#first-time buyer guide

Explore tagged Tumblr posts

Text

Comprehensive Mortgage Advice for First-Time Buyers

Understanding Mortgages

When it comes to purchasing your first home, understanding mortgages is crucial. A mortgage is a loan that you take out to buy a property. It's important to consider your budget, credit score, and financial stability before applying for a mortgage. Research different types of mortgages, such as fixed-rate and adjustable-rate mortgages, to determine which option is best for you.

#Mortgage Advice for First-Time Buyers#mortgage advice#first-time home buyers#mortgage tips#first-time buyer mortgage#mortgage guide#buying first home#home buying tips#mortgage options#first-time buyer loan#mortgage consultation#mortgage rates#first-time buyer programs#home loan advice#mortgage approval#first-time buyer checklist#getting a mortgage#mortgage broker#first-time buyer guide#home buying process#mortgage application.

1 note

·

View note

Text

Student Loans can have a major impact on your ability to buy a home. More student loan debt means less buying power. Here's a quick reference to how student loans affect the buying process for each of our loan programs.

#home mortgage#home loans#mortgage#first time home buyer#fha loans#mortgage lending#usda loans#va loans#home buyers guide#conventional mortgage#student loans#student debt

0 notes

Text

A Complete Guide to the Home Buying Process

Buying a home is one of the biggest financial decisions you'll make in your life—and knowing what to expect can make the journey smoother and more enjoyable. Whether you’re a first-time buyer or looking to upgrade, understanding each step of the home buying process is key to making informed decisions.

1. Determine Your Budget

Before browsing listings, assess your financial situation. Factor in your income, savings, monthly expenses, and how much you can afford for a down payment. Speaking with a mortgage lender early will help you get pre-approved and clarify your buying power.

2. Start Your Search

With your budget in mind, begin looking for properties that fit your lifestyle. If you’re interested in growing communities, there are plenty of homes for sale in Mustang OK that offer great schools, parks, and family-friendly neighborhoods. A real estate agent with local expertise can be invaluable during this stage.

3. Schedule Showings and Compare Options

Once you’ve narrowed down your choices, schedule showings to get a real feel for the homes. Take note of important factors like layout, condition, and location. Don’t hesitate to ask questions—this is a major investment.

4. Make an Offer

When you find the right home, your agent will help you submit an offer based on market value and conditions. Be prepared for possible negotiations with the seller regarding price or repairs.

5. Complete Inspections and Appraisals

After your offer is accepted, the home will go through an inspection and appraisal. These steps ensure there are no hidden issues and that the home is worth the agreed price.

6. Finalize Your Mortgage and Close

Work with your lender to finalize the mortgage paperwork. Once approved, you’ll attend a closing meeting to sign the final documents and officially take ownership.

With a clear understanding of each phase, you’ll feel confident as you move through the home buying process. Whether you're exploring the suburbs or want easy access to amenities, the variety of homes for sale in Mustang OK offers something for every lifestyle and budget.

#home buying guide#real estate tips#homes for sale in Mustang OK#first-time home buyer#home buying process#real estate Mustang OK#how to buy a home#home search tips#Mustang Oklahoma homes#buying a house checklist

0 notes

Text

Step-by-Step Financial Plan to Buy a Home in a Metro City

1. Define Your Budget

Research Property Prices in your target metro city (e.g., Mumbai, Delhi, Bangalore, Pune).

Account for all costs, not just the property price:

Registration + Stamp Duty (5–8%)

Brokerage

Home loan processing fee

Interiors / furniture

Moving costs

Example: For a ₹1 Cr flat, actual total cost can go up to ₹1.1–1.2 Cr.

2. Check Your Affordability

Use the 28/36 rule:

Max 28% of your gross income should go to home loan EMI.

Total EMIs (home + other loans) should not exceed 36%.

Example: If your monthly salary is ₹1,50,000 → safe EMI: ₹42,000

3. Check Loan Eligibility

Banks usually fund up to 75–90% of property cost.

