#biometric authentication for payments

Explore tagged Tumblr posts

Text

#trader biometric authentication#biometric authentication for payments#what are biometric payments#biometric based payment system#what is biometric payment#payment with fingerprint#biometric payment methods#biometric payment technology#Fingerprint scanners

0 notes

Text

What Are the Latest Breakthroughs in Wearable Tech?

In 2024, the world of wearable technology is evolving faster than ever. With advancements spanning health, fitness, productivity, and even entertainment, wearable tech has become an integral part of daily life. But what are the latest breakthroughs in wearable tech, and how are they shaping the future? From AI-driven health monitors to augmented reality (AR) devices, new innovations are pushing…

#AI#AI-driven#air quality#Apple Watch#AR Glasses#AR integration#augmented reality#biofeedback#biometric authentication#biometric payments#body temperature#brain sensors#contactless payments#digital health#e-textiles#ECG#emerging tech#environmental sensors#fitness tracking#future tech#glucose monitoring#Google Glass#health monitoring#HoloLens#innovation#IoT#medical wearables#Mental Health#mindfulness tech#mixed reality

0 notes

Text

How Modern Technology is Enabling Faster Payments - Technology Org

New Post has been published on https://thedigitalinsider.com/how-modern-technology-is-enabling-faster-payments-technology-org/

How Modern Technology is Enabling Faster Payments - Technology Org

In the fast-paced digital era, consumers and businesses are also looking for faster payments for their transactions.

Amongst Paypal, Venmo and Monzo, the payments industry in the US is expected to reach a value of $3,000 billion.

One notable avenue where modern technology has made significant strides is in mobile and SMS payments. This transformation has not only streamlined financial interactions but has also enhanced the speed and efficiency of transactions, offering a list of benefits to individuals and businesses alike.

Online payments, online shopping – artistic impression. Image credit: Blake Wisz

Mobile Wallets and Apps

Mobile wallets and applications play a pivotal role in expediting payments through mobile devices. These digital wallets, such as Apple Pay, Google Pay, and Samsung Pay, leverage Near Field Communication (NFC) technology to enable users to make seamless transactions by simply tapping their smartphones.

“The integration of mobile wallets with banking systems and various financial instruments has eliminated the need for physical cards in public places like restaurants and supermarkets,” explains Dan Kettle of financial startup, Pheabs. “This reduces friction and enhances the speed of payments. Another key benefit is that it is easy to record transactions in one centralized place, rather than multiple cards and statements.”

Instant Payment Platforms

The use of instant payment platforms has further accelerated transactions. These platforms, like Venmo and Cash App, facilitate peer-to-peer payments with just a few taps on a mobile device – and are perfect for paying back friends and contractors such as babysitters, plumbers and other handymen.

“Leveraging real-time payment systems, users can transfer funds instantly, eliminating the delays associated with traditional banking methods,” confirms Dean Benzaken, founder of tech trends site, TechNational. “This has proven particularly beneficial for individuals splitting bills or sharing expenses, as payments can be settled promptly and effortlessly.

SMS-based Payment Systems

SMS-based payment systems represent a more novel method to fast-track financial transactions.

Through text messages, users can initiate and authorize payments, making the process accessible even without a stable internet connection. This is particularly valuable in regions with limited internet access, where SMS remains a reliable communication medium.

Financial institutions and service providers have adopted SMS-based payment systems to reach a broader audience and cater to diverse demographics.

QR Code Technology

QR code technology has also become popular in facilitating swift payments. Mobile payment apps often generate unique QR codes for each transaction, allowing users to scan and confirm payments swiftly. This method not only adds layers of security but also significantly reduces the time required to complete transactions.

Richard Allan of funding platform Capital Bean explains that “Merchants, contractors on the road, shop owners and individuals alike can leverage QR codes to make payments in various scenarios, ranging from retail purchases to person-to-person transactions.”

Enhanced Security Measures and Risks?

Modern technology has not only accelerated payment processes but has also bolstered security measures. Biometric authentication, such as fingerprint and facial recognition, adds an extra layer of protection to mobile and SMS payments.

However, with more payments made through cell phones, this does add potential risks if a phone is stolen, since the culprit could have access not only to the phone but also bank accounts.

The combination of mobile technology, instant payment platforms, SMS-based systems, QR codes has created a new era of financial transactions.

As society increasingly embraces digital solutions, the efficiency, convenience, and security of mobile and SMS payments continue to improve. These advancements not only benefit individuals seeking faster and more accessible payment options but also empower businesses to streamline their operations and enhance customer experiences.

As technology continues to evolve, the trajectory of faster payments through mobile and SMS is poised for further innovation and growth.

#000#Accounts#app#apple#applications#apps#authentication#banking#billion#biometric#cell#code#communication#consumers#devices#digital payments#easy#efficiency#facial recognition#financial#financial transactions#fingerprint#Fintech news#friction#Funding#Google#growth#how#Industry#Innovation

1 note

·

View note

Text

The EFTPS quarterly tax payment system got a login overhaul and no one warned me.

I tried to log in to EFTPS last night to pay my quarterly taxes and was surprised that they've revamped their authentication flow.

They now have three options for Multi-Factor Authentication, and I had to pick one and set that up before I could even get to the page to enter my EFTPS credentials.

The first option they have, PIV/CAC is only for federal employees, so that's not helpful to me.

The next two options for everyone else are login.gov and id.me.

I looked at both options and login.gov seemed easier to set up quickly (and they’re not a private company that collects biometric data), so I’m gonna recommend them.

If you like processes, I took notes on my steps:

1. Visit https://www.eftps.gov/eftps/

2. Click the “MAKE A PAYMENT” button

3. Wait for a new page to load with three login options

4. Click the “LOGIN.GOV” button

5. Wait for the Login.Gov|Treasury page to load

6. Click “create an account”

7. Enter your e-mail address

8. Select English

9. Accept the Rules of Use

10. Click Submit

11. Check your e-mail for a confirmation link

12. Load the URL from the confirmation link

13. Enter a secure password

14. Set up MFA with your preferred methods (app-dependent and out of scope for these instructions)

15. At this point, if you were quick enough, it might take you straight to the EFTPS traditional login page, which still requires your old EFTPS enrollment credentials. If not, head back to the EFTPS page and click MAKE A PAYMENT and use your login.gov credentials and MFA now.

