#the american prospect

Text

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

464 notes

·

View notes

Text

According to the most recent polls, Republicans’ electoral fortunes have improved markedly over the last few weeks. Democrats went from a roughly two-point advantage in the generic congressional ballot at the beginning of October to about half a point today. It seems likely the GOP will take control of at least one chamber of Congress in 2023.

There has been a simmering debate over the past few years as to whether claims of conservative populism mean anything in a practical policy sense. Many have claimed that things have changed from the old days of tax cuts for the rich, business-friendly deregulation, and trickle-down economics—like Sen. Josh Hawley (R-MO), who once wrote, “We are a working-class party now. That’s the future.”

We now have an answer to this question, and it is firmly negative. If they win in 2022, Republicans are promising the same old massive cuts to social programs, above all Social Security and Medicare, which they’ve been trying to get at for decades. And they’re going to try to force President Biden to agree by threatening a global financial apocalypse. In the words of Roger Daltrey, meet the new boss, same as the old boss.

All four GOP representatives running to head the House Budget Committee have promised that they are going to take the debt ceiling hostage to get big cuts. “Our main focus has got to be on nondiscretionary—it’s got to be on entitlements,” said Rep. Buddy Carter (R-GA). Specifically, they mentioned increasing the eligibility age for Social Security and Medicare, and adding means tests or work requirements. Rep. Kevin McCarthy, who will probably be Speaker of the House if Republicans take control, endorsed the strategy. “You can’t just continue down the path to keep spending and adding to the debt,” he said.

To review, the debt ceiling is a legal mechanism dating from 1917 that says the government can only borrow a certain amount. So when Congress passes a budget requiring some borrowing (which is almost every time), if the resulting debt would go beyond the ceiling, Congress has to pass an additional measure to raise it. It’s as if you had a credit card with a borrowing limit that you could set yourself.

If this sounds weird and stupid, that’s because it is. The debt ceiling is a completely pointless legal archaism. The only other country that has one is Denmark, but its government rendered it inoperative years ago by raising it far above where its debt is ever likely to reach. (It’s a sad demonstration of America’s political dysfunction that we can’t even manage this kind of elementary national housekeeping.)

Despite its stupidity, should the debt ceiling be reached, it would cause a very real crisis. The Treasury Department would probably miss an interest payment, meaning a default on the national debt. Since U.S. government debt is considered about the safest possible asset in the world, and everyone from financial firms to institutional investors to central banks owns trillions of dollars of it, the hit to global economic stability would be severe. That’s why the debt ceiling is “a hostage that’s worth ransoming,” as Mitch McConnell put it in 2012 after doing just that the previous year.

We thus see that the core of Republican economic policy remains unchanged. From the 1980s to today, it is the belief that the rich are too heavily taxed. Aside from the military, the biggest pots of money in the federal budget that might be raided for more tax cuts for beleaguered billionaires are the big welfare programs: Medicare, Medicaid, and Social Security.

Ever since Donald Trump won in 2016, there have been innumerable articles, books, and conferences discussing a promised birth of new ideas in the conservative movement. But lo and behold! It’s the exact same party of granny-starving plutocrats as before, except now with a heavy dose of even more overt homophobia, transphobia, and antisemitism, not to mention sheer 200-proof lunacy.

One might wonder why Republicans didn’t gut Social Security and Medicare when they controlled the presidency and Congress in 2017-2018, or even try to do so. (There were large cuts in Trump’s budget proposed in 2018, but they never made it into actual legislation.) The reason is that doing so is grossly unpopular. When Trump proposed huge Medicare cuts in his 2020 budget (one that was dead on arrival because Democrats controlled the House), it polled at about 72% disapproval. A more recent poll by a pro–Social Security organization found overwhelming disapproval for cuts to the program, and overwhelming support for increasing benefits by removing the payroll tax cap. In short, Americans love their Social Security and Medicare, and if they want changes, it is to make the programs more generous, not less.

So Republicans would much prefer to get welfare cuts through coercion and brinkmanship rather than normal legislation. That way they can starve grandma in a bipartisan fashion, while simultaneously trusting that the average swing voter will blame President Biden for it, if not sticking the blame on him themselves.

At any rate, Democrats could defuse the political pipe bomb—which they handed to Republicans themselves, incidentally—in several ways. In the upcoming lame-duck session, they could pass the reconciliation bill they still have available for fiscal year 2023, raising the debt limit to an absurd amount (I personally favor Avogadro’s number), or alternatively implement some formula that would automatically keep the debt limit in line with new borrowing.

