#ecommerce payment processing

Explore tagged Tumblr posts

Text

Chargebacks: Unraveling Their Impact on Your Business

#Chargebacks: Unraveling Their Impact on Your Business#chargebacks#small business payment processing#merchant account for high risk business#high-risk business#credit card chargebacks#payment processing for small business#ecommerce business#credit card processing for small business#high risk business#chargebacks explained#a deep dive into high-risk business transactions#visa chargebacks#business transaction#cycles of chargebacks#discover chargebacks#chargeback on credit card#fight chargebacks

3 notes

·

View notes

Text

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

Ecommerce Payment Processing: What You Need to Know

Understanding Ecommerce Payment Processing Services

In the rapidly growing world of online retail, Ecommerce Payment Processing Services play a critical role in ensuring smooth, secure, and efficient transactions. Whether you're a small startup or a large enterprise, having the right payment processing system can make the difference between customer satisfaction and cart abandonment. Let's explore what Ecommerce Payment Processing Services are, why they matter, and what you should consider when choosing a provider.

What Are Ecommerce Payment Processing Services?

Ecommerce Payment Processing Services refer to the systems and technologies that handle online transactions between a customer and a merchant. These services facilitate the authorization, processing, and settlement of payments made through credit cards, debit cards, digital wallets, and other online payment methods.

Key functions of Ecommerce Payment Processing Services include:

Verifying customer payment information.

Authorizing transactions in real-time.

Ensuring funds are transferred securely.

Handling chargebacks and refunds.

With the growing popularity of online shopping, the demand for reliable Ecommerce Payment Processing Services has never been higher.

Why Ecommerce Payment Processing Services Are Crucial for Your Business

Choosing the right Ecommerce Payment Processing Services can directly impact your business success. Here are a few reasons why they are essential:

Security: Protect sensitive customer data and reduce fraud risk.

Efficiency: Ensure quick and seamless transactions.

Customer Trust: A reliable payment system boosts consumer confidence.

Global Reach: Accept payments from international customers.

Without dependable Ecommerce Payment Processing Services, businesses may struggle with declined transactions, customer dissatisfaction, and potential revenue loss.

Key Features to Look for in Ecommerce Payment Processing Services

When selecting a provider, it's important to evaluate the following features to ensure you're getting the best solution for your needs:

PCI Compliance: Ensure the provider adheres to industry security standards.

Multiple Payment Options: Support for credit cards, debit cards, e-wallets, and alternative payment methods.

Fraud Detection: Advanced tools to detect and prevent fraudulent transactions.

User-Friendly Interface: Easy integration with your ecommerce platform.

Transparent Pricing: Clear fee structure with no hidden charges.

Reliable Ecommerce Payment Processing Services offer these features to ensure that your customers have a smooth and secure payment experience.

Common Challenges with Ecommerce Payment Processing Services

While Ecommerce Payment Processing Services offer numerous benefits, they also come with certain challenges that businesses must navigate:

High Transaction Fees: Some providers charge high fees that can eat into your profit margins.

Chargebacks: Disputes and refunds can lead to financial losses if not handled properly.

Technical Glitches: Downtime or system errors can disrupt the customer experience.

Integration Issues: Compatibility problems with your ecommerce platform can cause delays.

By partnering with a trusted provider like Motus Financial, you can minimize these challenges and enjoy seamless Ecommerce Payment Processing Services.

The Role of Motus Financial in Ecommerce Payment Processing

At Motus Financial, we understand the unique needs of online businesses. Our Ecommerce Payment Processing Services are designed to offer secure, efficient, and cost-effective solutions that help businesses grow. We provide:

Advanced fraud protection and data security.

Seamless integration with major ecommerce platforms.

24/7 customer support.

Competitive pricing with no hidden fees.

Support for multiple currencies and payment methods.

By choosing Motus Financial for your Ecommerce Payment Processing Services, you ensure that your customers enjoy a seamless checkout experience while you benefit from reliable and secure transaction processing.

Boost Your Online Sales with Help from Motus Financial

At Motus Financial, our Google My Business profile showcases our expertise in Ecommerce Payment Processing Services. With detailed customer reviews, up-to-date business information, and insights into our latest service offerings, our GMB page serves as a valuable resource for businesses seeking reliable payment solutions. Visit our Google My Business profile to learn more about how Motus Financial can support your ecommerce success.

Contact Us

Ready to enhance your online business with trusted Ecommerce Payment Processing Services? Contact Motus Financial today to schedule a consultation and discover how we can help streamline your ecommerce transactions with security, efficiency, and customer satisfaction at the core.

0 notes

Text

🚨 Fraud detection is not a solo mission

🔒 Fraud doesn’t happen in isolation

Neither should your defense

At Fraud.net, they’re protecting global organizations through our 🌐 Global anti-fraud Network.

In today’s complex landscape, working in silos with limited visibility of global fraud data and emerging threats is a challenge.

