#cancel debt

Text

youtube

The people and industries of the world's richest countries have done the most to heat the planet. But they're terrified of being held liable for extreme weather they've made more violent. Meanwhile, the poorest can't afford to pay for the consequences of other people's pollution. So should the rich world be paying for climate damages – and what's the best way to do so?

Credits

Reporter: Ajit Niranjan

Video Editor: Markus Mörtz

Supervising editor: Kiyo Dörrer & Joanna Gottschalk

We're destroying our environment at an alarming rate. But it doesn't need to be this way. Our new channel Planet A explores the shift towards an eco-friendly world — and challenges our ideas about what dealing with climate change means. We look at the big and the small: What we can do and how the system needs to change. Every Friday we'll take a truly global look at how to get us out of this mess.

#PlanetA #Reparations #Climate

Read more:

COP27 agreement on loss and damage payments: https://unfccc.int/sites/default/file...

Historical CO2 emissions since 1850 from fossil fuels, cement and land use change: https://www.carbonbrief.org/analysis-...

Pakistan floods weather attribution study: https://www.worldweatherattribution.o...

Progress toward the $100 billion pledge: https://www.oecd-ilibrary.org/finance...

Fair shares of climate finance: https://cdn.odi.org/media/documents/A...

Chapters:

00:00 Introduction

01:10 Background

02:55 COP27

06:13 Climate Reparations

08:48 Tax Big Oil

10:04 Pollution Levies

10:46 Cancel Debt

11:47 Conclusion

#dw planet a#solarpunk#cop27#Climate Reparations#big oil#Pollution Levies#debt#cancel debt#climate crisis#climate chaos#climate change#climate breakdown#global warming#global heating#climate damage#climate displacement#Youtube#co2#fossil fuels#pakistan floods#climate finance

8 notes

·

View notes

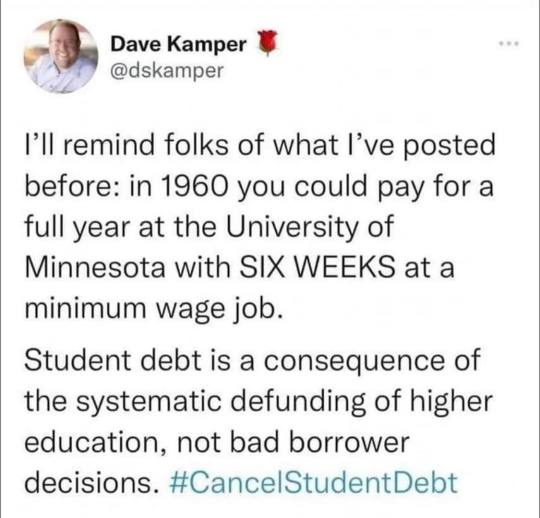

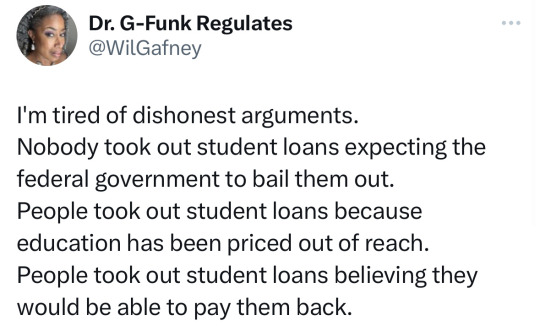

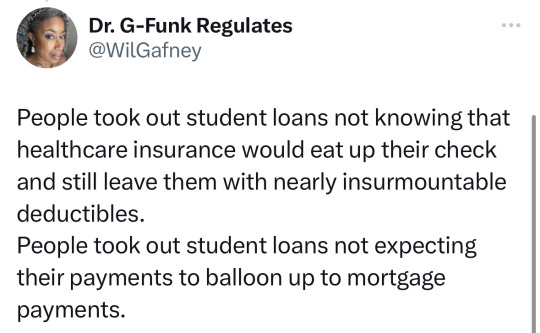

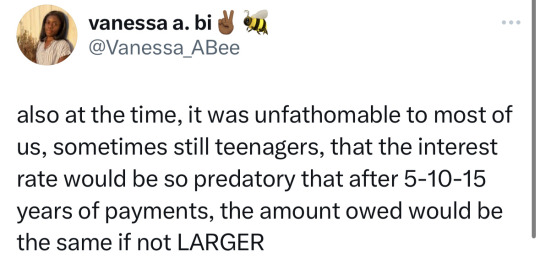

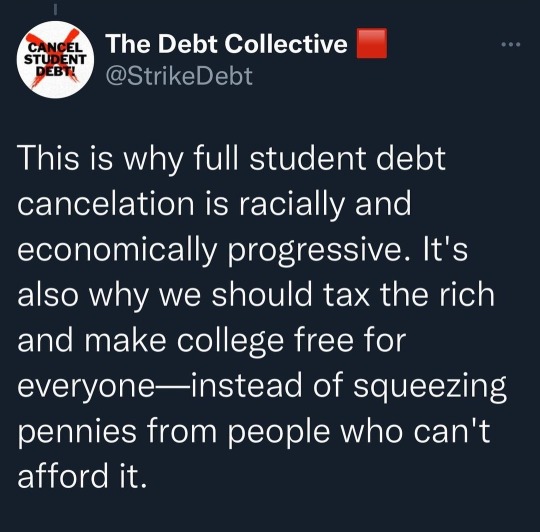

Text

#cancel student debt#student loans#current events#government#education#college#capitalism#eat the rich

