#Verification Code (OTP)

Explore tagged Tumblr posts

Text

#SMS verification#SMS verification code#two-factor authentication#OTP#online security#cyber threats#user authentication#secure login#SMS security#digital interactions

0 notes

Text

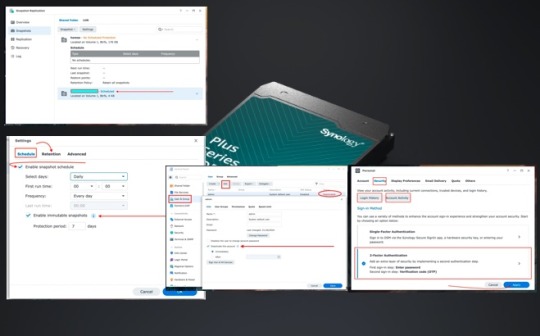

DSM Security: How to Protect Synology DS923+ NAS

We will adhere to industry best practices in configuring and proffering steps for “DSM Security: How to Protect Synology DS923+ NAS”. To ensure the protection of your data and system on the Synology DS923+, it is crucial to implement security controls actively. Active security measures enhance the overall defense posture, guard against potential threats and vulnerabilities, and fortify the…

View On WordPress

#Download Synology’s App#DSM Key Manager#Enable DoS Protection#Protect NAS#Protect Synology NAS#Recovery Point Objectives (RPO)#Recovery Time Objectives (RTO)#Synology#Synology Diskstation#Synology DS923+ NAS#Verification Code (OTP)

1 note

·

View note

Text

How to Register as a Chamet Agent: Step-by-Step Guide

Chamet offers an exciting opportunity to work from home, manage your own team, and earn substantial commissions. Becoming a Chamet agent is a simple process that opens doors to a flexible, rewarding career in live-streaming and networking.

This guide will walk you through everything you need to know to get started.

What Does a Chamet Agent Do?

As a Chamet agent, you’ll oversee hostesses who use the Chamet platform to engage in live streaming and private calls. You’ll also have the opportunity to recruit subagents, expanding your network and increasing your earnings. Chamet agents earn commissions from two main sources:

A percentage of their hostesses’ earnings.

Commission from subagents they recruit, based on their performance.

Benefits of Becoming a Chamet Agent

Flexible Work: Manage your agency from anywhere with just an internet connection.

Unlimited Earning Potential: Your income grows as your agency expands.

Network Marketing Opportunity: Build a team of subagents and earn passive income.

Comprehensive Support: Access to tools like the Chamet agency dashboard and mentoring programs to help you succeed.

Step-by-Step Guide to Register as a Chamet Agent

1. Fill Out the Registration Form

Visit the 🔗Chamet Agency Registration Page.

Enter your desired username, password, and the name for your agency.

Provide your phone number and select your country code.

Solve the CAPTCHA and click “Send” to receive an OTP.

2. Verify Your Phone Number

Enter the OTP received via SMS into the verification field.

Confirm your details to complete the initial registration process.

3. Access the Chamet Agent Dashboard

Log in to the Chamet Agent Management System using your username and password at 🔗 Chamet Agent Login.

This dashboard will be your primary tool for managing hostesses, monitoring performance, and growing your agency.

How Chamet Agents Earn Commissions

Chamet agents earn daily commissions based on the total monthly revenue generated by their hostesses and subagents. Below is a breakdown of the commission structure:

The higher your team’s performance, the greater your daily commission rate.

Tips for Success as a Chamet Agent

Recruit High-Quality Hostesses: Look for individuals who are charismatic, engaging, and committed to their work.

Focus on Subagent Recruitment: Expanding your team through subagents increases your earning potential exponentially.

Support Your Team: Provide guidance to hostesses and subagents to ensure their success on the platform.

Monitor Performance: Use the Chamet dashboard to track your team’s progress and identify areas for improvement.

Take the First Step Today

Ready to get started? Visit the 🔗 Chamet Agency Registration Page today and take your first step toward success!

3 notes

·

View notes

Text

i'm CACKLING at the fact the verification code that amazon gives you when you first make an account is called an OTP

#veero rambles#ik it stands for like one time password#but like cmon#like it needs my fave ship#so i can buy stuff#aaah it's hilarious :')

6 notes

·

View notes

Text

goa game: India’s Trending Colour Prediction Platform

Discover goa game – an exciting colour prediction game offering ₹58 sign-up bonus, referral rewards, and real cash withdrawals. Join today and win big.

What is goa game?

goa game is a colour prediction and casino-style gaming platform where users can win real money by betting on colours like Red, Green, or Violet. With a ₹58 instant sign-up bonus and user-friendly gameplay, goa game is rapidly gaining popularity across India.

How Does goa game Work?

The concept is simple:

Choose a colour (Red, Green, or Violet)

Place your bet before the timer ends

If your prediction is correct, you win!

goa game rounds happen every 3 minutes, giving you constant chances to earn.

Key Features of goa game

₹58 sign-up bonus

Daily login gifts

App download available at goagameindia.in

Refer & earn income system

Secure withdrawals via UPI

Easy and fun gameplay for beginners

How to Download and Register on goa game

Visit goagameindia.in

Tap on Register

Enter your phone number and verify with OTP

Claim your ₹58 bonus

Start predicting and playing!

To download the app, click on “Download App” on the homepage and follow instructions to install the APK.

Is goa game Safe?

Yes, goa game uses secure payment gateways for deposits and withdrawals. You can withdraw your winnings through UPI, bank accounts, or wallets after verification.

Tips to Play goa game Responsibly

Start with low bets to understand the pattern

Use daily gift codes for extra balance

Don’t chase losses

Follow goa game’s Telegram for official updates

Final Thoughts

If you’re interested in a simple and exciting way to earn from your phone, goa game is a great option. With daily bonuses and secure withdrawals, it offers both entertainment and opportunity.

