#challenges in mortgage processing

Explore tagged Tumblr posts

Note

a bit more on the fluff side but doing the "i cant pay my mortgage this month" tiktok prank with luigi? only if you like it!

my heart exploded while writing this. he's too cute.

contains: fluff, tiktok prank, talk about money/financial status

luigi mangione x fem!reader

"hey lu? i'm sorry, but i can't pay the mortgage this month," you said, voice barely a murmur.

the room was eerily still, the silence so thick you could almost see it stretching between you and your boyfriend, luigi. he looked up from his laptop, his expression a mix of confusion and concern. "what do you mean?" he asked, setting aside his work.

you swallowed hard, trying to keep the smirk off your face. "i just said, i can't pay the mortgage this month," you repeated, trying to sound as casual as possible. "i've had some trouble with my work. it's just not coming in like it should."

luigi's brows furrowed as he processed your words. "but you know i've got it, right?" he said, his voice a gentle reminder of the unspoken truth in your relationship. "you don't have to worry about that stuff when you're with me."

you nodded, your heart skipping a beat. you felt a twinge of guilt for the prank you were playing on him. in reality, you had more than enough to cover the mortgage, but you wanted to see his reaction. "i know, but i just…" you trailed off, pretending to be lost for words.

luigi's eyes narrowed slightly. "you know i got you covered, right?" he said, his voice calm but firm. "why are you even worried about it?"

you took a deep breath, preparing for the grand reveal. "because i want to contribute more, lu," you said, trying to sound as sincere as possible. "i don't want to just rely on you all the time."

he looked at you, his gaze searching. "you know i don't mind taking care of us," he said, his voice warm and reassuring. "but if it's really important to you…" he trailed off, his expression unreadable.

you couldn't hold it in any longer. the tension was too much. you burst into laughter, the room echoing with the sound. "luigi, i'm so sorry!" you exclaimed, wiping a tear from the corner of your eye. "it's a prank! a tiktok challenge going around!"

his face went from concerned to confused in a split second, and then the realization set in. "you… you little…" he started, but he couldn't keep his own smile from breaking through. he threw a cushion at you, which you deftly dodged, your laughter bubbling over.

his eyes twinkled with amusement as he took in your glee. "i can't believe you did that to me," he said, shaking his head. but there was no anger in his voice, only the gentle rumble of laughter. "i thought you were serious for a second there."

you slid over to him on the couch, wrapping your arms around his neck. "i'm sorry, i couldn't resist," you whispered, kissing his cheek. "you're always so good to me. i just wanted to see if i could get a rise out of you."

his arms wrapped around your waist, pulling you closer. "you definitely did," he said, his laughter subsiding into a chuckle. "you had me going for a second."

#luigi mangione fluff#luigi mangione fanfiction#uhc shooter#luigi mangione x reader#uhc assassin#real person fiction#rpf#luigi mangione fanfic#deny defend depose#luigi mangione imagine#mara's inbox *ੈ✩‧₊˚#mara's anons *ੈ✩‧₊˚

235 notes

·

View notes

Text

— 1D Monthly Fic Roundup —

Hi, and welcome to the 1D Monthly Fic Roundup for July 2024! Below you’ll find 1D fics that were all published this month. We hope you’ll check out these new fics! If you would like to submit your own fic, please check this post on how to submit or visit our blog @1dmonthlyficroundup. You can find all our other posts here.

Happy reading!

* Peeping by jacaranda_bloom / @jacaranda-bloom [E, 16k, Harry/Louis]

Louis hates his job as an accountant and desperately wants to be a teacher. Of course, that would mean going back to uni, which he can’t afford if he wants to keep up the mortgage payments on his house. It’s Niall that suggests Louis gets a housemate.

Harry is great around the house, loves cooking and cleaning, and everything is fine, lovely even. That is until Louis locks himself out of the house, and in his attempts to get inside, he stumbles upon Harry wanking to a video of Louis playing footy.

OR Louis has a thing for his housemate, Harry is under the impression that clothing around the house is an optional extra, and neither of them seem to be able to stop wanking long enough to get their shit together and admit their true feelings.

* Unbonded by jacaranda_bloom / @jacaranda-bloom [E, 24k, Louis/Harry]

“Look,” Louis says firmly. “Last time I checked, I’m still the pack leader, so you damn well better listen to me. It was Harry who worked out what I’d been poisoned with, then nursed me back to health. And it was Harry who thwarted the plan for my second assassination attempt by literally throwing himself in front of an arrow intended for me, nearly dying in the process, which is why we’re even having this argument in the first place. So if you think I’m going to set foot outside of this hut until he’s fully healed, you’ve all seriously misread the situation, and even more importantly, you’ve all seriously misread me.”

OR the one where Harry is an omega who has been cast out from his pack, Louis is the alpha leader of the pack where Harry finds a new home, Liam is an alpha with heart of gold, and Niall is a cook who can't seem to stop setting himself on fire.

* frightened by the bite, no harsher than the bark by localopa / @voulezloux [T, 21k, Louis/Harry]

louis loves going to the barricade during his shows. if it’s because he’s got a bit (lot) of touch deprivation and is using it as an excuse to have his big alpha bodyguard, harry, touch him, well, that’s a secret he doesn’t need to tell.

* the past might be painful, but i’m in love with our future by localopa / @voulezloux [T, 10k, Harry/Louis]

it takes a lot of convincing for louis to let harry take him to his first pride. harry understands his worries and fears. really, he does. he just wants to show his boyfriend that he doesn’t have to be alone anymore.

a don’t be afraid to love (and love again) time stamp. Part 2 of trans louis verse

* If Life Is a Photograph by @allwaswell16 [T, 2k, Louis/Harry]

Harry gets plucked out of the crowd to take Louis’ crew pic on stage in Guadalajara.

* It Was Electric Touch by @allwaswell16 [E, 2k, Harry/Louis]

Harry, assistant to The Snuts' manager, has been indulging in fantasies about the headliner and founder of the Away From Home Festival, Louis Tomlinson. He gets the chance to indulge in the real thing at the after party.

* Tastes Like Violets by @allwaswell16 [T, 2k, Louis/Harry]

Pop star Harry Styles has a bit of a crush on his makeup artist's brother.

Or Louis has a death metal band, Harry doesn't mind public challenges via Twitter, and Lottie thinks they're both hopelessly chaotic.

* Coração selvagem by Stria / @nooradeservedbetter [NR, 50k, Louis/Harry]

Louis keeps his eyes on the Wolf, careful about every movement he makes. He keeps his head tilted, deliberately showing the right side of his neck; the mating gland is on the other side, but this still shows he’s not a threat. Zayn answers at the third ring. “Lou?” he asks, confusion seeping into his voice. “Zed,” Louis says quietly, trying to keep his tone as calm as possible. “Zed, I’ve found Harry. He’s feral.”

Or, Louis' life in his newfound Pack gets disrupted by an old flame coming back for him, shifted and feral.

* No Surprises by @louislittletomlintum [E, 21k, Harry/Louis]

The thing was, Louis worked in an office, and it was fine. It could be worse.

But maybe, it could be better.

“I smoke socially, sometimes. Depends who I’m with,” Harry shrugged, taking another puff. Louis watched his soft little lips wrap around it and purse just slightly on the inhale. It wasn’t the first time he considered if Harry was perfectly made just to torment him.

