#dotcom bubble pop

Explore tagged Tumblr posts

Text

I don't even know yet what cohost is, but I already love them for their attitude about targeted ads.

adorable. doomed. sounds accurate tho

@ the people telling me cohost proves porn friendly social media is possible uhhh I don't know how to tell you guys this

they've been riding a temporary wave of people leaving twitter, and even with that behind them they only made around 10% of their operating costs in May

you can read their financial assessments yourself if you like, they are very upfront that profitability is all but impossible for social media without major investors who are willing to lose money on it (which means they are getting something else out of the deal, usually your data)

adorable. doomed.

they're a four person team with one superuser bankrolling them. I know their hearts are in the right place but I'd be amazed if cohost lasts another financial year. this is not proof of anything, the second payment processors notice they're hosting porn they are dead(er) in the water. sorry!

487 notes

·

View notes

Text

What kind of bubble is AI?

My latest column for Locus Magazine is "What Kind of Bubble is AI?" All economic bubbles are hugely destructive, but some of them leave behind wreckage that can be salvaged for useful purposes, while others leave nothing behind but ashes:

https://locusmag.com/2023/12/commentary-cory-doctorow-what-kind-of-bubble-is-ai/

Think about some 21st century bubbles. The dotcom bubble was a terrible tragedy, one that drained the coffers of pension funds and other institutional investors and wiped out retail investors who were gulled by Superbowl Ads. But there was a lot left behind after the dotcoms were wiped out: cheap servers, office furniture and space, but far more importantly, a generation of young people who'd been trained as web makers, leaving nontechnical degree programs to learn HTML, perl and python. This created a whole cohort of technologists from non-technical backgrounds, a first in technological history. Many of these people became the vanguard of a more inclusive and humane tech development movement, and they were able to make interesting and useful services and products in an environment where raw materials – compute, bandwidth, space and talent – were available at firesale prices.

Contrast this with the crypto bubble. It, too, destroyed the fortunes of institutional and individual investors through fraud and Superbowl Ads. It, too, lured in nontechnical people to learn esoteric disciplines at investor expense. But apart from a smattering of Rust programmers, the main residue of crypto is bad digital art and worse Austrian economics.

Or think of Worldcom vs Enron. Both bubbles were built on pure fraud, but Enron's fraud left nothing behind but a string of suspicious deaths. By contrast, Worldcom's fraud was a Big Store con that required laying a ton of fiber that is still in the ground to this day, and is being bought and used at pennies on the dollar.

AI is definitely a bubble. As I write in the column, if you fly into SFO and rent a car and drive north to San Francisco or south to Silicon Valley, every single billboard is advertising an "AI" startup, many of which are not even using anything that can be remotely characterized as AI. That's amazing, considering what a meaningless buzzword AI already is.

So which kind of bubble is AI? When it pops, will something useful be left behind, or will it go away altogether? To be sure, there's a legion of technologists who are learning Tensorflow and Pytorch. These nominally open source tools are bound, respectively, to Google and Facebook's AI environments:

https://pluralistic.net/2023/08/18/openwashing/#you-keep-using-that-word-i-do-not-think-it-means-what-you-think-it-means

But if those environments go away, those programming skills become a lot less useful. Live, large-scale Big Tech AI projects are shockingly expensive to run. Some of their costs are fixed – collecting, labeling and processing training data – but the running costs for each query are prodigious. There's a massive primary energy bill for the servers, a nearly as large energy bill for the chillers, and a titanic wage bill for the specialized technical staff involved.

Once investor subsidies dry up, will the real-world, non-hyperbolic applications for AI be enough to cover these running costs? AI applications can be plotted on a 2X2 grid whose axes are "value" (how much customers will pay for them) and "risk tolerance" (how perfect the product needs to be).

Charging teenaged D&D players $10 month for an image generator that creates epic illustrations of their characters fighting monsters is low value and very risk tolerant (teenagers aren't overly worried about six-fingered swordspeople with three pupils in each eye). Charging scammy spamfarms $500/month for a text generator that spits out dull, search-algorithm-pleasing narratives to appear over recipes is likewise low-value and highly risk tolerant (your customer doesn't care if the text is nonsense). Charging visually impaired people $100 month for an app that plays a text-to-speech description of anything they point their cameras at is low-value and moderately risk tolerant ("that's your blue shirt" when it's green is not a big deal, while "the street is safe to cross" when it's not is a much bigger one).

Morganstanley doesn't talk about the trillions the AI industry will be worth some day because of these applications. These are just spinoffs from the main event, a collection of extremely high-value applications. Think of self-driving cars or radiology bots that analyze chest x-rays and characterize masses as cancerous or noncancerous.

These are high value – but only if they are also risk-tolerant. The pitch for self-driving cars is "fire most drivers and replace them with 'humans in the loop' who intervene at critical junctures." That's the risk-tolerant version of self-driving cars, and it's a failure. More than $100b has been incinerated chasing self-driving cars, and cars are nowhere near driving themselves:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Quite the reverse, in fact. Cruise was just forced to quit the field after one of their cars maimed a woman – a pedestrian who had not opted into being part of a high-risk AI experiment – and dragged her body 20 feet through the streets of San Francisco. Afterwards, it emerged that Cruise had replaced the single low-waged driver who would normally be paid to operate a taxi with 1.5 high-waged skilled technicians who remotely oversaw each of its vehicles:

https://www.nytimes.com/2023/11/03/technology/cruise-general-motors-self-driving-cars.html

The self-driving pitch isn't that your car will correct your own human errors (like an alarm that sounds when you activate your turn signal while someone is in your blind-spot). Self-driving isn't about using automation to augment human skill – it's about replacing humans. There's no business case for spending hundreds of billions on better safety systems for cars (there's a human case for it, though!). The only way the price-tag justifies itself is if paid drivers can be fired and replaced with software that costs less than their wages.