Or President Biden could mint the famous platinum coin to increase his borrowing authority through seigniorage, or he could declare the debt ceiling unconstitutional under Section 4 of the 14th Amendment, which states that “The validity of the public debt of the United States … shall not be questioned.” This constitutional argument is surely correct—especially since Congress would be giving Biden contradictory legal instructions, requiring him to spend certain amounts through the budget process while also not allowing him to borrow the necessary balance.

Whatever choice they make, Democrats would be well advised to defuse the debt ceiling forever, before this session of Congress ends. So long as it exists, there is a live chance that Republicans will use it to do something appalling or insane.

#us politics#news#the American prospect#ryan cooper#op eds#2022 midterms#2022 elections#2022#Medicare#social security#video#sen. bernie sanders#Republicans#conservatives#gop#democrats#debt ceiling#economy#economics#global recession#biden administration#president joe biden#Rep. Buddy Carter#rep. kevin mccarthy#medicaid#department of treasury#welfare programs

19 notes

·

View notes

Text

Conservatives often argue against proposals for public remedy on grounds of futility. Public remedy will be ineffectual, they say, because the problems it is meant to fix arise from intractable social conditions or human nature. When the new Speaker of the House Mike Johnson recently responded to demands for gun regulation after a mass shooting by saying that “at the end of the day” the true problem is not guns but the “human heart,” he was making the futility argument.

The “futility thesis,” as Albert Hirschman calls it in his classic The Rhetoric of Reaction, has a long history, but it has special relevance to contemporary politics. It played a major role in the neoconservative attack on liberal programs of the 1960s and subsequent rollback of federal regulation and spending. One of Ronald Reagan’s favorite lines, “We had a war on poverty, and poverty won,” perfectly expressed the conservative charge that liberal reform was futile. That view helped persuade Congress under Reagan and his successors not only to cut programs for low-income communities but also to devolve policy to the states through such measures as block grants that let the states decide how money would be spent.

Although we hardly knew it at the time, the United States was conducting a national experiment: What would be the effect on Americans’ well-being if we turned over a wider array of policies to states controlled by political parties with opposed agendas?

...

What also unites conservatives is a complete absence of any self-reflection about the impact of their policies on life and death in America. The futility thesis must be a great consolation to those who believe in it because otherwise they would have to confront the toll that their policies have taken. The balance of power in the states has been literally a life-and-death matter. Liberals and progressives should know that the policies they have struggled to enact have not been in vain.

...

More at the link.

#public policy#federalism#american divide#paul starr#public health#life expectancy#social investment#conservative public policy#liberal#progressive#state comparisons#social science#social measurement#the american prospect

0 notes

Text

Get Financial Independence and Crush Your Debt Today!

Are you tired of living under the weight of your debts?

Do you find yourself struggling to make ends meet, despite your best efforts? At Debt Crusher Pro, we understand how difficult it can be to overcome financial difficulties. That’s why we’re here to help you get back on Get Financial Independence and Crush Your Debt Today!

Are you tired of living under the weight of your debts? Do you find yourself struggling to make ends meet, despite your best efforts? At Debt Crusher Pro, we understand how difficult it can be to overcome financial difficulties. That’s why we’re here to help you get back on track and achieve financial independence.

If you’re not sure how to resolve your debt, or if you’re looking for a way to pay less than what you owe, we’re here to help. Our expert team has over 15 years of experience negotiating debt settlement and securing small monthly payment plans for our clients. We can also help you improve your credit score and resolve any issues related to auto loans, mortgages, or business debt.

Don’t let your debt hold you back any longer. By working with Debt Crusher Pro, you can take control of your finances and achieve the financial freedom you deserve. Contact us today to schedule your free consultation and take the first step towards a brighter financial future.

#income inequality#anti capitalism#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters#college debt#wealth inequality#Important#crowfunding#branco#student loans

0 notes

Text

Looking at Jase Robertson and David Dayen, you wouldn't think the two of them have much in common. Robertson is known for his time on the A&E reality TV show Duck Dynasty. He currently hosts a show on the conservative digital outlet TheBlaze. David Dayen is a longtime progressive journalist and executive editor for The American Prospect magazine.

However, over the past few weeks, tweets from both Robertson's and Dayen's Twitter accounts have been sharing the exact same messaging.