“Hm. I won’t send you to jail for now, then. On crimes of fibbing,” Louis decided benevolently. He was about to open his mouth to spout off some other shite before he saw Harry had a bit of a pensive look in his features despite how his eyes were a little glassy.

“Lou,” he began, and god Louis loved that he’d earned that little nickname off of him. “Can I ask you summat?” Harry added, tapping the ash of the cigarette in the tray before taking another puff.

“You just did,” Louis smiled because Harry walked right into that one. “But I’ll give you another,”

“How did you know you were queer?”

or; an office au where louis is a loveable brat and harry is working himself out

* Listening to Intuition by @lululawrence [NR, 5k, Louis/Harry]

Now that Zayn was laying it all out like this, Louis got to wondering… could it be possible that he was never able to get a really good handle on what exactly aromanticism was because he’d never felt romantic attraction, and without that key piece, how could he possibly figure out what it truly meant to be lacking it?

Louis has a good grasp of his own identity and how all the pieces of him fit together in his life as a queer man in a committed relationship with his partner. Or so he thinks until his favorite aroace TikTok creator shows him another possibility he may have previously overlooked. Part 1 of Looking for a Good Time

* Smells Like TEAM Spirit by @persephoneflouwers [NR, 10k, Harry/Louis]

Punk Louis and quarterback Harry have been secretly dating for years. Feeling overwhelmed by his commitments, Harry suggests a short break, fearing he can't give Louis enough time. As Louis reflects on his vulnerabilities, Harry struggles on the field without him. Part 1 of ~ Pocket Tales unfolding on Screen ~

* If Control is My Religion… by LetTheMusicMoveYou / @letthemusicmoveyou28 [E, 14k, Louis/Harry]

“So just to recap, you’ve been vomiting every single morning, and then you seem to be fine for the rest of the day?”

Louis nods. “Except for yesterday when Liam was eating a tuna sandwich after practice and it smelled vile. Who the hell even likes tuna sandwiches?”

Niall sighs in the way that a disappointed parent might. “Louis, please don’t take this in the wrong way, because I’m not judging you at all. But is there any possibility that you’re pregnant?”

Louis scoffs. Technically, it is possible. Louis’ known he was a male carrier since his routine physical when he was sixteen. But it isn’t actually possible, not really. He and Harry always use a condom.

Except for that one day a few weeks ago when Louis had forgotten to buy more and they couldn’t wait. And the time the week before that when the condom had broke, but they both figured it was probably fine.

Shit.

(Or the one where Louis is a professional football player, who’s in a very mutually beneficial no-strings-attached relationship with the team’s medical trainer Harry. Everything in Louis’ life is exactly how he wants it. Until he finds himself unexpectedly pregnant).

* Forward by itsraininginengland / @ilovellama14 [E, 10k, Harry/Louis]

Harry and Louis must keep moving forward.

Quiet scenes from an older Louis and Harry, who are always working to be better together.

* Yesterday’s gone (it’ll be better than before) by red_panda28 / @red-pandaaa [E, 3k, Louis/Harry]

Leo’s frown. His attempt to call after Louis. Ed saying he was surprised to see Louis here. All those little moments fell into place the moment he spotted Harry Styles.

Harry Styles, his former bandmate.

Harry Styles, who he hadn’t seen face to face in over three years.

Harry Styles, who was technically still Harry Tomlinson-Styles.

OR Louis and Harry run into each other at the Euros, there's a mix up at the hotel and they have a past

* Following the Good Vibes by @lululawrence [NR, 6k, Harry/Louis]

"Oh my god, I can't believe it's really you!" Zayn said with a wide smile, hands on his hips as if he was truly stunned over the fact this guy was sitting just a couple of seats behind him. "I thought it might be when I heard your voice, but I haven't seen you in years! How are you doing..."

It was then Zayn realized he didn't have a fucking clue what this guy's name was and he was pretending they were long lost friends.

After an awkward pause, Zayn finally tacked on, "...Chad!"

When Zayn rescues a stranger named Harry from an awkward plane ride beside a total dick, he doesn't think much of it. Harry as the chance to pay it forward on a later flight, and in doing so he just might set into motion pieces that will determine the path his future takes. Part 2 of Looking for a Good Time

* It's Not That I Don't Want You by @parmahamlarrie [E, 12k, Louis/Harry]

It begins with a benign comment during a night in watching a show with his lovely boyfriend, Louis, and leads Harry to a months long journey to understand himself better. Will Harry figure out what makes him feel so different from everyone else? And will he find the courage to tell his boyfriend?

Or a character study into Ace Harry with the most supportive boyfriend, Louis.

* I'd Rather You (Hold Me)by we_are_the_same / @so-why-let-your-voice-be-tamed [T, 14k, Zayn/Louis]

He frowns when he hears the dial tone. By now, he knows just how many times the sound will come through, tinny on the speakers, before it clicks over to voicemail, and yet he still feels his heart trip over itself whenever the voice first comes through.

“Hi, you’ve reached Zayn-”

He sighs, rubbing at his forehead, where his headache always tends to bloom when he’s stressed. “Fuck’s sake,” he grumbles, disconnecting the call and resisting the childish urge to redial immediately, knowing that if Zayn’s not picking up now, he won’t no matter how much Louis bugs him.

It’s just - this isn’t like them. It isn’t like Zayn to dodge his calls for days, not unless he’s seriously incapacitated or dead, but if that were the case, Louis would’ve heard. Because Louis is his emergency contact, for one, and both their families know how much they mean to one another. Someone would’ve called, if something had happened, unless Zayn was dead in his own house, and, oh God, what if Zayn’s dead in his own house and Louis has been mentally calling him a dickhead while he’s rotting on the bathroom floor?

Spoiler: Zayn isn't dead. There is however, suddenly a baby.

* coming home by @nouies [E, 2k, Louis/Harry]

It’s coming home, one way or another.

* Never Wanted Love, Just A Fancy Car by LiveLaughLoveLarry / @loveislarryislove [M, 7k, Harry/fLouis]

“Anyways,” the man says, “someone as handsome as you shouldn’t be sitting all alone with an empty glass. Can I get you a drink?”Louis raises an eyebrow, snorting. “It’s an open bar,” he says. “The company is buying the drinks.”“Well.” The man laughs nervously. “I suppose so. But it is my company, so. I guess I already bought you a drink?”Louis feels his head jerk up in surprise, his mouth falling open as he looks into the face of COO Harry Styles, son of founder and CEO Desmond Styles.

When graphic designer Louis gets asked out by C-suite executive Harry, he thinks Harry is trying to take advantage of him. But he's willing to take advantage of him right back, if that's what it takes to get ahead in life and get his sister's new business off the ground.

* your brightest star by staybeautiful / @harruandlou [E, 35k, Louis/Harry]

“My baby,” Louis whispered into Harry’s neck, closing his eyes tightly into the embrace. Harry squeezed him closer and Louis could feel him nodding into his throat before he kissed him gently behind the ear.

“I love you,” Harry mumbled into his shoulder.

He tried to move closer, but they were already pressed together from cheek to where their ankles were tangled precariously together. “Me too, me too.”

“I’ve missed you so much,” he whispered, just for Louis’ ears. They swayed slightly, like a delicate dance to the distilled noise around them.

“Oh, darling. Sunshine.”

Or a series of timestamps from the sunshine, baby! universe 𖤓 Part 2 of you're the sun to me

* we could be enough by @hellolovers13 [M, 5k, Harry/Louis]

“You know I am flirting with you, right?”