What about radiologists? Radiologists certainly make mistakes from time to time, and if there's a computer vision system that makes different mistakes than the sort that humans make, they could be a cheap way of generating second opinions that trigger re-examination by a human radiologist. But no AI investor thinks their return will come from selling hospitals that reduce the number of X-rays each radiologist processes every day, as a second-opinion-generating system would. Rather, the value of AI radiologists comes from firing most of your human radiologists and replacing them with software whose judgments are cursorily double-checked by a human whose "automation blindness" will turn them into an OK-button-mashing automaton:

https://pluralistic.net/2023/08/23/automation-blindness/#humans-in-the-loop

The profit-generating pitch for high-value AI applications lies in creating "reverse centaurs": humans who serve as appendages for automation that operates at a speed and scale that is unrelated to the capacity or needs of the worker:

https://pluralistic.net/2022/04/17/revenge-of-the-chickenized-reverse-centaurs/

But unless these high-value applications are intrinsically risk-tolerant, they are poor candidates for automation. Cruise was able to nonconsensually enlist the population of San Francisco in an experimental murderbot development program thanks to the vast sums of money sloshing around the industry. Some of this money funds the inevitabilist narrative that self-driving cars are coming, it's only a matter of when, not if, and so SF had better get in the autonomous vehicle or get run over by the forces of history.

Once the bubble pops (all bubbles pop), AI applications will have to rise or fall on their actual merits, not their promise. The odds are stacked against the long-term survival of high-value, risk-intolerant AI applications.

The problem for AI is that while there are a lot of risk-tolerant applications, they're almost all low-value; while nearly all the high-value applications are risk-intolerant. Once AI has to be profitable – once investors withdraw their subsidies from money-losing ventures – the risk-tolerant applications need to be sufficient to run those tremendously expensive servers in those brutally expensive data-centers tended by exceptionally expensive technical workers.

If they aren't, then the business case for running those servers goes away, and so do the servers – and so do all those risk-tolerant, low-value applications. It doesn't matter if helping blind people make sense of their surroundings is socially beneficial. It doesn't matter if teenaged gamers love their epic character art. It doesn't even matter how horny scammers are for generating AI nonsense SEO websites:

https://twitter.com/jakezward/status/1728032634037567509

These applications are all riding on the coattails of the big AI models that are being built and operated at a loss in order to be profitable. If they remain unprofitable long enough, the private sector will no longer pay to operate them.

Now, there are smaller models, models that stand alone and run on commodity hardware. These would persist even after the AI bubble bursts, because most of their costs are setup costs that have already been borne by the well-funded companies who created them. These models are limited, of course, though the communities that have formed around them have pushed those limits in surprising ways, far beyond their original manufacturers' beliefs about their capacity. These communities will continue to push those limits for as long as they find the models useful.

These standalone, "toy" models are derived from the big models, though. When the AI bubble bursts and the private sector no longer subsidizes mass-scale model creation, it will cease to spin out more sophisticated models that run on commodity hardware (it's possible that Federated learning and other techniques for spreading out the work of making large-scale models will fill the gap).

So what kind of bubble is the AI bubble? What will we salvage from its wreckage? Perhaps the communities who've invested in becoming experts in Pytorch and Tensorflow will wrestle them away from their corporate masters and make them generally useful. Certainly, a lot of people will have gained skills in applying statistical techniques.

But there will also be a lot of unsalvageable wreckage. As big AI models get integrated into the processes of the productive economy, AI becomes a source of systemic risk. The only thing worse than having an automated process that is rendered dangerous or erratic based on AI integration is to have that process fail entirely because the AI suddenly disappeared, a collapse that is too precipitous for former AI customers to engineer a soft landing for their systems.

This is a blind spot in our policymakers debates about AI. The smart policymakers are asking questions about fairness, algorithmic bias, and fraud. The foolish policymakers are ensnared in fantasies about "AI safety," AKA "Will the chatbot become a superintelligence that turns the whole human race into paperclips?"

https://pluralistic.net/2023/11/27/10-types-of-people/#taking-up-a-lot-of-space

But no one is asking, "What will we do if" – when – "the AI bubble pops and most of this stuff disappears overnight?"

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/19/bubblenomics/#pop

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

tom_bullock (modified) https://www.flickr.com/photos/tombullock/25173469495/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

4K notes

·

View notes

Text

AFTER 10,000 YEARS I'M FREE! Nah, not really. But I am here to tease my upcoming fic Wild Pitch on this Seven Sentence Sunday.

Full disclosure, this fic was initially written for another fandom under a different name and is being recycled and changed in some ways to make it Tarlos-centric. I'm truly excited to be able to bring it back. It is a Tarlos college, enemies-to-lovers AU, and one of my favorite fics I have ever written. Enjoy this peek and look out for more teases and the full fic in March. 💜

Where was his phone charger? TK’s phone charger was literally always in the exact same spot. He never moved the damn thing from the outlet by the head of his bed. He moves his nightstand to see if maybe the cord had fallen behind, but even the plug itself was gone. He feels the beginning of a headache starting to form by his temples, his irritation growing. He moves to his desk, knowing that he always has spare cords laying around, and sure enough, none of them are where they should be either. Though his toothpaste was in his toiletry bag on his desk, exactly where it should be. Carlos. Gods, they couldn’t go a day without this, could they? He draws a slow, deep breath, pinching the bridge of his nose. Against his better judgement, he reaches for his phone to send a text message. This was going to be as fun as a trip to the dentist, he realizes as he selects the contact listed simply as ‘Don’t Answer.’

