#financial forecasting software

Text

From Startup to Success: How Moolamore Cash Flow Forecasting Can Boost Your Business

Wishing you could predict cash flow fluctuations with remarkable accuracy and make brilliant decisions to propel your SME company to unprecedented success?

Say goodbye to all your worries! There is a solution on the way! Enter the revolutionary Moolamore cash flow tool into the picture! Join us on this journey from startup to success as we discover how Moolamore can improve your financial management and decision-making processes! Make sure to read this blog to the end!

#cash flow forecasting for startup#cash flow forecasting tool#best cash flow forecasting software#financial forecasting software#budgeting tool#financial planning software#cash flow management tool#money management tool#business forecasting software#revenue forecasting tool#financial analysis tool#expense tracking software

0 notes

Text

Why Analyzing Financial Data is Crucial for Your Trucking Business

Photo by Pixabay on Pexels.com

If you’re having a tough time keeping your business on track. We get it—running a trucking company is no easy feat. There’s so much to juggle: maintenance, fuel costs, routes, driver management, and on top of that, financials. It’s overwhelming, and we know the last thing you want to think about is diving into those spreadsheets and financial reports. But let me…

View On WordPress

#accounting software#avoid bankruptcy#business#business decisions#business forecasting#business growth#business strategies#business success#cash flow management#cost savings#expense tracking#financial advisor#financial analysis#financial planning#financial tools#Freight#freight industry#Freight Revenue Consultants#fuel efficiency#increase profitability#logistics#optimize routes#profit margins#QuickBooks for truckers#reduce expenses#small business trucking#Transportation#truck fleet management#trucker tips#Trucking

0 notes

Text

Empower Your Accounting with Next-Gen BI and Automation

Maximize your accounting functions with PathQuest, which is a subsidiary of Pacific Accounting & Business Services (PABS). With PathQuest, you can efficiently manage accounts payable, gain valuable insights, and take control of your financial landscape. By eliminating manual tasks, you can focus on business growth. Experience advanced financial operations for informed decision-making, automated workflows, and simplified accounting processes. Utilize data and automation to drive next-generation financial intelligence, streamline accounts payable processes, and transform real-time financial data into actionable insights. With PathQuest, you'll harness the power of financial efficiency and achieve business success.

Read More at https://patch.com/users/pathquest-solutions

#Financial Management Software#Accounting automation software#cash flow forecasting software#fp&a software

0 notes

Text

Revolutionizing Revenue Recognition: The Power of Automation

The answer lies in automating the decision-making process itself.

Revenue accounting automation involves pre-defining rules based on policies and desired outcomes. These rules can then be applied directly to data sourced from sales contracts and various systems capturing orders, fulfillment, and billing. The result? Precise revenue calculations and forecast schedules over the contract term.

So, how does it actually work?

Imagine a revenue analyst reviewing a contract to identify critical components for revenue recognition. Similarly, automation software can be configured to identify these components through data mapping—things like contract number, customer name, contract term, deliverables, and pricing details.

Instead of relying on cumbersome spreadsheets, an automated revenue sub-ledger takes on the task of aggregating data, applying rules, and recognizing revenue based on predefined criteria.

Think of it as building a roadmap for revenue recognition—a set of rules and guidelines that automate the process from start to finish.

#Revenue Recognition#Automation#Accounting Automation#Revenue Accounting#Decision-Making Automation#Contract Management#Data Mapping#Forecasting#Rules-Based Automation#Financial Software