Ready to play? Register at goa game now and claim your ₹58 bonus!

0 notes

Text

How UPI Mobile Banking is Revolutionizing Digital Payments in India

Introduction to UPI Net Banking in the Digital Era

India is witnessing a rapid shift toward a cashless economy, largely driven by the rise of UPI mobile banking. The Unified Payments Interface (UPI) has become a cornerstone in India’s journey toward seamless digital transactions. Developed by the National Payments Corporation of India (NPCI), UPI allows users to send and receive money directly from their bank account using a smartphone — no branch visits, account numbers, or IFSC codes required.

By enabling fast, user-friendly, and secure payments, UPI net banking is empowering millions, from metro cities to rural villages, to take full control of their finances.

Core Features of UPI Net Banking and Mobile Banking Apps

UPI mobile banking is gaining widespread adoption due to its unique and practical features:

1. Instant Fund Transfers

Money transfers between bank accounts happen in real time, 24/7 — even on holidays. There’s no waiting period, unlike traditional banking systems such as NEFT or RTGS.

2. Multi-Bank Support

A single banking UPI mobile app can link multiple accounts from various banks. This gives users centralized access to all their banking needs.

3. Simple Setup

Users only need a mobile number linked to their bank account. The UPI account create process typically takes just a few minutes and doesn’t require any paperwork.

4. Always Available

With no dependency on banking hours, users can transact anytime. Whether it's paying a bill at midnight or sending money on a weekend, UPI is always available.

Key Benefits of UPI Mobile Banking

For Individuals

Quick Onboarding: Setting up a UPI net banking profile is simple and requires minimal information.

Enhanced Security: Each secure UPI payment is backed by multiple layers of verification like device binding and MPINs.

Zero Paperwork: Unlike traditional methods, UPI is completely digital and eliminates the need for forms or branch visits.

For Businesses

Faster Transactions: Instant credit of funds directly into a bank account improves cash flow.

Low Infrastructure Cost: No need for card-swiping machines or complicated POS systems.

Easy Integration: Businesses can integrate UPI banking with invoicing, billing, and e-commerce systems.

UPI vs. Traditional Online Banking

While older digital payment systems like NEFT and RTGS are still in use, they have limitations:

Feature

Traditional Net Banking

UPI Mobile Banking

Availability

Limited to bank hours

24/7

Speed

Delayed (few hours)

Instant

Setup

Requires IFSC, account number

Requires mobile number only

Accessibility

Desktop/browser-based

Mobile-first, app-based

UPI net banking offers a clean, user-friendly interface that can be easily used by individuals across age groups, even those new to digital banking.

How to Set Up a UPI Net Banking Account

Getting started is simple and requires only a few steps:

Download a UPI mobile banking app from your phone’s app store.

Register using your mobile number linked to your bank account.

Link your bank account by selecting your bank from a list.

Create a UPI PIN (MPIN) using your debit card credentials and an OTP.

Once complete, you can immediately begin making secure UPI payments and transfers.

This process allows you to set up your bank UPI in just a few minutes, with no in-person verification needed.

Security in UPI Mobile Banking

One of the strongest aspects of UPI mobile banking is its built-in security protocols:

Two-Factor Authentication: Every transaction requires device verification and MPIN.

End-to-End Encryption: Ensures that user data and payment details are protected.

Real-Time Notifications: Users are alerted immediately via SMS or email for every transaction.

Block/Unblock Features: Users can instantly suspend or secure their UPI credentials in case of suspicious activity.

These measures make UPI net banking a secure UPI payment method suitable for everyday use.

Future of UPI Net Banking and Mobile Payments in India

The future of banking UPI mobile technology is bright. With features like:

UPI 2.0 (supporting overdraft accounts, invoice attachment, and signed mandates)

UPI Lite for small-value offline transactions

Cross-border UPI payments for international remittances the system is rapidly evolving. As banks now offer online application for bank account with instant UPI linking, financial inclusion is reaching even the most remote areas of the country.

Integration with IoT devices, voice commands, and wearables will soon make UPI banking accessible beyond smartphones.

Conclusion

The rise of UPI net banking has been a game-changer in India’s digital transformation. It’s not just a tool for sending money — it's a gateway to paperless, cashless, and real-time banking. From simplifying everyday purchases to transforming how businesses collect payments, UPI mobile banking offers convenience, speed, and safety like never before.

Whether you're opening a new account, paying bills, or managing business finances, it’s time to embrace the UPI ecosystem. Set up your bank UPI today, and experience the true power of modern banking at your fingertips.

#banking mobile upi#upi net banking#upi account create#bank upi#banking upi mobile#bank app upi#upi apps#secure upi payment#mobilebanking app upi#upi app#mobile banking upi#net banking app upi#app upi mobile banking#upi bank account#upi bank

0 notes

Text

Keeping Your Business Safe with OTP SMS Verification

In today’s digital-first world, data security and user verification have become mission-critical for businesses across industries. With the rising threats of fraud, phishing, and data breaches, One-Time Passwords (OTP) sent via SMS have emerged as a trusted solution for ensuring secure customer authentication. In this blog, we’ll explore how OTP SMS works, its benefits, and why businesses should consider Dove Soft as their trusted OTP SMS provider.

What is OTP SMS?

OTP SMS is a time-sensitive numeric or alphanumeric code sent to a user’s mobile number to verify their identity. Typically used during login, registration, transactions, or password resets, OTP SMS acts as an additional layer of authentication—ensuring that only the rightful user gains access.

Why OTP SMS Matters for Business Security

Two-Factor Authentication (2FA): OTP SMS is a key component of two-factor authentication. By requiring a unique password and a mobile-delivered OTP, businesses can greatly reduce the risk of unauthorized access and cyberattacks.

