#erase student loan debt

Text

Important:

If you think you are going to be eligible for the student loan cancellation and have made payments that got you under either the 10k or 20k forgiveness during the pandemic pause on payments, you can request a refund to try to take full advantage of this.

So, do it. I can imagine we all need it.

445 notes

·

View notes

Text

#cancel student loans#erase student loans#cancel student debt#end student loans#student debt#class warfare#classism#fuck capitalism#fuck reagan#fuck republicans#fuck nixon

13 notes

·

View notes

Text

I’m not trying to make a statement about k-pop or East Asian politics (both of which I honestly don’t know shit about) or whatever with that post by the way I just think it’s funny when Joe Biden’s mummy looking ass poses with some celebrity Gen Z is into in a desperate attempt to be hip with the kids like when he had Olivia Rodrigo talk about coronavirus vaccines for no reason

39 notes

·

View notes

Text

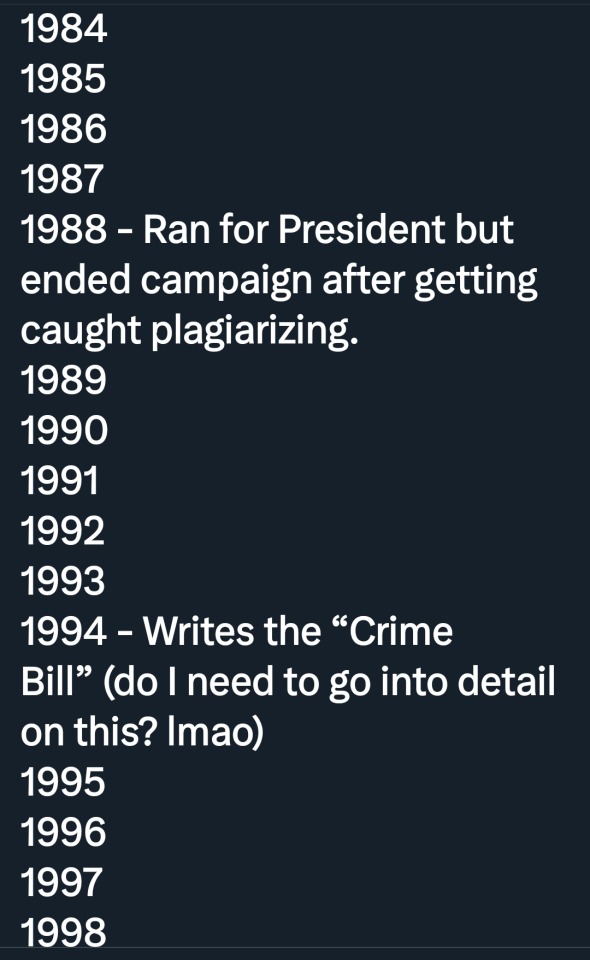

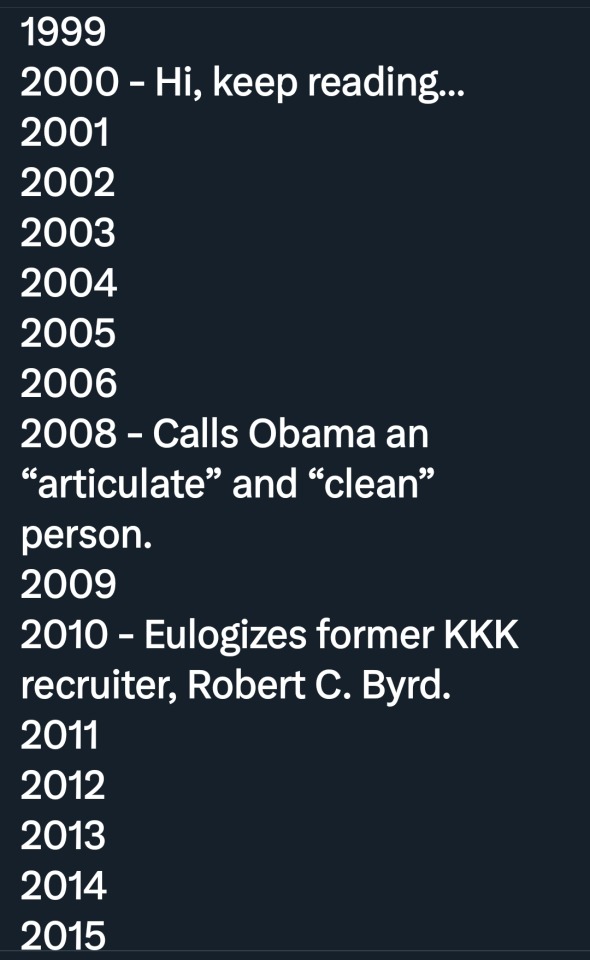

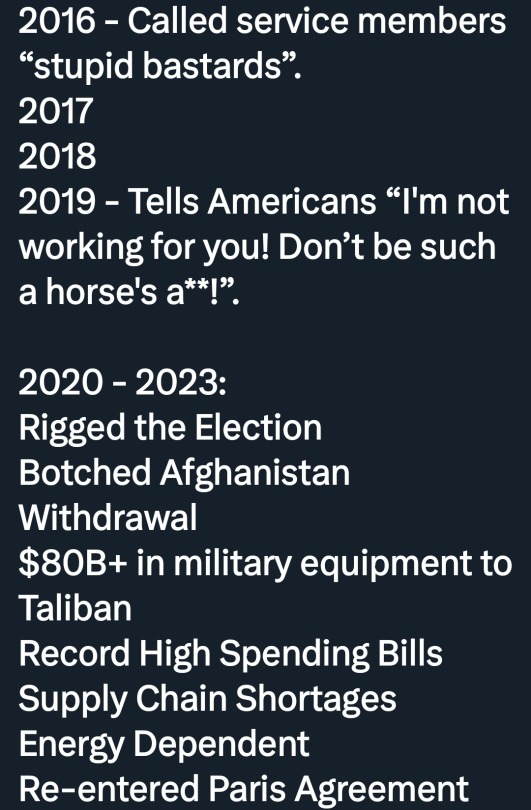

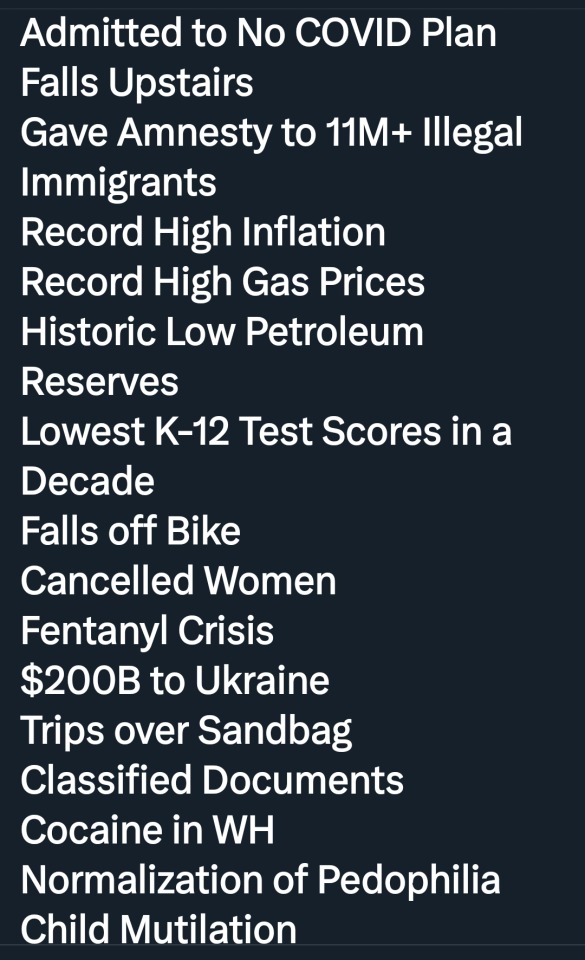

Oh yeah, don't forget the "I'm going to erase your student loan debt" lie.