Have you seen my phone charger? TK hits send before he can think better of the fire he is likely playing with. It takes a few moments before the little speech bubble pops up, indicating that a reply is being typed. His fingers drum lightly against the back of his phone, his brow furrowing at the response he receives. You really seem to have a problem keeping track of your things lately.

Tagging: @emsprovisions, @sapphic--kiwi, @carlos-in-glasses, @tellmegoodbye, @heartstringsduet

@alrightbuckaroo, @chicgeekgirl89, @cold-blooded-jelly-doughnut, @carlossreaders, @eclectic-sassycoweyes,

@firstprince-history-huh, @literateowl, @lightningboltreader, @mikibwrites, @nisbanisba

@nancys-braids, @captain-gillian, @paperstorm, @reyesstrand, @strandnreyes

@thisbuildinghasfeelings, @welcometololaland @lemonlyman-dotcom @henrygrass + Open tag

37 notes

·

View notes

Text

𝕄𝕦𝕥𝕦𝕒𝕝𝕤 !

↝My fellow penguins :3

— “ THERE ARE TIMES WHEN YOU'RE ON THE SAME WAVELENGTH AS THE ARTIST- ”

☆yukari — @ryuryuryuyurboat

✮aurora — @auroratumbles

☆rosey — @achy-boo

✮pix — @sleepypengwin

☆shin — @realkavehgf

✮snob — @snobwaffles

☆zee — @thestarswhisper

✮mori — @haliyarobin

☆star — @staretes

✮wysty — @wystiix

☆loqua — @manager-of-the-pudding-bank

✮eli — @overthemoonx

☆cazzie — @wonuyun

✮shojun — @sh0jun

☆heia — @heiayen

✮ura — @ura-niia

☆dresvi — @floraldresvi

✮mika — @glacialheart

☆mirei — @milk-violet

✮june — @strxnged

☆andi — @pookiepup

✮soup — @suiana

☆yeul — @y3u11aiu

✮eden — @ethereal-edens

☆rainbow — @bubble-pop-dotcom

✮ying — @mlkbwunnies

☆ @kizakiss

✮ @endataraxia

☆ @milkcake09

✮ @in-kaeya-we-thrust

—☆

If you'd like your name to be removed from this list or would like to change anything, please send me a dm (either on Tumblr or Discord) or ask!! I promise I will not get mad or anything

—☆

I forgot where these dividers came from so if someone knows pls tell me... (I'll look for them in a bit I promise I have to dig through my reblogs)

29 notes

·

View notes

Text

Are there any estimates for how much money per user tumblr needs to break even?

It’s common to think of Tumblr as an unkillable cockroach because it has survived several predictions of doom in the past, but note that all of those occurred in the cheap-money era when, even if Tumblr wasn’t making a profit, it was basically fine to ignore it and let it do its thing quietly off in the corner if it wasn’t losing too much money. That’s no longer the world we live in and, as @togglesbloggle mentioned, I do think there’s a good chance Tumblr will stop existing in the next 1-3 years. You should have a plan and exit strategy for if that happens.

(And if you want it not to happen, you need to get the subscription for ad-free tumblr or buy the checkmarks or something. Zero-interest rates and adtech made everyone forget this, but you really do have to pay for the stuff you use.)

2K notes

·

View notes

Text

so, let me see if i can trace this history for you. first (you'll see it's not at all the first but let's start here), the dotcom bubble. a large number of highly funded startup internet corporations preached promises about the immediate leap in quality of life they were about to cause. this was mostly a ruse to fool their credulous peers into generating venture capital, and just when the thing was about to pop, something unexpected happened. a mild, unassuming search engine named after a number figured out how to monetize the large dataset its unprofitable business was based on by using it to direct targeted advertising. suddenly every internet company who didn't figure out how to do this was dead

next, the housing bubble. the similarities are a bit hard to trace but let me see if i can outline them. a large number of highly funded fintech corporations preached promises about the immediate leap in quality in life they were about to cause (by selling overpriced houses to people who couldn't afford them and changing the available credit rating of the loans by bundling them into packets by the millions, called mortgage backed securities). this was mostly a ruse to fool their credulous peers into generating investment revenue, and just when the thing was about to pop, nothing unexpeted happened. nobody invented a crucial, game-changing innovation, and the whole thing was at risk of collapse. so, naturally, the government apologized to them and bailed everybody out, because that's not how business-tier capitalism is supposed to work

currently, we're doing another one. in retrospect it's probably going to become called some incredibly stupid industry term, like "the compute bubble." we spend a lot of time talking about AI, but i'm not sure who would win between the three if you compared capital outlay against quantum computing and datacenters. which one spent the most? (probably not quantum computing.) which one made the most? (probably datacenters.) is it that straightforward? (no, AI happens at datacenters)

anyway, a large number of highly funded compute corporations preached promisess about the immediate leap in quality of life they were about to cause. this was mostly a ruse to fool their credulous peers into generating revenue, and just when the thing was about to pop -- well, i guess you'll have to tune in next week, huh? this week's radio show has been sponsored by the eternal inflation model of cosmology. do you worry about what's going to happen to your profit margins after the heat death of the universe? stop that! and come on down to the eternal inflation megachurch

24 notes

·

View notes

Text

Thanks to @mikibwrites for the tag! Here is a snippet from a story about I’m referring to simply as Date Night.

‘Wish I was at home with you,’ TK’s text had read, and Carlos had pulled his phone from his pocket at the farmers market, standing among the sparse thrum of weekday shoppers, and frowned. His heart aches so easily when TK’s does, and he typed out an immediate reply.

‘Bad day, baby?’

It had taken TK almost three minutes to respond, text bubble popping up and disappearing, as if he was typing the message and then deleting it, typing and then deleting, all while Carlos stood there in a strange sort of liminal space, strangers ambling past him between stalls as he stood there waiting.