0 notes

Text

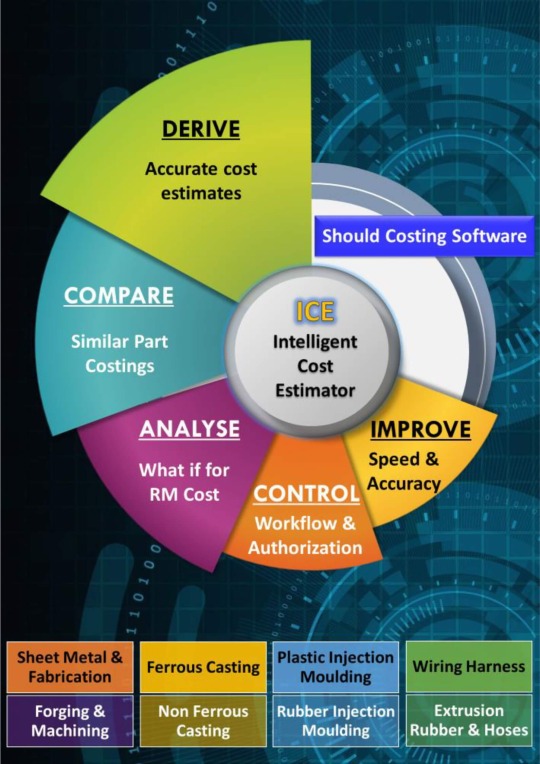

Best Estimating and Costing Software - Cost Masters

Find reliable project cost estimation and optimization with Cost Masters – a trusted provider of estimating and costing software. Streamline your budgeting process with our precise and efficient tools. Eliminate errors and simplify cost management. Learn more about Cost Masters today.

#Estimation and costing software#Cost management tools#Project cost estimation software#Budgeting software solutions#Cost optimization software#Price tracking and analysis tools#Procurement management software#Material cost estimation solutions#Cost calculation software#Project budgeting solutions#Pricing analysis tools#Expense management software#Cost forecasting and planning tools#Profitability analysis software#Resource allocation solutions#Financial planning and analysis software#Cost control and management tools#Spend analysis software

1 note

·

View note

Text

Outsourced bookkeeping services have emerged as a powerful tool for streamlining CPA practices, enabling professionals to focus on what truly matters: delivering exceptional financial advisory and consulting services. As the accounting landscape continues to evolve, embracing the advantages of outsourced bookkeeping can position CPA firms at the forefront of success.

#CPA Bookkeeping#Certified Public Accountant#Financial Accounting#Small Business Accounting#Tax Preparation#Financial Reporting#Ledger Management#Income Statement#Balance Sheet#Cash Flow Analysis#Expense Tracking#Payroll Services#Tax Compliance#Budgeting and Forecasting#Audit Support#Tax Planning#QuickBooks Accounting#Financial Statements#Tax Filing#Accounting Software

0 notes

Text

#forecast#financial#finance#food#fashion#film#football#software#funny#fitness#health & fitness#findyourthing#fanart#central banking#business#breaking news: investing#basketball#black and white#beauty#books and libraries#economy#properly#home & lifestyle#editorial

0 notes

Text

Moolahmore - Financial Tool | New Year Promo 50% OFF

Bring in the cheer, our #NewYear2023Promo is HERE!

We want you to feel the joy of the holiday season and start the year on the right foot, so we're offering a 50% discount on annual and monthly subscription to the Moolahmore app. With this powerful financial tool, you can get a real-time view of your cash position, make more confident decisions and optimise your business for success. This offer will only last from January 10 - 31, 2023.

Don’t miss out and SIGN UP TODAY

0 notes

Text

Moon in Virgo: Tidy Up Your Biz and Harvest Financial Abundance

Astrologers, rejoice! Business gurus, unite! Because under the meticulous gaze of the Moon in Virgo, it's time to blend cosmic wisdom with practical strategy. Get ready for a potent mix of grounded energy, keen analysis, and a sprinkle of earthy magic ready to boost your business and finances.

Virgo's Virgo-ness: Picture a spotless spreadsheet, a perfectly balanced budget, and a to-do list so organized it whispers sweet satisfaction. That's Virgo's domain. When the Moon dances through this earth sign, it brings a laser focus on details, a knack for efficiency, and an urge to declutter both your physical and financial spaces.

Business Benefits:

Sharpened Skills: Hone your expertise, take that online course, or finally master that new software. Virgo's energy fuels learning and skill development, making you a powerhouse of knowledge and competence.