The powerful network of real time intelligence helps break through those barriers, delivering the clarity and confidence needed to act.

What this means for you:

🔍 You tap into a trusted and effective intelligence network

📉 You reduce risk and operational costs

🛡️ You deliver a safer, more secure experience for your customers

It’s about collective intelligence

It’s about stopping fraud before it impacts your revenue

Let’s connect the dots

🔗 More here: https://www.fraud.net/technology/global-anti-fraud-network

#ai#artificial intelligence#fraud prevention#internet fraud#fintech#payment processing#ecommerce solutions#digital banking#cybersecurity#big data

0 notes

Text

Tackling Cart Abandonment with Digital Payment Solutions

Cart abandonment is a prevalent challenge in the e-commerce landscape, with studies indicating that nearly 70% of online shoppers leave their carts without completing a purchase. A significant contributor to this issue is a complicated or inefficient payment process.

Leveraging Digital Payment Solutions

Implementing advanced digital payment solutions can address these issues and enhance the customer experience:

Seamless Online Payment Gateways: Offering a user-friendly payment gateway ensures quick and secure transactions. Features like one-click payments and mobile optimization can significantly reduce checkout time.

Multiple Payment Methods: Providing various payment options, including credit/debit cards, UPI, mobile wallets, and Buy Now, Pay Later (BNPL) services, caters to diverse customer preferences and reduces the likelihood of cart abandonment.

E-Invoicing Solutions: Instant invoice generation and automated payment reminders can reassure customers and encourage them to complete their purchases.

Optimized Checkout Experience: Simplifying the checkout process by minimizing form fields, offering guest checkout options, and ensuring fast processing times can enhance user satisfaction and reduce drop-offs.

For a deeper dive into this topic, check out the full article here: How Digital Payment Solutions Can Reduce Cart Abandonment

#digital payments#payment processing#payment gateway#online payments#payomatix technologies#payment solution#ecommerce#cart abandonment#business growth#fintech#digital payment#invoice management system

0 notes

Text

India E-Commerce Payment Recovery: Proven Legal Solutions for US based Corporations to Recover Back their Struck Money from India in 2025

How does the e-commerce market in India deal with the problem of payment recovery? Along with the massive increase in electronic commerce purchases, uncompleted transactions, refunds, and chargebacks have become standard problems. The reports suggest that the country’s digital transactions market will be $10 trillion by 2026, making efficient recovery mechanisms all the more necessary. The businesses are using artificial intelligence in fraud detection, automatic reminders, and legal frameworks to process the recovery of payments, thereby reducing the loss.

#hire indian attorney for ecommerce debt recovery#how to recover money from indian online marketplaces#legal process for stuck ecommerce payments in india#legal solutions for us corporations stuck funds india#legal strategy to collect ecommerce payments from india

0 notes

Text

5 Signs It’s Time to Switch Payment Processors

If you allow customers to pay with debit or credit, then your payment processor is like the backbone of your business.

Among other things, a great processor will ensure transactions are seamless, costs are kept to a minimum, and customers remain satisfied.

But if you’re with a payment processor that subjects you to things like frequent downtime, hidden fees, or outdated technology, it can severely impact not just your bottom line, but also your reputation, your relationships with customers, and your ability to grow your business.

And considering how common some of this stuff is today, it’s no surprise that business owners are becoming less and less satisfied with their payment processors.

According to a J.D. Power survey, which polled more than 4,800 U.S. small businesses, as of 2023, small business satisfaction with payment processors had gone down six points from the previous year, as the cost of services increased and issues with processing payments continued.

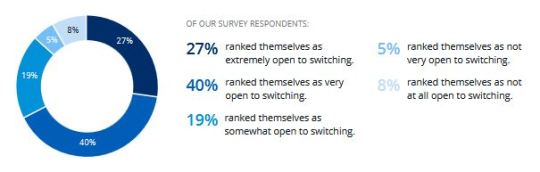

Interestingly enough, here in Canada, regardless of how satisfied businesses are with these services, the vast majority said they’d be willing to switch payment processors, if they’re given the right incentives.

As you can see from the graph below, a survey from Chase, which polled over 2,200 Canadian businesses, found that 86% of respondents were “at least somewhat willing to switch vendors.”

But in an industry that’s as convoluted as ours, it can be tough to know when it’s time to switch payment processors.

So, if you’re not happy with the services you’re currently getting, and you want to find a new payment processor, we want to help you make the best decision for your business by highlighting five signs it’s time to switch.

Is it Time to Switch Payment Processors?

If you don’t have a good grasp of how things work in our industry, then it’s going to be tough to tell if it’s time to switch payment processors.

And by the time you’ve noticed something’s not right, it may be too late, as the damage has already been done.

With that in mind, let’s explore five telltale signs that it’s time to switch payment processors.

1) You’re Paying Flat-Rate Pricing

In the payment processing industry, flat-rate pricing tends to be advertised as more convenient and affordable, but the truth is, it’s the most expensive way to pay.

