#calculating GST

Explore tagged Tumblr posts

Text

Are you tired of manually crunching numbers to calculate your GST amount? Say goodbye to the headache and hello to convenience with our user-friendly GST Calculator! In this blog post, we will break down what GST is, how it's calculated, provide you with a handy formula, show you how to use our calculation tool effortlessly, and answer some FAQs. Let's dive in and make calculating GST a breeze!

2 notes

·

View notes

Text

We are the best GST calculator of new Zealand and offer very easy and handy GST calculations, our portal is very fast, reliable and Free to use. Get GST calculator NZ

2 notes

·

View notes

Text

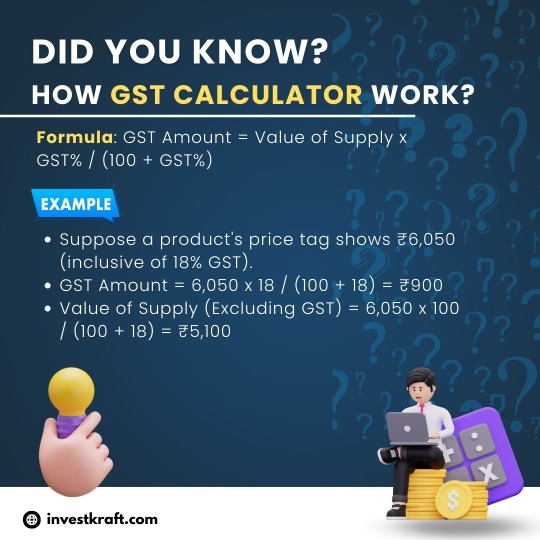

GST Confusion? Try Our Calculator for Easy Tax Calculation!

A GST Calculator simplifies the complex task of computing Goods and Services Tax (GST) in India. It efficiently determines the GST amount payable or included in a transaction, enabling accurate financial planning for businesses and individuals. Investkraft, a trusted financial platform, offers a user-friendly GST Calculator on its website. This tool allows users to swiftly calculate GST on various goods and services, ensuring compliance with tax regulations. With Investkraft's GST Calculator, users can input transaction details effortlessly and obtain precise GST figures, minimizing errors and saving time. Whether for business invoicing, tax filing, or personal budgeting, this calculator proves invaluable in navigating the intricacies of GST, empowering users to make informed financial decisions with ease.

2 notes

·

View notes

Text

🇨🇦💵 Canadians will receive increased ACWB payments starting July 2025, offering vital financial relief. 🇨🇦💵 Discover eligibility, payment details, and tips to maximize your benefits 👇🏻

#ACWB#ACWB eligibility criteria#Advanced Canada Workers Benefit 2025#Canada#Canada Child Benefit July 2025#canada news#Canada Workers Benefit calculator#CRA benefits 2025#CWB payment increase July 2025#government payouts Canada 2025#GST credit increase 2025#low-income support Canada#tax credit payments Canada

0 notes

Text

CompuTax GST Software – File Accurate GST Returns Instantly

File GST returns with ease using CompuTax GST software. Designed for seamless invoice tracking, returns, and audit trails.

0 notes

Text

What is a Home Loan Calculator?

A Home Loan Calculator is an online tool that helps you estimate your Equated Monthly Installment (EMI), total interest payable, and the overall cost of your home loan. You can get a clear picture of your financial obligations before taking out a loan by inputting detailed information like loan amount, interest rate, and loan tenure.

If you want to calculate any loan or EMI, please click this link.

#newcalculators#online free calculator#home loan#car loan calculator#personal loan calculator#EMI calculator#Loan calculator#Age calculator#GST calculator#Investment calculator#Online calculation tools

0 notes

Text

A Guide To Bank of Maharashtra’s Loan Offerings

In today’s financial landscape, access to tailored loan solutions is crucial for individuals and businesses. Whether you are a business owner seeking working capital, a farmer in need of financial assistance, or planning to buy a car, the right loan can ease your financial burden. Bank of Maharashtra (BoM) offers a variety of loan schemes designed to meet diverse financial needs, including the GST Loan Scheme, car loans and agricultural finance options like the Kisan Gold Loan.

Understanding the GST Loan Scheme

For businesses registered under the Goods and Services Tax (GST), securing working capital is now easier with the GST Loan Scheme. This scheme provides loans based on GST returns, making it a hassle-free financing option for MSMEs and startups. By leveraging this loan, businesses can manage their operational expenses, pay vendors and invest in growth without disruptions.

