#What is Cup and Handle Chart Pattern

Explore tagged Tumblr posts

Text

How to Trade Using Cup and Handle Chart Pattern

The cup and handle pattern is a decades-old chart pattern that was popularised by William J. O'Neil, a well-known investor and the founder of Investor's Business Daily. He introduced this concept in his book How to Make Money in Stocks, published in the 1980s. O'Neil observed that this pattern often appears in stocks before they make significant upward moves, especially when supported by strong trading volume during the breakout.

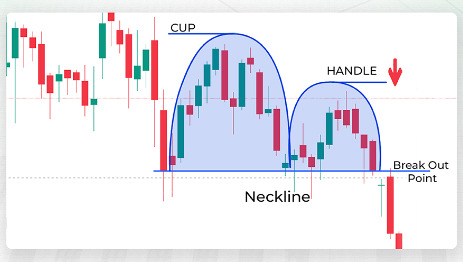

This pattern is used to identify potential bullish trends in stocks, commodities, or other financial instruments. The pattern gets its name due to its distinct resemblance to a cup with a handle when viewed on a price chart. The pattern begins with a rounded, U-shaped decline and recovery, forming the ‘cup’. After the cup is formed, there is a smaller, sideways or slightly downward consolidation phase, creating the ‘handle’. This handle typically represents a brief pause before the price breaks out in an upward direction.

Read More: https://www.truedata.in/blog/what-is-cup-and-handle-pattern-and-how-to-trade-it

#What is Cup and Handle Chart Pattern#How to Trade Using Cup and Handle Chart Pattern#Pros and Cons of using the Cup and Handle Pattern for Trading

0 notes

Text

Max Verstappen Through Tarot

Disclaimer: This is for entertainment purposes only, nothing observed or taken away from this should be considered fact. As a reminder, I know fuck all about Formula 1, I just like fast cars and have a dumb amount of knowledge of astrology and tarot.

So I watched the Hungarian GP, and I’ve decided that Max will get his own full birth chart reading. So this is only a tarot reading, where I look at the outward and inward personalities, and someone had a question regarding the patterns that need to be unlearned to be a better partner/friend. I am not sure when I will be able to get his full chart done, but it will be pretty high on my list.

Honestly his reading kind of made me really sad, like, I don't know anything about these people, but genuinely this one made me feel like there is a lot of sadness, and just unresolved things going on in the background.

Outward personality - 5 of Pentacles

The five of pentacles is about challenges, hard times, and a general lack of something (health, material things, etc.). I think when it comes to the outward personality this translates to not being able to handle challenges or conflict, I think that there is a hint of insecurity and imposter syndrome. When it comes to athletes in particular, I think this card is really hard to stomach. I feel like there is a lot of neglect happening in terms of general health. I’m sure that they have an incredible team of medical professionals around them making sure they are healthy, but is it just surface-level health?

Anyway, this is just a really long drawn way for me to say that in terms of Max’s personality, I think that this is indicative of there being a struggle with authority when things are difficult, some imposter syndrome, but overall there is stubborn nature and a man that is going to do whatever he needs to do to meet his own standards, even if it means sacrificing his own body.

Inward personality - The Moon

Fun fact, this is my favorite tarot card, so much so, that I have it tattooed on me in two different designs and places.

ANYWAYS. The Moon is a card of deception, apprehension, and anxiety. It’s one of those cards that makes me think about Shadow Work, and if someone is truly working on all aspects of themselves. I believe that there is a lot of confusion and feeling lost with this card as well, because it’s all about the deception by either others or themselves.

When it comes to the personality, I think that this is really telling of there being two (or more versions) of Max. There is the public-facing version we get, and the hidden reserved visions. I think that outwardly there are a lot of cocky and sure behaviors and actions, but I think internally there is a lot of struggle that takes place. I think that there is a lot of self-deception that goes on as well.

What to unlearn - Reversed 10 of Cups

This makes my heart hurt. When it comes to its reversed position, I think that there is a lot to unpack and potentially unlearn. I think the biggest thing that needs to be unlearned is holding onto the past in an unhealthy and unproductive way. Don’t get me wrong, I am absolutely not establishing boundaries due to prior experiences, but I think that is something that may be a possible struggle here. I think that there is a feeling holding onto something because it’s the societal expectation, even if it is potentially detrimental.

I think that the biggest thing that needs to be unlearned is, though, the force of happiness or cohesion. It’s okay to have those moments of sadness or doubt, it’s okay to let yourself feel things. I think that withholding a lot of things is an obstacle that needs to be unlearned to be a better partner or friend.

24 notes

·

View notes

Text

Boom vs. Doom - How Different Asset Classes Are Connected And Influence Each Other

As a refreshing change, on the In It To Win It Podcast, Steve Burton and I dive into both his questions and the ones coming in from those who were in attendance.

Watch The Video Here

Questions and topics that Steve asked me about include:

What do you do at The Technical Traders?

What technical indicators do you like to use?

What do you see happening down the road for the S&P 500?

How does the US dollar (DXY) look?

Is Gold a good play right now?

How does a cup and handle pattern work? What does it indicate?

Can you give your analysis on Newmont?

The chart of Barrick Gold – what do you see?

Moving onto silver, what is your analysis?

How do trend lines work?

Can you look at the Pan American Silver chart and let us know what you see?

The ETF SILJ, what are your thoughts?

What are your thoughts on the technical analysis of the underlying uranium spot price?