I would strongly recommend setting that all up now, and not waiting until January 16th, as this will be the first tax deadline this system was in place for and we have no idea how well the servers can handle the load.

Until next time, y'all, this is Joe Hills from Nashville, Tennessee.

Keep quarterly estimating!

372 notes

·

View notes

Text

Business Visa in Thailand

1.1 Statutory Foundations

Governed by Immigration Act B.E. 2522 (1979), Sections 34-38

Implemented through Ministerial Regulation No. 17 (B.E. 2534)

Modified by Royal Decree No. 338 (B.E. 2562) for digital nomads

2. Eligibility Criteria and Documentation

2.1 Standard Requirements

Corporate Sponsorship:

Thai entity registration documents

BOI certificate (if applicable)

Shareholder structure diagram

Personal Documentation:

Passport (minimum 18 months validity)

4x6cm photos (white background)

TM.86 form (for in-country conversion)

2.2 Financial Thresholds

Company Capitalization:

THB 2M (foreign-owned)

THB 1M (BOI-promoted)

Salary Requirements:

Minimum THB 50,000/month

THB 200,000/month (SMART Visa)

2.3 Special Cases

BOI Companies: 7-day fast-track processing

Regional HQs: Reduced capital requirements

Startups: DEPA digital visa pathway

3. Application Process Mechanics

3.1 Consular Processing (Overseas)

Document Preparation (5-10 business days)

Legalization of corporate documents

Bank statement certification

Embassy Submission:

Appointment scheduling

Biometric collection

Processing Timeline:

Standard: 3-5 business days

Express: 24 hours (+50% fee)

3.2 In-Country Conversion

From Tourist Visa:

Must apply within 15 days of entry

Requires TM.87 form

Processing Stages:

Preliminary review (7 days)

Committee approval (15 days)

Visa stamping (3 days)

4. Work Permit Integration

4.1 Legal Requirements

Section 9 Alien Working Act:

Mandatory for all employment

Board positions require limited WP

Quota System:

1 foreigner per THB 2M capital

1 foreigner per 4 Thai employees

5. Compliance and Reporting

5.1 Ongoing Obligations

90-Day Reporting:

Online or in-person

THB 2,000 late fine

Tax Compliance:

Personal income tax filings

Withholding tax submissions

5.2 Renewal Process

Documentation:

Updated company financials

Tax payment receipts

Employee list

Timeline:

Begin 30 days before expiration

15-day processing standard

6. Special Economic Zone Provisions

6.1 Eastern Economic Corridor (EEC)

Fast-Track Processing: 5 business days

Work Permit Exemptions: For technical experts

Tax Incentives: 17% personal income tax cap

6.2 Border Trade Zones

Cross-Border Visas: Special 1-year permits

Local Employment: Relaxed quotas

7. Emerging Trends (2024 Update)

8.1 Digital Transformation

E-Work Permit Pilot: BOI companies only

Blockchain Verification: For document authentication

Automated Approval System: AI-assisted processing

8.2 Policy Developments

Salary Threshold Increases: Proposed 20% hike

Remote Work Provisions: Under consideration

ASEAN Mutual Recognition: For professional qualifications

8. Strategic Considerations

9.1 Application Optimization

Document Preparation:

6-month bank statement continuity

Precise job description wording

Timing Strategies:

Avoid December/January peak

Align with fiscal year

9.2 Risk Management

Compliance Calendar: Track all deadlines

Backup Plans: Contingency visa options

Professional Support: BOI-certified agents

#thailand#visa#immigration#thaivisa#immigrationinthailand#thaiimmigration#businessvisa#businessvisainthailand#thailandvisa#thailandbusinessvisa

2 notes

·

View notes

Text

Federal Reserve Governor Michael Barr is urging banks to begin collecting behavioral and biometric data from customers to combat deepfake digital content created through ID. These deepfakes are capable of replicating a person’s identity, which “has the potential to supercharge identity fraud,” Barr warned.

“In the past, a skilled forger could pass a bad check by replicating a person’s signature. Now, advances in AI can do much more damage by replicating a person’s entire identity,” Barr said of deepfakes, which have the “potential to supercharge identity fraud.”

“[We] should take steps to lessen the impact of attacks by making successful breaches less likely, while making each attack more resource-intensive for the attacker,” Barr insists, believing that regulators should implement their own AI tools to “enhance our ability to monitor and detect patterns of fraudulent activity at regulated institutions in real time,” he said. This could help provide early warnings to affected institutions and broader industry participants, as well as to protect our own systems.”

Enabling multi-factor authentication and monitoring abnormal payments is a first step, but Barr and others believe that banks must begin to collect their customer’s biometric data. “To the extent deepfakes increase, bank identity verification processes should evolve in kind to include AI-powered advances such as facial recognition, voice analysis, and behavioral biometrics to detect potential deepfakes,” Barr noted.

Barr would like banks to begin sharing data to combat fraud. Deepfake attacks have been on the rise, with one in 10 companies reporting an attack according to a 2024 Business.com survey. Yet, will our data be safer in the hands of regulators?

2 notes

·

View notes

Text

Discover the future of self-service with Panashi’s latest kiosk designs – where cutting-edge technology meets sleek aesthetics.

Our newest range of kiosks is crafted to deliver a seamless user experience across industries, from banking and retail to healthcare and hospitality. Designed with a modern, minimalist touch, these kiosks feature responsive touchscreens, high-resolution displays and intuitive interfaces for faster and more engaging interactions.

Customizable to match your brand identity, they come in a variety of finishes and colors, blending effortlessly into any environment. Built for durability and performance, our kiosk machines support advanced features like biometric authentication, QR code scanning, contactless payments and even AI-driven recommendations. Whether you’re streamlining customer service or enhancing operational efficiency, Panashi’s kiosks are engineered to exceed expectations. Step into the future with kiosks that don’t just work — they impress. Experience innovation, elegance and reliability – all in one powerful solution.

