#matt stoller

Explore tagged Tumblr posts

Text

The reason you can’t buy a car is the same reason that your health insurer let hackers dox you

On July 14, I'm giving the closing keynote for the fifteenth HACKERS ON PLANET EARTH, in QUEENS, NY. Happy Bastille Day! On July 20, I'm appearing in CHICAGO at Exile in Bookville.

In 2017, Equifax suffered the worst data-breach in world history, leaking the deep, nonconsensual dossiers it had compiled on 148m Americans and 15m Britons, (and 19k Canadians) into the world, to form an immortal, undeletable reservoir of kompromat and premade identity-theft kits:

https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Equifax knew the breach was coming. It wasn't just that their top execs liquidated their stock in Equifax before the announcement of the breach – it was also that they ignored years of increasingly urgent warnings from IT staff about the problems with their server security.

Things didn't improve after the breach. Indeed, the 2017 Equifax breach was the starting gun for a string of more breaches, because Equifax's servers didn't just have one fubared system – it was composed of pure, refined fubar. After one group of hackers breached the main Equifax system, other groups breached other Equifax systems, over and over, and over:

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Doesn't this remind you of Boeing? It reminds me of Boeing. The spectacular 737 Max failures in 2018 weren't the end of the scandal. They weren't even the scandal's start – they were the tipping point, the moment in which a long history of lethally defective planes "breached" from the world of aviation wonks and into the wider public consciousness:

https://en.wikipedia.org/wiki/List_of_accidents_and_incidents_involving_the_Boeing_737

Just like with Equifax, the 737 Max disasters tipped Boeing into a string of increasingly grim catastrophes. Each fresh disaster landed with the grim inevitability of your general contractor texting you that he's just opened up your ceiling and discovered that all your joists had rotted out – and that he won't be able to deal with that until he deals with the termites he found last week, and that they'll have to wait until he gets to the cracks in the foundation slab from the week before, and that those will have to wait until he gets to the asbestos he just discovered in the walls.

Drip, drip, drip, as you realize that the most expensive thing you own – which is also the thing you had hoped to shelter for the rest of your life – isn't even a teardown, it's just a pure liability. Even if you razed the structure, you couldn't start over, because the soil is full of PCBs. It's not a toxic asset, because it's not an asset. It's just toxic.

Equifax isn't just a company: it's infrastructure. It started out as an engine for racial, political and sexual discrimination, paying snoops to collect gossip from nosy neighbors, which was assembled into vast warehouses full of binders that told bank officers which loan applicants should be denied for being queer, or leftists, or, you know, Black:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

This witch-hunts-as-a-service morphed into an official part of the economy, the backbone of the credit industry, with a license to secretly destroy your life with haphazardly assembled "facts" about your life that you had the most minimal, grudging right to appeal (or even see). Turns out there are a lot of customers for this kind of service, and the capital markets showered Equifax with the cash needed to buy almost all of its rivals, in mergers that were waved through by a generation of Reaganomics-sedated antitrust regulators.

There's a direct line from that acquisition spree to the Equifax breach(es). First of all, companies like Equifax were early adopters of technology. They're a database company, so they were the crash-test dummies for ever generation of database. These bug-riddled, heavily patched systems were overlaid with subsequent layers of new tech, with new defects to be patched and then overlaid with the next generation.

These systems are intrinsically fragile, because things fall apart at the seams, and these systems are all seams. They are tech-debt personified. Now, every kind of enterprise will eventually reach this state if it keeps going long enough, but the early digitizers are the bow-wave of that coming infopocalypse, both because they got there first and because the bottom tiers of their systems are composed of layers of punchcards and COBOL, crumbling under the geological stresses of seventy years of subsequent technology.

The single best account of this phenomenon is the British Library's postmortem of their ransomware attack, which is also in the running for "best hard-eyed assessment of how fucked things are":

https://www.bl.uk/home/british-library-cyber-incident-review-8-march-2024.pdf

There's a reason libraries, cities, insurance companies, and other giant institutions keep getting breached: they started accumulating tech debt before anyone else, so they've got more asbestos in the walls, more sagging joists, more foundation cracks and more termites.

That was the starting point for Equifax – a company with a massive tech debt that it would struggle to pay down under the most ideal circumstances.

Then, Equifax deliberately made this situation infinitely worse through a series of mergers in which it bought dozens of other companies that all had their own version of this problem, and duct-taped their failing, fucked up IT systems to its own. The more seams an IT system has, the more brittle and insecure it is. Equifax deliberately added so many seams that you need to be able to visualized additional spatial dimensions to grasp them – they had fractal seams.

But wait, there's more! The reason to merge with your competitors is to create a monopoly position, and the value of a monopoly position is that it makes a company too big to fail, which makes it too big to jail, which makes it too big to care. Each Equifax acquisition took a piece off the game board, making it that much harder to replace Equifax if it fucked up. That, in turn, made it harder to punish Equifax if it fucked up. And that meant that Equifax didn't have to care if it fucked up.

Which is why the increasingly desperate pleas for more resources to shore up Equifax's crumbling IT and security infrastructure went unheeded. Top management could see that they were steaming directly into an iceberg, but they also knew that they had a guaranteed spot on the lifeboats, and that someone else would be responsible for fishing the dead passengers out of the sea. Why turn the wheel?

That's what happened to Boeing, too: the company acquired new layers of technical complexity by merging with rivals (principally McDonnell-Douglas), and then starved the departments that would have to deal with that complexity because it was being managed by execs whose driving passion was to run a company that was too big to care. Those execs then added more complexity by chasing lower costs by firing unionized, competent, senior staff and replacing them with untrained scabs in jurisdictions chosen for their lax labor and environmental enforcement regimes.

(The biggest difference was that Boeing once had a useful, high-quality product, whereas Equifax started off as an irredeemably terrible, if efficient, discrimination machine, and grew to become an equally terrible, but also ferociously incompetent, enterprise.)

This is the American story of the past four decades: accumulate tech debt, merge to monopoly, exponentially compound your tech debt by combining barely functional IT systems. Every corporate behemoth is locked in a race between the eventual discovery of its irreparable structural defects and its ability to become so enmeshed in our lives that we have to assume the costs of fixing those defects. It's a contest between "too rotten to stand" and "too big to care."