Real-Time Verification: Unlike email or app-based authentication, SMS-based OTPs are delivered instantly and don’t require internet access. This real-time verification enhances user convenience while ensuring security.

Reduced Fraud Risk: With OTP SMS, businesses can protect against phishing attempts, SIM-swap fraud, and identity theft. It’s a critical tool for sectors like finance, e-commerce, healthcare, and government.

Compliance and Trust: Regulations like GDPR and PCI DSS demand robust data security protocols. OTP SMS helps businesses stay compliant while building customer trust.

Benefits of Using OTP SMS for Businesses

Enhanced customer experience with quick, secure logins

Reduction in fraudulent transactions

Improved onboarding and user authentication

Cost-effective compared to hardware tokens or biometrics

Scalable solution for startups to enterprises

Why Choose Dove Soft for Your OTP SMS Needs?

Dove Soft, a leading cloud communications provider based in Mumbai, specializes in secure and scalable OTP SMS solutions. With over a decade of experience, Dove Soft offers:

Robust and high-speed SMS gateways with 99.9% uptime

Direct operator connectivity for faster OTP delivery

Multi-route fallback for guaranteed message delivery

API/SMPP integration for seamless backend connectivity

Real-time analytics and delivery reports

Whether you're an e-commerce business verifying logins or a fintech platform securing transactions, Dove Soft provides a reliable OTP SMS service to keep your customers and data safe.

In 2025, businesses cannot afford to compromise on digital security. Implementing OTP SMS is no longer optional—it’s a necessity for protecting user data and ensuring a smooth, secure experience. With Dove Soft’s advanced OTP SMS solutions, your business can stay ahead of threats while building trust with every interaction.

0 notes

Text

Udyam Certificate Online: A Complete Guide

Starting a small business in India? Then you've probably heard about the Udyam Certificate download pdf . This certificate is essential for any Micro, Small, or Medium Enterprise (MSME) in India. The good news is that the entire registration process is online — quick, simple, and free of cost. In this guide, we'll explain everything you need to know about getting your Udyam Certificate online, step by step.

What is a Udyam Certificate?

The Udyam Certificate is a government-issued document that officially registers your business as an MSME (Micro, Small, or Medium Enterprise) under the Ministry of Micro, Small and Medium Enterprises.

It helps the government track MSMEs, and in return, it gives these businesses many benefits — like easier loans, tax rebates, government tenders, and more.

Who Can Apply for a Udyam Certificate?

Any business that falls under the MSME category can apply. This includes:

Manufacturing units

Service providers

Traders (from July 2021, retail and wholesale traders are also included)

Whether you run your business as a proprietorship, partnership, private limited company, or LLP, you are eligible for Udyam registration.

Benefits of Udyam Certificate

Access to Government Schemes: MSMEs get access to several benefits like subsidies, exemptions, and low-interest loans.

Ease in Getting Loans: Banks offer priority lending and collateral-free loans to MSME holders.

Tax Benefits: Many state governments provide tax rebates and subsidies.

Faster Approvals: Government licenses, registrations, and clearances are granted quicker.

Protection Against Delayed Payments: MSMEs are protected under the MSME Development Act if buyers delay payments.

Eligibility for Tenders: Certain government tenders are exclusively open to MSMEs.

How to Apply for Udyam Certificate Online (Step-by-Step)

The process is simple and can be done in 10–15 minutes. Follow these steps:

Step 1: Visit the Official Website

Go to the official Udyam Registration portal.

Step 2: Choose New Registration

Click on "For New Entrepreneurs who are not Registered yet as MSME".

Step 3: Enter Aadhaar Number

You need to enter the Aadhaar number of the business owner or authorized signatory.

For Proprietorship: Owner’s Aadhaar

For Partnership: Managing Partner’s Aadhaar

For Company/LLP: Authorized Signatory’s Aadhaar

You will receive an OTP on your Aadhaar-linked mobile number.

Step 4: Verify PAN and Fill Details

After Aadhaar verification, you’ll be asked to verify your PAN. The portal will auto-fetch the PAN details. You’ll then fill in the business details such as:

Business name

Address

Type of organization

Bank account details

Number of employees

NIC (National Industry Classification) Code

ALSO READ:- udyam registration online

Step 5: Enter Investment & Turnover Details

Mention your estimated investment in plant & machinery/equipment and annual turnover. This will help classify your enterprise into micro, small, or medium.

Step 6: Submit and Get Udyam Certificate

After reviewing all details, click “Submit and Get Final OTP”. After verification, your Udyam Certificate will be generated instantly.

You can download the certificate and also print it. It contains a unique Udyam Registration Number (URN).

Documents Required for Udyam Registration

You don’t need to upload any documents during registration. Just keep these details ready:

Aadhaar number of the applicant

PAN card of the business or applicant

Bank account details

Business address

NIC code of the business activity

Important Points to Remember

Only one Udyam Registration per enterprise is allowed. However, multiple activities (manufacturing + services) can be included.

The Udyam Certificate is valid for a lifetime. No renewal is required.

If you are already registered under Udyog Aadhaar, you should migrate to Udyam Registration.

You can update your registration online anytime.

Common Mistakes to Avoid

Wrong Aadhaar or PAN details: Make sure the numbers match official records.

Incorrect business type: Select the correct structure (e.g., LLP, Proprietorship).

Wrong NIC code: Choose the correct business activity category.

Entering old data: Always use the most recent turnover and investment numbers.

What Happens After You Get the Udyam Certificate?

Once you receive the certificate:

You become eligible for MSME schemes and benefits.

You can apply for government tenders, MSME loans, and subsidies.

You are also listed in the official MSME database, which helps in networking and outreach.