#Panashi#KioskTechnology#SelfServiceSolutions#Innovation#BusinessAutomation#SmartKiosks#PanashiKiosk#KioskDesign#TrendingDesign#InnovativeKiosks#RetailDesign#CustomerExperience#DigitalKiosks#UserFriendlyDesign#SmartRetail#DesignTrends#InteractiveKiosks#TechInRetail#KioskSolutions#ModernDesign#BrandExperience#RetailInnovation#DesignInspiration#FutureOfRetail#selfservicekiosk#businesssolution#kiosk#kioskmachine#bankingkiosk#insurancekiosk

2 notes

·

View notes

Text

Advancements in E-Commerce Credit Card Processing Techniques

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

The digital realm of e-commerce is a constantly shifting landscape, adapting to meet the ever-evolving needs of contemporary consumers. In today's age, the seamless acceptance of credit card payments remains a critical element for businesses. This article explores the most recent strides in e-commerce credit card processing techniques and their transformative impact on the operations of online businesses.

DOWNLOAD THE ADVANCEMENTS IN E-COMMERCE INFOGRAPHIC HERE

The Evolution of E-Commerce Credit Card Processing E-commerce has undergone a remarkable journey from basic payment gateways to the sophisticated systems of today. These innovations not only enhance transaction convenience but also significantly elevate security standards.

The High-Risk Challenge In sectors such as CBD or credit repair, navigating credit card processing can be intricate. Recent developments offer tailored solutions with high-risk merchant accounts and accompanying high-risk payment gateways. These tools provide the flexibility and security required to manage transactions effectively in high-risk industries.

Tailored Solutions for E-Commerce Generic payment processing systems fall short for e-commerce businesses. Specialized e-commerce merchant accounts cater specifically to online retailers, offering more than just payment processing. They provide insights into customer behavior and trends, empowering businesses to make data-driven decisions that enhance sales.

Streamlined Integration A significant advancement in e-commerce credit card processing is the seamless integration of payment gateways into websites. This integration eliminates the need for customers to leave the site to complete a transaction, thereby reducing cart abandonment rates. Online credit card processing becomes a natural part of the shopping journey.

The Role of Technology Cutting-edge technology, including machine learning and AI, plays a pivotal role in advancing credit card processing systems. Real-time detection and prevention of fraudulent transactions ensure the security of both businesses and customers. These technologies analyze extensive data, making instant decisions to approve or decline transactions.

youtube

The Future of E-Commerce Credit Card Processing With e-commerce's continued surge in popularity, the demand for enhanced payment processing solutions will only escalate. Looking forward, exciting developments such as biometric authentication for payments are anticipated, promising improved security and convenience. Additionally, the further integration of cryptocurrencies into e-commerce payment gateways is expected, expanding payment options for consumers.

Advancements in e-commerce credit card processing have reshaped the digital business landscape. From handling high-risk transactions to offering specialized e-commerce solutions, these developments streamline processes and bolster security. With technology's continual evolution, the future holds promising prospects for e-commerce payment processing.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#Youtube

21 notes

·

View notes

Text

How Aadhaar Payments Help You Save Time and Money

In today’s fast-paced digital world, financial transactions need to be quick, easy, and secure. Aadhaar-enabled payment services (AEPS) provide a seamless way to conduct transactions, ensuring instant money transfer and secure payment processing. Whether you are a business owner, a retailer, or an individual, Aadhaar payments can save you both time and money in multiple ways.

No Need for Bank Visits or ATMs

Traditional banking often involves long queues, paperwork, and waiting times at banks or ATMs. With Aadhaar payments, you can withdraw or transfer money directly from your Aadhaar-linked bank account using just your fingerprint and Aadhaar number. This eliminates the need to visit a bank or ATM, saving both time and travel expenses.

Instant Money Transfer with Minimal Effort

One of the biggest advantages of Aadhaar payments is the ability to perform instant money transfer without delays. Whether you need to send money to a family member or make a payment for goods or services, Aadhaar banking enables real-time transactions. Unlike traditional bank transfers that may take hours or even days, Aadhaar payments happen instantly, ensuring that funds are available when needed.

Secure Payment Processing Reduces Fraud Risks

Security is a major concern when it comes to digital payments. Aadhaar payments ensure secure payment processing by using biometric authentication, such as fingerprint or iris scanning, instead of passwords or PINs that can be forgotten or stolen. Since each Aadhaar number is unique, fraud risks are significantly reduced, making it one of the safest payment methods.

No Need for Debit or Credit Cards

Carrying debit or credit cards comes with risks, such as theft, loss, or misuse. Aadhaar payments eliminate this concern as they do not require any physical cards. Users can simply authenticate transactions with their biometric details, ensuring a smooth and secure experience. This also means no more worries about card renewal fees, PIN resets, or card maintenance charges.

Low Transaction Costs Mean More Savings

Traditional banking and digital wallets often charge service fees for fund transfers, withdrawals, and other transactions. Aadhaar payments typically come with minimal or no charges, allowing users to save on unnecessary banking costs. This is particularly beneficial for small businesses and individuals who rely on frequent transactions.

Helps Small Businesses and Retailers Save Time

For businesses, time is money.Aadhaar based payments allow merchants and small retailers to receive payments instantly without waiting for bank clearances. Since AEPS transactions require only biometric authentication, customers can make payments even if they do not have a smartphone or internet access, reducing delays and improving business efficiency.

Enables Financial Inclusion in Rural Areas

In remote areas, access to banking facilities can be limited. Aadhaar payments bridge this gap by allowing people to withdraw and transfer money without needing a physical bank branch. This not only saves time spent traveling to the nearest bank but also makes financial services more accessible, especially for those who do not have traditional banking knowledge.

Government Benefits Directly in Your Account

Many government subsidies, pensions, and welfare schemes are now directly transferred to Aadhaar-linked bank accounts. This eliminates the need for middlemen, ensuring that beneficiaries receive their money without delays or additional costs. It also prevents corruption and leakage of funds, making sure every rupee reaches the intended recipient.

Simplifies Bill Payments and Daily Transactions

From paying utility bills to purchasing essentials, Aadhaar payments make everyday transactions faster and hassle-free. No more standing in long queues for bill payments or withdrawing cash from ATMs. With just an Aadhaar number and biometric verification, payments can be completed within seconds.

24/7 Availability for Convenience

Unlike traditional banking services that operate within limited hours, Aadhaar payments are available 24/7. Whether it's early morning or late at night, users can perform transactions at any time, making financial management more convenient and efficient.

