#epi wafer supplier

Text

Know About The Advantages of Epitaxy

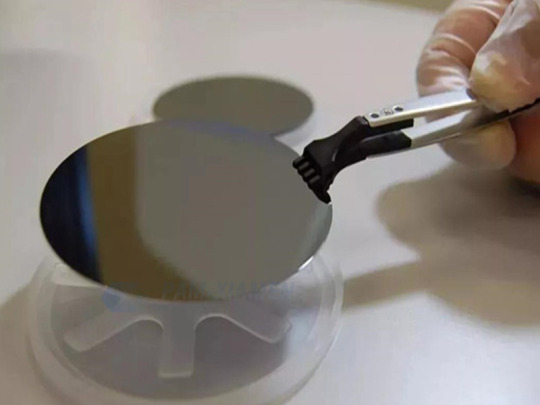

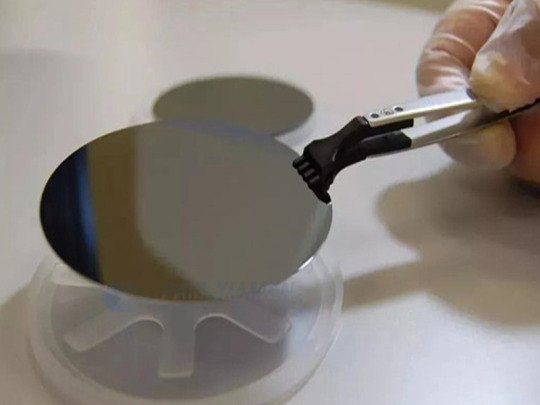

The word is derived from the Greek epi meaning above, and taxis meaning in an ordered manner. In the forming of layers, it involves the deposition of silicon or silicon compounds that help to continue and perfect the crystal structure of the bare silicon wafer below. The electrical characteristics of the Epi wafer surface are improved by epitaxy, which makes it suitable for highly complex microprocessors and memory devices. Selective Epitaxy is an Epitaxy process that on certain predetermined areas of the wafer only deposits silicon or a silicon compound.

Events Occurring During Epitaxy

To form the transistor channel region, as well as the source and drain, there is the selective deposition of Epitaxial layers. The source is the point where charge carriers like electrons enter the channel, and they leave from the drain. There is a gate between them that controls the conductivity of the channel. It can be even switched to allow electrons to flow or to prevent them from flowing. Epi wafer manufacturer can dope Epitaxy films to very precise concentrations of the dopant elements by combining them with additional elements in the processing source gases.

Advantages

In a highly controlled manner Epitaxy improves the electrical characteristics of the wafer surface, making it very much suitable for highly complex microprocessors and memory devices.

In the current scenario, we see that in the microelectronics industry CMOS technology is the driving technology, and the conventional way of fabricating integrated circuits on bulk silicon substrates has given problems such as the difficulty of making shallow junctions, unwanted parasitic effects, and latch-up. In recent years, in many aspects to their bulk counterparts, the advent of Silicon-on-Insulator has proven superior. The advantages here are the absence of latch-up, ability to operate at high temperature, the ease of making shallow junctions, radiation hardness, the reduced parasitic source and drain capacitance's, improved trans conductance, and sharper sub-threshold slope.

In creating SOI wafers there are several approaches available and here we discuss two particular techniques. First, through the Ultra-Thin Silicon process where high-quality Silicon-on-Sapphire (SOS) material is formed we seek to illustrate a heterosexuality technique. Next, to grow a homogeneous crystal laterally on an insulator Epi wafer supplier look at a homosexuality technique called Epitaxial Lateral Overgrowth (ELO) technique which seeks.

Original source: https://ganwafer.wordpress.com/

9 notes

·

View notes

Text

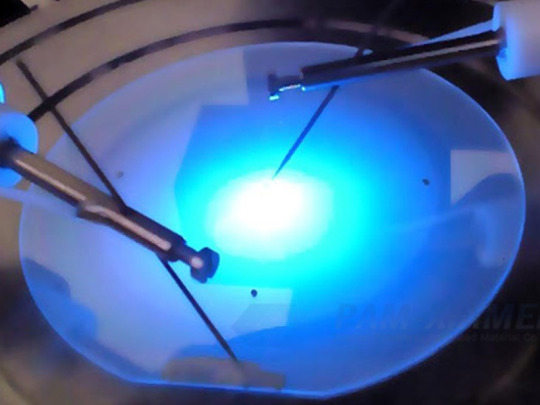

PAM XIAMEN offers GaN HEMT Epitaxial Wafers.

CZT wafer

Gallium Nitride (GaN) epitaxial wafers (epi-wafers). GaN high-electron-mobility transistors (HEMT) wafers on different substrates such as silicon essence, blue substrate, silicon carbide (SiC) substrate.

CZT wafer

We offer straight from the factory, along with therefore can offer the most effective prices on the industry for good quality GaN HEMT epi-wafers. Consumers from just about all over the world have got trustworthy PAM XIAMEN Products being a preferred supplier connected with GaN epi-wafers and GaN diffusion.

AlGaN/GaN HEMT upon only two in Conductive Semblable Wafer (GaN/SiC)

AlGaN/GaN HEMT in 2 in Blue Wafer

AlGaN/GaN HEMT about 3 inch Semi-Insulating Pareil Wafer (GaN/SiC)

AlGaN/GaN HEMT with 2 inch Mais Wafer (GaN/Si)

For a lot more information, please visit internet site: https://www.powerwaywafer.com,

send us e mail at sales@powerwaywafer. com in addition to powerwaymaterial@gmail. com

Found inside 1990, Xiamen Powerway Innovative Substance Co., Ltd (PAM-XIAMEN) is actually a leading manufacturer associated with semiconductor material in The far east. PAM-XIAMEN develops advanced ravenscroft progress and epitaxy technological innovation, making processes, engineered substrates as well as semiconductor devices. PAM-XIAMEN’s engineering enable higher efficiency and also lower cost developing of semiconductor wafer.

Top quality is the first top priority. PAM-XIAMEN have been ISO9001: '08, owns along with shares several modern facories which can easily provide quite a huge variety of qualified products to be able to meet diverse needs regarding our customers, each buy has to be managed by means of our rigorous top quality method. Test report will be presented to each shipment, in addition to each wafer are warrantee.

