#coinbased

Text

How to Make Money on Coinbase: A Simple Guide

Coinbase is a leading platform for buying, selling, and managing cryptocurrencies like Bitcoin and Ethereum. With millions of users worldwide, it’s a trusted choice for both beginners and experienced traders. Here’s how you can make money using Coinbase.

Why Use Coinbase?

Coinbase offers:

User-friendly interface: Ideal for newcomers.

Top-notch security: Advanced encryption and offline storage keep your assets safe.

Diverse earning methods: From trading to staking, there are plenty of ways to earn.

Ready to get started? Sign up on Coinbase now and explore all the earning opportunities.

Setting Up Your Coinbase Account

Sign up on Coinbase’s website and provide your details.

Verify your email by clicking the link sent to you.

Complete identity verification by uploading a valid ID.

Navigate the dashboard to track your portfolio, view live prices, and access the "Earn" section.

Ways to Make Money on Coinbase

1. Buying and Selling Cryptocurrencies

Start by buying popular cryptocurrencies like Bitcoin and Ethereum at a lower price and selling them when the price goes up. It’s the basic strategy for making profits through trading.

2. Staking for Passive Income

Staking allows you to earn rewards by holding certain cryptocurrencies. Coins like Ethereum and Algorand offer staking options on Coinbase. It’s a straightforward way to earn passive income.

Maximize your earnings—get started with Coinbase today and start staking your crypto.

3. Earning Interest

Coinbase lets you earn interest on some of your crypto holdings. Just hold these assets in your account, and watch your crypto grow over time.

Advanced Trading with Coinbase Pro

For those with more trading experience, Coinbase Pro provides lower fees and advanced trading tools. Learn how to trade efficiently using features like market charts, limit orders, and stop losses to enhance your profits.

Coinbase Earn: Learn and Earn

With Coinbase Earn, you can earn free cryptocurrency by learning about different projects. Watch educational videos and complete quizzes to receive crypto rewards—an easy way to diversify your holdings with no risk.

Coinbase Affiliate Program

Promote Coinbase using their affiliate program. Share your unique referral link (like this one: Earn commissions with Coinbase), and earn a commission when new users sign up and make their first trade. It’s a fantastic opportunity for bloggers, influencers, or anyone with an audience interested in crypto.

Want to boost your income? Join the Coinbase Affiliate Program now and start earning commissions.

Coinbase Referral Program

You can also invite friends to join Coinbase and both of you can earn bonuses when they complete a qualifying purchase. It’s a win-win situation that requires minimal effort.

Conclusion

Coinbase is an excellent platform for making money in the cryptocurrency world, offering various ways to earn through trading, staking, and affiliate marketing. Explore all its features to maximize your earnings.

Ready to dive in? Sign up today and start earning with Coinbase.

#coinbase#bitcoin#binance#ethereum#bitcoin news#crypto#crypto updates#blockchain#crypto news#make money on coinbase