Conclusion

Aadhaar payments are transforming the way financial transactions are conducted in India. With instant money transfer, secure payment processing, and minimal costs, they provide a fast, safe, and cost-effective way to manage money. Whether for individuals, businesses, or rural communities, Aadhaar-enabled payments offer significant savings in both time and money, making them a game-changer in India’s digital financial landscape.

2 notes

·

View notes

Text

What Are the Costs Associated with Fintech Software Development?

The fintech industry is experiencing exponential growth, driven by advancements in technology and increasing demand for innovative financial solutions. As organizations look to capitalize on this trend, understanding the costs associated with fintech software development becomes crucial. Developing robust and secure applications, especially for fintech payment solutions, requires significant investment in technology, expertise, and compliance measures. This article breaks down the key cost factors involved in fintech software development and how businesses can navigate these expenses effectively.

1. Development Team and Expertise

The development team is one of the most significant cost drivers in fintech software development. Hiring skilled professionals, such as software engineers, UI/UX designers, quality assurance specialists, and project managers, requires a substantial budget. The costs can vary depending on the team’s location, expertise, and experience level. For example:

In-house teams: Employing full-time staff provides better control but comes with recurring costs such as salaries, benefits, and training.

Outsourcing: Hiring external agencies or freelancers can reduce costs, especially if the development team is located in regions with lower labor costs.

2. Technology Stack

The choice of technology stack plays a significant role in the overall development cost. Building secure and scalable fintech payment solutions requires advanced tools, frameworks, and programming languages. Costs include:

Licenses and subscriptions: Some technologies require paid licenses or annual subscriptions.

Infrastructure: Cloud services, databases, and servers are essential for hosting and managing fintech applications.

Integration tools: APIs for payment processing, identity verification, and other functionalities often come with usage fees.

3. Security and Compliance

The fintech industry is heavily regulated, requiring adherence to strict security standards and legal compliance. Implementing these measures adds to the development cost but is essential to avoid potential fines and reputational damage. Key considerations include:

Data encryption: Robust encryption protocols like AES-256 to protect sensitive data.

Compliance certifications: Obtaining certifications such as PCI DSS, GDPR, and ISO/IEC 27001 can be costly but are mandatory for operating in many regions.

Security audits: Regular penetration testing and vulnerability assessments are necessary to ensure application security.

4. Customization and Features

The complexity of the application directly impacts the cost. Basic fintech solutions may have limited functionality, while advanced applications require more extensive development efforts. Common features that add to the cost include:

User authentication: Multi-factor authentication (MFA) and biometric verification.

Real-time processing: Handling high volumes of transactions with minimal latency.

Analytics and reporting: Providing users with detailed financial insights and dashboards.

Blockchain integration: Leveraging blockchain for enhanced security and transparency.

5. User Experience (UX) and Design

A seamless and intuitive user interface is critical for customer retention in the fintech industry. Investing in high-quality UI/UX design ensures that users can navigate the platform effortlessly. Costs in this category include:

Prototyping and wireframing.

Usability testing.

Responsive design for compatibility across devices.

6. Maintenance and Updates

Fintech applications require ongoing maintenance to remain secure and functional. Post-launch costs include:

Bug fixes and updates: Addressing issues and releasing new features.

Server costs: Maintaining and scaling infrastructure to accommodate user growth.

Monitoring tools: Real-time monitoring systems to track performance and security.

7. Marketing and Customer Acquisition

Once the fintech solution is developed, promoting it to the target audience incurs additional costs. Marketing strategies such as digital advertising, influencer partnerships, and content marketing require significant investment. Moreover, onboarding users and providing customer support also contribute to the total cost.

8. Geographic Factors

The cost of fintech software development varies significantly based on geographic factors. Development in North America and Western Europe tends to be more expensive compared to regions like Eastern Europe, South Asia, or Latin America. Businesses must weigh the trade-offs between cost savings and access to high-quality talent.

9. Partnering with Technology Providers

Collaborating with established technology providers can reduce development costs while ensuring top-notch quality. For instance, Xettle Technologies offers comprehensive fintech solutions, including secure APIs and compliance-ready tools, enabling businesses to streamline development processes and minimize risks. Partnering with such providers can save time and resources while enhancing the application's reliability.

Cost Estimates

While costs vary depending on the project's complexity, here are rough estimates:

Basic applications: $50,000 to $100,000.

Moderately complex solutions: $100,000 to $250,000.

Highly advanced platforms: $250,000 and above.

These figures include development, security measures, and initial marketing efforts but may rise with added features or broader scope.

Conclusion

Understanding the costs associated with fintech software development is vital for effective budgeting and project planning. From assembling a skilled team to ensuring compliance and security, each component contributes to the total investment. By leveraging advanced tools and partnering with experienced providers like Xettle Technologies, businesses can optimize costs while delivering high-quality fintech payment solutions. The investment, though significant, lays the foundation for long-term success in the competitive fintech industry.

2 notes

·

View notes

Text

Build a Seamless Crypto Exchange Experience with Binance Clone Software

Binance Clone Script

The Binance clone script is a fully functional, ready-to-use solution designed for launching a seamless cryptocurrency exchange. It features a microservice architecture and offers advanced functionalities to enhance user experience. With Plurance’s secure and innovative Binance Clone Software, users can trade bitcoins, altcoins, and tokens quickly and safely from anywhere in the world.

This clone script includes essential features such as liquidity APIs, dynamic crypto pairing, a comprehensive order book, various trading options, and automated KYC and AML verifications, along with a core wallet. By utilizing our ready-to-deploy Binance trading clone, business owners can effectively operate a cryptocurrency exchange platform similar to Binance.

Features of Binance Clone Script

Security Features

AML and KYC Verification: Ensures compliance with anti-money laundering and know-your-customer regulations.

Two-Factor Authentication: Provides an additional security measure during user logins.

CSRF Protection: Shields the platform from cross-site request forgery threats.

DDoS Mitigation: Safeguards the system against distributed denial-of-service attacks.

Cloudflare Integration: Enhances security and performance through advanced web protection.

Time-Locked Transactions: Safeguards transactions by setting time limits before processing.

Cold Wallet Storage: Keeps the majority of funds offline for added security.

Multi-Signature Wallets: Mandates multiple confirmations for transactions, boosting security.

Notifications via Email and SMS: Keeps users informed of account activities and updates.