How to Calculate Car Loan EMI

Before taking a car loan, it’s important to assess the repayment amount. Knowing how to calculate car loan EMI helps borrowers plan their finances effectively.

Kisan Gold Loan – Financial Aid for Farmers

Agricultural finance plays a crucial role in supporting the rural economy. The Kisan Gold Loan is designed to assist farmers by providing instant credit against their gold assets. This loan is particularly useful for meeting agricultural expenses, purchasing seeds, fertilizers and farming equipment. With easy repayment options and quick processing, it serves as an efficient solution for farmers in need of short-term credit.

Understanding Farmer Gold Loan Interest Rate

The farmer gold loan interest rate is an important factor when availing of agricultural loans. Interest rates may vary depending on the loan amount, tenure and repayment capacity. Generally, banks offer competitive interest rates for gold loans to ensure affordability for farmers. By leveraging their gold assets, farmers can access low-interest financing, reducing their dependency on informal credit sources.

Why Choose Bank of Maharashtra?

When it comes to reliable and affordable financial solutions, Bank of Maharashtra (BoM) stands out as a trusted name. The bank offers a diverse range of loan schemes tailored for businesses, individuals and farmers. With transparent processing, competitive interest rates and customer-friendly policies, BoM ensures that borrowers receive the best financial support. Whether it’s a car loan, a business loan, or an agricultural loan, BoM’s commitment to financial inclusion makes it a preferred choice among customers.

By choosing Bank of Maharashtra, borrowers can enjoy seamless banking services, quick loan approvals and hassle-free repayment options, making it easier to achieve their financial goals

#bank of maharashtra#GST Loan Scheme#How To Calculate Car Loan EMI#Kisan Gold Loan#Farmer Gold Loan Interest Rate

0 notes

Text

GST on Under Construction Properties – A Complete Overview | SMFG Grihashakti

GST on Under Construction Properties – A Complete Overview by SMFG Grihashakti to Understand GST Implications on Property Purchases.

0 notes

Text

Mastering GST Calculation with i-accountants: Your Trusted Financial Partner

At i-accountants, we specialize in providing expert guidance on GST calculation to help businesses navigate the complexities of the Australian tax system. Goods and Services Tax (GST) is a crucial aspect of financial management, and accurate calculations are essential for compliance and effective cash flow management. Our experienced team is dedicated to assisting you with every step of the GST process, from registration to calculating GST amounts and preparing Business Activity Statements (BAS). We understand that each business has unique needs, and we tailor our services to ensure you receive the best support possible. With our commitment to excellence and personalized service, you can trust i-accountants to simplify your GST obligations and help you achieve your financial goals. Contact us today to learn more about how we can assist you with GST calculation and other accounting services!

0 notes

Text

Calculate GST Online: Effortless and Precise Tax Calculations

Easily calculate GST online with our tool, ensuring accurate tax rates for your business. It helps save time, reduces errors, and keeps your GST calculations up to date with the latest regulations.

0 notes

Text

What is a GST Calculator and How Does It Work?

A GST calculator is a web-based device designed to make calculating the applicable Goods and Services Tax on many goods and services easy and simple. It is particularly very handy for businesses, consumers, or anyone who requires finding the amount of GST chargeable in a transaction. A GST calculator helps simplify financial planning and ensures compliance with taxation regulations.

What is GST?

GST is a consumption tax levied on the supply of goods and services in many countries. This includes India. It replaced several indirect taxes that central and state governments were imposing. Here, the GST system classifies goods and services into multiple tax slabs, for instance, 5%, 12%, 18%, and 28%. It makes it easier and helps in standardising the taxes charged on various sectors of business.

How Does the GST Calculator Work?

A GST calculator works with a simple and effective principle. A user can put all key information, including the base price and the applicable Goods and Services Tax, which varies as a function of the concerned goods or services. The calculator will calculate the GST amount. It will then provide the final selling price, which includes the base price and the GST charged. It aids businesses and persons to explicitly grasp tax consequences in their purchasing or sales.

How to Use the GST Calculator?

Here are a few procedures to use a GST Calculator.

Enter Base Price: Enter the base price of the product or service before GST. It is the pre-tax original price.

