#financial model excel example

Explore tagged Tumblr posts

Text

How an obscure advisory board lets utilities steal $50b/year from ratepayers

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in NYC on WEDNESDAY (26 Feb) with JOHN HODGMAN and at PENN STATE on THURSDAY (Feb 27). More tour dates here. Mail-order signed copies from LA's Diesel Books.

Two figures to ponder.

First: if your local power company is privately owned, you've seen energy rate hikes at 49% above inflation over the last three years.

Second: if your local power company is publicly owned, you've seen energy rates go up at 44% below inflation over the same period.

Power is that much-theorized economic marvel: a "natural monopoly." Once someone has gone to the trouble of bringing a power wire to your house, it's almost impossible to convince anyone else to invest in bringing a competing wire to your electrical service mast. For this reason, most people in the world get their energy from a publicly owned utility, and the rates reflect social priorities as well as cost-recovery. For example, basic power to run lights and a refrigerator might be steeply discounted, while energy-gobbling McMansions pay a substantial premium for the extra power to heat and cool their ostentatious lawyer-foyers and "great rooms."

But in America, we believe in the miracle of the market, even where no market could possibly exist because of natural monopolies. That's why about 70% of Americans get their power from shareholder-owned companies, whose managers' prime directive is extracting profit, not serving their communities. To check this impulse, these private utilities are overseen by various flavors of public bodies, usually called Public Utility Commissions (PUCs).

For 40 years, PUCs have limited private utilities to a "rate of return" based on a "just and reasonable profit." They always gamed this to make it higher than was fair, but in recent years, the "experts" who advise PUCs on rate-setting have been boiled down to a tiny number of economists, who have discovered that the true "just and reasonable profit" is much higher than it's ever been considered.

Mark Ellis worked for one of those profit-hiking "experts," but he's turned whistleblower. On paper, Ellis looks like the enemy: former chief economist at Sempra Energy, an ex-Exxonmobile analyst, a retired McKinsey Consultant, and a Socal Edison engineer. But Ellis couldn't stomach the corruption, and he went public, publishing a report for the American Economic Liberties Project called "Rate of Return Equals Cost of Capital" that lays out the con in stark detail:

https://www.economicliberties.us/wp-content/uploads/2025/01/20250102-aelp-ror-v5.pdf

I first encountered Ellis last week when he was interviewed on Matt Stoller and David Dayen's excellent Organized Money podcast, where he memorably referred to these utilities as "pocket-picking machines":

https://www.organizedmoney.fm/p/the-pocket-picking-machine

Dayen followed this up with a great summary in The American Prospect (where he is editor-in-chief):

https://prospect.org/environment/2025-02-21-secret-society-raising-your-electricity-bills/

At the center of the scam is a professional association called the Society of Utility and Regulatory Financial Analysts (SURFA). The experts in SURFA are dominated by just four consulting companies, who provide 90% of the testimony for rate-setting exercises. Just two people account for half of that input.

In order to calculate the "just and reasonable profit," these experts make use of economic models. Even in normal economics, these models are the source of infinite mischief and suffering, built on assumptions that legitimize the most abusive conduct:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

But even by the low standards of normal economic models, the utility models are really bad. They rely on unique "risk premium" and "expected earnings" calculations that no one else in finance will touch. As Dayen explains, these models are "perfectly circular."

This might be a bit confusing, but only because it's one of those scams that you assume you must have misunderstood because it's so, well, scammy. In the "expected earnings" analysis, the "just and reasonable profit" a utility is allowed to build into its rates is defined as "the amount of money it would like to make." In other words, if a utility projects future revenues of $10 billion over the next ten years, that is its "expected earnings." "Expected earnings" are treated as equivalent to "just and reasonable profits." So under this model, whatever number the utility puts in its financial projections is the number that it's allowed to take out of the pockets of ratepayers.

This is just as bad as it sounds. In 2022, the Federal Energy Regulatory Commission said that it "defied financial logic." No duh – even SURFA's own training manual says it "does not square well with economic theory."

In the world of regulated utilities, this kind of mathing isn't supposed to be possible. The PUC and its "consumer advocates" are supposed to listen to these outlandish tales and laugh the utility out of the room.

But it's SURFA that trains the consumer advocates who work for the PUCs, the large energy customers, and community groups. These people – who are supposed to act as the adversaries of the companies that pay SURFA members to justify rate-hikes – are indoctrinated by SURFA to treat its absurd models as accepted economic gospel. SURFA has co-opted its opposition, transformed it into a botnet that parrots its own talking-points.

Because of this, the private power companies that serve 70% of US households made an extra $50b last year, about $300 per household. What's more, because the excess profits available to companies that simply bamboozle their regulators are so massive, they swamp all the other tools regulators use to attempt to improve the energy system. No incentive offered for conservation or efficiency can touch the gigantic sums energy companies can make by ripping off ratepayers, so nearly all the incentive programs approved by PUCs have been dead on arrival.

What's more, utilities are allowed to fold the cost of hiring the experts who get them rate hikes onto the ratepayers. In other words, if a utility hires a $10,000,000 expert who successfully argues for a $1,000,000,000 rate-increase, they get to recoup the ten mil they spent securing the right to rip you off for a billion dollars on top of that cool bill.

We often talk about regulatory capture in the abstract, but this is as concrete as it can be. Ellis's report makes a raft of highly specific, technical regulatory changes that states or cities could impose on their PUCs. These are shovel-ready ideas: if you find yourself contemplating a sky-high power bill, maybe you could call your state rep and read them aloud.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/24/surfa/#mark-ellis

#pluralistic#surfa#organized money#david dayen#matthew stoller#matt stoller#the american prospect#whistleblowers#power#utilities#monopolies#antitrust#Society of Utility and Regulatory Financial Analysts#Mark Ellis#PUCs#podcasts

274 notes

·

View notes

Text

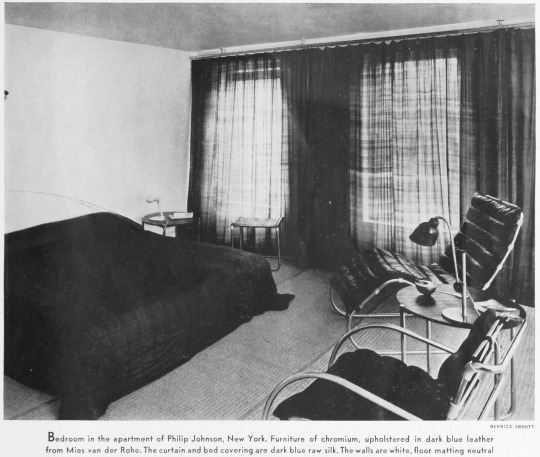

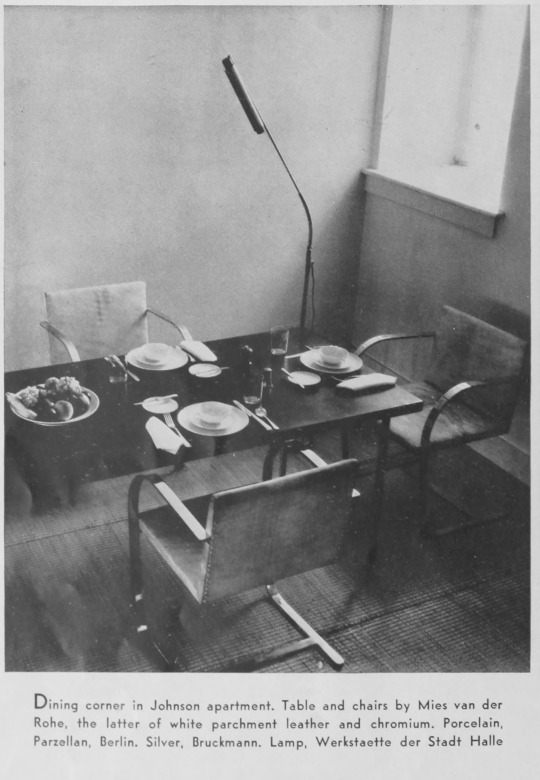

Berenice Abbott in Philip Johnson’s apartment

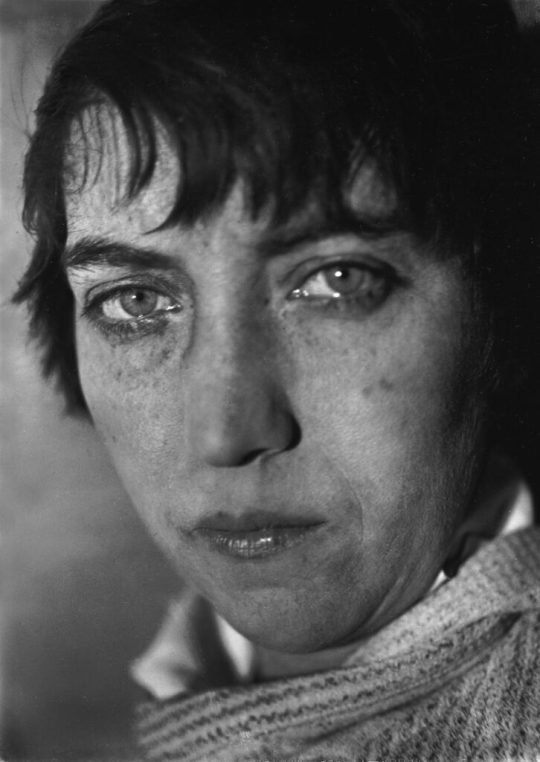

Berenice Abbott, 1930 (Walker Evans) / Philip Johnson, 1933 (Carl Van Vechten)

These portraits are the most obvious choices from this time period and conveniently suggest the biographical contrast between the two: Abbott had been a struggling American artist in Paris, an assistant to Man Ray, but she later established a portrait business, built a reputation and gained a steady flow of sitters. In January 1929, at age 30, she left for New York.

Abbott departed on the ship from France with the archive of Eugène Atget: 17 crates according to the Julia van Haaften's biography. She naively thought selling Atget prints and licensing would provide a healthy income.

The new architecture of the city enthralled her and Abbott quickly began to conceive and photograph a topographic survey of the city. By fall 1929 the stock market had crashed, the Great Depression had begun and the portrait business was no longer promising. Abbott wanted to charge $150 a portrait, at a time when you could get one done for a dollar. This environment forced her to change business models, looking for patrons for the New York project.

Abbott first encountered Philip Johnson in New York in 1931, at the “Rejected Architects” exhibit, a salon des refusés for modern architects and an early introduction of the International Style to New York.

Johnson was a 25-year-old who came from inherited wealth. Rachel Maddow’s "Prequel: An American Fight Against Fascism" suggests his portfolio produced, in today’s dollars, from $240,000 to $1.2M in dividends a year. His financial backing of the architecture department at MOMA resulted in him becoming director of that department. He had discovered Mies van der Rohe on one of his traipses across the continent and was eager to bring the new style to New York. While Johnson was financially very comfortable, he had unsatisfied ambitions, larger than being a curator of architecture and beyond architecture itself.

In 1932 Abbott was part of MOMA’s Murals by American Painters and Photographers exhibit, which Johnson certainly would have been aware of, if not directly involved in, as the point of the show was large modern murals for architecture projects such as Rockefeller Center in the form of seven by twelve foot murals. Greg Allen has the backstory on that exhibit (since his 2010 post the full catalog with her photos has been published on the MOMA site).

For her New York survey, Abbott was looking for $18,750 ($390,000 in today’s dollars), enough to fund a year long project, travel, a car with two full time assistants to deliver 350-500 prints and negatives. Johnson did not financially support Abbott’s New York project, nor did the museum sponsor it, but he offered a strong letter of recommendation, on MOMA letterhead: "You have a deep love for New York, you are an excellent photographic technician and you have the artistic power of selecting the essential."

The goal was to find 75 patrons among the wealthy MOMA donors to contribute $250 each. Despite Johnson’s endorsement, this fundraising effort was a flop. It would take her until 1940 to finish it, but "Changing New York" became one of the great photographic projects of the 20th century.

Van Haaften describes an architecture and photography exhibition Johnson and Abbott planned to do together, called "America Deserta," about the visual repercussions of the Depression. It sounds like an early version of what we now call "ruin porn." She writes that Johnson could have financed the project out of his own pocket, but neither he, nor the museum, pulled the trigger. (Decades later, architecture critic Reyner Banham wrote an excellent book about the actual desert titled "Scenes in America Deserta")

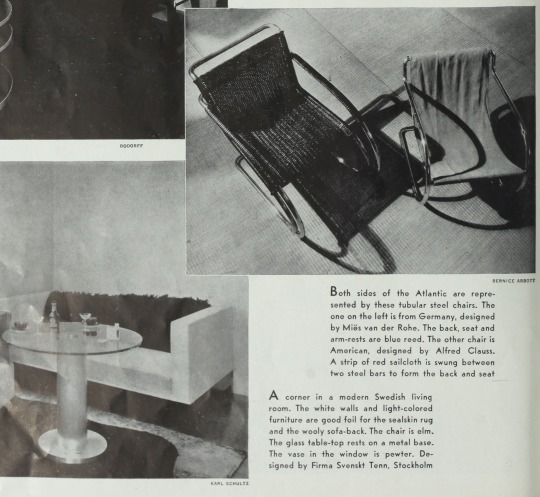

Johnson was doing interior design in New York for friends and acquaintances, hoping the examples of his work could help establish him (and the International Style he had signed on with). An early project was for MOMA’s Alfred Barr. Mark Lamster writes in "Man in the Glass House" that Barr couldn’t afford the real Mies furniture that Johnson had already acquired for himself, so Johnson designed knock-off tubular chairs.

cover of Arts and Decoration, September 1933, from the Burlingame, California library via archive.org

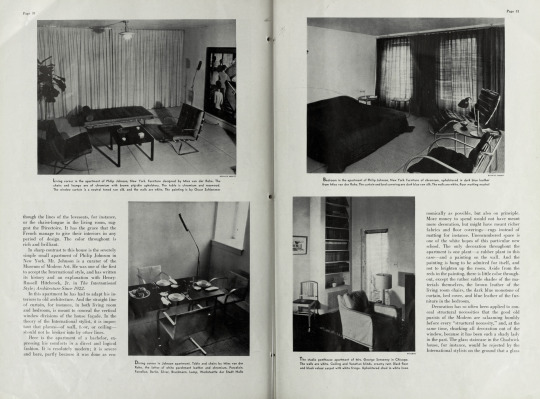

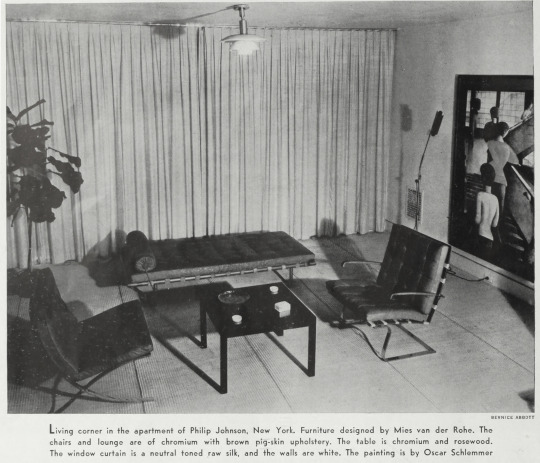

Johnson’s own apartment was his first top-to-bottom interior design project. He was eager, bordering on desperate to get paying clients, to establish himself. He didn't need the money, but wanted clients as a stamp of approval from the New York elite, like the Rockefellers. He enlisted Abbott to take photos to premiere it in Arts and Decoration magazine.

The International Style had already taken root in Los Angeles, but New York was not ready for what he was offering. Perhaps Abbott’s photos of his apartment are part of why the new thing seemed unconvincing. Starting with the watercolor cover or paging through this magazine aimed at the wealthy, the features contrast traditional style versus examples of the new style.

If you've never been in a modern interior before and these photos are your first glimpse, it's not appealing. Johnson was no Neutra and he had not found his Julius Shulman. The magazine's reproduction quality of the photography is not good. Abbott's photographs feel cramped. The lighting is a combination of murky corners and distracting shadows. The styling, a fiddle leaf fig, the place settings at the dining table, feels forced.

In terms of art history, the most interesting of Abbott's photographs features a painting directly from the Bauhaus. It's Oskar Schlemmer's Bauhaus Stairway (1932). Lamster outlines the very messy deal that brought the painting to New York. In March 1933 Barr asks Johnson to buy it, unseen, thinking it will end up at MOMA. As the Nazis breathe down Schlemmer's neck for being a "degenerate artist," Johnson sends a telegram offering a price, but then claims a typo added a zero and pays 10x less. This dispute isn't resolved until after the year 2000. Johnson keeps the painting in his collection for another ten years.

the captions drop the "e" Abbott had added to her name (Bernice vs Berenice).

What explains the vast difference between the great photos Abbott is making on the streets of New York and these mediocre interiors? She creates "Exchange Place" the same year. Spending time with Abbott’s archive on NYPL and Getty looking for interior photos to compare to these photos of Johnson's apartment to, left me with another question: Why are photographs of interiors uncommon until the 1940s? In her Paris portraits the interior of her studio plays a significant role as background.

Van Haaften writes that Abbott is using two cameras in these early years in New York:

5x7 inch view camera (with reducing back to 12x9cm, which is a large “medium format” negative )

Graflex that she acquired to do portraits of Guggenheim children (probably a 4x5 inch press style camera).

Abbott is on a ladder to make the photographs of Johnson's place and perhaps the combination of lens focal length and the size of the apartment presented a challenge in creating enough space. It’s possible, despite the two cameras, that she simply didn’t have a wide enough lens to do interior work at a time when lenses were expensive and money was tight. Or that she didn’t prefer to use spotlights or flash. Perhaps her focus was so intense on the exterior of the city that she rarely set up the camera indoors.

For Johnson, it’s possible to imagine if New York had been more open to the new style, if the magazine caused a stir, if he was encouraged to become an architect at this moment, his descent into fascism would have never happened. After the photos are published in the September 1933 issue, 1934 is a rollercoaster year for Johnson: he has a breakout hit of an exhibit in Machine Art (March-April). But by December, he quits MOMA to focus on his fascist party. He’s 28 years old. His pursuit of the fantasy of a domestic version of Nazism brings him to Germany, to cheer on the invasion of Poland. Lamster writes that he only to returns to architecture in 1941, when it’s clear that he has barely escaped being charged with treason. He goes from being a millionaire who shipped his own car to Europe for his Nazi tour to cleaning Army toilets.

Van Haaften’s biography of Berenice Abbott is not specific about when Abbott broke off her friendship with Johnson. We can assume it happens sometime between the apartment photoshoot and Johnson leaving MOMA. Abbott was a communist or socialist for most of her life and American Nazis like Johnson were very clear on what they would do to communists if they gained power. Van Haaften writes: "the two friends later parted ways over Johnson’s political views and his enthusiasm for the Third Reich." The book's footnote indicates the source for this is her 1993 phone interview with … Philip Johnson.

22 notes

·

View notes

Text

I've come around on my opinion that all those excellent yt vidos on 1-3 semester math classes are an universally good thing.

They are not.* Hear me out.

*For people who want to learn mathematical research. Not talking about applied maths here.

At the begining of their studies every math major has a course on linear algebra. (I'm gonna talk about linear algebra, but the same argument applies to analysis and stochastics as well.) The point of this course is not for the student to become really good at linear algebra. Of course lin alg is useful for topics like representation theory, but a majority of mathematicians will not use it in their research.

Also lin alg serves for a lot for examples for other concepts. Everyone loves teaching adjoints with forgetful and free functors between vector spaces and sets. But that is just because everyone knows lin alg (or topology or group theory or whatever).

Most of the work in math research (at least for me) is building internal models in my mind. Finding and sharpening intuitions as well as translating between them and formal notation. Lin alg allows you to learn doing this.

So why does everyone know lin alg, analysis and stochastics? Why not teach those concepts with knot theory? Well, most math students will not end up doing mathematical research. And for applied math, software engineering and management/financial math those subjects are the alpha and omega. So we might as well kill two birds with one pidgeonhole.

So, should a math student use these good yt vids? One must weigh the prospective benefits against the likelyhood of either career of course. And even when one strifes to become a researcher, as long as they don't rely on predigested intuition for all of those first few big subjects it's probably fine.

I'm interested to hear you folks' thoughts on this.

9 notes

·

View notes

Text

Artificial Intelligence is not infallible. Despite its rapid advancements, AI systems often falter in ways that can have profound implications. The crux of the issue lies in the inherent limitations of machine learning algorithms and the data they consume.

AI systems are fundamentally dependent on the quality and scope of their training data. These systems learn patterns and make predictions based on historical data, which can be biased, incomplete, or unrepresentative. This dependency can lead to significant failures when AI is deployed in real-world scenarios. For instance, facial recognition technologies have been criticized for their higher error rates in identifying individuals from minority groups. This is a direct consequence of training datasets that lack diversity, leading to skewed algorithmic outputs.

Moreover, AI’s reliance on statistical correlations rather than causal understanding can result in erroneous conclusions. Machine learning models excel at identifying patterns but lack the ability to comprehend the underlying causal mechanisms. This limitation is particularly evident in healthcare applications, where AI systems might identify correlations between symptoms and diseases without understanding the biological causation, potentially leading to misdiagnoses.

The opacity of AI models, often referred to as the “black box” problem, further exacerbates these issues. Many AI systems, particularly those based on deep learning, operate in ways that are not easily interpretable by humans. This lack of transparency can hinder the identification and correction of errors, making it difficult to trust AI systems in critical applications such as autonomous vehicles or financial decision-making.

Additionally, the deployment of AI can inadvertently perpetuate existing societal biases and inequalities. Algorithms trained on biased data can reinforce and amplify these biases, leading to discriminatory outcomes. For example, AI-driven hiring tools have been shown to favor candidates from certain demographics over others, reflecting the biases present in historical hiring data.

The potential harm caused by AI is not limited to technical failures. The widespread adoption of AI technologies raises ethical concerns about privacy, surveillance, and autonomy. The use of AI in surveillance systems, for instance, poses significant risks to individual privacy and civil liberties. The ability of AI to process vast amounts of data and identify individuals in real-time can lead to intrusive monitoring and control by governments or corporations.

In conclusion, while AI holds immense potential, it is crucial to recognize and address its limitations and the potential harm it can cause. Ensuring the ethical and responsible development and deployment of AI requires a concerted effort to improve data quality, enhance model transparency, and mitigate biases. As we continue to integrate AI into various aspects of society, it is imperative to remain vigilant and critical of its capabilities and impacts.

#proscribe#AI#skeptic#skepticism#artificial intelligence#general intelligence#generative artificial intelligence#genai#thinking machines#safe AI#friendly AI#unfriendly AI#superintelligence#singularity#intelligence explosion#bias

2 notes

·

View notes

Text

Tech4Biz Solutions’ Showcase: Driving Future-Ready Business with Cutting-Edge Innovations

In a world where technology is reshaping industries at an unprecedented pace, businesses must adapt to stay competitive. Tech4Biz Solutions has emerged as a trailblazer in providing future-ready business solutions that empower organizations to thrive in the digital age. With a comprehensive portfolio of offerings showcased on its platform, Tech4Biz Solutions is helping businesses unlock new possibilities and drive long-term growth.

1. Embracing Innovation for Business Growth

Innovation is no longer optional—it’s essential for business success. Companies need to adopt cutting-edge technologies to enhance their processes, improve customer experiences, and respond to evolving market demands. Tech4Biz Solutions understands the transformative power of technology and has developed a range of solutions that cater to the unique needs of different industries.

The company’s Showcase platform is a testament to its commitment to innovation, offering businesses a window into the latest advancements and success stories that demonstrate the impact of its solutions.

2. Key Offerings from Tech4Biz Solutions

Tech4Biz Solutions’ Showcase features a diverse range of services designed to accelerate business transformation. Here’s a closer look at some of its standout offerings:

Digital Twins for Operational Optimization: By creating virtual models of physical assets and processes, businesses can gain real-time insights and make data-driven decisions to improve operational efficiency.

Custom AI Models for Cybersecurity: With cyber threats growing more sophisticated, Tech4Biz provides AI-driven models that proactively detect and mitigate security risks.

Cloud Infrastructure Deployment: Tech4Biz helps businesses transition to the cloud with scalable, reliable infrastructure that supports agility and growth.

Learning Management Systems (LMS): From training to professional development, Tech4Biz’s LMS solutions make it easy for companies to upskill employees and stay competitive in today’s knowledge-driven economy.

These offerings are designed to deliver tangible results, helping businesses enhance productivity, reduce risks, and create new growth opportunities.

3. Real-World Impact: Case Studies from the Showcase

One of the most compelling features of the Tech4Biz Solutions Showcase is its portfolio of case studies. These success stories illustrate how businesses across industries have leveraged Tech4Biz’s solutions to achieve remarkable outcomes.

Manufacturing Excellence: A manufacturing company used Tech4Biz’s digital twin technology to reduce downtime and improve production efficiency by 20%.

Retail Transformation: A retailer partnered with Tech4Biz to deploy cloud infrastructure, resulting in a 25% increase in online sales and improved customer engagement.

Cybersecurity Strengthening: A financial services firm adopted Tech4Biz’s AI-powered cybersecurity solutions, which helped prevent data breaches and ensured compliance with industry regulations.

These examples highlight the real-world benefits of adopting cutting-edge innovations from Tech4Biz Solutions.

4. A Customer-Centric Approach to Innovation

At the heart of Tech4Biz Solutions’ success is its commitment to a customer-centric approach. The company tailors its solutions to meet the specific needs of each client, ensuring maximum impact and long-term success.

Here’s how Tech4Biz ensures its solutions are effective:

Customized Solutions: Every business is different, and Tech4Biz takes the time to understand each client’s unique challenges and goals before developing a tailored solution.

Seamless Integration: Tech4Biz ensures its solutions integrate smoothly with existing systems, minimizing disruptions and maximizing efficiency.

Expert Consultation: Clients benefit from access to experienced professionals who provide strategic guidance and support throughout the implementation process.

Continuous Support: Tech4Biz offers ongoing support and training to help clients get the most out of their technology investments.

This comprehensive approach ensures businesses can fully leverage the potential of Tech4Biz’s innovations.

5. Preparing Businesses for the Future

Tech4Biz Solutions is committed to staying ahead of emerging trends and technologies, ensuring its clients are always prepared for what’s next. The company’s forward-thinking approach includes:

Advanced Automation: Developing new automation tools to streamline workflows and free up human resources for higher-value tasks.

Predictive Analytics: Leveraging data to provide businesses with actionable insights and better decision-making capabilities.

Sustainability Solutions: Focusing on eco-friendly innovations that help businesses reduce their environmental impact while maintaining profitability.

These initiatives position Tech4Biz Solutions as a leader in driving future-ready business transformation.

6. Unlocking Potential with Tech4Biz Solutions

Tech4Biz Solutions’ Showcase is more than just a platform—it’s a roadmap for businesses looking to navigate the complexities of the digital era. By exploring the Showcase, businesses can discover the latest innovations and see firsthand how Tech4Biz’s solutions can help them achieve their transformation goals.

Whether it’s optimizing operations, enhancing cybersecurity, or transitioning to the cloud, Tech4Biz Solutions has the expertise and resources to empower businesses at every stage of their journey.

Conclusion

Tech4Biz Solutions is at the forefront of delivering cutting-edge innovations that drive business transformation. With a robust portfolio of services and a customer-centric approach, the company is helping businesses unlock new opportunities and stay competitive in an ever-evolving landscape.

Explore the Tech4Biz Solutions Showcase today to discover how your business can become future-ready with the latest technological advancements. Together, we can shape the future of business transformation.

For more details, reachout us: https://showcase.tech4bizsolutions.com/.

5 notes

·

View notes

Text

Toronto Accounting Recruiters Are Seeing High Demand for This Surprising Finance Role

Toronto’s finance and accounting sector is no stranger to evolving trends. From advancements in financial technology to shifting regulatory requirements, businesses are constantly adapting to stay competitive. Amid these changes, Toronto accounting recruiters have noticed a surprising surge in demand for a specialized role: the Financial Planning and Analysis (FP&A) Manager.

Once considered a behind-the-scenes position, the FP&A Manager has emerged as a strategic partner within organizations, driving decision-making and long-term growth. This shift highlights the growing need for professionals who can bridge the gap between data analysis and business strategy.

If your organization is searching for top FP&A talent, here’s why this role is in high demand and how accounting recruitment services in Toronto can help you secure the right candidate.

Why the FP&A Manager Role Is Gaining Momentum

The role of the FP&A Manager has expanded significantly in recent years. Traditionally responsible for budgeting and forecasting, FP&A professionals are now instrumental in providing strategic insights that shape business direction.

Several factors are driving this demand:

Data-driven decision-making: Organizations are increasingly relying on data to inform strategic initiatives. FP&A Managers play a crucial role in analyzing financial performance and forecasting future trends.

Economic uncertainty: In uncertain markets, businesses need professionals who can provide actionable insights to navigate challenges. FP&A Managers excel at scenario planning and financial modelling.

Technology integration: As organizations adopt advanced analytics tools and software, FP&A Managers who are tech-savvy and adaptable are in high demand.

The combination of technical expertise and strategic thinking makes the FP&A Manager a critical addition to any finance team.

Skills Toronto Companies Are Seeking in FP&A Professionals

Recruiters specializing in accounting recruitment services in Toronto are finding that the most sought-after FP&A candidates possess a unique blend of skills:

Analytical proficiency: Strong analytical skills are non-negotiable, as FP&A Managers must interpret complex financial data and provide actionable insights.

Communication skills: These professionals need to effectively convey financial information to non-financial stakeholders, making clear communication essential.

Strategic vision: FP&A Managers are expected to contribute to long-term planning and guide organizational strategy.

Technical expertise: Proficiency with tools like Excel, Power BI, and financial modelling software is a must.

By identifying candidates with these competencies, accounting recruiters in Toronto help organizations build finance teams that can tackle today’s challenges and prepare for tomorrow’s opportunities.

The Benefits of Partnering with Accounting Recruiters

With the demand for FP&A Managers rising, competition for top talent is fierce. Partnering with the best recruitment agency in Toronto can give your organization a significant advantage in securing skilled professionals.

Here’s how:

Market expertise: Toronto accounting recruiters have deep knowledge of the local job market and understand the nuances of finding candidates with specialized skills.

Extensive networks: Recruiting agencies maintain robust networks of qualified professionals, streamlining the hiring process.

Tailored solutions: Whether you need a full-time hire or a project-based consultant, accounting recruitment services can customize their approach to meet your needs.

BJRC Recruiting, for example, excels at connecting businesses with finance and accounting talent, helping organizations secure professionals who align with their goals and culture.

How to Stand Out to FP&A Candidates

The demand for FP&A Managers means candidates have more options than ever. To attract and retain top talent, organizations should focus on these areas:

Competitive compensation: Offering market-aligned salaries and benefits is essential in a competitive hiring landscape.

Professional development opportunities: FP&A professionals value opportunities for growth, such as certifications or leadership training.

Work-life balance: Flexible work arrangements and a supportive company culture are major draws for candidates in this role.

By addressing these factors, your organization can position itself as an employer of choice for top FP&A talent.

As businesses face increased complexity in financial planning and strategy, the demand for FP&A Managers continues to grow. These professionals are no longer just number crunchers; they are strategic partners who drive business success.

If your organization is looking to fill this pivotal role, BJRC Recruiting can help. With expertise in accounting recruitment services in Toronto, we connect businesses with top FP&A talent who are ready to make an impact.

Contact BJRC Recruiting today to find your next FP&A Manager and stay ahead in Toronto’s competitive finance landscape.

Know more https://bjrcrecruiting.com/2024/12/20/high-demand-finance-role-toronto-accounting-recruiters/

#toronto accounting recruiters#accounting recruiters in toronto#accounting recruitment services toronto#best recruitment agency in toronto

3 notes

·

View notes

Text

Millionaire Partner SystemMember area and video courses

buy now

The Millionaire Partner System is an outstanding platform for anyone looking to achieve financial success through online business strategies. The member area is exceptionally well-designed, offering easy navigation and access to a wealth of valuable resources. From the moment you log in, you’re guided step-by-step, making it ideal for beginners and seasoned entrepreneurs alike.One of the standout features is the comprehensive video courses. These are packed with actionable insights, real-world examples, and proven techniques that demystify complex concepts. The videos are engaging, easy to follow, and presented by experts who clearly know their field. Each module builds upon the last, ensuring a smooth learning curve and a clear path to success.The platform also excels in providing support. The responsive customer service team and the active community forums ensure that users are never left in the dark. Additionally, the system offers practical tools and templates that can be implemented immediately, saving time and effort.What truly sets the Millionaire Partner System apart is its focus on creating sustainable income streams. It’s not just about quick wins but building a long-term, scalable business model. If you’re serious about financial independence, this program is a must-try. Highly recommended!

buy now

#anya mouthwashing#artists on tumblr#bucktommy#agatha harkness#911 abc#batman#agatha all along#cats of tumblr#captain curly#dan and phil

2 notes

·

View notes

Text

Maximizing Business Insights with Power BI: A Comprehensive Guide for Small Businesses

Maximizing Business Insights Small businesses often face the challenge of making data-driven decisions without the resources of larger enterprises. Power BI, Microsoft's powerful analytics tool, can transform how small businesses use data, turning raw numbers into actionable insights. Here's a comprehensive guide to maximizing business insights with Power BI.

Introduction to Power BI

Power BI is a business analytics service by Microsoft that provides interactive visualizations and business intelligence capabilities. With an interface simple enough for end users to create their own reports and dashboards, it connects to a wide range of data sources.

Benefits for Small Businesses

1. User-Friendly Interface: Power BI's drag-and-drop functionality makes it accessible for users without technical expertise.

2. Cost-Effective: Power BI offers a free version with substantial features and a scalable pricing model for additional needs.

3. Real-Time Data: Businesses can monitor their operations with real-time data, enabling quicker and more informed decision-making.

Setting Up Power BI

1. Data Sources: Power BI can connect to various data sources such as Excel, SQL databases, and cloud services like Azure.

2. Data Modeling: Use Power BI to clean and transform data, creating a cohesive data model that forms the foundation of your reports.

3. Visualizations: Choose from a wide array of visualizations to represent your data. Customize these visuals to highlight the most critical insights.

Customizing Dashboards

1. Tailor to Needs: Customize dashboards to reflect the unique needs of your business, focusing on key performance indicators (KPIs) relevant to your goals.

2. Interactive Reports:Create interactive reports that allow users to explore data more deeply, providing a clearer understanding of underlying trends.

Real-World Examples

Several small businesses have successfully implemented Power BI to gain a competitive edge:

1. Retail: A small retail store used Power BI to track sales trends, optimize inventory, and identify peak shopping times.

2. Finance:A small financial advisory firm employed Power BI to analyze client portfolios, improving investment strategies and client satisfaction.

Integration with Existing Tools

Power BI seamlessly integrates with other Microsoft products such as Excel and Azure, as well as third-party applications, ensuring a smooth workflow and enhanced productivity.

Best Practices

1. Data Accuracy: Ensure data accuracy by regularly updating your data sources.

2. Training: Invest in training your team to use Power BI effectively.

3. Security: Implement robust security measures to protect sensitive data.

Future Trends

Power BI continues to evolve, with future updates likely to include more advanced AI features and enhanced data processing capabilities, keeping businesses at the forefront of technology.

Conclusion

Power BI offers small businesses a powerful tool to transform their data into meaningful insights. By adopting Power BI, businesses can improve decision-making, enhance operational efficiency, and gain a competitive advantage. Partnering with Vbeyond Digital ensures a smooth and successful implementation, maximizing the benefits of Power BI for your business. with Power BI: A Comprehensive Guide for Small Businesses

3 notes

·

View notes

Text

What are the 5 types of computer applications? - Lode Emmanuel Pale

Computer applications, also known as software or programs, serve various purposes and can be categorized into different types based on their functions and usage. Here are five common types of computer applications explained by Lode Emmanuel Pale:

Word Processing Software: Word processors are used for creating, editing, and formatting text documents. They include features for text formatting, spell checking, and sometimes even collaborative editing. Microsoft Word and Google Docs are popular examples.

Spreadsheet Software: Spreadsheet applications are used for managing and analyzing data in tabular form. They are commonly used for tasks like budgeting, financial analysis, and data visualization. Microsoft Excel and Google Sheets are well-known spreadsheet programs.

Presentation Software: Presentation software is used to create and deliver slideshows or presentations. These applications allow users to design visually appealing slides, add multimedia elements, and deliver presentations effectively. Microsoft PowerPoint and Google Slides are widely used for this purpose.

Database Software: Database applications are designed for storing, managing, and retrieving data efficiently. They are commonly used in businesses and organizations to store and manipulate large volumes of structured data. Examples include Microsoft Access, MySQL, and Oracle Database.

Graphics and Design Software: Graphics and design applications are used for creating visual content, such as images, illustrations, and multimedia presentations. These tools are essential for graphic designers, artists, and multimedia professionals. Adobe Photoshop, Adobe Illustrator, and CorelDRAW are popular graphic design software options.

These are just five broad categories of computer applications, and there are many more specialized software programs available for various purposes, such as video editing, 3D modeling, web development, and more. The choice of software depends on the specific needs and tasks of the user or organization.

8 notes

·

View notes

Text

Helplessness: On Depression, Development, and Death (Martin Seligman, 1975)

"Learned helplessness is caused by learning that responding is independent of reinforcement; so the model suggests that the cause of depression is the belief that action is futile.

What kind of events set off reactive depressions?

Failure at work and school, death of a loved one, rejection or separation from friends and loved ones, physical disease, financial difficulty, being faced with insoluble problems, and growing old.

There are many others, but this list captures the flavor.

I believe that what links these experiences and lies at the heart of depression is unitary: the depressed patient believes or has learned that he cannot control those elements of his life that relieve suffering, bring gratification, or provide nurture— in short, he believes that he is helpless.

Consider a few of the precipitating events: What is the meaning of job failure or incompetence at school?

Often it means that all of a person’s efforts have been in vain, that his responses have failed to achieve his desires.

When an individual is rejected by someone he loves, he can no longer control this significant source of gratification and support.

When a parent or lover dies, the bereaved is powerless to elicit love from the dead person.

Physical disease and growing old are helpless conditions par excellence; the person finds his own responses ineffective and is thrown upon the care of others.

Endogenous depressions, while not set off by an explicit helplessness-inducing event, also may involve the belief in helplessness.

I suspect that a continuum of susceptibility to this belief may underlie the endogenous-reactive continuum.

At the extreme endogenous end, the slightest obstacle will trigger in the depressive a vicious circle of beliefs in how ineffective he is.

At the extreme reactive end, a sequence of disastrous events in which a person is actually helpless is necessary to force the belief that responding is useless.

Consider, for example, premenstrual susceptibility to feelings of helplessness.

Right before her period, a woman may find that just breaking a dish sets off a full-blown depression, along with feelings of helplessness.

Breaking a dish wouldn’t disturb her at other times of the month; it would take several successive major traumas for depression to set in.

Is depression a cognitive or an emotional disorder? Neither and both.

Clearly, cognitions of helplessness lower mood, and a lowered mood, which may be brought about physiologically, increases susceptibility to cognitions of helplessness; indeed, this is the most insidious vicious circle in depression.

In the end, I believe that the cognition-emotion distinction in depression will be untenable.

Cognition and emotion need not be separable entities in nature simply because our language separates them.

When depression is observed close up, the exquisite interdependence of feelings and thought is undeniable: one does not feel depressed without depressing thoughts, nor does one have depressing thoughts without feeling depressed."

6 notes

·

View notes

Text

A TURN FROM B.Com OR BBA GRADUATE TO

DATA ANALYST

The business world is changing, and so are the opportunities within it. If you've finished your studies in Bachelor of Commerce (B.Com) or Bachelor of Business Administration (BBA), you might be wondering how to switch into the field of data analysis. Data analysts play an important role these days, finding useful information in data to help with decisions. In this blog post, we'll look at the steps you can take to smoothly change from a B.Com or BBA background to the exciting world of data analysis.

What You Already Know:

Even though it might feel like a big change, your studies in B.Com or BBA have given you useful skills. Your understanding of how businesses work, finances, and how organisations operate is a great base to start from.

Step 1: Building Strong Data Skills:

To make this change, you need to build a strong foundation in data skills. Begin by getting to know basic statistics, tools to show data visually, and programs to work with spreadsheets. These basic skills are like building blocks for learning about data.

I would like to suggest the best online platform where you can learn these skills. Lejhro bootcamp has courses that are easy to follow and won't cost too much.

Step 2: Learning Important Tools:

Data analysts use different tools to work with data. Learning how to use tools like Excel, SQL, and Python is really important. Excel is good for simple stuff, SQL helps you talk to databases, and Python is like a super tool that can do lots of things.

You can learn how to use these tools online too. Online bootcamp courses can help you get good at using them.

Step 3: Exploring Data Tricks:

Understanding how to work with data is the core of being a data analyst. Things like looking closely at data, testing ideas, figuring out relationships, and making models are all part of it. Don't worry, these sound fancy, but they're just different ways to use data.

Step 4: Making a Strong Collection:

A collection of things you've done, like projects, is called a portfolio. You can show this to others to prove what you can do. As you move from B.Com or BBA to data analysis, use your business knowledge to pick projects. For example, you could study how sales change, what customers do, or financial data.

Write down everything you do for these projects, like the problem, the steps you took, what tools you used, and what you found out. This collection will show others what you're capable of.

Step 5: Meeting People and Learning More:

Join online groups and communities where people talk about data analysis. This is a great way to meet other learners, professionals, and experts in the field. You can ask questions and talk about what you're learning.

LinkedIn is also a good place to meet people. Make a strong profile that shows your journey and what you can do. Follow data analysts and companies related to what you're interested in to stay up to date.

Step 6: Gaining Experience:

While you learn, it's also good to get some real experience. Look for internships, small jobs, or freelance work that lets you use your skills with real data. Even if the job isn't all about data, any experience with data is helpful.

Step 7: Updating Your Resume:

When you're ready to apply for data jobs, change your resume to show your journey. Talk about your B.Com or BBA studies, the skills you learned, the courses you took, your projects, and any experience you got. Explain how all of this makes you a great fit for a data job.

Using Lejhro Bootcamp:

When you're thinking about becoming a data analyst, think about using Lejhro Bootcamp. They have a special course just for people like you, who are switching from different fields. The Bootcamp teaches you practical things, has teachers who know what they're talking about, and helps you find a job later.

Moving from B.Com or BBA to a data analyst might seem big, but it's totally doable. With practice, learning, and real work, you can make the switch. Your knowledge about business mixed with data skills makes you a special candidate. So, get ready to learn, practice, and show the world what you can do in the world of data analysis!

***********

3 notes

·

View notes

Text

Bright future for Taurus

Venus infuses beauty into your chart. You must shine. Literally. Swarovski stones and all sorts of glitter on clothes, bags and hats. All sorts of cool rings. Through all this, the most important energy seeps into your life.

When you spend money on beautiful things, you stimulate the work of Venus, and she, in turn, attracts new resources. Cash can circulate easily and quickly in your pockets. To get good luck in love and work, you need to pump up Venus. Dress up (specifically). Go to master classes in drawing or clay modeling, for example... Draw. Venus will really like slow, unhurried and pleasant actions aimed at achieving an excellent result.

Secondly, she loves to enjoy the tastes. Go to a nice restaurant or cook dinner with your favorite dishes. Try to feel the full depth of taste of food. Another Venusian principle is relaxation and unhurriedness. Think about how you can revise your schedule to leave more time for ordinary idleness.

Choose clothes, think over your own image. Make your workplace beautiful By nature, you can manifest yourself as a practitioner. You have every opportunity to avoid poverty even in the most difficult times. Learn to appreciate and enjoy everyday comfort, coziness and luxury - strive for exquisite furniture, expensive accessories, beautiful interiors. Only in such conditions will you feel calm and stable. You have simple financial prudence, don't let it turn into greed. You have many opportunities and ways to get money, and just as many temptations to waste it.

And of course you need to be able to communicate with the highest strata of society, because you understand their motives. Success awaits you in public affairs. Improve your surroundings. Make influential friends. Try to benefit from everywhere: useful contacts, patrons, commercial transactions... Studying art, marketing, financial investments, dancing, clothing and jewelry design is useful. Innate sales skills can be the key to developing the sphere of love. Namely, to bring acquaintances and meetings with potentially wonderful partners, and then it’s up to you: whether you accept the gift of fate or not...

Never allow anyone to impose someone else’s way of behavior and thinking on you; it will never correspond to your own views. Do everything your own way and to the fullest. You have every right to do this. At the moment of your birth, a “warm place” was prepared for you. But you, like all of us, will have to go through the school of life and learn self-control before the fanfare sounds in your honor. You will certainly be accompanied by material and social success, and possibly a very high position.

Start with self-discipline. You may really miss her sometimes. You shouldn't be lazy and lower your goals. It can suck you in and make your goals impossible. Of course, this can be said to every person. But you have a real weak point, because of which everything will go down the drain. This means that, in principle, it’s generally impossible for you to do anything, despite the fact that you are always able to. Always be sure that the world will appreciate you what you deserve. This will allow you to save your personal energy and not waste it. If you truly love what you do, you will become an expert at your craft. And an excellent professional.

You must have many well-deserved awards. And you will always have something to be proud of.

*The article was published based on an individual natal chart.

💌 order a natal chart: [email protected]

👉synastry (compatibility with partner) 👉forecasts for the year. 👉forecasts for the day 👉monthly forecasts 👉children's horoscope. 👉analysis of a difficult situation Thank you all for your comments!🖐️

2 notes

·

View notes

Text

Why Toyota Used Cars Are a Smart Investment

Welcome to our blog post! Today, we are going to discuss why Toyota used cars are a smart investment. We understand that purchasing a used car can be a major decision, and we want to highlight the benefits and advantages of choosing a Toyota.

From quality and reliability to affordability and fuel efficiency, Ferntree Gully Toyota used cars offer a range of features that make them an excellent choice for any buyer. So, let's dive in and explore why Toyota used cars should be at the top of your list!

Quality and Reliability:

When it comes to quality and reliability, Toyota has built a reputation that is hard to beat. For years, Toyota has consistently produced vehicles that are known for their durability and long-lasting performance. Whether it's a brand-new model or a used car, Toyota's commitment to quality remains unwavering.

One of the reasons behind Toyota's reputation for reliability is their meticulous manufacturing process. Every Toyota vehicle undergoes rigorous testing and inspection to ensure that it meets the highest standards of quality. From the materials used to the engineering techniques employed, every aspect of a Toyota car is designed to withstand the test of time.

Don't just take our word for it - the numbers speak for themselves. According to various reliability studies, Toyota consistently ranks among the top automakers for reliability. Additionally, customer testimonials and reviews abound, with many Toyota owners sharing stories of their vehicles surpassing the 200,000-mile mark without major issues. These real-life experiences serve as a testament to the long-lasting nature of Toyota used cars.

Resale Value:

One of the key advantages of investing in a Toyota used car is its strong resale value. Toyota vehicles hold their value exceptionally well, often outperforming other brands in the used car market. This is largely due to Toyota's reputation for quality and reliability.

When it comes time to sell or trade-in your Toyota, you can expect to receive a higher resale value compared to other vehicles. This means that you can recoup a significant portion of your initial investment, making a Toyota used car a smart financial decision.

Certain Toyota models or features hold their value exceptionally well. For example, the Toyota Tacoma, known for its durability and off-road capabilities, retains its value better than many other trucks in its class. Similarly, Toyota's hybrid models, such as the Prius, offer excellent fuel efficiency and retain their value due to their eco-friendly features.

Affordability:

In addition to quality and resale value, affordability is another major advantage of choosing a Toyota used car. Buying a used Toyota can be a more cost-effective option compared to purchasing a brand-new vehicle.

One of the main reasons for this affordability is depreciation. New cars tend to lose a significant portion of their value in the first few years. By opting for a used Toyota, you can avoid the steep depreciation curve and enjoy a more budget-friendly purchase.

Toyota offers a range of popular models that are known for their affordability without compromising on quality. For instance, the Toyota Corolla has long been a favorite among budget-conscious buyers, offering a reliable and fuel-efficient option at an affordable price point. Similarly, the Toyota Camry provides a comfortable and spacious sedan with a reputation for longevity.

Fuel Efficiency:

Toyota is known for its commitment to producing fuel-efficient vehicles, and this extends to their used cars as well. Opting for a used Toyota can help you save money on fuel costs in the long run.

Toyota has been a pioneer in hybrid technology, with models like the Prius leading the way in fuel efficiency. These hybrid options combine a conventional gasoline engine with an electric motor, resulting in impressive fuel economy and reduced emissions. By choosing a used Toyota hybrid, not only will you save money at the pump, but you'll also contribute to a greener future.

Safety Features:

When it comes to safety, Toyota is committed to providing advanced features in their vehicles. Many used Toyota models come equipped with a range of safety technologies that enhance driver and passenger protection.

Toyota's dedication to safety is evident through features such as collision mitigation systems, adaptive cruise control, lane departure warning, and blind-spot monitoring. These technologies help prevent accidents and reduce the severity of collisions, ensuring the well-being of everyone on board.

Furthermore, Toyota has received numerous safety awards and accolades over the years. These accolades validate Toyota's commitment to safety and provide added peace of mind when choosing a used Toyota.

Warranty and Certification Programs:

To further enhance the buying experience, Toyota offers warranty programs and certified pre-owned options for their used cars. These programs provide additional peace of mind and protect buyers from unexpected expenses.

Toyota's warranty programs may vary depending on the age and mileage of the used car. However, they typically offer coverage for major components, providing reassurance against potential mechanical issues. Additionally, Toyota's certified pre-owned program ensures that used cars meet strict quality standards. These vehicles undergo a comprehensive inspection and come with an extended warranty, giving buyers added confidence in their purchase.

Conclusion:

When you choose Ferntree Gully Toyota used cars, you can be confident in its long-lasting performance and dependability. Whether you're looking for a fuel-efficient hybrid or a budget-friendly sedan, Toyota offers a range of options to suit your needs.

So, why wait? Consider a Toyota used car for your next vehicle purchase and experience the benefits firsthand. Thank you for joining us on this journey, and we hope you found this blog post helpful. If you have any questions or would like to share your thoughts, please feel free to leave a comment below.

2 notes

·

View notes

Text

The Growing Importance of Risk Management in Modern Investment Strategies

In today’s fast-paced and uncertain financial environment, investment is no longer just about chasing high returns—it’s about managing risk intelligently. Whether it’s inflation shocks, interest rate volatility, geopolitical tensions, or tech-driven market disruptions, modern investors need robust risk management strategies more than ever.

As financial markets grow increasingly complex, the demand for skilled professionals who can assess, model, and mitigate risk is skyrocketing. If you’re looking to build a future-proof finance career, enrolling in a Financial Analytics Certification in Bengaluru could be your ideal stepping stone.

What Is Risk Management in Investment?

Risk management in finance refers to identifying, analyzing, and mitigating the uncertainties that can negatively impact investment returns. It’s not about avoiding risk altogether—but rather about making informed decisions to balance risk and reward.

Key types of investment risk include:

Market Risk: Changes in stock prices, interest rates, or exchange rates

Credit Risk: Borrowers failing to repay loans or bonds

Liquidity Risk: Inability to sell assets quickly without price impact

Operational Risk: Failures in processes, systems, or people

Systemic Risk: Collapse of the entire financial system (e.g., 2008 crisis)

Why Risk Management Is More Crucial Than Ever

Increased Market Volatility: Markets are more interconnected and sensitive to global events. A war, a pandemic, or a regulatory shift can shake global indices overnight.

Diversification of Assets: With investors holding a mix of stocks, bonds, crypto, real estate, and commodities, portfolio risk has become more complex to track and analyze.

Rise of Retail Investing: More individuals are investing through platforms like Zerodha, Groww, and Upstox. Without proper risk education, poor decisions can lead to huge losses.

AI and Automation: While algorithmic trading and robo-advisors are popular, they also carry risks. Professionals must be able to interpret and monitor algorithmic outputs critically.

ESG and Regulatory Risks: Environmental, Social, and Governance (ESG) factors, along with stricter financial regulations, have added new dimensions to risk assessment.

Role of Financial Analytics in Risk Management

Modern risk management is data-driven. Financial analytics empowers professionals to:

Model scenarios using Monte Carlo simulations

Calculate Value at Risk (VaR)

Monitor real-time exposure and stress testing

Detect credit defaults and fraud

Use predictive analytics to foresee potential downturns

This shift has created a huge demand for financial analysts trained in data tools like Python, R, Excel, Power BI, and SQL.

Why Pursue a Financial Analytics Certification in Bengaluru?

Bengaluru—India’s tech and fintech capital—is a hotspot for financial innovation. From global banks to cutting-edge startups, the city is teeming with opportunities in risk analytics, investment strategy, and portfolio management.

A Financial Analytics Certification in Bengaluru offers:

Industry-aligned curriculum tailored to modern risk management

Live projects with fintechs and hedge funds based in the city

Access to expert mentors and placement assistance

Training in tools used by top global investment firms

You’ll not only learn financial theory but also how to apply it using analytics to manage investment risk in real-world scenarios.

Real-World Example: How Risk Analytics Works in Practice

Imagine a fund manager in Bengaluru managing a ₹100 crore multi-asset portfolio. Here’s how financial analytics is used:

Volatility Forecasting: Predicting which sectors may fluctuate more in the upcoming quarter.

Correlation Analysis: Evaluating asset correlations to maximize diversification.

Stress Testing: Simulating geopolitical or market shocks (like a sudden oil price spike) to understand portfolio impact.

AI Risk Signals: Using machine learning models to generate early warnings for market downturns.

These strategies require hands-on data analytics skills that a Financial Analytics Certification in Bengaluru can deliver effectively.

Career Roles in Risk Management and Financial Analytics

A background in financial analytics opens the door to specialized roles such as:

Risk Analyst / Credit Risk Analyst

Quantitative Risk Modeler

Portfolio Risk Manager

Investment Strategy Analyst

Fintech Risk Product Manager

Compliance and Regulatory Analyst

These positions are critical in financial institutions, asset management companies, fintech startups, and global consulting firms—all of which have a strong presence in Bengaluru.

Conclusion

As financial markets become more volatile and data-driven, risk management is no longer optional—it’s essential. Businesses and investors alike are turning to financial analysts who can interpret risk through the lens of analytics and technology.

If you’re ready to future-proof your career and make a meaningful impact in the investment world, a Financial Analytics Certification in Bengaluru can equip you with the tools, training, and confidence to succeed in this high-stakes field.

0 notes

Text

Rewards Cards vs. Cash Advance Apps: Choosing the Right Financial Tool

Learn the pros and cons of rewards credit cards and cash advance apps. Discover which tool is best for your financial goals and how to manage your money wisely.

In today's complex financial world, consumers have more tools at their disposal than ever before. From credit cards that reward your spending to apps that provide instant cash, navigating these options can be overwhelming. Understanding the unique purpose of each tool is the first step toward building a robust financial strategy. The key is to know which option to use in which situation, ensuring you maximize benefits while minimizing costs and risks.

The Power of Rewards Credit Cards

Rewards credit cards have become a staple for many savvy consumers. These cards offer points, miles, or cashback on purchases, turning everyday spending into tangible benefits. Some cards are tailored to specific categories, like travel or groceries, allowing users to earn accelerated rewards on their most frequent expenses. For example, a card might offer high cashback rates on dining and entertainment, making it a great choice for those who enjoy going out. The primary advantage is clear: you get rewarded for spending you would have done anyway. However, these benefits come with responsibility. High interest rates can quickly negate any rewards earned if you carry a balance, and some premium cards come with annual fees. To make the most of a rewards card, it's crucial to pay the balance in full each month. For more information on how credit cards work, the Consumer Financial Protection Bureau (CFPB) is an excellent resource.

Navigating Short-Term Cash Needs with Modern Apps

On the other end of the spectrum are cash advance apps. These tools are designed to solve a different problem: short-term liquidity. Life is full of unexpected expenses, from a car repair to a surprise medical bill, that can pop up between paychecks. A cash advance app provides a small amount of money to bridge that gap without the lengthy application process or high costs associated with traditional payday loans. These apps offer a financial safety net, helping users manage emergencies without derailing their budgets. Their convenience and speed are major selling points, offering access to funds often within minutes. This makes them a practical tool for immediate, unforeseen financial shortfalls rather than planned, everyday spending.

Choosing the Right Tool for the Job

The choice between a rewards card and a cash advance app depends entirely on your financial situation and immediate needs. A rewards credit card is a tool for planned spending and financial management, helping you build credit and earn perks over time. For instance, a card like the savorone is designed to reward consistent spending habits. However, it's not intended for immediate cash flow emergencies. When you need cash now to cover an unexpected expense, a cash advance app is often the more appropriate and cost-effective solution. Trying to use a credit card for a cash advance can trigger exorbitant fees and high interest rates from day one, making it a costly option for quick cash.

A Fee-Free Approach to Financial Flexibility

While many financial tools come with fees, a new generation of apps is changing the game. Gerald is a financial app that offers both Buy Now, Pay Later (BNPL) services and cash advances without the fees. Unlike credit cards, Gerald charges no interest or late fees. And unlike many other cash advance apps, there are no subscription costs or mandatory express transfer fees. Gerald’s model is unique: users can access fee-free cash advance transfers after making a purchase with a BNPL advance. This creates a balanced ecosystem where users can manage both their shopping and their cash flow needs without worrying about hidden costs. It combines the flexibility of BNPL with the safety net of a cash advance, all in one place.

Building a Smarter Financial Future

Ultimately, financial wellness isn't about finding a single magic-bullet solution; it's about building a versatile toolkit. Rewards credit cards and cash advance apps serve different but equally important purposes. By understanding the difference between BNPL or cash advances and credit cards, you can make informed decisions that align with your goals. Using a rewards card responsibly for planned purchases can help you earn valuable perks, while having access to a fee-free cash advance app like Gerald can provide peace of mind when unexpected costs arise. By using each tool for its intended purpose, you can take control of your finances and build a more secure future. As you evaluate your options, consider reading reviews and comparisons from trusted sources like Bankrate to find the best fit for your lifestyle.

#cash advance#cash advance app#cash advance apps#instant cash advance app#instant cash advance apps#free instant cash advance apps

0 notes

Text

Why Smart Investors Are Eyeing Nifty Next 50 Stocks Now

India’s evolving stock market landscape is more dynamic than ever — and the Nifty Next 50 stocks are quickly becoming the spotlight for investors looking to gain from tomorrow’s large-cap leaders.

📌 What Are Nifty Next 50 Stocks?

The Nifty Next 50 index represents the 50 companies that rank just below the Nifty 50 Stocks in terms of free-float market capitalization within the Nifty 100 universe. These companies are the rising stars — often industry leaders in their own right — poised to graduate into the Nifty 50 as their growth trajectory continues.

This positioning makes Nifty Next 50 stocks extremely attractive for investors who seek a balance between growth and stability. They’re not as mature (and often not as saturated) as Nifty 50 constituents, but they belong to the broader Nifty 100, and many will eventually become the next generation of blue-chip stocks.

🚀 Why Nifty Next 50 Stocks Are the New Sweet Spot

Smart investors are shifting their focus toward Nifty Next 50 companies due to several compelling reasons:

1. Track Record of Outperformance

Over longer time frames, the Nifty Next 50 index has often outperformed the Nifty 50, especially during bull runs. This is largely due to the growth potential of companies that are still in an aggressive expansion phase, unlike the more mature and stable businesses in the Nifty 50.

2. Part of the Nifty 100 – The Best of Both Worlds

Since these stocks are part of the Nifty 100, they benefit from large-cap visibility while offering mid-cap-like returns. Many also feature in Nifty LargeMidcap 250, which further highlights their hybrid nature — large enough for stability, but small enough for explosive growth.

💼 How Nifty Next 50 Fits Within India’s Market Indices

To fully appreciate the opportunity, let’s briefly map the Nifty Next 50 in context with other major Indian indices:

Nifty 50: India’s top 50 companies by market cap.

Nifty 100: Includes Nifty 50 + Nifty Next 50.

Nifty 200: A blend of large and mid-cap companies.

Nifty 500: The broadest representation of Indian equity market performance.

Nifty500 Equal-Cap: Equal-weighted version of the Nifty 500.

Nifty Total Market: Comprehensive coverage of India’s investable equity universe.

Within this broader framework, the Nifty Next 50 serves as a vital bridge — capturing companies that are too large for mid-cap indices but not yet in the top 50.

📈 Sectoral & Strategic Diversification

Unlike the Nifty 50, which is often dominated by banking and financials, the Nifty Next 50 brings in greater sectoral diversity — including consumer goods, pharmaceuticals, retail, energy, and industrials. It overlaps with:

Nifty Midcap 50

Nifty Midcap 100

Nifty Midcap 150

Nifty LargeMidcap 250

Nifty Midcap Select

Nifty Midsmallcap 400

This cross-index representation offers investors exposure to emerging leaders across sectors, without the elevated risks typically associated with small caps.

💹 Growth Potential Without Microcap Risk

For those hesitant to invest in the Nifty Microcap 250 or Nifty Smallcap 250, the Nifty Next 50 serves as an excellent middle ground. These are established businesses with strong fundamentals and proven revenue models — a step above micro and small-cap volatility but with enough runway to offer attractive long-term returns.

Additionally, investors looking to diversify into broader equity coverage, such as through Nifty500 Multicap, often find that Nifty Next 50 stocks are a key part of their core allocations.

🧠 Ideal for ETF, SIP & Passive Investing

With the rise of low-cost ETFs and index funds, retail and institutional investors alike are turning to passive instruments tracking Nifty Next 50. These funds provide:

Access to high-growth potential companies

Diversification across sectors

Rebalancing in line with index updates

Lower fees compared to active funds

For example, a SIP in a Nifty Next 50 ETF can compound significantly over 5–10 years, particularly when market cycles favor mid-to-large cap growth.

🏆 Regular Rebalancing Keeps It Fresh

The index is rebalanced semi-annually, removing laggards and adding rising performers. This built-in discipline ensures the Nifty Next 50 always reflects the next in line for Nifty 50 status.

As companies evolve, some move up to the Nifty 50, while others fall off — but investors benefit from being in a curated, forward-looking basket of stocks that are constantly monitored for relevance.

💥 Performance in Market Cycles

During recovery phases or economic expansions, Nifty Next 50 stocks tend to rally more sharply than their Nifty 50 counterparts. They often bounce back faster due to:

Higher earnings growth

More aggressive business models

Greater sector rotation impact

They also benefit from broader exposure in portfolios that mirror indices like Nifty Midsmallcap 400 or Nifty500 Equal-Cap, further validating their role in multi-cap or balanced strategies.

🔚 Conclusion: Nifty Next 50 Is a Smart Investor’s Gateway

To sum it up:

✅ Nifty Next 50 stocks offer a golden opportunity to tap into future market leaders. ✅ They combine the best of growth and quality, without diving into the high-risk small or microcap segment. ✅ Positioned within the Nifty 100, they are part of India’s core equity universe, yet still underappreciated by the masses. ✅ With ETF options, SIP feasibility, and strong fundamentals, they are tailor-made for long-term investors and strategic portfolio builders.

📌 Bonus Tip:

Keep an eye on index movements — when a Nifty Next 50 stock enters the Nifty 50, it usually triggers institutional buying and potential price re-rating. Anticipating such moves can provide significant alpha.

Are you investing in the future of India’s stock market — or just its past? Explore the Nifty 50 top gainer now and get ahead of the curve.

#Nifty 50#Nifty Next 50#Nifty 100#Nifty 200#Nifty 500#Nifty Midcap 50#Nifty Midcap 100#Nifty Midcap 150#Nifty Smallcap 50#Nifty Smallcap 100#Nifty Smallcap 250#Nifty Midsmallcap 400#Nifty500 Multicap#Nifty LargeMidcap 250#Nifty Midcap Select#Nifty Total Market#Nifty Microcap 250#Nifty500 Equal-Cap#Nifty 50 stocks#Nifty 50 companies#Nifty 50 top gainer#Nifty 50 index#Nifty stocks#Nifty share list#Nifty top stocks#NSE indices#NSE stocks#Indian stock market#Indian indices#stock market India

0 notes