Unfortunately, because of the way it’s advertised, and the fact that most business owners don’t know any better, many get fooled into thinking they’re getting a good deal.

But as we pointed out in our article on Why Interchange Plus Pricing Is the Best Way to Pay for Payment Processing, a CFIB survey found that 54% of respondents had trouble understanding the contract they signed with their payment processor, and 41% are unsure about their pricing.

That being said, it’s no surprise that business owners are being taken advantage of in this way.

What’s more, the average flat rate offered in our industry is currently 2.4%, with some processors charging up to 2.65% or even more.

But only a select few credit cards have an interchange rate of more than 2.4%.

So, while flat-rate pricing might sound great in a slick ad campaign, at the end of the day, it’s going to cost you more money.

With that in mind, if you’re paying flat-rate pricing, it’s time to switch payment processors.

And if you’re not sure what interchange rates are, or you just need a little refresher, you can read our article on What You Need to Know About Interchange Rates in Canada.

2) You’re Finding Hidden Fees on Your Statement

In addition to promoting misleading pricing, unscrupulous payment processors are also notorious for adding miscellaneous “hidden” fees to your statement.

Truth be told, these fees aren’t really hidden at all, if you know where to look.

But the problem is many business owners don’t know how to decipher what’s on their statements.

As a result, payment processors will often sell business owners on a “discounted rate” but then make up for those lower interchange rates, and then some, by tacking hundreds or even thousands of dollars in extra fees onto your monthly bill.

They’re also known to do things like charging different amounts for the same fee multiple times on the same statement or adding extra fees to cards for which you’ve already paid interchange.

If you’re not familiar with this sort of thing, it can be somewhat difficult to determine, but our article on What You Need to Know to Spot Hidden Payment Processing Feesexplains everything.

And if you do find these kinds of fees on your statement, you should definitely start thinking about switching payment processors.

3) You’re Unable to Accept All Forms of Payment

Today’s consumers expect convenience and flexibility, regardless of how they choose to pay.

And whether they’re making purchases using a credit card, debit card, digital wallet, or any other form of payment, if your payment processor doesn’t support these options, it can lead to lost sales, dissatisfied customers, and a ruined reputation.

Like it or not, the popularity of new forms of payment, including mobile payment options like Apple Pay and Google Pay, continues to grow, and if your processor doesn’t allow you to accept these forms of payment, you risk alienating a significant portion of your customers.

Similarly, if you operate internationally, being unable to accept foreign cards or currencies can limit your growth and deter potential customers.

With all that in mind, you’d be surprised how many processors are still using outdated technology that limits how customers can pay.

But the truth is, you don’t have to let limited payment options hold your business back, and there are many processors out there (us included) that support all major forms of payment.

So, if you’re turning customers away because they can’t pay the way they want, then it is definitely time to switch payment processors.

4) Your Payment Terminal Is Falling Apart

Believe it or not, there are many merchants out there who are still using old beat-up payment terminals.

This may not sound like a big deal, but the truth is a malfunctioning or outdated payment terminal can seriously harm your business.

At the end of the day, a functional, modern terminal is not just a convenience – it’s a critical part of your business’ reputation and revenue.

Because when customers encounter a slow, unreliable, or poorly functioning payment terminal, or they see that yours is falling apart, it makes you look unprofessional and unreliable, creating a negative impression that can lead to frustration and abandoned purchases.

And aside from the fact that they may not support the latest payment methods, older terminals might not comply with current security standards, which can expose your business – and your customers – to potential fraud or data breaches.

Frequent breakdowns or maintenance issues can also disrupt your operations, resulting in lost sales and time wasted on troubleshooting.

In any case, if your payment processor isn’t offering upgraded equipment or providing prompt technical support, it’s a clear sign that they’re not prioritizing your needs and it’s time to think about changing payment processors.

5) Your Provider Doesn’t Offer Online Integration

This doesn’t apply to all businesses, as some do all their sales in-person.

However, if you want to sell stuff online, but your provider can’t do eCommerce, then it’s probably time to switch payment processors.

Because if you’re unable to accept online payments, you could be missing out on a vast and growing market of customers who prefer the convenience of shopping from their devices.

And even if you primarily operate a physical store, offering an online option can help to boost sales, expand your reach, and provide a safety net during unexpected disruptions, like having to temporarily close your physical location.

At any rate, without seamless eCommerce integration, managing sales across different channels can be incredibly inefficient and prone to errors, and dealing with online transactions manually can lead to wasted time, accounting inaccuracies, and frustration for you and your staff.

Are you thinking about switching payment processors? Book a Rate Reduction Reviewto find out how much you can save with Lucid Payments or contact us for more information.

0 notes

Text

How to Optimize Your eCommerce Website for Better Conversions

In today’s competitive digital landscape, having an eCommerce website is just the first step. The real challenge lies in converting visitors into paying customers. With countless online stores vying for attention, optimizing your eCommerce website for better conversions is essential to boost revenue and grow your business. Here’s a comprehensive guide to achieving higher conversions through proven strategies.