Choose the GST Rate: Select the rate for GST, such as 5%, 12%, 18%, or 28% which is applicable for a type of product or service

Calculate: Click the calculate button. The GST calculator will:

Compute the GST amount

Show the price, including GST

It facilitates businesses to find out how much the total will cost and how to handle their tax liability in an efficient way

Advantages of GST Calculator

Some of the benefits of a GST Calculator include:

Accuracy: GST calculators eliminate human errors associated with calculating taxes when one has several products and different rates for GST. This is crucial in terms of compliance and in making good financial decisions.

Saves Time: Calculations made by a person can take so much time. A GST calculator can compute the values instantly, saving time and hence, making it easier to execute financial transactions for businesses and individuals.

Ease of Use: GST calculators are easy to use, requiring minimalistic inputs. They can, therefore, be used by businesses, freelancers, and consumers without the need to attain advanced tax knowledge.

Conclusion

A GST calculator is a very useful tool for any person who deals in transactions subject to Goods and Services Tax. It simplifies the process of calculating tax liabilities and total costs incurred upon goods and services. Whether one is a consumer checking out prices or a business person managing finances, the application of a GST calculator is bound to improve accuracy and efficiency in handling tax-related matters. For seamless GST calculations and more, you can rely on the Tata Capital app. The app offers a convenient and user-friendly calculator, helping you stay on top of your financial and tax-related needs, and ensuring you manage your finances with ease.

0 notes

Text

Simplify Your GST Billing Process with Our Invoice Temple - Online Bill Format

GST Billing

The Goods and Services Tax (GST) is an indirect tax imposed on the supply of goods and services in India. It has replaced several indirect taxes previously charged by the state and federal governments.

The GST is a complex tax scheme, and businesses might find it hard to comply with the numerous laws and regulations. Billing is one of the most difficult issues that businesses confront.

Businesses can, however, use our Invoice Temple — online bill format to ease their GST invoicing process and comply with GST rules and regulations.

In India, the GST (Goods and Services Tax) is an indirect tax levied on the sale of goods and services. It is a comprehensive tax system that has replaced many indirect taxes that were previously levied by the state and central governments. The GST has been introduced with the aim of simplifying the tax structure, reducing the tax burden on businesses, and boosting economic growth.

The GST bill works in the following way in India:

GST Registration: The initial step in the GST billing procedure is to register for GST. GST registration is required if the average annual turnover of the company exceeds Rs. 20 lakh (Rs. 10 lakh for rural and northeastern enterprises). Businesses receive a GSTIN (Goods and Services Tax Identification Number) after they register.

GST Invoicing: Once registered, businesses are required to issue GST-compliant invoices for all goods and services supplied. The GST invoice should include the supplier’s and recipient’s names and addresses, their GSTINs, the date of supply, the description of the goods or services supplied, the HSN code (Harmonized System of Nomenclature) or SAC code (Services Accounting Code), the quantity of goods or services supplied, the taxable value, and the GST rate and amount.

GST Calculation: The GST amount is calculated based on the GST rate applicable to the goods or services supplied. The GST rate varies depending on the nature of the goods or services supplied. There are four different tax rates under the GST regime — 5%, 12%, 18%, and 28%.

GST Payment: Once the GST invoice is issued, the supplier is required to collect the GST amount from the recipient and pay it to the government. GST payments can be made online through the GST portal or through authorized banks.

GST Returns: Businesses are required to file GST returns on a monthly or quarterly basis, depending on their turnover. The GST returns should include details such as the total sales, purchases, and GST paid and collected during the period. The GST returns can be filed online through the GST portal.

GST Billing Process with Invoice Temple:

We, Invoice Temple — online bill format is designed to make it easy for businesses to create GST-compliant invoices. It is a user-friendly platform that can be accessed from anywhere and at any time. With our online bill format, businesses can create invoices quickly and efficiently, and ensure that they are GST-compliant.

Our effective online billing software format is customizable, which means that businesses can add their company logo, address, and other details to the invoice. This helps to make the invoice look professional and adds a personal touch to it.

Our online bill format also makes it easy to add the details of the goods and services that have been supplied. The GST rules require businesses to provide specific information on their invoices, such as the HSN or SAC codes, the quantity of the goods or services, and the value of the goods or services. Our online bill format has pre-defined fields for all these details, making it easy for businesses to add them to the invoice.

In addition to this, Our Invoice Temple — online bill format also calculates the GST automatically. This means that businesses do not need to calculate the GST manually, which can be time-consuming and prone to errors. The online bill format automatically calculates the GST based on the HSN or SAC codes and the value of the goods or services supplied.

