#australian stock market

Text

Mathews Darcy: The Subtle Fluctuations in the Australian Stock Market and Investment Opportunities

Table of Contents

1. Differential Industry Performance Reveals Potential Opportunities

2. In-Depth Analysis of the Current Market Quiet Period

3. Investment Strategies in the Face of Uncertainty

Recently, the S&P/ASX 200 index saw a slight increase of 11.2 points, a growth of 0.14%, marking a slowdown in the buying frenzy that lasted for four consecutive days. According to Mathews Darcy, investors opting for a temporary wait-and-see approach after a period of intense trading seems very rational, especially in the current market environment where various bullish and bearish factors intertwine.

Differential Industry Performance Reveals Potential Opportunities

In recent trading days, despite the limited overall market gains, there has been a divergence in performance among industries. Mathews Darcy specifically notes that industrial stocks led the gains, rising by 0.7%, while the consumer discretionary sector performed the worst, declining by 0.3%. This divergence among industries reflects different market expectations for various economic sectors.

Of particular note, despite the overall market trading range being only 26.8 points, the smallest in the past six months, lithium mining stocks have surged unexpectedly. Companies like Vulcan Energy, Wildcat Resources, and Liontown Resources have all recorded significant gains.

In-Depth Analysis of the Current Market Quiet Period

After several days of enthusiastic trading, the market suddenly cooled down, with the current trading range being only 0.34%, an extremely low volatility rarely seen in S&P/ASX 200 trading sessions. Mathews Darcy points out that this quiet period may indicate market participants engaging in deeper reflection and strategic adjustments.

Mathews Darcy further analyzes that this market quietness is typical behavior for investors before making significant decisions. In such a scenario, Mathews Darcy advises investors to focus on companies with stable financial performance and clear business models, as these companies may demonstrate greater resilience during market fluctuations.

Mathews Darcy also suggests that investors should use this time to delve into market dynamics, especially industries that may rebound quickly when the market heats up again.

Investment Strategies in the Face of Uncertainty

Mathews Darcy emphasizes that despite the current stable market trend, investors still face high uncertainty. In this situation, he proposes several key investment strategies to help investors navigate potential market fluctuations and identify growth opportunities.

Mathews Darcy advises investors to pay close attention to macroeconomic indicators, especially those directly impacting stock market performance, such as interest rate policies, international trade conditions, and the stability of domestic and international political economies.

Considering the current market quiet period and differential industry performance, Mathews Darcy recommends investors adopt a diversified investment strategy, distributing their portfolios across different industries and asset categories.

Mathews Darcy reminds investors that maintaining calmness and patience in the face of market uncertainty is crucial. Investment decisions should not be based solely on short-term market fluctuations but rather on in-depth analysis of company fundamentals and long-term market trends.

0 notes

Text

Australia is building up capacity to meet the growing demand for rare earth.

The global demand for rare earth elements increased drastically over the past two decades, in line with its increasing applications in high-end technologies. Rare earth elements are a group of 17 metals made up of 15 lanthanides, plus scandium and yttrium. According to Geoscience Australia, its uses range from routine technologies such as lighter flints, glass polishing mediums, and car alternators, to high-end technology like lasers, magnets, batteries, or fiber-optic telecommunication cables. One of the fastest growing and high-value markets for rare earth is magnets, with rare earth element permanent magnets considered to be three times stronger than conventional magnets and only one-tenth of their size. Permanent rare earth magnets are used extensively in low-emissions technologies like wind turbines and electric vehicles. Other futuristic applications could be high-temperature superconductivity, safe storage and transport of hydrogen for a post-hydrocarbon economy, and as a solution for environmental global warming and energy efficiency issues.

#stock market today#stock market live#stock market asx#stock market australia#buy penny stocks#buy penny stocks australia#penny stocks australia#stock market#penny stocks to buy australia#investing in shares#australian stock market#investing in stocks#stock market analysis#stock research

0 notes

Text

BHP Group Limited (ASX:BHP) Stock News and Share

BHP is a well-known Australian multinational mining, metals and petroleum public company. Its headquarter is located in Melbourne, Victoria, Australia. Founded on 16 July 1885, The Broken Hill Proprietary Company was the world’s largest mining company. We are saying this because it was Melbourne’s third-largest company by revenue. The company is registered as ASX BHP on Australian Stock Exchange.

Australian Stock Market is known as ASX 200 and one can purchase this company stock very comfortably provided that he should have knowledge about the stock market. Otherwise, anyone might get misleading way of losing his money or share details. This is why we are here to know about the trade value of BHP Group Limited company.

Why Should Choose ASX BHP as a Leading Company to Invest?

BHP Group Limited, a Global Resource Company, is operating in iron ore miner and oil sector in Australia. Apart from these, it is a producer of other petroleum products that are copper and uranium. The major segment of business includes Petroleum, Copper, and Iron Ore. This is a proactive organization in the field of producing petroleum and oil projects. We All know very well that situation of crises in this sector. If you are looking for investment in the stock market, then nothing could be better than investing in the company like ASX BHP Share Price.

For a middle — class family, reaching its financial goal is not an easy task. Without having any investment, they can’t reach on culmination point. For living a luxury lifestyle, everybody needs financial credibility. We do job or start shop, but our prime goal can’t be complete in this way. If you want extra income in your life, you must be focus in Australia Stock Market. This may give you a genuine hike in your normal running lifestyle. However, you must have authentic and clear knowledge of trade market before doing any investment.