1 note

·

View note

Text

Gallium Arsenide (GaAs) Market Size Forecast to Reach $632.2 Billion by 2026

Gallium Arsenide (GaAs) Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026. GaAs is increasingly used as a replacement for silicon because of its enhanced electronic properties and was selectively grown on GaAs substrates patterned with SiO2 by conventional molecular beam epitaxy. Moreover growing demand for GaAs across various end-user industries such as aerospace & defense, electronics, and communications is analyzed to drive the Gallium Arsenide Market share. In addition, owing to a wide direct band gap material that resists radiation damage, GaAs is an excellent option for outer space electronics and optical windows in high power applications. Further, other key factors driving the growth of the GaAs market include increase in adoption of 5G networks across the world and the advent of IoT has been one of the major reasons responsible for the growing trend of the Gallium Arsenide market size. The technology has given rise to a demand for high-frequency communication devices made with GaAs based ICs. Furthermore, this remarkable growth in the Gallium Arsenide market is providing a huge number of opportunities for wafer, EPI wafer & metal-organic chemical vapor deposition equipment suppliers, and manufacturers in the forecast period 2021-2026.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=509501

Report Price: $ 5900 (Single User License)

Gallium Arsenide Market Segment Analysis - By Type

Vertical Gradient Freeze (VGF) Grown GaAs segment held significant market share of 40.5% in 2020. VGF Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength. Vertical gradient freeze (VGF) technology is a proven technique for growing semiconductors composed of multiple elements that include gallium, arsenic, indium, and phosphorus. Such semiconductors offer capabilities that exceed those of wafers created on a single crystal silicon substrate. The main advantages of the VGF process include its scalability, low stress, high mechanical strength, and a defect rate that is orders of magnitude lower than conventional compound semiconductor crystal growth processes. Hence these benefits are analysed to drive the growth rate of the gallium arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Application

Smart phones segment in Gallium Arsenide market is expected to witness a highest CAGR of 8.5% the forecast period. The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products. Moreover, the continuous advancements in consumer electronics and the use of sensors in various electronic products are proliferating the applications of plasma etching in smartphones and their demand across almost all the industry sectors. In 2018, the South Korean government announced to invest $1.34 billion for the next ten years to support the development of next-generation semiconductor technology, to support Samsung Electronics and SK Hynix. The investment will help Korean companies, such as Samsung and SK Hynix, to enhance their semiconductor manufacturing capabilities. Further with the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. As Gallium Arsenide will outperform silicon wafers due to its ultra-high frequency applications will enhance the demand for Gallium Arsenide industry in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Geography

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region. Countries such as India, China, Taiwan, South Korea and so on are few of the prominent markets for Gallium Arsenide, and this is primarily attributed to the growing demand for advanced technologies across numerous end-user industries, high growth of the consumer electronics industry, rising support for the semiconductor industry in the region. In May 2019, Taiwan Semiconductor has opened new branch in Beijing to accommodate the rapid growth in China and engage local talent in its business development efforts. Moreover, the emergence of new technologies in Asia-Pacific has boosted the demand for innovative and user-friendly smart devices. There has been a rising demand from South Korea and Taiwan for semiconductor wafers, due to the large production of consumer electronic devices such as televisions, smartphones, PCs and so on. Further governments of several countries in this region are supporting the growth of semiconductor production by various initiatives, for instance, Made in Chine 2025, Make in India and others will promote the growth of semiconductor industries thereby increasing the growth of Gallium Arsenide market in the forecast period 2021-2026.

Inquiry Before Buying @ https://www.industryarc.com/reports/request-quote?id=509501

Gallium Arsenide Market Drivers

Growing Penetration of 5G

With the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. Gallium Arsenide due to its ultra-high frequency applications able to outperform silicon wafers in some of the most important ways. Moreover, with the emergence of 5G, silicon usage in semiconductors will be further reduced. Further for the implementation of 5G network, GaAs can be seen as the next generation of integrated circuits due to its high band gap, which drastically outperforms silicon. According to semiconductor Association, it is expected that the overall market for semiconductors could pass a whopping $20 trillion by 2025. This will create significant demand for GaAs in the forecast period. Furthermore governments of several countries have been investing heavily for the deployment of 5G. In 2019, China is expected to invest over $150 billion in its 5G networks through 2025. Similarly, Germany made a step towards accelerating the development of 5G services in the country, pouring additional investments into backing domestic endeavours. Hence growing penetration of 5g will drive the Gallium Arsenide Market growth in the forecast period 2021-2026.

Growth of Semiconductor industry creates significant demand for Gallium Arsenide Market

Growth of semiconductor manufacturing is analysed to create significant opportunities in the forecast period. In 2020, Indian Government is planning to offer around $1 billion in cash to every company that sets up a chip manufacturing unit in India. Similarly, China’s ‘Made in China 2025’ initiative will also create significant demand for semiconductor manufacturing in the forecast period. Moreover, U.S government is also committed to invest around $50 billion for the growth of semiconductor industry. Silicon is the most important material for semiconductor electronics. Silicon devices and integrated circuits are dominant in most applications from consumer electronics to automotive. However, in certain areas, silicon is being challenged by other semiconductor materials, such as gallium arsenide. Gallium arsenide excels in ultra-high frequency applications and has emerged as leading contenders for ultrahigh speed applications in the next generation of supercomputers and communication equipment. Hence Gallium arsenide has become relatively important and is expected to increase sharply in the forecast period 2021-2026.

Gallium Arsenide Market Challenges

High Production Cost

Although Gallium Arsenide market is growing at a significant phase it poses some difficulties, compared with that of silicon. For instance, unlike silicon, there is no natural oxide that acts as a mask to produce simple elements of the Complementary Metal Oxide Semiconductor (CMOS) logic style. High production cost of Gallium Arsenide act as major threat for the growth of the market. This is partly due to this technology not being able to achieve high volumes to bring the cost down and in a large part also because of not having a straightforward way to bring costs down generation after generation by exploiting device scaling like CMOS. Further GaAs technology does not easily lend itself to integrating millions or billions of transistors on one integrated circuit. Most GaAs ICs can manage to integrate only a handful of transistors unlike silicon. Hence these challenges hamper the market growth in the forecast period 2021-2026.

Gallium Arsenide Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Gallium Arsenide market. Gallium Arsenide top 10 companies include Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Power way Advanced Material Co. Ltd. among others.

Acquisitions/Product Launches

In 2021 AXT, Inc., a leading manufacturer of compound semiconductor substrate wafers, has developed and shipped its first 8-inch diameter gallium arsenide (GaAs) substrates to a major customer. The 8-inch GaAs substrates, which are silicon doped, n-type substrates, demonstrate low etch pit densities (EPD) and low levels of slip lines.

In 2019, PAM-XIAMEN develops advanced crystal growth and epitaxy technologies, range from the first generation Germanium wafer, second-generation Gallium Arsenide with substrate growth and epitaxy on III-V silicon doped n-type semiconductor materials based on Ga, Al, In, As and P grown by MBE or MOCVD, to the third generation Silicon carbide and Gallium Nitride for LED and power device application.

Key Takeaways

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region.

Vertical Gradient Freeze (VGF) Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength

The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, the trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products.

Gallium Arsenide companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Related Reports

A.Semiconductor Market

https://www.industryarc.com/Report/18466/semiconductor-market-research-report-analysis.html

B.Compound Semiconductor Market

https://www.industryarc.com/Research/Compound-Semiconductor-Market-Research-507438

For more Electronics Market reports, please click here

About IndustryARC Market Research Reports

IndustryARC is a Research and Consulting Firm that publishes more than 500 reports annually, in various industries such as Agriculture, Automotive, Automation & Instrumentation, Chemicals and Materials, Energy and Power, Electronics, Food & Beverages, Information Technology, and Life sciences &Healthcare.