1. Streamline the User Experience (UX)

A seamless and intuitive user experience is the cornerstone of any high-converting eCommerce website. Ensure your site is easy to navigate, visually appealing, and responsive across all devices. Key points to focus on include:

Simple Navigation: Categorize products logically and provide clear menus.

Search Functionality: Incorporate advanced search features with filters and auto-suggestions.

Fast Loading Speed: Optimize images and code to ensure pages load in under 3 seconds.

2. Optimize Product Pages

Your product pages play a critical role in influencing purchase decisions. To maximize their impact:

Use high-quality images with zoom features.

Include detailed product descriptions that highlight key features and benefits.

Add customer reviews and ratings to build trust.

Provide clear calls-to-action (CTAs) such as “Add to Cart” or “Buy Now.”

3. Simplify the Checkout Process

A complicated or lengthy checkout process is one of the leading causes of cart abandonment. Optimize your checkout by:

Offering a guest checkout option to eliminate the need for account creation.

Reducing the number of steps required to complete a purchase.

Providing multiple payment options, including credit cards, digital wallets, and Buy Now, Pay Later (BNPL) services.

Displaying a progress bar during checkout to show customers how close they are to completion.

4. Leverage Personalization

Personalized experiences can significantly improve conversion rates. By analyzing customer behavior and preferences, you can tailor their journey:

Use personalized product recommendations based on browsing history.

Send targeted email campaigns featuring products customers viewed but didn’t purchase.

Show location-based offers or currency preferences.

5. Build Trust with Your Audience

Trust is a key factor in eCommerce success. To foster credibility:

Display secure payment badges and SSL certificates prominently.

Highlight a clear return and refund policy to ease concerns.

Include detailed contact information and live chat support for customer queries.

Showcase social proof through testimonials, ratings, and user-generated content.

6. Optimize for Mobile Commerce

With mobile devices accounting for a large percentage of online shopping, your website must be mobile-friendly.

Ensure your site is responsive and adapts seamlessly to different screen sizes.

Optimize mobile loading speeds to avoid slow performance.

Simplify navigation and checkout processes for smaller screens.

7. Use Data to Drive Decisions

Regularly analyze website data to identify bottlenecks and opportunities for improvement:

Track metrics such as bounce rates, time on page, and conversion rates.

Use heatmaps to understand how users interact with your site.

Conduct A/B testing to compare variations of your product pages, CTAs, and design elements.

8. Harness the Power of Social Proof

Social proof can significantly influence buying decisions. Implement the following:

Highlight customer testimonials and success stories on your homepage.

Showcase real-time purchase updates like “5 customers bought this item today.”

Encourage customers to leave reviews and share their purchases on social media.

9. Implement Retargeting Strategies

Not all visitors will convert on their first visit. Retargeting helps bring them back:

Use dynamic retargeting ads to remind users of products they viewed.

Send cart abandonment emails with incentives like discounts or free shipping.

Offer personalized deals to re-engage past customers.

10. Enhance Website Security

Customers are more likely to shop when they feel their data is safe.

Use secure HTTPS protocols for data encryption.

Regularly update software and plugins to avoid vulnerabilities.

Include a privacy policy to assure customers that their data is protected.

11. Engage Customers with Content

High-quality content can attract visitors and drive conversions.

Create detailed buying guides to help customers make informed decisions.

Use videos to demonstrate product features and benefits.

Publish blog posts that address common customer pain points or questions.

12. Offer Incentives to Drive Sales

Enticing deals and promotions can nudge hesitant buyers:

Provide limited-time discounts to create urgency.

Offer free shipping or bundles for higher-value purchases.

Implement loyalty programs to reward repeat customers.

Conclusion: Boost Conversions with a Strategic Approach

Optimizing your eCommerce website for better conversions involves a combination of user experience enhancements, personalized strategies, and data-driven decisions. By focusing on creating a seamless shopping experience, building trust, and leveraging modern technology, you can significantly improve your website’s performance and revenue.

Partner with SKAD IT Solutions for Retail and eCommerce Success

Looking to enhance your online store? At SKAD IT Solutions in Dubai, we provide cutting-edge retail and eCommerce solutions tailored to your business needs. From responsive designs to scalable platforms, our experts deliver strategies that maximize conversions and growth.

Contact us today to transform your eCommerce website into a high-performing retail powerhouse!

#Retail and E-Commrce Solutions#Retail and E-Commerce Platforms#Custom E-Commerce Solutions#POS and Payment Processing#ecommerce website solution#ecommerce web design Dubai#ecommerce website development Dubai#ecommerce development company in Dubai

0 notes

Text

What is the impact of artificial intelligence on e-commerce?

