#cobra insurance

Text

Your Super Simple Guide to COBRA Health Insurance

Keep reading.

If you found this helpful, consider joining our Patreon.

#cobra#cobra insurance#insurance#health insurance#unemployed#healthcare#medical bills#hospital bills

13 notes

·

View notes

Text

Can I Use My HSA for Headache Medicine?

So you've opened one of the best HSA accounts on the market and made contributions to start saving for healthcare expenses. What can you use your health savings account (HSA) for?

These unique savings accounts are purpose-built to help you manage the cost of healthcare. They're tax-advantaged and can grow with you over time. Everything you put into the account is tax-deductible, and distributions for qualified medical expenses are tax-free. Even the interest you earn from investing in your HSA is tax-deferred.

There's a lot to gain from opening an HSA, but you don't have to wait to use it. While many people don't touch these accounts as they grow, you can start using them to reap the tax rewards. But what kinds of products can you pay for with your HSA?

Paying for Over-the-Counter Products

It's not just doctor visits and ER bills that count as qualified medical expenses. Several over-the-counter products apply, too. One common item many rely on to stay comfortable is headache medicine. There's no shortage of pain relievers like Tylenol, Ibuprofen, Advil or Excedrin to reduce symptoms and get relief.

All of those products are qualified medical expenses. You can use your HSA for headache medicine. But that's not all.

You can also use your HSA to pay for items like Epsom salts and heating pads to address bodily pain. It also covers allergy medicine, menstrual products and more!

How Do You Use an HSA for Over-the-Counter Products?

Utilizing your HSA for products at the drugstore is easier than you think. Many big-name pharmacy stores now label HSA- and FSA-eligible goods. Even online retailers have dedicated HSA and FSA stores, allowing you to find the products you need without worrying about documentation or approval.

When you pay for qualified products like headache medicine, you can use your HSA debit card like any other payment method. The best HSA accounts typically provide an easy-to-use card. When used, the funds will come out of your HSA directly. If you don't have an HSA debit card, you can request reimbursement from your provider with a receipt.

Read a similar article about HDHP strategy here at this page.

#hsa for financial advisors#hsa#flexible spending account#cobra insurance#form 1099-sa#hsa eligible expenses#best hsa accounts

0 notes

Text

What Are Cobra Benefits?

Having health insurance is important. Making sure your insurance doesn’t lapse is important too. In the instance, your health insurance lapses, you could suffer several injuries or issues that could end up costing you thousands of dollars. To help prevent this, COBRA (Consolidated Omnibus Budget Reconciliation Act) helps employees who lose their benefits to continue their benefits for a limited period. This can help workers and their families greatly. Let’s take a look at some of the COBRA insurance benefits and what that could mean to you and your family.

COBRA Insurance Benefits

One of the main COBRA benefits is the provision of health benefits in the instance an employee involuntarily loses their job, has their hours reduced, goes through a divorce, transitions to another job, or experiences a change in other major life events. It should be noted that employees may need to pay their entire premium and possibly up to 102 percent of costs associated with their plan. However, this is better than not being covered at all. COBRA provides all the necessary information to allow workers and their family to elect their continuation coverage.

In Addition to COBRA

Health savings accounts work with COBRA to save you additional money on your healthcare needs. HSAs are owned by the employee. After termination, an employee can still use their account balance to pay for healthcare expenses.

Set Up an HSA Today

Healthcare can be expensive, and you don’t want to be without coverage in the instance you suffer an injury or illness. In the event you lose your job or need other forms of safeguarding, an existing HSA can help you greatly. You don’t want to leave your healthcare needs to change. Contact Lively today to enroll in an HSA.

Read a similar article about healthcare and taxes here at this page.

#how to increase employee retention#insurance open enrollment process#high deductible health plan#cobra insurance#2023 contribution limits for fsa#how to optimize healthcare spending#options to invest your hsa

0 notes

Text

today, August 20, I finally received a letter in the mail, which was dated August 12, that my health insurance "is ending" [present tense, yes] on August 1.

such letter also advises me that if I want to continue my health coverage, one of my options is COBRA, which I should expect information about from my employer in the mail (I will give you one guess if I have received such information by now, 20 days after I was laid off)

this is definitely a functional and customer-friendly system! it's definitely very normal that it took them 12 days to send a paper letter to confirm this and they could not send an email about it instantly or at least within like, 5 business days???

