#GST amount

Text

Are you tired of manually crunching numbers to calculate your GST amount? Say goodbye to the headache and hello to convenience with our user-friendly GST Calculator! In this blog post, we will break down what GST is, how it's calculated, provide you with a handy formula, show you how to use our calculation tool effortlessly, and answer some FAQs. Let's dive in and make calculating GST a breeze!

2 notes

·

View notes

Text

driving guilt confessional

#personal#had a left to turn to gst back to the house#accidentally stopped all the way#realized another driver begind me was also trying to go left#freaked out#had started accelerating again and must have stopped suddenly#they (i think) had to slam on their brakes#** wait no they weren’t turning left they were going straight which probably marenit worse#anyway they honked. (fair)#i went left but then freaked out bc even though there was 0 impact#ocd brain tried to convince me someone gor hurt#so i went back and found a place to park#(was near a drive way path) and made sure they weren’t still there#they Were Not.#and like. it’s a good reminder to be mindful#and people take some degree of risk when they got on the road#and all that stuff i try to tell myself#and just to be more careful next time#but I still feel insane amounts of guilt#bc of what COULD have happened#and my brain trying to convince me that it did#it literally did not#edit: it doesn’t help that this came directly after a dd drive where i had trouble finding the customer’s order#fuck not order address#and she was really nive abt it#but I was already Big Anxious post that#anyway. home now.

0 notes

Text

Welcome to the Bodyguard Bracket!

What's better than a character whose sole job is to protect someone else, even at the expense of themselves. Here we're going to let all the bodyguards battle it out!

Rules

Character MUST be a bodyguard. This can be in title OR if they are either employed to guard someone or do so on their own for a significant amount of time

No guarding objects. The character must be guarding someone with sentience and/or personhood. It'll ultimately be up to my personal discretion if it counts or not. If you're unsure, submit anyways and give me a good case/thorough explanation of why you think they would qualify

No ocs, real people, Harry Potter, or Attack on Titan (sorry!)

Mcyt IS allowed on the condition that you can explain how they are a separate/unique character and not just the youtuber playing themselves (this is because I'm an old man who still is kinda confused by the whole thing, I have no personal problems with it, I just am a bit lost)

One character per submission form, but multiple different submissions can be made (just don't submit the same character multiple times!)

Submissions Close August 1st @ 7 PM (GST)

Submit them here!

Tagging for reach: @obscurecharactershowdown @obscure-skirmish @eviltransswag @badass-queer-couples-battle @straightbaittournament @most-canon-non-canon-ship-poll @controversial-blorbo-bracket @look-how-they-massacred-them @hot-take-tournament @obscuredilfoff @fave-fight @qprsmackdown @tournamentofchaoticneutral @tournamentdirectory

207 notes

·

View notes

Note

You’ve probably been asked this question before, but does the government tax you for your commissions? If so, how?

i do pay taxes on my income yes, the 'how' is bit of a long and boring answer though so im going to put it under the cut (fyi im in australia so my info is only applicable to australians)

-first off, in australia you have a tax-free threshold of about $18,500, govt doesnt really seem to care if you report your earnings under that or not, idk though you should check whether or not you legally Have To. better to stay on the tax mans good side.

-i have an accountant who does the maths and lodges my taxes for me, all i have to do is payg the ATO an amount of money 4 times a year based on my reported earnings

-i report my earnings once a year around july-ish, but if you have a tax agent i believe the ATO tends to give you more leeway on When exactly you do your annual taxes

-i am a registered sole trader, this means that while i run a business, i don't have employees other than myself, so i dont pay the taxes business owners with employees would.

-businesses that make over 70k aud/year have to pay GST, which is a 10% tax on all sales within australia. this does not affect my customers abroad and it does mean my australian customers get a special invoice :)

-if you hold onto your receipts, you can get certain things as a tax write off, ex. new work computer, new drawing tablet, office chair, as long as it is justifiably related to your business and you dont abuse it, on the off chance you get audited youll be safe as houses

-see if any charities you donate to can be tax write-offs too. thats just general advice but plenty of charities are tax deductible so go crazy.

#croaks#make sure to fact check me against the ato website if any of this is relevant to you btw#i dont think im wrong but i could be#also with the price of food and living and the fact that im 23 with very little to my name in terms of equity#it does rankle a bit that i have to pay so much while rupert murdoch pays $0#money sucks but i need it to live

189 notes

·

View notes

Text

Build-a-BL Form!