#Twitter#Stolen#Verified#Scammed#Support#Mashable#Jase robertson#David dayen#A&e#Tv#Duck Dynasty#Theblaze#The American prospect#Messaging

0 notes

Text

Still sad, because Sonia Chang-Diaz would've been a great governor.

0 notes

Text

Terrace, Prospect Park, William Merritt Chase, circa 1887

Pastel

9 ⅛ x 13 ⅞ in. (23.3 x 35.2 cm)

Smithsonian American Art Museum, Washington, DC, USA

#art#painting#william merritt chase#impressionism#1880s#19th century#19th century art#prospect park#brooklyn#new york#new york city#pastel#smithsonian american art museum#american

47 notes

·

View notes

Text

Oh sick turns out actually MULTIPLE of my meds have gone up in price.

#again.#I literally already couldn’t afford them#at this point I might have to just stop taking the more expensive ones...#but going off meds you’ve been on for a minute cold turkey is a horrible horrible horrible idea#and I fuckin need them AHHH#idk what to do#the prospect of having to go off my suboxone my adhd meds prozac or seroquel is terrifying#if anyone wants to buy content please please dm me#I need help I was not expecting this raise in price :/#medications#ugh#American health care system is a fucking joke

13 notes

·

View notes

Text

I was literally not made to live in a world where bring able to drive & car ownership is essentially a prerequisite of societal participation/having a social life/getting anything done in a timely fashion

Guess who had an anxiety meltdown about the Ontario highway test. Again.

#alternately. i was not made to drive in ontario with its EXTRA set of driving tests#y'all. i dont like the highway. if i could just stay at a g2 license forever that would be fine#but noooooo it expires and if i dont oass the highway test i gotta start again#DESPITE THE FACT. I WILL NOT BE USING THE HIGHWAY REGULARLY. ITS MY NEMESIS#i literally just need to be able to putz around to run errands#i do not need to drive otherwise#the irony here being i cant afford to live downtown proper where i dont need a car#i have no desire to live rural (or job prospects there)#so i am currently in car bound hell#FUCK north american infrastructure for REAL

17 notes

·

View notes

Text

The learned helplessness of Pete Buttigieg

The apocalyptic airline meltdown over the Christmas break stranded thousands of Americans, ruining their vacations and costing them a fortune in unexpected fees. It wasn't just Southwest Airlines' meltdown, either - as stranded fliers sought alternatives, airlines like AA raised the price of some domestic coach tickets to over $10,000.

This didn't come out of nowhere. Southwest's growth strategy has seen the airlines add more planes and routes without a comparable investment in back-end systems, including crew scheduling systems. SWA's unions have spent years warning the public that their employer's IT infrastructure was one crisis away from total collapse.

But successive administrations have failed to act on those warnings. Under Obama and Trump, the DoT was content to let "the market" discipline the monopoly carriers, though both administrations were happy to wave through anticompetitive mergers that weakened the power of markets to provide that discipline. Obama waved through the United/Continental merger and the Southwest/AirTran merger, while Trump waved through Virgin/Alaska.

While these firms were allowed to privatize their gains, Uncle Sucker paid for their losses. Trump handed the airlines $54 billion in covid relief, which the airlines squandered on stock buybacks and executive bonuses, while gutting their own employee rosters with early retirement buyouts:

https://www.bloomberg.com/opinion/articles/2020-05-04/airlines-got-the-sweetest-coronavirus-bailout-around

Incredibly, the airlines got even worse under the Biden administration. In the first six months of 2022, US airlines cancelled more flights than they had in all of 2021, while the airlines increased their profits by 45% - and kept it, rather than using it to pay back the $10b in unpaid refunds they owed to fliers:

https://www.economicliberties.us/press-release/economic-liberties-releases-model-legislation-to-eliminate-airlines-liability-shield/

Dozens of state attorneys general - Republicans and Democrats - wrote to Transportation Secretary Pete Buttigieg, begging him to take action on the airlines. After months without action, they wrote again, just days before the Christmas meltdown:

https://www.levernews.com/state-officials-warned-buttigieg-about-airline-mess/

For his part, Secretary Buttigieg claimed he was doing all he could, trumpeting the order to refund fliers as evidence of his muscular regulatory approach (recall that these refunds have not been paid). He assured Americans that the situation "is going to get better by the holidays."

https://www.youtube.com/watch?v=6FlD6fHq8-g&t=145s

But the numbers tell the tale. Under Buttigieg, the DOT "issued fewer enforcement orders in 2021 than in any single year of the Trump and Obama administrations."