485 notes

·

View notes

Text

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

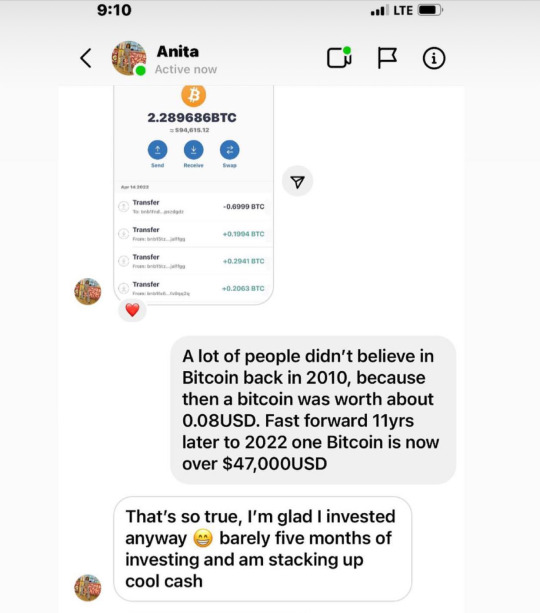

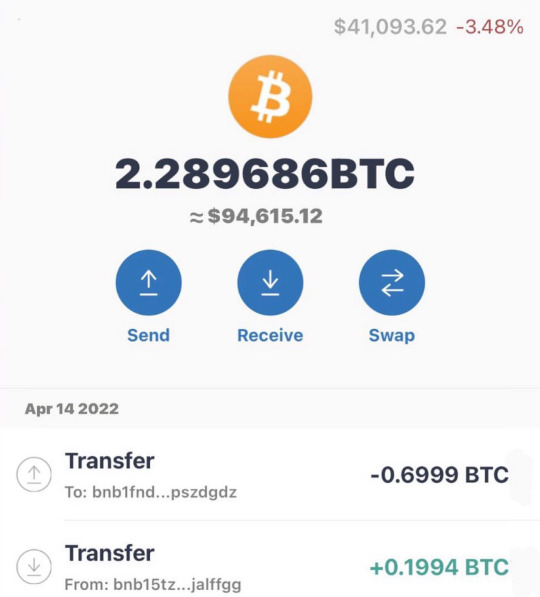

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

412 notes

·

View notes

Text

You guys remember when Dan Olson's "The Line Goes Up" video dropped and was so damning and incriminating that, overnight, hundreds of the most beloved content creators and Youtubers quietly dropped any and all mention/support of crypto in their videos?

#remember when jerma was sponsored by coinbase#remember when buzzfeed unsolved ryan and shane would make to the moooooon jokes#this isn't me making broad statements about these people that i don't know and often still enjoy and respect#i'm just watching the vid essay again rn and remembered#oh yeah being into crypto was extremely cool and normal for youtubers#until this single bombshell of a vid essay dropped and utterly embarrassed all of them.#personal#delete later

346 notes

·

View notes

Text

House of Emirates® in London is the first ever brand in the world to tokenize ancient coins and treasures and list them on the blockchain.

#houseofemirates #luxury #RWAs #blockchain #Tokens #shares #InvestmentOpportunities #Investments #trade #Stocks #StocksToBuy #StocksToTrade #London #DubaiLuxury #AbuDhabi #UAE #News #Silver #Gold #jewels #diamonds

#house of emirates#coins#antiques#ancient coins#luxury store#blockchaintechnology#blockchain#tokens#tokenization#bitcoin#coinbase#blackrock#token generator#artwork#art process#my art#drawing#art style#dogecoin#London#england#dubai visa#dubai#dubailife#dubairealestate#jobs in dubai#abudhabi#uae#luxury gifts#luxury

45 notes

·

View notes

Text

CAPTAIN WEBGENESIS // HOW TO FIND LOST BITCOIN

You can Recover Your Funds from Illegal Online Investment Scams with the aid of scam recovery companies. Captain WebGenesis, a certified Crypto Hacker with a US base who specialize in recovering lost cryptocurrency and assets, is who I would advise. My life retirement assets were saved by the Expert from an online fraudster. Any victim looking for an ethical hacker should get in touch with Captain WebGenesis to get your funds back.

99 notes

·

View notes

Text

Bitcoin has been the only outstanding cryptocurrency that has the ability to hitting $50k soon. We have a new trading technique called the FARM TRADING SYSTEM. Don’t be left out on this great opportunity of trading 💰🪙….

#shitcoin#poverty#non binary#ethereum#elon musk#bitcoin#binaryoptions#binance#crypto currency#crypto#investments#investment#blockchain#coinbase#coining post#solana#money#sol

24 notes

·

View notes

Text

Coinbase's Legal Battle with the SEC: A Push for Transparency and Clear Regulation

The ongoing tension between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken a new turn. In recent months, Coinbase has launched two significant legal actions against the SEC, reflecting the company's growing frustration with the regulatory environment for cryptocurrencies in the United States. These actions underscore the urgent need for transparency and clear rules in the rapidly evolving digital asset industry.

Lawsuit Over FOIA Requests

In June 2024, Coinbase filed lawsuits against both the SEC and the Federal Deposit Insurance Corporation (FDIC) for failing to comply with Freedom of Information Act (FOIA) requests. Coinbase's FOIA requests sought critical information on two fronts:

The SEC's View on Ethereum: Coinbase is particularly interested in how the SEC perceives Ethereum, especially after its transition to a proof-of-stake consensus mechanism. This shift has sparked debates about whether Ethereum should be classified as a security under current U.S. laws.

