#bloodmoney

Text

When Testament is Enby but said they're Okay with He or She because they don't wanna Cause any Conflict but Kliff and Johnny is not making this Easy...

(I want to Believe Kliff would still Love his own Non-Binary and Adopted Child if he never Passed Away yet...)

#kliff undersn#guilty gear#guilty gear strive#johnny#testament#johnnytest#enby#arc system works#guiltygear#nonbinary#guilty gear testament#johnny guilty gear#guilty gear johnny#testament guilty gear#testament undersn#bloodmoney#kliff#team red#ggstrive#ggst

111 notes

·

View notes

Text

anyways ✌️

#🖼️#(?)#utg#undertale gold au#undertale yellow au#bloodmoney#haha. yeah. no thoughts behind this one.#but#first i did monotvid#now this#am i like. cursed#to draw for a crackship of any fandom i get into from now on#uty#no fear. maintag it#undertale yellow

42 notes

·

View notes

Text

‼️ATTENTION JOHNNY x TESTAMENT SHIPPERS‼️

i’ve finally come up with a new ship name for them

johnnytest is a funny one but it also makes my insides shrivel up like raisins SO I PRESENT TO YOU……

BLOODMONEY

it’s perfect and if u disagree i’ll fight you in the back of a wendy’s

#guilty gear#guilty gear strive#ggst#johnny guilty gear#testament guilty gear#johnny x testament#bloodmoney#text post#slash jay……………..#bloodmoney is still a swag ship name imo

45 notes

·

View notes

Text

Poppy performing All the Things She Said [EDIT: BLOODMONEY!], London, 11/27/22.

#poppy#cult of poppy#queen#poppy's world#i'm poppy#cute#on stage#video#performance#singer#rock star#poppy updates#instagram#poppyupdxtes#bloodmoney#i disagree

91 notes

·

View notes

Text

KEEP TELLING YOURSELF THAT YOU’VE BEEN PLAYING NICE AND GO BEG FOR FORGIVENESS FROM JESUS TO CHRIST

233 notes

·

View notes

Text

BLOODMONEY 🩸💵

#poppy#that poppy#moriah pereira#bloodmoney#i disagree#i disagree by poppy#metal#nu metal#women in rock#female rage

23 notes

·

View notes

Photo

Credit: RD On the Beatz

#art#photography#shell#hell#neonlight#neonsign#RDontheBeatz#surreal#bloodmoney#war#climatechange#ukrainewar#Russia#money#dirty money

24 notes

·

View notes

Photo

A rose and his thorn // trying some like stuff, new ways of laying/picking colour, one layer type stuff. Just things to get me excited about art again!

Lafayette belongs to @qaming and Ruby is mine!!

#make ocs with your friends#itll make you happier#my art#dnd5e#dnd chraracter#dnd#Lafayette#Ruby#Bloodmoney#I love them with my whole heart

11 notes

·

View notes

Text

Of course there's a Mod of Testament wearing Johnny's Hat and Now I wanna see Johnny wearing Testament's Hat too...

(And Testy's wearing John's Glasses too...)

#johnnytest#guilty gear#guilty gear strive#johnny#testament#johnny guilty gear#guilty gear johnny#arc system works#guilty gear mods#memes#guilty gear testament#ggstrive#ggst#testament guilty gear#testament undersn#glasses#sunglasses#team red#guilty gear memes#bloodmoney

59 notes

·

View notes

Text

she's so pretty :)

15 notes

·

View notes

Text

youtube

#music#poppy#bloodmoney#found this song and poppy playtime too close together so now they’re connected 🤦🏻♀️

4 notes

·

View notes

Text

Poppy Halloween night in Milwaukee, Wisconsin.

#poppy#cult of poppy#queen#poppy's world#i'm poppy#cute#instagram#alienfrogsarecool#impoppy#halloween#tokyo mew mew#halloween costume#tour 2022#tour look#spirits on fire tour#poppy tour#video#guitar#bloodmoney#what do you believe#when no one is around#singer#singer songwriter#artist#on stage#musician

136 notes

·

View notes

Text

The Secret Life Of Money

It may seem strange to talk about the secret life of money when a lot of people devote their lives to it. It’s not really when you consider the same thing has been happening around God for many millennia. Human beings have a propensity for this sort of thing, it seems. Money has a secret life because most of us do not understand what it is and how it actually works. Modern economies on the national scale are very large and complex things. Macro economics does not operate in the same manner as our own individual financial set up functions. This is why most people struggle to grasp how money and the economy as a whole really work.

Secrets About Money In America

Did you know that the US Federal Reserve, America’s central bank pumped $29 trillion into the economy post-GFC? This was not made public, as the Federal Reserve is under no compunction to declare its hand. Americans were jumping up and down about the $800 billion the US Government put in under the Obama administration to bail out the banks, but the real amount was far, far greater. The thing about sovereign currencies in the modern era is that countries and their central banks can just push buttons to virtually print more money. There is no constraint on this ability. Nations like the US cannot run out of their own currency and go broke. Australia is in the same position. So all this negative talk about such worries is political BS. The debt ceiling in America is an artificial constraint imposed by Congress and can be extended (as it so often has been) and could be removed. The deficit will not economically bring down the country directly– it is a political farrago of lies, mistruths, and misunderstanding.