https://www.economicliberties.us/press-release/economic-liberties-releases-model-legislation-to-eliminate-airlines-liability-shield/

As the crisis raged, enraged fliers and opponents of unchecked corporate power blamed Buttigieg. So did opportunistic, bad-faith Republicans looking to score political points. The "liberal" media lumped all this criticism together, insisting that Buttigieg had done everything in his power and declaring it unreasonable to expect the Transport Secretary to prevent transportation catastrophes:

https://www.levernews.com/the-partisan-ghost-in-the-media-machine/

Buttigieg's defenders trotted out a laundry list of excuses for the failure, ranging from the nonsensical to the implausible to the contradictory - Pete's Army continued to claim that the aviation meltdown was the weather's fault, even after Buttigieg himself went on national TV to say this wasn't the case:

https://twitter.com/GMA/status/1608075800254767105?s=20&t=wmaJq3OWU0r0e6TS9V-9sA

Buttigieg is the Secretary of a powerful administrative agency, and as such, he has broad powers. Neither he nor his predecessors have had the courage to wield that power, all of them evincing a kind of learned helplessness in the face of industry lobbying. But there is a difference between being powerless and acting powerless.

To see what a fully operational battle-station looks like, cast your eye upon Lina Khan, chair of the FTC, another agency that has a long history of dormancy in the face of corporate power, but which Khan has transformed - not through ideology, but through competence. Khan - and her fellow Biden administration trustbusters Jonathan Kantor and the recently departed Tim Wu - have an encyclopedic knowledge of their powers, and they haven't been shy about using them:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

Over the Christmas break, even as the airline industry was stranding Americans far from their families, Khan proposed a rule to ban noncompete agreements, which are widely used to prevent low-waged workers like fast-food cashiers from quitting their jobs and seeking better pay from competitors:

https://mattstoller.substack.com/p/antitrust-enforcers-to-ban-indentured

These are, as Matt Stoller writes, a form of indentured servitude, used by private equity crooks to lock in their workforces. "30% of hair stylists works under a non-compete, as do 45% of family physicians." Noncompetes destroy the livelihoods of workers who start their own businesses, too: "One comment to the FTC came from a graphic designers for signage who was bankrupted by a lawsuit from her control-hungry former boss and a small town judge":

https://www.regulations.gov/comment/FTC-2019-0093-0015

Noncompetes are a scourge, and there should be bipartisan agreement on this. If you're a Democrat who believes in labor rights, noncompetes are manifestly unfair. But that's also true if you're a Republican who believes in competition and the power of entrepreneurship.

Nevertheless, noncompetes have trundled on, with neither Congress nor the administrative branch showing the courage to act - until now. Khan's proposed rule bypasses Congressional inaction by invoking powers that she already has, under Section 5 of the Federal Trade Commission Act.

Section 5 gives the FTC broad powers to prohibit "unfair methods of competition" - an incredibly broad power to wield, and one that the FTC hasn't bothered to use since the 1970s (!):

https://casetext.com/case/national-petroleum-refiners-assn-v-f-t-c

Which brings me back to Secretary Buttigieg and the airlines. Because Chair Khan isn't the only federal regulator with these broad powers. As David Dayen writes for The American Prospect, "the Department of Transportation has the exact same authority":

https://prospect.org/infrastructure/transportation/ftc-noncompete-airline-flight-cancellation-buttigieg/

Under USC40 Section 41712(a), Buttigieg has the power to unilaterally ban transportation industry practices that are "unfair and deceptive" or "unfair methods of competition." Per the DOT's own guidance, this provision is "modeled on Section 5 of the Federal Trade Commission Act":

https://www.govinfo.gov/content/pkg/USCODE-2020-title49/pdf/USCODE-2020-title49-subtitleVII-partA-subpartii-chap417-subchapI-sec41712.pdf

The are a lot more recent examples of the DOT using this power than there are of the FTC using its Section 5 authority, like the Tarmac Delay Rule. But as Robert Kuttner writes, the airlines reneged on their end of the $54b bailout, slashing staffing levels and failing to invest in IT modernization - examples of the "unfair and deceptive" practices that the DOT could intervene to prevent:

https://prospect.org/infrastructure/transportation/ftc-noncompete-airline-flight-cancellation-buttigieg/

As Dayen writes, "The definition of 'deceptive' is 'likely to mislead a consumer, acting reasonably under the circumstances.' If the airline scheduled a flight, took money for the flight, and knew it would have to cancel it (or, if you prefer, knew it would have to cancel some flights, all of which it took money for), that seems plainly deceptive."