"Pause Letters": Coinbase also requested copies of "Pause Letters" referenced in an Office of Inspector General report. These letters could provide insight into the SEC's internal communications and strategies regarding the regulation of digital assets.

By taking legal action, Coinbase aims to compel these agencies to release the requested information. The company alleges that federal financial regulators are attempting to "cripple the digital-asset industry" and believes that greater transparency will shed light on the true motivations and actions of these regulators.

Petition for Rulemaking

The second significant legal action by Coinbase is its April 2023 lawsuit against the SEC, which seeks to force the agency to respond to a petition for rulemaking. Coinbase initially submitted this petition in July 2022, requesting formal guidance on the regulatory framework for the crypto industry. The SEC's prolonged silence prompted Coinbase to seek judicial intervention, hoping to secure a clear and actionable response.

This lawsuit highlights Coinbase's argument that the SEC's current approach—termed "regulation by enforcement"—is detrimental to the crypto industry. Coinbase asserts that the lack of clear rules creates uncertainty and stifles innovation. The company contends that formal guidance would provide the necessary clarity for businesses operating in the digital asset space.

Broader Context and Implications

These legal battles are part of a broader debate over the regulation of cryptocurrencies in the United States. The SEC has taken a stringent stance, asserting that most cryptocurrencies are securities and should be regulated as such. This perspective has led to numerous enforcement actions against various crypto companies, including Coinbase.

In March 2024, a federal judge ruled that most of the SEC's claims against Coinbase could proceed to trial, marking a significant setback for the company's efforts to dismiss the lawsuit. Coinbase argues that the SEC's aggressive stance is counterproductive and calls for a more collaborative approach to developing a comprehensive regulatory framework.

Aligning with Coinbase's Mission

These legal actions are not just strategic moves but are deeply aligned with Coinbase's mission statement of promoting financial freedom. By challenging the SEC and advocating for transparent and clear regulations, Coinbase is doing everything in its power to create an environment where digital assets can thrive. This dedication to financial freedom and innovation is at the core of Coinbase's goals, reflecting its commitment to transforming the financial landscape.

Conclusion

Coinbase's legal actions against the SEC and FDIC reflect a pivotal moment in the relationship between the crypto industry and U.S. regulators. By demanding transparency and clear rules, Coinbase is advocating for a regulatory environment that supports innovation while protecting investors. As this legal battle unfolds, it will undoubtedly shape the future of cryptocurrency regulation in the United States and potentially set precedents for other jurisdictions around the world.

#Coinbase#SEC#Cryptocurrency#CryptoRegulation#Bitcoin#Ethereum#FinancialFreedom#FOIA#Transparency#DigitalAssets#CryptoNews#Blockchain#LegalBattle#CryptoCommunity#CryptoInnovation#CryptoLaw#CoinbaseVsSEC#CryptoUpdates#DigitalCurrency#CryptoEconomy#CryptoLawyers#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

8 notes

·

View notes

Text

#UNDRGRND PURCHASE: MOTHMAN:\>A_MAGNETIC_RAIN_GAZE.GIF by @1bitnecro

UNDRGRND PURCHASES WORK FROM ARTISTS FEATURED IN UNDRGRND DIGS. THESE PIECES GO ON TO BE DISPLAYED IN THE UNDRGRND GALLERY.

#tezos (xtz)#nftmagazine#cryptoart#nft#nftcollection#crypto#nftcommunity#undrgrnd#nftgallery#nft4art#bitcoin#ethereum#binance#cryptocurrencies#coinbase#cryptoexchange

16 notes

·

View notes

Text

BITCOIN KING OF CURRENCY

Bitcoin, the revolutionary digital currency, has been making waves in the financial world since its inception in 2009. With its decentralized nature and secure transactions, it has gained popularity among investors and tech enthusiasts alike. In this article, we will delve into the world of Bitcoin, exploring its features, benefits, and the future it holds.

What is Bitcoin?

Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for intermediaries such as banks. It was invented by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Operating on a technology called blockchain, Bitcoin ensures secure and transparent transactions through a network of computers known as nodes.

How Does Bitcoin Work?

Bitcoin works on the principle of blockchain technology, a distributed ledger that records all transactions made using the indo3388 cryptocurrency. When someone initiates a Bitcoin transaction, it is broadcasted to the network of nodes. These nodes validate the transaction by solving info slot complex mathematical problems. Once verified, the transaction is added as a block to the blockchain.

Benefits of Bitcoin

Decentralization: Bitcoin operates on a decentralized network, meaning that no central authority controls or governs it. This provides individuals with more control over their finances and reduces the risk of government interference or manipulation.

Security: Bitcoin transactions are highly secure due to the use of cryptographic algorithms. Each transaction is digitally signed to ensure authenticity and integrity, making it nearly impossible to counterfeit or manipulate.

Anonymity: While Bitcoin transactions are public, users have the option to remain anonymous. Instead of using personal information, Bitcoin addresses are used, providing a certain degree of privacy.

Low Transaction Fees: Traditional financial institutions often charge hefty fees for international or large-scale transactions. Bitcoin eliminates the need for intermediaries, resulting in lower transaction fees, especially for cross-border transfers.

Global Accessibility: Bitcoin can be accessed by anyone with an internet connection, regardless of their geographic location. This allows for seamless international transactions and financial inclusion for the unbanked population.

The Future of Bitcoin

The future of Bitcoin looks promising, with its growing acceptance and adoption in various industries. Here are some slot gacor key factors shaping its future:

Increased Institutional Adoption: With companies like Tesla and Square investing in Bitcoin, institutional adoption is on the rise. This not only adds credibility to the cryptocurrency but also paves the way for more mainstream acceptance.

Technological Advancements: As technology evolves, so does Bitcoin. Innovations such as the Lightning Network aim to improve scalability and transaction speeds, addressing some of the current limitations of the network.

Central Bank Digital Currencies (CBDCs): Governments around the world are exploring the concept of CBDCs, digital currencies issued and regulated by central banks. This could potentially lead to a greater acceptance and integration of Bitcoin into the traditional financial system.

Store of Value: Bitcoin is often referred to as "slot online" due to its limited supply and scarcity. As a store of value, Bitcoin can act as a hedge against inflation and economic uncertainty, making it an attractive asset for long-term investment.

In conclusion, Bitcoin has emerged as a revolutionary form of digital currency, offering benefits such as decentralization, security, and low transaction fees. Its future looks promising, with increasing institutional adoption and technological advancements. Whether Bitcoin will become the currency of the future remains to be seen, but its impact on the indo3388 financial landscape is undeniable. So, are you ready to embrace the world of Bitcoin and explore the possibilities it holds?

#bitcoin#crypto#cryptocurrency#blockchain#defi#ethereum#bitcoin mining#coinbase#binance#crypto exchange

15 notes

·

View notes

Text

Coinbase Launches Wrapped Bitcoin (cbBTC) On Base: What to Expect?

Coinbase, a renowned American crypto exchange, has launched wrapped Bitcoin (cbBTC) on its Ethereum Layer-2 solution, Base. As a result, Bitcoin (BTC) holders can now access BTC on Decentralized Applications (dApps) on Base and the Ethereum (ETH) ecosystems.

3 notes

·

View notes

Text

I'm selling a bunch of shit, to try and make my phone bill on time tomorrow. My craft closet is getting stripped, so if any of you want just random AF doodads or craft supplies, DM me a (USPS) shipping sticker and I'll just send it to you -- free. Just ask and I'll lyk if I have anything that would work for your niche.

#if you want to donate via paypal. zelle. or coinbase... that's beyond cool... but I'd probably still send you a cute bobble.#i have a bunch of shit like old knives/swords. brooches. OG clothing from pre-90s. other stuff you'd prolly find in a Florida thrift shop

5 notes

·

View notes

Text

#video games#min#minecraft#youtube#gaming#minecraft oc#mine#not mine#mineblr#minecraft build#minecraft fanart#minecraft art#minecraft mods#minecraft villager#minecraft lore#crypto updates#usdt#miner scales#coinbase#sb crypto guru news#crypto news

2 notes

·

View notes

Text

youtube

3 notes

·

View notes

Text

Base: activity in Mainnet. Free NFTs on Base.