Channel your inner Hermione Granger under the Virgo Moon! Devour knowledge like polyjuice potion, mastering that new software with flick-of-the-wand ease. Whether it's an online course on astrological forecasting or the intricacies of blockchain technology, Virgo's studious energy makes you a sponge for information, transforming you into a confident, competence-wielding powerhouse ready to tackle any business challenge.

Streamlined Operations: Virgo loves a well-oiled machine. Use this lunar phase to audit your business processes, identify bottlenecks, and implement systems that save time and resources.

Don your efficiency hat, because under the meticulous Virgo Moon, streamlining your business becomes a cosmically ordained quest. Scrutinize processes like a celestial accountant, unearthing time-sucking bottlenecks and banishing them with automated spells (aka, handy new systems). Watch as email chains unfurl into streamlined communication channels, meetings morph into laser-focused action sessions, and your once-chaotic workflow hums like a perfectly tuned engine, freeing up precious time and resources for your entrepreneurial magic to truly shine.

Networking with Purpose: Quality over quantity is Virgo's motto. Connect with potential clients or collaborators who share your values and expertise. Think strategic partnerships, not random coffee chats.

Forget the business card bingo of generic gatherings – Virgo's discerning Moon demands quality connections. Seek out collaborators and clients who mirror your values and expertise, like kindred spirits drawn together by constellations of shared passion. Think chess match, not cocktail party. Craft targeted pitches that resonate with their specific needs, and cultivate strategic partnerships that feel like cosmically ordained alliances. This intentional networking isn't about collecting contacts, it's about igniting mutually beneficial collaborations that propel your business towards the stars.

Marketing Magic: Craft targeted campaigns that speak directly to your ideal customer's needs. Virgo's analytical prowess helps you understand your audience and deliver messaging that resonates.

Under the analytical gaze of the Virgo Moon, ditch the shotgun marketing blasts and unleash laser-focused campaigns that whisper sweet nothings to your ideal customer's soul. Virgo's eagle eye pinpoints their deepest desires and pain points, transforming you into a messaging maestro. Craft content that speaks their language, addresses their specific struggles, and showcases your solutions like the missing puzzle piece to their perfect life. Let go of generic pitches and embrace storytelling that resonates with their values, because under this lunar influence, targeted marketing isn't just effective, it's downright magical.

Financial Fortunes:

Budgeting Bliss: Break out the spreadsheets and get granular. Categorize expenses, track income, and create a budget that feels secure and sustainable. Virgo loves a balanced bottom line.

Spreadsheets sing and budgets balance under the Virgo Moon! Unleash your inner accounting alchemist and transform financial chaos into crystal-clear clarity. Categorize expenses with the precision of a cosmic librarian, track every penny like a moonbeam, and craft a budget that feels not like a restrictive cage, but a beautifully organized, secure haven for your financial future. Virgo craves equilibrium, so find that sweet spot where income and outgoings waltz in perfect harmony, leaving you feeling abundant and empowered, the maestro of your own financial orchestra.

Debt Disposal: Tackle outstanding debts with renewed determination. Negotiate better terms, make extra payments, and experience the liberation of financial freedom.

Ditch the debt demon and embrace the warrior spirit under the Virgo Moon! Channel your inner debt disposal dragon, breathing fire upon outstanding balances with renewed determination. Hone your negotiation skills like a celestial diplomat, securing lower interest rates and crafting repayment plans that fit your budget like a cosmic glove. Make extra payments with the fervor of a moonbeam illuminating a dark cave, watching those numbers shrink faster than a vampire in sunlight. Embrace the sweet liberation of financial freedom, feeling the weight of debt lift like a cosmic spell dissolving, leaving you empowered and ready to conquer your financial Everest.

Savvy Investments: Research, compare, analyze – Virgo's energy is perfect for making informed investment decisions. Seek advice from trusted professionals and prioritize long-term stability over short-term gains.