Login Protection: Monitors login attempts to detect suspicious activity.

Biometric Security: Utilizes fingerprint or facial recognition for secure access.

Data Protection Compliance: Adheres to relevant data privacy regulations.

Admin Features of Binance Clone Script

User Account Management: Access detailed user account information.

Token and Cryptocurrency Management: Add and manage various tokens and cryptocurrencies.

Admin Dashboard: A comprehensive interface for managing platform operations.

Trading Fee Setup: Define and adjust trading fees for transactions.

Payment Gateway Integration: Manage payment processing options effectively.

AML and KYC Oversight: Monitor compliance processes for user verification.

User Features of Binance Clone Script

Cryptocurrency Deposits: Facilitate easy deposit of various cryptocurrencies.

Instant Buy/Sell Options: Allow users to trade cryptocurrencies seamlessly.

Promotional Opportunities: Users can take advantage of promotional features to maximize profits.

Transaction History: Access a complete record of past transactions.

Cryptocurrency Wallet Access: Enable users to manage their digital wallets.

Order Tracking: Keep track of buy and sell orders for better trading insights.

Binance Clone Development Process

The following way outline how our blockchain experts develop a largely effective cryptocurrency exchange platform inspired by Binance.

Demand Analysis

We begin by assessing and gathering your business conditions, similar as the type of trades you want to grease, your target followership, geographical focus, and whether the exchange is intended for short-term or long-term operation.

Strategic Planning

After collecting your specifications, our platoon formulates a detailed plan to effectively bring your ideas to life. This strategy aims to deliver stylish results acclimatized to your business requirements.

Design and Development

Our inventors excel in UI/ UX design, creating visually appealing interfaces. They draft a unique trading platform by exercising the rearmost technologies and tools.

Specialized perpetration

Once the design is complete, we concentrate on specialized aspects, integrating essential features similar to portmanteau connectors, escrow services, payment options, and robust security measures to enhance platform functionality.

Quality Assurance Testing

After development, we conduct thorough testing to ensure the exchange platform operates easily. This includes security assessments, portmanteau and API evaluations, performance testing, and vindicating the effectiveness of trading machines.

Deployment and Support

Following successful testing, we do with the deployment of your exchange platform. We also gather stoner feedback to make advancements and introduce new features, ensuring the platform remains robust and over-to-date.

Revenue Streams of a Binance Clone Script

Launching a cryptocurrency exchange using a robust Binance clone can create multiple avenues for generating revenue.

Trading Fees

The operator of the Binance clone platform has the discretion to set a nominal fee on each trade executed.

Withdrawal Charges

If users wish to withdraw their cryptocurrencies, a fee may be applied when they request to transfer funds out of the Binance clone platform.

Margin Trading Fees

With the inclusion of margin trading functionalities, fees can be applied whenever users execute margin transactions on the platform.

Listing Fees

The platform owner can impose a listing fee for users who want to feature their cryptocurrencies or tokens on the exchange.

Referral Program

Our Binance clone script includes a referral program that allows users to earn commissions by inviting friends to register on the trading platform.

API Access Fees

Developers can integrate their trading bots or other applications by paying for access to the platform’s API.

Staking and Lending Fees

The administrator has the ability to charge fees for services that enable users to stake or lend their cryptocurrencies to earn interest.

Launchpad Fees

The Binance clone software offers a token launchpad feature, allowing the admin to charge for listing and launching new tokens.

Advertising Revenue

Similar to Binance, the trading platform can also generate income by displaying advertisements to its users.

Your Path to Building a Crypto Exchange Like Binance

Take the next step toward launching your own crypto exchange similar to Binance by collaborating with our experts to establish a robust business ecosystem in the cryptocurrency realm.

Token Creation

Utilizing innovative fundraising methods, you can issue tokens on the Binance blockchain, enhancing revenue generation and providing essential support for your business.

Staking Opportunities

Enable users to generate passive income by staking their digital assets within a liquidity pool, facilitated by advanced staking protocols in the cryptocurrency environment.

Decentralized Swapping

Implement a DeFi protocol that allows for the seamless exchange of tokenized assets without relying on a central authority, creating a dedicated platform for efficient trading.

Lending and Borrowing Solutions

Our lending protocol enables users to deposit funds and earn annual returns, while also offering loans for crypto trading or business ventures.

NFT Minting

Surpass traditional cryptocurrency investments by minting a diverse range of NFTs, representing unique digital assets such as sports memorabilia and real estate, thereby tapping into new market values.

Why Should You Go With Plurance's Ready-made Binance Clone Script?

As a leading cryptocurrency exchange development company, Plurance provides an extensive suite of software solutions tailored for cryptocurrency exchanges, including Binance scripts, to accommodate all major platforms in the market. We have successfully assisted numerous businesses and entrepreneurs in launching profitable user-to-admin cryptocurrency exchanges that rival Binance.

Our team consists of skilled front-end and back-end developers, quality analysts, Android developers, and project engineers, all focused on bringing your vision to life. The ready-made Binance Clone Script is meticulously designed, developed, tested, and ready for immediate deployment.

Our committed support team is here to help with any questions you may have about the Binance clone software. Utilizing Binance enables you to maintain a level of customization while accelerating development. As the cryptocurrency sector continues to evolve, the success of your Binance Clone Script development will hinge on its ability to meet customer expectations and maintain a competitive edge.

#Binance Clone Script#Binance Clone Software#White Label Binance Clone Software#Binance Exchange Clone Script

2 notes

·

View notes

Text

Eko API Integration: A Comprehensive Solution for Money Transfer, AePS, BBPS, and Money Collection

The financial services industry is undergoing a rapid transformation, driven by the need for seamless digital solutions that cater to a diverse customer base. Eko, a prominent fintech platform in India, offers a suite of APIs designed to simplify and enhance the integration of various financial services, including Money Transfer, Aadhaar-enabled Payment Systems (AePS), Bharat Bill Payment System (BBPS), and Money Collection. This article delves into the process and benefits of integrating Eko’s APIs to offer these services, transforming how businesses interact with and serve their customers.

Understanding Eko's API Offerings

Eko provides a powerful set of APIs that enable businesses to integrate essential financial services into their digital platforms. These services include:

Money Transfer (DMT)

Aadhaar-enabled Payment System (AePS)

Bharat Bill Payment System (BBPS)

Money Collection

Each of these services caters to different needs but together they form a comprehensive financial toolkit that can significantly enhance a business's offerings.