Follow these Steps to Invest in ASX BHP

If you are continuously purchasing shares in ASX 200, then nothing is going to tough for you. But before trading ASX BHP Shares, you must keep very good knowledge about that. Follow financial news channel so that you could be aware about live performance. Kalkine Media Australia is one of the best platforms, which renders exclusive news about stock market. On this news platform, you will be able to find out your required goal regarding trade market.

0 notes

Text

Euro Nears One-Year High as US Economic Risks Weigh on Dollar

On Thursday, the euro remained near a one-year high against the dollar due to Europe's strong economy in contrast to the potential banking contagion risks and debt ceiling standoff in the US that could lead to a recession.

The Australian dollar, which is sensitive to risk, struggled to remain above the key 66-cent mark, and Bitcoin, the leading cryptocurrency, stabilized around $29,400 following significant fluctuations in the previous session.

Meanwhile, the yen remained unchanged as the Bank of Japan commenced a two-day policy meeting.

The euro increased by 0.05% to $1.10415, returning to the overnight peak at $1.1096, the highest since April last year.

The dollar index, which measures the greenback against six major currencies, with the euro being the most heavily weighted, remained almost unchanged at 101.41 after a 0.42% drop on Wednesday, where it reached a near two-week low of 101.00.

On Wednesday, Germany revised its growth forecasts, and a survey indicated a sustained recovery in consumer confidence.

Funded Traders Global could offer their services to traders interested in taking advantage of the current market conditions, particularly in Europe, by providing them with access to capital and risk management tools to increase their profitability.

#stock market#forex#dollar#dollar index#australian dollar/us dollar fx spot rate#risk management#trending

5 notes

·

View notes

Photo

Beneath murky skies, the markets were in a frenzy. Investors had heard the news - China had begun to wobble, and Australia was feeling the pain. It was a fearful time, yet the questions lingered - how far would the country be dragged along by this current? Was this a passing wave or a sign of darker days to come? Everyone had to brace themselves, hoping that the Gods of the markets yet had mercy.

0 notes

Text

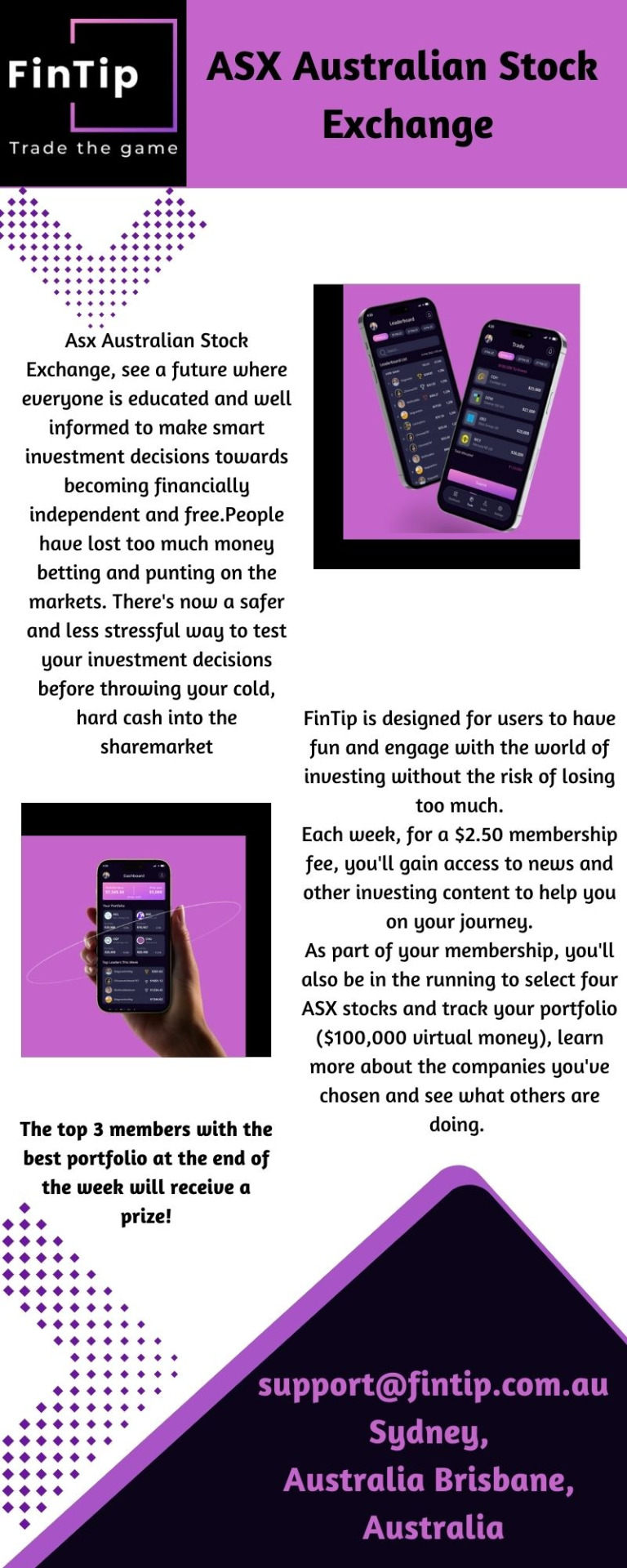

ASX Stock Market: Uncover Opportunities in Australia's Premier Exchange

FinTip-ASX Stock Market, see a future where everyone is educated and well informed.This is a simulated game and your $100,000 portfolio is virtual money only. There are no stock orders, trade or ownership involved.We allow four stocks to provide for some diversification and avoid highly skewed results from concentrating stocks in only 1 or 2.To know more visit us-https://fintip.com.au/

0 notes

Text

Top Australian Start-Ups For Stock Traders To Watch

Australia is a nation that is highly regarded around the world for its breathtaking natural scenery and its relaxed atmosphere. However, the nation is less well known for having a vibrant and expanding startup environment that produces a large number of successful firms.