Our online bill format also generates reports that can be used for GST compliance. Businesses can generate reports for sales, purchases, and other transactions, which can be used to file GST returns. The reports are generated in a standardized format that is compliant with the GST rules and regulations.

Invoice Temple online bill format is also secure and reliable. It is hosted on secure servers that are protected by firewalls and other security measures. This ensures that the data is safe and secure and cannot be accessed by unauthorized persons.

Another benefit of our online bill format is that it is cost-effective. Businesses do not need to invest in expensive software or hardware to use the online bill format. They can simply access it through a web browser and start using it immediately.

Finally, the online bill format is scalable. It is suitable for companies of all sizes, from small start-ups to major businesses. As the business grows, the online bill format can be adjusted and scaled to match the demands of the company.

Final Thoughts

In conclusion, our online bill format is an essential tool for businesses that need to comply with the GST rules and regulations. It simplifies the GST billing process and makes it easy for businesses to create GST-compliant invoices. With its customizable fields, automatic GST calculation, and reporting features, the online bill format saves time and effort for businesses. It is also secure, reliable, cost-effective, and scalable, making it an ideal solution for businesses of all sizes.

0 notes

Text

Streamlining Business Operations with Smart Invoicing Tools

As a small business owner, managing daily tasks efficiently has always been a top priority for me. One of the most time-consuming aspects of running my business used to be invoicing. It felt like a constant struggle to create professional invoices, keep track of payments, and stay organized. But recently, I came across a tool that has completely transformed the way I handle invoicing.

This tool is incredibly easy to use, and it has streamlined my entire billing process. Now, I can create professional invoices in just a few clicks, track payments effortlessly, and even automate recurring payments. What used to take hours is now completed in minutes, giving me more time to focus on what truly matters—growing my business and connecting with customers.

Having the right tools to simplify operations is a game-changer for any business, whether you’re just starting out or are already established. Tools like these not only save time but also reduce stress, helping you stay organised and productive.

If invoicing has ever been a challenge for you, I highly recommend exploring software that can make the process efficient and hassle-free. It’s made a huge difference for me, and I believe it can do the same for you!

#invoicing solution for small businesses#automate payments#Reliable Invoicing#GST Calculator#invoicing software

0 notes

Text

Complete Guide to GSTR-3B: Importance, Filing Eligibility, Due Dates, and Expert Consultation for 2024

In the ever-evolving landscape of Goods and Services Tax (GST) compliance in India, GSTR-3B stands as a crucial return that taxpayers must file regularly. This blog provides a detailed overview of GSTR-3B, including its due dates, who needs to file, penalties for late submissions, and comparisons with other GST returns.

What is Gaster-3b? GST-3B Due Dates for Quarterly Returns

GSTR-3B is a self-declared summary return that GST-registered taxpayers must file monthly or quarterly (for those under the QRMP scheme). This return provides a consolidated report of sales, Input Tax Credit (ITC) claims, and the net tax liability for the period. It is essential for ensuring compliance and accurate reporting under GST.

Features of Gaster-3B:

Summary Nature: It includes summary figures instead of detailed transaction data.

Monthly Filing: Taxpayers generally file GSTR-3B every month, but quarterly filers under the QRMP scheme submit it every three months.

Non-revisable: Once filed, GSTR-3B cannot be revised, making accuracy essential.

Quarterly Gaster-3B Due Dates Gaster-3B Due Dates for Quarterly Returns

For taxpayers opting for the QRMP scheme, the due date for filing GSTR-3B is either the 22nd or 24th of the month following the end of the quarter, depending on the state or Union Territory of the principal place of business. For example, for the quarter ending September, the due date would be either 22nd or 24th October, based on your location.

For taxpayers opting for the Quarterly Return Monthly Payment (QRMP) scheme, the due dates for filing GSTR-3B are as follows:

For the first quarter (January to March):

22nd April for taxpayers in certain states (for others, it’s 24th April).

For the second quarter (April to June):

22nd July for certain states (for others, it’s 24th July).

For the third quarter (July to September):

22nd October for certain states (for others, it’s 24th October).

For the fourth quarter (October to December):

22nd January for certain states (for others, it’s 24th January).

Always check the GST portal or consult with Taxring tax advisor for the most current dates and any updates specific to your state.

Who should file Gaster-3b?