1. Money Transfer API Integration

Eko’s Money Transfer API allows businesses to offer domestic money transfer services directly from their platforms. This API is crucial for facilitating quick, secure, and reliable fund transfers across different banks and accounts.

Key Features:

Multiple Transfer Modes: Support for IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), and RTGS (Real Time Gross Settlement), ensuring flexibility for various transaction needs.

Instant Transactions: Enables real-time money transfers, which is crucial for businesses that need to provide immediate service.

Security: Strong encryption and authentication protocols to ensure that every transaction is secure and compliant with regulatory standards.

Integration Steps:

API Key Acquisition: Start by signing up on the Eko platform to obtain API keys for authentication.

Development Environment Setup: Use the language of your choice (e.g., Python, Java, Node.js) and integrate the API according to the provided documentation.

Testing and Deployment: Utilize Eko's sandbox environment for testing before moving to the production environment.

2. Aadhaar-enabled Payment System (AePS) API Integration

The AePS API enables businesses to provide banking services using Aadhaar authentication. This is particularly valuable in rural and semi-urban areas where banking infrastructure is limited.

Key Features:

Biometric Authentication: Allows users to perform transactions using their Aadhaar number and biometric data.

Core Banking Services: Supports cash withdrawals, balance inquiries, and mini statements, making it a versatile tool for financial inclusion.

Secure Transactions: Ensures that all transactions are securely processed with end-to-end encryption and compliance with UIDAI guidelines.

Integration Steps:

Biometric Device Integration: Ensure compatibility with biometric devices required for Aadhaar authentication.

API Setup: Follow Eko's documentation to integrate the AePS functionalities into your platform.

User Interface Design: Work closely with UI/UX designers to create an intuitive interface for AePS transactions.

3. Bharat Bill Payment System (BBPS) API Integration

The BBPS API allows businesses to offer bill payment services, supporting a wide range of utility bills, such as electricity, water, gas, and telecom.

Key Features:

Wide Coverage: Supports bill payments for a vast network of billers across India, providing users with a one-stop solution.

Real-time Payment Confirmation: Provides instant confirmation of bill payments, improving user trust and satisfaction.

Secure Processing: Adheres to strict security protocols, ensuring that user data and payment information are protected.

Integration Steps:

API Key and Biller Setup: Obtain the necessary API keys and configure the billers that will be available through your platform.

Interface Development: Develop a user-friendly interface that allows customers to easily select and pay their bills.

Testing: Use Eko’s sandbox environment to ensure all bill payment functionalities work as expected before going live.

4. Money Collection API Integration

The Money Collection API is designed for businesses that need to collect payments from customers efficiently, whether it’s for e-commerce, loans, or subscriptions.

Key Features:

Versatile Collection Methods: Supports various payment methods including UPI, bank transfers, and debit/credit cards.

Real-time Tracking: Allows businesses to track payment statuses in real-time, ensuring transparency and efficiency.

Automated Reconciliation: Facilitates automatic reconciliation of payments, reducing manual errors and operational overhead.

Integration Steps:

API Configuration: Set up the Money Collection API using the detailed documentation provided by Eko.

Payment Gateway Integration: Integrate with preferred payment gateways to offer a variety of payment methods.

Testing and Monitoring: Conduct thorough testing and set up monitoring tools to track the performance of the money collection service.

The Role of an Eko API Integration Developer

Integrating these APIs requires a developer who not only understands the technical aspects of API integration but also the regulatory and security requirements specific to financial services.

Skills Required:

Proficiency in API Integration: Expertise in working with RESTful APIs, including handling JSON data, HTTP requests, and authentication mechanisms.

Security Knowledge: Strong understanding of encryption methods, secure transmission protocols, and compliance with local financial regulations.

UI/UX Collaboration: Ability to work with designers to create user-friendly interfaces that enhance the customer experience.

Problem-Solving Skills: Proficiency in debugging, testing, and ensuring that the integration meets the business’s needs without compromising on security or performance.

Benefits of Integrating Eko’s APIs

For businesses, integrating Eko’s APIs offers a multitude of benefits:

Enhanced Service Portfolio: By offering services like money transfer, AePS, BBPS, and money collection, businesses can attract a broader customer base and improve customer retention.

Operational Efficiency: Automated processes for payments and collections reduce manual intervention, thereby lowering operational costs and errors.

Increased Financial Inclusion: AePS and BBPS services help businesses reach underserved populations, contributing to financial inclusion goals.

Security and Compliance: Eko’s APIs are designed with robust security measures, ensuring compliance with Indian financial regulations, which is critical for maintaining trust and avoiding legal issues.

Conclusion

Eko’s API suite for Money Transfer, AePS, BBPS, and Money Collection is a powerful tool for businesses looking to expand their financial service offerings. By integrating these APIs, developers can create robust, secure, and user-friendly applications that meet the diverse needs of today’s customers. As digital financial services continue to grow, Eko’s APIs will play a vital role in shaping the future of fintech in India and beyond.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko India#Eko API Integration#api integration developer#api integration#aeps#Money transfer#BBPS#Money transfer Api Integration Developer#AePS API Integration#BBPS API Integration

2 notes

·

View notes

Text

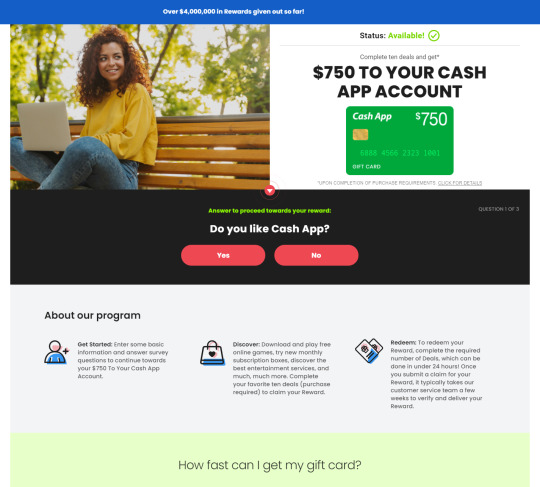

Your Chance to get $750 to your Cash Account!