‘Difficult day,’ was the eventual reply. Carlos found his favourite fruit vendor, and bought two punnets of strawberries.

No pressure tags go to @carlos-in-glasses @lemonlyman-dotcom @basilsunrise @iboatedhere @rmd-writes @sanjuwrites @largepeachicedtea @taralaurel @chaotictarlos and @bonheur-cafe

#the strawberries are relevant to date night shenanigans#tarlos fic#tk strand#carlos reyes#tarlos#wip wednesday

50 notes

·

View notes

Text

BATTLEFLAGG presents: Ghosts

Expansive indie rock meets synth pop

BATTLEFLAGG

Produced by Daniel Knowles (Sharon Van Etten, Cigarettes After Sex), the song is the first off of his EP Solastalgia. The music is inspired by the missed connections while one's known world disappears into the rearview.

He shares, "Solastalgia is defined by philosopher Glenn Albrecht in his 2005 article on the subject as “the homesickness you have when you are still at home,” where you may find your home environment changing in distressing ways. It is a lived evanescence of what you have always known, like standing in one place as the life, memories and places fade away. Unlike nostalgia, solastalgia is distressing and is often attributed to environmental or other changes completely out of one's control.

Check the cool indie video of Ghosts in YouTube:

youtube

The project of Philadelphia-based singer/songwriter, Jeff Hartwig, Battleflagg was conceived in 2020 after demoing a new set of songs and feeling the need to regain some agency in an age of personal, social and political unrest. Battleflagg is not so much a band but a collective of like-minded musicians and visual artists, formed during the pandemic to combat an age of creeping cynicism. With a sound that blends traditional rock instrumentation with ambient synths, drum loops and samples, Hartwig’s Battleflagg songs seek to straddle the Heartland/Americana/Indie rock divides, leaning into direct, heart-on-sleeve lyrics and arena-size, sing-along choruses.

Hartwig’s musical backstory is prolific. His first pro gig was opening for the Ramones as the lead singer of King Flux, made up of former members of punk rock innovators the Plasmatics, a show for which he was castigated by Johnny Ramone for jumping on Johnny's stage box during the opening set. After a year of powering through the downtown scene at CBGBs and other Lower East Side clubs, King Flux dissolved -- Richie Stotts, the band's founder, went on to grad school -- and Hartwig found himself opening as a solo act for bands on the Blues/Americana circuit, including The Holmes Brothers, Clarence Gatemouth Brown and Commander Cody.

Looking for a change of sound and scenery, the singer-songwriter moved to San Francisco in the late 90s, where he immediately fell into a thriving Indie/Americana/Punk scene. Fronting an Americana(ish) band called the Dangs, he established a strong following playing with then-rising bands Third Eye Blind, Cake and Train, who the Dangs opened for at the Fillmore Auditorium on the release of Train’s debut album. The Dangs also shared stages with many Americana/Indie acts while on tour, including Dave Alvin, The Connells, and Dash Rip Rock.

As the new Millenium approached, Hartwig inked a deal with About Records -- a UMG-distributed imprint formed by veteran music executive George Daly and producer/engineer Chuck Plotkin (Bruce Springsteen) -- as a solo artist, spending a year writing and developing songs for his first release. When About reorganized in the wake of the bursting dotcom bubble, however, Hartwig lost the momentum and was ready to make a change, this time to law school.

instagram

Over the next decade, Hartwig pursued a career in corporate law, all the while continuing to write songs and playing the occasional live show. In 2019, with numerous demos in hand and a new desire to be a part of the democratization of music distribution, Hartwig contacted Brit-Award winning producer, Chris Potter (Richard Ashcroft, Rolling Stones), who agreed to produce Battleflagg's first EP, The Blood Meridians, which was released by Hartwig's own label, Resolute Juke, in November 2022. The Blood Meridians was recorded in London and the south of England and would feature talent from both the UK and US, including the guitar work of Rob Marshall (Humanist) and Steve Wyremann (Richard Ashcroft), the drumming of Steve Sidelnyk (Seal), and the soul-searing vocals of Miko Marks.

After the release of The Blood Meridians, Hartwig again set the production process in motion. Upon hearing Sharon Van Etten's hit single, "Mistakes", and loving the sonic vibe, he reached out to its producer, Daniel Knowles (SVE, Cigarettes After Sex), to see if Mr. Knowles would have interest in producing his upcoming EP. Knowles listened to the demos and readily agreed to be a part of the project. After almost 18 months of recording and mixing, the new EP, Solastalgia, is ready for its release on January 7, 2025 (with its first single Ghosts to be released December 4, 2024). Co-produced by Knowles and Battleflagg, the breadth of musical collaborators on Solastalgia even exceeds that of The Blood Meridians and includes members of The War on Drugs, Ethel Cain, Japanese Breakfast and Elvis Costello.

When asked what he hopes people would take away from listening to his new music, Hartwig says "When listening to these songs, I want the listener to understand, and feel the power of, the simple snapshots described within, and how such moments are common to many. Hopefully, in understanding that the experiences in the songs are common to all of us, particularly in the face of massive change, the listener will find a deeper connection to the people and places around them."

0 notes

Text

Wouldn't be the worst, I just wish we had a functional search engine to go with it.

Before tumblr there were forums, before discord there was irc. Whatever happens to social media in the new economic paradigm, we'll still find ways to talk to each other all across the world.

Even if we might not have free image hosting when we do.