This is the same authority that Buttigieg used to fine 5 non-US airlines (and Frontier, the tiny US carrier that flies 2% of domestic routes) for cancelling their flights - his signature achievement to date. But as Dayen points out, this authority isn't limited to taking action after the fact.

The DOT can - and should - act before Americans' flights are canceled. It can use its authority under 41712(a) to "say that the cancellation itself is an unfair and deceptive practice and issue a fine for each canceled flight." It could "promulgate a rule saying that cancellations due to insufficient crews, or due to dysfunctional computer scheduling systems, are unfair and deceptive, with stiff fines for each violation."

Both of these were within Buttigieg's power months ago, when the State AGs begged him to take action to prevent the mounting epidemic of cancellations. Both of these are within his power now. Heads of federal agencies are among the most powerful people in the world and they can use that power to materially improve the lives of the American people.

Just ask Lina Khan.

Image:

Gage Skidmore (modified)

https://www.flickr.com/photos/gageskidmore/49560191032

CC BY-SA 2.0

https://creativecommons.org/licenses/by-sa/2.0/

[Image ID: A vector drawing of a man slumped at a desk with his face on his laptop. The man's face has been replaced with that of Transport Secretary Pete Buttigieg. He has a DOT logo on his shoulder. There are also DOT logos on a coffee-cup on the desk and behind the desk, on the wall.]

#pete buttigieg#lina khan#ftc#dot#regulation#Section 41712a#airlines#noncompetes#mayo pete#david dayen#the american prospect#matt stoller

178 notes

·

View notes

Text

On Monday, a three-judge panel of the Eighth Circuit Court of Appeals instituted an emergency injunction of President Biden’s student debt cancellation program. The verdict granted standing to sue to an alleged plaintiff which has said publicly and in writing that it had nothing to do with the lawsuit, and no relationship with the office that filed it. The ruling, in effect, turned a non-plaintiff into a plaintiff.

It’s the kind of decision that makes you wonder what the law is, and whether it matters what it says. But the conservative judiciary could see these same tactics used by determined plaintiffs with different priorities. This would force right-wing judges to come up with what amounts to two different legal systems, one for policies they like and another for policies they don’t, eating away at the increasingly unpopular system of judicial supremacy.

The Eighth Circuit’s ruling is not the only adverse one for Biden’s student debt program, which would cancel up to $20,000 in loan balances for tens of millions of borrowers. A federal judge in Texas last week struck down the Biden plan on behalf of two students who didn’t qualify for full debt relief. The plaintiffs argued they had standing to sue because they were unable to provide comment expressing their disapproval of the program. Judge Mark Pittman agreed, even though the law the administration is using to enact debt relief explicitly says it can waive the notice and comment period. Pittman even acknowledged that later in the same ruling.

That inanity was only mirrored by the Eighth Circuit’s six-page, unsigned decision on Monday. In it, the three judges, appointed by Presidents George W. Bush and Donald Trump, reversed a lower court, which had said that none of the six states that sued Biden and the Department of Education over the debt cancellation plan had jurisdiction to sue. The judges singled out one entity, a student loan servicer named the Missouri Higher Education Loan Authority (MOHELA).

MOHELA, which is called a “state instrumentality,” services loans for the federal government. The state uses MOHELA revenue to fund capital projects at state colleges, as well as a modicum of financial aid (less than $6 million per year). If federal loan balances are reduced through forgiveness, MOHELA will service fewer loans, and there will be less money to go to capital funding and scholarships, the plaintiffs in the case have argued. “Due to MOHELA’s financial obligations to the State treasury, the challenged student loan debt cancellation presents a threatened financial harm to the State of Missouri,” the judges wrote.

But in this case, MOHELA itself, in a letter responding to questions from Rep. Cori Bush (D-MO), explicitly said that its executives “were not involved with the decision” to file for a preliminary injunction this September. MOHELA added that it has no relationship with the Missouri Attorney General’s office, which filed the suit, and that the documents the attorney general presented proving MOHELA’s potential financial harm from student debt cancellation had to be procured through formal sunshine law requests. Those have been the only communications between MOHELA and the AG’s office.