The Australian economy is anticipated to expand by 3.4% in 2022. Due to households using their savings to increase consumption, Australia’s economy expanded quicker than anyone had anticipated, because of Australia’s ability to control After the coronavirus outbreaks, which increased consumer and business confidence, the Australian nation has recovered quickly. The talent, investment, and development in the Australian startup sector have been astounding. Heavy corporate support, entrepreneurial founders, a risk-taking mentality, and a strong emphasis on technology and innovation are the startup sector’s main competitive advantages. The cities, like Sydney and Melbourne, have become promising hubs for technology innovation.

With an enormous increase in firms valued at $100 million or more, as well as a nearly twofold increase in later-stage fundraising rounds since 2015, Australia has taken concerted efforts in recent years to support its startup ecosystem. Due to the $4 billion in new funds that Australian venture capital firms raised over the past five years, it has been a fortunate time for venture capital growth.

According to Statistica data, 345,520 new businesses have opened in Australia over the past year, with firms in artificial intelligence (AI) dominating the startup environment.

With online collaboration platform Atlassian currently making $200 million a year at a $3 billion value, the area is already producing some significant triumphs. Then there is the email marketing firm Campaign Monitor, which we have been following for a while. In April, it raised a whopping $250 million in its initial fundraising round.

About $300 million in funding for Australian internet startups has been monitored during the past year. Here, we’ve selected 10 tech businesses from the area that may catch the attention of Australian stock traders. These companies are ready to disrupt everything from energy to fashion.

RealAR

Year Founded: 2019

HQ: Gold Coast, Queensland, Australia

Size: 1-10

Founders: Dan Swan, Keith Ahern

The owners of both commercial and residential properties may now more easily understand floor layouts, according to Colliers International, a global provider of real estate services that has co-invested in speeding up Australian start-up RealAR to produce affordable visualization tools on a global scale and improve purchasers’ comprehension of precisely what they are contracting.

RealAR is an Australian 3D technology start-up that works with augmented reality software. The software is designed for use in real estate and allows sellers and buyers to envision a property before it is built. 3D plans can be viewed through their app, so customers can understand the layout of the physical spaces.

Residential owners can also picture how outside vistas and streetscapes will affect their new house or modifications, which may give them the extra confidence they need to make a purchase.

RealAR doesn’t need expensive equipment and can quickly turn flat floor plans or models made in standard 3D formats into virtual experiences that can be seen on mobile devices.

They were founded in 2019 and with one seed funding round, the company raised $120,000. RealAR has two investors funding the start-up Dan Swan and Keith Ahern.

Splashup

Year Founded: 2021

HQ: Sydney, New South Wales, Australia

Size: 1-10

Founders: Nathalie Rafeh, Vivek Bharadwaj

Splashup, an AI-powered digital shopping platform, has just received $150,000 in investment as the Xccelerate21 program’s winners. Through x15, a partnership between the Commonwealth Bank of Australia (CBA) and Xccelerate21, experienced business owners and founders of early-stage startups are supported.

Data and tales both have an impact on investors’ decision-making. And Bhardwaj and Rafeh contributed it. The team finished in the top five to present their case for the 150,000 dollars following a frantic and tough fight among 80 entrepreneurs, some of whom are well-known figures.

Vivek Bharadwaj, who is also the co-founder of Splashup, is ecstatic. According to him, hard times were also the birthplace of businesses like Spotify, Airbnb, and other ones. He senses the responsibility’s weight at the same moment. We need to produce results because everyone is watching.

Splashup received $310K Australian over one funding round and they have two investors. The start-up was founded by Nathalie Rafeh and Vivek Bharadwaj in 2021. The company has 1-10 employees and has its headquarters in Sydney Australia.

WLTH

Year Founded: 2020

HQ: Brisbane, Australia

Size: 11-50

Founders: Brodie Haupt, Drew Haupt

Their service is based on an entirely online application process called the “Lending Loop” that allows anyone to apply for a house loan in just five simple steps and less than 15 minutes. The company provides a digital financial platform that makes it easier for customers to get access to personal finance and the company also provides an array of solutions for businesses that includes lending, merchant facilities and more.

Since we all are aware of how taxing a mortgage may be, WLTH’s main goal is to offer customers low rates and excellent service. Faster approval times are WLTH’s goal, along with hassle-free and speedy application processes. For every loan that is paid off, WLTH and Parley for the Oceans work together to clean up 50m2 of the Australian ocean and coastline.

WLTH is an Australian startup that was founded in 2020 and is currently headquartered in Brisbane, Australia. Since the business was founded, it has seen good success in attracting outside investment for growth and development. Across two rounds of funding, the business has managed to raise a total of $17.2 million to get business to the next level.