Transform into a celestial stockbroker under the Virgo Moon! Put on your research goggles and analyze potential investments like a cosmic detective, comparing, contrasting, and sniffing out hidden risks. Consult trusted financial oracles for guidance, but ultimately, let your own Virgo-honed discernment be your compass. Prioritize long-term stability over fleeting trends, building a portfolio that grows like a well-tended celestial garden, not a gambler's dice roll. Embrace the slow and steady path, for under Virgo's meticulous gaze, informed investments blossom into financial freedom, one calculated decision at a time.

Unexpected Windfalls: Keep an eye out for unexpected opportunities to increase your income. Virgo favors those who put in the work, so your dedication could be rewarded with a bonus, a new client, or a lucky windfall.

Keep your antennae tuned to cosmic whispers under the Virgo Moon, for fortune often favors the prepared! Your dedication and sharpened skills could attract unexpected boons like a bonus shimmering out of thin air, a new client drawn by your newfound expertise, or a windfall landing softly as a celestial feather in your lap. Remember, Virgo rewards hard work, so keep hustling, honing, and learning, and trust that the universe may just surprise you with a bonus chapter in your financial story.

Bonus Tip: Embrace the earthy magic of Virgo! Surround yourself with green spaces, incorporate crystals like citrine and jade into your workspace, and practice grounding exercises to channel the Moon's practical energy.

So, there you have it! The Moon in Virgo is your invitation to tidy up your biz, fine-tune your finances, and reap the rewards of your focused efforts. Remember, success is a marathon, not a sprint. Pace yourself, celebrate the small wins, and trust that under Virgo's meticulous guidance, your business and finances will shine.

Now go forth and conquer, astrologically savvy entrepreneurs! Your financial stars are aligned.

#Moon in Virgo#Virgo Moon#business astrology#Astrology business#finance astrology#astrology updates#astro#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology community#astrology observations#astropost#astro observations#astro community

46 notes

·

View notes

Text

Boosting Efficiency: The Role of ERP Software in Modern Manufacturing Operations

In today's fast-paced manufacturing landscape, efficiency is not just a desirable trait; it's a necessity. To stay competitive and meet the demands of the market, manufacturers must streamline their processes, optimize resource utilization, and enhance decision-making capabilities. This is where Enterprise Resource Planning (ERP) software steps in as a game-changer. In this article, we'll delve into the pivotal role of ERP systems in revolutionizing manufacturing operations, particularly in India's thriving industrial sector.

Understanding ERP for Manufacturing Industry

ERP systems for manufacturing are comprehensive software solutions designed to integrate and automate core business processes such as production planning, inventory management, supply chain logistics, financial management, and human resources. By consolidating data and operations into a unified platform, ERP empowers manufacturers with real-time insights, facilitates collaboration across departments, and enables informed decision-making.

Streamlining Operations with ERP Solutions

In the dynamic environment of manufacturing, where every minute counts, efficiency gains translate directly into cost savings and competitive advantages. ERP software for manufacturing offers a multitude of features that streamline operations and drive efficiency:

1. Enhanced Production Planning: ERP systems enable manufacturers to create accurate production schedules based on demand forecasts, resource availability, and production capacity. By optimizing production timelines and minimizing idle time, manufacturers can fulfill orders promptly and reduce lead times.

2. Inventory Management: Efficient inventory management is crucial for balancing supply and demand while minimizing holding costs. ERP software provides real-time visibility into inventory levels, automates reorder points, and facilitates inventory optimization to prevent stockouts and overstock situations.

3. Supply Chain Optimization: ERP solutions for manufacturing integrate supply chain processes from procurement to distribution, enabling seamless coordination with suppliers and distributors. By optimizing procurement cycles, minimizing transportation costs, and reducing lead times, manufacturers can enhance supply chain resilience and responsiveness.

4. Quality Control: Maintaining product quality is paramount in manufacturing to uphold brand reputation and customer satisfaction. ERP systems offer quality management modules that streamline inspection processes, track product defects, and facilitate corrective actions to ensure adherence to quality standards.

5. Financial Management: Effective financial management is essential for sustaining manufacturing operations and driving profitability. ERP software provides robust accounting modules that automate financial transactions, streamline budgeting and forecasting, and generate comprehensive financial reports for informed decision-making.