Base is a secure, inexpensive and user-friendly tool for Ethereum L2 developers that was created to attract users to web3. It’s worth mentioning that Base is built as an MIT OP Stack in collaboration with Optimism. And as stated by the Base team, they specifically joined Core Dev working on the OP Stack to make it publicly available to everyone.

According to the developers, Base is the easiest way for decentralized applications to use the products and distribution of Coinbase, which has over 110 million users with over $80 billion in assets in the Coinbase ecosystem, thereby once again putting an emphasis on scalability.

For almost six months, there has been a testnet. Activity in which was steadily covered in our airdrops section, and recently the project team announced the launch of Mainnet.

Preparation

To interact with the network, you will need to add it to our wallet. If you have already done this, you can skip this point.

Go to the site, connect the wallet and click Add to Metamask:

Preparation

Next, you will need to transfer funds. To do this, you can use both the official bridge and third-party ones. Each of these methods has its pros and cons.

Official Bridge

According to the crypto-community, this method is the most reliable and correct, but the deposit can only be made from the Ethereum Mainnet.

Go to the site and connect the wallet.

Enter the desired amount, click Deposit ETH and confirm the transaction:

Official Bridge

Stargate Bridge

Using this protocol has several pluses, namely: additional activity in LayerZero and the ability to make a transfer from the L2 network.

Go to the site and connect the wallet.

Choose the network from which we will transfer, for example, Optimism. Enter the desired amount, click Transfer and confirm the transaction:

Stargate Bridge

Orbiter Bridge

Another cross-chain protocol from which users expect a drop.

Go to the site and connect the wallet.

Choose the network from which we will transfer. You can choose L1 or any L2 and Base. Enter the desired amount, click Send and confirm the transaction:

Orbiter Bridge

Note: you don’t have to focus on one bridge. You can combine them, thereby hitting multiple protocols. For example, deposit funds using Stargate and withdraw via Orbiter.

Interacting with DeFi

Focusing on the criteria of past airdrops from similar L2, we can assume that this item is one of the main ones. It is desirable not only to make swaps of a couple of dollars, but also to gain the volume of transactions.

In the guide we will touch only a part of the protocols deployed on Base. A more extensive list can be found on DefiLlama. But always keep DYOR in mind.

SushiSwap

Go to the site and connect the wallet. If another network is selected, switch it to the right one:

Interact with SushiSwap. Step 1

Choose tokens for exchange. Enter the desired amount, click Swap and confirm the transaction:

Interact with SushiSwap. Step 2

Go to the Pools tab and select the Base network:

Interact with SushiSwap. Step 3

Select a token pair and click on it. Next Create position:

Interact with SushiSwap. Step 4

Click Full Range and add funds to the pool as shown in the screenshot:

Interact with SushiSwap. Step 5

You can find your position on the My Positions section. To withdraw liquidity, click on it. Then select the Remove tab. Specify the amount of funds you want to withdraw, click Remove and confirm the transaction:

Interact with SushiSwap. Step 6

Maverick

Go to the website and connect the wallet.

Choose tokens to exchange and make the exchange:

Interact with Maverick. Step 2

Next, open the Pools tab, select the desired pair and click on it:

Interact with Maverick. Step 3

Click Next. Select a mod (you can use Static) and click Next again. Enter the desired amount and confirm the addition of liquidity as shown in the screenshot:

Interact with Maverick. Step 4

You can find your position on the Portfolio tab. To close it, click Manage and then Remove. Select Select All and confirm the withdrawal of assets:

Interact with Maverick. Step 5

Aave

A borrowing protocol that allows you to borrow tokens against your cryptocurrency and also gives you the opportunity to lend your tokens at a small APR. In this article, let’s look at this particular mechanic.

Go to the site and connect the wallet.

Change the network to Base, if necessary, and click Supply:

Interact with Aave. Step 2

Enter the desired amount and confirm the addition by clicking Supply ETH:

Interact with Aave. Step 3

Withdraw assets by clicking Withdraw on the homepage.