39 notes

·

View notes

Text

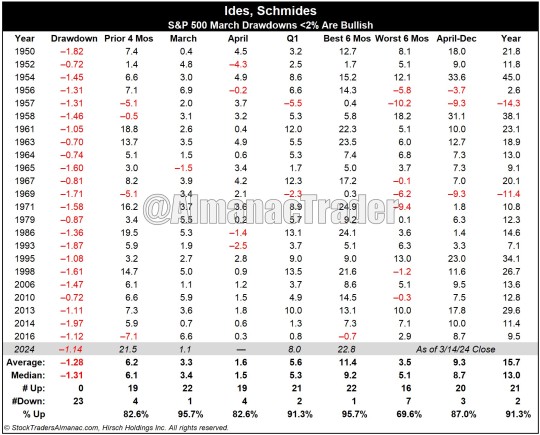

Ides, Schmides – March Drawdowns <2% Rather Bullish

While our 2024 outlook has remained decidedly bullish since our December “2024 Forecast: More New All-Time Highs Anticipated,” we’ve warned to “Beware the Ides of March.” That this overbought market is due for a pullback. That stuff happens in March, especially in election years (think 1980 Hunt Bros, 2000 Dotcom Bubble Pop and 2020 Covid Crash).

But what does it mean if this AI-driven bull powers ahead through March without a hitch? Well, it’s bullish, that’s what. Gains beget gains and when macro forces overpower weak seasonality, those forces often gather momentum when the seasonal period ends.

While there is still time left for March’s history of volatility to kick in, especially during notoriously treacherous week after Triple Witching, should the market escape the usual March retreat that would support continued robust bullish market action for the rest of 2024. When March’s drawdown is <2% the Best Six Months November-April are up 95.7% of the time, average gain 11.4%; Worst Six Months are not bad, up 69.6% of the time, 3.5% average; rest of the year is up 87% of the time, average 9.3%; and the full year is up 91.3% of the time with an average gain of 15.7%.

0 notes

Text

A short history of my parents and my relationship with them

This is personal and longer than I thought it would be, so I'm putting it under the cut.

My parents are by no means perfect, and certainly have a lot of boomer issues (they are actually boomers and were both raised devout Catholic) but their life hasn't been easy. My mom is second generation Italian-American, and grew up under their parents who were discriminated because of being Italian. She grew up on an apple orchard, and when she was 3 she got scarlet fever during a winter harsh enough that the Dr couldn't visit and diagnose until much later, and we believe that the fever itself caused brain damage amongst other long term issues. Because of her parents growing up during the 20's and during the Great Depression, the idea of any support you need is a crutch was ingrained in her and so she refused to get mental health therapy until it was severely needed and then only went till it wasn't severe (and specifically for OCD), meaning that her anxiety was virtually unchecked. She struggled in school because of the brain damage (it was the early 60s so developmental disabilities weren't respected), and struggled at home because of... well it's the 60s and her parents were Catholic, so domestic abuse was rampant, so she certainly suffered from even if she doesn't view it as trauma. Her anxiety totally unchecked, even to this day. Both of my parents are definitely neurodivergent, but was forced to hide it and cope, so they don't fully understand why I haven't been able to do the same.

My parents met in Highschool, and they got married just after my mom graduated HS. My mom went to school for interior design (she wanted to be an architect but the school refused to let her pursue that because "women can't do math." My dad is endlessly optimistic. Trying to have a serious conversation about bad shit happening is… trying. They were married for almost 20 years before they had me, and when I was born my mom developed a form hyperthyroidism called Graves Disease, which causes fatigue and anxiety, and has plagued her mental health the rest of her life.

My parents had saved up a modest amount of money, so they decided to move to NC. Just after my dad left his job (he worked in telecommunications), bought a piece of land and started building a house, then the dotcom bubble popped, before we even got to move to NC. We arrived, but jobs in my dad's field were totally gone, so he went back to school (he didn't finish college because Bell South offered him a full time job with full training and it was '72 so who even needed a degree then). At the same time, my mom's Graves Disease got really bad and they had to burn out her thyroid with radiation therapy, which was a lot on her system. My maternal grandma had a stroke, and despite having more money than us, none of my mom's 3 siblings were willing to take her in, so we did. My dad, who just finished one of his trade school degrees, again couldn't find a job thanks to the 2008 recession. We lost our only car and our house, my dad still blames himself for that and the mental health issues that came from that experience no matter how many times I try to convince him otherwise (honestly I'm glad it happened so early to me, otherwise I wouldn't've discovered communism). It forced my mom to get a job, but the recession was still on, she was a stay at home mom for 17 years and the interior design field was dead, so the only job she could get was Home Depot. Honestly I don't even remember what my dad did at that time, he was working 2 jobs and went back to school again.

My relationship with my parents is always tenuous. They both grew up in loud, extremely social families, and they cannot comprehend my struggles with socializing, let alone socializing with family. E.g. my mom sends messages near this long at least once a week, with messages every other day that are at least 500 words, and that's after down after me having to go low contact on them because of how overwhelming it was (she expected a similarly sized reply, and tri-weekly phone calls too). They both have what I used to think of as "word rot," in that they talk to fill space with literally anything, and "bulldoze" over others beginning to talk because they're still talking (I swear I have no idea how they do it). This was really hard to grow out of, I felt uncomfortable because I didn't have space to think, but also I felt uncomfortable when I was alone because I didn't have that when I was developing.

They were not accepting of me coming out as trans, and the only way I could get them to respect it was through threatening low contact, which I had to follow through on for 4 months. They still supported and loved me, but because I was their child, not because of who I am. They're much more respectful now, though I do still feel that they're just putting on a face because they want to see me, not because they respect who I am.