6. Human Resource Management: People are the cornerstone of manufacturing operations, and managing workforce efficiently is critical for productivity and employee satisfaction. ERP systems for manufacturing include HR modules that automate payroll processing, manage employee records, and facilitate workforce planning to align staffing levels with production demands.

The Advantages of ERP for Manufacturing Companies in India

India's manufacturing sector is undergoing rapid transformation, fueled by factors such as government initiatives like "Make in India," technological advancements, and globalization. In this dynamic landscape, ERP software plays a pivotal role in empowering manufacturing companies to thrive and remain competitive:

1. Scalability: ERP solutions for manufacturing are scalable, making them suitable for companies of all sizes – from small and medium enterprises (SMEs) to large conglomerates. Whether a company is expanding its operations or diversifying its product portfolio, ERP systems can adapt to evolving business needs and support growth.

2. Compliance: Regulatory compliance is a significant concern for manufacturing companies in India, given the complex regulatory environment. ERP software incorporates compliance features that ensure adherence to industry regulations, tax laws, and reporting requirements, minimizing the risk of non-compliance penalties.

3. Localization: ERP vendors catering to the Indian manufacturing sector offer localized solutions tailored to the unique requirements of the Indian market. From multi-currency support to GST compliance features, these ERP systems are equipped with functionalities that address the specific challenges faced by Indian manufacturers.

4. Cost Efficiency: Implementing ERP software for manufacturing entails upfront investment, but the long-term benefits far outweigh the costs. By streamlining processes, optimizing resource utilization, and reducing operational inefficiencies, ERP systems drive cost savings and improve overall profitability.

5. Competitive Edge: In a fiercely competitive market, manufacturing companies in India must differentiate themselves through operational excellence and agility. ERP software equips companies with the tools and insights needed to outperform competitors, adapt to market dynamics, and capitalize on emerging opportunities.

Choosing the Right ERP Software for Manufacturing

Selecting the right ERP solution is crucial for maximizing the benefits and ensuring a smooth implementation process. When evaluating ERP software for manufacturing, companies should consider the following factors:

1. Industry-specific functionality: Choose an ERP system that offers industry-specific features and functionalities tailored to the unique requirements of manufacturing operations.

2. Scalability and flexibility: Ensure that the ERP software can scale with your business and accommodate future growth and expansion.

3. Ease of integration: Look for ERP systems that seamlessly integrate with existing software applications, such as CRM systems, MES solutions, and IoT devices, to create a cohesive technology ecosystem.

4. User-friendliness: A user-friendly interface and intuitive navigation are essential for ensuring widespread adoption and maximizing user productivity.

5. Vendor support and expertise: Select a reputable ERP vendor with a proven track record of success in the manufacturing industry and robust customer support services.

Conclusion

In conclusion, ERP software has emerged as a cornerstone of modern manufacturing operations, empowering companies to enhance efficiency, drive growth, and maintain a competitive edge in the global market. For manufacturing companies in India, where agility, scalability, and compliance are paramount, implementing the right ERP solution can be a transformative investment that paves the way for sustainable success. By harnessing the power of ERP, manufacturers can optimize processes, streamline operations, and unlock new opportunities for innovation and growth in the dynamic landscape of the manufacturing industry.

#ERP software providers in India#Manufacturing enterprise resource planning#ERP systems for manufacturing companies#ERP system for manufacturing industry#ERP for manufacturing companies#ERP software for engineering company#ERP software for engineering companies in India#ERP software for engineering companies in Mumbai#ERP solution providers in India#ERP for manufacturing industry#ERP systems for manufacturing#ERP solutions for manufacturing#ERP software manufacturing industry#ERP for manufacturing company in India#India

7 notes

·

View notes

Text

Exploring the Best Cash Flow Forecasting Tools: A Comprehensive Comparison

Are you fed up with the financial uncertainty affecting your business? Do you wish there was a way to easily monitor and precisely predict your ins and outs, allowing you to make well-informed decisions about the next steps for your small business?