Remember last February, when we all discovered that there was a company called Change Healthcare, and that they were key to processing virtually every prescription filled in America? Remember how we discovered this? Change was hacked, went down, ransomed, and no one could fill a scrip in America for more than a week, until they paid the hackers $22m in Bitcoin?

https://en.wikipedia.org/wiki/2024_Change_Healthcare_ransomware_attack

How did we end up with Change Healthcare as the linchpin of the entire American prescription system? Well, first Unitedhealthcare became the largest health insurer in America by buying all its competitors in a series of mergers that comatose antitrust regulators failed to block. Then it combined all those other companies' IT systems into a cosmic-scale dog's breakfast that barely ran. Then it bought Change and used its monopoly power to ensure that every Rx ran through Change's servers, which were part of that asbestos-filled, termite-infested, crack-foundationed, sag-joisted teardown. Then, it got hacked.

United's execs are the kind of execs on a relentless quest to be too big to care, and so they don't care. Which is why their they had to subsequently announce that they had suffered a breach that turned the complete medical histories of one third of Americans into immortal Darknet kompromat that is – even now – being combined with breach data from Equifax and force-fed to the slaves in Cambodia and Laos's pig-butchering factories:

https://www.cnn.com/2024/05/01/politics/data-stolen-healthcare-hack/index.html

Those slaves are beaten, tortured, and punitively raped in compounds to force them to drain the life's savings of everyone in Canada, Australia, Singapore, the UK and Europe. Remember that they are downstream of the forseeable, inevitable IT failures of companies that set out to be too big to care that this was going to happen.

Failures like Ticketmaster's, which flushed 500 million users' personal information into the identity-theft mills just last month. Ticketmaster, you'll recall, grew to its current scale through (you guessed it), a series of mergers en route to "too big to care" status, that resulted in its IT systems being combined with those of Ticketron, Live Nation, and dozens of others:

https://www.nytimes.com/2024/05/31/business/ticketmaster-hack-data-breach.html

But enough about that. Let's go car-shopping!

Good luck with that. There's a company you've never heard. It's called CDK Global. They provide "dealer management software." They are a monopolist. They got that way after being bought by a private equity fund called Brookfield. You can't complete a car purchase without their systems, and their systems have been hacked. No one can buy a car:

https://www.cnn.com/2024/06/27/business/cdk-global-cyber-attack-update/index.html

Writing for his BIG newsletter, Matt Stoller tells the all-too-familiar story of how CDK Global filled the walls of the nation's auto-dealers with the IT equivalent of termites and asbestos, and lays the blame where it belongs: with a legal and economics establishment that wanted it this way:

https://www.thebignewsletter.com/p/a-supreme-court-justice-is-why-you

The CDK story follows the Equifax/Boeing/Change Healthcare/Ticketmaster pattern, but with an important difference. As CDK was amassing its monopoly power, one of its execs, Dan McCray, told a competitor, Authenticom founder Steve Cottrell that if he didn't sell to CDK that he would "fucking destroy" Authenticom by illegally colluding with the number two dealer management company Reynolds.

Rather than selling out, Cottrell blew the whistle, using Cottrell's own words to convince a district court that CDK had violated antitrust law. The court agreed, and ordered CDK and Reynolds – who controlled 90% of the market – to continue to allow Authenticom to participate in the DMS market.

Dealers cheered this on: CDK/Reynolds had been steadily hiking prices, while ingesting dealer data and using it to gouge the dealers on additional services, while denying dealers access to their own data. The services that Authenticom provided for $35/month cost $735/month from CDK/Reynolds (they justified this price hike by saying they needed the additional funds to cover the costs of increased information security!).

CDK/Reynolds appealed the judgment to the 7th Circuit, where a panel of economists weighed in. As Stoller writes, this panel included monopoly's most notorious (and well-compensated) cheerleader, Frank Easterbrook, and the "legendary" Democrat Diane Wood. They argued for CDK/Reynolds, demanding that the court release them from their obligations to share the market with Authenticom:

https://caselaw.findlaw.com/court/us-7th-circuit/1879150.html

The 7th Circuit bought the argument, overturning the lower court and paving the way for the CDK/Reynolds monopoly, which is how we ended up with one company's objectively shitty IT systems interwoven into the sale of every car, which meant that when Russian hackers looked at that crosseyed, it split wide open, allowing them to halt auto sales nationwide. What happens next is a near-certainty: CDK will pay a multimillion dollar ransom, and the hackers will reward them by breaching the personal details of everyone who's ever bought a car, and the slaves in Cambodian pig-butchering compounds will get a fresh supply of kompromat.

But on the plus side, the need to pay these huge ransoms is key to ensuring liquidity in the cryptocurrency markets, because ransoms are now the only nondiscretionary liability that can only be settled in crypto:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

When the 7th Circuit set up every American car owner to be pig-butchered, they cited one of the most important cases in antitrust history: the 2004 unanimous Supreme Court decision in Verizon v Trinko:

https://www.oyez.org/cases/2003/02-682

Trinko was a case about whether antitrust law could force Verizon, a telcoms monopolist, to share its lines with competitors, something it had been ordered to do and then cheated on. The decision was written by Antonin Scalia, and without it, Big Tech would never have been able to form. Scalia and Trinko gave us the modern, too-big-to-care versions of Google, Meta, Apple, Microsoft and the other tech baronies.

In his Trinko opinion, Scalia said that "possessing monopoly power" and "charging monopoly prices" was "not unlawful" – rather, it was "an important element of the free-market system." Scalia – writing on behalf of a unanimous court! – said that fighting monopolists "may lessen the incentive for the monopolist…to invest in those economically beneficial facilities."