“The extraordinary scope and magnitude of the recent financial crisis of 2007–09 required an extraordinary response by the Fed in the fulfillment of its lender-of-last-resort function. The purpose of this paper is to provide a descriptive account of the Fed’s response to the recent financial crisis. It begins with a brief summary of the methodology, then outlines the unconventional facilities and programs aimed at stabilizing the existing financial structure. The paper concludes with a summary of the scope and magnitude of the Fed’s crisis response. The bottom line: a Federal Reserve bailout commitment in excess of $29 trillion.”

- (https://www.levyinstitute.org/pubs/wp_698.pdf)

Photo by Anna Nekrashevich on Pexels.com

Money & Its Clandestine Roots

The thing about money is that many of us don’t understand where it came from in the first place. Therefore, we have basic misunderstandings as to its nature and purpose. Money did not primarily emerge out of some Robinson Crusoe like barter system, as is taught in schools around the world. There is no archaeological evidence for this anywhere. Rather, assumptions and origin stories have been made up over time and by those with vested interests in having people see it this way. The evidence in the ancient world points toward ‘wergild’ or blood money being the main culprit in the evolution of money. This was the price paid to families of those you may have transgressed against by killing or maiming one of their members. Eventually, this debt payment would be owed to the state instead of the aggrieved family, which is where we find ourselves today. The state fines folks for petty crimes and sends them to prison for more serious one’s. Money grew out of this need to pay what is owed to the state. Taxes are the main thing that citizens are required to give over to the state. Money and taxes are inextricably linked on this basis. The important takeaway here is that money is a state invention and operates as an IOU from the state today. The state owns the money via its central bank. Philosophically, this acknowledgement may change things for some people. Money, the thing that they have been striving for their entire lives, is what links them to the state.

Photo by Sharefaith on Pexels.com

The Financial System

The US financial system is being driven by private equity, by the pension funds and their money managers. It is their might and power which propels the economy in different directions. Where and how that volume of money is invested makes waves. The GFC came about because of securitization, the bundling up of securities into financial products to be bought and sold and bet upon. The enormous appetite for risk, which equates to big returns on investment, and the lax oversight in the mortgage sector produced a perfect storm. This was turned into a tsunami when the major players stopped bankrolling the investment banks and it flattened the global economy.

“What actually happened is that default rates on risky mortgage loans rose sharply while home prices plateaued. Megabanks took a look at their balance sheets and realized they were not only holding trashy mortgage products, but also lots of liabilities of other mega financial institutions. It suddenly dawned on them that all the others probably had balance sheets as bad as theirs, so they refused to roll-over those short-term 7 liabilities. And since the Leviathans were highly interconnected, when they stopped lending to one another the whole Ponzi pyramid scheme collapsed.”

- (https://www.levyinstitute.org/pubs/wp_681.pdf)

Photo by David McBee on Pexels.com

Of course, something motivated those in the sector to behave in the ways that they did, which set up this house of cards to fall so spectacularly. Greed is an old fashioned word, but this was structurally inserted into the compensation equation for those in the financial sector.

“In 1990 the equity-based share of total compensation for senior managers of U.S. corporations was 20%. By 2007 it had risen to 70%. Meanwhile, the investment management industry has been transformed by the rise of private equity firms and hedge funds, both of which prominently feature market-based compensation as the basis of their supposed virtue. The norm at these funds is the “2 and 20” rule, whereby compensation is tied to the size of assets being managed (the 2%) and to managers’ performance as measured by the financial markets (the 20%, or “carried interest”). As detailed below, the rise of the alternative-assets industry has altered behavior through much of the financial sector. Financial-markets-based compensation has become the norm in modern American capitalism.”

- (https://hbr.org/2012/03/the-incentive-bubble)

The secret life of money beats at the heart of our financial institutions and drives the lives of all those who work within them. It is a measuring stick for success everywhere you look. It is meanly carved out at the micro level where you and I have to make a living. In contrast to this, it is churned out en masse at government levels via central banks, as if they were channelling oceans or bodies of water. In nations with tens or hundreds of millions of people the amounts considered are in the billions and trillions. It is very hard for individuals to comprehend such sums. Macro economics is rarely understood by the general populace. Politicians make use of this ignorance to stir up trouble for their opponents by suggesting stuff like national bankruptcy and other awful fates, which cannot really happen. Applying personal fears and anxieties to these things provides them with political leverage in the polls. Government debt is compared to personal debts in the mind’s of the voter, which do not actually correlate.

You and I cannot print our own money without going to prison if caught, whereas national governments with a sovereign currency can.