Conclusion

udyam registration form is a must-have for small businesses in India. It helps you grow faster, get access to funding, and receive government support. The process is simple, fast, and 100% online.Whether you're just starting out or already running a small business, getting your Udyam Certificate online is one of the smartest moves you can make. So, if you haven’t registered yet, now is the best time to do it!

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

How Secure Are Online Utility Payment Systems?

In a digital-first world, more people are paying their utility bills online for the sake of convenience and speed. Whether it’s electricity, water, gas, or internet, digital platforms have made it easier to manage and pay bills on time. However, this growing shift toward online transactions brings with it a vital question

How secure are online utility payment systems?

Security is one of the most critical components of any utility payment solution, as it deals directly with financial data and personal user information. Consumers must feel confident that their transactions are safe, and utility providers need assurance that their platforms are robust and reliable. A secure payment environment is not just a feature—it’s a necessity.

Why Security Matters in Utility Payment Systems

Online utility payments involve sensitive information such as:

Bank account and card details

Personally identifiable information (PII) like names, phone numbers, and addresses

Billing history and account credentials

If any of this data is compromised, it can lead to identity theft, unauthorized transactions, and significant reputational damage for the utility provider. A strong security framework is the foundation of trust between users and service providers.

Key Security Features of a Reliable Utility Payment Solution

To ensure maximum protection, a well-designed utility payment platform must include multiple layers of security. Here's a breakdown of the essential components that make online utility payment systems secure:

1. Data Encryption

All sensitive data transmitted through the platform—such as payment credentials and user information—must be encrypted using strong protocols like SSL (Secure Socket Layer) and TLS (Transport Layer Security). Encryption scrambles the data, making it unreadable to unauthorized users during transmission.

2. PCI-DSS Compliance

A reputable utility solution provider ensures that the platform adheres to the Payment Card Industry Data Security Standard (PCI-DSS). This standard outlines strict guidelines for handling credit and debit card information, ensuring secure storage, transmission, and processing.

3. Multi-Factor Authentication (MFA)

Authentication is crucial in verifying user identity. The use of multi-factor authentication—such as OTPs (One-Time Passwords), biometrics, or device-based verifications—adds an extra layer of protection against unauthorized access.

4. Tokenization

Tokenization replaces sensitive payment data with unique tokens that hold no exploitable value. These tokens are used to complete transactions without exposing the actual account details. This method is widely adopted in secure payment systems to minimize fraud risks.

5. Secure Payment Gateways

An effective utility payment solution integrates with secure and trusted payment gateways that offer fraud detection mechanisms, real-time monitoring, and chargeback protection. These gateways are constantly updated to meet the latest security threats.

6. Regular Security Audits and Penetration Testing

Routine vulnerability assessments, penetration tests, and code audits help detect potential security flaws before they are exploited. A proactive utility solution provider will carry out these checks to keep the platform resilient against emerging threats.

7. Fraud Detection and Monitoring

Modern platforms utilize AI-driven fraud detection systems to identify unusual activity, such as multiple failed login attempts, suspicious IP addresses, or irregular payment behaviors. Immediate alerts and automated locks prevent potential breaches.

8. Role-Based Access Control (RBAC)

Only authorized personnel should be allowed to access administrative or sensitive parts of the system. Role-based access control ensures that employees and partners only interact with the parts of the platform necessary for their role.

9. User Privacy Protection

Data privacy regulations like the GDPR or local data protection laws must be observed. The platform should offer users transparency about what data is collected and allow them to manage their privacy preferences.

What Customers Should Know

While a utility payment solution may offer advanced security measures, customers also play a role in ensuring safe transactions. Here are some best practices for users:

Avoid using public Wi-Fi when making payments

Always log out of accounts after transactions

Use strong and unique passwords

Enable two-factor authentication whenever possible

Regularly monitor account statements for unauthorized transactions

By adopting these practices, customers can enhance their safety and reduce the risk of online threats.

How Providers Ensure Platform Security

A capable utility solution provider doesn’t just deploy technology—they maintain, update, and optimize it continuously. Security is not a one-time task but an ongoing process that evolves with cyber threats. Regular training for support teams, system upgrades, and compliance updates are all part of maintaining a secure platform.

Companies like Xettle Technologies take these responsibilities seriously, offering end-to-end solutions designed with security at their core. From robust encryption to advanced fraud detection, their utility platforms are built to protect both the utility providers and their customers.

Conclusion

Online utility payment systems are highly secure when built and maintained using best industry practices. With features like encryption, tokenization, secure gateways, and compliance measures, today's leading platforms offer a high degree of protection against cyber threats.

Still, security is a shared responsibility. While utility providers must invest in advanced, reliable infrastructure, consumers must also be cautious and informed in their usage. By working together, both parties can enjoy the convenience of digital payments with confidence.

In a digital world where trust is everything, a secure utility payment solution isn’t just a technical advantage—it’s a business imperative.

0 notes

Text

Leading Dating App Development Agency in USA – Building Intuitive, Scalable Solutions for Digital Connections

Building real relationships via internet technologies is a cutting-edge undertaking driven by transformative technology. What we explain below is the manner in which a Dating App Development Agency in USA designs personalized, accessible dating applications meeting the date demands of the moment. From natural interfaces to intelligent matching capabilities, the best developers are transforming the way humans match humans. The article highlights top-tier services, application performance, and strategic design methods implemented in the current business. They will also get to know how a well-established business like Derived Web creates scalable dating app solutions worth achieving success in a transforming virtual world.

Why A Specialist Dating App Agency Is Important

Swipe mechanisms have merely performed now for dating app users. Emotional intelligence, data protection, advanced filtering, and tailored matchmaking are no longer attractive. A specialized partner Dating App Development Agency in USA brings these core abilities to your platform. Professionals with relationship psychology and UI/UX bias can deliver experiences that emotionally connect, enable interaction, and retain. From location integration in your app to real-time available chat safety, everything is coded with empathy and compassion.