In other words, in order to prevent monopolists from being too big to care, we have to let them have monopolies. No wonder Trinko is the Zelig of shitty antitrust rulings, from the decision to dismiss the antitrust case against Facebook and Apple's defense in its own ongoing case:

https://www.ftc.gov/system/files/documents/cases/073_2021.06.28_mtd_order_memo.pdf

Trinko is the origin node of too big to care. It's the reason that our whole economy is now composed of "infrastructure" that is made of splitting seams, asbestos, termites and dry rot. It's the reason that the entire automotive sector became dependent on companies like Reynolds, whose billionaire owner intentionally and illegally destroyed evidence of his company's crimes, before going on to commit the largest tax fraud in American history:

https://www.wsj.com/articles/billionaire-robert-brockman-accused-of-biggest-tax-fraud-in-u-s-history-dies-at-81-11660226505

Trinko begs companies to become too big to care. It ensures that they will exponentially increase their IT debt while becoming structurally important to whole swathes of the US economy. It guarantees that they will underinvest in IT security. It is the soil in which pig butchering grew.

It's why you can't buy a car.

Now, I am fond of quoting Stein's Law at moments like this: "anything that can't go on forever will eventually stop." As Stoller writes, after two decades of unchallenged rule, Trinko is looking awfully shaky. It was substantially narrowed in 2023 by the 10th Circuit, which had been briefed by Biden's antitrust division:

https://law.justia.com/cases/federal/appellate-courts/ca10/22-1164/22-1164-2023-08-21.html

And the cases of 2024 have something going for them that Trinko lacked in 2004: evidence of what a fucking disaster Trinko is. The wrongness of Trinko is so increasingly undeniable that there's a chance it will be overturned.

But it won't go down easy. As Stoller writes, Trinko didn't emerge from a vacuum: the economic theories that underpinned it come from some of the heroes of orthodox economics, like Joseph Schumpeter, who is positively worshipped. Schumpeter was antitrust's OG hater, who wrote extensively that antitrust law didn't need to exist because any harmful monopoly would be overturned by an inevitable market process dictated by iron laws of economics.

Schumpeter wrote that monopolies could only be sustained by "alertness and energy" – that there would never be a monopoly so secure that its owner became too big to care. But he went further, insisting that the promise of attaining a monopoly was key to investment in great new things, because monopolists had the economic power that let them plan and execute great feats of innovation.

The idea that monopolies are benevolent dictators has pervaded our economic tale for decades. Even today, critics who deplore Facebook and Google do so on the basis that they do not wield their power wisely (say, to stamp out harassment or disinformation). When confronted with the possibility of breaking up these companies or replacing them with smaller platforms, those critics recoil, insisting that without Big Tech's scale, no one will ever have the power to accomplish their goals:

https://pluralistic.net/2023/07/18/urban-wildlife-interface/#combustible-walled-gardens

But they misunderstand the relationship between corporate power and corporate conduct. The reason corporations accumulate power is so that they can be insulated from the consequences of the harms they wreak upon the rest of us. They don't inflict those harms out of sadism: rather, they do so in order to externalize the costs of running a good system, reaping the profits of scale while we pay its costs.

The only reason to accumulate corporate power is to grow too big to care. Any corporation that amasses enough power that it need not care about us will not care about it. You can't fix Facebook by replacing Zuck with a good unelected social media czar with total power over billions of peoples' lives. We need to abolish Zuck, not fix Zuck.

Zuck is not exceptional: there were a million sociopaths whom investors would have funded to monopolistic dominance if he had balked. A monopoly like Facebook has a Zuck-shaped hole at the top of its org chart, and only someone Zuck-shaped will ever fit through that hole.

Our whole economy is now composed of companies with sociopath-shaped holes at the tops of their org chart. The reason these companies can only be run by sociopaths is the same reason that they have become infrastructure that is crumbling due to sociopathic neglect. The reckless disregard for the risk of combining companies is the source of the market power these companies accumulated, and the market power let them neglect their systems to the point of collapse.

This is the system that Schumpeter, and Easterbrook, and Wood, and Scalia – and the entire Supreme Court of 2004 – set out to make. The fact that you can't buy a car is a feature, not a bug. The pig-butcherers, wallowing in an ocean of breach data, are a feature, not a bug. The point of the system was what it did: create unimaginable wealth for a tiny cohort of the worst people on Earth without regard to the collapse this would provoke, or the plight of those of us trapped and suffocating in the rubble.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/28/dealer-management-software/#antonin-scalia-stole-your-car

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#matt stoller#monopoly#automotive#trinko#antitrust#trustbusting#cdk global#brookfield#private equity#dms#dealer management software#blacksuit#infosec#Authenticom#Dan McCray#Steve Cottrell#Reynolds#frank easterbrook#schumpeter

996 notes

·

View notes

Text

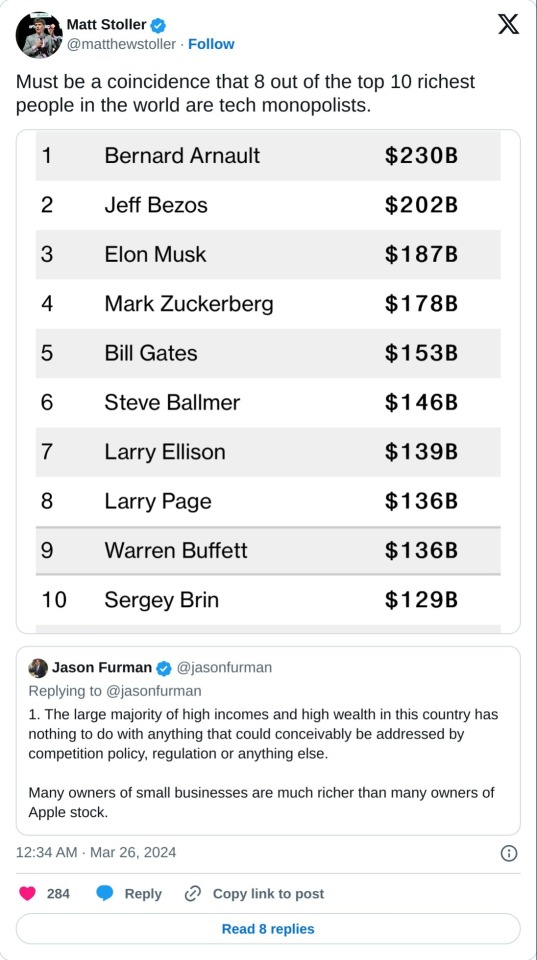

#twitter#us news#news#healthcare#corporations#corporate greed#money money money#USA#barack obama#matt stoller

86 notes

·

View notes

Text

I think most people characterize a monopoly as kind of an economic thing or, you know, just a commercial thing. But really, a monopoly is a political institution. So, when we're talking about monopolies, we're talking about what is effectively a private government over a market, over an industry. If you're operating in a market which is monopolized, then you have a political boss who sets the prices, the terms of trade, who can buy, who can sell, and you're under their thumb. And yeah, it's your trade, right? So, it looks like the quote unquote economy, but in fact, it's really that a person or a firm has political power over you. And if you have enough monopolies in an economy, then at least in the commercial sector, which is a big part of our lives, we're not living in a democratic society. We're living in a society of a bunch of private governments — authoritarian governments over markets. ... There's a good quote from a plumber in the Wall Street Journal who said that, you know, the government can fine me, but Google can put me out of business because Google could take his business off Google Maps. They could change his ranking in Google search. And so, he was way more afraid of Google than the government. And that's because Google has governing power over the internet. ... So, what you have in a lot of areas — and in most, I think — is monopoly or oligopoly, which is just a small number of companies controlling a market, and [this] is now a systemic feature of the American economy. And it didn't used to be.

John Sherman, of the Sherman Antitrust Act, said that if we will not be ruled by a monarch, we should not be ruled by an autocrat of trade. He was very explicit about the link between monarchy and authoritarianism and monopoly. And they were using the term monarchy because fascism hadn't happened yet, but monarchy did exist. In the 19th century, Americans were looking across the ocean and they were seeing a bunch of kingdoms. There was a little bit of democracy, but that's what they were really looking at. And they were like, we don't want that. Today we would just say fascism, and we did analogize monopoly to fascism in the 1920s, 30s, and 40s. It has always been foundational in America that concentrations of power are what we escaped, and they are not what we want here. And there's always been this tension because you do need to consolidate capital and effort to do great public works and to do great works in general. But how do you control the power of that? How do you control the power of industry? If you're going to put a billion dollars together to build a railroad across the country, that’s awesome. Now you have a transcontinental railroad. But who runs that railroad and controls the prices they charge, or the ability for them to charge different prices to different classes of people based on who they want to see succeed? Now, all of a sudden, you're talking about a political problem.

8 notes

·

View notes

Text

As I’ll show in this piece, that’s not a one-off, but systemic. The White House communications team routinely tells voters the government doesn’t do anything for them. That is, it’s not that Biden doesn’t have a message. He does. That message is “we don’t do anything for you.” And Americans hear that message loud and clear.

14 notes

·

View notes

Text

Merger cases don’t have juries, they are ‘bench trials.’ The judge is not only making all forms of rulings on procedural motions, but is the decider of the case as well. And thus, except for the vague possibility of an appeal, the judge becomes all-powerful, able to reorganize industries almost based on gut feel.

As a result, the entire social dynamic is organized around the judge, who sits physically above everyone else on a raised platform. Every joke from the judge is hilarious, every story is charming, and every command is obeyed instantly. Everyone stands when the judge enters or exits, and anyone saying anything to the judge uses ���his honor’ or ‘her honor’ at all times. If the judge wants brown M&Ms, fifteen lawyers paid $1 million apiece will reach out their hands holding a bag their junior associates spent all night sorting.

-Matt Stoller, All Rise: How Judges Rule America

42 notes

·

View notes

Text

This is why people are more hostile. The television stations do the same thing.

#quotes#psyops#hostility#the signal 2007#television#facebook#social media#twitter#online outrage fiesta#matt stoller#outrage#outrage culture#uncle outrage#bar fight#metaphor#simile#hostile#vicious#mean#hate#hatred#anger#angry#anger issues#fear#disgust#reddit#rage bait#rage post#abandonment

0 notes

Text

1 note

·

View note

Text

To talk about monopoly & antitrust, I want to start off with your first day in Econ 101, when you learn "how prices work". The toy model that nearly everyone learns as one of the first things ever is that classic supply-and-demand graph of price and quantity; you know it, I don't need to show it. And in relation to how firms set price in a market, the explanation you get is something like:

"In a world with perfect information, zero transaction costs, rational agents, and no barriers to entry, new firms and/or increased output will enter the market until marginal price equals marginal cost"

This (seemingly) portrays a model where new companies "entering the market" is how prices go down. Like say there are Firms A, B, and C, engaging in oligopolistic pricing for a normal good; what happens is some new Firm X (with the same production costs) emerges with the sole business strategy of "offer prices lower than them because they are skimming" and it drives everyone's prices down in a race to the bottom. That, in a sense, competition between identical firms drives the price equilibrium.

That isn't very true, not in practice and not even theoretically; the 101 stuff just sort of biases you to see it that way. Firm X above is being rational in one way but silly in others; why would it enter a market where its competitors are making healthy profits just to fuck that up, knowing it has no advantage they can't immediately replicate in response? And pay all the fixed costs other firms have already paid to make that 0.1% profit? In real life firms almost never do this, they compete over (actual or perceived) advantage or market segmentation. And it also means that - if all firms are truly the same in a market - cooperating on price, far from being aberrant behavior, is the natural thing to do. Why would I look at my rival firm and lower my price to "undercut" them, knowing that they 100% can just lower it too? We both lose, immediately. In practice, companies often set their prices by looking at the prices of competing firms and matching them!

Many things actually drive the price equilibrium of course, but one of the biggest - and most useful for our purposes - is the substitution effect. If companies defacto cooperate on prices all the time, why is the price not infinity? Well because if you are selling steaks and set the price to infinity, I'm not gonna buy it! I can just buy chicken, for me it's pretty much the same. And chicken is cheaper to make than steak. As a chicken firm, I totally can set my price under your steak and you can never, ever match it; that is a real advantage, one from asymmetries of production. The price of steak is driven by the need to compete with chicken much more than it is driven by the need to compete with "other steaks". And so on down a chain of a million desires and costs and needs.

So to wrap this around to antitrust, there is a common idea out there that monopolistic pricing is increasing from the past because if I look at different industries, so many of them today are consolidated into 2-3 big firms. Your grocery stores are all Giant or Safeway or w/e it is in your city, if you are buying a TV Samsung & LG are half the entire US market. How could these companies not collude on price? Of course they do, and they don't need explicit agreements that would violate extant FTC regulations to do it; they can just softly communicate and feel out cooperation. So you gotta break them up and change the rules so they can't do that.

The trap is thinking this is any different if it was 10 firms - it really isn't! Maybe marginally, sure, and if it was 2000 firms yeah okay the sheer chaos would probably create some price churn; but in the past prices were not driven down by the diversity of firms making price cooperation impossible. The long history of guilds, business associations, chambers of commerce, and so on shows that they had plenty of avenues for cooperation - and often did straight-up set prices. Meanwhile, when Wal-Mart, Target, Aldi, and others all cut prices at around the same time, they are not mainly competing with each other. If they were they would just mutually agree to not do that, without even saying anything! How stupid do you think they are? That isn't hard to do. Instead they are competing with Amazon; with boutique local stores; with restaurants; with the changing price of labor; with shifting consumer sentiment and expectations. The industry concentration doesn't matter.

Until it does of course! Because what is the substitution good for oil? They exist of course, but they ain't cheap; people will still buy gas at gigantic ranges of prices. Here, the fundamental structure of the market is monopolistic - and also a geopolitical clusterfuck, but let's not get into that. Producers openly rig prices sometimes, and antitrust actively regulates against it, and it is a hot mess of governments and companies and all that. Are people who hold patents engaging in monopoly pricing? Obviously, that is the point of patents! It is by design; but there are tons of arguments to be made around creeping exploitation of the IP system. Sometimes hundreds of firms in a dominant market niche will offer complex, bundled products where the price of each piece of obfuscated and the value is subjective, but consensus is you can't not buy the product or you will be screwed and since you can't tell what the product even is, let alone how valuable it is, you can't object when they set the price - I hear these are called "universities", but they go by other names in other sectors.

All of the above are something like "monopolies", which maybe are getting worse over time, but they are monopolies for different, product-specific reasons. I think there is a good deal of FTC work and other reforms that could be done in the US to identify areas where this kind of rent extraction is happening. But what it doesn't look like is opposing blanket industry consolidation. And in fact the correlation is honestly pretty weak. Because identical firm competition does not drive the price equilibrium.

#antitrust discourse#This is not a review of Biden's FTC policy - they are aware of this reality at least in part#This is obliquely a critique of Matt Stoller he is not aware of this

197 notes

·

View notes

Text

First, his tariff plan is bad. On Friday, I discussed it in a technocratic way. Let me be more blunt now. It’s incredibly stupid and destructive. That’s not because tariffs are bad, but because across the board immediate and high tariffs, without any certainty they will continue, combined with zero aid from the government to re-shore anything and no time to adjust, is a recipe for depression. Every day I read about more parts of government he’s shutting down that could help this transition. Today it’s the elimination of Manufacturing Extension Partnerships. Tomorrow it’ll be something else. And the day after. And the next. You can’t rebuild through arson.

Matt Stoller

81 notes

·

View notes

Text

How an obscure advisory board lets utilities steal $50b/year from ratepayers

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in NYC on WEDNESDAY (26 Feb) with JOHN HODGMAN and at PENN STATE on THURSDAY (Feb 27). More tour dates here. Mail-order signed copies from LA's Diesel Books.

Two figures to ponder.

First: if your local power company is privately owned, you've seen energy rate hikes at 49% above inflation over the last three years.

Second: if your local power company is publicly owned, you've seen energy rates go up at 44% below inflation over the same period.

Power is that much-theorized economic marvel: a "natural monopoly." Once someone has gone to the trouble of bringing a power wire to your house, it's almost impossible to convince anyone else to invest in bringing a competing wire to your electrical service mast. For this reason, most people in the world get their energy from a publicly owned utility, and the rates reflect social priorities as well as cost-recovery. For example, basic power to run lights and a refrigerator might be steeply discounted, while energy-gobbling McMansions pay a substantial premium for the extra power to heat and cool their ostentatious lawyer-foyers and "great rooms."

But in America, we believe in the miracle of the market, even where no market could possibly exist because of natural monopolies. That's why about 70% of Americans get their power from shareholder-owned companies, whose managers' prime directive is extracting profit, not serving their communities. To check this impulse, these private utilities are overseen by various flavors of public bodies, usually called Public Utility Commissions (PUCs).

For 40 years, PUCs have limited private utilities to a "rate of return" based on a "just and reasonable profit." They always gamed this to make it higher than was fair, but in recent years, the "experts" who advise PUCs on rate-setting have been boiled down to a tiny number of economists, who have discovered that the true "just and reasonable profit" is much higher than it's ever been considered.

Mark Ellis worked for one of those profit-hiking "experts," but he's turned whistleblower. On paper, Ellis looks like the enemy: former chief economist at Sempra Energy, an ex-Exxonmobile analyst, a retired McKinsey Consultant, and a Socal Edison engineer. But Ellis couldn't stomach the corruption, and he went public, publishing a report for the American Economic Liberties Project called "Rate of Return Equals Cost of Capital" that lays out the con in stark detail:

https://www.economicliberties.us/wp-content/uploads/2025/01/20250102-aelp-ror-v5.pdf

I first encountered Ellis last week when he was interviewed on Matt Stoller and David Dayen's excellent Organized Money podcast, where he memorably referred to these utilities as "pocket-picking machines":

https://www.organizedmoney.fm/p/the-pocket-picking-machine

Dayen followed this up with a great summary in The American Prospect (where he is editor-in-chief):

https://prospect.org/environment/2025-02-21-secret-society-raising-your-electricity-bills/

At the center of the scam is a professional association called the Society of Utility and Regulatory Financial Analysts (SURFA). The experts in SURFA are dominated by just four consulting companies, who provide 90% of the testimony for rate-setting exercises. Just two people account for half of that input.

In order to calculate the "just and reasonable profit," these experts make use of economic models. Even in normal economics, these models are the source of infinite mischief and suffering, built on assumptions that legitimize the most abusive conduct:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

But even by the low standards of normal economic models, the utility models are really bad. They rely on unique "risk premium" and "expected earnings" calculations that no one else in finance will touch. As Dayen explains, these models are "perfectly circular."

This might be a bit confusing, but only because it's one of those scams that you assume you must have misunderstood because it's so, well, scammy. In the "expected earnings" analysis, the "just and reasonable profit" a utility is allowed to build into its rates is defined as "the amount of money it would like to make." In other words, if a utility projects future revenues of $10 billion over the next ten years, that is its "expected earnings." "Expected earnings" are treated as equivalent to "just and reasonable profits." So under this model, whatever number the utility puts in its financial projections is the number that it's allowed to take out of the pockets of ratepayers.

This is just as bad as it sounds. In 2022, the Federal Energy Regulatory Commission said that it "defied financial logic." No duh – even SURFA's own training manual says it "does not square well with economic theory."

In the world of regulated utilities, this kind of mathing isn't supposed to be possible. The PUC and its "consumer advocates" are supposed to listen to these outlandish tales and laugh the utility out of the room.

But it's SURFA that trains the consumer advocates who work for the PUCs, the large energy customers, and community groups. These people – who are supposed to act as the adversaries of the companies that pay SURFA members to justify rate-hikes – are indoctrinated by SURFA to treat its absurd models as accepted economic gospel. SURFA has co-opted its opposition, transformed it into a botnet that parrots its own talking-points.

Because of this, the private power companies that serve 70% of US households made an extra $50b last year, about $300 per household. What's more, because the excess profits available to companies that simply bamboozle their regulators are so massive, they swamp all the other tools regulators use to attempt to improve the energy system. No incentive offered for conservation or efficiency can touch the gigantic sums energy companies can make by ripping off ratepayers, so nearly all the incentive programs approved by PUCs have been dead on arrival.

What's more, utilities are allowed to fold the cost of hiring the experts who get them rate hikes onto the ratepayers. In other words, if a utility hires a $10,000,000 expert who successfully argues for a $1,000,000,000 rate-increase, they get to recoup the ten mil they spent securing the right to rip you off for a billion dollars on top of that cool bill.

We often talk about regulatory capture in the abstract, but this is as concrete as it can be. Ellis's report makes a raft of highly specific, technical regulatory changes that states or cities could impose on their PUCs. These are shovel-ready ideas: if you find yourself contemplating a sky-high power bill, maybe you could call your state rep and read them aloud.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/24/surfa/#mark-ellis

#pluralistic#surfa#organized money#david dayen#matthew stoller#matt stoller#the american prospect#whistleblowers#power#utilities#monopolies#antitrust#Society of Utility and Regulatory Financial Analysts#Mark Ellis#PUCs#podcasts

274 notes

·

View notes

Text

13 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 18, 2025

Heather Cox Richardson

Jan 19, 2025

Shortly before midnight last night, the Federal Trade Commission (FTC) published its initial findings from a study it undertook last July when it asked eight large companies to turn over information about the data they collect about consumers, product sales, and how the surveillance the companies used affected consumer prices. The FTC focused on the middlemen hired by retailers. Those middlemen use algorithms to tweak and target prices to different markets.

The initial findings of the FTC using data from six of the eight companies show that those prices are not static. Middlemen can target prices to individuals using their location, browsing patterns, shopping history, and even the way they move a mouse over a webpage. They can also use that information to show higher-priced products first in web searches. The FTC found that the intermediaries—the middlemen—worked with at least 250 retailers.

“Initial staff findings show that retailers frequently use people’s personal information to set targeted, tailored prices for goods and services—from a person's location and demographics, down to their mouse movements on a webpage,” said FTC chair Lina Khan. “The FTC should continue to investigate surveillance pricing practices because Americans deserve to know how their private data is being used to set the prices they pay and whether firms are charging different people different prices for the same good or service.”

The FTC has asked for public comment on consumers’ experience with surveillance pricing.

FTC commissioner Andrew N. Ferguson, whom Trump has tapped to chair the commission in his incoming administration, dissented from the report.

Matt Stoller of the nonprofit American Economic Liberties Project, which is working “to address today’s crisis of concentrated economic power,” wrote that “[t]he antitrust enforcers (Lina Khan et al) went full Tony Montana on big business this week before Trump people took over.”

Stoller made a list. The FTC sued John Deere “for generating $6 billion by prohibiting farmers from being able to repair their own equipment,” released a report showing that pharmacy benefit managers had “inflated prices for specialty pharmaceuticals by more than $7 billion,” “sued corporate landlord Greystar, which owns 800,000 apartments, for misleading renters on junk fees,” and “forced health care private equity powerhouse Welsh Carson to stop monopolization of the anesthesia market.”

It sued Pepsi for conspiring to give Walmart exclusive discounts that made prices higher at smaller stores, “[l]eft a roadmap for parties who are worried about consolidation in AI by big tech by revealing a host of interlinked relationships among Google, Amazon and Microsoft and Anthropic and OpenAI,” said gig workers can’t be sued for antitrust violations when they try to organize, and forced game developer Cognosphere to pay a $20 million fine for marketing loot boxes to teens under 16 that hid the real costs and misled the teens.

The Consumer Financial Protection Bureau “sued Capital One for cheating consumers out of $2 billion by misleading consumers over savings accounts,” Stoller continued. It “forced Cash App purveyor Block…to give $120 million in refunds for fostering fraud on its platform and then refusing to offer customer support to affected consumers,” “sued Experian for refusing to give consumers a way to correct errors in credit reports,” ordered Equifax to pay $15 million to a victims’ fund for “failing to properly investigate errors on credit reports,” and ordered “Honda Finance to pay $12.8 million for reporting inaccurate information that smeared the credit reports of Honda and Acura drivers.”

The Antitrust Division of the Department of Justice sued “seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage,” Stoller went on. It “sued $600 billion private equity titan KKR for systemically misleading the government on more than a dozen acquisitions.”

“Honorary mention goes to [Secretary Pete Buttigieg] at the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights,’” Stoller concluded. He added more results to the list in his newsletter BIG.

Meanwhile, last night, while the leaders in the cryptocurrency industry were at a ball in honor of President-elect Trump’s inauguration, Trump launched his own cryptocurrency. By morning he appeared to have made more than $25 billion, at least on paper. According to Eric Lipton at the New York Times, “ethics experts assailed [the business] as a blatant effort to cash in on the office he is about to occupy again.”

Adav Noti, executive director of the nonprofit Campaign Legal Center, told Lipton: “It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president’s family in connection with his office. It is beyond unprecedented.” Cryptocurrency leaders worried that just as their industry seems on the verge of becoming mainstream, Trump’s obvious cashing-in would hurt its reputation. Venture capitalist Nick Tomaino posted: “Trump owning 80 percent and timing launch hours before inauguration is predatory and many will likely get hurt by it.”

Yesterday the European Commission, which is the executive arm of the European Union, asked X, the social media company owned by Trump-adjacent billionaire Elon Musk, to hand over internal documents about the company’s algorithms that give far-right posts and politicians more visibility than other political groups. The European Union has been investigating X since December 2023 out of concerns about how it deals with the spread of disinformation and illegal content. The European Union’s Digital Services Act regulates online platforms to prevent illegal and harmful activities, as well as the spread of disinformation.

Today in Washington, D.C., the National Mall was filled with thousands of people voicing their opposition to President-elect Trump and his policies. Online speculation has been rampant that Trump moved his inauguration indoors to avoid visual comparisons between today’s protesters and inaugural attendees. Brutally cold weather also descended on President Barack Obama’s 2009 inauguration, but a sea of attendees nonetheless filled the National Mall.

Trump has always understood the importance of visuals and has worked hard to project an image of an invincible leader. Moving the inauguration indoors takes away that image, though, and people who have spent thousands of dollars to travel to the capital to see his inauguration are now unhappy to discover they will be limited to watching his motorcade drive by them. On social media, one user posted: “MAGA doesn’t realize the symbolism of [Trump] moving the inauguration inside: The billionaires, millionaires and oligarchs will be at his side, while his loyal followers are left outside in the cold. Welcome to the next 4+ years.”

Trump is not as good at governing as he is at performance: his approach to crises is to blame Democrats for them. But he is about to take office with majorities in the House of Representatives and the Senate, putting responsibility for governance firmly into his hands.

Right off the bat, he has at least two major problems at hand.

Last night, Commissioner Tyler Harper of the Georgia Department of Agriculture suspended all “poultry exhibitions, shows, swaps, meets, and sales” until further notice after officials found Highly Pathogenic Avian Influenza, or bird flu, in a commercial flock. As birds die from the disease or are culled to prevent its spread, the cost of eggs is rising—just as Trump, who vowed to reduce grocery prices, takes office.

There have been 67 confirmed cases of the bird flu in the U.S. among humans who have caught the disease from birds. Most cases in humans are mild, but public health officials are watching the virus with concern because bird flu variants are unpredictable. On Friday, outgoing Health and Human Services secretary Xavier Becerra announced $590 million in funding to Moderna to help speed up production of a vaccine that covers the bird flu. Juliana Kim of NPR explained that this funding comes on top of $176 million that Health and Human Services awarded to Moderna last July.

The second major problem is financial. On Friday, Secretary of the Treasury Janet Yellen wrote to congressional leaders to warn them that the Treasury would hit the debt ceiling on January 21 and be forced to begin using extraordinary measures in order to pay outstanding obligations and prevent defaulting on the national debt. Those measures mean the Treasury will stop paying into certain federal retirement accounts as required by law, expecting to make up that difference later.

Yellen reminded congressional leaders: “The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past.” She added, “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Both the avian flu and the limits of the debt ceiling must be managed, and managed quickly, and solutions will require expertise and political skill.

Rather than offering their solutions to these problems, the Trump team leaked that it intended to begin mass deportations on Tuesday morning in Chicago, choosing that city because it has large numbers of immigrants and because Trump’s people have been fighting with Chicago mayor Brandon Johnson, a Democrat. Michelle Hackman, Joe Barrett, and Paul Kiernan of the Wall Street Journal, who broke the story, reported that Trump’s people had prepared to amplify their efforts with the help of right-wing media.

But once the news leaked of the plan and undermined the “shock and awe” the administration wanted, Trump’s “border czar” Tom Homan said the team was reconsidering it.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Consumer Financial Protection Bureau#consumer protection#FTC#Letters From An American#heather cox richardson#shock and awe#immigration raids#debt ceiling#bird flu#protests#March on Washington

30 notes

·

View notes

Text

Detailed legal explanation of the tiktok ban and then "unban" (actually a 90 day extension on the ban after which tiktok may still be banned), from Matt Stoller's anti-monopoly blog "Big".

35 notes

·

View notes

Text

In 1933, Supreme Court Justice Louis Brandeis penned one of his most famous dissents on a case, Liggett v Lee, involving a Florida law prohibiting the expansion of chain stores. Brandeis was writing at the height of the Great Depression, during the worst wave of bank failures in American history, as Germany was falling into fascism and democracies collapsed worldwide. It was a moment of total paralysis, not only economically but psychologically as well. Citizens had stopped believing they could govern themselves. They hungered for someone, anyone to step up. No one was in charge, and a spiral downward, of banks, of prices, of lives, of hunger, continued. In that moment, the Supreme Court made it slightly worse.

-Matt Stoller, The Monopolies Behind the Adderall Shortage

30 notes

·

View notes

Text

So this is what the Biden administration spent it's last week in office doing. It's important to know this isn't unusual activity for them. But this is all just in one week:

"Out With a Bang: Enforcers Go After John Deere, Private Equity Billionaires

https://www.thebignewsletter.com/p/out-with-a-bang-enforcers-go-after

At least for a few more days, laws are not suggestions. In the end days of strong enforcement, a flurry of litigation is met with a direct lawsuit by billionaires against Biden's Antitrust chief.

Matt Stoller

Jan 16, 2025

It’s less than a week until this era of antitrust ends. And while much of the news has been focused elsewhere, enforcers have engaged in a flurry of action, which will by legal necessity continue into the next administration. One case in particular angered some of the most powerful people on Wall Street, the partners of a $600 billion private equity firm called Kohlberg Kravis Roberts (KKR).

But before getting to that suit, here’s a partial list of some of the actions enforcers have taken in the last two weeks.

The Federal Trade Commission

Filed a monopolization claim against agricultural machine maker John Deere for generating $6 billion by prohibiting farmers from being able to repair their own equipment, a suit which Wired magazine calls a “tipping point” for the right to repair movement.

Released another report on pharmacy benefit managers, including that of UnitedHealth Group, showing that these companies inflated prices for specialty pharmaceuticals by more than $7 billion.

Sued Greystar, a large corporate landlord, for deceiving renters with falsely advertised low rents and not including mandatory junk fees in the price.

Issued a policy statement that gig workers can’t be prosecuted for antitrust violations when they try to organize, and along with the Antitrust Division, updated guidance on labor and antitrust.

Put out a series of orders prohibiting data brokers from selling sensitive location information.

Finalized changes to a rule barring third party targeted advertising to children without an explicit opt-in.

The Consumer Financial Protection Bureau

Went to court against Capital One for cheating consumers out of $2 billion by deceiving them on savings accounts and interest rates.

Fined cash app purveyor Block $175 million for fostering fraud on its platform and then refusing to offer customer support to affected consumers.

Proposed a rule to prohibit take-it-or-leave-it contracts from financial institutions that allow firms to de-bank users over how they express themselves or whether they seek redress for fraud.

Issued a report with recommendations on how states can update their laws to protect against junk fees and privacy abuses.

Sued credit reporting agency Experian for refusing to investigate consumer disputes and errors on credit reports.

Finalized a rule to remove medical debt from credit scores.

The Antitrust Division

Sued to block a merger of two leading business travel firms, American Express Global Business Travel Group and CWT Holdings.

Filed a complaint against seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage.

Got four guilty pleas in a bid-rigging conspiracy by IT vendors against the U.S. government, a guilty plea from an asphalt vendor company President, and convicted five defendants in a price-fixing scam on roofing contracts.

Issued a policy statement that non-disclosure agreements that deter individuals from reporting antitrust crimes are void, and that employers “using NDAs to obstruct or impede an investigation may also constitute separate federal criminal violations.”

Filed two amicus briefs with the FTC, one supporting Epic Games in its remedy against Google over app store monopolization, and the other supporting Elon Musk in his antitrust claims against OpenAI, Microsoft, and Reid Hoffman.

And honorary mention goes to the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights.’"

It's worth reading the entire piece because the Biden people have also gone after KKR which is one of the biggest and most well-connected private equity firms. Remember when suddenly last year all the rich people who used to donate to both parties stopped giving money to Democrats? The billionaires coup against Biden was because of anti trust enforcement.

IF YOU'RE THINKING "GOSH I NEVER HEARD ABOUT ANY OF THIS BEFORE" I HOPE YOU CAN PUT TOGETHER THAT THE NEWS AND SOCIAL MEDIA PLATFORMS ARE ALL OWNED BY BILLIONAIRES WHO ARE VERY ANGRY ABOUT ALL OF THIS AND MAYBE THAT'S WHY YOU NEVER SAW ANYONE TALK ABOUT THE HUGE RESURGENCE OF ANTI TRUST WORK DONE BY BIDEN FOR THE LAST FOUR YEARS.

And no, Trump cannot magically make this all go away. The lawsuits will have to be played out and many of them have state level components that mean the feds can't just shut them down.

X

11 notes

·

View notes

Text

Deadline’s Contenders Television, the event where stars and showrunners talk up their shows ahead of Emmy voting, has unveiled its lineup.

The event kicks off on Saturday April 13 and runs through Sunday April 14 at the Directors Guild of America in LA. There will also be a virtual livestream of the event. Full details of the event and an RSVP link can be found here.

It will give you a sense of the hits of the last twelve months, as well as some shows that you’re about to be talking about, as the networks, studios and streamers vie for some awards love.

Stars attending include Tom Hiddleston, Nicole Kidman, Brie Larson, Kristen Wiig, Rebecca Ferguson, Lily Gladstone, David Oyelowo, Common, Jimmy Fallon, Giancarlo Esposito, Joey King, Andrea Riseborough, Sebastian Maniscalco, Bill Pullman, Kiefer Sutherland, Logan Lerman, Kelsey Grammer, Matt Bomer, Jonathan Bailey, Allison Williams, Maya Erskine, Nathan Fielder, Skeet Ulrich, Jeff Probst, Omar J. Dorsey, Harriet Dyer, Patrick Brammall, Sophia Di Martino, Sarayu Blue, Ji-young Yoo and Taylor Zakhar Perez.

Shows that will be featured across the two days include Parish, Masters of the Air, Lessons in Chemistry, The Morning Show, Silo, Palm Royale, The New Look, Survivor, Colin From Accounts, A Murder at the End of the World, True Detective: Night Country, We Were the Lucky Ones, Under the Bridge, Murdaugh Murders: The Movie, Loki, Alice & Jack, Genius: MLK/X, The Tonight Show Starring Jimmy Fallon, 3 Body Problem, Mr. Monk’s Last Case: A Monk Movie, Lawmen: Bass Reeves, Frasier, Mr. & Mrs. Smith, Fallout, Expats, Red, White & Royal Blue, Fellow Travelers, The Curse, The Caine Mutiny Court-Martial, Platonic and Bookie.

There will also be numerous top showrunners and exec producers including Chuck Lorre, David Benioff, D.B. Weiss, Alexander Woo, Benny Safdie, Graham Yost, Gary Goetzman, Lee Eisenberg, Abe Sylvia, Brit Marling, Zal Batmanglij, Gina Prince-Bythewood, Francesca Sloane, Lulu Wang, Sarah Schechter and Nicholas Stoller.

The studios, networks and streamers participating include AMC, Apple TV+, CBS, CBS Studios, FX, HBO and Max, Hulu, Lifetime, Marvel Studios and Disney+, Masterpiece on PBS, National Geographic, NBCUniversal, Netflix, Peacock, Paramount+, Prime Video, Showtime, Sony Pictures Television and Warner Bros. Television.

The event is sponsored by Apple TV+, Eyepetizer Eyewear and Final Draft + ScreenCraft in partnership with Four Seasons Resort Maui and 11 Ravens.

---

Both Tom and Sophia will be there.

32 notes

·

View notes