You need to arrange 10–25% down payment + extra charges.

For ₹1 Cr property: Down payment of ₹20–25 lakh

4. Start Saving for Down Payment

Set a target and timeline (e.g., ₹25L in 3 years → ~₹70,000/month)

Use a mix of:

SIPs in Mutual Funds (for returns)

RD/FD (for safety near goal time)

Avoid risky investments like crypto or stocks if goal is short term

5. Build Emergency Fund

Keep 6 months of expenses aside even after you buy.

Owning a home comes with new expenses (repairs, maintenance, society charges).

6. Improve Your Credit Score

A 750+ CIBIL score ensures better interest rates.

Pay EMIs, credit cards on time; avoid multiple loans or credit inquiries.

7. Factor in Additional Costs

Monthly EMI

Society maintenance

Property tax

Utility bills (especially if bigger space or gated complex)

8. Compare Loan Options

Look for:

Lowest interest rate (check both public and private banks)

Tenure flexibility (longer = lower EMI, more interest paid)

Prepayment/foreclosure charges

Use home loan calculators on bank websites

9. Consider Joint Ownership

If you’re married, both incomes can be used for higher loan eligibility.

Both partners can also get tax benefits under 80C and 24(b).

10. Tax Planning

Home loan gives tax deductions:

Up to ₹1.5L under Sec 80C (principal)

Up to ₹2L under Sec 24 (interest)

First-time homebuyers may get additional benefits under Section 80EE/EEA

Tip: Should You Rent or Buy?

Calculate Rent vs Buy over 10–15 years.

In many metros, renting is cheaper in short-term, but owning builds equity long-term.

Would you like me to create a custom financial plan based on your income, city, and budget? Just share a few details or directly connect with us.

Your monthly income

Target city (e.g., Mumbai, Bangalore)

Timeline to buy (e.g., 3 years)

Current savings (if any)

#Home Buying Tips India#Financial Planning for Home#Buying House in Metro Cities#Real Estate Investment Tips#Home Loan Guide India#Down Payment Planning#Budgeting for First Home#Property Purchase Tips#Home Loan Eligibility#How to Save for a House#Rent vs Buy India#Buying a Flat in Mumbai/Bangalore#Urban Home Buying Guide#First Time Home Buyer India#Saving Money for House

0 notes

Text

How to Choose the Best Investment Strategy for Growth: A Simple Guide 💰📈

Hey there, financial dreamers it’s Nada Azzouzi ! 🌟 If you’re feeling overwhelmed by the world of investing, don’t worry—you’re not alone! 😌 In today’s blog, I’ll break down how to choose the best investment strategy for growing your wealth. I’ll share some simple, practical tips to help you make smart decisions, no matter where you are in your financial journey. Let’s dive in! 🏊♀️ 1️⃣ Know…

#bonds#cryptocurrency#diversification#financial education#Financial Freedom#financial goals#financial growth#Financial Planning#Financial Success#First-Time Home Buyers#Homeownership#investing consistently#investing for beginners#investing tips#investment advice#investment guide#investment research#investment routine#Investment Strategy#long-term investments#money management#passive income#personal-finance#portfolio management#real estate#Real Estate Investing#risk tolerance#short-term investments#smart investing#stocks

0 notes

Text

Difference Between Freehold and Leasehold Resale Properties: What You Need to Know Before Buying or Selling

Whether you're buying your first home or investing in a resale property, one of the most common (and confusing) terms you'll hear is Freehold vs Leasehold.

What is a Freehold Property?

In the simplest terms, a Freehold property means you own the property AND the land it’s built on, outright and forever. There’s no time limit, no rent to pay, and no landlord to report to.

✅ Key Features of Freehold Properties:

You have complete ownership of the property and the land.

There’s no lease agreement involved.

You can modify, sell, or transfer the property whenever you like.

Maintenance is your responsibility—but also your control.