They have a hard time keeping up with my mental gymnastics, and view their childhoods mostly through rose-tinted glasses: To them, their parents were near flawless parents, so they always fallback on "the parent is always right," or WWJD. My dad has no idea how to handle trauma and it's near impossible to get serious reflection out of him, so I have no idea how to approach this, because it usually devolves into me having to make neutral counterpoints that are relatively pessimistic compared to his views. That often gets overblown into "You're being too negative," or getting frustrated with beating my head into a wall to the point where I feel that the only way to get through to them is by pointing out extreme counterpoints, which are shocking enough that they refuse to believe it and shut down that line of topic. Honestly I still don't know how to approach them about this, because their views that "Everything is God's plan", "being older = being wiser", "Parents always know what's best for their child" and that somehow their personal logic doesn't line up with mine mean that I feels like unless I present an ultimatum there is no learning from the conversations.

On top of all that, I don't have their traditional view of family, as I believe that family is who to choose and not from whom you're born, and because of that plus my family not understanding how I interact with others, I felt pushed away, and pushed away myself.

All that said, I care about them deeply because they are honest and do their best, even if it's misguided at times. Saying I love them is difficult, partially because of my drive to be fair clashes with it: would I love them if I didn't live with them for 20 years? I don't know. At the same time, I care about them so much and I want to see them grow, to enjoy life, to follow their dreams.

I guess I do love them

4 notes

·

View notes

Text

As the clock is about to strike 12 & reset our life, I thought of you and the journey that we have been on. Still walking the tight rope between the past and the future with a knowing that life is about to be structurally shift forever in this magnificent year that’s upon us. We are together part of a history that’s being written in our own personal capacity & as each cell of our body contributes to us similarly each one of us contributes to the collective universe we create - together we are creating a new world & we collectively have a choice how we want it to look like.

When Saturn Pluto start their 34 year synod on 12th Jan (geocentric) or 10th Jan (heliocentric), we reset the very fabric that creates our little microcosm of existence. It’s the set of life rules, structural boundaries that we live by which help us decide every big decision we take e.g. what road we take when we arrive at a fork. And usually year before this final conjunction is spent in creating this fork cause decision doesn’t just suddenly comes with this conjunction. We are given time & 2019 was that time cause 2020 is showtime. So fork roads were created, choices presented, multiple options created when Jupiter in Sagittarius expanded our vision in 2019 to include more choices in life, making us aware that we are & can be & should be more than we thought we were. We thank 2019 for presenting us through push or pull choices - yes gift of choices that we have.

Now with Jupiter joining Saturn Pluto in Capricorn participating in two other synods in 2020 will tell us to choose. Choose one path. Cause duality isn’t a path of choice for earthy mountain goat Capricorn which will dominate 2020. We are being given the gift of Long term prosperity & growth but at the cost of loosing a few detours & focussing our gifts. There are no wrong choices - but there is always one that our soul chooses cause that’s what we want to experience in this lifetime. What’s the experience your soul wants to choose - it doesn’t have to feel easy - when we try to imagine the path forward it seldom feels easy. Cause it’s new with a lot of unknowns & yeah many always have not made it. But what fundamentally feels like “you”, we didn’t come here to live another’s life - each life is unique like our prints - our prints left after us would be each unique. What legacy you want to leave ?

At this stage I will quote Yoda “Do or do not, there is no try” - Jupiter in Capricorn is Yoda’s words personified - choose a path, make it your own, own it live it eat it drink it in 2020. That’s the road to success in no uncertain terms of this year that’s upon us. Three synods, 5 eclipses, multiple retrogrades of planets in their ruling signs - there is no question that world globally as we know it will turn to what we have never seen before in 2020. We would be writing history. What is yours ? Jupiter in Capricorn rewards the focussed, the well planned, the one that’s willing to burn the boats cause it knows in its soul that he or she will take over the island in 2020.

You have to do one thing in this eclipse season which will accelerate the process - choose.

That’s why Mercury has just joined the party of planets in Capricorn- in this period between the two eclipses - Solar eclipse that just passed on 26th Dec and Lunar eclipse that’s upon us on 10th Jan - you will find yourself getting clarity on your choice. We want to dedicate 2020 to one & only one goal. It’s gotto be material, it has to have an end goal in mind - mountain goat doesn’t climb to infinity - it has an end goal material one - well we are material beings having a substantially material experience & using that for our souls evolution. We do have to be careful though on the material part taking over - don’t forget this is for YOU - this experience this life this goal is for YOU so it has to fulfil you - it’s not about what’s “material” to the rest of the world. Cancer eclipse of 10th January will bring that message loud & clear.

There is no way for us to miss our destiny & cosmos in 2020 will make sure of it - more importantly it will teach us how to successfully live our destiny. Sometimes we get there but don’t know how to keep it.

Saturn in Capricorn creates base of a legacy that lasts - you would never again respond to life’s structural challenges in the way you did before. It’s not a New Years resolution - it’s just the new way of life that’s born & lived - with Saturn - there are no fireworks but we never go back to old rulebook. We can never go back & you would in no uncertain terms know when you are back tracking. 8th January Jupiter Ketu conjunction will remind us of old ways of clinging to a comfort zone we must not go back to anymore. Comfortable is subjective - it’s more of familiar that we are clinging onto - 8th Jan events & those around will give you a clue what boat you aren’t burning still - holding you away from your future as past feels too rosy.

Pluto in Capricorn makes sure we are being true to our power & not compromising it for the sake of worldly success as much as we would be driven to “succeed” in all material senses in 2020. Drive will be at its peak but can’t compromise our truth - you would never again suppress your strength & power to “smooth over” the ripples that you would create in 2020. You would never again doubt who you know you truly are. Again it’s not a New Years resolution cause resolution self extinguish by third week of January- this is the new structure of our life which is there up on us to be lived. And sometimes Pluto pushes us to that optimal breaking point before the element we are made of shifts from dusty carbon to diamond - Pressure will be dialled up from day 1.