33K notes

·

View notes

Text

The Paradox of Rejecting Universal College: A Dive into Conservative Logic

buy this sticker: https://cancelempires.etsy.com/listing/1416680711

In the ongoing debate about universal college, a curious argument has emerged from some conservative quarters. The contention? They don’t want to accidentally fund the education of the rich, as it wouldn’t be fair to those who can’t afford college. At first glance, this might seem like a noble sentiment, championing the cause of…

View On WordPress

0 notes

Text

#twitter#tweet#tweets#cancel student loans#student loan crisis#student debt#student loans#debt cancellation

14K notes

·

View notes

Text

State schools should be free. Community College should be free.

Student debt should not be public policy.

[Private schools will always have billions in endowments and charge $50,000 per year. ]

21K notes

·

View notes

Text

#us politics#2022#twitter#tweet#the serfs#debt forgiveness#student debt forgiveness#student debt#cancel student debt#student loans#memes#shitpost#biden administration#president joe biden

4K notes

·

View notes

Text

The pressure to repay debts is forcing poor nations to continue investing in fossil fuel projects to make their repayments on what are usually loans from richer nations and financial institutions, according to new analysis from the anti-debt campaigners Debt Justice and partners in affected countries.

The group is calling for creditors to cancel all debts for countries facing crisis – and especially those linked to fossil fuel projects.

“High debt levels are a major barrier to phasing out fossil fuels for many global south countries,” said Tess Woolfenden, a senior policy officer at Debt Justice. “Many countries are trapped exploiting fossil fuels to generate revenue to repay debt while, at the same time, fossil fuel projects often do not generate the revenues expected and can leave countries further indebted than when they started. This toxic trap must end.”

According to the report, the debt owed by global south countries has increased by 150% since 2011 and 54 countries are in a debt crisis, having to spend five times more on repayments than on addressing the climate crisis.

#climate change#fossil fuels#colonialism#debt#debt cancellation#what a perverted twisted economic system

531 notes

·

View notes

Text

PLEASE DO NOT GIFT ME BADGES

Tumblr is getting rid of avatars and no longer showing where a reblog comes from in post headers to “afford more room for badges.”

I always felt kinda bad when I was gifted badges and then didn’t use them, cuz people spent actual money on them. So I’m asking, please do not gift me badges, or any other tumblr merch for that matter.

I threw them a bone last year and paid for the ad-free because the ads and blazed softcore porn on the app were infuriating, but I’m canceling it. They’re not getting anything from me anymore. I’ll have to switch back to using the Firefox mobile browser. Hopefully the new dash un-fuckers that are going around will work on mobile.

#for the record ‘running an experiment’ now means ‘this is how it’s going to be regardless of feedback’#someone posted screenshots of responses from two different staff members#that were exact copies of each other#they were in response to separate feedback messages sent almost a month apart#one about the dash layout and one about the avatars#they’re lucky cuz staff never even graced me with a response to the long thought out civil message I’d sent them#maybe I was too civil#this is all the more reason for me to get rid of my iphone too#apparently apple makes it impossible for Firefox to run extensions on mobile browser#so idk if I can fix my dash#and if/when this update hits the app too AMD I cancel ad free it’ll be completely unusable#@staff#are you in so much debt that you’re intentionally trying to blow up the site? is that what’s going on?#because you know we’re a petty spiteful user base and won’t give you a dime if this goes on#so what’s the plan here?#tumblr update#dashboard update#badges

252 notes

·

View notes

Text

In October, tens of millions of borrowers will be required to pay their monthly federal student loan bills for the first time since March 2020, the Department of Education clarified Monday.

The pandemic-related pause on both payments and interest accumulation has been set to end later this summer, though the exact date payments would be due was a little fuzzy.

The Biden administration had previously said that the pause would end either 60 days after June 30 or 60 days after the Supreme Court rules on the separate student loan forgiveness program – whichever comes first.

A law passed in early June to address the debt ceiling officially prevented the pandemic-related pause from being extended again. The repayment date has been extended a total of eight times under both the Biden and Trump administrations.

“Student loan interest will resume starting on September 1, 2023, and payments will be due starting in October. We will notify borrowers well before payments restart,” the Department of Education said in a statement sent to CNN Monday.

The update was first reported by Politico.

Borrowers typically receive their bill statements from their loan servicer a few weeks before they are due. Not every borrower’s bill is due at the same time of the month.

The Department of Education has said that it will be in direct communication with borrowers and ramp up its communication with student loan servicers before repayment resumes.