If so, you're in for a treat! Prepare to transform your financial management and planning as we explore cash flow forecasting with the industry's best tool, Moolamore. Discover its amazing features, advantages, and everything in between. This comprehensive blog guide will explain why this is the solution you've been searching for.

#cash flow forecasting tool#best cash flow forecasting software#financial forecasting software#budgeting tool#financial planning software#cash flow management tool#money management tool#business forecasting software#revenue forecasting tool#financial analysis tool#expense tracking software

0 notes

Text

Strengths & Weaknesses

Strengths & Weaknesses

Entering the world of entrepreneurship is an exhilarating yet intimidating experience. When I think back on my own business abilities, I see both my Strengths & Weaknesses . Gaining an understanding of these can direct my professional development and success.

Strengths

Adaptability: This is one of my strongest suit. I work well in dynamic settings and modify my plans in response to fresh knowledge or evolving conditions. For instance, we ran across unforeseen software problems in college when managing a project team. I came up with a backup plan really fast to make sure we didn't sacrifice quality in order to meet our deadline.

Creative Problem-Solving: I am great at coming up with novel solutions by thinking outside the box. I created a distinctive social media campaign during my internship at a marketing company, which raised customer engagement by 30%. This experience proved that I can come up with original concepts that work.

Resilience: Being an entrepreneur comes with a lot of hurdles, and one of the main reasons I have succeeded is my resilience. I turned adversity into opportunity when my first attempt to create an e-commerce store encountered logistical difficulties. I learnt from the setbacks, improved my business plan, and successfully relaunched.

Weaknesses

Delegation: I occasionally find it difficult to assign work to others since I frequently believe that completing everything myself will produce the finest results. Nevertheless, this strategy may result in inefficiency and burnout. In order to get better, I'm concentrating on developing my team's trust and employing clear communication techniques to make sure jobs are finished efficiently.

Financial Acumen: I know the fundamentals of financial management, but I also know I can improve in areas like financial forecasting and budgeting. In order to improve my knowledge in this crucial area, I intend to enroll in online financial management classes and look for mentorship from seasoned business owners.

Networking: I find big networking gatherings scary, even if I feel at ease in small group situations. To get around this, I am establishing modest, do able objectives for every occasion, like striking up a discussion with three new individuals and then getting in touch with them later to create lasting relationships.

2 notes

·

View notes

Note

What are your thoughts of all the layoffs announced by the tech companies? How would you navigate this if you were laid off or not from one of these companies?

Great question!

Unfortunately I'm not surprised by the tech layoffs. Before I retired in early 2022 my company was regularly losing good (and not so good) software engineers to Microsoft, Facebook, Salesforce and Amazon. The compensation offers were off the charts and I didn't believe it was sustainable. I didn't blame them for leaving, but the compensation seemed too good to be true and in my experience situations like that rarely last (ex. real estate prices going up 15% year after year).

Although some tech firms had begun to announce minor trimming of their work force in Q3, it seems like Twitter really opened the floodgates. Now more companies could follow and once all the big tech employers were cutting, there was less risk of losing the most valuable, talented staff to competitors. My heart goes out to anyone impacted by the layoffs, but I firmly believe this disruption is temporary and talented software engineers will be in demand for a very long time.

What would I do if I was laid off?

Set a deadline (no more than a week) by which time you will stop feeling sorry for yourself, etc. Most people can probably think of reasons why they shouldn't have been cut, but it doesn't matter any more. Accept the unfortunately reality of your situation and get to work.

Take advantage of any outplacement services offered by your former employer, especially resume writing. The last time I sent a resume it was read by a human. That's not the case today. Make sure your resume has the necessary key words to get past the AI screener.

Work your network - personal, college, family, previous employers, LinkedIn. It still helps to have someone recommend you to the hiring manager and/or recruiter. At the very least it may help secure an interview. Don't be shy about telling people you've been laid off. Anyone with any professional experience knows that this isn't a personal shortcoming. Layoffs can happen to the best employees.