Cash App is a mobile payment service developed by Square, Inc. It allows users to send and receive money to friends and family, as well as pay for goods and services using a mobile app. Here are some key features and aspects of Cash App:

Peer-to-Peer Payments: Cash App enables users to send money to other users quickly and easily using their mobile phone number, email address, or $cashtag (a unique username).

750$ Cashapp

Cash Card: Cash App offers a customizable debit card called the Cash Card, which is linked to the user's Cash App balance. Users can use the Cash Card to make purchases at retail stores or online, withdraw cash from ATMs, and even earn rewards on certain purchases.

Bitcoin Transactions: Cash App allows users to buy, sell, and store Bitcoin directly within the app. This feature provides users with a convenient way to invest in cryptocurrencies.

Direct Deposit: Users can set up direct deposit to receive paychecks or government benefits directly into their Cash App account. This feature eliminates the need for a traditional bank account for those who prefer to manage their finances through the app.

750$ Cashapp

Cash Boosts: Cash App offers a rewards program called Cash Boost, which provides users with instant discounts on purchases made with their Cash Card at select merchants. Users can choose from a variety of Boosts, which may include discounts on coffee shops, restaurants, and popular retailers.

Security Features: Cash App employs various security measures to protect users' accounts and transactions, including encryption, biometric authentication (such as fingerprint or Face ID), and optional security features like passcode locks and transaction notifications.

Fees: While Cash App is free to download and use for sending and receiving money, it may charge fees for certain transactions, such as instant transfers or Bitcoin transactions. Users should review the app's fee schedule for more information.

Overall, Cash App provides a convenient and user-friendly platform for sending money, making purchases, and managing finances on the go

Enter to Win 750$ Cashapp Dollar

5 notes

·

View notes

Text

Fast, Secure, and Always On: How MCC Banking Is Redefining Instant Payments

In today’s hyperconnected world, speed and trust aren’t just nice-to-haves—they’re non-negotiable. Whether you’re sending money to a loved one, paying a vendor, or managing your small business, you need a banking solution that works as fast as you do. That’s why MCC Banking has taken a bold step forward in redefining the modern payment experience.

With a powerful new platform designed for immediate and secure transactions, MCC Banking is empowering users to move money in seconds—without compromising on security or transparency.

⚡ Instant Transfers, Real Results

Gone are the days of waiting hours—or even days—for your money to reach its destination. MCC Banking’s new system enables instant transfers that are processed in real time, allowing funds to be sent and received in just a few clicks.

Whether you’re paying rent, splitting a dinner bill, or managing employee salaries, MCC Banking makes the process fast, easy, and dependable. No delays. No uncertainty. Just instant access to your money when you need it most.

🔐 Built-In Biometric Security

Speed means nothing without security—and at MCC Banking, your peace of mind comes first. Every transaction on our platform is backed by biometric authentication, including facial recognition and fingerprint scanning, to ensure that only you can authorize payments.

This added layer of protection is powered by AI-driven fraud detection that monitors unusual activity in real time and instantly flags potential threats. Combined with end-to-end encryption, MCC Banking provides a closed-loop security system that is both invisible and impenetrable.

So while your money moves at lightning speed, it stays under the tightest protection.

📲 Designed for Everyday Life

We know that your banking needs don’t stop at 5 PM—and neither do we. MCC Banking’s mobile and web platforms are built for on-demand convenience, giving you 24/7 access to manage your finances wherever you are.

Our interface is intuitive and user-friendly, so whether you’re a tech-savvy entrepreneur or simply trying to send funds to a family member, you’ll find it simple to:

Make instant transfers in just a few taps

Verify payments with biometric login

Track your transaction history in real time

It’s banking that moves at the speed of life—because we believe that your time is valuable.

🌐 Total Transparency, No Surprises

One of the cornerstones of MCC Banking’s philosophy is radical transparency. Every transfer you make comes with full visibility:

✅ No hidden fees ✅ Real-time confirmation ✅ Clear transaction records

We believe that trust is built on honesty, and our platform reflects that. You’ll always know where your money is going, when it will arrive, and what it costs—which is often nothing at all.

This approach is especially valuable for small businesses and freelancers, who rely on predictable cash flow and clear financial reporting.

🌍 Empowering a New Era of Digital Banking

The shift to digital payments isn’t coming—it’s already here. As customer expectations evolve, banks must adapt by offering more agile, secure, and intelligent solutions.

MCC Banking is proud to be leading this transformation. By combining instant transfers with biometric security and user-first design, we’re not just keeping up with the future of finance—we’re shaping it.

Whether you’re paying a supplier across the country or sending money to a friend across town, MCC Banking makes it fast, safe, and hassle-free.

🌟 Make the Smart Move Today

If you’ve ever wished for a faster, simpler, and more secure way to send money, that solution is here. MCC Banking is your partner in financial empowerment, giving you tools that match the speed of your life—with the trust and reliability you deserve.

Experience banking that finally works for you—not the other way around.

🔗 Learn more here: https://www.msn.com/es-es/dinero/noticias/comunicado-pagos-inmediatos-y-seguros-la-nueva-apuesta-de-mcc-banking-por-la-digitalizaci%C3%B3n/ar-AA1AMgah?ocid=finance-verthp-feeds

0 notes

Text

Why Self-Service Kiosks Are the Future of Hospitality and Retail !!

The retail and hospitality industries are constantly evolving to meet the demands of modern consumers. As businesses strive for efficiency, convenience and improved customer experience, self-service kiosks have emerged as a game-changing solution. From quick-service restaurants to retail stores and hotels, kiosks are revolutionizing how customers interact with businesses, making transactions smoother, reducing wait times and enhancing overall satisfaction.

The Growing Demand for Self-Service Solutions

With the rise of digital transformation, consumers now expect seamless, tech-driven interactions in every aspect of their lives. Self-service kiosks address this demand by providing :

Speed and Efficiency – Customers can place orders, check-in or make payments quickly without waiting in long lines.

Reduced Labor Costs – Businesses can optimize staff allocation, reducing operational expenses while maintaining quality service.

Enhanced Customer Experience – Customizable interfaces and multilingual support ensure a smooth and personalized experience for diverse audiences.

Improved Accuracy – Self-service kiosks eliminate human errors in order placement, payment processing, and service requests.