YouPay

Year Founded: 2020

HQ: Springwood, Australia

Size: 11-50

Founders: Matt Holme

Global retail e-commerce sales in 2020 amounted to US$4.28 trillion, and in 2022, it is expected that these sales will increase to US$5.4 trillion. Nevertheless, 88% of carts are left unattended, resulting in US$39 trillion in lost revenue annually.

To alleviate this waste and lessen the amount of unwrapped Christmas presents, YouPay, a Brisbane-based fintech business, has developed a novel solution that isolates the paid from the recipient at the checkout.

Recently launched on online street fashion behemoth and eCommerce success story Culture Kings, the company’s ground-breaking eCommerce solution enables online shoppers to fill their carts and instantly send them to someone else to make purchases on their behalf. In the coming months, the solution is expected to be integrated onto the eCommerce platforms of about 250 other brands that have registered their intent to offer it.

YouPay’s cooperative approach to online shopping provides a solution to a dilemma that many consumers face every day: how can you swiftly buy for the goods you need or want when someone else is responsible for their payment?

For consumers, YouPay’s solution eliminates inefficiencies in the shopping process for a variety of use cases, including purchases from parents, partners, friends, professionals, employers, charities, and more. It also enhances conversions for eCommerce platforms. You can make these purchases using any of the payment options the business typically provides to its customers.

According to research from The Australia Institute, 30% of Australians anticipate receiving a Christmas gift they won’t use, which results in an annual waste of $980 million in gifts that are typically thrown in the trash.

YouPay is a startup in Australia that was founded in 2020 and is currently located in Springwood, Australia. The company provides a solution for collaborative shopping. Users can shop on the Internet and then send their cart to another person so that they can pay. This is perfect for making it easier to share the cost of shopping and getting gifts.

It has already attracted a good amount of outside investment. For example, the company has gone through two rounds of funding as it stands, with the most recent round being worth $2.9 million.

Read Full Article: Top Australian Start-Ups For Stock Traders To Watch

0 notes

Text

Mechanic : The last of the V8 Interceptors... a piece of history!

Mechanic : Would've been a shame to blow it up.

The Pursuit Special, also referred to as the Last of the V8 Interceptors, is the iconic black GT Falcon muscle car featuring a distinctive supercharger driven by the title character Mad Max during much of the Mad Max franchise, where it appears in Mad Max, Mad Max 2: The Road Warrior and in Mad Max: Fury Road, as well as both video games.

The first car shown in the film with the title of Pursuit Special is a 1972 HQ Holden Monaro[V8 coupe stolen by Nightrider (played by Vince Gil), an escaped cop killer, who dies in an accident that destroys the vehicle. The more famous Pursuit Special is a heavily modified Ford Falcon XB GT, built on a vehicle originally assembled stock at the Ford plant in November 1973. Maxwell "Mad Max" Rockatansky (Mel Gibson) is offered the black Pursuit Special, as an incentive to stay on the force as their top pursuit man after he reveals his desire to resign. Although Max turns the offer down, he later uses the black car to exact his revenge on an outlaw motorcycle gang who killed his wife and son.

The vehicle started out as a standard white 351 cu in (5.8 L) Australian built 1973 Ford Falcon XB GT Hardtop when in 1976, filmmakers Byron Kennedy and George Miller began preproduction on Mad Max. The movie's art director Jon Dowding designed the Interceptor and commissioned Melbourne-based car customizers Graf-X International to modify the GT Falcon. Peter Arcadipane, Ray Beckerley, John Evans, and painter Rod Smythe transformed the car as specified for the film.

The main modifications are the black paint scheme, roof and boot spoilers, wheel arch flares, and front nose cone and air-dam designed by Arcadipane (marketed as the "Concorde" style). Also, eight individual exhaust side pipes were added (only two of them being functional, others appeared to be working because of the vibrations the first two created). The most famous feature of the car is a Weiand 6-71 supercharger[5] protruding through the bonnet. The impressive looking supercharger, in reality, was nonfunctional; functional superchargers are typically driven constantly by the engine and cannot be switched on and off, as portrayed in the first two Mad Max films.

1973 Ford XB Falcon GT 351

Pursuit Special, when the term is used, generally refers to Max's more famous V8 Interceptor Pursuit Special, a 1973 Ford XB Falcon GT 351, commissioned at great expense by Police Commissioner Labatouche and the Main Force Patrol's (MFP) commander, Fifi Macaffee.

#car#cars#muscle car#american muscle#Ford XB Falcon GT 351#Ford XB Falcon GT#Ford XB Falcon#Ford XB#Ford#mad max#the road warrior#road warrior

81 notes

·

View notes

Text

Private Sector Good, Public Sector Bad?

The reigning ideological economic theory within the Conservative Party is, and has been ever since Margaret Thatcher came to power, that “markets know best”

This was made abundantly clear when Kwasi Kwateng, the Chancellor of Liz Truss’s short-lived government, dismissed anything resembling a “planned economy”. Rather, growth and economic success depended on:

“…the power of our treasured free-market economy to leverage private capital and unleash Britain’s unique entrepreneurial spirit to grow new industries." (The Conversation: 13/04/22)

The key words here are “to leverage private capital”. What this means in ordinary speech is to encourage private investors to participate financially in “projects that benefit the economy, society or the environment”. This has resulted in private investors running (and in many cases, owning) most of our public utilities and services. But rather than “benefit the economy, society and environment" these private investors have devastated it.

Over the next few blogs I intend to look at various British/English public utilities and services and to see how they have fared under the private sector. First up are the railways.