Looking at the big picture of oil, what do you see?

Is there a good ETF for natural gas?

Watch The Video Here

2 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with just 3 weeks left in the year, equity markets continued to show strength with large cap and tech indexes approaching all-time highs. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) continued to drop. The US Dollar Index ($DXY) continued to bounce in the downtrend while US Treasuries ($TLT) did the same. The Shanghai Composite ($ASHR) looked to continue the downtrend while Emerging Markets ($EEM) dropped in broad consolidation.

The Volatility Index ($VXX) looked to remain very low and stable creating a positive environment for equity markets to move to the upside. Their charts looked strong, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY looked to continue to drift higher. The $IWM had taken the lead in the short term.

The week played out with Gold finding support and reversing to the upside while Crude Oil broke below $70/bbl before finding support and reversing. The US Dollar met resistance and fell back while Treasuries continued their move to the upside. The Shanghai Composite found support at a retest of the October low while Emerging Markets reversed and made a 4 month high.

Volatility continued little changed, holding just above the 2019 support level. This continued the breeze at the backs of equities and they marched higher all week. This resulted in the QQQ closing at a new all-time high and the SPY only 5 points away from a record with the IWM reaching the top of a 2 year channel. What does this mean for the coming week? Let’s look at some charts.

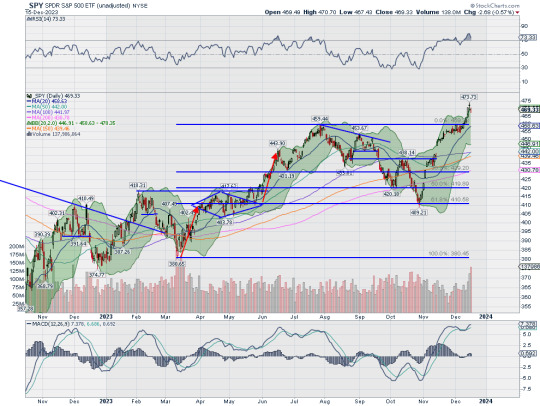

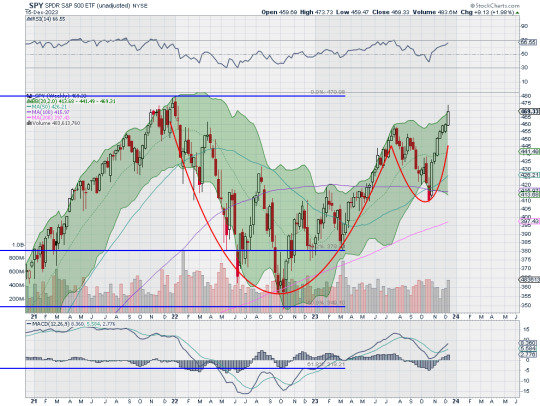

SPY Daily, $SPY

The SPY came into the week retesting the July high. It pushed through that Monday and continued to move higher through Thursday, closing at a nearly 24 month high and just off the all-time high. It printed an Evening Star reversal pattern though and confirmed with a move lower on the daily chart Friday. This saw the RSI rising into overbought territory and end the week pulling back with the MACD turning to flat near where prior peaks have occurred.

The weekly chart shows the longer term Cup and Handle pattern finally with a definitive trigger. It has a target to 570. The Bollinger Bands® on this timeframe are open higher with the RSI rising in the bullish zone and the MACD positive and climbing. There is resistance at 470 and 471 then 473 and 478.50. Support lower comes at 466 and 463.50 then 460 and 457 before 454 and 451. Uptrend.

SPY Weekly, $SPY

With the December FOMC meeting and Quadruple Witching in the books, equity markets posted another stellar week as they head into the last full week of the year. Elsewhere look for Gold to continue higher while Crude Oil continues to trend lower. The US Dollar Index continues to drift to the downside while US Treasuries continue in their short term uptrend. The Shanghai Composite looks to continue the trend lower while Emerging Markets possibly break resistance to the upside.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially the SPY and QQQ on the longer timeframe. On the shorter timeframe the IWM, QQQ and SPY could use a reset on momentum measures as all are extended. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview December 15, 2023 with special Holiday Pricing

2 notes

·

View notes

Text

Cup and Handle Pattern: A Classic Setup with a Modern Twist

The cup and handle pattern is one of the most recognized and reliable chart formations in technical analysis. First popularized by William O’Neil in his book “How to Make Money in Stocks”, this pattern signals a potential continuation of an uptrend and often precedes strong bullish breakouts.

But beyond its classic structure, the cup and handle pattern offers unique insights into market psychology, accumulation, and breakout timing—making it a favorite among swing traders and position investors.

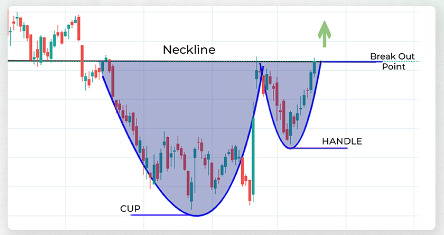

What is the Cup and Handle Pattern?

As the name suggests, this pattern visually resembles a tea cup:

The “cup” forms a rounded bottom, resembling a “U” shape.

The “handle” appears as a small pullback or consolidation on the right side of the cup.

Once the price breaks out above the resistance level formed by the top of the cup, the pattern is considered complete.