Understanding the influence of artificial intelligence (AI) on e-commerce is essential in today’s digital landscape. AI technologies are reshaping how businesses operate online, from personalized shopping recommendations to efficient inventory management. This article delves into the multifaceted impact of AI on e-commerce, exploring its benefits and transformative potential.

Know more https://www.pcdoctorsnet.com/what-is-the-impact-of-artificial-intelligence-on-e-commerce/

#What is the impact of artificial intelligence on e-commerce#ai#artificial intelligence#ecommerce website design#ecommerce#digital marketing#usa#seo#seo services#digital marketing services#social media marketing#best digital marketing company#seo company#marketing#business#digital marketing company#digital marketing agency#supply chain management#supply chain#inventory management#PC Doctors .NET#Strategies#payment processing#customer retention

0 notes

Text

Ditch checkout lines, embrace checkout bliss! AuxPay smooths payments, boosts business, & makes customers swoon. Frictionless future awaits! Join the revolution! +1-844-452-1234 #payments #paymentprocessing #paymentgateway #paymentsystem #paymentsolutions #auxpay ✨

#business#business strategy#fintech#payment systems#payment services#payment solutions#merchant services#finance#high risk merchant account#customerexperience#high risk merchant highriskpay.com#high risk payment processing#high risk payment gateway#payment gateway#payment processing#payments#ecommerce#credit cards

0 notes

Text

Unlock the full power of your e-commerce venture with seamless payment integration. 🌐💳 Explore the future of online transactions with AuxPay. Your success, simplified. 💼✨ #ecommerce #paymentsolutions #AuxPay #payments #paymentsystems #pointofsalesystem

#business#payment solutions#finance#fintech#management#staffing#technology#business strategy#business consulting#high risk merchant account#ecommerce#shopping#high risk merchant highriskpay.com#high risk payment processing#high risk payment gateway#payment services#payment gateway#payment systems#payment processing#payments

0 notes

Text

Say Goodbye to Payment Woes: Choose WebPays' Reliable eCommerce Payment Gateway

In the ever-evolving landscape of eCommerce, where digital transactions dictate success, the importance of a reliable and secure payment gateway cannot be overstated. As the global eCommerce market continues its upward trajectory, businesses find themselves at a crossroads, grappling with the pivotal decision of selecting a trustworthy payment solution. In this pivotal moment, WebPays emerges as a beacon of reliability, offering a lifeline to businesses navigating the complex realm of online payments.

Navigating the Seas of eCommerce Growth

Recent statistics from reputable sources like Statista illuminate the staggering growth of the eCommerce sector, reaching an unprecedented $5.7 trillion in global sales in 2022. This exponential surge in online transactions underscores the critical need for seamless and secure e-commerce payment gateway. Consumers demand frictionless transactions, and businesses must rise to the occasion, integrating robust payment solutions to meet these expectations.

WebPays: The Epitome of Reliability

In this crowded landscape, WebPays distinguishes itself through a powerful combination of cutting-edge technology and an unwavering commitment to security. As indicated by a recent survey conducted by eMarketer, 56% of consumers prioritize security in online transactions, reinforcing the paramount importance of a secure payment infrastructure. WebPays, a high risk payment processing provider cognizant of this concern, employs state-of-the-art encryption protocols, erecting an impervious fortress around customer data.

99.9% Uptime: A Testament to Reliability

One of the foremost concerns for businesses venturing into the eCommerce sphere is payment reliability. The repercussions of a payment glitch can be severe, leading to dissatisfied customers and potential revenue loss. WebPays confronts this challenge head-on, proudly boasting a remarkable 99.9% uptime. This impressive statistic underscores WebPays' commitment to providing a consistent and reliable payment gateway for businesses of all sizes.

Seamless Integration: A Gateway for All Businesses

WebPays caters to the diverse needs of businesses, whether they are burgeoning startups or established enterprises. The platform's user-friendly interface ensures a hassle-free integration process, aligning with the findings of a study by Gartner, which reveals that businesses prioritizing user experience witness a substantial 20% increase in customer satisfaction. In an era where user experience reigns supreme, WebPays positions itself as a reliable ally for businesses seeking to enhance their payment processes.

Global Reach, Local Expertise: A Winning Combination

WebPays' global reach is complemented by its acute understanding of local nuances, acknowledging the findings of the PYMNTS.com survey that indicates 77% of consumers prefer localized payment options. Recognizing the diverse preferences of consumers across different regions, WebPay’s e-commerce global payment gateway offers a myriad of payment methods, ensuring businesses can tailor their payment processes to align with local trends and demands. This localized approach sets WebPays apart, positioning it as a versatile and adaptable solution for businesses operating on a global scale.

Fortifying Against Fraud: A Proactive Approach

In an era besieged by digital threats, WebPays adopts a proactive stance against fraud. The platform employs sophisticated artificial intelligence algorithms that analyze transaction patterns in real-time, swiftly identifying and preventing fraudulent activities. According to a report by Juniper Research, AI-based fraud prevention systems have the potential to reduce fraud-related costs by up to 40%. This proactive approach positions WebPays as a reliable guardian, safeguarding businesses and their customers from the ever-looming specter of online fraud.