IndustryARC primarily focuses on cutting edge technologies and newer Applications in a Market. Our Custom Research Services are designed to provide insights on the constant flux in the global supply-demand gap of markets. Our strong team of analysts enables us to meet the client research needs at a rapid speed, with a variety of options for your business.

We look forward to support the client to be able to better address their customer needs, stay ahead in the market, become the top competitor and get real-time recommendations on business strategies and deals. Contact us to find out how we can help you today.

More about IndustryARC Market Research Reports

0 notes

Text

Gallium Arsenide (GaAs) Market Size Forecast to Reach $632.2 Billion by 2026

Gallium Arsenide (GaAs) Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026. GaAs is increasingly used as a replacement for silicon because of its enhanced electronic properties and was selectively grown on GaAs substrates patterned with SiO2 by conventional molecular beam epitaxy. Moreover growing demand for GaAs across various end-user industries such as aerospace & defense, electronics, and communications is analyzed to drive the Gallium Arsenide Market share. In addition, owing to a wide direct band gap material that resists radiation damage, GaAs is an excellent option for outer space electronics and optical windows in high power applications. Further, other key factors driving the growth of the GaAs market include increase in adoption of 5G networks across the world and the advent of IoT has been one of the major reasons responsible for the growing trend of the Gallium Arsenide market size. The technology has given rise to a demand for high-frequency communication devices made with GaAs based ICs. Furthermore, this remarkable growth in the Gallium Arsenide market is providing a huge number of opportunities for wafer, EPI wafer & metal-organic chemical vapor deposition equipment suppliers, and manufacturers in the forecast period 2021-2026.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=509501

Report Price: $ 5900 (Single User License)

Gallium Arsenide Market Segment Analysis - By Type

Vertical Gradient Freeze (VGF) Grown GaAs segment held significant market share of 40.5% in 2020. VGF Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength. Vertical gradient freeze (VGF) technology is a proven technique for growing semiconductors composed of multiple elements that include gallium, arsenic, indium, and phosphorus. Such semiconductors offer capabilities that exceed those of wafers created on a single crystal silicon substrate. The main advantages of the VGF process include its scalability, low stress, high mechanical strength, and a defect rate that is orders of magnitude lower than conventional compound semiconductor crystal growth processes. Hence these benefits are analysed to drive the growth rate of the gallium arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Application

Smart phones segment in Gallium Arsenide market is expected to witness a highest CAGR of 8.5% the forecast period. The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products. Moreover, the continuous advancements in consumer electronics and the use of sensors in various electronic products are proliferating the applications of plasma etching in smartphones and their demand across almost all the industry sectors. In 2018, the South Korean government announced to invest $1.34 billion for the next ten years to support the development of next-generation semiconductor technology, to support Samsung Electronics and SK Hynix. The investment will help Korean companies, such as Samsung and SK Hynix, to enhance their semiconductor manufacturing capabilities. Further with the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. As Gallium Arsenide will outperform silicon wafers due to its ultra-high frequency applications will enhance the demand for Gallium Arsenide industry in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Geography

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region. Countries such as India, China, Taiwan, South Korea and so on are few of the prominent markets for Gallium Arsenide, and this is primarily attributed to the growing demand for advanced technologies across numerous end-user industries, high growth of the consumer electronics industry, rising support for the semiconductor industry in the region. In May 2019, Taiwan Semiconductor has opened new branch in Beijing to accommodate the rapid growth in China and engage local talent in its business development efforts. Moreover, the emergence of new technologies in Asia-Pacific has boosted the demand for innovative and user-friendly smart devices. There has been a rising demand from South Korea and Taiwan for semiconductor wafers, due to the large production of consumer electronic devices such as televisions, smartphones, PCs and so on. Further governments of several countries in this region are supporting the growth of semiconductor production by various initiatives, for instance, Made in Chine 2025, Make in India and others will promote the growth of semiconductor industries thereby increasing the growth of Gallium Arsenide market in the forecast period 2021-2026.

Inquiry Before Buying @ https://www.industryarc.com/reports/request-quote?id=509501

Gallium Arsenide Market Drivers

Growing Penetration of 5G

With the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. Gallium Arsenide due to its ultra-high frequency applications able to outperform silicon wafers in some of the most important ways. Moreover, with the emergence of 5G, silicon usage in semiconductors will be further reduced. Further for the implementation of 5G network, GaAs can be seen as the next generation of integrated circuits due to its high band gap, which drastically outperforms silicon. According to semiconductor Association, it is expected that the overall market for semiconductors could pass a whopping $20 trillion by 2025. This will create significant demand for GaAs in the forecast period. Furthermore governments of several countries have been investing heavily for the deployment of 5G. In 2019, China is expected to invest over $150 billion in its 5G networks through 2025. Similarly, Germany made a step towards accelerating the development of 5G services in the country, pouring additional investments into backing domestic endeavours. Hence growing penetration of 5g will drive the Gallium Arsenide Market growth in the forecast period 2021-2026.

Growth of Semiconductor industry creates significant demand for Gallium Arsenide Market

Growth of semiconductor manufacturing is analysed to create significant opportunities in the forecast period. In 2020, Indian Government is planning to offer around $1 billion in cash to every company that sets up a chip manufacturing unit in India. Similarly, China’s ‘Made in China 2025’ initiative will also create significant demand for semiconductor manufacturing in the forecast period. Moreover, U.S government is also committed to invest around $50 billion for the growth of semiconductor industry. Silicon is the most important material for semiconductor electronics. Silicon devices and integrated circuits are dominant in most applications from consumer electronics to automotive. However, in certain areas, silicon is being challenged by other semiconductor materials, such as gallium arsenide. Gallium arsenide excels in ultra-high frequency applications and has emerged as leading contenders for ultrahigh speed applications in the next generation of supercomputers and communication equipment. Hence Gallium arsenide has become relatively important and is expected to increase sharply in the forecast period 2021-2026.

Gallium Arsenide Market Challenges

High Production Cost

Although Gallium Arsenide market is growing at a significant phase it poses some difficulties, compared with that of silicon. For instance, unlike silicon, there is no natural oxide that acts as a mask to produce simple elements of the Complementary Metal Oxide Semiconductor (CMOS) logic style. High production cost of Gallium Arsenide act as major threat for the growth of the market. This is partly due to this technology not being able to achieve high volumes to bring the cost down and in a large part also because of not having a straightforward way to bring costs down generation after generation by exploiting device scaling like CMOS. Further GaAs technology does not easily lend itself to integrating millions or billions of transistors on one integrated circuit. Most GaAs ICs can manage to integrate only a handful of transistors unlike silicon. Hence these challenges hamper the market growth in the forecast period 2021-2026.

Gallium Arsenide Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Gallium Arsenide market. Gallium Arsenide top 10 companies include Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Power way Advanced Material Co. Ltd. among others.