What Makes Top Dating App Development Services

Being unique from other app development agencies, Dating App Development Services USA specializes in the dating industry and offers feature-rich solutions. A few of the differences are:

● Custom Matching Algorithms: Utilizing machine learning and behavior trends for creating improved matches.

● State-of-the-Art User Verification: Minimizing fake accounts through biometric login, OTP verification, and AI moderation.

● Seamless Communication Features: Spontaneity-free text, voice, and video chat for creating real connections.

● Gamification Features: Invite user participation with quizzes, badges, or matching scores.

These customized features spark platform loyalty and satisfaction rates—both are critical indicators in the world of dating.

Core Features Offered by Dating App Development Companies

Effective dating apps have world-class modules that encompass the value proposition of the app and the user experience. Some of the prevalent yet reasonable features designed by a Dating App Development Agency in USA are outlined below:

● Profile Personalization: Personalized profiles with images, descriptions, hobbies, and interests created by users.

● Instant Notifications: Push, match, or activity notifications for enhanced user interaction.

● AI-Based Suggestions: Intelligent suggestions through swipes, interactions, and user behavior.

● Membership Plans: Subscription member plans for premium feature coverage.

● Admin Control Panel: Complete back-end admin control panel for user management, analytics, content moderation, and earnings tracking.

All these features demonstrate the fact that innovation in Dating App Development Services USA isn't about connecting at all—it's all experience optimization.

End-to-End Development Process Defined

Reliable agencies have an optimized iterative development process in order to deliver dating apps of quality. It usually comprises:

● Discovery & Planning: A thorough evaluation of your idea, market trend, and users forms the cornerstone of a success plan. Competitive differences and user journey maps are established by agencies.

● Design & Wireframing: Designers create the layout and design of the app, usability, looks, and interactive features being the primary concern for them. Prototyping is done in this phase.

● Development & Integration: Developers launch the app with state-of-the-art technology stacks. Geolocation, payment, and messaging APIs are easily integrated.

● Testing & QA: Consecutive cycles of tests to remove bugs and enhance performance on Android and iOS platforms.

● Launch & Post-Launch Support: The application is now deployed into app stores, with continuous monitoring, support, and optimization in features.

This bug-free workflow ensures the final product is secure, scalable, and user-friendly—the qualities of a top-notch Dating App Development Agency in USA.

Industry-Inspired Innovations Shaping Dating Apps

Technology is one of the primary drivers for dating apps. There are companies today leveraging:

● AI & Machine Learning for better match proposals

● Blockchain for data security and payment transparency

● Augmented Reality (AR) for live user profiles and live interaction

● Cloud Infrastructure for real-time scalability and zero-downtime

They are the new way to more fun, secure dating with Dating App Development Services USA.

Why User Experience is the True Matchmaker

Design and usability can break or make a dating app. Great agencies go the extra step to

● Simple Interfaces with minimalism and user intent in mind

● Quick Load Times to enable seamless swiping and messaging

● Dark Modes & Accessibility Options to facilitate making everyone a part of it

● Transparency of Data to enable trust regarding management of information

These user-centric designs form activation and emotional trust between the users and the website.

Derived Web—Experts with Consistent Competence in Building Dating Apps

Derived Web Technologies is one of the best Dating App Development Company in USA providing highly customized and secure apps on the basis of extensive industry experience.

The passion of the team to develop scalable, user-oriented applications has benefited startups, entrepreneurs, and businesses succeeding. The combination of human design, agile concepts, and AI-driven features distinguishes Derived Web from others. They deliver end-to-end solutions from UI/UX to backend development, third-party integrations, and post-launch services. Founded Web not only constructs dating apps—it constructs ecosystems of engagement and systems of connection on which brands may build and flourish in the digital relationship economy.

Conclusion

Derived Web Technologies is leading in the Dating App Development Services USA with custom, high-performance apps that transform user experience and connect. Backed by advanced solutions designed in sync with the newest technology and end-user trends, they are the first choice for dating apps aspiring to long-term success.

0 notes

Text

Receive sms Online Free and Fast

try it and receive you code OTP verification

1 note

·

View note

Text

How to Apply for a Bank Account Online Using UPI: Step-by-Step Guide with Best Apps

In the age of digital transformation, traditional banking methods have evolved dramatically. You no longer need to visit a bank branch or fill out paper forms to open a savings account. With the help of modern account opening apps, you can now apply for a bank account online in minutes and start using UPI payments immediately. Whether you’re opening your first account or switching to a more convenient digital option, this guide explains how to submit an application for opening a bank account with ease.

What is Online Account Opening?

Account opening online refers to the process of creating a new bank account using a mobile app or website, without visiting a physical bank. It’s fast, paperless, and accessible 24/7. The process typically includes digital KYC (using Aadhaar and PAN), mobile verification, and instant access to your account through an app.

Benefits of Applying for a Bank Account Online

📝 No paperwork required

📲 Instant mobile banking access

💳 UPI and debit card support from day one

💼 Ideal for professionals, students, freelancers

🕒 Submit application anytime — no working hours needed

How to Apply for Bank Account Online: Step-by-Step

Here’s how you can apply using any account opening app:

Step 1: Choose a Bank or Fintech Platform

Popular banks offering online account opening:

Kotak Mahindra (Kotak 811)

ICICI (iMobile Pay)

Axis Bank (ASAP)

SBI (YONO App)

Fintechs: Paytm, Airtel Payments Bank, Jupiter

Step 2: Download the Account Opening App

Head to Google Play Store or App Store and install the chosen bank or fintech app.