All taxpayers registered under GST are required to file GSTR-3B, including:

Regular taxpayers

Taxpayers under the QRMP scheme

Exemptions: The following categories do not need to file GSTR-3B:

Taxpayers registered under the Composition Scheme

Input service distributors

Non-resident suppliers of OIDAR services

Non-resident taxable persons

Late Fee & Penalty for GST-3B

Filing GSTR-3B after the due date incurs late fees and penalties. Here’s how it works:

Regular Filers: ₹50 per day of delay (₹25 each for CGST and SGST).

Nil Tax Liability Filers: rs20 per day of delay (₹10 each for CGST and SGST).

Interest: If GST dues remain unpaid after the due date, an interest of 18% per annum will be charged on the outstanding tax amount.

Due Dates for GST-3B Filing

Up to December 2019: The due date was the 20th of the subsequent month.

From January 2020 Onwards: The due dates have been staggered:

Monthly filers: 20th of every month

Quarterly filers under the QRMP scheme: 22nd or 24th of the month following the quarter.

Important Note:

Taxpayers must ensure timely payment of taxes and filing of GSTR-3B to avoid penalties.

Gaster-3B vs Gaster-2A & Gaster-2B: Cupris

GSTR-2A:

Real-Time Updates: GSTR-2A is a dynamic statement reflecting all ITC available based on suppliers’ GSTR-1 filings.

No Filing Required: GSTR-2A is auto-generated and does not require filing.

GSTR-2B:

Monthly Summary: GSTR-2B is a static summary statement of available ITC for a particular month.

Used for Reconciliation: Taxpayers should reconcile GSTR-2B with GSTR-3B to ensure accurate ITC claims.

Importance of Reconciliation:

Reconciliation helps avoid notices due to excess ITC claims, ensures compliance, and improves the GST compliance rating.

Difference between Gaster-1 and Gaster-3b

GSTR-1:

Detail Requirement: Requires detailed reporting of all sales transactions.

Monthly or Quarterly Filing: Depending on the taxpayer’s category.

GSTR-3B:

Summary Nature: Requires only summarized figures of sales and ITC claims.

Mandatory Filing: Must be filed by all GST-registered taxpayers.

How to FileGaster-3B Texting

Filing GSTR-3B on Taxring is a straightforward process that ensures compliance and accuracy. Here’s a step-by-step guide:

Log into Taxring: Access your account using your credentials.

Navigate to GSTR-3B: Go to the GST filing section and select GSTR-3B.

Enter Required Details: Fill in the summary of sales, ITC claims, and net tax payable.

Review Data: Ensure that all information is accurate and reconciled with GSTR-2A and GSTR-2B.

Submit Filing: Click on the submit button and wait for the acknowledgment of your filed return

CONCLUSION

GSTR-3B is a vital component of GST compliance, ensuring that taxpayers report their sales, ITC claims, and tax liabilities accurately. By understanding the due dates, filing processes, and key differences with other GST returns, businesses can maintain compliance and avoid penalties. Leverage tools like Taxring for a seamless filing experience and stay updated with the latest GST regulations to streamline your compliance process!

Read also- Best GST Return filing service , GST Return Filing Overview , Check GST Status

#gstr3b#gstr3b return filing#gstr3b how to file#gst late fees calculator for gstr 3b#gst r1 and 3b difference#gstr 3b#gstr 3b due date#what is gstr 3b#gstr 3b meaning#due date for gstr 3b#gstr 3b last date november 2023#gstr 3b means#late fee for gstr 3b#how to file gstr 3b#gstr 3b format#late fees for gstr 3b

0 notes

Text

Efficient GST Calculations Made Easy

Efficient GST Calculations Made Easy

In today’s fast-paced business world, accurate and efficient tax calculations are crucial for financial success and compliance. Goods and Services Tax (GST) is a significant aspect of many countries' tax systems, and understanding how to calculate it accurately can save time, reduce errors, and ensure compliance with tax regulations. Fortunately, a GST calculator is a powerful tool that simplifies this process. In this guide, we’ll explore what a GST calculator is, why it’s essential, how to use it, and its benefits for businesses and individuals.

What is a GST Calculator?

A GST calculator is a tool designed to compute the amount of Goods and Services Tax applicable to a transaction. It helps users determine how much GST needs to be added to a purchase or how much GST is included in the price of an item. GST calculators can be found as online tools, mobile apps, or integrated features in accounting software. They typically require basic input, such as the cost of goods or services and the applicable GST rate, to provide quick and accurate results.

Why Use a GST Calculator?