Confirmed elements of the BL:

Country of Origin: Thailand

Here is the form for y'all to submit things for the Build-a-BL thing we've got going on: right here!

The form will be open until July 27 @ 7 PM (GST)

Some notes for this form that is different than the others:

There are no mandatory questions. Submit anything and everything you want that's relevant, but no worries if you can't think of something for some of the questions!

For every topic, you have an unlimited amount that you can submit for it! This means that I'd appreciate it if y'all only filled the form out once. To make this easier, I've enabled form editing! So you can always go back and add more thing before it closes!

If you would rather fill out multiple forms (with different info in each) that is also fine!

The questions on there are not exhaustive of what we'll be having polls on, they're just the ones I need community input for!

This bracket, more than the previous ones, will really require on word of mouth kind of spreading, as I can't just tag a bunch of popular shows with a fandom for people to discover on their own. That's just to say that reblogs are always welcome and very appreciated!!! Even if it is a smaller bracket compared to the others in terms of popularity, I hope we can all have fun with it!!!

Also if you're only interested in this and not my other brackets, you can follow the tag: #build a bl

49 notes

·

View notes

Text

OTTAWA — The New Democrats say they are using their agreement with the Liberal government as leverage to push for more ways to save Canadians money in the next federal budget.

Party leader Jagmeet Singh said he expects to see money in the budget to expand dental care coverage to teens, seniors and people living with a disability, which was part of the confidence-and-supply agreement with the Liberals.

But he also wants to see the government extend the six-month boost to the GST rebate, introduced last fall, which temporarily doubled the amount people received.

"That's something that we're going to use our power on," Singh said in an interview with The Canadian Press. [...]

Continue Reading.

Tagging: @politicsofcanada

66 notes

·

View notes

Text

‼️IMPORTANT ANNOUNCEMENT‼️

Hello everyone!

If you applied before April 20, 7AM GST, please read this post!

Based on feedback and a (positively) overwhelming amount of responses to the zine's application, we've made changes regarding the application process and the zine's general schedule.

Fret not! This is just some housekeeping.

✉️EMAIL IN THE APPLICATION FORM✉️

Our first Google form didn't require applicants to provide an email address. This was a mistake. We need your email in order to communicate results properly later on.

If you applied before April 20, 7AM GST please make sure to resubmit the form!

You can access the form here.

📅ZINE TIMELINE📅

Several people expressed concern regarding our rather tight schedule. As such, we decided to revise the timeline to give more time to our future contributors.

Hopefully, this will work better for everyone. Thank you so much for your feedback!

The application period was extended to make up for these last minute changes.

Additionally, we've been receiving a lot of applications and will need a bit more time to go through them all. We truly appreciate your warm response!

We're sorry for the inconvenience and the confusion. However, we need to make these changes now to ensure everything goes well for the rest of the project.

Thank you for your understanding. We'll do our best to learn from this moving forward!

7 notes

·

View notes

Text

Hassle-Free GST Return Filing Services in Delhi by SC Bhagat & Co.