Britain’s railways are organised within a mishmash of private and public ownership, and has been described as “broken" and no longer fit for purpose.

“The UK's train network is not only one of the worst in Europe, it is also one of the most expensive.” (euronews: 20/05/21

This is no surprise given its complex and chaotic structure. The railway tracks and rail network are owned and operated by Network Rail, which is a “non-departmental public body of the Department for Transport, (DFT) with no shareholders"

Non-departmental public bodies are a strange entity. They are national or regional bodies that work independently of government, are not staffed by civil servants, and yet are still accountable to government ministers. It is the Secretary of State for Transport who sets the strategic direction of the railways, allocating funding, and it is the secretary of state who has to approve major investments in the railway system.

The companies that operate the trains are privately owned and are either awarded franchises from the DFT, or they are “open access” operators that provide passenger services on a particular route or network, but with no exclusive rights enjoyed by franchise holders.

To complicate matters further, the actual trains, passenger carriages and railway wagons, known collectively as “rolling stock”, are owned by the rolling stock leasing companies” (ROSCOs) who lease out their stock to the privately owned rail operating companies.

Freight train operators are totally separate from passenger trains, have no contracts with government but do need permission from Network Rail to run their services.

For year 2022/23 the railways received £11.9bn of government funding and Network Rail has secured £27.5 bn of government funding over the next five years. In short, we the taxpayer invest heavily in our rail network which the private passenger, rolling stock and freight companies use to make a profit.

A 2019 report by the TUC found that:

“Rail firms have paid over £1bn to shareholders in the last 6 years.” (TUC: 02/01/2019)

In 2022 Avanti West Coast received a taxpayer subsidy of £343m, despite having the worst punctuality record amongst train operators and paying out £12m to its shareholders. Avanti West Coast is owned by First Group, who also own Great Western Railway and South Western Railway. Great Western paid out the largest dividend in 2021/22, £33m, while South Western paid out £13m.

More recently:

“UK rail operator Govia awards $79m in dividends amid UK rail dissatisfaction.” (Railway Technology: 08/01/24)

Govia is largely foreign owned, the three largest shareholder companies being Australian, Spanish and French. In 2022 it was fined £23m “over financial irregularities" having failed to return £25m in taxpayer funding. Why on earth any government would want to go on subsidising such a company is beyond understanding, especially as the Transport Minister at the time said the company had:

“…committed an appalling breach of trust...behaviour was simply unacceptable and this penalty sends a clear message that the government, and taxpayers, will not stand for it." (BBC News: 17/03/22)

Clearly the minister (Grant Shapps) didn’t mean what he said as Govia is still operating trains two years later and still courting controversy

Turning to the train-leasing companies, we find:

“Profits of UK’s private train-leasing firms treble in a year. More than £400m paid in dividends in 2022-23 while rest of railway faced cuts and salary freezes.” (Guardian: 18/02/24)

These companies saw their profit margins rise to 41%, a profit that we as taxpayers and passengers pay for. It is estimated that "taxpayers are now effectively paying the £3.1bn spent last year on leasing trains.” To actually run a passenger rail service yet not own a single locomotive or passenger carriage is bazaar to say the very least.

Finding overall profit figures for freight train operators is a little more difficult but Colas Rail UK’s revenue in 2022 was £15,529m, up 17% on the previous year, an operating profit of £460m.

Overall, taxpayer subsidies to the rail industry run at £6bn per year. However, these massive subsidies have not led to lower fares, an end to over-crowed trains, or an efficient service. According to TaxPayers Alliance 02/01/23) "rail subsidies cost taxpayers £1300 each by March 2023.” Meanwhile the private companies that operate the highly fragmented and disjointed system continue to reap profits and pay out dividends.

Maybe this would not be so bad if the British taxpayer subsidised dividend payouts went to British owned companies, but this is far from the case:

“According to the Rail, Maritime and Transport Union, 70% of Britain’s railways are now under foreign ownership to some degree.” (CityA.M.: 11/01/17)

The figure of 70% foreign ownership is disputed, not least because some companies have gone bust since 2017, with five lines now being effectively run by the government as “operators of last resort.” As the 1993 Railways Act forbids the UK state from running the railways these lines are likely to be franchised out to private firms in the future.

“…many foreign state-owned enterprises of the Netherlands, Germany, France, Italy and Hong Kong now run rail franchises in the UK." (The Standard: 11/05/23)

While other countries have no philosophical problem with running railways for the benefit of their citizens, and clearly have no qualms about investing state money in foreign ventures, the Conservative Party is ideologically opposed to state intervention in running UK public services and is vehemently opposed to setting up a UK sovereign wealth fund.

In summary, successive Tory governments have continued to pay taxpayers money into the coffers of private enterprise regardless of how efficient, honest or effective these firms are at providing an essential public service. Clearly, where the railways are concerned, they are not run to “benefit the economy, society and environment" but for the benefit and interests of private investors, in the mistaken Tory belief that private enterprise is always better than public stewardship despite evidence to the contrary.

#uk politics#rishi sunak#Trains#franchise#leasing network rail#taxpayer money#profits private enterprise#inefficient#expensive#p

10 notes

·

View notes

Text

The "Budget" in Budget Keyboards is changing

The budget keyboard landscape has changed.

Back in 2020, a budget keyboard would usually mean buying something from Ali Express or Amazon. However, this all changed during 2022 and onward as the keyboard market changed and provided new offerings to enthusiasts and those entering the hobby.