Accuracy: Calculating GST manually can be prone to errors, especially when dealing with multiple transactions or varying tax rates. A GST calculator automates these calculations, ensuring precise results.

Time Efficiency: Instead of spending time performing complex arithmetic, a GST calculator quickly provides the GST amount and the total cost, allowing you to focus on other aspects of your business.

Compliance: Properly calculating GST is essential for tax compliance. Using a GST calculator helps ensure that you are charging and remitting the correct amount of tax, avoiding potential legal issues and penalties.

Financial Planning: Accurate GST calculations contribute to better financial planning and budgeting. By knowing the exact tax amount, you can manage cash flow more effectively and avoid unexpected expenses.

How to Use a GST Calculator

Using a GST calculator is straightforward. Here’s a step-by-step guide to help you utilize this tool effectively:

Select a GST Calculator: Choose a reliable GST calculator. Many financial websites offer free calculators, and you can also find apps or features in accounting software tailored to GST calculations.

Input the Cost of Goods or Services: Enter the base amount of the transaction, which is the cost before GST is applied. This is the price of the goods or services without tax.

Enter the GST Rate: Input the applicable GST rate. This rate can vary depending on the country or type of goods/services. For example, if the GST rate is 18%, enter 18 into the calculator.

Calculate GST: Once you’ve entered the necessary information, click the calculate button. The calculator will process the inputs and provide you with the GST amount and the total price, including tax.

Review and Adjust: Examine the results to ensure they meet your needs. Some calculators allow you to adjust inputs or perform additional calculations, such as excluding GST from a total price.

Examples of Using a GST Calculator

Retail Purchase: Suppose you buy a product priced at $100, and the GST rate is 10%. Enter these values into the GST calculator. It will show that the GST amount is $10, making the total cost $110.

Service Invoice: For a service invoice of $500 with a GST rate of 18%, input these values into the calculator. The GST amount would be $90, resulting in a total invoice amount of $590.

Tax Filing: If you need to report GST collected over a period, use the calculator to determine the total GST collected from various transactions, ensuring accurate reporting and compliance.

Benefits of Using a GST Calculator

Enhanced Accuracy: By automating the calculation process, a GST calculator reduces the risk of manual errors, ensuring that the GST amount is precise and compliant with tax regulations.

Time Savings: A GST calculator quickly performs complex calculations, saving you valuable time and allowing you to focus on other critical business tasks.

Ease of Use: Most GST calculators are user-friendly, requiring minimal input to provide accurate results. This ease of use makes them accessible even for those without advanced mathematical skills.

Financial Transparency: By clearly showing the GST amount and total cost, a GST calculator helps maintain transparency in financial transactions, fostering trust with clients and customers.

Common Pitfalls to Avoid

Incorrect GST Rates: Ensure that you input the correct GST rate applicable to your region and type of goods or services. Using an outdated or incorrect rate can lead to inaccurate calculations and potential compliance issues.

Manual Errors: Double-check the input values to avoid mistakes. Incorrectly entering the cost of goods or the GST rate can result in erroneous calculations.

Overlooking Exemptions: Some goods or services may be exempt from GST or subject to different rates. Ensure you’re aware of any exemptions or special rates that apply to your transactions.

Not Accounting for Changes: GST rates and regulations can change. Stay updated on current rates and tax laws to ensure that your calculations remain accurate and compliant.

Conclusion

A GST calculator is an essential tool for anyone involved in managing financial transactions subject to Goods and Services Tax. By providing accurate and efficient calculations, it helps ensure compliance, saves time, and facilitates better financial planning. Whether you’re a business owner, accountant, or individual managing personal finances, utilizing a GST calculator simplifies the process of handling GST and enhances your overall financial management. Embrace the convenience and accuracy of a GST calculator to streamline your tax-related tasks and focus on achieving your financial goals.

#gst calculator#apy calculator#love calculator#tip calculator#concrete calculator#loan emi calculator

0 notes

Text

Feeling overwhelmed by tax season? Are you a Chartered Accountant or Tax professional in India struggling with complex calculations, mountains of paperwork, and the ever-changing tax landscape? This podcast is your one-stop shop for conquering tax season! Join us as we explore Electrocom's revolutionary EasyOffice and EasyGST software solutions, designed specifically to streamline your workflow, boost productivity, and ensure compliance.

#tds filing software#income tax filing software#income tax calculation software#tds return software#gst reconciliation software#tds return filing software#gst return filing software

0 notes