Key Features of a Valid Cup and Handle Pattern

Prior Uptrend: The pattern generally forms after a healthy rally. It’s a continuation pattern, not a reversal one.

Rounded Cup: The bottom should be smooth and gradual, not a sharp “V”. This indicates accumulation, not panic buying or selling.

Handle Formation: The handle often slopes downward and should not fall more than 15–20% from the top of the cup.

Volume Confirmation: Volume often decreases during the cup and handle formation, then spikes at the breakout.

What Makes the Cup and Handle Pattern Unique?

What sets the cup and handle pattern apart from other bullish patterns is its ability to trap impatient traders during the handle phase. This brief consolidation or minor dip often shakes out weak hands—setting the stage for a powerful breakout driven by strong hands.

Moreover, this pattern reflects a shift in market sentiment: from correction, to stability, to anticipation, and finally to bullish conviction.

Why Traders Love the Cup and Handle Pattern

Clear Entry Point: The breakout above the resistance line (top of the cup) is a well-defined entry.

Predictable Target: Many traders set the target by measuring the depth of the cup and projecting that above the breakout point.

Strong Momentum: Breakouts from this pattern are often supported by volume, suggesting institutional interest.

Common Mistakes to Avoid

Misidentifying the Pattern: Not every “U” shape with a dip qualifies as a valid cup and handle. Look for proper volume behavior and structure.

Entering Too Early: Jumping in before the breakout can lead to false starts. Always wait for confirmation.

Ignoring Market Context: The broader market trend plays a role. This pattern works best in bullish or recovering markets.

Final Thoughts

The cup and handle pattern may look simple, but it reflects complex behavior—from fear and uncertainty to renewed buying confidence. It tells a story of consolidation followed by conviction. When recognized correctly and used with discipline, it can become a high-probability setup in any trader’s toolkit.

Whether you’re just starting out or looking to refine your chart-reading skills, the cup and handle pattern is a classic you can trust—with plenty of modern relevance in today’s fast-paced markets.

0 notes

Text

Shiba Inu coin has indicated a three-year long cup and handle pattern which is a positive pattern on the price chart.

This pattern seen on the weekly candle of SHIB indicates the possibility of the upward movement to continue.

Market analyst CryptoELITES recently pointed out this formation and what it could mean for Shiba Inu price.

SHIB has a descending trendline acting as a resistance level from October 2021 as depicted by the chart.

According to the analyst, a break of this resistance may open the way to targets of $0.000085171, $0.000183312, and as high as $0.0004729.

This forecast puts a possible rise of 1,700% from the current price of $0.00002802 for SHIB.

0 notes

Text

What are the most popular chart patterns in trading?

Here are the most popular chart Patterns in trading.

Head and Shoulders

Double Top and Double Bottom

Triangles (Ascending, Descending, Symmetrical)

Flags and Pennants

Cup and Handle

Understanding the most popular chart patterns in trading can help you become a more confident and strategic trader.

While no pattern guarantees success, using them alongside other tools—like volume analysis, moving averages, and risk management—can significantly improve your chances.

#chart patterns#most popular chart patterns in trading#chart patterns in trading#trading chart patterns

1 note

·

View note

Text

Unlocking Smart Trading: How SEBI Registered Investment Advisors and Trade Ideas Help You Find the Best Stocks to Swing Trade

Introduction

In today’s dynamic financial markets, retail investors are constantly looking for smarter ways to generate returns. While long-term investing remains a solid strategy, swing trading has emerged as a popular method to profit from short- to medium-term price movements. But successful swing trading requires the right tools, guidance, and research. That’s where SEBI registered investment advisors and reliable Trade Ideas come in.

What Is a SEBI Registered Investment Advisor?

A SEBI registered investment advisor (RIA) is certified and regulated by the Securities and Exchange Board of India. These professionals are authorised to offer personalised investment advice to clients, ensuring compliance with strict regulatory standards. Working with a SEBI-registered advisor ensures that the recommendations you receive are unbiased, transparent, and tailored to your financial goals.

Why Choose a SEBI Registered Investment Advisor?

Trust and Credibility: Backed by SEBI regulations.

Tailored Advice: Investment strategies based on your risk profile.

Transparency: Clear fee structures and unbiased recommendations.

Regulatory Protection: Investors have recourse in case of misconduct.

The Power of Trade Ideas

Trade Ideas refer to carefully selected trading opportunities that are identified based on technical analysis, market trends, and fundamental research. These ideas are often generated by analysts or advisory platforms to help traders identify stocks with strong breakout potential or reversal setups.

What Makes a Trade Idea Valuable?

Data-Driven Insights: Based on market patterns and price action.

Timely Execution: Ideal for short-term trading opportunities.

Backed by Research: Combines technical indicators with macro trends.

Risk-Reward Balance: Highlights optimal entry and exit points.

Finding the Best Stocks to Swing Trade

Swing trading thrives on identifying stocks with strong momentum, volatility, and clear technical signals. The best stocks to swing trade are typically:

In a trending sector or theme (e.g., renewable energy, digital tech).

Showing bullish chart patterns like breakouts, flags, or cup-and-handle formations.

Supported by increasing trading volumes and favorable news sentiment.

Undergoing positive earnings revisions or institutional interest.

With the help of a SEBI registered advisor and expert trade ideas, traders can shortlist such opportunities confidently.

How to Combine Advisory with Trade Ideas

The real advantage comes when you combine both personalised advice and curated stock picks:

Advisory Backing: Get professional validation for trade ideas.