Introduction: Navigating the complexities of Goods and Services Tax (GST) return filing can be daunting for businesses. To ensure compliance and avoid penalties, it's crucial to have a reliable partner who can manage your GST returns efficiently. SC Bhagat & Co. offers top-notch GST return filing services in Delhi, helping businesses streamline their tax processes and stay compliant with the latest regulations. In this blog, we'll explore the importance of GST return filing, the services provided by SC Bhagat & Co., and why they are the best choice for your business in Delhi. Why GST Return Filing is Important GST return filing is a mandatory requirement for businesses registered under the GST regime in India. Regular and accurate filing of GST returns is essential for several reasons: Compliance: Ensures adherence to tax laws and regulations, avoiding legal issues and penalties. Input Tax Credit (ITC): Facilitates the claim of ITC, which helps reduce the overall tax liability. Business Credibility: Enhances the credibility and trustworthiness of your business among clients and stakeholders. Avoid Penalties: Prevents hefty fines and interest charges that result from late or incorrect filing. Comprehensive GST Return Filing Services by SC Bhagat & Co. SC Bhagat & Co. provides a full range of GST return filing services in Delhi, tailored to meet the unique needs of your business. Here’s what you can expect: 1. Accurate GST Return Preparation Our experienced professionals ensure that your GST returns are prepared accurately, reflecting all transactions and complying with the latest GST laws. We handle all types of GST returns, including GSTR-1, GSTR-3B, GSTR-9, and more. 2. Timely Filing Timely filing is crucial to avoid penalties and interest charges. SC Bhagat & Co. guarantees prompt filing of your GST returns, keeping track of all deadlines and ensuring that you never miss a due date. 3. Error-Free Data Management We meticulously review all your financial data to ensure that your GST returns are error-free. Our team double-checks every detail, reducing the risk of discrepancies and ensuring smooth processing. 4. ITC Reconciliation Our experts assist in reconciling your Input Tax Credit (ITC) to ensure you claim the correct amount, maximizing your tax benefits and minimizing liabilities. 5. Regular Updates and Compliance GST laws and regulations are subject to frequent changes. SC Bhagat & Co. stays updated with the latest amendments and ensures that your GST returns comply with the current rules and guidelines. 6. Personalized Support We provide personalized support to address any queries or issues you may have regarding GST return filing. Our team is always available to assist you with expert advice and solutions. Why Choose SC Bhagat & Co. for GST Return Filing Services in Delhi Expertise and Experience With years of experience in tax consulting, SC Bhagat & Co. has a deep understanding of GST regulations and filing procedures. Our expertise ensures that your GST returns are handled professionally and accurately. Client-Centric Approach We prioritize our clients' needs and provide tailored solutions to meet their specific requirements. Our client-centric approach ensures that you receive the best possible service and support. Advanced Technology SC Bhagat & Co. leverages advanced technology and software to streamline the GST return filing process. Our tech-driven approach enhances efficiency and accuracy, saving you time and effort. Proven Track Record Our proven track record of successful GST return filings speaks for itself.

2 notes

·

View notes

Text

The Dilemma of The Down and Out

People will tell you.

If you can't manage where you are, well get out move on and leave.

But they don't understand the dilemma of what it takes to do that.

Firstly it takes money to move. And resources and people to help. But most people who are financially broke simply don't have the available cash or credit to do that.

Worse, they may no longer have family or friends left to help, particularly if they are Seniors.

It takes money to move. It takes resources. And without subsidized housing, another rental if readily available is likely to be triple the costs of and older place with a modest mortgage and hydro cost.

The availability of subsidized housing in the province of New Brunswick is next to nil and the wait lists over a mile long.

And with bills piling up, and no steady income except for an insulting amount from the province, you soon are in default and the bank and other creditors pile in.

And don't look at bankruptcy - that simply will cost you any tax refund you may have and your hst gst if applicable. And a trustee fee for the lawyers. And don't look to add your house to the bankruptcy - they only will do unsecured debt and not able to put property tax on it.

Can't do that, because that property is for the bank et al.

So financially you can't stay and you can't move without help or subsidized housing.

It's the corner with no exit. No way out.

It's purposely designed that way in my opinion.

They don't want you to succeed. The system doesn't.

Without selling your soul to you know who.

Never!!!!

Their days are numbered. Won't be me judging them.

For myself, I only feel love and forgiveness for all.

Father, forgive them as you have forgiven me so many times.

I love you. In spite of my situation.

The Power and the Glory of God.

Amen.

^^^

My blog and my opinion.

Take that to the bank.

8 notes

·

View notes

Text

Gir Jungle Safari (3 Hrs)

Gir Jungle Trail is the forest department organized open Jeep Safari ride of approximately 3 hours inside the dense forest of Gir National Park. One may get chance to see Asiatic Lion, leopards, and many other wild animals, birds & rich flora and fauna of Gir forest.

Gir Jungle Trail Package Rate & persons allowed in one vehicle:

INR 4500/- to 4800/- for Indians (Per Jeep)

INR 12,000 to 15,000/- for Foreigners (Per Jeep)

One Jeep can accommodate maximum 6 adults and 1 child. Age till 12 years considered as child and more than 12 years considered as adult for safari booking. If number of adults are less then more children can be added up to 7. Since the rates are per Jeep and not per person, rates will be same for 1 person and for 6 persons boarding the safari.

What is Included in this Package?

Permit issued by Forest department to enter in to the Gir Jungle Trail

Open Gypsy vehicle (old model), Driver & Guide approved by Forest Department

Payment processing charges & GST

Safari coordinator service charge who will assist you while Boarding.

What is Not Included?

Camera fees, if any. (There is no charge for Mobile Phones)

Pick-up / Drop from Resort / Hotel. It can be arranged at extra charge.

Gypsy vehicles are subject to availability at the time of boarding. If Gypsy vehicles are not available, new Bolero vehicle will be alloted compulsorily and guest has to pay INR 1500/- extra to the driver.

Reporting Place & Time: Boarding / Reporting point for safari is “Sinh Sadan, Sasan Gir”. Visitor Need to report at least 30 minutes before scheduled Safari time. There is ample parking facility for visitors to park their vehicles and board Jeep.

Safari Timings and Availability of Permits: There are 3 Safari timings as mentioned below & Forest department issue limited Permit for each time slots. 100% of Permits are available for advance booking, on the spot booking is not available.

Gir Jungle Trail remains closed from 16th June to 15th Oct every year. However, you can enjoy Devaliya Jeep Safari throughout the year.

Cancellation Policy

Cancellation Before 10 Days: 75% Refund

Cancellation Before 05 Days: 50% Refund

Cancellation Before 02 Days: 25% Refund

Cancellation Less than 02 Days: 0% Refund

Note: Days are calculated excluding the Safari Boarding day & Cancellation request day. Cancellation request received after 6 PM will be considered on next working day. Cancellation policy mentioned above is subject to change.

It is mandatory to provide ID proof detail of all members while booking. ID proofs submitted while Safari Booking will be verified with the original ID proofs at safari boarding time. Boarding will not be possible if found any discrepancy and any refund will not be processed in this case. No ID proofs are accepted other than mentioned in the Booking Form.

Once the safari is booked, any kind of modification is strictly NOT possible, like Change in the ID proof number, name of person including spelling mistake, addition or deletion of person, change in safari date or time slot, etc.

There are 13 routes for this jeep safari. Any of the routes is allocated to each jeep randomly. Possibility of lion sighting is equal in each route and it is purely on your luck. One can get a chance to see lots of wildlife animals including lions & Leopards.

We will refund full amount within 2 working days in case of unavailability of requested jeep safari.

Forest depart reserves the right to cancel the permit or slightly modify the timing in unavoidable circumstances. Decision of the forest department will be final in such case.

vist our website: https://www.girnationalpark.co.in/safaris/gir-jungle-trail

5 notes

·

View notes

Text

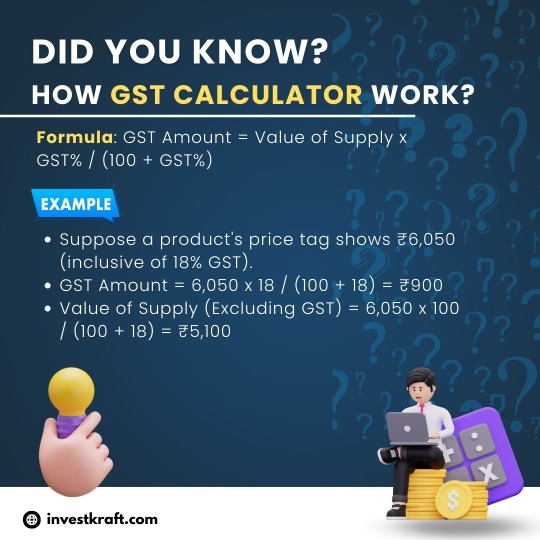

GST Confusion? Try Our Calculator for Easy Tax Calculation!

A GST Calculator simplifies the complex task of computing Goods and Services Tax (GST) in India. It efficiently determines the GST amount payable or included in a transaction, enabling accurate financial planning for businesses and individuals. Investkraft, a trusted financial platform, offers a user-friendly GST Calculator on its website. This tool allows users to swiftly calculate GST on various goods and services, ensuring compliance with tax regulations. With Investkraft's GST Calculator, users can input transaction details effortlessly and obtain precise GST figures, minimizing errors and saving time. Whether for business invoicing, tax filing, or personal budgeting, this calculator proves invaluable in navigating the intricacies of GST, empowering users to make informed financial decisions with ease.

2 notes

·

View notes

Note

Wooooheeee merch!! Me is excited!!! Food for thought, maybe you could start a kickstarter campaign or something to cover publishing costs? I know they have a publishing category 🤔 I don't exactly know their policies so it's best to check further but I've definitely seen erotica books/art campaigns on there. Might be a good idea?

Hi anon,

I think this is a cool idea if you're a) American and b) can get to a post office, lol.

The thing is, I can't do anything that would involve me fulfilling orders from my house.

Firstly, there's simply too many books to cover (Game Theory would have to be broken down into 4 volumes, with the possibility of a 2-part release later on). I don't want to run complicated and stressful Kickstarter campaigns every 6 months forever. (Not to mention, frankly, that most Kickstarter campaigns fail to earn the amount they need, and I'm still figuring out how to make minimum wage via Patreon).

I do not have the spoons to think about dealing with the shipment costs (let alone the fact that I can't drive or catch public transport and therefore get to post offices) of extremely heavy, chunky books. But what I do know is that a lot of readers will be extremely put off by shipping costs easily in excess of $50-100 alone - not including the books or the tax on the books. Australia has one of the highest tax rates for books in the world, we have some of the must punitive shipping charges (some of your favourite Australian artists use drop shippers and this is why), etc. I used to ship small original pieces of art internationally, about half the size of a piece of paper, and extremely light-weight, and the *starting price* for shipping was around $30 USD. For heaver books it shoots up immediately.

For this reason, I actually have zero confidence in how this is actually going to work out without using a drop-shipper and distributor like IngramSpark. Mosk Kickstarters don't fulfill out of Australia wherever possible. And I have no intention of paying thousands of dollars to put books in my tiny cottage, only to realise I've shafted myself and all my international readers (which is...nearly all of you) by forcing everyone to pay an extra 10% GST on the book itself along with the extortionate postage prices for what will be, honestly, heavy books (postage is calculated by weight). Not to mention that I then can't get to a post office, and am completely dependent on other people to help me with that! And then on top of that, I don't believe many books will actually sell, so I'd prefer to use third party vendors wherever possible so I can be not miserable about it. When people can always read the ebooks for free, the only folks who are going to dish out money for paperbacks/hardbacks are going to be the really hardcore fans (I do not have a ton of these, though I love every one of them), or folks who hate ebooks.

Even if I had money at my disposal, I could never use a system like this (Kickstarter / paying for the mass printing of books), and almost no Australian author would, tbh.

On the other hand, aside from the book cover fees, I could technically list a book today on IngramSpark and my only fee would be the ISBNs.

And that's way less stressful than a Kickstarter. ;) And if I get booted for my content, that's just gonna be how it is. It possibly leaves Lulu as an option, but I'd prefer not to go that route mostly because it dumps more of the cost on you folks, and it also eats more profit margins for me.

The biggest issue is and has always been tbh the editing and the fact that chunks of Game Theory need to either be completely rewritten, or removed (the spanking chapter is incredibly OOC), and working out the covers because if the story has to be broken into multiple volumes, continuity in design is vital.

#asks and answers#pia on publishing#i cannot overstate just how punitive shipping costs are in australia when sending internationally#this has been the reason i haven't offered merch for over 7 years via Patreon#and if i do offer merch again it will have to be once every 6 months#and that will be for *extremely light-weight goods*#there's so many things people in the northern hemisphere are privileged to be able to do#especially folks in the USA#which is that you can generally access fast shipping#and generally affordable shipping#did you know in january of last year i couldn't get anything shipped to me from the US#for under $150#it's better now x.x#but not by much

11 notes

·

View notes

Text

PINK! AHH!

I got three things yesterday that made my life way more able to do some stuff for me

I got a higher-than-expected paycheque;

I got my GST;

I got another gov't amount from ??? somewhere? Not gonna question it

As a result, I JUST BOUGHT A TICKET TO SEE P!NK IN CONCERT

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAH

I've loved P!nk since I was 19, that woman's helped me survive to this age, I'm finally going to get to see her in cONCERRRRRRT!

2 notes

·

View notes

Text

Anyway if anyone wants to send me like 50 dollars Canadian so I can clear my negative PP balance and order some McD's. I would appreciate it. I start work tomorrow and get my gst cheque soon so I'll stop begging then

14 notes

·

View notes

Text

Zerodha Discount Broker Review 2020: Compare Broker Online

Zerodha with a one of a kind name and significance, Zero + rodha (Barrier in English) is developing as the single largest discount broker in India you will see in this zerodha discount broker review 2020. The reason Zerodha turning into the best trading platform in India is expected to giving “the best internet exchanging stage India”, “low brokerage and high presentation”, “free direct shared reserve venture stage” and “effective client assistance.”