We now have budget keebs that have an aluminium body, LED screens, a really good sound profile, etc etc. All these cool features and it doesn't have to break the bank. However, there are other keyboard vendors out there that like to brand themselves as "budget" and "affordable," but it doesn't look that way when you look at the cost.

So as the hobby starts to open its doors to more in-stock options, and people are now being careful about whom they're giving their money towards, What defines the budget in "Budget Keyboard?"

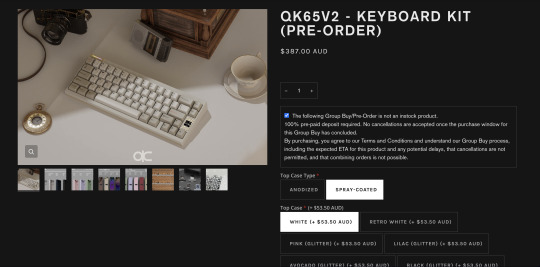

I'm sorry, the QK65 V2 cost how much?!

What made me decide to write this blog post was looking at the cost of the QK65 V2.

I used to own the R2 of the QK65. Unfortunately, I sold it because I wasn't really happy with it + I have the QK75 version on the way. That keyboard alone was $300 AUD alone.

So now enters the QK65 V2, which many describe as a huge upgrade from its predecessor. In my honest opinion, the keyboard looks similar to the Think6.5 by Graystudios, only it has an LED screen, not a light block.

So it shouldn't shock you that the cost of the QK65 is nearly similar to the Think 6.5 in the aftermarket.

According to SwitchKeys.com, if I were to order this entire keyboard without any extras, it's going to cost me nearly $390, excluding shipping. Based on my previous QK pre-order experience, I get free shipping because I'm a local.

My second-hand Think 6.5 Valentine's edition was around 500. Just $110 off the new QK keyboard.

The reason I bring this up is because the QK lineup was described as the budget option for those who love Owllab's products. After all, QwertyKeys (the manufacturer of the QK lineup) is the sister company of Owllabs.

Even YouTubers who reviewed the ORIGINAL QK65 were shocked at how good it sounds, as well as its price.

youtube

What was the budget keyboard landscape like back in the day?

youtube

Back in the day, the budget keyboard market was pretty underwhelming. It was mostly plastic keyboards, many of which have north-facing LEDs. Or you'd get something made with multiple acrylic layers stacked up. One thing these boards have in common is that they sound very terrible. Like seriously, you need to mod the heck out of them if you want it to sound very decent.

This obviously changed over the years with the release of the Monsgeek M series, Keychron, and the QK and Neo lineup, just to name a few. The same can be said for keycaps, with vendors like Osume and Canonkeys releasing in-stock options.

And while it's great to hear that there are IN-STOCK options for those entering the hobby, you also need to be wary of the price of these metal rectangles. Just because the group buy model is slowing down doesn't mean we should forget the price of these machines.

Anything above $300 AUD is not budget, it's mid-tier

youtube

In my very honest opinion, any new keyboard produced by QwertyKeys shouldn't be considered as budget anymore. I think they're entering the mid-tier market, especially due to its quality and features.

While it's cool to see that there are many "affordable" keyboards in the market, I think the community needs to draw a line on what is considered to be "budget" and for me, that's anything above $300 AUD.

As of writing $300 Australian dollars converts to $204 USD. And I think it's fair to say that anything above $200 USD or $300 AUD is too much for the budget label.

But just because that marks out QK doesn't mean there are no options left for very good budget keyboards. If you're someone who wants a decent LED screen, get the Gamakay LK75. It's super affordable and it's only $99 USD. Another good alternative is literally anything from Keychron. I tried some of them when I went to PAX Aus this year and their boards cost between $100 to $270 AUD. I wish this was my board instead of the GMMK Pro that I bought overseas.

And speaking of the GMMK Pro, can we all agree that we were very delulu, thinking that this keyboard was "budget" when clearly, it wasn't?

The budget keyboard market is changing. And as prices increase and features get added, we need to determine what counts as "budget." And to me, the QK65 v2 and anything above $300 AUD no longer counts. But that's okay because, with enough elbow grease, you can make a cheap acrylic/plastic keyboard to sound really good.

7 notes

·

View notes

Text

Investors who buy at dip are looking to purchase a stock when it has fallen from its recent peak. They assume that the price decline is temporary and the fall is an opportunity to buy shares at a discount price. Investors who buy the dip have already hold the shares of a company whose price has declined from a recent high. Investors buying at dip generally are looking to build a larger position in a stock, and use temporary price decline to increase their holdings. Those who buy the dip expect the stock’s price to bounce back. As the investor buys more shares of a stock they already hold during a dip, they “average down” to lower the net average price of their position in the stock.