Cost-Effective Solutions for Sustainable Growth

Understanding the financial challenges faced by businesses, especially in their formative years, WebPays offers competitive pricing models. This enables businesses to manage costs efficiently, a critical factor for sustained growth according to a survey by Deloitte, where 85% of businesses cite cost management as vital for their long-term success. By providing cost-effective solutions, WebPays empowers businesses to channel their resources strategically, fostering sustainable growth in the fiercely competitive eCommerce landscape.

Responsive Customer Support: A Pillar of Assurance

In the dynamic landscape of eCommerce, issues can surface at any moment. WebPays distinguishes itself by offering responsive customer support, ensuring that businesses have a lifeline whenever problems arise. According to a Zendesk survey, 90% of customers consider excellent customer service vital in their decision-making process. WebPays recognizes the importance of this pillar of assurance, standing ready to assist businesses in navigating the intricacies of online transactions.

Future-Proofing Your Business with WebPays

As the eCommerce landscape continues to evolve, businesses must adopt solutions that not only meet their current needs but also future-proof their operations. WebPays stands as a beacon in this regard, with continuous updates and innovations designed to keep pace with the dynamic nature of online commerce. The platform's forward-thinking approach positions it as a strategic partner for businesses aiming not just for immediate success but for sustained growth in the ever-changing eCommerce terrain.

The Road Ahead: Making an Informed Choice

In conclusion, the choice of an ecommerce payment gateway can make or break an eCommerce venture. WebPays, with its reliable infrastructure, commitment to security, global reach, and cost-effective solutions, stands out as a frontrunner in the competitive landscape. Embrace a future free from payment woes—choose WebPays and unlock the full potential of your eCommerce business. As businesses navigate the complex seas of online transactions, WebPays emerges as a steadfast anchor, providing the stability and reliability needed to thrive in the ever-evolving eCommerce ecosystem.

0 notes

Text

#ecommerce#online#online store#paying#payment gateway#payment processing#payment systems#payments#payouts#small business#businesses#business#high risk merchant account#high risk payment gateway#paypal#payout#payout api#payment collection#payervault#payervault payment gateway

1 note

·

View note

Text

youtube

Drawing from real experience, I explain the challenges of managing multiple systems - from credit card processing to order fulfillment, customer service, and website management. I share a real example of how seemingly small issues, like American Express payments silently failing, can go unnoticed for weeks, significantly impacting conversion rates and revenue. Finally, I introduce how AI technology is the key to reducing this complexity and streamlining eCommerce operations with Buyist Pro.

28 notes

·

View notes

Text

RECENT ECOMMERCE NEWS (INCLUDING ETSY), LATE JULY 2024

Things have been hectic so this is a long one update - all the Etsy and other ecommerce news from the past month, broken down for your convenience!

Next week could be a big Etsy news week, with the 2nd quarter report being released, and the mature items ban kicking in. I'm also working on analysis of the new Creativity Standards, but we may not have more substantial information on those until Etsy makes another move. Right now the categories are a mess, but that could change.

A reminder that you can receive more timely updates plus exclusive content - including live chats with me on select topics such as Etsy's new Creativity Standards - by supporting my Patreon: patreon.com/CindyLouWho2

TOP NEWS & ARTICLES

The European Union is considering making packages valued under 150 euros subject to customs duties when entering the EU. This is widely seen as a way to reduce Shein and Temu orders.

The Etsy Creativity Standards announced on July 9th have a lot going on; here is my short summary so far. [post by me on Patreon] While I would not worry too much about this just yet, I expect them to be more important in the near future. Etsy adding "Made by", "Handpicked by" to every listing is currently full of errors, but more disturbingly, even when a seller points out these errors with arguments from the written policy, Etsy Support is sometimes insisting that the designations are correct. For example, original paintings are lumped in with AI designs and digital downloads. [Post by me on LinkedIn]

Amazon is imposing new rules regarding on-time delivery rates (OTDR); sellers that do not meet the standard of 90% on time delivery will not be able to continue selling. Businesses are exempted if they use the following tools: Shipping Settings Automation, Automated handling time, and Amazon Buy Shipping. Amazon is allowing only 5 days after shipment for products to arrive within the US. You can read the announcement and vigorous forum discussion here, and EcommerceBytes did a summary of the changes and some complaints.