Student loan experts recommend that borrowers reach out to their student loan servicer with any questions about their loans as soon as possible, especially if they are interested in enrolling in an income-driven repayment plan. Those plans, which set payments based on income and family size, can lower monthly payments but require borrowers to submit some paperwork.

Federal student loan borrowers can check the Federal Student Aid website for updates on resuming payments.

SOME BORROWERS COULD BE AT RISK OF DEFAULT

Some borrowers may struggle to resume paying their monthly student loan bills.

More student loan borrowers are currently behind on other kinds of bills than they were before the COVID-19 pandemic, according to a recent study by the Consumer Financial Protection Bureau.

The report also said that about 1 in 5 student loan borrowers have risk factors that suggest they could struggle when scheduled payments resume, like being delinquent on student loan payments before the pandemic or having multiple student loan servicers.

When payments restart, many people might be confused about how much they owe, when to pay and how. Millions of borrowers will have a different servicer handling their student loans since the last time they made a payment.

Originally, the pause on federal student loan payments was put in place to help borrowers struggling financially due to the pandemic.

From a jobs perspective, the economy has largely recovered from the pandemic-related disruptions. In May, 3.7 million more people were working than in February 2020.

But there are some soft spots. Major layoffs have recently been announced at big companies like Disney and Amazon. Earlier this year, a regional banking crisis was set off by the collapse of Silicon Valley Bank, the largest bank to fail since the 2008 financial crisis. And inflation remains high but is cooling after reaching a 40-year peak last year.

STUDENT LOAN FORGIVENESS STILL ON THE TABLE

Meanwhile, all eyes are on the Supreme Court as borrowers wait to see if the Biden administration will be allowed to move forward with its student loan forgiveness program. A decision is expected in late June or early July.

Under the proposal, individual borrowers who made less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 a year could see up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

But several lawsuits argue that the Biden administration is abusing its power and using the pandemic as a pretext for fulfilling the president’s campaign pledge to cancel student debt.

No debt has been canceled yet. But if the Supreme Court allows the program to take effect, it’s possible the government moves quickly to forgive the debts of 16 million borrowers who the administration already approved for relief.

If the Justices strike down Biden’s student loan forgiveness program, it could be possible for the administration to make some modifications to the policy and try again – though that process could take months.

#us politics#news#cnn politics#president joe biden#biden administration#student loan forgiveness#cancel student loans#federal student loans#student debt forgiveness#student loan debt#us supreme court#scotus#2023#Department of Education#politico#Consumer Financial Protection Bureau

171 notes

·

View notes

Text

Get out and vote for Biden/Harris or suffer under the crushing debt, low wages, persecution Trump Republicans will bring.

#student debt relief#Biden cancels student debt#Republicans hate you#republican assholes#maga morons#traitor trump#crooked donald#never trump#resist

52 notes

·

View notes

Text

Important:

If you think you are going to be eligible for the student loan cancellation and have made payments that got you under either the 10k or 20k forgiveness during the pandemic pause on payments, you can request a refund to try to take full advantage of this.

So, do it. I can imagine we all need it.

445 notes

·

View notes

Text

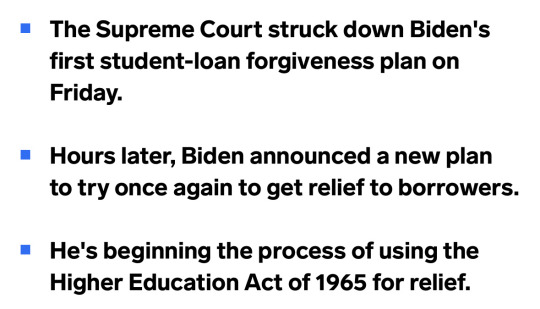

Source

All hope is not lost

#education#Joe Biden#student debt#scotus#Supreme Court#cancel student debt#politics#us politics#government#the left#progressive#current events#news

24K notes

·

View notes

Text

President Joe Biden on Wednesday will announce $1.2 billion of student debt relief for nearly 153,000 borrowers

The administration’s latest tranche of loan forgiveness covers borrowers who are enrolled in Biden’s new loan repayment program, initially borrowed $12,000 or less and have been repaying their debt for at least 10 years.

The administration says that it has now approved loan discharges totaling nearly $138 billion for nearly 3.9 million borrowers through dozens of administrative actions since coming into office.

#student loans#student loan debt#Thanks Biden#Joe Biden#politics#us politics#good news#debt relief#student loans canceled

23 notes

·

View notes

Text

Beaver Hollow - Roanoke Ridge

#doing some side quests#helped penelope braithwaite#met hamish and his lovely horse#I love how arthur spoke so kindly to buell#also cancelled all of strauss' debts and kicked him out of camp#I didn't see it coming but I understand#arthur morgan#rdr2#red dead redemption 2#mick squeaks#no spoilers please#liveblogging#levi my horse

20 notes

·

View notes

Text

US health care system is based on profits, not providing care. No other leading countries give their citizens a bill. There is no medical debt.

1K notes

·

View notes