How Kiosks Are Transforming Retail Retailers are integrating self-service kiosks to streamline operations and improve shopping experiences. Some key benefits include:

Faster Checkout – Self-checkout kiosks minimize congestion at traditional cash registers, reducing wait times.

In-Store Navigation & Product Lookup – Customers can quickly locate products and access real-time stock availability.

Loyalty Program Integration – Kiosks enable customers to register for rewards programs, check points, and redeem offers effortlessly.

Seamless Omnichannel Experience – Integration with e-commerce platforms allows customers to order online and pick up in-store.

Upselling and Cross-Selling Opportunities – Kiosks can suggest complementary products or promotions based on customer preferences.

The Impact of Kiosks in Hospitality In the hospitality industry, self-service kiosks are redefining guest experiences by offering:

Faster Hotel Check-Ins and Check-Outs – Guests can skip front desk lines and access rooms with digital keys.

Self-Ordering at Restaurants – Quick-service and fast-casual restaurants use kiosks to enhance order accuracy and speed.

Automated Ticketing and Reservations – Kiosks streamline the process for theme parks, movie theaters and travel agencies.

Personalized Customer Interactions – AI-powered kiosks can recommend services, upgrades, or add-ons based on customer preferences.

Multi-Functionality – Kiosks can serve as concierge services, providing guests with local recommendations and travel assistance.

The Future of Self-Service Kiosks The future of self-service kiosks is driven by technological advancements, including:

AI and Machine Learning – Personalized recommendations and predictive analytics will enhance user engagement.

Contactless and Mobile Integration – NFC payments and mobile app connectivity will further simplify transactions.

Biometric Authentication – Facial recognition and fingerprint scanning will improve security and user convenience.

Sustainable and Eco-Friendly Kiosks – Digital receipts and energy-efficient designs will support environmental initiatives.

Cloud-Based Management – Remote monitoring and software updates will enable seamless kiosk operations.

Voice-Activated Interfaces – Enhancing accessibility for all users, including those with disabilities.

Conclusion Self-service kiosks are no longer a luxury but a necessity for businesses aiming to enhance efficiency, reduce costs and improve customer satisfaction. As the retail and hospitality industries continue to evolve, adopting kiosk technology will be key to staying competitive and meeting the ever-growing expectations of tech-savvy consumers.

What are your thoughts on the future of self-service kiosks? Share your insights in the comments below!

#PanashiKiosk#KioskDesign#TrendingDesign#InnovativeKiosks#RetailDesign#CustomerExperience#DigitalKiosks#UserFriendlyDesign#SmartRetail#DesignTrends#InteractiveKiosks#TechInRetail#KioskSolutions#ModernDesign#BrandExperience#RetailInnovation#DesignInspiration#FutureOfRetail#selfservicekiosk#businesssolution#kiosk#kioskmachine#bankingkiosk#insurancekiosk#telecomkiosk#vendingmachine#interactivetellermachine#QSRkiosk#restaurantkiosk#donationkiosk

2 notes

·

View notes

Text

High-Risk Payment Processing Techniques: Best Practices

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving realm of e-commerce, payment processing takes center stage, enabling businesses to smoothly accept credit card payments and ensure seamless customer transactions. However, for industries deemed high-risk, such as credit repair and CBD sales, navigating the payment processing landscape presents distinct challenges. In this article, we dive into the intricacies of high-risk payment processing methods and present best practices to guarantee secure and efficient transactions. Whether you're a newcomer to high-risk payment processing or looking to refine your current strategies, these insights will steer you toward favorable outcomes.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

Understanding High-Risk Payment Processing Effective navigation of the high-risk payment processing sphere necessitates a clear comprehension of high-risk industries. Sectors like credit repair and CBD sales often fall into this category due to intricate regulations and an elevated risk of chargebacks. Consequently, high-risk merchants require specialized payment processing solutions tailored to mitigate associated risks.

The Importance of Merchant Accounts Merchant accounts form the backbone of efficient payment processing. These accounts, specifically designed for high-risk businesses, facilitate the secure transfer of funds from customers' credit cards to the merchant's bank account. Establishing a high-risk merchant account ensures seamless payment processing, enabling businesses to broaden their customer base and enhance revenue streams.

Exploring High-Risk Payment Gateways High-risk payment gateways serve as virtual checkpoints between customers and merchants. These gateways safeguard sensitive financial information by encrypting data during transactions. When selecting a high-risk payment gateway, emphasize security features and compatibility with your business model to guarantee safe and smooth payment processing.

Tailored Solutions for Credit Repair Businesses Credit repair merchants face unique challenges due to the industry's regulatory landscape. Obtaining a credit repair merchant account equipped with specialized payment processing solutions can aid in navigating these complexities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance and fosters customer trust.

CBD Sales and Payment Processing CBD merchants operate in a market brimming with potential but also shrouded in uncertainty. Shifting regulations demand a flexible approach to CBD payment processing. Collaboration with experienced payment processors well-versed in the intricacies of CBD sales and the utilization of age verification systems can streamline transactions and bolster customer confidence.

Mitigating Chargeback Risks Chargebacks pose a significant threat to high-risk merchants, frequently arising from disputes, fraud, or unsatisfactory service. Proactively address this issue by providing exceptional customer support, transparent refund policies, and clear product descriptions. Consistent communication can forestall chargebacks and maintain a healthy merchant-consumer relationship.

youtube

Future-Proofing High-Risk Payment Processing Advancing technology necessitates the evolution of high-risk payment processing techniques to stay ahead of potential threats. Embrace emerging solutions like AI-driven fraud detection and biometric authentication to enhance security and streamline payment processing. Staying informed and adapting to industry trends ensures the future-proofing of payment processing strategies for high-risk merchants.

High-risk payment processing amalgamates industry knowledge, tailored solutions, and cutting-edge security measures. Whether operating in credit repair or CBD sales, a comprehensive understanding of high-risk payment processing intricacies is imperative. Leveraging specialized merchant accounts, payment gateways, and proactive chargeback prevention methods enables high-risk merchants to confidently accept credit card payments and cultivate long-term customer relationships. In an ever-evolving landscape, embracing innovative payment processing solutions guarantees a secure and prosperous future for high-risk businesses.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#Youtube

17 notes

·

View notes