ETSY NEWS

As Etsy's widespread ban on many adult-themed products is about to take effect on Monday, I considered why Etsy felt the need to take far more drastic steps than Amazon & eBay has in the same markets. [post by me on Tumblr] The upcoming ban started by getting media attention from Mashable, and quickly escalated to the New York Times [not a gift link; soft paywall]. Etsy is still not commenting on why they are doing this. From the NYT article: "Even before the ban, it was getting harder to run his business, Mr. Goldstein said. So, he thought, “Why don’t we just make our own marketplace?” This year, he started the website Spicerack as an independent alternative to Etsy. The online boutique already has about 75 sellers, which are vetted to make sure they’re not “dropshippers” or simultaneously listing products on e-commerce behemoths like AliExpress or Amazon. Mr. Goldstein said that Spicerack is in the process of adding about 100 more sellers, half of whom signed up when the Etsy ban was announced." From the BBC: “In many countries there is pressure on platforms, sometimes backed by new legislation, to do more to prevent under-18s from encountering explicit content, and to remove illegal or "harmful" content from their platforms. Payment processors are also increasingly wary of working with platforms that enable sex based commerce....those concerns could be addressed by more clearly labelling and separating adult product listings..." The Guardian interviewed a few sellers who are affected.

While Etsy previously stated that the new shop set-up fee would be $15 USD, they quietly changed that, to whatever they feel like charging. [post by me on Patreon]

In case you missed it, the new listing form seems to be triggering Etsy Ads campaigns to start without the seller’s knowledge. [post by me on LinkedIn] Since my post, there are still more reports of this happening, and even more.

I regret to inform you that Etsy’s Search Analytics are going to disappear after August 14 [post by me on LinkedIn], per a banner on the page.

Canadian sellers will have to pay a 1.15% “Regulatory Operating Fee” on all of their sales income (including shipping and gift wrap) starting August 15. This is likely due to a new law taxing large ecommerce platforms 3% of their Canadian income, which came into effect June 28. The tax applies retroactively back to the beginning of 2022, so Etsy is likely overcharging us to cover those earlier amounts.

Sellers having difficulties with the domestic pricing tool not working correctly may want to try these tips from an Etsy forum thread: Set the domestic price to the global price amount, save, and then go back in and change the domestic price to your preferred amount, then save again. This apparently works for both new and existing listings, but there are 3 drawbacks: 1) it is time-consuming, 2) it needs to be done any time a listing is changed/edited (including renewals), and 3) it doesn’t seem to work for France. (I don’t ship to France so I cannot test the last point.) Remember, if you have a sale go through for the wrong price, contact Etsy and demand to be compensated the difference.

Still don’t believe that Etsy is serious about shipping on time? See this Reddit thread by a seller who ignored a 30-day warning, so all of their items were removed from search. From this screenshot, it appears their average order value was fairly high, but that doesn’t mean Etsy will tolerate late shipping from shops with cheaper items, so beware.

Etsy is testing filtering out digital items from search results unless the terms match a digital item search. See Etsy forum threads here and also here.

A new academic study calls out Etsy and other online marketplaces for allowing illegally-killed bats to be sold on their sites. “We refute any assertion that the online bat trade is ethical. Again, statements that bats were captive-bred are absurd—bat farms are nonexistent—and it would be impossible for suppliers to find bats that have died naturally in the kind of condition and numbers needed to supply an ornamental trade. These bats were hunted.” The New York Times has also now covered this story [soft paywall].

The virtual seller education event Etsy Up is scheduled for September 10. You can register here, but there is no program yet. Usually this event has almost nothing worthwhile for experienced shops, and Etsy generally uses it to push their paid services and integrations along with basic info.

Etsy is looking for sellers to join their Advocacy program and “share your story”. Beware that sometimes Etsy’s “advocacy” is as much for Etsy as for its sellers, so they are looking for stories that fit Etsy’s own goals.

The Etsy Design Awards have opened; the final date for submissions is August 8.

Etsy’s second quarter results for 2024 will be released July 31.

ECOMMERCE NEWS (minus social media)

General

Shein and Temu are facing investigations under the EU’s Digital Services Act. “In a press release, the EU said it’s asking Shein and Temu for more information about measures they’ve taken to meet DSA obligations related to what’s known as “Notice and Action” mechanisms, which should allow users to notify the marketplaces of illegal products.It has also requested info related to the design of their online interfaces, which the pan-EU law mandates must not deceive or manipulate users, such as via so-called “dark patterns”.” Temu is also being sued by Arkansas for having an invasive app that is accused of harvesting data without user permissions. “According to the complaint, Temu is allegedly obscuring its unauthorized access to data through misleading terms of use and privacy policies that do not alert users to the full scope of data that the app can potentially collect. That includes not telling users about tracking granular locations for no defined purpose and collecting "even biometric information such as users’ fingerprints."

Amazon

Amazon now has an AI shopping “assistant” on its US app, called Rufus. “Customers can ask questions about products, comparisons and buying considerations. The AI can provide suggestions for specific tasks or projects.” As per usual with AI, “tests show Rufus doesn’t always provide accurate information.” A review from Marketplace Pulse notes that “Amazon’s AI assistant fails to help shoppers find the best product among the millions in the catalog. It transforms broad questions like “What are the best cycling gloves for winter?” into a few links to product searches — the same searches a shopper could have typed themselves. It refuses to make product recommendations, show specific products, or suggest from the thousands of options. It can’t directly answer the question, “What are the cheapest batteries for my TV remote?”