#i literally signed up for a new plan thru the same insurance company yesterday.#because I was worried about waiting any longer for this alleged 'cobra information' and then not getting on any plan before september#i was like: surely this piece of mail can't be information about the new plan i just signed up for less than 24 hours ago lmao#i cant believe they sent me paper mail just to say the plan ended at this point#i've also definitely done all the opt-in settings for paperless notifications wherever possible#so i woudnt be mad about the paper mail coming late if i had also been emailed promptly.#nor would i be mad about this being someting that is maybe required to be notified on paper if it came sooner#but also it definitely is not the case bc ive ended a plan with this same company before#and got a confirmation email about it!!!!!#like i still have that damn email!#yes I'm still pissed off about this#rl sp#d

2 notes

·

View notes

Text

It's remarkable how little spread there is in the cost of COBRA plans. I have a low-price Kaiser plan right now, that is, in COBRA, only about $100/mo less than my Facebook plan, which was one of the best health insurance policies I've ever heard of. My FB policy was Aetna in-network (which almost not at all limiting) it was $10 copay per visit/procedure, with no approval (including MRI, childbirth, etc.) or deductable, and even allowed out of network stuff if you got certain prior approval (and that came with a chat app where people would help you get that taken care of). Like, the insurance was $750/month which is a lot, but it had almost zero mental load associated, and the rest of care was very cheap. If I had a choice to keep my current plan, or spend $100/mo more to get something that much better, I would seriously consider it.

Related, I went on the health insurance exchanges, and for $850/mo (no subsidy) I can get a plan that is worse than the employer one I currently have! I really don't mind employer health care, but it is weird that the big companies can get that much *better* insurance for exactly the same price, unsubsidized.

3 notes

·

View notes

Text

it's not often anymore that I am left looking for an Adultier Adult but health insurance does it every time

#because I have historically carried our insurance#it's time to decide if we go a month without insurance to get Good Hilton Insurance or go onto Leah's BCBS to avoid a lapse in coverage#American healthcare is a nightmare#And to be clear -- it is a nightmare and I am one of the lucky ones because I am married AND continuously employed#I went to try to enroll in COBRA to carry us the month over until we could get on my new insurance#and was told it would take 45 days to enroll which just#the fuck

13 notes

·

View notes

Text

I’m unemployed!!!! I’m free!!!!

#I can worry about getting a new job on Monday#I have to start worrying about signing up for health insurance now#forgot to do that last week when I first found out the company isn't COBRA eligible#they gave me a card that everyone signed (haven't had a chance to read it yet) and an engraved glass plaque

2 notes

·

View notes

Text

Ready for another year of helping clients who get their health insurance through Pennie!

Ready for another year of helping clients who get their health insurance through Pennie! Open enrollment starts November 1st 2024 and ends January 15th 2025! (215)355-2121 https://lnkd.in/bhhqqAJ

#aca#cobra pennie#COBRAalternative#cobraalternatives#healthinsurance#healthinsuranceinPA#healthinsurancenearby#HealthInsuranceNearMe#healthinsuranceNJ#pennie#penniehealth#PennieHealthEquity#penniehealthinsurance#penniehelp#PennieInsurance#penniepa#affordable care act#guidance health insurance self insured HRA#marketplace health plans obamacare#The Marketplace

0 notes

Text

.

#sometimes the inhumanity of this fucking country just hits me#my pregnant coworker just found out that when she goes on her (UNPAID) 12 week maternity leave she’ll be taken off her health insurance#her husband doesn’t seem to get insurance thru his job so that’s not an option#and in our dept we make too much money to qualify for gov assistance programs#she can pay $3000/month for cobra; her husband can get some corporate job ASAP; or she just won’t have insurance by th time she gives birth#we work in healthcare btw#the irony of a healthcare provider removing access to healthcare when it’s needed the most is apparently missed by HR#i don’t even know what to say at this point i’m so disgusted

0 notes

Text

fuck okay so my leave end this monday and i want to quit the same day

BUT i have a specialist appt for that FRIDAY to see if i have RA. i cant extend the current leave im on but i wonder if i can start a NEW leave just so i can keep this appointment before my insurance gets canceled

#txt#only idk if i can start a new like (personal) leave bc i dont have paperwork for another medical one#and COBRA is literally 250$ a month but i only need insurance for like one more week ugh

0 notes

Text

Our (Ridiculously Simple) Method for Choosing the Right Healthcare Plan For You

Choosing the right healthcare plan can be intimidating, especially if you’re doing it for the first time. The stakes are high; the options are confusing; there’s often a small window during which you can make the choice before you lose your chance; and the whole thing highlights the merciless jank that is our healthcare system!