Risk Management: Use advisor strategies to limit losses and protect gains.

Diversification: Advisors help balance your swing trades with long-term holdings.

Consistent Learning: Improve your trading knowledge with expert feedback.

Conclusion

For traders aiming to make informed and confident moves in the market, the combination of a SEBI registered investment advisor, powerful Trade Ideas, and a disciplined swing trading strategy is invaluable. Whether you’re a beginner or an experienced trader, aligning your actions with credible insights and expert guidance will significantly enhance your chances of success.

Start identifying the best stocks to swing trade with the help of trusted advisors and market-tested trade ideas—because smart investing begins with the right partnership.

0 notes

Text

"Mastering the Cup and Handle Pattern: A Key Indicator for Spotting Bullish Breakouts"

Introduction:

Introduce the concept of technical analysis and the importance of chart patterns in identifying profitable trading opportunities.

Briefly explain that the Cup and Handle pattern is a powerful technical pattern that helps traders spot bullish breakouts, offering high potential for profit.

State the purpose of the blog: to explain the Cup and Handle pattern, how to spot it, and how to trade it effectively.

What is the Cup and Handle Pattern?

Definition: The Cup and Handle is a continuation chart pattern that indicates a period of consolidation before a potential bullish breakout. It resembles a cup with a handle, where the price forms a rounded bottom (the cup) followed by a consolidation phase (the handle), and then breaks out to the upside.

Components:

Cup: The "cup" represents the price action forming a rounded bottom. It often takes several weeks or months to form.

Handle: The "handle" is the small consolidation that occurs after the cup, often forming a slight downward or sideways movement. The handle is typically shorter in duration than the cup.

Breakout: The breakout happens when the price breaks above the resistance level formed at the top of the cup.

Why is the Cup and Handle Pattern Important?

Bullish Signal: The Cup and Handle is considered a bullish continuation pattern, indicating that after a period of consolidation, the price is likely to rise significantly.

Predicts Bullish Breakouts: When the price breaks above the handle's resistance, it often signals the start of a strong uptrend.

Helps Traders Enter Early: The pattern allows traders to enter near the breakout point, often before the full trend begins, capturing significant profit potential.

How to Identify the Cup and Handle Pattern

The Cup Formation:

Shape: The cup should be rounded, forming a U-shape rather than a V-shape. A sharp decline followed by a quick rise may not constitute a proper cup.

Volume: During the cup formation, volume should typically decrease as the price declines and then increase as the price rises back up.

Timeframe: The cup formation usually takes a few weeks to a few months to develop. A shorter timeframe may signal weaker signals, while a longer formation tends to offer more reliability.

The Handle Formation:

Consolidation: After the cup completes, a handle forms as the price consolidates, often moving sideways or slightly downward. The handle should ideally be shallow and last for a few weeks.

Volume: Volume should decrease during the handle formation. Low volume during the handle suggests that there isn’t much selling pressure, which makes the breakout more likely.

The Breakout:

Confirmation: A breakout occurs when the price moves above the resistance level at the top of the cup (the cup's "rim"). This is the key entry point for traders.

Volume Surge: A strong breakout is confirmed when it is accompanied by a rise in volume, indicating strong buying interest.

How to Trade the Cup and Handle Pattern

Entry Point:

The best time to enter a trade is when the price breaks above the handle’s resistance level, often accompanied by an increase in volume. This confirms that the trend is likely to continue upward.

Stop Loss Placement:

Place a stop loss just below the handle’s support level or below the lowest point of the cup to protect yourself in case the breakout fails and the price reverses.

Target Price:

The price target is typically calculated by measuring the height of the cup (from the bottom of the cup to the top) and projecting this distance upwards from the breakout point.

Example: If the cup’s height is $10 and the breakout occurs at $100, the price target would be $110.

Risk-Reward Ratio:

Ensure that your risk-to-reward ratio is favorable. A typical Cup and Handle pattern offers a 2:1 or higher risk-to-reward ratio, meaning the potential reward should be at least twice the risk you’re willing to take.

Key Tips for Successful Cup and Handle Trades

Look for Strong Trend: The Cup and Handle pattern works best in an overall uptrend. If the market is in a downtrend or sideways market, the pattern may be less reliable.

Patience is Key: Don’t rush to enter the trade before the breakout. Waiting for the breakout confirmation above the resistance level ensures that the pattern is valid.

Volume Analysis: Pay attention to volume. A breakout without an accompanying increase in volume is less reliable and may result in a false breakout.

Avoid False Breakouts: Sometimes, the price may break above the handle’s resistance only to quickly reverse. Using a stop loss and waiting for confirmation can help avoid this scenario.

Common Mistakes to Avoid When Trading the Cup and Handle Pattern

Entering Too Early: Don’t enter before the breakout occurs. Many traders jump the gun and end up getting caught in false breakouts.

Ignoring Volume: Volume confirmation is crucial for a successful breakout. If the breakout happens on low volume, it’s often a sign of a weak move that could quickly reverse.

Not Considering Market Conditions: The Cup and Handle pattern works best in strong bull markets. In bearish or sideways markets, it may not perform as well.

Real-World Example of the Cup and Handle Pattern

Example: Let’s say stock XYZ has been trending upward for several months and starts to consolidate, forming a cup shape. After completing the cup, the stock forms a handle that moves sideways for a few weeks, creating low volume during the consolidation phase. When the stock breaks above the handle's resistance at $50, accompanied by a surge in volume, this could signal a strong bullish breakout, with a target price potentially calculated as $60, based on the height of the cup.

Conclusion

Recap the power of the Cup and Handle pattern as a key tool for identifying potential bullish breakouts. By understanding how to spot the pattern and trade it effectively, traders can capitalize on the opportunities it presents.

Encourage readers to practice identifying Cup and Handle patterns in real charts and use them in their trading strategy.

End with a call to action: “Start mastering the Cup and Handle pattern today and use it to make smarter, more profitable trades. By waiting for a proper breakout and understanding the volume dynamics, you’ll increase your chances of riding the next big trend!”

0 notes

Text

Cup and Handle Pattern:2024

What is the Cup Handle Pattern?

The Cup and Handle Pattern is a candlestick chart pattern shaped like a cup with a handle. Conventional traders use it as a reliable breakout strategy.

It is a dependable indicator for traders to predict when prices may spike higher. They trade at the breakout point after waiting for the pattern to fully form and anticipating a significant upward rise.

It is considered a strong indicator that prices may increase when combined with the concepts of supply and demand.

Analysis of Cup Handle Pattern

The cup and handle pattern resembles a teacup on a chart. The handle is the smaller part below the cup.

The price first drops, then goes up, forming a "U" shape. After that, it drops a bit but not as much as before and then goes up again, making a smaller "u or v" shape. This pattern is seen as a good sign that prices might go up. Once the handle is finished forming, there's a point where prices could break and go even higher. That breakout point is when the handle is complete.

In easy words, we can also say that this pattern explains that the buyers are trying to take the price up by overpowering the sellers.

The formation of the cup takes place when the price steeps low but also recovers to its same point. After the formation of the cup takes place then the price of the market tries to stoop low but it is not equivalent to the depth of the cup and a strong pullback makes the handle part.

What is an Inverted Cup Handle Pattern?

The inverted cup and handle pattern is the opposite of the regular cup and handle. Instead of signaling an uptrend, it signals a downtrend. The “U” shape in the cup indicates the prices going high and low on the market.

Then, a "U" shape forms, and the price reaches a new high by moving sideways. This new high of the pattern is slightly lower than the previous one, and then it again falls down, resulting in the “U or V” shape. This “U or V pattern is identified as a Handle.

Analysis of Inverted Cup Handle Pattern

The inverted cup and handle pattern shows a potential shift in the direction of a trend. When it appears during a downtrend, it suggests that the downtrend might continue in the trading market.

But if it shows up during an uptrend, it could mean the trend is about to change. Usually, when this pattern forms and there's a breakout, it often leads to a downtrend. Traders might take advantage of this by selling short.

0 notes

Text

🚀 Complete Guide to Technical Analysis: How Traders Read Charts Like Pros

Technical analysis isn’t just about looking at squiggly lines and colors on charts. It’s about decoding market psychology, price behavior, and decision-making—all through historical price data. For traders across the globe, including in India's NSE and BSE, technical analysis is a cornerstone of strategy.

Whether you're day trading Nifty 50 or analyzing long-term opportunities in Reliance or Infosys, this guide will equip you with the complete technical toolkit to trade like a pro.

🎯 What Exactly Is Technical Analysis (And Why Do Traders Trust It?)

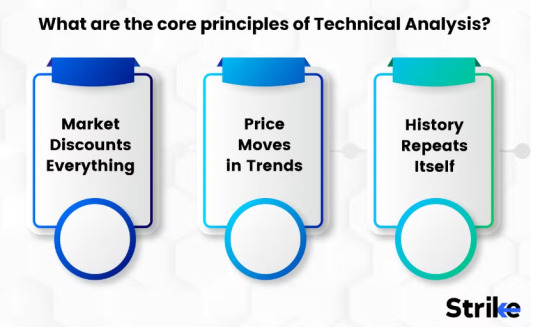

Technical analysis is the study of past market data—primarily price and volume—to forecast future price movements. Unlike fundamental analysis, which evaluates a company’s intrinsic value through financials, TA assumes everything is already priced in.

📚 Originating from the ideas of Charles Dow (yes, the Dow Theory guy), it laid the foundation for tools used by millions of traders worldwide today. Even in India, market veterans like Rakesh Jhunjhunwala and Radhakishan Damani have acknowledged the importance of timing—something TA aims to master.

✅ Traders in the Indian stock market use technical analysis on stocks like Tata Steel, HDFC Bank, and Infosys, particularly for intraday and swing trades. Tools like Strike Money, TradingView, and MetaTrader provide advanced charting features that simplify this process.

🧠 The Mindset Behind Technical Analysis: 3 Core Principles

🔁 History Repeats Itself Markets are driven by crowd psychology. Patterns that worked in 2010 often work in 2025. For example, Wipro's double bottom in 2020 triggered a breakout that analysts had seen before.

📉 Price Discounts Everything Whether it’s an RBI rate hike or company earnings, technical analysts believe all news is already reflected in price movements.

📈 Trends Are Your Friends A stock in motion stays in motion—until proven otherwise. Traders follow trends rather than fight them. For example, Adani Enterprises’ uptrend in early 2021 saw record participation because of trend momentum.

🖼️ Types of Charts: Reading Candles, Lines & Bars Like a Pro

Charts are the visual language of the markets. If you're staring at numbers, you're doing it wrong.