Acquisitions/Product Launches

In 2021 AXT, Inc., a leading manufacturer of compound semiconductor substrate wafers, has developed and shipped its first 8-inch diameter gallium arsenide (GaAs) substrates to a major customer. The 8-inch GaAs substrates, which are silicon doped, n-type substrates, demonstrate low etch pit densities (EPD) and low levels of slip lines.

In 2019, PAM-XIAMEN develops advanced crystal growth and epitaxy technologies, range from the first generation Germanium wafer, second-generation Gallium Arsenide with substrate growth and epitaxy on III-V silicon doped n-type semiconductor materials based on Ga, Al, In, As and P grown by MBE or MOCVD, to the third generation Silicon carbide and Gallium Nitride for LED and power device application.

Key Takeaways

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region.

Vertical Gradient Freeze (VGF) Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength

The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, the trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products.

Gallium Arsenide companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

0 notes

Text

Gallium Arsenide Market - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth And Forecast 2021 - 2026

Gallium Arsenide (GaAs) Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026. GaAs is increasingly used as a replacement for silicon because of its enhanced electronic properties and was selectively grown on GaAs substrates patterned with SiO2 by conventional molecular beam epitaxy. Moreover growing demand for GaAs across various end-user industries such as aerospace & defense, electronics, and communications is analyzed to drive the Gallium Arsenide Market share. In addition, owing to a wide direct band gap material that resists radiation damage, GaAs is an excellent option for outer space electronics and optical windows in high power applications. Further, other key factors driving the growth of the GaAs market include increase in adoption of 5G networks across the world and the advent of IoT has been one of the major reasons responsible for the growing trend of the Gallium Arsenide market size. The technology has given rise to a demand for high-frequency communication devices made with GaAs based ICs. Furthermore, this remarkable growth in the Gallium Arsenide market is providing a huge number of opportunities for wafer, EPI wafer & metal-organic chemical vapor deposition equipment suppliers, and manufacturers in the forecast period 2021-2026.

Gallium Arsenide Market Report Coverage

The report: “Gallium Arsenide Market Report– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Gallium Arsenide market

By Type: Liquid Encapsulated Czochralski Grown GaAs, Vertical Gradient Freeze (VGF) Grown GaAs, Others

By Application: Smartphones, Computer, Photovoltaic Cells, Laser Diodes, Infrared Emission, Automotive Electronics, Military Area, Wireless Communication, Optoelectronic Devices, Other.

By Geography: North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle East and Africa)

Key Takeaways

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region.

Vertical Gradient Freeze (VGF) Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength

The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, the trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products.

Gallium Arsenide companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Global Gallium Arsenide Market, By Region, 2020

For More Details on This Report - Request for Sample

Gallium Arsenide Market Segment Analysis - By Type

Vertical Gradient Freeze (VGF) Grown GaAs segment held significant market share of 40.5% in 2020. VGF Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength. Vertical gradient freeze (VGF) technology is a proven technique for growing semiconductors composed of multiple elements that include gallium, arsenic, indium, and phosphorus. Such semiconductors offer capabilities that exceed those of wafers created on a single crystal silicon substrate. The main advantages of the VGF process include its scalability, low stress, high mechanical strength, and a defect rate that is orders of magnitude lower than conventional compound semiconductor crystal growth processes. Hence these benefits are analysed to drive the growth rate of the gallium arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Application

Smart phones segment in Gallium Arsenide market is expected to witness a highest CAGR of 8.5% the forecast period. The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products. Moreover, the continuous advancements in consumer electronics and the use of sensors in various electronic products are proliferating the applications of plasma etching in smartphones and their demand across almost all the industry sectors. In 2018, the South Korean government announced to invest $1.34 billion for the next ten years to support the development of next-generation semiconductor technology, to support Samsung Electronics and SK Hynix. The investment will help Korean companies, such as Samsung and SK Hynix, to enhance their semiconductor manufacturing capabilities. Further with the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. As Gallium Arsenide will outperform silicon wafers due to its ultra-high frequency applications will enhance the demand for Gallium Arsenide industry in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Geography

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region. Countries such as India, China, Taiwan, South Korea and so on are few of the prominent markets for Gallium Arsenide, and this is primarily attributed to the growing demand for advanced technologies across numerous end-user industries, high growth of the consumer electronics industry, rising support for the semiconductor industry in the region. In May 2019, Taiwan Semiconductor has opened new branch in Beijing to accommodate the rapid growth in China and engage local talent in its business development efforts. Moreover, the emergence of new technologies in Asia-Pacific has boosted the demand for innovative and user-friendly smart devices. There has been a rising demand from South Korea and Taiwan for semiconductor wafers, due to the large production of consumer electronic devices such as televisions, smartphones, PCs and so on. Further governments of several countries in this region are supporting the growth of semiconductor production by various initiatives, for instance, Made in Chine 2025, Make in India and others will promote the growth of semiconductor industries thereby increasing the growth of Gallium Arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Drivers

Growing Penetration of 5G

With the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. Gallium Arsenide due to its ultra-high frequency applications able to outperform silicon wafers in some of the most important ways. Moreover, with the emergence of 5G, silicon usage in semiconductors will be further reduced. Further for the implementation of 5G network, GaAs can be seen as the next generation of integrated circuits due to its high band gap, which drastically outperforms silicon. According to semiconductor Association, it is expected that the overall market for semiconductors could pass a whopping $20 trillion by 2025. This will create significant demand for GaAs in the forecast period. Furthermore governments of several countries have been investing heavily for the deployment of 5G. In 2019, China is expected to invest over $150 billion in its 5G networks through 2025. Similarly, Germany made a step towards accelerating the development of 5G services in the country, pouring additional investments into backing domestic endeavours. Hence growing penetration of 5g will drive the Gallium Arsenide Market growth in the forecast period 2021-2026.

Growth of Semiconductor industry creates significant demand for Gallium Arsenide Market

Growth of semiconductor manufacturing is analysed to create significant opportunities in the forecast period. In 2020, Indian Government is planning to offer around $1 billion in cash to every company that sets up a chip manufacturing unit in India. Similarly, China’s ‘Made in China 2025’ initiative will also create significant demand for semiconductor manufacturing in the forecast period. Moreover, U.S government is also committed to invest around $50 billion for the growth of semiconductor industry. Silicon is the most important material for semiconductor electronics. Silicon devices and integrated circuits are dominant in most applications from consumer electronics to automotive. However, in certain areas, silicon is being challenged by other semiconductor materials, such as gallium arsenide. Gallium arsenide excels in ultra-high frequency applications and has emerged as leading contenders for ultrahigh speed applications in the next generation of supercomputers and communication equipment. Hence Gallium arsenide has become relatively important and is expected to increase sharply in the forecast period 2021-2026.