Also, when WW3 breaks out, Gen Z is going to get drafted.

Remember kids, elections have consequences!

1K notes

·

View notes

Text

Things Biden and the Democrats did, this week. #6

Feb 16-23 2024

The EPA announced 5.8 billion dollars in funding upgrade America's water systems. 2.6 billion will go to wastewater and stormwater infrastructure, while the remaining $3.2 billion will go to drinking water infrastructure. $1 billion will go toward the first major effort to remove PFASs, forever chemicals, from American drinking water. The Administration all reiterated its plans to remove all lead pipes from America's drinking water systems, its spent 6 billion on lead pipe replacement so far.

The Department of Education announced the cancellation of $1.2 billion in student loan debt reliving 153,000 borrowers. This is the first debt cancellation through the Saving on a Valuable Education (SAVE) Plan, which erases federal student loan balances for those who originally borrowed $12,000 or less and have been making payments for at least 10 years. Since the Biden Administration's more wide ranging student loan cancellation plan was struck down by the Supreme Court in 2023 the Administration has used a patchwork of different plans and authorities to cancel $138 billion in student debt and relieve nearly 4 million borrowers, so far.

First Lady Jill Biden announced $100 million in federal funding for women’s health research. This is part of the White House Initiative on Women’s Health Research the First Lady launched last year. The First Lady outlined ways women get worse treatment outcomes because common health problems like heart attacks and cancer are often less understood in female patients.

The Biden Administration announced 500 new sanctions against Russian targets in response to the murder of Russian dissident Alexei Navalny. The sanctions will target people involved in Navalny's imprisonment as well as sanctions evaders. President Biden met with Navalny's widow Yulia and their daughter Dasha in San Francisco

The White House and Department of Agriculture announced $700 Million in new investments to benefit people in rural America. The projects will help up to a million people living in 45 states, Puerto Rico, and the Northern Mariana Islands. It includes $51.7 million to expand access to high-speed internet, and $644.2 million to help 158 rural cooperatives and utilities provide clean drinking water and sanitary wastewater systems for 578,000 people in rural areas.

The Department of Commerce signed a deal to provide $1.5 billion in upgrades and expand chip factories in New York and Vermont to boost American semiconductor manufacturing. This is the biggest investment so far under the 2022 CHIPS and Science Act

the Department of Transportation announced $1.25 billion in funding for local projects that improve roadway safety. This is part of the administration's Safe Streets and Roads for All (SS4A) program launched in 2022. So far SS4A has spent 1.7 billion dollars in 1,000 communities impacting 70% of America's population.

The EPA announced $19 million to help New Jersey buy electric school buses. Together with New Jersey's own $45 million dollar investment the state hopes to replace all its diesel buses over the next three years. The Biden Administration's investment will help electrify 5 school districts in the state. This is part of the The Clean School Bus Program which so far has replaced 2,366 buses at 372 school districts since it was enacted in 2022.

Bonus: NASA in partnership with Intuitive Machines landed a space craft, named Odysseus, on the moon, representing the first time in 50 years America has gone to the moon. NASA is preparing for astronauts to return to the moon by the end of the decade as part of the Artemis program. All under the leadership of NASA Administrator, former Democratic Senator and astronaut Bill Nelson.

#Thank Biden#Joe Biden#student loans#student loan forgiveness#climate change#climate crisis#Russia#Alexei Navalny#women's health#NASA#odysseus#moon landing#good news#Democrats#Politics#us politics

707 notes

·

View notes

Note

I'm a little confused by the left's repeated assertion that they're "trying to hold Biden accountable" and push him left, things they've been talking about since before he was elected, and the ramifications of that at this point in time. I do think we need to be calling out things we disagree with and making our feelings known, but seeing people like Nina Turner complain about student loan forgiveness when it's been made abundantly clear Biden is doing all he can and he can't actually cancel anything as just the President (without being sued or having it reversed by Republicans - please correct me if I'm wrong and there's more he could do here?) doesn't feel like it's that? I just don't understand the logic behind people on the left adding to this narrative that he isn't trying hard enough on what we want, rather than the Republicans are preventing things from being done. We need to not sit back and get complacent, yes, sure, but I feel like the line where it goes from helpful and necessary to harmful and more beneficial to the right was crossed a while ago.

The thing is, you're confused by it because it's a bad-faith argument. Actually "holding someone accountable" means honestly assessing what they can do, what they have done, what they can be expected to do in the future, and if they haven't done it, what's stopping them (i.e. have they just not done it or are they being actively stopped from doing it by factors beyond their control)? It doesn't mean "constantly moving the goalposts to constantly criticize someone if they don't magically get everything done immediately, regardless of reality." The way Online Leftists use it, "holding Biden accountable" means "relentlessly criticize him every instant he doesn't magically transform into the Socialist Messiah overnight, the end." That's not actually a useful, honest, reliable, or constructive metric.

This is also the case because their version of good policy is "someone thinks the Correct Thoughts all the time and any failures to achieve it means they are not thinking the Correct Thoughts hard enough." I'm not sure how anyone could have missed what SCOTUS is doing right now, but Online Leftists remain determined to discount, minimize, or otherwise totally ignore its role, because that would mean a) there is in fact a difference between the parties, b) Hillary Clinton would not have made the same appointments Trump did, and c) they might therefore have some responsibility in not voting for her, none of which can be countenanced. As such, if Biden has failed to wave a magic wand and get all student debt erased for everyone overnight, He Is Just Not Trying Hard Enough. SCOTUS very notably outlawed his first forgiveness program? BIDEN'S FAULT!

Even though Biden extended the Covid-era payment pauses as long as he could (it was Congress that passed the law mandating an end to them, because THE PRESIDENT IS NOT AN ABSOLUTE MONARCH!), and even though he's now rejiggered the entire repayment program so that your monthly payments can get lowered to $0, these count as payments, and no interest accumulates as long as you "make" them, which in practice adds up to full forgiveness -- this still isn't good enough for the Online Leftists, because it happened after trial and error, is a partial solution, doesn't snap its fingers and erase everything, and relies on slow and careful policy work. And yet, it's going to be a lot harder for SCOTUS to overturn than just "the president forgives your debt," which was the first thing he tried to do and it didn't work! With a different SCOTUS, it might have! But we have this nightmare court BECAUSE OF TRUMP, and all the Pure Thoughts in the world won't get rid of it!

Biden is the most liberal president we have ever had, period, full stop. It's not sexy and it's not exciting and it's not something the Online Leftists will ever acknowledge, but it's the truth. And whenever he is actually and extensively pushed, he goes more left, not less. I suspect at least part of the recent negative press barrage he's gotten is because he's openly come out with a plan to raise the tax rate on billionaires to 25%, and the corporations and oligarchs that own the mainstream media Really Don't Like That. (They've always been unfair to Democrats, but look for it to be especially so.) That would be, BY FAR, the highest the top-rate tax bracket has been since Reagan. Biden is the first president ever to actually address the scam of "Reaganomics" and take credit for "Bidenomics," which actually does represent a major rearrangement of the way capital is envisioned and distributed in this country for the first time in the 40+ years since Reagan wrecked it. That's why the capitalist media is really, REALLY determined to muckrake him as much as possible, and to do Kamala even dirtier than they did to HRC in 2016.

Anyway also: Holding someone accountable also implies that you're working with them and will reward them (i.e. voting for them, engaging with them) if they do the things you expect, which is another thing the Online Leftists won't do. So yes. This. The end.

492 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

184 notes

·

View notes

Text

The Best News of Last Week #049

1. First 100,000 KG Removed From the Great Pacific Garbage Patch

The Ocean Cleanup has been working on ridding the world of the GPGP since 2013. Its founder and CEO, Boyan Slat, said the company’s current cleanup platform, System 002, had collected 101,353kg of plastic since being deployed in August 2021. The cleanups swept a 3,000 square kilometer area of the Pacific, roughly equivalent to the size of Rhode Island or Luxembourg.

2. There are 40% more tigers in the world than previously estimated

It’s the Year of the Tiger, and a new population assessment offers some hope for the endangered species.

An estimated 3,726 to 5,578 tigers currently live in the wild worldwide — up 40% from 2015, according to a new tiger assessment from the International Union for Conservation of Nature (IUCN). Tigers are still considered endangered and remain on the IUCN’s Red List, which assesses endangered species.

3. Fourth patient seemingly cured of HIV

A man who has lived with HIV since the 1980s seems to have been cured in only the fourth such case, say doctors. He was given a bone marrow transplant to treat blood cancer leukaemia from a donor who was naturally resistant to the virus.

The 66-year-old, has stopped taking HIV medication. He said he was “beyond grateful” the virus could no longer be found in his body. The man is known as the “City of Hope” patient after the hospital where he was treated in Duarte, California.

4. Pennsylvania nurses receiving student debt cancellation

Nurses across Pennsylvania will begin receiving notifications next week about whether they are eligible for a share of the $55 million the state is making available to lower or erase their student loan debt.

The money for Pa. Student Loan Relief for Nurses Program comes out of state’s share of federal American Rescue Plan funds. This one-time offer will relieve selected state-licensed nurses who cared for patients during the COVID-19 pandemic at a Pennsylvania health care facility of up to $7,500 of student loan debt.

5. This beautiful blue parrot has returned to the wild 2 years after being declared extinct

After teetering on the edge of extinction, the beautiful Spix’s macaw has made its return to the wild, over two decades after the last bird was seen in nature. Eight of the bright blue parrots have been released into a protected nature reserve in Brazil.

“They’re doing absolutely wonderful. So far there is 100 per cent survival. The birds are all staying together as a group… They’re staying in around the release area. And they’re also beginning to forage on natural occurring foods,” biologist Tom White told The Current guest host Duncan McCue.

6. New research shows that signs of Alzheimer’s can be found in blood 17 years before symptoms begin.

A newly developed immuno-infrared sensor allowed researchers to discover biomarkers for Alzheimer’s disease in blood samples 17 years before clinical symptoms appeared.

The goal is to determine the risk of developing Alzheimer’s dementia at a later stage with a simple blood test even before the toxic plaques can form in the brain, in order to ensure that a therapy can be initiated in time.

7. Drone lifeguard saves boy, 14, from drowning in sea in Valencia in Spain

youtube

A pioneering drone lifeguard has saved a 14-year-old boy from drowning in the sea in Valencia in Spain.

The drone lifeguard service, which has been rolled out across Spanish beaches, dropped a life vest into the sea this month that was able to keep the teenager afloat just as he started to sink, its operators have said. The vest kept the boy afloat until a physical lifeguard team arrived moments later.

...

That’s it for this week. This newsletter will always be free. If you liked this post you can support me with a small kofi donation:

Buy me a coffee ❤️

573 notes

·

View notes

Note

13, 16, 21 for the Bad Batch ask!!

13. What jobs do you think each of the Batchers would have in a Modern AU?

Crosshair: I think he's the grumpy manager at a small coffee shop that every employee loves and every customer is terrified of. Any time a customer makes one of the baristas uncomfortable Crosshair is right there ready to throw hands. He's kicked out so many people. That protective streak is going to make him an employee favorite.

Hunter: maybe some kind of camp counselor. Takes the kids on hikes. Is the dude at the bonfire that is really committed to keeping the fire going.

Tech: bro is either a professional gamer or he is a scary good hacker that erases people's medical and student loan debt. Ya know what, maybe both. He is a streamer as his regular job and uses his skills to help people on the DL.

Echo: I think he is either an engineer or he is some sort of doctor. I think he'd thrive helping people but would need something fast paced or challenging to keep himself interested. Oh! Oh wait!!! What if he was a fire fighter?!?! That could work! It's dangerous, it requires a lot of strength and endurance, and it very much helps people. I think he'd be a fire fighter. Fits him perfectly.

Wrecker: I think he'd like being a personal trainer. Someone that helps people reach a certain goal. He loves helping people improve their strength or gain more flexibility or confidence. That's a lot of fun for him.

Omega: Vet. I feel like this just fits.

16. What are some headcanons you have about Echo?

Oh boy. What headcanons do I have about Echo?!?! Well I'm GLAD YOU ASKED!!!

I think Echo has always had anxiety. I think he's channeled that anxiety into learning the regs, honing his skills, and trying to be a top performing (just like a lot of us with anxiety did as kids. we have to be the best so we sure do try.)

He's a tricky little thief. He can steal something right out from under someone's nose and they'd never know. He picked that habit up early on and it never went away. Sometimes he does it just to see if he still can and to practice. He's an excellent thief.

He has broken his knuckles punching someone in the face before. Why do I think that? IDK. He just has.

Sometimes he follows the batch around the ship. Sometimes he talks, sometimes he doesn't. But he tends to pace (can't sit still) and he doesn't like to be alone so it's almost absentmindedly.

Has learned (particularly with Crosshair) that his silence hurts worse than anything he could say to them during a fight. If he's quiet for too long the rest of them get really uncomfortable about it. They'd rather apologize than endure silence from him. It feels too much like disappointment and Echo being disappointed in you is THE WORST.

He tie-dyed one of Hunter's bandanas as a prank once and then hid all the other ones so Hunter HAD to wear it. Hunter still has no idea who did it. Tech knows. Tech has never told anyone. Echo will remember the look on Hunter's face sometimes and laugh to himself.

He actively seeks out Wrecker when he needs a distraction. Wrecker is great at that. Whether it's a physical distraction like sparring, a dance party (let me have my dance parties I neeeeeeed them), or some cuddles Wrecker is the BEST and Echo will seek him out if he needs to.

Speaking of dance parties!!! Echo loved going out to bars/clubs with Fives to go dancing. They had a song that they loved so much they made a dance routine to it. It came on at most clubs and they really stole the show.

With the same idea: He wasn't too sure about dancing in public after being rescued from Skako so it took him a little bit to warm up to the idea but the batch LOVES dancing and he finally caved and went with them. Turns out Wrecker and Tech can learn dances in ten minutes and love to be the life of the dance floor. Echo had a lot of fun that first night and has since learned to just drag Crosshair and Hunter into their antics otherwise they'll sit on the sidelines and watch instead of participating. He's stopped waiting for them to join. He's going to go get them, make them join. They don't get a choice anymore they're gonna dance with them.

ok i'll stop now i got carried away

21. Road trip with the Batch! Where are you going? Who’s driving? Who has the snacks? Who is in charge of music? Who got left behind at the gas station? And other headcanons you have about going on a road trip with the Bad Batch.

We're going to somewhere like... the grand canyon or Yellowstone bc I've never been and I want to go SO BAD and I've never been that far west before and just need to go so I'm choosing a nature/sight seeing trip. Maybe some stops along the way. Maybe there's a fun amusement park or zoo or something on the way!!!

Tech is driving bc I feel like he'd be annoyed with everyone else's driving and he likes to drive. Plus he can handle driving long distance and has it all planned out. Plus he speeds so we'll get there faster.

Wrecker is in charge of snacks. He'll bring A TON. And he knows the best snacks. We'd never go hungry.

Music is tough for me bc I feel like Crosshair and I have similar taste so I'd pick Crosshair but then I think the rest of the batch would complain about the music the whole time. So I'd also consider Echo who has a decent mix of music that I love and music that I've never heard before so I'd find new bops. Cross and Echo fight over the aux cord final answer.

Hunter gets left behind at the gas station. He spent too long looking at the nuts in the snack section. No one did a head count when they were back in the car.

#whew I got long winded I'm so sorry#I spent over an hour typing this lol#i loved these they were great picks#thanks for asking <3<3<3<3

8 notes

·

View notes

Text

NO TO JEEPNEY PHASEOUT !!!!!!

SAY HELLO TO A WORSENED TRANSPORT CRISIS BY 2024

By: Mariella Angela H. Olden (December 28, 2023 | 9:25 PM)

Following a meeting with transportation officials, President Ferdinand Marcos Jr. said on December 12 that no further extensions for consolidation of public utility vehicles (PUV) shall be granted.

One of the cultural markers of Philippine identity is the jeepney. Jeepneys have been the primary mode of transportation for Filipinos due to its affordability and accessibility, particularly for students and workers. Furthermore, it has traditionally been the primary occupation of drivers and operators.

In June 2017, the government established the Public Utility Vehicle Modernization Program (PUVMP), intending to replace and eventually phase out traditional jeepneys to improve public transportation. However, with the impending phaseout of jeepneys by December 31, 2023, drivers and operators will be forced to purchase costly modern vehicles supported by the government.

Data from the Land Transportation Franchising and Regulatory Board (LTFRB) indicates that five days before the consolidation deadline, 31,058 traditional jeepneys, or 73.5% of them in Metro Manila, have yet to be consolidated. These unconsolidated units are highly not a minority.

Why should drivers, operators, commuters, and workers fight back? Among the many effects of the PUVMP is the increase in the minimum fare that will continue to make Filipinos suffer. The PUV Modernization program is a business. Corporations and large businesses will take over and have the advantage of raising fares to pay for expensive "modern jeeps." In contrast, this is a big disadvantage to the families of the drivers and operators, who will sink into debt due to the burden of the monthly payment of the modernized vehicle.

In addition, the Department of Energy and LTFRB has reported that the number of registered vehicles in the Philippines exceeds 9 million. Just over 250,000, equivalent to 2% of jeepneys, make up the total.

More detrimental effects of this program include the modern jeepney being way more expensive than the traditional jeepney. The price of a typical jeepney ranges from P150,000 to P250,000. The cost of operating a modern e-jeepney will rise by 1,766.7% to P2.8 million for drivers and operators. Although P160,000 will be given as a subsidy according to LTFRB, which amounts to a mere 5.7% of the jeepney's entire cost, jeepney drivers will be forced to make at least more earnings each day to be able to settle their loan if they were to switch to the modern jeepney.

By the year 2024, the mass transport crisis in the country will worsen. The government cannot fill such a large and significant gap in public transport in the country. With the influx of imported cars, many local manufacturers and industries will be affected.

The PUVMP program is forcefully erasing one of the main parts of our identity as Filipinos and only in favor of a few rich and foreign interests, making the Filipino masses suffer, further impoverished, and left behind.

Drivers, operators, commuters, and workers—

Unite and fight for #NoToJeepneyPhaseout #NoToPUVPhaseout #NoToPUVModernizationProgram!

#philippines#news article#news writing#journalism#writer#publication#jeepney#notopuvphaseout#notojeepneyphaseout#notopuvmodernizationprogram

17 notes

·

View notes

Text

President Joe Biden outlined a new round of federal student loan forgiveness on Wednesday to address the “unsustainable debt” that borrowers accumulate to complete their college education.

The announcement comes as borrowers brace for payments to restart after a three-year pause that began during the COVID-19 pandemic and Biden tries to fulfill his campaign promises on debt relief as he runs for reelection.

The Democratic president’s latest step will help 125,000 borrowers by erasing $9 billion in debt through existing programs. In total, 3.6 million borrowers will have had $127 billion in debt wiped out since Biden took office.

32 notes

·

View notes

Text

Millions of Americans strapped with student loan debt are still not paying their bills after a three-year payment hiatus ended this fall.

Federal student loan payments restarted at the beginning of October after President Biden declined to extend the pandemic-era pause that first began in March 2020 under his predecessor, former President Trump.

However, 40% of the 22 million borrowers who had bills due failed to make a payment as of mid-November, according to a new report published by the Department of Education. That means about 9 million Americans who have payments due are not making them.

The figure does not include borrowers who are still in school or who recently left and do not yet owe payments, or whose payment deadlines were extended due to loan servicing errors.

"While most borrowers have already made their first payment, others will need more time," Education Department Under Secretary James Kvaal wrote in the report. "Some are confused or overwhelmed about their options. We want to make sure borrowers know that our top priority is to support student loan borrowers as they return to repayment."

Although payments did not officially restart until the beginning of October, interest began accruing again on Sept. 1. As a result, borrowers who do not make payments now will see their payments continue to grow.

MANY STUDENT LOAN BORROWERS UNSURE HOW THEY’LL RESTART PAYMENTS AFTER PAUSE ENDS, SURVEY SAYS

The average monthly bill hovers between $200 and $299 per person, although it is even higher for some borrowers, according to the most recent Federal Reserve data.

Collectively, borrowers resumed paying about $10 billion a month in October, according to a separate analysis from JPMorgan.

The resumption of student loan payments comes as consumers continue to face sky-high interest rates and chronic inflation, which has rapidly eroded their purchasing power. Experts say the addition of student loan payments could deliver a financial shock to millions of Americans – and hinder their ability to shop at big-name stores like Target, Nike, Under Armour and Gap.

Many borrowers hoped that their loans would be wiped out, but the Supreme Court earlier this year struck down Biden's student loan forgiveness plan that would have erased up to $20,000 in loans per borrower.

Since then, the White House has announced other efforts to reduce student loan debt, including erasing $127 billion of debt owed by about 3.6 million borrowers.

14 notes

·

View notes

Text

It’s never been a better time to get rid of your student debt.

Although President Joe Biden’s plans to cancel up to $400 billion in student debt for tens of millions of Americans were foiled over the summer at the Supreme Court, his administration has explored all of its existing authority to leave people with less education debt.

As a result, more than 3.7 million Americans have received loan cancellation during Biden’s time in office, totaling $136.6 billion in aid.

In a recent exclusive interview with CNBC, Rep. James Clyburn, D-S.C., who has been a vocal advocate for student loan borrowers, said he’s heard from the U.S. Department of Education that every two months over the next four years, another 75,000 people will be eligible to have their debt forgiven due to changes in income-driven repayment plans and Public Service Loan Forgiveness.

-----

The Biden administration has been evaluating millions of borrowers’ loan accounts to see if they should have had their debt forgiven. So far, more than 930,000 people have benefited, receiving over $45 billion in debt cancelation.

Most people with federal student loans qualify for income-driven repayment plans, and can review the options and apply at Studentaid.gov.

Recently, the Education Department also announced it would soon cancel the debts of those who’ve been in repayment for a decade or more and originally took out $12,000 or less. To qualify, borrowers need to be enrolled in the administration’s new Saving on a Valuable Education, or SAVE, plan.

-----

The Biden administration has tried to reverse the trend of borrowers being excluded from the relief on technicalities. It has broadened eligibility and allowed people to reapply for the relief, as long as they were working in the public sector and paying down their debt.

Some 790,000 public servants have gotten their debt erased as a result, amounting to more than $56 billion in relief.

------

The Biden administration has also forgiven the student debt of more than 510,000 disabled borrowers. The $11.7 billion in aid was delivered under the Total and Permanent Disability Discharge.

----

Another 1.3 million borrowers have walked away from their debt over the past few years thanks to the Borrower Defense Loan Discharge. These people received $22.5 billion in relief.

Borrowers can be eligible for the discharge if their schools suddenly closed or they were cheated by their colleges.

-----

The Biden administration is also working to revise its broad forgiveness plan to make it legally viable.

The president may try to deliver that relief before November.

That alternative plan, which has become known as Biden’s “Plan B,” could forgive the student debt for as many as 10 million people, according to one estimate.

#thanks Biden#Joe Biden#student loans#student loan debt#student loan forgiveness#if you have student loan debt one of these programs likely applies to you#check it out

62 notes

·

View notes

Text

More student loan relief is coming. Thank you, Brandon!

#Joe Biden#Biden#student loans#loans#debt#student#students#college#relief#forgive#forgiveness#Thank you Brandon

11 notes

·

View notes

Text

7 notes

·

View notes