Get your financial house in order. Do a cash-flow forecast and assume you'll be out of work for six months. Eliminate/minimize unnecessary expenses but be sure to sign up for COBRA medical coverage. Don't let a mountain of debt accumulate - take part time gigs if you need to.

Update your skills/certifications.

If you're a software engineer, make sure your profile/projects in GitHub are a positive reflection of your skills.

What would I do if I wasn't laid off?

I was a senior executive in the corporate travel industry before and after 9/11 and the financial meltdown on 2008/9. In both cases business travel plummeted and the survival of the company required layoffs. Unlike the tech companies today, we weren't guilty of mindlessly pursuing growth at any cost, but we had to do layoffs just the same. I helped determine how many cuts were necessary across the company and had to layoff members of my team. In each case we tried to minimize the number of layoffs by cutting expenses/compensation at all levels.

When laying off people it is important to act with as much empathy as possible and to try to do it all at once, rather than leaving the remaining employees with the fear that their job may be cut later. It just as important to be fair - HR has to carefully review the recommendations to make sure that no group (especially protected groups) is being unfairly targeted.

As an executive who hadn't been laid off, I had to accept that many current and former employees would view me as one of the bad guys. In a situation like this, people need someone to blame and for some people that person was me. Layoffs destroy or at least significantly degrade a company's culture, impact productivity, damage it's reputation with customers and potential employees and it takes a long time (years) for those things to recover. Time, patience and genuine empathy are required.

Regardless of your job situation, it is a good habit to update your resume every year. Your CV shouldn't keep growing longer, but you should keep it current with your latest accomplishments while trimming the details of past.

Thanks for the question. Hope that helped.

37 notes

·

View notes

Text

Unveiling the Secrets of Corporate Tax Efficiency with Transcend Accounting

At our firm, we specialize in aiding investors to expand their businesses across diverse nations, with a particular focus on the UAE. Our comprehensive services encompass everything from facilitating business establishment in the region—including Company Formation, Visa Procedures, and Bank Account Opening—to Managing HR, Payroll, VAT, Corporate Tax and accounting needs. We provide stress-free and worry-free business services that cater to all the requirements of our investors, ensuring seamless operations and optimal growth.

Strategic Planning: The Backbone of Tax Efficiency

At the core of enhancing corporate tax efficiency lies strategic planning. Our accounting team specializes in crafting bespoke tax strategies that precisely align with the unique needs and objectives of businesses. Through meticulous analysis of financial data and forecasting future trends, we assist businesses in optimizing their corporate tax structure to minimize liabilities and maximize savings.

Leveraging Local Tax Incentives

One of the key advantages of utilizing our accounting's corporate tax services in Dubai is tapping into the array of local tax incentives and exemptions. From free zone benefits to specific industry incentives, we have a deep understanding of the local tax landscape and can guide businesses in leveraging these opportunities to their advantage. By strategically positioning businesses within the appropriate tax jurisdictions, we can unlock significant cost savings.

Technology-Assisted Simplified Tax Procedures

In the age of digitization, increasing tax efficiency requires the use of technology. we use state-of-the-art instruments and software to automate tedious work, reduce errors, and expedite corporate tax procedures. By using technology, businesses can save time and money on tax compliance, allowing them to focus on their core operations and key strategic initiatives.

Global Expansion:

Expanding your business globally opens up a world of opportunities, but it also introduces complexities in terms of taxation and compliance. corporation tax services are vital in helping companies who are expanding into foreign markets by offering them the necessary support. These services ensure compliance with tax rules and regulations in numerous jurisdictions and have the experience to navigate the complexities of cross-border taxation.

Peace of Mind:

Businesses can have priceless peace of mind knowing that their tax matters are being managed by appropriately qualified professionals when they use corporate tax services.

Taxation is a complex and ever-changing field, and attempting to manage it internally can be daunting and time-consuming for businesses.