Step 3: Start the Application for Account Opening in Bank

Click on “Open New Account” or “Start Application.” You’ll be asked for:

Name

Date of Birth

Email ID

Mobile number (linked to Aadhaar)

Step 4: Complete eKYC Process

Most apps will require:

PAN card number

Aadhaar number verification via OTP

Some may conduct video KYC

Step 5: Set Up UPI and Mobile Banking

After successful verification:

Get your account number, IFSC, and virtual debit card

Choose your UPI ID (e.g., yourname@upi)

Set your UPI PIN

You can now make instant account UPI payments for bills, transfers, and online shopping.

Top Account Opening Apps in India (2025)

App/Platform

Type

Key Features

Kotak 811

Bank App

Zero balance, full mobile banking, UPI

Bank App

Government bank, Aadhaar-based eKYC

Instant account number, digital onboarding

Advantages of UPI-Linked Accounts

🔄 Send and receive money instantly

🏪 Pay at stores using QR codes

📥 Get salary or business payments directly

🔐 Secure PIN-based authentication

📲 Manage all banking from your phone

Once submitted, the app generates your account credentials and enables UPI payments instantly.

Conclusion

Submitting an application for opening a bank account has never been easier. With powerful account opening apps and instant UPI payment integration, anyone can apply for a bank account online and go fully digital in just minutes. Whether you're opening your first account or looking for a smarter way to bank, choose a trusted platform and enjoy the future of finance today.

#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry

0 notes

Text

Aadhaar KYC API provider

🔐 Simplify Identity Verification with Ekychub’s Aadhaar KYC API

In today’s fast-moving digital economy, secure and seamless identity verification is essential—especially for businesses in finance, fintech, insurance, and online services. One of the most reliable ways to verify Indian identities is through Aadhaar-based eKYC. That’s why Ekychub offers a robust, secure, and real-time Aadhaar KYC API to help businesses stay compliant and onboard customers faster.

✅ Why Aadhaar KYC Is Critical for Digital Onboarding

Aadhaar, the unique identity number issued by UIDAI, is widely accepted for KYC (Know Your Customer) processes across industries. Verifying Aadhaar allows businesses to:

Authenticate users securely and instantly

Prevent identity fraud

Simplify digital onboarding

Meet regulatory requirements (especially in finance & telecom)

Manual document-based KYC is time-consuming, expensive, and prone to errors. Ekychub’s Aadhaar KYC API offers a paperless and automated alternative.

⚙�� Key Features of Ekychub’s Aadhaar KYC API

🔍 Real-Time Aadhaar Verification

Instantly verify Aadhaar details directly via secure UIDAI-compliant systems.

🔐 OTP-Based eKYC

Authenticate users using Aadhaar-linked mobile OTP for secure and fast identity confirmation.

📜 XML & QR Code Support

Supports Aadhaar XML file and QR code scanning for offline eKYC use cases.

🧩 Easy API Integration

Developer-friendly REST API that can be integrated into any app, website, or onboarding workflow.

🔒 Data Security & Compliance

Built with end-to-end encryption and adheres to UIDAI data protection standards.

👤 Who Can Use Aadhaar KYC API?

Ekychub’s Aadhaar KYC API is perfect for:

Fintech apps & payment gateways

Loan providers & NBFCs

Digital banks & neobanks

Telecom & insurance providers

E-commerce platforms & aggregators

Whether you're onboarding customers, verifying agents, or ensuring compliance, Aadhaar eKYC ensures speed, trust, and accuracy.

🚀 Benefits of Using Ekychub’s Aadhaar KYC API

Reduce manual verification delays

Prevent identity fraud and duplication

Cut down operational costs

Increase user trust and conversion

Comply with KYC and AML norms

🔗 Get Started with Ekychub’s Aadhaar KYC API

In a digital-first world, identity verification should be quick, secure, and reliable. Ekychub’s Aadhaar KYC API empowers your business to do just that—verify users instantly and onboard them confidently.

#technology#technews#tech#identityvalidation#aadhaarintegration#techinnovation#ekychub#fintech#kycverificationapi#aadhaarverificationapi#InstantValidation#GSTVerificationapi#panverificationapi#kychyb#upiverificationapi#AadhaarKYC#AadhaarVerification#eKYCAPI#AadhaarAPI#UIDAIAPI#KYCVerification#DigitalKYC#AadhaarValidation#AadhaarCheck#SecureKYC

0 notes

Text

Fantasy Cricket App Development in 2025: Features, Tech Stack & Cost Breakdown

The rise of fantasy sports is rewriting the playbook for digital engagement in India, and at the center of this revolution is fantasy cricket. As one of the most-loved sports in the country, cricket offers a perfect foundation for fantasy gaming platforms that attract millions of users, especially during major tournaments like IPL and ICC events. If you're considering building your own fantasy cricket app in India, 2025 is the ideal time to jump in.

This guide covers everything you need to know—from features and tech stack to development costs—to help you launch a successful fantasy cricket app.

Why Invest in Fantasy Cricket App Development?

India is home to over 160 million fantasy sports users, and that number is expected to grow with improved internet access and smartphone penetration. A well-designed fantasy cricket platform not only taps into this massive fan base but also opens doors to diverse monetization models—entry fees, in-app purchases, brand partnerships, and more.

This makes fantasy cricket app development a high-potential investment for startups, entrepreneurs, and even existing sports brands.