#stock market today#stock market live#technical analysis#how to invest in share market#stock market investment#market research companies#investing in shares#stock analysis#australian stock market#stock recommendations#stock market report#investing in stocks#stock#market analysis#research#stock advice#equity research#stock broker#stock market graph#stock market trends

0 notes

Text

an example of a market in the abstract sense is a market in the traditional sense where a bunch of farmers show up with their produce and a bunch of customers show up to buy it in a robust exercise of price discovery, but most of us today do not acquire our food in that fashion.

firstly many farms have become much larger as they have been acquired by consolidated corporate entities, then their produce is sold to a shrinking number of distributors who convey it nationally and internationally, and it is finally sold to the consumer through supermarket chains that again operate nationwide or even globally.

but we can go further! why should supermarkets negotiate with Heinz for beans when they can go direct? each supermarket chain has the incentive to cut out the middlemen over time and go direct to the farms themselves, purchasing an ever increasing fraction of their output and gaining pricing power thereby, along with insight into consumer behaviour through loyalty programs and surveillance across all of their stores, such that a small independent grocery store cannot possibly compete.

now of course there's nothing in the rules that says a small independent grocery store has to be capable of competing, and it can potentially hang on by stocking niche products and imports at higher prices or simply appealing to customers on the grounds that it's small and local, which some do.

the end result is the Australian grocery market is divided between:

Woolworths (37%)

Coles (28%)

Aldi (11%)

IGA (7%)

it's noteworthy that Aldi is the recent foreign competitor shaking up the market and taking marketshare from the local duopoly, and it's a multinational giant with revenues of over a hundred billion dollars, which is what it takes to compete in this industry.

it's reminiscent of the car industry, which ends up divided between a few companies per continent, and the airline industry, but still falls below the level of market domination seen in some tech industries.

59 notes

·

View notes

Photo

The stock market is always a good indicator of a country's economy. When the stocks start to dip, it usually means that there is something wrong with the country's financial stability. This is definitely the case with China, whose wobbles have been causing a lot of concern among Australian investors.

0 notes

Text

Invest in ASX: Australian Stock Exchange Opportunities in Australia-FinTip

FinTip-Asx Australian Stock Exchange, see a future where everyone is educated and well informed to make smart investment decisions towards becoming financially independent and free.People have lost too much money betting and punting on the markets. There's now a safer and less stressful way to test your investment decisions before throwing your cold, hard cash into the sharemarket. To know more visit us-https://fintip.com.au/

0 notes

Text

Day 14 - Viloria to Villafranca Montes de Oca

Just over 12.5 miles today according to the book and my phone is showing 13 so it’s there or there abouts.

We left at 7:30, after a breakfast which was a help yourself affair. It was cold and misty outside after a night of heavy rain and you couldn’t see very far.

The initial part of the path to Belorado wasn’t terribly inspiring as it followed a busy main road that had plenty of lorries thundering down it.

Eventually the skies cleared up and it was cracking walking weather, cool and sunny. We stopped in Belorado for coffee and admired the wall paintings. Sometimes the sides of houses are painted a bright orange colour, and one we passed today had what looked like glasses sticking out.

We eventually left the noise of the road and walked through the now familiar barley and rape fields for a while before stopping late morning at some benches next to a church for a break of biscuits and an apple.

On the road up Jane had picked up a flip flop that had been dropped. We mentioned it to a Canadian who was just leaving the rest stop and was staying where we were, and he mentioned it to others and lo and behold the owner was found!

We changed out of our shoes into our sandals and carried on (it’s nice for our feet to be in something different), stopping again in the next village to go to the loo and have an ice cream.

The path eventually came back to the road after some ruins. We dodged the noisy trucks to get through Villafranca to reach the hostel we are staying in by about 1:30. It’s a lovely place, mainly acting as a hotel but with a hostel attached which is immaculate. The beds are sturdy and we have both bagsed bottom bunks in a mixed room with 9 sets of bunks. Our lovely Korean friends Jacob and Lucia are in here too along with Alva from last night and Nicole, our Australian friend.

Jane went for a coffee while I had a shower and did a bit of washing (by hand). Basically you take a shampoo soap bar with you that doubles for everything - hair, body, clothes. You just have to be careful to let it dry properly afterwards. I took one from the UK but it disintegrated pretty quickly, so have found a very good Spanish one.

After an hour or so of feet up we went for a couple of glasses of wine, meeting Alex and her dad from Texas that we realised were in Orisson at the start with us, and Alison, another American, in her 20’s, who has her own marketing company and is also a yoga teacher.

We stocked up on breakfast and snack stuff from the very small shop in the village, cake and fruit, as the first leg tomorrow is 7.5 miles up hill without facilities of any sort.

Dinner tonight was the Pilgrim menu, and at 18 euros was quite steep, but it was well worth it. We both had a plate of broccoli cooked with a chicken and a cream and Parmesan sauce, I then had meatballs and Jane had cod, followed by crème caramel for me and rice pud for Jane, washed down with red wine. We were sat with Nicole and Alison and were joined by Pat, 68, from the US. The conversations became really wide ranging and philosophical.

This is now the end of week 2, and we’re 152 miles down, our daily mileage increasing to just under 12 miles a day. We’re settling into the walking and the routine, and enjoying the countryside and villages. However what is making it special is meeting all the different people along the way and hearing all their stories and perspectives on life.

9 notes

·

View notes

Text

Advert Alchemy: The Jingle

In this series, Squideo is breaking down the eight key ingredients to turn your advertising content into gold! In the last edition of Advert Alchemy, we examined the importance of location when releasing your marketing campaign to the world. This week, we’re looking at the effectiveness of a jingle.

This short, catchy advertising technique is similar to a slogan except it’s set to a tune. Unlike a soundtrack, a jingle is only a few seconds long but they can wriggle into your customers’ memory – ensuring they remember your product for a long time!

The Power of an Earworm

An earworm is a song or melody that keeps repeating in your head. Some of the most commonly reported earworms are songs like It’s a Small World (Disney), Who Let the Dogs Out? (Baha Men), Gangnam Style (Psy), Karma Chameleon (Culture Club) and YMCA (The Village People).