Asked whether MOHELA supports the lawsuit to block student debt relief, it answered: “MOHELA is faithfully fulfilling its obligations pursuant to its federal loan servicing contract.” It is possible that MOHELA is being cagey about this because, under California law, it could be liable for hundreds of billions of dollars in penalties for blocking student loan relief.

The Justice Department filed a brief informing the Eighth Circuit of MOHELA’s letter to Rep. Bush, so the judges should have been aware of its existence. Nevertheless, they ruled for MOHELA, the unwilling plaintiff. And under those terms, they instituted the injunction. None of the merits of the case were discussed at all, with the judges merely saying that they are “substantial.”

These peculiar decisions have thrown the Biden administration’s plans into doubt. It has stopped collecting applications for debt relief, after 26 million applied. Debtor advocates have proposed several options going forward.

One argument all along has been that the administration’s legal complications are tied up with the program’s contours. Means-testing the relief required an application process and slowed things down enough for opponents to fund lawsuits and find courts willing to overturn the program. Plus, the administration used the HEROES Act of 2003 as its authority for debt forgiveness, a limited program that, it’s reasonable to suggest, was not intended for this type of mass relief.

Compromise and settlement authority from the Higher Education Act, under this theory, is a much more robust option, allowing for cancellation of debt by fiat. Astra Taylor, one of the leaders of the activist group Debt Collective, argued in The Guardian Monday that “Biden could knock the legs out from under these cynical lawsuits tomorrow by extinguishing all federal student loans immediately and permanently using compromise and settlement authority.”

A potential complication to this is that the Education Department in 2016 amended implementing regulations for compromise and settlement that Justice Department lawyers have argued narrow its potential use. The new rules, according to DOJ lawyers with the Office of Legal Counsel (OLC), make it so that the authority could only be used if the cost of collecting debt exceeded what the agency could expect to collect. Other experts have looked at these regulations and said they do not prevent the Secretary Of Education from canceling debt, but the OLC hasn’t seen it the same way.

The regulations would take 18 months to change through administrative procedure. Of course, it took Biden more than 18 months to decide what course of action to take on student debt cancellation. The administration could have provided regulatory clarity and cancelled debt en masse in less time than it took to come up with a new authority and a cumbersome application process.

This would have served the dual purpose of speeding up the whole process. Determining debt cancellation unconstitutional right before national elections, and taking relief away from 26 million borrowers, would have been another stark display of judicial control of government. On the off chance that it got past the judiciary, Biden would have given a tangible benefit to tens of millions of borrowers.

Because of the uncertainty of cancellation, several groups are arguing to extend the payment pause, which is due to expire at the end of the year. The pause has been in place for nearly three years without legal challenge. That would prevent financial stress in a time of high inflation and dwindling discretionary income.

But given the outlandish nature of the judicial rulings, another more operatic option looms down the road. If plaintiffs can make up any story to justify standing to block federal programs they disfavor, they surely will. Liberal activists have plenty of problems with endless wars, climate pollution, and dozens of other issues. It’s plausible that violations of congressional war powers or the right to clean air and water exist from these activities. Liberal plaintiffs never had a hook to bring cases before, but they could simply say they have standing to sue because they never got to comment on the federal actions, or because some related entity will be harmed if the plans go through.

These precedents from the student debt rulings are being set, and they amount to sticks of dynamite for would-be litigants. Liberals can forum-shop too, and move these cases through the system. If nothing else, it would force the conservative higher courts to spend lots of time fending off cases. It would likely yield rulings where the courts would say that notice-and-comment standing claims are fine for conservative activists but not for liberal ones.

The judiciary’s legitimacy is already at a low ebb; making up different sets of rules depending on the plaintiff would nosedive that even further. This legitimacy, while it seemingly doesn’t matter to unelected elites in robes, clearly had an impact on the 2022 elections. And in U.S. history, when the judiciary has been seen as a cancer on American life, it has often changed course, like the Lochner Court during the New Deal.

Whatever the strategy, the Biden administration will need to rebut charges that they conned young voters by offering debt relief before the election, only to have it taken away by the courts, as they knew it would be. They have at least a few ways to prove that conspiratorial belief wrong.

#us politics#news#the American prospect#2022#biden administration#president joe biden#student loan debt#student debt forgiveness#student debt#student loan forgiveness#debt forgiveness#Eighth Circuit Court of Appeals#Judge Mark Pittman#Department of Education#Missouri Higher Education Loan Authority#Rep. Cori Bush#department of justice#HEROES Act of 2003#Higher Education Act#Office of Legal Counsel#Astra Taylor#Debt Collective#the guardian#student loan debt collection moratorium

14 notes

·

View notes

Photo

Still waiting for salvation

https://www.youtube.com/watch?v=s093kYOeMag

Prospect, Nevada

#nikon n55#prospect nevada#this band has people in it#zach bradley#film photography#nevada#ghost town#ghosts in love#desert ghosts#abandoned#americana#american southwest#southwest#a e s t h e t i c#filmisnotdead#indie#emotive#analog#35mm#places#rural#ghosttown#vingtage aesthetic#original photography#photographers on tumblr

159 notes

·

View notes

Note

1) In the US cider is non-alcoholic by default and alcoholic cider is differentiated as 'hard' cider

2) beer tastes like piss but enjoy your grain water ig lol you can have my share

god why do people get so irate about beer. I didn't tell you to drink it, just stop pretending it's objectively bad lmao

anyway: the more you know i guess. i still don't really get why non alcoholic cider is the default cider, odd!

#ask#anon#i do not think americans should form opinions on beer until they've drunk some african european and asian beers#and not like stella artois lol#drinking beer in america was such a grim prospect tbf and i could see forming an incorrect opinion with the usual stuff you have on tap

10 notes

·

View notes

Note

Happy Valentine's Day

This is so sweet!! Happy Valentine's Day ♡

#thank you for the ask!!#a little ask like a piece of paper sneaked into a high school locker........#my high school did not have lockers while I was there but used to. I was excited about the prospect of lockers like in American tv shows#they retired them shortly before my first year. there were abandoned broken down lockers in some of the hallways when I got there#so I did not experience anything sneaked into a locker. I mean I wouldn't have anyway even if we had had lockers#I don't know why I dropped all this lore... that's your reward for sending me an ask...#ask#anon

2 notes

·

View notes

Text

st andrews literally have weixin weibo AND xiahongshu oh they are totally gonna suck my dick

#pandering to americans and chinese they’re making sure they’re covering all of the prospective student bases lmfao#sisi.txt

1 note

·

View note

Text

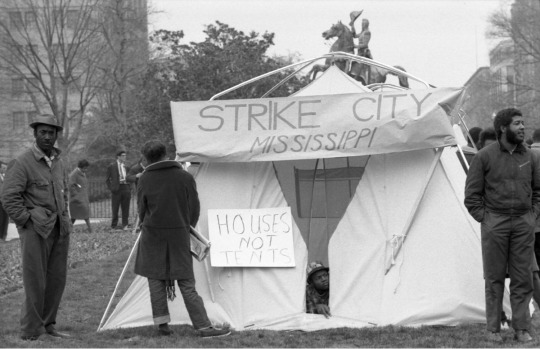

What Happened When a Fearless Group of Mississippi Sharecroppers Founded Their Own City

Strike City was born after one small community left the plantation to live on their own terms

— September 11, 2023 | NOVA—BPS

A tin sign demarcated the boundary of Strike City just outside Leland, Mississippi. Photo by Charlie Steiner

In 1965 in the Mississippi Delta, things were not all that different than they had been 100 years earlier. Cotton was still King—and somebody needed to pick it. After the abolition of slavery, much of the labor for the region’s cotton economy was provided by Black sharecroppers, who were not technically enslaved, but operated in much the same way: working the fields of white plantation owners for essentially no profit. To make matters worse, by 1965, mechanized agriculture began to push sharecroppers out of what little employment they had. Many in the Delta had reached their breaking point.

In April of that year, following months of organizing, 45 local farm workers founded the Mississippi Freedom Labor Union. The MFLU’s platform included demands for a minimum wage, eight-hour workdays, medical coverage and an end to plantation work for children under the age of 16, whose educations were severely compromised by the sharecropping system. Within weeks of its founding, strikes under the MFLU banner began to spread across the Delta.

Five miles outside the small town of Leland, Mississippi, a group of Black Tenant Farmers led by John Henry Sylvester voted to go on strike. Sylvester, a tractor driver and mechanic at the A.L. Andrews Plantation, wanted fair treatment and prospects for a better future for his family. “I don’t want my children to grow up dumb like I did,” he told a reporter, with characteristic humility. In fact it was Sylvester’s organizational prowess and vision that gave the strikers direction and resolve. They would need both. The Andrews workers were immediately evicted from their homes. Undeterred, they moved their families to a local building owned by a Baptist Educational Association, but were eventually evicted there as well.