Read the writing on the wall of your new life when it comes with a clear messaging on 12th Jan as Mercury is a participant in Pluto Saturn conjunction so new world order doesn’t begin in silence - it begins in a clear exchange of words. Actions of the new start come in full swing in March but January early & bright we know in clear words what 2020 is going to be about. As I said focus is key this year & focus is created early & bright. Mercury is grounded, intellectually, fantastically structured in Capricorn so we discuss objectively, decide for our prosperity & future what’s best & we do the right things. It couldn’t be in a better sign at this time & we couldn’t have a knowing more clear as we would in my view at this time. But voila just like that fate is written & crafted and administrative structures shift, rules seem to be rewritten, decision seem to be decided and we spend 2020 in making the path we have chosen a success..

That’s how I see it.

There will be bubbles that would pop cause Pluto Jupiter synod is known as a bubble buster of dotcom bubble burst fame. Mid year in July we would see certain industries & companies or enterprises which were never meant to be Long term or took short cuts in reporting etc not following the moral code of signature earth sign year - disappear into the thin air from where they suddenly came. Credit will be tight from the get go & we would see corporate greed rampant in first half as earth’s shadow side breeds overly focus on resources & power hog by a few which would ultimately not go well. If there was a year to thoroughly follow a moral code, it would be 2020 cause karma in my view would be instant. It’s not about loosing your flexibility, it’s about showing that you want it enough & you are willing to follow the right route to get to it. Don’t loose sight of following the requisite steps in drive to get there.

Dedicate less hours to wondering why it can’t happen for you & more on making your effort efficient - darkness of thoughts is a side effect of too much earth energy but a working cloud makes its darkness rain hard & makes it count - make every dark thought coming to you count for it indicates how much more you want it - and a strong desire finds a way. Get busy working, planning, finding answer - when you see a dark cloud, make it rain!

Never before a sea of people were gifted with such defining aspects that would shape history - let’s make each day of 2020 count.

Happy new year!

2020 key focus areas of each sign

♈️ Aries - Career growth, public image, leadership style & positions, life structure & path, father, dealings with authority & becoming the authority of ones own life. Physical body & health

♉️ Taurus - Travel, education, publication of significance, becoming a teacher, sharing your higher knowledge, philosophy & higher mind, expanding the framework of your mind by exposing yourself to totally different & variant experiences & thoughts. Growing in knowledge, influence & gaining back sense of adventure

♊️ Gemini - Year of regaining personal & physical strength through learning the art of merging resources, talents with other people & standing your ground in partnerships. Period of rebirth as you finally find your life purpose & come in your full element especially after May.

♋️ Cancer - Partnerships, contracts, significant others & their place in your life versus you & your life path. Year of walking your life purpose but more importantly learning how to walk it with your committed partner/s. Partnerships come in more than one form & shape, learning what’s the model of yours

♌️ Leo - Mind body connection - finding the job or work environment that fulfils you & gives your sense of purpose - healing your body health. Understanding you & only you are the master of your life & your daily life events - taking control of your daily environment & hence health.

♍️ Virgo - Love, passion, hearts desires - living the life on your terms for your passions - betting it all in some senses - taking a chance on yourself & for yourself. Finding what floats your boat emotionally & professionally - leaving now stone unturned to find it & get it. Children or the child like joy from within filling your heart up & your Life - like a karmic blessings from beyond

♎️ Libra - Home, family, real estate - your grounding your base - like coming home to yourself in peace & security . Coming from a place of security & confidence propelling you on solid ground to new big professional shifts & life path changes that are upon you in tandem

♏️ Scorpio - your words your mind your communication skills & commercial aspect of your skills - writing, reading, selling, talking, Publishing - reframing restructuring your mind & reaping the rewards of what you have learned by sharing it with the world in commercially viable ways

♐️ Sagittarius - Finances, assets, your values & ability to generate material abundance from your skills - the skills you mastered or learned or honed in 2019, nows the time to reap commercial & financial rewards from it - creating new assets & monetary growth from existing assets. Establishing your valets system & your self worth as you master the art of turning around financial situations for you & for yours

♑️ Capricorn - You - you are surely the focus & in spotlight with so many major planets focusing their light on you - your life path, physical body, leadership skills reset to a trajectory you didn’t know existed as you are introduced to you in all your strength. Use each day of this year wisely with focus towards your goals as you are gifted with expansion opportunities not seen before as the very frame from which you looked at your life is expanded & enhanced. Happy birthday & it’s surely the year of Capricorn!

♒️ Aquarius - Long distance travel, healing, psychology, untapped potential/ skills / talents - time of God’s timing with hidden support & strength opportunities showing up as your life resets from end 2020, this year will feel like your soul journey where you might be alone sometimes but always with support from beyond - huge amount of faith & rebirth of belief in life & your place in the universe. Lot has been happening below the surface much of which comes above the surface from March.

♓️ Pisces - Network, social influence, big wealth, vision, platform, mass influence, friends, business network, your position in social networks & society of influence - your vision & social influence and position is given a boost as you walk boldly on the path you think is your life’s purpose with the set of people who support you, help you, build you up to bring out your natural gifted talents to larger set of audience or people to benefit the society. World needs good leaders but more importantly it needs visionaries and you fit the bill.

Good luck & much love and success for 2020 💕

Love & more

#2020 astrology horoscope#aries#taurus#gemini#cancer#leo#virgo#libra#scorpio#sagittarius#capricorn#aquarius#pisces#astrology#horoscope#aries 2020#taurus 2020#gemini 2020#cancer 2020#leo 2020#virgo 2020#libra 2020#scorpio 2020#sagittarius 2020#capricorn 2020#aquarius 2020#pisces 2020#2020 astrology#2020 horoscope#capricorn 2020 astrology horoscope

105 notes

·

View notes

Text

@bubble-pop-dotcom

actually no, we're not "dating". we're bound together for infinity. like the stars. so, fuck you, actually.

