledge-of-trading Add:- Baba Complex, U 135, 1st & 3rd Floor, Laxmi Nagar In front Of Gate No. 4 Laxmi Nagar Metro Station, New Delhi 110092

0 notes

Text

How to Read Stock Charts for Beginners?

If you’re new to investing, learning how to read stock charts for beginners can feel like deciphering a foreign language. But don’t worry—it’s easier than it looks. Stock charts are powerful tools that help you understand market trends, spot opportunities, and make smarter investment decisions. Whether you're a casual trader or planning long-term investments, mastering the basics of stock charts is the first step toward building confidence and growing your portfolio.

How to Read Stock Charts for Beginners – Understanding the Basics

Stock charts visually show a stock's price over time. They allow investors to track price movements, trading volume, and patterns that can help predict future performance.

The most common types of stock charts include:

Line charts – Simple and clean, showing the closing prices over a set period.

Bar charts – Display opening, closing, high, and low prices for each time unit.

Candlestick charts – Popular among traders, offering visual cues with color-coded bars.

Key Components of a Stock Chart

1. Price and Time Axes

Stock charts usually have time on the horizontal (X) axis and price on the vertical (Y) axis. This setup shows how the stock's price changes over days, weeks, or months.

2. Volume Bars

Volume bars appear at the bottom of most charts. They show how many shares were traded during a specific period. High volume often means strong interest or big news.

3. Moving Averages

Moving averages smooth out price data over a certain period, helping you spot trends.

Simple Moving Average (SMA): The average price over a defined time (e.g., 50-day SMA).

Exponential Moving Average (EMA): Gives more weight to recent prices.

Reading Candlestick Charts

Candlestick charts are ideal for beginners who want more detail in a visual format. Each candlestick represents one period (like a day) and shows:

Open and Close: The “body” of the candle.

High and Low: The “wicks” or “shadows” above and below the body.

Color: Green means the stock closed higher than it opened; red means it closed lower.

Recognizing common candlestick patterns—like dojis, hammers, and engulfing candles—can help forecast market behavior.

Identifying Trends and Patterns

Understanding trends can help you determine when to buy or sell.

Types of Market Trends

Uptrend: A series of higher highs and higher lows.

Downtrend: A series of lower highs and lower lows.

Sideways/Flat: Little movement in either direction.

Common Chart Patterns

Head and Shoulders: Indicates potential trend reversal.

Double Top/Bottom: Suggests strong support or resistance.

Flags and Pennants: Short-term continuation patterns.

Practical Tips for Beginners

Keep It Simple

Start with line or candlestick charts and focus on one stock at a time.

Combine Charts with Research

Charts are helpful, but always consider news, earnings reports, and broader market conditions.

Use Reliable Tools

Many platforms offer beginner-friendly charting tools. For a helpful resource on getting started, check out this complete beginner’s guide on how to read stock charts.

📊 Final Thoughts + CTA

Learning how to read stock charts for beginners doesn’t have to be overwhelming. By focusing on basic chart types, understanding key components, and recognizing simple patterns, you’ll gain the confidence to analyze stocks like a pro.

1 note

·

View note