Gallium Arsenide Market Challenges

High Production Cost

Although Gallium Arsenide market is growing at a significant phase it poses some difficulties, compared with that of silicon. For instance, unlike silicon, there is no natural oxide that acts as a mask to produce simple elements of the Complementary Metal Oxide Semiconductor (CMOS) logic style. High production cost of Gallium Arsenide act as major threat for the growth of the market. This is partly due to this technology not being able to achieve high volumes to bring the cost down and in a large part also because of not having a straightforward way to bring costs down generation after generation by exploiting device scaling like CMOS. Further GaAs technology does not easily lend itself to integrating millions or billions of transistors on one integrated circuit. Most GaAs ICs can manage to integrate only a handful of transistors unlike silicon. Hence these challenges hamper the market growth in the forecast period 2021-2026.

Gallium Arsenide Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Gallium Arsenide market. Gallium Arsenide top 10 companies include Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Power way Advanced Material Co. Ltd. among others.

Acquisitions/Product Launches

In 2021 AXT, Inc., a leading manufacturer of compound semiconductor substrate wafers, has developed and shipped its first 8-inch diameter gallium arsenide (GaAs) substrates to a major customer. The 8-inch GaAs substrates, which are silicon doped, n-type substrates, demonstrate low etch pit densities (EPD) and low levels of slip lines.

In 2019, PAM-XIAMEN develops advanced crystal growth and epitaxy technologies, range from the first generation Germanium wafer, second-generation Gallium Arsenide with substrate growth and epitaxy on III-V silicon doped n-type semiconductor materials based on Ga, Al, In, As and P grown by MBE or MOCVD, to the third generation Silicon carbide and Gallium Nitride for LED and power device application.

Relevant Report Titles:

Semiconductor Market:

Report Code: ESR 0563

Compound Semiconductor Market:

Report Code: ESR 87979

For more Electronics Market reports, please click here

0 notes

Text

Gallium Arsenide Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026.

Gallium Arsenide (GaAs) Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026. GaAs is increasingly used as a replacement for silicon because of its enhanced electronic properties and was selectively grown on GaAs substrates patterned with SiO2 by conventional molecular beam epitaxy. Moreover growing demand for GaAs across various end-user industries such as aerospace & defense, electronics, and communications is analyzed to drive the Gallium Arsenide Market share. In addition, owing to a wide direct band gap material that resists radiation damage, GaAs is an excellent option for outer space electronics and optical windows in high power applications. Further, other key factors driving the growth of the GaAs market include increase in adoption of 5G networks across the world and the advent of IoT has been one of the major reasons responsible for the growing trend of the Gallium Arsenide market size. The technology has given rise to a demand for high-frequency communication devices made with GaAs based ICs. Furthermore, this remarkable growth in the Gallium Arsenide market is providing a huge number of opportunities for wafer, EPI wafer & metal-organic chemical vapor deposition equipment suppliers, and manufacturers in the forecast period 2021-2026.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=509501

Report Price: $ 5900 (Single User License)

Gallium Arsenide Market Segment Analysis - By Type

Vertical Gradient Freeze (VGF) Grown GaAs segment held significant market share of 40.5% in 2020. VGF Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength. Vertical gradient freeze (VGF) technology is a proven technique for growing semiconductors composed of multiple elements that include gallium, arsenic, indium, and phosphorus. Such semiconductors offer capabilities that exceed those of wafers created on a single crystal silicon substrate. The main advantages of the VGF process include its scalability, low stress, high mechanical strength, and a defect rate that is orders of magnitude lower than conventional compound semiconductor crystal growth processes. Hence these benefits are analysed to drive the growth rate of the gallium arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Application

Smart phones segment in Gallium Arsenide market is expected to witness a highest CAGR of 8.5% the forecast period. The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products. Moreover, the continuous advancements in consumer electronics and the use of sensors in various electronic products are proliferating the applications of plasma etching in smartphones and their demand across almost all the industry sectors. In 2018, the South Korean government announced to invest $1.34 billion for the next ten years to support the development of next-generation semiconductor technology, to support Samsung Electronics and SK Hynix. The investment will help Korean companies, such as Samsung and SK Hynix, to enhance their semiconductor manufacturing capabilities. Further with the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. As Gallium Arsenide will outperform silicon wafers due to its ultra-high frequency applications will enhance the demand for Gallium Arsenide industry in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Geography

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region. Countries such as India, China, Taiwan, South Korea and so on are few of the prominent markets for Gallium Arsenide, and this is primarily attributed to the growing demand for advanced technologies across numerous end-user industries, high growth of the consumer electronics industry, rising support for the semiconductor industry in the region. In May 2019, Taiwan Semiconductor has opened new branch in Beijing to accommodate the rapid growth in China and engage local talent in its business development efforts. Moreover, the emergence of new technologies in Asia-Pacific has boosted the demand for innovative and user-friendly smart devices. There has been a rising demand from South Korea and Taiwan for semiconductor wafers, due to the large production of consumer electronic devices such as televisions, smartphones, PCs and so on. Further governments of several countries in this region are supporting the growth of semiconductor production by various initiatives, for instance, Made in Chine 2025, Make in India and others will promote the growth of semiconductor industries thereby increasing the growth of Gallium Arsenide market in the forecast period 2021-2026.

Inquiry Before Buying @ https://www.industryarc.com/reports/request-quote?id=509501

Gallium Arsenide Market Drivers

Growing Penetration of 5G

With the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. Gallium Arsenide due to its ultra-high frequency applications able to outperform silicon wafers in some of the most important ways. Moreover, with the emergence of 5G, silicon usage in semiconductors will be further reduced. Further for the implementation of 5G network, GaAs can be seen as the next generation of integrated circuits due to its high band gap, which drastically outperforms silicon. According to semiconductor Association, it is expected that the overall market for semiconductors could pass a whopping $20 trillion by 2025. This will create significant demand for GaAs in the forecast period. Furthermore governments of several countries have been investing heavily for the deployment of 5G. In 2019, China is expected to invest over $150 billion in its 5G networks through 2025. Similarly, Germany made a step towards accelerating the development of 5G services in the country, pouring additional investments into backing domestic endeavours. Hence growing penetration of 5g will drive the Gallium Arsenide Market growth in the forecast period 2021-2026.

Growth of Semiconductor industry creates significant demand for Gallium Arsenide Market

Growth of semiconductor manufacturing is analysed to create significant opportunities in the forecast period. In 2020, Indian Government is planning to offer around $1 billion in cash to every company that sets up a chip manufacturing unit in India. Similarly, China’s ‘Made in China 2025’ initiative will also create significant demand for semiconductor manufacturing in the forecast period. Moreover, U.S government is also committed to invest around $50 billion for the growth of semiconductor industry. Silicon is the most important material for semiconductor electronics. Silicon devices and integrated circuits are dominant in most applications from consumer electronics to automotive. However, in certain areas, silicon is being challenged by other semiconductor materials, such as gallium arsenide. Gallium arsenide excels in ultra-high frequency applications and has emerged as leading contenders for ultrahigh speed applications in the next generation of supercomputers and communication equipment. Hence Gallium arsenide has become relatively important and is expected to increase sharply in the forecast period 2021-2026.