🧠 Real-life Example:

Let’s say you buy a bungalow in Pune marked as a freehold property. You don’t just own the house—you own the plot too. You can plant a garden, extend the porch, or even sell the entire thing without anyone else’s permission.

📝 What is a Leasehold Property?

A Leasehold property means you’re buying the right to live in or use the property for a fixed period, usually 30 to 99 years, but the land still belongs to a government authority, trust, or private landlord.

⚠️ Key Features of Leasehold Properties:

You own the structure (like an apartment) but not the land.

You need to pay a ground rent or lease fee.

Any major changes or resale often need the landowner’s permission.

After the lease expires, ownership typically reverts back to the original landowner—unless renewed.

🧠 Real-life Example:

Suppose you're buying a resale flat in Mumbai that's under MHADA or CIDCO. Chances are it’s leasehold. Even if the flat looks like a steal, make sure to check how many years are left on the lease. Less than 30 years left? Financing might be tough.

Which One Should You Buy in Resale?

It depends on your long-term plans:

Want full control, long-term value, and fewer legalities? Go Freehold.

Looking for a budget-friendly home in a high-demand area with limited availability? A Leasehold resale might be worth considering—but only after checking lease terms and hidden costs.

🛑 Final Tips Before Buying or Selling

. Check Title Deeds: Always verify ownership documents and lease agreements.

. Consult a Property Lawyer: Especially for leasehold properties.

. Evaluate Remaining Lease Period: Less than 30 years left? Reconsider or renegotiate.

. Understand the Rules: Some leasehold properties come with usage restrictions (like commercial activity bans).

💬 Final Thoughts

Both Freehold and Leasehold properties have their pros and cons, especially in the resale market. The key is not just understanding what they mean—but what they mean for YOU.

#realestate#property tips#home buying#freehold vs leasehold#indian real estate#property guide#first time home buyer#property investment#resale property#house hunting

0 notes

Text

How to Market Properties to First-Time Buyers in Ireland

Purchasing a property is a significant milestone for first-time buyers. In Ireland, this process can feel overwhelming, especially with the current property market dynamics. As a real estate agent or seller, understanding how to market properties effectively to this audience can make all the difference. Here’s a guide on how to attract and engage first-time buyers in Ireland, ensuring your properties are at the top of their consideration list.

#First-Time Buyers#Property Marketing#Ireland Real Estate#Market to Buyers#First Home Tips#Buyer Marketing Guide#Ireland Property Tips#First-Time Buyer Tips#Real Estate Marketing#Selling to Buyers

0 notes

Text

#Buying a home in Sydney#Sydney property market#Buyer's agent Sydney#Sydney real estate#First-time home buyers Sydney#Sydney property buying guide#Benefits of buyer's agent#How to buy a home in Sydney

0 notes

Text

you can give seven days of internet connection to someone in gaza for just 6 USD

gazaesims.com is a website dedicated to helping people donate esims for people in gaza. (for the ultimate guide to donating an esim, see http://tinyurl.com/gaza-esims) there are multiple options for where to purchase an esim to donate, for the price i listed you want to use nomad esims. you can get a $3 discount by using someone's referral code from the notes of this post. it also will give the referrer credit to buy more esims! (you can only use a referral code on your first purchase) @/fairuzfan also a tag for esim referral codes here, some of which are nomad. BACKPACKNOMAD is another code to get $3 off your first purchase, it's been working for some people but not others so try out a referral code instead if you can't get it to work. also it took over an hour for the email with my information to come through so don't panic if it doesn't show up right away. (logging back into your nomad account seems to have helped some people get their emails to send!) NOMADCNG is a code for 5% off any middle east region nomad esims from connecting gaza. it can be used on any purchase, not just your first but is generally going to give less off than the first-purchase only codes, so use those first. it can be used in combination with nomad points. AWESOME NEW CODE: nomad esim discount code for 75% off any plan, NOMADCS25 do not know how long it lasts but this is an amazing deal esp. since they are really low on esims right now! (nomad promo codes do not work on plans that are already on sale, unlimited plans, and plans under $5)

weekly tuesdays only code on nomad web, PST timezone! it gives 10% off plans 10gb and above. NOMADTUE

for the month of may, first time referrals give 25% off for a person's first purchase and 25% off the referrer's next purchase! it's a great time to use someone's referral code from the notes if you are a first time buyer.