Interacting with NFT

In this section, we will show you how to commit NFT to MintFun and provide you with a list of marketplaces that support Base.

MintFun

If you want to learn more about this marketplace and earn points for mint, you can visit our guide.

Go to the site, connect your wallet and select the Base network, as shown in the screenshot:

Interacting with MintFun. Step 1

Leaf through the page below, select your favorite collection and click on Mint Now:

Note: the site has both free and paid collections.

Interact with MintFun. Step 2

Choose the quantity of NFTs and confirm the mint.

NFTs can be sold and bought on the following marketplaces: OpenSea, Element, Zonic.

New Activity

Onchain Daily on Galxe

Go to Galxe and perform active tasks. To find out which activities you need to perform, click Detail:

Onchain Daily on Galxe. Step 1

In this task, you need to mint the NFT on the site:

Onchain Daily on Galxe. Step 2

Perform other tasks by analogy and watch for new ones:

Onchain Daily on Galxe. Step 3

Mint NFT

Go to Zora’s site and mint the memorable NFT:Mint a commemorative NFT on Zora

Note: mint deadline is March 1, 2024 at 22:00 (Kiev).

Getting Roles in Discord

The project has an extensive list of roles in Discord. You can get them with the help of Guild for various tasks. What actions you need to perform to get this or that role is described in detail on the portal itself.

Go to the Discord of the project and pass verification.

Open the site, connect to the portal using the wallet and social networks:

Next, look at the available roles and get the desired ones by performing this or that action.

Note: if you’ve been interacting with the Base network for a long time, some roles will count automatically.

After execution, return to the Discord of the project. Open the rolles branch, click Join BaseGuild to verify and get roles:

Base Onchain Summer

The project team has launched Onchain Summer campaign. The activity involves completing quests to accumulate points, which can later be spent in the Shop tab on merch. Predominantly the quests consist of minting various NFTs, the average price of which at the time of writing is around $2.5 in ETH.

There have been no official announcements about this or that prize pool in dollar equivalent. At the time of writing, the only confirmed rewards are merch. The store will launch in July, but it is not yet known how many points are needed to convert into physical merchandise. Do your own research and consider all risks because the costs are substantial.

Despite this, the campaign is official and the possibility of additional announcements cannot be ruled out. So for those who are active in Base with an eye on drops, it may be worth it to accumulate a few levels with risk management in mind.

Follow the link and connect Coinbase Wallet.

Choose a quest from the proposed categories and perform it according to the instructions on the site:

Note: verification of completion and crediting of points may be delayed.

Conclusion

The network has entered Mainnet relatively recently, but already has an extensive infrastructure that simply cannot be covered in one guide. If you are interested in this blockchain, the best solution is to explore and interact with different dApps yourself. This will multiply your chances of a drop if the project team decides to make one.

Highlights:

Blockchain has an extensive infrastructure.

You need to be active periodically.

You don’t need to perform all the above activities at once. The best solution is to stretch the walkthrough over several days.

It is important to rack up not only the number of transactions but also the volume of transactions.

2 notes

·

View notes

Text

Golem Network, an open-source computing platform, recently sold 24,400 ETH, valued at $72 million, across major exchanges like Binance, Coinbase, and Bitfinex, showcasing their strategic financial maneuvers. This sale significantly impacts Golem’s financial standing, leaving them with 127,634 ETH. Initially, Golem held 152,034 ETH, highlighting the cryptocurrency's appreciation since their ICO in 2016.

Transaction details reveal substantial activity: Binance received 5,930 ETH through multiple transfers, Coinbase received 1,769.99973679 ETH, and Bitfinex saw 1,200 ETH in transfers. These transactions total 8,899.99973679 ETH. Following these transactions, Golem's remaining ETH is valued at approximately $372 million.

In November 2016, Golem's ICO raised 820,000 ETH, worth about $8.364 million at the time, indicating significant value growth. Golem’s recent ETH liquidation underscores their strategic financial actions and highlights their robust presence in the cryptocurrency market.

3 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

2 notes

·

View notes