Luckily, there’s an incredibly easy, 100% foolproof way to make the decision. Here’s our secret to choosing the right healthcare plan:

First, you put it off until there’s only, like, two days left to pick. Then, you forward all your onboarding documents to your dad’s wife, Carol. She is the perfect person for the task, being both generous and detail-oriented in a way you will never understand. Finally, you pick whichever one she says, and never think about it again until your soul walks the halls of the Duat and Anubis weighs your heart against Ma’at’s Feather of Eternal Truth.

Keep reading.

Like this article? Join our Patreon!

27 notes

·

View notes

Text

Short-term health insurance For temporary gaps in coverage

However, while short-term health insurance provides immediate relief, it’s essential to understand its limitations. These plans often exclude coverage for pre-existing conditions, preventive care, maternity care, and mental health services, among other essential benefits required by the Affordable Care Act (ACA).

As such, short-term coverage should be approached as a temporary solution while…

View On WordPress

#affordable health insurance#best health insurance#buy health insurance#cheap health insurance#cobra health insurance#health insurance#health insurance 101#health insurance explained#health insurance for self employed#health insurance marketplace#insurance#medical insurance#short term health insurance#short term health insurance explained#short term medical insurance#short-term health insurance#temporary health insurance#types of health insurance

0 notes

Text

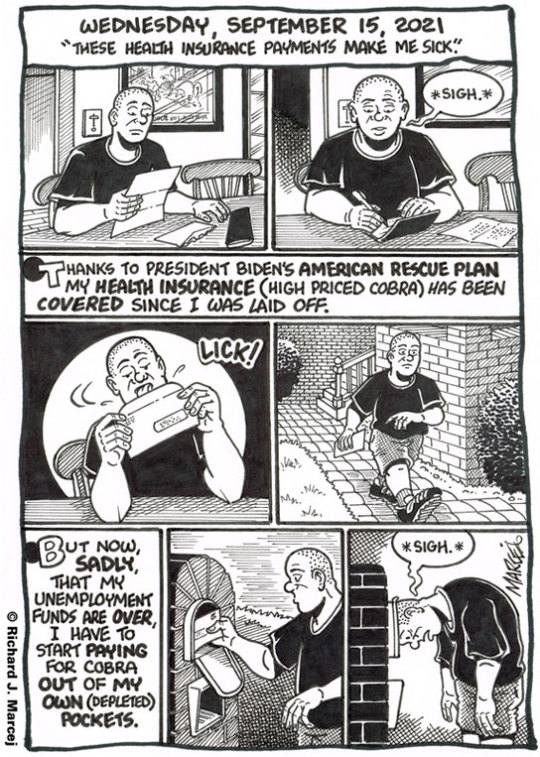

Daily Comic Journal: September 15, 2021: "These Health Insurance Payments Make Me Sick."

I was pleasantly surprised months ago when I realized my COBRA payments were covered. I was mailing in payments only to have them sent back, being told that they were covered.

I have NO idea how long my inability to get a job will last (or, to be truthful, if I’ll ever get a job again. After all I am 60) but all the money I’ve saved over the last six, several months, should come in handy now that…

View On WordPress

#A Check#American Rescue Plan#Bills#COBRA#Health Insurance#Joe Biden#Mail#Mail Box#Unemployment Checks

0 notes

Text

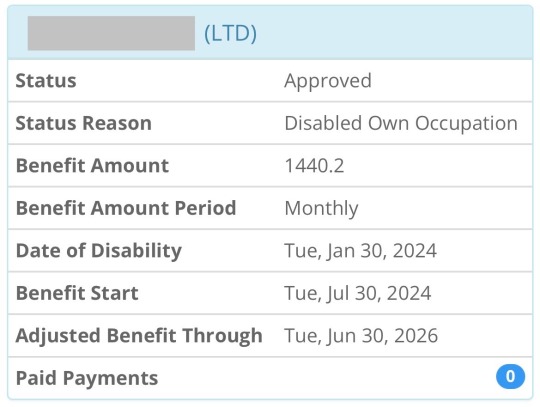

I got accepted onto long-term disability through my employer/the state, but that doesn’t take effect until August 1st because it’s based off of my resignation date with the district.