Louis freezes mid-bite. Just manages not to choke on his steak.

Harry laughs a bit too loudly, almost like he’s nervous. “Yeah, should’ve known you weren’t the observant kind. You think I get this dressed up for a random dinner with a mate on a Tuesday night?”

or Louis never imagined anyone could love him for who he truly is.

Then he meets Harry.

* Just The Way You Are by @enchantedlandcoffee [G, 780 words, Louis/Harry]

"Do you miss it?" "Miss what, love?" He could hear the frown in Louis’ voice, and tried to subtly release soothing pheromones into the kitchen "You know...sex and all that." "Where's this coming from, Haz?"

Or, the one where Harry confesses his worries, and Louis reassures him. Part 1 of I Just Wanna Love You

* This Feels Like Home by @enchantedlandcoffee [G, 300 words, Harry/Louis]

After one too many nights alone in a hotel bed, Harry flies home on a whim to surprise his husband.

83 notes

·

View notes

Text

[A reply on this product photography post.]

So... is this subjective criticism or is this mean and hurtful?

I mean, I don't think everyone has to like every style of photography. But some of the photos on the post were mine and this just felt sucky inside my brain when I read it.

I am also frustrated with how many people get mad when artists try to make a living with their art. I love taking product photos. It is a way I can do something I love and maybe pay my mortgage bill. Would I rather be photographing something of my choosing? Perhaps. But I enjoy the challenge and the process more than anything, so I feel artistically fulfilled.

And all products need images. I wish our disgust for advertising could be separated from the art that helps artists keep the lights on. Some makeup bottles getting water splashed on them has to be the least offensive kind of advertising image there is. No one is lying to you. No one is making deceptive claims. It's just bottles of makeup with splashes. Personally if all advertising was that innocent I'd feel a lot better about the marketing industry.

46 notes

·

View notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

Savor the Seasons Emma’s Bakery Seasonal Treats Collection

In the quaint metropolis of Maplewood, nestled between lush inexperienced hills and sparkling rivers, Emma Carter had usually been known as the woman with the golden touch for baking. Her journey from a domestic baker to the proud owner of a thriving artisan bakery is a testament to resilience, ardour, and unwavering determination.

Emma’s Bakery seasonal treats collection

The Beginning

Emma’s love for baking began in her grandmother’s kitchen. Growing up, she spent infinite afternoons kneading dough, blending batters, and paying attention to her grandmother’s tales of the way every recipe was extra than simply elements; it changed into a story. Little did Emma know, those youth reminiscences could become the inspiration of her entrepreneurial journey.

After graduating college with a degree in literature, Emma determined herself operating a corporate job within the city. The 9-to-5 grind turned into far eliminated from the cozy warm temperature of her grandmother’s kitchen. Although she excelled at her process, she frequently felt unfulfilled. To cope, she started out baking on weekends, sharing her creations with pals and circle of relatives. The feedback become overwhelmingly tremendous, with many urging her to keep in mind promoting her treats.

Taking the Leap

The turning factor got here in the course of a specially disturbing period at paintings. Emma realized she wanted extra out of life than spreadsheets and meetings. With financial savings she had diligently set aside, she decided to take the plunge and turn her passion into a enterprise. It became a risky decision, however Emma knew that authentic achievement regularly required ambitious movements.

She began by using promoting her baked goods at the nearby farmer’s market. Armed with a small desk, a banner that study "Emma’s Artisan Bakery," and her grandmother’s recipes, Emma added her network to a number of breads, pastries, and cakes. Her signature object, the honey lavender scone, fast became a crowd favorite. Word unfold, and shortly, Emma changed into receiving special orders for birthdays, weddings, and other events.

Overcoming Challenges

Starting a business became far from smooth. Emma confronted numerous demanding situations, from securing allows to handling budget. The early days were marked by using lengthy hours, sleepless nights, and moments of doubt. One of the largest hurdles became opposition. Maplewood already had a few established bakeries, and breaking into the market required Emma to differentiate herself.

She centered on fine and strong point. Emma sourced her elements regionally, helping close by farmers and ensuring her merchandise have been constantly sparkling. She additionally experimented with innovative flavors and designs, creating a niche for artisanal, handcrafted baked items. Social media performed a big function in her strategy. Emma shared in the back of-the-scenes glimpses of her baking method, engaged along with her target market, and posted mouthwatering pix of her creations. Her authenticity resonated with followers, and her online presence grew unexpectedly.

The First Big Break

Emma’s difficult paintings paid off when a famous nearby meals blogger featured her bakery in a piece of writing titled “Maplewood’s Hidden Gems.” Overnight, her orders tripled. She found out she could no longer perform from her small domestic kitchen. With the cash she had saved and a small commercial enterprise mortgage, Emma rented a comfy storefront inside the coronary heart of Maplewood.

Transforming the gap into her dream bakery became a labor of affection. She worked tirelessly to create an inviting ecosystem, blending rustic attraction with contemporary aesthetics. The partitions had been adorned with vintage baking gear, and the aroma of freshly baked goods crammed the air.

Building a Loyal Customer Base

Emma’s Artisan Bakery formally opened its doorways on a cold October morning. Despite the cold, a line had shaped outdoor even earlier than she unlocked the doors. The community’s guide became overwhelming, and Emma made it a point to take into account her clients’ names and alternatives.

She delivered tasks like “Customer Appreciation Wednesdays,” where regulars obtained a free deal with with their purchase, and “Baking with Emma” workshops, wherein she taught contributors how to make a number of her signature recipes. These efforts fostered a feel of community and became first-time site visitors into loyal consumers.

Weathering the Storm

In 2020, when the global pandemic hit, Emma’s bakery confronted certainly one of its hardest demanding situations. Foot visitors diminished, and she was compelled to temporarily near her doorways. But Emma refused to give up. She pivoted to online orders and presented doorstep deliveries.

Using her social media systems, she stored her clients up to date, shared comforting recipes, or even organized virtual baking training. Her efforts paid off, and the bakery not most effective survived but emerged stronger. Customers preferred her resilience and dedication, and many left sparkling reviews on-line, similarly boosting her enterprise.

Expansion and Recognition

By 2023, Emma’s Artisan Bakery had become a household call in Maplewood. She expanded her menu to consist of gluten-loose and vegan alternatives, catering to a wider target market. Her bakery gained numerous nearby awards, which include “Best Bakery” and “Business of the Year.”

Emma also started participating with other neighborhood organizations, which includes coffee stores and florists, to offer curated gift packages. She employed a small crew to assist with operations, permitting her to cognizance on growing new recipes and tasty along with her network. Despite the increase, Emma remained deeply involved in every aspect of her commercial enterprise, ensuring that her grandmother’s legacy of love and care changed into reflected in each object offered.

Giving Back

Success didn’t make Emma forget her roots. She began a “Baking for a Cause” initiative, donating a part of her income to local charities and organizing free baking classes for underprivileged youngsters. She additionally mentored aspiring entrepreneurs, sharing her experiences and inspiring them to pursue their goals.

Looking Ahead

Today, Emma’s Artisan Bakery isn't just a commercial enterprise; it’s a symbol of what ardour and perseverance can acquire. Emma has plans to write a cookbook, shooting her adventure and sharing her cherished recipes with the arena. She additionally goals of beginning a second region in a neighboring city.