Gallium Arsenide Market Challenges

High Production Cost

Although Gallium Arsenide market is growing at a significant phase it poses some difficulties, compared with that of silicon. For instance, unlike silicon, there is no natural oxide that acts as a mask to produce simple elements of the Complementary Metal Oxide Semiconductor (CMOS) logic style. High production cost of Gallium Arsenide act as major threat for the growth of the market. This is partly due to this technology not being able to achieve high volumes to bring the cost down and in a large part also because of not having a straightforward way to bring costs down generation after generation by exploiting device scaling like CMOS. Further GaAs technology does not easily lend itself to integrating millions or billions of transistors on one integrated circuit. Most GaAs ICs can manage to integrate only a handful of transistors unlike silicon. Hence these challenges hamper the market growth in the forecast period 2021-2026.

Gallium Arsenide Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Gallium Arsenide market. Gallium Arsenide top 10 companies include Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Power way Advanced Material Co. Ltd. among others.

Acquisitions/Product Launches

In 2021 AXT, Inc., a leading manufacturer of compound semiconductor substrate wafers, has developed and shipped its first 8-inch diameter gallium arsenide (GaAs) substrates to a major customer. The 8-inch GaAs substrates, which are silicon doped, n-type substrates, demonstrate low etch pit densities (EPD) and low levels of slip lines.

In 2019, PAM-XIAMEN develops advanced crystal growth and epitaxy technologies, range from the first generation Germanium wafer, second-generation Gallium Arsenide with substrate growth and epitaxy on III-V silicon doped n-type semiconductor materials based on Ga, Al, In, As and P grown by MBE or MOCVD, to the third generation Silicon carbide and Gallium Nitride for LED and power device application.

Key Takeaways

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region.

Vertical Gradient Freeze (VGF) Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength

The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, the trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products.

Gallium Arsenide companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Related Reports

A.Semiconductor Market

https://www.industryarc.com/Report/18466/semiconductor-market-research-report-analysis.html

B.Compound Semiconductor Market

https://www.industryarc.com/Research/Compound-Semiconductor-Market-Research-507438

For more Electronics Market reports, please click here

0 notes

Text

Gallium Arsenide (GaAs) Market Size Forecast to Reach $632.2 Billion by 2026

Gallium Arsenide (GaAs) Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026. GaAs is increasingly used as a replacement for silicon because of its enhanced electronic properties and was selectively grown on GaAs substrates patterned with SiO2 by conventional molecular beam epitaxy. Moreover growing demand for GaAs across various end-user industries such as aerospace & defense, electronics, and communications is analyzed to drive the Gallium Arsenide Market share. In addition, owing to a wide direct band gap material that resists radiation damage, GaAs is an excellent option for outer space electronics and optical windows in high power applications. Further, other key factors driving the growth of the GaAs market include increase in adoption of 5G networks across the world and the advent of IoT has been one of the major reasons responsible for the growing trend of the Gallium Arsenide market size. The technology has given rise to a demand for high-frequency communication devices made with GaAs based ICs. Furthermore, this remarkable growth in the Gallium Arsenide market is providing a huge number of opportunities for wafer, EPI wafer & metal-organic chemical vapor deposition equipment suppliers, and manufacturers in the forecast period 2021-2026.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=509501

Report Price: $ 5900 (Single User License)

Gallium Arsenide Market Segment Analysis - By Type

Vertical Gradient Freeze (VGF) Grown GaAs segment held significant market share of 40.5% in 2020. VGF Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength. Vertical gradient freeze (VGF) technology is a proven technique for growing semiconductors composed of multiple elements that include gallium, arsenic, indium, and phosphorus. Such semiconductors offer capabilities that exceed those of wafers created on a single crystal silicon substrate. The main advantages of the VGF process include its scalability, low stress, high mechanical strength, and a defect rate that is orders of magnitude lower than conventional compound semiconductor crystal growth processes. Hence these benefits are analysed to drive the growth rate of the gallium arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Application

Smart phones segment in Gallium Arsenide market is expected to witness a highest CAGR of 8.5% the forecast period. The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products. Moreover, the continuous advancements in consumer electronics and the use of sensors in various electronic products are proliferating the applications of plasma etching in smartphones and their demand across almost all the industry sectors. In 2018, the South Korean government announced to invest $1.34 billion for the next ten years to support the development of next-generation semiconductor technology, to support Samsung Electronics and SK Hynix. The investment will help Korean companies, such as Samsung and SK Hynix, to enhance their semiconductor manufacturing capabilities. Further with the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. As Gallium Arsenide will outperform silicon wafers due to its ultra-high frequency applications will enhance the demand for Gallium Arsenide industry in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Geography

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region. Countries such as India, China, Taiwan, South Korea and so on are few of the prominent markets for Gallium Arsenide, and this is primarily attributed to the growing demand for advanced technologies across numerous end-user industries, high growth of the consumer electronics industry, rising support for the semiconductor industry in the region. In May 2019, Taiwan Semiconductor has opened new branch in Beijing to accommodate the rapid growth in China and engage local talent in its business development efforts. Moreover, the emergence of new technologies in Asia-Pacific has boosted the demand for innovative and user-friendly smart devices. There has been a rising demand from South Korea and Taiwan for semiconductor wafers, due to the large production of consumer electronic devices such as televisions, smartphones, PCs and so on. Further governments of several countries in this region are supporting the growth of semiconductor production by various initiatives, for instance, Made in Chine 2025, Make in India and others will promote the growth of semiconductor industries thereby increasing the growth of Gallium Arsenide market in the forecast period 2021-2026.

Inquiry Before Buying @ https://www.industryarc.com/reports/request-quote?id=509501

Gallium Arsenide Market Drivers

Growing Penetration of 5G

With the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. Gallium Arsenide due to its ultra-high frequency applications able to outperform silicon wafers in some of the most important ways. Moreover, with the emergence of 5G, silicon usage in semiconductors will be further reduced. Further for the implementation of 5G network, GaAs can be seen as the next generation of integrated circuits due to its high band gap, which drastically outperforms silicon. According to semiconductor Association, it is expected that the overall market for semiconductors could pass a whopping $20 trillion by 2025. This will create significant demand for GaAs in the forecast period. Furthermore governments of several countries have been investing heavily for the deployment of 5G. In 2019, China is expected to invest over $150 billion in its 5G networks through 2025. Similarly, Germany made a step towards accelerating the development of 5G services in the country, pouring additional investments into backing domestic endeavours. Hence growing penetration of 5g will drive the Gallium Arsenide Market growth in the forecast period 2021-2026.