Must-Have Features for a Fantasy Cricket App in 2025

To stand out in a competitive space, your app needs more than just basic functionality. Here's a breakdown of essential features:

1. User Registration and Login

Social logins (Google, Facebook, Apple ID)

OTP-based mobile verification for security

2. Live Match Integration

Real-time match updates

Ball-by-ball commentary feed

Player stats and live scores synced with official data

3. Create & Join Contests

Public, private, and mega contests

Entry fee and prize pool customization

Leaderboards with real-time rankings

4. Fantasy Team Building

Player selection based on credits and match format

Captain/vice-captain selection with multiplier effects

Notifications for lineup announcements

5. Wallet and Payment Integration

Secure in-app wallet for deposits and withdrawals

Integration with Razorpay, Paytm, Stripe, or UPI

Transaction history and withdrawal status

6. Admin Dashboard

Manage matches, users, contests, and payments

Ban/suspend users or edit contest details

Real-time revenue analytics and reporting

7. Referral & Bonus Systems

Promote viral growth via referral codes

Signup bonuses and loyalty rewards to boost engagement

Recommended Tech Stack

Choosing the right technologies ensures performance, scalability, and security. Here’s a tech stack ideal for a fantasy cricket app in India:

Frontend (Mobile App): Flutter or React Native for cross-platform support

Backend: Node.js or Django for high-speed, scalable server architecture

Database: MongoDB or PostgreSQL

Real-Time Data Sync: Firebase or Socket.IO

Payment Gateway: Razorpay, Paytm, or Stripe

Push Notifications: Firebase Cloud Messaging (FCM)

Hosting: AWS, Google Cloud, or Azure

Many gaming app development companies specialize in these tools and offer custom development packages tailored to Indian audiences.

Development Cost Breakdown

The cost of building a fantasy cricket app depends on several factors, including features, platform support (Android/iOS), UI/UX complexity, and third-party API integrations.

Here’s an approximate cost range:

Development Stage

Estimated Cost (USD)

UI/UX Design

$2,000 – $5,000

App Development (MVP)

$8,000 – $15,000

Backend + API Integration

$5,000 – $10,000

Admin Panel

$3,000 – $6,000

Real-Time Data Feed APIs

$2,000 – $4,000/year

Total (Basic to Advanced App)

$20,000 – $40,000

Note: Costs may vary based on developer rates and region. Partnering with experienced gaming app development companies in India may offer better affordability without compromising on quality.

Final Thoughts

As cricket continues to dominate the Indian sports scene, the demand for intuitive, feature-rich fantasy platforms will only grow. Whether you're a startup entering the market or a sports brand looking to enhance fan engagement, investing in fantasy cricket app development offers excellent growth potential.

Choosing the right development partner, defining your feature set clearly, and focusing on user experience are key to standing out in this competitive landscape.

#real money game development services#fantasy cricket app development#appcurators#mobile apps#fantasy

0 notes

Text

Integrating WhatsApp OTP with CRM Systems

WhatsApp OTP (One-Time Password) is a secure and reliable method for verifying user identities. It has become increasingly popular for businesses looking to provide easy, fast, and secure authentication for their customers. But what if you could integrate WhatsApp OTP with your CRM (Customer Relationship Management) system? Doing so can further streamline your customer interactions and enhance your business operations.

In this blog, we will walk you through the process of integrating WhatsApp OTP with your CRM system and explain the benefits of doing so.

1. What is CRM Integration and Why Does it Matter?

CRM integration is the process of connecting your WhatsApp OTP system with a CRM platform, enabling you to manage and sync customer data, messages, and communications in one place. This integration allows you to automate customer interactions, track communication history, and enhance customer engagement.

Integrating WhatsApp OTP with your CRM system offers several benefits:

Real-time synchronization of customer data between WhatsApp and your CRM.

Streamlined verification for customer sign-ups or logins.

Automated customer support and follow-up messages.

2. Choosing the Right CRM System for WhatsApp OTP Integration

To start integrating WhatsApp OTP with your CRM, you’ll first need to ensure that the CRM system supports WhatsApp Business API integration. Some popular CRMs that allow WhatsApp integration include:

WappBiz

HubSpot

Salesforce

Zoho CRM

Freshsales

Pipedrive

These CRMs offer API access and provide the ability to integrate with WhatsApp Business API, making it easy to send OTPs and automate customer communication.

3. Steps to Integrate WhatsApp OTP with Your CRM

Step 1: Set Up WhatsApp Business API

To begin the integration process, you first need to set up the WhatsApp Business API. You can either set it up on your own server or use a third-party API provider like WappBiz,Twilio, 360Dialog, or MessageBird. Once set up, you will have access to the API endpoints needed to send WhatsApp OTPs.

Step 2: Connect Your CRM to WhatsApp API

Once your WhatsApp Business API is set up, you need to integrate it with your CRM. If you are using a CRM that already offers WhatsApp Business API integration (like Zoho CRM or Salesforce), this step can be as simple as linking the CRM with your WhatsApp API account.

If your CRM does not have a built-in integration, you can connect it using Zapier or custom API development to push customer data between the two platforms.

Step 3: Create OTP Templates in WhatsApp

Now that your CRM is connected to WhatsApp Business API, you’ll need to create an OTP template. These templates must be approved by WhatsApp before you can use them for sending OTPs. The template must include the text of the OTP message, which will be sent to users.

Example OTP Template: "Your OTP for logging into [Your Business Name] is {{OTP}}. This OTP is valid for the next 10 minutes."

Step 4: Automate OTP Generation and Delivery

With the CRM and WhatsApp API integration in place, the next step is to automate the OTP generation and delivery process. Here’s how to do it:

User requests OTP: When a user requests an OTP for verification (e.g., via your website or mobile app), your CRM triggers the OTP generation process.

Generate OTP: Use your OTP generation tool or service to create a unique code for the user.

Send OTP via WhatsApp: Your CRM system sends the generated OTP via WhatsApp using the WhatsApp Business API. The OTP message is sent using the pre-approved template you created earlier.

Step 5: Verify OTP

Once the OTP is sent, the user enters the code in your application or website. Your CRM system will verify the entered OTP against the one sent and confirm whether it’s correct. If the OTP is valid, the user is successfully authenticated.