🕯️ Candlestick Charts are the favorite among Indian traders. Originating from 18th-century Japanese rice traders, these charts reveal psychology behind price moves. A bullish engulfing pattern spotted on TCS in April 2023 led to a 12% rally in a week.

📊 Line Charts show closing prices only. Great for spotting long-term trends.

🪵 Bar Charts give similar data as candlesticks but are harder to interpret visually.

On platforms like Strike Money, you can switch between chart types with a click and compare multiple stock patterns in real time.

📍 Chart Patterns That Consistently Predict Breakouts

Patterns are more than just shapes—they are footprints of market participants.

👤 Head and Shoulders: Seen on Infosys before its correction in late 2022. It signals a trend reversal. 🏆 Cup and Handle: Seen on Maruti Suzuki in 2021 before a multi-month uptrend. 🔺 Ascending Triangles: These breakout setups are powerful in bull markets. Hindalco displayed one in 2020 before it shot up over 80% in 6 months.

Patterns are not guarantees—but when combined with volume analysis, they offer strong probability setups.

📊 Indicators That Add Muscle to Your Analysis

Indicators give you confirmation, timing, and momentum. The best traders don’t use dozens—they master a few.

📉 RSI (Relative Strength Index) tells you when a stock is overbought or oversold. For example, Nifty 50’s RSI dropped below 30 in March 2020, signaling panic—and a rebound followed.

⚡ MACD (Moving Average Convergence Divergence) shows trend momentum. A bullish MACD crossover on ICICI Bank in 2021 led to a 15% rise.

📉 Bollinger Bands, created by John Bollinger, are powerful for spotting volatility squeeze setups. Stocks like Zomato often show these during consolidation.

📐 Fibonacci Retracement, inspired by Leonardo Fibonacci’s sequence, helps identify potential pullback levels. For instance, SBI retraced to 61.8% in mid-2022 before continuing its rally.

With Strike Money, you can layer these indicators onto charts, analyze confluence, and even run backtesting for free.

💡 How Indian Traders Use Technical Strategies: Intraday to Swing

🎯 Intraday Trading: Traders look for 5-minute breakouts on stocks like Tata Motors or Bank Nifty. Strategies often involve VWAP, RSI, and price action.

🔄 Swing Trading: Timeframe shifts to daily or weekly. Stocks like L&T or Sun Pharma often exhibit clean trends perfect for swing setups.

💥 Breakout Trading: Stocks like Paytm breaking long resistance zones often reward breakout traders with strong momentum.

🔁 Mean Reversion: When stocks like HDFC Life drop below the lower Bollinger Band with RSI < 30, contrarian trades are triggered.

A key part of strategy is risk management—using stop losses and risk-reward ratios. A common rule: never risk more than 2% per trade.

🛠️ Charting Tools Every Indian Trader Should Know

📍 Strike Money: A rising star in the Indian charting space, it offers intuitive charting, live data, and tools like Fibonacci, moving averages, and volume overlays—perfect for both beginners and pros.

📍 TradingView: Popular worldwide, supports scripts like Pine editor and advanced backtesting.

Having the right tools isn’t optional—it’s essential. With mobile-first platforms like Strike Money, analysis happens in real-time, anywhere.

❌ Common Mistakes That Ruin Technical Trades

🚫 Using too many indicators: Analysis paralysis is real. 5 indicators telling different stories leads to confusion.

🚫 Ignoring volume: Price moves without volume = fakeouts. Always confirm with volume, like in Reliance’s breakout in 2020—it had massive volume spikes.

🚫 No backtesting: If you haven't tested a strategy on historical data, don’t risk real capital.

🚫 Overtrading: Many intraday traders in India fall into the trap of chasing every candle. Patience > FOMO.

Research by SEBI in 2023 showed that 89% of intraday traders lost money—often due to poor strategy and lack of discipline.

🧪 Can You Trust Technical Analysis? Let’s Talk Research & Reality

A 2014 study by the Journal of Financial Markets showed that technical trading rules can generate above-average returns in emerging markets—including India. However, effectiveness drops if widely known strategies are overused.

In India, a 2021 report by Zerodha revealed that traders who combined technical analysis with position sizing and journaling had 3x better performance than those trading on tips and news alone.

So yes—technical analysis works, if applied with consistency and risk control.

🧭 Technical vs Fundamental Analysis: Should You Choose One?

📈 Technical = Timing 📊 Fundamental = Value

Let’s say you're bullish on Tata Power due to renewable energy reforms. That’s a fundamental bet. But when to enter? Technical analysis shows a breakout in volume and RSI divergence—your green light.

In volatile sectors like pharma and fintech, many investors use both approaches. Combining the ‘why’ of fundamentals with the ‘when’ of technicals gives a holistic trading edge.

🙋♂️ FAQs About Technical Analysis

🤔 Can TA predict the future? No—but it gives you probabilities, not certainties. It's like a weather forecast.

⌛ How long does it take to learn? 3–6 months of daily practice using tools like Strike Money can build a solid foundation.

💰 Is it good for crypto or forex? Yes. BTC, ETH, USD-INR—all follow patterns and react to indicators.

📉 Is TA just for short-term trading? Not at all. Long-term investors use it to spot better entry points too.

🎬 Final Thoughts: Is Technical Analysis Right for You?

Technical analysis isn't magic. It's a tool. A very powerful one—when used with discipline, strategy, and backtesting. Whether you’re trading TCS, Bank Nifty, or Zomato, TA gives you an edge in a game that’s all about timing and precision.