A truly well-crafted jingle has the potential to become one of these insanely catchy earworms. Before we dive into some of the best jingles to grace our screens, let’s explore how to create a jingle.

Keep it simple. In the examples below, no jingle is longer than thirteen words. The shorter it is, the easier it is for your audience to remember! Use repetition, rhyme and keep your language simple.

Choose the right music. Make sure it has the right tempo and speed for the voiceover artist to sing along to. Do your market research as well to discover which music genre your audience will respond to.

Know your product. What is the unique selling point you want your jingle to convey? Do similar products use marketing jingles? How can you set yourself apart from the competition?

Jingle Jamming

Think you’re ready to create a jingle of your own? Before you do, look through Squideo’s top ten picks for the best advertising jingles. Consider what these jingles say about the brand. Which ones would work for your brand?

01. Haribo

Kids and grown-ups love it so, the happy world of Haribo.

Jingles are perfect for child-targeted advertising. These catchy songs catch their attention, ready to be repeated to their parents nonstop. The German confectionary company Haribo has used this jingle across all of its English-speaking markets for over twenty years, making it instantly recognisable to people of all ages.

02. McDonald’s

Ba-da-ba-ba-baaa… I’m lovin’ it.

First used in 2003, this jingle was implemented at a time when sales for this enormous American fast-food chain was in trouble. Its stock prices had dropped and they needed to attract more customers – fast! German advertising firm Heye & Partner created this simple jingle which was rolled out internationally. It was only meant to play in McDonald’s adverts for two years… twenty years later, the jingle is still going strong.

03. Cadbury’s Fudge

A finger of fudge is just enough to give your kids a treat.

To a younger generation, Cadbury’s most iconic advert is likely the Gorilla campaign which ran in 2007. Go back a few decades, however, and this jingle for Cadbury’s Fudge bar created one of the most popular advertising campaigns of the 1970s. There is a longer version which was played as a song in some adverts, however this shorter jingle remains more memorable.

04. Hastings Direct

0800 00 1066.

Jingle’s usually contain one of three key pieces of information – the company name; the product; or how to get in touch. In 2005, Hasting’s Direct impressed their telephone number upon a nation – making 0800 00 1066 almost as well-known as 999. By choosing a familiar date (1066, the year of the Battle of Hastings which is taught to most Britons at school), half the work was done for them. Through repetition and the use of a catchy tune performed by their mascot Harry Hastings, the full phone number was soon memorised. Very clever!

05. Compare the Market

Compare the meerkat; compare the market. Simples!

First launched in 2009 on British and Australian television, the advertisers behind this campaign were dedicated to its success from the get-go. Creating a Facebook and Twitter account for their mascot Aleksandr the meerkat, and a fictional website for comparethemeerkat.com, the advert series runs to this day. And at the end of each advert comes this memorable jingle.

06. Calgon

Washing machines live longer with Calgon.

Whether or not the statement made by this jingle is true – trust us, there’s been a lot of debate over the years – the memorability certainly created a huge boom for Calgon sales. Despite Which? making a complaint to the Advertising Standards Agency in 2011 over the validity of its marketing claim, the jingle is still used in their adverts thirty years on from its introduction. A true credit to its effectiveness.

07. Lilt

With a totally tropical taste.

Launched in 1975, the drink soon became associated with its jingle thanks to some memorable advertising campaigns that ran in the 1980s and 90s, including the popular “Lilt Man.” Unfortunately, in February 2023, it was announced by Lilt’s owners, Coca Cola, that the drink would be replaced by ‘Fanta Pineapple and Grapefruit.’ We’ll certainly be sad to see the last of these adverts but glad the tropical taste survives.

08. Toys ‘R’ Us

I don’t want to grow up, I’m a Toys ‘R’ Us kid.

This jingle for Toys ‘R’ Us, which was used in the 1980s and 90s, and was co-written by the crime novelist James Patterson. That’s an interesting piece of trivia for your next quiz night! This memorable line was produced by the J. Walter Thompson advertising agency. The idea was to create a simple jingle that children could easily memorise and sing along with when it came on the television. It was later extended into a song.

09. PC World

Where in the world? PC World.

Considering the brand no longer exists, it’s a testament to the power of a jingle that it is still remembered long after the company it represented. After its merger with Curry’s, ‘Curry’s PC World’ still used the jingle for a time in its new adverts, clearly recognising a useful marketing tool when they saw it. Removing the PC World name in 2021, the only trace left of this former retail chain is a jingle that refuses to leave the head of anyone who ever heard it.

10. Cadbury’s Smash

For mash get Smash.

As the second Cadbury jingle to enter the list, it really goes to show this company knows what it’s doing! Launched in 1969, Smash is a brand of instant mashed potatoes – although it is no longer owned by Cadbury. Cadbury introduced the iconic Smash Martians in 1974 to promote their product through a catchy jingle. It was so memorable that in 2005 it was voted the UK’s most popular advert. The Martians even received their own fan mail while the advert was aired!

Content Worth Gold

Get in touch with the Squideo team today to find out how we can improve your advertising strategy with video production, motion graphics, social media management and much more!

youtube

#advert alchemy#earworm#haribo#mcdonalds#cadbury fudge#hastings direct#compare the market#calgon#lilt#toys r us#james patterson#pc world#smash#cadbury smash#smash robots#advertising#advertisement#marketing strategy#marketing

7 notes

·

View notes