4. Benefits of Integrating WhatsApp OTP with Your CRM

Streamlined User Authentication

Integrating WhatsApp OTP with your CRM system allows businesses to streamline the user authentication process. Customers can receive their OTP directly on WhatsApp, eliminating the need for SMS-based OTP systems or email verifications.

Real-Time Data Sync

Once integrated, your CRM will have real-time access to data, including OTP status, which ensures your teams always have up-to-date customer information. This is especially useful for sales teams, customer support, and marketing.

Improved Customer Experience

WhatsApp is one of the most widely used messaging platforms globally. Sending OTP via WhatsApp ensures that customers receive their authentication codes in a secure, familiar, and fast way, improving the overall customer experience.

Automation for Customer Support

By integrating WhatsApp OTP with your CRM, businesses can automate customer support processes. For instance, after OTP verification, your CRM can trigger follow-up messages, send purchase details, or provide onboarding instructions automatically.

Enhanced Security

OTP verification helps ensure that only authorized users can access accounts, protecting against fraud and unauthorized access. The integration with your CRM enhances security by allowing your system to verify users quickly and accurately.

5. Challenges of Integrating WhatsApp OTP with CRM

While the integration of WhatsApp OTP with your CRM system brings significant benefits, it’s not without its challenges:

API Limitations: Depending on your CRM and the WhatsApp API provider you choose, there may be limitations in terms of message volume, functionality, or customization.

User Consent: You must ensure that users give explicit consent to receive OTPs via WhatsApp, especially for GDPR compliance.

Data Security: As with any integration involving personal data, it's essential to comply with data protection regulations, ensuring the security of the OTP and the user’s personal information.

Conclusion

Integrating WhatsApp OTP with your CRM system is an effective way to improve user authentication, automate workflows, and enhance customer experiences. By using WhatsApp Business API alongside your CRM, you can create a seamless, secure process for sending OTPs and verifying user identities. While there may be challenges along the way, the benefits of integration — including real-time data synchronization, automated customer support, and improved security — make it a worthwhile investment for businesses looking to streamline their operations and improve customer engagement.

By following the steps outlined in this blog, you can successfully integrate WhatsApp OTP with your CRM and take your business operations to the next level.

0 notes

Text

Common Mistakes to Avoid While Filing Your Income Tax Return

Filing your Income Tax Return (ITR) is an essential responsibility for every earning individual. Not only does it ensure compliance with the law, but a properly filed return can also help in availing refunds, easing loan applications, and even serving as a proof of income. However, the process can be tricky, and even minor errors can lead to delays, penalties, or even notices from the Income Tax Department.

To make your filing experience smoother and stress-free, here are some common mistakes to avoid while filing your income tax return:

1. Selecting the Wrong ITR Form

One of the most frequent mistakes taxpayers make is selecting the incorrect ITR form. The Indian tax system offers multiple forms based on your income type — salary, business income, capital gains, or foreign income.

Common Errors:

A salaried individual using a form meant for business owners.

Freelancers choosing a form designated for salary earners.

Tip: Carefully read the eligibility criteria for each ITR form or consult a tax professional to ensure you pick the right one.

2. Ignoring Form 26AS and AIS (Annual Information Statement)

Form 26AS and the AIS are critical documents that reflect the taxes deducted on your behalf and other financial transactions reported to the tax authorities.

Mistake: Filing returns without reconciling the TDS (Tax Deducted at Source) in Form 26AS or missing high-value transactions in AIS.

Tip: Always download and review your Form 26AS and AIS from the income tax portal before filing. This ensures all your income sources and TDS deductions are accurately reported.

3. Incorrect Declaration of Income

Some taxpayers declare only their primary source of income (like salary) and forget about secondary incomes like:

Interest from savings accounts

Rental income

Capital gains from mutual funds or shares

Freelance or side gig earnings

Mistake: Not reporting all sources of income can be seen as income concealment, leading to notices or penalties.

Tip: Disclose every source of income, no matter how small, to avoid future complications.

4. Missing Deductions and Exemptions

While many individuals are aware of common deductions like Section 80C (investments in PPF, ELSS, LIC premiums), others are often overlooked:

80D for medical insurance premiums

80TTA/80TTB for savings account interest

24(b) for home loan interest

10(14) allowances like HRA (House Rent Allowance)

Mistake: Failing to claim eligible deductions increases your taxable income unnecessarily.

Tip: Keep a checklist of all possible deductions and exemptions applicable to your financial situation, and collect relevant documents in advance.

5. Providing Incorrect Personal Details

Simple clerical mistakes like wrong PAN number, bank account details, or address can delay refunds or even invalidate your return.

Common Issues:

Incorrect IFSC codes leading to refund failures.

Typos in PAN or Aadhaar numbers causing mismatch errors.

Tip: Double-check all personal and banking information before submitting your ITR.

6. Not Verifying the Filed Return

Filing your return is not the final step — you must verify it within 30 days (or as per the latest guidelines) for it to be considered valid.

Mistake: Many filers forget to e-verify or send the physical signed ITR-V acknowledgment to the Centralized Processing Center (CPC).

Tip: Use easy online verification methods like Aadhaar OTP, net banking, or digital signature to complete the verification instantly.

Conclusion

Filing your Income Tax Return accurately and on time is crucial for maintaining financial health and avoiding legal hassles. By steering clear of common mistakes like choosing the wrong form, overlooking secondary incomes, missing deductions, and failing to verify your return, you can ensure a smooth filing process and optimize your tax savings.

Preparation, attention to detail, and a little professional guidance (if needed) can make your ITR filing experience straightforward and rewarding. After all, careful filing today means peace of mind tomorrow.

0 notes