After two months of striking, and now facing homelessness for a second time, the strikers made a bold move. With just 13 donated tents, the strikers bought five acres of land from a local Black Farmer and decided that they would remain there, on strike, for as long as it took. Strike City was born. Frank Smith was a Student Nonviolent Coordinating Committee worker when he went to live with the strikers just outside Leland. “They wanted to stay within eyesight of the plantation,” said Smith, now Executive Director of the African American Civil War Memorial and Museum in Washington, D.C. “They were not scared.”

Life in Strike City was difficult. Not only did the strikers have to deal with one of Missississippi’s coldest winters in history, they also had to endure the periodic gunshots fired by white agitators over their tents at night. Yet the strikers were determined. “We ain’t going out of the state of Mississippi. We gonna stay right here, fighting for what is ours,” one of them told a documentary film team, who captured the strikers’ daily experience in a short film called “Strike City.” “We decided we wouldn’t run,” another assented. “If we run now, we always will be running.”

But the strikers knew that if their city was going to survive, they would need more resources. In an effort to secure federal grants from the federal government’s Office of Economic Opportunity, the strikers, led by Sylvester and Smith, journeyed all the way to Washington D.C. “We’re here because Washington seems to run on a different schedule,” Smith told congressmen, stressing the urgency of the situation and the group’s needs for funds. “We have to get started right away. When you live in a tent and people shoot at you at night and your kids can’t take a bath and your wife has no privacy, a month can be a long time, even a day…Kids can’t grow up in Strike City and have any kind of a chance.” In a symbolic demonstration of their plight, the strikers set up a row of tents across the street from the White House.

John Henry Sylvester, left, stands outside one of the tents strikers erected in Washington, D.C. in April 1966. Photo by Rowland Sherman

“It was a good, dramatic, in-your-face presentation,” Smith told American Experience, nearly 60 years after the strikers camped out. “It didn’t do much to shake anything out of the Congress of the United States or the President and his Cabinet. But it gave us a feeling that we’d done something to help ourselves.” The protestors returned home empty-handed. Nevertheless, the residents of Strike City had secured enough funds from a Chicago-based organization to begin the construction of permanent brick homes; and to provide local Black children with a literacy program, which was held in a wood-and-cinder-block community center they erected.

The long-term sustainability of Strike City, however, depended on the creation of a self-sufficient economy. Early on, Strike City residents had earned money by handcrafting nativity scenes, but this proved inadequate. Soon, Strike City residents were planning on constructing a brick factory that would provide employment and building material for the settlement’s expansion. But the $25,000 price tag of the project proved to be too much, and with no employment, many strikers began to drift away. Strike City never recovered.

Still, its direct impact was apparent when, in 1965, Mississippi schools reluctantly complied with the 1964 Civil Rights Act by offering a freedom-of-choice period in which children were purportedly allowed to register at any school of their choice. In reality, however, most Black parents were too afraid to send their children to all-white schools—except for the parents living at Strike City who had already radically declared their independence . Once Leland’s public schools were legally open to them, Strike City kids were the first ones to register. Their parents’ determination to give them a better life had already begun to pay dividends.

Smith recalled driving Strike City’s children to their first day of school in the fall of 1970. “I remember when I dropped them off, they jumped out and ran in, and I said, ‘They don't have a clue what they were getting themselves into.’ But you know kids are innocent and they’re always braver than we think they are. And they went in there like it was their schoolhouse. Like they belonged there like everybody else.”

#The Harvest | Integrating Mississippi's Schools | Article#NOVA | PBS#American 🇺🇸 Experience#Mississippi Delta#Cotton | King#Abolition | Slavery#Black Sharecroppers#Mechanized Agriculture#Mississippi Freedom Labor Union (MFLU)#Leland | Mississippi#Black Tenant Farmers#John Henry Sylvester | Truck Driver | Mechanic#A.L. Andrews Plantation#Fair Treatment | Prospects#Baptist Educational Association#Frank Smith | Student | Nonviolent Coordinating Committee#Strike City#Executive Director | African American | Civil War Memorial & Museum | Washington D.C.#Federal Government | Office of Economic Opportunity#Congress of the United States | The President | Cabinet#Brick Homes | Black Children | Literacy Program#Wood-and-Cinder-Block | Community Center

5 notes

·

View notes