115K notes

·

View notes

Video

vimeo

Most popular websites since 1993 from James Eagle on Vimeo.

Our #DigitalEconomy has experienced several rapid waves of evolution. It began with Dotcom companies, where over exuberance saw fortunes lost when the tech bubble popped.

But even before that the search engine emerged. It eventual brought #Google into our daily lives. A fews year down the line, just 15 years ago, #socialmedia also exploded into our live.

What will be the next emergence? Perhaps the dominance of video conference sites like Zoom?

Nothing about #digitalisation is preditable. In just a few decades the digital economy has changed, reinvents itself and disrupts our lives. It’s exciting, exhilarating and slight frigtening to watch. That’s why I created this #datavisualisation.

If you like this, why not follow me. There will be plenty more data stories like this to come.

Music: Jabali by Xack, Epidemic Sounds

What did I use to make this? For this piece I used Python to build the dataset. I then used the D3 package of Javascript to built this racing pie chart.

If you would like to share this data visualisation on LinkedIn or any other social platform, you're more than welcome to. All I ask is that you credit me in your post.

Below is a downloadable link to the video file: lnkd.in/eanV8KAi

#digital #economy #tech #digitalization

0 notes

Text

How would you describe the economy that Gerald Ford inherited from Richard Nixon?

COMMENTARY:

Nixon inherited the inflation from the way LBJ financed Vietnam and the economic stagnation from the end of the war. Nixon and Moynihan collaborated on the economic policy to end the resulting “Stagflation” by implementing the conversion of the Military Industrial Complex to the Aerospace Entrepreneurial Matrix made possible by Eisenhower’s 1956 Presidential Platform. Affirmative Action was the legilative package designed to achieve those outcomes. Affirmative Action was the precursor to the Green New Deal.

Ford and Carter inherited both the Stagflation and Affirmative Action and if either Carter or GHW Bush had been re-elected, the Green New Deal would have spontaneously appeared, globally, to support a NASA-Soyuz base on the moon by 2001, just like the movie. The stagnation ended with the combination of electronic trading on Wall Street and Reagan’s deficit spending for the impending Desert Storm battle. The inflation persisted until Clinton’s economic program tripped a Wall Street correction after the March Triple Witching in 1994 and all the inflation got flushed out along with the unhealthy speculative froth characteristic of the structural moral hazard of Reaganomics.

This was the beginning of the Clinton semi-Green New Deal, which persisted until the Enron Engergy gambit popped the dotcom bubble and Bush/Cheney began to create the conditions for the 2008 mortgage crises.

Reaganomics has stalled the Green New Deal for 40 years. The Movement Conservatives who came to town with Reagan in 1981 remain committed to restoring the Free Market milieu of Herbert Hoover’s pre-Social Security/United Nations plantation economic model.

Apollo 11 created a global synergies wave that Nixon recognized as an opportunity to take America through a cultural looking glass into a new Star Trek paradigm. Silicon Valley is a legacy of the combination of Affirmative Action and this global synergies wave. The ZOOM culture is the looking glass we have begun to go through because of Covid-19. Biden’s Build Back Better $2.2 Trillion Infrastructure Reparations and Renewal Capital Budget will take us the rest of the way if we can get Moscow Mitch and the House Freedom Caucus out of the way.

The Nixon-Moynihan Affirmatic Action is an example of the Hegelian dialectic synthtesis and was based squarely on Critical Race Theory. The movie Putney Swope illustrates their common understanding that Critical Race Theory is a capitalist tool.

Ford inherited this agenda to improve the economy and enrich the world.

0 notes

Text

yknow it's wrong to say that investment "cooled" through the whole 2000s. It returned strongly in late 2002, it kept getting stronger up til 2008 collapsing all sorts of things temporarily, and THEN its things kicking back up around 2010. In part because tech investments had done better than the general market through the 2008 crisis.

Because the big story of the 2000s was that consumer adoption skyrocketed. Broadband, real computers, phones and smartphones in particular.

User growth at all costs quickly reasserted itself because of this: a wildly successful user count in like 2000 for an internet service as the bubble started to pop was something that quickly became routine when it got to like 2005 and you had internet users globally hitting the 1 billion vs ~0.36 billion in 2000 - and far more of them had broadband. This really increased the potential market for things highly constrained by dialup, like high photo social media (say MySpace, started in 2003 and bought for $580 million by Fox in 2005 with not much in the way of viable revenue) or fuckin YouTube (started 2005, bought for $1.65 billion in 2006 with absolutely 0 plan for profitability).

This very website is an expensive mid-2000s vc funded company. Same with Twitter, etc. Neither had any actual profitability expected or projected for years and years. They were pure user base size plays.

Frankly it's just wrong to say the 2000s were a low investment time with minimal big corporation influence online? You had all the big ptre-bubble companies like Microsoft controlling vast empires. You had all the big players who were formed in the dotcom bubble and survived and to substantial effect thrived in pretty safe niches with bubble damage having taken out their best competition - like Google or Amazon or even still things like AOL and Yahoo who'd fucked some shit up bad but still had huge resources. You had all the quickly growing stuff that is still around today. Most of these splashed their cash to acquihire employees and technology from various startups which had been funded in the first place by VCs who now expected "get bought by other company" a much more reliable goal than piling in with IPOs in the wake of the dotcom crash.

You treat Club Penguin as an example of small scale independent business, but in reality they got bought out by Disney within 2 years of launch (2005 launch, 2007 purchase) for over $350 million!

Even Cheezburger Network went from 1 guy on a small scale site without ads in the beginning of 2007 at founding to a multi contributor monetized blog to an investor controlled site by September the same year for a 2 million dollar payout and a rapid purchase of rival and similar sites to form an advertising driven network with it! Sure it's no billions but it was already being staked out for vc control

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes