#creditors

Text

Welcome to Nightvale Ep. 226: Creditors

478 notes

·

View notes

Text

Elmore Bolling, he was too successful.

Elmore Bolling, whose brothers called him Buddy, was a kind of one-man economy in Lowndesboro, Ala. He leased a plantation, where he had a general store with a gas station out front and a catering business; he grew cotton, corn and sugar cane. He also owned a small fleet of trucks that ran livestock and made deliveries between Lowndesboro and Montgomery. At his peak, Bolling employed as many as 40 people, all of them African like him.

One December day in 1947, a group of white men showed up along a stretch of Highway 80 just yards from Bolling’s home and store, where he lived with his wife, Bertha Mae, and their seven young children. The men confronted him on a section of road he had helped lay and shot him seven times — six times with a pistol and once with a shotgun blast to the back. His family rushed from the store to find him lying dead in a ditch.

The shooters didn’t even cover their faces; they didn’t need to. Everyone knew who had done it and why. “He was too successful to be a Negro,” someone who knew Bolling told a newspaper at the time. When Bolling was killed, his family estimates he had as much as $40,000 in the bank and more than $5,000 in assets, about $500,000 in today’s dollars. But within months of his murder nearly all of it would be gone. White creditors and people posing as creditors took the money the family got from the sale of their trucks and cattle. They even staked claims on what was left of the family’s savings. The jobs that he provided were gone, too. Almost overnight the Bollings went from prosperity to poverty. Bertha Mae found work at a dry cleaner. The older children dropped out of school to help support the family. Within two years, the Bollings fled Lowndes County, fearing for their lives.

Elmore Bolling and his wife, Bertha Mae Nowden Bolling, in Alabama circa 1945.

#elmore bolling#bolling#alabama#creditors#african#kemetic dreams#africans#afrakan#brownskin#brown skin#afrakans#business#african american#bertha mae

252 notes

·

View notes

Quote

Stay tuned next for everything that’s already happened, but reversed. And as always. Good night, Night Vale. Good night.

Episode 226 - Creditors

57 notes

·

View notes

Text

Beautiful Tom 🖤

46 notes

·

View notes

Text

Studies have shown that those who do not eat food, consume water, and breathe air are all dead. wait- STOP RIGHT NOW, Harrison Kip! Were you about to complain in the tags that it’s all three at once??? Don’t do it, Mr. Kip! How can you need food/water/air if you really need food/water/air to survive???

This poll has been brought to you by our sponsor, The Council for Food/Water/Air.

#welcome to night vale#wtnv#wtnv podcast#wtnv 227#wtnv 226#wtnv 225#a word with dr. jones#creditors#renegotiations

14 notes

·

View notes

Text

Single women headed households as independent widows, deserted wives, single mothers and spinsters, earning their own livings, often on the breadline in rural communities, but sometimes very successful in towns: especially in luxury goods and retail business, lending small amounts of money to familiar faces – trusted creditors.

"Normal Women: 900 Years of Making History" - Philippa Gregory

#book quote#normal women#philippa gregory#nonfiction#single women#head of the household#independent#widow#deserted#wife#single mother#spinster#breadline#rural communities#towns#luxury goods#retail#moneylending#creditors#trusted

2 notes

·

View notes

Text

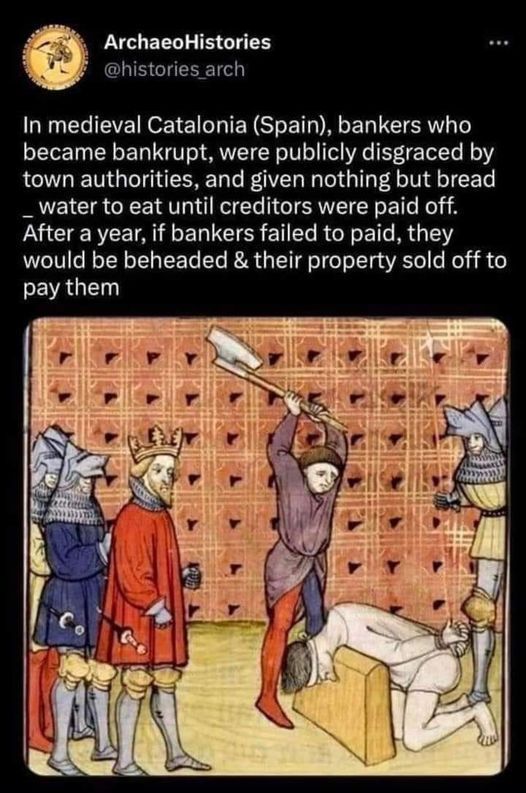

#archeology#archeaology#medieval#banking#justice#bankruptcy#execution#creditors#interesting facts#history

8 notes

·

View notes

Text

Just a blog to record some of Tom Burke's fabulous career. For even more details, highlights and links join us at https://www.facebook.com/groups/1505169286613179/?ref=share

#doctors dilemma tom burke#the musketeers#tom burke#the musketeers bbc#bbc strike#fedya dolokhov#the wonder#fyodor dolokhov#the show#Rosmersholm#creditors#lazarus project#true things

4 notes

·

View notes

Text

If you want things to go your way – go the right way.

I saw this picture come across my feed. Angelina Jolie (she is so beautiful) was in the backdrop. It read, “As long as you know your heart and intentions are pure, don’t explain yourself to anyone.” It reminded me of three things.

First, what my finance teacher told me in high school. Second, something I taught my kids and what I share with my clients. Third, when your intentions are good, you…

View On WordPress

#bill collectors#blessings#creditors#encouragement#favor#financial advice#good intentions#Inspiration#Motivation#pure heart#Purpose#well being

0 notes

Link

#BeTheMentor#Budgets#Creditors#DebtConsolidation#DesignYourOwnLife#Expenses#FinancialCoaching#FinancialEducation#FinancialFreedom#FinancialGoals#FromZero2Hero#IncomeGeneration#IncomeStreams#LeadByExample#SelfImprovement#SmallBusiness#YEVLPtyLtd

0 notes

Text

Akermon Rossenfeld Co: Effective Strategies to Get Out of Debt Fast

In today's fast-paced world, managing finances can be a daunting task. Unexpected expenses, mounting bills, and economic uncertainties can lead to overwhelming debt. However, with the right strategies and mindset, it is possible to regain financial freedom and get out of debt fast. In this blog, we will explore effective strategies offered by Akermon Rossenfeld Co, a renowned debt collection agency, to help individuals and businesses tackle their debt burdens.

Understanding Your Debt

The first step towards getting out of debt is understanding the nature and extent of your debts. Make a list of all your debts, including credit card balances, loans, and outstanding bills. Determine the total amount owed, interest rates, and minimum monthly payments for each debt. This will give you a clear picture of your financial situation and help you prioritize your debts.

Creating a Budget

Once you have a clear understanding of your debts, it's time to create a budget. A budget will help you track your income and expenses, identify areas where you can cut back, and allocate more funds towards debt repayment. Be realistic when creating your budget and make sure to include all essential expenses such as rent, utilities, and groceries.

Negotiating with Creditors

Don't hesitate to reach out to your creditors to negotiate lower interest rates or flexible repayment plans. Many creditors are willing to work with you to find a solution that works for both parties. Be honest about your financial situation and provide them with a realistic repayment plan. This can help reduce your monthly payments and make it easier to get out of debt faster.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can help simplify your debt repayment process and reduce the total amount of interest you pay over time. However, it's important to carefully consider the terms and conditions of the consolidation loan to ensure that it's the right choice for you.

Seeking Professional Help

If you're struggling to manage your debts on your own, it may be beneficial to seek professional help. Akermon Rossenfeld Co offers tailored debt solutions that can help you negotiate with creditors, consolidate debts, and develop a personalized repayment plan. Their team of experts has years of experience in debt management and can provide you with the support and guidance you need to become debt-free.

Changing Your Spending Habits

Getting out of debt requires a change in mindset and spending habits. Identify the habits that led to your debt accumulation and make a conscious effort to change them. Avoid unnecessary expenses, prioritize your needs over wants, and focus on building a solid financial foundation for the future.

Celebrating Small Victories

Getting out of debt is a journey that requires patience and perseverance. Celebrate small victories along the way, such as paying off a credit card or sticking to your budget for a month. These small wins will keep you motivated and focused on your goal of becoming debt-free.

Conclusion

Getting out of debt fast is possible with the right strategies and mindset. By understanding your debt, creating a budget, negotiating with creditors, and seeking professional help when needed, you can take control of your finances and work towards a debt-free future.

Akermon Rossenfeld Co is here to support you every step of the way with their effective debt solutions. Remember, financial freedom is within reach – all it takes is determination and a willingness to change.

#DebtFreeJourney#FinancialFreedom#DebtManagement#BudgetingTips#NegotiateDebt#DebtConsolidation#FinancialPlanning#PersonalFinance#MoneyManagement#DebtRelief#Creditors#FinancialGoals#DebtHelp#DebtSolutions#SmartSpending#FinancialEducationn.

0 notes

Text

Evergrande Group's Debt Crisis Threatens Global Economy: Will Chinese Real Estate Developer Avoid Liquidation?

#assetsales #Chineserealestatedeveloper #corporatedebt #creditors #debt #debtrestructuring #default #evergrandegroup #financialdifficulties #financialmarkets #globaleconomy #investors #liquidationproceedings #offshorebonds #propertymarket #slowingeconomy. #subsidiarystake

#Business#assetsales#Chineserealestatedeveloper#corporatedebt#creditors#debt#debtrestructuring#default#evergrandegroup#financialdifficulties#financialmarkets#globaleconomy#investors#liquidationproceedings#offshorebonds#propertymarket#slowingeconomy.#subsidiarystake

0 notes

Text

Challenging Possession of Property by Fixed Charge LPA Receivers

Fixed charge receivership is an important debt recovery tool for creditors in England & Wales, offering a legal avenue to reclaim outstanding debts secured against specific assets. The appointment of LPA Receivers often sparks debate surrounding property rights and debtor protections. In this article, we look at the legal landscape of fixed charge receivership in the UK, exploring its statutory…

View On WordPress

#ADR#banking#Banks#creditors#debt#freezing injunction#Injunctions#Insolvency#Insolvency Rules#Mediation#Mortgage Fraud#property#Property Disputes

0 notes

Text

Bankruptcy in the UK: What to Expect and How to Prepare

Are you teetering on the brink of financial ruin, the weight of insurmountable debt bearing down upon you like a suffocating weight?

Bankruptcy may offer a lifeline in the stormy sea of financial distress, providing a path towards redemption and renewal.

In this blog post, we embark on a journey through the realm of bankruptcy in the UK, shedding light on what to expect and how to prepare for…

View On WordPress

#Bankruptcy#BankruptcyAdvice#BankruptcyLaw#BankruptcyProtection#BankruptcyUK#Creditors#DebtForgiveness#DebtFree#DebtRelief#DebtRepaymentPlan#FinancialCrisis#FinancialFreedom#FinancialFreshStart#FinancialHardship#FinancialRecovery#FinancialStruggle#FinancialSupport#Insolvency#LegalAdvice#MoneyMatters

0 notes

Text

Tom Burke in “Creditors” (2010)

39 notes

·

View notes

Text

By the time Reg Uhr was back on the Suttor and Bowen in 1866, Philip Sellheim had walked off Strathmore and Cuthbert Fetherstonhaugh had lost the Hermitage to his creditors. Yet in his ruin Fethers found consolation.

For though I had money, labour, and to some extent, health, I had in a most extraordinary manner in 1865, while at The Hermitage, found that which is of a thousandfold greater value than riches, success and health all put together. I had found myself, I had found my own soul, and I had found God.

So many of his sins were now clear to him. But not on the list in his memoirs was the massacre of Aborigines.

"Killing for Country: A Family History" - David Marr

#book quotes#killing for country#david marr#nonfiction#reginald uhr#suttor river#bowen river#native police#60s#1860s#19th century#financial crisis#economic downturn#philip sellheim#strathmore#cuthbert fetherstonhaugh#the hermitage#creditors#consolation#money#labor#health#loss#riches#success#soul searching#finding god#born again christian#christianity#sins

0 notes