Growth of Semiconductor industry creates significant demand for Gallium Arsenide Market

Growth of semiconductor manufacturing is analysed to create significant opportunities in the forecast period. In 2020, Indian Government is planning to offer around $1 billion in cash to every company that sets up a chip manufacturing unit in India. Similarly, China’s ‘Made in China 2025’ initiative will also create significant demand for semiconductor manufacturing in the forecast period. Moreover, U.S government is also committed to invest around $50 billion for the growth of semiconductor industry. Silicon is the most important material for semiconductor electronics. Silicon devices and integrated circuits are dominant in most applications from consumer electronics to automotive. However, in certain areas, silicon is being challenged by other semiconductor materials, such as gallium arsenide. Gallium arsenide excels in ultra-high frequency applications and has emerged as leading contenders for ultrahigh speed applications in the next generation of supercomputers and communication equipment. Hence Gallium arsenide has become relatively important and is expected to increase sharply in the forecast period 2021-2026.

Gallium Arsenide Market Challenges

High Production Cost

Although Gallium Arsenide market is growing at a significant phase it poses some difficulties, compared with that of silicon. For instance, unlike silicon, there is no natural oxide that acts as a mask to produce simple elements of the Complementary Metal Oxide Semiconductor (CMOS) logic style. High production cost of Gallium Arsenide act as major threat for the growth of the market. This is partly due to this technology not being able to achieve high volumes to bring the cost down and in a large part also because of not having a straightforward way to bring costs down generation after generation by exploiting device scaling like CMOS. Further GaAs technology does not easily lend itself to integrating millions or billions of transistors on one integrated circuit. Most GaAs ICs can manage to integrate only a handful of transistors unlike silicon. Hence these challenges hamper the market growth in the forecast period 2021-2026.

Gallium Arsenide Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Gallium Arsenide market. Gallium Arsenide top 10 companies include Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Power way Advanced Material Co. Ltd. among others.

Acquisitions/Product Launches

In 2021 AXT, Inc., a leading manufacturer of compound semiconductor substrate wafers, has developed and shipped its first 8-inch diameter gallium arsenide (GaAs) substrates to a major customer. The 8-inch GaAs substrates, which are silicon doped, n-type substrates, demonstrate low etch pit densities (EPD) and low levels of slip lines.

In 2019, PAM-XIAMEN develops advanced crystal growth and epitaxy technologies, range from the first generation Germanium wafer, second-generation Gallium Arsenide with substrate growth and epitaxy on III-V silicon doped n-type semiconductor materials based on Ga, Al, In, As and P grown by MBE or MOCVD, to the third generation Silicon carbide and Gallium Nitride for LED and power device application.

Key Takeaways

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region.

Vertical Gradient Freeze (VGF) Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength

The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, the trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products.

Gallium Arsenide companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Related Reports

A.Semiconductor Market

https://www.industryarc.com/Report/18466/semiconductor-market-research-report-analysis.html

B.Compound Semiconductor Market

https://www.industryarc.com/Research/Compound-Semiconductor-Market-Research-507438

For more Electronics Market reports, please click here

About IndustryARC Market Research Reports

IndustryARC is a Research and Consulting Firm that publishes more than 500 reports annually, in various industries such as Agriculture, Automotive, Automation & Instrumentation, Chemicals and Materials, Energy and Power, Electronics, Food & Beverages, Information Technology, and Life sciences &Healthcare.

IndustryARC primarily focuses on cutting edge technologies and newer Applications in a Market. Our Custom Research Services are designed to provide insights on the constant flux in the global supply-demand gap of markets. Our strong team of analysts enables us to meet the client research needs at a rapid speed, with a variety of options for your business.

We look forward to support the client to be able to better address their customer needs, stay ahead in the market, become the top competitor and get real-time recommendations on business strategies and deals. Contact us to find out how we can help you today.

More about IndustryARC Market Research Reports

Contact info

Venkat Reddy, Sales Director, Email: [email protected], Website: https://www.industryarc.com, Phone: (+1) 970-236-3677.

0 notes

Text

Gallium Arsenide (GaAs) Market Size Forecast to Reach $632.2 Billion by 2026

Gallium Arsenide (GaAs) Market Size is forecast to reach $632.2 billion by 2026, growing at a CAGR of 7.1% during 2021-2026. GaAs is increasingly used as a replacement for silicon because of its enhanced electronic properties and was selectively grown on GaAs substrates patterned with SiO2 by conventional molecular beam epitaxy. Moreover growing demand for GaAs across various end-user industries such as aerospace & defense, electronics, and communications is analyzed to drive the Gallium Arsenide Market share. In addition, owing to a wide direct band gap material that resists radiation damage, GaAs is an excellent option for outer space electronics and optical windows in high power applications. Further, other key factors driving the growth of the GaAs market include increase in adoption of 5G networks across the world and the advent of IoT has been one of the major reasons responsible for the growing trend of the Gallium Arsenide market size. The technology has given rise to a demand for high-frequency communication devices made with GaAs based ICs. Furthermore, this remarkable growth in the Gallium Arsenide market is providing a huge number of opportunities for wafer, EPI wafer & metal-organic chemical vapor deposition equipment suppliers, and manufacturers in the forecast period 2021-2026.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=509501

Report Price: $ 5900 (Single User License)

Gallium Arsenide Market Segment Analysis - By Type

Vertical Gradient Freeze (VGF) Grown GaAs segment held significant market share of 40.5% in 2020. VGF Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength. Vertical gradient freeze (VGF) technology is a proven technique for growing semiconductors composed of multiple elements that include gallium, arsenic, indium, and phosphorus. Such semiconductors offer capabilities that exceed those of wafers created on a single crystal silicon substrate. The main advantages of the VGF process include its scalability, low stress, high mechanical strength, and a defect rate that is orders of magnitude lower than conventional compound semiconductor crystal growth processes. Hence these benefits are analysed to drive the growth rate of the gallium arsenide market in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Application

Smart phones segment in Gallium Arsenide market is expected to witness a highest CAGR of 8.5% the forecast period. The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products. Moreover, the continuous advancements in consumer electronics and the use of sensors in various electronic products are proliferating the applications of plasma etching in smartphones and their demand across almost all the industry sectors. In 2018, the South Korean government announced to invest $1.34 billion for the next ten years to support the development of next-generation semiconductor technology, to support Samsung Electronics and SK Hynix. The investment will help Korean companies, such as Samsung and SK Hynix, to enhance their semiconductor manufacturing capabilities. Further with the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. As Gallium Arsenide will outperform silicon wafers due to its ultra-high frequency applications will enhance the demand for Gallium Arsenide industry in the forecast period 2021-2026.

Gallium Arsenide Market Segment Analysis - By Geography

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region. Countries such as India, China, Taiwan, South Korea and so on are few of the prominent markets for Gallium Arsenide, and this is primarily attributed to the growing demand for advanced technologies across numerous end-user industries, high growth of the consumer electronics industry, rising support for the semiconductor industry in the region. In May 2019, Taiwan Semiconductor has opened new branch in Beijing to accommodate the rapid growth in China and engage local talent in its business development efforts. Moreover, the emergence of new technologies in Asia-Pacific has boosted the demand for innovative and user-friendly smart devices. There has been a rising demand from South Korea and Taiwan for semiconductor wafers, due to the large production of consumer electronic devices such as televisions, smartphones, PCs and so on. Further governments of several countries in this region are supporting the growth of semiconductor production by various initiatives, for instance, Made in Chine 2025, Make in India and others will promote the growth of semiconductor industries thereby increasing the growth of Gallium Arsenide market in the forecast period 2021-2026.