If you want to cut through the noise, make informed trades, and build confidence, learning technical analysis is a no-brainer.

✨ Start with one indicator, one pattern. Use tools like Strike Money to chart and journal your trades. Don’t chase perfection—chase progress.

0 notes

Text

Master the Market with These Top Chart Patterns for Trading

Trading isn’t just about numbers; it’s about mastering the art and science of the financial markets. At Funded Traders Global, we’re here to help you do just that, and it all starts with understanding the power of Top Chart Patterns for Trading.

In our latest blog, we’ve unraveled the secrets of chart patterns, revealing how they can be your compass in the complex world of trading. We have also uploaded a detailed blog on Chart Patterns. You can check that for more detailed learning about Chart Patterns.

So let’s first understand what is chart pattern…

Understanding Chart Patterns

Basics of Technical Analysis

Before diving into chart patterns, it’s essential to understand the fundamentals of technical analysis. This approach relies on historical price data and volume to predict future price movements. By studying charts, you can spot recurring patterns that indicate potential buying or selling opportunities.

Role of Price Action

Price action is at the heart of chart patterns. It represents the collective psychology of market participants. Chart patterns are formed as a result of price action, and understanding this action is crucial for interpreting patterns accurately.

Benefits of Recognizing

Recognizing chart patterns has numerous advantages. It can improve your entry and exit points, enhance risk management, and increase the probability of profitable trades. Furthermore, chart patterns provide a visual representation of market sentiment, making it easier to spot trends and reversal

Common Chart Patterns

Head and Shoulders

The head and shoulders pattern is a classic reversal pattern. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). This pattern signals a potential trend reversal from bullish to bearish.

Double Top and Double Bottom

Double top and double bottom patterns are also reversal patterns. They indicate a potential shift in market sentiment. Double tops suggest a bearish reversal, while double bottoms imply a bullish reversal.

Bullish and Bearish Flags

Flags are continuation patterns. They represent brief pauses in a prevailing trend before resuming in the same direction. A bullish flag forms during an uptrend and is a bullish continuation signal, while a bearish flag forms during a downtrend and is a bearish continuation signal.

Cup and Handle

The cup and handle pattern resembles the shape of a teacup. It is a bullish continuation pattern that indicates a potential upward trend continuation.

Symmetrical, Ascending, and Descending Triangles

These triangle patterns signify potential breakouts. Symmetrical triangles suggest uncertainty, ascending triangles indicate bullish sentiment (Expectation of price rise), and descending triangles indicate bearish sentiment (Expectation of price decline).

Funded Traders Global can provide the capital and resources you need to start trading with confidence. They offer funding programs and support to traders looking to grow their portfolios.

Advanced Chart Pattern

Pennants

Pennants are short-term consolidation patterns that often precede sharp price movements. They resemble small symmetrical triangles and can be bullish or bearish, depending on the preceding trend.

Wedges

Wedges are similar to triangles but are typically sloped. Rising wedges are bearish while falling wedges are bullish.

Gaps

Gaps occur when there is a significant difference between the closing price of one candlestick and the opening price of the next. They often indicate strong price momentum and can be used to identify potential support or resistance levels.

Harmonic Patterns

Harmonic patterns are complex but highly accurate. They include patterns like the Gartley, Butterfly, and Bat patterns, which are based on Fibonacci ratios and symmetry.

Practical Tips for Chart Patterns Trading

To successfully trade using chart patterns, you should:

Implement robust risk management strategies.

Identify precise entry and exit points.

Choose appropriate timeframes for your trading style.

Combine chart patterns with other technical indicators for confirmation.

Conclusion

Are you ready to take your trading to the next level? At Funded Traders Global, we’re committed to helping you become a more skilled and successful trader.

Start your journey by mastering Top Chart Patterns for Trading—a fundamental tool in the trader’s toolkit. Recognize patterns, make informed decisions, and manage risk with confidence.

Join Us on Discord or Contact Us directly. Don’t wait—seize the opportunity to transform your trading career with us!

1 note

·

View note

Text

4 Trade Ideas for Block: Bonus Idea

Block, $SQ, comes into the week at resistance. This time it is from a higher low, setting up an Cup and Handle pattern with a target to 122 on a break higher. The RSI is rising in the bullish zone with the MACD positive and moving up. The Bollinger Bands® are also pointing higher. There is resistance at 82.50 and 85.75 then 90.75. Above 90.75 is the break of a nearly 2 year consolidation zone. Then resistance is at 98 and 107 before 118.50 and 127. Support lower comes at 76 and 74. Short interest is low at 2.7%. The stock does not pay a dividend.

The company is expected to report earnings next on May 2nd. The March options chain shows biggest open interest at the 75 put strike and then 77.50. On the call side it is biggest at 75 then 80 and 85. In the April chain open interest is spread from 80 to and biggest at 70 on the put side. The call side sees a wider 65 to 100 range, biggest at 80 and 90. The May chain cover the earnings report and sees open interest focused at the 70 put strike while it is spread evenly from 80 to 115 and also at 70.

Block, Ticker: $SQ

Trade Idea 1: Buy the stock on a move over 82 with a stop at 78.

Trade Idea 2: Buy the stock on a move over 82 and add an April 77.50/70 Put Spread ($2.20) while selling the May 105 Calls ($1.75).

Trade Idea 3: Buy the April/May 90 Call Calendar ($2.55) while selling the April 70 Put ($1.20).

Trade Idea 4: Buy the May 70/82.50/90 Call Spread Risk Reversal (15 cent credit).

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the March options expiration week, saw equity markets showed some fatigue.

Elsewhere look for Gold to continue its uptrend while Crude Oil consolidates in a tighter range. The US Dollar Index looks better to the downside while US Treasuries bounce in their downtrend. The Shanghai Composite looks to continue the short term move higher while Emerging Markets move up in consolidation.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe, but with some indecision candles this week. On the shorter timeframe the IWM, the QQQ and the SPY all ended with some short term weakness. This could signal a correction through price or time. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

Trader Pearl's Insights, Chart Patterns, and Strategies for Mastering Swing Trading

Trader Pearl's Insights, Chart Patterns, and Strategies for Mastering Swing Trading

A well-liked trading technique called swing trading seeks to profit from short- to medium-term price changes that occur within a trend. Swing trading entails holding positions for a few days or weeks, in contrast to day trading, which entails completing trades in a single day. This piece will explore the realm of swing trading, going over different approaches, stressing the significance of chart patterns, and presenting Trader Pearl—a priceless tool for would-be traders.

Strategies for Swing Trading:

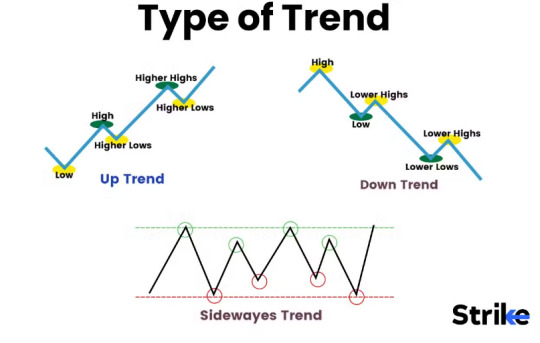

1. Trend Following: - Use technical analysis tools to determine the dominant trend.

- To profit from price momentum, enter trades in the trend's direction.

- For trend confirmation, use momentum indicators, trendlines, and moving averages.

2. Trading Countertrends: - Recognize overbought or oversold market circumstances.

- To identify possible reversals, use oscillators such as the stochastic oscillator and the relative strength index (RSI).

- Use caution when executing trades that deviate from the dominant trend.

3. Breakout Trading: - Determine pivotal levels of support and resistance.

- When the price breaks through these levels, suggesting a possible continuation of the trend, execute trades.

- Put risk management strategies into practice to reduce false positives.

4. Pullback Trading:- Watch for a price retracement inside an established trend.

- To ride the continuation of the trend, enter trades at advantageous levels.

- To find possible entry points, use moving averages and Fibonacci retracement levels.

Chart Patterns' Function:

1. Head and Shoulders:- Signifies a reversal in the trend.

- Once the neckline is broken, entry takes place.

2. Double Tops and Bottoms:- Indicates a possible reversal in the trend.

- Admission following verification of the design.

3. Ascending, Descending, Symmetrical Triangles: - Patterns of signal continuation.

- Entry after the triangle breaks or emerges.

Handle and Cup:- This suggests a bullish continuation.

- Entry following the formation of the handle.

Trader Pearl: Your Passport to Expert Trading:

A comprehensive platform called [Trader Pearl] was created to give traders the information, perspective, and resources they need to trade profitably. A sample of what Trader Pearl has to offer is this:

1. Educational Resources: - Comprehensive classes that cover a range of trading topics, from basic to advanced.

- Live sessions and webinars with seasoned traders.

meetings and conversation forums.

Trading Insights and Case Studies

- Gain knowledge from seasoned traders via interviews, case studies, and insights.

- Recognize the attitude and tactics that result in successful trading.

Final Thought:

The dynamic strategy of swing trading necessitates the integration of risk management, technical analysis, and ongoing education. Incorporating chart patterns and utilizing tools such as Trader Pearl can help traders improve their abilities and raise their chances of success in the constantly changing financial markets. Recall that profitable swing trading is only one aspect of successful swing trading; another is cultivating a methodical and knowledgeable approach to the markets

0 notes

Text

Cifdaq

Shiba Inu coin has indicated a three-year long cup and handle pattern which is a positive pattern on the price chart.

This pattern seen on the weekly candle of SHIB indicates the possibility of the upward movement to continue.

Market analyst CryptoELITES recently pointed out this formation and what it could mean for Shiba Inu price.

SHIB has a descending trendline acting as a resistance level from October 2021 as depicted by the chart.

According to the analyst, a break of this resistance may open the way to targets of $0.000085171, $0.000183312, and as high as $0.0004729.

This forecast puts a possible rise of 1,700% from the current price of $0.00002802 for SHIB.

www.cifdaq.com

0 notes

Text

How To Combine Market Geometry And Chart Patterns To Trade Precisely Caterpillar Stock Like A Pro

Learn more.

#market geometry#chart patterns#cup and saucer#Cup and handle pattern#inverted head and shoulders#Trading tips#swing trading tips#trading tips and tricks#day trading tips#stock trading tips#trading tips#pitchfork trading system#what is pitchfork tool#pitchfork tool trading#pitchfork#pitchfork trading#trading fibonacci#fibonacci sequence#fibonacci numbers#fibonacci trading#cci#trading rsi divergence#rsioscillator#rsi oscillator#FX#Forex#binary options videos#binary betting#binary trader#binary options

3 notes

·

View notes