Photo by Karolina Grabowska on Pexels.com

Inflation & Secret Money

Inflation is the echo of the travails of secret money, in some instances. The creation of money via quantitative easing, where the central bank injects new funds into the economy by purchasing government bonds does not, generally, result in higher inflation. This is because it is all about how the new money enters the economy. Often it just sits on the balance books and does not make spending waves within the economy. The hard and fast rule is that too much money supply chasing too few things pushes the prices up of those things. This can, then, trigger inflationary spirals as the players within the economy chase each other’s tails to meet the demands of higher prices. During times of high inflation governments can employ fiscal policies of lowering spending and raising taxes to dampen demand within the economy. The latter strategy is politically unpopular and so, reducing government spending is more often employed. Central banks raise the cash interest rate as their main monetary policy lever to combat high inflationary times.

Sticky Inflation & High Migration Intake Levels

“The most important way in which a booming population is affecting inflation, however, is via the rental market. CBA’s Ottley points out the vacancy rate in capital cities fell to a record low of 0.9 per cent last month, which is causing advertised rents to surge by about 10 per cent and feeding into higher inflation generally.

House prices aren’t part of the consumer price index, but they, too, are being pushed higher by the combination of fast population growth and a lack of supply of new homes. Economists, who were wrong-footed by the surprising strength of house prices despite rapid interest rate rises, are pointing to the migration surge as a key reason for the market’s buoyancy.

So in economic jargon, the surge in population growth is having some big impacts on both the supply and demand sides of the economy. Migration has eased skills shortages and there are signs it is causing parts of the labour market to loosen. That should ultimately flow into lower inflation as wage costs ease, but it’s a gradual process. In the shorter term, the population boom is boosting demand.”

- (https://www.smh.com.au/business/the-economy/booming-population-is-part-of-our-sticky-inflation-dilemma-20231102-p5egyo.html)

Photo by Andrea Piacquadio on Pexels.com

Governments like the influx of new migrants because they are cashed up to spend, which improves bottom line productivity in the economy. Many of them also have the skills in demand by the businesses within the economy. It is a dance really with multiple pros and cons being triggered within the economy. The housing and rental crisis is stretching things for the working poor, as they cannot afford to live where they work. The cost of living, high inflationary period is also stripping them of their savings. Meanwhile, the government has to remain committed to lowering its spending. The poor always get shafted during these challenging economic times, it seems. Money is the government’s IOU to its citizens and that is in short supply during this high inflationary period. Getting by on the smell of an oily rag is hard too because of the high petrol prices thanks to Russia invading Ukraine and now the Israeli war in Gaza. Energy prices are very high too with the price of gas and electricity in the upper reaches due to similar global issues and the transition to renewables required by the economy. It is expensive to live in a modern economy in the 21C at the moment.

The secret life of money is a real thing because we are born into systems that we don’t truly understand and most of us just go along with what is happening. Most human beings are unquestioning about stuff like money and God. These things are seen as too big to take apart; and we are encouraged by our parents and the status quo to shut up and get working. Security is very much tied up with money and probably God too, especially as we get a lot older. Not understanding how the economy functions is not advantageous. Indeed, there will come a time in everybody’s life when not knowing this stuff will bite and bite hard.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©MidasWord

Photo by Pixabay on Pexels.com

Read the full article

0 notes

Text

I know what it feels like to have my soul sucked out of my body

I finally know what it feels like to be dead

BLOODMONEY, Poppy

0 notes

Text

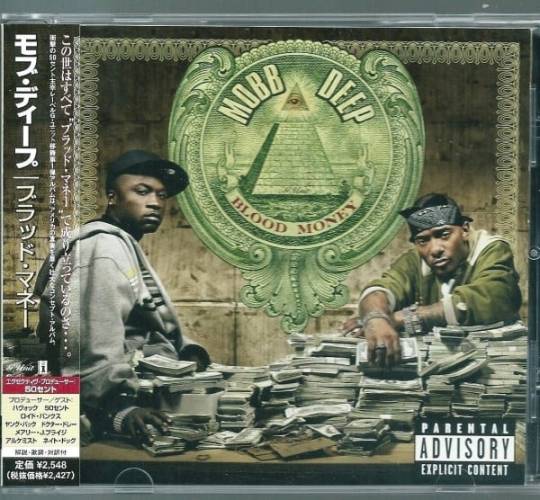

HIPHOPRAISEDMETHEBLOG.COM IT WAS ON THIS DATE IN HIP HOP HISTORY MAY 2, 2006 MOBB DEEP RELEASED THEIR SEVENTH STUDIO ALBUM BLOOD MONEY

@hiphopraisedmetheblog it was on this date in hip hop history!! Blood Money is the seventh studio album by @mobbdeepqb , released on May 2, 2006. It is the group’s only album on G-Unit & Interscope.

So where does Blood Money Fall on your list of greatest of hip hop albums?? Was it a classic or was it wick wick wack??

View On WordPress

0 notes