troubleshooting hint 1: if you are trying to pay through paypal, make sure you have pop-ups enabled! otherwise the payment window won't be able to appear.

troubleshooting hint 2: if you are trying to purchase an esim using the provider's app, it may block you from purchasing if your phone does not fit the requirements to install and use their esims. use their website in your browser instead and this problem should go away.

edit as of 5/21/24: holafly (israel and egypt), nomad (regional middle east), simly (palestine and middle east), mogo (israel), and airalo (discover) are currently in the highest in demand. here is a purchase guide i made that covers all of the esim platforms, including these three platforms. if it has been more than 3 weeks since you initially sent your esim and your esim has not been activated, you can reforward your original email with the expiration date in the subject line. you can see gothhabiba’s guide for how to tell if your esims have been activated. if your esim has expired without use, you can contact customer service to renew or replace it.

79K notes

·

View notes

Text

Pompano Beach Real Estate Market

Pompano Beach Home Buyer’s Guide 2025: A Smart Investment in Coastal Living

Pompano Beach, Florida, offers the perfect mix of relaxed coastal lifestyle and long-term property value. Located in Broward County, this city offers quick access to Fort Lauderdale, Miami, and major transit routes, while boasting direct access to the Atlantic Ocean and the sea, creating a truly coastal environment.

Homebuyers can choose from oceanfront condos, modern townhomes, and custom single-family homes in well-established neighborhoods.

Key benefits of buying in the Pompano Beach housing market:

Direct access to beaches, marinas, and water sports along the gorgeous sea

The city’s gorgeous beachfront views and relaxing lifestyle

Strong infrastructure and ongoing development

Excellent potential for both primary and investment properties

Access to shopping, dining, and entertainment within minutes

The city offers a vibrant life with access to relaxing and gorgeous coastal amenities, making it an ideal place to enjoy the best of seaside living.

This is a prime location for buyers looking for lifestyle, convenience, and appreciation potential.

Call today to explore available homes in Pompano Beach.

Local Market Insight for Smart Homebuyers

Pompano Beach currently offers favorable conditions for buyers. With increased inventory and longer days on market, homebuyers have more options and stronger negotiating power. The latest trend in the Pompano Beach real estate market shows sustainable growth and increasing attractiveness for long-term investment.

Current highlights:

Median home price is around $370,000 (Realtor.com), offering substantial value in South Florida

Average sale timeline of 108 days, giving buyers time to make informed choices

Low competition means buyers can negotiate without bidding wars

Ed Cook Real Estate helps you navigate these trends with up-to-date market data and strategic buying advice. We provide key insights to help buyers make informed decisions and buy with confidence.

Contact us for a free market consultation tailored to your goals.

Home Prices and Market Trends in Pompano Beach

Pompano Beach continues to offer strong opportunities for homebuyers, with the area experiencing rising popularity and rapid development. The median price per square foot is $282, with sellers accepting offers at an average of 94.5% of the list price.

Buyers can choose from a range of affordable condos, family-friendly homes, and high-end properties in well-established and emerging neighborhoods.

Market advantages right now:

Prices down 5.4% year-over-year

High inventory creates more negotiating room

Sellers increasingly open to below-list-price offers

Rise in investment opportunities as the local economy and real estate market continue to grow

Yes, it’s a buyer’s market. But it won’t last forever. Market conditions shift quickly, and the best deals move fast. Understanding the process when purchasing in a rising market is crucial for maximizing these opportunities.

Ed Cook Real Estate keeps you ahead with regular updates and expert negotiation strategies.

Call today for custom property alerts and personalized buying support.

Explore Pompano Beach Neighborhoods

Pompano Beach offers diverse communities to suit every lifestyle, from oceanfront living to quiet, inland neighborhoods. Experience how you can live in Pompano Beach neighborhoods, where comfort, convenience, and a vibrant lifestyle come together. Whether you’re seeking a luxury condo or a family-friendly home, there’s a fit for every budget.

Popular Broward County options include:

Ocean Blvd area: Steps from the beach, close to dining, parks, nightlife, and a variety of cultural activities

Inland communities: Spacious single-family homes with larger lots and lower prices, where residents enjoy access to community amenities

Gated communities: Added privacy, security, and amenities like pools, fitness centers, and organized events for residents

Each neighborhood offers something different: location, schools, access to water, investment potential, and opportunities to participate in local cultural activities.

Ed Cook Real Estate offers personalized neighborhood tours and insider guidance to help you find the perfect fit.

Property Types in Pompano Beach

Pompano Beach offers a wide selection of homes to match every lifestyle and budget. Whether you’re buying your first home or upgrading to a luxury residence, the options are diverse and location-driven.

Available property types include:

Condominiums: Range from affordable units to high-end towers with full amenities

Single-family houses: Found in both established neighborhoods and new developments

Townhomes: Modern designs with low-maintenance living and shared community perks

Luxury waterfront estates: Direct access to the ocean or Intracoastal Waterway

Amenities may include pools, gyms, security, and community parks. For residents of waterfront properties, diving is a popular activity thanks to Pompano Beach’s excellent conditions and nearby coral reefs and shipwrecks. Be aware of HOA fees and potential assessments when creating your budget.

Ed Cook Real Estate helps you evaluate all costs and match you with the right property more efficiently.

What to Know Before Buying a Home in Pompano Beach

Savvy buyers look beyond the listing price to fully understand the cost and fit of a property. Taking the proper steps early helps avoid surprises later.

Essential factors to consider:

Property taxes, closing costs, and homeowners’ insurance

Mortgage pre-approval and available loan options

School zones, commute times, and nearby amenities

HOA fees, association rules, and any special assessments

Ongoing expenses such as maintenance costs, association fees, and other regular payments

Full property inspection to catch issues before closing

Buyers may need to pay certain expenses upfront, such as down payments or reserve studies, so it’s essential to manage your money effectively and plan for both immediate and long-term costs.

Ed Cook Real Estate connects buyers with reliable lenders, inspectors, and local experts to streamline the process.

How to Navigate the Pompano Beach Home Buying Process

Buying a home is easier when you follow a clear, guided path. Ed Cook Real Estate streamlines every step with local expertise and personalized support.

Steps to a smoother purchase:

Get pre-approved to strengthen your offers

Proceed by completing the required application or inquiry form to move forward in the process

Research neighborhoods and property types with your agent

Tour homes and evaluate total ownership costs

Negotiate confidently with expert guidance

Stay on track through inspection, paperwork, and closing

We help you avoid delays, sidestep pitfalls, and close with confidence.

Financing and Incentives for Pompano Beach Home Buyers

Securing the right financing can significantly enhance your buying power. Pompano Beach buyers have access to a variety of loan programs and incentives.

Key options include:

Conventional, FHA, and VA loans with flexible terms

Down payment assistance programs for qualifying buyers

Incentives for first-time buyers and specific neighborhoods

Reduced fees or interest rates on select loan programs

Choosing the right lender is just as important as finding the right home. Ed Cook Real Estate connects you with trusted local lenders who understand the market and help you get approved quickly.

For more details about available financing and incentive programs, contact Ed Cook to access program details and application processes.

Understanding Association Fees and Rules

Many Pompano Beach properties are part of homeowners’ or condo associations. These fees support shared amenities and maintenance, but can impact your monthly budget.

What buyers need to review:

Monthly HOA fees cover services like landscaping, security, and pool care

Governing rules on rentals, renovations, and property use

Special assessments for significant repairs or community upgrades

A clear understanding of these costs helps avoid surprises after closing. Ed Cook Real Estate enables you to break down the details so you know exactly what you’re paying for.

Community Amenities That Add Real Value

Pompano Beach communities often feature amenities that enhance lifestyle and long-term value. These shared amenities can significantly improve daily living and increase a property’s resale appeal.

Common amenities include:

Resort-style pools and fitness centers

Clubhouses, parks, and walking trails

Gated entries and on-site security

Private beach or marina access in select communities

Some amenities may incur additional fees, so it’s essential to factor these into your ownership costs. Ed Cook Real Estate provides complete transparency on what’s included in each community.

Contact us today to find homes with the features that matter most to you.

Maximize Long-Term Value with the Right Investment

Pompano Beach real estate offers substantial potential for appreciation and rental income. With the right property, buyers can benefit from both lifestyle upgrades and long-term gains.

What impacts resale value?

Location and proximity to beaches, schools, and transit

Community amenities and neighborhood growth

Property condition, updates, and curb appeal

Ed Cook Real Estate helps buyers identify properties with solid investment potential and strong resale performance, backed by local market expertise.

Why Work with a Pompano Beach Real Estate Expert

Buying a home is smoother and more strategic when you have a local expert by your side. Working with experienced agents provides valuable guidance and insights into property values, development plans, and investment opportunities.

Ed Cook Real Estate brings deep knowledge of the Pompano Beach market, ensuring you make confident, informed decisions.

What we provide:

Access to off-market listings and the best local deals

Expert negotiation and contract guidance

Insight into neighborhoods, schools, and commute options

Step-by-step support from the first showing to the final closing

With Ed Cook Real Estate, you don’t just buy a property – you secure the right home in the right location at the right purchase price.

Contact us today to begin your home search with a trusted local expert.

Florida Market Trends That Impact Your Purchase

Pompano Beach is part of the dynamic Broward County and South Florida housing market. Regional trends significantly influence pricing, inventory, and long-term value.

Key factors shaping the market:

Job growth and inbound population shifts

Ongoing development and infrastructure upgrades

Statewide changes in inventory and buyer demand

Understanding Florida’s broader market helps you time your purchase, evaluate value, and plan for the future.

Ed Cook Real Estate provides regular market insights to help you stay ahead of changes and make informed, strategic decisions.

Ready to find your ideal home in Pompano Beach? Contact Ed Cook Real Estate for expert guidance and a free consultation!

vimeo

#pompano beach home buyer’s guide#homes for sale in pompano beach fl#pompano beach real estate market#how to buy a home in pompano beach#pompano beach housing market trends#pompano beach median home price#waterfront homes for sale pompano beach#oceanfront condos pompano beach#single-family homes pompano beach#townhomes for sale in pompano beach#gated communities in pompano beach#best neighborhoods in pompano beach#pompano beach property taxes#pompano beach home closing costs#cost of living in pompano beach#home loan options in pompano beach#fha and va loans pompano beach#down payment assistance pompano beach#first time home buyer pompano beach#luxury homes for sale pompano beach#investment properties in pompano beach#pompano beach real estate agent#pompano beach home inspection checklist#pompano beach hoa fees#buying a condo in pompano beach#pompano beach community amenities#low maintenance homes pompano beach#pool homes for sale in pompano beach#marina access homes pompano beach#ed cook real estate pompano beach

0 notes

Text

Student Loans can dramatically affect your ability to secure a mortgage loan. Here's some info to help you navigate the process and take into consideration your student loan debt.

#home mortgage#home loans#mortgage#first time home buyer#fha loans#mortgage lending#va loans#usda loans#home buyers guide#conventional mortgage#student loans

1 note

·

View note

Text

Hire Trusted Real Estate Experts in Oklahoma City, OK

Searching for a reliable realtor in Oklahoma City, OK? Look no further than Mona Michelle Realtors—your trusted partner in the home buying and selling process. With deep local knowledge and a genuine passion for helping clients, we make your real estate experience seamless and stress-free. Whether you're a first-time homebuyer or a seasoned investor, our team delivers personalized service and expert market insight. Explore beautiful homes, secure the best deals, and move forward with confidence. With Mona Michelle, your dream home is just a call away. Reach out today and let’s get started!

We offer the following real estate services:

Homes for Sale in Putnam City OK

Homes for Sale in Deer Creek OK

Homes for Sale in Edmond Oklahoma

Homes for Sale in Yukon OK

Homes for Sale in NW Oklahoma City OK

Homes for Sale in Moore Oklahoma

#real estate#real estate agent#homes for sale#property listings#buying a home#selling a home#real estate market#real estate tips#home buying guide#real estate investment#luxury real estate#first-time home buyer#real estate trends#real estate expert#home staging#open house#real estate marketing#real estate photography#mortgage tips#real estate deals#property for sale#real estate advice#real estate listings

0 notes

Text

Top 10 Mistakes New Construction Buyers Make – And How to Avoid Them

Buying a new construction home is an exciting experience. The thought of moving into a brand-new home, built just for you, with no previous owners, is a dream for many. However, new construction purchases come with unique challenges, and many buyers make costly mistakes that could have been avoided with the right knowledge. What a lot of people don’t realize is that the cost of having their own…

#Arcadia neighborhood#Arizona#Arizona neighborhood#Arizona neighborhoods#Avondale neighborhoods#chandler neighborhoods#first time home buyers#Glendale neighborhoods#Goodyear neighborhood#Guide#Home buying#laveen neighborhood#mesa neighborhoods#new build#new build home#paradise valley neighborhood#Peoria neighborhoods#phoenix neighborhoods#Real Estate#scottsdale neighborhoods#surprise neighborhood#things you should know about buying new build homes

0 notes

Text

Feeling stuck in your home-buying journey?

Feeling stuck in your home-buying journey? 🏠 Here are 4 motivation killers to watch out for

#Home Buying Tips#Real Estate Advice#How to Buy a Home#Home Buying Journey#Real Estate Motivation#First Time Home Buyer#Home Buying Process#House Hunting Tips#Buying a House Guide#Stay Motivated Home Buying#Real Estate Tips for Buyers#Home Buying Challenges#Real Estate Strategies#Homeownership Tips#Buying a House Advice

1 note

·

View note

Text

Understanding Legalities for First-Time Home Buyers in Mumbai

Navigating the real estate market in Mumbai can be an exhilarating yet intricate adventure, particularly for first-time home buyers. The city’s dynamic and diverse landscape offers myriad opportunities for potential homeowners, yet it simultaneously demands meticulous legal scrutiny to ensure that your property purchase is both secure and beneficial. Given the complexity and scale of Mumbai’s market, understanding the legal frameworks and processes is not just helpful, but essential. This comprehensive guide covers legalities for first-time home buyers in Mumbai and helps to empower you with crucial legal knowledge needed to adeptly navigate the myriad challenges of buying your first home in Mumbai.

#legalities for first-time home buyers in Mumbai#home buying tips#home buying guide#home buying in mumbai

0 notes

Text

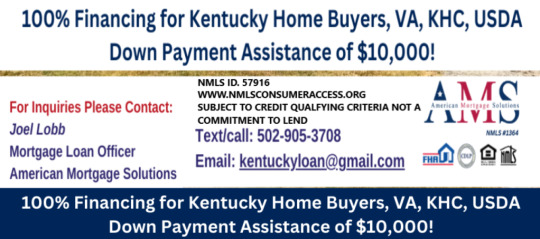

Mortgage Guide for First-Time Home Buyers in Kentucky

Mortgage Guide for First-Time Home Buyers in Kentucky

View On WordPress

#100 down kentucky fha loan#Federal Housing Administration#fha#FHA insured loan#Kentucky#ky first time home buyer#Louisville Kentucky#Mortgage Guide for First-Time Home Buyers in Kentucky#Mortgage loan#Refinancing#zero down loan kentucky

0 notes