In only a limited capacity to focus time (9+ years) Zerodha top the list to become the best stock broker in India as far as dynamic customers. Zerodha contributions & backing is developing step by step.

The principle contributing exercises offered by Zerodha are exchanging value, value F&O, ware, cash on NSE, BSE, MCX and MCX-SX and interest in Direct Mutual Funds through SIP and single amount, ETFs, Government protections, and securities.

Zerodha offers free exchanging value delivery and charges a low brokerage of Rs 20 or .03% whichever is lower for exchanging value Intraday, F&O, cash, and ware.

The Demat administrations provided are of being a DP of CDSL. Furthermore, there is NRI trading facility at Rs 200 or .1% per request whichever is lower for value conveyance and Rs 100 for each request for value F&O.

Zerodha Mutual Fund Investment

This is the first broker in quite a while to offer a Direct Mutual Fund investment facility to its clients for nothing.

In this, you can put resources into direct shared store plots that give you better returns contrasted with customary common reserve plans.

Fundamentally, there is no commission setting off to the brokerage house from your common store speculation.

Zerodha Account Opening Process and 3-in-1 Account

You would instant be able to open records with them. The advantages of 3-in-1 record are offered in tie-up with IDFC First bank in the structure of Zerodha-IDFC FIRST Bank 3-in-1 record.

The business as usual of the record – a solitary record comprehensive of exchanging, DEMAT and financial balance for consistent and bother free web based banking and contributing experience. It has now become the exchanging and self-clearing part to give customers the advantage of no clearing charges. In addition, Zerodha provides cover request and section request (CO/BO) with trailing stop misfortune include for value and F&O best among the top 10 discount brokers in India.

Zerodha Charge/Fee Structure:

Protections Transaction Tax (STT): This is charged distinctly on the sell side for intraday and F&O exchanges. It’s charged on two sides for Delivery exchanges Equity.

Stamp Duty: Charged according to the condition of the customer’s correspondence address.

Merchandise and Enterprises Tax (GST): This is charged at 18% of the complete expense of brokerage in addition to exchange charges.

Different Charges (Zerodha Hidden Fees):

Call and Trade highlight is accessible at an additional expense of ₹50 per call.

Source - https://medium.com/@deepakcomparebroker/zerodha-discount-broker-review-2020-compare-broker-online-2e0b057bef50

Related - https://comparebrokeronline.com/

#best trading platform in india#top stock broker#best stock broker in india#lowest brokerage charges#top share broker#zerodha review

2 notes

·

View notes

Text

Kewal Ahuja's SGF India Franchise Scam Dupes Many: From Youth to Seasoned Professionals

SGF’s Kewal Ahuja is a franchisee owner who has grown up well in this franchising segment of business, especially during the covid times. He has become an owner of franchisee from few to many, from nowhere to everywhere. Paid PR and advertisement clean his image on media and social media. SGF India is reported to be a leading restaurant food chain with many branches across the country. This is the same reason why innocent people fell for the potential fraud conducted by Kewal Ahuja SGF Fraud.

The story behind the curtain, SGF owner Kewal Ahuja SGF has played so smartly and wittily here. He presented this business to the people in such a way that it had looked so tempting & lucrative business with high return value in minimum frame of time. High returns & more than a sustainable revenue generation were offered by SGF -Kewal Ahuja in his 2 modules of business FOFO & FOCO. The investors, especially people who were being told to leave their job or lost their jobs during the pandemic, were in need of finding an option to generate income joined hands with SGF franchise.

Large sum was collected as franchise fee by Spice grill flame and this amount was not reported to regulators such as Income Tax Department and GST Council under regulatory filings. SGF is non-compliant in MCA filings as well. The latest reports suggest that compliance irregularities and siphoning of funds from SGF India follows these which throws light to the potential financial fraud conducted by Kewal Ahuja SGF.

youtube

Kewal Ahuja SGF uses his influence to cover up these facts and represents his business in the society as a genuine firm. Kewal Ahuja also has a strong political background. His family is into politics and Mr. Ahuja is currently the treasurer of the BJYM Delhi state unit. He uses his political influence to his favour for putting the complaints away from the eyes of the public. He holds himself as a well-established entrepreneur who is genuine and works for the welfare of the public as well. But the truth is that he runs the food business not to serve the public, but to improve his political image.

2 notes

·

View notes