We offer a pathway to financial optimization for businesses operating in the dynamic landscape of Dubai. By employing strategic planning, leveraging local tax incentives, and embracing technology, we empower businesses to maximize tax efficiency and save money. Achieving long-term financial success can be significantly increased by partnering with Transcend Accounting.

So, why not take the leap and explore the advantages of Transcend Accounting's corporate tax services in Dubai today?

#TaxEfficiency#DubaiBusiness#CorporateTax#FinancialOptimization#TranscendAccounting#TaxSavings#StrategicPlanning#TechnologyInTax#TaxIncentives#BusinessGrowth#taxation#uaebusiness#business strategy

3 notes

·

View notes

Text

Mastering Strategic Finance: A Guide to Success

In today's dynamic business landscape, financial acumen is not just a desirable trait but a crucial necessity for professionals aiming to navigate the complexities of the corporate world. Whether you're an aspiring entrepreneur, a seasoned executive, or a finance enthusiast looking to elevate your skills, a comprehensive course in strategic finance can be the catalyst for your success. In this blog post, we delve into the significance of strategic finance and explore what makes a great course in this field.

Understanding Strategic Finance: Strategic finance goes beyond mere number crunching; it involves analyzing financial data to make informed decisions that drive long-term growth and profitability. From budgeting and forecasting to risk management and investment analysis, strategic finance encompasses a wide array of disciplines aimed at optimizing financial performance and maximizing shareholder value.

Key Components of a Strategic Finance Course:

Financial Analysis Techniques: A solid grasp of financial analysis tools and techniques is fundamental to strategic decision-making. A good course should cover topics such as ratio analysis, trend analysis, and variance analysis to help participants interpret financial statements and assess a company's financial health accurately.

Strategic Planning and Budgeting: Effective strategic planning is at the core of successful businesses. A course in strategic finance should equip learners with the skills to develop strategic financial plans, set realistic budgets, and align financial goals with overall business objectives.

Capital Budgeting and Investment Appraisal: Evaluating investment opportunities and allocating capital efficiently is critical for sustainable growth. Participants should learn how to assess the viability of projects using techniques like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period analysis.

Risk Management and Mitigation: In today's volatile market environment, understanding and managing financial risks are imperative. A comprehensive course should cover topics such as risk identification, assessment, and mitigation strategies, including hedging techniques and insurance mechanisms.

Financial Modeling and Forecasting: Building accurate financial models and making reliable forecasts are essential skills for finance professionals. Participants should learn how to create robust financial models using spreadsheet software and leverage forecasting techniques to support strategic decision-making.

Corporate Finance and Capital Structure: An understanding of corporate finance principles, including capital structure optimization, debt vs. equity financing, and dividend policy, is crucial for optimizing a company's cost of capital and maximizing shareholder value.

Choosing the Right Course: When selecting a course in strategic finance, consider factors such as the reputation of the institution or provider, the expertise of the instructors, the comprehensiveness of the curriculum, and the flexibility of delivery (online vs. in-person). Look for courses that offer practical, real-world case studies and opportunities for hands-on learning to reinforce theoretical concepts.

Conclusion: Investing in a strategic finance course is not just an investment in your career; it's an investment in your future success. By mastering the principles of strategic finance, you'll gain the confidence and expertise needed to excel in today's competitive business environment. Whether you're aiming for a C-suite position, launching your own venture, or simply looking to enhance your financial literacy, a strategic finance course can provide you with the knowledge and skills to thrive in any professional setting. So why wait? Start your journey to mastering strategic finance today!

2 notes

·

View notes

Text

iquidi - Best Accounting Software in Bangladesh

iquidi – is the best Accounting software in Bangladesh which is designed to help businesses manage their finances. It is used to record, store, and analyze financial information such as invoices, bills, and payroll.

iquidi as an Accounting software also simplifies the process of filing tax returns and preparing financial statements.

Additionally, it can provide businesses with detailed financial insights, such as cash flow analysis, budgeting, and forecasting. This information can be used to make informed decisions and monitor the health of the business by providing the insights needed to make informed decisions.

2 notes

·

View notes