Inquiry Before Buying @ https://www.industryarc.com/reports/request-quote?id=509501

Gallium Arsenide Market Drivers

Growing Penetration of 5G

With the powerful 5G cellular network being introduced to the world in 2019, mobile devices need a semiconductor that can handle the faster signal speed. Gallium Arsenide due to its ultra-high frequency applications able to outperform silicon wafers in some of the most important ways. Moreover, with the emergence of 5G, silicon usage in semiconductors will be further reduced. Further for the implementation of 5G network, GaAs can be seen as the next generation of integrated circuits due to its high band gap, which drastically outperforms silicon. According to semiconductor Association, it is expected that the overall market for semiconductors could pass a whopping $20 trillion by 2025. This will create significant demand for GaAs in the forecast period. Furthermore governments of several countries have been investing heavily for the deployment of 5G. In 2019, China is expected to invest over $150 billion in its 5G networks through 2025. Similarly, Germany made a step towards accelerating the development of 5G services in the country, pouring additional investments into backing domestic endeavours. Hence growing penetration of 5g will drive the Gallium Arsenide Market growth in the forecast period 2021-2026.

Growth of Semiconductor industry creates significant demand for Gallium Arsenide Market

Growth of semiconductor manufacturing is analysed to create significant opportunities in the forecast period. In 2020, Indian Government is planning to offer around $1 billion in cash to every company that sets up a chip manufacturing unit in India. Similarly, China’s ‘Made in China 2025’ initiative will also create significant demand for semiconductor manufacturing in the forecast period. Moreover, U.S government is also committed to invest around $50 billion for the growth of semiconductor industry. Silicon is the most important material for semiconductor electronics. Silicon devices and integrated circuits are dominant in most applications from consumer electronics to automotive. However, in certain areas, silicon is being challenged by other semiconductor materials, such as gallium arsenide. Gallium arsenide excels in ultra-high frequency applications and has emerged as leading contenders for ultrahigh speed applications in the next generation of supercomputers and communication equipment. Hence Gallium arsenide has become relatively important and is expected to increase sharply in the forecast period 2021-2026.

Gallium Arsenide Market Challenges

High Production Cost

Although Gallium Arsenide market is growing at a significant phase it poses some difficulties, compared with that of silicon. For instance, unlike silicon, there is no natural oxide that acts as a mask to produce simple elements of the Complementary Metal Oxide Semiconductor (CMOS) logic style. High production cost of Gallium Arsenide act as major threat for the growth of the market. This is partly due to this technology not being able to achieve high volumes to bring the cost down and in a large part also because of not having a straightforward way to bring costs down generation after generation by exploiting device scaling like CMOS. Further GaAs technology does not easily lend itself to integrating millions or billions of transistors on one integrated circuit. Most GaAs ICs can manage to integrate only a handful of transistors unlike silicon. Hence these challenges hamper the market growth in the forecast period 2021-2026.

Gallium Arsenide Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Gallium Arsenide market. Gallium Arsenide top 10 companies include Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Power way Advanced Material Co. Ltd. among others.

Acquisitions/Product Launches

In 2021 AXT, Inc., a leading manufacturer of compound semiconductor substrate wafers, has developed and shipped its first 8-inch diameter gallium arsenide (GaAs) substrates to a major customer. The 8-inch GaAs substrates, which are silicon doped, n-type substrates, demonstrate low etch pit densities (EPD) and low levels of slip lines.

In 2019, PAM-XIAMEN develops advanced crystal growth and epitaxy technologies, range from the first generation Germanium wafer, second-generation Gallium Arsenide with substrate growth and epitaxy on III-V silicon doped n-type semiconductor materials based on Ga, Al, In, As and P grown by MBE or MOCVD, to the third generation Silicon carbide and Gallium Nitride for LED and power device application.

Key Takeaways

Gallium Arsenide market in Asia-Pacific region held significant market share of 36.5% in 2020, owing to growing consumption of smartphones and other high-performance electronics devices in the region.

Vertical Gradient Freeze (VGF) Grown GaAs will remain the largest manufacturing technology, and it is expected to witness highest growth during the forecast period as it produces substrates with relatively low defect densities and higher mechanical strength

The demand for Gallium Arsenide is driven by smartphones and other applications across the consumer electronics industry, which require semiconductor ICs. In addition, the trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment, in a bid to attain intelligent products.

Gallium Arsenide companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Related Reports

A.Semiconductor Market

https://www.industryarc.com/Report/18466/semiconductor-market-research-report-analysis.html

B.Compound Semiconductor Market

https://www.industryarc.com/Research/Compound-Semiconductor-Market-Research-507438

For more Electronics Market reports, please click here

#Gallium Arsenide (GaAs) Market#Gallium Arsenide (GaAs) Market share#Gallium Arsenide (GaAs) Market size

0 notes

Text

STANDARD SAPPHIRE WAFERS (C-PLANE)

https://www.cryscore.com/products/standard-sapphire-wafers/

CRYSCORE can offer Epi-Ready grade sapphire wafer with a very low surface roughness in complete orientation options.

C-plane(0001) sapphire wafers are being extensively used for epitaxial growth of III-V and II-VI compounds, such as gallium nitride (GaN), aluminum nitride (AlN), for bright blue and green LED and laser diodes.

Technical Applications of Standard Sapphire Wafers

C-plane sapphire wafers are widely used to grow III-V and II-VI deposited films of wide band-gap nitride and oxide semiconductor materials such as gallium nitride (GaN), aluminum nitride (AlN), indium nitride (InN), zinc oxide (ZnO ultraviolet light emission) and tin oxide (SnO2 ultraviolet luminescent material), etc.

In addition, standard C-plane(0001) sapphire wafers are widely applied to fabricate LED white and blue light, ultraviolet and deep UV LED epitaxial wafers by Metal-Organic Vapor Deposition(MOCVD), Molecular Beam Epitaxy (MBE), Plasma Enhanced Chemical Vapor Deposition(PECVD) and other epitaxy growth methods.

CRYSCORE standard sapphire wafers also are used as the substrates of heterojunction bipolar transistor (HBT), a laser diode (LD), UV detector, nanotube, and the heat dissipation material of high temperature and high power high-frequency electronic device.

Competitive Advantages of CRYSCORE's Sapphire Wafers

99.999 % high purity single crystal Al2O3 material.

Special CMP (Chemical Mechanical Polishing) technology to ensure its performance at a low cost.

Excellent surface quality in all orientations (less than 0.2 nm for C-plane, less than 0.5 nm for A-plane, M-plane, R-plane, N-plane, V-plane, 10-14, etc.)

Cleaned in class 100 cleanroom by ultrapure water with quality above 18MΩ *cm.