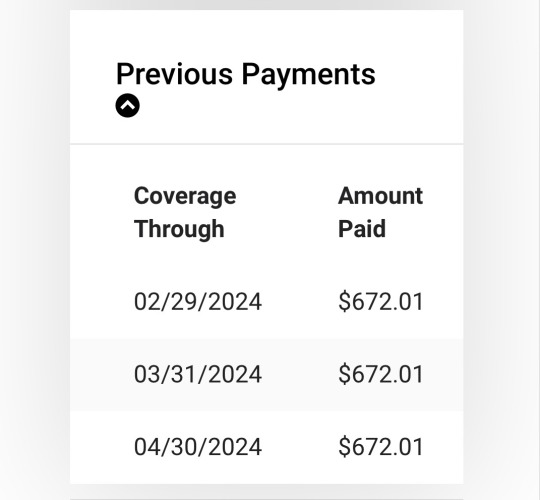

I’m making monthly $672.01 COBRA payments to keep my insurance until then, which I need for 100% of my nutrition and hydration through feeding tube and central line.

I’ll need $2016.03 to make it via COBRA alone until August. That’s on top of all of our other bills and my spouse working full-time.

If you can’t donate, please support me by reblogging and following my other socials so I can monetize my content on other platforms.

@ paralyzedguts on TikTok and Instagram, I make educational content about disability and other social justice topics. I’ve been featured on NowThis Impact and work with organizations like The Oley Foundation and G-PACT.

$0 / $2016.03

Cash.app: $forcewielder

Message for PayPal and Venmo

LinkTree

Amazon Wishlist (medical supplies)

Feeding tubes and port under the cut!

1K notes

·

View notes

Text

...In the suit, Faren asserts that she signed a severance agreement with ZeniMax, which stipulated that they’d provide her COBRA coverage (18 months of healthcare coverage after leaving the job) on the condition that she not file a discrimination lawsuit.

This was allegedly after a year of transphobic aggressions in her workplace after she came out (which the company seems to admit, if they’ve asked her not to file a discrimination suit). Oh, and she says she was pressured to come out because her supervisor outed her on Slack during a meeting before she could talk to the team herself. Faren documented all of this through screenshots, recorded phone calls, and more.

However, all of that isn’t even what the lawsuit is about. The suit is about what came next. ...

“In mid-June, Ms. Faren confirmed with Blue Cross and Blue Shield that she was still covered under the plan and scheduled her surgeries to take place in July. However, the coverage was retroactively terminated after the surgeries took place, leaving Plaintiff with hospital and doctor’s bills.

Ms. Faren continued to be without health insurance until September 25, 2022, resulting in high priced prescription drug payments, as well as physician and hospital bills, many of which she was not aware of for months following services. ..."

Even the most well-intentioned human resources departments don’t actually exist to help employees. They exist to protect the company from getting sued. That’s their main function. In Faren’s case, that happened in a straightforward way when her health coverage was held hostage so she wouldn’t file a discrimination lawsuit. But HR departments do this in more subtle ways, too. ...

4K notes

·

View notes

Text

I go through a week of yelling at both my HMO and COBRA to get them to reinstate the insurance I'm paying for and I had to call to make an in person visit to confirm I still have ADHD and finally that's all done and my health care is working again and I go to fill my prescriptions and 10 minutes later my doctor calls and says he can't give me ADHD meds because one of the times I was in office, my blood pressure was elevated.

GEE I CAN'T IMAGINE WHY I WOULD BE A LITTLE UPTIGHT AND STRESSED BY THIS QUALITY HEALTHCARE

155 notes

·

View notes