Any sellers who had items removed for being plants or seeds when they actually aren’t should follow the instructions linked to here to get the situation resolved. An Amazon employee warned sellers: “Please do not acknowledge the violations as these will result in the deactivation of your listings.” Affected businesses should instead appeal the flags.

Amazon is planning a discount drop shipping from China section, widely seen to be competition to Temu and Shein. However, “[i]t is not clear if these shipments will be made using a U.S. trade provision that exempts individual packages worth less than $800 from U.S. customs duties.”

The European Commission has asked Amazon for more information on “recommender systems, ads transparency provisions and risk assessment measures.”

Only 1% of US Amazon sellers also offer their items outside of North America. “Due to its proximity to the U.S., Canada has more successful sellers from the U.S. than Canada.” If you have a unique product, this could be an opportunity. Amazon returns are creating huge workloads for UPS stores and other retailers that accept them. “Amazon “makes up about one-tenth of our profits, but it takes up about 90 percent of the working day,” said Jeremy Walker, a store associate who worked at a UPS Store near Dallas that received between 300 and 600 returns per day.”

Depop

After trying it out in the UK, Depop is removing selling fees for the United States, starting July 15. Payment processing fees still apply. “[B]buyers will now be charged a "marketplace fee" of up to 5% plus a fixed amount up to $1.”

An interview with Depop CEO Kruti Patel Goyal reveals they plan “to bring Depop to a bigger and broader audience over time.”

eBay

eBay is slowly rolling out changes to the Active Listings page.

eBay sellers can now get cash advance loans through Liberis, the balance of which gets paid as a percentage of the seller's sales.

New sellers in the UK might see “automated feedback” on some of their orders, to "help [users] buy and sell with confidence". It will say "This seller successfully completed an order", and is removed once the actual buyer leaves feedback.

Michaels MakerPlace

Abby Glassenberg reviews Michaels’ MakerPlace popups inside their retail stores. Results seem mixed.

Shopify

A few hundred thousand Shopify users may have had their names, addresses and other data put up for sale on July 3 after a breach. Shopify denies it had any security issues and claims the data came from a third-party app. There was a known data breach at Evolve Bank and Trust in June; that institution is a supporting partner for Shopify Balance. It does appear that Shopify is notifying the affected individuals.

Walmart Walmart is adding pre-owned collectibles to its marketplace. “Eligible categories include Toys (Figures, Dolls, Trains, Plushies, Games, LEGO, Funko, Diecast Cars & Hot Wheels); Media & Music (Movies, Vinyl, Music, SteelBooks, Musical Instruments & Entertainment Replicas); Trading Cards; Comic Books & Books; Sports Memorabilia; and Coins.”

All Other Marketplaces

Indiegogo is opening an ecommerce website for items created through crowdfunding campaigns on the platform, called IndieShop.

Etsy-owned Reverb now has an “outlet” page, where businesses can sell off their overstock, seconds and out-of-date models for 20% off and free shipping. Most products sold through the main portion of Reverb are used, not new, so this competes with regular sellers.

Not sure if selling on Faire is right for your business? Here’s a handmade-focussed review of the wholesale site.

Payment Processing

Klarna is now available through Adobe Commerce (previously Magento).

Shipping

USPS rates for labels on most platforms went up July 1, ahead of the previously-announced July 14th increases. Ina Steiner re-posted the numbers from eBay and Pirate Ship.

USPS released the addresses and other data of logged-in Informed Delivery users to Meta, LinkedIn and Snap. The company claims it didn’t know the data transfer was happening.

The free USPS Priority medium shipping tubes are no longer being made, but you can still order existing stock.

Royal Mail’s Tracked 28 & 48 are now available at post offices.

UPS’s holiday surcharge rates for the US have been released; the lower surcharges start September 29th.

Shippo has new Canada Post rates from now until January, and the Tracked Packet rates to everywhere but the United States are cheaper than Etsy’s (which are based on Level 4 of Solutions for Small Business). Remember that Shippo makes you pay for a higher tier of service if you use over 30 labels per month.

12 notes

·

View notes

Text

India E-Commerce Payment Recovery: Proven Legal Solutions for US based Corporations to Recover Back their Struck Money from India in 2025

How does the e-commerce market in India deal with the problem of payment recovery? Along with the massive increase in electronic commerce purchases, uncompleted transactions, refunds, and chargebacks have become standard problems. The reports suggest that the country’s digital transactions market will be $10 trillion by 2026, making efficient recovery mechanisms all the more necessary. The businesses are using artificial intelligence in fraud detection, automatic reminders, and legal frameworks to process the recovery of payments, thereby reducing the loss.

#file civil suit in india to recover ecommerce dues#hire indian attorney for ecommerce debt recovery#how to recover money from indian online marketplaces#legal process for stuck ecommerce payments in india#legal solutions for us corporations stuck funds india

0 notes