Emma��s story is a reminder that success doesn’t come in a single day. It calls for tough work, adaptability, and a genuine reference to one’s network. Her adventure from a small table on the farmer’s market to a thriving bakery is an idea to every person with a dream. And for Emma, the candy odor of achievement will continually be intertwined with the comforting aroma of freshly baked bread.

2 notes

·

View notes

Text

Navigating the Property Market with Confidence

The Australian property market is dynamic and often unpredictable. It offers numerous opportunities for wealth building but also presents challenges for those who are unprepared. Whether you're a first-time buyer, a seasoned investor, or someone looking to make an informed move, navigating the property market confidently is crucial to ensuring success. By understanding key market trends, knowing what to expect at each stage of the process, and partnering with trusted professionals, you can make smarter decisions and achieve your property goals with peace of mind.

This guide will walk you through the essential steps of property market navigation, from understanding the fundamentals to closing the deal, all while building the confidence to make informed decisions at every turn.

1. Understanding the Basics of the Property Market

Before diving into the property market, one must grasp the fundamental concepts that drive it. Understanding supply and demand, market cycles, and how economic conditions influence property prices will give you a solid foundation.

Supply and Demand: The core principle of the property market is supply and demand. In simple terms, when more people want to buy or rent in a particular area than there are properties available, prices rise. Conversely, when supply exceeds demand, property prices can fall. Population growth, job opportunities, and infrastructure development can drive demand in specific locations.

Market Cycles: The property market operates in cycles, with periods of growth, stability, and decline. Recognising where the market is in its cycle can help you make better purchasing decisions. A buyer's market (when there are more properties for sale than buyers) may present opportunities for negotiation, while a seller's market (when demand outstrips supply) might require quicker decision-making and fewer opportunities to haggle on price.

Interest Rates: Interest rates have a profound impact on the property market. When interest rates are low, borrowing becomes more affordable, driving up demand for property. Conversely, higher interest rates tend to cool down the market by making borrowing more expensive. Staying informed about the Reserve Bank of Australia's (RBA) monetary policy and interest rate movements can help you anticipate shifts in the market.

Economic Indicators: Broader economic conditions, including employment rates, wage growth, and consumer confidence, shape the property market. For example, if the economy performs well, demand for homes and investment properties tends to rise. On the other hand, during economic downturns, people may be less willing to buy, leading to a slowdown in property price growth.

2. Setting Clear Property Goals

One of the first steps to confidently navigating the property market is setting clear and achievable property goals. Whether you're looking to buy your first home, expand your property investment portfolio, or purchase a new property, having a well-defined goal will guide your decisions and help you avoid impulsive choices.

Personal Goals: If you're a first-time homebuyer, you might be focused on finding a place to settle down and start a family. In this case, your goals include proximity to work, schools, or public transport and a manageable mortgage.

Investment Goals: Property investors, conversely, will have goals centred around rental income, capital growth, or both. Defining your investment objectives—maximising rental yields or accumulating properties for long-term wealth creation—will help you determine the type of properties to focus on.

Time Horizon: Knowing your investment time frame can significantly affect your strategy. Are you looking for a short-term return, or will you hold onto your property for many years to benefit from long-term capital gains? The market conditions will differ depending on your time horizon, and understanding this will help you make decisions aligned with your goals.

3. Researching the Market

Successful property navigation involves thorough research. Understanding the ins and outs of the market will help you identify the right opportunities, avoid pitfalls, and negotiate the best deals. Below are some key elements to consider when conducting your research:

Location, Location, Location: The location of a property has the greatest influence on its value and potential for growth. Factors to consider include:

Proximity to public transport, schools, shopping centres, and employment hubs.

Future infrastructure projects, such as new roads, public transport links, or commercial developments, may enhance the area's value over time.

Demographics and demand: Consider the age, income level, and lifestyle preferences of the area's residents. Areas with young professionals or growing families may see greater demand for housing.

Market Trends: Research recent sales data and market trends in your target area. Are property prices trending upwards, stable, or declining? Sites like Domain and Realestate.com.au provide comprehensive data on property prices, which can give you a sense of how the market is performing. Additionally, pay attention to vacancy rates, which indicate rental demand.

Rentability: If you're buying for investment purposes, assessing the potential rental income of a property is vital. Look at the rental yield (the annual rent divided by the property value) in the area to ensure it will provide sufficient cash flow. High rental demand areas typically offer strong rental yields and low vacancy rates.

Comparable Properties: Analyse similar properties in the area that have recently sold. Comparable sales (also known as comps) can give you a better idea of what price range is reasonable and identify potential underpriced opportunities.

4. Building Your Team of Experts

Navigating the property market confidently requires expert guidance at each process stage. While the internet offers a wealth of information, professional support ensures you make the right decisions and protect your interests. Building a team of professionals is one of the smartest ways to ensure a successful property transaction.

Buyers' Agent: A buyers' agent is an invaluable asset when searching for properties. Their expertise allows them to identify opportunities you might have missed, negotiate favourable prices, and assist with everything from conducting due diligence to handling the paperwork. With access to off-market listings, a buyers' agent often has an edge in securing the best deals.

Mortgage Broker: A mortgage broker helps you secure financing by comparing loan options from various lenders. They can advise on loan types, interest rates, and repayment structures that best suit your financial situation. Brokers can also help you get pre-approved, strengthening your position when making offers.

Conveyancer/Solicitor: Property transactions involve significant legal paperwork, and it's crucial to have a solicitor or conveyancer ensure everything is in order. They'll review contracts, handle settlement procedures, and ensure the transfer of ownership is smooth.

Property Inspector: A building and pest inspection is necessary before purchasing a property. This will give you a clear picture of the property's condition and help avoid costly repairs later. Inspectors can uncover hidden issues like termites, structural damage, or plumbing problems that could impact the property's value.

Accountant or Tax Adviser: Consulting with an accountant or tax expert is a good idea if you're buying property as an investment. They'll ensure you maximise tax deductions (such as negative gearing and depreciation) and help with property portfolio structuring for the best financial outcome.

5. Securing the Right Financing

Financing is one of the most critical aspects of the property-buying process, and confidence in your financing options will help you move forward easily. The right loan can distinguish between a successful investment and one that strains your budget.

Pre-Approval: Before seriously looking at properties, seek pre-approval for a mortgage. This involves the lender assessing your financial situation (income, assets, liabilities) and determining how much they will lend you. Pre-approval gives you a budget and makes you a more attractive buyer, as it signals to sellers that you have the financial backing to complete the purchase.

Loan Types: Understand the different loan options available. For investors, specific loans, such as interest-only loans, are designed to assist with property purchases, which can help with cash flow management. First-time buyers may be eligible for government schemes like the First Home Owner Grant or the First Home Loan Deposit Scheme.

Loan Repayments: Make sure the loan repayments are manageable and align with your financial goals. Consider factors like interest rates, loan terms, and whether you want a fixed-rate or variable-rate mortgage. Speak with a mortgage broker to find the best option for your situation.

6. Making an Offer and Closing the Deal

Once you've found the right property, the next step is to make an offer. Understanding the nuances of the offer process will help you navigate this critical phase confidently.

Private Treaty or Auction: In Australia, properties are typically sold either by private treaty or at auction. In a private treaty, you offer to the seller, who may accept, reject, or counter your bid. In an auction, bidding is competitive, and the highest bidder wins. For auctions, setting a maximum price beforehand is crucial to avoid overspending in the heat of the moment.

Negotiation: A strong negotiating position is essential whether buying via private treaty or auction. Buyers' agents can assist with negotiations, helping you secure the best price. If you're buying for investment, don't forget to factor in potential maintenance costs, market conditions, and future growth when negotiating.

Due Diligence: Conduct all necessary due diligence before signing a contract. Ensure the property has a clear title, conduct building and pest inspections, and review the contract of sale with a solicitor. Due diligence ensures there are no surprises after the deal is done.

Settlement: Once the offer is accepted, you'll enter a settlement period, where the legal and financial aspects are finalised. Your solicitor or conveyancer will handle the settlement process, ensuring everything is in order before transferring ownership.

Conclusion: Empower Yourself to Navigate the Property Market

The property market can be complex, but you can confidently navigate it with the right preparation, research, and expert support. Whether you're purchasing your first home or expanding your investment portfolio, staying informed, setting clear goals, and building a team of professionals will put you in a strong position to make smart, confident decisions. With the right mindset and strategy, you can achieve your property goals and set yourself up for long-term success in the market.

2 notes

·

View notes

Text

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

The Art of Saving Money

One of the toughest challenges for any individual is mastering the art of budgeting and having a consistent amount of savings every month.

I just learned about Kaikebo, a Japanese technique for budgeting that's over 100 years old. It combines mindfulness with spending decisions and helps you simply take control of your finances.

The kakeibo is a simple budgeting journal from Japan that helps you save money by setting goals and tracking spending. It encourages mindful thinking and reflection to improve your saving habits every month.

Kakeibo is a budgeting method that involves tracking every purchase, categorizing spending into needs, wants, culture, and unexpected expenses, and regularly reviewing expenses to track progress toward financial goals. The four categories of spending in kakeibo are needs, wants, culture, and unexpected expenses. Kakeibo is popular because it aligns with the Japanese value of "mottainai" and provides a straightforward way to manage finances.

Saving money is essential in today's fast-paced world for achieving financial independence, planning for life events, and creating a safety net. Developing a habit of saving can give you greater control over your financial future.

Kakeibo, a budgeting technique created by Japanese journalist Hani Motoko in 1904, helps individuals manage monthly expenses, understand spending habits, and practice frugality. It has gained popularity among young individuals for its effectiveness in saving for financial goals and accounting for unexpected costs.

Why i trust japanese art of saving money?

Between 1960 and 1994, Japanese households saved an average of one-sixth of their after-tax income, sometimes reaching nearly one-fourth, significantly higher than the 7.1% average savings rate of American households during the same period. While official statistics indicate that Japanese households are big savers, comparisons can be misleading due to differences in measurement across countries. Adjusting for these discrepancies, it appears that while Japan still saves more than the U.S., the actual difference is smaller than reported. Japan also has a higher savings rate in comparison to other countries, although there are various nations with differing savings behaviours.

Understanding the Kakeibo Method of Budgeting

The Kakeibo method is a Japanese budgeting technique that helps individuals manage their household expenses effectively. Created by journalist Hani Motoko in 1904, Kakeibo encourages mindful spending and can result in savings of up to 35% when practised consistently. The method involves categorizing all expenditures into four main areas: Needs (essential items for survival), Wants (non-essential luxuries), Culture (spending on cultural experiences), and Unexpected expenses (unforeseen costs). Practitioners maintain two notebooks to track their spending—one large notebook for categories and a smaller notebook for jotting down daily expenses. This process instils a sense of accountability and promotes financial discipline, aiding individuals in achieving their savings goals and preparing for emergencies.

How do you use Kakeibo in your life? An individual should use the following steps to incorporate Kakeibo in his life fruitfully:

1. Understand your fixed expenses You start with analyzing the monthly expenses, including your monthly fixed expenses such as rent, utility expenses, loan emis etc.

Fixed expenses are consistent monthly costs that are predictable and easy to incorporate into a budget, unlike variable expenses which fluctuate based on production levels. Key examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, property taxes, utility bills, child care costs, tuition fees, and gym memberships. To calculate fixed expenses, one should gather their budget or income statement, identify the non-variable expense categories, and sum the amounts from each category. Managing fixed expenses is crucial as they can significantly impact overall spending and understanding these costs can lead to better resource allocation and budgeting decisions

2. Effective Budgeting: Tracking Income and Expenses Here you include all the sources of income you are going to have over the next month. For salaried employees, these include their monthly income, and you also add back the deduction such as health insurance premiums or provident funds that are deducted first before giving you your salary. Non-salaried individuals such as entrepreneurs and freelancers can work with a future income they expect to generate over the next month.

The text outlines the steps necessary for effective budgeting, which includes tracking income and expenses, and comparing the two to ensure spending is managed. Key points include: 1. **Tracking Income**: Monitor gross monthly income, which includes salary and bonuses. To calculate annual gross income, multiply your hourly wage by your weekly hours, then multiply by 52 and divide by 12 for monthly figures. 2. **Tracking Expenses**: Understand fixed costs (e.g., rent, insurance) and flexible expenses (e.g., food, entertainment). Utilize tools such as bank statements and receipts for accurate tracking. 3. **Comparing Income and Expenses**: Subtract total expenses from total income. A positive result indicates that you are spending less than you earn while a negative result shows overspending. 4. **Creating a Budget**: Set financial goals, adjust spending accordingly, and apply budgeting rules like the 50/30/20 rule to effectively allocate your income. This guidance helps individuals maintain financial health by promoting awareness of their earnings and expenditures.

The 50/30/20 Budget Rule with Examples

Explore the power of the 50:30:20 budget rule for effective financial planning. Learn how to manage your money wisely and achieve financial balance using this proven budgeting principle. Take control of your finances and pave the way for financial freedom.

3. Determining Your Ideal Savings Rate

Here you decide how much exactly you wish to save over the next month. The goals should be such that they are not easily achievable or unrealistic that you can’t save anything.

Determining your ideal savings rate is influenced by individual financial situations, lifestyles, and goals. Experts recommend setting aside at least 20% of monthly income for savings, which aids in creating an emergency fund, managing unexpected expenses, and planning for long-term objectives such as retirement.

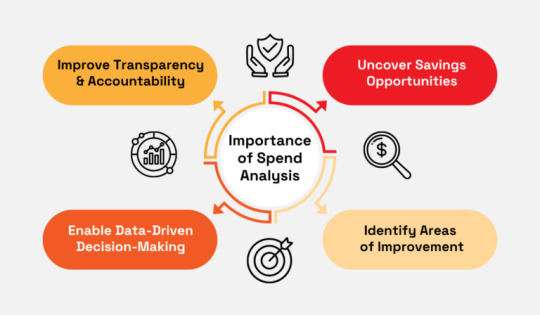

4. Analyze how much you can spend These expenses include all the expenses apart from your fixed expenses. Let’s try to understand all of these with an example. Let us assume you have an Income = 50000 Fixed Expenses (Rent, Utilities etc.) = 20000 Saving Goals = 10000 Then considering the above four points, the amount of money you are left to spend monthly is as follows: The money you can spend = Income – Fixed Expenses – Saving i.e. The money you can spend = 50000 – 20000 – 10000 = 20000 Thus, as an individual with a 50000 income, you are left with 20000 to manage all your expenses apart from your fixed expenses. Spend analysis is a method for understanding spending habits and identifying cost-saving opportunities. 1. Goal Identification: Clearly define what you aim to achieve with spend analysis, whether it's cost reduction or enhancing supplier performance. 2. Data Gathering: Collect all relevant spending data to ensure comprehensive analysis. 3. Data Management: Clean and organize this data to enhance accuracy and usability. 4. Spending Categorization: Group expenditures into categories to facilitate analysis. 5. Trend Analysis: Examine spending patterns to identify trends and recurring expenses. 6. Improvement Opportunities: Highlight areas where costs can be lowered or supplier performance can be enhanced. 7. Ongoing Monitoring: Regularly revisit and update insights to ensure they remain relevant. 8. Cost Reduction: Leverage insights to pinpoint specific areas for spending cuts. 9. Efficiency Improvement: Use findings to streamline operations for better efficiency. 10. Risk Mitigation and Strategic Support: Assess potential risks and utilize insights for informed strategic decision-making regarding investments or expansions.

By analyzing total expenditures, and zeroing in on specific business units, products, quantities, payment terms, and more, you get the answers to four crucial questions: What are we spending money on? Who are we spending it with? Are we getting what we need? Is there a better way to do this? The analysis can either be a comprehensive one or target just different categories of spend. Make your track record up to date regularly.

5. Divide the spending money by 4 The assumption being we have four weeks within a month. As an individual with 20000 spending money, you are allowed to spend a maximum of 5000 every week. Thus it would be best if you restricted your weekly expenses to 5000 such that you do not ever go over budget

The 40/30/20/10 rule is a budgeting method that allocates income into four distinct categories to help individuals manage their finances effectively. Key insights include: 1. Categories Explained:

The rule divides income into needs (40%), discretionary spending (30%), savings or debt repayment (20%), and charitable giving or financial goals (10%).

2. Needs Definition:

The 40% allocated for needs covers essential expenses like rent, mortgage, utilities, and groceries.

3. Discretionary Spending:

The 30% set aside for discretionary spending includes activities such as dining out, entertainment, and shopping.

4. Savings and Debt:

The 20% portion is intended for saving money or paying off existing debts, promoting financial security.

5. Charitable Giving:

The 10% of income is earmarked for donations or other financial goals, encouraging philanthropy.

6. Comparison to 50/30/20 Rule:

An alternative budgeting method, the 50/30/20 rule, simplifies the approach by categorizing income into needs (50%), wants (30%), and savings/investments (20).

7. Flexibility:

Both rules allow individuals to customize their financial plans according to personal priorities and circumstances.

8. Promotes Financial Awareness:

Adopting such rules encourages individuals to reflect on their spending habits and make informed financial decisions. The 40-30-20-10 rule offers a structured approach to budgeting that divides income into specific percentages for necessities, discretionary spending, savings, and charitable giving. The rule is grounded in long-standing financial wisdom, emphasizing the importance of living within one's means. It suggests allocating 40% of income for necessities like housing and groceries, 30% for discretionary expenses, 20% for savings or debt repayment, and 10% for charitable contributions.This budgeting method helps individuals create a balanced financial plan, tailoring it to their unique situations Differentiating between needs (essentials for survival) and wants (desires) is crucial for making informed financial decisions.The rule serves as a guideline, allowing for flexibility based on individual financial circumstances. Understanding and applying the rule can lead to improved financial health and future savings. Alternative budgeting methods similar to the 40-30-20-10 rule exist, offering variations in allocations while maintaining core principles. It provides a clear framework for managing finances, making it easier to track and control spending.

The Kakeibo method is a Japanese budgeting technique designed to help individuals manage their expenses and maximize savings by fostering mindful spending habits. 1. Definition of Kakeibo: Kakeibo translates to "household financial ledger" and was developed by journalist Hani Motoko in 1904 to aid homemakers in budget management. 2. Spending Awareness: The method encourages individuals to reflect on their spending habits, distinguishing between needs, wants, cultural expenses, and unexpected costs to better allocate their finances. 3. Categorization of Expenses: Kakeibo divides expenses into four categories: needs (essentials), wants (luxuries), culture (enriching experiences), and unexpected expenses (unforeseen costs). 4. Expense Tracking: Practitioners maintain two notebooks—one for ongoing expense tracking and another for summarizing weekly expenditures according to the four categories, promoting accountability. 5. Establishing Fixed Expenses: Users should first determine their fixed monthly costs, such as rent and utilities, which are critical for accurate budgeting. 6. Income Analysis: Assessing all sources of income and accounting for deductions (like health insurance) is essential for creating a realistic spending plan. 7. Setting Savings Goals: It is crucial to establish a specific savings target each month that is neither overly ambitious nor too easy to achieve, ensuring financial growth. 8. Budgeting Monthly Spending: After determining fixed expenses and savings goals, the remaining income is allocated as monthly spending money, which can be divided into weekly limits to maintain discipline. 9. Weekly Review: A comparison of planned versus actual spending at the end of each week fosters reflection on financial behavior and allows for adjustments in future spending to stay within budget. 10. Mindful Spending: The method encourages ongoing evaluation of expenses, helping individuals distinguish between essential and non-essential purchases to preserve their savings goals.

Other Kakeibo Lessons Delay any non-essential purchase till the next month. If you still feel the urge for that item after a month, analyze its affordability and what value it may add to your life. Always carry a shopping list when going to market for your monthly purchase.

The Kakeibo method is a disciplined approach towards expense management. This method teaches us the value of each expense made and the sacrifices that need to be made to achieve our targets.

We don't have to be smarter than the rest. We have to be more disciplined than the rest.

Warren Buffet said

Expense management is important because it helps companies control costs, meet budgets, and comply with regulations.

Thanks to all authors who wrote

Date of Publish: 10/ Jan / 2025

3 notes

·

View notes

Text

HOW IS IT APRIL ALREADY

who wants a chaotic life update coz here we go

We just submitted an offer on a house in palmy, eeeeeeeek. So moving to a whole other city an hour and a half away from where we currently live. Likely to be accepted and have been working through all the admin for mortgage approvals and selling our current home and buying new up there. We’ll be going from a 90m2 house to a 200m2 house on a larger section - it’s going to be hilarious to live somewhere so massive.

Antidepressants are the best things in the world I should have done them years ago.

Work is a wild shitshow, thanks to a prime minister who can’t accept that running a country and a company are two fundamentally different things. Consequently, work is currently calling for voluntary redundancies and then will kick off a change process in May. Will I have a job come 1 July? Who knows. Current math suggests job losses for ~1200 people across our 3500 ish back office staff so watch this space.

Thanks to antidepressants, I can’t even be stressed about this. It’s amazing!!!

Dave got a solid bonus this year, which is amazing. They did it so tough last year through all the flooding and having clients on suicide watch and everything else and they really Fkn earned it so yay. Waiting to find out what his pay rise will be as well.

At least both of us can keep our current jobs when we move and just commute a couple of days a week ( I’m in denial about the reality of this but anyway)

Naturally my sister and her husband couldn’t possibly be left out so have also put an offer on a house up there but it was so impulsive and a really dumb choice but it’s been accepted so their only hope now is they can’t sell their current house.

Fuck I’m glad we don’t have stamp duty in this country.

I signed up for an online bootcamp class on zoom that’s 530 every morning coz let’s be real I ain’t doing nothing after work apart from collapsing in a heap and it’s been so fun! They are v much like, this is your first start back in a while these are your regressions we expect to see you using them and then don’t shame you for it either? And are just like, too hard? Don’t use weights then? And my god is it ever a relief for my poor overweight body to not be forcing it to move in ways it can’t and reminding myself that actually I can do pretty amazing things if I give it a chance and it’s just been such a massive mental win. Maybe over the next few months I might get my eating sorted you never know.

I signed up for it as a 6 week challenge kinda thing and I’m 99% sure I haven’t lost any weight which was not at all the point of signing up for it - it was proving to myself I could be consistent with something and I’ve achieved that so yay.

Dave and I are good which is lovely. Even started talking to the counsellor about all my sex hang ups which is deeply unpleasant and awkward but at least it moving things along a bit??? 🤮🤮🤮😬😬😬😳😳

Have I mentioned lately how good antidepressants are honestly?? I have my brain back and my personality and it’s wild.

We wanna start having kids this year? Also wild.

Had a birthday and now I’m 34 and somehow it’s April? I do not understand time at all honestly.

I fucking love my new doctor he’s actually the best I will not be changing when we move.

I’m excited for a slower, quieter pace of life and more chill. I’m honestly done with my girl boss era. I’ve made the money and chased the titles and it’s exhausting honestly. (Watch this change again rapidly)

I was away for 7 of 8 weekends across Feb and March and it was INSANE. weddings. TAYLOR SWIFT ERAS TOUR!!!!! Birthdays and friend birthday and mum and I went to Pink and other birthdays and it was way too much. Oh, and house hunting mixed in. Plus ya know, a full time job in the mix.

It’s been a Fkn massive start to the year, and she ain’t slowing down any time soon.

Antidepressants man. Wild the difference they have made to my life. WILD.

Happy and grateful for my life and everyone in it and all the madness that it is right now. Someday it’ll be chill right??? I’ve been saying that since 2019 at some point I’ll accept that the answer is no.

Cool cool cool what a wild ride.

7 notes

·

View notes

Text

Conquering Debt: Strategies to Pay Off Credit Card Debts

Credit card debt is a financial burden that can weigh heavily on anyone, leading to stress and financial instability. However, with the right strategies, it’s possible to pay off credit card debts and achieve financial freedom. In this article, we will explore effective methods to manage and eliminate credit card debt, providing a comprehensive guide to help you conquer your financial challenges.

Understanding Credit Card Debt

Before diving into strategies to pay off credit card debts, it’s essential to understand what credit card debt entails. Credit card debt occurs when you use a credit card to make purchases and don’t pay off the balance in full by the due date. The remaining balance incurs interest, which can quickly accumulate and lead to significant debt if not managed properly.

The Impact of Credit Card Debt

Credit card debt can have several negative effects on your financial health:

High-Interest Rates: Credit cards often come with high-interest rates, which can make it challenging to pay off the principal balance as interest accumulates rapidly.

Credit Score Damage: Carrying high balances on your credit cards can negatively impact your credit score, affecting your ability to secure loans, mortgages, and even employment opportunities.

Financial Stress: The burden of credit card debt can lead to stress and anxiety, impacting your overall well-being and quality of life.

Strategies to Pay Off Credit Card Debts

Now that we understand the impact of credit card debt, let’s explore various strategies to help you pay off credit card debts effectively.

1. Create a Budget and Stick to It

Creating a budget is the first step in managing your finances and paying off credit card debts. A budget helps you track your income and expenses, ensuring that you allocate enough funds towards debt repayment.

Steps to Create a Budget:

1. List all sources of income.

2. Categorize and list all expenses, including fixed costs (rent, utilities) and variable costs (groceries, entertainment).

3. Identify areas where you can cut back on spending.

4. Allocate a specific amount towards debt repayment each month.

By sticking to a budget, you can ensure that you’re consistently making progress towards paying off your credit card debts.

2. Pay More Than the Minimum Payment

While making the minimum payment on your credit card keeps you in good standing with your creditor, it does little to reduce your overall debt. Paying only the minimum can extend your debt repayment period and increase the total amount of interest you pay.

To effectively pay off credit card debts, aim to pay more than the minimum payment each month. This approach reduces the principal balance faster, decreasing the amount of interest you accrue.

3. Prioritize High-Interest Debts

If you have multiple credit card debts, it’s essential to prioritize them based on interest rates. The “avalanche method” is a strategy where you focus on paying off the debt with the highest interest rate first while making minimum payments on other debts.

Steps for the Avalanche Method:

1. List all your credit card debts along with their interest rates.

2. Allocate extra funds towards the debt with the highest interest rate.

3. Once the highest interest debt is paid off, move to the next highest, and so on.

By targeting high-interest debts first, you can save money on interest payments and accelerate your debt repayment process.

4. Consider the Snowball Method

Another popular strategy to pay off credit card debts is the “snowball method.” This approach involves paying off the smallest debt first, then moving to the next smallest, and so on. The snowball method provides psychological motivation by giving you quick wins and a sense of accomplishment.

Steps for the Snowball Method:

1. List all your credit card debts from smallest to largest balance.

2. Allocate extra funds towards the smallest debt while making minimum payments on others.

3. Once the smallest debt is paid off, move to the next smallest, and repeat the process.

The snowball method can be particularly effective for those who need motivation to stay committed to their debt repayment plan.

5. Balance Transfer Credit Cards

A balance transfer credit card allows you to transfer your existing credit card debt to a new card with a lower interest rate or an introductory 0% APR period. This strategy can help you save money on interest and pay off credit card debts faster.

Steps to Utilize a Balance Transfer Card:

1. Research and compare balance transfer credit cards to find the best offer.

2. Apply for the card and transfer your existing credit card balances.

3. Pay off the transferred balance before the introductory period ends to avoid high interest rates.

Keep in mind that balance transfer cards may come with fees, so it’s essential to weigh the cost against the potential interest savings.

6. Debt Consolidation

Debt consolidation involves combining multiple credit card debts into a single loan with a lower interest rate. This strategy simplifies your payments and can reduce the overall interest you pay.

Steps for Debt Consolidation:

1. Assess your total credit card debt and research consolidation loan options.

2. Apply for a consolidation loan that offers a lower interest rate than your current debts.

3. Use the loan to pay off your credit card balances.

4. Make consistent payments on the consolidation loan until it’s paid off.

Debt consolidation can be an effective way to manage and pay off credit card debts, but it’s crucial to avoid accumulating new debt while paying off the consolidation loan.

7. Negotiate with Creditors

In some cases, you may be able to negotiate with your creditors to lower your interest rates or settle your debt for less than the full amount owed. Creditors may be willing to work with you if you’re experiencing financial hardship or if you have a history of making timely payments.

Steps to Negotiate with Creditors:

1. Contact your creditors and explain your financial situation.

2. Request a lower interest rate, a payment plan, or a debt settlement.

3. Get any agreement in writing to ensure clarity and protection.

Negotiating with creditors can provide immediate relief and make it easier to pay off credit card debts.

8. Increase Your Income

Finding ways to increase your income can provide additional funds to put towards debt repayment. Consider taking on a part-time job, freelancing, or selling unused items to generate extra cash.

Ideas to Increase Income:

1. Offer services such as tutoring, pet sitting, or house cleaning.

2. Sell items online through platforms like eBay or Facebook Marketplace.

3. Take on freelance work in your area of expertise.

Increasing your income can accelerate your ability to pay off credit card debts and achieve financial freedom sooner.

9. Use Windfalls Wisely

If you receive a windfall, such as a tax refund, bonus, or inheritance, consider using it to pay off credit card debts. Applying these unexpected funds directly to your debt can significantly reduce your balance and save you money on interest.

Steps to Use Windfalls Wisely:

1. Assess the total amount of the windfall.

2. Allocate the funds towards the highest-interest debt or the smallest balance.

3. Continue making regular payments to maintain momentum.

Using windfalls wisely can provide a substantial boost to your debt repayment efforts.

10. Seek Professional Help

If you’re struggling to manage your credit card debt, seeking professional help from a credit counseling agency or financial advisor can provide valuable guidance and support. Credit counselors can help you create a debt management plan and negotiate with creditors on your behalf.

Steps to Seek Professional Help:

1. Research reputable credit counseling agencies or financial advisors.

2. Schedule a consultation to discuss your financial situation.

3. Follow their recommendations and stick to the debt management plan.

Professional help can provide the expertise and resources you need to effectively pay off credit card debts and regain control of your finances.

Maintaining a Debt-Free Lifestyle

Once you’ve successfully paid off credit card debts, it’s essential to maintain a debt-free lifestyle to prevent future financial challenges. Here are some tips to help you stay on track:

1. Build an Emergency Fund

An emergency fund provides a financial cushion for unexpected expenses, reducing the need to rely on credit cards. Aim to save three to six months’ worth of living expenses in a separate, easily accessible account.

2. Use Credit Cards Wisely

If you continue to use credit cards, do so responsibly by paying off the balance in full each month. Avoid carrying a balance to prevent accruing interest and falling back into debt.

3. Live Within Your Means

Living within your means involves spending less than you earn and avoiding unnecessary debt. Stick to your budget, prioritize savings, and make mindful spending decisions.

4. Monitor Your Credit

Regularly monitoring your credit report and score can help you stay aware of your financial health and catch any errors or potential fraud early. Use free credit monitoring services and review your credit report annually.

5. Set Financial Goals

Setting financial goals provides direction and motivation to maintain a debt-free lifestyle. Whether it’s saving for a home, investing for retirement, or planning a vacation, having clear goals can help you stay focused and disciplined.

Conclusion

Conquering debt and paying off credit card debts is a challenging but achievable goal. By implementing the strategies outlined in this article, you can take control of your finances, reduce your debt burden, and work towards a financially secure future. Remember, the key to success is consistency, discipline, and a commitment to making positive financial choices. Start your journey today and take the first step towards a debt-free life.

2 notes

·

View notes

Text

How a Mortgage Broker Can Simplify Your Home Buying Experience

Buying a home is one of the most significant financial decisions many people will make in their lifetime. With numerous mortgage options, complex paperwork, and ever-changing interest rates, navigating the home buying process can feel overwhelming. This is where a mortgage broker comes in—a professional who can simplify the entire experience, saving you time, stress, and potentially a lot of money.

What Is a Mortgage Broker?

A mortgage broker acts as a middleman between you, the homebuyer, and potential lenders. Unlike a loan officer who works for a specific bank, a broker works with multiple financial institutions to find a mortgage that best fits your financial situation. Their role is to assess your financial status, shop around for loan options, and guide you through the application process.

How Does a Mortgage Broker Help?

Here are several ways a mortgage broker can streamline the home buying process:

1. Access to Multiple Lenders

Mortgage brokers have access to a wide range of lenders, including banks, credit unions, and private lenders. This extensive network allows them to compare multiple loan products and find one that aligns with your needs and budget. Instead of applying for loans individually, your broker can handle everything at once, presenting you with the best offers.

2. Expert Guidance and Advice

One of the most challenging parts of buying a home is understanding all the terminology and requirements surrounding mortgages. Mortgage brokers are experts in this area, and they can explain complex terms and conditions in a way that makes sense to you. They assess your financial situation, help you understand your options, and recommend the most suitable mortgage product.

3. Negotiating Better Rates

Because brokers work with numerous lenders and bring in multiple clients, they often have leverage to negotiate better interest rates and terms than a borrower could secure independently. This can lead to significant long-term savings.

4. Streamlined Paperwork and Documentation

Mortgage applications require detailed documentation, including income verification, credit history, employment status, and more. A mortgage broker will help you gather and organize all necessary paperwork, ensuring that everything is submitted correctly. This reduces the chances of delays or mistakes, keeping the process on track.

5. Time and Stress Savings

Instead of spending hours researching loans, comparing rates, and filling out multiple applications, a mortgage broker handles these tasks for you. They simplify the process by acting as a single point of contact for all your mortgage-related needs, making the entire experience less stressful and time-consuming.

6. Tailored Loan Solutions

Every buyer’s financial situation is unique. Whether you’re a first-time homebuyer, self-employed, or have less-than-perfect credit, a mortgage broker can help you find loan options tailored to your circumstances. They have experience with various loan types, including conventional, FHA, VA, and jumbo loans, ensuring you receive a solution that fits your specific needs.

7. Guidance Through Closing

The closing process is where many buyers feel the most overwhelmed. A mortgage broker assists with the final stages, ensuring that everything runs smoothly—from securing final loan approval to signing the necessary documents at closing. Their guidance reduces the chances of last-minute surprises, making the final steps of home buying seamless.

Is Using a Mortgage Broker Worth It?

For many homebuyers, especially those unfamiliar with the mortgage process, using a mortgage broker can be a smart move. The broker's expertise, access to multiple lenders, and ability to save you time and money make them a valuable asset. Some brokers charge a fee for their services, while others are paid by the lenders—so it’s important to discuss costs upfront. However, the potential savings from securing a better mortgage rate or avoiding costly mistakes usually outweigh these fees.

Conclusion

Purchasing a home doesn’t have to be a stressful or complicated experience. By working with an expert, independent mortgage broker, you can simplify the process, receive expert guidance, and find the best loan for your situation—all while saving time and money. Whether you're a first-time buyer or a seasoned homeowner, a mortgage broker can be the key to a smoother, more efficient home buying experience.

3 notes

·

View notes

Text

Affordable Housing Bubble

I'm worried about the processes by which the government are going to try to meet their campaign promises, I've already seen a few occasions where the Labour party, Rayner and Starmer have come under fire for falling behind on their affordable housing goal for this parliament, the opposition have pressed it a few times and the media have mentioned it.

1000 new homes per day

At the time of writing, we're 50 days into the government, that's 50,000 additional homes they've promised and I'm betting construction hasn't started on these.

There will be plenty of opportunities for private firms to buy land and secure the ability to build on it, build some homes. But private firms have a vested interest in producing fewer bigger more expensive homes, fewer homes available means less supply and higher demand increasing the prices.

With so many new affordable homes the intent of the government may be to pop the housing market, make houses more affordable by driving down both the price of new houses as well as existing ones.

This, if not done carefully, is going to saddle a lot of people with negative equity on their mortgages which may have economic knock on effects.

So Private companies are either going to be less inclined to take on this challenge as it bumps their risk while reducing their return on investment. Meaning the government are going to have to turn the screws to make this happen through other methods.

So we turn our attention to local authority housing and social housing providers to do this.

There are still some local authorities with housing stock that may be able to incorporate this into their systems, but if the housing stock was previously sold off developing a whole system to go along with the modern responsibilities of a social landlord is not something they can attempt